thepupil

Member-

Posts

4,060 -

Joined

-

Days Won

4

thepupil last won the day on April 25

thepupil had the most liked content!

About thepupil

- Birthday 11/22/1988

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

thepupil's Achievements

-

I think this is a good thread on the matter. https://x.com/compound248/status/1816878276662497773

-

so I guess my idea of manipulation is making false statements about the company. I don't consider a price target in itself (which is subjective) to be a false statement or misleading. the complaint details Left coming up with a sensational price target (without basis) to move the stock. that's the crux here. But can an opinion on where a stock should trade be false and misleading? If you say you're still "extremely short" something when you've covered 75% of your position, is that illegal? what if beforehand you were simply even more extremely short? I would assume that a complaint of this nature would include people pumping up a stock (or trying to get it down) by making false/misleading statements about the company the complaint alleges that Citron's intent to buy/sell the securities at the time of release of information was not disclosed to investors. the "stupid disclaimer" does just that. just seems like tons of leaps/grey areas/points of concern that when brought to logical conclusion would apply to almost anyone, but in the end, he's going down. no one wins against SEC once they come after you. he's done.

-

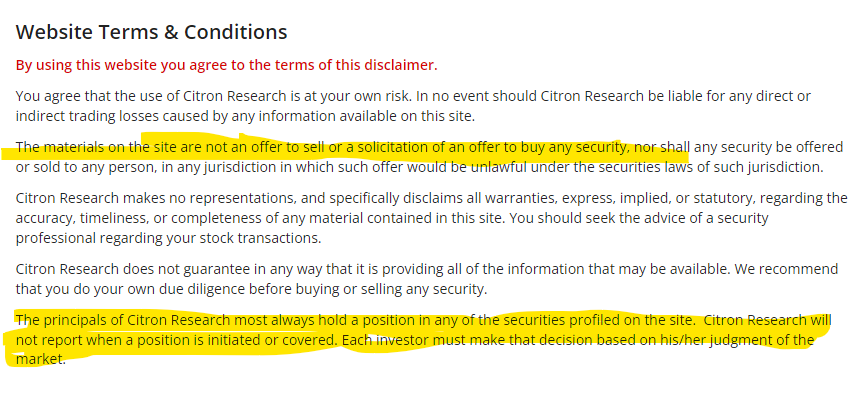

also, isn't this the whole reason every activist short or long has something like this in their materials/website?

-

Left seems to be the most egregious in monetization of short term moves, but I did not, until today, know that is was illegal to publish a price target and then take an action inconsistent therewith. I think there's enough false statements made for SEC to have a case, but I find some of the implications of what is legal / not legal to be both disturbing and far reaching. Here's the full complaint. https://www.sec.gov/files/litigation/complaints/2024/comp-pr2024-89.pdf What I find most interesting about this is the idea that having a price target and then selling / covering at some price different from that price target is "false and misleading" (see the appendix) By this definition, if I on twitter said that I think AIV is worth $16 and then sold half my position at $9, having bought at $6.50, I've made a false and misleading statement, when in fact, I'm merely taking profits. Now if i did that 25 times and used sensational language and did it on small moves on a number of stocks over very short time frames and told my colleagues i was taking retail investors money like candy from a baby, and i had 100K twitter followers instead of 7K, then maybe the SEC would come after me. But a lot of the individual acts by left here don't seem "false and misleading" to me.

-

I agree w/ this, but I'll always be at least like 80% equities because can't time the re-entry. curious if you think we're still in a time of "volatile and/or rising inflation?"

-

haha, those were some good bonds...FWIW I'd probably leave the last two points to someone else.

-

if we include 2022, indeed S&P 500 equal weight is < t-bills at 3% ish, SPY at almost 8%/yr, 3% ish for stocks outside US. EM and bonds are negative. Gold a nice 11%/yr. so yea, I agree with you over that time frame that non mag7 stocks not really worth owning vs t-bills (with the benefit of hindsight).

-

not sure I agree. since the beginning of 2023, bonds have been worse than t-bills, Equal Wgt S&P500, ACWI ex United States, EM stocks, Gold. it's not just a Mag7 thing. I've been building bonds all the way over that time period. The bond index is now my single biggest line item (but still only like 9% of my nut), but let's not pretend that bonds have done well or added any benefit to relative to other asset classes thus far. so far it's been wrong to have any. may be different going forward. only been a couple of years with +real rates.

-

yep, was aware of the 1256 (hence no wash sales). I definitely can do it more optimally and need to sit down build an excel sheet/plan. @aws objective is to have no economic gains/losses, not use "substantially identical" securities and have an array of unrealized gains/losses to choose from.

-

another factor is XLF flows. When Berkshire has a short term run-up (or down) it's often in tandem w/ XLF (driven by big banks, asset managers, payments, etc)

-

example: I went long about $xxxK notional of $VT via (synthetic long, short put long call) and short the same of SPX via futures options expiring in december. so long world / short US, not the exact same security, but about 65% or so pretty similar since world is 65% US. I'm invested mostly in US in all accounts including tax advantaged so being short US for this trade wasn't a concern. I lost $xxK on the short SPX leg and was up $xxK on the $VT leg at time I closed out the SPX short and realized $xxK of losses. I then re-established a similar short position in a slightly different US based index (even though 1256 contracts don't have wash sales so this was not necessary). Assuming the $VT leg is still profitable at expiry, I can choose to exercise in December (which will require borrowing a bit of money) which will build the gain into the VT shares but allow me to control timing of realization. there's a number of iterations. I think the "right" way to do this would be to diversify across tons of highly correlated pairs including individual stocks, but I'm optimizing for pre-clearing as few things as possible at my employer.

-

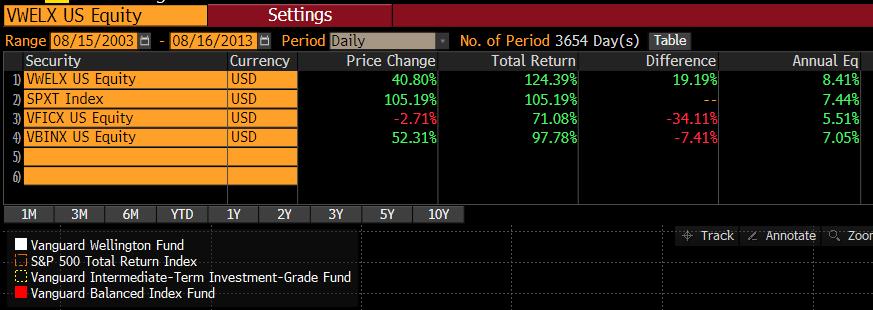

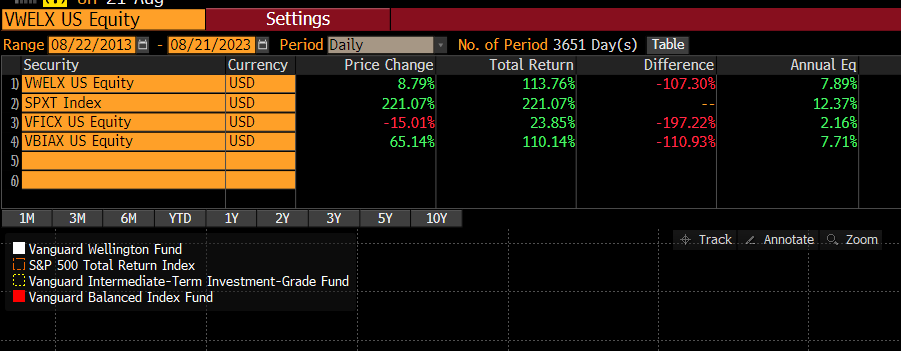

are we "fixating" on bonds or just moving from #neverbonds to #maybesomebonds? of course, since I wrote that, SPY is +30.1% and bonds are +6.8%, but it's also been 9 months and not 7-10 years.

-

I manage my money as well as that of my retired parents. Their taxable portfolio is ~50% basis / ~50% unrealized appreciation but the positions at the top (Berkshire / Google / Apple / Black Stone Minerals / Microsoft etc) are 5% - 30% basis with rest in unrealized appreciation creating significant tax friction for selling. Nevertheless as florida retirees, paying 15-23% on trims isn't so terrible and is portfolio is relatively tax efficient. My own portfolio is traded much more aggressively and is much more concentrated and far less tax efficient; on top of that I'm in a high tax state. My own taxable's portfolios CAGR is much higher than theirs (last 5 years = 25%/yr for taxable, last 5 years = 13% / yr for theirs). TO be clear, this is my main taxable account's CAGR and not my whole portfolio and reflects a very favorable time frame and is obviously not a sustainable return. Way too high. Will be much lower. On a longer time frame, I'm more like SPY +3% (of which I'm proud because as a value luddite, I do the whole "OP'd without tech" nonsense) but much of that +3% has likely gone to taxes. I think given the tax inefficiency of my approach, their portfolio's risk adjusted after tax return is better than mine and their approach is probably where I'll shake out eventually. the result of my greater aggression has been compounding at a higher rate, but I've also been paying taxes as a I go whereas they build a favorable form of leverage with a DTL. It takes a pretty big delta in returns to overcome taxes. Nevertheless, I do not prioritize tax efficiency because a) so far more or less have paid for the increased taxes w/ better returns b) have built a (top 1% for age I suspect) amount of tax advantaged accounts from $0 over last 13 years so a portion of my investing will always be tax agnostic. Lately, I've introduced a tax overlay on my own portfolio where I'm long and short various indices, trying to generate $0 of net PnL but lots of gross positive and negative pnl. thus far this has been moderately successful and allowed me to sell all my highly appreciated berkshire with minimal tax friction, but it's also because I just haven't made that much money this year and paid lots of taxes in the past. long way of saying, I kind of get both sides of this debate. regarding berkshire, my view of the core businesses competitive position (Burlington vs UNP, GEICO vs Progressive, BHE/utes on an absolute basis) etc has dimmed relative to 3,5,7 years ago. My view of apple's valuation has as well, and the P/B multiple is quite healthy particularly considering just how much is in liquid stuff available at market outside of berkshire. the DTL is more likely to be realized / real as Buff dog trims Aapl, so you're paying quite a premium to an already rich valuation for a pretty big portion of the book. I've been at $0 of berkshire 2x in 13 years. I may regret it. it remains my parents largest position. I expect it to do okay from here over the long term.

-

i sold all my remaining Berkshire yesterday.

-

I disagree. 100's of managers shut down a year without committing fraud. Him losing AUM and shutting down and the management company being worthless is completely normal. Even highly successful fund managers shut down. I can think of a few who voluntarily returned billions and just quit as well as many more who lost their AUM because they failed from an investment standpoint or failed from a sales standpoint. the vast majority of fund managers have no terminal value beyond the founder's career. having your management company become worthless is not equivalent to fraud and not equivalent to your investment funds going to zero. the disagreement re the loan payments is sketchy and deserves scrutiny. my gut is chanos would not commit such blatant fraud, but we'll see. courts will figure out.