Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

The beginning of my deep dive into Fairfax and India is linked above. The remaining pieces are contained below. 4.) A short history of Fairfax’s non-insurance investments in India Fairfax’s first large non-insurance investment in India was Thomas Cook India in 2012. Modi’s election in 2014 led to Fairfax’s next big move - the creation of Fairfax India in 2015. As a result, we are going to split this short history into two buckets: Thomas Cook India and Fairfax India. Thomas Cook India In 2012 Fairfax purchased 87.1% of Thomas Cook India (TCI) for $172.7 million. This was Fairfax’s largest single purchase in India and the start of much more to come. At that time, Thomas Cook was designated the vehicle for Fairfax’s future non-insurance investments in India. In early 2013, TCI purchased 74% of IKYA - renamed Quess - (Founder CEO - Ajit Isaac) for $47 million. In 2014, TCI purchased Sterling Resorts for $140 million. In 2015, TCI purchased Kuoni India for $32.5 million and Kuoni Hong Kong for $47.9 million. In 2017, Thomas Cook India sold 5.4% of Quess for $97 million. Thomas Cook India completed its spin-off of Quess (which became a stand alone company) in December of 2019. Fairfax’s direct ownership in Quess was 32% (at Dec 2019: cost = $33 million; market value $332 million; carrying value = $704 million). ---------- Prime Minister Narendra Modi’s election in 2014 caused an important change in Fairfax’s strategy with its investments in India. Given Modi’s election (and expected ‘business friendly policies’), Fairfax decided to accelerate the pace of its investing in India. However, Thomas Cook India’s resources were a constraint on growth. What to do? Fairfax made a significant pivot and decided to launch Fairfax India. From Prem’s Letter 2014AR: “Mr. Modi’s election led us to rethink the investment opportunities in India and our ability to fund them. While we have $26 billion in investments at Fairfax, regulatory constraints limit our ability to invest significant amounts in India. Given our excellent long term track record investing in India, our very significant on the ground resources with Harsha Raghavan at Fairbridge, Madhavan Menon at Thomas Cook India, Ajit Isaac at Quess (the new name for IKYA), Ramesh Ramanathan at Sterling Resorts and also S. Gopalakrishnan, the long serving head of investments at ICICI Lombard, we felt it was appropriate to create a new public company, Fairfax India, to invest in India.” Fairfax India In 2015, the Fairfax India IPO raised $1.1 billion, $300 million from Fairfax (28% equity ownership and 95% of voting control at inception). In 2017 Fairfax India raised an additional $500 million; Fairfax participated and owned 30.1% of equity interest and 93.6% of the voting rights. Today, Fairfax owns 41.9% of Fairfax India. Company Profile: “Fairfax India Holdings Corporation is an investment holding company publicly traded on the Toronto Stock Exchange whose investment objective is to achieve long-term capital appreciation, while preserving capital, by investing in public and private equity securities and debt instruments in India and Indian businesses or other businesses with customers, suppliers or business primarily conducted in, or dependent on, India.” Fairfax India overview - powerpoint presentation from AGM on April 20, 2023 https://s1.q4cdn.com/293822657/files/doc_presentations/2023/Fairfax-India-AGM-2023.pdf From Prem’s Letter in 2022AR: “Since Fairfax India began, it has completed investments in 12 companies and exited one (14 currently as one has been split into four listed entities), all sourced and reviewed by Fairbridge, Fairfax’s wholly-owned sub-advisor in India. Fairbridge does outstanding work under the excellent leadership of CEO Sumit Maheshwari, supported by its Director Anish Thurthi, Vice President Sheetal Sancheti and analysts Jinesh Rambhia, Ramin Irani and Chinar Mathur. Fairfax India’s Mauritius subsidiary, FIH Mauritius Investments, ably led by its CEO Amy Tan, supported by its Vice President Vishal Mungur and its independent Board of Directors, is an integral part of the investment process. Also, since Fairfax India began, Deepak Parekh, both as a trusted advisor and a member of the Board of Directors, has provided us with invaluable advice on almost all of its transactions.” “All of Fairfax India’s investments are in outstanding companies with a history of strong financial performance, led by founders and management who are not only excellent but also adhere to the highest ethical standards.“ Bangalore International Airport Limited (BIAL) Fairfax’s India’s largest and most important investment is Bangalore International Airport Limited (BIAL). At Dec 31, 2022 Fairfax had invested a total $653 million in BIAL which at that date had a fair value of $1.2 billion. Fairfax India just announced an additional purchase of 3% of BIAL from Siemens for $75 million and agreed to acquire an additional 7% later in 2023 (taking their ownership to 64%) for $175 million. This would take Fairfax India’s ownership in BIAL to 64%. “As I have said many times in past annual reports, the crown jewel (and largest) of Fairfax India’s investments is the Bangalore International Airport, run by Hari Marar. In 2022, Hari and his team did the impossible – they built the most beautiful airport in the world (Terminal 2 or T2) in a record four years, of which two were interrupted by COVID! In my mind, there is no airport in the world like T2 and it will be an inspiration for travellers arriving in Bangalore, the state of Karnataka and India. It will show the world anything is possible in India.” Fairfax India’s performance: Fairfax India’s Anchorage IPO: From Fairfax India’s 2022AR: “In June 2019, Fairfax India created a 100% owned subsidiary in India named Anchorage Infrastructure Investments Holdings (Anchorage). It is intended that this company will be Fairfax India’s flagship investment vehicle for airports and other infrastructure investments in India and that all the shares it owns in Bangalore International Airport (BIAL) will eventually be transferred to Anchorage.” “In September 2021, Fairfax India, as previously agreed, transferred 43.6% out of the 54% that it owns in BIAL to Anchorage and OMERS (the pension plan for municipal employees in the Province of Ontario, Canada) invested $129.2 million to acquire from Fairfax India an 11.5% interest on a fully diluted basis in Anchorage. This resulted in OMERS indirectly owning approximately 5% of BIAL. At that time, this transaction valued 100% of BIAL at $2.6 billion.“ “Fairfax India intends to complete an IPO of Anchorage, although we did not move forward on this in 2022 as we are awaiting regulatory approvals. Once Anchorage is listed, the proportion of the publicly listed investments in Fairfax India will increase from the current 39.2% to 79.8% of the overall portfolio.” Summary Over the past 11 years, Fairfax has dramatically increased the number and size of its equity investments in India. It holds some of these investments directly. More recent investments are held primarily though Fairfax India, of which BIAL is the largest single holding. Anchorage is poised to be a growth vehicle for Fairfax India in the coming years. ---------- List with press releases of most of Fairfax’s and Fairfax India’s transactions in India: https://fairbridgecapital.com/history.html ---------- 5.) People The CEO of Fairfax, Prem Watsa, was born and raised in India. Since at least 1995, Fairfax has had important resources allocated to India. In 2011, this commitment increased considerably with the creation of Fairbridge Capital which provides Fairfax with significant ‘boots on the ground’ resources in India. Chandran Ratnaswami Chandran is one of the true heroes of this story. He was hired by Fairfax in 1995. Currently a Senior Managing Director at Hamblin Watsa (responsible for East Asia), he is also CEO of Fairfax India. His fingers are all over Fairfax’s investments in India for the past 28 years. Here is what Prem had to say in Fairfax’s 2017AR: “In 1995, Chandran Ratnaswami joined us to build our international insurance and common stock investments, particularly in India. I said then, ‘‘this may be an acorn for a future oak tree.’’ Well what an oak tree Chandran has developed! We, with ICICI Bank, created the largest non-government-owned property and casualty insurance company in India from scratch, managed an Indian investment portfolio with outstanding results for over 20 years, created Fairbridge with Harsha Raghavan as Managing Director, acquired a 77% interest in Thomas Cook India which then acquired Quess and Sterling Resorts, and finally created Fairfax India which now has a market value of $2.5 billion. Chandran was intimately involved with all of these activities and serves on most of the Boards of our Indian companies.” Fairbridge Capital: https://fairbridgecapital.com Established in 2011, Fairbridge is a subsidiary of Hamblin Watsa that researches and advises on Fairfax’s and Fairfax India’s investments in India. From the Fairbridge Capital web site: “Fairbridge takes a long-term value approach towards acquisitions and investments in the Indian region. We focus on long-term capital appreciation through a flexible and value-oriented approach, underpinned by our guiding principles, including integrity, transparency and responsiveness in all our dealings. Our permanent capital base enables us to execute unique set of transactions; by taking a very long-term view, combined with the ability to execute highly flexible and creative deal structures.” Fairfax also leverages the knowledge and expertise of the various founder/CEO’s of the companies it controls in India, like Thomas Cook (Madhaven Menon), Quess (Ajit Isaac) and others. ---------- Fairfax has been building out its ‘people’ capabilities in India for decades. Most importantly, it has a dedicated team, Fairbridge Capital, with deep local knowledge that is able to act as opportunities present themselves. ---------- 6.) Summary Fairfax’s investing strategy in India: Insurance: all insurance investments will be held at Fairfax. Legacy non-insurance investments, Thomas Cook and Quess, will remain at Fairfax. Most new non-insurance investments will be held at Fairfax India. What have we learned about Fairfax and India? deep understanding of the country government deregulation is a significant driver of opportunity partner with strong founder/owners decentralized ownership structure supportive / very good partner long term focus strategic adaptive opportunistic entrepreneurial diversified From the very beginning, Fairfax has excelled with both its insurance and non-insurance investments in India. This success is due primarily to the people talent Fairfax has amassed at Hamblin Watsa and Fairbridge Capital. It is like Fairfax has been quietly building out its capabilities in India… preparing and waiting for the right moment… and it appears that right moment may have arrived. If India is the top performing global economy over the next decade, Fairfax certainly looks very well positioned to capitalize on that growth. Zig Ziglar quote: “Success occurs when opportunity meets preparation”

-

After the US and Canada, India is Fairfax’s most important geography. In a world starved for growth, India is expected to be one of the fastest growing economies over the next decade. Morgan Stanley is projecting an economic boom in India (see below). Fairfax has repeatedly said they believe India is best country to invest in today. So, we should expect India to increase in importance for Fairfax investors in the coming years. I thought it would be interesting to do a bit of a deep dive on India and Fairfax. Over the next few days I am planning to post on a number of topics: 1.) India: the big picture I will then zoom into Fairfax and India 2.) Summary of current investments in India 3.) History: Insurance investments 4.) History: Non-insurance investments 5.) People 6.) Summary ----------- 1.) India: the big picture India is exceptionally well positioned today: demographic tailwind: India has the largest population in the world, and it is very young with a median age of 28.2 years (China’s is 39). This should drive higher domestic consumption. regulatory tailwind: India has a pro-business government - ease of doing business in India is improving greatly. This should drive investment spending. geopolitical tailwind: companies are aggressively looking to diversify supply chains away from China - Apple’s plans to shift 25% of iPhone production to India being just one example Many important building blocks are in place. This should result in very strong economic growth for India over the next decade. India looks positioned to finally realize its vast potential - it is no longer just a dream. ------------ Morgan Stanley: “India’s Impending Economic Boom: India is on track to become the world’s third largest economy by 2027, surpassing Japan and Germany, and have the third largest stock market by 2030, thanks to global trends and key investments the country has made in technology and energy.” https://www.morganstanley.com/ideas/investment-opportunities-in-india The Future of India (this video was mentioned by Prem in his letter in the 2022AR) Deepak Bagla, Managing Director & CEO, Invest India https://www.youtube.com/watch?v=45PrXujlQCo ---------- 2.) Summary of Fairfax’s current investments in India Fairfax's business model has much more of an international focus than most of its P&C insurance peers. This is true for both insurance and non-insurance investments. India is Fairfax's most important international market. Fairfax does a good job of summarizing for shareholders all of their investments in India each year in the annual report. Below is the summary provided in the 2022AR. Key take-aways: Insurance investments (Digit) fair value = $2.3 billion Non-insurance investments fair value = $1.5 billion Fairfax has a total of about $15 billion in equity investments. At Dec 31, 2022, non-insurance investments in India of $1.5 billion represented about 10% of Fairfax’s total. ---------- 3.) A short history of Fairfax’s insurance investments in India Fairfax began its insurance journey in India in 2000. That was the year the government in India opened up the property and casualty insurance industry to foreign investment. Fairfax partnered with ICICI Bank, a large private bank in India, and created a joint venture called ICICI-Lombard. Fairfax invested $10 million for an interest of 26% in the new venture, the maximum allowed by Indian law at the time. ICICI-Lombard experienced rapid growth in the years that followed and by 2006, they had become the largest private general insurance company in India with a 12.5% market share. Over the years Fairfax made numerous capital infusions to support the growth of ICICI-Lombard and maintain their ownership at 26%. In 2015, the Indian government allowed foreign ownership in insurance companies to increase to 49%. That year Fairfax purchased an additional stake of 9% in ICICI-Lombard from ICICI Bank for $234 million; this increased Fairfax’s ownership in ICICI-Lombard to 35%. In 2017, ICICI Bank decided it was time to take ICICI-Lombard public. ICICI Bank wanted to maintain ownership of at least 55% (to maintain control). Indian law required the public to own at least 25% of an IPO. This meant Fairfax would need to reduce its position to a ‘mere’ 20%. Solution? Fairfax decided it was time to start their own P&C insurer in India. So, they partnered with Kamesh Goyal and brought start-up Digit into the Fairfax family. What a gutsy call this was at the time. Indian law does not permit ownership of 10% or greater in more than one insurance company so an agreement was struck with ICICI Bank for Fairfax to reduce their interest in ICICI-Lombard to below 10%. In 2017, Fairfax reduced their equity interest in ICICI-Lombard from 35% to 9.9% and booked an after-tax gain of $930 million. Fairfax sold their remaining position in ICICI-Lombard in 2019 for $729 million and booked another $311 million gain. My guess is Fairfax earned more than $1.15 billion after-tax from its 20-year investment in ICICI-Lombard. Impressive value creation for shareholders. Digit is now the property and casualty insurance engine for Fairfax in India. Growth has been rapid. In 2019, three private equity firms purchased 10% of Digit for $91 million; this valued the company at $858 million. In 2021, Digit raised another $200 million; this capital-raise valued the company at $3.5 billion. In 2021, Fairfax recorded a net unrealized gain of $1.4 billion on its investment in Digit compulsory convertible preferred shares (CCPS). Additionally, “The company anticipates recording additional gains of approximately $400 upon consolidating its investment in Digit, which is subject to regulatory approvals permitting the company to increase its 49.0% equity interest in Digit to a control position.” Fairfax is still waiting for final approval from Indian regulators (yes, this is understated… buy i am trying to keep this summary short). From Prem’s Letter in the 2022AR: “Digit, led by Kamesh Goyal, had another strong year: after only five years since its inception, premiums are over $900 million, up 50% over the last 12 months in local currency, and with the benefit of investment income it had another profitable year. Digit entered the Fortune India magazine’s ranking of India’s 500 largest companies by total revenue during the year at 398th on the list – we expect that will move up going forward! Digit is exploring an IPO in 2023 which would fund future growth.” At December 31, 2022, Digit had a cost of $154 million and a fair value of $2.28 billion = a compound annualized return of 79.5%. Fairfax looks exceptionally well positioned to grow in insurance in India with Digit. ---------- Next: 4.) A short history of Fairfax’s non-insurance investments in India

-

I don’t think you can compare Berkshire with pretty much any company out there today. It is a unique company. And it is also being managed in a strange sort of way - primarily wealth preservation. It is not the same company it was 20 or more years ago. The CEO is in his 90’s. I view Berkshire as a bond-like substitute. It will probably provide a return similar to the S&P500 over time. Fairfax is a completely different set up. The company was until very recently a hated stock. As a result it got wicked cheap. It is still crazy cheap. My guess is it will earn $150/share in 2023. With shares trading at $729, that is a PE under 5. Lets use $120/share as a normalized run rare for earnings the next few years… that puts the PE at… 6x. Really? That only makes sense if Fairfax has a shitty insurance business, poorly managed investments and sub-par management team. And that, of course, is completely wrong. The size of the insurance business has increased in size 4x in last 9 years, from $6 billion in 2014 to $24 billion in 2023E. Digit has been a home run. Fairfax are also good underwriters. Fairfax has done a stellar job managing their insurance businesses over the past 9 years. Fairfax’s fixed income portfolio is best in class right now. They just completed a historic pivot (in how they managed the duration). Duration is getting pushed out. And 80% of it is in government securities (very high credit quality). The TRS on FFH shares was a brilliant purchase and one that will earn Fairfax well over $1 billion. Eurobank is firing on all cylinders… it just released its Q1 report and is projecting to earn Euro 0.22/share in 2023 after earning 0.18/share in 2022. Fairfax is exceptionally well positioned in India. They also look very well positioned in energy/commodities. Fairfax’s equity portfolio has never looked better. The management team at Fairfax has been hitting the ball out of the park for years. They are a best in class group. . For the current positioning of the insurance business and investments, given the quality of the management team, and given the quality of earnings that are coming, Fairfax remains historically undervalued. The ‘narrative’ surrounding the company is simply wrong. It is slowly changing - as Fairfax continues to deliver outstanding results.

-

@keegomaster other than very top-line, I do not spend a lot of time thinking about what might happen in 4 years and further out. For any company… not just Fairfax. There are simply too many moving parts to be able to have a strong opinion about granular things looking that far into the future. Who predicted 4 years ago that interest rates would spike to 5% in the US? No one. Who predicted in 2015 that a hard market in insurance would start in 2019? No one. What you are really asking is: 1.) do you trust management? 2.) how good is management? And today i do trust management at Fairfax. And for the past couple of years their decision making and execution has been best in class in the P&C industry. (Time to state the obvious.) Looking out 4 years, i expect total earnings at Fairfax to continue to grow. There will be puts and takes. Perhaps underwriting profit flatlines or even declines (if we get a full-on soft market). That will be made up elsewhere. Fairfax will be investing billions in each of the next three years. Those new investments will create significant additional value for shareholders looking out to year 4. In short, the management team will do what they are supposed to do: allocate capital well and grow value for shareholders.

-

Fairfax Financial: 'The big fish that got away’ Investors have lots of regrets. Missed opportunities. 'The big fish that got away.' Like not buying Fairfax (or selling your position) at US$492 on Dec 31, 2021. On Friday, FFH shares closed at US$690. That is a 40% increase in 15.5 months. Fairfax also paid out two $10 dividends. How has the S&P500 performed since December 31, 2021? It is down 13%. Yikes! That makes Fairfax’s performance even better! But guess what? Fairfax is actually a better buy today (at US$690) than it was on Dec 31, 2021 (at $492). As we digest Q1 results, the big fish is back and once again taunting investors… How can this be? It’s not that complicated if you believe the following: a stock is worth the present value of the cash flows that are expected to be generated in the future. To prove our preposterous claim we need to answer three questions (we are going to keep things very top line… to make it as easy as possible to follow): 1.) what did investors expect future operating cash flows to be for Fairfax at Dec 31, 2021 when shares closed at $492? 2.) what actually happened with the business over the past 15.5 months? 3.) what do investors expect future operating cash flows to be for Fairfax at May 13, 2023 when shares closed at $690? ----------- 1.) what did investors expect future operating cash flows to be for Fairfax at Dec 31, 2021 when shares closed at $492? Fairfax earned $1.8 billion in operating income in 2021 (see table below) or $77/share pre-tax. investors expected this to increase to perhaps to $2 billion in 2022, with modest growth thereafter. that was the level of operating earnings that were built into Fairfax’s stock price of $490 at December 31, 2021. 2.) what actually happened with the business over the past 15.5 months? For this part, we are only going to look at three asset sales by Fairfax: in June 2022, Fairfax sold its pet insurance business for $992 million after-tax = $40/share in July 2022, Fairfax sold Resolute Forest Products at the top of the lumber cycle for $625 million plus $180 million CVR. Dec 31, 2021, Resolute had a carrying value of $276 million. With the sale, Fairfax crystallized $350 a million gain (plus $180 CVR). Let’s say this was a $10 after-tax gain (let's be conservative). in January 2023, Fairfax sold Ambridge Partners for $400 million plus $100 million performance incentive. Pre-tax gain will be $255 million (plus present value of performance incentive). The deal closed in May. Let’s say this is another $10/share after-tax gain. These three transaction delivered an unexpected $60/share after-tax gain for Fairfax shareholders. This $60 was a one time gift for shareholders. Totally unexpected. Like finding a pile of gold in your back yard. 3.) what do investors expect future operating cash flows to be for Fairfax at May 13, 2023 when shares closed at $690? Fairfax earned $3.1 billion, or $132/share pre-tax, in operating income in 2022. This was much more than expected at the start of the year. Fairfax is poised to earn $3.8 billion in operating income in 2023, or $167/share pre-tax. Nobody thought this was remotely possible Dec 31, 2021. This is more than double what Fairfax earned in 2021, or an increase of $90/share pre-tax. Think about that. Double. And Fairfax is poised to earn $3.8 billion in operating income in 2024 and 2025. What happened? underwriting profit beat expectations: hard market is lasting longer than expected. In 2022, Fairfax grew net premiums written by 25% and delivered a better than expected CR of 94.7. interest and dividend income: interest rates spike much higher than expected. And Fairfax just locked in higher rates moving from 1.2 year average duration Dec 31, 2021 to 2.5 years at March 31, 2023. share of profit of associates: earnings from Fairfax’s collection of associate holdings increased much more than expected. This is expected to grow further in the coming years. all three 'buckets' are delivering much more earnings than expected - new records every year. Especially interest and dividends and share of profit of associates. Most importantly, 2023 operating earnings of $3.8 billion are expected to be the new baseline for Fairfax moving forward. 2024 and 2025 operating earnings should be able to grow from 2023 levels. In short, $3.8 billion in operating earnings will be D-U-R-A-B-L-E. This is the critical point that I think many investors are missing today. So Fairfax’s stock price went up $200 over the past 15.5 months. Three unexpected asset sales delivered $60 after-tax to shareholders. That leaves us with $140. How much is an increase in operating earnings of $1.9 billion ($90/share pre-tax = $70/after-tax) worth to shareholders? Is it worth $140/share? It is worth much, much more than that. Because it is durable. What is the better buy? A.) Fairfax at $490/share at Dec 31, 2021 - knowing what was known then. B.) Fairfax at $690/share at May 13, 2023 - knowing what we know now. My choice is B. And it’s not even close. Just like December 31, 2021, that big fish (called Fairfax) is once again staring investors right in the face. And guess what? It’s probably going to slip away from most investors for a second time. And in another couple of years they will think back to today and kick themselves. And the story of ‘the big fish that got away’ will get even bigger.

-

Fairfax full-year 2023 earnings update What did we learn from Fairfax's Q1 earnings? The story continues to get better. As a result, I am bumping up my 2023 full-year earnings estimate to US$150/share (from $130/share made back in Feb). 2023YE BV = US$904 = $764 + $150 - $10 Stock price May 12, 2023 = $690 Fairfax trades today at a PE of 4.6 and P/BV = 0.76 (2023YE) IFRS-17: it will take me a while to better understand how IFRS-17 will impact Fairfax’s results moving forward. If i have messed up with my numbers below please let me know. Assumptions: underwriting profit = $1.2 billion top line grows at 8-10% and CR = 95 assumptions: an average year for catastrophes; small tailwind from hard market; reserve releases similar to 2022. interest and dividends = $1.5 billion average duration was increased in Q1 from 1.6 to to 2.5 years. This locks in $1.5 billion for 2023, 2024 and 2025. Share of profit of associates = $1.1 billion Q1 was a positive surprise at $334 million Eurobank was the standout in Q1, coming in at $94 million. IFRS-17: Effects of discounting and risk adjustment Q1 was $310 million I will update this number each quarter as we get results. Life Insurance and Run-off = similar to 2022 Other (non-insurance consolidated companies) = $75 million This was a disappointment in Q1, coming in at - $68 million. Interest expense = $500 million Q1 was $124 million Corporate overhead and other = similar to 2022 Net gains on investments = $1.1 billion $771 million in Q1 (stocks = $410; bonds $319 million) Other gains = $555 million Ambridge sale = $255 million gain (May) GIG gain = $300 million (2H) Income tax = guess (19%?) Non-controlling interests = guess (11%?) Effective share outstanding March 31, 2023 = 23.23 million purchased in Q1 a total of 156,685 shares for $100 million (US$638/share) Notes: Underwriting profit: includes insurance and reinsurance; does not include runoff or Eurolife life insurance. Interest and dividends: includes insurance, reinsurance and runoff.

-

Below are the answers to the questions i posed before Q1 results were released. Great start to the year. Insurance: 1.) what is top line growth? Over or under 10%? Answer: 6% growth is slowing; but still solid. 2.) what is the CR? Over or under 95? Answer: 94 like other insurers, sightly elevated cat losses in Q1. 3.) update on hard market. What is outlook for 2023? positive outlook overall. Fixed income portfolio: 4.) what kind of increase do we see in interest income? $382 million Run rate for interest and dividend income looks to have levelled off at $1.5 billion. 5.) did average duration of bond portfolio get pushed out closer to 2 years? Yes. Got to 2.5 years. $1.5 billion in interest and dividend income is likely for 2023, 2024 and 2025. 6.) given fall in interest rates in March, do we see mark to market gains in fixed income? Yes. $319 million gain. Equity Portfolio: 7.) what is amount of mark to market gain? $410 million My estimate was around $300 million. 8.) Resolute closed in Q1. Proceeds were $625 million. Likely used to purchase longer dated treasuries. Other: 9.) share of profits of associates? $334 million. surprisingly high. Lead by Eurobank at $94 million. tracking at more than $1.1 billion for 2023, which would be a record. 10.) Book value? $803 (including IFRS-17) Dec 31 BV (old) = $658/share Dec 31 BV (IFRS-17) = $764/share (+$106 vs old) March 31 BV (new) = $764 + $49 (earnings) - $10 (dividend) = $803/share 11.) share buybacks during quarter? Yes. At March 31, 2023, effective common shares outstanding = 23.2 million. At Dec 31, 2022, effective common shares outstanding = 23.3 million. 12.) what is net debt? No material change from Dec 31, 2022. 13.) capital allocation priority moving forward? strong financial position support growth of insurance subs share buybacks Updates/Commentary: 14.) Ambridge Partners: sale close in May. Gain = $255 million. 15.) GIG purchase of Kipco’s 46% stake: should close in 2H; will result in $300 million gain. 16.) Digit IPO: timing update? Working on getting regulatory approvals. IPO will happen when market conditions are supportive. ————— Is Fairfax on glide path to earn $2.4 billion from underwriting income + interest and dividend income in 2023? Yes. New estimate = $2.6 billion. —————

-

I just added to my overweight position in Fairfax. I am updating my earnings estimate for 2023 and i think it will come in around US$140-$150/share. Stock is trading at $692. BV is $803. PE is under 5 x 2023E earnings. P/BV is 0.86 ROE = 17.4% With the average duration of the bond portfolio getting pushed to 2.5 years we now know interest and dividend income will be $1.5 billion in 2023, 2024 and now 2025. Importantly, it is also perfectly positioned for a US recession, with 80% in government bonds and a small 14% in corporate bonds that are short term. When credit spreads blow out Fairfax is ready to shift into higher yielding longer duration corporates bonds. Smart buggers. Share of profit of associates was over $300 million. This puts it on a run rate of better than $1.1 billion in 2023. My guess is we should see $1.2 billion in 2024 and $1.3 billion in 2025. Eurobank is on fire. Wait until Atlas gets going. Insurance continues to grow nicely. The hard market in property cat is picking up steam. The top line growth is slowing and my guess is this is because Fairfax is prioritizing profitability - something we all want to see. This should keep their CR in the mid 90’s moving forward. This will lock in underwriting profit of more than $1 billion per year moving forward. And insurance results (top and bottom line) will get a nice boost when the GIG transaction closes and their results get added to the international bucket. Ambridge gains of $255 million are coming in Q2. GIG gain of $300 million is coming in 2H. In terms of capital allocation, it was nice to see Fairfax buying stock in Q1 ($100 million). They also paid out $250 million in the quarter for the $10 dividend. I would expect Fairfax to keep buying back stock in Q2 - spending perhaps $150-$200 million. Growing earnings and lower share count is a great one-two punch for investors. I think we will also get - slowly and over time - multiple expansion as more investors come to understand the new Fairfax. And then we will have the trifecta: growing earnings + lower share count + higher multiple. When i weave it all together, the Fairfax story continues to get markedly better. My usual approach would be to lock in big gains. Instead, i decided to channel my Peter Lynch and buy more. I decided to water my flowers (not pull them). Over the past 5 years Fairfax has morphed right in front of our eyes from an ugly caterpillar and transformed itself into a beautiful butterfly. Time is the friend of the wonderful business. And yes, after a lost decade, i think we can today call Fairfax ‘a wonderful business’.

-

i think they simply want to keep buying longer dated treasuries in Q2 and Q3 as bonds mature - and still be able to get Q1 yields: “where the contracts held will provide an investment opportunity to buy U.S. treasury bonds as other fixed income investments mature.” Very smart. Creative. Opportunistic.

-

Where to start... There is so much to digest from Fairfax's Q1 earnings release. But of course there is one thing that dwarfs everything else - and that is what they did with the fixed income portfolio. What Fairfax has done with their fixed income portfolio over the last 18 months will go down as one of their best investment decisions ever (well, string of decisions). in Q4 of 2021, as interest rates approached zero, Fairfax shortened their fixed income portfolio to an average duration of 1.2 years. They nailed the move to shorter duration. Most P&C insurers were around 4 years. in 2022, interest rates spiked. During 2022 Fairfax extended the average duration of their fixed income portfolio to 1.6 years. and in Q1 of 2023, as interest rates topped out, we just learned the crazy bastards at Fairfax extended the average duration to 2.5 years. That is nuts. They just nailed the move to longer duration. This now locks in $1.5 billion in interest and dividend income for 2023, 2024 and 2025 - just what Prem said at the AGM. He telegraphed this move. This gives Fairfax earnings much greater predictability for years into the future. Ratings agencies will love this. Analysts love this. This is a big input into the multiple that the shares should trade at. So we now know what Fairfax was spending most of their money on in Q1: extending the duration of their fixed income portfolio. How did they do this? In Q1, Fairfax sold $5.3 billion of bonds due in 1 year or less and after 1 year through 3 years. They booked a loss on these sale of $332 million. Think about that. And then they proceeded to buy $7 billion of longer dated treasuries (mostly 3 to 5 years, but also 5 to 10 years). Fairfax saw a fat pitch... and knocked the ball out of the park. And how does Fairfax's balance sheet look? at Dec 31, 2022 Fairfax was sitting on a $967 million loss on their bond portfolio (see below). at March 31, 2023, three short months later, Fairfax is now sitting on a $210 million loss. And given the move in interest rates so far in Q2, Fairfax is likely sitting on gains in its bond portfolio today. As the US heads into a likely recession, what about credit quality? - "Our fixed income portfolio is conservatively positioned with effectively 80% of our fixed income portfolio in government bonds and only 14% in primarily short-dated corporate bonds." Freaking brilliant! When looking at fixed income portfolios, Fairfax is best in class among P&C insurers (and it's not even close). Well done to the fixed income team at Fairfax. ---------- One more thing... what are 'US treasury bond forward contracts'? Fairfax entered into notional amount of $2.985 billion of these... cha ching! "U.S. treasury bond forward contracts: During the first quarter of 2023 the company entered into forward contracts to buy U.S. treasury bonds with a notional amount at March 31, 2023 of $2,984.7 (December 31, 2022 - nil) where the contracts held will provide an investment opportunity to buy U.S. treasury bonds as other fixed income investments mature. These contracts to buy U.S. treasury bonds have an average term to maturity of less than six months and may be renewed at market rates." ---------- Investors can speculate on future prices and use a fixed income forward contract to lock in the price today for a profit. For example, an investor may believe that interest rates will drop... which will cause the bond to increase in value. Therefore, they enter a fixed income forward contract to buy the bond in the future and lock in the delivery price today. If the speculation proves right, the investor could buy the bond in the future for cheaper than its market value. https://corporatefinanceinstitute.com/resources/fixed-income/fixed-income-forward-contract/ ----------

-

The sale of Ambridge just closed. Proceeds are $400 million (with the opportunity to receive another $100 million subject to 2023 performance targets) and will result in a sizeable realized gain of $275 million for Fairfax. This gain will increase Q2 after tax earnings by +$10/share. - https://www.fairfax.ca/news/press-releases/press-release-details/2023/Amynta-Group-Completes-the-Acquisition-of-Ambridge-Group-from-Brit-a-subsidiary-of-Fairfax/default.aspx With the recent closing of both Resolute and Ambridge deals, Fairfax has received proceeds of about $1 billion. This is a significant amount of money. At the same time, Fairfax is also earning a record amount of operating earnings (around $675 million per quarter). It will be interesting to see what new investments Fairfax makes. The sale of Ambridge is yet another example of Fairfax being opportunistic. This time with the sale of an asset at a premium valuation. Well done. ---------- Brit purchased 50% of Ambridge in 2015 (shortly after Fairfax purchased Brit) for $29 million. Brit purchased the remaining 50% in 2019 for $46.6 million. In 2021, Brit combined their US operations with Ambridge. --------- Of interest, Fairfax purchased Brit for $1.657 million in 2015. Ambridge is being sold for $400 million (with the opportunity to receive another $100 million subject to 2023 performance targets). --------- FFH 2022 AR: Sale of Ambridge Group by Brit On January 7, 2023 Brit entered into an agreement to sell Ambridge Group, operations, to Amynta Group. The company will receive approximately $400 on closing, comprised principally of cash of $275.0 and a promissory note of approximately $125. An additional $100.0 may be receivable based on 2023 performance targets of Ambridge. Closing of the transaction is subject to customary closing conditions, including regulatory approvals, and is expected to occur in the next few months. On closing of the transaction, the company expects to deconsolidate assets and liabilities with carrying values at December 31, 2022 of approximately $284 and $160, and to record a pre-tax gain of approximately $275 (prior to ascribing any fair value to the additional receivable). From Brit 2021 YE Press Release: In 2021, we combined our US operations to create a single operation under the Ambridge brand. It now operates as a global MGA, managing over $600m of premium in the US and internationally. Our clients have the benefit of the well- recognised Ambridge MGA model giving them better access to products and enhanced service, and our underwriting teams are better able to capitalise on business opportunities. FFH 2019AR: On April 18, 2019 Brit acquired the 50.0% equity interest in Ambridge Partners LLC (‘‘Ambridge Partners’’) that it did not already own for $46.6, remeasured its existing equity interest to fair value for a gain of $10.4, and commenced consolidating Ambridge Partners. FFH 2016AR: In 2015 Brit purchased 50% of Ambridge Partners, one of the world’s leading managing general agencies of transactional insurance products. In 2016 Ambridge produced gross premiums written of $32 million for Brit at a combined ratio well below 100%. FFH 2015AR: In December, Brit made an investment in Ambridge Partners, one of the world’s leading managing general underwriters of transactional insurance products. These products insure losses as a result of breaches or inaccuracies in warranties and indemnities relating to M&A, restructuring activities, business financing and tax issues. Ambridge, which has been a partner of Brit for the last nine years, produces $128 million of premiums and is highly profitable. We welcome Jesseman Pryor (CEO), Jeffery Cowhey (President) and their team of 29 employees to Fairfax.

-

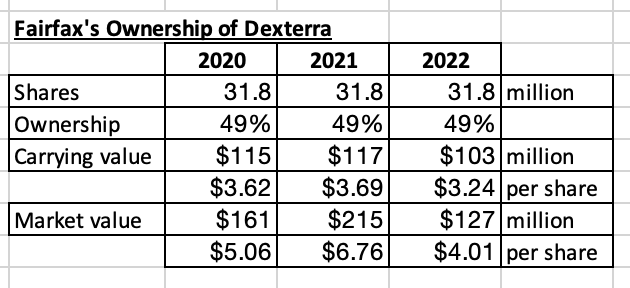

If I was Fairfax, what would be my next take-private equity purchase? Probably Dexterra. Yes, not a needle mover. But it would be a solid addition to their current collection of private companies. Why? Dexterra is dirt cheap (the stock), generates solid free cash flow and has solid growth prospects. And Fairfax has the cash. What is the Dexterra story? in 2018, Fairfax purchased Carillion Canada out of bankruptcy. The problem with Carillion was its UK parent went bankrupt. Fairfax paid about 5 times free cash flow for the Canadian operations. In 2020, Dexterra acquired Horizon North Logistics in a reverse takeover. Fairfax owned 49% of the combined company. This deal closed in May of 2020 (as covid was raging). At the time, Dexterra’s CEO, John MacCuish, set the audacious target for C$1 billion in revenue and C$100 million in EBITDA in the ‘next few years’. How is the company doing? After hitting a speed bump in 2022, Dexterra is on track to achieve both of their financial targets in 2024. As part of an updated 5-year vision just unveiled today at the AGM, a new C$2 billion revenue target has been set. The growth at Dexterra is being funded by internally generated cash and debt (which is reasonable). EBITDA conversion to free cash flow is expected to be 50%. What was the speed bump in 2022? Inflation knocked two business units on their ass: 1.) IMF: was not able to reprice contracts quick enough 2.) Modular Solutions: BC contracts did not have inflation clause (CEO of this division has since left) In Q1, 2023 we learned IMF profitability is getting back to targeted levels. In modular, the remainder of the unprofitable BC contracts will be run off in Q2 and Q3 (the financial hit was largely already booked in Q4, 2022). The turnaround in modular will likely be a late 2023 or 2024 story. Bottom line, 2023 is shaping up to be a decent year for the company. More acquisitions are coming. Growth should pick up again in 2024. Dividend yield is a solid 6.8% (with no risk of being cut). Chug, chug, chug. - https://dexterra.com/wp-content/uploads/2023/05/2023-AGM-Presentaion.pdf - https://dexterra.com/wp-content/uploads/2023/05/Analyst-Presentation-v6-Q1-2023.pdf ————— Dexterra (DXT.TO) Stock price = C$5.15 Market cap = C$335 million Dividend = C$0.0875/share = $0.35/year = 6.8% yield 2023 revenue est = C$1 billion 2023 EBITDA est = C$85 million 2023 free cash flow est = C$40 million ————— What are Dexterra’s businesses? It is a really diverse collection of businesses. 1.) Integrated Facilities Management (IFM) - growth engine 2.) Workforce Accommodations, Forestry, Energy Services (WAFES) 3.) Modular Solutions - https://dexterra.com/wp-content/uploads/2021/03/Dexterra_ServicingTheFuture_Brochure.pdf ————— ————— What would it cost Fairfax to buy the 51% of Dexterra they do not own? C$6.50/share? x 33.2 million shares = $222 million? If Dexterra shares continue to trade in the low C$5 range in 2023 I think Fairfax may swoop in and take the company private similar to what they did with Recipe in 2022. Like with Recipe, have Dexterra fund part of the cost with debt (which they can then quickly pay off). Opportunistic. Smart. ————— 2022AR: Dexterra is on track to achieve its vision of becoming a leader in delivering quality solutions to create, manage and operate infrastructure. John MacCuish is retiring after an outstanding performance for us, from rescuing Carillion from bankruptcy to the merger with Horizon North to form Dexterra. A big thank you to John for his leadership and dedication to Dexterra and best wishes to him and his family for a long and healthy retirement. The new CEO Mark Becker has been a senior leader in the organization for several years and is supported by three strong business unit Presidents. Dexterra closed two important integrated facilities management acquisitions early in the year and, coupled with organic growth, this strategic business unit almost doubled in size in 2022. The workforce accommodations segment also continued to build market share and deliver strong profitability while capitalizing on higher activity levels in Canada’s resource industries, although Dexterra’s modular business experienced short-term profitability challenges given high inflation and supply chain disruptions. Management expects to continue to build its modular platform and diversify its product mix, with strong demand for social and affordable housing across Canada. ————— 2021AR: Dexterra remains on track to achieve Cdn$1.0 billion in sales and Cdn$100 million in EBITDA in the near term. John MacCuish is leading the transformation to be a capital-light business. The workforce accommodations segment experienced strong growth and had strong profitability as resource industries in Canada rebounded in 2021. The strong underlying demand in affordable housing across Canada is also a priority for both the federal and provincial governments, and Dexterra’s modular solution business is in an excellent position to support this very important social issue. In January 2022, Dexterra also closed two facilities management acquisitions at attractive multiples with a combined purchase price of approximately Cdn$50 million. Dana Hospitality expands the company’s existing culinary services into education, entertainment, healthcare and leisure activities. Tricom Facility Services group, a business with a long history of providing janitorial and building maintenance services, builds the company’s strength in the hospitality, transit and entertainment verticals. These acquisitions have been financed by the company’s existing credit facility and the company’s balance sheet continues to be strong to support future growth. ————— 2020AR: The development of Dexterra’s business was dramatically reshaped by the reverse takeover in May 2020 of Horizon North. Dexterra, now a listed public company and led by John MacCuish, has a vision to build a Canadian support services champion. Its activities include a comprehensive range of facilities management, workforce accommodations, and forestry and modular build capabilities, including being a leader in social housing projects. Dexterra has publicly stated that it is on course in the next few years for Cdn$1 billion in revenue and Cdn$100 million in EBITDA. Acquisition of Horizon North Logistics On May 29, 2020 Horizon North Logistics Inc. (‘‘Horizon North’’) legally acquired 100% of Dexterra by issuing common shares to the company representing a 49.0% equity interest in Horizon North. The company obtained de facto voting control of Horizon North as its largest equity and voting shareholder and accounted for the transaction as a reverse acquisition of Horizon North by Dexterra. The assets, liabilities and results of operations of Horizon North were consolidated in the Non-insurance companies reporting segment. Horizon North, which was subsequently renamed Dexterra Group Inc. (‘‘Dexterra Group’’), is a Canadian publicly listed corporation that provides a range of industrial services and modular construction solutions. ————— 2019AR: Dexterra continues to provide industry-leading facilities management and operation solutions in Canada under the leadership of John MacCuish, its CEO. Bill McFarland is also Chair of Dexterra. The company continues to be the go-to service provider for some of the country’s largest airports, premier retail and commercial properties, corporate campuses, research and education facilities, large industrial sites, defence and public assets, camps and catering and state-of-the-art healthcare infrastructure. The company is also one of the country’s largest reforestation contractors and forest firefighters. ————— 2018AR: I am happy to report that we also made two significant private company investments in 2018/2019 – Dexterra and AGT. Dexterra, led by John MacCuish as CEO, is the new name for Carillion Canada which went into bankruptcy because of the bankruptcy of its parent in the U.K. Dexterra provides industry-leading facilities management and operation solutions across Canada, including maintenance solutions for over 50 million sq. ft. of high-quality infrastructure. This includes some of the country’s largest airports, premier retail and commercial properties, corporate campuses, research and education facilities, large industrial sites, defence and public assets and state-of-the-art healthcare infrastructure. The company is also one of the country’s largest reforestation contractors – planting over 40 million trees annually, it annually completes 4,400 hectares of forest thinning/brushing and 1,200 hectares of site preparation–it employs hundreds of firefighters, with an emphasis on Indigenous communities, and for the last 30 years it has been supplying and operating full-service remote workforce services. We were able to buy Dexterra at about 5x free cash flow. Acquisition of certain businesses of Carillion Canada Inc. On March 7, 2018 the company acquired the services business carried on in Canada by Carillion Canada Inc. and certain affiliates thereof relating to facilities management of airports, commercial and retail properties, defense facilities, select healthcare facilities and on behalf of oil, gas and mining clients. The acquired business was subsequently renamed Dexterra Integrated Facilities Management (‘‘Dexterra’’). Dexterra is an infrastructure services company that provides asset management and operations solutions to industries and governments. The assets and liabilities and results of operations of Dexterra were consolidated in the Other reporting segment. Purchases of subsidiaries, net of cash acquired of $163.1 in 2018 primarily related to the acquisitions of Dexterra (100%) and Toys ‘‘R’’ Us Canada (100%).

-

i always enjoy listening to Druckenmiller. Was he sounding a little gloomier than normal? An age thing? Interesting that he is neutral in terms of positioning: i.e. in a couple of years we could see 8% inflation OR deflation. Why such an extreme variation in outcomes? IT ALL DEPENDS ON WHAT THE FED DOES. Since 2010 all an investor has had to do to be successful is to follow the Fed. So what does the Fed do when inflation gets down to 3% and unemployment starts to increase? Do we get Burns or Volker? Of course, we don’t know that right now. Hence, Druckenmiller’s view we might get 8% inflation (Burns) or deflation (Volker).

-

@OliverSung Nice write-up. It is very difficult to write a comprehensive article on Fairfax given the many important pieces - and the significant changes over the past 5 and 10 years. I really enjoyed reading you article. Thanks for posting.

-

With the Fairfax Q1 report set to be released after markets close on Thursday here are a few of the things i will be watching. Insurance: 1.) what is top line growth? Over or under 10%? what increases is reinsurance seeing? Especially at Odyssey? 2.) what is the CR? Over or under 95? - some insurers are reporting elevated cat losses in Q1 compared to PY. 3.) update on hard market. What is outlook for 2023? Fixed income portfolio 4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income? - Run rate was $950 million end of Q2, $1.2 billion the end of Q3 and $1.5 billion the end of Q4. 5.) did average duration of bond portfolio get pushed out closer to 2 years? - 1.2 years at end of Q2 and 1.6 years at end of Q4. - this is a big deal. If Fairfax is able to push duration out to 2 (or more) years then investors will get more comfortable that $1.5 billion will be durable for years. That could be a game changer for Fairfax - that should lead to multiple expansion. 6.) given fall in interest rates in March, do we see mark to market gains in fixed income? - if duration was pushed out in Q1 then this could be a big number (given how much rates came down in March). Equity Portfolio 7.) what is amount of mark to market gain? 8.) Resolute closed in Q1. Proceeds were $625 million. Will be used for? Other 9.) share of profits of associates? 10.) Book value? 11.) share buybacks during quarter? 12.) what is net debt? 13.) capital allocation priority moving forward? Updates/Commentary: 14.) Ambridge Partners: $400 million sale. On track? 15.) GIG purchase of Kipco’s 46% stake: timing on close? 16.) Digit IPO: timing update? ————— I am estimating Fairfax will earn $122/share in 2023. After we see Q1 results, does this number need to change?

-

With Fairfax Q1 earnings coming on Thursday I thought it would be good as a primer to post an update to my last estimate (April 2). ---------- The big change that will happen in Q1 is the move to IFRS-17 accounting. Fairfax said that reported BV at Dec 31, 2022, will be increasing by $94/share. It will likely take a couple of quarters of results to better understand how IFRS-17 impacts Fairfax's reported results. ---------- My comments below are NOT including any changes resulting from the move to IFRS-17. My guess is Fairfax will earn about $37/share in Q1. That would put March 31 book value at US$685 = $658 + $37 - $10 div. Shares are trading today at $694 = 1 x BV. Fairfax will see about a $300 million gain in the market value of its associate common stock holdings (equity accounted) in Q1. This will put the market value of associate holdings at about $575 million over carrying value (about $25/share pre-tax). This is not captured in book value. The sale of Ambridge did not happen in Q1. When this sale closes, likely in Q2, Fairfax will book a $275 million pre-tax gain (about $10/share after tax). I am not expecting much in the way of share buybacks in Q1. The dividend is paid in Q1 and this is about a $250 million use of cash (common and preferred). Fairfax is now generating significant cash flow in underwriting profit and interest and dividend income each quarter (est $700 million in Q1). The sale of Resolute for $625 million also closed in Q1. The sale of Ambridge will bring in more ($275 million cash and $125 million promissory note). It will be interesting to see what Fairfax does with the all the cash moving forward. When I weave it all together: Fairfax looks poised to report a very good Q1. More importantly, 'the story' at Fairfax continues to get better. Shares continue to look cheap. My current estimate is Fairfax will earn about $122/share in 2023 = P/E of 5.7 ($694/$122). My 2023 year-end BV estimate is $770 = forward P/BV multiple = 0.90 Assumptions: 1. Underwriting profit = $330 million = flat to PY. My guess is net premiums earned will come in +10% to PY. CR will be a little higher than 2022 (when it was a stellar 93.1). 2. Interest and dividends = $350 million. Q4 2022 came in at $314 million. Fairfax said current run rate is $1.5 billion per year. 3. Share of profit of associates = $200 million. Slightly higher than PY. 4. Life ins & run-off = - $25 million. A little more than PY. 5. Other (revenue - expenses) = $50 million. Expect increase in ownership of Recipe to start to move the needle here in 2023. 6. Interest expense = $125 million. Same as Q4, 2022. 7. Corporate overhead = - $80 million. Same as PY. (no idea) 8. Net gains = $500 million. Equity gains = $375-$400 and bond gains = $100-$150 million. Mostly unrealized. 9. Income taxes = - $228 million. 19%? Guess. 10. Non-controlling interest = $110 million? Guess.

-

@Spekulatius I agree. I am not looking to invest in Kennedy Wilson the stock. Fairfax’s ownership of 10% of Kennedy Wilson is likely table stakes (as Jamie Dimon would say). It looks like Fairfax has been getting good value from the KW relationship. It is interesting looking at all the different relationships that Fairfax has been cultivating over the years. Stuff like Kipco in Kuwait. Relationship started in 2010. And culminated in sale of Kipco’s stake in GIG to Fairfax this year. Kennedy Wilson is another, this time focussed on global real estate. Lots also going on in Greece. And of course, even more in India. These relationships can take a decade to bear fruit. And Fairfax is extracting more value from these relationships with each passing year. It really is impressive the network across assets and geographies that they have built. Its almost like the senior team at Fairfax has been working on a portrait for years and we are just now able to start to make the picture out.

-

@Parsad yes, Buffett and Munger will not be around forever. And, yes, that is hard to take. However, the heir apparent is out there right now. In fact, there are likely a bunch on them out here. And that is what i love about investing: it is a process of constant change and constant learning. Life continues to get better. As Buffett says, living in ‘the West’ is a gift. You have won the birth lottery. “Who is the next Buffet”’. That should really be the title of your post. Not “I’m sad.” They are out there. And right now. A gift. We just need to find them When Buffett is no longer around he is not going to want us to be sad. Rather, he is going to want to reward the investing principals stood for. Ben Graham passed the torch to Warren Buffett and Peter Lynch. Investing legends. Who are the next torchbearers? That is what i want to know. PS: is is not likely Greg Abel (and that is not intended to be a slight on Greg Abel).

-

@glider3834 Great catch. What happens if Fairfax's insurance business (CR) moves a little closer to Markel and WR Berkley's in the coming years? Much higher re-insurance rates should help Allied and especially Odyssey. And those two are the big dogs at Fairfax. Cat exposure has been the big issue at Brit and Fairfax has said they are looking to reduce Brit's exposure to cat. Small iterative changes. I also wonder how much WRB's results the past few years have benefitted from super low reinsurance pricing (below cost). Now that reinsurance pricing is spiking... maybe WRB's results get a little more lumpy. If that happens the P/BV multiple on the stock will likely come down a little. Something to watch moving forward. I have listened to Tom Gaynor at Markel for years. Great stories. I keep hearing "ignore our results this year... we are focussed on the long term." It kind of reminds me of 'old Fairfax'. Here are Markel's 5 year results (see table below) - and I don't think Markel pays a dividend: 5 year CAGR in book value per common share of 6% 5 year CAGR in closing stock price per share of 3% As a reminder, we have been in a hard market for insurance since late 2019. And interest rates are the highest they have been in +15 years. As an insurance company, if you aren't hitting the ball out of the park right now when will you? ---------- Investing is like driving on the freeway. Sometimes you get boxed in on your lane and can't get out. Meanwhile, traffic two lanes over is motoring. It gets really frustrating as an investor when you get boxed in - it can last for years (cough - Fairfax - cough, cough). It looks to me like the lane has just opened up for Fairfax. They have no one in front of them for miles and they are putting the pedal to the metal and making up for lost time. At the same time, others are now stuck in traffic a few lanes over... Leadership sometimes changes. ---------- The table below is from Markel's 2022AR.

-

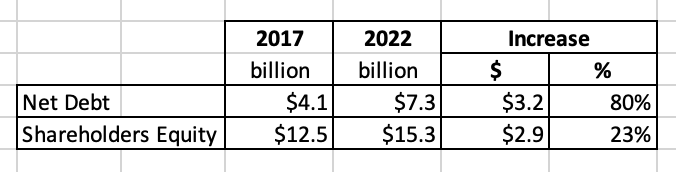

Comparing Fairfax, Markel and WR Berkley is interesting. Their market caps today are similar. But what about the size of their insurance businesses? And their investment portfolios? Yes, all three have different business models. However, all three are still insurance companies at their core. Let’s take a quick look at some of the key metrics and see what we can learn. Fairfax Financial, Markel and WR Berkley all have similar market caps today. Markel = $18.3 billion Fairfax = $16.0 billion WR Berkley = $15.6 billion This suggests investors expect future earnings (total $) to be roughly similar. Let’s start by looking at the insurance side of the businesses and net premiums written. Net premiums written (2022): Fairfax = $22.3 billion WR Berkley = $10 million Markel = $8.2 billion Fairfax’s net premiums written is larger than both Markel and WR Berkley combined. That is a big difference. What about underwriting profit? Underwriting profit (2022): WR Berkley = $960 million Fairfax = $950 million (when you net out losses from runoff) Markel = $610 million In terms of underwriting profit, WRB and Fairfax are earning similar amounts (total $) and Markel is earning quite a bit less. However, both WRB and Markel each have a much lower CR. Let’s now pivot and look at the investments side of the businesses. Investment portfolio (2022): Fairfax = $55.5 billion Markel = $27.4 billion WR Berkley = $22.9 billion Fairfax’s investment portfolio is larger than both Markel and WR Berkley combined. What about interest and dividend income? Interest and dividend income: 2022 2023E Fairfax = $960 million $1.5 billion WR Berkley = $780 million $940 million Markel = $450 million $620 million In 2023, Fairfax is going to earn about the same as WRB and Markel combined. That is significant outperformance. Yes, Markel has Markel Ventures. Fairfax also has significant equity holdings. ‘Share of profit of associates’ for Fairfax is expected to be about $900 million in 2023 and my guess is this is larger than what Markel Ventures will deliver in 2023. WRB is much smaller. What about realized investment gains? This bucket of earnings has always been a significant advantage for Fairfax over Markel and WRB and my guess is this will continue in the future. What are analysts expecting for net earnings in 2023? Fairfax = $2.5 billion WRB = $1.3 billion Markel = $1 billion Analysts expect Fairfax to earn more than WRB and Markel combined. What is the learning from all of this? Fairfax's market cap / earnings does not make any sense when compared to Markel and WR Berkley. Same market cap for 2 times the earnings? That only makes sense if you think earnings for Fairfax are inflated. Or not durable. This suggests to me that investors still do not appreciate what has happened with Fairfax's investment portfolio over the past couple of years: Share of profit of associates: delivering close to $1 billion per year moving forward Interest and dividend income delivering more than $1.5 billion in 2023, 2024 and 2025. As a result, Fairfax's stock continues to be very undervalued when compared to peers. Note: share count is basic (easier to find). The table above is meant to be directional (not precise) to allow very top line comparisons to be made for the three companies. —————— Notes: WRB and Markel have better quality insurance businesses (much lower CR) Fairfax’s fixed income portfolio is much larger and looks better positioned today. Fairfax’s net debt is likely higher (interest costs are included in net earnings estimate). Fairfax’s insurance business is much more international. WRB has been a very consistent performer over the years (by far, the most consistent of the three).

-