-

Posts

15,114 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Interesting observation on the gold standard and I agree it was a major infliction point. I think some folks rightly point out that abandoning the gold standard was like ripping off a band aid. Unfortunately if you are bleeding from a wound and rip the band aid off, the bleeding increases. There is also the theory that abandoning the gold standard let to the first oil crisis in 1974 as the Arabs then got aware that they were getting screwed over inflation and decided to put the squeeze on. FWIW, they are doing the same right now, just piece meal with supply reductions, while also trying to dump $50B worth in Aramco stock. They definitely have gotten smarter over the years.

-

Looks like both ships are completely destroyed. https://x.com/UKikaski/status/1701890251306762666?s=20 Yes, for the Russians it must feel like the Ukraine uses a cheat code when using western weapons.

-

USB down ~4% today. I did not see any news, except an unchanged dividend. I think USB used to raise their dividend in the third quarter almost every year and this year they apparently didn't. Maybe that has spooked the market, or is there anything else going on? Even $C has raised this year and so did $BAC. $PNC, $JPM.

-

Looks like Storm shadows have damaged a newer Submarine and a larger Landing ship in Sebastopol harbor. Crimea is strategically worthless for Russia now; https://x.com/UKikaski/status/1701894717615546754?s=20

-

What makes you think the CEO (Hayes) is incompetent? UTX did quite well when he was CEO from 2014-2020. I would even state that the merger with Raytheon was a good capital allocation move, as was the spinoff of Carrier and RESI.

-

For R&R, besides going in the wrong direction (wide body vs narrow body) ,the technical issues with engine reliability, they also had (and still have) a very inefficient manufacturing which results in high cash losses of the engines as sold. They were relying on service revenues to make up for that, but that means that cash flows are backloaded and causes a cash crunch, which had to be resolved with capital raise. RTX does not have the same issues. Due to their merger with Raytheon, has a stable and growing source of cash besides the air craft engine business, which is enough to fund the business and the dividends. So there is no cash crunch issue with RTX. Similar to @Xerxes, I regard my RTX holding as a critical infrastructure that's not going anywhere (perhaps not up either in the short term). I would have added more at $73 but it never got there so far.

-

Reduced JXN and sold WTW

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

How do people here about tail risk for Berkshire BHE - utilities have huge tail risk if they cause fires now. Apple - risk of China syndrome Then we have the catastrophe risk from the insurance business. Something to think about if you have a huge position. -

Search in Amazon for "Keys to Learning" and look for a book available in Kindle only and published in 2023. There you have Mike's book: Probably a good read for my son who started college just a few days ago. I asked him if he is interested.

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

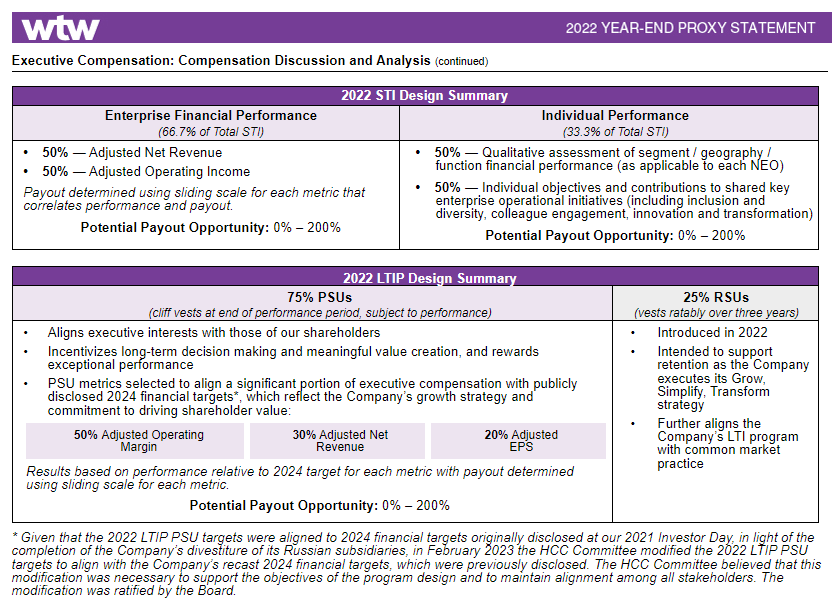

the VIC comments are indeed insightful, as they noted the lack of FCF. FCF has been lower than operating income and usually that's not the case with insurance brokers. Based on what I read at in CC transcript and the comments, I made a bet with myself that the proxy won't have FCF as a metric for executive comp and that is correct: So management runs WTW not for cash returns but accrual earnings. Not a fan at all. Then I hear (or read) the CEO (Hess) talking his BS and my spider sense goes off. My spider sense is often wrong though. I could be wrong here as well, but sold my shares because if things go wrong here, I will have no conviction to average up. -

It’s pretty much a 2 year project to work through these engine issues. Nevertheless, I added a few shares today.

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

I read the Cc transcript of WTW presentation for the KBW conference and I get a bad feeling about this stock. Quite frankly the CEO Hess sounds like bullsh$tter. Right, Right? You tell us… https://app.tikr.com/stock/transcript?cid=36623&tid=317560689&e=1854199080&ts=2904877&ref=o94y6y I have a feeling there are good reasons why this stock trades where it does, partly structural and partly due to management. -

RTX update on engine issues: https://finance.yahoo.com/news/rtx-provides-pratt-whitney-gtf-110000268.html Not a small financial impact. i think I am going to add a little if this breaks $80.

-

-

Where could I fin information on recent spin-offs?

Spekulatius replied to Fundmanagerthrwawy's topic in General Discussion

I think that’s correct. Counting from the spin date, spin-offs have underperformed the market as a group in the last few years Totally different situation from 20 years ago when Greenblatt wrote about the opportunity. I think management have learned to spin off turds with too much debt. That does not mean that opportunities can’t be found. -

Interview with Spekulatius on QUCT

Spekulatius replied to EricSchleien's topic in General Discussion

-

Where could I fin information on recent spin-offs?

Spekulatius replied to Fundmanagerthrwawy's topic in General Discussion

https://stockspinoffinvesting.com/upcoming/ Rich Howes Website above. You need to pay to get all the content though. -

Problem solved already. https://www.theverge.com/2023/9/7/23863258/bmw-cancel-heated-seat-subscription-microtransaction I think the biggest tax on consumers are frivolous lawsuits but tort reform is not an FTC issue. Forcing union membership is another issue. I have nothing against unions per say, but they literally force some workers to join. Also, Non compete agreements should be forbidden for all but the highest rank managers. They are already forbidden in CA and it's large boon for their economy.

-

Returns are hugely driven by 2019 and 2020 vintages , perhaps by the SAAS boom.

-

China exposure of US companies : https://www.investors.com/etfs-and-funds/sectors/sp500-companies-face-much-larger-problems-in-china-than-apple/?src=A00220 Of course Apple not just has revenue exposure, but also huge supply chain exposure. Then add Taiwan… Risk are not priced in for the likes of QCOM , TXN or MPWR, imo.

-

Belt and road / Kazakhstan: My guess is that Chin really does not give a damn if Belt and road is economically viable, it’s all about buying influence.

-

Well my wife typically shops these things. We typically prefer to buy at Costco and that's where we got the air fryer. I don't know if she looks at these brands first, but they are certainly on the list of brands to check out (depending on exactly what we buy) and then i give my input (which is typically - just buy it). I can say I had input on the vacuum and we chose this Shark model because it has the attachments that we use and wasn't super heavy as well as having multi use filters that are easy to clean. We bought this in 2015 and it's still running well. As I said, solid and smart designs and well priced unlike some other brands that are clumsy and badly design and don't last.

-

PRNDY and KVUE (starters). Adds to OUT, C, LHX

-

No comment on the stock, but I think the brands Shark and Ninja have value. We have a Shark vacuum and Ninja air fryer and they are both and smart designed and solid and not overpriced either (Dyson...). Much better brands than Hamilton beach or Black and Decker etc and many others.