Viking

Member-

Posts

4,614 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Canfor (CFP.TO) at C$14.35. Time to scratch my (monthly?) lumber itch. Market cap is $1.7 billion. Net debt is a positive $300 million (net cash position). So enterprise value is about $1.4 billion. They also have +$900 million of duties on deposit. This is worth something. The stock is selling off aggressively because interest/mortgage rates have moved higher.

-

@MMM20 It is interesting how everyone views Fairfax’s equity portfolio. Mostly, people seem to view it through the prism of their own investing framework. The reason i like their current equity portfolio so much is more because of a relative perspective: 7 years ago it was stuffed full of underperforming holdings; or holdings with a poor outlook. That is no longer the case (or much less the case). As a result, i expect it to perform much better compared to the portfolio that existed 7 years ago.

-

@Dinar If Fairfax has performed so poorly on the investment side, how did they compound book value at 18.4% over 38 years? Insurance/underwriting?

-

@MungerWunger given my visibility on this board and Twitter when it comes to Fairfax, i am hesitant to post on position size. For a whole bunch of reasons. But let me try and answer in a different way. My goal is to get my Fairfax weighting down to 33% of my total portfolio - it is higher than that today. Context is important when discussing weightings. Today, i own no real estate. I do not have a day job. All i have are financial assets. So having even 33% in one stock is probably a dumb idea. Most of my financial assets are held in tax free accounts - so i can move in and out of positions easily with no tax consequences. I also sometimes flex my stock positions up and down to take advantage of volatility. As an example, i doubled my small Canfor position today when the stock fell to C$14.55. I was adding to my Telus and BCE positions 2 weeks ago when they sold off. When these stocks move higher i will likely sell some and reduce my position size. So my position weightings will bounce around depending on volatility. Why 33% for Fairfax? That feels like a reasonable position size given its prospects today (which i like a lot). But i remain open minded. Importantly, I might change my mind tomorrow. If Fairfax starts to allocate capital in a way that i do not like i might shrink my allocation. Or when i get to 33% i might decide that my weighting is still too high (i use my gut to help me with position size - so i won’t know until i get there). Or i might decide my weighting is too low. Perhaps something else happens (my health? … knock on wood) that causes me to want to reduce my position size. Perhaps another investment i understand really well gets even cheaper than Fairfax and i decide to shift some funds. One more example: In Q1 2020 when Covid was coming (and before equity markets crashed), i moved 100% of my portfolio to cash. Bottom line: lots of variables are at play that determine position size for me - for all my holdings. The important thing is people need to do find an investment strategy that fits their personal situation and how they are wired. Position size of any one holding is part of this. And concentration is usually a terrible idea for most investors. ————— Broad based index funds are now 30% of my portfolio (XIC, VO and VOO - 1/3 in each). I am really enjoying this 2H 2023 decision. My goal is to get my index fund weightings to over 50% over the next year or two. I want to get a big chunk of my portfolio into ‘set and forget’ mode. As i get older i am shifting from ‘build wealth’ to ‘preserve wealth’. Index funds today seem like a good option. Getting started with index funds also seems to make sense from an estate planning perspective (my spouse is not a financial person). And i have suggested to my kids that they invest exclusively through index funds (when i am not around to help them out).

-

@petec perhaps were you and i differ: i agree with you that rising interest rates was a big opportunity for Fairfax. But opportunity means nothing without proper execution. And the execution at Fairfax has been excellent. And as a result we now have $2 billion a year of interest income. I think it is incredibly difficult to do what Fairfax did with their fixed income portfolio over the past 3 years. 1.) they took the average duration down to 1.2 years in Q4 2021. Sold a bunch of corporate bonds at a yield of 1%. 2.) they were then super disciplined as interest rates started to rise - they waited all through 2022. It wasn’t until Q1 2023 that they started to meaningfully extended the average duration (to 2.5 years). And having the discipline to wait until Q4 to get really aggressive extending duration (to 3 years) was, in hindsight, sheer brilliance. I remember when everyone thought the 10 year US Treasury yield would peak at 3%. The fact the fixed income team did not meaningfully extend duration earlier and at much lower yields is amazing.

-

What do people on the board feel are the biggest risks when investing in Fairfax today? Let’s spend some time discussing/debating these as a group - it is important that we live in the real world. So please post your thoughts. When I was at Fairfax’s AGM a number of people I talked to identified interest rates/lower bond yields as a big risk. So let’s start here. Fairfax risk: “What if interest rates/bond yields are much lower in 4 or 5 years time. Causing interest income to fall precipitously?” Interest rates/lower bond yields were a watch out for me at Fairfax when the average duration of the fixed income portfolio was 1.6 years at the end of 2022. But in Q1 2023 we learned Fairfax had pushed this out to 2.5 years. And in Q4 2023 we learned Fairfax had pushed it out again, this time to about 3 years. Fairfax has locked in interest income of about $2 billion for each of the next 3 to 4 years. Significantly extending duration is a big deal. So ‘much lower’ interest rates/bond yields, if that happens, is really a potential problem looking out 4 or 5 years. Predicting macro Trying to predict macro looking out 1 year is pretty tough… buy trying to predict macro looking out 4 or 5 years? Good luck with that. I think we will see persistently higher inflation in the coming years. Perhaps an average of around 3% to 3.5% per year. As a result, i think Fairfax will be given lots of opportunities in the coming years to keep the average duration of their fixed income portfolio at around 3 years if that is what they want to do. Just like what we are seeing today (mid-April), where bond yields have spiked and Fairfax is being given a nice opportunity to extend duration if they want. Alignment When investing in Fairfax over the last 2 decades, i find it is helpful to be aligned with the positioning of their investment portfolio (it allows that ‘sleep well at night’ thing). From around 2011 to 2018 i did not like how Fairfax was positioned with their investment portfolio so i did not own the stock. Today? I like how Fairfax is positioned with their investment portfolio; it is a good fit for me. Given i think it likely that inflation remains higher than expected in the coming years: Fixed income: I like that they have extended the average duration to 3 years. And i am comfortable they will be able to reinvest at an acceptable rate in the coming years. Equities: I like the exposure to commodities and industrials. I think paying attention to macro is useful mostly at inflection points. The rest of the time, it is probably best to just ignore it.

-

@petec I really appreciate the opportunity to discuss/debate Fairfax. One of the keys to valuing Fairfax today is your assessment of two things: 1.) How good is their insurance business? - Is it average or above average (compared to peers)? 2.) How good is their investment team at Hamblin Watsa? - Is it average or above average (compared to peers)? Here is my quick assessment: I think the insurance business is above average (compared to peers). Not best-in-class yet but definitely better than average. Importantly it appears to be improving in quality; trend is important when looking forward. I think their investment team (at Hamblin Watsa) is best-in-class (compared to peers). Especially in a high interest rate environment (versus a zero interest rate environment) with lots of volatility in financial markets. This is important because Fairfax generates about 80% of their income streams from investments and only 20% from insurance underwriting. (I think most insurers are about 55-60% from investments and 40-45% from insurance underwriting - don't quote me on this split). Fairfax is currently earnings about 7.5% on its investment portfolio and this is significantly more than P/C insurance peers. This outperformance will likely continue for the next couple of years (one reason being the average duration of the fixed income portfolio has been extended to about 3 years). There is a very good chance Fairfax's average ROE over the next three years will be 15% or higher (it could easily be in the high teens). Fairfax has been the best performing P/C insurance company over the past 5 years (in terms of BV growth). It also has the best prospects looking out three years (given its significant leverage to investments and their current positioning). And it is by far the cheapest today. It is within this context that I think Fairfax trading today at a P/BV = 1.1 is crazy cheap. Especially when compared to P/C insurance peers today. Most trade at a P/BV of 1.4 x or higher. The set-up today at Fairfax looks an awful lot like a much younger Berkshire Hathaway. In that context I think a P/BV multiple of 1.1 x is nuts.

-

@petec great comment. Lots of interesting ideas to discuss/debate. “Personal view but I think the board has a good handle on the facts, but the psychology has swung about 70% of the way from focussing on the bad to focussing on the good.” I agree that the psychology of people on the board has shifted. My view is the shift has happened because execution, fundamentals and results have been steadily improving at Fairfax. Most of the discussions on the board are focussed on what has been happening at Fairfax - the facts. Fairfax has been executing exceptionally well. The fundamentals keep getting better every year. Reported results have been excellent. As a result most of the posts in recent years have had a positive spin. Now i don’t expect this to continue forever. I do expect at some point the Disney movie called ‘Fairfax Financial’ will end - and Fairfax will become a regular boring company. And the posts on the board will reflect that reality and become a little more balanced. I am trying to find the bad. But it is really hard right now. Yes, that is a bizarre statement to make. Especially when it comes to Fairfax. But today, the important tailwinds greatly outnumber the important headwinds. Still. Importantly, i am not going to make bad stuff up. So i can tick the ‘bad stuff’ box in my analysis of the company. When you make stuff up (both good and bad) it gets into your head. And likely warps your valuation of the company - and position size. Making stuff up is dangerous - i know this from personal experience. Following Fairfax right now is like watching Michael Jordan in his prime. Now back in the day, when watching Jordan play, i could have tried to find a bunch of things that he was doing poorly. Would that have been helpful? I have two questions: 1.) If investors understand the facts so well today why does Fairfax trade at a P/BV of 1.1 x (ext. March 31 book value) and a PE of 6.7 x (est 2024 earnings)? For the past 3 years, Fairfax has been playing like Michael Jordan in his prime. But Fairfax’s stock is being valued today like they are a bench player. That makes no sense. 2.) If investors understand the facts so well why are so many people thinking/discussing selling down their position? Now i do understand that people only buy a stock for one reason - they think it’s going to go up in price. And yes, people sell a stock for a multitude of reasons: It is fully valued They find another stock they like more (offers better value) They are way overweight Tax reasons Need the cash Take profits - “That suckers gone up a lot” But i think a lot of people are thinking about selling just because the stock has gone up a lot. Their mental process has less to do with facts and more to do with fear/greed/psychology. —————- Now i do have a long list of risks for Fairfax that i am monitoring/managing. I have discussed many of these risks over the past 3 years. My biggest risk owning Fairfax today is my concentrated position. But that risk has much more to do with me than it does with Fairfax. This post is long enough already. Let’s leave the discussion of risks to another day.

-

@LC This is a great question. Your answer will depend of your assessment of three things: 1.) what Fairfax has accomplished over the past year 2.) what the company is worth today 3.) how the company should be valued. Fairfax earned $189/share in 2023. My view is intrinsic value went up by more than that. The earnings visibility of Fairfax has improved markedly (with extending the duration of the fixed income portfolio). I think the quality of the company is better today than it was a year ago - we had another 12 months to grade management. One of the reasons i go to the AGM i get the opportunity to talk to really smart investors. Most people i talked to said they felt Fairfax was probably worth about 1.5x book value. This is a higher multiple than last year. ————— “is Fairfax as easy of a “buy” today, versus 6, 12, 24 months ago?” That depends on whether or not you view Fairfax as a higher quality company today than what you thought a year ago (use whatever time-frame you want here). And whether it deserves a higher multiple than you thought a year ago. Fairfax trades today at a P/BV of about 1.1 (to my estimated March 31 BV) and a PE of 6.6 x (my estimated 2023 earnings of $160). Is it cheap? Yup.

-

@MMM20 My steroid comment was directed more at the growth that we are seeing in earnings, particularly operating income. Probably the wrong way to phrase it. In terms of fragility, i don’t think Fairfax is more susceptible today to a black swan event than they were five years ago. The hard market in insurance has likely given Fairfax (and all insurers) the opportunity to get their reserves more in order (from the soft market years pre-2019). Terms and conditions on policies have also likely improved on business written over the past 4 years. The fixed income portfolio is locked and loaded with about $2 billion in interest income coming each year over the next 4 years. That is a big, big shock absorber. Within the equity portfolio, most of the holdings have moved up the quality ladder. At the same time, mark to market holdings are now less than 50% of the holdings - this will significantly reduce volatility moving forward. Bottom line, today Fairfax’s looks much better positioned today to deal with any future adversity / black swan event than they were 5 years ago.

-

Below are some random thoughts from attending Fairfax’s Annual General Meeting in April of 2024. Fairfax organized events: Going to the Fairfax, Fairfax India and Helios/Fairfax AGM’s were good. Before the Fairfax and Fairfax India AGM’s, having an opportunity to talk to the management teams of Fairfax’s various insurance and non-insurance subsidiaries was good. But what i have learned from attending the past 2 Fairfax AGM’s is there is much more to this week than attending the Fairfax organized events. And that is the opportunity to meet and hang out with a large group of smart, nice, highly motivated and highly successful investors/people. And the group is wickedly diverse: age/life stage, geography, objective, occupation, expertise etc. The opportunity to do this is like sprinkling ‘pixie dust’ on those involved. How can you not come away from the experience a better person/investor? So i want to give a big, big thank you to all the people who organized all the various additional events (those not organized by Fairfax). I now look forward to attending those events even more than the Fairfax organized events (which i also like and get a lot of value from). Two AGM’s later, acquaintances have become friends. I also want to say ‘thank you’ to all the members of Corner of Berkshire and Fairfax. Given the increase in Fairfax’s share price over the past 4 years, and my prolific posting, i have achieved a certain level of notoriety. Lots of people have made an enormous amount of money on Fairfax. I really appreciated meeting and talking to all the people who hunted me down during the various events to introduce themselves and/or to say ‘thanks’. But i try to explain to people that the inspiration and lots of the content in my posts come from the larger ‘Corner of Berkshire and Fairfax’ community. I might be the front man. But if you like or find value in what you read, there is a much larger group of people (in the shadows) who deserve a bunch of the credit/goodwill. Bottom line, thanks to everyone on this board for taking the time to post your thoughts - and not just on Fairfax. I also explain to people that any success they are having from investing in Fairfax has much more to do with them than anything they read on the board. Their success has come primarily from their investment process, decision-making and the actions they have taken. This will also be true in the future (good and bad). Your success (and failures) will be driven primarily from your own actions. ————— Some takeaways from attending Fairfax's AGM: 1.) Sentiment in Fairfax has shifted. The ‘mood of the crowd’ at the AGM was decidedly upbeat. one questioner said he thought the Blackberry purchase by Fairfax was a good decision. I almost fell out of my chair. Prem’s response? “Please come back to future AGM’s.” Those in the audience laughed out loud - but in a good way. The fact we can discuss past failures (like Blackberry), recognize they were failures and move on is important. 2.) There were no surprises. It looks to be like we are at the ‘boring’ chug, chug, chug stage with Fairfax. Six years of hard work has brought us to this point in time: all three of their economic engines are performing at a very high level and delivering record results. 3.) The future looks very bright. Fairfax is poised to deliver a record amount of earnings over the next 3 years (perhaps more than $12 billion). This is an extremely exciting time to be a shareholder. I can’t wait to see what Fairfax does in the coming years (how it allocates capital) and how much earnings grow from here. Prem’s comments 4.) “Culture is our (Fairfax’s) most valuable asset.” Creation and protection, trust, long term focus, fair and friendly Guess how much time investors/analysts spend on this topic? Close to zero. And yet we think we understand Fairfax and can value it properly without understanding this? 5.) Personnel announcements: Retiring: Brad Martin 6.) Conference Calls Prem will no longer participate in conference calls. They will be handled by Peter Clark, Jen Allen and Wade Burton. This is a big change for Fairfax. I am looking forward to hearing from Wade Burton. 7.) The average duration of the fixed income portfolio at Dec 31 was about 3 years. Yield = 4.6%. Limited credit risk (mostly government securities). 8.) Insurance Market Odyssey - Brian Young Market is slowing / Shrinking crop insurance / Reinsurance - positive / Challenge to grow in 2024. It’s looking like Brian is being groomed to be Andy Barnard’s eventual replacement. Solid succession planning, as a number of key Fairfax executives are getting long on the tooth. Allied - Lou Things are starting to moderate / Growth phase allowed the company to scale - hence their low expense ratio / Issues: inflation and climate change - trying to anticipate future losses / Market is stable / Industry adjusted for higher cost of risk / Not a great flow of new capital coming in. 9.) Kennedy Wilson - Bill McMorrow Fairfax has invested $13 billion with Kennedy Wilson over the last decade / Of this total $8 billion has been returned / On returned funds, return to Fairfax has been in excess of 20%. Keys: Trust, Culture, Ability to make decisions quickly. PacWest deal was 30 days (inception to close). 10.) Poseidon - David Sokol Cost to build a new ship today is 30% higher than when Poseidon placed their significant new-build orders. Expect net income to increase 20% in 2024. Expect Fairfax’s investment should go up 50% based on increase in cash flows (not sure time-frame). $18 billion in contracted revenue. New capacity is coming - expects significant scrapping to happen, driven by most fuel inefficient vessels. Poseidon’s performance was a disappointment for me in 2023. It appeared to me that management got caught unprepared for spiking interest rates. It looks like we should see improving results moving forward. This is a very large holding for Fairfax. I think i also heard that Poseidon is looking for sell APR (but this might just be a false rumour). 11.) Question: what has Prem learned from Charlie? Buying good businesses at fair prices. Strong track record Strong management “Looking for positions where we can compound for the long term.” Given its large size today, are we seeing Hamblin Watsa shift their value investing framework to more of a ‘quality at a fair price’ and away from ‘deep value?’ 12.) How to model catastrophes? Peter Clark answered. Calculate probable maximum losses Benefit from diversification of premiums across global operations Write with limits. I think he said all the insurance companies do their own modelling and these all roll up to Fairfax where they do the same thing on a total company basis. 13.) Eurobank Fairfax’s cost basis = €0.92/share Dividend est €0.09/share; will likely be lump sum payment when it happens. As Eurobank is an associate holding the dividend will not hit ‘interest and dividend’ bucket, but it will show up as increase in cash at Fairfax. Payout ratio goal in 2025 = 40% and in 2026 = 50%. Decided 100% dividend for 2023; moving forward, split between dividend and share repurchases will depend on share price (buy back shares when they trade under book value). Why Cypress is an ideal launchpad into Europe for businesses in India? The two counties share some important things: both were part of the British Commonwealth, therefore they have similar legal systems and business language (english). 14.) Orla mining: Pierre Lasonde is a large investor. There are roots to Franco Nevada. Backing smart people Low cost producer Pierre Lassonde is also a big investor in Foran Mining. Fairfax wants to partner with the right people. 15.) Plans to grow investments in China? Currently own a legacy stake in insurer Alltrust (15%? With a value of $75 million?) No plans to invest any more money in China; prefer democracies. 16.) FFH - TRS Counterparties are Canadian banks. TRS position has been extended 2025 or 2026? Fairfax today is inexpensive. Huge potential to that position. 17.) Final comments from Prem Fairfax has seen a big tansformation over the past 6 years. Size: company has increased substantially Now has income stability: interest income of $2 billion Fairfax’s book value is conservatively stated. Could sell insurance companies at multiples of stated book value. How to value Fairfax? Start with book value. Use ROE over time. Investing - has changed over the last couple of years. Phil Carret: management

-

@ValueMaven Fairfax usually posts the AGM presentation to their web site shortly after the meeting happens. Not sure on the exact timing (it's not there yet, from what I can see).

-

What do board members think… Do we collectively have a good handle on Fairfax today? How about the more general investment community? Or, in another 12 months will we look back and say… ‘boy, was i ever off in my analysis of the company.’ Just like what has happened in each of the past 4 years. ————— Fairfax - 4 Years Later - Are We Really Any Smarter? Fairfax’s stock has compounded at 40.1% for each of the last 4 years. Lots of investors missed participating in the run-up of the stock because they misunderstood and mis-judged the company. Fast forward to today. Most investors think they have a much better understanding of Fairfax and the opportunity it currently presents. I am not so sure. I think Fairfax remains a misunderstood company. And that is because: The fundamentals at Fairfax have been improving at a faster rate than investors generally understand or recognize. Driven by the reinvestment of $4 billion in annual earnings, profit growth over the next couple of years will likely exceed investors expectations. So investors continue to materially underestimate the potential of the company and the growing earnings it will be able to generate in the coming years. ————— At the 15th Annual Fairfax Financial Shareholders Dinner on Wed April 10 there were a number of different events. One event was a Q&A on Fairfax moderated by Trevor (Tidefall Capital) with 2 panelists: me and Asheef @SafetyinNumbers. Below are my opening comments: I want to start by saying thanks to Rob and the rest of the people involved for getting this event organized on short notice. It is a real privilege for me to be here. I also want to give thanks to the board members of the investing forum ‘Corner of Berkshire and Fairfax’. Much of what I have written on Fairfax over the past 3 years was inspired and augmented by members on this investing forum. A special thanks to Tarn for making the trip all the way from Australia. Thanks to Asheef and Trevor for joining me for this session. A quick message from the legal department Nothing discussed tonight is intended to be financial advice. It is intended to educate and entertain. Consult your financial advisor before buying any stocks. ———— OK, let’s get at why we are all here… to discuss that scrappy, unloved, misunderstood P/C insurance company called Fairfax Financial. Yes, make no mistake, it is still unloved and misunderstood. ———— Let’s start with a quick review of a few things. Over the past 4 years Fairfax’s stock has delivered a total return of 286%. That is a 4 year CAGR of 40.1%. How does that compare to the market averages? The S&P500 is up a total of 89%. The TSX is up a total of 60%. Bottom line, over the past 4 years Fairfax’s absolute and relative return has been outstanding. Ok, with a show of hands… 4 years ago, who in this room saw Fairfax delivering a CAGR of 40% per year over the following 4 years? Don’t be shy… No one. (No one in the room raised their hand.) That, I think, is super interesting. ————— Let’s fast forward to today. We are all so much smarter now when it comes to understanding Fairfax. Right? Me? I am not so sure. ————— So where are we at with Fairfax today? That’s what everyone here really wants to know. The stock is up 286% over the past 4 years… so it must be overvalued today… right? What’s the problem with this ‘analysis’? Well, it’s not actually ‘analysis’. The fact that Fairfax is up 286% tells us very little about the current valuation of the stock. And that is because price, on its own, is a terrible way to value a stock. ————— Ok. So what measures should we use to value Fairfax? Let’s look at two simple ones: PE and P/BV Fairfax’s: PE is under 7 x my estimate of normalized earnings, which is about $160/share P/BV is 1.1 x my estimate of book value at March 31, 2024 What do both of these two valuation measures tell us? Fairfax’s stock is crazy cheap. Yes, even after a 286% increase over 4 years. That is nuts. ————— How is this possible? First: Starting point matters. Fairfax was a hated stock in back in April of 2020. So Fairfax’s stock was much, much cheaper than any of us realized back in 2020. Second: Since 2018 the management team at Fairfax has been executing well. And since 2021 their execution has been exceptional. Here are 5 examples: Hard market in insurance. Over the past 4 years, net premiums written have increased from $13.3 billion to $22.9 billion or 73%. The CR has averaged 95.2%. The purchase of total return swaps in late 2020/early2021 has so far delivered about $1.4 billion in investment gains. The buyback of 2 million shares of Fairfax in December 2021 at $500/share. That is almost a 50% discount to current book value. And we know intrinsic value is much higher than book value. Sale of the pet insurance business in 2022 - which delivered a $1 billion after tax gain. This was like finding a pile of gold in your back yard - no one even knew they owned this business. Active management of the average duration of the fixed income portfolio. The move to 1.2 years in late 2021 and then the pivot to more than 3 years in late 2023. The financial benefit to Fairfax from these two moves can be measured in the billions. I’m just scratching the surface with these 5 examples. I could easily list another 10 examples of decisions made by Fairfax in recent years that have had a positive and meaningful impact on their financial results. Bottom line, the fundamentals at Fairfax have been not just getting better - they have been literally exploding higher. I have never seen anything like it in my 25 years of investing. As Peter Lynch would say ‘The story just keeps getting better’. But kind of on steroids. ————— Let’s try and summarize things: Where are we at with Fairfax today? The stock trading at a crazy cheap valuation. Fairfax has three of economic engines: Insurance investments - fixed income Investments - equities All three are performing at a high level at the same time - for the first time in the company’s history. As a result, Fairfax is poised to generate historically high earnings of $4 billion (more?) in each of the next 3 years. It should also deliver an average ROE of about 15%. The management team is best-in-class. When it comes to capital allocation, in Buffett’s words, the management team at Fairfax is hitting the ball like Ted Williams. In Druckenmiller’s words, the management team at Fairfax is on a hot streak. This highly performing team is about to get $12 billion in earnings over the next 3 years. Think of the value creation that is coming. ————— OK. So after all that… What is an investor to do? If you don’t know the answer to this question… well, you might want to stick to investing in index funds.

-

When you save you are ‘spending’ your money. It is being spent on financial independence. This appeals to people who value their independence.

-

What i do not understand is where Hamas fits into this war. I think they are the duly elected government of the people of Gaza. I think they are supported by a majority of the population of Gaza (i have read support is as high as 70%). i also think it is Hamas’ (stated?) objective to kill every Israeli citizen. That ‘River to the sea’ thing. Does Hamas not control education (everything) in Gaza? Are kids in Gaza not taught at a young age that killing Israeli’s is a good thing? Listening to the calls that Hamas fighters sent to their family back in Gaza - as they were murdering Israeli’s - was frightening. It provided great insight into the mindset of Hamas and many of the people in Gaza. I hear people/news organizations talking all the time about Palestine. NOBODY wants to talk about Hamas. Which to me is completely bizarre. Hamas controls Gaza - as long as it is in power, it is effectively Gaza. We might get a solution in Gaza when Hamas says publicly that it agrees to Israel’s right to exist. Of course, that will never happen. How do you negotiate with a political entity that has a stated aim to wipe you out? How do you agree to a two state solution when one side only wants to wipe the other side out? We are so naive in the West. I wish people would replace Palestinian with Hamas when they post on this topic. https://www.americanpurpose.com/articles/from-the-river-to-the-sea/

-

Updated April 8: For board members who are interested I have posted an updated version of 'Fairfax - Hiding in Plain Sight' PDF and the companion Excel workbook. Chapter 1 (overview of Fairfax) and Chapter 4 (float) have been updated. The PDF contains 350 pages of information on Fairfax. The Excel file contains a detailed build for my earnings estimate. Let me know if you have any suggestions for improvement. Missing material? Errors? Happy reading! PS: FYI, I will always keep the most recent version of both documents (PDF file and Excel workbook) in the first post of this thread. Fairfax Apr 8 2024.pdf Fairfax Apr 8 2024.xlsx

-

@This2ShallPass a question: Regarding BDT, when you calculate your total return of 70% are you assuming Fairfax invested the full $978 million in 2009? To calculate a reasonably accurate annual rate of return for Fairfax I think we would need a little more information (like how much Fairfax actually invested in BDT each year since 2009). We would also need to understand what is built into 'market value' of holdings at Dec 31, 2023 (many of the holdings are private companies). For the private holdings we rely heavily on the communication from Fairfax. I don't think Prem is blowing smoke when he says "Byron and his team have generated fantastic long-term returns for Fairfax, and we very much look forward to our continued partnership." Over the past 6 years, it looks to me like Fairfax has been steadily shifting capital from poor performers to stronger performers. If capital allocated to BDT and Shawkwei is increasing it tells me Fairfax sees these two organizations as being solid opportunities moving forward. Why do I give Fairfax the benefit of the doubt? Fairfax's capital allocation track record the past 6 years has been outstanding. For me, they have earned a certain level of trust.

-

@giulio I really enjoyed reading (and thinking) about your post. Probably the biggest point I have been trying to make with the equity portfolio is the 'change' thing. The end result? I think the equity portfolio is poised to earn a higher rate of return for Fairfax than it has historically. Like you, I have been thinking a lot about the amount of earnings that is being generated by Fairfax, capital allocation and compounding. The set-up today reminds me of a much younger Berkshire Hathaway. There is a good story in there somewhere!

-

@Dinar I think the investments with ShawKwei and BDT are mostly private in nature - not mark to market. A fair bit of the value is likely surfaced over long periods of time as the assets are sold. “We expect Kyle to make higher returns on monetization of his major assets.” Bottom line, my reference point is investments like Blackberry, Resolute Forest Products, Eurobank (the first purchase), Exco (before bankruptcy), Fairfax Africa, APR, AGT (before take private), Mosaic Capital, Farmers Edge, Astarta… Compared the that gallows row of investments, BDT and ShawKwei look just fine to me. But each unto their own…

-

What is the quality of Fairfax’s equity portfolio? In my last long-form post I posed a question: What is the quality of Fairfax’s equity portfolio? My thesis is as follows: Fairfax’s equity holdings (as a group) have materially improved in quality over the past 6 years. And I don’t think this fact is yet fully recognized by investors today. Moving forward, this could continue to be an important tailwind to earnings. This is the topic we will explore in this post. Now I know for some investors, reading the words ‘quality’ and ‘equity portfolio’ and ‘Fairfax’ all in the same sentence will cause them to laugh uncontrollably out loud. If this is you, try and keep an open mind. I also would appreciate hearing what board members think about this post. Sometimes I get an idea and I have a hard time explaining it (which usually means it is still all jumbled up in my head). So, like spaghetti, I throw it against the proverbial wall at COBF, and see what sticks. The feedback received from other board members helps me flesh out ideas. Am I on to something important? Or am I out to lunch? Let’s start with the big picture. A quick review: The 3 drivers of earning at Fairfax Insurance + fixed income investments + equity investments = earnings Earnings feeds ROE, which feeds into the multiple, which feeds into the stock price. The important take-away for this post: the return on the equity investments is one of the key drivers of Fairfax’s stock price. Of interest, most investors today likely own Fairfax to get exposure to its insurance business and its fixed income portfolio. Its equity portfolio? Woof! (Not so much.) 20 years ago, investors owned Fairfax to get exposure to its equity and fixed income portfolios. Insurance? Woof! How the narrative at Fairfax has changed. But what if the current narrative attached to the equity portfolio is wrong? Why do we care about the ‘quality’ of the equity portfolio? The ‘quality’ of Fairfax’s equity portfolio will impact two things: The return achieved over time The volatility of the return Today investors view Fairfax’s equity portfolio as being of low quality (overall). And they think it is highly volatile. That is what is built into Fairfax’s stock price today. But what if both of these assumptions are wrong? What if Fairfax’s equity portfolio can be characterized as being ‘high quality’ today? And what if it also has lower volatility moving forward than in the past? If true, this means investors are likely underestimating both the earnings potential of Fairfax and the multiple those earnings deserve (which is tied to volatility). How are we going to measure the quality of Fairfax’s equity portfolio? Let’s open this big can of worms. There is no standard definition of ‘quality’ that can be applied to all companies and industries - this is because every investor has their own definition. The problem with this type of analysis is most people come at it in a subjective way. Not an objective way. So discussing it with others can be like trying wrestle with a greasy pig. How do we remove our own biases from our assessment? Of course, we can’t. Most people don’t even want to. We all have our own investing framework - it’s what allows us to function as investors. And it’s the prism we use when we evaluate the management team at Fairfax. When we look at a stock that Fairfax owns and we comment ‘good’ or ‘bad’ - well, often we are telling others more about our own mental model than about the actual holding or the management team at Fairfax. What about volatility? We can’t really answer the ‘quality’ question without also discussing volatility. Current finance theory states: low volatility = high quality. Potential return matters less. We are going to look to Warren Buffett for guidance on this topic. “Gyrations in Berkshire's earnings don't bother us in the least: Charlie and I would much rather earn a lumpy 15% over time than a smooth 12%.” Berkshire Hathaway 1996AR From our perspective, if volatility can be reasonably expected to deliver a higher rate of return over time then we can ignore it from the quality discussion. Let’s circle back to our objective. What methodology are we going to use in our analysis? There are a couple of different methods we can use to help us answer the ‘quality’ question: Quantitative - top down/follow the money - focus on the total return being delivered by the equity holdings (as a group). Qualitative/quantitative - bottom up - look at each of the individual holdings and sum our findings into a total. Quantitative - top down - measure of quality “For a value investor, price has to be the starting point. It has been demonstrated time and time again that no asset is so good that it can’t become a bad investment if bought at too high a price. And there are few assets so bad that they can’t be a good investment when bought cheap enough.” Howard Marks “Price is what you pay. Value is what you get.” Warren Buffett Fairfax has stated they have a pre-tax return target for their equity investments of 15%. Can we use this target as a core input into our ‘quality’ measure? I think we can. I come at the quality discussion in a very simple and selfish way. As an investor in Fairfax, when looking at the equity portfolio (in aggregate), what I want to know is ‘will it deliver a return of 15% per year on average over the next couple of years?’ If the equity portfolio has a good chance of delivering a pre-tax return of: 15% per year = high quality 10% per year = average quality 5% per year = below average quality Negative return = dog with fleas Do I really care what Fairfax owns? I kind of do. But what I care about much more is whether or not their portfolio of holdings can hit the stated 15% target. What return would the equity portfolio have to deliver to hit 15%? This number is easy to calculate. The equity portfolio had a market value of about $19 billion at March 31, 2023. (This uses carrying value. And values the FFH-TRS at its notional value). $19 billion x 15% = $2.85 billion Can Fairfax’s equity holdings deliver a pre-tax return of $2.85 billion in 2024? We have already done this work. It is contained in our earnings estimate for 2024. What do the numbers say? Dividends = $170 million Share of profit of associates = $1.03 billion Other / Non-insurance consolidated holdings = $150 million Mark to market investment gains = $1 billion Realized one-time investment gains = $300 million Change in excess of fair value over carrying value for associate and consolidated holdings = $200 million Total = $2.85 billion Of course, the 6 buckets above do not capture everything. Especially for non-insurance consolidated holdings. And I also cheated a little - I include both insurance and non-insurance holdings when estimating ‘realized one-time investment gains’. But I think my estimate is directionally accurate. Bottom line, my current earnings forecast has Fairfax generating a return of about 15% from its equity holdings in 2024. My guess is this comes as a surprise for most Fairfax shareholders. Based on our quantitative framework, can we conclude that Fairfax’s equity portfolio is high quality? Yes, I think we can. Let’s now see what our second measure says. Qualitative/quantitative - bottom up - measure of quality Let’s pivot with our analysis and now look at the individual holdings to see what we can learn. The 80-20 rule applies here. The big holdings are the key - if they perform well then Fairfax’s total return for the equity portfolio will likely be good. Context is also important. How did things look in 2017? How do things look today? Is the trend getting better? If so, how much better? What are some questions we would want to ask when evaluating the individual holdings? To help answer the ‘quality’ question when looking at the individual holdings, here are a few questions that come to mind: How good is the management team? Capital allocation? Is the balance sheet in good shape? Leverage? Is the company profitable? Is growth funded via retained earnings? What are the future prospects of the business? Other considerations (geography, political/economic situation etc)? What has Fairfax’s return been since purchase? What is Fairfax’s return potential looking forward? Back in 2017, Fairfax had a number of large holdings (a majority?) that could be described as follows: Poorly managed. Stressed balance sheets. Not profitable. Poor future prospects. Past returns for Fairfax were poor. Future return potential for Fairfax was poor. Fast forward to 2024 and it is amazing the turnaround that has been executed by the team at Hamblin Watsa. Over the past 6 years the equity portfolio has seen a complete make-over. The many problems have largely been fixed (run-off, sold, restructured, merged). And capital allocation has been outstanding (new position purchased, buying more of existing positions etc). Let’s look at Fairfax’s top 15 equity holdings: Fairfax has a pretty concentrated equity portfolio. The top 15 positions represent 67% (2/3) of the total portfolio. 1.) Eurobank Fairfax’s biggest holding today - by far - is Eurobank. It is also the best example of the renaissance that has happened in Fairfax’s equity portfolio over the past 6 years. Back in 2017, Greece was ruled by a far left government and its economy was a mess. Eurobank’s balance sheet was not good (lots of non-performing loans). But look at the transformation that has happened since: In 2019, Greece elected a center/right government who got to work reforming the Greek economy. Fairfax merged Grivalia Properties with Eurobank to improve its capital position. Eurobank’s management team has always been solid - they aggressively shed non-performing loans and shifted capital from Serbia (selling their operations there) to Cypress (buying Hellenic Bank). Greece just re-elected the center/right government so the pro-business reforms to the economy will continue. Greece is expected to have one of the top performing economies in Europe in the coming years. Bottom line, Eurobank is very well positioned today. Was Eurobank a quality holding back in 2017? No. It and Greece were turnarounds with an unknown future. Is Eurobank a higher quality holding today than it was in 2017? The answer is an unambiguous yes. And we see this in the return it is delivering to Fairfax. My guess is Eurobank was not earning much money back in 2017. Today? My current forecast is Eurobank will deliver $440 million in share of profit of associates to Fairfax in 2024. Fairfax’s carrying value for Eurobank was $2.1 billion at December 31, 2023. This would deliver a return of 21% to Fairfax. Outstanding. 2.) Fairfax - Total Return Swap Fairfax’s second largest equity holding is the FFH-TRS. I include this holding in the ‘equity’ bucket. This holding did not exist is 2017. Fairfax did exit their equity hedge position in late 2016. But in 2017, Fairfax still had significant short positions in place on individual stocks. These positions were not closed out until 2020 and lost about $1 billion in total from 2017-2020. The ‘swing’ here is enormous - losing $1 billion shorting something you clearly didn’t understand very well - to making +$1 billion on something you understand exceptionally well (your own company). This has been great swing trade for Fairfax and its shareholders. At December 31, 2023 the FFH-TRS position was valued at $1.8 billion. My current forecast is this investment will deliver gains of $500 million in 2024 ($250/share x 1.96 million shares). This would deliver a return of 28% to Fairfax. 3.) Poseidon Of all of Fairfax’s largest holdings, Poseidon was the biggest disappointment for me in 2023. The spike in interest rates seemed to catch management at Poseidon flat footed - and thrown a wrench into expected profit growth. Was 2023 the low point for earnings? 2024 will be an important year for Poseidon. My current forecast is Poseidon will deliver $180 million in share of profit of associates to Fairfax in 2024. Fairfax’s carrying value for Poseidon was $1.7 billion at December 31, 2023. This would deliver a return of 10.5% to Fairfax. While below the hurdle rate of 15%, this return is far from being a catastrophe. And it is expected to improve in the coming years. “Poseidon is expected to make net earnings in excess of $400 million in 2024 and $500 million in 2025. We carry our 43% ownership in Poseidon at $1.7 billion – 10x 2024 expected earnings or 8x 2025 expected earnings.” Fairfax 2023AR 4.) Fairfax India The key to this holding is BIAL. Is BIAL a higher quality asset today than it was in 2017? The answer is an unambiguous ‘yes’. What BIAL has accomplished over the past 6 years is amazing. It added a second runway and a second terminal. It is perfectly positioned to grow rapidly in the coming years - the runway is long. The management team in place is very good. In 2017, Fairfax owned 48% of BIAL - it did not yet have a control position. Today, Fairfax India owns 64% of BIAL (not adjusting for Anchorage), putting it firmly in control. Today, Fairfax also owns significantly more of Fairfax India (42%) than it did in 2017 (30%). Modi appears he will be re-elected to a third consecutive term in India. This should cement India’s economic pivot away from a socialist/Soviet model to a more capitalist model. Global capital is exiting China with India being a big beneficiary. India is projected to be the top performing economy in the world over the next decade and Fairfax India is well positioned to benefit from this strong tailwind. Fairfax’s carrying value for Fairfax India is comically low $768 million. A 15% return for Fairfax = $114 million. That is a lay-up. 5.) Recipe I have been highly critical of Recipe in the past. Minority shareholders were used like a piggy bank to fund its aggressive and flawed roll-up of restaurant chains in Canada. However, there is a decent business there. Covid was a gut punch - it hit dine-in full service restaurants in Canada especially hard. Spiking inflation, taxes and minimum wages threw more sand in the wheels. Bottom line, Recipe needed to restructure its operations. It got the process started back in 2021 - poorly performing locations/franchisees were closed and debt levels were materially reduced. But that is a hard thing to do as a publicly traded company. In 2022 Fairfax took Recipe private. Fairfax got a great price. And Recipe got the ability to complete its restructuring out of the public/shareholder spotlight. Fairfax’s carrying value for Recipe was $684 million at December 31, 2023. Free cash flow was US$92 million (C$125 million) in 2023 - back to pre-pandemic levels. Price paid matters a lot. Fairfax was able to take Recipe private at a very good price. The company is delivering a solid return to Fairfax. “Recipe, operating in its first full normal year since the pandemic, achieved record system sales in 2023. Sales increased to Cdn$3.7 billion, up 9% from 2022 and 5.6% higher than 2019. Margins also increased by 20 basis points, or 15% in dollars terms, over 2022. Impressively, the company delivered over Cdn$150 million in free cash flow and reduced overall leverage to less than 2.5x. Frank Hennessey, Ken Grondin and his team are focused on continuing to improve the overall margin rate while emphasizing top line growth. Expansion is underway in the United States and India markets as well as organic growth in Canada driven by new restaurants. The company will also be launching new products in its already sizable consumer packaged goods business (where Recipe’s brands are sold in grocery stores). Recipe is carried at 8x enterprise value to EBITDA on our balance sheet or 10x free cash flow.” Fairfax 2023AR The next 5 holdings 6.) BDT Capital Partners (private) - this has been an outstanding long-term holding for Fairfax. Who are they? “BDT & MSD Partners is a merchant bank with an advisory and investment platform built to serve the distinct needs of business owners and strategic, long-term investors. We are distinguished by our decades of experience advising at the intersection of founders, families, and businesses, as well as by our differentiated capital base and culture of aligned investing.” https://bdtmsd.com “We continue to invest with Byron Trott through various BDT Capital Funds. Since 2009, we have invested $978 million, have received $979 million in distributions and still have investments with a year-end market value of $683 million. Byron and his team have generated fantastic long-term returns for Fairfax, and we very much look forward to our continued partnership.” Fairfax 2023AR 7.) Thomas Cook India (public) - management implemented an aggressive cost cutting plan during Covid. In 2023, people in India started travelling again and revenue at TCIC spiked higher. With a structurally lower cost base, profits have surged. TCIC was a star performer for Fairfax in 2023 - its stock has increased 140% over the past 15 months. “Thomas Cook’s business rebounded in 2023 as travel recovered, with revenues up and a pre-tax profit of $34 million, up from a loss of $2 million last year. Thomas Cook stock price was up 90% in the Indian stock market in 2023. We sold 40 million shares at $1.67 to repay the $60 million we invested last year in the company. Future prospects for Thomas Cook look excellent in the years to come.” Fairfax 2023AR 8.) Grivalia Hospitality (private) - this holding gets an ‘incomplete’ from me today. It is a bet on the jockey. George Chryssikos has had the Midas touch for Fairfax in Greece - making them +$1 billion so far. I am inclined to give Fairfax the benefit of the doubt on this one - my guess is it works out ok. We should know much more in 2024 as more resorts come on line. “Grivalia Hospitality, under George Chryssikos, had a strong year of execution as two assets, including its largest, opened for business. The One & Only resort in Athens is a flagship in ultra-luxury hospitality and we are the proud owners. If you haven’t booked your summer vacation yet – you know what to do! 2024 will see one additional asset come into operation – which will take the operating portfolio to five. These include Amanzoe in Porto Heli, ON Residence in Thessaloniki, Avant Mar in Paros, One & Only and 91 Athens Riviera in Athens. Focus now turns to operational and service excellence for these resorts with Greece forecast to receive a record number of tourists in 2024. George has another five high end hotels in development over the next few years. George has an outstanding track record in real estate and as I said last year, he has already made us $1 billion! We expect George to repeat that accomplishment with Grivalia Hospitality over time! At year end we carried Grivalia at €513 million for our 85% stake.” Fairfax 2023AR 9.) ShawKwei & Partners (private) - this holding has been a solid long-term performer for Fairfax. The fact Fairfax is adding new capital suggests they like the prospects. “Since 2008 we have invested with founder Kyle Shaw and his private equity firm ShawKwei & Partners. ShawKwei takes significant stakes in middle-market industrial, manufacturing and service companies across Asia, partnering with management to improve their businesses. We have invested $536 million in two funds (with a commitment to invest an additional $64 million), have received cash distributions of $217 million and have a remaining value of $504 million at year-end. The returns to date are primarily from our investment in the 2010 vintage fund, which, though decreasing 8.8% in value in 2023, has generated a 12% compound annual return since 2010. The 2017 vintage fund, which has drawn about 84% of committed capital to date, increased 23.1% in value in 2023 but has a compound annual return of 3.5% since inception. We expect Kyle to make higher returns on monetization of his major assets.” Fairfax 2023AR 10.) Micron Technologies (public) - Fairfax materially increased their position in Micron in Q3 of 2022; likely around $60/share. The stock closed today at $128/share so Fairfax is likely up about 100% on its position in less than 2 years. Outstanding. The next 5 holdings 11.) EXCO Resources (private): This holding has been a solid performer for Fairfax in recent years. Consolidation seems to be a big trend in oil and gas. My guess is the company gets taken out at some point in the next year or two. “In 2023, Exco Resources (a U.S. oil and gas producer) repurchased 8% of its shares. This increased Fairfax’s ownership of Exco from 44% to 48%. After year end, Exco repurchased another 2% of its shares, increasing our ownership to 49%. Both transactions occurred at steep discounts to intrinsic value. Sometimes, as T. Boone Pickens noted, “it is cheaper to drill for oil (and gas!!) on the stock exchange than it is to drill directly”. Of course, Exco also did plenty of drilling. In 2023, Exco added more than twice as much to its reserves as it extracted through production. With weakness in commodity prices, the present value of proved reserves dropped. However, production volumes increased 3.2% year over year. Exco is well-positioned to navigate commodity price volatility. It has a strong balance sheet, nimble operations and decisive leadership. Chairman John Wilder and CEO Hal Hickey lead Exco. Fairfax’s Wendy Teramoto and Peter Furlan are on its Board. Fairfax is well served by our long-term partners, John and Hal, who transformed Exco into a resilient oil and gas company. Exco is carried on our balance sheet at $418 million or $18.24 per share, approximately 3x net income in 2023, an increase from $12.59 per share last year, due to our share of their 2023 earnings of $5.65 per share.” Fairfax 2023AR 12.) Stelco (public): In late 2018, Fairfax paid $193 million for 14.7% of Stelco. Since then Stelco has paid Fairfax $106 million in dividends. Over the past 3 years Stelco has also repurchased 38% of all shares outstanding - so Fairfax now owns 23.6% of Stelco. The CEO of Stelco, Alan Kestenbaum, is a rock star - even Billy Idol would agree. When the next bull market hits the steel market, Stelco and Fairfax are going to make an absolute killing; remember, Fairfax now owns 23.6% of the company. There is also a good chance Stelco gets taken out at a premium valuation by a bigger player. When Fairfax announced their Stelco purchase in late 2018 I hated it. At the time, it screamed ‘old Fairfax’ to me. Boy was I wrong. But I have since updated my view of the holding and I love it today. Facts are facts. But talk to Fairfax detractors - and my guess is they still view Stelco as a shitty investment. It is a commodity producer after all! It cracks me up when I hear the detractors talk about Fairfax’s equity holdings. They usually have no idea what they are talking about. But boy do they ever have a lot of conviction when they express their views. “In a year of volatile steel prices, Stelco performed well, highlighting its competitive cost structure. Stelco’s talented team – led by Alan Kestenbaum, Sujit Sanyal, and Paul Scherzer – continues to be excellent stewards of the business with a keen focus on creating shareholder value. We believe that Stelco owns the best-in-class blast furnace assets in North America, which is highlighted by its industry leading margins. The company’s Lake Erie Works facility has had recent upgrades to its blast furnace, coke battery, a newly constructed co-generation facility and a new pig iron caster. Nippon recently announced an agreement to acquire US Steel at a multiple of 7.8x 2024 EBITDA, a significant premium to Stelco’s trading multiple. We believe the US Steel acquisition highlights the value of blast furnace operations. Stelco continues to have significant net cash on its balance sheet, providing management with flexibility to take advantage of both organic and inorganic growth opportunities. The company rewarded shareholders with a Cdn$3 per share special dividend in addition to its Cdn$1.68 per share regular dividend in 2023. Stelco has raised its regular dividend for 2024 to Cdn$2.00 per share. We believe Stelco has a bright future under Alan Kestenbaum’s leadership. Stelco is carried on our books at $22.44 per share versus a market price of $37.84 per share.” Fairfax 2023AR 13.) Commercial International Bank (public): This is a very well run bank. Unfortunately, perpetual currency devaluations in Egypt have made this a tough investment for Fairfax. Fairfax invested $330 million in 2014. As of March 31, 2024, their position was valued at $362 million. Over the past decade, the opportunity cost to Fairfax from this investment has been significant. This holding is one of the last ‘old Fairfax’ positions remaining at Fairfax (that is a decent size). “Commercial International Bank (CIB) results were very strong in 2023 with an ROE of over 40%, net interest margin of almost 8% and loan-loss provision coverage ratio of approximately 230%. There is significant hidden value in the build-up of provisions on the balance sheet which if adjusted for, reduces the price-to-book ratio well below 2x. Since 2014, the bank has continued to compound book value per share and EPS by nearly 20% per annum. The key driver of value to Fairfax and other foreign investors in CIB is the stability of the Egyptian Pound. Fairfax invested the vast majority of its position in CIB in the spring of 2014 when the market cap was less than $5 billion, at exchange rates at the time. During that same time, net profit at CIB in USD terms (at current exchange rates) has more than doubled and the market cap stands at just $7 billion with an estimated 2024 price to earnings ratio of 6x. By comparison, in local currency, the market cap has increased over five times! The Egyptian government has begun a massive asset disposal program to address the country’s high sovereign debt. Execution will be critical to ensure foreign investors more than just tread water on their investments. Hisham Ezz Al-Arab, the Founder of the modern CIB Bank, came back as Chairman in December 2022.” Fairfax 2023AR 14.) Occidental Petroleum (public): Initiated in 2022, this is a relatively new position for Fairfax. They increased it meaningfully in 2023. Their average cost is likely around $60/share. Stock closed today at $67. This holding looks well positioned. And it has Warren Buffett’s seal of approval. 15.) Mytilineos (public): a global industrial and energy company covering two business Sectors: Energy and Metallurgy. Fairfax initiated their position in Mytilineos in 2012. They more than doubled their position in late 2022 at €18.50/share. Shares closed today at €34. This has turned into another outstanding investment for Fairfax. Summary After all that what have we learned? Can we conclude that Fairfax’s collection of equity holdings are higher quality than what they were in 2017? Yes, i think we can. And by a lot. Fairfax has been hard at work the past 6 years improving the overall quality of its basket of equity holdings. It takes years for that work to show up in reported results. And that is what we are now seeing. We are just now starting to learn what the true earnings power of the equity portfolio is today. Can we also call the collective holdings ‘high quality’? Given they look poised to deliver a 15% return, yes, i think we can. And my guess is Fairfax is not done with its move up the quality ladder with its collection of equity holdings. This bodes well for higher future returns. Total Return on Investment Portfolio: Fixed income yield = 4.7% Equity return = 15% Total return on investment portfolio = 7.4% What about further out - a couple of years into the future? That will depend on the capital allocation decisions that are made. If Fairfax continues to make good capital allocation decisions i don’t see why total return on the investment portfolio can’t stay in the 7.5% range for the next 5 years. Is that baked into the expectations of investors today? No, i don’t think it is.

-

@Luca I like all three investments. See below for comments. 1.) BDT has been an outstanding long term investment for Fairfax. “We continue to invest with Byron Trott through various BDT Capital Funds. Since 2009, we have invested $978 million, have received $979 million in distributions and still have investments with a year-end market value of $683 million. Byron and his team have generated fantastic long-term returns for Fairfax, and we very much look forward to our continued partnership.” 2.) ShawKwei looks like it has been a solid long term performer. The fact Fairfax is adding new capital suggests they like the prospects. “Since 2008 we have invested with founder Kyle Shaw and his private equity firm ShawKwei & Partners. ShawKwei takes significant stakes in middle-market industrial, manufacturing and service companies across Asia, partnering with management to improve their businesses. We have invested $536 million in two funds (with a commitment to invest an additional $64 million), have received cash distributions of $217 million and have a remaining value of $504 million at year-end. The returns to date are primarily from our investment in the 2010 vintage fund, which, though decreasing 8.8% in value in 2023, has generated a 12% compound annual return since 2010. The 2017 vintage fund, which has drawn about 84% of committed capital to date, increased 23.1% in value in 2023 but has a compound annual return of 3.5% since inception. We expect Kyle to make higher returns on monetization of his major assets.” 2.) Grivalia Properties gets an incomplete from me today. It is a bet on the jockey play. George Chryssikos has had the Midas touch for Fairfax in Greece - making them +$1 billion so far. I am inclined to give Fairfax the benefit of the doubt on this one - my guess is it works out ok. We should know much more in 2024 as more resorts come on line. “Grivalia Hospitality, under George Chryssikos, had a strong year of execution as two assets, including its largest, opened for business. The One & Only resort in Athens is a flagship in ultra-luxury hospitality and we are the proud owners. If you haven’t booked your summer vacation yet – you know what to do! 2024 will see one additional asset come into operation – which will take the operating portfolio to five. These include Amanzoe in Porto Heli, ON Residence in Thessaloniki, Avant Mar in Paros, One & Only and 91 Athens Riviera in Athens. Focus now turns to operational and service excellence for these resorts with Greece forecast to receive a record number of tourists in 2024. George has another five high end hotels in development over the next few years. George has an outstanding track record in real estate and as I said last year, he has already made us $1 billion! We expect George to repeat that accomplishment with Grivalia Hospitality over time! At year end we carried Grivalia at €513 million for our 85% stake.”

-

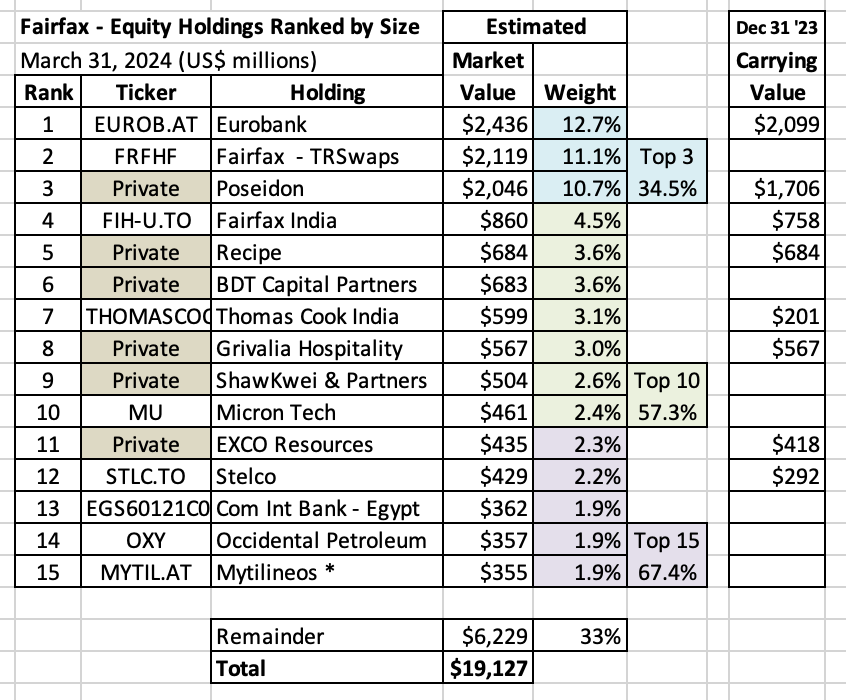

Below is a chart updating Fairfax's top equity holdings to March 31, 2024. The total is about $19b. What stands out? - Concentrated. - International. - Cyclical. - Most holdings are well managed with solid prospects. That is a big, big change from what the portfolio looked like back in 2017. 6 years of hard work (fixing problems) and making good decisions (with new investments) is really starting to shine through. - Overall quality continues to improve. Higher quality means higher future earnings. We are seeing this show up in the different growing income streams at Fairfax. Total return of 15% = $2.85b. This looks attainable for Fairfax in 2024. Please note, my definition of 'quality' is very loose: will the holding be able to deliver Fairfax a return of 15% per year? And lumpy is ok. We know Fairfax's fixed income portfolio is locked and loaded for the next 4 years. If Fairfax's equity portfolio is able to start returning 15%... well guess what that means for Fairfax's total return on investments? Yes, a big number. 7.5% is probably a good base number to use for the next couple of years. Fairfax is also much more levered to investments (in terms of total earnings) than most P/C insurers. So earnings monster returns on its investment portfolio is a big deal.

-

@Hamburg Investor i don’t have a lot of insight as to why P/C insurers trade at the multiples they do compared to other industries and the market as a whole. P/C insurance is a pretty small sector and i don’t think it is followed all that closely by most investors. But i think i can spot cheap. Fairfax is trading at about 1.1 x BV (est March 31, 2024) or at a PE of 6.5 x (est 2024 earnings). Of all the valuation measures, P/BV appears to be the most important. Multiple expansion has been happening for Fairfax over the past couple of years - investors are warming to the Fairfax story. If Fairfax continues to deliver solid results in 2024 and 2025 my guess is we will see multiple expansion continue.

-

Telecom in Canada is in a price war. Shaw’s sale to Rogers, forcing Freedom Mobile’s sale to Quebecor, appears to have unleashed a sprint for market share. Canada is the land of oligopolies. The kind that tend to play nicely in the sand box. So investing in Canada’s oligopolies has generally been pretty good for investors. How times have changed. BCE is trading today at C$44.00, where it was trading back in 2013. Its dividend yield is 8.5%. Telus is trading at C$21.20, where it was trading back in late 2014. Its dividend yield is 7%. Bottom line, telecom stocks are getting killed. Again. They all got taken out behind the woodshed late last year. I don’t follow the Canadian telecom industry all that closely. Although i will say my telecom bill (cell, internet and TV) has come down materially over the past year. The current environment is great for consumers - not so great for shareholders. Is the current competitive dynamic the new normal for Canadian telecom companies? Or will they become rational actors again? Has something structurally changed in this industry that means profitability moving forward will be permanently lower? Or is the current price war just a temporary bout of insanity among the major players? I bought more BCE today and i added to my Telus position last week. Do board members have favourites in the sector? Rogers? Quebecor?

-

How is the Fed going to cut rates with inflation over 3%?

Viking replied to ratiman's topic in General Discussion

The problem is we have been taught to believe that it is the Fed’s job to fight inflation. If the Fed throws in the towel on fighting inflation - what happens next? Brave new world? We KNOW the politicians (of all parties) will not do anything - until catastrophe hits. It really is an interesting set up. i think we are learning that fiscal policy trumps monetary policy in todays environment when it comes to inflation. And those in charge of fiscal policy are going to deny it to their dying breath. That suggests to me that inflation will probably remain elevated. Especially if central banks start to ease (that will stimulate interest rate sensitive sectors of the economy like housing). The bond market just might be the thing to watch moving forward. After all, bond investors have the most to lose if inflation gets out of control. And my assumption is they are not idiots - but i really have no idea.