Viking

Member-

Posts

4,930 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Capital allocation is the most important responsibility of a management team. Why? Capital allocation decisions drive the long term performance of the company. Stuff like reported earnings, growth in book value and return on equity. And this in turn drives share price and investment returns for shareholders. Capital allocation, when done well, does two fundamental things. It delivers a solid return and, over time, improves the quality of the company. Therefore, the fundamental task for an investor is determining if management, over time, is making intelligent decisions regarding capital allocation. What is capital allocation? Capital allocation is the process of determining how capital is raised, managed and disbursed by a company. Capital allocation decisions often play out with a lag, sometimes years in length. So an investor needs to take a multi-year approach with their analysis. How does Fairfax do capital allocation? Internal capabilities: Capital allocation at Fairfax is managed by the senior leadership team, lead by CEO Prem Watsa. Since 2010, the insurance business has been lead by Andy Barnard. The investment business is managed by the large team at Hamblin Watsa. The fixed income team is lead by Brian Bradstreet, who has been with Fairfax almost from day 1. The equities team is lead by Wade Burton, who joined Fairfax in 2009 from fund manager Cundill Investments, and Lawrence Chin, who also joined from Cundill in 2016. In India, Fairfax has Fairbridge, a boots on the ground investment team. Fairfax also leverages the knowledge of the CEO’s of its many equity holdings. From Fairfax’s web site: “Since 1985, investments have been centrally managed for all of the Fairfax group companies by Hamblin Watsa Investment Counsel Ltd. (www.hwic.ca), a wholly-owned subsidiary of Fairfax. Hamblin Watsa emphasizes a conservative value investment philosophy, seeking to invest assets on a total return basis, which includes realized and unrealized gains over the long-term.” Below is a slide from the Fairfax’s annual meeting held April 2023. Fairfax has a large internal team with expertise across many different asset classes and geographies. They are a long-tenured group with experience managing through many different market cycles, including the high inflation period of the 1970’s. They are also a battle tested team. They have established a strong long term track record. External capabilities: Fairfax has actively been cultivating relationships with a large network of individuals/companies in the investment world for decades. They have established partnerships and expertise across many different asset classes (real estate, private equity, commodities) and geographies (India, Greece, Africa, Middle East). These external partnerships have been an important source of ideas and diversification while also delivering solid returns to Fairfax over the years. This important external capability allows Fairfax to leverage the knowledge and skills of a much larger group of people and organizations. Over decades, Fairfax has built out a large team and network of highly skilled internal and external capital allocators. In a world where active management is back, this has become a big tailwind for Fairfax. Fairfax is well positioned at exactly the right time. In general, what are the basic capital allocation options available to management? reinvest in the business - grow organically: support slow and steady growth of existing operations. acquisitions/mergers/sales - higher risk, but can be transformative. pay down debt: most predictable option as cost of repaid debt is known. pay dividends: although tax-inefficient, usually indicates financially healthy, shareholder-friendly business. share buybacks: impactful, if purchased below intrinsic value, by improving per-share financial metrics: EPS & BVPS. What has Fairfax done? The management team at Fairfax has been extremely active on the capital allocation front. Every year they typically make between 5 to 10 meaningful decisions. So much has been happening on the capital allocation front it is hard for shareholders to keep up - especially understanding the impact on current and future business results. Below we are going to take a quick look at 15 of Fairfax’s bigger decisions made in recent years to see what we can learn. Reinvest in the business: 1.) 2019-2022, hard market in insurance: Net written premiums increased 68% over the past three years from $13.3 million in 2019 to $22.3 million in 2022, an average increase of 19% per year. Fairfax is now delivering record underwriting profit of $1.1 billion (at 95CR). 2.) in 2017, seeded start-up Go Digit in India: at a cost of $150 million and a fair value today of $2.3 billion. This investment has turned into a home run, with a possible IPO coming in 2023 (more upside). Acquisitions / sales: insurance: 3.) in 2017, purchased Allied World, with the help of minority partners, for $4.9 billion (1.3 x book value). Price paid was not an overpay. Net written premiums have increased from $2.37 billion in 2018 to $4.46 billion in 2022, an increase of 88% in 4 years. With the onset of hard market in 2019, the timing of this purchase was perfect. 4.) in 2017/2019, sale of ICICI Lombard for $1.7 billion: realized a $1 billion pre-tax investment gain. Due to regulations in India, Fairfax had to sell down its position in ICICI Lombard to be able to invest in Digit. Brilliant strategic shift of insurance business in India. 5.) in 2020/2021, sold Riverstone UK (runoff) for $1.3 billion (plus $236 million CVI). At a time when they needed the cash, Fairfax sold their UK run-off business at a much higher price than expected at the time. 6.) in 2022, sale of pet insurance business to JAB Holding Co. for 1.4 billion: realized a $1 billion after-tax gain. This sale was a home run for Fairfax as the sale price was far in excess of what anyone thought possible. 7.) in 2023, the pending purchase of Kipco’s 46% stake in Gulf Insurance Group for $860 million, payable over 4 years. Great strategic purchase will solidify Fairfax’s presence in MENA region for insurance. Acquisitions/sales: investments 8.) in 2018, made initial investment in Poseidon/Atlas/Seaspan. Fairfax partnered with David Sokol (formerly Buffett’s heir apparent at Berkshire). Today Fairfax owns 45.5% stake valued at $2 billion. Poseidon is entering significant growth phase. 9.) in late 2018, purchased 13% of Stelco for $193 million. Fairfax partnered with Alan Kestenbaum. Investment has already delivered close to a 150% investment gain. Today, Fairfax owns 23.6% of Stelco (having invested no new money). 10.) in 2020/21, initiation of total return swap position giving exposure to of 1.96 million FFH shares at an average cost of $372/share. With Fairfax shares trading today at $745, this investment has already delivered an investment gain of +$750 million in 30 months. This has been another home run. 11.) in Dec 2021, reduced average duration of $37 billion bond portfolio to 1.2 years (as interest rates bottomed); followed by pivot in 2022/23 and extension of average duration to 2.5 years (after interest rates had spiked). Protected the balance sheet. And today the fixed income portfolio is delivering record interest income of more than $1.4 billion per year. This string of decisions over less than 24 months was nothing short of brilliant and delivered billions in gains to Fairfax shareholders. 12.) in 2020 and 2023, partnership with Kennedy Wilson. Phase 1, in 2020, was establishment of $3 billion real estate debt platform. Phase 2, in 2023, was purchase of $2 billion of PacWest loans yielding a fixed rate to maturity of 10%. Fairfax, through long term partner Kennedy Wilson, taking advantage of severe temporary market dislocation. 13.) in 2022, sold Resolute Forest Products for $626 million (plus $183 million CVR) at top of lumber cycle. 14.) in 2023, sold Ambridge Partners for $400 million: delivered a $255 million pre-tax investment gain. Dividend: Fairfax has continuously paid a $10 dividend since 2011. Share buybacks: Effective shares outstanding have decreased 16% over the past five years from 27.8 million in 2017 to 23.3 million in 2022, an average decrease of 3.2% per year. 15.) in 2021, re-purchased 2 million shares at $500/share. Fairfax’s book value is $803/share (Q1) and the stock is trading today at $745. This repurchase was another home run. The list above captures only the largest capital allocation decisions made by Fairfax in recent years. We could easily add another 15 smaller examples of transactions that are also proving to be material to Fairfax. For a more complete list, i have attached my Excel file to the bottom of this post. See tab 2 in the Excel file - titled ‘Moves’ - where I have document many of Fairfax’s moves for each year going back to 2010. Important: asset sales are one part of capital allocation that really separates Fairfax from its peers. In selling an asset, Fairfax is essentially trading a stream of future cash flows for a lump sum today. Why sell an asset? Sometimes another company - who is willing to pay up - values an asset at a much higher value than you do. The sale of the pet insurance business is a great insurance example of this. The sale of Resolute Forest Products is a great non-insurance example. There also can be important strategic reasons to sell an asset. Like if a sale allows the company to better focus on its other businesses - which should lead to improved results. The sale of APR to Atlas in 2019 is a good example of this. Asset sales have been an very important part of Fairfax’s capital allocation framework, realizing significant value for Fairfax and its shareholders over the years. Is Fairfax’s capital allocation record perfect? No, of course not. I see two notable misses: Taking until late 2020 to exit last short position and not exiting earlier. Not finding a way to unload Blackberry during the wallstreetbets mania that caused the stock price to spike for a very short period of time in 2021. Fairfax says they were unable to act due to being in a blackout period at the time. Looking at everything they have done over the past 5 or so years, it is clear Fairfax has been executing exceptionally well. Peter Lynch: “In this business, if you are good, you’re right 6 out of 10 times. You’re never going to be right 9 out of 10.” In recent years, Fairfax has been right with their capital allocation decisions at a rate much higher than 6 out of 10. In Druckenmiller parlance, Fairfax has been on a multi-year ‘hot streak’. Or in Buffett parlance, Fairfax has been hitting the ball like Ted Williams the past couple of seasons. Has Fairfax simply been lucky? Did Prem give the team at Fairfax a sip of ‘liquid luck’ back in 2018? Some luck likely has been involved. But I like this definition of luck: what happens when preparation meets opportunity. That describes what has happened at Fairfax beautifully: looks to me like they made their own luck. So what did we learn? Here are the words i would use to describe Fairfax’s approach to capital allocation: Flexible - use the full suite of options available Opportunistic - taking advantage of opportunities as they arise Countercyclical - act contrary to prevailing investment trends Speed - act quickly when necessary Conviction (position sizing) - go big when risk/reward is highly compelling/asymmetrical Creative - be open minded during the process Long term focus - generate above-market returns Strategic - make the company stronger - both insurance and investments Rational - capital goes to the best (risk adjusted) opportunities Equally capable in executing across both insurance and investment businesses What has been the financial impact of Fairfax’s capital allocation decisions? Operating Income: Let’s start by looking at operating income given it is viewed by analysts as the most important part of an insurers total earnings. For the 5-year period from 2016-2020, operating income at Fairfax averaged $1 billion per year or $39/share. Compared to the 5-year averaged from 2016-2020: in 2021, operating income doubled to $1.8 billion or $77/share. in 2022, operating income tripled to $ 3.1 billion or $132/share in 2023, operating income is on track to quadruple to $3.8 billion or $167/share in 2024 and 2025, operating income is poised to grow even more, although at a slower rate. The run rate for operating income is now 4 times larger than it was just a few short years ago. The reason? The spike higher is due in large part to the exceptional capital allocation decisions made by the management team at Fairfax, primarily over the past 5 years. Investment Gains: The other important part of earnings is investment gains. This lumpy part of earnings has historically been a strength for Fairfax - the pet insurance and Resolute sales in 2022, and the Ambridge Partners sale in 2023, being three recent examples. We should expect Fairfax to continue to deliver solid (but lumpy) investment gains moving forward. My current estimate has Fairfax on track to deliver earnings of $150/share in 2023. Return On Equity: For the 5-year period from 2016-2020, ROE averaged 5.2% per year. For the period 2021-2023, ROE is tracking to average 14.2%. Given expected trend in operating earnings, this is likely a good target for 2024 and 2025 as well. Driven by strong capital allocation decisions, all important financial metrics at Fairfax have been materially improving in recent years. This strong performance looks set to continue in 2023, 2024 and 2025 (as far out as our crystal ball looks). How is the strategic positioning of Fairfax’s businesses? Insurance Significant expansion by acquisition 2015-2017 - build out of global platform is complete. Significant expansion by organic growth 2019-2023 - hard market Ongoing bolt-on acquisitions, like Singapore Re, has further strengthened the business. Ongoing buy-out of minority partners, like Eurolife in 2021 and Allied World in 2022, has further strengthened the business. quality of insurance business has never looked better. delivering record net written premiums and record underwriting profit. Investments - fixed income 2021: shortened duration of portfolio to 1.2 years and primarily government bonds in late 2021, to protect the balance sheet. 2023: extended duration to 2.5 years in Q1, to lock in much higher rates. 2023: capitalizing on dislocations in financial markets to lock in even higher rates - with Kennedy Wilson, purchased $2 billion in PacWest real estate loans yielding a fixed rate of 10%. positioning of fixed income portfolio has rarely looked better. delivering record interest and dividend income. Investments - equities Total return swaps, giving exposure to 1.96 million Fairfax shares, looks well positioned. Eurobank - balance sheet is fixed, earnings are strong. Greece is expected to be a top performing economy in Europe. Poseidon / Atlas - is currently in rapid growth mode. India is expected to be a top performing global economy. rest of portfolio looks well positioned. quality of collection of equities owned has never looked better. delivering record share of profit of associates and sold investment gains. Bottom line, the strategic positioning of each of Fairfax’s three engines (insurance, fixed income and equities) have all steadily improved over the past 5 years. In fact, in terms of quality they have never looked better. And it is extremely rare to have all three engines performing at a high level at the same time, like is happening today. Conclusion strong management team. executing exceptionally well over the past 5 years. record financial results across all important metrics (EPS, growth in BV and ROE). both businesses, insurance and investments, are exceptionally well positioned. Fairfax is nailing the dual core objectives from capital allocation: 1.) deliver good/great returns on capital deployed 2.) over time, improve the quality of each of the businesses - insurance and investments As a result, i think we can fairly conclude that the management team at Fairfax have demonstrable best-in-class capital allocation skills. And not just within their peer group in P&C insurance. Are Fairfax’s capital allocation abilities reflected in the price of its stock? Given the glide path of operating earnings, total earnings are expected to be very strong in 2023, 2024 and 2025. A management team - with proven skills in capital allocation - is about to get… a record amount of free cash flow to allocate over the next three years. Fairfax’s stock is trading today at $745/share (June 15, 2023). Book value is $803 (Q1, 2023). Earnings for 2023 are estimated to be $150/share (my estimate as of today). PE = 5 (2023E earnings) price to book value = 0.93 return on equity is 17% (2023E earnings) The stock is trading today at a historically low valuation (if you ignore the covid low). The stock price does not yet reflect the significant improvement in fundamentals that we are seeing. Fairfax’s stock has dramatically outperformed the market over the past 29.5 months. Mr. Market is clearly warming to the Fairfax story. My guess is the outperformance by Fairfax will continue. Best-in-class capital allocators + record earnings + bear market + power of compounding + time = exceptional returns for shareholders. Fairfax Equity Holdings May 23 2023.xlsx

-

I played a lot of sports when i was younger. Not the most talented; still loved it. Over time got pretty good. Great physical and mental workouts. Strong relationships built over time. Continuous improvement. The competition was great. Lots of peaks and a few valleys. And it always felt great when your team won; especially the important games. i love investing for many of the same reasons. Except with investing you are competing with the best. And the rewards, if you are good at it can be life changing - and not just for you but your entire family. I have friends who have chosen to step away from investing in recent years. I am not there yet. I still love the game/competition too much - and, for an old guy, the pay is still pretty good.

-

@Munger_Disciple no, i have not done this type of analysis as i am not an in-the-weeds insurance guy. In the past, others on the board have modelled what % of total catastrophe losses Fairfax has tended to experience (to get a rough approximation of what their share might be to a once in a 100 year cat event). I think Fairfax has stated they are reducing Brit’s total exposure to cat losses (as that is the part of their business that has been underperforming). We also are seeing the mother of all hard markets in cat reinsurance, although it likely will not last long (as new capacity enters to due to the higher returns).

-

@Munger_Disciple We all have our own investment tolerances. Fit is important. Clearly, Fairfax is not a fit for you, which is ok. There are thousands of different opportunities out there. For me, i am more than ok with the risks owning Fairfax. Their capital allocation decisions the past 5 years have been outstanding. They are absolutely schooling their other insurance peers in this regard. I think it is highly unlikely Fairfax puts on another ‘equity hedge’ type hedge/trade anytime soon. If they do something that i really don’t like, i will simply reduce my position. Yes, Fairfax does run with more leverage than most peers. With record operating income (the more predictable kind of earnings) coming each of the next 3 years i am not concerned. But yes, something to monitor. in terms of investments, their fixed income portfolio skewed highly to government bonds is best in class in terms of risk, with the exception of Berkshire. And their equity portfolio is perhaps the highest quality today (in terms of its holdings) it has been in a long, long time. When i put it all together i continue to see Fairfax as a great investment opportunity. Stock is trading at 5 x 2023 earnings; 0.9 x BV; ROE of 18%. Despite the spike in the stock price, it is still wicked cheap. And that is what makes a market Best of luck with Berkshire - it is a great set-and-forget investment.

-

The key to position size for me is how asymmetric the opportunity is. Very high return / low risk = back up the truck. That is my assessment of Fairfax today. Moderate return / yes, lower risk = Berkshire today. My guess is Fairfax will generate total investor returns of around 25% each year over the next couple of years. Berkshire will probably generate high single digit returns. In terms of risk, the chances of Fairfax blowing up are very small, absent a once in a 100 year catastrophe (probability is likely less than 1% or 2%). And other than a sudden catastrophe, i think i will be given some notice so that i will have time to re-size my position (like what happened with covid in Feb 2020, when investors were given a couple of weeks notice). Yes, the chances of Berkshire blowing up is even less. Also, i do not keep my concentrated positions in place for long periods of time. Usually, the mis-pricing in the shares is corrected over a couple of years.

-

My guess is the Fed funds rate will average around 3.5-4% over the next 5 years. Of course two of the key variables will be inflation and economic growth. My guess is the Fed will have a hard time getting inflation to and keeping it at its 2% target. The future path of the economy is impossible to predict with and accuracy. As a result, i do not have a high degree of confidence in my forecasting ability looking 5 years out (my degree of confidence is actually quote low). And i am certainly not making any investment decisions today based on what i think the world will look like in 5 years time.

-

@steph you nailed what is missing in my post - the ‘equity hedge/short’ trade was just one piece in the bigger picture of what Fairfax was doing at the time. Fairfax’s decisions are not made in a vacuum. That is perhaps the biggest flaw with my long form posts… they usually do not include an overlay of other important ‘big picture’ pieces. Readers need to keep this in mind.

-

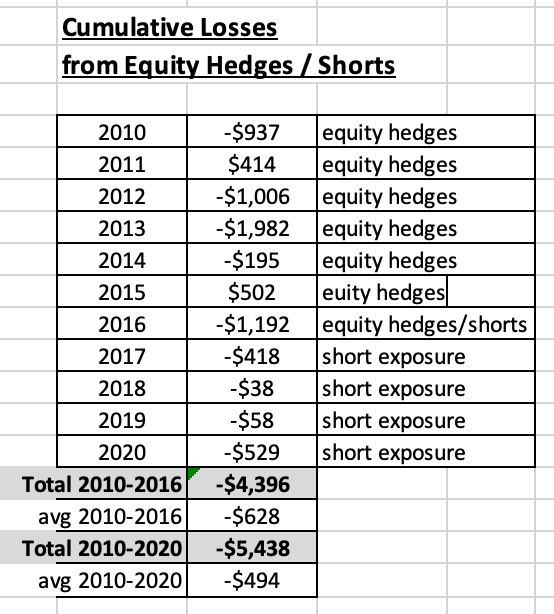

“Those who cannot remember the past are condemned to repeat it." (George Santayana) Given it has come up in discussion on this thread, I thought this would be useful to review what has to be Fairfax’s biggest ever investment mistake: the equity hedges. Why are they Fairfax's biggest investment mistake? The ‘equity hedges’ were in place from 2010 to 2016… and they caused investment losses of $4.4 billion; an average loss of $628 million per year for 7 straight years. Shareholders equity in 2010 was $7.7 billion. So losing $628 million in ONE YEAR was a big deal. And, as a reminder, this happened, on average, for 7 straight years. Book value per share was $376 in 2010 and in 2016 it has fallen to $367. Yes, Fairfax did pay a $10/share dividend every year so shareholders did earn a positive return over these years. Why did Fairfax put on the equity hedge trade? They were afraid “the North American economy may experience a time period like the U.S. in the 1930s and Japan since 1990.” From Prem’s letter 2010AR: “2010 was a disappointing year for HWIC’s investment results because of the two factors mentioned earlier. Hedging our common stock investment portfolio cost us $936.6 million or $45.61 per share in 2010. Our hedging program masked the excellent common stock returns we earned in 2010, of which a significant amount was realized ($522.1 million). We began 2010 with about 30% of our common stock hedged. In May and June we decided to increase our hedge to approximately 100%. Our view was twofold: our capital had benefitted greatly from our common stock portfolio and we wanted to protect our gains, and we worried about the unintended consequences of too much debt in the system – worldwide! If the 2008/2009 recession was like any other recession that the U.S. has experienced in the past 50 years, we would not be hedging today. However, we worry, as we have mentioned to you many times in the past, that the North American economy may experience a time period like the U.S. in the 1930s and Japan since 1990, during which nominal GNP remains flat for 10 to 20 years with many bouts of deflation.“ Why did Fairfax exit the equity hedge trade? The US presidential election on November 8, 2016. From Prem’s letter 2016AR: “Unfortunately, the presidential election on November 8, 2016 changed the world for us, so we reacted quickly by removing all our index hedges and some of our individual short positions and reducing the duration of our fixed income portfolios to approximately one year – all of which resulted in a $1.2 billion net loss on our investments in 2016 which, in turn, resulted in a loss in 2016 of $512 million or $24.18 per share.” But our sad story does not end here because even though Fairfax exited all of their equity hedge positions late in 2016 they continued with some short positions. From 2017-2019, Fairfax lost another $514 million on short positions. From Prem’s letter 2019AR: “In the past, to protect our equity exposures in uncertain times, we shorted indices (mainly the S&P500 and Russell 2000) and a few common stocks. After much thought and discussion, it became clear to me that shorting is dangerous, very short term in nature and anathema to long term value investing. As I mentioned to you in last year’s annual report, shorting has cost us, cumulatively, net of our gains on common stock, approximately $2 billion! This will not be repeated! In the future, we may use options with a potential finite loss to hedge our equity exposure, but we will never again indulge anew in shorting with uncapped exposure. Your Chairman continues to learn–slowly!!” But even after the mea culpa above in 2019 shareholders learned in 2020 that there was still one last mystery short position on the books. Only after another $529 million in losses in 2020, did Fairfax finally come to the conclusion that shorting was a tricky business. Margin and unlimited losses can be a bitch, especially in a decade long bull market (S&P500 was 1,133 on Jan 1, 2010 and 3,756 on Dec 31, 2020). And there we have it: Fairfax’s lost decade for shareholders from 2010-2020. From Prem’s letter 2020AR: “I said in our 2019 annual report that we would not short stock market indices (like the S&P500) or common stocks of individual companies ever again, and our last remaining short position was closed out in 2020 (not soon enough, as it cost us $529 million in 2020).” So as they began 2021, Fairfax shareholders were finally able to close the book on the whole ‘equity hedge/short’ trades. What was the cost to Fairfax? 1.) Investment losses of $5.4 billion from 2010-2020, or $494 million per year on average. 2.) Additional significant opportunity cost - easily in the billions. 3.) The massive size of the losses each year likely warped capital allocation decisions, especially 2010-2016 when the losses were larger. 4.) Long lasting harm to Fairfax’s reputation in the investment community. 5.) Exit of many long-term shareholders. What went wrong? The size and duration of the position. The losses were massive. And they were allowed to go on (pretty much) for 11 straight years. What explains the mistake? No idea. But my guess is hubris. Hubris Comes From Ancient Greece: “English picked up both the concept of hubris and the term for that particular brand of cockiness from the ancient Greeks, who considered hubris a dangerous character flaw capable of provoking the wrath of the gods. In classical Greek tragedy, hubris was often a fatal shortcoming that brought about the fall of the tragic hero. Typically, overconfidence led the hero to attempt to overstep the boundaries of human limitations and assume a godlike status, and the gods inevitably humbled the offender with a sharp reminder of their mortality.” Merriam-Webster Will Fairfax make the same mistake again? Well this is where things get interesting. Fairfax has stated publicly numerous times that they won’t make that exact same mistake again. To the best of my knowledge, they have never discussed publicly the failures with their internal processes that allowed such flawed investment to be made (in such a large size and for such a long duration). Did they identify the internal failures? Have they made the internal changes necessary to ensure it (a terrible investment decisions that results in another lost decade for shareholders) does not happen again? I’m not sure… I do think something changed at Hamblin Watsa around 2018 - and for the better. Their capital allocation decisions for the past +5 years have been stellar. And that will be the subject of a future long-form post, so stay tuned. Summary: As shareholders, I think it is important that we discuss/remember not only Fairfax’s successes but also their failures. I call it 'eyes wide open'. The equity hedges were an unmitigated disaster for Fairfax and its shareholders. There is no way to put lipstick on this pig. ————— Fairfax's 2016AR: Prem’s Letter: "Unfortunately, the presidential election on November 8, 2016 changed the world for us, so we reacted quickly by removing all our index hedges and some of our individual short positions and reducing the duration of our fixed income portfolios to approximately one year – all of which resulted in a $1.2 billion net loss on our investments in 2016 which, in turn, resulted in a loss in 2016 of $512 million or $24.18 per share." "When we removed our hedges near the end of 2016, we realized a loss of $2.6 billion in 2016, but that included $1.6 billion which had gone through our statements in prior years. As discussed earlier, since 2010 we have had $4.4 billion of cumulative net hedging losses and $0.5 billion of unrealized losses on deflation swaps (which we still hold), offset entirely by net gains on stocks of $2.7 billion and net gains on bonds of $2.2 billion. The volatility of our earnings caused by our hedges and long bond portfolios is over – and as I said earlier, we are focused on once again producing excellent investment returns." Equity contracts Throughout 2015 and most of 2016, the company had economically hedged its equity and equity-related holdings (comprised of common stocks, convertible preferred stocks, convertible bonds, non-insurance investments in associates and equity-related derivatives) against a potential significant decline in equity markets by way of short positions effected through equity and equity index total return swaps (including short positions in certain equity indexes and individual equities) and equity index put options (S&P 500) as set out in the table below. The company’s equity hedges were structured to provide a return that was inverse to changes in the fair values of the indexes and certain individual equities. As a result of fundamental changes in the U.S. that may bolster economic growth and business development in the future, the company discontinued its economic equity hedging strategy during the fourth quarter of 2016. Accordingly, the company closed out $6,350.6 notional amount of short positions effected through equity index total return swaps (comprised of Russell 2000, S&P 500 and S&P/TSX 60 short equity index total return swaps). The short equity index total return swaps closed out in 2016 produced a realized loss of $2,665.4 (of which $1,710.2 had been recorded as unrealized losses in prior years). The company continues to maintain short equity and equity index total return swaps for investment purposes, and no longer considers them to be hedges of the company’s equity and equity-related holdings. During 2016 the company paid net cash of $915.8 (2015 – received net cash of $303.3) in connection with the closures and reset provisions of its short equity and equity index total return swaps (excluding the impact of collateral requirements).

-

@Spekulatius at the end of the day, what the Fed does will impact Canadian inflation in a big way. But the Bank of Canada also has an important role to play (feels kind of strange to write that). The Bank of Canada was already on pause (since January). There was only one reason for them to hike this week… and it had little to do with the Fed. Or the Canadian dollar. High inflation (4%ish) is starting to get entrenched as the new normal here. I think the tipping point was the strong rebound in the resale housing market since January (they paused and housing took off). i am beginning to think there is only one thing that is going to get inflation under control - and that is a recession. My guess is the US is in the same boat. Central banks are going to have to chose. I was surprised the Bank of Canada increase rates - with their premature pause in January i thought they had already made the decision to let inflation run at 4% for a few years (that is how you solve a too much debt problem). It looks like i might be wrong - and the Bank of Canada just might be coming to the conclusion they need a recession - and higher unemployment - to get inflation all the way back down to their 2% target. ————— A big problem the Bank of Canada has is they only control the monetary side of the equation. As i posted earlier, the federal government and some of the provincial governments are spending like drunken sailors. So the fiscal response is highly stimulative today. At the same time the government is bringing in a record number of foreign students/foreign workers/immigrants and that is also highly stimulative to the Canadian economy. So we have this crazy set up where monetary and fiscal policies are working at cross purposes. So i am very interested to see where we go from here… the Bank of Canada might need to hike a few more times. If they keep going they will get a recession at some point. ————- I am looking forward to seeing what the Fed does next week and, perhaps more importantly, what their communication is. I wonder if they learn the lesson of Canada and Australia - a pause is just an illusion. It simply gives inflation more time to work its dark magic on the economy. The last thing the Fed needs is a rebound in US housing and the stock market taking off - which is probably what happens if they pause.

-

@nwoodman and @glider3834 thanks for all the info on Digit. Another nice tailwind for Fairfax. Love it.

-

With all due respect i think you are way overthinking this thing. The simplest answer is usually the right one. Why did Putin do it? Because he thought he could get away with it. He miscalculated. And now he and Russia is screwed. Why does any dictator do anything? Might is right. Hunger for more. Legacy. Hubris. A toxic combination. I love history (and Russian history). Putin is simply trying to do do what many Russian leaders before him have tried in previous centuries. The problem for Putin was even before the war in Ukraine, Russia was already a corpse of an empire. Like i said above, he miscalculated. And all he has done with his catastrophic invasion is expose how rotten Russia really is to the rest of the world and accelerated the country’s decline. Empires disappear all the time. Just look up ‘Ottoman’ or ‘Austro-Hungarian’ or ‘British’ or ‘German’. And when they disappear most do not go quietly into the night… their leaders often do really stupid things (like trying to return to the ‘good old days’) to hasten the end.

-

Great description of this guy. He has a simple, narrow narrative that appeals to lots of people (simple narratives are a must for the masses… repetition too…). He finds lots of facts to support his simple narrative (very easy). And ignores everything else… the other 70% that refutes his narrative. I find i learn next to nothing when i listen to Mearsheimer. He is a dog with a bone. And i am not looking to get brainwashed… There are lots of other great sources of information out there.

-

Clearly i am an idiot. ‘Ounce of prevention’? Seriously? What have they prevented? And check out the ‘tonne of cure’ below… that is a cure? Seriously? So Russia decided to invade a sovereign country because of the risk of nukes getting placed there. As a result of their actions, they also are now directly responsible for: 1.) forcing Finland to join Nato. Hello nukes very close. FYI, Finland is about the same distance from Moscow as Ukraine (in rocket terms). 2.) forcing Sweden to join Nato. The Baltic Sea now belongs to Nato. 3.) revitalizing Nato, which was crumbling and close to becoming obsolete before the invasion. 4.) forcing all countries in Europe to aggressively re-arm, including big ones like Germany. So in the coming years Russia is going to be surrounded by hostile and armed to the teeth neighbours. (Yes, people in Europe get hostile when they see the atrocities of what Russia is doing to Ukraine today). 5.) killing to date 20,000 of its own citizens (Russians!) with 100,000 casualties (Russians!) 6.) materially impairing the living standard of most Russians, likely for a generation 7.) materially impairing the future prospects of most Russian children 8.) forcing hundreds of thousands of young Russian men to flee the country to avoid fighting in the war 9.) economically speaking, has effectively become China’s concubine Man looks to me like Russia just nailed it with this invasion. My list above is just scratching the surface of what they have ‘achieved’.

-

@bizaro86 Parts of Vancouver are really in decline; Chinatown being an easy current example. Tent cities have popped up everywhere (not just a Vancouver thing… i saw it even in rural BC) - and it has now become a way of life for many. Catch and release is looking like a disaster; especially when mental illness is involved. The Provincial government is using BC as a test kitchen when it comes to drug use/treatment in general and i am not sure the reality on the ground is going to live up to the theory in the study. My read is we are reaching a tipping point where it is going to become an important factor at the polls. Vancouver just had a civic election and a right of center party swept the slate (extremely rare occurrence). Voters are getting pissed off. B.C.’s drug decriminalization experiment is off to disastrous start - https://www.theglobeandmail.com/opinion/article-bcs-drug-decriminalization-experiment-is-off-to-disastrous-start/

-

About 66% (2/3) of Canadians own their primary residence and 33% rent. 40% of all Canadian home owners carry no mortgage on their property. 50% of Vancouver home owners carry no mortgage. So higher interest rates have little impact for these people. And of the 60% who carry a mortgage a mortgage probably 2/3 of this group have likely owned for 10 years so their mortgage is very small. Here rising interest rates matter some. So my guess is 20% of Canadian home owners are likely stressed by the increase in interest rates. Some of these will have fixed rate mortgages (5 year fixed being the most popular) so it will take a few years for higher rates to fully impact even this group. If i am close, that means 13% of Canadians (20% x 66%) are feeling the heat of higher rates (via their mortgage). My guess is some of these people will get help from their parents (who are sitting on significant wealth). This might explain a little why higher interest rates is not having its usual impact in slowing economic activity. ————— Oh, and lets not forget about savers. My 91 year old mother in law is now earning 4.5% to 5% on her GIC’s, up from zero 18 short months ago. This is a material increase for her. And she is spending her newfound source of income. Lots of seniors out there in the same boat. And let’s not forget about all those Canadians who are sitting on enormous real estate gains, many of whom are mortgage free. Add in pensions. A decade of stock and bond market gains. That is an enormous amount of wealth that is impacting spending patterns - and it is largely insensitive to interest rates. Do they care if your restaurant bill went up 10%? Does it change their behaviour? Nope. Bottom line, the Bank of Canada is slowly learning that the old models need to be updated…

-

@SharperDingaan my guess is employment is the key moving forward. If employment stays reasonable strong then i have a hard time seeing how house prices move much lower in Vancouver/Toronto. I think we will need to see a recession and higher unemployment to cause house prices to fall. And even then, the fall likely will be mild (10% from here?). We have a severe shortage of housing right now. Very low listings of homes for resale. Exceptionally low vacancy rate (around 1% i think). So the market is frozen right now. No one can move. (Rent increase for new tenants is running close to 20%; rent increase for existing tenant was 2% this year - as mandated by provincial government - after a 1.5% increase in 2022.) Canada also had about 1 million immigrants come in over the last year: international students, foreign workers and regular immigration. Most want to live in Toronto or Vancouver. Cost to build a condo in Vancouver is C$1,100-$1,200 a square foot. For a 2 bedroom 850 square foot apartment that is $1 million. Interest costs for builders is spiking so this cost is likely too low. About 1/3 of a builders costs today are now taxes (municipal, provincial, federal) - all levels of government need housing to chug along. Bottom line, the real estate market is Vancouver and Toronto is NUTS. It is completely warped out of shape (like a pretzel). The crazy thing is the housing boom has made millions of Canadians millionaires. It has also become a cultural thing… want to get rich? Buy real estate. It is everywhere in society. Hockey is no longer Canada’s pastime - it is now real estate. At the end of the day, i am watching real estate closely. I have three kids, the first of who just graduated from university. I would love for all three to live in Vancouver (we all like each other…). If they don’t live in Vancouver it will likely be Toronto (the center of the world for employment in Canada).

-

@John Hjorth my guess is the Canadian banks will do ok. Canadians do not default on their mortgages. In terms of return, if you look at the last 5 years, Canadian banks have delivered a total return = dividend payout. I have bought a basket of the Canadian banks over the past year when they have sold off aggressively… and then sold them when they went up 3 or 4% (in tax free accounts). I have done this a couple of times. Canada right now has a number of attractive options if someone wanted to build a high yield dividend payout portfolio with an average dividend yield of around 5.5% (and likely a conservative total return of around 8-10% moving forward). For Canadian, in taxable accounts, income in the form of dividends is taxed at a very low level. - Canadian banks - Canadian telco’s - Canadian pipelines - Canadian energy ————— “In Canada, mortgages are typically recourse loans. However, in Alberta and Saskatchewan—non-recourse loans are more common. If you put less than a 20% down payment on your home, you would be required to have the CMHC insurance, which automatically makes your mortgage a recourse loan.”

-

The key is what Fairfax thinks: - fair value is for their stock is today (1.3 x BV?) - what the prospects are for earnings over the next 12, 24, 36 months (my base case is $120/year) - what the plan is for share buybacks (as the hard market ends, share buybacks could increase materially to reduction of +4% per year if they wanted) Fairfax, of course, has better information than we do. I would continue to hold the TRS.

-

Yesterday, the Bank of Canada delivered a surprise rate increase. Today they provided more details of why… what a shocker: “A lot of uncertainty remains. But it’s possible long-term interest rates will be higher in the coming years than what Canadians are used to,” Beaudry said on Thursday. By outlining these key forces, Beaudry said he hopes he “will help people be prepared in the eventuality that we have entered a new era of structurally higher interest rates.” ————— Bank of Canada Suggests Higher Rates May Not Have as Much Bite - https://www.bloomberg.com/news/articles/2023-06-08/bank-of-canada-flags-upside-risk-to-neutral-rate?srnd=premium-canada In a speech to the Greater Victoria Chamber of Commerce a day after policymakers raised the benchmark borrowing rate to 4.75%, Deputy Governor Paul Beaudry flagged concerns about a reversal in core inflation and said officials were surprised by household spending on goods and services. He also said that neutral rates — a theoretical level of borrowing costs that neither stimulate nor restrict the economy — may drift to higher levels compared to before the pandemic. Beaudry said stalling globalization, rising wages, and increasing investment opportunities in artificial intelligence as well as the transition to a low-carbon economy were contributing to the increase. “A base-case scenario where the real neutral rate remains broadly in its pre-pandemic range is possible, but the risks appear mostly tilted to the upside,” Beaudry said, adding that there was “meaningful risk” neutral rates could go up. While Beaudry was careful to note that the current neutral rate is still volatile, the comments will fuel speculation policymakers at the Bank of Canada are increasingly of the view their aggressive increases to interest rates are less restrictive. The statement, which came a day after the bank raised borrowing costs for the first time in three meetings, also highlighted the possibility rates need to move higher for longer in order to bring inflation to heel. “A lot of uncertainty remains. But it’s possible long-term interest rates will be higher in the coming years than what Canadians are used to,” Beaudry said on Thursday. By outlining these key forces, Beaudry said he hopes he “will help people be prepared in the eventuality that we have entered a new era of structurally higher interest rates.”

-

@giulio Sorry if my wording is not clear. My view is Buffett today has capital preservation as his single most important objective. It hit me like a bag of bricks when I watched him a couple of years ago when he had the online only annual meeting Q&A. He said that many long term shareholders had a majority of their wealth (and their families wealth) in Berkshire and he felt a massive responsibility to ensure that this wealth would be protected so it could be passed to future generations. Now don't get me wrong... Yes, Buffett also wants to make a decent return for shareholders. Now it is possible that Buffett has had the exact same mindset over the decades since he started. And Berkshires size is primarily what is causing returns to fall dramatically (from those earned in the past).

-

We have seen a massive increase in interest rates over the past year; far in excess of what anyone felt would happen. The Fed is also engaged in QT. We have a banking crisis at regional US banks, which is tightening credit. The Treasury needs to issue something like $1 trillion over the next 6 months to refinance and refill coffers (which will suck liquidity out of the system). Looks to me like risks to the economy are pretty elevated right now. Or traditional monetary policy no longer works - that new paradigm / this time is different thing. Does this mean people should move to cash? No, of course not. My base case is the US and global economies keep rolling along with slow growth. But i am very happy right now to lock in gains on a part of my portfolio. My cash weighting is back up to 35%. Happy to sit in the weeds (with cash earning a risk free 4%) and wait for some market dislocation where Mr Market serves up some fat pitches. I am pretty certain i will get at least a couple mouth watering opportunities in the coming months/year. Just like 2022. And 2021. And 2020… Buy and hold (index investing) worked like a charm when we lived in a QE world. It didn’t really matter what you owned… everything went up - every year. In the QT world of today, i wonder if active management might do a little better…

-

i agree. Prem has said that they feel their shares are worth much more than book value. My guess is he is probably thinking a minimum of 1.3 x BV (i am probably low). Fairfax also know earnings could total $300/share over the next 11 quarters. Book value today is $800. Book value could easily be $1,100 the end of 2025. At a 1.3 x multiple that would put the value of Fairfax shares (low end) at $1,400 at Dec 2025. Buying shares today at $750 is a bargain for Fairfax.

-

So in the 2019AR Prem said “After much thought and discussion, it became clear to me that shorting is dangerous, very short term in nature and anathema to long term value investing.” And what did we learn in the 2020AR? When Prem said what he said above they STILL HAD a massive short position on. And they kept it in place for another year. That cost Fairfax shareholders another $529 million. That stream of communication was not one of Prem’s finer moments. When questioned about the miscommunication i am pretty sure he said… well in 2019 i said i would not put on a NEW position. The loss was not a new position… so my previous communication was accurate. Technically correct, but… This was an example of terrible communication by a CEO. Fairfax is no longer a small family owned Canadian business. They are now a Goliath… a top 20 global insurer. Simply an amazing story. Put simply, Fairfax has entered the big leagues. Prem is now going to be held to a new standard in terms of communication. And rightly so. So many Canadian companies have failed to make this transition (Saputo being the best immediate example i can think of). If Prem wants to be viewed as a best-in-class global company he needs to improve on the communication (especially to shareholders). Or not. And suffer the consequences. His choice. ————— Just to be clear, i am not a Prem hater. I am a hard marker (ask my kids). Call a spade a spade. Prem has many strengths. He has been able to attract and retain outstanding people. People at Fairfax appear to really like him and enjoy working for the company. He/Fairfax has built a huge collection of amazing relationships in the business/political world. He is strategic. And focussed on the long term. I have no doubt that he is a first-class human being. He has Fairfax poised to do exceptionally well over the next few years. And like all of us, yes, he also has flaws. Am i happy he is CEO of Fairfax? Of course.

-

The problem is Fairfax does not run the business to attract a long-term shareholder base. The decisions/results/communication they delivered 2010-2020 are all the proof that is needed on that front. It was terrible (on balance). My guess is many long-term shareholders capitulated and sold in the bloodbath in 2020. Trust in management was lost and at an all time low. Fairfax is a blank canvas today. They are starting over and building a new relationship with shareholders. If they want long term shareholders they need to play their part. They need to re-establish trust. Communication needs to be stellar. Look at Buffett today. He is running Berkshire like a trust. Capital preservation is paramount; not return. And you see it in Berkshires results... they are not close to what they were. (I am not saying this is how Fairfax should be run.) Will I hold Fairfax long-term? I don't know is the honest answer. We are still too early into the turnaround. I love the set-up for the company right now. Management has delivered for the past 5 years. At the end of the day... I call it fit. To own a stock long term there has to be a match with how a shareholder is wired and how a company is run. ---------- At the AGM I asked Prem what lessons Fairfax had learned from the lost decade for shareholders (2010-2020). And had any processes changed within Fairfax to make sure the same TYPES of mistakes are not made again. I got a non-answer. Which of course WAS an answer. Another question at the AGM was if Fairfax carried too much debt (operated with too much leverage). Prem's answer was they could sell Odyssey and be debt free. I found the answers to both questions to be lacking. But I remain open minded.

-

I would also like to see a stock split. Perhaps 5 for 1. As you said, this would open Fairfax up to more smaller investors. This would also improve liquidity, especially in the US. I don't see a stock split as likely.