Leaderboard

Popular Content

Showing content with the highest reputation since 04/24/2021 in all areas

-

2 points

-

This is one of my favorite things to rant about so let me apologize in advance. This isn't a comment about Brett Horn in particular - I don't know him, and maybe he's great. But what I strongly recommend is to look to the broker analysts as a gauge of popular sentiment (if even that) or to understand how brokers drum up business. Nothing more. It is not a coincidence that companies reliant on capital raising tend to get the widest coverage and the best ratings. But since the ostensible separation of research from investment banking (and the removal of skin in the game - analysts ability to actually buy stocks in their coverage universe - in the name of removing conflicts of interest), the job is basically a glorified sales job for trading volumes. And many of them, if they do get a real nugget of information or have an actual insight, share it behind closed doors with whichever client trades the most through their bank. In other words... I wouldn't think that hard about it. The analyst incentive is to not stand out in a bad way and keep making ~$1-2mm/year to keep their kids in fancy schools. Even if one is actually bearish, he/she almost certainly won't stick his/her neck out and risk embarrassment and losing that cushy gig. Sorry, I've done that job as a bright eyed and bushy tailed junior analyst and unfortunately saw how the sausage is made, so maybe I'm too cynical now. Maybe the general takeaway is to keep your expectations low and allow yourself be pleasantly surprised, but the clear and simple fact is that @Viking and others with real insight and skin in the game do a 10x better job than any broker analyst. Maybe this wasn't the case in Lee Cooperman's days at GS (though it was probably even sketchier then) but it is now. At the bare minimum, the pay and prestige aren't what they used to be. The real talent is elsewhere. Expect the sell side estimates to keep climbing higher as Fairfax executes.2 points

-

I once saw a cheers-less post. Gregmal was being disciplined over in the Disney thread…2 points

-

@newtovalue you are welcome. Nice to hear that others find value in some of the posts. I use writing as a way to get my thoughts in order. And i love it when people take the other side as i spend a fair bit of time trying to figure out why i am wrong. I think my track record is pretty decent figuring out the earnings part of the equation. I am pretty terrible at figuring out the multiple expansion part of the equation (i tend to sell my big positions too early).2 points

-

See pages 13-14 of their report: https://www.fairfax.ca/wp-content/uploads/2023-Fairfax-Financial-Holdings-Limited-ESG-Performance-Report.pdf Overall, it seems that they have done well over the last few years with the risk 'appetite' aspect and maybe they are getting better? It may take something like 250 years to know with more certainty though.1 point

-

Different recap…”when I went all in” always owned shares sometimes much less than others. 2002/2003 Peter Cundill was buying Fairfax hand over fist and that is what brought me here. I was able to buy shares in free fall at $67 per share during bear raid in 2003. It was an american holiday and it was an epic crash day i will never forget it. Sanjeev put a crew of vagabonds together and we all made small fortunes on the upswing into $300. (Cdn) analyzing and more appropriately believing in Prem Watsa…we have bonded (pardon the pun) forever. Brian Bradstreet had a billion dollar gain on “the long bond” bet in 2003 and that was the size of the market cap at the time. (I recently came across momento’s from that time and sent them to Prem’s office) 2007/2008 We were able to calculate the credit default swap values by looking at the financials and calling traders for quotes in the marketplace. Our AI! Fairfax made $2b plus on those bets and we all knew it but the market did not…had 50% of my net worth in Fairfax. It was the third best performing stock in the world in 2008 up 50%. Did you know that Brian Bradstreet offered to buyout all Michael Burry’s clients at 100 cents on the dollar? Very disappointed Fairfax was not in “the big short”. Covid debacle/2021 Once again I loaded up in the $350 range…unfortunately I sold the largest of my position after the tender offer…there were many other bargains around but i highly regret missing a lot of the $700 move up…I have been a buyer this year though Fairfax has become a powerhouse! There are high quality people on this board and with regards to Fairfax that certainly could be a movie but they would rather watch “Roaring Kitty”! Lol. Sign of the times. I cut my teeth here and Prem and Fairfax are the foundation of what I am good at…we learned how to fish on this board and I will never forget it. Thank you Fairfax team you have been feeding my family for more than two decades. cheers, Dazel1 point

-

Bought my first shares in FFH way back when SAC was trying to put FFH under. Everything about it was just flat out wrong; and super pissed about it, I bought some shares cheap, and found COBF. Crip, Dazel, and a few others were the main posters at the time ... and I learnt at the feet of the many masters. Hopefully; I gave back as much as I learnt! We haven't been in FFH for many years, but periodically visit as dividend, climate change, and short attack (MW) opportunities present. Had CS not blown up, and the BTC-ETF not become a 'thing', we would probably be using FFH as one of our 'near' cash equivalents FFH is a great learning experience, but all fledglings eventually need to leave the nest and do their own thing. Today, we're good enough at risk management that we can comfortably afford the higher risks that we take, and earn that higher 'Sharpe' ratio. There's a reason for the 'Sharper' in SharperDingaan! Good luck to all. SD1 point

-

Off topic : - - - o 0 o - - - @Jaygo, Thank you for sharing that personal very touching story. In a way it is also a fascinating story about much that a priori may have seemed about impossiible, actually is possible and achieveable, if the right attitude and flexiblity to obtain better life conditions and social mobility is at place, or embedded and dormant, to surface, after being triggered some way. It's also a fascinating story about progress in our world over the long term. Again, thank you for sharing. - - - o 0 o - - - Now, back to topic again.1 point

-

Muddy: fair value marks are criminally high Viking: fair value marks are criminally low Does it confirm criminality?1 point

-

Inventory trading may well be a consideration, it would take some of the pressure off. You just know that Fairfax will have some angle that will be enlightening1 point

-

Fuzzy or hard to interpret financials and poor communication from management - seems like something to avoid. There are so many publicly traded real estate stocks. What do you like about this one? That of course doesn’t mean you shouldn’t ask questions. Thank you for sharing.1 point

-

I just don’t see the attraction of a business that has been flat more than a decade. Looking up older annual reports, they made $72M in net earnings in 2005 and they only really beat this earnings number in 2022 with revenue more than double the 2005 #. And now, to break out of this runt, they have done a merger that years 4 years to work out: In any case, trucking cos tend to have strong earnings about a year after a recession and then the profits seem to fade. Thats not much of a runway.1 point

-

D, ideally lower. The fraud and cheating will usually start small but if they get away with it, they are likely to scale up, so it must be dissuaded from the start. I have a friend who ran a private midsize tech company. His cofounder, who oversaw the financial side of the business, hired his secret mistress as an office manager and when they got larger, the controller. Over several years she embezzled many hundreds of thousands, possibly more than a million, including using corporate cards for family vacations and such. The cofounder couldn't do anything because the mistress was blackmailing him, and my friend had no idea until they had an outside audit done. In the end she basically got a slap on the wrist.1 point

-

+1. I never understood the concept of "positioning". Why buy any position unless you know it as well as possible and have enough confidence to own it large? Imagine if a small business owner "positioned" his/her interest. Or a real estate owner. The objective is for it to grow. Generally diversification equates to mediocrity. Rather than diversifying, maintain sufficient cash or liquidity to ride out down cycles and also so you can take advantage of them. I fully realize that this is not the prevailing view (and would get me fired from most financial advisor jobs) but there are reasons why some folks achieve massive financial success and diversification is not one of them.1 point

-

Trying to be "conservative" is a mistake. You should try to be accurate. How many great and very reasonably priced companies have value investors missed because they were too "conservative". I agree with Gregmal, you should be looking out at least 3-5 years. Trailing earnings are already priced into the stock. Forward earnings are usually too (though Meta is an example of "conservative" investors missing forward earnings by a mile). If you look at only forward earnings, every great company will look expensive. If you use trailing earnings, every value trap will look cheap. Nvidia is a great cautionary tale. In January 2022, TTM (2022) was $4.44. actual fwd (2023) was $3.34. You could have been conservative and estimated 2024 earnings at $3 or $4 or $5. But actual 2024 earnings were $12.96. Sure, you might have missed the drawdown from $300 to $100. But you would also miss the run from $100 to $900. Conservatism comes at a price. --- This also depends on your strategy. If you are buying a cyclical, you should be looking at the past 10-20 years. And then maybe overlay some thoughts on forward earnings. For a real growth stock, you should be looking out 5-10 years.1 point

-

Depends on how short, but in general are a better inflation hedge than most other assets. The best immediate inflation hedge is oil. But oil is also exposed to idiosyncratic risks like cratering demand if the economy is also weakening (and politics!). So a basket that is heavily skewed to oil, some to gold, and some short-term fixed income should be a reasonably good hedge against inflation. Oil is immune to interest rates, but not immune to the economy. Gold/short term bonds are largely immune to the economy, but not real rates. As a basket, they should diversify the idiosyncratic risks of real rates, nominal rates, and the economy while hedging inflation. Future implications of deficit spending? More volatile inflation going forward.1 point

-

1 point

-

What? Have you actually read the report? Key takeaways: Fairfax is GE, not Berkshire Hathaway MW believes that there should $4.5B in adjustments to assets on the balance sheet Fairfax is pulling financial levers to improve results and book value since 2018 Fairfax has missed their ROE target of 15% for several years Ok, the 4th one is pretty much a joke. Buffett and Munger have talked for decades about lumpy 15% versus an even 12% return every year. Fairfax is an insurance company that invests its float for income, so there will be volatility in annual returns. With that, you can get rid of the 1st one as well, since GE was engineering earnings to get a consistent annual return, not accepting volatile annual returns. I'm glad Block really studied GE! Slide #4 of MW's report shows how Allied put pressure on Fairfax and they wrote a 107% CR in the year acquired. Then I guess somehow, Fairfax finagled a 97.3% CR since. Last I checked, writing below 100% was the target for insurance companies, not what they necessarily wrote historically. Again, not sure why he brings up Allied, since CR's are well under 100% for the last 5 years. For mispriced assets: Recipe They talk about the $15.30 takeover price for Recipe being artificial...well they have to talk to the PCAOB about that, because under IFRS fair value tests, the last market price or takeover price is what they have to use. They say that PWC restated goodwill and intangibles in 2021 compared to Recipe's previous auditor KPMG. Although, they don't note that PWC also restated the 2020 goodwill and intangibles for Recipe. So there was no real net tangible gain after acquiring Recipe if you simply look at Section 12 in the 2021 FFH AR showing total goodwill and intangibles for Recipe in 2020 and 2021 since the increase would have also been reflected in the restated 2020 financials for FFH in the 2021 report. Quess They argue that Quess was deconsolidated to create an artificial accounting gain. You can look at that whatever way you want. It was treated fairly under IFRS. Again, if there are issues, it's a PCAOB issue. Also, they don't account for the fact that Indian companies have not transitioned yet to IFRS and there might be adjustments in valuation between Indian Accounting Standards and IFRS. EXCO They say it is overstated by $220M or so on the books. I'll leave it to someone else with more understanding of the long history of EXCO to comment. Grivalia/Eurobank Essentially saying that Eurobank overstated goodwill by $62M...you can quibble this whatever way you want, but $62M is barely material here relative to Eurobank's equity and assets. Riverstone Suggested that the sale to OMERS and then subsequent sale from OMERS to CVC Capital was financial engineering to hide losses at Riverstone and show a profit at FFH. Yes, OMERS took the risk of buying Riverstone simply to help out FFH. Not that anything like that could risk OMERS entire being as a public pension plan, cause sanctions and fines against the investment team at OMERS, bar those managers from working in the industry, and possibly lose their CFA/Advisory designations. Sure, let's help a friend out with some financial chicanery and risk everything, including our reputation. As an aside, they mention that CVC Capital acquired Riverstone from OMERS with asset note guarantees by Fairfax for 4 years...they also suggest that the associate shares Fairfax put up as collateral were simply stuffed into Riverstone to hide paper losses on those associate shares. The funny thing is, most of those shares have recovered significantly since the pandemic and Fairfax would have been able to book tons of paper gains if they held those shares. No comment on that of course! Also no breakdown by MW's if any losses have been paid on the 4 year guarantee! Fairfax Africa/Helios They state that Helios was booked at $5.25 USD while the price on the date of deconsolidation (December 8, 2020) was $4.04 USD. No mention that the stock traded up to $6 USD on the days after December 8, 2020. Total gain...$43M...on $21B of shareholder equity. APR Energy They say that Fairfax sold APR to Atlas (a friend) so they wouldn't have to show a loss. Hmmm, funny how FFH hasn't bought it back, nor the fact that David Sokol and Bing Chen were willing to destroy their reputation solely to help Fairfax out. Bizarre Take on Prem's sale of Atlas shares - Prem sold shares of Atlas at the $15.50 tender offer and accepted the same number of shares from Poseidon...simply to align himself with the $1B investment by FFH into Poseidon. MW's states without any real issue of criticism that they don't understand why Prem would sell ahead of the minority shareholders. No idea what the argument is here. Eurolife/OMERS transactions - again, I'll leave this one for Fairfax to comment on, because there are a number of transactions that make it more convoluted than I have time to examine it. Essentially, MW's says that there was a $262M gain that should not be on the books. Ok, again that is 1% of shareholder equity and one tenth of what they will earn in 2024. Brit/Odyssey/OMERS transactions - MW's says it boosted book by $421M when portions of those were sold to OMERS because the remaining amounts were now carried at fair value. They say they were essentially financial transactions to boost book with a call option to buy back. Not sure how this is any different than any company under IFRS boosting liquidity by a partial sale of a fully consolidated entity. Berkshire, Markel, etc would all book this the same way. The most hilarious section of the analysis is Fairfax's accounting adjustments for Digit in 2021/2022 and the use of the FFH swaps. They say Fairfax began booking the gains on valuation of Digit later than they should have by a quarter so that they could juice the results for those quarters. Yet, the irony is if they had began when MW's suggests, then the gain in book value would have been inflated for 2021, a year which they say Fairfax was inflating gains widely through their transactions. They also note that they haven't made any adjustments to book based on the value of the swaps! In terms of a downward valuation of Digit that they suggest...I'm not sure I agree with the number, but Fairfax may have to adjust that based on prices for all fintech companies in India. Depending on markets, it could just as easily be valued upwards again. But I'll leave it to the auditors on this...I'm certain Muddy Waters has no clear idea either. Even MW notes that Sequoia invested $3.5B into Digit and relegates it to Silicon Valley's lack of discipline. Here's another big one that you can argue either way. They say that under IFRS 17 Fairfax received too much in adjusted gains. That their adoption gain divided by contract liabilities was about 6%...higher than the industry. Yet, they don't note that Fairfax also generally books higher redundancies on statutory capital compared to the industry and it is around that 6% mark. Could FFH book that more conservatively...sure. Did FFH book that accurately...yes. Farmer's Edge - another one that I'm not 100% up to speed on, but it's a $71M adjustment according to MW's. That's in the negligible territory when you look at $26B in equity. Lastly, they suggest that the 46% acquisition of Gulf Insurance is the latest piece of financial engineering by Fairfax and they purposely overpaid at 2.4 times book for the new stake. Yet Gulf made $125M in 2022 and 26% would be about $58M. The $860M cost amounts to about 15 times earnings. Which isn't expensive when you are paying up for a leading, quality insurer. One which also had a closing condition that the $2.00 per share price could not be lower than the 6-month moving average market share price leading up to the closing of the deal. Thus why the premium offered was 100% to market price rather than 60-70%...to ensure the deal would close and KIPCO couldn't walk away. Anyway, I'll leave it to brighter minds to approve or disapprove of the MW report. But to lackadaisically say that an ex-partner of the audit firm sits on their BOD's is somehow irregular and that what happened in the past regarding the short seller attack and financial restatements without even glancing over the facts...well that's just bloody lazy analysis! Not too mention the liability that the auditors could be exposed to, Fairfax could be exposed to, employees jobs, shareholder's account values...does anyone really think that Fairfax and the auditors would risk all of that for plus/minus 2-5% of book value?! Cheers!1 point

-

Yea I totally respect someone like Steve Eisman and the way he goes about it, but these bullshit artists who basically do nothing but take positions and then rant and rave on social media and TV....total scumbags.1 point

-

I haven’t crunched the numbers in this so it might be worth digging a little deeper for yourself: ”The S&P 500 has a forward price-to-earnings (P/E) ratio of about 15.5x excluding the Magnificent Seven, while the Magnificent Seven has a P/E of about 35x, according to data compiled by FactSet as of January 2, 2024.” https://www.capitalgroup.com/institutional/insights/articles/magnificent-seven-chart-diversify.html#:~:text=The S%26P 500 has a,as of January 2%2C 2024. It’s not hard to find sectors at single digit or low double digit PE’s if you go looking. AI type stocks are a bit speculative however I’m not see a broad market bubble.1 point

-

Thanks for starting this discussion Luca! I have used leverage successfully during covid (the highest I reached was 1.28 margin) and during the slump of late 2022 (mostly through LEAPS this time, maybe 1.15 or so). I find it easy to identify moments when markets are already down quite a bit and people are in fear mode and I'm good at staying calm and adding during those moments without trying to time the bottom or overthinking the crisis du jour. For those who do use leverage, how have the new interest rates changed that? I believe USD at Interactive Brokers went from around 2.5% to around 6%. Given the long term returns of stocks around 7%, I find the 6% hurdle too high and I'm currently at zero margin (but fully invested). Maybe it's just anchoring from the past. looking back we've been spoiled, what an opportunity for leverage the past 15 years have been!1 point

-

I can't speak for others but based on the 2024 portfolio thread, JOE is still one of the most commonly held / heavily weighted positions. Kuppy recently commented on valuation on his Twitter (this is his largest position), reiterating that there is still a significant discount to NAV despite the run-up in price.1 point

-

Just came back from my two-week trip to China. It's the first time seeing my family and friends in more than four years. Stayed in a small city near Shanghai and travel around in the region. Here are some observations: Overall economy is very challenging, although some high end restaurants seem to be doing fine. real estate will be doomed for years to come according to a real estate company executive friend. Even rural areas have a lot of high rise apartments (around 30 stories). I suspect these will be very costly to maintain and most Chinese are known for their frugalness. Don't feel good about the value of these building in 20 years. and most people i know already have multiple apartments. world class infrastructure everywhere, ie high speed rail, subway, etc. some of those projects were built to increase land value. While they look great, I'm not sure about the economic soundness. They are also very costly to maintain. e-commerce is very active, many people do grocery online nowadays. It's hard to increase consumption. most wealth is concentrated in people born in 60s, 70s. They grew up frugal and most people don't feel the desire to consume. The biggest spending is on food, but you can only eat 3 meals a day. secondly, the income decease is very real. a few years ago, local government employees were making over RMB300k, now it's about half, sometime lower. most people are stressed except the retirees. rich people (some centimillionaires) are worried about their shrinking net worth. and poor people are working 10-hour days to make their mortgage payment. although national birth rate are low. people i know are still having kids. but it could be they are local in a small city that is more affordable. most of the wealthy people's kids are living/studying in US or Europe. some of my friends, who used to drive BMW, Audi, are now driving Chinese made EVs.1 point

-

Went on a 5 day Christmas market trip basel=ok Starsburg=not good Cologne=amazing and good party Berlin=good and amazing city München=good salzburg=ok Vienna=amazing for couples and family’s Budapest=poor but best food by a mile. so if you ever want to go to a Christmas market in Europe that’s my score. Will travel like crazy this year every two weeks somewhere in the world :d excited1 point

-

Historical comparisons are not valid for a lots of reasons. Valuation levels need to reflect that. A few of the most important changes 1. In the past say 1880 or 1900 or 1920 or 1940... no one can put together a diversified portfolio of stocks at a cost less than 2% per year in expenses. That is direct expenses. Then you have insufficient information, risk with paper stock certificates, fraud, etc in buying stocks. Even if you ignore these indirect expenses, at a minimum you are paying 2% fees annually (brokerage costs, bid ask spreads, over the typical holding period) and unit trusts had loads and annual fees that averaged these as well. So if stocks returned 6.5% real, you still ended up with 4.5% returns and at best not in a very diversified way. Now an investor can buy total stock market fund at 3 bps. To get the same returns as in the past in a much more convenient way, investors can pay a lot more due to lower costs. 2. As much as many look down at economists and central bankers, they did learn a lot. The great depression - the bogeyman for many stock investors, is not going to happen again. We had a good practice run in COVID. Should something really bad happen short of a worldwide annihilation event (when your portfolio would be of little value/use anyway) you can predict what Fed would do. No points for guessing. You should be able to guess what politicians would do (Trump to Biden and everyone in between) - spend and spend some more. And they wont be wrong. This takes away the greatest risk to stock markets - that aggregate spending would fall i.e. consumers would not be able to spend money. Thus companies revenues are protected. This is a dramatic change from the past. If risk is lower, it is only natural to expect higher valuations and lower returns in future. 3. People also have wised up. They are not stupid. They do have 150 years of data that shows, every single time the stocks crashed, it was a buying opportunity. Short of a revolution (Russia, Germany, Japan...) when it does not matter what you hold (ok gold to some extent) everything is going to be worthless. Short of that, it is clear to anyone and their dog, that buying when stocks are down is a no-brainer. 4. In the past people worked until they dropped dead. Now people spend several years in retirement. For that they save (not everyone, but anyone who has wealth) and invest in the stock market. 401k, ira, etc. Everyone paycheck vast sums get deposited into these and they are automatically invested in markets. To expect stocks to get to a PE of 7 or 10 is stupid. Not going to happen except for very very brief amount of time - a few days at most. So valuations are going to average much higher in future. Vinod1 point

-

Investors are in this because they are expecting 15%+ returns. Prem himself mentioned I think they would not be investing in India if they did not think they can make 20% (OK, that is Prem being Prem ). Paying 1.5% + 20% performance over 5%, would seem perfectly reasonable for most of these investors when returns are north of 15%. Realized returns are 8.5%. Worse, these are investors who went to emerging markets seeking higher returns and they find S&P 500 had much higher returns. Now, they feel stupid for paying the performance fee. So they are going to capitalize the costs and discount it. Hence, the discount to BV. I dont think the discount would close unless 1) Fairfax India starts generating 15% annual returns, or 2) Fairfax India vastly outperforms US stocks, even if absolute performance does not reach 15%. Investors would be flocking to these non-US alternatives in that case. Vinod1 point

-

I think the best rebuttal is that the "bullish assumption" is from our odd crowd that represents ~1% of the composition of the market. It's still crickets from the 99%. And the opposite of love is not hate but indifference, right? I just can't see (though I guess that's your point!) how is this close to bullish sentiment just b/c like 12 of us on this niche value nerd forum are bulled up and while it still trades at what seems to me at least like a pretty depressed (or at least nothing close to stretched) valuation and with 2 questions on the call. As far as I can tell, we started off ~2-3 years ago at "child slave labor strip mine" sentiment and are like ~25% of the way to "generally recognized as the next BRK" levels. That's my proprietary scientific scale.1 point

-

@mcliu, I have to say I'm actually more than just surprised to see this video clip by Mr. Stoltenberg. Huge red flag. What I'm curious about is a date / time stamp for this statement, and the written statement by Mr. Putin, and its date. I have to admit, that this somehow has skipped my attention.1 point

-

Hard to discuss this topic of “life is better in America” without discussing “at who’s expense.” American wealth is a facade of wealth flown in from cheap labor markets and built on the backs of exploited labor. Everything we have in this country that is tangible comes from markets like that. Consumerism as a metric for judging a country’s success or quality of life is meaningless if that country cannot sustain that same level internally. The consumerism you call “success or quality of life” has given us nothing but the worst mental health conditions in the world. The highest pharmaceutical drug use in the world. Some of the highest suicide rates. Some of the lowest happiness scores. Political division. Worse overall health with no improvements in longevity or quality. Declining birth rates. A crumbling education system withA society addicted to debt. A veteran population thrown under the bus. A hollowed out middle class. The list goes on! But hey, we’ve built a few social networks and developed better ways to get fast food and cheap Chinese made products delivered to our door in hours so we can keep our eyes fixed to screens! What are some big American achievements that have nothing to do with unbridled consumerism in the last 30-40 years? A few drug breakthroughs? YOUR life might be better, but is the COUNTRY better? Is the US better positioned for long term success? Not sure, it does seem like people and politicians are waking up to this fact. The IS is a big shop and it’s slow to steer, so hopefully over the next 20 years we can get some actual leadership instead of these phonies to usher in a new golden era in American innovation and wealth. I’m confident that we will because when the towing gets tough, Americans tend to rise up like no other nation. But looking around at society and the people described by RKbang in the AV thread, it might be a while! There is a reason this song is blowing up with the average person in the US right now.1 point

-

http://www.aastocks.com/en/stocks/news/aafn-news/NOW.1280596/2 " Xi said the capital market should be enlivened to boost investor confidence." Lots of words...need actions and follow through....1 point

-

For Europe.......with friends like the US who needs enemies Back to what I mentioned a couple of pages back.......Macron has articulated this view.........Europe is a price taker of US foreign policy in the region and most certainly in other regions......Europe minus a robust German (& French) military capability....is a toothless tiger from strategic autonomy point of view.....the US and Europe are sympatico on so many things...we are great allies in that respect.......but there's divergence there too.......and the Ukraine/Russia stuff is an example.....perpetuating the war in Ukraine......is a mechanism by which the US can ensure structurally higher energy prices for German manufacturers they compete with......and the list goes on.......minus the billions of dollars the war is costing the US....in some respects there's lots of upside with limited downside.....the US gets to slowly cripple the Russian state/army fighting with other people soldiers......energy intensive European manufacturing becomes structurally uncompetitive vs. the US's unlimited Then you get interesting little incidents like the US spending a decade protesting against Nordstream 2 & ever closer energy integration between Europe and Russia..............and a gas pipeline getting blown up by mystery saboteur that no European country wants to talk about right now... The realpolitik of all this is very simple - and explained by the realist IR perspective: - a great power looks to secure its own region first....becoming a regional hegemon...the US spent much of the 1800's and early 1900's doing this...and was hugely successful....not a single person in the USA ever wakes up with concerns about neighbouring sovereign aggression....the US is totally secure with the Monroe Doctrine in place - regional hegemon then seeks to play in other regions (Europe/Asia/Africa) to contain and box in the rise of regional hegemon emerging that one day could go global - boxing in & constraining the emergence of regional hegemons is very logical.........a regional hegemon once they have dominated and secured their own region.....seeks to 'play' in other regions....potentially your region!!!!....cause thats exactly what you started doing once you'd secured yours....the US understands the playbook - the pivot to Asia by the USA....is not some charity exercise its concerned with ensuring China never fully dominates Asia in the way the USA dominates the Americas......if China achieved this regional hegemon state.....it would be likely to begin to play deeper games in South America/Caribbean bringing 'trouble' to the US's doorstep........its why a conflict in the South China sea at some point is so likely.....better to go toe to toe with China there....than the Caribbean Sea! - nations are chiefly concerned with their own survival and security....it drives everything in international relations....while we tell a heroes story about WWI & WWII.....great powers joined the conflict (WWI - britain, then the USA...and WWII (both)...as it became clear that Germany, if successful, would potentially emerge as a regional hegemon ala the Unites States if they didn't.....Britain and the USA at various junctures identified this as a strategic threat to their own sovereignty and security and joined the French in fighting. To contain China...and stop its emergence as a regional hegemon....we've already got bases all over Asia.....and are ready in various arenas to go toe to toe with China.....Korea, Taiwan, Japan....ideally you do it in a Ukraine fashion......send money/arms and let others die doing the fighting and furthering your strategic objectives of containing/diminishing a potential rival/competitor. Europe, as I mentioned needs to step up now with its own military capability aspirations, balance of power dynamics I think requires a third force between the USA and an emergent China.....left alone in a bilateral global competition the escalation dynamics are too easy to get out of control.....the situation is best served by a kind of EU referee but a referee with an army, nukes & artillery (the EU is already an economic superpower) and enough strategic autonomy to be neither China or US's "bitch".1 point

-

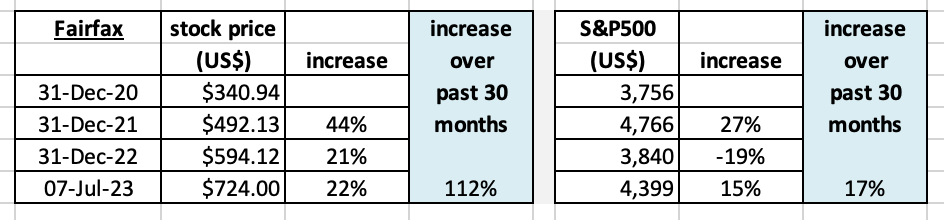

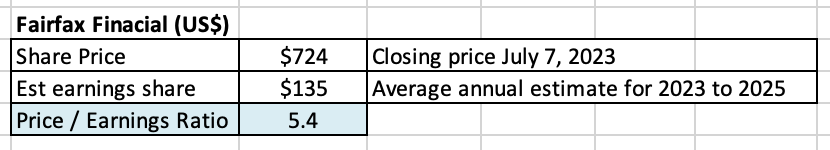

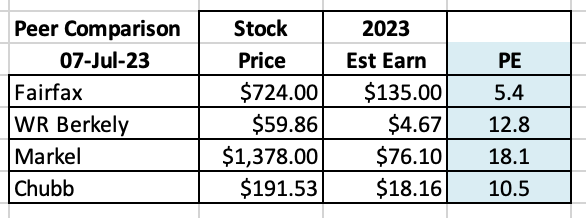

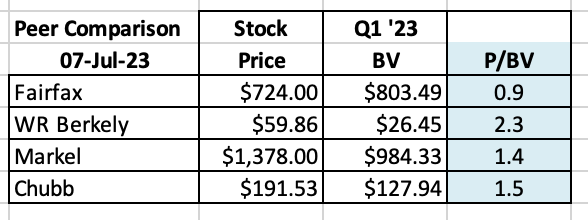

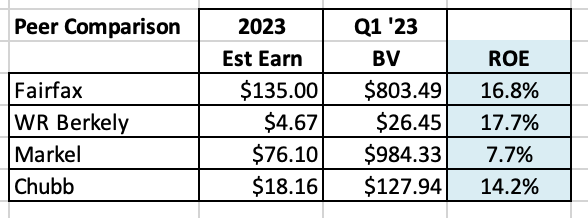

Is the stock priced properly? Efficient market hypothesis: “The efficient market hypothesis (EMH) is a hypothesis that states that share prices reflect all information and consistent alpha generation is impossible. According to the EMH, stocks always trade at their fair value on exchanges, making it impossible for investors to purchase undervalued stocks or sell stocks for inflated prices…” Investopedia A lot has happened at Fairfax over the past 30 months. Let’s do a quick review and see what we can learn. Most importantly, is the stock priced correctly, as the EMH would suggest? How has Fairfax’s stock performed over the past 30 months? First, let’s get some context. Fairfax has been one of the best performing stocks over the past 30 months both in absolute and relative terms. The outperformance has been remarkably consistent each year. Fairfax’s stock has outperformed the S&P500 by 95% over the past 30 months. That outperformance must make Fairfax one of the top performing large cap (in Canada) stocks over the past 30 months. Does this mean the stock is now expensive? The proverbial ‘big fish that got away’ from investors? Let’s find out. Let’s try and keep an open mind. What do the numbers tell us? And what about management? And future prospects? Let’s start by looking at the traditional valuation tools: Price to earnings ratio (PE) My current estimate has Fairfax earning about $145/share in 2023 and $135 in both 2024 and 2025. I view this as a mildly conservative estimate for the next three years. I’ll provide more details in my 3-year earnings forecast for Fairfax - coming in the next week or so. Importantly, the quality of the earnings being delivered by Fairfax are the highest in the company’s history; it is primarily being delivered by record operating earnings (underwriting profit + interest and dividend income + share of profit of associates). All three individually are at record levels. We learn in the chart above that Fairfax is trading today at a forward PE multiple of 5.4 times. That is crazy cheap, especially given the quality and durability of earnings. What is the PE multiple of the overall market? The forward PE multiple of the S&P500 is 20. Fairfax’s stock is trading at a SIGNIFICANT discount to the S&P500. Fairfax’s stock price could double from here and it would still be trading at a 50% discount to the S&P500 multiple. How about compared to some P&C insurance peers? Looking at PE, Fairfax is trading at 48% (Chubb) to 70% (Markel) below peers. Fairfax’s stock looks dirt cheap. But let’s keep digging. Price to book value multiple (P/BV) and return on equity (ROE) Let’s now look at the price-to-book value (P/BV) and return-on-equity (ROE). These two are the preferred metrics used to value insurance companies. Let’s start with P/BV. How does Fairfax stack up compared to peers? Looking at P/BV, Fairfax is trading 36% (Markel) to 61% (WR Berkley) below peers. How about ROE? Looking at ROE, Fairfax is poised to deliver an exceptional 16.8%, at the high end compared to peers. What can we conclude after looking at the valuation metrics? Looking at PE and P/BV, Fairfax’s stock is exceptionally cheap compared to the market and peers. At the same time Fairfax is delivering best-in-class ROE. This makes no sense. Let’s keep digging. What about management? I recently did a long-form post where I reviewed capital allocation at Fairfax over the past 5 years. Bottom line, it can be argued that Fairfax currently has a best-in-class management team (compared to peers). The mystery deepens. What about the future prospects of Fairfax? Fairfax has three engines driving its business: Insurance: Fairfax has grown net premiums written by 400% over the last 9 years. At a 95CR, underwriting profit is on track to be a record $1 billion in 2023. Investments - fixed income: Fairfax has navigated the spike in interest rates masterfully in their $40 billion fixed income portfolio, moving to 1.2 years average duration in Dec 2021 and then pivoting and moving to 2.5 years average duration in Q1 2023, locking in higher yields. As a result interest and dividend income is expected to be a record +$1.5 billion for each of 2023, 2024 and 2025. Investments - equities: Fairfax’s $16 billion equity holdings have been performing very well, lead by Eurobank and total return swaps on 1.96 million FFH shares. Most importantly, all engines are performing very well at the same time, perhaps for the first time in the company’s history. Significant asset sales over the past 12 months have been icing on the cake: pet insurance ($1.4 billion), Resolute ($626 million+$183 million CVR), Ambridge Partners ($400 million). In short, Fairfax’s prospects have never looked better. What are external groups saying? AM Best, the credit ratings agency who specializes in insurance companies, just upgraded Fairfax’s ratings (including those of its two largest subs - Odyssey and Allied) because of its much improved financial profile. Most sell-side analysts have been warming to Fairfax over the past year, repeatedly increasing their estimates and target prices. Most have Fairfax as ‘outperform’ and a few have it as a ‘top pick’. Conclusion What did we learn about Fairfax? The stock price is unambiguously cheap in absolute terms and when compared to peers. The quality of the earnings are high and durable. The management team is best-in-class. Future prospects have never been better. Ratings agencies are drinking the Kool-Aid, with upgrades. Sell side analysts are drinking the Kool-Aid, with upgrades. The cheap stock price stands out like a sore thumb. How do we explain it? The answer is simple: Mr. Market is wrong. Now I know, according to EMT, this is not supposed to happen. What we have today is a real life example of where the efficient market hypothesis is bullshit. At least in the short run. We have situation where Mr. Market is grossly mis-pricing a stock. Now I do think the EMT is generally accurate over the medium to long term… the mis-pricing usually does not last for long. The disconnect with Mr. Market is fundamentals. The fundamentals have been improving at Fairfax for the past couple of years but are just now showing up in earnings. It’s like Mr. Market has been standing on the beach the last couple of years wondering why the water is running out to sea. The answer is we have a tsunami of earnings coming from Fairfax in the coming quarters and years. Mr. Market will figure it out. But in usual fashion, only when the wall of water comes crashing in (wiping out all the wrong-headed thinking on the company in the process). "What a shocker!" everyone will say. "Who could have known?" A similar thing happened to Fairfax in the 2006-2009 period. The coming spike in earnings is not a surprise to those who follow the company closely. So we are in this surreal environment where the future is kind of knowable (a spike in earnings leading to a spike in the share price). What to do? Trust the analysis (be right). Get the correct position size. Have patience (sit tight). ————— “And right here let me say one thing: after spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets . I’ve known many men who were right at exactly the right time, and began buying and selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine - that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.” Reminiscences of a Stock Operator1 point

-

The way that most CCP members will use this kind of articles is different than the way you used it, though. one way they use it is like the following: if a party member is going to propose a policy change, they will check through this article to see whether they can find "support" to claim that their policy change proposal is to bring about the "intended results" based on XJP's thought. At the same time, they will check whether their proposal can be viewed as against XJP’s thought by others (including their political competitors/ enemies.) For example, if one is going to propose to abolish the Hu-Kuo system, he/she will check against this article to see whether he/she can gain support or can get in trouble or not. Another way is to compare the article against earlier articles to check the difference to see whether there is any indications about the change of the “direction.”1 point

-

Peter Zeihan Uber bearish on China as usual Demographics, poor geostrategic location , Leadership with personality cult etc. I don’t think he quite gets the advantage China has in manufacturing stuff. Mexicos population is not too skilled to take on Chinese manufacturing . They may have different skilled but what China is doing manufacturing electronics like Apples iPhone and many other things is very very complex. It’s not just many workers, these workers are very very skilled at what they are doing and it’s hard to automize (fine motor skills, complexity , tight tolerances. You just can’t hire the same sort of workers anywhere but perhaps in Vietnam or Indonesia (which has Chinese population as well). Anyways, worth listening to, but you need to take some of Zeihans statements with a grain of salt. I do think he gets the broad picture right , after all he is a big picture guy.1 point

-

1 point

-

1 point

-

There must be a correlation between number of podcast Markel folks do every three months and Markel’s premium to book. Wait till Prem gets on that bandwagon1 point

-

The recession forecasting and stock market timing stuff is a grand illusion because on paper it’s so simple. Everything is with the benefit of hindsite. If you just followed a, b, c indicators and bought here and sold at this point on the chart, and then bought back here…voila! On top of this, well, short term, stocks will either go up or down, 50/50 right? Every time this has happened, that has happened…until it doesn’t. Then we debate of this time is different. There’s literally an academic playbook for everything. Except what makes the markets so awesome is they are adaptive and evolving and almost always 5 steps ahead of everyone. When you look at folks who make claims of forecasting success, the most successful ones are very often the ones who aren’t actually doing the buying and selling. Well, correction, they’re doing the selling but it’s in the form of newsletters and advice which to anyone who’s ever laced em up and stepped on the court knows…ain’t even close to the same thing. The majority of the business on WS is….selling! Selling investors everything they need to get rich. Selling companies everything they need to grow forever. Selling those in the middle whatever they need to get to where they need to get. But the great illusion is just that…the game is simple. Build your shit. Buy quality. Be disciplined. Do what’s unconventional. Bet on yourself. That’s it. You don’t even need to “beat the index”…just don’t do stupid shit!1 point

-

1 point

-

50% BRK 30% Privately Held 12% BABA 3% iBonds 3% S&P500 1% SAVE (formerly ATCO) 1% Cash "Private" is the S-corp I work for. No debt, 9% FCF, essentially all of which is paid out as a divi, growing since I started 22 years ago at 10% CAGR. Market downturns bring me joy -- BRK's brains and cash do all the work. I'd love to find a smaller company that give me the same joy. I'm not interested in buying any individual stock that BRK could conceivably buy... rather just put that money into BRK and let them figure it out. I should roll SAVE into BRK. I'm open to a BABA alternative. Ideally something with good FCF, that BRK would never buy, that will profit if US grows dumber than the rest of the world over the next 20 years.1 point

-

Analysts starting to get it...the final paragraph looks like all they did was read Viking's posts. -Crip1 point

-

1 point

-

The Ivys are special. But they’ve all been selling expertise that works great in theory and then fails in the real world for decades because folks buy it. I’ve never seen someone consistently forecast anything for something as useless and ambiguous as a 500 company collection of stocks repping “the market”. It’s like folks who buy lottery tickets. “You ever win those scratch offs?” Lol I mean not to pick on Kyle Bass but he got popular in June and July and came nowhere close to being right about his forecasts; has done dismally with anything publicly traceable all decade, and nevertheless marches on unabated and unashamed still touting the same crap. In fact, Cathy Wood in 2018 or whatever was more correct/precise with her Tesla price target(hitting it like 3-4 different times although continuing to up it the whole way)…that should say something to folks about the stupidity of the guessing game. Bizarrely, the only guy I’ve seen who changed his stripes recently was Prem Watsa. Finally just shut his mouth and stopped pretending to be a macro expert, sure he covered his shorts at the top, but otherwise just basically packed it in and decided to invest in his circle of competency and the results the last few years have been very good. So IDK, I’m just perplexed when I see folks continuously trying to play this game. You don’t beat the house. Definitely not over the long run, if you’re playing their games. Successful investing isn’t “guess” the collection of 500 stock weighted average earnings, “guess” the multiple, wait aimlessly until it goes way below that, buy, then “guess” next years 500 stock weighted average earnings, “guess” next years weighted average earnings multiple, and then wait endlessly til it reaches that to sell. Like what’s even the point in trying to do that?1 point

-

Well - its official. Munger's other mystery foreign stock in DJCO's marketable securities portfolio is TenCent Holdings (0700.HK). https://i.ibb.co/svsC7CC/TenCent.jpg Bill1 point

-

Fascinating purchase by Berkshire. A couple of thoughts. 1. Is this a cheap way to ride the Apple juggernaut? 2. Is this more Munger than Buffett? Charlie being interviewed tomorrow on CNBC - coincidence? 3. TSMC were down another 10% from the end of Q3 so perhaps this position is closer to $5-6bn (taken into account the bounce and Buffett pop). 4. Would the recent discussions of 3nm manufacture in the USA figure at all i.e. more USA exposure less China risk.1 point

-

It always surprises me that when Buffett and Munger say that cryptocurrencies are worthless, there are thousands of intelligent people arguing otherwise. Buffett and Munger have a very, very high success rate with these predictions. The counter argument is always that Buffett doesn't understand crypto. That's like saying Einstein doesn't understand the relativitaets theory. An asset is worth the discounted cash flows. Since crypto doesn't produce anything, they are worthless.... Crypto people always come up with elegant theories, but investing is simple. The elegant theories are probably made from the people who are selling or profiting from high crypto prices or are technology people, which like the technology aspects of crypto. Investing is simple, but not easy.1 point

-

I agree with much of the above - family & travel. I do think, however, once the kids are grown up and you've made enough money, then you need to prepare for the 2nd half of your life. And that should be better than the first half. It will require staying strong and staying healthy. In that pursuit, I spent lots of time doing stuff like cardio & CrossFit. Hands down however - the best thing I discovered is weight training via a program called "Starting Strength". The motto might be - If you want to stay out of the nursing home - stay strong. Today at 68 years old - I'm stronger than I've ever been in my life. And I feel 25 years younger. Some of you might want to check it out: Starting Strength I'll plug it by saying - it can change your life. 3X a week @ 90 minutes per workout will do it. Here's a couple of videos.1 point

-

Einhorn Says "Value Investing May Never Come Back!" https://finance.yahoo.com/news/david-einhorn-says-value-investing-192102025.html Usually comes back when a numbnutz says something stupid like that! Cheers!1 point

-

+1! Why can't you be articulate like this without the politics and cursing. Cheers!1 point

-

They are simply offering a price they are willing to pay to acquire the outstanding shares. I’m sure most of us have placed a low ball bid on the shares of a company we like at some point. Based on their condition, it’s up to the majority of the minority to ultimately make the decision, not Fairfax nor the Consortium. That’s what makes it fair. The sellers decide if they like the price. If you don't like the price, just vote no with your shares.1 point

.thumb.png.e9643dd797bb6bfa93083ce1311ba74d.png)