Viking

Member-

Posts

4,930 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

i think they simply want to keep buying longer dated treasuries in Q2 and Q3 as bonds mature - and still be able to get Q1 yields: “where the contracts held will provide an investment opportunity to buy U.S. treasury bonds as other fixed income investments mature.” Very smart. Creative. Opportunistic.

-

Where to start... There is so much to digest from Fairfax's Q1 earnings release. But of course there is one thing that dwarfs everything else - and that is what they did with the fixed income portfolio. What Fairfax has done with their fixed income portfolio over the last 18 months will go down as one of their best investment decisions ever (well, string of decisions). in Q4 of 2021, as interest rates approached zero, Fairfax shortened their fixed income portfolio to an average duration of 1.2 years. They nailed the move to shorter duration. Most P&C insurers were around 4 years. in 2022, interest rates spiked. During 2022 Fairfax extended the average duration of their fixed income portfolio to 1.6 years. and in Q1 of 2023, as interest rates topped out, we just learned the crazy bastards at Fairfax extended the average duration to 2.5 years. That is nuts. They just nailed the move to longer duration. This now locks in $1.5 billion in interest and dividend income for 2023, 2024 and 2025 - just what Prem said at the AGM. He telegraphed this move. This gives Fairfax earnings much greater predictability for years into the future. Ratings agencies will love this. Analysts love this. This is a big input into the multiple that the shares should trade at. So we now know what Fairfax was spending most of their money on in Q1: extending the duration of their fixed income portfolio. How did they do this? In Q1, Fairfax sold $5.3 billion of bonds due in 1 year or less and after 1 year through 3 years. They booked a loss on these sale of $332 million. Think about that. And then they proceeded to buy $7 billion of longer dated treasuries (mostly 3 to 5 years, but also 5 to 10 years). Fairfax saw a fat pitch... and knocked the ball out of the park. And how does Fairfax's balance sheet look? at Dec 31, 2022 Fairfax was sitting on a $967 million loss on their bond portfolio (see below). at March 31, 2023, three short months later, Fairfax is now sitting on a $210 million loss. And given the move in interest rates so far in Q2, Fairfax is likely sitting on gains in its bond portfolio today. As the US heads into a likely recession, what about credit quality? - "Our fixed income portfolio is conservatively positioned with effectively 80% of our fixed income portfolio in government bonds and only 14% in primarily short-dated corporate bonds." Freaking brilliant! When looking at fixed income portfolios, Fairfax is best in class among P&C insurers (and it's not even close). Well done to the fixed income team at Fairfax. ---------- One more thing... what are 'US treasury bond forward contracts'? Fairfax entered into notional amount of $2.985 billion of these... cha ching! "U.S. treasury bond forward contracts: During the first quarter of 2023 the company entered into forward contracts to buy U.S. treasury bonds with a notional amount at March 31, 2023 of $2,984.7 (December 31, 2022 - nil) where the contracts held will provide an investment opportunity to buy U.S. treasury bonds as other fixed income investments mature. These contracts to buy U.S. treasury bonds have an average term to maturity of less than six months and may be renewed at market rates." ---------- Investors can speculate on future prices and use a fixed income forward contract to lock in the price today for a profit. For example, an investor may believe that interest rates will drop... which will cause the bond to increase in value. Therefore, they enter a fixed income forward contract to buy the bond in the future and lock in the delivery price today. If the speculation proves right, the investor could buy the bond in the future for cheaper than its market value. https://corporatefinanceinstitute.com/resources/fixed-income/fixed-income-forward-contract/ ----------

-

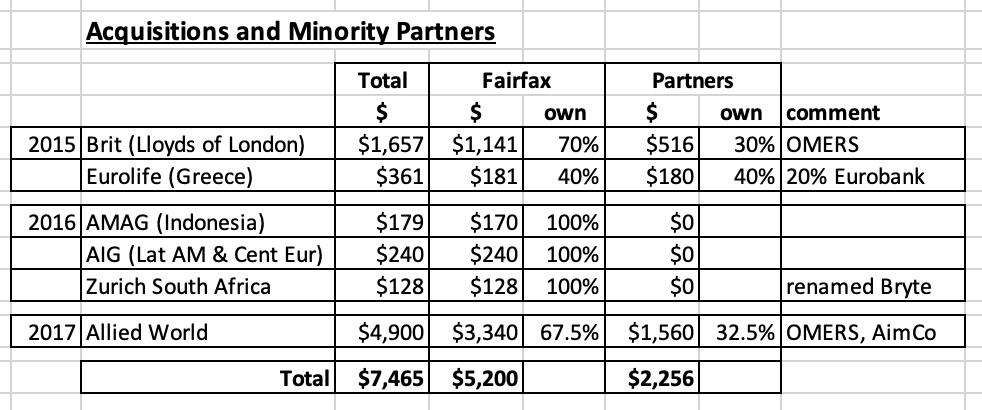

The sale of Ambridge just closed. Proceeds are $400 million (with the opportunity to receive another $100 million subject to 2023 performance targets) and will result in a sizeable realized gain of $275 million for Fairfax. This gain will increase Q2 after tax earnings by +$10/share. - https://www.fairfax.ca/news/press-releases/press-release-details/2023/Amynta-Group-Completes-the-Acquisition-of-Ambridge-Group-from-Brit-a-subsidiary-of-Fairfax/default.aspx With the recent closing of both Resolute and Ambridge deals, Fairfax has received proceeds of about $1 billion. This is a significant amount of money. At the same time, Fairfax is also earning a record amount of operating earnings (around $675 million per quarter). It will be interesting to see what new investments Fairfax makes. The sale of Ambridge is yet another example of Fairfax being opportunistic. This time with the sale of an asset at a premium valuation. Well done. ---------- Brit purchased 50% of Ambridge in 2015 (shortly after Fairfax purchased Brit) for $29 million. Brit purchased the remaining 50% in 2019 for $46.6 million. In 2021, Brit combined their US operations with Ambridge. --------- Of interest, Fairfax purchased Brit for $1.657 million in 2015. Ambridge is being sold for $400 million (with the opportunity to receive another $100 million subject to 2023 performance targets). --------- FFH 2022 AR: Sale of Ambridge Group by Brit On January 7, 2023 Brit entered into an agreement to sell Ambridge Group, operations, to Amynta Group. The company will receive approximately $400 on closing, comprised principally of cash of $275.0 and a promissory note of approximately $125. An additional $100.0 may be receivable based on 2023 performance targets of Ambridge. Closing of the transaction is subject to customary closing conditions, including regulatory approvals, and is expected to occur in the next few months. On closing of the transaction, the company expects to deconsolidate assets and liabilities with carrying values at December 31, 2022 of approximately $284 and $160, and to record a pre-tax gain of approximately $275 (prior to ascribing any fair value to the additional receivable). From Brit 2021 YE Press Release: In 2021, we combined our US operations to create a single operation under the Ambridge brand. It now operates as a global MGA, managing over $600m of premium in the US and internationally. Our clients have the benefit of the well- recognised Ambridge MGA model giving them better access to products and enhanced service, and our underwriting teams are better able to capitalise on business opportunities. FFH 2019AR: On April 18, 2019 Brit acquired the 50.0% equity interest in Ambridge Partners LLC (‘‘Ambridge Partners’’) that it did not already own for $46.6, remeasured its existing equity interest to fair value for a gain of $10.4, and commenced consolidating Ambridge Partners. FFH 2016AR: In 2015 Brit purchased 50% of Ambridge Partners, one of the world’s leading managing general agencies of transactional insurance products. In 2016 Ambridge produced gross premiums written of $32 million for Brit at a combined ratio well below 100%. FFH 2015AR: In December, Brit made an investment in Ambridge Partners, one of the world’s leading managing general underwriters of transactional insurance products. These products insure losses as a result of breaches or inaccuracies in warranties and indemnities relating to M&A, restructuring activities, business financing and tax issues. Ambridge, which has been a partner of Brit for the last nine years, produces $128 million of premiums and is highly profitable. We welcome Jesseman Pryor (CEO), Jeffery Cowhey (President) and their team of 29 employees to Fairfax.

-

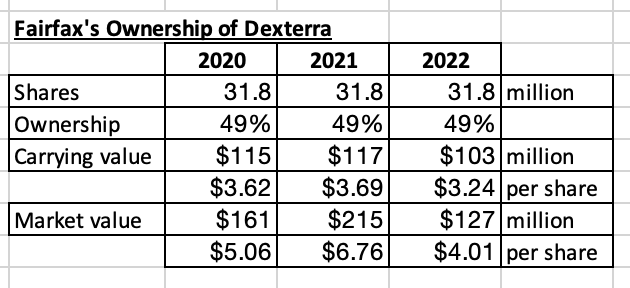

If I was Fairfax, what would be my next take-private equity purchase? Probably Dexterra. Yes, not a needle mover. But it would be a solid addition to their current collection of private companies. Why? Dexterra is dirt cheap (the stock), generates solid free cash flow and has solid growth prospects. And Fairfax has the cash. What is the Dexterra story? in 2018, Fairfax purchased Carillion Canada out of bankruptcy. The problem with Carillion was its UK parent went bankrupt. Fairfax paid about 5 times free cash flow for the Canadian operations. In 2020, Dexterra acquired Horizon North Logistics in a reverse takeover. Fairfax owned 49% of the combined company. This deal closed in May of 2020 (as covid was raging). At the time, Dexterra’s CEO, John MacCuish, set the audacious target for C$1 billion in revenue and C$100 million in EBITDA in the ‘next few years’. How is the company doing? After hitting a speed bump in 2022, Dexterra is on track to achieve both of their financial targets in 2024. As part of an updated 5-year vision just unveiled today at the AGM, a new C$2 billion revenue target has been set. The growth at Dexterra is being funded by internally generated cash and debt (which is reasonable). EBITDA conversion to free cash flow is expected to be 50%. What was the speed bump in 2022? Inflation knocked two business units on their ass: 1.) IMF: was not able to reprice contracts quick enough 2.) Modular Solutions: BC contracts did not have inflation clause (CEO of this division has since left) In Q1, 2023 we learned IMF profitability is getting back to targeted levels. In modular, the remainder of the unprofitable BC contracts will be run off in Q2 and Q3 (the financial hit was largely already booked in Q4, 2022). The turnaround in modular will likely be a late 2023 or 2024 story. Bottom line, 2023 is shaping up to be a decent year for the company. More acquisitions are coming. Growth should pick up again in 2024. Dividend yield is a solid 6.8% (with no risk of being cut). Chug, chug, chug. - https://dexterra.com/wp-content/uploads/2023/05/2023-AGM-Presentaion.pdf - https://dexterra.com/wp-content/uploads/2023/05/Analyst-Presentation-v6-Q1-2023.pdf ————— Dexterra (DXT.TO) Stock price = C$5.15 Market cap = C$335 million Dividend = C$0.0875/share = $0.35/year = 6.8% yield 2023 revenue est = C$1 billion 2023 EBITDA est = C$85 million 2023 free cash flow est = C$40 million ————— What are Dexterra’s businesses? It is a really diverse collection of businesses. 1.) Integrated Facilities Management (IFM) - growth engine 2.) Workforce Accommodations, Forestry, Energy Services (WAFES) 3.) Modular Solutions - https://dexterra.com/wp-content/uploads/2021/03/Dexterra_ServicingTheFuture_Brochure.pdf ————— ————— What would it cost Fairfax to buy the 51% of Dexterra they do not own? C$6.50/share? x 33.2 million shares = $222 million? If Dexterra shares continue to trade in the low C$5 range in 2023 I think Fairfax may swoop in and take the company private similar to what they did with Recipe in 2022. Like with Recipe, have Dexterra fund part of the cost with debt (which they can then quickly pay off). Opportunistic. Smart. ————— 2022AR: Dexterra is on track to achieve its vision of becoming a leader in delivering quality solutions to create, manage and operate infrastructure. John MacCuish is retiring after an outstanding performance for us, from rescuing Carillion from bankruptcy to the merger with Horizon North to form Dexterra. A big thank you to John for his leadership and dedication to Dexterra and best wishes to him and his family for a long and healthy retirement. The new CEO Mark Becker has been a senior leader in the organization for several years and is supported by three strong business unit Presidents. Dexterra closed two important integrated facilities management acquisitions early in the year and, coupled with organic growth, this strategic business unit almost doubled in size in 2022. The workforce accommodations segment also continued to build market share and deliver strong profitability while capitalizing on higher activity levels in Canada’s resource industries, although Dexterra’s modular business experienced short-term profitability challenges given high inflation and supply chain disruptions. Management expects to continue to build its modular platform and diversify its product mix, with strong demand for social and affordable housing across Canada. ————— 2021AR: Dexterra remains on track to achieve Cdn$1.0 billion in sales and Cdn$100 million in EBITDA in the near term. John MacCuish is leading the transformation to be a capital-light business. The workforce accommodations segment experienced strong growth and had strong profitability as resource industries in Canada rebounded in 2021. The strong underlying demand in affordable housing across Canada is also a priority for both the federal and provincial governments, and Dexterra’s modular solution business is in an excellent position to support this very important social issue. In January 2022, Dexterra also closed two facilities management acquisitions at attractive multiples with a combined purchase price of approximately Cdn$50 million. Dana Hospitality expands the company’s existing culinary services into education, entertainment, healthcare and leisure activities. Tricom Facility Services group, a business with a long history of providing janitorial and building maintenance services, builds the company’s strength in the hospitality, transit and entertainment verticals. These acquisitions have been financed by the company’s existing credit facility and the company’s balance sheet continues to be strong to support future growth. ————— 2020AR: The development of Dexterra’s business was dramatically reshaped by the reverse takeover in May 2020 of Horizon North. Dexterra, now a listed public company and led by John MacCuish, has a vision to build a Canadian support services champion. Its activities include a comprehensive range of facilities management, workforce accommodations, and forestry and modular build capabilities, including being a leader in social housing projects. Dexterra has publicly stated that it is on course in the next few years for Cdn$1 billion in revenue and Cdn$100 million in EBITDA. Acquisition of Horizon North Logistics On May 29, 2020 Horizon North Logistics Inc. (‘‘Horizon North’’) legally acquired 100% of Dexterra by issuing common shares to the company representing a 49.0% equity interest in Horizon North. The company obtained de facto voting control of Horizon North as its largest equity and voting shareholder and accounted for the transaction as a reverse acquisition of Horizon North by Dexterra. The assets, liabilities and results of operations of Horizon North were consolidated in the Non-insurance companies reporting segment. Horizon North, which was subsequently renamed Dexterra Group Inc. (‘‘Dexterra Group’’), is a Canadian publicly listed corporation that provides a range of industrial services and modular construction solutions. ————— 2019AR: Dexterra continues to provide industry-leading facilities management and operation solutions in Canada under the leadership of John MacCuish, its CEO. Bill McFarland is also Chair of Dexterra. The company continues to be the go-to service provider for some of the country’s largest airports, premier retail and commercial properties, corporate campuses, research and education facilities, large industrial sites, defence and public assets, camps and catering and state-of-the-art healthcare infrastructure. The company is also one of the country’s largest reforestation contractors and forest firefighters. ————— 2018AR: I am happy to report that we also made two significant private company investments in 2018/2019 – Dexterra and AGT. Dexterra, led by John MacCuish as CEO, is the new name for Carillion Canada which went into bankruptcy because of the bankruptcy of its parent in the U.K. Dexterra provides industry-leading facilities management and operation solutions across Canada, including maintenance solutions for over 50 million sq. ft. of high-quality infrastructure. This includes some of the country’s largest airports, premier retail and commercial properties, corporate campuses, research and education facilities, large industrial sites, defence and public assets and state-of-the-art healthcare infrastructure. The company is also one of the country’s largest reforestation contractors – planting over 40 million trees annually, it annually completes 4,400 hectares of forest thinning/brushing and 1,200 hectares of site preparation–it employs hundreds of firefighters, with an emphasis on Indigenous communities, and for the last 30 years it has been supplying and operating full-service remote workforce services. We were able to buy Dexterra at about 5x free cash flow. Acquisition of certain businesses of Carillion Canada Inc. On March 7, 2018 the company acquired the services business carried on in Canada by Carillion Canada Inc. and certain affiliates thereof relating to facilities management of airports, commercial and retail properties, defense facilities, select healthcare facilities and on behalf of oil, gas and mining clients. The acquired business was subsequently renamed Dexterra Integrated Facilities Management (‘‘Dexterra’’). Dexterra is an infrastructure services company that provides asset management and operations solutions to industries and governments. The assets and liabilities and results of operations of Dexterra were consolidated in the Other reporting segment. Purchases of subsidiaries, net of cash acquired of $163.1 in 2018 primarily related to the acquisitions of Dexterra (100%) and Toys ‘‘R’’ Us Canada (100%).

-

i always enjoy listening to Druckenmiller. Was he sounding a little gloomier than normal? An age thing? Interesting that he is neutral in terms of positioning: i.e. in a couple of years we could see 8% inflation OR deflation. Why such an extreme variation in outcomes? IT ALL DEPENDS ON WHAT THE FED DOES. Since 2010 all an investor has had to do to be successful is to follow the Fed. So what does the Fed do when inflation gets down to 3% and unemployment starts to increase? Do we get Burns or Volker? Of course, we don’t know that right now. Hence, Druckenmiller’s view we might get 8% inflation (Burns) or deflation (Volker).

-

@OliverSung Nice write-up. It is very difficult to write a comprehensive article on Fairfax given the many important pieces - and the significant changes over the past 5 and 10 years. I really enjoyed reading you article. Thanks for posting.

-

With the Fairfax Q1 report set to be released after markets close on Thursday here are a few of the things i will be watching. Insurance: 1.) what is top line growth? Over or under 10%? what increases is reinsurance seeing? Especially at Odyssey? 2.) what is the CR? Over or under 95? - some insurers are reporting elevated cat losses in Q1 compared to PY. 3.) update on hard market. What is outlook for 2023? Fixed income portfolio 4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income? - Run rate was $950 million end of Q2, $1.2 billion the end of Q3 and $1.5 billion the end of Q4. 5.) did average duration of bond portfolio get pushed out closer to 2 years? - 1.2 years at end of Q2 and 1.6 years at end of Q4. - this is a big deal. If Fairfax is able to push duration out to 2 (or more) years then investors will get more comfortable that $1.5 billion will be durable for years. That could be a game changer for Fairfax - that should lead to multiple expansion. 6.) given fall in interest rates in March, do we see mark to market gains in fixed income? - if duration was pushed out in Q1 then this could be a big number (given how much rates came down in March). Equity Portfolio 7.) what is amount of mark to market gain? 8.) Resolute closed in Q1. Proceeds were $625 million. Will be used for? Other 9.) share of profits of associates? 10.) Book value? 11.) share buybacks during quarter? 12.) what is net debt? 13.) capital allocation priority moving forward? Updates/Commentary: 14.) Ambridge Partners: $400 million sale. On track? 15.) GIG purchase of Kipco’s 46% stake: timing on close? 16.) Digit IPO: timing update? ————— I am estimating Fairfax will earn $122/share in 2023. After we see Q1 results, does this number need to change?

-

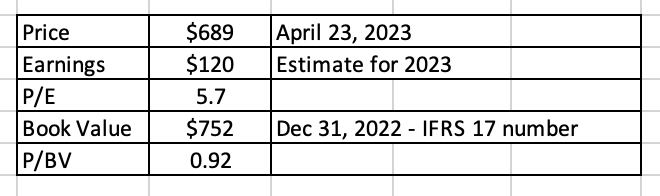

With Fairfax Q1 earnings coming on Thursday I thought it would be good as a primer to post an update to my last estimate (April 2). ---------- The big change that will happen in Q1 is the move to IFRS-17 accounting. Fairfax said that reported BV at Dec 31, 2022, will be increasing by $94/share. It will likely take a couple of quarters of results to better understand how IFRS-17 impacts Fairfax's reported results. ---------- My comments below are NOT including any changes resulting from the move to IFRS-17. My guess is Fairfax will earn about $37/share in Q1. That would put March 31 book value at US$685 = $658 + $37 - $10 div. Shares are trading today at $694 = 1 x BV. Fairfax will see about a $300 million gain in the market value of its associate common stock holdings (equity accounted) in Q1. This will put the market value of associate holdings at about $575 million over carrying value (about $25/share pre-tax). This is not captured in book value. The sale of Ambridge did not happen in Q1. When this sale closes, likely in Q2, Fairfax will book a $275 million pre-tax gain (about $10/share after tax). I am not expecting much in the way of share buybacks in Q1. The dividend is paid in Q1 and this is about a $250 million use of cash (common and preferred). Fairfax is now generating significant cash flow in underwriting profit and interest and dividend income each quarter (est $700 million in Q1). The sale of Resolute for $625 million also closed in Q1. The sale of Ambridge will bring in more ($275 million cash and $125 million promissory note). It will be interesting to see what Fairfax does with the all the cash moving forward. When I weave it all together: Fairfax looks poised to report a very good Q1. More importantly, 'the story' at Fairfax continues to get better. Shares continue to look cheap. My current estimate is Fairfax will earn about $122/share in 2023 = P/E of 5.7 ($694/$122). My 2023 year-end BV estimate is $770 = forward P/BV multiple = 0.90 Assumptions: 1. Underwriting profit = $330 million = flat to PY. My guess is net premiums earned will come in +10% to PY. CR will be a little higher than 2022 (when it was a stellar 93.1). 2. Interest and dividends = $350 million. Q4 2022 came in at $314 million. Fairfax said current run rate is $1.5 billion per year. 3. Share of profit of associates = $200 million. Slightly higher than PY. 4. Life ins & run-off = - $25 million. A little more than PY. 5. Other (revenue - expenses) = $50 million. Expect increase in ownership of Recipe to start to move the needle here in 2023. 6. Interest expense = $125 million. Same as Q4, 2022. 7. Corporate overhead = - $80 million. Same as PY. (no idea) 8. Net gains = $500 million. Equity gains = $375-$400 and bond gains = $100-$150 million. Mostly unrealized. 9. Income taxes = - $228 million. 19%? Guess. 10. Non-controlling interest = $110 million? Guess.

-

@Spekulatius I agree. I am not looking to invest in Kennedy Wilson the stock. Fairfax’s ownership of 10% of Kennedy Wilson is likely table stakes (as Jamie Dimon would say). It looks like Fairfax has been getting good value from the KW relationship. It is interesting looking at all the different relationships that Fairfax has been cultivating over the years. Stuff like Kipco in Kuwait. Relationship started in 2010. And culminated in sale of Kipco’s stake in GIG to Fairfax this year. Kennedy Wilson is another, this time focussed on global real estate. Lots also going on in Greece. And of course, even more in India. These relationships can take a decade to bear fruit. And Fairfax is extracting more value from these relationships with each passing year. It really is impressive the network across assets and geographies that they have built. Its almost like the senior team at Fairfax has been working on a portrait for years and we are just now able to start to make the picture out.

-

@Parsad yes, Buffett and Munger will not be around forever. And, yes, that is hard to take. However, the heir apparent is out there right now. In fact, there are likely a bunch on them out here. And that is what i love about investing: it is a process of constant change and constant learning. Life continues to get better. As Buffett says, living in ‘the West’ is a gift. You have won the birth lottery. “Who is the next Buffet”’. That should really be the title of your post. Not “I’m sad.” They are out there. And right now. A gift. We just need to find them When Buffett is no longer around he is not going to want us to be sad. Rather, he is going to want to reward the investing principals stood for. Ben Graham passed the torch to Warren Buffett and Peter Lynch. Investing legends. Who are the next torchbearers? That is what i want to know. PS: is is not likely Greg Abel (and that is not intended to be a slight on Greg Abel).

-

@glider3834 Great catch. What happens if Fairfax's insurance business (CR) moves a little closer to Markel and WR Berkley's in the coming years? Much higher re-insurance rates should help Allied and especially Odyssey. And those two are the big dogs at Fairfax. Cat exposure has been the big issue at Brit and Fairfax has said they are looking to reduce Brit's exposure to cat. Small iterative changes. I also wonder how much WRB's results the past few years have benefitted from super low reinsurance pricing (below cost). Now that reinsurance pricing is spiking... maybe WRB's results get a little more lumpy. If that happens the P/BV multiple on the stock will likely come down a little. Something to watch moving forward. I have listened to Tom Gaynor at Markel for years. Great stories. I keep hearing "ignore our results this year... we are focussed on the long term." It kind of reminds me of 'old Fairfax'. Here are Markel's 5 year results (see table below) - and I don't think Markel pays a dividend: 5 year CAGR in book value per common share of 6% 5 year CAGR in closing stock price per share of 3% As a reminder, we have been in a hard market for insurance since late 2019. And interest rates are the highest they have been in +15 years. As an insurance company, if you aren't hitting the ball out of the park right now when will you? ---------- Investing is like driving on the freeway. Sometimes you get boxed in on your lane and can't get out. Meanwhile, traffic two lanes over is motoring. It gets really frustrating as an investor when you get boxed in - it can last for years (cough - Fairfax - cough, cough). It looks to me like the lane has just opened up for Fairfax. They have no one in front of them for miles and they are putting the pedal to the metal and making up for lost time. At the same time, others are now stuck in traffic a few lanes over... Leadership sometimes changes. ---------- The table below is from Markel's 2022AR.

-

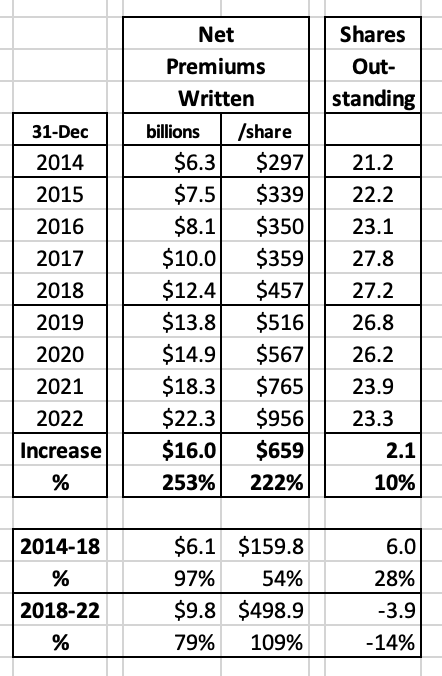

Comparing Fairfax, Markel and WR Berkley is interesting. Their market caps today are similar. But what about the size of their insurance businesses? And their investment portfolios? Yes, all three have different business models. However, all three are still insurance companies at their core. Let’s take a quick look at some of the key metrics and see what we can learn. Fairfax Financial, Markel and WR Berkley all have similar market caps today. Markel = $18.3 billion Fairfax = $16.0 billion WR Berkley = $15.6 billion This suggests investors expect future earnings (total $) to be roughly similar. Let’s start by looking at the insurance side of the businesses and net premiums written. Net premiums written (2022): Fairfax = $22.3 billion WR Berkley = $10 million Markel = $8.2 billion Fairfax’s net premiums written is larger than both Markel and WR Berkley combined. That is a big difference. What about underwriting profit? Underwriting profit (2022): WR Berkley = $960 million Fairfax = $950 million (when you net out losses from runoff) Markel = $610 million In terms of underwriting profit, WRB and Fairfax are earning similar amounts (total $) and Markel is earning quite a bit less. However, both WRB and Markel each have a much lower CR. Let’s now pivot and look at the investments side of the businesses. Investment portfolio (2022): Fairfax = $55.5 billion Markel = $27.4 billion WR Berkley = $22.9 billion Fairfax’s investment portfolio is larger than both Markel and WR Berkley combined. What about interest and dividend income? Interest and dividend income: 2022 2023E Fairfax = $960 million $1.5 billion WR Berkley = $780 million $940 million Markel = $450 million $620 million In 2023, Fairfax is going to earn about the same as WRB and Markel combined. That is significant outperformance. Yes, Markel has Markel Ventures. Fairfax also has significant equity holdings. ‘Share of profit of associates’ for Fairfax is expected to be about $900 million in 2023 and my guess is this is larger than what Markel Ventures will deliver in 2023. WRB is much smaller. What about realized investment gains? This bucket of earnings has always been a significant advantage for Fairfax over Markel and WRB and my guess is this will continue in the future. What are analysts expecting for net earnings in 2023? Fairfax = $2.5 billion WRB = $1.3 billion Markel = $1 billion Analysts expect Fairfax to earn more than WRB and Markel combined. What is the learning from all of this? Fairfax's market cap / earnings does not make any sense when compared to Markel and WR Berkley. Same market cap for 2 times the earnings? That only makes sense if you think earnings for Fairfax are inflated. Or not durable. This suggests to me that investors still do not appreciate what has happened with Fairfax's investment portfolio over the past couple of years: Share of profit of associates: delivering close to $1 billion per year moving forward Interest and dividend income delivering more than $1.5 billion in 2023, 2024 and 2025. As a result, Fairfax's stock continues to be very undervalued when compared to peers. Note: share count is basic (easier to find). The table above is meant to be directional (not precise) to allow very top line comparisons to be made for the three companies. —————— Notes: WRB and Markel have better quality insurance businesses (much lower CR) Fairfax’s fixed income portfolio is much larger and looks better positioned today. Fairfax’s net debt is likely higher (interest costs are included in net earnings estimate). Fairfax’s insurance business is much more international. WRB has been a very consistent performer over the years (by far, the most consistent of the three).

-

Over the past 2 years Kennedy Wilson has become a much more important part of Fairfax’s investment portfolio. A very successful real estate investment partnership has blossomed to now include a significant real estate debt platform. Since 2010 the real estate investment partnership has delivered gains of about $470 million (annual return of 22% on completed projects since 2010). Started two short years ago, the real estate debt platform is on track to deliver (much more?) than $190 million in interest income in 2023 ($2.4 billion invested at a 7.9% floating rate at Dec 31, 2022). The real estate debt platform increased from $1.44 billion (average yield 4.7% = interest income of $68 million) at Dec 31, 2021 to $2.4 billion (average yield 7.9% = interest income $190 million) at Dec 31, 2022. At the same level of growth this platform could increase to $3.5 billion in 2023 and at 7.9% yield = $277 million in interest income. This will be something to monitor when Fairfax reports quarterly results during 2023. The expansion of the relationship with Kennedy Wilson provides another good example of how Fairfax over the last 5 years has been: 1.) leveraging and expanding existing, successful, long term partnerships 2.) methodically diversifying their investment portfolio - in this case the fixed income part The result is yet another new, growing, significant and steady stream of earnings for Fairfax. ————— What is the timeline of Fairfax’s various investments in/with Kennedy Wilson? Started in 2010 Kennedy Wilson stock (KW) initial equity investment was US$100 million (9% of company) today position is worth $200 million (13.3 million shares x $14.98/share) current annual dividend of $0.96 = 6.4% yield = $12.8 million in interest income per year Wade Burton is on the board (along with Stanley Zax, who sold Zenith to Fairfax in 2010) investment partnership: started with $278 million in 2010 Prem’s 2022 letter: “we have invested $1.2 billion alongside with them in real estate, have received cash proceeds of $1.1 billion and still have real estate worth about $570 million. Our average annual realized return on completed projects is approximately 22%.” Expanded in 2020 Real estate debt platform: to pursue first mortgage loans secured by high-quality real estate in the Western U.S., Ireland and the U.K. 2020 = initial amount of $2 billion 2022 = increased to $5 billion Prem’s 2022 letter: “$2.4 billion invested through Kennedy Wilson in well-secured first mortgages, primarily on high quality residential apartment buildings, at a floating rate (currently 7.9%)” = $190 million in interest income. Expanded further in 2022 2022: Perpetual preferred equity investment = $300 million pays an annual dividend of 4.75% = $14.25 million includes 7-Year warrants for 13 million shares at strike price of $23/share. What does Fairfax see in Kennedy Wilson? Prem’s comment from the 2022 press release from Kennedy Wilson: “We are pleased to make this new investment in Kennedy Wilson and to build on our outstanding partnership that dates back to 2010,” said Prem Watsa, Chairman and CEO of Fairfax. “We believe in their global business model, the strength of their high-quality, income-generating assets, and their best-in-class management team.” https://ir.kennedywilson.com Q4 2022 InvestorPresentation: https://ir.kennedywilson.com/~/media/Files/K/Kennedy-Wilson-IR-V2/reports-and-presentations/presentations/q4-2022-investors-presentation.pdf ————— Interesting trivia point: Bill McMorrow (CEO and Chairman of KW) was the genesis behind Fairfax's investment in Bank of Ireland in 2011. I think Fairfax made over $1 billion from that one investment. Thank you Bill! (see Prem's comments below from 2011AR) ========== 2020: Kennedy Wilson and Fairfax Launch New $2 Billion Real Estate Debt Platform https://ir.kennedywilson.com/news-events-and-presentations/press-releases/2020/05-14-2020-105955816 “Kennedy Wilson and Fairfax first invested together in 2010 when the two companies acquired $250 million of real estate assets, including real estate secured loans and real property. Over the past decade, the companies have partnered on $7 billion in aggregate acquisitions, including over $3 billion of real estate related debt investments. In addition, Fairfax currently has an equity ownership interest in Kennedy Wilson of approximately 9%.” ————— 2022: Kennedy Wilson Announces $300 Million Perpetual Preferred Equity Investment From Fairfax Financial https://ir.kennedywilson.com/news-events-and-presentations/press-releases/2022/02-23-2022-211613501 “Kennedy Wilson and Fairfax began their relationship in 2010 when Fairfax made a $100 million equity investment in Kennedy Wilson. Over the past decade, the companies have partnered on $8 billion in aggregate acquisitions, including approximately $5 billion of real estate related debt investments. Fairfax currently has an equity ownership interest in Kennedy Wilson of approximately 9%.” ========== Kennedy Wilson 2010AR: In 2010, Kennedy Wilson formed a $278 million investment partnership with Fairfax Financial, and the venture’s first major transaction was the purchase of a 65% interest in the Japanese apartment company. Kennedy Wilson previously owned 35% of the company. The added bonus of our Fairfax partnership was the addition of Stanley Zax to our Board of Directors. Stanley’s counsel and insights have been invaluable to our success in 2010 and 2011. ========== 2022AR Prem: Since we met Bill McMorrow and Kennedy Wilson in 2010, we have invested $1.2 billion alongside with them in real estate, have received cash proceeds of $1.1 billion and still have real estate worth about $570 million. Our average annual realized return on completed projects is approximately 22%. We also own 10% of the company. More recently we have been investing with Kennedy Wilson in first mortgage loans secured by high quality real estate in the western United States, Ireland and the United Kingdom with a loan-to-value ratio of 60% on average. At the end of 2022, we had invested in $2.0 billion of mortgage loans in the U.S. at an average yield of 8.1% and an average maturity of 1.7 years, and in approximately $350 million of mortgage loans in the U.K. and Europe at an average yield of 6.0% and an average maturity of 2.5 years. The combination of interest and dividends and profit from associates accounted for a 3.7% return on our portfolio in 2022, the highest return in the last five years (average 2.5%). We expect to earn these returns in 2023 as well, partly because we have $2.4 billion invested through Kennedy Wilson in well-secured first mortgages, primarily on high quality residential apartment buildings, at a floating rate (currently 7.9%). —————— 2021AR Prem: We have an outstanding partnership with Kennedy Wilson, led by its founder and CEO Bill McMorrow and Bill’s partners, Mary Ricks and Matt Windisch. Since we met them in 2010, we have invested $1,150 million in real estate, received cash proceeds of $1,070 million and still have real estate worth about $542 million. Our average annual realized return on completed projects is approximately 20%. We also own 9% of the company. More recently we have been investing with Kennedy Wilson in first mortgage loans secured by high quality real estate in the western United States, Ireland and the United Kingdom with a loan to value ratio of 60% on average. At the end of 2021, we had committed to mortgage loans of $1.44 billion in the U.S. at an average yield of 4.7% and an average maturity of 1.9 years. We had also committed to approximately $500 million of mortgage loans in the U.K. and Europe at an average yield of 3.8% and an average maturity of 1.7 years. We are truly grateful to Bill and his team, and Wade Burton on our side, for a very profitable and enjoyable relationship. In February 2022, we committed to invest $300 million in a 4.75% perpetual preferred in Kennedy Wilson, with seven-year warrants exercisable at $23 per share. ————— 2020AR Prem: We have an outstanding partnership with Kennedy Wilson, led by its founder and CEO Bill McMorrow and Bill’s partners, Mary Ricks and Matt Windisch. Since we met them in 2010 we have invested $1,130 million in real estate, received cash proceeds of $1,054 million and still have real estate worth about $582 million. Our average annual realized return on completed projects is approximately 20%. We also own 9% of the company. More recently we have been investing with Kennedy Wilson in first mortgage loans secured by high-quality real estate in the western United States, Ireland and the United Kingdom with a loan to value ratio of less than 60%. At the end of 2020 we had committed to mortgage loans of approximately $1.5 billion at an average yield of 5% and an average maturity of four years. We are very grateful to Bill and his team for a very profitable and enjoyable relationship. —————— 2019AR Prem: no special mention in his lette During 2019 the company recorded share of profit of a KWF LP of $57.0 (A53.6) related to the sale of investment property in Dublin, Ireland. The KWF LP was subsequently liquidated and its carrying value reduced to nil when the company received final cash distributions of $169.4 (A150.0). ————— 2018AR Prem: Kennedy Wilson. We have had an excellent relationship with Kennedy Wilson, its CEO Bill McMorrow and Bill’s partners, Mary Ricks and Matt Windisch, since we met them in 2010. We own 9.2% of the company. In 2018, Kennedy Wilson sold three of our joint venture properties in Dublin for a gain of $74 million, an average annual return of 21% on our original investment, and returned $107 million of the proceeds to Fairfax. Since inception in 2010, we have invested $855 million with Kennedy Wilson, received cash proceeds of $858 million and still have real estate worth about $351 million. Our average annual realized return since inception was 21%. We continue to acquire properties through Bill, Mary and Matt with the purchase of one office building on 26 acres in Denver, Colorado for $85 million with a cash on cash yield of 6.7%; three office buildings outside Portland, Oregon for $29 million with a cash on cash yield of 6.2%; and nine office buildings on 67 acres outside Los Angeles, California for $163 million with a cash on cash yield of 7.5%. These Class A office buildings are anchored by investment grade tenants in strong and growing markets and were available at quite significant discounts to replacement cost. During 2018 three KWF LPs sold investment property in Dublin, Ireland. The company recognized its share of profit of $73.6 (A64.2) from those sales in share of profit of associates in the consolidated statement of earnings. The three KWF LPs were subsequently liquidated and their carrying values reduced to nil when the company received final net distributions of $107.3 (A91.9). ————— 2017AR: no mention of significance ————— 2016AR Prem: We have invested $692 million in real estate investments with Kennedy Wilson over the last seven years. Through sales of real estate and mortgage loans, as well as refinancings, we have received distributions of $645 million. Our total net cash investment in real estate investments with Kennedy Wilson is therefore now $47 million, and that investment is probably worth about $284 million. Annual net investment income from these real estate investments amounts to $12 million. Also, we continue to own 10.7% of Kennedy Wilson (12.3 million shares): our cost was $11.10 per share, and the shares are currently trading at about $22. A big thank you to Bill McMorrow and his team at Kennedy Wilson. ————— 2015AR Prem: We have invested $645 million in real estate investments with Kennedy Wilson over the last six years. Through sales of real estate and mortgage loans, as well as refinancings, we have received distributions of $625 million. Our total net cash investment in real estate investments with Kennedy Wilson is therefore now $20 million, and that investment is probably worth about $237 million. In 2015 Kennedy Wilson sold its Japanese real estate for a gain of $78 million, a return of 45% on our original investment, and returned $125 million of the proceeds to Fairfax. Also, we continue to own 10.4% of Kennedy Wilson (12.2 million shares): our cost was $11.37 per share, and the shares are currently trading at about $20. A big thank you to Bill McMorrow and his team at Kennedy Wilson. ———— 2014AR Prem: We have invested $629 million in real estate investments with Kennedy Wilson over the last five years. Through refinancings, sale of some loan portfolios and gains on hedging contracts on Japanese yen, we have received distributions of $465 million. Our total net cash investment in real estate investments with Kennedy Wilson is therefore now $164 million, and that investment is probably worth about $350 million. We have yet to sell though, while our cash flow return of 11.2% is very acceptable. Also, we continue to own 10.7% of Kennedy Wilson (11.5 million shares): our cost was $11.90 per share, and the shares are currently trading at $26.19. During 2014 the company sold its holdings in two KWF LPs and recognized net gains of $21.5 and $9.9 respectively. ————— 2013AR Prem: We continued to invest with Bill McMorrow from Kennedy Wilson in 2013. We invested in the Clancy Quay apartments and some well-leased office buildings in Dublin and we also invested in a U.K. loan pool. We have invested a net cumulative $305 million in real estate deals with Kennedy Wilson in California, Japan, the U.K. and Ireland – deals at significant discounts to replacement costs and with excellent unlevered cash on cash returns, in which Kennedy Wilson is the managing partner and an investor. Also, we continue to own a fully diluted 10.9% interest (11.5 million shares) in Kennedy Wilson. The KWF LPs are partnerships formed between the company and Kennedy-Wilson, Inc. and its affiliates (‘‘Kennedy-Wilson’’) to invest in U.S. and international real estate properties. The company participates as a limited partner in the KWF LPs, with limited partnership interests ranging from 50% to 90%. Kennedy-Wilson holds the remaining limited partnership interests in each of the KWF LPs and is also the General Partner. For the KWF LPs where the company may exercise veto rights over one or more key activities, those partnerships are considered joint ventures under IFRS 11. Where the company has no veto rights over key activities, the company is considered to have significant influence under IAS 28. The equity method of accounting is applied to all of the KWF LPs. ————— 2012AR Prem: We continued to purchase commercial real estate investments with Bill McMorrow and his team at Kennedy Wilson, as discussed in last year’s Annual Report. For example, we purchased, 50/50 with Kennedy Wilson, perhaps the finest office building in Dublin, built in 2009 and 100% leased to State Street Bank for 25 years, for one- third of its construction cost with an unleveraged yield of approximately 8.5%. We also own, with Kennedy Wilson, some of the finest apartment buildings in Dublin with similar return characteristics. Rest assured we return Bill’s calls very promptly! ————— 2011AR Prem: I have attended the Berkshire Hathaway shareholders’ meeting since there were only 200 shareholders in attendance about 30 years ago. I still find I learn something each year from Warren and Charlie. At the meeting in 2010, I met Bill McMorrow through Alan Parsow, who is a money manager based in Omaha and a great friend. Bill founded Kennedy Wilson, a real estate services and investment company, in 1988, and he now owns 26% of the company. As a result of this meeting, we invested $100 million in a Kennedy Wilson 6% preferred convertible at $12.41 per share, and later purchased $32.5 million of a 6.45% preferred convertible at $10.70 per share and 400,000 common shares at $10.70 per share. Fully diluted we own 18.5% of the company. In 2010 and 2011, we also invested $290 million in several real estate deals with Kennedy Wilson in California, Japan and the U.K. – deals at significant discounts to replacement cost and with excellent unlevered cash on cash returns, in which Kennedy Wilson is the managing partner and a minority investor. We are thrilled to be partners with Bill and his team, who always focus on the downside and have the expertise to manage these investments and finally harvest them. You never know what you will find at a Berkshire meeting!! And there is more to the McMorrow story. While Bill was negotiating the purchase of some real estate loans from Bank of Ireland, he was really impressed with Ritchie Boucher, the Bank’s CEO. Bill introduced Ritchie to us, and we too were very impressed. With the help of our friends at Canadian Western Bank, one of the best banks in Canada, we thoroughly reviewed the opportunity and then quickly formed an investment group with Wilbur Ross, Mark Denning from Capital Research and Will Danoff at Fidelity, which purchased $1.6 billion of Bank of Ireland shares on a rights issue (Fairfax’s share was $387 million).

-

@glider3834 Looks like the ratings agencies are giving Fairfax credit for the positioning of their fixed income portfolio and the much higher operating income that will be coming in 2023 and future years. Well done! Just another indication that the worm has turned. ---------- "The Long-Term ICR upgrade for Fairfax reflects its ability to limit investment volatility through year-end 2022, and the prospective earnings outlook from deploying substantial cash into higher yielding debt instruments. Fairfax has benefited from solid underlying returns among its core operating subsidiaries in recent years, despite elevated catastrophic losses in the North American market. Furthermore, due to its relatively low duration and strong cash position at year-end 2021, Fairfax’s unrealized losses from the market turmoil in 2022 were materially less than peer averages. The upgrade also considers that Fairfax’s financial leverage has improved materially compared with historically higher levels and has been consistently maintained at levels largely in line with comparably rated peers in recent years. AM Best expects that Fairfax will continue to maintain financial leverage at or near current levels going forward. The group’s capital position should continue to improve over time, as it benefits from higher levels of dividend and interest incomes, which should further reduce the group’s reliance on external debt."

-

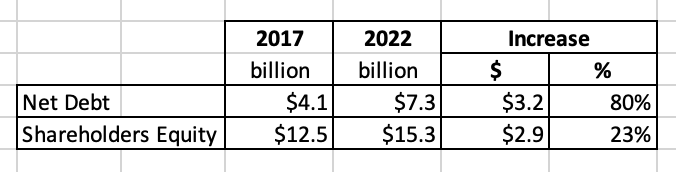

I have spilt lots of ink writing what I like about Fairfax. Does that mean i am ignoring the risks? No, of course not. So let’s flip the script today and write about a few of the risks of investing in Fairfax. What am i missing? For starters, there are the usual run-of-the-mill risks: 1.) Will this be another bad year for catastrophes? 2.) Is the hard market over? 3.) Is a severe recession coming? These risks are important but out of Fairfax’s control. With this post, I want to discuss the risks that are more specific to Fairfax - and firmly in their control. What are the risks of investing in Fairfax? 1.) Can management be trusted? 2010-2020 was a lost decade for Fairfax shareholders. Buffett says "It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently." Well, Fairfax shredded their reputation not in 5 minutes but over a 10 years period. What happened? Bad decisions. Poor communication. Terrible business results. Not a great combination. Long term shareholders capitulated in May of 2020, and the stock dropped to US$230. Yes covid was partly to blame. But only partly. The interesting thing is things actually started improving at Fairfax in about 2018. For the past 5 years we have seen much better decisions. Better communication. Very good business results. Record high stock price. Does that mean we are the clear? No. Trust can only be re-built with time. So we will see. PS: Trust is the core building block of strong relationships. If Fairfax wants long term shareholders they need to be a trustworthy partner. The next two risks fall under the ‘capital allocation’ bucket: 2.) Do they make another ‘equity hedge’ type decision? This is the big one for me. This one decision cost Fairfax shareholders a total of $5.4 billion from 2010 to 2020 (an average loss of $494 million for 11 straight years). Most of the losses happened from 2010-2016. However, in one last slap in the face of investors, Fairfax delivered one final $529 million loss in 2020. (Yes, how could an ‘equity hedge’ lose that much money in the bear market of 2020?) Fairfax has said many times over the past few years that the ‘equity hedge’ position was a mistake. Further, they have said they will no longer short individual stocks or market indices. This was THE key driver of underperformance at Fairfax from 2010-2020. So we know this specific mistake will not be repeated in the future. But does Fairfax make another big bet that sets them back +5 years? I don’t see one today. But my eyes are wide open. 3.) Do they make a string of bad equity purchases in the near future? Fairfax’s equity picks from 2014-2017 were mostly terrible. By my count Fairfax made 10 different purchases during this period that performed poorly and resulted in the company booking various losses of about $1.5 billion ($200 million on average per year) over the past 8 years. The good news? It looks to me like something changed in about 2018. Fairfax’s equity purchases from 2018 to today have been very good. As well, the equities purchased from 2014-2017 that were under-performing have largely been fixed. So I am not concerned today. But I do monitor each of their equity purchases. 4.) financial leverage: increase in net debt Fairfax is comfortable using leverage to boost shareholder returns. Over the past 5 years net debt at Fairfax has increased 80%. Over the same time period common shareholders equity has increased 23%. I don’t see Fairfax’s current net debt level as a problem. However, for the next year or two, it would be nice to see net debt remain at this level (or even go a little lower). I expect earnings to be very good over the next few years and this should increase shareholders equity meaningfully. Net debt is something to monitor. 5.) corporate governance Fairfax is a family controlled company (not unlike other founder led companies). Prem has a 10% economic interest and a 43.9% voting interest. Two of Prem’s kids currently serve as directors: Christine McLean and Ben Watsa. When a company is performing well, the issue of family control tends not to matter. However, when the company is not performing well, the issue of family control can become a big issue. Minority shareholders have little recourse should they be unhappy with the decisions management is making. This is what it is.

-

Love it. Fairfax has learned they are not a private equity turn-around shop. It appears much more work needs to be done at Blackberry. An exit of Blackberry at a fair price would let Fairfax shift the proceeds into other opportunities with better risk/reward/management. It would be an opportunity to further improve the quality of the equity portfolio. ————— Blackberry is a great example of ‘old Fairfax’: buy a declining business that was poorly managed that needed lots of strategic help from Fairfax to right the ship. Result? Loads of work. And a decade of very poor performance. As a result, this investment caused significant reputational damage to Fairfax (it was such a large position for years). ————— And, of course, there is also the psychological benefit of exiting Blackberry. For long-term shareholders.

-

@jfan the thing i struggle with the most when valuing a company like Fairfax is what multiple to attach. My miss with Apple in 2016 was mostly multiple related, which increased from something like 10 x earnings to 30 x earnings over the next 5 years. Mr Market went from hating the stock to loving it. So what multiple should Fairfax trade at given its execution the past couple of years, current situation and near term prospects? 1.2 x BV seems low but reasonable as a next step. My guess is BV will come in around US$690 when Q1 is reported (i am ignoring IFRS 17 until after Fairfax reports). So this suggests to me a low fair price for Fairfax today is around $830. With shares trading today at $690 this suggests Fairfax is 20% undervalued. This seems too low to me, given the current set up for the company. How has the mood of Mr Market changed with Fairfax? - 2020: extreme pessimism - 2021: pessimism - 2022: neutral - 2023/2024: slow shift to mild optimism? If Fairfax delivers $120/share in earnings in 2023 and again in 2024 then i think we will see Mr Market shift to mild optimism… and this should lead to multiple expansion. Perhaps we get to a conservative multiple of 1.2 x earnings by the end of 2024: - BV at end of 2024 = $880/share ($660+$120+$120-$10-$10). - 1.2 x BV = $1,050/share - stock price today = $690 = 50% return over next 7 quarters. Impossible to know. But is is important to think/model how things might play out.

-

@Thrifty3000 my crystal ball only looks out about 2 years. I continue to estimate earnings of US$120 for both 2023 and 2024. Looking further out to 2025 and 2026, yes, lots of things could change. The key driver of earnings looking out a couple of years could well be capital allocation. Fairfax’s capital allocation track record since 2018 has been very good. Over 4 years, 2022 to 2025, i think Fairfax might generate more than $8 billion in free cash flow ($2 billion per year). If they invest this $8 billion wisely they could earn 10% per year (10% is a modest estimate). By the beginning of year 5 (2026) that would result in an incremental $800 million in earnings/increase in intrinsic value. That would be about $40/share pre-tax (my guess is share count will be close to 21 million in 4 years). Fairfax today has no pot holes left to fill. No annual cash burn of $500 million from equity hedges. No annual cash burn of $200-$250 million from fixing broken equity holdings. Moving forward, pretty much all of the free cash flow will be invested into assets that will generate a future return for shareholders. That is a big, big deal for shareholders. The turn started in 2018. But it often takes years for good capital allocation decisions to flow through to reported results. We have seen much improved results at Fairfax in 2021 and 2022 (when you net out the loss from fixed income). The outlook for 2023 and 2024 is even better. My guess is another tailwind is coming for Fairfax… and it is the fruits of years of good capital allocation decisions combined with the magic of compounding.

-

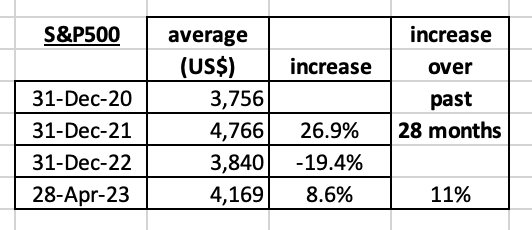

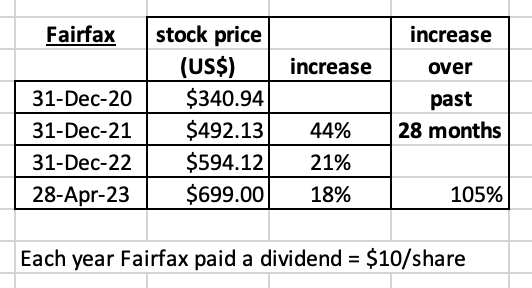

Is it time to sell Fairfax? Fairfax’s stock has delivered a cumulative 105% return to investors over the past 28 months (since Dec 31, 2020). It has also paid three $10 dividends each year (all at once in January) so total returns have been even better. How does this compare to the overall market? The S&P500 is up 11% over the past 28 months. The performance of Fairfax’s share price the past 28 months has been breathtaking - both in absolute and relative terms. So what is a rational investor to do with their shares? Why SELL of course. At least that is what I would have probably done in the past. ————— Successful investors need to get two things right: when to buy AND when to sell. Over my investment career I have been much better at the ‘when to buy’ decision than the ‘when to sell’ decision. I have a history of selling my big winners way too early. An example? After a +100% gain over a couple of years, I sold most of my concentrated position in Apple in early 2016 - right around the time some guy names Warren Buffett started to buy. What was my mistake? My sell decision was primarily focussed on price - not fundamentals. Apple’s underlying business in 2014 and 2015 was getting better each year. After a +100% gain over 24 months the stock was still cheap when I sold it - and their future prospects never looked better. The crazy part is I knew all of this - I follow my largest positions very closely. So selling Apple in 2016 was a big mistake. Right? Not necessarily. One of the things I really like about investing is your mistakes can often lead to your greatest successes. What was the lesson? Clearly, I needed to get better at the ‘when to sell’ part of investing. Here is what Peter Lynch has to say: The key to knowing when to sell, he says, is knowing "why you bought it in the first place." Lynch says investors should sell if: The story has played out as expected and this is reflected in the price. ————— Let’s get back to Fairfax. What’s happened with the fundamentals at Fairfax over the past 28 months? We don’t have Q1 results yet so let's just look at the 24 months from Dec 31, 2020 to Dec 31, 2022. 1.) insurance: we have been in a hard market the past 2 years. net written premiums were up 50% over the two years from 2020 to 2022. CR has been improving. Underwriting profit has increased a whopping 260% from $308 million in 2020 to $$1.1 billion in 2022. Digit: we also learned Fairfax owns a large chunk of a start-up insurance company in India that is growing like a weed... 2.) investments - fixed income: we have shifted from QE to QT over the past 2 years. at the end of 2020 interest rates were very low with central banks saying they would remain very low for years. Interest income at Fairfax was falling like a stone. 2020 = $717 million. 2021 = $568 million. 2 short years later, at the end of 2022, interest rates had spiked. Interest income has now spiked higher. 2022 = $874 million. more importantly, the guide from Fairfax is for interest income to come in around $1.4 billion for 2023, 2024 and 2025. 3.) investments - equities: stock picking and active management is back. over the last 2 years Fairfax’s various equity holdings have spike higher. Fairfax’s style of investing (active management, value, commodities, energy) appears ideally suited for the current environment. new investment: TRS of FFH shares, a position initiated late 2020 and early 2021, was up $500 million pre-tax in 2 years ($700 million the past 28 months). share of profit of associates has ballooned from -$113 million in 2020 to $1.1 billion in 2022. This should come in around $900 million per year moving forward. 4.) investments - realized gains: chug, chug, chug... pet insurance was sold in 2022 for $1 billion after tax gain = $40/share. This was like found money. Resolute Forest Products was sold at the top of the lumber cycle for $625 million plus $180 million CVR. Resolute had a carrying value of $134 million at Dec 31, 2020. This was a significant increase in value for shareholders. 5.) shares outstanding: has come down 11% from 26.2 million on Dec 31, 2020 to 23.3 million on Dec 31, 2022. in late 2021 Fairfax repurchased 2 million shares at $500/share. ---------- OK, let’s summarize things from a fundamental perspective. Over the past two years, Fairfax has delivered: 1.) record underwriting profit 2.) record interest and dividend income 3.) record share of profit of associates 4.) more than $2.5 billion in asset monetizations 5.) double digit decline in share count So we have that interesting situation where Fairfax’s intrinsic value has been growing at 20-25% per year (2021 and 2022). Yes, the stock went up 21% in 2022 but my guess is intrinsic value in 2022 went up much more than that. So even after a 21% increase, the stock was likely cheaper at Dec 31, 2022 ($594) than it was on Dec 31, 2021 ($492). How do Fairfax’s future prospects look? The three engines of their business (insurance, investments - fixed income and investments - equities) all look very well positioned in the current environment. For the first time in Fairfax’s history they are all performing well at the same time. And this set-up is expected to continue in the coming years. That suggests profitability at Fairfax should remain robust. How do the usual valuation metrics look? P/E multiple: stock is trading at < 6 times 2023 earnings (est $120) P/BV multiple: stock is trading at about 1.06 x Dec 31 BV or 1 x est March 31 BV. ROE = 18% ($120 / $658) note: i did not use IFRS 17 BV = + $94/share at Dec 31, 2022. Using that measure just makes Fairfax stock look even cheaper. Across all three metrics, Fairfax still looks cheap to dirt cheap. Less than 6 times earnings? An 18% ROE grower trading at 1 times BV? So what is a rational investor to do after a 105% return in 28 months? What would Peter Lynch do? I think Peter Lynch would stick with this winning stock. PS: The management team at Fairfax has been executing exceptionally well since about 2018. The fundamentals have been improving every year since then. ————— The Peter Lynch Approach to Investing in "Understandable" Stocks - https://home.csulb.edu/~pammerma/fin382/screener/lynch.htm Lynch is an advocate of maintaining a long-term commitment to the stock market. He does not favor market timing, and indeed feels that it is impossible to do so. But that doesn’t necessarily mean investors should hold onto a single stock forever. Instead, Lynch says investors should review their holdings every few months, rechecking the company "story" to see if anything has changed either with the unfolding of the story or with the share price. The key to knowing when to sell, he says, is knowing "why you bought it in the first place." Lynch says investors should sell if: The story has played out as expected and this is reflected in the price; for instance, the price of a stalwart has gone up as much as could be expected. Something in the story fails to unfold as expected or the story changes, or fundamentals deteriorate; for instance, a cyclical’s inventories start to build, or a smaller firm enters a new growth stage. For Lynch, a price drop is an opportunity to buy more of a good prospect at cheaper prices. It is much harder, he says, to stick with a winning stock once the price goes up, particularly with fast-growers where the tendency is to sell too soon rather than too late. With these firms, he suggests holding on until it is clear the firm is entering a different growth stage. Rather than simply selling a stock, Lynch suggests "rotation"--selling the company and replacing it with another company with a similar story, but better prospects. The rotation approach maintains the investor’s long-term commitment to the stock market, and keeps the focus on fundamental value.

-

@glider3834 that was very well explained. Thank you for taking the time to figure out all the different pieces to this deal. It will help us lots moving forward… my guess is Fairfax will buy back another chunk of Allied World this year. It appears to me that the the real benefit to Fairfax is it cleans up their balance sheet. They no longer have to make the fixed payments. And if they fund future buy backs with cash then it can be viewed as deleveraging. Which given the amount of debt they currently have would be a good thing.

-

@Thrifty3000 what Fairfax does with capital allocation in 2023 will be super interesting to follow. They could easily take out 1 million shares = 4% of shares outstanding. Fairfax had to pay the dividend in Q1 = @ $250 million so it makes sense share buybacks might be lighter to start the year. I really like what they have been doing the last couple of years - a nice balance between: - strengthen balance sheet - buy out minority partners - Allied World last year - growth - organic - support subs - hard market - growth - acquisition - insurance - GIG is a good example here - growth - acquisition - non-insurance - Recipe is a good example here - share buybacks

-

Interesting tug of war going on in oil markets. Fundamentals (supply and demand) vs financial markets (futures activity - net speculative demand is down substantially and short interest is up substantially). The winner? By July/Aug we should know. I am betting the fundamental side wins out… yesterday i was happy to add to SU the last 2 days close to C$40. - “hated bull market” - music to my ears. - Josh thinks we might see an economic slow down in 2H and much higher oil prices.

-

@Luca On the Chubb call yesterday Evan Greenberg sounded pretty confident that 2023 would be another solid year in terms of top line growth (high single digit). This suggests to me that that the hard market is slowing - but we are still in a hard market. What comes next? Looking at history i think it is normal after the hard market to get a couple of sideway years (not hard or soft). And then a soft market. No one really knows… so we take it one quarter at a time.

-

Fairfax has grown their excess and surplus lines insurance in the US by about 80% over the past 2 years. They were the 4th largest player in 2022, up from 7th in 2020. What is excess and surplus lines insurance (E&S)? Progressive explains it well: Excess and surplus lines (E&S) insurance is a market that protects high-risk businesses that standard insurers won’t cover. This market is also known as surplus lines or non-admitted insurance. Companies with unusual or elevated risks often need E&S insurance because the admitted market considers them too risky to cover. These businesses could get a policy through a qualified E&S carrier. https://www.progressivecommercial.com/business-insurance/excess-and-surplus-insurance/ ---------- Excess & Specialty - US Top 25 – 2022 Top US excess and surplus carriers see premiums surge, market share slip in 2022 https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/top-us-excess-and-surplus-carriers-see-premiums-surge-market-share-slip-in-2022-75096783 “Fairfax Financial was the lone company among the top 10 that picked up market share in 2022, rising to 5.0% from 4.8%. The company also experienced a 26.6% surge in premiums.” ----------- Excess & Specialty - US Top 25 – 2021 Most top E&S insurers see market shares decline in 2021; premiums rise YOY https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/most-top-e-s-insurers-see-market-shares-decline-in-2021-premiums-rise-yoy-70287307 “Fairfax Financial Holdings Limited, the fourth-largest insurer in the rankings, was the only company among top 10 players to log a year-over-year increase in market share. The insurer's share of the E&S market rose to 4.77% from 4.50%. Fairfax Financial jumped two spots in the rankings, thanks to a 40% increase in premiums to $3.0 billion from $2.14 billion a year ago.”

-

I re-wrote my conclusion to the article i posted yesterday. This is more on-point. Conclusion: So after all this, what did we learn? The management team at Fairfax has been masterful at taking advantage of the changing environment - both the external (in the insurance market) and internal (at Fairfax). Their planning, creativity and execution over the last 8 years has built Fairfax into a global insurance giant that is exceptionally well positioned in the current environment. What does this mean for investors? Growth investing is identifying and investing in companies with above average growth prospects compared to the industry/peers. Over time higher growth - leads to higher earnings - leads to a higher stock price. For growth investing to work the company needs to be successful; does the growth and higher profitability actually happen? What does this have to do with Fairfax? Well the growth has already happened at Fairfax. And profitability is spiking. And yet little of this is reflected in the stock price - yet. Investors in Fairfax today are getting years of growth that has already happened (top and bottom line) for free. That, of course, sounds preposterous. But it is true. How can that happen? Its not that complicated. The current narrative around the company is completely wrong. Fairfax is a great example of how dumb the ‘smart money’ can be at times.