Viking

Member-

Posts

4,920 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

My guess is with Trump we are entering uncharted waters (at least in terms of the last 75 years or so) in terms of what a President will try to do. And people want change. So my guess is he will get a lot of rope, especially early. I think we are likely going to get a lot of different ideas/actions. Kind of like a bunch of science experiments all happening at the same time - where we aren’t really sure how they are all going to work out (individually or collectively). I agree. I think there is a risk inflation could surprise to the upside looking out 12 to 24 months. Except i also think Trump will not tolerate a Fed that does not do what he wants (another science experiment). Bond vigilante's? Like a game of ‘whack-a-mole’, Trump and his team will not sit idly by. But the US seems to want change. I think Trump is going to deliver - in spades. I am cheering for him and the US. I hope it works out / goes as planned. At the end of the day, we want people/countries to succeed. And perhaps there are parts of his plan that other countries can use to their advantage. But the next round of elections are only 2 years away… so pitter patter he better get atter. And i think he will.

-

@Xerxes Hopefully there are a lot of people on this board who have been able to make a little money on Fairfax's amazing 4-year run. And yes, the run we have seen in 2024 has been epic (after how much it had already gone up in 2021, 2022 and 2023). The crazy thing is the stock is still cheap. Yes, not as cheap as it was... but still cheap. Why is it still cheap? 1.) Its past performance (last 4 years), measured by change in BVPS, has been best in class among P/C insurance companies. 2.) Its P/C insurance businesses are better quality than is generally understood. 3.) Its investment portfolio is poised to delivering a return of +7.5% per year, which is exceptional. 4.) As a result, the company is poised to deliver ROE of 15% for each of the next 3 years. 5.) Its management team has been executing very well over the past 5 or 6 years. Its capital allocation has been exceptional (insurance and investments). This suggests ROE should continue to be very strong looking out 4 or more years. Yet, despite the historic increase, the stock continues to trade below peers (P/BV and PE). Given its past performance, outlook and strong management team, should Fairfax not trade at a premium to peers? The only reason to say 'no' is because it hasn't historically. But that isn't true. For many years, Fairfax traded at a significant premium to peers. Most investors just either don't know this, or they have forgotten. Fairfax has morphed from a turnaround to a value play. It is now morphing right in front of everyone's eyes into a quality play. (That is called multiple expansion for those of you who are not paying attention.) As Fairfax demonstrates that it is indeed a high quality company, it deserves to trade at a higher multiple. And the longer it continues to outperform, the better the multiple it should trade at. This process could run for years. Three things drive a stock price: Earnings Multiple Share count All three are working in Fairfax's favour today. Of the three, multiple expansion is the rocket fuel to the stock price. Just ask a company called Apple - multiple expansion happened continuously over an 8 year period.

-

@gfp I agree. And I think that is what makes using 'macro' as a core input pretty much a losing proposition for most investors. I think there are times when paying attention to macro matters - like when we get to historic extremes (like the 2006/07 housing bubble). I don't think that is where we are today.

-

@73 Reds , there is an easy solution to the problem you have highlighted... and it has been what governments have been doing for hundreds/thousands of years... and that is to inflate it away. I don't think it is all that complicated. Who are the losers? Savers/lenders. Who are the winners? Owners of assets - pretty much everything, excluding fixed income. That is bullish for stocks moving forward. Also bullish for commodities. Real estate (housing). And that is what we have seen over the past decade. Asset prices (in general) have been on fire. And I think the US has just elected a president who is likely to enact policies that could accelerate this trend (if inflation accelerates, my guess is he will do his best to not let the Fed increase rates). It really is a super interesting set up. We could get some pretty wicked volatility - which would be normal when you enter uncharted territory. "Everyone has a plan until they get punched in the face." Mike Tyson - modern day philosopher

-

@73 Reds , my crystal ball is about as good as the next person. Here in Canada, stocks have underperformed for a long, long time. So a 23% move in one year is nothing crazy in my mind. And in the US, if you get lower interest rates, lower taxes, less regulation, return of animal spirits (more business investment), acceleration in onshoring production of goods, and deficit spending from the government… how do stocks not go higher? So i am mildly optimistic for stock returns over the next year (XIC.TO and VOO). I would not be surprised to see a melt-up in stocks. Not my base case. But a possibility. Of course there are watch-outs, like there are every year. Geopolitical would be one. Trump doing something nuts would be another. Super high deficit spending by Western governments would be another - although this is likely more a 2026 or 2027 risk. Perhaps the biggest risk might be a resurgence in inflation later in 2025 or 2026 - this could be a big one because people now hate inflation - and the hand has just been over the flame, so the reaction to a resurgence in inflation from people (and bond/financial markets) could be dramatic. Bottom line, important to monitor. Bit nothing IMHO flashing red today. And looking further out, if Canada elects a Conservative government in October, 2025, that could release animal spirits in the Canadian economy (there are so many important things a new government could do to improve the economy). That would bode well for Canadian stocks for 2026. We could easily see a couple of years of above average returns for Canadian stocks.

-

Fairfax is up 52% + dividend = 54% VOO is up 26% + dividend = 27% XIC.TO is up 21% + dividend = 23% Making money in 2024 has been like shooting fish in a barrel. Congratulations to all those investors who bought pretty much anything - because that is about all it took to do well this year. And i say that with all due respect…

-

Well, at least this is good news for Recipe and their +1,000 restaurants in Canada. Does Prem have Trudeau’s ear? “The government is proposing that the GST/HST be fully and temporarily relieved on holiday essentials, like groceries, restaurant meals, drinks, snacks, children’s clothing, and gifts, from December 14, 2024, to February 15, 2025.” The GST on restaurant meals in Canada is 5%. More for provinces with the HST (harmonized federal and provincial taxes). So this is a meaningful reduction. - https://www.canada.ca/en/department-finance/news/2024/11/more-money-in-your-pocket-a-tax-break-for-all-canadians.html# The current federal Liberal government has to be the worst federal government in Canadian history - at least in my lifetime. And we have had some bad ones. The current $250 cheque per adult + 2 month tax break (on a few things) is just the latest in their bat shit crazy management of the Canadian economy, especially over the past 6 or 7 years. I have tried to keep away from politics - but this Liberal government just keeps setting new lows. I am completely dumbfounded by what they say and do. Fortunately, Canada is less than 12 months away from a federal election - my only hope is that Trudeau stays on as leader of the Liberals. PS: My family will now be getting cheques for 5 x $250 = $1,250. Money we do not need. I suppose i should be celebrating…

-

@modiva , over my investing career I have always been comfortable with cash / cash equivalents. I flex my cash position up at times (when i like the risk/reward set-up). And i flex it back down at times (when i don’t like the risk reward set-up). It continues to amaze me how often ‘once in every 10 or 20 year’ investments come along (often one or two comes along every year). But to capitalize, you often need to have cash on hand. Today my cash weighting is about 15%. If markets continue to rip higher, I will probably increase my cash weighting to 20%. In terms of ‘safe’ assets, when it comes to equities, I think broad based ETF’s/index funds like VOO and XIC.TO fit. But only if you are a long term investor and ok with volatility, sometimes extreme volatility. About 50% of my portfolio is in broad based index funds. I am a new convert to this asset class, making my first purchases about a year ago. So far, I love it. I am also going to be doing some digging to see if I can find a balanced ETF/index fund that is 60% equities and 40% fixed income. My wife is VERY risk averse. A 100% stock ETF/index fund is not a good fit for her (should I no longer be around). So i want to find a fund (perhaps 2) that is a good fit for her and shift some of her assets into it. Just so she knows what to do if I get hit by a bus one day. If we get a melt-up in stocks, i like the idea of shifting into a balanced fund. I think this is also what Boggle did with his portfolio. My views on risk and concentration are evolving. Age and situation are definitely factors. As usual, i am trying to be inquisitive and open minded. Rational. And action oriented. Try stuff, see how I feel, make any necessary course corrections. For me its a pretty dynamic process.

-

@nwoodman, my problem is i am not an accountant. So it takes me some time (and lots of questions to others on the board) to get some things figured out. But we do get there eventually. As always, thanks for the help.

-

What i find very interesting is how a person is wired when it comes to things like risk management and portfolio concentration etc largely comes from their life experiences. The people who lived through the great depression (or people who have lost everything) are a great example. The chances of total loss might be small. But if the consequences are going to be severe... My guess is most people think they are being rational when it comes to risk management. More likely, they are unknowingly betting that something really bad doesn’t happen. For most people it won’t. And that will be confirmation for them that they were right. Even though they were actually wrong. They just got lucky. It is such a fascinating topic.

-

@glider3834 , this makes sense. When Fairfax reports their equity holdings in the AR, when they report non-insurance consolidated holdings they have a zero value for 'other'. It makes sense that is where AGT should be captured... and it looks like it is. Solves a riddle. Another question the Odyssey summary gives us is the approximate total value for Meadow Foods = $250 million (carrying value). I don't think we have ever been told how much Fairfax owns today. On the Q3 conference call, Wade Burton called out Meadow Foods as one of the large private investments over the past 2 years (along with Sleep country and Peak). It's interesting... when running my numbers, the carrying value that Odyssey reports (using US GAAP) did not match up with what Fairfax reports (using IFRS 17) for lots of the holdings. But the market values kind of did match up for most holdings. Which actually makes sense.

-

@glider3834 , thanks for bringing this forward. So we probably can roughly calculate Fairfax's carrying value at Dec 31, 2024 as; 2023 EBITDA = C$160 million = US$115 million Enterprise value = 6 x $115 = $691 million My guess is enterprise value includes debt. Do I need to net debt out before calculating an estimate for Fairfax's carrying value?

-

Can someone educate me a little: Fairfax appears to be reducing its preferred share exposure and shifting it to debt (where the capital is held on the balance sheet is shifting). Other than saving a little (or a lot?) on the cost side (after tax), are there also strategic reasons/benefits to what they are doing? Preferred shares are considered equity capital. Fairfax's financial position and earnings trajectory has never been better.

-

@Hoodlum , thanks for posting the link. This is the part that really got my attention "This sale returns significant capital to AGT." Fairfax took AGT private in 2018. The total company back then was valued at C$436 million. AGT is a large company. Over the years, we have received very little new information on what has been happening at this company - and what its value is today. It makes sense that Fairfax does want to get paid for its significant investment in AGT. Perhaps we see a nice dividend get to sent to Fairfax when this deal closes. ----------- Welcome to 'new Fairfax'. 6 years ago many of the equity holdings were burning cash (at the Fairfax level) and the time of Fairfax's senior management team. 6 years later, after much creativity and effort, Fairfax's equity portfolio has been fixed. New equity purchases since 2018 have been very good (like Stelco). The old portfolio of holdings (from pre-2018) has been completely cleaned up. There will always be a few sub-performers in any equity portfolio - these types of holdings are now de-minimus for Fairfax. This is very bullish for future returns at Fairfax from its equity portfolio (future returns should be much better than past returns). AGT is an example of a legacy company (pre-2018) that Fairfax decided to keep. It will be interesting to learn more about the transaction announced yesterday. After 6 years of ownership, it is likely a good time for Fairfax (and its shareholders) to start to get paid. When you look at Fairfax's current stable of equity holdings... the 'surprises' we are getting are mostly skewed in one direction - we are getting 'good' surprises. Like I said, welcome to 'new Fairfax.'

-

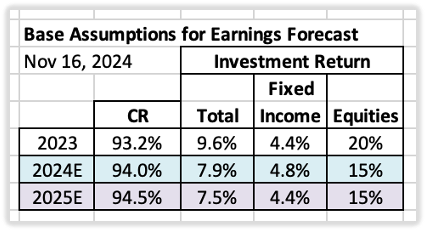

@73 Reds I agree. Fairfax's other 'secret sauce' is not being restricted to bonds when investing. They are currently generating a return of better than 7.5% on their $70 billion investment portfolio. When you combine that with strong underwriting profit... well... +15% ROE is the result. The current fixed income yield of 4.7% is a game changer. As is a 15% return on equities.

-

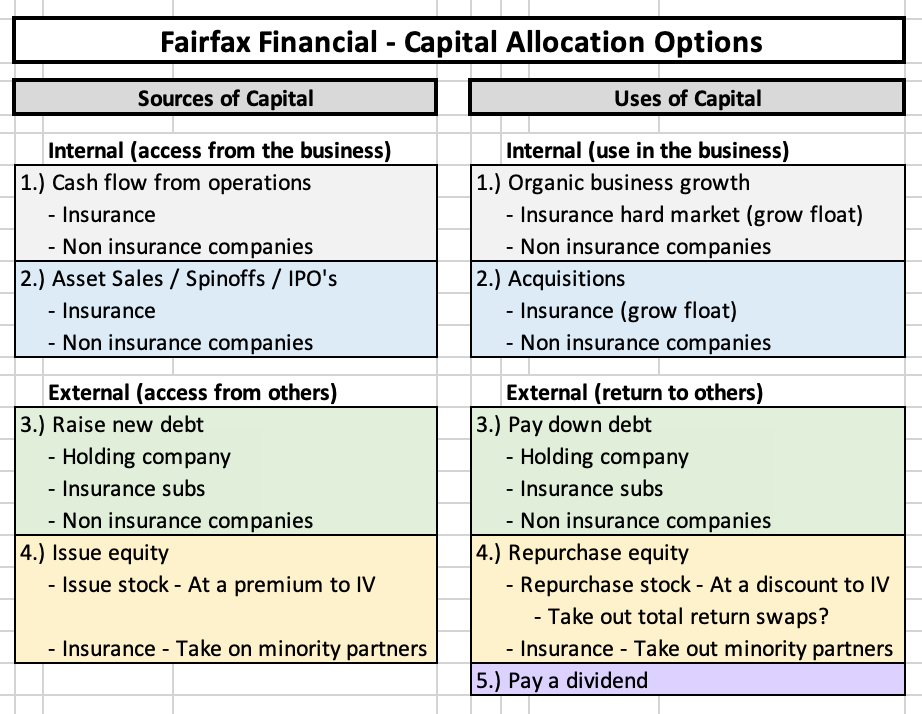

@73 Reds , thanks for the feedback As I continue to peel back the layers on Fairfax, the piece that has me the most excited is capital allocation. I call what Fairfax does 'unconstrained capital allocation' - because they have no self-imposed limitations. In this respect they look an awful lot like Henry Singleton. What Fairfax is doing today - from a capital allocation perspective - looks unique in P/C insurance. Some might use Berkshire Hathaway and Markel as comparable for Fairfax but I don't think that works very well. BRK is now a massive conglomerate, with a large P/C insurance business. This now significantly restricts BRK's options when it comes to capital allocation. Buffett also has many self imposed restrictions. For example, up until recently, he refused to do share buybacks. Bottom line, Berkshire Hathaway today is not a good comparable for Fairfax when it comes to business model/capital allocation. What about Markel? If I have to describe Tom Gaynor's approach to capital allocation it would be: he is doing his best trying to convince his shareholders that he is following in BRK's footsteps. What does that mean? I am not sure. And that is the problem I have with Markel. Instead of going down their own road/path, they appear to be much more focussed on trying to clone/mimic Berkshire Hathaway. Trying to convince others that you are Buffett/BRK reincarnate is not my idea of a well run company. Fairfax, on the other hand, is clearly forging their own path. Their structure is similar to a younger BRK - decentralized operation. Capital allocation managed/driven by the senior team. Well run P/C insurance operations. But how Fairfax does capital allocation is completely different than Buffett/BRK - and it always has been. And Fairfax makes no apologies for it. From my perspective, Fairfax is uniquely positioned today in P/C insurance. They are taking the P/C insurance model that has been used so successfully over the years by so many outstanding investors to create enormous wealth: Buffett/BRK, Singleton/Teledyne, Markel family/MKL, Singleton/Teledyne, Davis etc. The difference is almost all of these great companies are gone or, in BRK's case, have morphed into something else. Fairfax looks like it is in its prime - it is executing exceptionally well. They are in the process of writing a brand new book on how to fully exploit the P/C insurance model - using their style of capital allocation - and in the process, they are building enormous value for shareholders. Do they actually pull it off? (Perhaps a better question is 'how long can they continue to deliver outsized returns for shareholders?') We will have to wait and see. But based on what I have seen over the last 6 years, I really like their chances. The challenge for lots of investors today is they are looking for another Buffett/BRK. And of course, that is never going to happen. History never repeats. But, as we learn from Mark Twain, history does have a habit of rhyming. The key for an investor is to be inquisitive and open minded... and to follow the facts. A capital allocation framework that is unique in P/C insurance today: Each year, the management team at Fairfax takes what Mr Market gives it - they are very opportunistic. This year, it was stock buybacks. Growth in insurance. Digit IPO. Sale of Stelco. Purchases of Sleep Country and Peak. Along with a bunch of other things.

-

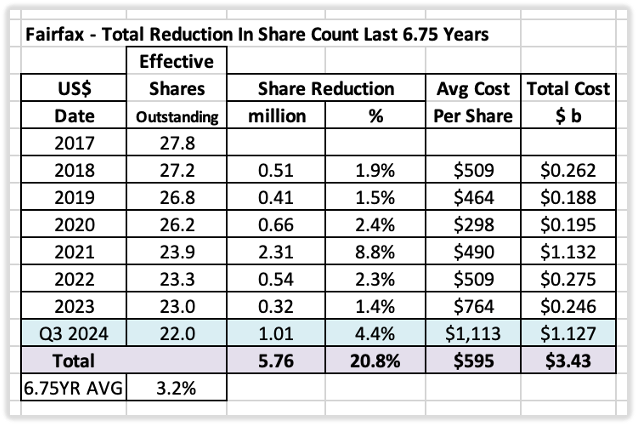

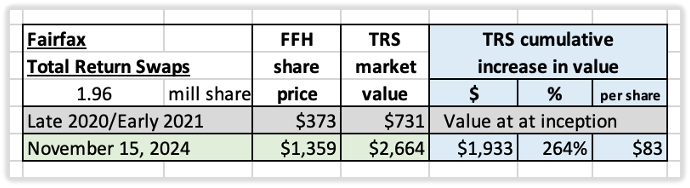

Share Buyback History - Fairfax The big picture Three factors drive stock returns over the long term: Earnings Multiple Shares outstanding The last factor is often ignored by investors. Capital allocation Capital allocation is the most important function of a management team and stock buybacks are one of many options that are available. Share buybacks can be very beneficial for shareholders if they are done in a responsible manner (purchased at attractive prices) and sustained over many years. It is counterintuitive, but for long term shareholders a low share price can be a big benefit - if the company is buying back shares and in a significant quantity. Especially if it persists for years. How does Fairfax approach buybacks? Prem laid out Fairfax’s strategy regarding share buybacks in the 2018 annual report: “I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years.” Prem Watsa – Fairfax 2018AR Fairfax approaches share buybacks from the framework of a value investor: buy back shares when they are cheap and back up the truck when they are really cheap. What has Fairfax been doing in recent years? 2015 to 2017 – Issue shares to fund international P/C insurance expansion. Fairfax’s year-end ‘effective shares outstanding’ peaked in 2017 at 27.75 million. Fairfax issued a total of 7.2 million shares in 2015, 2016 and 2017 to help fund its aggressive international expansion. The new shares were issued at an average price of about $462/share. 2017 to today – Aggressively buy back shares. At September 30, 2024, the ‘effective shares outstanding’ at Fairfax had fallen to 22.0 million shares. Over the last 6.75 years (2018-Q3 2024), Fairfax has reduced effective shares outstanding by approximately 5.67 million shares or 20.8%. The average price paid to buy back shares was about $595/share. That is a significant reduction in shares outstanding. Did Fairfax get good value with its buybacks? From 2018 to 2022, Fairfax was able to buy back 4.4 million shares at an average price of $464/share. The average price paid was the same as the average price of the shares that were issued at from 2015-2017 ($462/share). Fairfax’s book value at September 30, 2024 was $1,033/share. Fairfax’s intrinsic value is well above its book value. Fairfax has been able to buy back a significant number of shares at a very attractive average price – at a significant discount to book value and intrinsic value. Is Fairfax done with buybacks? In the first 9 months of 2024, Fairfax has reduced effective shares outstanding by 1.01 million or 4.4%. That is more than the average for the past 6.75 years of 3.2%. So far in 2024, Fairfax has accelerated the pace of share buybacks. Why is the pace of buybacks picking up? Likely for three key reasons: Robust cash generation: Fairfax is generating an enormous amount of free cash flow. The hard market in P/C insurance is slowing: The P/C insurance companies no longer need capital to grow. In fact, the opposite is happening – the P/C insurance businesses are generating excess capital, which is being sent to Fairfax. Cheap stock: Fairfax’s stock trades at a big discount to its intrinsic value. For the stock repurchased to September 30, 2024, Fairfax has paid an average price of $1,113/share. This price is a slight premium to current book value ($1,033/share). Importantly, book value does not include the following: “At September 30, 2024 the excess of fair value over carrying value of investments in non-insurance associates and market traded consolidated non-insurance subsidiaries was $1,921.4 compared to $1,006.0 at December 31, 2023. The pre-tax excess of $1,921.4 is not reflected in the company’s book value per share, but is regularly reviewed by management as an indicator of investment performance.” Fairfax Q3-2024 Interim Earnings Report This is $1.9 billion, or $87/share (pre-tax), in value that is not captured in book value. Bottom line, in 2024 Fairfax has bought back more than 1 million shares, or 4.4%, at $1,113/share. Which is less than 1 x 2024 year-end ‘adjusted’ book value (if we include excess of FV over CV). That is delivering exceptional value to long term shareholders. ————— Fairfax’s total return swaps (TRS) on 1.96 million Fairfax shares Some investors consider this investment to represent a buyback of sorts. Over the past 4 years, the TRS-FFH has increased in value by about $1.9 billion (before carrying costs). This is turning into one of Fairfax’s best investments ever. ————— What does Warren Buffett have to say about share buybacks? ---------- Tracking the Per Share Change in Net Premiums, Investments and Float - Fairfax Three of the most important metrics to measure the growth of a P/C insurance company over time are net premiums written, total investment portfolio and float. The change in the total values is important. But what is much more important, is the change in per share values over time. How has Fairfax performed? Over the past 9 years, growth at Fairfax across all three metrics has been very strong. Especially when measured per share. Net premiums written CAGR per share = 15% Investment portfolio CAGR per share = 12.3% Float per share CAGR = 12.5% The growth from 2016 to 2018 was driven by acquisitions (and share issuance). The growth from 2019 to 2024 has been driven by the hard market in insurance (and share repurchases). It should be noted that Fairfax has achieved this impressive growth in both soft and hard P/C insurance markets. Perhaps surprisingly, given the slowdown of the hard market, the per share growth in 2024 across all three metrics has continued at a robust pace: Net premiums written YOY growth estimate per share = 17% Investment portfolio YOY growth estimate per share = 13% Float per share YOY growth estimate per share = 13% The per share growth in 2024 is being driven by acquisitions (GIG), a continuation of the hard market and meaningful share buybacks. Fairfax has many levers it can pull to continue to grow its business in the coming years – even if the hard market in insurance slows further. This is further proof of how well the management team at Fairfax has been performing for long term shareholders.

-

@sholland, a year ago i think lots of investors (and board members) felt $2 billion per year in interest and dividend income was unsustainably high. It was such a large number compared to what Fairfax had ever earned before… it just HAD to come down. What actually happened over the past year? Interest and dividend income went up and by a lot (especiallyon a per share basis, which is what really matters). What were the mistakes made? I can come up with a couple: 1.) Using Fairfax’s historical total interest and dividend numbers was wrong headed - they do not determine future interest and dividend income. What does? Two things: The size of the fixed income portfolio. And the average yield. Looking into the future. 2.) The absolute size of the fixed income portfolio increased about 10%. And Fairfax has bought back close to 5% of shares outstanding. As a result, fixed income investments per share has increased about 15% in 2024. 15% growth was completely unexpected. 3.) At the same time, interest rates have remained higher than expected. And now Fairfax has extended the average duration to 3.5 years. And bond yields (other than less than one year) have popped higher once again. What about 2025? Given what we know today, Fairfax’s generic guide of $2 billion is likely much too low. Fixed income investments per share will continue to grow nicely - something in the low double digit range seems reasonable. Yes, the average yield will comedown a little (more in Canada and Europe). Bottom line, total interest and dividend income per share should hold up pretty well in 2025. Looking at interest and dividends is instructive. It provides a good example of how many investors continue to underestimate Fairfax and its EPS trajectory moving forward. They are underestimating the impact of $4 billion in earnings and the impact of Fairfax’s capital allocation decisions on EPS. Not knowing exactly what Fairfax is going to do (when it comes to $4 billion in earnings and capital allocation) doesn’t mean an assumption of them doing nothing is reasonable or appropriate. IMHO, that is not being conservative. That is simply going to lead people to undervalue the company. So part of the valuation process boils down to: ‘do you trust management?’ Do you think they are any good at capital allocation? If so, how good?

-

Fairfax Earnings Estimate Update for 2024 & 2025 Below is my two-year earnings estimate for Fairfax. This forecast includes learnings from Fairfax’s earnings releases and ‘new news’ from the past couple of months (since the last update). Summary My current estimate is Fairfax will earn about $160/share in 2024 and about $166/share in 2025. I think both of these estimates have been constructed using mildly conservative assumptions. To the right of the table below is the annual change in ‘excess of fair value over carrying value’ for Fairfax’s associate and consolidated equity holdings. This is value that is being created each year in Fairfax’s equity holdings that is not reported in EPS, BVPS or ROE. Bottom line, Fairfax’s economic performance in recent years has been stronger than that captured by its accounting results. Will retained earnings be re-invested in a way that builds value for shareholders? Perhaps the hardest piece to forecast with Fairfax today is what they will be doing with the substantial amount of earnings that they are currently generating (about $4 billion per year). And the impact the re-investment of current earnings will have on future earnings. Both the size - how much. And the speed - how fast. When it comes to re-investing earnings, Fairfax has a lot of very good options: Grow insurance - Continuation of the hard market? Bolt-on acquisitions? Buy out minority partners in insurance? Buy equities or fixed income securities? Buy back a meaningful amount of Fairfax stock? Looking at the last 5 years, the management team at Fairfax has done an outstanding job with capital allocation. My guess is they will continue to make good decisions (on balance) and this will benefit shareholders in the coming years – likely providing a tailwind to my forecasts for 2025 and beyond. What are the key assumptions built into the forecast? To estimate future EPS, BVPS and ROE for Fairfax, an investor needs to estimate three things: Combined ratio – How good is Fairfax at underwriting? Return on the total investment portfolio = return on fixed income + return on equities Capital allocation – How good is management? Note, when calculating investment returns for equities, I am including the change each year for ‘excess of FV over CV’ for associate and consolidated holdings. As stated earlier, this is value that is being created and it needs to be incorporated into models that estimate future returns. When it comes to capital allocation, the management team at Fairfax has been best in class among P/C insurance peers over the past 5 years. This is borne out in the change in BVPS over time – over the past 5 years, Fairfax has significantly outperformed peers like CB, WRB, MKL, TRV, IFC.TO and BRK. Interest rates: I am assuming interest rates remain roughly at current levels (at November 16, 2024). Of course, this will likely not be the case. Given the duration of the fixed income portfolio (about 3.5 years) is now closer to the duration of the insurance liabilities (a little under 4 years?), changes in interest rates will likely roughly balance out (in ‘net gains/losses on investments’ and ‘effects of discounting and risk adjustment- IFRS 17’). Bottom line, changes in interest rates should result in much less volatility in Fairfax’s reported results moving forward. Mr. Market should like that. Below is a 6-year snapshot of earnings for Fairfax. It communicates in a concise manner the dramatic transformation that has happened at the company, beginning around 2021. There has been a spike in operating income per share – from an average of $39/share from 2016-2020, to $192/share in 2023. This much higher amount now looks like the new baseline for the company. For 2024, my estimate has operating income increasing to $212/share, which is a 444% increase from the average from 2016-2020. ‘Normalized earnings’ at Fairfax have moved to a much higher level – and, importantly, this higher level looks durable/sustainable. What are current analyst’s earnings estimates for Fairfax? Using Yahoo Finance as a guide, analysts estimate that Fairfax will earn (November 11, 2024): US$139/share (C$194) in 2024 US$148/share (C$206) in 2025 From what I can see, most analysts are assigning little benefit to the reinvestment of Fairfax’s significant earnings and the company’s proven capital allocation skills. My guess is most analysts will include these benefits into their earnings estimates only after Fairfax has announced something. As a result, analyst estimates will likely be too low. And that is what we have seen over the past 3 years. Here are the most important assumptions that went into each line item in our forecast: 1.) Underwriting profit: Estimate = $1.48 billion in 2024. Net premiums written growth of 11% in 2024 and 4% in 2025. This is being driven by: For 2024, continuation of the hard market, which we estimate will add $800 million of NPW. The Gulf Insurance Group (GIG) acquisition, which will add $1.7 billion of NPW. For 2025, continuation of the hard market. Growth at Odyssey and Brit could also pick up (management mentioned this on the Q3 earnings call). Combined ratio (CR) of 94% in 2024 and 94.5% in 2025.Catastrophe losses: 2024 will be a more normal year (higher than 2023). Fairfax continues to modestly shrink their total catastrophe exposure. Reserve releases: continuation of the positive trend observed in 2023 and YTD 2024. 2.) Interest and dividend income: Estimate = $2.4 billion in 2024. The size of the fixed income portfolio is estimated to increase as follows: 2023 = $45 billion 2024E = $50 billion (GIG + reinvestment + growth) 2025E = $54 billion (reinvestment + growth) The average yield of the fixed income portfolio at September 30, 2024 was 4.7% and the average duration was 3.5 years. For 2025 we estimate the average yield will be 4.4% 3.) Share of profit of associates: Estimate = $855 million in 2024 and $900 million in 2025. Earnings at Eurobank and Poseidon/Atlas should continue to chug along. In 2024, GIG (shifted to a consolidated holding) was a small headwind. In 2025, Stelco (sold) and Peak (shifted to a consolidated holding) will be small headwinds. 4.) Effects of discounting and risk adjustment (IFRS 17): The two key drivers for this bucket are the trend in net written premiums of the insurance business and changes in interest rates. Net written premiums growth of 11% in 2024 should be a tailwind. Now that the average duration of the fixed income portfolio (3.5 years) is about the same as the average duration of the insurance liabilities (a little under 4 years?), changes in interest rates should roughly balance out. This bucket is difficult to model – therefore, my confidence level in my estimates is low. 5.) Life insurance and runoff: Estimate = a loss of $325 million in 2024 and 2025. This combination of businesses lost an estimated $348 million in 2023 (not including the returns on its investment portfolio). 6.) Other (revenue-expenses) - non-insurance subsidiaries: Includes: Recipe, Dexterra, AGT, Grivalia Hospitality, Boat Rocker etc. This combination of businesses earned $46 million in 2023. 2024E = $170 million Sleep Country was added in Q4, 2024 2025E = $300 million Peak Achievement will be added when the sale closes (likely later in Q4, 2024) This bucket is poised to grow nicely in the coming years. Yes, the results will be lumpy. 7.) Interest expense: Estimate = $640 million in 2024 and $660 million in 2025. An increase from 2023, which was $510 million. 8.) Corporate overhead and other: Estimate = $490 million in 2024 and $500 million in 2025. An increase from 2023, which was $430 million. 9.) Net gains on investments: 2024E = $770 billion Big driver: FFH-TRS position 2025E = $1 billion FFH-TRS = $400 million = $200 x 1.96 million shares Remaining mark to market holdings = $600 million = $8 billion x 7.5% 10.) Gain on sale/deconsol of insurance sub: This is where I put the large asset sales/revaluations. These items are very lumpy and therefore difficult to forecast precisely for any one year. However, the gains are easier to forecast looking out over a longer time frame. 2023 = $550 million (Sale of Ambridge and the revaluation of GIG). 2024E = $500 million (Sale of Stelco and the revaluation of Peak Achievement). 2025E = $500 million. Over the last 5 years, the average gain has been $530 million per year. Bottom line, this bucket is a wild card. But Fairfax has a long history of surfacing the significant value that is residing/hidden on its balance sheet. When they do, we see significant realized gains (from both insurance and non-insurance holdings). 11.) Income taxes: The historical average was around 20%. It has increased in 2024 due to changes in the Caribbean and India. On the Q3, 2024 earnings call, Fairfax upped guidance to 22% to 25%. 2024E = 24.5% 2025E = 24% 12.) Non-controlling interests: I expected Fairfax to take out one of its P/C insurance minority partners in 2024. Other than increasing its position in GIG from 90 to 97%, this did not happen. My guess is we will see something happen in 2025. Perhaps at Brit. Or Allied World. 2023 = 14.0% (amount of net earnings that was allocated to non-controlling interests) 2024E = 8.5% (this is the run-rate Sept YTD, 2024) 2025E = 8.5% As minority P/C insurance partners are taken out, the result is a greater share of total earnings at Fairfax will accrue to shareholders. This is a solid use of free cash flow to grow EPS. 13.) Effective Shares Outstanding (year-end): We focus on effective shares outstanding as this is what Fairfax highlights in its reporting. 2023 = 23.0 million 2024E = 21.9 million Fairfax is on pace to buy back 4.8% in 2024. That is a significant amount. This has been Fairfax’s largest capital allocation decision / investment in 2024. 2025E = 21.5 million We estimate Fairfax will continue to buy back shares in 2025, although at a slower pace compared to 2024. Additional notes: ‘Underwriting profit’: Includes insurance and reinsurance; does not include runoff or Eurolife life insurance. ‘Interest and dividends’ and ‘share of profit of associates’: Includes insurance, reinsurance and runoff. ————— Return on Equity Calculation Return on equity (ROE) is calculated using ‘average equity’ which is: (PY ending BV/share + CY ending BV/share) / 2 I think most of the industry (other P/C insurance companies, analysts) calculates ROE using an average number for equity. This should make my ROE estimates comparable with industry numbers.

-

@Hamburg Investor, as per usual, your instincts are spot on. Buffett teaches us that absolute numbers (earnings, book value, investment portfolio, float) are not what really matters. It is the growth in the per share numbers over time that really matters. Over the past 3.75 years, Fairfax has reduced effective shares outstanding from 26.2 million at Dec 31, 2020 to 22.0 million at Sept 30, 2024. This is a reduction of 4.2 million or 16%. So when it comes to ‘excess of FV over CV’, over the past 3.75 years, Fairfax shareholders have benefitted in two ways: 1.) via the $2.6 billion increase in the value of ‘excess of FV over CV’ 2.) via the 16% reduction in effective shares outstanding - this boosts the per share benefit even more. Fairfax is pulling so many good moves… they really have been putting on a clinic over the past 6 years on how to do unconstrained capital allocation - how to fully exploit the P/C insurance model to build shareholder value.

-

@73 Reds , as i do my deep dives on Fairfax it is helping me get to the core of value creation. With a large equity portfolio there are so many ways value is created - but much of it is not captured in real time by the accounting models (EPS and BVPS). This was likely the biggest reason why i missed out on the big gains in BRK 20 years ago - I did not understand all the value that was building (and compounding) in the equity holdings that was not showing up in the reported results. One of the things i like about Fairfax is they do have a habit of surfacing this value. This makes it easier for investors to understand what is going on under the hood. Having said all that, there is still a lot that we don’t understand: - Depsite its big run the past 4 years, Eurobank still looks very undervalued. - What is Poseidon worth today? My guess is it is worth much more than its reported CV. - What is BIAL worth today? - How is Grivalia Hospitality doing? It is an asset play, not an earnings play. And property prices in Greece have spiked higher for years. - What is AGT Food Ingredients worth? - I could go on. Fairfax also has a large amount (well over $1.5 billion) invested with private equity shops like BDT, Shaw Kwei, JAB Holdings etc. They are reported as mark to market but they really are not. My guess is there is a significant amount of value residing on the balance sheets of those companies that is waiting to be harvested in the coming years. Bottom line, BVPS at Fairfax is likely much more understated than investors realize. The other way to think about that is reported earnings for Fairfax over the past 4 years has been materially understating the value that is being created by the company. This will become apparent in the coming years as these hidden gains get harvested. Lots of investors will say … ‘Who could have possibly known?’ Patience really is probably the most important trait to have to be a successful investor… (Unfortunately that is not my strength. @dealraker is my role model in this regard).

-

Excess of FV over CV - Are you paying attention? EPS, BVPS, ROE and Calculating Intrinsic Value Successful investing is centred around properly calculating the intrinsic value of a company. This involves properly estimating the cash flows of the business - past, present and future. Do only accounting cash flows matter? With a little help from Warren Buffett, that is the question we will try and answer in this post. For Fairfax, annual EPS and the change in BVPS provides an incomplete picture of the growth in intrinsic value that is happening at the company. We need to supplement these important performance measures with other sources. Fortunately, Fairfax helps investors do this with their communication and some of their additional disclosures. Having an information advantage is a wonderful way to make money One of the easiest way to outperform other investors is to have an information advantage over them. It is like taking candy from a baby. But markets are efficient… right? Everything that is know about a company - at any point in time - is priced into its share price. Or at least that is how the story goes. Right? Of course, that is complete garbage. Especially for under-followed, misunderstood and under appreciated companies. Like Fairfax. The really interesting thing is Fairfax has been doing a very good job of trying to help investors understand the company. But despite Fairfax’s best efforts, many investors do not seem to be paying attention. As a result, many investors do not have an accurate grasp on the economic results that Fairfax has been delivering - they are underestimating Fairfax’s past performance (the cash flows it has delivered). And this is causing them to underestimate Fairfax’s future performance (and cash flows), leading them to undervalue the company. What are we talking about? Read on grasshopper… How to value a P/C insurance company Investors are taught that the correct way to value a P/C insurance company is to focus on two metrics: 1.) ROE - How much is the company earning? ROE = EPS / (average) BVPS 2.) P/BV - What does Mr. Market expect earnings to be in the future? P/BV = Stock price / BV Because it feeds into both ROE and BVPS, annual EPS is the key input to both metrics. The one year change in EPS is generally what drives the one year change in book value. And the one year change in book value is used as a rough approximation for the change in intrinsic value. Easy peasy. Annual EPS, which feeds ROE, is also a good measure of the performance of the management team. This approach (centred on ROE and P/BV) works well for most P/C insurance companies. And that is because most P/C insurance companies hold mostly bonds in their investment portfolio. And bonds are very easy to value. Therefore, BVPS is a solid tool to use to calculate intrinsic value. And the annual change in BVPS is a good measure of how the management team is performing. Over time, for most P/C insurance companies the annual change in accounting value tends to be highly correlated with the change in economic value. This works for most P/C insurance companies. But not for some. Like Berkshire Hathaway. Markel. And increasingly, Fairfax. What is so special about Berkshire Hathaway, Markel and Fairfax? These three companies do not invest their investment portfolios primarily in bonds. They invest a significant amount of their investment portfolio in equities. But we need to make a distinction here. Publicly traded stocks (that are market to market accounted) are not the issue. Yes, publicly traded stocks are volatile. But over time, Mr. Market tends to value publicly traded stocks properly. So for publicly traded mark to market stocks the change in value over time will get reflected in EPS and BVPS for companies like BRK, MKL and FFH. The issue lies with associate and consolidated equity holdings. Because of how accounting works, the economic/intrinsic value of these holdings can diverge greatly from their accounting value (the 'carry value' which is what is what is captured in book value). Over time the divergence can become very large. The net result is annual EPS chronically understates the annual increase in economic/intrinsic value that is happening at the company. EPS feeds BVPS. Over time, BVPS diverges more and more from the economic/intrinsic value of the company. As a result, BVPS eventually becomes a poor tool to use to value a company. And that is what happened at Berkshire Hathaway. What was Warren Buffett’s solution? In the 2018 annual report, Buffett banished book value from existence at Berkshire Hathaway. It was a seismic event for Berkshire Hathaway shareholders. They had been trained for 53 years by Buffett to worship at the alter of book value. And in 2018… poof… it was gone. Why would Buffett do this? Because it was important. Really important. Book value had ‘lost the relevance it once had’ as a tool for investors to use to value Berkshire Hathaway. Buffett did it to help investors. Here is what Buffett had to say in Berkshire Hathaway’s 2018AR: “Long-time readers of our annual reports will have spotted the different way in which I opened this letter. For nearly three decades, the initial paragraph featured the percentage change in Berkshire’s per-share book value. It’s now time to abandon that practice. “The fact is that the annual change in Berkshire’s book value – which makes its farewell appearance on page 2 – is a metric that has lost the relevance it once had. Three circumstances have made that so. First, Berkshire has gradually morphed from a company whose assets are concentrated in marketable stocks into one whose major value resides in operating businesses. Charlie and I expect that reshaping to continue in an irregular manner. Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mismark that has grown in recent years. Third, it is likely that – over time – Berkshire will be a significant repurchaser of its shares, transactions that will take place at prices above book value but below our estimate of intrinsic value. The math of such purchases is simple: Each transaction makes per-share intrinsic value go up, while per-share book value goes down. That combination causes the book-value scorecard to become increasingly out of touch with economic reality.” What does this have to do with Fairfax? What has Fairfax been doing over the past 5 years? Fairfax has been rapidly growing out its collection of associate/consolidated equity holdings, with Sleep Country being the most recent example. Fairfax has more than $20 billion in equity investments and more than $10 billion are now associate/consolidated holdings. Importantly, the economic value of these holdings is diverging from their accounting or ‘carrying value.’ This divergence has been increasing in size in recent years. This is creating an EPS and book value informational problem for Fairfax investors - increasingly, EPS and book value is not telling investors what they think it is. Fairfax is trying to help investors Unlike Berkshire Hathaway, Fairfax has not (yet) decided to throw out book value. When Fairfax reports results each quarter they do report book value. But they also report another item: ‘excess (deficiency) of fair value over adjusted carrying value’ for their non-insurance associate and consolidated equity holdings. In their quarterly/interim and annual reports Fairfax report these two items together in the ‘Book Value Per Basic Share’ section of the reports. Why does Fairfax report the two items together? This is also important. Fairfax is trying to educate and inform investors - give them the information they need to properly value the company and to evaluate the management team. They are telling investors loud and clear that if they want to properly evaluate management’s performance they need to consider two things each year: The change in BVPS (adjusted for dividends paid). The change in excess of FV over CV for non-insurance associate and consolidated equity holdings. But don’t take my word for it. Here is what Fairfax had to say in their Q3, 2024 interim report. “The table below presents the pre-tax excess (deficiency) of fair value over adjusted carrying value of investments in non-insurance associates and market traded consolidated non-insurance subsidiaries the company considers to be portfolio investments. Those amounts, while not included in the calculation of book value per basic share, are regularly reviewed by management as an indicator of investment performance.” Fairfax Q3 Interim Earnings Report Fairfax is providing a roadmap for investors. Of course, investors need to actually use the roadmap for it to be of value. What do the numbers tell us? At September 30, 2024, the excess of FV over CV was $1.9 billion or $87/share (pre-tax). Over the past 3.75 years, the excess of FV over CV has increased by an average of $689 million per year. This is a significant amount of value creation over 4 years that did not show up in EPS or book value. This means it also does not show up in ROE. Is this important? I think it is. A lot. Let’s try and fold this in to EPS and ROE. We can break the numbers down by year and apply a tax rate (we use 25%). This allows us to make an ‘adjusted’ estimate for EPS, BVPS and ROE that includes ‘excess of FV over CV’. Our goal is to use the information provided by Fairfax to: Better understand the change in the intrinsic value of the company. Better evaluate the performance of the management team. What do we learn? As measured by ‘excess of FV over CV’, over the past 4 years, Fairfax has created additional value for shareholders of about $20/share per year (after -tax). This boosts ROE by about 2.5% per year. This is a meaningful increase. Bottom line, the management team has been doing much better than the reported numbers suggest. (And the reported numbers already suggest that have been doing an exceptional job in recent years). What will happen moving forward? I am in process of updated my earnings estimates for Fairfax for 2024 and 2025 (so the numbers I use below might change a little). For 2024, I adjusted ‘excess of FV to CV’ down from its current value of $1.9 billion to $1.6 billion to reflect the sale of Stelco. For 2025, I estimate ‘excess of FV over CV’ will increase about $300 million = $10/share. If my estimates for 2024 and 2025 are accurate, for the 5-year period from 2021 to 2025, adjusted ROE at Fairfax will average about 19% per year. That is exceptional performance over a 5-year period. Fairfax’s stock continues to trade at a valuation multiple (you pick whatever one you want to use) that is well below that of peers. Does that make any sense? Importantly, Fairfax’s management team is executing exceptionally well. And Fairfax’s prospects have rarely looked better. An important source of future investment gains ‘Excess of FV over CV’ will be a source of significant investment gains for Fairfax in the future. Fairfax has many ways of harvesting/monetizing the gains sitting in ‘Excess of FV over CV’. Asset sales. Stelco is a timely example. The deal to sell Stelco to Clevelenad-Cliffs closed on November 1, 2024. At September 30, 2024, the excess of FV over CV for Fairfax’s position in Stelco was $366 million. When Fairfax reports Q4 results, they will book an investment gain of $366 million from the sale of Stelco. Asset re-valuations. Sometimes Fairfax will change its ownership stake in an associate or consolidated holdings and this will usually trigger a revaluation of the carrying value of the asset (to the new value). This is what will likely happen with Peak Achievement when it closes in Q4 (Fairfax bought out its majority partner). Importantly, in the coming years, the significant amount of value residing (hiding?) in ‘excess of FV over CV’ should supply a steady stream of investment gains for Fairfax. We can be pretty certain that sizeable gains are coming. We just don’t know the amount and the timing. When they do get recognized, like with Stelco in Q4, 2024, they will flow through the accounting statements and provide a nice bump to EPS, BVPS and ROE. Importantly, the coming investment gains from ‘excess of FV over CV’ are not currently built into analyst estimates. Like Stelco, these gains will be ’surprise’ gains. Per share (Hat tip to @Hamburg Investor for pointing this out.) Buffett teaches us that absolute numbers (earnings, book value, investment portfolio, float) are not what really matters. What really matters to shareholders is the growth in the per share numbers over time. Over the past 3.75 years, Fairfax has reduced effective shares outstanding from 26.2 million at Dec 31, 2020, to 22.0 million at Sept 30, 2024. This is a reduction of 4.2 million shares or 16%. So when it comes to ‘excess of FV over CV’, over the past 3.75 years, Fairfax shareholders have benefitted in two ways: Via the $2.6 billion increase in the value of ‘excess of FV over CV’ Via the 16% reduction in effective shares outstanding - this boosts the per share benefit even more. 'One more thing' ‘Excess of FV over CV’ is just one example of how Fairfax is building value for shareholders with its equity holdings in a way that is not captured by EPS and book value. There are more examples. Like what? The fair value for some of Fairfax’s associate and consolidated equity holdings look like they are materially understated. The best example of this is Fairfax India with a FV of $856.8 million. The FV is calculated using the stock price of Fairfax India ($15.07) at September 30, 2024. If FV was instead calculated using the BVPS of Fairfax India ($21.67/share) it would be $1.25 billion. That is a $400 million gap. And for Fairfax India, intrinsic value is likely much higher than BVPS. The bottom line is the quality of the equity portfolio at Fairfax (in terms of management and earnings power) has never been better. The equity portfolio is generating significant value for Fairfax and its shareholders. However, a significant amount of the value creation is not showing up in reported EPS and BV. Learning the lesson of missing the big money with Berkshire Hathaway I have followed Berkshire Hathaway for decades. I understood the amazing abilities of Warren Buffett. And i understood the value of the P/C insurance model (float and equities). How much money did i make from my ‘knowledge’? Very little. Especially compared to what Berkshire Hathaway delivered to its shareholders. What was my big miss? I was focussed on accounting value. And i completely missed the economic value that was being generated each year, primarily by Berkshire Hathaway’s equity holdings. The economic value being created each year was much larger than the accounting value. And over the years this ‘excess value’ compounded. I thought i understood Warren Buffett and Berkshire Hathaway. I did not. My ignorance cost me dearly - it caused me to missed out on making the big money. I am determined to not let this happen a second time - this time with Fairfax. Conclusion For P/C insurance companies, reported EPS, BVPS and ROE are important metrics to use to calculate intrinsic value and to evaluate the performance of the management team. However, for a company like Fairfax, these measures are incomplete. The standard tools need to be supplemented with an additional tools, one of which Fairfax provides for investors: the ‘excess of FV over CV’ for associate and consolidated holdings. Fairfax is doing their best to help investors. They make it easy. But as the old saying goes… “You can lead a horse to water, but you can’t make it drink.” So the next time you talk to someone about Fairfax ask them if they are incorporating ‘excess of FV over CV’ into their analysis of the company, especially their future EPS estimates. My guess is they won’t know what you are talking about. And that probably tells you something about how well they understand the company. ———— Excess of Fair Value over Carrying Value Below are details of Fairfax’s associate and consolidated holdings. And the change in value over each of the past 4 years. Key take aways: Over the past 3.75 years, the fair value has increased from $4.3 billion to $10.1 billion, or a total of 135%, which is a CAGR of 25.6%. That is significant growth. Excess of FV over CV has increased $2.6 billion, from a deficiency of $663 million at December 31, 2020, to an excess of $1.9 billion at Sept 30, 2024. Excess of FV over CV has increased by an average of $689 million per year over the past 3.75 years. This is an average of $27/share (pre tax).

-

@Haryana , I think Fairfax has stated in the past that they expect their equity investments to earn 15% per year. I am assuming they mean pre-tax. And i think that generally is their targeted return when making new equity investments, although it is probably not meant to be a straight jacket for the team at Hamblin Watsa. So there are probably exceptions. Prem was asked at the AGM in 2023 if Fairfax carried too much debt/had too much leverage. He said no. One of the reasons he gave is he said they have assets they could sell if they needed to raise cash (should the need arise). I think one of the reasons they like the non-insurance consolidated holdings is they are firmly in control of what happens to those assets moving forward.