Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Its not the $100 million purchases/decisions i worry about. Its the $500 million and up purchases/decisions. But Fairfax has been putting alot of cookies back in the cookie jar the past couple of years with their big decisions: 1.) TRS on FFH: up to this point… a brilliant purchase. With a long runway ahead of it (with lots of expected volatility). 2.) Atlas: looks good. Could be great. But i have a hard time understanding the business and there is so much going on with take private, new builds, interest rates spiking, violent economic swings of post covid world (shift from goods to services in 2023), geopolitical strife affecting trade routes etc. 3.) bond duration at 1.2 years at Dec 31, 2021: not an equity purchase… but this was a big swing and could end up making Fairfax serious money over the next couple of years (while also protecting their balance sheet in 2022 at the same time the bond market was in a historic bear market). 4.) pet insurance sale for almost $1 billion after tax. WTF? Really? 5.) Eurobank: has this actually turned into a great investment seemingly overnight? It has played out like some Greek version of Disney’s Cinderella. (I am getting all teary eyed…). Shares closed at 1.365 Euro on Friday. 6.) Resolute Forest Products sale: sold at the top of the lumber cycle for what could work out to $800 million (if the CVR pays out). Tissue, newsprint, paper… don’t let the door hit you on the ass on your way out The only big miss i can identify the past 3 years has been Blackberry and not finding a way to unload it in 2021. Fairfax did restructure the debenture (smaller in size) and at much more favourable terms. That sale would have been cathartic in so many ways. But, hey, you rarely get everything you want in life. Gotta take the good with the bad. And with Fairfax, we have been getting spoiled a little with all the good the past few years.

-

@Xerxes i think most investors in insurance companies (me included) have little appreciation for approximately how the sausage is made. For a company like Fairfax, my guess is there is a great deal of complexity: 1.) while mostly in the US, their business is very geographically dispersed. Much more than most large insurers. 2.) they are 75% P&C insurance and 25% insurance 3.) their P&C insurance business is very diverse 4.) they continue to have a legacy runoff business 5.) their industry is highly regulated - and regulations vary by country 6.) their investment style is extremely varied and opportunistic - equities: deep value, private equity, commodities, real estate, emerging markets, non-traditional Perhaps i am over-stating the complexity. Bottom line, i try and understand Fairfax at 10,000 feet. It is difficult to get too in the weeds as to how everything is coordinated within Fairfax. My guess is it is all coordinated in some fashion (insurance, investments, op co, geography).

-

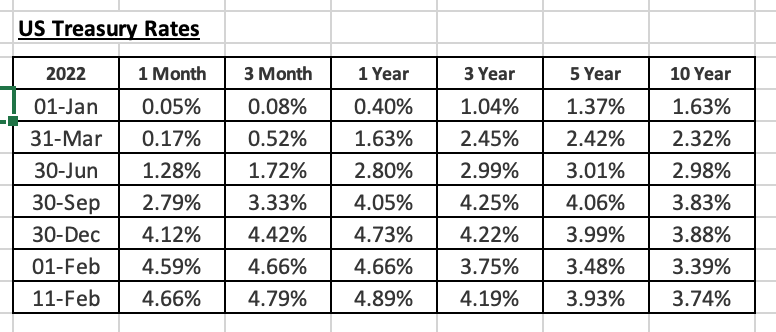

Since bottoming out Feb 1, US Treasury yields have been spiking again. This is good news for Fairfax given the very short average duration of their bond portfolio (of 1.6 years at Sept 30). It will be very interesting to see what Fairfax does with its bond portfolio in 2023. 1.) Do they continue to extend duration? (It increased from 1.2 years at June 30 to 1.6 years at Sept 30.) 2.) Do they shift portfolio composition from government and more to to corporates to take advantage of higher yields? The Fed is telling us that they will be taking the Fed Funds rate to over 5% in the coming months and will likely be keeping it there for all of 2023. We will see. When Fairfax reports on Thursday we will see interest income spike higher. We will also learn what the average duration of the bond portfolio is. ---------- Looking back 12 short months ago it is amazing to see the significant increase in Treasury rates right across the curve. Fairfax's positioning of its bond portfolio on Dec 30, 2021 might just turn out to be one of its best calls in its history (of course, like the horse story, we will see...). Now Fairfax was positioned similarly (very short duration) for years... so there was definitely significant opportunity cost over many years. But for an investor in Fairfax today (with shares trading today at US$650) the future certainly looks bright... and a big reason is the positioning of the bond portfolio even the current interest rate environment.

-

@SharperDingaan i do not follow the drillers at all. Precision Drilling (PD.TO) got killed today (expensing stock based compensation can be a bitch). Do you (or other posters) have any thoughts on current valuation? Oil/gas services companies look very well positioned to grow profitability in coming years.

-

Below is an interesting presentation regarding the energy transition. I am starting to wonder if ‘energy transition’ is not similar to the US housing bubble around 2005 or 2006. In terms of how completely wrong/unrealistic the dominant narrative is/was. And as reality sets in both will have/had enormous impacts on the global economy. The housing bubble bursting almost took down the global economy in 2008. The ‘energy transition’ is going to result in prices for metals/energy to spike to unheard of levels and that will have an equally enormous impact on the global economy. The energy transition (as its currently constructed) looks to me like a slow motion train wreck. Using basic logic, it is pretty much an impossibility when you look out just 2 or 3 years. What should an investor do? 1.) buy oil stocks. Oil is going to be needed in INCREASING quantities for decades. But we are massively underinvesting in it. The ‘energy transition’ is going to happen much slower than people currently think (due to shortages of raw materials). 2.) buy metal stocks. Prices are going higher than people can imagine. Bringing new metal supply on stream is even more difficult than oil (takes 5-7 years). The ‘energy transition’ is going to be much, much more expensive that people currently think. 3.) elevated inflation will be the new norm (with lots of volatility). Unheard of prices for metals and oil will drive global inflation. 4.) geopolitical strife will increase. China has enormous leverage, especially in processing of metals. At some point they will play that card. Bottom line, the world over the next 10 years will be very different than the world of the past 20 or 30 years. Not worse. But very different. ————— Humanity is going to continue to invent. Machines need to eat too… ————— If anyone comes across a video/presentation that provides a counter argument (to the thesis Mark lays out in his video below) please attach it. I remain inquisitive and open minded

-

@dealraker i love the comments… please keep them coming. Great wisdom. As i get older i am starting to question if Buffett’s and Lynch’s wisdom - that an average person can learn to successfully invest on their own - is actually realistic/possible (for most people). I just see so few people who are actually able to figure it out over time. Worse, i know a fair number of people who have tried and failed… some miserably. None of my family members have been able to figure it out. Why not? I am wondering if the vast majority of people simply do not have the required emotional make-up to be successful self-directed investors. So few people get rich the way Warren Buffett did (financial markets) - perhaps its not as easy as it looks. ————— By ‘successfully invest’ i mean they are able to achieve results (over decades) that are better than the relevant market benchmark.

-

The energy story continues to improve. 1.) china re-opening: likely to add 1 to 1.5 million barrels per day to demand 2.) US pretty much ending SPR releases: removing 800,000 barrels per day from supply 3.) And as oil companies report Q4 earnings, we are learning we will see limited production growth from US shale. If true, that is a big deal. 4.) Russia remains a wild card… with the risk skewed 90% to the down side (meaning they will supply less oil moving forward). If US shale does not ramp production in 2023 (more than forecast) then global oil supply is going to come up short. While demand keeps increasing. The question is not IF the oil price is going higher. The question is HOW HIGH will the oil price go? (Patience will be required… it will could take until Q3 for the supply - demand imbalance to really start to bite.) ————— Occidental’s CEO Says Stock Buybacks Take Priority Over Oil Growth - https://finance.yahoo.com/news/occidental-ceo-says-stock-buybacks-184029344.html Occidental Petroleum Corp. may redeem Berkshire Hathaway Inc.’s preferred stock this year as the oil giant prioritizes share buybacks over production growth, said Chief Executive Officer Vicki Hollub. ”There won’t be significant growth from us because there’s still a lot more value to be gained for us by continuing to focus on delivering value to shareholders through share repurchases,” Hollub said during an interview with Bloomberg TV at the Smead Investor Oasis conference in Scottsdale, Arizona. “A big focus for us in 2023 is repurchasing our common and potentially the preferred.” Warren Buffett’s Berkshire bought $10 billion of preferred stock in Occidental during the driller’s 2019 takeover of Anadarko Petroleum. Berkshire is also the biggest owner of Occidental common stock with a 21% stake, according to data compiled by Bloomberg. Occidental climbed 0.5% to $61.53 a share at 1:31 p.m. in New York even as the S&P 500 Energy Index dropped 0.6%. The decision by Occidental, one of the biggest shale oil producers, to focus on buybacks rather than production growth is another sign that US output is unlikely to accelerate much this year, despite companies being flush with cash. In recent days, Exxon Mobil Corp. and Chevron Corp. have both said shale growth will slow this year. Most publicly traded producers, who have indicated growth will likely stand below 5% annually, are due to report earnings and announce their capital spending plans later this month.

-

I recently came across the attached video on Peter Lynch. I think it is an excellent introduction for people who do not know him. And also a good review for the rest of us. His book “One Up On Wall Street” is one of my top 5 best books on investing for the impact it had on me when i was getting started and still today. (At the same time i first read Lynch’s book i was also reading: Ben Graham’s “Intelligent Investor”, Robert Hagstrom’s “The Warren Buffett Way” (1st Edition), Burton Malkiel’s “A Random Walk Down Wall Street”… amazing the information available to investors, even back then.) In terms of educating investors, I put Peter Lynch in the same category as Buffett and Graham (close enough for me). Lynch has lots of very useful advice: - if you don't have the time/interest/skill to buy individual stocks buy an ETF (called a mutual fund in his day) - only invest in what you know/understand well - this might be his most important point (and often gets drowned out by all the other good things he has to say) - volatility is opportunity - sell only when the story changes/deteriorates (don't pull the flowers and water the weeds) - you don't need to be right with every pick - it helps if you have an edge - ignore macro / general news media - market timing doesn't work My add (and I am sure Lynch would agree): small investors have three more big advantages today compared to 1994: 1.) access to information has never been better - see my bolded point above! 2.) transaction costs have dropped significantly which increases return for investors 3.) tax advantaged accounts are now available (in Canada - RRSP, TFSA, RESP and soon to start Home Buyer Plan) which increases after-tax return for investors

-

CVE and a smaller amount of SU. Shares are cheap (both were taken out behind the woodshed the past 5 days). Free cash flow is large. What to do? Buy back stock hand over fist. Canadian oil companies are going to be buying back large amounts of shares in 2023. Should also provide a floor in the stock price.

-

@StubbleJumper i agree philosophically with what you are saying. The challenge is most investors do not follow insurance companies closely enough to be able to ‘look through’ volatility in investments. Especially a company like Fairfax with all of its complexity. So when investment markets go down a lot (like last year), and earnings and BV get hit, most investors do not adjust their numbers. They look at reported numbers and take them at face value. Same with most analysts. So in Q4 and again in Q1 we will likely see big gains in equities as stock prices return to fair value. We also will see gains in bonds as interest rates normalize (go lower). In turn, this will normalize Fairfax’s BV - which in Fairfax’s case means it will increase a fair bit. And given P&C insurers are largely valued primarily using BV, a higher BV should result in a higher share price. ————— It will be interesting to see what changes Fairfax has made to its investment portfolio in Q4: 1.) bonds: Dec 31, 2021 average duration was 1.2 years. Sept 30, 2022 average duration had increased to 1.6 years. Did Fairfax extend duration further out in Q4? Hopefully, yes. 2.) stocks: Fairfax has been very active adding to their equity holdings all year. This added exposure will benefit shareholders in many different ways. Fairfax also tends to be very opportunistic in down markets so i am looking forward to seeing if they have done anything creative to get extra exposure to stocks while prices are low (total return swaps?).

-

Net gains (losses) on investments - both bonds and stocks - was a significant headwind for Fairfax in the first three quarters of 2022. Fairfax had a great year in 2022 but the significant losses in their bond and stock portfolio made reported results look terrible, at least over the first three quarters. In Q4, stocks rebounded and the losses likely stopped in bonds. My earnings estimate for Fairfax for 2023 is about US$105/share. One of the key inputs is net gains on investments = $750 million for the year. Well one month into 2023 how are we looking? I think we might be close to my $750 annual estimate after 1 month. How? 1.) Ambridge Partners sale for $400 million. We don't know the gain yet. Brit paid $100 million for Ambridge but also merged it with part of their operation. I am going to assume a gain on sale of $200 million. Note, this deal might close in Q2. 2.) Mark to market equity gains are tracking at about $370 million today (total equity portfolio is up about $810 million as of today). 3.) Investment gains on bonds. This is the hard one for me (I don't have a model for this). Given the big decline in bond yields we are seeing 3 years and further out on the yield curve, my WAG for $250 million in gains on the bond portfolio. Total: $200 + $370 + $250 = $820 million Bottom line, from here it would not be a stretch for Fairfax to report +$800 in net gains on investments in Q1. Early days; but something to watch. And a big headwind in 2022 is poised to be a big tailwind in 2023. ---------- So in 2023 we could see record underwriting income, record interest and dividend income and near record share of profit of associates. And perhaps also a big bounce back year in net gains on investments. The story keeps getting better and better... ---------- Fairfax Equity Holdings Feb 1 2023.xlsx

-

Mr Market did not like Chubb's earnings; stock was down today 6.2% in a strong market. Travellers was also down 3.1% and WRB was down 1.5%. Looks like the best days of the hard market are now behind us. Still a decent position for most companies. But discipline will be more important than ever moving forward, especially if companies see development in prior year loss reserves like Markel.

-

This update from Morgan Stanley was an eye-opener for me. Their forecasts have been pretty good over the past year. “Given these developments, we have revised lower our Treasury yield forecasts. We see the 10 year Treasury yield ending the year near 3%, and the 2 year yield ending the year near 3.25%. That would represent a fairly dramatic steepening of the Treasury yield curve in 2023.” https://podcasts.apple.com/ca/podcast/thoughts-on-the-market/id1466686717?i=1000597464912

-

The problem is 8% inflation. That causes all sorts of economic and societal problems. 3% inflation is needed… over many years that solves our too much debt problem. The pivot today signals the Fed is OK with some inflation… They also don’t want to return to disinflation and potential deflation. Bottom line, great place to be for stock investors. Bond investors are also going to make out like bandits as rates across the curve normalize (fall). Volatility. Active management. Are we back to normal financial markets for the first time in a long time?

-

The two keys are labour market and services inflation (labour). IF we get a weak labour report the Fed is likely done. Regardless, if the current trends continue, the Fed is done after the next increase in March. The important point is the Fed is largely done with rate increases. The economy needs certainty. People/businesses can then plan and get on with their lives. We now have certainty (give or take a month or so… close enough). Housing stocks (builders and lumber producers) are popping. Metal stocks are popping. Much of the economy has been slowly digesting higher interest rates. And they now know they are peaking on the short end of the curve. The 2 year treasury could be in the low 3% range later this year. Lower rates are a big deal… and further out on the curve they are already down big. The chances that the Fed will get a soft landing just went way up today. Pretty good set up for risk assets. And my guess is most people continue to be under-invested (in stocks). So people got hammered last year and likely sold down their stock positions in December (that stop the pain thing). And they are waiting for markets to crash again so they can get back in. Perhaps stocks slowly keep going higher from here (climbing that wall of worry). Fear will be replaced by FOMO. Sell low and buy high… ouch! Making money in stocks is a pretty tough thing! —————- All the fear mongers / Fed haters are screwed. The world (probably) isn’t going to end.

-

Well… sounds to me like the Fed is close to a pivot. Regardless, they are no longer hawks. Stock market ripping? Not a problem. Falling bond yields (further out on the curve)? Not a problem. Weakening US$? Not a problem. Any crack in the labour market and the Fed is done. Rate cuts later this year? Today, the Fed moved to where the bond market currently is. Super interesting. Sounds like risk on to me.

-

At the end of the day, people need to find an investment strategy that works for them. Their intellect, their emotional make-up and their life situation. Not that complicated (in theory If following macro (just one of many examples) doesn’t help you then don’t do it. But if it doesn’t work for you, does that mean it doesn’t work for other people? Other people shouldn’t use it because it doesn’t work for you? Or you don’t understand it so they are stupid for using it? When it comes to investing my view is there is no ‘one way’ that works for everyone. That is what makes the game so interesting and fun. Be inquisitive. And open minded (to quote that dummy Druckenmiller). ————— Please note, the picture below is NOT directed at older board members… rather it is directed at the mind set…

-

@nwoodman Yes, Eurobank certainly has been on the move. They were dealt a pretty shitty hand for many years... The management team there certainly has been executing well for years. The bank sure looks well positioned. If the Atlas go-private is rejected (and the stock sells off) then Eurobank could well pass Atlas and become Fairfax's largest equity holding. The FFH total return swaps have also been spiking higher the past 4 months. Those three holdings are much larger than any other single equities that Fairfax owns. US$ Market Value of FFH stake Jan 31 change from Dec 31, 2022 1.) Atlas $1.94 billion -$69 2.) Eurobank $1.57 billion +$264 3.) FFH TRS $1.31 billion +$141 Of interest, these three positions represent about 30% of Fairfax's total equity exposure. And about 9.5% of Fairfax's total investment portfolio. ---------- Another tailwind for Fairfax is currency (US$ weakness). Fairfax has significant international holdings.

-

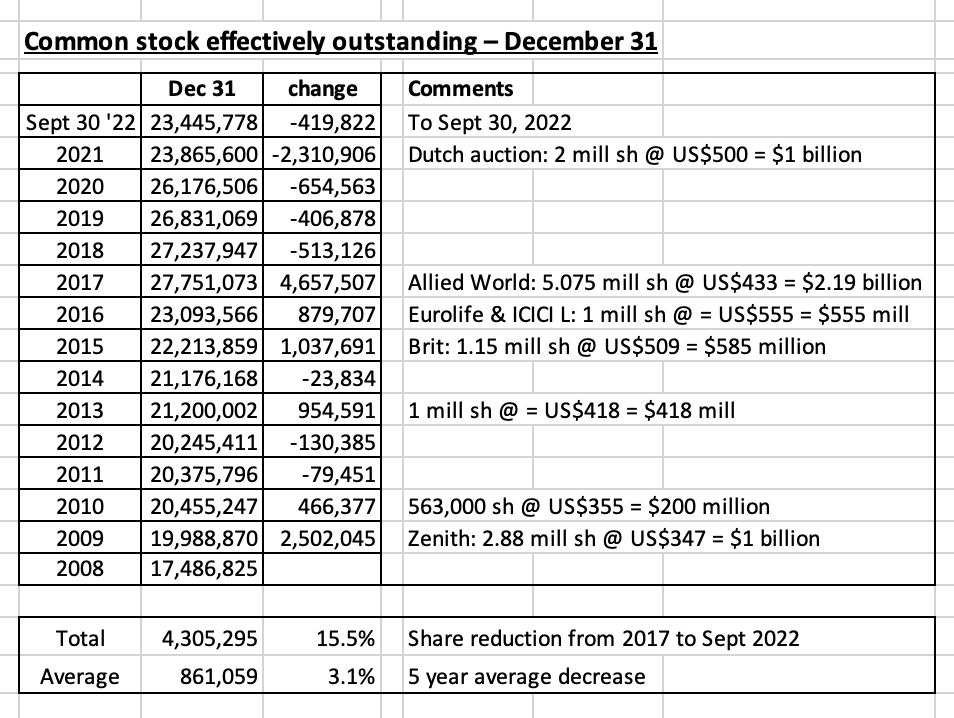

Share buybacks, done in a responsible manner (purchased at attractive prices) and sustained over many years, can be very beneficial for shareholders. Fairfax’s 'common stock effectively outstanding' peaked in 2017 at 27.75 million shares. At September 30, 2022, share count had fallen to 23.45 million shares. Over the last 5 years, Fairfax has reduced its share count by approximately 4.3 million shares or 15.5% = 3.1% per year (or 860,000 shares per year). See table at the bottom of this post for details. The big share repurchase came in December 2021, when Fairfax executed a substantial issuer bid and purchased 2 million shares at US$500/share at a total cost of $1 billion. With Fairfax shares trading at US$670 today, this repurchase is already looking like a great decision for shareholders. Fairfax has been doing a solid job on the buyback front the past 5 years: share count has come down nicely and shares have been repurchased at attractive prices. What could we see in 2023? The good news is Fairfax’s free cash flow should be very high in 2023, driven by record underwriting income, record interest and dividend income and solid realized investment gains. The bad news is Fairfax’s share price is trading today at new all time highs (US$670) so Fairfax will have to ‘pay up’ a little. It looks pretty likely that we should see Fairfax continue to buy back stock in 2023. My guess is a repurchase of 2% of shares outstanding is a pretty safe minimum amount (470,000 shares @ $670/share = cost of $315 million). A much larger repurchase is also very possible. Much will depend on how cheap Fairfax feels their shares are. My guess is Fairfax feels US$670 is dirt cheap. So it would not surprise me to see Fairfax execute another large buyback while shares are still cheap. Perhaps something in the range of 1 million shares (cost @ $670 million at todays share price). They could easily do this as part of their approved NCIB. Much will depend on opportunity cost: Fairfax has lots of good options of what to do with their growing free cash flow: 1.) we are still in a hard market: supporting growth at insurance subs will likely be the top priority 2.) we are in a bear market for equities: lots of companies are cheap 3.) continue to buy out minority shareholders (Allied, Odyssey, Brit): while not technically a buyback, taking out minority shareholders does increase the amount of earnings that flows to Fairfax shareholders. Some on this board have likened this activity to a stock buyback. We will know much more when Fairfax reports Q4 results. It will be interesting to see what they have been up to on the capital allocation front. And to learn how they are thinking as we begin 2023. ————— Below is Prem’s quote from 2018 that suggests Fairfax will continue to be aggressive with share buybacks in the coming years. It is interesting that Prem discusses share buybacks and buying out minority partners in the same paragraph (viewed as being similar activities?). 2018AR Prem’s letter to shareholders: “I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years. We began that process by buying back 1.1 million shares since we began in the fourth quarter of 2017 up until early 2019 – about half for cancellation and half for various long term incentive plans we have across our company. This was after we increased our ownership of Brit to 89% from 73% while having the funds ready to increase our ownership of Eurolife from 50% to 80% in August 2019.” ————— Fairfax’s total return swaps on 1.96 million Fairfax shares: some on this board consider this investment to represent a buyback of sorts. Here is an update on this holding. It is turning into one of Fairfax’s best investments ever. Cost at Inception = $733 million ($372.96) - initiated late ‘20 & early ‘21 Value Sept 30, 2022 = $913 million ($464.80 share price) Value Dec 31, 2022 = $1.167 billion ($594.12 share price) Value Jan 31, 2023 = $1.305 billion ($665.74 share price) Increase in value of position from inception = $574 million = + 79% over 26 month holding period (not including any costs to maintain TRS position). From Q3 2022 Report: Long equity total return swaps During the first nine months of 2022 the company entered into $217.4 notional amount of long equity total return swaps for investment purposes. At September 30, 2022 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount of $1,012.6 (December 31, 2021 - $866.2), which included long equity total return swaps on 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn $476.03) per share that produced net losses of $82.3 and net gains of $7.1 during the third quarter and first nine months of 2022 (2021 - net losses of $50.4 and net gains of $51.1). —————

-

What we are seeing is more analysts looking out the front windshield. Analysts have no choice… regardless of what they think of Fairfax as a company, they have to update their models. Lots of good things were happening under the hood at Fairfax in 2022 but they were masked by market to market losses, mostly in their bond portfolio (equities as well). Now that the losses in the bond portfolio are over (and likely reversing) we will see the earnings power of the company shine through. Who knew??? The BMO note also illustrates beautifully ALL ANALYSTS CARE ABOUT: ‘operating earnings’. They hate ‘investment gains’ - likely because of their volatility quarter to quarter. Analysts are awakening to the fact that operating earnings at Fairfax are exploding and the higher amounts are sustainable. Underwriting income and interest and dividend income are no brainers. I was pleased to see BMO also giving Fairfax credit for ‘share of profit of associates’. I wasn’t sure how analysts would treat that line item. My guess is Fairfax could deliver about $3.5 billion in ‘operating earnings’ in 2023 = about $150/share (underwriting profit + interest & dividend income + share of profit of associates). If analysts include share of profit of associates in their estimate of operating earnings (the ‘predictable’ items) then we could be off to the races in terms of upgrades/investor interest. Analysts use operating earnings as their ‘north star’ to value P&C insurance companies. Bottom line, analysts are finally getting their analysis of Fairfax correct when it comes to underwriting income, interest and dividend income and share of profit of associates. But where are analysts still messing up? Investment gains. BMO clearly has no idea how to model investment gains. So they assume they mostly do not exist. That is easy. And safe. But way underestimates what Fairfax will likely deliver. BMO is estimating Fairfax will deliver an average of US$280 million per year in investment gains in 2023 and 2024. The Ambridge sale already announced should deliver a big gain in 2023 (we should know more when Fairfax reports Q4 results). We also know a $100 move in FFH share price = US$200 million in gains (thank you TRS). Fairfax has a large mark-to-market equity portfolio. They likely will monetize more assets over the next 2 years (for sizeable gains). The $280 million estimate looks comically low to me… but we will see. The good news is only very modest ‘investment gains’ are built into BMO’s updated estimates. So future investment gains should provide further upside to BMO’s estimates. The bottom line is Fairfax has two engines of growth: insurance AND investments. And both engines are performing exceptionally well right now. Nice to see analysts starting to figure out at least one engine.

-

The price of oil is driven by demand and supply factors. On the supply side, it appears US SPR releases have effectively ended. That is a significant amount of oil supply that will need to come from somewhere else moving forward. And of course, if the US hopes to re-fill the SPR (the goal eventually), that will become a significant new source of demand for oil. Good thing we are not getting any large increases to demand in the coming months (something like China reopening). Oh, wait… Bottom line, a tight oil market is getting tighter.

-

Atlas is Fairfax's largest equity holding. It appears Fairfax has exercised the remaining 6 million warrants it held in Atlas around Jan 12 (see note 2 below). After exercise, my math says Fairfax holds 130.9 million shares (excluding those held directly by Prem and the charity controlled by Fairfax) = 45.8% of total shares outstanding (287.565 million - including 6 million FFH warrants). The value of Fairfax's holding in Atlas = $2.0 billion.

-

Looks to me like Mr Market likely did not like WRB’s outlook for the hard market. A few insurers traded lower today. Chubb’s commentary when they report after market on Tuesday should provide more good insight. ————— As others have pointed out, if we get clear signs the hard market is ending we will likely get multiple contraction across all P&C insurance stocks. Something to monitor. ————— WRB - 2.94% TRV - 1.74% CB. - 1.64% FFH. - 2.61%

-

I agree. If Fairfax wants to attract new long term shareholders they need to be very careful not to pick old scabs. My watch out is arrogance. Do they have some success with Mr Market in 2023 (shares rip higher), get cocky and then mess up with a big purchase/macro bet/empire building. Not my base case... but definitely something to monitor.

-

Lots of great information on the current state of the P&C insurance market from WR Berkley's release today (with a listen if you have time). WRB posted great Q4 results. But I wonder if the decelerating top line growth spooks markets tomorrow. Of note, Fairfax has an average yield of 1.6 years on their fixed income portfolio at the end of Q3, the shortest by far of any P&C insurer. WRB is next, with a duration of 2.6 years. WRB saw the yield on their fixed income portfolio increase from 3% in Q3 to 3.6% in Q4. We know the yield on Fairfax's fixed income portfolio increased in Q4... perhaps the increase in WRB's yield of 0.6% gives us a clue. ---------- 1.) top line growth: net premiums written: growth slowed to 6.6% in Q4 compared to 13% for the full year. Elyse Greenspan: And then you made a lot of good market commentary on different business lines. You've in the past spoken about, right, 15-plus premium growth, that's obviously come down reflective, right, of some of the trends in the comp and in liability lines. How do you think when you put everything together, and I know that's hard, where do you think the top line growth could trend over the coming year? Robert Berkley: As far as your question about growth, we'll have to see how it unfolds. I would tell you that based on the limited data I have on January so far, early returns are encouraging. But my ability to speak at a detailed level beyond that, I just wouldn't want to mislead you. But we see a lot of opportunity, and we're watching the opportunity shift from over time from one product line to another. So I think we have good balance to the shift, but we also are very nimble amongst the different parts of the business. ---------- Rob Berkley: As far as rate goes, as you would have seen from the release we got just shy of 7 points of rate and we think that that comfortably helps us keep up with trend and more likely than not perhaps we are exceeding trend. ---------- Rob Berkley: Another comment that I did want to make is on renewal retention ratio. Obviously, different product lines, different parts of the business, we target different levels of renewal retention. When we look at our portfolio overall, we look through the renewal retention to sort of float somewhere between 77 and 80, maybe 81 depending on the mix. When we see that renewal retention ratio ticking up above that, from our perspective, it is an invitation to be pushing rate harder. We want to be in the market at a granular level, testing it every day to be getting as much rate as we can to ensure that we are at a minimum at rate adequacy. That's a very important thing that is a priority for us as an organization. 2.) investment income Richard Biao EVP & CFO: Our book yield on the fixed maturity portfolio increased from 3% for the third quarter to 3.6% for the fourth quarter, which compares very favorably to 2.2% in the year ago quarter. Our new money rate exceeds the roll-off of our invested assets and we expect net investment income to continue to grow. The investment funds performed well, with a book yield of 5.6%, despite the deterioration in the broader equity markets in the third quarter. And as you may remember, we report investment funds on a one quarter lag. The credit quality of the portfolio remains very strong at a double A minus with the duration on our fixed maturity portfolio, including cash and cash equivalents of 2.4 years. ---------- The unrealized loss position on fixed maturity securities improved in the quarter. ---------- Rob Berkley: And I think as Rich flagged and I will flag again, the new money rate these days is north of 4.5%, we're flirting with 5%. So I will leave it to others to fill in the blanks as to what this means for our economic model. But obviously, when you think about the spread between the book yield and the new money rate and what we're able to achieve and you extrapolate that for what it means for our economic model, I think it is very encouraging. One last quick comment on the investment front. While we are not in a rush and we are going to do it in a very thoughtful way, we certainly are considering beginning to push that duration out towards to 2.6, maybe more towards 2.8 over time. But again, we are not in a rush. We're going to do that in an opportunistic way as windows open and close.