Leaderboard

Popular Content

Showing content with the highest reputation since 04/24/2021 in Posts

-

This is one of my favorite things to rant about so let me apologize in advance. This isn't a comment about Brett Horn in particular - I don't know him, and maybe he's great. But what I strongly recommend is to look to the broker analysts as a gauge of popular sentiment (if even that) or to understand how brokers drum up business. Nothing more. It is not a coincidence that companies reliant on capital raising tend to get the widest coverage and the best ratings. But since the ostensible separation of research from investment banking (and the removal of skin in the game - analysts ability to actually buy stocks in their coverage universe - in the name of removing conflicts of interest), the job is basically a glorified sales job for trading volumes. And many of them, if they do get a real nugget of information or have an actual insight, share it behind closed doors with whichever client trades the most through their bank. In other words... I wouldn't think that hard about it. The analyst incentive is to not stand out in a bad way and keep making ~$1-2mm/year to keep their kids in fancy schools. Even if one is actually bearish, he/she almost certainly won't stick his/her neck out and risk embarrassment and losing that cushy gig. Sorry, I've done that job as a bright eyed and bushy tailed junior analyst and unfortunately saw how the sausage is made, so maybe I'm too cynical now. Maybe the general takeaway is to keep your expectations low and allow yourself be pleasantly surprised, but the clear and simple fact is that @Viking and others with real insight and skin in the game do a 10x better job than any broker analyst. Maybe this wasn't the case in Lee Cooperman's days at GS (though it was probably even sketchier then) but it is now. At the bare minimum, the pay and prestige aren't what they used to be. The real talent is elsewhere. Expect the sell side estimates to keep climbing higher as Fairfax executes.2 points

-

I once saw a cheers-less post. Gregmal was being disciplined over in the Disney thread…2 points

-

@newtovalue you are welcome. Nice to hear that others find value in some of the posts. I use writing as a way to get my thoughts in order. And i love it when people take the other side as i spend a fair bit of time trying to figure out why i am wrong. I think my track record is pretty decent figuring out the earnings part of the equation. I am pretty terrible at figuring out the multiple expansion part of the equation (i tend to sell my big positions too early).2 points

-

2 years later after start of thread and bonds have underperformed t-bills by 4%/yr and SPY by 8%/yr as the index's yield has increased from 3.5% to 5.25% (actually yields more since that's YTW and MBS will yield more than their YTW) I'm continuing to plow the entirety of my 401k into bonds and have recently started to buy long term tsy's on margin in my taxable (having sold most of my IG corporates after the late 2023 rally). credit risk free MBS >6%, LT tsy's approaching 5%. good stuff. I'm a buyer. no corporates. IG spreads way too low in my opinion. not for everyone but if you buy say 30% in LT tsy's at 4.8% on margin at interactive brokers, at top federal tax rate, you're making 3% after tax yield, fund w/ 6.2% margin and you have negative carry of 3% on 30% of your portfolio. At constant yields you lose 90 bps/yr on the portfolio. But in a recession where rates drop just 1%, you get 30% of your portfolio going up 20%, 2% =42% for 600 - 1200 bps of PnL when you want it most from liquid monetizable instrument. if rates go up another % you lose 15% on your 30% / -450 bps. almost no mgn requirement. JPow is making bonds great again.1 point

-

The hard reality is that Israel f****d up badly when they struck the Iranian consulate in Damascus; senior officials rolled the dice, and almost pulled the US and UK into Gulf War III. There are a lot of bills to pay for last nights bail-out, and there will be consequences. The only reason we don't have Gulf War III this morning is because Iran also has very smart generals, who managed to launch a face-saving sovereign-on-sovereign strike that was designed to reliably fail. Now it's purely a personal matter between families; the perpetrators will be known, and its old world 'eye-for-an-eye'. One day ... they will be suddenly gone, the matter closed, and we will all be the safer for it. https://www.aljazeera.com/news/2024/4/4/why-does-israel-keep-launching-attacks-in-syria Lot of very smart people acted last night; we owe them all an enormous favour. SD1 point

-

Lmao this dude is a clown. Imagine shorting Microsoft or Amazon because its 18% overvalued based on what you think fair value should be. If I was an investor in his fund I'd be pulling capital right now because he obviously doesn't know how to manage money. Probably has a burner on r/WSB1 point

-

At this point the guys best and highest use would be running charity auctions for the right to be punched in the face by current and former clients whom he's cheated with his antics.1 point

-

Hi folks. Longtime lurker, first-time poster here. Just wanted to chime in with a few comments, some general, some related to the topic of this thread. First, I want to echo those who have highlighted @gfp's contributions to this board over the years. Thank you for your thoughtful posts—I hang on every word. (I'm grateful to all the members of this forum, I should add!) Re: the topic of this thread, a comment that Seth Klarman made in an old issue of Outstanding Investors Digest (at least, I think that's where I found it) comes to mind. An interviewer asked Klarman about his hurdle rate, clearly expecting his answer to be some crazy nominal figure like 20%/yr. Klarman emphatically replied that he never targets nominal returns, only risk-adjusted returns. I agree that that's the metric to target. I would hazard that Berkshire has pretty much always (and maybe literally always, but I won't go that far) offered at least plausible risk-adjusted returns, including over the past two decades. As gfp mentioned, the key is not to interrupt quality compounding, and the easiest way to avoid interruption is to own low-risk assets that you know intimately. The stock's decent risk-adjusted prospects hold even today. Compare owning (an admittedly slightly pricey) Berkshire now with owning the S&P 500 at a Shiller P/E of 34 and with after-tax corporate profits/GDP near all-time highs, not to mention a degree of concentration that Ben Inker of GMO argues all but ensures underperformance in megacap stocks. So, has Berkshire "killed it" since 2000? On a risk-adjusted basis, yes, and it has a good shot of continuing to do so for the next ten+ years, especially if its dividend policy holds. My 1991 shares have done 14.46% p.a. for 33 years, my 2011 shares have done 15.04% for 12 years, and my 2020 shares have done 25% for four years. If you bought conservatively over the past three decades, you probably killed it in non-risk-adjusted terms, too. Anyway! Nice to meet all of you. Looking forward to many exchanges on this forum.1 point

-

Your mortgage is fixed for 30 years in the U.S. generally. The bank isn't going to come in and sell your house from underneath you if the price falls but you can still pay your mortgage payment. Cheers!1 point

-

The same kind of volume spikes happened last January - I assume it has something to do with the timing of the dividend, the counterparties to the TRS and the calendar year.1 point

-

Thank you, @Luca, It was actually not so much - here, in this context - about Investor AB as such, but more about the overall mindset at Investor for how to choose [pick], invest in and run businesses. As shown by me above, the particular mindset was first crystalized in writing in 1946 at Investor AB, and still saturates everything there. Another way to phrase it conceptually is the following : "Stagnation is not stagnation - stagnation is regression" "'Good' is the worst enemy of the great company" Long term it is more about quality and growth than price [paid], @Spekulatius wrote in a post upstream. I don't think anyone here on CoBF would disagree with that. It is about a business simply breaking the 'usual business life cycle' to stay alive and also prosper and staying relevant going forward, no matter its age, instead of it to die. On the rim, it's about staying relevant due to innovation and development by investments in the future. Such businesses actually aren't few, nor seldom. They're just about everywhere. The World is actually stuffed with them. We just need to find them and pick them, carefully, to our best [not easy!] avoiding loosers and laggards. Mr. Buffett in his 50 years anniversary Berkshire letter from 2014 calls such a good company 'sprawling', and calls Berkshire sprawling, too, in that letter. Personally, It think we have quite some fairly young CoBF members by now who have the potential to take this really far for themselves, if they early on get it right and don't become subscription paying members of the foolish crowd by avoiding and stearing clear of serious and material mistakes early on, ref. the basics of compounding.1 point

-

@Luca, In my opinion the option : "Unopinionated" is missing. Happy New Year to you.1 point

-

Went on a 5 day Christmas market trip basel=ok Starsburg=not good Cologne=amazing and good party Berlin=good and amazing city München=good salzburg=ok Vienna=amazing for couples and family’s Budapest=poor but best food by a mile. so if you ever want to go to a Christmas market in Europe that’s my score. Will travel like crazy this year every two weeks somewhere in the world :d excited1 point

-

What Im loving looking and laughing at lately is all these fruitcake permabears who are trying to claim rates going down is now bearish because thats signaling a recession LOL. It. Never. Ends.1 point

-

I do. It's sort of an irish classic now. Many Irish folk bands play it.1 point

-

1 point

-

Canada has been taking a hard turn left under the federal Liberals… entrepreneurs are exploiters… businesses exist to pay taxes. Government regulation of the economy is increasing. Not a model, IMHO, that will surpass the US. The Liberal ‘experiment’ of ramping immigration/foreign workers/international students boosted Canada’s population by over 1 million last year. Total population of Canada is 40 million. The problem? We have a severe shortage of housing. And the economy here is slowing more than in the US (the Canadian mortgage market resembles that of the US in 2006 - and the low teaser rates are now expiring - so higher interest rates are slowing aggregate demand). The severe housing shortage looks like it is becoming THE political issue. It will take +5 years for the supply problem to be addressed. The crazy high number of newcomers is spiking demand. Many Canadians (who are pro immigration) are questioning if this is the right time to be bringing in record numbers of people into the country. We will see. I don’t think any of this affects Fairfax. If Fairfax grows insurance it will likely be outside of Canada. Given Canadas hard move left (and attitude towards businesses), I am not sure it is a great place to invest in today. There will be a Federal election in 2025 - if the Conservatives are elected we would see a shift to the right.1 point

-

1 point

-

Are global scale economies not a moat in the insurance business? I think we’ve increasingly seen that in Fairfax’s results. And could a deep pocketed investor replicate Fairfax’s footprint and well managed operation today? How much capital and how many years and missteps would that take? I think that’s real now. Also, what are the best private businesses in Canada? Would those owners see Prem as someone who would take good care of their babies and so consider selling to FFH at lower prices than some random private equity firms? If not, well, that seems like a missed opportunity. I think of that as the secret sauce for BRK, a reputation well and hard earned over many decades of doing what they say as permanent owners. So to the degree Fairfax is moving in that direction, they are gradually widening the moat and incremental returns should remain high (if volatile/chunky) for a long time.1 point

-

Was a terrific movie! Benicio is one of the best actors of his generation. Still can't believe how he stole every scene as the honest Mexican cop in Traffic, and his best role ever was the assassin ex-lawyer in Sicario. Cheers!1 point

-

I think the direction of interest rates determined the outcome here. Rising and now higher for longer interest rates are detrimental to the private equity model, especially the Brookfield variant where they hold large stakes in subsidies. The high leverage packed on assets works both ways great when prices move up and interest rates go lower, but mot so much when things go the other way.1 point

-

1 point

-

Very exciting discussion between @Viking and @Munger_Disciple. Thank you! Maybe some thoughts on this: In the end, Munger's approach reminds me a bit of the early Buffett of Cigar Butt Investments. Of course not really, because Munger is also interested in the PE ratios and not the liquidation value; but Munger just insists on a very cautious assessment of the earnings, also sees no moat, and thus consequently focuses very strongly on the "margin of safety"; and especially this point reminds me of Cigar Butt. Viking, on the other hand, I often understand to mean that with the many in-depth analyses of the individual parts and the many changes in perspective, he ends up - in my perception - shedding much more light on management and its capabilities, and thus, in my view, the overall picture evolves of a value-oriented company that has become increasingly well-managed over the years and that uses "float" as leverage. Whereas decades ago, CRs were regularly extremely poor relative to the market, Fairfax has averaged a few percentage points better than the market over the past decade. Thus, Prem is following much more closely in the footsteps of a Buffett or Gayner at this point. Fairfax has had by far the strongest premium growth of the top 25 insurers over the past three years. Many investments in India, Greece and the U.S. have paid off or are performing well right now. And so on. And then Viking also builds in a Margin of Safety (one that I personally think is sufficient and reasonable!), but just less conservative than Munger. So the picture that emerges is one of many positive individual decisions that form an overall picture of how Fairfax has changed after 2016. Viking's number analyses are important, but a second layer (management, moat) is forming, and I personally read a strong case for management and the presence of a moat above all else from the mosaic of many individual analyses. And at the end Viking also builds in a Margin of Safety, but to show a possible, conservatively realistic compounding perspective it is lower than Munger's. Both seem perfectly legitimate and consistent to me. They are just completely different methods. Gayner explained in a podcast some time ago ("the evolution of a value investor") that he now pays much more attention to the development of a company than to its current state. In a sense, he said he is much more interested in the corporate movie that is being created over time than a still image (or something like that). If you have a company with a moat, the best way to recognize it is in a movie, that is, in an analysis over a longer period of time in the past, than by looking at just one point in time. I was very attracted to the idea. It is probably rare that a company can already be considered cheaply valued without a moat and it (possibly; tbd) also has a moat on top. Otherwise, there would probably not have been this exchange here. Either way, there is a lot to be said for either a good investment or even one along the lines of "Once in a Lifetime" . We will see.1 point

-

I just don't believe it's gonna get 6% on the S&P. Requires average earnings to go up 5-6% per annum and NOT contract on multiple. Earnings are already contracting and accounting moves are becoming more aggressive to hide the extent of the shrinkage judging by the difference in GAAP profits and tax receipts. A large chunk of the EPS growth we've seen over the last decade came from 1) expanding margins and 2) repurchases. Not organic revenue growth. Neither of those are sustainable into perpetuity as trends. Margin expansion will have to stop, at some point, if not outright contract. Repurchases? Currently generating a 3-4% ROE based on the earnings yield - so way below the 5-6% you'd need as a hurdle rate. They'd be better off repaying debt or keeping cash on hand to pay off the debt when it comes due. You remove those things and the engine that resulted in the bulk of EPS growth over the last decade is gone, or operating in reverse. I don't see how we get to 5-6% without significant nominal inflation to goose revenues. Which, if we get, you will NOT see 25-30 multiples on infinite duration assets like equities - it'll be another 2022. So...you're still gonna take a f*cking beating up front which may then set the stage for equities being attractive again. And all of this is trying to get to 6%. Why not buy mortgages, corporates, HY, and EM all which yield more than that to start and call it a day?1 point

-

This is why I'm buying bonds. Even if you're not bearish on equities like I am, the assumptions you have to make on earnings growth are herculean to outperform spread fixed income. 6-7% in mortgages, 6.5-7% in IG corporates, 8-10% in EM and HY. You starting at 2-3x the implied return for the S&P 500 without making any assumptions on price returns, multiples, and interest rates. I don't think bonds are the biggest no-brainer on an absolute basis, but relative to equities it is hard to make a case for not owning them. Especially if the Fed KEEPS raising rates as a ton of duration has been removed from the market already - each rise in rates is going to do more for future reinvestment and income than price hits to bonds.1 point

-

For anyone that is curious about Berkshire's Q2 activity in Foreign stocks other than BYD, here is Gen Re's Q2 activity - no equity purchases. Sales of Nestle, Munich Re, and Allianz. (one page pdf attached) gen re q2 page 159.pdf1 point

-

@steph you are welcome. I learn so much from other posters… and what i learn usually makes its way into my future posts. This is a great community. We are very lucky right now. I have been following Fairfax for about 20 years. Only 2 other times has the set up looked as favourable as it does today: 2003 (short attack) and 2006/07 (short attack when they were sitting on giant CDS position). We all need to thank the gods for how everything with Fairfax has played out over the past 33 months. It has been a crazy wonderful ride. And the stock still trades well under 6 x 2023E earnings. Nuts.1 point

-

1 point

-

Well this is a double digit decline......7.2% + ~5% inflation = -12% real fall But your right the peak to trough ~24% fall in earnings that accompanies a traditional recession is still to play out Earnings going down while SPY goes up = bear market rally The fundamental are disimproving & we still have an inflation problem. How you trade that is up to you. This chart below tells the story about the recent rally of the October lows: Price diverging from earnings.......now you could argue that somehow the market is looking through those earnings.....but if you overlay the inflaiton problem.....they are looking through with way too much optimism....kind of like inflation is done (without unemployment/GDP contraction) delusion1 point

-

“Janet Yellen concerned about Chinas new export controls”….. Think Janet is equally “concerned” about any of the US policy directed towards China or Russia? Even Canadian tariffs? Nah bro. https://www.cnbc.com/2023/07/07/yellen-says-shes-concerned-about-chinas-new-export-controls.html1 point

-

National Stock Exchange of India (NSE) - unlisted market transactions are suggesting valuation around US$20B - on that basis Fairfax India 1% stake would be worth around US$200M - timing of IPO still unclear https://www.livemint.com/market/ipo/nse-ipo-creates-buzz-in-unlisted-market-shows-the-investor-interest-in-issue-11687254813352.html 'The current share price in the unlisted market values the bourse at around ₹1,65,825 crore.' “At this price, the PE Ratio of the bourse stands at roughly 22 times on historical basis versus BSE Ltd at 37 times and MCX at 50 times and international exchanges trading between 30x to 40x," the brokerage report said.1 point

-

I don't see why Xi has to figure out how the US does things in order to lead his country. Even so, I doubt Xi is dumb or otherwise incapable of understanding any complex topic, including "how the free markets operate".1 point

-

New all-time high today! Let's break $1,000 CDN next week! https://finance.yahoo.com/quote/FFH.TO/?p=FFH.TO Cheers!1 point

-

Yeah this is an important point. There are two types of "Inflation" and two types of "Deflation." Type 1 Inflation, call it "temporary inflation," is the type caused by Covid-era supply shocks. In a free market system these work themselves out in due time. This type of inflation cannot be helped much by Fed action and raising rates may make it worse. Type 2 Inflation, call it "real monetary inflation," is caused primarily by increases in the amount of "money" circulating in the system, primarily because of fiscal policy deficit spending (but also for many years pre-2008 to the enormous and very fast growing eurodollar market for offshore dollar assets - they don't even try to calculate M3 anymore!). Fed changes to overnight rates are not the best way to handle this type of inflation and might not work at all. Moderating the size of fiscal deficits can work here but do not directly control the entire supply. Type 1 Deflation, call it "wonderful deflation," is a wonderful byproduct of economic efficiency. My microprocessor gets better and cheaper every year, offshore labor reduced prices on consumer goods at Walmart, etc. Nobody complains about this type of deflation most of the time. It's great. Type 2 Deflation, call it "deflationary monetary conditions," is the worst of the worst. This is what causes severe recessions and depressions. This is when money tightens up and if it isn't temporary (in order to rein in a too-hot economy or soak up some over-done monetary inflation of the recent past) it will cause a lot of problems in a modern monetary economy. 2008 was a good example. There are reasons to worry that we are going into a deflationary monetary conditions period now, despite 7% of GDP deficit spending in the US pouring stimulus on the US economy.1 point

-

1 point

-

~7-8% return on investments would be a home run b/c it translates to ~15%+ return for FFH shareholders b/c of leverage. Rough numbers, roughly right. If FFH underwrites at breakeven, that equates to borrowing at a 0% interest rate on roughly half the asset base at the current size of the insurance operations. This is why the intelligent growth in the insurance side over the last 5-7 years is such a big deal even if they “only” break even longer term. Buffett has talked about that power of insurance float for 60 years and it is still widely misunderstood IMHO… at least in the Fairfax case. FWIW, that float leverage is a big absolute *and relative* advantage for well managed insurance companies again, with borrowing costs for other industries back off the zero bound. Also, as they flip to highly cash generative, the share count and minority interests should continue to shrink. From this valuation starting point, that all could translate to a ~8-10x return over the next decade with mid teens EPS growth (even with zero growth on the insurance side) if the “exit” multiple expands to a fair low-to-mid teens multiple of earnings. Haters would be in shambles not investment advice1 point

-

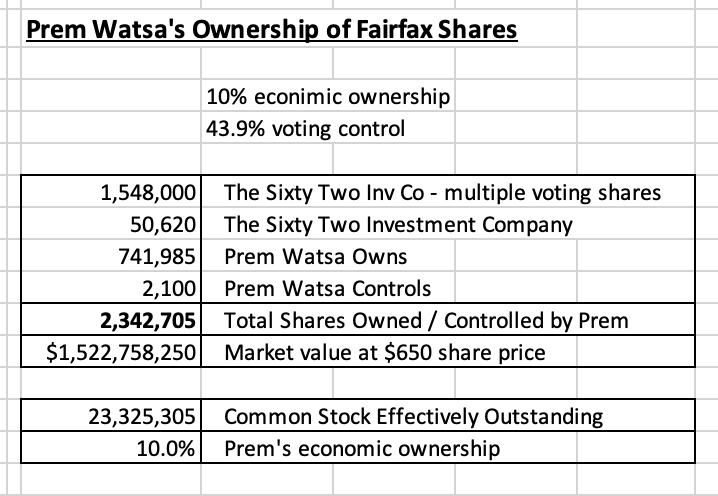

What is Prem’s ownership position in Fairfax today? 10% economic interest valued at $1.52 billion ($650/share on April 6). 43.9% voting interest. What does the mean? Prem is firmly in control of Fairfax. Two of his children serve on the board: Christine McLean and Ben Watsa. ————— How much does Prem get paid by Fairfax? 1.) Salary: $600,000/year. this salary has stayed the same for decades 2.) Stock-based compensation: unlike other executives at Fairfax, Prem does not earn any stock based compensation. For companies of Fairfax’s size this is a pretty unique compensation package. And looking t it strictly from a compensation perspective, this is a smoking hot deal for shareholders. ————— On June 15, 2020, Prem Watsa announced he had purchased 482,600 shares of Fairfax at a total cost of $148.95 or $308.64/share. With shares closing on April 7, 2023 at $650, Prem has made a paper gain of $165 million = + 110%. Not too shabby over 34 months. Prem is a value investor and he certainly nailed this purchase. The significant size of the purchase was surprising, given how much Fairfax stock he already owned. Fairfax shares bottomed out at $250 in May of 2020. Of interest, book value bottomed out at $442/share at March 31, 2020. The share price dropped to the $260 level in October of 2020. Shares were trading at prices last seen in 2007. For long term investors in Fairfax these were the darkest of days. Many capitulated and sold their shares. The sentiment index in Fairfax was flashing ‘extreme fear’. ————— Prem Watsa Acquires Additional Shares of Fairfax - https://www.fairfax.ca/news/press-releases/press-release-details/2020/Prem-Watsa-Acquires-Additional-Shares-of-Fairfax/default.aspx Mr. Watsa commented as follows in connection with this purchase: “At our AGM and on our first quarter earnings release call, I said that our shares are ‘ridiculously cheap’. That statement reflected my recognition that in the 35 years since Fairfax began, I have never seen Fairfax shares sell at a bigger discount to their intrinsic value than they have recently. I have now backed up my strong words by purchasing close to US$150 million of Fairfax shares in the market over the last few days, as I believe that this will be an excellent long term investment.”1 point

-

They all must be mocked equally. I especially enjoy how much rage the underperforming value bros throw at Cathie. Deep down, they know she’s superior to them…the goal for neither is to really compound, but make money. And Cathie’s biz just had a run like few ever had and it eats at those fucks which is why she gets so much hate. Would I ever invest with her? Hell no. Although I’d consider investing in the parent company who generates fees off the crazy ARKs. But girl has a fuckin business and a brand, thats for sure. Someone like Hussman? Not so much.1 point

-

1 point

-

@Viking Thanks for the great posts about Fairfax & I hope all is well with you & family. Buffett always talked about float being "costless" (which can be interpreted as 100% CR) to Berkshire in his reports. Here is Warren: 2021 AR: One final thought about insurance: I believe that it is likely – but far from assured – that Berkshire’s float can be maintained without our incurring a long-term underwriting loss. I am certain, however, that there will be some years when we experience such losses, perhaps involving very large sums. 2020 AR: The massive sum held by Berkshire is likely to remain near its present level for many years and, on a cumulative basis, has been costless to us. That happy result, of course, could change – but, over time, I like our odds. 2016 AR: If our revolving float is both costless and long-enduring, which I believe it will be, the true value of this liability is dramatically less than the accounting liability. I also recall Buffett saying very similar things during the annual meetings. Berkshire actually earned a very modest underwriting profit over the years but their "goal" is to write business so that float costs them 0%. I do agree with you that Fairfax's bond portfolio is well managed and they are currently benefiting from staying very short in duration. Whether the current bond earnings can be thought of as "normalized", I am not sure as it is hard to predict the trajectory of interest rates. If one is in "higher for longer" camp, then of course yes at least for the next 5 years.1 point

-

I agree and I dont get it either. People talking out of both sides of their mouth and its a waste of time. You hear about impending recessions that the market "just hasnt realized yet" and then in the next breathe complaints that there are no value opportunities because "efficient market theory" has priced everything in. Humans have bias and naturally want to look for confirmation, reading tea leaves to paint a narrative that they either want...or fear. Its much less stressful to play the ball as it lays. Take what is presented. To your point, markets are gonna market. These guys should WANT volatility! Why wouldnt you? I dont understand why someone that wasnt say, 5 years from retirement, WANT another recession, and view it as a once in a decade or more OPPURTUNITY to make some serious money. And honestly if you are close to retirement you should be positioned as such anyway, so even then it shouldnt be catastrophic. The manic Mr Market analogy shouting crazy price offerings. Literally ANY other item goes on ridiculous discount...70" Sony flatscreen TV normally $1500 at the store, you walk buy and they have it on clearance for $100 or a $400 Xbox for $50 because some kid at the store made a mistake with the barcode scanner or read the pricing sheet wrong, nobody would assume the item was junk, they would just quietly fill a cart up and make their way to the checkout line, but when it comes to solid businesses that they have held or are looking to take a position in, they freak out. WHAT $400 XBOX is now worth $50?! I better go home, kick my kid off his game, and throw that thing on Craigslist while I still can!! LOL New BMW on the lot for $5000 anyone? Rolex in the display case for $300? Philosophically I sometimes think of this like Walt Whitmans writings: "Do I contradict myself? Very well then, I contradict myself, I am large, I contain multitudes". He is embracing something seen as a shortcoming (seeming unreliable), into a positive. The idea that a person has to adhere to hard principles all the time , but doesnt acknowledge that principles can change. We want consistency all the time or risk appearing weak or unreliable. Whitman says the person who never contradicts himself doesnt think deeply enough or is too simple minded. Applied to the market. If you are thinking enough, your strategies should change as opportunities present, rather than wishing for (or expecting) slow and steady increases in the market that allow cookie cutter DCF projections, accept, expect, and embrace volatility. Acknowledge that the market doesnt always stick to hard principles and you dont have to either. Continuing with your analogies, the ship is most safe in the harbor, but thats not what ships are made for. Safe space for investors does not present the best opportunity for investors. AND when you buy solid companies, for instance BRK (obviously) and COST, I think of the WB's analogy, to focus most on picking the right person to marry, and then not worry if you paid a little too much for the ring. What a horrible way to live, constantly trying to predict things that are nearly impossible, stress when things are good because something MIGHT happen, stress when those fears become REALITY, stress when things happen that you didnt see coming. Just roll with it.1 point

-

1 point

-

1 point

-

Yes. That remains very true. Prem had appointed Paul Rivett as President. After Paul left, Peter Clarke was appointed President. Peter has been with Fairfax forever. So if something happens to Prem, Peter Clarke would take over as CEO with Andy Barnard overseeing Insurance as he does and Wade Burton leading Hamblin-Watsa. I would imagine Jean Cloutier would take over as President and COO...who has also been with Fairfax forever. You also still have many of the old guard like Chandran overseeing India...Brian (bond guru) Bradstreet overseeing Fixed Income investments...Jennifer Allen as CFO...pretty much all of the VP's at all of the insurance subs have been in that position for 10+ years. You have Lawrence Chin backing Wade at Hamblin-Watsa and if there ever was a pinch, Francis is a phone call away! Lastly, the board of directors retains a lot of the old guard experience like David Johnston, Timothy Price, Brandon Sweitzer, while adding newer, younger capable directors like Lauren Templeton. The Watsa Family would remain well represented with Ben and Christine on the board. I also wouldn't be surprised to see Paul Rivett back on the FFH board some time in the future, as Nordstar is now under arbitration and will be divided. I'm far less worried about Fairfax than I would be with Berkshire. The current team under Prem has shown years of success. If something happens to Buffett, Charlie and Ajit...that's three guys that are completely irreplaceable. Prem as a leader is irreplaceable, but the investment and insurance teams at Fairfax are as capable as him. Fairfax will keep rolling as usual, just shareholder's won't have that voice and face to lean on which is mighty comforting like Buffett & Charlie. Can someone run National Indemnity like Ajit? Can someone make acquisitions like Buffett? Maybe they will just roll all of the excess cash flow to Ted and Todd, and let the CEO's of each sub make their own acquisitions rather than leaving it to the parent company. It's simpler at Fairfax...everything flows through Andy to make insurance acquisitions or Wade to make investments. Prem and eventually Peter just gives the ok. Cheers!1 point

-

Same. BRK and Constellation Software - companies with low debt and cash flow to deploy in volatile times.1 point

-

I didn't see alot of pundits saying "sell, sell, sell" back in November. Today, the pundits are screaming "sell, sell, sell" after a 25% drop in the overall market, and a solid 60-90% drop in speculative areas. And I'm sure once markets have turned up a solid 20%-30% plus at some point, they will be screaming "buy, buy, buy!" Cheers!1 point

-

1 point

-

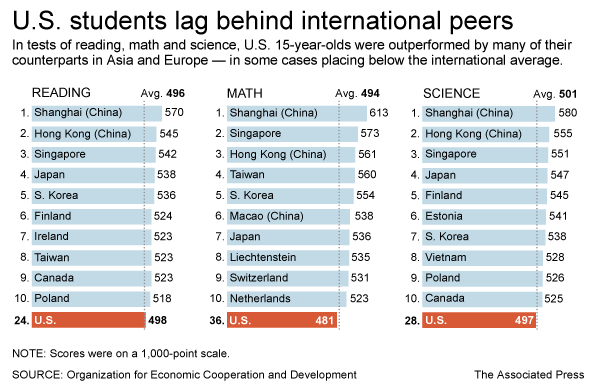

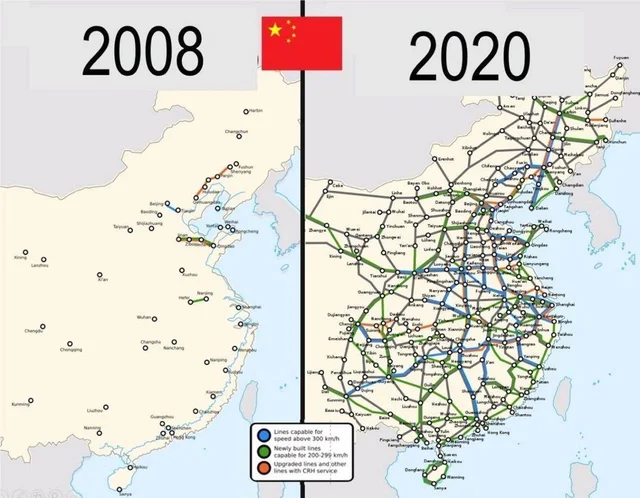

China has numerous problems, but so does every country. These China analysts keep failing because they only focus on the problems but miss the big picture. If anything, it's the Western governments that are failing its constituents by failing to provide quality education and infrastructure. Luckily, we can rely on the private sector for some of the shortcomings but private sector can't do it all. Education: Infrastructure:1 point

-

They are simply offering a price they are willing to pay to acquire the outstanding shares. I’m sure most of us have placed a low ball bid on the shares of a company we like at some point. Based on their condition, it’s up to the majority of the minority to ultimately make the decision, not Fairfax nor the Consortium. That’s what makes it fair. The sellers decide if they like the price. If you don't like the price, just vote no with your shares.1 point

-

We are getting pretty good value for our money here. I think I paid $20 way back then and that's probably one of the best deals out there. I have come to love the changes in the website, so much easier to put in gif's now. My recommendation is to put a tip jar link on your site somewhere. I am sure some member will drop some change there.1 point