Viking

Member-

Posts

4,923 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

I need the help of board members. It can be confusing to understand how the business results of Fairfax's vast collection of equity holdings flows through to Fairfax's income statement and balance sheet at the end of each quarter. I have put together a 'cheat sheet' with 'rules of thumb' to help investors better understand this flow. Does this look generally accurate? What is wrong? What is missing? Can the layout be improved? Please feel free to rip it apart (you won't hurt my feelings). Comment on this thread or private message me. Thanks! PS: it is one sheet, but I copied it with two pictures so it can be more easily read.

-

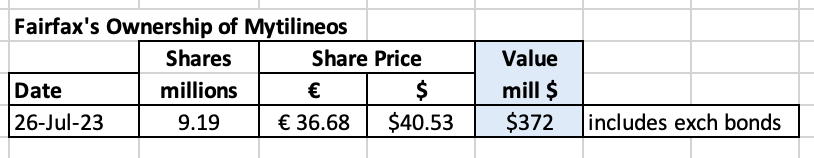

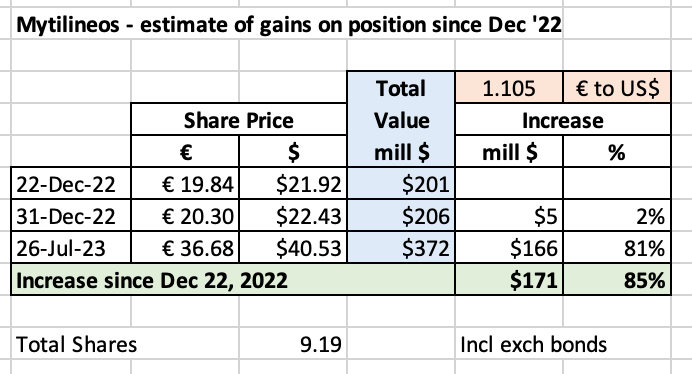

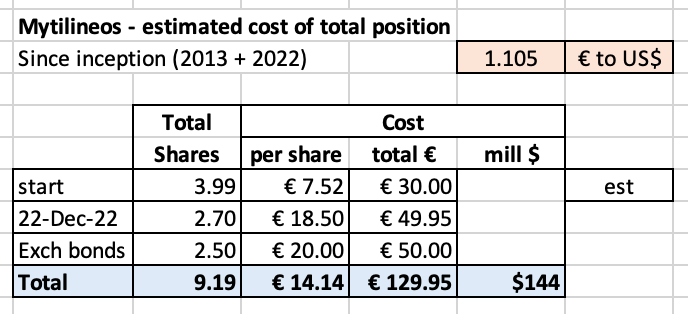

Mytilineos shares have been on a tear in 2023. Here is an short update of what it means for Fairfax. Who is Mytilineos? Ticker: MYTIL.AT (trades on the Athens stock exchange) Stock price: $36.68 (July 26, 2023) Market cap: €5.07 billion Dividend = €1.24 = 3.4% From the company’s web site: “MYTILINEOS Energy & Metals is a global industrial and energy company covering two business Sectors: Energy and Metallurgy. The Company is strategically positioned at the forefront of the energy transition as an integrated utility, while already established as a reference point for competitive green metallurgy at the European and global level. It has a consolidated turnover and EBITDA of €6.35 billion and €823 million, respectively, and employs more than 5,442 direct and indirect employees in Greece and abroad.” Corporate presentation Jun 2023: https://www.mytilineos.com/media/k5lj10q0/corporate_presentation_june_2023.pdf How much of Mytilineos does Fairfax own? Fairfax owns 9.19 million shares (including the exchangeable bonds) with a value of $372 million. This makes the company a top 15 holding in Fairfax’s equity portfolio. Fairfax made its first investment in Mytilineos in 2012 or 2013 (€30 million stake). In November of 2022, Fairfax owned 3.99 million shares. In December 2022, Fairfax more than doubled their stake: they purchased 2.7 million shares at €18.50. they purchased exchangeable bonds that gives them the right to buy another 2.5 million shares at €20. Fairfax is now the second largest shareholder. How has the investment performed since Fairfax added to their position in December, 2022? Fairfax’s position is up $171 million or 85% over the past 8 months. ————— October 21, 2013: Canada's Fairfax buys Mytilineos stake in second bet on Greece https://www.reuters.com/article/us-greece-fairfax/canadas-fairfax-buys-mytilineos-stake-in-second-bet-on-greece-idUSBRE99K05H20131021 December 13, 2022: Fairfax becomes the 2nd largest shareholder in MYTILINEOS https://www.mytilineos.com/news/company-news/fairfax-becomes-the-2nd-largest-shareholder-in-mytilineos ---------- Estimated cost to Fairfax of total position (very rough) My estimate below of €14.14 is likely high. It does not include dividends, which Mytilineos has paid since 2018. And my estimate of €7.52 for the initial 3.99 million shares is a guess. Given the large size of the position, Fairfax will likely give us the correct number in a future annual report.

-

I don’t even know where to begin. $50? Really? But hey, if a $50 fee is keeping idiots like that off this board… well, that is priceless!

-

Timely lessons from Buffett's 1999 Fortune article

Viking replied to LearningMachine's topic in Berkshire Hathaway

@LearningMachine great trip down memory lane. Thanks for posting. Lots about investing has not changed much. For small investors, costs have come way down. And much better information is available. What hasn’t changed with small investors? If i had to pick one thing it is probably psychology… still making the same mistakes. -

As i mentioned in my previous post, the closing of the Gulf Insurance Group (GIG) deal (Q4?) - boosting Fairfax’s ownership to 90% - will be an important growth driver of Fairfax’s 2024 results. GIG recently updated their web site. They added a bunch of new information. Below is the link to a 40 page report that provides a great overview of the company. - https://www.gulfinsgroup.com/Frontend/EN/GIG-Corporate-Profile-ENG.pdf?download=false Here are the financial highlights (2022): Net premiums written = $1.7 billion Underwriting surplus = $164 million Total Investments = $2.4 billion Shareholders equity = $748 milion Net profit = 125 million (Q1, 2023 = $34 million) The purchase price of the 46% owned by Kipco is $860 million. However, the true cost to Fairfax is far less, due to the time value of money. Fairfax will pay $200 million at close and then 4 annual instalments of $165 million. If we use an 10% discount rate, the cost to purchase Kipco’s stake when it closes in Q4 is closer to $700 million ($200+$149+$134+$120+$108). This is a good example of solid capital allocation on the part of Fairfax. They are paying a premium for quality. That is interesting. They are also playing the long game with this purchase as it is a very strategic purchase for them that solidifies their presence in the MENA region. It is also anther example of using their current robust cash flow to take out a partner in a business they understand very well.

-

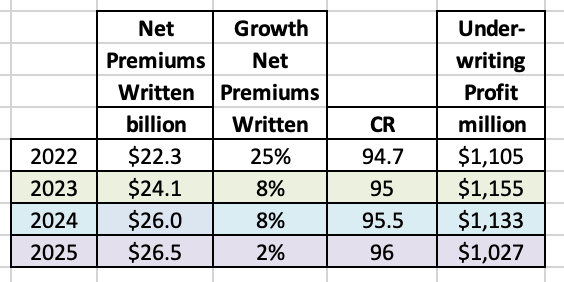

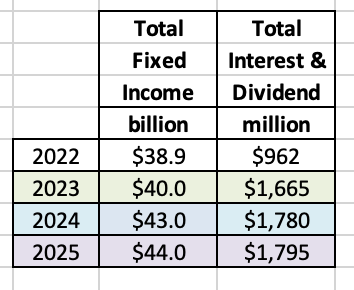

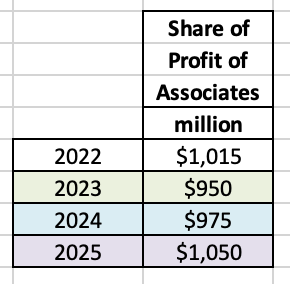

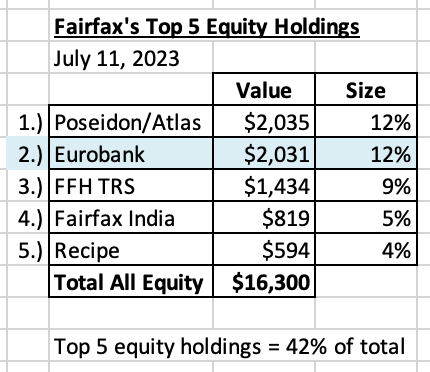

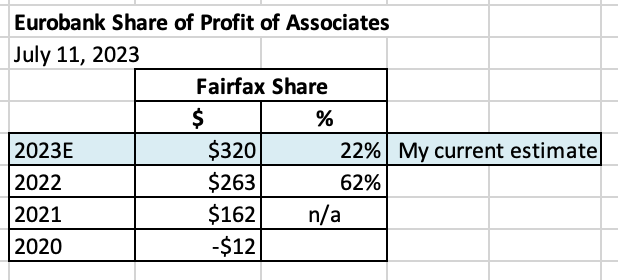

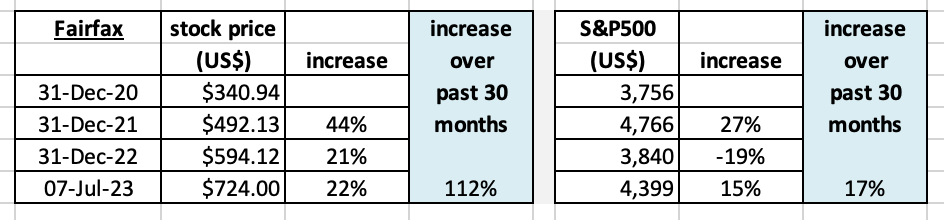

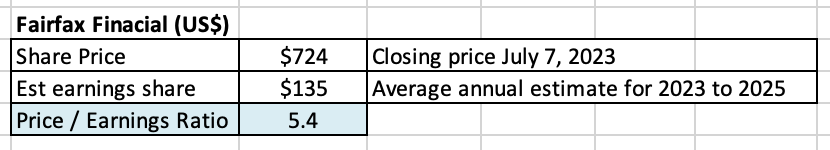

As we begin Q3, this is a good time to update earnings estimates for Fairfax for 2023. And look ahead to 2024. I am also going to take a stab at 2025. I don’t like to go much beyond 2 years with earnings estimates - there are simply to many moving parts. But it useful to get a three year view on earnings to better be able to value the stock price today - so lets give it a shot. My first big learning has been: the GIG acquisition is going to be a material development for Fairfax when it closes. I need to get up to speed with GIG (I may need to revise my estimates below). Please chime in with your thoughts. Too optimistic? Too pessimistic? Any thoughts on what GIG is going to deliver? What important things are missing? Please get into the weeds. Conclusion: Let's skip ahead to the conclusion. My estimate is Fairfax will earn about $140/share, on average, over the next three years. I consider this to be a mildly conservative estimate - what i mean by that is i think it is more likely that earnings will come in higher than lower. The big ‘miss’ with my estimates is capital allocation. We don’t know much of what the management team at Fairfax is going to do with all the earnings (around $3.2 billion) coming each of the next 3 years. Looking at the last 5 years, the management team has been best-in-class with capital allocation. My guess is they will continue to make good decisions (on balance) and this will benefit shareholders - providing a tailwind to my forecast. I am also assuming interest rates remain roughly at current levels. Of course this will not be the case. But if rates rise - or go lower - Fairfax will have lots of puts and takes. I am also forecasting no impact from IFRS 17 (as I have stated before, I am still learning how this accounting change affects Fairfax’s reported results over time.) I love the following 8-year snapshot of Fairfax. It communicates really well the dramatic transformation that has happened at the company beginning in 2021. It is a pretty amazing story. What are the key assumptions? 1.) underwriting profit to be flat to slightly down. Estimates for both premium growth and CR are conservative. When the GIG transaction closes (Q4?) Fairfax will be getting a big boost to its insurance business. I think GIG might be adding $1.8 billion to net written premiums. GIG is the driver to top line growth of 8% in 2024. If the hard market continues into 2024 then top line growth at Fairfax will likely be +10%. I am forecasting Fairfax’s CR to increase from 94.7 in 2022 to 96 in 2025. Do I think this will happen? No. My guess is they will continue to deliver a 95 CR - until I learn something that tells me something new. The hard market will end at some point. But do things quickly turn ugly? Probably not, but not sure. 2.) interest and dividend income: Will increase modestly. Extending the average duration of the fixed income portfolio to 2.5 years largely locks in these numbers. Tailwinds: GIG: will add about $2.4 billion to total investment portfolio. At estimated total return of 4.5% = $110 million. I expect the majority of this would be interest income. PacWest loans: $100 million incremental ($200 million total) to interest income? Half in 2H, 2023 and half in 1H, 2024. Eurobank: likely dividend starting in 2024 = $60 million? Headwind: Short term treasury rates likely come down lowering interest on cash/short term balances. 3.) Share of profit of associates: Will increase modestly. It fell in 2023 because of the sale of Resolute Forest Products - who contributed $159 million in 2022. GIG purchase will subtract $80 million in 2024 (same as what is built in for 2023). growing earnings at Eurobank and Poseidon/Atlas will power this higher. My estimates for Stelco and EXCO are very conservative (a combined total of $110 million per year). 4.) Effects of discounting and risk adjustment (IFRS 17). Interest rate changes drive this bucket. I need time to learn how much. Given I am forecasting interest rates to remain about where they are today I am leaving this number the same over the forecast period. 5.) Life insurance and runoff. This combination of business lost $167 million in 2022. I am forecasting this bucket to lose $175 million in each of the next three years. We should expect Eurolife to grow its earnings nicely over time. 6.) Other (revenue-expenses): improving results from consolidated holdings. In the near term, perhaps we get write downs in both Boat Rocker and Farmers Edge. Recipe should deliver solid and growing earnings of better than $100 million per year. Earnings at Dexterra are growing again. AGT is a sleeper holding. Grivalia Properties is in its peak investment phase; earnings should grow nicely looking out a year or two. This bucket could really start to shine through for Fairfax in the coming years. 7.) Interest expense: modest increase. 8.) Corporate overhead and other: took the average of last 3 years and added 10% 9.) Net gains on investments: This is a wild card. My estimates assume: mark-to-market equity holdings of $7.8 billion increase in value by 10% per year = $800 million. there is a small bump of $200-$300 million per year in additional gains (equities and fixed income). Total return on investment portfolio is: 2023 = 7.5% 2024 = 6.8% 2025 = 7.0% (I get this by adding up the following line items: 2.) + 3.) + 6.) + 9.) and divided the total by the value of their investment portfolio). These percent returns, while high compared to recent years, are hardly heroic given Fairfax is currently earnings about 4% on their fixed income portfolio. 10.) Gain on sale/deconsol of insurance sub: this is where I put the really large monetizations. 2022 was the sale of pet insurance and Resolute. 2023 was the sale of Ambridge and the purchase of GIG (resulting in a write up of the existing holding). I am building in nothing for 2024 and 2025 and this is highly unlikely. We likely will get a Digit IPO at some point over the next year and this could result in a significant gain for Fairfax. We could get an event that triggers a revaluation of Eurobank (carrying value is currently $500 million below market value and this will likely widen significantly in the coming years). We could see an AGT IPO. Fairfax is likely to sell another large holding for a significant gain. Bottom line, this is probably where I will be most wrong with my forecast. Developments here will have a material positive impact to Fairfax’s reported results (earnings and book value). 11.) Income taxes: estimated at 19% 12.) Non-controlling interests: estimated at 11% (not really sure) 13.) Shares Outstanding: reduced by 500,000 per year. This is in line with a normal year from Fairfax. It would not surprise me to see Fairfax do one more big repurchase to take advantage of the low share price while it lasts.

-

Thanks for giving me my belly laugh for the day i really appreciate it!

-

@glider3834 thanks for all the links to articles that you post. You are quite the blood hound finding interesting and important developments that are relevant to Fairfax. i agree, Cypress is a region to watch (quite profitable). I have been very impressed with capital allocation decisions made at Eurobank over the past few years. I think they were short duration on their fixed income portfolio at the end of 2021 (sound familiar). The purchases of the stakes in Hellenic Bank (you posted) were a steal. And the sale of the Serbian assets (in a non-core market) at a good price looks smart amd well timed (provide the funds to growth in Cypress, a core market). Scale really matters in banking. And it is becoming even more important. The big boys really do have massive advantages over smaller players. Makes sense we should see alot of consolidation in the coming years. Should benefit the big boys.

-

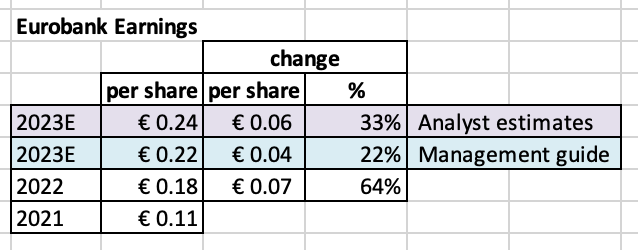

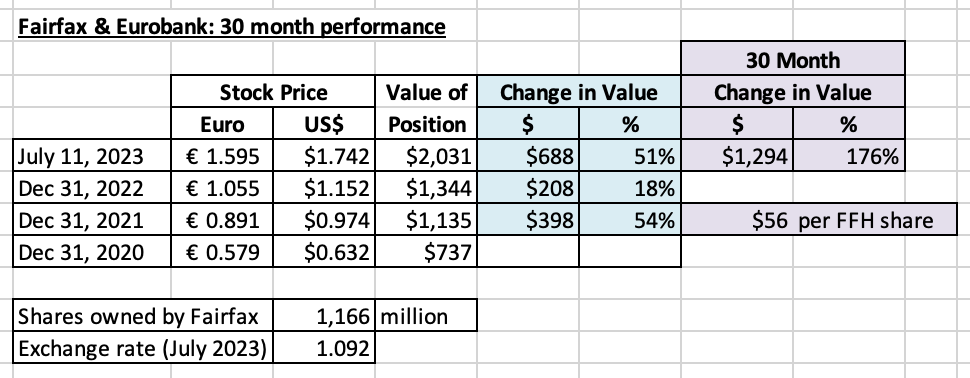

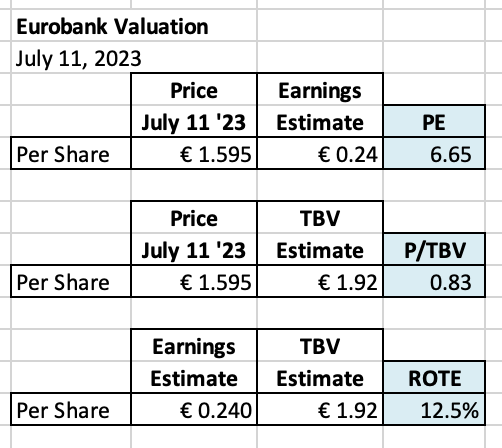

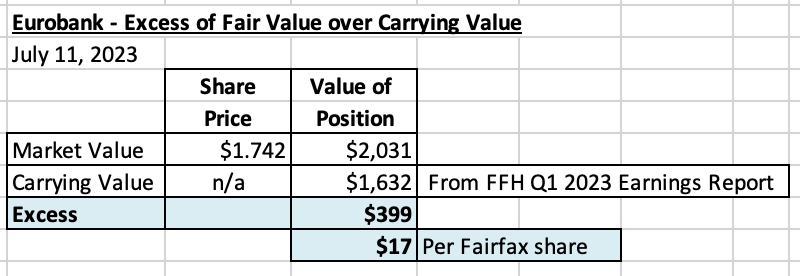

@nwoodman thank you for providing the MS report. It motivated me to write an update on Eurobank. Eurobank's stock is one again hitting all time highs (€1.595 today). It is now tied with Poseidon/Atlas as Fairfax’s largest equity holding. Time to do a review of what has been Fairfax’s best performing equity holding over the past couple of years. This review will focus on the numbers and will be mostly forward looking. Who is Eurobank? Eurobank is one of the largest banks in Greece (and the region). Its core markets are Greece, Bulgaria and increasingly Cypress. It is recognized as being one of the best managed banks in Greece. Q1, 2023 Management Presentation: https://www.eurobankholdings.gr/-/media/holding/omilos/grafeio-tupou/etairikes-anakoinoseis/2023/1q-2023/1q2023-results-presentation.pdf Of interest, Eurobank, Eurolife and Grivalia (all Fairfax holdings) are all joined at the hip. More on this in another post. Let’s start by looking at the big picture. What are prospects for the Greek economy? Greece is positioned very well right now. The Greek economy turned the corner a couple of years ago now. Tourism is booming. As is the property market. Prime Minister Mitsotakis (center-right) was just re-elected with another majority for a second consecutive 4-year term. This ensures the significant economic (pro-market) reforms to the Greek economy will continue. Greece is expected to have one of the better performing economies in Europe over the next couple of years. This is a very positive backdrop for Eurobank. How much of Eurobank does Fairfax own? Fairfax owns 32.2% of Eurobank (1.166 billion shares). A stake worth $2 billion today. Timeline of key events for Fairfax and Eurobank: Dec 2014: FFH investment #1 in Eurobank of $444 million for 12.5% position Nov 2015: FFH investment #2 in Eurobank (recapitalization) of $389 million for 17% position Dec 2015: FFH purchase of 80% of Eurolife from Eurobank for $360 million May 2019: Eurobank recapitalization / merger with Grivalia Properties - Fairfax owns 32.4% July 2022: Fairfax increases stake in Grivalia Hospitality from 33.5% to 78.4% (from Eurobank) for $195 million Importantly, Eurobank is Fairfax’s minority partner in Eurolife and Grivalia Hospitality. How important is Eurobank to Fairfax? Eurobank is tied with Poseidon/Atlas as Fairfax’s largest equity holding. With a market value of $2 billion, Eurobank represents about 12% of Fairfax’s total equity holdings of around $16.3 billion. For context, Fairfax has an investment portfolio of about $56 billion, with fixed income investments of $40 billion and equities of $16.3 billion. What is the trend for earnings at Eurobank? Earnings have been on a steady upwards trajectory in recent years. Management is guiding to earnings of €0.22/share in 2023. Management is conservative with their forecasts. Analysts are expecting earnings to come in around €0.24/share in 2023. How has the stock price of Eurobank performed? Eurobank’s stock price has been spiking higher - it is up 176% over the past 30 months. The market value of Fairfax’s position in Eurobank is up $1.3 billion over the past 30 months, or $56 per Fairfax share. Clearly, Mr. Market is recognizing and rewarding the improving fundamentals and results at Eurobank. How is Eurobank stock valued today? Despite the 176% increase over the past 30 months, Eurobank’s stock is still cheap (sound familiar?). The stock is trading at a forward price earnings of 6.65; price to tangible book value of 0.83; return on tangible equity of 12.5%. Note: I used the analysts guide for EPS for 2023 of €0.24/share because it is the likely number. Morgan Stanley currently has a price target for Eurobank of €2.10/share = $2.29/share. With shares trading at €1.595 today this suggests 32% upside. Currently 79% of analysts who follow Eurobank have the stock rated ‘Overweight’. Of interest, if Eurobank traded at €2.10/share, Fairfax's position would be worth $2.675 billion. How is Eurobank valued on Fairfax’s books? Eurobank is not a mark-to-market holding for Fairfax. Since Jan 1, 2020 it has been a consolidated holding (equity accounted). At March 31, 2023, Eurobank had a carrying value at Fairfax of $1.6 billion. So as of today there is an excess of $400 million of market value over carrying value ($17/share pre-tax). This excess is not captured in Fairfax’s reported financial results (although they do highlight it in their commentary). This is a good example of where Fairfax’s book value is understated. How do results at Eurobank flow though to Fairfax? Dividends. Eurobank currently does not pay a dividend. The plan is for Eurobank to start paying a dividend in 2024. In Q1 2023, Eurobank said they are targeting a minimum payout ratio of 25% - for both dividend and buybacks - in 2024. Let's assume Eurobank goes with a payout ratio of 20% for the dividend. This would likely mean an annual dividend of around €0.048/share. In this scenario, Fairfax would start receiving dividends of $61 million per year. For context, Fairfax currently receives about $135 million in dividends per year from all their various holdings. A dividend from Eurobank would increase this amount by 45%. This would be significant for Fairfax. Something to watch for in 2024. Share of profit of associates. Eurobank is a big reason we are seeing ‘share of profit of associates’ at Fairfax spike to over $1 billion per year in recent years. And as Eurobank grows earnings ‘share of profit of associates’ at Fairfax will only grow more. Investment Gains. Down the road, as Eurobank gets more fully valued, Fairfax could start to sell down its large position. That would crystallize any 'excess of fair value over carrying value'. Today the 'excess' is $400 million. How much has Fairfax earned from this holding since inception? Fairfax is up about $935 million or 85% over the 8.5 years it has owned Eurobank. Fairfax 2019AR Prem’s Letter: “The animal spirits are coming back to Greece and we think the Greek economy and Greek companies will thrive. Eurobank should benefit!! Our cost of 1.2 billion shares of Eurobank after the Grivalia transaction is now 94¢ versus a book value of approximately 135¢ per share post the transaction. At year end, Eurobank was selling at 68% of book value and 6.5x normalized earnings. We still believe it will be a good investment for us.” Conclusion Despite getting off to a terrible start in 2014, Eurobank has turned into a very good investment for Fairfax. This has only happened due to the hard work over many years from the Eurobank team in Greece, lead by CEO Fokion Karavias and Vice Chairman George Chryssikos. Having a long-term oriented, strong, supportive and patient partner in Fairfax also helped greatly. Most importantly, Eurobank is poised to perform even better in the coming years. Given it is such a large holding this should benefit Fairfax shareholders greatly. Making the initial investment in Eurobank also had important added benefits for Fairfax. It led Fairfax to buy 80% of Eurolife which has been an exceptional investment. It also led them to buy a 78.4% stake in Grivalia Hospitality (it is still early days on this investment). Importantly, Fairfax is viewed as being a trusted and strong foreign investor and partner in Greece.

-

The simplest answer is usually the best. It is obvious Putin is a mole for the West. He was likely recruited in St. Petersburg before his political career got going. He single-handedly has: revitalized NATO convinced Finland and Sweden to join NATO, when neither country wanted to before convinced all countries in Europe neighbouring Russia to quickly and heavily re-arm severed decades old economic linkages with Germany convinced Germany to re-arm set the Russian economy back a generation permanently lowered the living standards of current and future generations of Russian kids killed tens of thousands of young Russian men; turning what was already a demographic problem into a nightmare convinced tens of thousands of Russians to leave their country (lots of whom are educated) accelerated by decades the decline of the Russian state economically, made Russia a vassal state of China Simply amazing what he has accomplished in less than 18 months. And i don’t think he is close to being done.

-

@Madpawn my holding as of today is 100% Fairfax. I just added to Fairfax when it went under C$960. I prefer to primarily hold Fairfax today given how cheap i think it is (and i am way overweight). I have held Fairfax India in the past (i recently sold my small remaining position at just just under $14), and sometimes large stakes. But i use it more as a trading vehicle. That works when a stock moves in a sideways band (like Fairfax India has been the past couple of years). But if/when it pops higher then i am toast. I often get too cute with situations like Fairfax India. Fairfax India is unambiguously cheap. And the potential catalysts are there (big undervaluation, holdings are performing well, BIAL is a jewel/trophy asset, management buying back stock, Anchorage IPO, general interest in India). It has a very good management team. The stock is bumping up against $14, so someone is buying… If it sold off I likely would add back. But it would not surprise me to see the stock just keep powering higher.

-

@newtovalue i have not done a Q2 estimate yet. I will put something together before they report. The problem i am having is understanding the impact of much higher interest rates and IRFS 17. Any insight other posters have on interest rate changes and impact on IFRS 17 would be appreciated

-

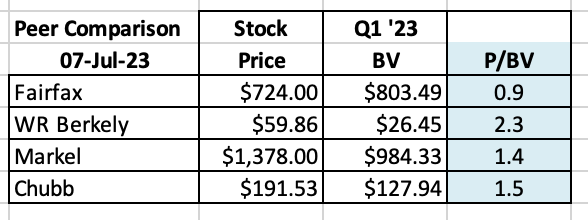

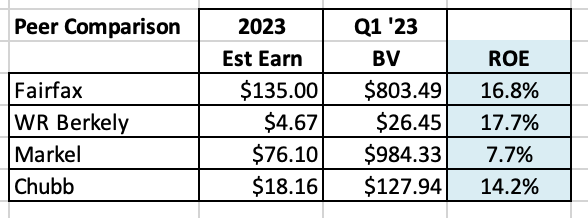

@Munger_Disciple i agree. That is why i look at both BV and ROE together. IFRS popped BV for Fairfax but it also depressed ROE. Looking at the two together provides a more accurate picture. If we used old GAAP for Fairfax then P/BV would be a little higher for Fairfax’s (probably a little over 1 x BV) but ROE would be approaching 20% (much higher than peers). It would lead to the same conclusion - Fairfax’s stock is too cheap compared to peers. That is also why i like looking at PE. What other large stock is trading at a 5.4PE today? And the earning are real. And not abnormally high, driven by some one time event - my current mildly conservative estimate is Fairfax will earn an average of $135/year in 2023, 2024 and 2025. There are lots of catalysts am not including that could drive earnings higher (like a Digit IPO, more asset sales etc). And i am still learning about IFRS 17. It will take me 6-12 more months to get more comfortable with all the puts and takes (i am slow to grasp some stuff… but i do get it eventually). So my estimates could be off due to IFRS 17 impacts i do not yet understand.

-

Fairfax’s stock price has a history of selling off around 15% in June-Oct. This makes sense as this is hurricane season, and losses from catastrophes in recent years have been elevated. Last year the stock was trading around $550 in April and $450 in Oct; this decline happened AFTER announcing the pet insurance sale which delivered an after tax gain of $990 million. In 2021, the stock traded at $470 in May and bottomed around $410 in October. Where will the stock trade the rest of this year? No idea. Sometimes history repeats; sometimes it doesn’t. I like to look at it to understand potential outcomes… so i do not get caught by surprise when something happens. If we do get a sell off it makes sense to me that Fairfax would get more aggressive on the share buyback front, but perhaps not until we are on the other side of hurricane season.

-

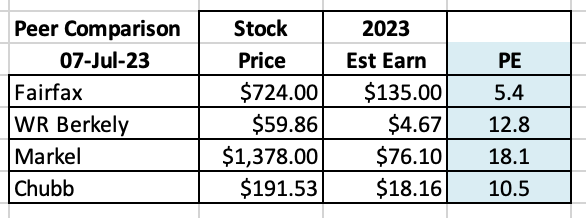

Is the stock priced properly? Efficient market hypothesis: “The efficient market hypothesis (EMH) is a hypothesis that states that share prices reflect all information and consistent alpha generation is impossible. According to the EMH, stocks always trade at their fair value on exchanges, making it impossible for investors to purchase undervalued stocks or sell stocks for inflated prices…” Investopedia A lot has happened at Fairfax over the past 30 months. Let’s do a quick review and see what we can learn. Most importantly, is the stock priced correctly, as the EMH would suggest? How has Fairfax’s stock performed over the past 30 months? First, let’s get some context. Fairfax has been one of the best performing stocks over the past 30 months both in absolute and relative terms. The outperformance has been remarkably consistent each year. Fairfax’s stock has outperformed the S&P500 by 95% over the past 30 months. That outperformance must make Fairfax one of the top performing large cap (in Canada) stocks over the past 30 months. Does this mean the stock is now expensive? The proverbial ‘big fish that got away’ from investors? Let’s find out. Let’s try and keep an open mind. What do the numbers tell us? And what about management? And future prospects? Let’s start by looking at the traditional valuation tools: Price to earnings ratio (PE) My current estimate has Fairfax earning about $145/share in 2023 and $135 in both 2024 and 2025. I view this as a mildly conservative estimate for the next three years. I’ll provide more details in my 3-year earnings forecast for Fairfax - coming in the next week or so. Importantly, the quality of the earnings being delivered by Fairfax are the highest in the company’s history; it is primarily being delivered by record operating earnings (underwriting profit + interest and dividend income + share of profit of associates). All three individually are at record levels. We learn in the chart above that Fairfax is trading today at a forward PE multiple of 5.4 times. That is crazy cheap, especially given the quality and durability of earnings. What is the PE multiple of the overall market? The forward PE multiple of the S&P500 is 20. Fairfax’s stock is trading at a SIGNIFICANT discount to the S&P500. Fairfax’s stock price could double from here and it would still be trading at a 50% discount to the S&P500 multiple. How about compared to some P&C insurance peers? Looking at PE, Fairfax is trading at 48% (Chubb) to 70% (Markel) below peers. Fairfax’s stock looks dirt cheap. But let’s keep digging. Price to book value multiple (P/BV) and return on equity (ROE) Let’s now look at the price-to-book value (P/BV) and return-on-equity (ROE). These two are the preferred metrics used to value insurance companies. Let’s start with P/BV. How does Fairfax stack up compared to peers? Looking at P/BV, Fairfax is trading 36% (Markel) to 61% (WR Berkley) below peers. How about ROE? Looking at ROE, Fairfax is poised to deliver an exceptional 16.8%, at the high end compared to peers. What can we conclude after looking at the valuation metrics? Looking at PE and P/BV, Fairfax’s stock is exceptionally cheap compared to the market and peers. At the same time Fairfax is delivering best-in-class ROE. This makes no sense. Let’s keep digging. What about management? I recently did a long-form post where I reviewed capital allocation at Fairfax over the past 5 years. Bottom line, it can be argued that Fairfax currently has a best-in-class management team (compared to peers). The mystery deepens. What about the future prospects of Fairfax? Fairfax has three engines driving its business: Insurance: Fairfax has grown net premiums written by 400% over the last 9 years. At a 95CR, underwriting profit is on track to be a record $1 billion in 2023. Investments - fixed income: Fairfax has navigated the spike in interest rates masterfully in their $40 billion fixed income portfolio, moving to 1.2 years average duration in Dec 2021 and then pivoting and moving to 2.5 years average duration in Q1 2023, locking in higher yields. As a result interest and dividend income is expected to be a record +$1.5 billion for each of 2023, 2024 and 2025. Investments - equities: Fairfax’s $16 billion equity holdings have been performing very well, lead by Eurobank and total return swaps on 1.96 million FFH shares. Most importantly, all engines are performing very well at the same time, perhaps for the first time in the company’s history. Significant asset sales over the past 12 months have been icing on the cake: pet insurance ($1.4 billion), Resolute ($626 million+$183 million CVR), Ambridge Partners ($400 million). In short, Fairfax’s prospects have never looked better. What are external groups saying? AM Best, the credit ratings agency who specializes in insurance companies, just upgraded Fairfax’s ratings (including those of its two largest subs - Odyssey and Allied) because of its much improved financial profile. Most sell-side analysts have been warming to Fairfax over the past year, repeatedly increasing their estimates and target prices. Most have Fairfax as ‘outperform’ and a few have it as a ‘top pick’. Conclusion What did we learn about Fairfax? The stock price is unambiguously cheap in absolute terms and when compared to peers. The quality of the earnings are high and durable. The management team is best-in-class. Future prospects have never been better. Ratings agencies are drinking the Kool-Aid, with upgrades. Sell side analysts are drinking the Kool-Aid, with upgrades. The cheap stock price stands out like a sore thumb. How do we explain it? The answer is simple: Mr. Market is wrong. Now I know, according to EMT, this is not supposed to happen. What we have today is a real life example of where the efficient market hypothesis is bullshit. At least in the short run. We have situation where Mr. Market is grossly mis-pricing a stock. Now I do think the EMT is generally accurate over the medium to long term… the mis-pricing usually does not last for long. The disconnect with Mr. Market is fundamentals. The fundamentals have been improving at Fairfax for the past couple of years but are just now showing up in earnings. It’s like Mr. Market has been standing on the beach the last couple of years wondering why the water is running out to sea. The answer is we have a tsunami of earnings coming from Fairfax in the coming quarters and years. Mr. Market will figure it out. But in usual fashion, only when the wall of water comes crashing in (wiping out all the wrong-headed thinking on the company in the process). "What a shocker!" everyone will say. "Who could have known?" A similar thing happened to Fairfax in the 2006-2009 period. The coming spike in earnings is not a surprise to those who follow the company closely. So we are in this surreal environment where the future is kind of knowable (a spike in earnings leading to a spike in the share price). What to do? Trust the analysis (be right). Get the correct position size. Have patience (sit tight). ————— “And right here let me say one thing: after spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets . I’ve known many men who were right at exactly the right time, and began buying and selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine - that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.” Reminiscences of a Stock Operator

-

@Thrifty3000 can you please tell me what the ‘problematic pattern’ is? We have know for years that runoff is a drag of $150 to $200 million per year. I don’t consider known events that are baked into historical results (and future estimates) to be ‘problems’. Is there something new here that is now emerging that is making this a bigger issue? Not speculation but something concrete? With interest rates spiking, my guess is the runoff fixed income portfolio will be earning much higher interest income. This tells me runoff portfolio will likely be less of a drag on earnings for Fairfax in 2023 and future years than in recent years when interest rates were zero. But as i constantly say… i am not an insurance guy and so I remain open minded.

-

@Luca Have you watched the video below? The liberal democracies of the West and the CCP are completely different animals. When i watch this video it makes the hair on the back of my neck stand up. It provides a great real life example of how the CCP operates - basically it does whatever it needs to do to stay in power… WITH ZERO CHECKS AND BALANCES. Yes, all liberal democracies are flawed. But the CCP is a frightening form of government (putting it politely).

-

@glider3834 thanks for sharing. Great to see the ratings agencies recognizing the significant improvements being made under the hood at Fairfax and its largest subsidiary. Its funny because it looks to me like AM Best might be further along in this regard than the equity analysts; probably because they are more specialized? Who is AM Best? AM Best is the largest credit agency in the world specializing in the insurance industry. It is the gold standard for insurance companies (please correct me if i am wrong). What did we learn from this news release? The financial strength rating of Odyssey has been upgraded to A+ (Superior). This is the same rating that AM Best currently has for both WR Berkley and Markel. As far as AM Best is concerned, Fairfax’s largest insurance subsidiary, Odyssey, belongs in that group. Why the upgrade? balance sheet strength, which AM Best assesses as strongest strong operating performance favorable business profile appropriate enterprise risk management I am not an insurance expert. AM Best is. For those board members who are worried about ‘reserving’ or ‘risk management’, at least at Odyssey, things look very good. We also learn a little about Fairfax in the news release: “The rating upgrades recognize the removal of ratings drag from Odyssey Group’s parent company, Fairfax Financial Holdings Limited (Fairfax), which has demonstrated sustained improvement in its overall credit profile in recent years. Fairfax has reduced its debt leverage materially and improved its overall operating performance, while maintaining consistently sound balance sheet strength and financial flexibility. As a result, debt servicing metrics have improved sustainably, reducing the burden imposed on Fairfax subsidiaries and supporting the removal of ratings drag on Odyssey Group.” We also learn a little more about Odyssey in the news release: Odyssey has been slowly building out is specialty insurance business (the business everyone is trying to grow because it is higher margin and has more of a moat) in the US and this positive development gets a shout-out from AM Best. “Odyssey Group otherwise continues to produce consistently strong underwriting results, despite elevated global catastrophe losses and is well-positioned to take advantage of continued rate improvement in many of its key business lines. Odyssey Group’s risk-adjusted capitalization remains strongly supportive of its strongest overall balance sheet strength assessment, and the group continues to benefit from its position as a global reinsurer with a well-diversified portfolio that also includes a significant position in the specialty primary market in the United States.”

-

We are told that the 10 year US treasury is the security that all other investments are priced off of. The yield on the 10 year is now 4.04%. If it takes out the March high of 4.08% and keeps going this could get interesting. The current yield takes us all the way back to 2007. Brave new world. What does it all mean for asset classes? I am not really sure. There are simply too many cross currents today to have a strong opinion about how it all plays out. My guess is we will see elevated volatility. The bond market has been on a 6 Flags roller coaster ride with yields spiking in early March, plummeting in April and once again spiking in June/July. Stocks? Straight up. Hymmmm…

-

@Munger_Disciple I do not spend a great deal of time looking far into the past. It is interesting/fun to do. What I really care about is the future. My guess is Fairfax should easily outperform Berkshire moving forward. And by a lot. There are a couple of reasons for this: 1.) Fairfax is way underpriced - probably 30% or more. Berkshire no where near as cheap. So Fairfax's starting point is much better. 2.) Fairfax earnings are spiking for all the reasons we have discussed on this board. This will drive the stock price higher. 3.) Active management is working right now. And Fairfax has been on a hot streak. The management team at Fairfax has been executing exceptionally well in recent years. That is not to suggest that there isn't a place for Berkshire in an investors portfolio. It is a well run, rock solid company. With a pretty good guy in charge.

-

@UK i will give you a portfolio update as of today. But please note, i am ok with concentrated positions. This strategy has worked well for me for +20 years but it is not for everyone. Please note, I might decide to change my position tomorrow and i will not provide an update. I have no desire to provide daily, weekly or monthly portfolio updates. Because it messes with my head too much (i start to feel responsible for everyone else). People need to do their own research. And come to their own conclusions. And not get overly influenced by what some anonymous blogger is posting. Having got that out of the way, Fairfax has been may largest position since late 2020. ‘The story’ at the company continues to improve every quarter. As a result, despite the incredible run-up, i think the stock is still dirt cheap. So i continue to hold a concentrated position. I consider 30% to be a minimum position for me today (given what i know today). Currently i am at a 45% weighting. And I move around quite a bit (around the edges). I am also 35% cash today. The remainder is split pretty evenly between 3 other buckets: oil, banks and Canadian high yielding dividend stocks. I move around i these holdings quite a bit. ————— If you look at most successful investors most of their outperformance was the result of only a couple of holdings that performed spectacularly well over 5 or 10 years. My view is these turbocharged opportunities only come along every couple of years (something you understand very well that is dirt cheap with catalysts). So when you find one you have to be patient and ride it for as long as possible. Because the next one might be years away. My fear right now with Fairfax isn’t holding too much… it is holding too little. My fear is lightening up (locking in big gains) and then having the stock take off higher on me. My biggest mistake investing is selling my big winners too early. Selling because they went up a lot. And then they kept going higher… My mistake was selling using price as my guide. So i am trying to be more patient in situations where the fundamentals continue to improve - like the situation with Fairfax today. ————— My average return over the past 20 years is 19% per year. Over that 20 year span i have had two down years (of -4% each year). So my strategy works for me. I also spend LOTS of time on investing… because i really enjoy it. People need to figure out their own strategy. Something that fits their knowledge, emotional make-up, situation, interest, time etc. There are no short cuts.

-

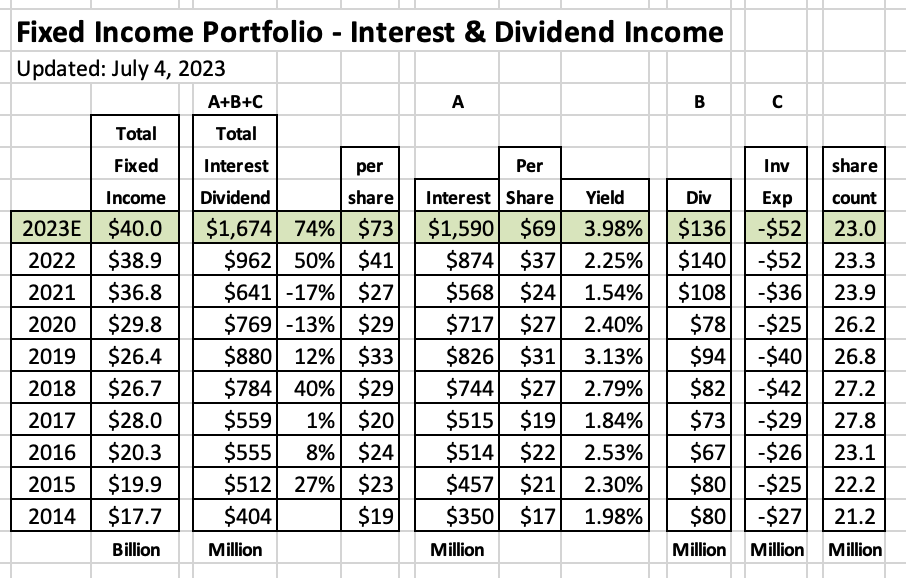

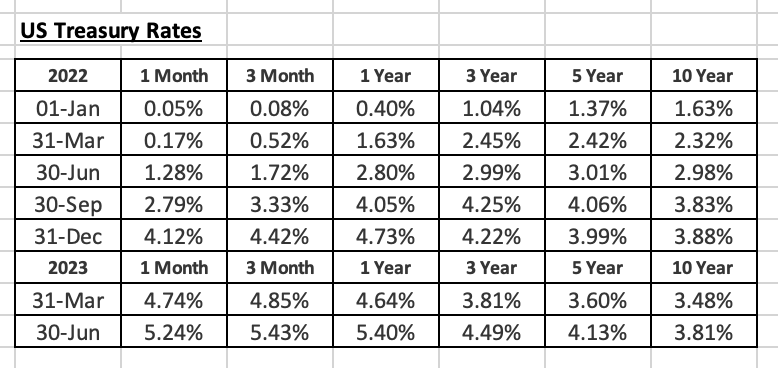

Of all of the many positive developments at Fairfax over the past 18 months, the spike in interest rates (and subsequent increase in interest income) is the most exciting for shareholders. That is because the interest and dividend bucket is now the biggest driver of earnings for Fairfax. Fairfax has done a masterful job over the past 2 years of navigating the extreme volatility we have seen in interest rates. In Q4 2021, Fairfax did two things: they moved their average duration to 1.2 years and shifted their fixed income portfolio to high quality government securities. In 2022, as interest rates spiked higher, they began extending duration - in Q4, 2022 the average duration had been increased to 1.6 years. The positioning in late 2021 protected Fairfax’s balance sheet when interest rates spiked in 2022 (saving them billions in unrealized losses). It also allowed them to quickly take advantage of much higher interest rates. As a result, Fairfax earned record interest and dividend income in 2022. And 2023 is going to blow 2022 out of the water. What did we learn when Fairfax reported Q1 results? The big news was they had pushed the average duration of their fixed income portfolio out to 2.5 years. This is a significant development. Because it means the record interest and dividend income will continue for 2023, 2024 and into 2025 - this earnings stream is now predictable and durable. Investors and analysts like this. What did we learn in Q2? We learned four very important things in Q2: 1.) Central banks are not done raising interest rates. This is because inflation (especially core readings) is still too high. And parts of the economy are starting to grow again (like housing) and employment remains tight. So, some central banks who had paused rate hikes in early 2023, like Canada and UK, have been forced to start hiking rates again. And despite the recent pause, Powell has telegraphed the Fed will be hiking the US rates at least one more time (and likely two) in the coming months. In addition to the US, Fairfax has significant fixed income holdings in Canada, the UK and Europe. The average duration of their fixed income portfolio is still quite low at 2.5 years (especially when compared to peers, who are closer to 4 years). A higher for longer interest rate regime means Fairfax will be able to roll their maturing bonds into higher yielding securities - which should deliver even higher interest income. 2.) Interest rates are rising again. It looked like treasury yields peaked out March 8 in the US. At the end of March yields had plummeted. Fast forward three months to the end of June and treasury yields have spiked higher, with durations of 3 years and less setting new highs. Fairfax is being given another opportunity to increase the average duration of their fixed income portfolio if they want to. Doing so would lock in meaningful interest income beyond 2025. This will be something to monitor when they report Q2 results. 3.) Higher interest rates are causing parts of the financial market to crack, with the meltdown in US regional banks in April the most recent example. Some regional banks have been forced to sell loans at a heavy discount to raise liquidity. In partnership with Fairfax, Kennedy Wilson purchased $2.3 billion (face value) in loans from PacWest Bank. Fairfax will earn 10% on its $2 billion investment, which will generate about $200 million annually in interest income (mostly) and investment gains. I think we can assume Fairfax is likely earning an incremental 5% on this investment (if we assume they were earning 5% on their old investment) so this should result in about $100 million in incremental interest income per year beginning in July (+$25 million per quarter). 4.) Dividend income is headed higher. Extending its close partnership with Kennedy Wilson, Fairfax also invested $200 million in preferred shares with a 6% dividend. This will deliver an incremental $12 million in dividend income to Fairfax each year. (As part of the deal, Fairfax also received warrants for 12.3 million shares of KW with a strike price of $16.21.) Fairfax has most of its fixed income portfolio in government bonds. One of the big advantages of this positioning in the current environment is it allows Fairfax to be very opportunistic to quickly take advantage of temporary market dislocations, like we have just seen with the KW/PacWest transaction. Smart. As central banks continue to increase interest rates it is possible the US could enter a recession later in 2023 or 2024. If this happens it is normal for credit spreads to dramatically widen. Fairfax has stated they are ready to shift a chunk of their fixed income portfolio from government into corporate bonds should yields on the latter pop higher. The cat is ready to pounce. Over the past 20 months we have been getting a master-class from Fairfax on the benefits of active management of a fixed income portfolio. What does all this mean for Fairfax? Record interest and dividend income is going even higher. The already good ‘fundamentals’ of Fairfax continue to get better. What do the actual numbers look like? Interest and Dividend Income: 2021 = $641 million ($27/share). 2022 = $962 million ($41/share) = 54% increase YOY. 2023E = $1.674 billion ($73/share) = 76% increase YOY. Fairfax’s share price is $753. The company is trading today for 10 x 2023E interest and dividend income. Compare that to any other insurer… that is NUTS. Especially given the durability of this earnings stream and the quality of the bond portfolio. ————— Interest & dividend income = interest income + dividend income - investment expenses. Interest income: Fairfax has a fixed income portfolio of about $40 billion. Interest income will come in around $1.59 billion in 2023 = yield of 3.98%. This is up from 2.25% in 2022 and 1.54% in 2021. Dividend income: Fairfax currently earns about $135 to $140 million per year in dividends from its equity holdings. Investment expenses: Fairfax incurred investment expenses of $52 million in 2022, up from $36 million in 2021. My estimate for 2023 is $52 million. FYI, Fairfax did not break out interest, dividends and investment expenses when they reported Q1 earnings (they just reported the total number). So some guesswork as to the split will be needed moving forward. Check out the unbelievable move in Treasury yields over the past 18 months from Jan 1, 2022 to June 30, 2023.

-

I don’t understand all the hate for strategies people don’t use. At the end of the day there is no ‘right’ strategy. It comes down to fit. Find a strategy that works for you. Yes, it would be stupid to use a strategy that you did not understand or believe in. The fact other people use a strategy you do not use does not make them stupid. And of course, calling them stupid for doing so is… well, obviously thats just plain dumb (putting it politely). i love all the different ways people chose to invest. I hope they all get filthy rich in the process - or achieve whatever their investment/life goals are. Best of luck to all…

-

Fairfax's equity holdings (that I track) finished Q2 up $766 million or about $33/share. mark to market = +$275 million associates = +$364 million consolidated = +$127 million This does not include the $260 million pre-tax gain from the sale of Ambridge which closed in Q2. Including Ambridge, that puts it over $1 billion in gains for the quarter from equities and realized gains. I do not track lots of Fairfax's holdings so the gain in equities is likely a little higher. The rub, of course, will be the bond portfolio. Interest rates spiked in Q2. And we have IFRS 17. So my guess is these two items will result in a sizeable unrealized loss. How much? Not sure; I need to give it more thought. Do others have an estimate? Bottom line, I love that interest rates are motoring higher. Fairfax still has a very short 2.5 year average duration with their fixed income portfolio. I wonder if they are using the current spike in bond yields to move the average duration even further out. ---------- Back to the equity holdings. Below were the biggest movers in Q2: Eurobank +$378 million FFH TRS +$165 million Thomas Cook India +$84 million Stelco -$78 million ---------- I have attached my Excel spreadsheet if board members want a closer look. Fairfax Equity Holdings June 30 2023.xlsx

-

@petec I agree with point 1.). There was more to the purchase than just Sokol and the Washington Family. I am not sure about point 2.). Interest expense doubled year over year in Q1 from $40 to $80 million. Much higher borrowing costs are eating into earnings. My guess is this gets worse before it gets better. Not sure. But a watchout.