Leaderboard

Popular Content

Showing content with the highest reputation since 04/24/2021 in all areas

-

This is one of my favorite things to rant about so let me apologize in advance. This isn't a comment about Brett Horn in particular - I don't know him, and maybe he's great. But what I strongly recommend is to look to the broker analysts as a gauge of popular sentiment (if even that) or to understand how brokers drum up business. Nothing more. It is not a coincidence that companies reliant on capital raising tend to get the widest coverage and the best ratings. But since the ostensible separation of research from investment banking (and the removal of skin in the game - analysts ability to actually buy stocks in their coverage universe - in the name of removing conflicts of interest), the job is basically a glorified sales job for trading volumes. And many of them, if they do get a real nugget of information or have an actual insight, share it behind closed doors with whichever client trades the most through their bank. In other words... I wouldn't think that hard about it. The analyst incentive is to not stand out in a bad way and keep making ~$1-2mm/year to keep their kids in fancy schools. Even if one is actually bearish, he/she almost certainly won't stick his/her neck out and risk embarrassment and losing that cushy gig. Sorry, I've done that job as a bright eyed and bushy tailed junior analyst and unfortunately saw how the sausage is made, so maybe I'm too cynical now. Maybe the general takeaway is to keep your expectations low and allow yourself be pleasantly surprised, but the clear and simple fact is that @Viking and others with real insight and skin in the game do a 10x better job than any broker analyst. Maybe this wasn't the case in Lee Cooperman's days at GS (though it was probably even sketchier then) but it is now. At the bare minimum, the pay and prestige aren't what they used to be. The real talent is elsewhere. Expect the sell side estimates to keep climbing higher as Fairfax executes.2 points

-

I once saw a cheers-less post. Gregmal was being disciplined over in the Disney thread…2 points

-

@newtovalue you are welcome. Nice to hear that others find value in some of the posts. I use writing as a way to get my thoughts in order. And i love it when people take the other side as i spend a fair bit of time trying to figure out why i am wrong. I think my track record is pretty decent figuring out the earnings part of the equation. I am pretty terrible at figuring out the multiple expansion part of the equation (i tend to sell my big positions too early).2 points

-

Trying to be "conservative" is a mistake. You should try to be accurate. How many great and very reasonably priced companies have value investors missed because they were too "conservative". I agree with Gregmal, you should be looking out at least 3-5 years. Trailing earnings are already priced into the stock. Forward earnings are usually too (though Meta is an example of "conservative" investors missing forward earnings by a mile). If you look at only forward earnings, every great company will look expensive. If you use trailing earnings, every value trap will look cheap. Nvidia is a great cautionary tale. In January 2022, TTM (2022) was $4.44. actual fwd (2023) was $3.34. You could have been conservative and estimated 2024 earnings at $3 or $4 or $5. But actual 2024 earnings were $12.96. Sure, you might have missed the drawdown from $300 to $100. But you would also miss the run from $100 to $900. Conservatism comes at a price. --- This also depends on your strategy. If you are buying a cyclical, you should be looking at the past 10-20 years. And then maybe overlay some thoughts on forward earnings. For a real growth stock, you should be looking out 5-10 years.1 point

-

There was no explicit mention of IDBI but it was alluded to that the decision would be post India election (early June). Generally I got the sense that activity will pick up across the board in India once the election is over. Also, I was the “someone else” who had the opportunity to sit on the panel with Viking at the dinner. I hope I made sense even if I wasn’t memorable!1 point

-

1 point

-

@Luca I like all three investments. See below for comments. 1.) BDT has been an outstanding long term investment for Fairfax. “We continue to invest with Byron Trott through various BDT Capital Funds. Since 2009, we have invested $978 million, have received $979 million in distributions and still have investments with a year-end market value of $683 million. Byron and his team have generated fantastic long-term returns for Fairfax, and we very much look forward to our continued partnership.” 2.) ShawKwei looks like it has been a solid long term performer. The fact Fairfax is adding new capital suggests they like the prospects. “Since 2008 we have invested with founder Kyle Shaw and his private equity firm ShawKwei & Partners. ShawKwei takes significant stakes in middle-market industrial, manufacturing and service companies across Asia, partnering with management to improve their businesses. We have invested $536 million in two funds (with a commitment to invest an additional $64 million), have received cash distributions of $217 million and have a remaining value of $504 million at year-end. The returns to date are primarily from our investment in the 2010 vintage fund, which, though decreasing 8.8% in value in 2023, has generated a 12% compound annual return since 2010. The 2017 vintage fund, which has drawn about 84% of committed capital to date, increased 23.1% in value in 2023 but has a compound annual return of 3.5% since inception. We expect Kyle to make higher returns on monetization of his major assets.” 2.) Grivalia Properties gets an incomplete from me today. It is a bet on the jockey play. George Chryssikos has had the Midas touch for Fairfax in Greece - making them +$1 billion so far. I am inclined to give Fairfax the benefit of the doubt on this one - my guess is it works out ok. We should know much more in 2024 as more resorts come on line. “Grivalia Hospitality, under George Chryssikos, had a strong year of execution as two assets, including its largest, opened for business. The One & Only resort in Athens is a flagship in ultra-luxury hospitality and we are the proud owners. If you haven’t booked your summer vacation yet – you know what to do! 2024 will see one additional asset come into operation – which will take the operating portfolio to five. These include Amanzoe in Porto Heli, ON Residence in Thessaloniki, Avant Mar in Paros, One & Only and 91 Athens Riviera in Athens. Focus now turns to operational and service excellence for these resorts with Greece forecast to receive a record number of tourists in 2024. George has another five high end hotels in development over the next few years. George has an outstanding track record in real estate and as I said last year, he has already made us $1 billion! We expect George to repeat that accomplishment with Grivalia Hospitality over time! At year end we carried Grivalia at €513 million for our 85% stake.”1 point

-

1 point

-

Valuations are probably less relevant than the past because a lot of buying of stocks is price insensitive e.g. corporate share buybacks. When times are good and stock prices are high companies buy back far more shares than when times are bad and stock prices are low. And with ZIRP companies have been able to use financial engineering to borrow at cheap rates to buy back shares. As interest rates come back down this practice will resume. e.g. pension contributions. there is a continual inflow of money into index funds from this. e.g. switch from active to passive strategies. In the past (in theory at least) active managers used to buy undervalued stocks and sell overvalued stocks or even short them. Now the main active investors are hedge funds and retail trades both of whom favour momentum strategies and flavour of the month investments with a good story. e.g. Fed has been doing successive rounds of QE while keeping interest rates low (until recently) so if you can only earn next to nothing in cash or bonds then you tend to be a lot less discriminate when it comes to buying stocks i.e TINA. Even with higher interest rates a 4-5% long bond yield seems unappealing when investors are using to doubling their money every year in bitcoin or Big Tech and even in index funds are making double digit returns and investors are well schooled that dips are buying opportunities and the stock market always recovers quickly and without any lasting pain. Even during COVID while the market panic was scary by the end of the summer the market had already recovered made new highs. And while the 2022 bear market was more protracted than investors were used to the index only fell about 20% as confidence in a pivot and Chat GPT turned the tide and 2023 instead of being a down year saw the market recover most of its losses with the rest made up this year. And now AI has given the perfect excuse for markets to send Big Tech stocks to the moon and price in much better prospects for the rest of the economy with the idea that there will be a productivity miracle that will shock that economy out of its post-GFC doldrums and increase trend growth rate in the same way as in the mid 90s before it all went sour. Also interesting is that markets have pretty much shrugged at the good economic data and Fed talk walking down rate cuts. I suppose they have realized that the economy is a lot more resilient to higher interest rates than previously thought and Big Tech's growth prospects are being revised upwards so that even using a higher discount rate they are still worth a lot more. So I think we are only getting started. And probably the only things that will ruin the party are: a) Big Tech results disappointing and the roll-out of new AI initiatives not living up to the hype resulting in much slower adoption b) Inflation rearing its ugly head again and forcing the Fed into rate hikes or at least convincing markets in higher for longer. The V-shaped recovery carries with it the implicit assumption that the Fed was right along and inflation was transitory and the inflation shock is over. c) A hard landing with inflation not falling enough to justify a Fed rescue and earnings across the board falling.1 point

-

1 point

-

Here is one more soundbite from the WSJ interview with Charlie, Re: Apple Charlie Munger isn't too worried about Apple's valuation. During a recent conversation with the Berkshire Hathaway vice chairman, I asked if he thought the tech giant's shares have gotten expensive to continue being a major Berkshire holding. Apple is trading at about 26.7 times its projected earnings over the next 12 months, compared with a 10-year average of 18.5, according to FactSet. “I don’t think we’ve got any rules about what we do at Berkshire. If it makes sense at the time in a rough kind of way, we do it. And that’s our system,” Munger responded. “I would argue that Berkshire would have less advantageous future prospects if we didn’t have our Apple.”1 point

-

Thank you, @Luca, Yes, I practice gallows humor [German : Galgen witz, Danish : Galgenhumor] to mentally cope with and to mentally survive the madness thats going on here in Europe. It is for sure needed. I have started to follow Sahra Wagenknecht, based on the content of your last post. My spoken German is a bit rusty, but I have no problem taking care of dailyday activity by speaking German, while in Germany, while I have absolutely no problem with understading all shades and nuances of the German language spoken or written. [Insufficient active vocabulary, because of lack of practice]. I also feel like a touchy bitch when our North American friends here on CoBF talks about money and starts blending US South border security into this European warfare matter. It concerns preventive measures in relation to 1st or 2nd order effects in relation to other and European NATO member states in case the situation escalates further. If our common North American CoBF members cannot or will not understand this, then I am not able to explain it. Just to try to trigger some kind of embarrassment into our fellow North American CoBF members with such stance, I will try to dig up some factual data about how Denmark has behaved in relation to Ukrainian refugees coming to Denmark since the war in Ukraine started. @Luca, Nassim Taleb would express it as "You simply don't have the same skin in the game as your North American friends on CoBF." -Period. - - - o 0 o - - - Edit : Bloomberg [September 26th 2023] : Erdogan Says Turkish Approval of Sweden NATO Bid Hinges on F-16s. Just Recep Tayyip Erdogan oportunistic modus operandi.1 point

-

Something tells me you might enjoy this Twitter account https://x.com/trudeaus_ego/status/1706453975061475605?s=46 Sad to see Canada and the US in the state they are in. Politicians are so out of touch with what the people want or what’s best for both countries it’s starting to look like France just before the chateaus started burning.1 point

-

@UK, @no_free_lunch, there has not been a poll done in at least a year of US citizens asking whether or not they would be willing to pay $100 per person per year to support the war in Ukraine. You may think $25bn per annum is a small price to pay, but US citizens think otherwise. Also, nobody is talking about handing the region over to Russia. However, it is NOT the job of US taxpayers to support Ukraine. It is the job of Ukrainians. Yes, we are obligated to defend Poland and the Baltics due to treaty obligations. Meanwhile, let's not forget, Ukraine has never existed as a country. Western Ukraine was part of Austro-Hungarian empire for centuries, and eastern Ukraine was called Little Russia for centuries, and part of Russian empire, and was Russian speaking. Hell, Kiev was called the mother of Russian cities.1 point

-

It's less timing and more systematic. I sell a small portion of each position at it rises by 10-20% pending it's historical volatility and where it's RSI is at. I've been trimming Fairfax ever since we passed $650 USD. Haven't had much opportunity to repurchase it yet so maybe this one is a bust that doesn't work out. But I trimmed Altius at various points all the way up to $20 USD and have purchased nearly all of those shares back. Have pulled thousands out of the position while retaining similar ownership. Eurobank has been trimmed by ~25% over the last year - I have just successfully bought the tranche of shares I sold for ~0.85/share for ~0.75/share. I have other limit orders out to buy more back if the price keeps falling to rebuild that 25%. I've been systematically trading Whitecap Resources a ton since 2021. There have been probably a have dozen opportunities to sell shares between $10-12 and repurchase them back between $8-9 over the last 18-24 months. I've done this with nearly every position I own or sold covered calls against them with premiums going into fixed income. The name of the game is to compound as quickly and as much as possible. I'm not afraid of stocks - I think my returns will be better in fixed income. I'm motivated by greed- not fear. I'm the same guy who owns sizable portfolio allocations to Bitcoin, was buying Sberbank after the sanctions, and has been sitting on Fannie Mae preferreds for a decade. I'm comfortable with high risk. I'm comfortable with high drawdowns. But only when I feel I'm being compensated for it via the potential upside. Point is, volatility doesn't scare me - I just want to get paid for accepting it. Im buying bonds because they pay well for the the downside potential I expect. Stocks, on average, pay poorly for the downside potential I expect. Outside of a handful of individual equities, I expect bonds to outperform.1 point

-

Comparing Fairfax, Markel and WR Berkley is interesting. Their market caps today are similar. But what about the size of their insurance businesses? And their investment portfolios? Yes, all three have different business models. However, all three are still insurance companies at their core. Let’s take a quick look at some of the key metrics and see what we can learn. Fairfax Financial, Markel and WR Berkley all have similar market caps today. Markel = $18.3 billion Fairfax = $16.0 billion WR Berkley = $15.6 billion This suggests investors expect future earnings (total $) to be roughly similar. Let’s start by looking at the insurance side of the businesses and net premiums written. Net premiums written (2022): Fairfax = $22.3 billion WR Berkley = $10 million Markel = $8.2 billion Fairfax’s net premiums written is larger than both Markel and WR Berkley combined. That is a big difference. What about underwriting profit? Underwriting profit (2022): WR Berkley = $960 million Fairfax = $950 million (when you net out losses from runoff) Markel = $610 million In terms of underwriting profit, WRB and Fairfax are earning similar amounts (total $) and Markel is earning quite a bit less. However, both WRB and Markel each have a much lower CR. Let’s now pivot and look at the investments side of the businesses. Investment portfolio (2022): Fairfax = $55.5 billion Markel = $27.4 billion WR Berkley = $22.9 billion Fairfax’s investment portfolio is larger than both Markel and WR Berkley combined. What about interest and dividend income? Interest and dividend income: 2022 2023E Fairfax = $960 million $1.5 billion WR Berkley = $780 million $940 million Markel = $450 million $620 million In 2023, Fairfax is going to earn about the same as WRB and Markel combined. That is significant outperformance. Yes, Markel has Markel Ventures. Fairfax also has significant equity holdings. ‘Share of profit of associates’ for Fairfax is expected to be about $900 million in 2023 and my guess is this is larger than what Markel Ventures will deliver in 2023. WRB is much smaller. What about realized investment gains? This bucket of earnings has always been a significant advantage for Fairfax over Markel and WRB and my guess is this will continue in the future. What are analysts expecting for net earnings in 2023? Fairfax = $2.5 billion WRB = $1.3 billion Markel = $1 billion Analysts expect Fairfax to earn more than WRB and Markel combined. What is the learning from all of this? Fairfax's market cap / earnings does not make any sense when compared to Markel and WR Berkley. Same market cap for 2 times the earnings? That only makes sense if you think earnings for Fairfax are inflated. Or not durable. This suggests to me that investors still do not appreciate what has happened with Fairfax's investment portfolio over the past couple of years: Share of profit of associates: delivering close to $1 billion per year moving forward Interest and dividend income delivering more than $1.5 billion in 2023, 2024 and 2025. As a result, Fairfax's stock continues to be very undervalued when compared to peers. Note: share count is basic (easier to find). The table above is meant to be directional (not precise) to allow very top line comparisons to be made for the three companies. —————— Notes: WRB and Markel have better quality insurance businesses (much lower CR) Fairfax’s fixed income portfolio is much larger and looks better positioned today. Fairfax’s net debt is likely higher (interest costs are included in net earnings estimate). Fairfax’s insurance business is much more international. WRB has been a very consistent performer over the years (by far, the most consistent of the three).1 point

-

There is a big gap in what the Taiwanese education system produces and what the businesses need. Nowadays, the tech companies send people into senior high schools (10-12 grades) to give seminars, hoping to persuade teenagers to go for a science-engineering education. The typically starting salary in Hsinchu Science Park for a MS student places him/her at around 90 percentile of Taiwanese household income. However, not everyone wants to learn science and engineering.1 point

-

Can't speak on the fees, but @Parsad it would be sweet if the merchandise section had some merch. Cups, caps, and since we have a books section, add referral links to those books so that when bought the site can make money? The Merch doesn't necessarily need to have CoBF logo on it either, could be an internal joke or wisdom from within the thread, like John Hjorth talking about the Egg or his 'kinks' or Brookfield, a 'Why buy an egg' cup would be cool. Luca's reactions to a comment maybe as a picture on a cap, or Gregmal's one liners, Spek's wise words on a shirt. Food for thought.1 point

-

100%. I’ve never really seen a case where a DCF was applied by people who actually understood the businesses. It’s always by some excel warrior trying to find a blanket approach to arrive at a simplified way of valuing something that probably requires a bit of work and/or industry specific experience.1 point

-

1 point

-

1 point

-

Other than inputing individual trades into a spread sheet to figure out my rate of return, I didn't know how to see if I was doing better than passive investing and by how much. My brokerage shows you cumulative time weighted returns, which would give me an accurate answer only if I didn't make any additions or withdrawls to the account. So I don't have a good estimate for returns in my taxable account. BUT I just realized that my ROTH IRA hasn't had any additions in a while (I converted some of my traditional IRA to a Roth IRA during the temporary tax cut year, but haven't added since because taxes went back up). So when I used the tool, it's comforting to see that all my efforts aren't producing a result that is worse than passive investing. I have no desire to ever manage money for anyone, and honestly if someone was looking over my shoulder and questioning some of the dumpster dive stocks, I might be tempted to hug the index and underperform just like the pros. But I do think individual investors can play a different game than the pros and part of the positive returns are due to this website. The signal to noise ratio is very good here and reading up on a thread here is part of my process (along with 10-ks, investor presentation, trade mags, interviews with the CEO etc). I definitely make fewer errors by being able to bounce ideas off of smart people here and get their feedback. And talking with people with compounder mindsets is helping me look for more of them and avoid quick pops in commodity shitcos. So thanks to everyone on here for your help. I appreciate the culture of sharing and generosity on here. From July 1, 2020 to July 6, 2023 Showing prior-day close of business data Select to view help about how often this performance data is calculated Cumulative time weighted return 93.99% Select to view help aboutHow is this cumulative time weighted returnvalue calculated? S&P 500 TR View selected benchmark index help 49.23% Select a benchmark indexto compare with your historical performance from the dropdown menu in the layer1 point

-

@UK i will give you a portfolio update as of today. But please note, i am ok with concentrated positions. This strategy has worked well for me for +20 years but it is not for everyone. Please note, I might decide to change my position tomorrow and i will not provide an update. I have no desire to provide daily, weekly or monthly portfolio updates. Because it messes with my head too much (i start to feel responsible for everyone else). People need to do their own research. And come to their own conclusions. And not get overly influenced by what some anonymous blogger is posting. Having got that out of the way, Fairfax has been may largest position since late 2020. ‘The story’ at the company continues to improve every quarter. As a result, despite the incredible run-up, i think the stock is still dirt cheap. So i continue to hold a concentrated position. I consider 30% to be a minimum position for me today (given what i know today). Currently i am at a 45% weighting. And I move around quite a bit (around the edges). I am also 35% cash today. The remainder is split pretty evenly between 3 other buckets: oil, banks and Canadian high yielding dividend stocks. I move around i these holdings quite a bit. ————— If you look at most successful investors most of their outperformance was the result of only a couple of holdings that performed spectacularly well over 5 or 10 years. My view is these turbocharged opportunities only come along every couple of years (something you understand very well that is dirt cheap with catalysts). So when you find one you have to be patient and ride it for as long as possible. Because the next one might be years away. My fear right now with Fairfax isn’t holding too much… it is holding too little. My fear is lightening up (locking in big gains) and then having the stock take off higher on me. My biggest mistake investing is selling my big winners too early. Selling because they went up a lot. And then they kept going higher… My mistake was selling using price as my guide. So i am trying to be more patient in situations where the fundamentals continue to improve - like the situation with Fairfax today. ————— My average return over the past 20 years is 19% per year. Over that 20 year span i have had two down years (of -4% each year). So my strategy works for me. I also spend LOTS of time on investing… because i really enjoy it. People need to figure out their own strategy. Something that fits their knowledge, emotional make-up, situation, interest, time etc. There are no short cuts.1 point

-

How many forum members does it take to change a light bulb? Answer : Count them yourself! : "1 to change the light bulb and to post that the light bulb has been changed. 14 to share similar experiences of changing light bulbs and how the light bulb could have been changed differently. 7 to caution about the dangers of changing light bulbs. 27 to point out spelling/grammar errors in posts about changing light bulbs. 53 to flame the spell checkers. 41 to correct spelling/grammar flames. 6 to argue over whether it's "lightbulb" or "light bulb"...another 6 to condemn those 6 as anal-retentive 2 industry professionals to inform the group that the proper term is "lamp". 15 know-it-alls who claim *they* were in the industry, and that "light bulb" is perfectly correct. 156 to email the participant's ISPs complaining that they are in violation of their "acceptable use policy". 109 to post that this group is not about light bulbs and to please take this discussion to a lightbulb group 203 to demand that cross posting to hardware forum, off-topic forum, and lightbulb group about changing light bulbs be stopped. 111 to defend the posting to this group saying that we all use light bulbs and therefore the posts *are* relevant to this group. 306 to debate which method of changing light bulbs is superior, where to buy the best light bulbs, what brand of light bulbs work best for this technique, and what brands are faulty. 27 to post URL's where one can see examples of different light bulbs. 14 to post that the URL's were posted incorrectly and then post the corrected URL's. 3 to post about links they found from the URL's that are relevant to this group which makes light bulbs relevant to this group. 33 to link all posts to date, quote them in their entirety including all headers and signatures, and add "Me too". 12 to post to the group that they will no longer post because they cannot handle the light bulb controversy. 19 to quote the "Me too's" to say "Me three". 4 to suggest that posters request the light bulb FAQ. 44 to ask what is a "FAQ". 4 to say "didn't we go through this already a short time ago?" 143 to say "do a Google search on light bulbs before posting questions about light bulbs". 1 forum lurker to respond to the original post 6 months from now and start it all over again..." Off topic : I follow a carefully chosen Danish Twitter account for about a couple of years now, or so. It's soo forthcoming and wise, what comes from this person every day on Twitter on about everything related to life and about everything in general, that it is to me stunning - from what I understand from the account info this man has been working in retailing all his active life, now retired : Today : Little advice in the summer heat for those who have difficulty falling asleep. I have started arguing with my wife before bed. Because then there is cold air between us! (Never slept better ) #pjank - - - o 0 o - - - Take it easy!1 point

-

The incredibly high living standard the US enjoys today is largely the result of the global world order it imposed/built/lead after world war II (with, of course, lots of help along the way from other nations). This positioning allows US companies dominate the world (economically) - China and Russia exempted (perhaps India too). If the US retreats, the void will simply be filled by China/Russia/totalitarian regimes. Shrinking your empire is never a good choice - it is usually catastrophic. That is, after all, what the Soviet Union did in 1991. Reversing a bad decision is pretty much impossible (Putin is learning that lesson today).1 point

-

I find these arguments hard to take seriously: Chinese leadership is dumb/sick and will destroy the country Chinese is in secular decline (US wouldn't be worried ifs this were true) Chinese leadership doesn't change (they turn on a dime -- Jack Ma's kidnapping, one-child-policy, COVID lockdown/reopen) I believe these arguments: China demographics will be a problem Nobody wants to move to China (how can they prosper if they cannot attract talent?)1 point

-

Liberty (remember them? They used to post here back in the day) posted this graphic on twitter that I thought was a pretty good illustration of why Buffett and other successful investors like to stay in the market all the time. Hard to argue with this graphic ->1 point

-

1 point

-

Peter Zeihan Uber bearish on China as usual Demographics, poor geostrategic location , Leadership with personality cult etc. I don’t think he quite gets the advantage China has in manufacturing stuff. Mexicos population is not too skilled to take on Chinese manufacturing . They may have different skilled but what China is doing manufacturing electronics like Apples iPhone and many other things is very very complex. It’s not just many workers, these workers are very very skilled at what they are doing and it’s hard to automize (fine motor skills, complexity , tight tolerances. You just can’t hire the same sort of workers anywhere but perhaps in Vietnam or Indonesia (which has Chinese population as well). Anyways, worth listening to, but you need to take some of Zeihans statements with a grain of salt. I do think he gets the broad picture right , after all he is a big picture guy.1 point

-

There must be a correlation between number of podcast Markel folks do every three months and Markel’s premium to book. Wait till Prem gets on that bandwagon1 point

-

If you buy on the last day of the month - you get full month credit. If you sell on the first day of the month - you'll get full month credit. So really, you can time it so you only lose 1 month of interest.1 point

-

"The key organ in your body in the stock market is your stomach. It’s not the brain. If you can add 8 and 8 and get reasonably close to 16, that’s the only level of math you need to know. " I've always liked this Peter Lynch quote. He's got a lot of pithy quotes.1 point

-

From my point of view Ferrari and Porsche SE (HoldCo) are not comparable. I also didnt run alot of number chrunching here. PAH3 is more or less a public listed family office of the families Porsche/Piech. As a HoldCo the gap to NAV will never close in total and thats fine for me. I see a lot of potential here. The emphasis surely lies in their major invesmtments Volkswagen and Porsche but they are smart people and if you look at their additional investment portfolio I think they invested in some good companies (areas). Just look at the latest investment in ABB e-mobility. P911 is a great company. Not that of a nieche market as Ferrari but still nieche. They are confident to reach a 20% margin and planning to distribute 50% of profits via dividends. Volkswagen will use the IPO proceeds to strenghten the e-mobility (Software and battery research and capabilities). There is still a huge cap to close with regard to Tesla and I think it will take some time but it is manageable. Plus they have some more valuable Brands like Lamborghini or Audi. Following the PAH3 management statement they intent to keep the dividend constant and paying down the debt they took on to finance the P911 stake. They also keep investing in portfolio companies. As a HoldCo PAH3 pays only minor taxes according to German Corporate Tax Law. The proceeds from sale of investments and received dividends are 95% tax free if you hold a minimum 10% stake in equity. So if 5% of Volkswagen and P911 dividends are taxable at approx. 30% then the current effective tax rate on those cash-flows is 1.5% only and 98.5% of the dividends can be used for operating business or paying down the debt. I intend to keep the investment in PAH3 at least 10 years. Will see how it unfolds.1 point

-

Everyone “sees disruption coming” for these types of companies because they’re incredibly asset light.1 point

-

I've tried multiple OEM cables (both USB A and C), and cubes (5w and 20w), and also tried connecting to my MacBook Pro M1. Nothing. No lights, no sounds, nothing. I feel like Steve Jobs would've had someone pilloried for this. Contacted support and escalated to a complaint. Also sent feedback. I expect to hear back from them some time after the polar ice caps melt. I've been without a phone for a week now and it's kind of liberating. It hasn't been as bad as I thought it would be. There have been a handful of occasions where I was inconvenienced but whatever. My iPad Pro is now my phone.1 point

-

1 point

-

https://moralfoundations.org/ Jonathan Haidt has some interesting theories and research, covered in brief on that page but in more depth in his book "The Righteous Mind: Why Good People are Divided by Politics and Religion" The gist of it is that evolution baked into us a basic framework of "moral taste buds" -- we can tell when something is fundamentally unfair, or when someone is being disloyal or cheating, etc. Troops of monkeys with an overly vicious alpha will naturally form a coalition to do away with the tyrant. Sic semper tyrannis, since before humans walked the earth. I remember hearing about a study with monkeys where two monkeys are separated but they can see each other, and they each have to do the same task in order to get a reward. The first monkey is given some grapes, a favorite food for them. The second monkey sees this. Then the second monkey is given some cucumber slices instead of grapes for its reward. The second monkey brain must emotionally be screaming "UNFAIR!" because it takes the cucumber slices and throws them in the face of the lab tech. Being able to detect when things seem fair will tend to lead toward survival of the group, so genes which help us detect fair treatment have been kindly baked in through evolution, or they're god-given by his/her magnificent evolutionary process. We've got a lot of pro-social genetic behaviors baked in like that. We experience a thing called "Elevation Emotion" when we witness acts of moral beauty. Just witness this pizza delivery guy who saved a bunch of kids from a burning house and try not to feel elevation emotion. That feeling is baked in to most of us (minus perhaps the psychopaths) But that's just the beginning. Biological evolution gets you to cave man level where life is pretty much like the Hobbes quote "solitary, poor, nasty, brutish, and short." Then comes the cultural dynamics. By the power of language we have shared stories and myths. Using these shared stories, we humans have been improving on our genetic hardware by installing new moral ideas as software "Necktop Apps" (Daniel Dennett's fun term) ... we build agreed sets of guidelines and hard rules for the really important stuff ... but it has morphed over time. We have evidence that very ancient people used to kill children and bury them under the foundation stones of new dwellings. Perhaps their gods told them that it helped ward off evil spirits. Warding of evil spirits was an important concern through the ages. People in England during Shakespeare's time would put three big scratch marks on their fireplace mantles to repel witches who might otherwise descend into the house through the chimney. Even up through the middle 1800s in American folk religious belief, people used "Lamen parchments" with religious power words on them like "Tetragrammaton" and seven pointed stars and funky line drawings, and amulets on necklaces and coin shaped talismans. Why did they stop sacrificing kids? In the Abrahamic tradition it's arguable that they stopped because of the story of Abraham and Isaac and the ancient interpretation which is essentially: "This story proves it's okay to stop killing kids, and kill rams and sheep instead." To our modern minds it is so far out of context that it just looks like Abraham had a psychotic break and turned murderous on his kid. Just because something is "made up" as you say, it doesn't mean it has no power. Money is "made up" and yet Osama Bin Laden, a great hater of all things USA, had suitcases full of dollars. Why? Because if everyone else in the world agrees that you can trade suitcases full of green paper for real physical goods, then it's real. The superpower of humans is our ability to have millions or billions of people share the same ideas and act according to them. Take the story of Job in the Old Testament. I don't think that guy really existed and I don't think god and satan placed bets on how far he could be pushed, etc. But whether or not Job was a real person is like the least interesting question you could ask about the text. The interesting questions are along the lines of, "What were the authors grappling with and how did this story serve their community? What can we learn from the story?" Can anyone name one single way in which the story of Job is _more_ powerful if there is a real human versus an allegory. Our lives are uncertain and temporary. Against this backdrop, the human mind craves certainties. I admit I grew up believing Job was a totally real person, but I find the story so much more interesting when I'm not painted into that corner of believing an all powerful being did a good guy so dirty just because of a bet. There are plenty of hints that Job wasn't real, by the way, which is why I changed my mind. (There are multiple different endings to the story right there in the text of the old testament, for example -- and this is a pretty good indication that some editing was taking place.) One more way to look at it: Aesops Fable of the Tortoise and Hare. Does the power of that fable derive from the fact that a real tortoise one day had a race with a hare and won because he kept at it slow and steady? Nope. But when you're having a hard slog of it one day, you might remember the old story and feel a bit of inspiration to just keep plugging away at your task and eventually complete it. The inspiration came from the story, not from a literal physical race. At least when the atheists think there's a right thing to do they can be expected to give you their rationale. Because they aren't leaning their moral authority against the idea of a god, they basically _have to_ back up their arguments and try to be convincing. On the other hand, I have often experienced an exasperating form of know-it-all-ism where religionists think they get to declare "This is what is right, both for me and for you. Because god." And then they walk off like they think they just dropped the mic. I don't think any human deserves that much unquestioned loyalty. That kind of environment would be an incubator for religious tyrants. When you boil it all down, why would you say our sense of morality needs to be founded on a god, I mean the kind that exists even when nobody believes in him/her? Why does that provide anything better than what we've got which is a set of moral rules that have evolved with our civilizations? If there really does exist an unambiguous Absolute Morality with a real god backing it up, then which god is it and what are the North Star rules? And more to the point, why would those rules be _more_ valid if the god is real?1 point

-

There does exist a downside that we can't just wish away. Effectively, duration is the sensitivity of the value of your bond port to a change in interest rates. So, if you have a duration of 1.6 and there was an overnight 100 bps upward shift in the yield curve, the value of your bond port would decrease by about 160 bps. In the case of FFH's $28 billion bond port, that type of situation would give you an overnight haircut on your bond port of about $450m. Okay, that's not the end of the world. Now, Prem has signalled that FFH intends to shift to a duration of 2-ish during 2023. So, once again, taking a hypothetical 100 bps increase across the term structure of interest, FFH's $28B bond port would be haircut by about 200 bps, or $560m. TwoCities has expressed a preference for a duration of about 3, so the hypothetical 100 bps increase in rates would haircut the $28B bond port by about $840m. It's worth noting that if you hold your fixed income instruments to maturity as FFH usually does, there is no economic significance to those valuation changes as they will reverse themselves as the instruments progressively approach maturity. Where it does matter is for the insurance subs' underwriting capacity. Even if you plan to hold that fixed income port to maturity, you still need to mark those bonds to market which flows through the subs' balance sheets. Their underwriting capacity is a direct function of their capital level. For some of them, this is of no consequence while for others, like C&F, capital has been tight for a few years and hair-cutting the bond port could result in an actual underwriting constraint. To compound matters, if you get an interest rate increase, what else is happening at the same time? So, the type of scenario that Jen Allen should be concerned about is the situation where the Fed engages in an evangelical fight against inflation and elects to continue the aggressive tightening during 2023. Should that occur, what happens to equity prices? We've seen a recent stock market rally that might be attributable to investors believing that the Fed's tightening process is largely complete, that we will soon see a pause, and then maybe even a modest cut late in 2023. But, what happens if that's not what the fed does? Equity prices likely drop in that scenario which once again results in marking those $5B of securities to market and reducing the subs' capital levels. If you are thinking about Prem's 1-in-50 year scenario, it's not too hard to imagine the Fed going all out into Volker mode, interest rates rising another 200 bps during 2023 and the stock market plummeting 10-20% as a result. That type of scenario would be a pretty significant hit to the subs' statutory capital levels and underwriting capacity. When it comes to risks to the subs' capitalisation, the principal risk management tools that Prem and Jen Allen have are essentially portfolio allocation (ie, $5b of equities vs $28b of fixed income) and duration. While many of us think that duration should have been pushed out a bit more during Q4, we shouldn't pretend that there's no risk or no downside. SJ1 point

-

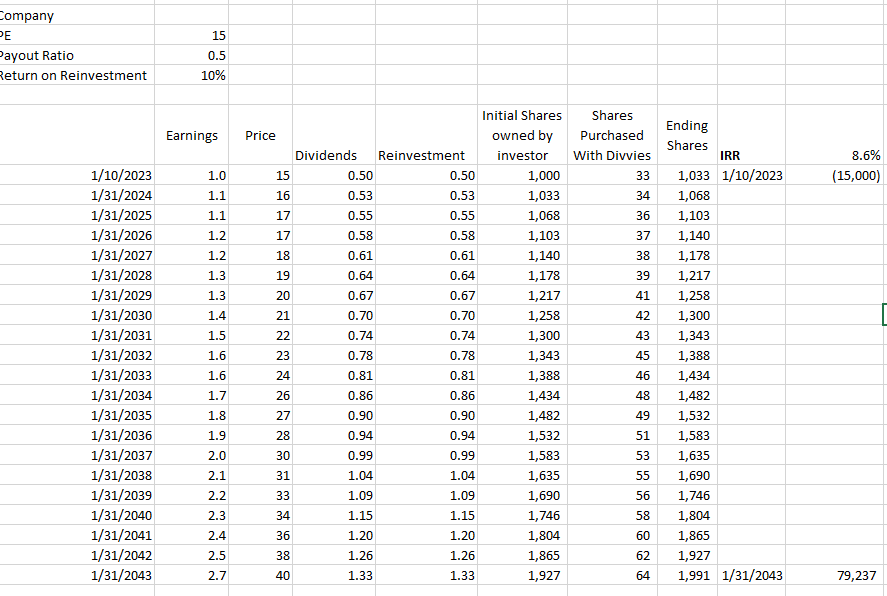

in short, they are the same thing (except for tax treatment which for US taxable investors favors buybacks). Company A distributes 50% of earnings in form of dividend and earns 10% on reinvested earnings. Company A is purchased for 15x earnings / 3.3% yield. It grows by 5% / yr and is exited at 15x earnings. Dividends are reinvested. Sold in 20 years. For a nontaxable holder: Investor makes 8.6% IRR Company B is same company but repo's instead of divvy. Same assumptions (excuse the quick and ugly spreadsheet). 8.6% IRR. Company B1 point

-

I don’t know. But I know @Parsad has suggested that FFH has a far deeper bench than say Berkshire. I am curious if that view still holds. That said, I hope Prem would live a long life and continue his amazing journey (at the helm or in the background as “paramount leader”), whichever1 point

-

“We have purchased total return swaps with respect to 1,407,864 subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 (Cdn$443.93) per share)”. —- Feb. 2021 At $574 USD per share today’ print, that “bet-on-myself” play is worth $808.5 million USD. A nice 66% return over two years.1 point

-

These are from quarterly NAIC filings: NAIC = National Association of Insurance Commissioners. Columbia Insurance is a large insurance subsidiary of Berkshire Hathaway that goes all the way back to the Diversified Retailing days (it was a subsidiary of Diversified Retailing, the department store company). National Indemnity even larger, as you would expect. Other individual filers are General Re and Berkshire Hathaway Specialty Insurance. Some insurance subsidiaries don't file on their own because they are subsidiaries of other insurance companies. These are screenshots because to find this information in the filing would take most people a lot of time. Here are a few of the Q3 filings (attached) - edit: they are too big and taking too long to upload so here is one. You can buy the individual filings at the naic website here https://insdata.naic.org Another interesting thing you can see from these filings is the internal structure of Berkshire Hathaway through the multiple Org charts they include on what all the corporate entities are, which subsidiaries own what, etc. Also it becomes very obvious that Berkshire went huge on affordable housing tax credits when it hired over the guy that build AIG's affordable housing business. National Indemnity Q3 NAIC.pdf1 point

-

1 point

-

Communism is a hell of a suppressant. Story used to be “Russia probably has some crazy technology!”. Turns out they didn’t either. There is some good discussion on this in the Intel thread on this. Idk if it’s they can’t, vs the barrier to entry and accumulated knowledge base on process makes it extremely difficult to catch-up.1 point

-

Square this with what the majority of folks like Roubini, et al are saying, predicting, rooting for, and the course of action they’re proposing to get us there? Even look at how he frames it…if the Fed “wimps out”…in other words, a 12 year old style condescension of the path they’d take that would prove him wrong hoping to assert some sort of bizarre control over the narrative. There has basically been one instance or period of bad inflation in the US and that was the 1970s. We’ve had 18 months of it coinciding with COVID measures and inflation has already begun tapering off in tandem with it. Yet based off a sample size of….wait for it….ONE, all these people are absolutely certain it’s going to go on forever if rates aren’t raised to like 8%…and oh by the way, how they’re financially positioned is just a coincidence? Eh, not buying it. Especially when they’ve been rooting for the same outcome and making the same complaints regarding monetary policy for decades.1 point

-

I just learned over the weekend what a Fury was. My son has a couple that go to his school. The demographics looking forward look dismal.1 point

-

This podcast is pretty good on the Fed /interest rates and the impact on the economy: https://podcasts.apple.com/us/podcast/odd-lots/id1056200096?i=1000563964446 In addition, Aswath Damodaran’s recent presentations on YouTube regarding inflation and impact on equity valuations (discount rates ) are also very good. FWIW, when you listen to the odd lots podcast , the guests opinion is that the Fed has implicitly removed the Fed put, meaning that the Fed may ignore stocks going down for the time being, and just limit themselves to looking out for orderly credit markets.1 point

-

Speaking for myself. Parsad, I thank you for sponsoring this board to share valuable ideas and information. Whatever you need to do to keep the site operation is probably okay with me, as my tolerance for noise is fairly high and the signal level is sufficiently high enough to keep me coming back. Maybe there are other high roller out there that where every second lost can mean the difference of a few million lost. I find that long term investing is fairly tolerant in regards to timing and think that if we can weed out short term thinkers by adding more ads, I’d welcome that. Again, thanks for keeping this site operational. From rolling my own sites, I know this stuff is not cheap, time and resource wise and I hope others can appreciate that.1 point

-

I’ll do my best but keep in mind that I don’t have the time to structure it like a proper tutorial so just bear with my adhd, dislexia and my poor spoken english but this might be very useful to you and a few more people. give me some hours and I will get back with a video link1 point

(1).thumb.png.afef2977f5053cb2dd62f46c5f452643.png)