-

Posts

15,104 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I actually agree with this. Should be done via profit sharing, same indexing for everyone.

-

I don't know if that's still the case, but at automobile companies, Engineers got overtime pay, just like hourly employees. That was about 20 years ago and probably rank dependent.

-

Why now?

-

Where could I fin information on recent spin-offs?

Spekulatius replied to Fundmanagerthrwawy's topic in General Discussion

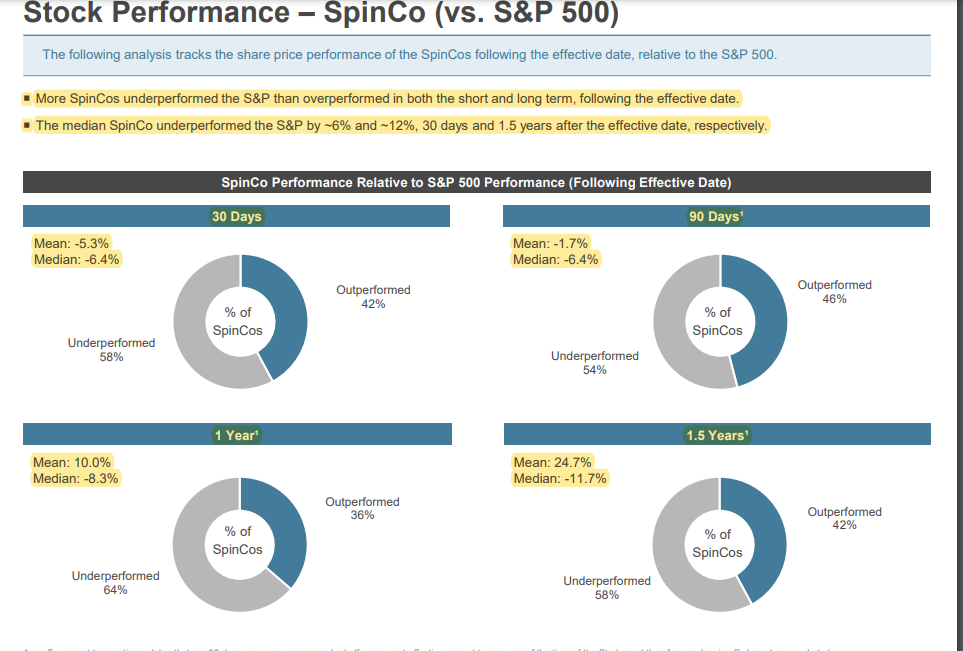

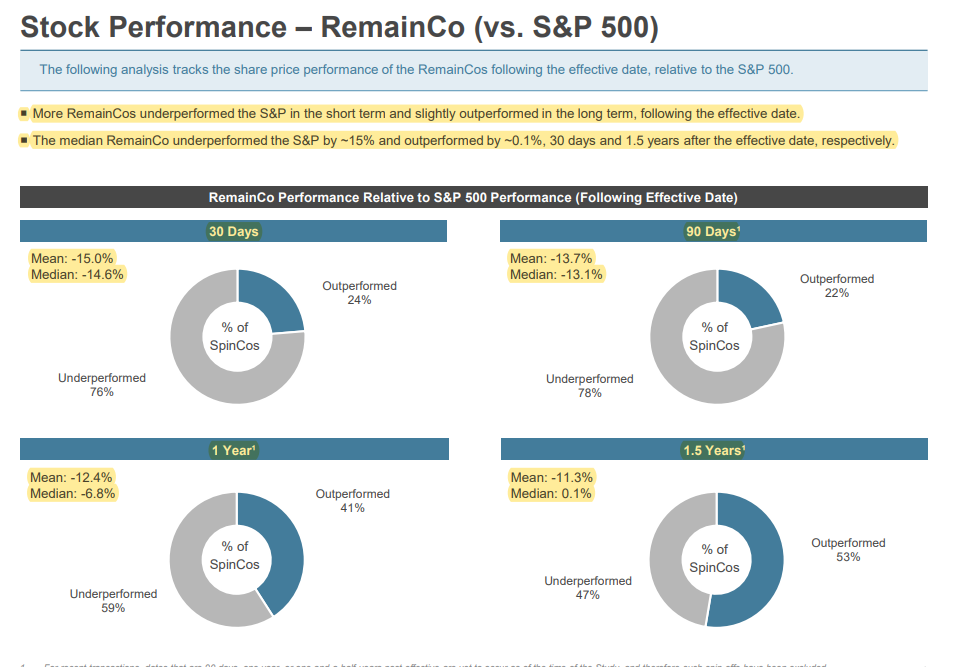

Here is a study from the Focusedcompounding fellows: https://focusedcompounding.com/wp-content/uploads/2023/09/2022-spin-off-transaction-study-.pdf This confirms the underperformance of the Spinco population that I have seen in another study recently: What I did not know is that remainco's also underperform: -

My Costco in NH would work, I think. Current Gold price is $1940 so $1980 is just a ~2%markup. Pay this on a Costco CC and with the cashback credit you are buying this below FMV of the Gold essentially. Item cannot be returned unfortunately - otherwise you would have a short term out option with it for free as well. https://slickdeals.net/f/16931002-costco-members-1-troy-ounce-gold-bar-rand-refinery-new-in-assay-1969-99?page=7#comments Not available for me at my warehouse unfortunately.

-

As far as I can tell, the economy and the banking sector are still alive.

-

My guess is that Mike Burry is also more of a trader than investor now.

-

Trudeau can't make open accusations but then has nothing to show. If he can't share intelligence, then he can't go public either and needs to work diplomatic channels only. Seems like a very elementary mistake.

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

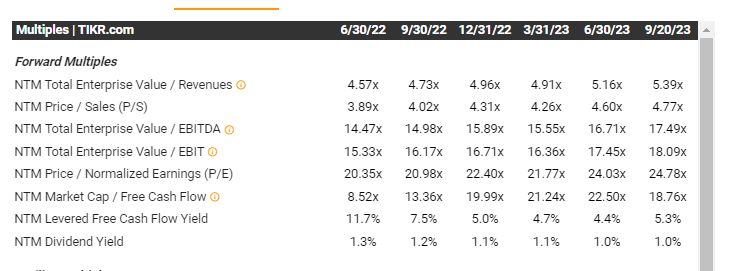

Refinitv and tikr (which pulls consensus) has AJG at ~25x earnings. I think the 45x PE is backwards looking and may be GAAP not "operating earnings". I think AJG trades in-line with BRO, if not a bit cheaper. -

I just added a little to RTX this AM. While the engine issue is an overhang, their defense business with a lot of exposure to electronics, missiles (hypersonics) is very well positioned to grab more business. it also does not seem that the military engine business from P&W is affected.

-

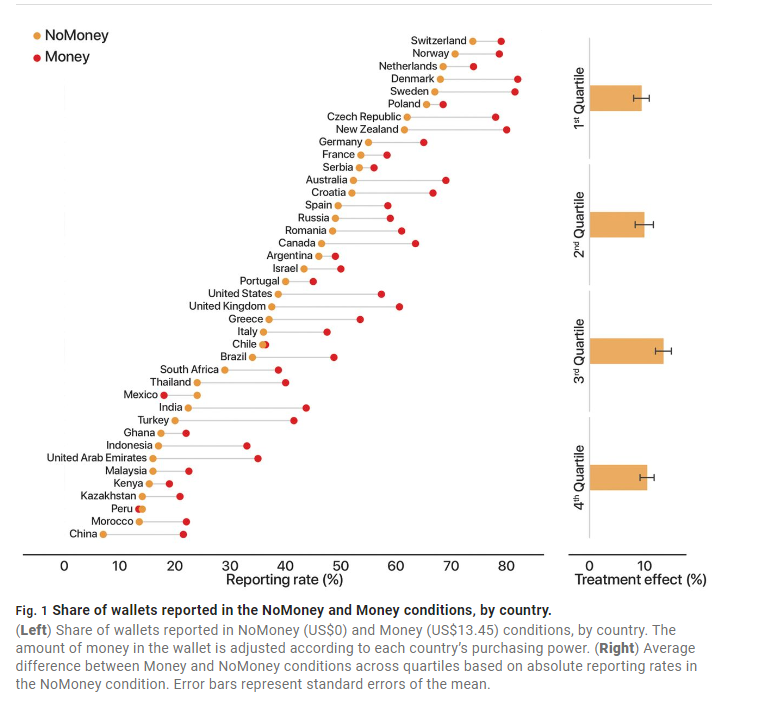

I will say this much. Chinese don’t care about strangers but they would much less likely steel from a family member than in most westerns societies. This applies even to a work environment generally. I never had anything stolen at work while I worked in China. If they know you well enough, they won’t steal from you. It is also noticeable that the US does not look that great in this chart either.

-

LOL - percentage of lost wallets returned as a measure of honesty by country: https://www.science.org/doi/10.1126/science.aau8712

-

Public Company Share Repurchase-Cannibals

Spekulatius replied to nickenumbers's topic in General Discussion

I have not listened to Chitchat AZO podcast, but you likely get better info here (Acquired Podcast): https://podcasts.apple.com/be/podcast/autozone-exemplary-capital-allocation/id1559120677?i=1000542928430 -

For Chinese stocks to work, 6% GDP growth or taking over the USA as the largest economy is not needed and I would argue even that looking at these things is mostly irrelevant. For Chinese stocks to work, XI needs to leave the economy alone more and let it do what it (or the people) wants to do. Whether it growth by 3% or 6% does not matter all that much, especially if the extra 3% growth may come from prestige projects with very little economic utility.

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

@longterminvestor thank you for your incredible work. I was looking at BRP too and went into the too hard pile. I simply could not understand the financial statements and it is obvious that there is not much FCF, but the exact reasons (other than debt service costs) were not clear to me. I have no a much clearer picture of what exactly is going on there without having to do any work. -

Public Company Share Repurchase-Cannibals

Spekulatius replied to nickenumbers's topic in General Discussion

I listened to the Discover episode - it wasn't very good and I think they got the business wrong. These Chit chat guys are not very good analysts and paint these business in very broad strokes. I personally think you can find better work (Deep dives) elsewhere and you are wasting your time listening to them. The name says it all - it's chit chat. -

The higher long yields are an indication of the economy doing better than expected. Looks like we have no problem with 5% interest rates, at least the doom and gloom that was predicted did not happen.

-

Public Company Share Repurchase-Cannibals

Spekulatius replied to nickenumbers's topic in General Discussion

$DFS does not do car loans. I think you are referring to $COF. $DFS is a very simple business - i hope they dump the student loan business as they seem to be contemplating - it has less return and there are a lot of regulatory issues. What people missing with these cannibals is that for a cannibal to do their work (buying back huge chunks of their own shares), they need to have a low multiple. A 5x PE gives you a 20% earnings yield, which means you can buy back 20% of the outstanding (assuming no re-investment) while with a 20x PE, the company can buy back 5%. That's why the $JXN, $DFS or $BTU and similar cheap stocks are better cannibals now than $AZO. -

Public Company Share Repurchase-Cannibals

Spekulatius replied to nickenumbers's topic in General Discussion

$DFS is one I am buying now, even though they are not buying back shares right now, due to regulatory overhang. They are down to 253M shares, which is less than half what they had a decade ago: -

The economic situation is always confusing. What we have right now does not strike me as unusual. I think what is unusual are the higher interest rate, but only if you don’t look back further than 20 years.

-

I think the "Big short" episode in 2007/2008 changed him and at the end may have cost him a lot of mental sanity and money as well. He has changed a lot from his earlier days. He may have done better losing money in 2008 like every one else and just keep doing what he has been doing before.

-

I think WEB does not like defense for political reasons (or avoid political discourse) and except in a GD special situation when he front run tender offers, he stayed away from them. Other than that, I think they meet the Buffet test of being around 15x earnings (or close) and very likely to be earning more in 5 years than they do now. Producing weapons was probably one of the first human activities before even taming fire and may well be the last. I don't see much of a terminal value risk there.

-

It helps a lot when nobody tries to "Sell" anything. Twitter / X has interesting aspects to it, but almost anyone who becomes popular or contacts you directly tries to sell something. Anonymity is preferable because it keep emotions in check (Doesn't hurt at much to call @Spekulatius and idiot than calling me names) and makes it easier to change my mind.

-

The impact of ESG is dwarfed by the impact of prices. Yes, the high prices last year have impacted production, but so have the low prices from 2019-2020. Longer term, one thing that will be interesting to watch is China. China produces 26% of the carbon emissions right now, but there is little doubt that they have a massive effort ongoing to decarbonize. I think they might be getting there quicker than thought with the massive energy consuming construction sector faltering (steel and concrete need massive amount of energy - mostly coal to produce ) This won’t impact the the balances this year or next, but I think in 5 or 10 years it will make a massive difference. https://www.eiu.com/n/china-road-to-net-zero-reshape-the-country-and-the-world/

-

Fighting with beer against the French in Africa : https://www.marketwatch.com/video/how-wagner-used-beer-to-spread-russian-influence-in-africa/C9257E93-0074-4BBB-8F37-94EA63CAD82A.html