Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

The sell off in oil is a gift for investors that can handle the volatility. The fundamentals have not changed much. In fact the fundamentals are getting better as companies will be reigning in spending on increasing production. The sell off in oil is being driven primarily by sentiment. The sell off is great for oil companies. Yes, even at $68 oil they are still making buckets of money. Over the last 2 years they have completely deleveraged their balance sheets. Most oil companies are now returning 50-75% of free cash flow to investors. The problem with buybacks is they are usually done at high prices. Significant buybacks in the coming months (at very low prices) will be very accretive for shareholders. Today both SU and CNQ have dividend yields of 5.5%. Very good in a low interest rate world. Oil stocks (and the oil market) continue to be very mis-understood by investors.

-

Built out a portfolio of Canadian high dividend payers. 5% of my portfolio. Average dividend yield is 5.8%. With interest rates cratering, my guess is dividend paying stocks are positioned very well. Will build this out on stock market declines. - Communication: T.TO, BCE - Banks: RY, BNS, CM, CWB - Utilities: ENB, TRP - Life insurer: SLF

-

Added to SU. Starter positions CNQ, JPM, MS, WRB. - not much has changed with oil from a fundamental perspective. Sentiment stinks. Love one day 10% declines in stocks when it is being driven by sentiment.

-

BAC, WFC, C, SU All down more than 5%. It looks to me like the big banks will be the big winners. The business at all the small banks that are going under will need to squish somewhere.

-

What did Signature Bank in was its involvement with crypto. Banking is all about confidence. Crypto is blowing up everywhere. So lack of confidence in Signature (caused by its past involvement with crypto) put it out of business. Would any of this have happened if it never got involved with crypto? No. It would still be in business.

-

Good update on Canadian real estate. Lots of issues. A frozen market. No one wants to list right now (inventory is super low). Affordability is at historic highs. Investors buying today are cash flow negative. In short, bubble mentality largely continues.

-

The challenge might be knock on effects. The stuff that is likely out there but needs a match to set it off. Or its like a pressure cooker… pressure just keeps building until it blows. Can’t see it looking forward. Makes sense looking back. My guess is high interest rates have created lots of problems. We just don’t see it clearly yet. The next couple of weeks will be interesting. My guess is more weak links will be exposed. The short crowd are like a pool of piranha.

-

So stockholders get wiped out. Bondholders likely get wiped out. Both Silicon Valley and SignatureBank. The new news is uninsured depositors get bailed out. Does this mean deposit insurance in US just got extended to everybody and is now unlimited? Looking ahead, what is the next band-aid that gets ripped off for banks? Do the commercial real estate vultures start circling? How would that layer onto the current issues? What happens if we get a recession later this year? If banks balance sheets are messed up right now, what happens when a recession hits? And things actually get bad? interesting times…

-

“No losses will be borne by taxpayers.” Does this not make a sale more difficult? Messy unwinding over months can hardly be a good thing for regulators. 1.) Silicon Valley Bank. 2.) Signature Bank - i remember following years ago when Edi E had it on his buy list (it has been off for years). What a spectacular fall. Crypto… the gift that keeps on giving… 3.) next? ————— “We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.”

-

Fairfax India BV at Dec 31, 2022 =$19.11/share. Stock closed on Friday at $12.60. Is Fairfax India a good investment? Well it certainly looks cheap with a price to BV = 0.66. How cheap? This depends on what you think about book value. Does it fairly reflect the value of the companies owned by Fairfax India? The disclosure provided by Fairfax India on each of the companies it owns is very good. The largest asset owned by Fairfax India is BIAL (40% of BV?) …. Probably a good place to start. Another question that has been debated on this board for years is: What will cause the significant discount to BV to close? The following question might be a better starting point: Why does the discount exist today? It didn’t always exist. ————— If Fairfax India is as cheap as it looks (let’s assume it is worth $19.11/share), does the fee structure matter? Is it material to making a purchase decision today?

-

“Success is when opportunity meets planning.” Success in investing is also all about getting the big rocks right. We are learning in real time the genius of the management team of Fairfax. At least the last few years. Genius is a big word. But i think it applies in this case. What are the big rocks at Fairfax? 1.) insurance 2.) investments: fixed income 3.) investments: equities The positioning of Fairfax’s massive $38 billion fixed income portfolio on Dec 31, 2021 was absolute genius: significant sales as interest rates bottomed locking in large realized gains: “During 2021, we sold $5.2 billion in corporate bonds, mainly acquired in March/April of 2020, at a yield of approximately 1%, for a gain of $253 million.” duration of the portfolio was shortened and composition of portfolio was shifted to higher credit quality holdings, mostly treasuries: “At the end of 2021, our fixed income portfolio, inclusive of cash and short term treasuries, which effectively comprised 72% of our investment portfolio, had a very short duration of approximately 1.2 years and an average rating of AA-.” part of the fixed income portfolio was hedged: “To economically hedge its exposure to interest rate risk (primarily exposure to certain long dated U.S. corporate bonds and U.S. state and municipal bonds held in its fixed income portfolio), the company held forward contracts to sell long dated U.S. treasury bonds with a notional amount at December 31, 2021 of $1,691.3 (December 31, 2020 – $330.8). In 2021 Fairfax realized significant gains, improved the credit quality, reduced the duration and hedged their fixed income portfolio. They did all this right before hell was unleashed by the Fed. That… was… genius. What’s the big deal? With the Fed spiking interest rates higher in 2022, Fairfax has benefitted as follows: 1.) low duration (part 1): Fairfax has already been able to reinvest a large portion of its fixed income portfolio into securities with much higher yields and this is resulting in an immediate and significant increase in interest income: - 2019 = $826 million - 2020 = $717 - 2021 = $568 - 2022 = $874 - 2023E = $1.5 billion 2.) low duration (part 2): Fairfax has experienced only modest mark-to-market loss on its fixed income portfolio in 2022. This loss was absorbed by the business and Fairfax actually saw an increase in book value in 2022. Most P&C insurers saw book value fall 10-20% in 2022. And as we have just learned with Silicon Valley Bank, large unrealized losses sitting on your balance sheet usually don’t matter… but sometimes they do. 3.) credit quality: there is a good chance the US could enter recession later in 2023. Should this happen, credit spreads will likely blow out and holders of lower quality (corporate) bonds will see the value of their bonds fall leading to more unrealized losses. This in turn will lower the book value of some insurers even more. My guess is Fairfax is well positioned here compared to other insurers (given Prem has warned about this risk). Bottom line: Fairfax is exceptionally well positioned in the current rising/high interest rate and increasingly stressed economic environment. Especially compared to other P&C insurers. As Peter Lynch would say “the story” for Fairfax continues to get better. It could be argued that Fairfax today is actually a safer investment than most other P&C insurers. It also has one of the best earnings growth profiles looking out the next couple of years (probably THE best). Lower risk AND much better profit growth. So given how well it is positioned today, Fairfax must trade at a premium multiple compared to other P&C insurers. Right? No. Not even close. Fairfax currently trades under 1 x book value. Most of its P&C peers trade at 1.5 to 2 x book value. Fairfax’s stock significantly outperformed the market averages in 2021. And again in 2022. My guess is Fairfax’s stock is going to make it a three-peat in 2023. ————— Prem’s Letter 2021: Our interest and dividend income continued to drop from $880 million in 2019 to $769 million in 2020 to $641 million in 2021, reflecting declining interest rates and the fact that we have 50% of our investment portfolio in cash and short term investments. During 2021, we sold $5.2 billion in corporate bonds, mainly acquired in March/April of 2020, at a yield of approximately 1%, for a gain of $253 million. At the end of 2021, our fixed income portfolio, inclusive of cash and short term treasuries, which effectively comprised 72% of our investment portfolio, had a very short duration of approximately 1.2 years and an average rating of AA-. Rising rates in 2021 resulted in a small unrealized bond loss of $261 million. During the last two years, we were able to invest $1.6 billion in first mortgages with Kennedy Wilson at an average rate of 4.5%, with an average term of three years. ————- 2021AR: To economically hedge its exposure to interest rate risk (primarily exposure to certain long dated U.S. corporate bonds and U.S. state and municipal bonds held in its fixed income portfolio), the company held forward contracts to sell long dated U.S. treasury bonds with a notional amount at December 31, 2021 of $1,691.3 (December 31, 2020 – $330.8). These contracts have an average term to maturity of less than six months, and may be renewed at market rates. During 2021 the company recorded net gains of $25.7 (2020 – net losses of $102.0) on its U.S. treasury bond forward contracts.

-

i agree it makes little sense. (Most shareholders are perhaps Canadians and anchored to the stock price in Can$?) I view it as a historical quirk. Fairfax India is listed on the TSX but only trades in US$. Weird. But whatever. Small potatoes. As long as they keep delivering stellar results i don’t really care.

-

True. But look at all the commercial real estate that was bought in recent years at cap rates that are 1/2 of what it costs to borrow today (with loans coming due in the next year or two). Today in Canada probably 25% of all mortgages are now negative amortizing (the monthly payment no longer covers the interest costs… so the difference is being added to the mortgage balance). There are so many examples like this of excesses that continue… until they can’t.

-

So what did we learn today? The 15th largest bank in the US just blew up. WOW! Largest take down of a financial institution since 2008. Is this a big deal? Yes. How big? Well we just don’t know… yet. interest rates were close to zero 12 months ago. As of yesterday, rates were 5% and talk was they were going to 6%. Higher interest rates impact the economy 12-18 months later. The timing of SVB blowing up is not a fluke. When interest rates went from 5% to zero over the past 10 years, an absolute ton of money was made. Now that interest rates have gone from zero to 5%, an absolute ton of money has been lost. Except lots of these losses have not yet been realized. SVB blowing up is going shine the spotlight on other asset mis-matched / highly levered parts of the economy (with debt needing to be refinanced): commercial real estate looks like an obvious next shoe to fall. Who is exposed? Which REIT’s? Which banks? What about the unregulated shadow banks? SVB blowing up is likely going to cause a ripple effect through financial markets… where are the cockroaches? Capitalism can be a vicious thing… the knives are coming out. And the Fed is getting what it wants… a tightening of financial conditions. An end of free money excesses. It just better hope things don’t get out of control. —————- US treasury yields are cratering… the 2 year is down something like 50 basis points in 2 days. Stocks? All hunky dory.

-

SPAC lender (based in tech land - San Francisco). What a surprise! Lots more cockroaches out there. Anyone who has a large amount of debt either variable rate or coming due the next year or two is going to have their come to Jesus moment. Commercial real estate? REIT’s? Lots of companies are praying the Fed cuts rates and soon. Hope is not a good strategy. A decade of deals (and whole industries) were build on the assumption of free money. That ship has sailed. Perhaps we see credit spreads start to widen out…

-

Perhaps we are starting to see the effects of rapid Fed tightening just starting to play out. The initial cracks. Give it another 6 months; especially if interest rates go higher. Investors have been living a Disney movie for the past 13 years - the Fed ALWAYS had their back. As a result, all financial assets (housing, stocks, bonds) were a one way bet… much higher. Most investors think their stellar returns over the past decade were the result of skill. 2022 was a terrible year for most investors. 2023? Probably more of the same.

-

BAC and WFC. Down double digits since Monday and close to 15% over the past month.

-

It certainly will be interesting to see what Fairfax does with their fixed income portfolio in Q1. Mr Market is giving them a wonderful opportunity to increase both the yield and duration. And if the Fed funds rate goes closer to 6% in Q2, as some now project, that would be icing on the cake. The jobs report Friday and the inflation report on Tuesday will likely be key to the path for interest rates for the remainder of March. Here is how i see the bull case for Fairfax currently: 1.) rising interest rates: resulting in higher interest and dividend income. 2.) continuing hard market in insurance: driving increasing operating income 3.) spiking ‘high quality’ operating earnings (1 and 2 above): leading Mr Market to bump Fairfax’s market multiple a little higher - perhaps to 1.1 x BV

-

@Spooky i have been locking in pretty good YTD gains for a while now (my total portfolio is up about 12%). As i have said before, most of my investments are in tax free accounts (i only pay tax when i withdraw the money) so i can be very tactical. As of today, i am at 55% cash and that is earning a very respectable interest rate of 4%. Persistent inflation + Strong economy + Rising interest rates + hawkish Fed = volatile stock market. I wonder if financial markets are going to get one more tough love lesson from the ‘don’t fight the Fed’ instruction book. My guess is Mr Market is going to serve up a few more fat pitches later this year. I think patience + cash will be rewarded.

-

So what are we learning as we begin month 3 of 2023? Inflation is a bitch. Not transitory after all (we really mean it, this time). What does this mean for investors? Interest rates are going higher. Perhaps the Fed funds rate in the US will get to 6%. What does this mean for stocks? Apparently nothing. The economy can easily handle much higher rates. That is a surprise to me… buy hey, we all know the stock market is always right. The US (and Canadian) employment report on Friday will be super interesting. If the job market stays strong… we could see a 50 basis point increase when the Fed next meets. The Canadian $ is getting killed today. Interest differential matters. The Bank of Canada is willing to tolerate higher inflation - many Canadian households carry far too much variable rate debt (unlike the US) - home mortgages, lines of credit etc. The Bank of Canada is on pause at 4.5%. 1.) So a plunging Can $ will drive inflation higher in Canada. Because lots of everything we buy is imported (i.e. get ready for another big price increase from Apple). 2.) And government spending at both Federal, Provincial (BC anyways), and municipal continues at exceptionally high levels. Property taxes in the city of Vancouver are increasing 10.7% this year; and they are projected to increase something like 8% on average over the next 4-5 years. 3.) Some economists have estimated as many as 1 million new people entered Canada last year (illegal and legal immigrants, international students etc). 4.) there is a good chance oil prices are headed higher in 2H as we get into the period of season strength. Chinese demand should also really be picking up by then. And perhaps we see Russian supply start to dip (sanctions, lack of investment). But the Bank of Canada is convinced the current 4.5% BofC rate will lick inflation up here… good luck with that.

-

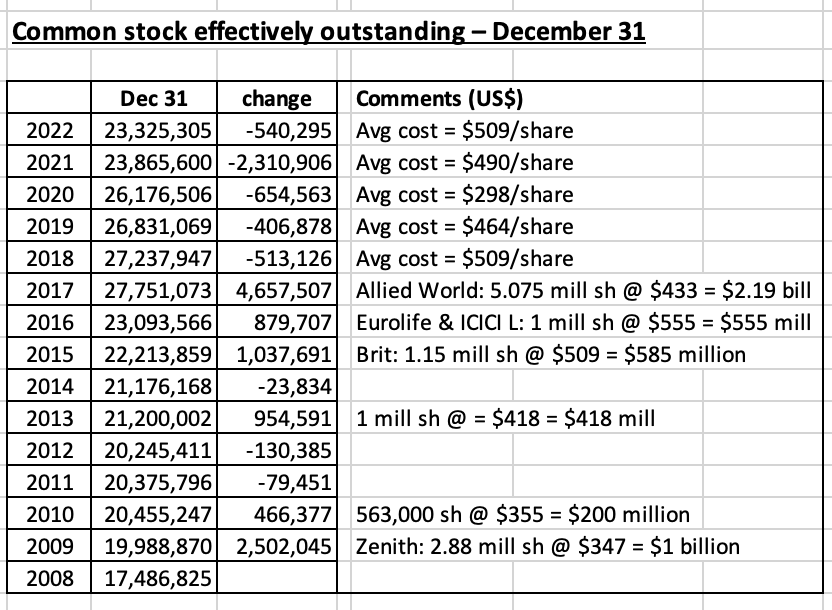

Despite what we have been hearing lately from politicians, share buybacks can be beneficial for shareholders if done in a responsible manner (purchased at attractive prices) and sustained over many years. Here is an update to a post I made recently. Fairfax’s effective shares outstanding peaked in 2017 at 27.75 million shares. Fairfax issued a total of 7.2 million shares over 2015-2017 to help fund its international insurance expansion (Brit, Eurolife and mostly Allied). The average price of the newly issued shares was US$462/share. At December 31 2022, the share count at Fairfax has fallen to 23.3 million shares. Over the last 5 years, Fairfax has reduced its share count by approximately 4.4 million shares or 15.9% = 3.2% per year (see table at the bottom of this post for details). The average cost paid by Fairfax over the past 5 years was US$464/share. Fairfax book value is US$658/share. Shares are trading today at US$686/share. So Fairfax has been able to buy back shares in volume over the past 5 years at an average price well below both current book value and current market price. The average price of the shares repurchased over the past 5 years is about the same price at which they were issued +5 years ago. Interesting. The big share repurchase came in December 2021, when Fairfax executed a substantial issuer bid and purchased 2 million shares at US$500/share for a total cost of $1 billion. To fund the purchase, Fairfax sold 10% of Odyssey for US$900 million. With Fairfax shares trading at US$686 today, this repurchase is looking like a great decision for shareholders. Summary: Fairfax has been doing a solid job on the buyback front the past 5 years: share count has come down nicely and shares have been repurchased at attractive prices. I think we can safely conclude that Fairfax's share buybacks have been very beneficial for shareholders. What could we see in 2023? The good news is Fairfax’s free cash flow should be very high in 2023, driven by record underwriting income, record interest and dividend income and solid realized investment gains. The bad news is Fairfax’s share price is trading today at new all time highs (US$686) so Fairfax will have to ‘pay up’ a little. My base case is Fairfax will repurchase about 2% of effective shares outstanding = 466,000 shares. The cost would be @$320 million (at $686/share). A much larger repurchase is also very possible. Fairfax has lots of good options of what to do with their growing free cash flow: 1.) pay down debt: total debt actually increased in 2022 ($750 million at Fairfax and $100 million at Recipe) 2.) support growth of insurance business at subs: we are still in a hard market (especially property cat reinsurance) 3.) buy out minority partners: $733 million was spend in 2022 to increase ownership in Allied from 70.9 to 82.9 - while not technically a buyback, taking out minority shareholders does increase the amount of earnings that flows to Fairfax shareholders. Some on this board have likened this activity to a stock buyback. 4.) increase ownership in current equity positions: in 2022 Fairfax increased its ownership in: - take private: Recipe and Grivalia Hospitality - bought more shares: Fairfax India, Mytilineos, Micron - exercised warrants: Atlas, Altius, Foran - converted debs: Ensign - converted preferred shares: Thomas Cook India - issued preferred equity: Kennedy Wilson - issued convertible debentures: John Keells 5.) invest in financial markets (lots of companies are cheap): new positions established in 2022: - Bank of America, Occidental, Chevron, BABA - JAB - JCP V investment fund 6.) buy back stock: bought back 2.3% of effective shares outstanding in 2022. Based on what we saw in 2022, my guess is we see Fairfax continue to do a mix of all of the above. Perhaps the big move in 2023 will be to buy back another chunk of Allied (funded this time with free cash flow and not debt). ————— Here is Prem’s quote from the 2018AR that suggests Fairfax will continue to be aggressive with share buybacks in the coming years: “I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years. We began that process by buying back 1.1 million shares since we began in the fourth quarter of 2017 up until early 2019 – about half for cancellation and half for various long term incentive plans we have across our company. This was after we increased our ownership of Brit to 89% from 73% while having the funds ready to increase our ownership of Eurolife from 50% to 80% in August 2019.” ————— Fairfax’s total return swaps on 1.96 million Fairfax shares: some on this board consider this investment to represent a buyback of sorts. Here is an update on this holding. It is turning into one of Fairfax’s best investments ever. - Cost at Inception = $733 million ($372.96) - initiated late ‘20 & early ‘21 - Value Dec 31, 2022 = $1.167 billion ($594.12 share price) - Value March 3, 2023 = $1.345 billion ($686.25 share price) Increase in value of position from inception = $612 million = + 83% over 28 month holding period (not including any costs to maintain TRS position). —————

-

Do people want to get into the US? Yup. Desperately. Do lots of people want to get out of countries like China. Yup. Desperately. Is the US perfect. No, of course not. It never has been. Go back and watch some videos from the 1960’s and 1970’s. What a mess… What about the 1920’s or 1930’s? Even worse. Despite all the hand wringing, the US is and will be fine. It will prosper and its people will prosper. The winners and losers will change at the margin. Just like always. I am finding one of the great challenges of getting old is to not become that ‘crazy old uncle’. Angry. Unable to handle change.

-

In August 2021, Fairfax invested C$100 million into Foran Mining - an exploration and development company. At the time, the purchase was a bit of a head scratcher. An exploration company? Mining? Canada? Really? Well, 18 months later, what have we learned? 1.) the energy transition to EV’s is happening. And lots of inputs, especially copper, are likely going to be in short supply looking out 2 or 3 years. Copper prices are spiking. 2.) ‘the story’ at Foran continues to get better. They are discovering more, large deposits (copper, zinc, gold and silver). Mine development is progessing, with initial production scheduled to begin in 2025. More savvy, deep pocketed partners are signing on. The company is looking to ‘graduate’ its stock listing from the venture exchange to the TSX. What is Fairfax’s exposure? As of today, Fairfax owns 25% of Foran. - Aug 2021: 55.6 million shares @ C$1.80 = C$100 million - Oct 2022: exercised 16 million warrants @ C$2.09 = C$33 million Shares of Foran Mining closed Friday at C$3.88, near a 52 week high. - 71.6 million shares x C$3.88 = C$277 million = US$204 million. - the value of Fairfax’s initial investment has doubled over the past 18 months. What does it mean for investors in Fairfax? The story at Foran Mining continues to get better. Yes, it is still early days. And there will be lots of volatility. The significant exposure to copper could turn this investment into a big winner in the coming years for Fairfax shareholders. Foran Mining is looking like yet another example of the team at Fairfax hitting the ball out of the park with their equity purchase decisions over the past couple of years. - https://foranmining.com/wp-content/uploads/2022/09/Foran-Corporate-Presentation.pdf - https://foranmining.com/wp-content/uploads/2022/08/WILTW_2022-08-18_E02_BHP_Groups_bid_for_OZ_Minerals_highlights_its_forecast_for_accelerated.pdf

-

i think it is Friday, March 10. To others: please correct me if i am wrong.

-

GREAT NEWS on so many fronts. Proceeds to Fairfax from the sale of Resolute will be @US$630 million + $180 million CVR. Resolute was sold at $20.50/share. For perspective, back in March 2020, Resolute shares traded at US$1.20/share. Fairfax owned 30.5 million shares so Resolute’s value 2 short years ago was a total of US$37 million. Pre-pandemic, Resolute traded at an average valuation of about $6. In the record lumber market post 2020, Resolute’s share traded at an average around $12. Bottom line, at $20.50, Fairfax got an outstanding price for this company. But price is just the beginning of why this is a great move for Fairfax shareholders. Resolute also owned some pretty crappy business: newsprint, paper and tissue. And the ‘good’ business, lumber, is getting killed today by higher interest rates (yes, i do like lumber looking out a year or two). I think Resolute also had a pretty large pension liability on its books. Bottom line, Fairfax also got rid of what was overall (still) a pretty shitty business. There is also the psychological benefit (to long term followers) of Fairfax selling Resolute. This shouldn’t matter but it does. Resolute was one of Fairfax’s larger purchases (total investment of $791 million) from a decade ago. It was also one of Fairfax’s great investment busts. An absolute dog with fleas. This train wreck of an investment started all the way back in 2008 when Fairfax spend $350 million on a convertible bond of Abitibi (the predecessor of Resolute). And as ‘the story’ kept getting worse, Fairfax kept buying more. Also buried in Resolute’s sad history was the smelly (putting it politely) take-out in 2012 of Fibrek (SFK Pulp). I am guessing there are lots of long term shareholders of Fairfax who are very happy that Fairfax has sold Resolute. It is yet another example of ‘old Fairfax’ being laid to rest by the current team at ‘new Fairfax’. The good news part of the Resolute story is Prem admitted in his letter in the 2018AR (and again in the 2019AR) that Resolute had been a very poor investment. Terrible business. Poor management. Double down. I think the ‘lessons’ of Resolute was taken to heart by Fairfax in 2018. And shareholders have been reaping the reward ever since (with much better decisions on new equity purchases - putting a premium on management among other things). Fairfax now has $630 million to redeploy into higher quality investments. Given their stellar track record over the past 5 years in deploying capital i can’t wait to see what they do. ————— To be fair, the management team at Resolute has done a very good job over the past 4 to 5 years. The purchase of the three lumber mills in the US south in 2020 (at the bottom of the lumber cycle) was especially well done. Bottom line, they got the company to a position where it was taken out at a very good price. Well done! ————— From 2018AR - Prem’s Letter: ”We have invested $791 million in Resolute and received a special dividend of $46 million, for a net investment cost of $745 million. Our initial investment was a convertible bond purchased in 2008 for $347 million. We invested an additional $131 million prior to Resolute entering into creditor protection and most of the remainder during the period from December 2010 to 2013. Subsequent to write-downs and our share of profits and losses over time, at December 31, 2018 we held our 30.4 million Resolute shares in our books at $300 million ($9.87 per share). The current fair market value of these shares is $244 million ($8.03 per share). You can see that Resolute has been a very poor investment to date!” ————— Trip down memory lane from 2008 to present… - https://www.resolutefp.com/About_Us/Our_History/