Viking

Member-

Posts

4,923 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Here are the swings I see in Q2 (from the 13F). Exited Bank of America. Not surprising given what we learned over the past 4 months (lots of negative headwinds for this sector). Buffett was also aggressively selling his bank holdings. Proceeds from BAC and CVX sales were rolled into Occidental, where position size was doubled, when oil shares in general were weak. Net/net, Occidental is now close to a $400 million position for Fairfax. This puts it around 2.5% of Fairfax's equity portfolio or #10 holding by size. Still pretty small in the big scheme of things. But if you add EXCO and Ensign, energy is close to $1 billion = 6.1% of the total equity portfolio. That looks like a decent weighting towards energy. The Vanguard Index 500 - VOO - is a tiny position. It will be interesting to see if this purchase is one and done or if they grow the position size meaningfully.

-

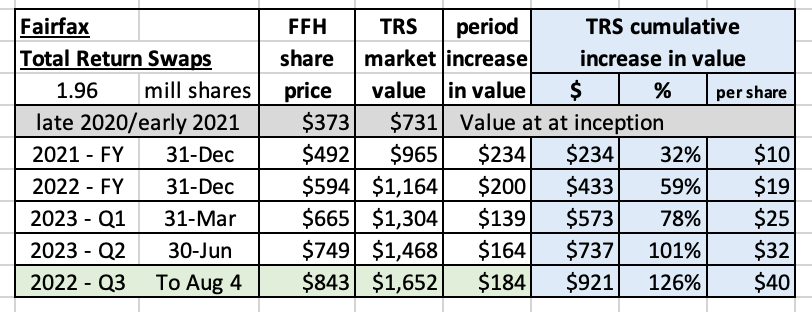

@StubbleJumper Yes, i did not discuss where the money came from to fund the $6.2 billion buying spree. I thought the post was already long enough Here are some quick thoughts: 2020-2021 - FFH TRS purchase has been a home run. Yes, at the time, Fairfax did not have the cash. Hence, the genius of this investment. And with Fairfax shares today trading at 5.3 x 2023E earnings i think this investment has much further to run. Yes, there is a cost to hold this position. But I trust that Fairfax is laser focussed on this and they will exit the TRS at an appropriate time. With the significant earnings coming in each of the next three years Fairfax has the ability to help the share price get closer to what they believe is intrinsic value (by cranking up buybacks). My guess is Fairfax holds this position for a couple more years. Late 2021 - Dutch auction taking out 2 million shares at $500 million was also a home run. At the time Fairfax did not have the cash. Another very good investment with book value today at $834/share and likely on its way to $900 by year end. To fund it, yes, they had to sell 10% of Odyssey in a funky deal with partners (OMERS) who i think get a fixed return of around 8%. However, in return i think Fairfax is able to buy back the stake at a fixed price (set when the deal was struck). And (i believe) Fairfax keeps 100% of the growth in value of the underlying business, including the 10% owned by the minority partners. So the 8% ‘cost’ is likely much less (as long as the business grows in value). Not really sure - just my guess. 2022 - The sale of the pet insurance deal will do down as one of the biggest heists in the insurance industry in recent years. So yes, Fairfax ‘sold an asset.’ But that was a criminally good deal for Fairfax investors. The sale of Riverstone UK is a little more nuanced. I think it was a very well run operation. However, a run off business is never going to be valued anywhere close to an appropriate level by Mr Market. Bottom line, i also like this sale given what Fairfax was able to do with the proceeds. I think i look at things a little differently than you. When looking at the individual transactions it is always through the lens of Fairfax as a whole. Is their total level of debt today ok? Yes. Especially considering the likely trajectory of operating earnings (2023-2025). Are they reducing ‘minority interest’ in insurance subs? Yes. As you point out, with some puts and takes. I expect this trend to continue in the coming years - Fairfax will continue (on balance) to take out more of its minority partners. Insurance asset sales (pet insurance, Riverstone UK, Ambridge) are delivering significant value to shareholders. This is not a negative, this is a big positive. Non-insurance asset sales are the same (Resolute Forest Products). I expect this to continue. The net/net of all the moves over the past 3 years is Fairfax is a much, much stronger company today than it was June 30, 2020. Were all the decisions perfect? No, of course not. But taken as a whole, they have hit the ball out of the park. They are delivering a clinic in value investing. Now where the Fairfax story gets really interesting is right about now. In the past, Fairfax was capital constrained. Not anymore. My current forecast is for Fairfax to deliver net earnings of around $11.3 billion in 2023, 2024 and 2025 (total over these three years - after minority interests). For reference, my past estimates have been on the low side and i think that could well be the case here too. Today, being short of capital is not a concern for me for Fairfax.

-

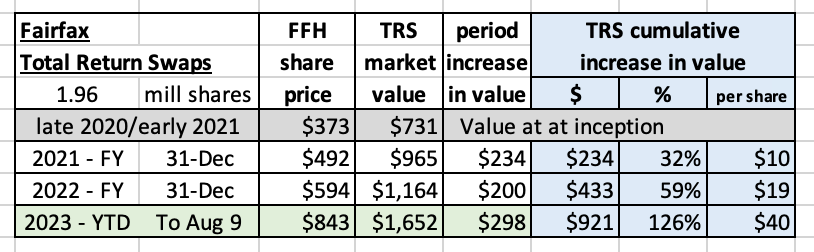

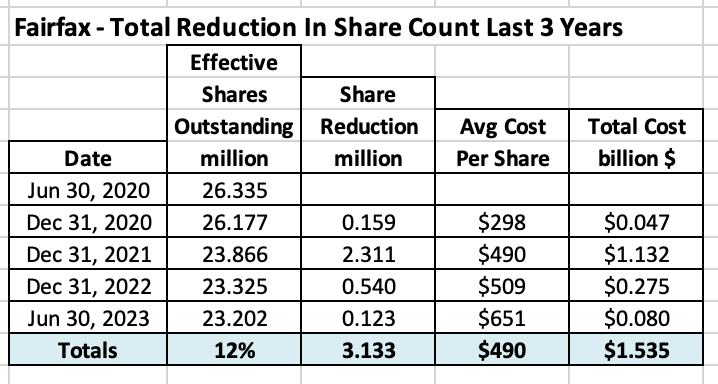

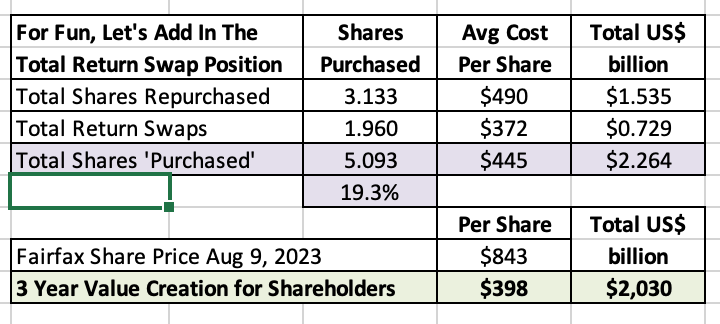

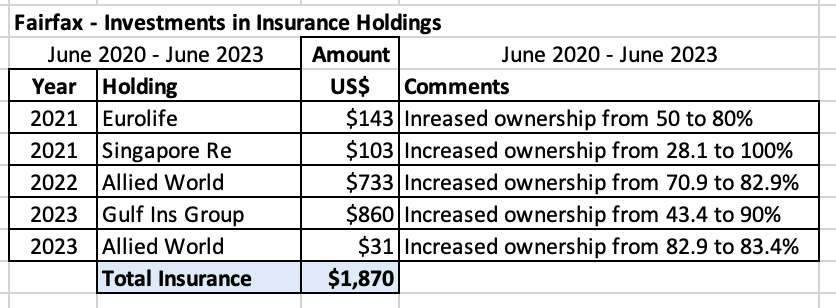

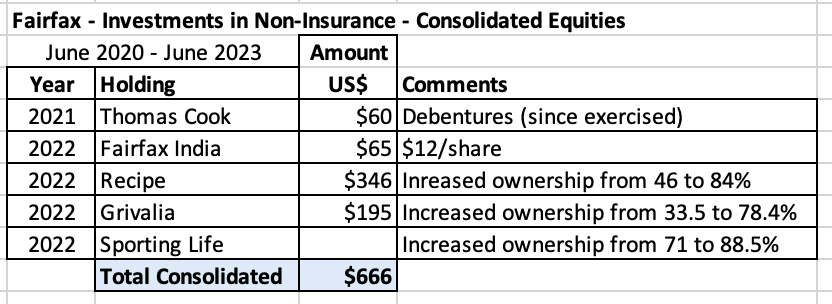

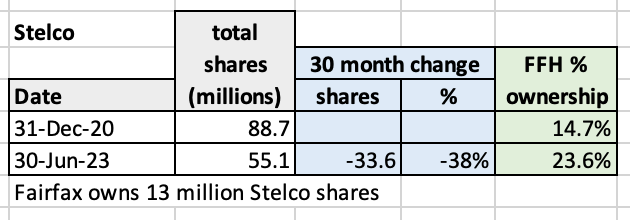

What kind of an investor is Fairfax? Most people would answer: ‘value investor.’ That is the right answer but it doesn’t really tell us much. What kind of a value investor? To answer this question we are going to look at what Fairfax has been doing. What have they actually been buying? What can we learn? We are going to go back three years (June 30 2020, to Aug 11 2023). ————— But first, let’s set the table. 1.) "The single most important thing (when investing in the stock market)… is to know what you own." Peter Lynch The problem with Peter Lynch is he says so many smart (and funny) things that his ‘most important thing’ gets lost in the shuffle. This is the ‘north star’ of everything else he writes. From this naturally flows another of Peter Lynch’s nuggets of gold. 2.) "The best stock to buy is the one you already own." Peter Lynch This makes intuitive sense. You have already done the research on the stocks you own. You know ‘the story’ and you like it (that’s why you own it). Assuming the fundamentals are still solid, then buying more should be a no brainer. Buffett takes this idea a little further with the following quote: 3.) "Diversification may preserve wealth, but concentration builds wealth." Warren Buffett The idea is to invest with conviction around you best ideas. Especially if the stock is on sale. This leads us to our next point. 4.)"‘The three most important words in investing are margin of safety." Warren Buffett Ben Graham introduced ‘margin of safety’ as the central concept of investing in Chapter 20 of his book, The Intelligent Investor. The idea is to only purchase stocks when they are trading at a big discount to their intrinsic value (buy something for $0.50 that is worth $1.00). This approach limits your downside if you are wrong and it provides significant upside if you are right. What do we get when we combine these four points? Often, your best investment is to simply buy more of something you already own - especially when it is on sale. One added twist: 5.) "If you search world-wide, you will find more bargains and better bargains than by studying only one nation." John Templeton Invest wherever in the world the best opportunities are. ————— What does all of this have to do with Fairfax? Well, guess what Fairfax has been doing for the past 3 years? It has invested close to $6.2 billion in stuff it already owns. Yes, during this time Fairfax has been investing in new ventures but the amount spent is much smaller. In short, Fairfax has been feasting at the buffet of companies it already owns. Let’s review the actual investments that Fairfax has been making the past 3 years (Aug 2020 to Aug 2023) that fit this theme to see what we can learn. 1.) Buy Fairfax stock = $2.26 billion Late 2020/early 2021: purchased total return swaps giving them exposure to 1.96 million Fairfax shares Total investment = $732 million (notional) = $372/share Late 2021 - dutch auction: purchased 2 million Fairfax shares Total investment = $1 billion = $500/share June 30, 2020-June 30, 2023 - SIB purchase of an additional 1.133 million shares Total investment = $535 million = $490/share Over the past 3 years Fairfax has ‘purchased’ 5.09 million shares of Fairfax, 19.3% of total effective shares outstanding, at an average cost of $445/share. With shares trading today at $843, the value creation for Fairfax shareholders has been $2 billion. Fairfax saw incredible value in their shares. They invested with conviction (backed up the proverbial truck). Shareholders are now making out like bandits (the value created by Fairfax is flowing though to a much higher share price). Value investing at its best. Who does this string of purchases remind you of? Not Lynch, Buffet or Graham. Who then? Henry Singleton. Who is this guy? From Prem’s letter in Fairfax’s 2018AR: ““I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years.” At the time, many laughed at Prem for making this comment. I don’t think these same people are laughing at Prem today. 2.) Increase Ownership of Insurance Businesses - Buy Out Partners = $1.9 billion Insurance is the most important economic engine Fairfax has. Top line growth in the insurance businesses is critical to sustainable profit growth at Fairfax over time. And profitability is what determines the share price over the medium to long term. Fairfax is slowly and methodically taking out the minority partners in its insurance companies. They spent $1.9 billion over the past 3 years doing this. As a result they own a larger share of (growing) future earnings of these high quality companies. 3.) Increase Ownership of Equity investments: Consolidated Equities = $0.67 billion These are the equity investments that Fairfax exerts a great deal of control over. They invested $666 million the past three years. The big purchase was taking Recipe private and being able to buy the stock at a big pandemic discount. Remaining Equity Holdings = $1.4 billion These are the equity investments Fairfax doe not exert a great deal of control over. They invested $1.4 billion the past three years. The biggest deal was expanded the partnership with Kennedy Wilson in real estate, with the 2 transactions below being part of much the bigger deal (debt platform and PacWest loans). There are lots of solid single type of investments on this list. In total, over the past three years, Fairfax has invested a total of $6.2 billion to increase ownership in companies it already owns. Many of the investments were opportunistic and made at bear market low prices. Investments were made all over the world - value drove the decision, not geography. As a result Fairfax (and its shareholders) now own a greater proportion of the future earnings streams of these many businesses. The returns on the investments made in recent years are starting to come in and they are very good (in aggregate). With lots of upside in the future. Conclusion: What did we learn? How Fairfax is investing right now is incredibly simple. Invest in what you know. Buy at a discount. Act with conviction. Cast a wide net (global). Boring. Safe. Generating a very good return for shareholders. Something i think the masters would approve of. In short, Fairfax has been putting on a master-class in value investing over the past three years. So, after all that, let’s get back to our initial question. What kind of an investor is Fairfax? Fairfax is a value investor. Their approach is a hybrid of 5 masters: Lynch, Buffett, Graham, Templeton and Singleton. ————— Some of the companies Fairfax owns are doing the same thing: The best example is Stelco who has reduced shares count by 38% over the past 2.5 years, which has increased Fairfax’s stake in the company from 14.7% to 23.6%. Actions like these provide additional benefits to Fairfax and its shareholders. When combined with what Fairfax is doing, they have a ‘multiplicative’ effect for Fairfax shareholders (in terms of owning larger proportion of future earnings).

-

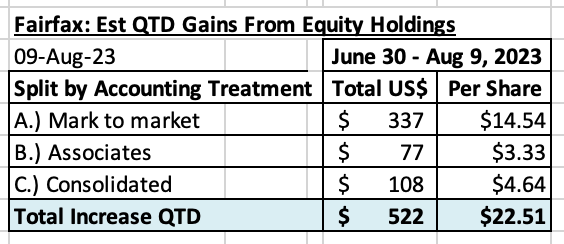

@nwoodman , your post on Thomas Cook motivated me to do an update. As of Aug 9, Fairfax's equity holdings (that I track) are up about $522 million ($22.51/share) so far in Q3. Great start to the quarter. Split by accounting treatment can be seen below. I have attached my Excel file if you want a closer look. Top 5 Movers? All up this quarter: FFH TRS = $169 million Eurobank = $108 million Thomas Cook India = $102 million John Keells = $51 Mytilineos = $33 Fairfax Aug 9 2023.xlsx

-

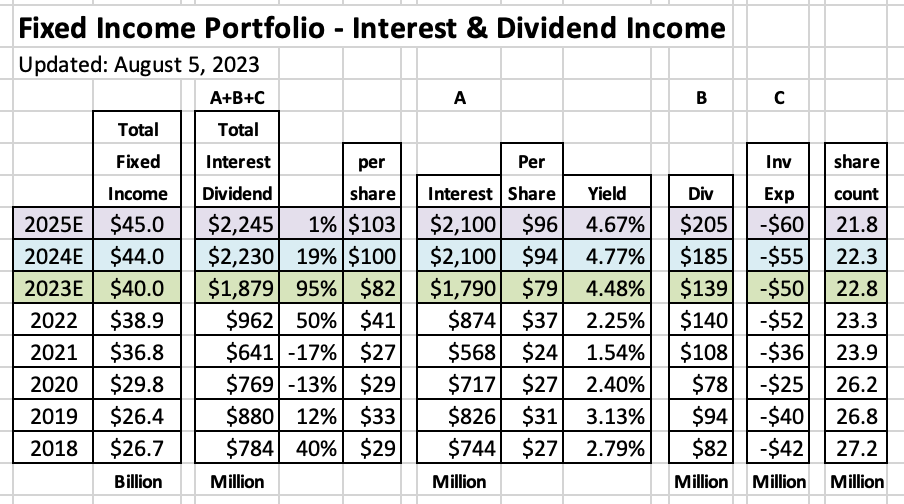

Fairfax just reported Q2-2023 results. The surprise for me? Underwriting profit, interest and dividend income and share of profit of associates all came in higher than I expected. As a result, I decided it was time to update my earnings estimates for Fairfax for 2023, 2024 and 2025. I have the highest confidence level in my 2023 forecast. My 2025 forecast is largely an educated guess. A lot can change in 2 years (both good and bad). Please keep this in mind as you are reading. Conclusion: Let's skip ahead to the conclusion. My rough estimate is Fairfax will earn about $160/share in 2023. This is up from my last estimate which was $145/share (made in early July). The increase reflects the better-than-expected operating earnings Fairfax reported for Q2. For 2024, my new estimate is $166/share and for 2025 it is $174/share. The big ‘miss’ with my estimates in 2024 and 2025 is likely capital allocation. We don’t know what the management team at Fairfax is going to do with all the earnings (around $3.6 billion) that is likely coming in each of the next 2.5 years. Looking at the last 5 years, the management team has been outstanding with capital allocation. My guess is they will continue to make good decisions (on balance) and this will benefit shareholders - providing a possible tailwind to my forecasts. I am also assuming interest rates remain roughly at current levels. Of course, this will not be the case. But if rates rise - or go lower - Fairfax will have lots of puts and takes. Below is an 8-year snapshot for Fairfax. It communicates in a concise manner dramatic transformation that has happened at this company, beginning in 2021. It is a pretty amazing story. What are the key assumptions? 1.) underwriting profit: Estimated to increase to a record $1.3 billion in 2023. I am forecasting Fairfax’s combined ratio (CR) to remain flat at 94.5 in 2023 (the same as 2022). When the Gulf Insurance Group transaction closes in 2H-2023, Fairfax should get a nice boost to its insurance business. I think GIG will add about $1.7 billion to net written premiums, which should drive low double-digit top-line growth in 2024. The hard market will end at some point. But do things quickly turn ugly? Probably not, but I am not sure. 2.) interest and dividend income: Estimated to increase to a record $1.9 billion in 2023. The average duration of the fixed income portfolio was increased to 2.4 years in 1H-2023. GIG should add about $2.4 billion to the total investment portfolio. PacWest loans will deliver incremental interest income (of $80-$90 million?), with half coming in 2H-2023 and the other half in 1H-2024. Eurobank: the plan is to start paying a dividend in 2024. If this happens, we might see dividend income increase by $40 to $50 million. Potential headwind: Short-term treasury rates might come down in 2024. If this happens, interest income on cash/short term balances could fall. 3.) Share of profit of associates: Estimated to increase to a record $1.1 billion in 2023. Earnings at Eurobank, Poseidon/Atlas, EXCO, Stelco and Fairfax India, in aggregate, should continue to grow nicely. 2023 headwind: Sale of Resolute Forest Products - Contributed $159 million in 2022. 2024 headwind: I estimate GIG will contribute $100 million in 2023. When Fairfax’s purchase of Kipco’s stake is approved the financial results for this holding will be reported with Fairfax’s insurance operations. In anticipation of this deal closing later in 2H-2023, I removed $100 million from my 2024 estimate. 4.) Effects of discounting and risk adjustment (IFRS 17). Interest rate changes drive this bucket. My estimates here could be a little messed up. Given I am forecasting interest rates to remain about where they are today, I am leaving this number the same over the forecast period (at my estimate for June 30, 2023). 5.) Life insurance and runoff. This combination of businesses lost $167 million in 2022. I am forecasting this bucket to lose $200 million in each of the next three years. 6.) Other (revenue-expenses): improving results from consolidated holdings. In the near term, we could get write downs in both Boat Rocker and Farmers Edge. With Covid in the rear-view mirror, earnings at Recipe could move higher ($100 million per year?). Earnings at Dexterra are growing again. AGT is a sleeper holding. Grivalia Hospitality is in its peak investment phase; earnings could grow nicely looking out a year or two. This bucket is poised to grow nicely for Fairfax in the coming years. 7.) Interest expense: A slight increase. 8.) Corporate overhead and other: A slight increase. 9.) Net gains on investments: Estimated to come in around $900 million in 2023. My estimates assume (this is very general): Mark-to-market equity holdings of about $7.8 billion increase in value by 10% per year, or $800 million. A small bump of $200 to $250 million per year for additional gains (equities and fixed income). ---------- My estimated total return on the investment portfolio for each year is as follows: 2023 = 8.0% = $4.5bn / $56bn 2024 = 7.6% = $4.5bn / $59bn 2025 = 7.8% = $4.7bn / $61bn What is the math? For each year, add the following line items: 2.) + 3.) + 6.) + 9.) and divided the total by the estimated value of Fairfax’s investment portfolio. These estimated annual percent returns, while high compared to recent years, are driven largely by the spike in interest and dividends and share of profit of associates. ---------- 10.) Gain on sale/deconsol of insurance sub: This is a wild card. This is where I put the large asset sales. In 2022, it was the sale of pet insurance business. In 2023, it was the sale of Ambridge and the pending purchase of GIG (resulting in a write-up of the existing holding). For 2024 and 2025, I estimate no gains from sales/write up of assets. There could be something: Perhaps we get a Digit or AGT IPO. Perhaps Fairfax sells another holding for a large gain. This ‘bucket’ is perhaps where I will be most wrong with my forecast. Developments here will likely have a material positive impact to Fairfax’s reported results (earnings and book value). 11.) Income taxes: estimated at 19% 12.) Non-controlling interests: estimated at 11% (not really sure) 13.) Shares Outstanding: Estimated that effective shares outstanding is reduced by 500,000 per year. This is in line with a normal year from Fairfax. Notes: Underwriting profit: Includes insurance and reinsurance; does not include runoff or Eurolife life insurance. Interest and dividends: Includes insurance, reinsurance and runoff.

-

@StubbleJumper and @Tommm50 , great comments. I have said many times, i am not an insurance guy. So i really appreciate hearing from those who work(ed) in the industry. I appreciate the colour. And please point out the flaws in my logic in my posts… otherwise i will just keep repeating my mistakes. Thank you.

-

@StubbleJumper i have enormous respect for your knowledge about all things insurance. So please keep the comments coming. I agree there is a risk that the hard market could quickly reverse and become a shit show - which would hit underwriting income. But what is the probability of that actually happening? My understanding is when the last hard market ended things went sideways for 3 or 4 years - it did not deteriorate into a shit show. My point is risks need to be considered. And probabilities attached. Insurance companies are laser focussed on generating an acceptable return for shareholders. Pricing (rate increases) look like it actually accelerated a little higher in Q2. With my estimates/forecasts i lean heavily on what i think i know. That is why i only like to look out about 2 years. As new information becomes available i will make updates.

-

@StubbleJumper i agree that the insurance market will soften at some point in the future. I also think the investment side of Fairfax is being underestimated. Investors don’t know what they are going to do with all the cash that will be rolling in so they are very conservative with their return estimates from investments. My big miss with Fairfax the past couple of years is how well they are executing on the capital allocation front and the impact that is having on earnings. As a result my past earnings estimates (looking foolishly high when made) have been too conservative. I expect Fairfax will continue to allocate capital well in the coming years. My guess is increasing returns from investments will more than offset any slow down in underwriting profit looking out a few years.

-

The key to forecasting is getting the ‘big rocks’ right. From an earnings perspective, there is no more important item to Fairfax today than ‘interest and dividend income.’ This one ‘bucket’ now represents about 40% of Fairfax’s total pre-tax earnings. Next year it could be as high as 45% of pre-tax earnings. So, if we can get can get our estimates for this part of earnings modelled properly we should be well on our way to coming up with a quality earnings estimate for the company as a whole. When looking at ‘interest and dividends’ for Fairfax, dividends represent about 7% of the total. Interest income represents about 93% of the total, so that is what we are going to focus on. Two items drive interest income: The size of the fixed income portfolio The average yield earned on the investments held in the portfolio It is quite simple. It is relatively easy to calculate. It is not volatile quarter to quarter. And it is predictable, looking out a couple of years. This is why ‘interest and dividend income’ is considered the highest quality source of earnings for an insurance company. So, let’s look at Fairfax and see what we can learn. How big is the fixed income portfolio at Fairfax and how fast is it growing? The fixed income portfolio at Fairfax is about $40 billion today. In 2016, it was $20.3 billion. Over the last 7 years, the size of the portfolio has doubled, which is growth of about 10% per year. Growth in 2024 should be similar (at 10%, or $4 billion). The GIG acquisition will add around $2.4 billion to investments when it closes later this year. Earnings are coming in strong and we are still in a hard market, which should also support modest growth of the fixed income portfolio in 2024. Next, let’s review the average yield. From 2016 to 2022, Fairfax earned an average of about 2.4% on its fixed income portfolio (see chart below). Yes, that is a low number. Fairfax has been very conservative with the positioning of their fixed income portfolio over the past 7 years (low duration and high-quality holdings). What about 2023? The average yield in 2023 is estimated to be about 4.5%. What about 2024? The average yield in 2024 is estimated to be about 4.8%. The average yield that Fairfax is earnings on its fixed income portfolio has doubled. This is important: The size of Fairfax’s fixed income portfolio has doubled over the past 7 years. At the same time, the rate of return that Fairfax is earnings on its fixed income portfolio looks like it is also poised to double. Investors are getting served up a double-double with Fairfax’s fixed income portfolio (that line will only make sense to Tim’s coffee drinkers). What does it mean for Fairfax? Interest income is poised to increase from $514 million in 2016 to an estimated $2.1 billion in 2024. That is a 300% increase over 8 years. Exactly what you would expect when the size of the portfolio doubles and the rate of return also doubles. Average duration In the first quarter we learned that Fairfax had materially extended the average duration of their fixed income portfolio and as of June 30, 2023, it was at 2.4 years (from 1.6 years at Dec 31, 2022, and 1.2 years at Dec 31, 2021). This is important because it locks in the rate of return on a large part of the portfolio for a couple of years making the earnings stream more durable. What does this mean for investors? The most important bucket of earnings for Fairfax (for a P&C insurer), interest and dividend income, is poised to deliver a record amount in 2024. And 2025 looks promising as well. Efficient Market Theory Of course, everything I have written above is from publicly available information. So, it is priced into the share price of Fairfax’s stock today. Right? Fairfax’s Price Earnings Ratio = 5.6 = $843 / 2023 $150E per share (as of Aug 4, 2023) My current estimate (another word for guess) is Fairfax could earn about $150/share in both 2023 and 2024 (that will be the topic of a future post). Given my analysis of interest income above, I trust my earnings number (please note, that doesn’t mean you should!). So, the appropriate question for me to ask: “is 5.6 an appropriate multiple to pay to get $150 in estimated earnings from Fairfax.” Mr. Market thinks so. I disagree. I think the multiple is too low. My guess is Mr. Market does not yet fully grasp the significance of what a fixed income double-double means for the future earnings of Fairfax. Dividends Extending its close partnership with Kennedy Wilson (KW), Fairfax also invested $200 million in preferred shares of KW with a 6% dividend. This will deliver an incremental $12 million in dividend income to Fairfax each year. Eurobank would like to start paying a dividend, likely in 2024. As a result, I have added $40 million in dividends to my forecast for 2024. Interest & dividend income = interest income + dividend income - investment expenses. ————— Interest rates are once again moving higher Interest rates have moved higher in recent months. As a result, Fairfax will have the ability to continue to re-invest maturing bonds at higher yields. This suggests interest income has not peaked.

-

@StubbleJumper i agree with everything you said. There are a few analysts out there who clearly do not follow Fairfax all that closely. But they are at least smart enough to raise their price targets over time (to reflect improving quality of earnings). The problem with Morningstar is they are sticking with C$790/share fair value estimate for the stock. That makes them look like idiots. It reflects badly on Morningstar as a company. RBC uses Morningstar as part of its research coverage offered to investors. So it also makes RBC look foolish, given Fairfax is a very large Canadian company. The solution is for Morningstar to end coverage of Fairfax. But to @Parsad ‘s comment, some investors probably make decisions based on what companies like Morningstar have to say - and that just creates fat pitches for other investors. So i guess i should welcome their idiocy.

-

@John Hjorth thank you for your comments. To answer your question, yes, guests can download the PDF file for free. That is why the post was put in the Books thread. Making the file available for free was very important to me - its goal is to educate and entertain. To do this it also needs to be accessible to all. Hopefully it pulls more investors to this wonderful forum and motivates them to become active, contributing members.

-

The movie 'Groundhog Day' keeps playing out for Fairfax shareholders and the Total Return Swaps. Another month has gone by and Fairfax is once again sitting on another big unrealized gain for this position. Five weeks into Q3 the position is up another $184 million, or $8/share. The cumulative gain on this one investment is now about $921 million, or $40/share (pre-tax) in 32 months. Well, Bill Murray does get the girl in the end. Fairfax shareholders are making out pretty good themselves. ---------- Let's try and conceptualize what this size of a gain means for an insurer like Fairfax. Fairfax has earned an average of $345 million per year on this investment since inception. Most insurers invest primarily in fixed income instruments. What size of a fixed income portfolio would Fairfax need to earn $345 million per year in interest income? With a yield of 4.5%, Fairfax would need a fixed income portfolio of $7.7 billion to generate $345 million in interest income. So the TRS position the past 32 months has generated a return equivalent to a $7.7 billion fixed income portfolio. That is insurance speak for 'holy shit!' For perspective, WR Berkley had a total investment portfolio of $22.9 billion at Dec 31, 2022; Markel was $27.4 billion. So $7.7 billion is a big deal. The TRS position is definitely punching above its weight for Fairfax right now. And the success of the TRS position demonstrated the power of Fairfax's business model when it comes to investing versus a traditional insurer. At least when it's working, like The TRS position has been for the past 32 months. Tax treatment: does anyone have any insight on the tax treatment of interest income and gains from a TRS? What is the TRS-FFH investment? In late 2020 and early 2021, Fairfax purchased total return swaps giving it exposure to 1.96 million Fairfax shares with an average notional amount (cost) of US$373/share. At the time, Fairfax had about 26.2 million effective shares outstanding, so this investment represented 7.5% of the company’s shares. Effective shares outstanding at the end of Q2, 2023 dropped to 23.2 million so this investment now represents 8.4% of the company’s shares.

-

Updated September 10, 2024 Another update of my book/collection of posts on Fairfax is attached below. I don't re-read the entire document when I post updated versions. If you see any big errors please let me know. The document now almost 500 pages. My goal is not size - but I will continue to add material that I think adds value for those interested in learnings more about Fairfax. Please note, not everything in the book has been brought up to date. That would have required a couple of months of work… and by the time it was done, much of it would be out of date again. My current plan is to keep updating parts of the document as time goes by. It continues to be a working document for me. The bottom line, this document should be a much better resource for board members / investors than what existed before. I hope you find it useful. --------- For members who enjoy reading my posts on Fairfax I have attached at the bottom of this post two documents: 1.) Fairfax - The Emergence of a Wonderful Companyt: PDF file contains about 80 of my best posts on Fairfax, organized into 17 chapters (now +400 pages long). 2.) Excel workbook: companion document to the PDF file, contains 11 worksheets (see below for details). Sanjeev, thanks for everything you do running this board. For all the members on this investing forum, ‘thank you’ for breaking bread on a daily basis and sharing your thoughts on investing and life. Over the years, it has been a life changing experience for me and my family. What is contained in this document is the collective wisdom of this group. Let’s hope i have captured it reasonably well. I always appreciate getting some feedback… maybe one or two things you like and one or two things you don’t. What is missing? Thank you. A message from the legal department: Both documents are incomplete and contain errors. What is contained in the attached documents is not intended to be investing/financial advice. Its purpose is to educate and entertain. ----------- The Excel file contains 11 worksheets: 1.) FFH-23: lists and tracks many of Fairfax's equity holdings in real time 2.) Size: ranking of Fairfax's equity holdings by size 3.) Moves: detailed compilation of many on Fairfax's transitions going back to 2010 - organized by year 4.) 23 Earn Est: detailed 2023 earnings estimate 5.) Premiums: the build for 'underwriting profit' 6.) Interest: the build for 'interest and dividend income' 7.) Associates: the build for 'share of profit of associates' 8.) Consol: Non-insurance Consolidated Companies 9.) Investments: the build for return on the total investment portfolio 10.) Shares: reviews 'effective shares outstanding' 11.) Float: the build for float 12.) 13yr View: A 13 year view of many key metrics for Fairfax 13.) IFRS 17: Effects of discounting and risk adjustment - quarterly summary of build Fairfax Financial Volume 2 - Sept 10 2024.pdf Fairfax Aug 28 2024.xlsx

-

@nwoodman Atlas has been my watch-out for a while. Unlike Fairfax, they appeared unprepared for higher rates. Head scratcher for me. I am pretty sure Eurobank had some hedges or something so they actually benefitted from higher rates early in 2022 - my thinking at the time was someone from Fairfax got to them and Eurobank got positioned properly. But Atlas… disappointing. I am not concerned. Its just a step back for the business - before they continue to move forward. Thank god they are a private company where it is much easier to take the medicine and get on with it.

-

@SafetyinNumbers that is a great point. The difference between fair value and carrying value for associate and consolidated holdings is significant and should be included in the discussion of BV. Additional margin of safety.

-

@AlwaysDay1 my writing is a little unclear at times… i am saying 2 things will likely bump interest and dividend income to over $500 million in Q3: 1.) incremental interest earned from $1.8 billion PacWest portfolio 2.) incremental interest earned from bonds that mature and are rolled over at higher maturities

-

@LC here is my logic. 10% on $1.8bn = $180mn. But we need to net out what they were earning on the $1.8 billion previously. My guess is 5% = $90 million. So we get $90 million in incremental earnings. Some of this will be investment gains (not dividends) as the bonds were purchased at a discount. So my guess is incremental interest and dividend amount will be $80 million or $20 million per quarter. I didn’t come across the dividend amount. Please share (if anyone else knows).

-

That was the number that slapped me upside the head when i was reading… WOW!

-

Great quarter. Boring. But let’s look under the hood to see what we can learn. Here are three key takeaways: 1.) interest and dividend income = $464.6 million. This is now running at $1.86 billion/year. This does not include: - the higher interest income from the $1.8 billion in PacWest loan portfolio. This closed late in Q2. My guess is this will add $20 million per quarter to interest income. - as bonds continue to mature, Fairfax will be able to re-invest them at a much higher rate. My guess is Interest and dividend income for Q3 will be above $500 million. That would put it at $2 billion per year. That is $86/share. Fairfax is trading at 9.4 x estimated annual interest and dividend income. Holy shit Batman! 2.) combined ratio = 93.9. This was an elevated quarter for catastrophe losses… so this is a very good result. What happened? “…prudent expense management and decreased catastrophe losses.” Reading that in a Fairfax press release is music to my ears. Fairfax said they were decreasing Brit’s exposure to catastrophes and it appears we are seeing the benefits of this play out (probably company wide). My thesis is Fairfax has been slowly improving the quality of their insurance businesses for the last decade (under Andy Barnard’s leadership) and results this quarter support this idea. And how about Allied World’s CR of 91%… this sub looks like it has supplanted Odyssey as Fairfax’s top performing insurance sub. 3.) interest rates spiked late in Q2. We knew Fairfax was going to take a hit on their fixed income holdings in the quarter and now we know the number: a loss of $405.3 million. But this is a great thing for Fairfax. Their balance sheet has completely digested the spike in interest rates we have seen over the past 6 quarters. This is a big deal. Higher interest rates are a big tailwind for Fairfax. Their fixed income portfolio is still pretty low duration (2.5 years at the end of Q1). So lots of bonds will be rolling off every quarter. And Fairfax will now be able to reinvest at much higher rates, locking it in for years into the future. I hope we learn on the conference call what the average duration of the fixed income portfolio was at the end of Q2.

-

@OCLMTL welcome to the wild side (posting). Thanks for sharing your thoughts. I agree with you that the current valuation makes no sense… even with the big move in the share price. we are learning a few things: 1.) Fairfax shares got stupid cheap. So everyone’s starting/reference point is wrong. 2.) The phenomenal growth in the insurance companies over the past decade spiked the earnings power of the company - but low interest rates and Fairfax’s strategy of going low duration hid this increase in earnings power for a couple of years. 3.) the execution by the team at Fairfax is still being grossly under appreciated. Especially what they did with their fixed income portfolio. The spike in earnings is happening. It is sustainable. But few understand or believe. 4.) Investment professionals are still in denial. Its almost like a badge of honour in the industry to say ‘i haven’t followed Fairfax for the past five years’ and then they follow it up with ‘oh, and don’t invest in that company… its a mess.’ Meanwhile their clients portfolios underperform. Psychology is such an important part of investing. I was talking to a family member about Fairfax tonight (they are way up on their investment) and they asked me if it was time to sell and lock in crazy big gains? I said ‘forget how much you are up for a second. You own a well run company and it is trading at 5.5 x earnings and its future prospects are very good. What do you think you should do?’ They got a blinding glimpse of the obvious - they decided to stay invested. I probably should have told them to stop looking at the stock price every day… hard when it keeps hitting fresh all time highs.

-

@Maxwave28 your understanding is correct. When i do my updates i use the old accounting logic as much as possible. And 4.) becomes a plug kind of number. We will learn more about IFRS 17 when Fairfax reports tomorrow. My expectation is it will impact 4.) My hope is, over time, we will slowly learn what drives 4.) and how much (like changes in interest rates). So we can make educated guesses in models. Right now i feel like i am flying a little blind. I am not concerned.

-

@steph you are welcome. I learn so much from other posters… and what i learn usually makes its way into my future posts. This is a great community. We are very lucky right now. I have been following Fairfax for about 20 years. Only 2 other times has the set up looked as favourable as it does today: 2003 (short attack) and 2006/07 (short attack when they were sitting on giant CDS position). We all need to thank the gods for how everything with Fairfax has played out over the past 33 months. It has been a crazy wonderful ride. And the stock still trades well under 6 x 2023E earnings. Nuts.

-

@nwoodman great comment. But i would take it a step further. I think Fairfax has been winnowing the vast collection of contacts they have. I think they know today who the top performers are. And the top performers are the ones getting the cash. And this has been happening for a few years. How will we know? Future results… when they keep surprising to the upside.

-

Kennedy Wilson is a misunderstood and underappreciated part of Fairfax’s investment portfolio. Most investors think of Kennedy Wilson through the lens of an equity holding. Looking at the performance of KW’s stock price the past 5 years… what a dog! Woof! KW shares were trading around $21.40 five years ago and today they closed at $16.44/share. What a terrible investment by Fairfax. Right? Wrong. Kennedy Wilson has been one of Fairfax’s best investments. What is wrong with the analysis above? It completely misses the point of WHY Fairfax is invested in Kennedy Wilson – it is to tap into Kennedy Wilson’s extensive global real estate expertise. First, let’s do a quick review. Fairfax began its relationship with Kennedy Wilson in 2010. A very successful real estate investment partnership has recently blossomed to now include a significant real estate debt platform. Over the past 3 years, Kennedy Wilson has become a much more important part of Fairfax’s investment portfolio. The partnership now includes both equity and fixed income investments: 2010: $100 million direct investment in Kennedy Wilson stock 2010: Real estate investment partnerships 2020: Real estate debt platform 2022: $300 million debenture (4.75%) 7-year warrants for 13 million common shares with strike price of $23. 2023: Purchase of $2.3 billion in real estate loans from PacWest 2023: $200 million debenture (6%) 7-year warrants for 12.3 million common shares with strike price of $16.21 Roughly, how much does Fairfax currently earn annually from its different investments with Kennedy Wilson? My very rough estimate is around $481 million. Fairfax has about $5.7 billion invested with Kennedy Wilson so this represents about a 8.4% annual rate of return for Fairfax (mostly interest and dividends). Of this total, about $429 million is interest and dividends. The PacWest loan transaction just closed so the incremental earnings from this investment will start to show in the interest and dividend income bucket starting in Q3. The expansion of the relationship with Kennedy Wilson provides another good example of how Fairfax over the last 5 years has been: Leveraging and expanding existing, successful, long-term partnerships Methodically diversifying their investment portfolio - in this case into real estate The result is yet another new, growing, significant and steady stream of earnings for Fairfax. ————— What is the timeline of Fairfax’s various investments in/with Kennedy Wilson? Started in 2010 Kennedy Wilson (KW) stock initial equity investment was US$100 million (9% of company) today position is worth $200 million (13.3 million shares x $14.98/share) current annual dividend of $0.96 = 6.4% yield = $12.8 million in dividend income per year Wade Burton is on the board (along with Stanley Zax, who sold Zenith to Fairfax in 2010) investment partnership: started with $278 million in 2010 Prem’s 2022 letter: “we have invested $1.2 billion alongside with them in real estate, have received cash proceeds of $1.1 billion and still have real estate worth about $570 million. Our average annual realized return on completed projects is approximately 22%.” Expanded in 2020 Launched a real estate debt platform: to pursue first mortgage loans secured by high-quality real estate in the Western U.S., Ireland and the U.K. 2020 = initial amount of $2 billion 2022 = increased to $5 billion Prem’s 2022 letter: “$2.4 billion invested through Kennedy Wilson in well-secured first mortgages, primarily on high quality residential apartment buildings, at a floating rate (currently 7.9%)” = $190 million in interest income. Expanded further in 2022 2022: KW perpetual preferred equity investment = $300 million pays an annual dividend of 4.75% = $14.25 million includes 7-Year warrants for 13 million shares at strike price of $23/share. Expanded further in 2023 PacWest debt purchase of $2.3 billion: KW is buying loans at a discount for $2.1 billion, of which Fairfax is buying $2 billion (95%). Fairfax is also assuming $1.7 billion in future funding obligations. Average loan to value is 51%. More than 70% of the loans relate to multifamily or student residences; the remainder are a mix of industrial, hotel and life sciences office property projects. Fairfax expects the average annual return to exceed 10%. Remaining term to maturity is 1.7 years, with some loans carrying extension rights (max 2 years). 2023: KW perpetual preferred equity investment = $200 million pays an annual dividend of 6% = $12 million includes 7-Year warrants for 12.3 million shares at strike price of $16.21/share. Ownership of stock: Kennedy Wilson has 139.4 million shares outstanding Fairfax owns 13.3 million = 9.5% Fairfax also owns warrants: 13 million at $23 12.3 million at $16.21 If Fairfax exercises all warrants it would own 38.6 million shares = 23.4% (164.7 total) Fairfax is getting paid 4.75% and 6% while waiting for the warrants to get in the money (they have seven years). What does Fairfax see in Kennedy Wilson? Prem’s comment from the 2022 press release from Kennedy Wilson announcing the PacWest transaction: “We are pleased to make this new investment in Kennedy Wilson and to build on our outstanding partnership that dates back to 2010,” said Prem Watsa, Chairman and CEO of Fairfax. “We believe in their global business model, the strength of their high-quality, income-generating assets, and their best-in-class management team.” https://ir.kennedywilson.com Q4 2022 Investor Presentation: https://ir.kennedywilson.com/~/media/Files/K/Kennedy-Wilson-IR-V2/reports-and-presentations/presentations/q4-2022-investors-presentation.pdf ————— Interesting trivia point: Bill McMorrow (CEO and Chairman of KW) was the genesis behind Fairfax's investment in Bank of Ireland in 2011. Fairfax made around $1 billion from that one investment. Thank you, Bill! (see Prem's comments below from 2011AR) ————— 2020: Kennedy Wilson and Fairfax Launch New $2 Billion Real Estate Debt Platform https://ir.kennedywilson.com/news-events-and-presentations/press-releases/2020/05-14-2020-105955816 “Kennedy Wilson and Fairfax first invested together in 2010 when the two companies acquired $250 million of real estate assets, including real estate secured loans and real property. Over the past decade, the companies have partnered on $7 billion in aggregate acquisitions, including over $3 billion of real estate related debt investments. In addition, Fairfax currently has an equity ownership interest in Kennedy Wilson of approximately 9%.” 2022: Kennedy Wilson Announces $300 Million Perpetual Preferred Equity Investment From Fairfax Financial https://ir.kennedywilson.com/news-events-and-presentations/press-releases/2022/02-23-2022-211613501 “Kennedy Wilson and Fairfax began their relationship in 2010 when Fairfax made a $100 million equity investment in Kennedy Wilson. Over the past decade, the companies have partnered on $8 billion in aggregate acquisitions, including approximately $5 billion of real estate related debt investments. Fairfax currently has an equity ownership interest in KW of approximately 9%.” ————— 2023: Fairfax Financial Partners With Kennedy Wilson to Acquire Loan Portfolio From Pacific Western Bank, Makes Additional Equity Investment in Kennedy Wilson https://www.fairfax.ca/press-releases/fairfax-financial-partners-with-kennedy-wilson-to-acquire-loan-portfolio-from-pacific-western-bank-makes-additional-equity-investment-in-kennedy-wilson-2023-06-05/ Kennedy Wilson’s Press Release https://ir.kennedywilson.com/news-events-and-presentations/press-releases/2023/06-09-2023-110020523 “The acquisition of this Loan Portfolio from Pacific Western Bank highlights Kennedy Wilson’s historic ability to find off-market transactions during periods of uncertainty, move with speed, and build on our successful track record of investing through all real estate cycles,” said William McMorrow, Chairman and CEO at Kennedy Wilson. “The foundations of Kennedy Wilson are our deep relationships, our reputation as a great partner, and our strength in being nimble when opportunity arises; all of which came into play with this loan portfolio acquisition.” ————— 2022AR Prem: “Since we met Bill McMorrow and Kennedy Wilson in 2010, we have invested $1.2 billion alongside with them in real estate, have received cash proceeds of $1.1 billion and still have real estate worth about $570 million. Our average annual realized return on completed projects is approximately 22%. We also own 10% of the company. More recently we have been investing with Kennedy Wilson in first mortgage loans secured by high quality real estate in the western United States, Ireland and the United Kingdom with a loan-to-value ratio of 60% on average. At the end of 2022, we had invested in $2.0 billion of mortgage loans in the U.S. at an average yield of 8.1% and an average maturity of 1.7 years, and in approximately $350 million of mortgage loans in the U.K. and Europe at an average yield of 6.0% and an average maturity of 2.5 years.” “The combination of interest and dividends and profit from associates accounted for a 3.7% return on our portfolio in 2022, the highest return in the last five years (average 2.5%). We expect to earn these returns in 2023 as well, partly because we have $2.4 billion invested through Kennedy Wilson in well-secured first mortgages, primarily on high quality residential apartment buildings, at a floating rate (currently 7.9%).” ————— 2013AR: “The KWF LPs are partnerships formed between the company and Kennedy-Wilson, Inc. and its affiliates to invest in U.S. and international real estate properties. The company participates as a limited partner in the KWF LPs, with limited partnership interests ranging from 50% to 90%. Kennedy-Wilson holds the remaining limited partnership interests in each of the KWF LPs and is also the General Partner. For the KWF LPs where the company may exercise veto rights over one or more key activities, those partnerships are considered joint ventures under IFRS 11. Where the company has no veto rights over key activities, the company is considered to have significant influence under IAS 28. The equity method of accounting is applied to all of the KWF LPs.” ————— 2011AR Prem: “I have attended the Berkshire Hathaway shareholders’ meeting since there were only 200 shareholders in attendance about 30 years ago. I still find I learn something each year from Warren and Charlie. At the meeting in 2010, I met Bill McMorrow through Alan Parsow, who is a money manager based in Omaha and a great friend. Bill founded Kennedy Wilson, a real estate services and investment company, in 1988, and he now owns 26% of the company. As a result of this meeting, we invested $100 million in a Kennedy Wilson 6% preferred convertible at $12.41 per share, and later purchased $32.5 million of a 6.45% preferred convertible at $10.70 per share and 400,000 common shares at $10.70 per share. Fully diluted we own 18.5% of the company. In 2010 and 2011, we also invested $290 million in several real estate deals with Kennedy Wilson in California, Japan and the U.K. – deals at significant discounts to replacement cost and with excellent unlevered cash on cash returns, in which Kennedy Wilson is the managing partner and a minority investor. We are thrilled to be partners with Bill and his team, who always focus on the downside and have the expertise to manage these investments and finally harvest them. You never know what you will find at a Berkshire meeting!!” “And there is more to the McMorrow story. While Bill was negotiating the purchase of some real estate loans from Bank of Ireland, he was really impressed with Ritchie Boucher, the Bank’s CEO. Bill introduced Ritchie to us, and we too were very impressed. With the help of our friends at Canadian Western Bank, one of the best banks in Canada, we thoroughly reviewed the opportunity and then quickly formed an investment group with Wilbur Ross, Mark Denning from Capital Research and Will Danoff at Fidelity, which purchased $1.6 billion of Bank of Ireland shares on a rights issue (Fairfax’s share was $387 million).”

-

@nwoodman thanks for posting the article. Eurobank’s guidance for EPS was increased from €0.22/share to €0.28/share. Shares closed today at €1.59/share. I am wondering if the earnings of Fairfax’s various associate and consolidated equity holdings will exceed expectations when they report on Thursday. Eurobank is the biggest, so we are already off to a great start. Recipe? Thomas Cook?