-

Posts

14 -

Joined

-

Last visited

About TorontoChaosTheatre

- Birthday August 18

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

TorontoChaosTheatre's Achievements

-

Andrew Wilkinson Thirst Post/Book

TorontoChaosTheatre replied to TorontoChaosTheatre's topic in General Discussion

That's right and I agree with this. Thank you (also, we are lucky to have you as admin).- 14 replies

-

- tiny

- andrew wikinson

-

(and 2 more)

Tagged with:

-

Andrew Wilkinson Thirst Post/Book

TorontoChaosTheatre replied to TorontoChaosTheatre's topic in General Discussion

Update: I am in the process of creating/designing a custom Andrew Wilkinson t-shirt for my own personal use at university. I am finally going to be cool. I am with Parsad on this. That's the right way to think of this. Andrew Wilkinson is the next Andrew Wilkinson. I really look forward to reading his book and learning more about his approach. Also, for the skeptics, there are many ex-employees you can sleuth on LinkedIn, and they all speak very, VERY highly of him. Otherwise, this is a really interesting podcast by an ex-employee. https://podcasts.apple.com/ca/podcast/invest-like-the-best-with-patrick-oshaughnessy/id1154105909?i=1000620745533 Tim being taken is a shame and a loss for an entire gender. Also, Parsad, I was finally able to show her a photo of you (the only one I could find is the one of you next to Wayne Gretzky), and she says she would date you over "some dumb hockey player any day." You are a contender! All you need next is to take your Premier Diversified Holding public (PDH), so she can buy shares. Don't tell Wayne, though; he might short it and make baseless accusations regarding the company's accounting in a hundred-page PowerPoint, and Trevor Scott would need to go on BNN again. Luckily, I think she would be a loyal shareholder and would ignore the shorts or buy more. Again, everyone, I am not saying you should invest in Tiny. The extent of my analysis is that I vote Andrew the best-looking value investor of 2024. If more females learn about value investing as a philosophy and career because of Andrew's physique, I view that as a positive. Whenever I mention value investing on a date, it is like I am speaking an alien language. The second place for best looking is Mohnish, but only ex-moustache and in pyjamas. Third is Dr. Michael Burry because he is ripped, played football and is a musician. To conclude, I think about the image below often and, going forward, will strategically add naps to my research process. I genuinely think napping played a role in Mohnish's success as an investor... ...however, counterfactual thinking leads me to be somewhat sad that Mohnish left a nascent pyjama modelling career to be a legendary hedge fund manager and philanthropist. Happy Bargain Hunting, and remember, sleep comes before beauty and great investment results!- 14 replies

-

- tiny

- andrew wikinson

-

(and 2 more)

Tagged with:

-

This is amazing THANK YOU

-

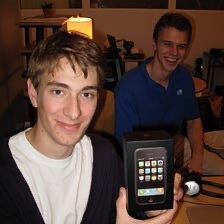

*Beware, this post is only slightly exaggerated and contains sarcasm* Today, I met a girl in the accounting and finance program on the TTC. We talked about investors we admired when she revealed to me that she is IN LOVE with Andrew Wilkinson after hearing one of his podcasts on My First Million because of how he talks. What she failed to anticipate is that I AM MORE IN LOVE WITH ANDREW WILKINSON than she is because I had already pre-ordered his book "Never Enough From Barista to Billionaire" for $19.99. Great title, except I think the title should be extended to include "from Barista to Full Time Bakery Owner and part-time Tech Billionaire and back." Maybe he should ask Joel Greenblatt for tips on naming a book. I am a little disappointed that the person at the top of the building is not (when zooming in) a TINY version of Andrew Wilkinson but instead some RANDO. Furthermore, I cannot pre-order the audiobook version. I will start a proxy war/activist campaign if he does not narrate the audiobook himself. However, this story is not a happy ending. This post is about young heartbreak at TMU (formerly called Ryerson, which he attended briefly). I also told her how "Andrew Wilkinson signed the Giving Pledge alongside his wife." Her reaction: WAIT, HE IS NOT SINGLE?!?!?! She is a long-suffering shareholder in Tiny, so I hope she does not sell her position just because he is taken. Maybe Chris Sparling is available? To mourn our loss, we have compiled a list of photos in no particular order showing Andrew's transformation from Barista to Billionaire. P.S. She still thinks he is cute.

- 14 replies

-

- tiny

- andrew wikinson

-

(and 2 more)

Tagged with:

-

How to buy stocks in the London AIM market?

TorontoChaosTheatre replied to TorontoChaosTheatre's topic in General Discussion

Hello everyone, First of all, I am very grateful for the many thoughtful responses and thank you for helping an undergraduate out with how to buy their first ownership stake in a business! I was able to open an account on interactive brokers, and it trades there (I double-checked, and I made an error believing it was harder to trade than it was). I wish my thesis were more in-depth. I only started taking accounting classes recently, and from my poor reading and analysis, it is cheap. I have no catalyst or unique analysis indicating why it will cease to be cheap. Only if it has no debt is it hard to go bankrupt. I am also slowly making my way through the footnotes and also need to finish reading the proxy (THIS LEGALESE LANGUAGE IS DENSE, and I am sorta lost, to be frank). My pre-mortem for what could go wrong is that local demand falters. It's high uncertainty and low risk as long as they are profitable. I am publicly committing to selling if that situation changes. Sorry about saying what you said was a question (that's right, it was a statement), and thank you so much for helping me out here with that link. It is intellectually stimulating. I started rereading Peter Cundill's bio (I am ashamed I forgot about many of the situations). Some of the international situations are epic. But I am sure they were not as clear-cut bargains as they seem in hindsight. Does anyone know where to buy those 1840s unpaid Mississippi bonds? Thank you for the article. Happy Bargain Hunting! -TorontoChaosTheatre- 17 replies

-

How to buy stocks in the London AIM market?

TorontoChaosTheatre replied to TorontoChaosTheatre's topic in General Discussion

That's a great question. So, what happened is that it initially traded in the main exchange. Now however, it trades on the less known AIM now because it no longer meets the requirements for the Main Exchange. I hope that helps.- 17 replies

-

How to buy stocks in the London AIM market?

TorontoChaosTheatre replied to TorontoChaosTheatre's topic in General Discussion

GKP in London is the specific company I want to buy. Also, thank you so much for your quick response.- 17 replies

-

How to buy stocks in the London AIM market?

TorontoChaosTheatre replied to TorontoChaosTheatre's topic in General Discussion

Also, this is an even more obscure question. How can I find out how to buy LEAPS on the company's shares?- 17 replies

-

TorontoChaosTheatre started following How to buy stocks in the London AIM market?

-

How to buy stocks in the London AIM market?

TorontoChaosTheatre posted a topic in General Discussion

Hi, I want to buy shares in a company that trades in the London Alternative Investment Market, and I need help finding a single Canadian discount brokerage that allows me to do this. My advantage as a small investor is that I can go where others cannot; however, I believe the company, in particular Gulf Keystone Petroleum, does not even trade on Interactive Brokers. I would appreciate any help. Questrade requires someone to invest a minimum of USD 5000 and charges a 195 USF fee for international trades (which is pretty much my net worth). Interactive Brokers, unfortunately, only offers AIM shares traded on the AMSM segment that trades on SETSmm. https://markets.ft.com/data/equities/tearsheet/profile?s=GKP:LSE Happy Bargain Hunting! I hope the above request is reasonable.- 17 replies

-

Thank you for the thoughtful response. I think BAMSEC is the correct choice for most money managers. However, if I can give some pushback, BAMSEC is super expensive for students, at 69 USD a month. When taking into Canadian currency conversion, the cost is over $1000 a year. I think the question was answered, but the problem of cheaper alternatives remains. I hope to have a better reply in the future, but if you are using BAMSEC, what do you like or dislike about it? What would you change or recommend the creators add? Thank you so much again.