Leaderboard

Popular Content

Showing content with the highest reputation since 03/13/2024 in all areas

-

2 points

-

I'm not so hot on EPIC Systems overall. Having watched its adoption and implementation at a large hospital system, it's terrible software that requires huge amounts of in-house effort to keep maintained. The only thing is that between EPIC and Cerner neither is very good. I fully expect AI and software innovation to come for EHR, ERP, and business process software developers. What appear to be moats now because of complexity will be worn away by AI/software development streamlining the innovation of these complex systems.1 point

-

The position of Ukraine and Zelensky is completely logical and rational. Trump fully follows Putin’s line: Ukraine must cede the Russian-speaking territories and become fully neutral. This means no EU or NATO membership and demilitarization (a military limited to a maximum of 85,000 troops, missiles with a maximum range of 40 km, etc.). So, if no security guarantees are attached to this, Ukraine would be completely defenseless in the future, entirely at the mercy of Russia’s goodwill. Trump wants a quick peace, he wants Ukraine’s minerals, but he refuses to provide any security guarantees to Ukraine. During the argument in the White House, this was clearly the key issue. If you listen carefully, you’ll hear that Zelensky is demanding nothing but security guarantees—something Trump and Vance are unwilling to grant him. If Zelensky were to accept the deal Trump is putting on the table, he would be utterly naive. Who would willingly give up all their leverage without any guarantees? For Ukraine, this would be nothing less than total and unconditional surrender. Given the situation on the battlefield and Ukraine’s position in Europe, it seems that Zelensky and Ukraine still have other options besides complete and unconditional capitulation... so his response is not driven by a lust for war or territorial demands, but is his only option at the moment... I really don't envy that man's position !1 point

-

I assume the dividend is so Prem and the employees can afford to do some good works with their wealth while they are still alive! Also, it’s probably better for people to not get used to selling if they are going to enjoy the whole ride.1 point

-

@Buffett_Groupie, I just wanted to say… I really appreciated you asking the question you did at the AGM last April. That took a lot of guts. And you handled it with class. Fairfax needs to hear from shareholders like you - so they don’t get complacent. Especially now that they are on a hot streak. I look forward to chatting with you again at this year’s AGM!1 point

-

1 point

-

Actually, I'll add some merchandise (baseball cap and shirts) with the logo and name in the shop section, and the web address on the back. If you want to buy it and wear it to the AGM, go ahead. Maybe we'll be like the Yellow BRK'ers at the Berkshire AGM with the big yellow cowboy hat! It will also let you connect with other COBF'ers at the AGM or elsewhere. Cheers!1 point

-

First bought FFH at $498/share in 1998 when you sold yours as I must have bought yours and the rest is in the clip, enjoy 2024-04-11 Fairfax AGM Q&A.mp41 point

-

I first bought FFH in 1993-94 at about $40 and sold at about $400 around 1998. Got back in around 2002 at about $165 and still own most of those shares.1 point

-

mananainvesting https://www.choufunds.com/pdf/Letters of the Manager Since 1998.pdf I read these at least once a year. I always find something new. Another source that might interest you is an interview he did in Robin Speziale's book, (this link isn't the really good stuff). https://robinrspeziale.com/2017/03/02/my-interview-with-francis-chou/1 point

-

This is going to sound horrible, but I think the California fire situation is about to drive premiums, including reinsurance up quite a bit. The property loss must be immense, and even if insurance losses are not that big, it might still enforce underwriting discipline.1 point

-

1 point

-

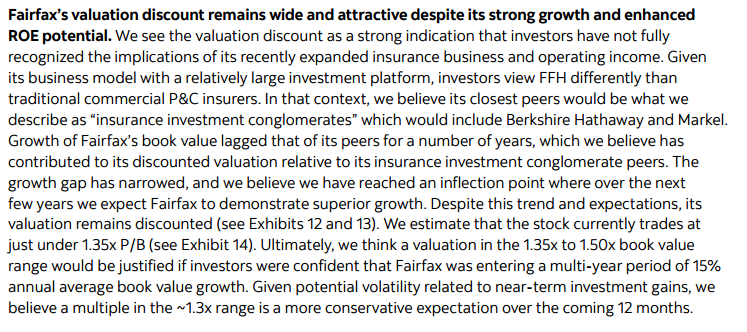

@mananainvesting , that is a great question. I will admit that ‘multiple’ is the most difficult part of the valuation process for me. Back in 2021 and probably 2022, I probably would have said i would be happy with a P/BV multiple of 1.3 x. But that would have been largely built off of Fairfax version 2010-2020. Much has changed regarding Fairfax over the past 4 years. As a result, my view today is a P/BV multiple of 1.3 x is too low. What is an appropriate valuation/multiple today? My short answer is higher than where we are at today. How high? I’m not sure. My guess is I will know it when we get there (ora least get closer to ‘it’).1 point

-

Annoucement, if there is one, will be on Dec 6 at around 5pm. Dec 20 is also options and futures expiry so volume is normally quite high. They pick the third Friday of the month for a reason.1 point

-

Well, at least this is good news for Recipe and their +1,000 restaurants in Canada. Does Prem have Trudeau’s ear? “The government is proposing that the GST/HST be fully and temporarily relieved on holiday essentials, like groceries, restaurant meals, drinks, snacks, children’s clothing, and gifts, from December 14, 2024, to February 15, 2025.” The GST on restaurant meals in Canada is 5%. More for provinces with the HST (harmonized federal and provincial taxes). So this is a meaningful reduction. - https://www.canada.ca/en/department-finance/news/2024/11/more-money-in-your-pocket-a-tax-break-for-all-canadians.html# The current federal Liberal government has to be the worst federal government in Canadian history - at least in my lifetime. And we have had some bad ones. The current $250 cheque per adult + 2 month tax break (on a few things) is just the latest in their bat shit crazy management of the Canadian economy, especially over the past 6 or 7 years. I have tried to keep away from politics - but this Liberal government just keeps setting new lows. I am completely dumbfounded by what they say and do. Fortunately, Canada is less than 12 months away from a federal election - my only hope is that Trudeau stays on as leader of the Liberals. PS: My family will now be getting cheques for 5 x $250 = $1,250. Money we do not need. I suppose i should be celebrating…1 point

-

All depends on temperament, time of life, desired return, etc. I don't know how old Modiva is, but when I was much younger, I would easily swing for the fences like that, because I didn't have as much money or had time to recover from such risk. But today at 55, comfortable and enjoying life, like you, I don't need to swing for the fences any more and I sleep really well. Although, I'm pretty sure if I see something just stupidly priced, like Fairfax or Meta was in the last few years, I will take huge positions again. And just like this time, I will reduce the positions as they rebound and maintain allocations that I'm comfortable with. I just live by my mantra for the last 10 years...never fall in love with any stock or investment. The goal is the best return you can generate while minimizing permanent loss risk to the portfolio. The portfolio is what you should love...not the components of the portfolio! Cheers!1 point

-

@nwoodman, thanks for the update and attaching the files. They were very helpful. The Eurobank story just keep getting better and better - the management team at this bank is exceptional. ROTE of +15% looks likely for the foreseeable future (management guide and they are conservative). It will be very interesting to see if they bump capital return to 50% and what the allocation is to buybacks. My guess is if they can buy back stock below (or close to) tangible book value they are going to buy as many shares as they can get (and rightly so). And their profit growth profile is so strong any shares they take out moving forward will look like a steal in another couple of years. Eurobank has so many irons in the fire… Eurobank is Fairfax’s largest equity holding. It is poised to grow and deliver exceptional returns in the coming years. Poseidon also looks like it should grow earnings nicely moving forward. The FFH-TRS should continue to increase in value. If we ever see that Anchorage IPO, Fairfax India should see a nice pop in value. Fairfax’s largest equity holdings look very well positioned. This suggests a 15% return on the equity portfolio is not only possible but perhaps likely. PS: The fixed income portfolio currently has an average yield of 4.7%… The investment portfolio looks very well positioned.1 point

-

The stock trades very stupidly. Sells off good on earnings and then takes time to recover in time for next earnings. For the past few months, I've been selling puts and buying calls monthly. I also have a core position here too and don't mind if I get shares put on me.1 point

-

I agree with you that most investors don’t spend the time to understand how the value is being built but that has nothing to do with if FFH will ever fully reflect its intrinsic value. Multiple expansion takes aggressive buyers and reluctant sellers. The buying is coming from the 60 index add and all of the Canadian active funds that are underweight which is value insensitive . Meanwhile, share buybacks and the TRS have cleaned up 7m shares since 2019 from the weakest (read value investor) hands. For those remaining, 2024 will be the fourth year with ROE north of 15%. I think anyone who has a rudimentary understanding of the business model can predict the next 4 years will also be north of 15% on average. If I’m right, the shareholders left will be reluctant sellers by the end of 8 years and the multiple could challenge something like Intact Financial at 3x BV despite recent poor returns. That’s why my plan to sell is based on forward returns and not valuation. Call me a reluctant seller.1 point

-

I’m not a REIT expert. Occasionally things go up in value despite higher rates, but it is rare. I didn’t check your math, but it might be worth checking if management has incentive plans and what the targets are. It’s possible to boost the values a little bit here, a little there and a little over yonder and pretty soon the portfolio is worth a lot and maybe Wall Street will agree, the stock goes up and top management gets their payout. After all, who is to say a building is worth exactly “x” vs “x” plus or minus 10%? Especially over a 6-24 month period. There is also incentive misalignment with the appraisers. If they want to get hired for the next job, it is in their best interest to get close to management’s expectations lest they shop for a different appraiser. The same thing happened at the rating agencies during the GFC.1 point

-

I don't know if Ben is capable of doing 22% annualized returns long-term...that's Buffett territory. But I'm pretty sure he's capable of doing 13-15% annualized...and that's all investor's and Fairfax need. Only time will tell. Cheers!1 point

-

For me, one very interesting comment was that even if CAT 4 hit Tampa directly, Fairfax would still have an underwriting profit for the year. Another was that interest and dividend income are running at $2.5bn per annum, vs $2.2bn previously stated.1 point

-

Post Q324 there is nothing to stop index arbs from running up FFH shares into the likely 60 add in December. Book value is growing 3-5% per quarter which makes it easy to own. The wild card is where investors let go of their shares. Based on the discussions on this board maybe we won’t see much multiple expansion but there is only one way to find out. I’ll be holding on to my shares regardless of multiple as long as BV keeps growing 10%+/yr.1 point

-

"2024 third quarter results, which will be announced after the close of markets on Thursday, October 31" https://www.fairfax.ca/press-releases/fairfax-announces-conference-call-2/1 point

-

I think we can make some pretty good guesses on underwriting income, investment income and profit from some of the big holdings like Eurobank, Poseidon and the TRS for the next three years assuming no multiple expansion. Multiple expansion will only help the TRS. It also helps the company is buying back stock at these levels providing a floor for the multiple and that the 60 add is in front of us. If the multiple does expand, the excess capital will go from buying back stock to buying back the minority interests in the insurance subsidiaries. That could add another ~$25/sh in earnings. If there is a market correction or a widening of credit spreads that would also returns as capital could be allocated from treasuries to higher returning investments. Digit could also be sold down and reallocated to higher yielding investments (not necessarily higher returning). There is a lot of right tail optionality in the portfolio although we don’t know which levers they will pull and when.1 point

-

That's one worry I've had due to the K1 but hopefully its a good problem to have down the line. I'm semi expecting to pay taxes in my non-taxable accounts.1 point

-

I just don’t see the attraction of a business that has been flat more than a decade. Looking up older annual reports, they made $72M in net earnings in 2005 and they only really beat this earnings number in 2022 with revenue more than double the 2005 #. And now, to break out of this runt, they have done a merger that years 4 years to work out: In any case, trucking cos tend to have strong earnings about a year after a recession and then the profits seem to fade. Thats not much of a runway.1 point

-

https://25iq.com/2015/10/24/a-dozen-things-ive-learned-from-charlie-munger-about-ethics/ “Once you start doing something bad, then it’s easy to take the next step – and in the end, you’re a moral sewer.” After chewing on it for a bit, the right thing to do is to disclose no matter what amount. In law, they(judges?) purposely go out of their way to avoid even the appearance of bias (at least they're suppose to). The difference between $1 and $1m can be explained away like a slow boiling frog, so if it might appear wrong, why do it? If it's really an exception, disclose it at the minimum to the board, and let the board decide if it's really worthy of an exception. Just merely putting up some roadblock (disclosure) to avoid such behaviour is a win in my book. A small price to pay.1 point

-

Sounds like a clear ethics violation. Most public companies have an anonymous number for that. As a regular employee, you can and generally will fired for much less than that. As for disclosure, I think the answer is <$10k or <$100k. Below that, it’s a matter of corporate policies which should apply to everyone, including CEO‘s.1 point

-

D, would even push for lower - My first job out of college was working as an accounts payable accountant. The amount of grift the CEO did by employing his wife to do tasks such as decorating the office, catering for events, the company even paid her commission for art work, and she paid herself a very handsome hourly rate for her services. Even had her own LLC to keep things appearing on the up and up. My bosses were all powerless to do anything about it. Just run of the mill petty corporate theft. I did manage to get the CFO to draw the line on her accompanying the CEO on his business trips to Europe. He was even wanting us to pay for a couples weekend in Venice that had nothing to do with any company business or was anywhere close to where the business meetings were taking place. And we also managed to ding him for trying to have the company pay for her round trip business class ticket as well. Plus the corporate policy was he, himself, was only allowed to take Premium economy given the length of flight. Needless to say I wasn't very popular with him after that.1 point

-

@Viking What would be the lowest price you would sell your $FRFHF shares today? (Which should closely reflect what its worth according to you). I would probably sell my shares at $2000 USD, as I think there is a high chance Fairfax will earn 15% ROE over the foreseeable future and selling any lower is not worth the hassle of redeploying money in other ideas.1 point

-

+1. I never understood the concept of "positioning". Why buy any position unless you know it as well as possible and have enough confidence to own it large? Imagine if a small business owner "positioned" his/her interest. Or a real estate owner. The objective is for it to grow. Generally diversification equates to mediocrity. Rather than diversifying, maintain sufficient cash or liquidity to ride out down cycles and also so you can take advantage of them. I fully realize that this is not the prevailing view (and would get me fired from most financial advisor jobs) but there are reasons why some folks achieve massive financial success and diversification is not one of them.1 point

-

But also, if you invest i think 1m then your annual fee drops to 0.5% and higher it drops to 0. But still, id hate to pay 20% of my gains above 6% to some guy who does 0 trades for 8 years drinking coffee at home and reading books Consider this: You give Guy Spier 800k of your money. He takes 1.5% annually of that->12k a year, for investing close to half of his fund into Berkshire, Exor, Prosus and Nestle. So i pay him 500 bucks a month just to hold these stocks HA! And mastercard, bank of america? Are these hard to understand mega cap stocks you need to have 5 years of training to understand when to buy and when to sell? I am envious, he makes bank for doing quite literally nothing Thats why i think Nick Sleep was the best fund manager ever. He told you the truth: Get out of this fund and just buy Berkshire, Amazon and Costco and do nothing. Thats transparent, thats honest and thats of high moral character. And also @John Hjorth, if you want to invest with Semper or Guy you need to prove yourself to be of the right "character" for the fund, they ask you if you panic liquidate etc so you HAVE to have background knowledge in investing in order to get in at the first place.1 point

-

Point is, it is morally of lower character to charge money for investing other peoples money while then outsourcing that capital to someone else who invests the money for you. While that's not exactly what guy spier and Semper are doing, they are still half way with the foot in the water. IF you are smart enough to give someone like guy spier your money, shouldn't you be smart enough to just copy him/invest your money into BRK etc? Thats where I wonder, who are their investors? If you are smart enough to not invest in your expensive local bank fund and find intelligent guys like the ones I mentioned, why wouldn't you just skip the middleman? Guy doesn't do any trading, you can find all of his positions online. You can simply copy it and be done. Yes in a crash maybe he does a few things but id say with his style of investing the best really is to do nothing. A mystery!1 point

-

Yeah there is! I would say that thread and then listening to the management team and reading their annuals. The management team is very aligned and allocates capital with opportunity cost in mind. It was refreshing to listen to them. Other than that growing revenue above 15 percent a year, trading less than 15 2023 net operating numbers. Maybe even less than 10 now. Lots of assets that are worth more than accounted for. Trying to close the nav, but not in a rash way. Honestly though none of the above would make me want to buy it though if it wasn’t for how the management team sounds.1 point

-

1 point

-

Perhaps I am getting a little bit to excited / to early excited (maybe because also of this general market volatility), but I sold some extra shares I bought during MW attack, earlier, mainly only because of the position size (which still remains and will continue to be very large in any case) and now already thinking about buying them back. But perhaps I also should wait for some weather event to do this. Most likelly this is just a silly, immaterial and unnecessary trading, because of some more free time in a summer:)1 point

-

1 point

-

Well, are you then going to give credit to Paul for the move to put Andy Barnard as President of all of the insurance businesses? What about the credit default swap investments? How about bringing in Wade Burton? It's easy to discount what happened during Paul's watch because things are going so well now. Fairfax is a team...no egos...no individuals! The team has done better. Cheers!1 point

-

I very much disagree with your opinion towards climate change. Average global temperatures have increased at an unprecedented rate starting about 200 years ago or so. This directly correlates with humanity’s large usage of fossil fuels for energy. I’m not a fanatic who stands in front of cars and demands for oil executives to be hung, I think fossil fuels have done an unbelievably great service for humans. However, I do think people need to consider how we are going to transition from our current energy situation. The future of the world depends on it.1 point

-

In May they sold 45M shares in one week, which was about 25% of the total volume. It might have been less, the announcement of the ATM offering and announcement it was concluded were one week apart so I'm assuming it took the whole week. But they could have sold it more quickly and been a higher percentage. On Friday GME traded 182M shares, so 75M would have been around 40% of the volume. They did not announce conclusion of the sale on Saturday, so it seems likely they still have shares left to sell. But at 25% of the volume they should be done today. My guess is they had very few shares left before today because when they sold 25% of the volume that week in May the stock price only dropped from $23 to $19, while the stock price was utterly crushed on Friday, which implies they sold higher than 25% of the shares traded. What should be scary to DFV is that the 45M share sale netted $21/share, so clearly management is happy to sell shares above $20, and nothing stops them from doing additional ATMs if the price increases again. He paid over $5/share for put options for 12M shares with a June 21 expiration, so it looks very likely he's going to take a big loss and is at significant risk of having them expire worthless for a $65M loss. Establishing a huge option position that was barely in the money and expires in 3 weeks to bet on a short squeeze in a company that just demonstrated that they are now ready to drop ATM offerings at a days notice seems like one of the dumbest trades in world history. But I still have to wade through numerous tweets on my timeline proclaiming Keith Gill is really an incredible actor who faked everyone out playing an idiot on livestream while he's actually playing Putin level 5D chess.1 point

-

Regardless of size of the positions or whatever profits might be realized, what puzzles (concerns) me is the lack of clarity about the investment philosophy/approach for Todd and Ted. Warren (and Charlie) over the years has talked (and written) many times about his view of stock purchases of companies such as American Express, Coca Cola, or Apple as partial ownership of companies. I realize it's unrealistic that every equity purchase initiated by Warren over the years squarely fell into this category. And not all of them worked out (e.g. airlines -- at least twice). But that's true for some of the wholly owned companies as well. But at least I understood what their "ideal" situation is and can understand and articulate their core philosophy and approach. I cannot do this for Todd and Tedd. For exaample, I've never understood purchases such as SNOW or PAYTM. Both felt so far outside of what Warren & Charlie would do or have explained to us as partial owners in the company with them. I've been wondering about drift for several years now. I am more than a bit wary of the idea of the two of them taking over investment decisions for Warren someday. I was relieved to hear earlier this month of Warren's confidence in Greg's ability to make capital allocation decisions. The way I heard Greg talk about capital allocation sounded just like Warren and Charlie. I left Omaha feeling better about Greg's role in the company.1 point

-

There was no explicit mention of IDBI but it was alluded to that the decision would be post India election (early June). Generally I got the sense that activity will pick up across the board in India once the election is over. Also, I was the “someone else” who had the opportunity to sit on the panel with Viking at the dinner. I hope I made sense even if I wasn’t memorable!1 point

-

Who in their right mind doesn't see that 100 today is not 100 in 50 years. The 100 year Austrian bond was the height of lunacy as if Austria will be a Sovern nation in 100 years anyway? People who lend, banks ect are playing a different game with different ideas. Buffett buys treasuries to earn a bit while waiting for something real to come by like a railroad. He doesn't do it to make 1-5% Lending money long term is tough to understand unless the rates far exceed the level of inflation. In the 70's a big mac was less than 50 cents, today its 10x that or more. Our paper/ digit money looses value every day and has for a long time. Gold was 154 in 1974 today its 2400. Gold is money, paper or digits is just for transactions. Does it matter what the transaction number is? 10-100-1000 its just a digit. Will my house cost 18 million Canadian in 50 years, maybe maybe not who cares as long as its roughly the same value as today. I bet it will, gas will be 12 bucks a L, gold 25k OZ. all just a number. What we should care about is life expectancy, number of people starving, happiness, wars, have the leaf's won the cup ect1 point

-

1 point

-

1 point

-

1 point

-

I watched Dune 2 again. This time on IMAX. The theatre was packed. And i am sure they are mostly second or third viewings. speaking of which, this is funny.1 point

-

Don't agree with the view that 3-4% inflation as some kind of new normal is a nothing burger......if it's the new normal going forward you should probably get short the trillions of assets that are pricing in a return to sustainable low 2's inflation......if the Fed throws in the towel and just implicitly or explicitly says hey 3.x% is a pretty good inflation number if we can keep unemployment below 5%....you've got a tonne stuff out there which has to incorporate that inflation drag on the future returns demanded. One thing I do agree with @Gregmal on.....is that Powell has somewhat shown his cards.......he was pretending to be Volker....but he's really Alan Greenspan....cause with relatively limited forward visibility on his actual 2% target being achieved......he started hitching up his skirt and talking about rate cuts....and so he's going to use his dual employment mandate as a reason, at any sign of trouble, to start cutting I think.......and he might get away with it...in some respects the dual mandate has codified the Fed put...the progress on inflation has been impressive without a weakening in economic fundamentals to achieve it.........I fundamentally misjudged productivity....both underlying innovation productivity and the secret productivity gains that came post COVID from illegal & legal immigration ramping up again which have been the hidden secret of the domestic deflationary wins we've had....that and China's economic woes exporting large disinflationary forces to the rest of the world but the USA most strongly helping on the import side. Not sure if its enough to get us to two.....but getting to mid-3's with this little economic should be something to be thankful for. It's kind of upside down world.....turn on the TV.......and its the crisis at the southern border....Crisis? You mean the one that keeps sending industrious young people North who want to have families and are lining up to work on construction sites, clean drains, bus tables and generally work like three jobs in an economy/country thats sparsely populated, resource rich and fundamentally short labor while the rest of the world is facing demographic collapse & a kind of endemic laziness & lack of industriousness.....or maybe its Cold War 2.0 'crisis' with our enemy China?......the enemy that is exporting a tonne of goods disinflation to us now and accepting printed dollars in exchange for those very real goods they send....all from a sovereign fiscal authority that is printing 7% annual budget deficits in economic good times with a debt to gdp of 120%.....I mean lots of countries would love to a couple of crisis like that going on simultaneously.1 point

-

I actually think, although haven’t thought too heavily, about how decent a hedge trade it would be to go long an obnoxious amount of like 20 year treasuries on margin. Right so buying puts is generally a sophisticated white collar guys way of throwing money in the garbage. Shorting as well is largely a fools game. But if I can borrow/margin at 6-7%, while getting paid 4.5%, what’s my upside and what’s my downside? The never relenting “inflation fanatics” who have seen inflation everywhere for much of the last decade or so still see it, and after nearly two years of monthly declines in the data we get an expected hiccup or two…no it doesn’t mean we re heading back to 5-10%…but it’s given us a neat setup as a few of the fringe participants start leaning on the very short term data because gee, if we can’t trade or gamble on every daily or weekly theme…whats the point? So really, if I go long a monstrous amount of the 20 year treasury, maybe I assume 10-15% upside risk if we run back to last years highs which were basically just a well timed Ackman pump? Plus the margin rate minus the interest so call it another 3? But if shit hits the skids….Fed drooling to cut. Could we hit 30-50% upside? Definitely think so. So a heads I’m hedging and not losing much and my longs soar on more good data, tails I have a hero trade on my hands at de minimus cost….1 point

.thumb.png.e9643dd797bb6bfa93083ce1311ba74d.png)