Viking

Member-

Posts

5,117 -

Joined

-

Last visited

-

Days Won

51

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

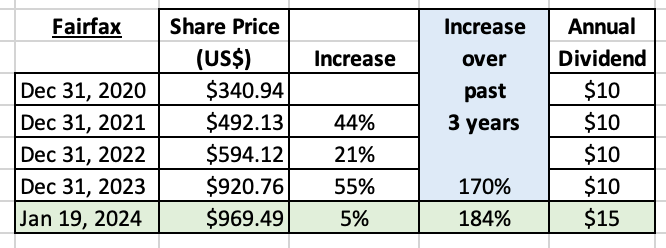

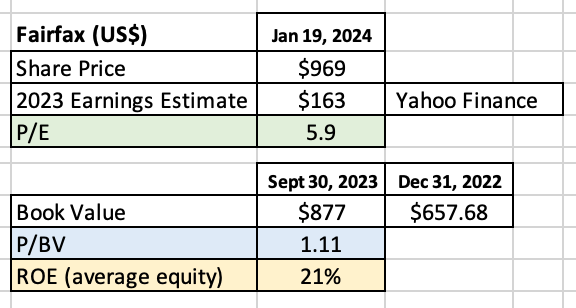

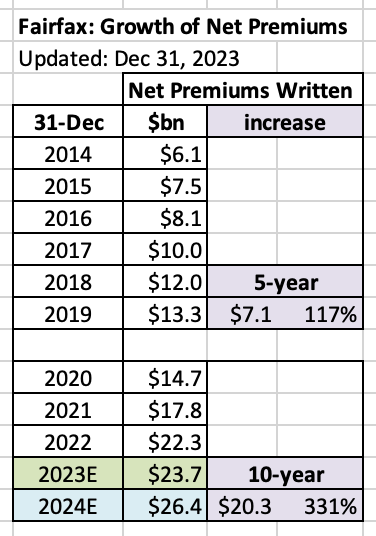

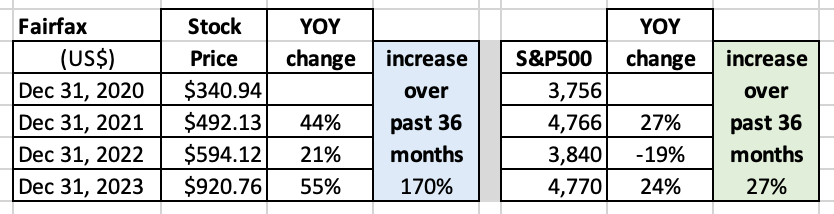

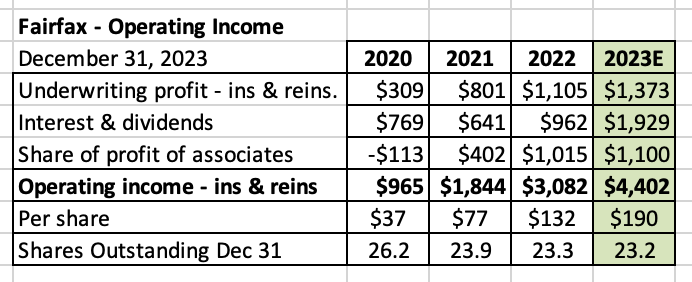

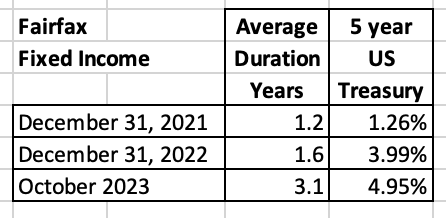

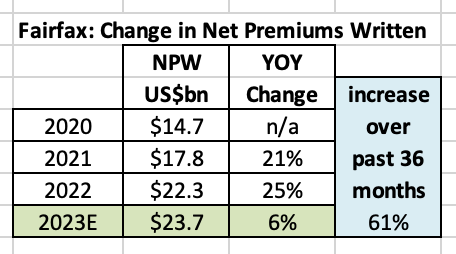

Fairfax: The Big Fish that Got Away? “The stock market is there to serve you and not to instruct you.” Warren Buffett Investors have lots of regrets. Missed opportunities. Not buying a stock that afterwards turns into a big winner. Or selling a winning position way too early. ‘The big fish that got away’ kind of story. In 2021, Fairfax’s shares returned 44%. An investor looking at Fairfax in early 2022 might have concluded ‘dang, missed that one!’ and not invested. In 2022, Fairfax’s shares returned 21%. Most stocks got crushed in the bear market of 2022, so Fairfax’s performance compared to the averages was exceptional. That same investor, looking at Fairfax in early 2023, might have come to the same conclusion: ‘dang, missed that one! For the second year in a row!’ and not invested again. The fish story just got bigger. Well, here we are now in early 2024. How did Fairfax's stock do in 2023? It was up another 55%. Over the past three years shares are up 170%. Investors who did not buy shares (or sold their position too early) over the past three years are left asking themselves what happened? How did they miss out? And what should they do now? The fish story is turning into a whopper of a tale. Three weeks into 2024 the stock is up another 5%. This puts the total increase at 184% since Dec 31, 2020, making it almost a two-bagger in Peter Lynch’s parlance. Fairfax, the ‘big fish,’ continues to taunt investors. What is the lesson to be learned? By itself, the increase in Fairfax’s share price of 184% since Dec 31, 2020, tells you little (nothing?) about Fairfax’s valuation today. This is because price (if used by itself) is a terrible valuation tool. Over the past three years, 'investors' who used price as their primary valuation tool for Fairfax have been led astray. As Buffett teaches us, a stock price exists to serve investors, not instruct them. Let’s take the discussion in a slightly different direction to see what we can learn. What happens if we increase the timeframe? Let’s humour ourselves and play the price game for a little longer. But this time with a couple of added twists. Let’s zoom out - instead of looking at Fairfax’s share price for the past three years, let’s look at the share price for the past 9 years. And let’s include operating earnings - let’s make our analysis a little more robust. From 2015 to 2019 (right before Covid hit), Fairfax’s share price traded in a pretty tight band around US$500. About 50% of the time Fairfax’s share price was over $500 and the other 50% of the time it was under $500. So for 5 years straight investors felt Fairfax was worth about US$500/share. Over this 5-year span, operating earnings at Fairfax averaged about $1.07 billion per year. So from 2015-2019, investors felt $1.07 billion in operating earnings warranted a Fairfax share price of about US$500. Let’s now compare this historical period to today to see what we can learn. Let’s start with the share price. Fairfax’s share price closed today at about US$970/share. The stock is up 94% from the average of about $500/share from 2015-2019. Let’s now look at operating earnings. Operating earnings are forecasted to come in at about $4.4 billion for 2023. That is an increase of 305% from the average of $1.07 billion from 2015-2019. My current estimate is for operating earnings to increase in 2024 to about $4.6 billion. Because the share count has come down meaningfully in recent years, this would put operating earnings per share over $200/share in 2024. This is 359% more than the average from 2015-2019 (about $44/share). Importantly, the increase in operating earnings is durable (the average duration of the fixed income portfolio was increased to 3.1 years in October 2023, which locks in interest income for the next couple ofyears, the largest component of operating income). Let’s put the two together. Fairfax’s stock is up about 90% over the past 9 years. And operating earnings per share - the high quality stuff - is forecasted to be up 359% (over the trend from 2015-2019). High quality earnings have exploded and the stock price has increased modestly. Valuation: Buffet teaches us that a stock is worth the present value of the cash flows (things like operating earnings) that are expected to be generated in the future. Conclusion Looking at Fairfax’s share price and using a 3-year time horizon it is easy to conclude the stock must be crazy expensive today. Looking at Fairfax’s share price and using a 9-year time horizon (and including operating earnings) it is easy to conclude the stock must be crazy cheap today. How can it be both crazy cheap and crazy expensive at the same time? The answer, of course, is that it can’t be both. Let’s circle back to my original comment - using the share price, on its own, as your primary tool to value Fairfax is pretty dumb. As we begin 2024, that big fish (called Fairfax) is once again staring investors right in the face. And guess what? It’s probably going to slip away from them yet again. And in another couple of years, they will think back to today and likely kick themselves. And the story of ‘the big fish that got away’ will get even bigger. ————— How do the traditional valuation metrics look today? Fairfax’s stock has a PE of 5.9 (to Yahoo Finance’s estimate of 2023 earnings). The ROE for 2023 is tracking to be a little over 20%, which is very good. Price to book value (P/BV) is 1.11, which is very low - and this could come down to around 1.05 when Fairfax reports Q4 results in a few weeks. Expensive? Really? ————— What happened in recent years to spike operating earnings so much at Fairfax? Lots of things. Below is one of them. Fairfax is a P/C insurance company. Net premiums written have grown from $6.1 billion in 2014 to an estimated $26.4 billion in 2024 (my current estimate), an increase of 331% over 10 years. Now over-lay this exceptional growth over 10-straight years with the much more modest increase seen in Fairfax’s stock price over the same time frame. Things that make you go hymmm…

-

@Crip1 i agree with your thinking: “I’m increasingly less concerned about three years down the road…” At the start of 2023, many people were concerned that higher interest income was not sustainable. Fairfax’s fixed income portfolio had an average duration of 1.6 years and there were concerns a recession was likely later in 2023 (which would drive interest rates lower). A year later… what actually happened? 1.) Fairfax earned a record amount of interest income in 2023 (est $1.8 billion). That baby has been delivered. What a surprise. 2.) current run rate of interest income is likely over $500 million per quarter. It looks like 2024 will deliver another record year of interest income (third straight year). A second surprise. 3.) on the Q3 conf call, Prem stated average duration was extended to 3.1 years. High interest income is now locked in for 2024, 2025 and 2026. A third surprise. Investors response? Yes… BUT… My guess is lots of people still think interest income still has to come down… ‘soon’. My guess is this line of thinking is driven by recency bias. From Charles Schwab: “Recency bias can lead investors to put too much emphasis on recent events, potentially leading to short-term decisions that may negatively affect their long-term financial plans.” With hindsight, it is now clear that Fairfax was grossly under-earning on its fixed income portfolio for many years. It was under-earning primarily for two reasons: 1.) central bank policy - zero interest rate 2.) Fairfax positioning - very short duration and high quality (government). This happened way back in late 2016 (Fairfax pivoted after Trumps’s election). So the interest income numbers from 2017-2021 are abnormally low for Fairfax - and probably by a lot in some years (like 2021). Are they a good number to use as a baseline? Only if you think the Fed is going back to zero interest rates and you think Fairfax is going to go back to extremely conservative positioning (low duration and high quality government bonds). Otherwise, Fairfax’s historical numbers are a terrible baseline to use for interest income - looking forward. They will lead you to expect something that is highly unlikely. That is not being conservative… That is simply using faulty logic. For example, interest income was $568 million in 2021. It will come in around $1.8 billion in 2023 and likely north of $2 billion in 2024. What is the right number to use looking out a few years? An average of 2021 and 2023 = $1.2 billion? No. That is complete garbage. $568 million in 2021 is an outlier. As a result, you have to throw it out when doing your estimates for future interest income. What is a reasonable number? Probably something north of $2 billion. Why? 1.) Today, it looks highly unlikely that global central banks will be returning to zero interest rate policy. The risks look (to me) more skewed to inflation turning up again - but that is just a guess. 2.) The fixed income portfolio at Fairfax is going to increase in size - and it will probably be meaningful: - We are still in a hard market. - The GIG acquisition will add about 5%. - Minority partners (insurance) will likely get taken out. - Fairfax will do some other things in the coming years that will grow the size of the fixed income bucket. If the fixed income portfolio increases in size by 10% and the average yield comes down 10% (not a given) then total interest income will be (about)… flat. Still a very big number. 3.) Fairfax has been moving up (not down) the risk spectrum with its fixed income portfolio. And, as we said earlier, it has been extending duration not shortening it. - $1.8 billion in Pac West loans, taking the KW real estate loan portfolio to over $4 billion. In December, Fairfax increased the ‘capacity’ of this program to $10 billion, suggesting more real estate loans will be brought on board. These were earning around 8 to 9% in Q3. What if Fairfax expands the KW real estate program to $6 billion? Or $8 billion in 2024. Remember, capacity just got expanded to $10 billion. Earning an average yield of even 8%. That would support an even higher average yield on the total fixed income portfolio than what we have today. - Fairfax also has been slowly increasing its corporate holdings and they have talked about doing more of this should the right opportunity come along. When i forecast i like to stick to one or two years (three max). Looking out 4+ years, as i have said before, it is really a bet on the capital allocation skills of management. And for the past 6 years Fairfax has been best-in-class. And that is just another reason to be optimistic about future results.

-

Prem Watsa - Fairfax Q3, 2023 Conference Call: “As I've said for the last number of quarters, the most important point I can make for you is to repeat what I have said in the past. For the first time in our 37-year history, almost 38 years now, I can say to you we expect, of course no guarantees, our operating income to be more than $3 billion annually for the next three years. Operating income consisting of $1.5 billion-plus frominterest and dividend income we earned $1.4 billion year-to-date, $1 billion from underwriting profit, we made $943 million year-to-date, and $500 million from associates and management companies versus $1 billion year-to-date. This works out to be over $100 per share after interest expenses overhead and taxes. “We continue to exceed our expectations for the year with the year-to-date operating income already at $3.1 billion, excluding the effects of discounting and risk margin. Fluctuations in stock and bond prices will be on top of that. And this only really matters, as I've said many times, over the long-term. Recently, in October, during spike in treasury yields, we have extended our duration to 3.1 years with an average maturity of approximately 4 years, and yield of 4.9%. In the next four years, we are likely to have a recession in the United States, resulting in corporate spreads widening, allowing us to extend our maturities further.”

-

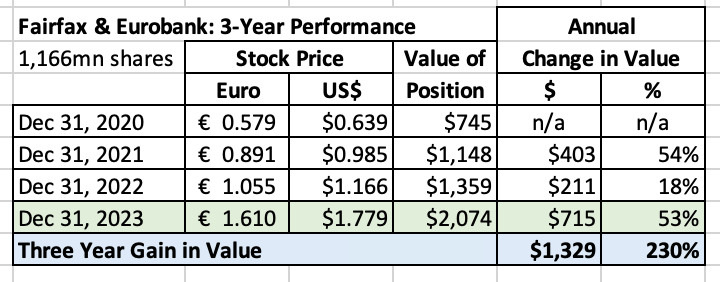

@nwoodman thanks for all the info on Eurobank. It has been invaluable. MS new price target of €2.33/share is 45% higher than where shares closed 2023 (€1.61/share). Fairfax’s position in Eurobank was worth $2 billion at year end. 45% upside = $900 million gain. That is not on anyones radar right now (analysts who follow Fairfax). Eurobank is a monster-sized position for Fairfax - and it is poised to get much larger. It really is amazing the turnaround that has happened at Eurobank over the past 3 years. It has been super interesting to watch the management team at Eurobank for the past 3 years - a steady stream of good decisions. The Hellenic Bank acquisition looks like it could be very good. And i can’t wait to see what the management team at Eurobank does in 2024. To use an old hockey analogy: for years, out of necessity (an economic depression will do that), Eurobank was playing Chris Chelios defense (ugly, brutal). Now they have shifted to playing an Edmonton Oiler offense (I am taking about the Gretzky, Messier, Kurri, Coffee version). As a fan, I much prefer watching the ‘Oilers in their prime’ version.

-

@juniorr i am not sure. I will figure that out over time.

-

@Luca before we did anything with the kids we talked to them first and got an agreement - any money they get from us is permanent savings. Not for spending - vehicles, vacations, wedding etc. The one exception might be a house. Yes, there is a risk that something could go wrong. But i am not worried (i think i know my kids and their attitude about financial literacy and money habits). As a family, we have been talking about financial topics their whole life (I ran a financial literacy club at their high school). Since we joined the real world (opened their TFSA’s about 18 months ago) the benefits far exceed anything i imagined. The kids are learning in small, slow increments. They are now able to help each other (setting up accounts, how the accounts work etc). Most importantly, they are starting to understand the power of compounding. And i am able to mentor them. Seeing how well everything has been going, we made all three of our kids an offer. After they graduate from university and get their first job we will match (100%) whatever they are able to save in their first year of working. No limit. The goal here is to help in-still the habits of thrift, live below your means and pay yourself first. My oldest graduated from university in 2023. She landed her first ‘big girl’ job. The day after she signed her offer letter she came to me with her savings plan and financial goals for the next year (on her own… not me badgering her). Her plan is to save about $25,000 in her first year. If she can do this, she will have $50,000 (in addition to TFSA and FHSA). To do this she is living at home (i called her a room mate and my wife almost killed me). We rent a big house (4 bedroom, 2,300sq ft with two living levels) so it is not a problem for my wife and me. There is also an estate planning / wealth transfer aspect to all of this. My wife and i have more than we will ever need. Shifting a small amount of our estate into tax free accounts (or index funds that they never sell in taxable accounts) to our kids - when they are very young - in a thoughtful, methodical, educational, habit building way is looking like a really good idea right now. I think each of my 3 kids could have $200,000 each, largely socked away in tax free accounts, by the time they are 25 years old. That is crazy. At the same time, they will understand most of the important building blocks of personal finance. And they will hopefully be developing good financial habits. The early results have been very positive. But it is a work in progress.

-

@nwoodman , here is a little more information: 1.) probably my biggest strength over the years has been avoiding bear markets. 2.) my biggest weakness the past 15 years is being too cautious coming out of bear markets (not simply being fully invested). 3.) my outperformance versus the market averages (thank you Fairfax, with assists from oil and extreme volatility) the past 3 years has been large - moving a chunk into index funds locks in that significant outperformance. My guess is stocks will rip again at some point in the next couple of years and what you own will matter much less than simply being fully invested. 4.) estate planning is becoming more important. If i am ever ‘hit by a bus’ i want my wife and kids to know what to do - and that is mostly index funds. So i decided i needed to migrate a significant chunk of my portfolio to index funds - so i can over time fine tune which index funds and weightings. My family is also learning at the same time (i have my wife/kids read about them and actually buy them in the accounts so they get familiar with the mechanics) which is super important (learning financial concepts in small incremental steps is key). My guess is i will flex how much of my portfolio i actively manage. Today, other than Fairfax, i do not have many high conviction ideas. But that might change. My plan right now is to over time get 2/3 of my portfolio on autopilot with index funds. My view is index funds offer reasonable (XIC.TO and VO) valuation today. XIC.TO is up about 14% since Feb 2020. That is terrible performance. If you include inflation, investors real returns are likely flat. VO is up 24% since Feb 2020 - real return has not been great. VOO is up about 42% since Feb 2020. And i am hoping all my index funds drop in value and i am able build out my index holdings at lower prices (which of course just means future returns will be higher).

-

Insightful post. I agree. All three of my kids (early 20’s) each have TFSA, FHSA (both tax free) and investment accounts. Their big advantage today over all other investors is time. Should they pick stocks? No. Index funds. Right now i am thinking 1/3 each in XIC.TO, VO and VOO. Set and forget (and easy) way to get rich. i now have 30% of my total investments in index funds (same three i listed above). That is a first for me. Over time, my plan is to have weightings of 2/3 index funds and 1/3 active management (i pick). At least that is the plan today. ————— I will point out that today i do have most of their investments in Fairfax (we started down this path 18 months ago). But new money will go to index funds (we have started). And as Fairfax approaches fair value (not there yet) i will shift them to 100% index funds. ————— I also tell them to pray for a long bear market in stocks - to hope their portfolio goes lower. Buy low, hopefully for years. They want a bull market in stocks when they are much older.

-

@Hamburg Investor I am going to push back on what you are trying to ask: I don’t think you can separate Fairfax management from external factors/events - the two are symbiotic. Is this what Soros called ‘reflexivity’? Let’s look at interest rates. If interest rates stay where they are, Fairfax will likely sit on current holdings/positions and collect interest. If interest rates fall 100 basis points on the long end, Fairfax will perhaps shorten duration and harvest some gains. If interest rates increase 100 basis points on the long end, Fairfax will likely extend duration and lock in high yields. My point is Fairfax will thoughtfully adjust to high volatility events. Look what happened last April. We had a mini-banking crisis. If we had discussed it before it happened, we probably would have guessed it would probably be bad for Fairfax (for any number of reasons). It ended up being good for Fairfax because they were able to pick up $1.8 billion in real estate loans that they will earn a return on of about 10%. Partner Kennedy Wilson picked up PacWest’s real estate team - greatly expanding their capabilities; my guess is this over time will prove be a great move. There will also be second order effects over time. Back to interest rates… Over time, where interest rates go will also impact parts of the insurance market (underwriting margins), although i am sceptical the linkage is as strong as some on this board think is the case. So if long rates decline 100 basis points then perhaps the hard market continues in parts of the insurance market. The opposite id long rates increase 100 basis points. If the hard market persists Fairfax will continue to allocate capital to insurance subs. If the hard market turns soft, Fairfax will shift and allocate capital to investments / dividends / stock buybacks. My point is Fairfax will thoughtfully adjust to events. A Trump victory in the fall? We need to see what the platform is for each candidate. My guess is Trump will run on a pro-business (less government) type of platform. He also will likely be a big spender (the government will continue to run big deficits) - he is a real estate guy after all. I think you would want to have your portfolio positioned for higher economic growth and higher inflation - but that is my early guess. (It would not surprise me to see Trump fire Powell and appoint Fed members who will support his views/policies.) How will this impact Fairfax? No idea. But i am confident we will get volatility in financial markets and Fairfax will be ready to pounce (again). In terms of investors reaction and stock price… well, anything can happen in the short run. Fairfax’s stock price is being set day-to-day by Mr Market (a manic depressive). With Fairfax I am focussed on earnings. And capital allocation. Macro, especially high volatility, is opportunity for Fairfax. At least that is how things have played out the past 5 years. Active management appears to matter again. Did i answer your question? ————— Perhaps you are trying to look at Fairfax through the lens of an economist… let’s assume Fairfax management does nothing… how would a change in interest rates affect Fairfax? This is perhaps a ‘theory’ based way of looking at things. I prefer (try?) to focus on a ‘reality’ based way of looking at Fairfax. What do i think will actually happen in the real world. Toggling between the two is perhaps the best approach (understand the theory but also how things are likely to play out in the real world).

-

@glider3834 thanks! I’ll take a closer look tomorrow.

-

@SafetyinNumbers i think your list is a good start. Here are some thoughts: 1.) equity position with most upside in 2024? Eurobank. I was surprised to see the stock value of Fairfax’s position up +$700 million in 2023. That values Eurobank at Euro 1.61/share. I think analyst price targets are currently in the Euro 2.25/share range. Eurobank could easily be up 30% in 2024 = $600 million gain for Fairfax. Re-starting the dividend at Eurobank will be very good. But Hellenic Bank could really drive earnings later in the year. The Eurobank management team is very good - my guess is they are not done growing. 2.) FFH-TRS: it would not shock me to see Fairfax’s share price increase $300 in 2024 = another $600 million gain. Not a prediction. We will see. If you prediction of Fairfax getting added to the TSX60 comes true - that would just be another tailwind, and probably a significant one. 3.) India has been a very quiet region for Fairfax for a couple of years now. I suspect that will change in 2024. You highlight two big potential catalysts: - Digit IPO: could we see a +$500 million increase in the value of Fairfax’s stake? There are also the ‘compulsory convertible preferred shares’ that Fairfax owns… when they get valued properly that will increase Fairfax’s ownership stake in Digit (74%?) and result in a big gain ($300 million?). - Anchorage IPO (BIAL): i think BIAL is the real deal. The more i read/research the more i like that asset. And there are reports Fairfax is bidding for part of IDBI Bank. if successful, that would be a big investment (even for a 10% stake). - https://www.livemint.com/companies/news/carlyle-fairfax-dbs-bank-may-bid-for-idbi-bank-11670349260107.html The problem with India is it is impossible to predict the timing of these events. I would probably be 50% for Digit IPO and 40% for Anchorage IPO - but those are wild guesses (more than my usual guesses). 4.) Is 2024 the year investors start to notice Fairfax’s group of consolidated holdings? Do we see $200 million in annual earnings from this group? Perhaps $250 million? Does Fairfax continue to grow the number of holdings in this group? Is the plan at Fairfax to morph into more of a Berkshire type structure? And make a concerted effort to grow another large income stream (that would complement the insurance businesses)? I am not sure. But they kind of appear to be moving in that direction a little. 5.) Poseidon. This is a massive holding for Fairfax. And it has been in a holding pattern for the past 2 years. More of the same in 2024? Or do we see earnings (finally) start to grow as the company modelled a couple of short years ago. They certainly messed up with the structure of their debt in a rising rate environment (surprising given Fairfax’s positioning two years ago). But i do think Sokol will get the train back on the rails… just not sure if it happens in 2024 or 2025. Probably 2025 - but we will see. 6.) Commodity holdings: Stelco, Foran Mining, EXCO, OXY, Altius Minerals - i think some of these holdings are going to rip higher in the next up-cycle in commodities (late 2024 or 2025?). Just not sure if that is 2024 or 2025. I love Stelco - it is a coiled spring. Foran is a lottery ticket. I wonder if EXCO gets sold (nat gas). Buffett sees something with OXY. 7.) Insurance - I am looking forward to seeing what GIG does to Fairfax’s balance sheet at year end when it gets consolidated. Total investments/float should get a nice pop. - Does the hard market continue into 2024? If Fairfax can get another year of 5 or 6% growth in net premiums written that would be great. With GIG that would put them +10% for the year, which would be very good. - Can we get another year with CR of around 95% or 96%? Lots of investors think it has to go to 100% - and quickly. I am not convinced. 8.) Kennedy Wilson debt platform. This went from $2 to over $4 billion in 2023. Do we go over $6 billion (or higher) in 2024? What is average interest rate earned? Is 8% a crazy high number? $6 billion at 8% = $480 million. 9.) Rabbit: For the past couple of years, Fairfax has pulled a rabbit out of their hat - something that no one is expecting that is good for shareholders. I think we get another one in 2024 - and, of course, i have no idea what it is. 10.) Like each of the past 5 or 6 years, capital allocation is going to be huge again in 2024. Why? Earnings at Fairfax are so high. The team is going to have billions to allocate, especially if they sell/monetize one or two largish holdings. What new income streams are they going to seed/create? In what bucket? Insurance or investments? Public or private? Anyways, there are some random/rambling thoughts about 2024… Would love to hear what others are thinking.

-

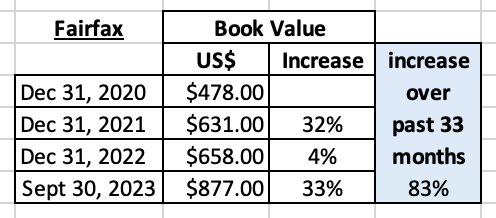

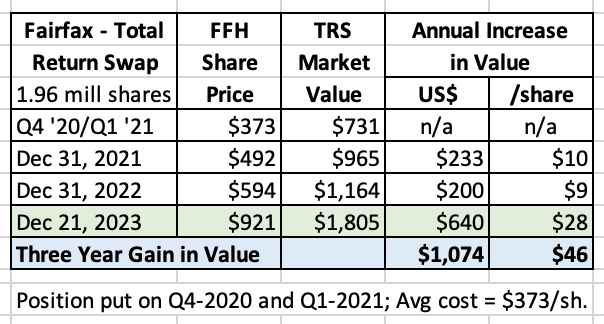

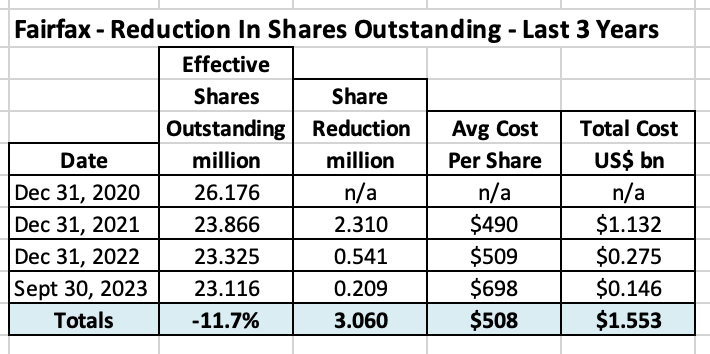

2023 Top 10 List: Fairfax Achieves ‘Escape Velocity’ At the end of each year I put together list of what I think are the 10 most important events that have happened at Fairfax during the year (usually in terms of driving shareholder value). This is the fifth year of me doing this list. Reading each of the summaries in succession provides an interesting 5-year view of what has been going on at Fairfax. Years 2019-2022 can be found in Chapter 14 of ‘Hiding in Plain Sight,’ a collection of my old posts on Fairfax (click the link below to access the PDF file). https://thecobf.com/forum/topic/20253-fairfax-financial-60-of-the-best-posts-all-in-one-document/#comment-526661 Am I missing anything? Let me know your thoughts as, yes, the list below is quite subjective. ———— 'Escape velocity' Fairfax edition, featuring David Bowie - Space Oddity https://youtu.be/iYYRH4apXDo?si=d4s1WQjQEBdQufBP Prem to Fairfax investors: “Take your protein pills and put your helmet on.” Prem needs to show up at the AGM this year dressed like David Bowie... especially the hair and platform shoes! ————— Fairfax’s business and financial results have been steadily improving each of the past three years. 2023 was the year overall company performance achieved ‘escape velocity’ - finally breaking free from the gravitational pull/orbit of its recent past (2010-2020). The company - its business results/earnings and reputation - is now charting new territory. Investors have noticed. Fairfax’s stock increased 55% in 2023. Over the past 3 years, Fairfax’s stock is up 170% and it has outperformed the S&P500 by a staggering 143%. Book value per share increased at Fairfax by 33% in the 9 months to Sept 30, 2023, and 83% over the past 33 months. My guess is BV will be up nicely in Q4. This is best-in-class performance compared to other P/C insurance peers. The performance of a few that I follow - Chubb, WR Berkley and Markel (all good P/C insurers) - has not come close to the performance of Fairfax over the past three years (in terms of growth of BV/share). A dividend of US$10/share was paid Jan 2023. Fairfax recently announced the dividend to be paid in January 2024 will increase to $15/share, which is an increase of 50%. ————— Top 10 'events’ driving shareholder value in 2023 1.) Exceptional overall company performance. This might sound like a cop-out. But i don’t think so. ALL three of Fairfax’s economic engines performed at a very high level in 2023: Insurance Investments - fixed income Investments - equities/derivatives As a result, Fairfax is poised to deliver - for the second year in a row - record results in each of underwriting profit, interest and dividend income and share of profit of associates. In 2023, operating income per share is poised to increase 43% (to $190/share) over 2022. Over the past three years, operating income per share is up a staggering 415% - this very important measure of company results has indeed achieved ‘escape velocity.’ My latest estimate has Fairfax delivering an ROE of about 20% in 2023. That is exceptional performance. But more important than the results delivered in 2023, Fairfax’s insurance and investment holdings continue to grow in size and improve in quality. This sets the table nicely for continued earnings growth (and high ROE’s) in the coming years. 2.) Extending the average duration of the fixed income portfolio from 1.6 years at Dec 31, 2022 to 3.1 years in October 2023. Prem Watsa - Fairfax Q3, 2023 Conference Call: “Recently, in October, during the spike in treasury yields, we have extended our duration to 3.1 years with an average maturity of approximately 4 years, and yield of 4.9%.” Over the past three years, the fixed income team at Fairfax has superbly navigated the company (and Fairfax shareholders) through the greatest fixed income bubble top and subsequent bear market in history. They protected the balance sheet from booking billions in losses. And, by meaningfully extending the average duration, they have locked in high interest income for years in the future. 3.) Insurance subsidiary Allied World is delivering great results again in 2023 (after having a stellar 2022) To Sept 30, CR = 90.6%, UW profit = $318.5 million and net premiums written were +10.2% to $3.88 billion. To be fair, most of Fairfax’s insurance subsidiaries are having a very good year. There is a good chance Fairfax could deliver a company-wide CR under 94% for 2023. 4.) Using the stock price, the value of Fairfax’s position in Eurobank increased about $715 million in 2023. Over the past three years, the position is up $1.33 billion. Eurobank earnings spiked higher in 2022 and again in 2023. The company has solid growth prospects; the pending acquisition of Hellenic Bank will be a catalyst in 2024. Dividend will likely be re-instated in early 2024 and this should be supportive of the stock price. Fairfax’s decision to merge Grivalia Holdings into Eurobank in 2019 is looking especially brilliant. With hindsight, the move allowed Fairfax to sell high (Grivalia) and buy low (Eurobank). At the time, the transaction was good for both parties. 5.) The value of Fairfax’s position in FFH-Total Return Swaps increased $640 million in 2023 (giving it exposure to 1.96 million Fairfax shares). Since inception (basically three years), the position is up $1.07 billion. Fairfax shares continue to look very cheap, which suggests this position could continue to perform well for Fairfax. 6.) Estimated increase in net premiums written in 2023 of $1.4 billion or 6% to $23.7 billion. The hard market in P/C insurance that started in late 2019 continued in 2023. Over the last three years, net premiums written have increased $9 billion or 61%. For some perspective, Warren Buffett purchased P/C insurer Alleghany in 2022 for $11.2 billion. In 2022, Alleghany had gross premiums written of $8.5 billion. The growth Fairfax has experienced the past three years in net premiums written has increased the intrinsic value of the company considerably. 7.) Purchase of KIPCO’s 44.3% interest in Gulf Insurance Group, increasing Fairfax’s stake from 43.7% to 90%. Cost? Aggregate fair valuation consideration of approximately $740 million (upfront payment of around $177 million and then 4 equal annual payments of $165 million). Prem on Fairfax Q1, 2023 Conference Call: “We structured it (the deal) in a way that perhaps a lot of it (annual payments) will come from the company itself, dividends from the company.” Size of GIG (2022): Net premiums written of $1.7 billion and investments of $2.4 billion. Deal closed in December. In Q4, Fairfax will book a pre-tax gain of around $290 million. Fairfax goes from being a minority shareholder in GIG to the controlling shareholder. Strategically, this secures Fairfax’s position as one of the leading P&C insurance providers in the Middle East North Africa (MENA) region. Fairfax is using its substantial cash flow to grow its insurance operations. It is also buying more of something it already owns (and knows well), a capital allocation strategy endorsed by both Peter Lynch and Warren Buffett. 8.) Purchase of $1.8 billion of PacWest real estate loans with expected annual return of 10%. This was one of Fairfax’s big capital allocation decision of 2023; very contrarian, very opportunistic and deep value. Expansion of real estate/debt platform partnership with Kennedy Wilson (to over $4 billion in total). Fairfax also invested $200 million directly in KW in debentures (6%) with 7-year warrants (12.3 million shares with strike price of $16.21). In December, it appears Fairfax increased their commitment to the KW debt platform by $2 billion from $8 billion to $10 billion. This will be something to monitor in 2024. 9.) The market value of Fairfax’s position in Thomas Cook India (TCIL) increased about $305 million in 2023. The excess of market value to carrying value (at Sept 30) increased by about $379 million. A significant portion of the value of TCIL is not captured in Fairfax’s book value (about $338 million at YE). On December 1, Fairfax sold 40 million shares for proceeds of $67 million. Covid hit TCIL especially hard. TCIL (and Sterling Resorts) aggressively cut costs. With its travel businesses rebounding strongly in 2023, the much lower cost base is now spiking profits. 10.) Monetized another asset and booked a $275 million pre-tax investment gain (closed in Q2, 2023). Sale of Ambridge Group (MGU operations of Brit) to Amynta Group for $379 million (and an additional $100 million subject to 2023 performance targets). Fairfax also entered into multi-year strategic partnership with Amynta Asset sales are important part of capital allocation framework at Fairfax, and this is something that differentiates it from BRK and Markel. Why sell an asset? Someone values it much more and/or for strategic reasons (the asset is a better fit elsewhere). Account Change: Implementation of IFRS 17 accounting standard Jan 1, 2023, increase book value per share by $104.60. On January 1, 2023, Fairfax (and all Canadian insurers) were required to implement IFRS 17 accounting standard. The cumulative effect of implementing IFRS 17 resulted in an increase in common shareholders’ equity at Fairfax of $2.4 billion at December 31, 2022. Pre-IFRS 17, at December 31, 2022, BV/share was US$658. Post-IFRS 17, at December 31, 2022, BV/share was US$762. Below is what Fairfax has to say about IFRS 17 when they released Q1, 2023 results: Honourable mention: Digit - growth of the business during the year was solid. BIAL - back in growth mode. Fairfax India purchased another 10% for $250 million. Increase in value of Mytilineos share price. Turnaround at Brit? After a couple of years of underperformance (from an underwriting perspective) it looks like Brit might have turned the corner in 2023. Reduction in size of Blackberry debenture to $150 million (to Feb 14, 2024), down from $365 million (was $500 million in 2020). Capital is being re-allocated from under-performers to better opportunities. I estimate Fairfax will reduce shares outstanding by about 1% in 2023. This is at a slower pace than the past couple of years. Over the past three years, the share count has been reduced by 3.06 million shares or 11.7%, at an average cost of US$508. My guess is Fairfax’s BV will finish 2023 north of US$900. This is yet another example of excellent capital allocation by Fairfax. Incomplete: Meadow Foods (UK): how much did Fairfax spend to purchase a majority position in August? What are prospects of the company? (Company had £550 million in sales…) Negatives: Continued decline in prospects of Blackberry/share price (market value of Fairfax’s position is down to $165 million at Dec 31, 2023). End of Farmers Edge: Fairfax is trying to take company private (to harvest significant tax losses?). Adverse reserve development in runoff of $80 million in 1H. Something to monitor moving forward. Digit IPO: in 2023, company appeared to continued to fumble the ball with regulators in India. Digit - still waiting for clarity on compulsory convertible preferred shares (expected to take Fairfax’s ownership position from 49% to 74%); appears to be another issue with regulators in India. Personnel announcements: January 2023 Fairfax news release: “Brian Young, CEO of Odyssey Group, will begin to share oversight responsibilities with Andy Barnard, President of Fairfax Insurance Group, over all of Fairfax’s insurance and reinsurance operations. Brian Young will continue as CEO of Odyssey Group.”

-

@Dinar the article you link to might be discussing what happened last year. For information on what is happening now or what might happen moving forward, below are some links you might find helpful: AM Best - 2024 Guide To Understanding the Insurance Industry https://bestsreview.ambest.com/default.aspx?altsrc=2 Gallagher Re - What A Difference A Year Makes - Jan 2024 (I haven't read this but it looks interesting) https://www.ajg.com/gallagherre/-/media/files/gallagher/gallagherre/news-and-insights/2024/january/what-a-difference-a-year-makes.pdf Other: https://www.reinsurancene.ws Great ongoing news source https://www.swissre.com/institute/ https://www.spglobal.com/ratings/en/sector/insurance/property-casualty

-

@thrifty For fun, here are some rough numbers for 2024: Poseidon = $200 to $250 Eurobank = $400 to $450 FFH-TRS = $400 to $500 Fairfax India = $125 Recipe = $75 Top 5 could deliver $1.2 billion in ‘value creation’ on their own. The FFH-TRS position is already up $120 million one week into the new year. If Eurobank announces the initiation of a dividend when they report YE results that likely will pop their share price. Of interest, much of the TRS notional position is not captured in BV (just the gains are captured in BV). So gains in that position really helps the ROE math.

-

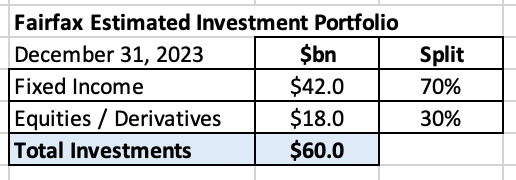

As of December 31, 2023, my guess is Fairfax has an investment portfolio that totals about $60 billion, with the split being roughly as follows: In this post we review the holdings in the equities ‘bucket.’ To value a holding we normally used current ‘market value,’ which is the stock price at Dec 31, 2023, multiplied by the number of shares Fairfax owns. For private holdings we use Fairfax’s latest reported market value (sometimes carrying value). Derivative holdings, like the FFH-TRS, are included at their notional value. Where we have done something ‘funky’ we provide an explanation (see ‘additional notes’ below). We have attempted to capture a value for each holding that we feel roughly reflects its ‘intrinsic’ or actual economic value to Fairfax. For Fairfax India and Recipe, some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. We used share counts that reflect what we think Fairfax actually owns/controls. (I think some Poseidon shares are also included in this note but I am not sure so I did not make an adjustment for this - so the Poseidon position below might be understated by about 9%). Additional notes: Atlas: $2,100 = 2,046 FV at Q3 + $50 Q4 earnings (likely low) Fairfax India: $1,220 = $20.89 BV at FIH.U x 58.4 million shares Recipe: $900 = ($17.25 CV at Dec 31, 2022 x 49.4 million shares) + $50 million (2023 earnings est) AGT Food Ingredients: $350 million. A guess; probably low. EBITDA was C$150 million in 2022. Mytilineos: includes exchangeable bonds John Keells: includes convertible debentures Ok, let’s get to the fun part of this post. What are some key take-aways? Below are mine. What are yours? 1.) Fairfax has a pretty concentrated portfolio The top 5 holdings make up 45% of the total The top 15 holdings make up close to 70% of the total 2.) Steady improvement in quality of the top 15 holdings over the past 6 years: What happened? New money has been invested at Fairfax very well (FFH-TRS, buying more of existing holdings) Some high quality businesses have continued to execute well (Fairfax India, Stelco) Some businesses, after years of effort, have turned around (Eurobank). Some businesses that were severely affected by Covid have emerged stronger (Thomas Cook India, BIAL, Recipe?) Some businesses were restructured/taken private (EXCO, AGT) and are now performing much better. Some low quality business were sold/merged/wound down (Resolute Forest Products, APR, Fairfax Africa). Some low quality businesses have shrunk in size due to poor results (BlackBerry, Farmers Edge, Boat Rocker). The important point is the quality of Fairfax’s largest holdings have steadily been increasing. And this should result in higher overall returns from the equity portfolio in the coming years. 3.) What rate of return should this collection of equity holdings be able to deliver in 2024? 12% return x $18 billion = $2.16 billion (made up of share of profit of associates + dividends + ‘other’ consolidated non-insurance co’s + investment gains) This looks like a reasonable target for 2024, looking at the solid prospects/earnings profiles of the top 15 holdings (with a 70% weighting). 4.) A slow shift away from mark-to-market holdings. Today, less than 50% of the total portfolio is held in the mark-to-market bucket. Back in 2019, my guess is closer to 80% of the total portfolio was held in the mark-to-market bucket. This shift should have the effect of smoothing Fairfax’s reported results moving forward, especially during bear markets. As a reminder, in Q1, 2020, Fairfax had $1.1 billion in unrealized losses (when the equity portfolio was much smaller). As more holdings shift to the ‘Associates’ and ‘Consolidated’ buckets, it is the trend in underlying earnings at the individual holdings that will matter to Fairfax’s reported results and not a stock price - earnings are much more consistent than a stock price. Lower volatility in reported earnings should help Fairfax’s valuation (as volatility is considered bad by Mr. Market). This shift will also start to create a Berkshire Hathaway problem for Fairfax: over time book value will become an increasingly poor tool to use to value Fairfax. Why? The value of the ’Associates’ and ‘Consolidated’ companies captured in book value each year will fall short of the increase in their true economic value. Fairfax India is a good example of this today. Eurobank is a holding to watch moving forward. Bottom line, Fairfax looks very well positioned today. But the story gets better: like the past 6 years, I expect the quality of Fairfax's equity holdings to continue to improve in 2024. That will improve future returns. And, like a virtuous circle, the growing cash flows will be re-invested growing the companies even more. Thoughts? Am I missing something? What number below is most wrong? Why?

-

+1 Fairfax needs to re-build investor confidence. That is extremely important. Increasing the dividend is a no-brainer way to do that (yes, just one of many things that need to happen). And a material - 50% - increase in the dividend is even better (as long as it is sustainable… which it is in this case). Three things drive a share price: 1.) earnings 2.) multiple 3.) share count The spike higher in Fairfax’s shares the past three years has been driven by a spike in earnings and a rapid decrease in the share count. Multiple expansion HAS NOT HAPPENED. Yet. I think it will. But to get multiple expansion the management team will need to keep doing what they are doing - delivering solid results and communicating well. Multiple expansion is rocket fuel to a share price.

-

@nwoodman i agree. There are a number of catalysts that might come to fruition in 2024 for Fairfax in India: 1.) Digit IPO - surface value in Digit 2.) Anchorage IPO - surface value in BIAL 3.) NSE and Seven Island Shipping IPO’s - surface value in Fairfax India There were also the rumours of Fairfax making a bid for IDBI Bank.

-

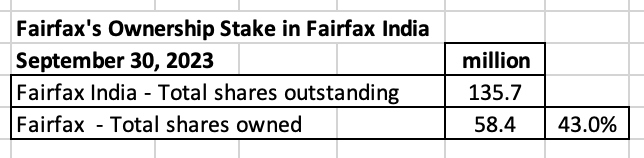

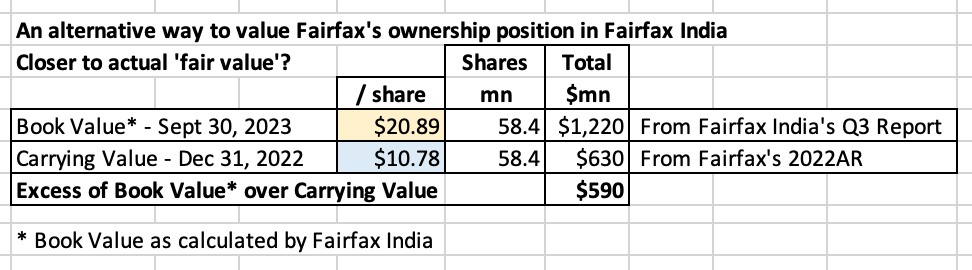

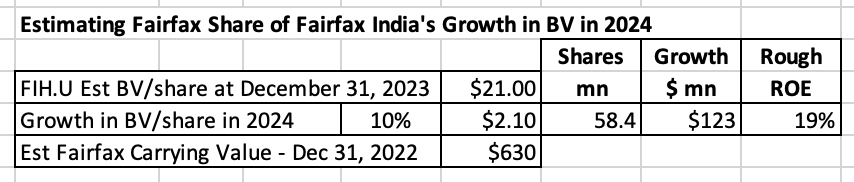

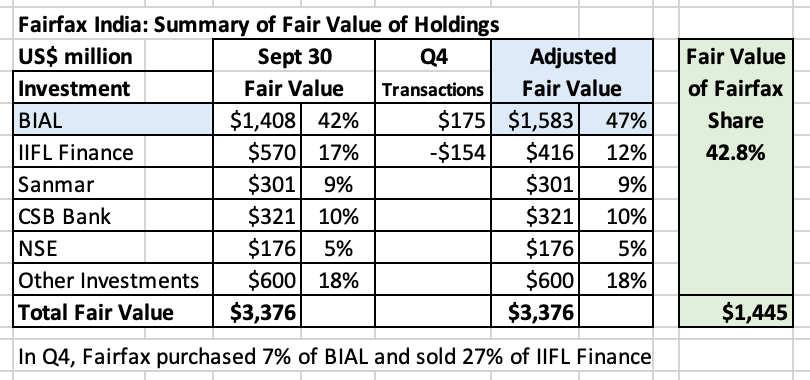

Fairfax India was launched in 2015. It has grown into a wonderful business for Fairfax. Solid collection of assets. Very well managed. Very good track record. Well positioned for the future. In this post we are going to get into the weeds of how Fairfax India is valued by its parent, Fairfax. Let me know if you think i have messed up with my math/logic/assumptions… that is how we all learn. How much of Fairfax India does Fairfax own? When Fairfax India was launched in 2015, Fairfax owned 28.1%. My math says Fairfax now owns 43.0% of Fairfax India, which is an increase of more than 50% over the past 8 years. Fairfax India is also now a much larger company - common shareholders equity has increased from $1 billion at inception in 2015, to $2.8 billion at Sept 30, 2023, which is an increase of 180%. So today, Fairfax owns 50% more of a company that has increased in size by 180%. That sounds great. But what does the math look like? How many shares of Fairfax India does Fairfax actually own? It can be a little confusing to understand exactly how many shares of Fairfax India that Fairfax actually owns. This is because some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. On Feb 16, 2022, when they added to their position, Fairfax confirmed they ‘beneficially owned, and/or exercised control or direction over’ a total of 58.4 million shares of Fairfax India. I am assuming that is the number of shares they ‘own’ today. A short history of the growth of Fairfax’s ownership of Fairfax India (total shares and %) can be found at the bottom of this post. Market value and carrying value What is the market value that Fairfax uses to value its stake in Fairfax India? To determine market value, Fairfax uses Fairfax India’s stock price, which at Dec 31, 2023, was $15.20/share. This gives a total market value to Fairfax’s position of $888 million. What is the carrying value that Fairfax uses to value its stake in Fairfax India? Carrying value is important. This is the value that finds its way into book value. And, as we know, book value is the ‘holy grail’ use by investors to value P/C insurance companies. In the 2022AR, Fairfax said the carrying value for their investment in Fairfax India was $10.78/share, or $630 million (using my share count of 58.4 million). What is the excess of market value over carrying value? It appears Fairfax’s book value is understating the market value of its stake in Fairfax India by about $250 million. (Yes, i know my dates are messed up… directionally, it appears Fairfax India’s carrying value at Fairfax is low). OK. Are we done? No. There is a wrinkle. Fairfax India’s stock price is a terrible measure to use to value Fairfax’s stake in Fairfax India. And that is because Fairfax India’s stock price trades at a severe discount to the fair value of the collection of companies that it owns. My guess is accounting standards require Fairfax to report carrying value and market/fair value the way they do. What should we do? Fairfax India has very good disclosures. We should simply use Fairfax India’s book value - that is the best measure of what the collection of assets they own are actually worth. What is the value of Fairfax’s stake if we use Fairfax India’s book value? Fairfax India has a book value of $20.89/share (at Sept 30, 2023), which puts the value of Fairfax’s stake at $1.22 billion (using my share count of 58.4 million). It appears Fairfax’s book value is understating the value of its stake in Fairfax India by about $590 million. That is much larger than our previous estimate of $250 million. If we use a fair value of $1.22 billion, this suggests Fairfax India is Fairfax’s 4th largest holding, along with Eurobank, Poseidon and FFH-TRS. These 4 holdings represent about 40% of Fairfax’s total equity exposure. What does Prem think about Fairfax India’s reported book value? Prem thinks that Fairfax India’s intrinsic value is ‘much higher’ than its reported book value. If Prem is right, then the value of Fairfax’s stake in Fairfax India is worth even more than $1.22 billion. Below are Prem’s comment from Fairfax’s 2022AR: Growth prospects Fairfax India reported a book value of $20.89/share at Sept 30, 2023. My guess is it will be well over $21 at Dec 30, 2023. Let’s assume Fairfax India grows BV/share at 10% in 2024, which would be $2.10/share. This would put Fairfax’s share of growth in BV at $123 million ($2.10/share x 58.4 million shares). This would also deliver a (very rough) high teens ROE. Is 10% growth in BV/share an aggressive assumption? No, I actually think it will prove to be conservative. Why? BIAL is now 47% of total investments at Fairfax India. Its value has gone sideways for the past 3 years - as a result of Covid. However, the airport is beginning its next significant growth phase (as second runway and recently completed Terminal 2 ramp up). An Anchorage IPO in 2024 could unlock significant value that has been building at BIAL. Two other private holdings in Fairfax India also might see IPO’s in 2024: NSE and SIS, which would likely unlock more value for Fairfax India. The remaining holdings of Fairfax India are well run companies and should continue to increase in value. If my rough math is accurate, Fairfax’s stake in Fairfax India is poised to grow in value by about $123 million in 2024. Some of this value will show up in the ‘share of profit of associates’ bucket. However, like the past 8 years, a large part of the value will likely not show up in Fairfax’s reported results. As a result, the gap between fair value and carrying value will continue to widen. Conclusion Since being launched in 2015, Fairfax India has quietly been growing like a weed. It is a great example of exceptional long term value creation by the team at Fairfax/Fairfax India/Fairbridge. However, the value creation has largely not been reflected/captured in Fairfax’s accounting results - especially book value. Fairfax India is a great example of how book value at Fairfax is understated. There are likely more examples. —————- Warren Buffett on book value Warren Buffett in 2018 decided to no longer publish the book value for Berkshire Hathaway as he felt it was no longer a useful tool for investors to use to value Berkshire Hathaway’s share price. I wonder how much longer book value will serve as a useful tool for investors to value Fairfax’s share price. “Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mis-mark that has grown in recent years.” —————- Fairfax India: Summary of ‘total existing Indian investments’ At Sept 30, 2023, Fairfax India held total investments with a fair value of $3.376 billion. If we adjust for Q4 transactions (increase in BIAL and decrease in IIFL Finance): BIAL (manages BLR Airport) = 47% All other holdings = 53% Fairfax India Shareholders equity = $2.833 billion Debt = $500 million —————- A short history of Fairfax’s investment in Fairfax India Fairfax India was launched in 2015. At inception, Fairfax invested a total of $300 million ($10/share) for a 28.1% ownership position. Fairfax India did a second capital raise in January 2017 (at $11.75/share) and Fairfax participated to keep its ownership position of similar size (it was 30.2% at the end of 2017. Fairfax has also received two performance fees in shares of Fairfax India (2018 and 2021). Today Fairfax owns 58.4 million shares of Fairfax India. My rough math says they paid a total of $539 million or an average of $9.23/share. Share count at Fairfax India peaked at 152.9 million at December 31, 2018. Since that time, the share count has come down 11.2% to 135.7 million. With the stock trading well below book value, Fairfax India has been taking out shares on the cheap. Smart. With Fairfax’s share count going up and Fairfax India’s share count coming down, Fairfax has increased its ownership interest in Fairfax India from 28.1% in late 2015 to 43.0 at Sept 30, 2023. That is an increase of more than 50% over the past 8 years. That is a meaningful increase. ————— Summary of Fairfax India’s exceptional track record (at Sept 30, 2023) CAGR of ‘Total existing Indian Investments’ = 13.0% CAGR of ‘Total monetized Indian Investments’ = 17.5% From Fairfax India's Q3 Interim Report - Page 32 - https://www.fairfaxindia.ca/wp-content/uploads/FIH-2023-Q3-Interim-Report-Final.pdf ————— Summary of key metrics for Fairfax India (from 2022AR)

-

@petec as i was working through my BIAL post it became clear to me that i needed to do a valuation post on Fairfax India. It should be out this weekend. Another layer of complexity with Fairfax India (and Recipe) is some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. Fairfax reports they ‘beneficially owned, and/or exercised control or direction over’ these shares so they should be included as shares Fairfax ‘owns’ today. I think the shares being held in the ‘asset value note’ are slowly shrinking - hopefully this continues in Q4 (yes, Fairfax will need to spend some $ to buy the shares). The ‘asset value note’ looks to me like another example of Fairfax using leverage to boost returns. The FFH-TRS is another example. When i do my next size ranking of Fairfax’s equity holdings i am going to try and include the positions held in the ‘asset value note’ and Fairfax India at fair value (i will use Fairfax India’s reported book value). I might also take a stab at some private holdings like AGT and Bauer. This will increase the size of the equity bucket. And likely boost estimates of the returns from the equity bucket.

-

I love the 50% increase in the dividend to $15 (it had been at US$10 forever). Fairfax has paid a dividend for many years - and it is not going to stop (now that would be an idiotic thing to do). The fact Fairfax modestly increased the dividend should also not come a surprise to anyone. As was mentioned upthread, the payout ratio remains very low at 9% ($15 / $170 earnings in 2023). Yes, the increase of 50% looks dramatic - but let’s be honest, the amount is small potatoes in the big scheme of things ($5 for a company that is likely earning $170). Total shareholder return at Fairfax (buybacks + dividends) has been very high at Fairfax for the past 5 years. Fairfax HAS delivered on the share buyback front - especially if you include the FFH-TRS position. Capital allocation, in general, has been excellent. I can understand that some investors might not like dividends. There is an easy answer - stick to stocks that don’t pay a dividend. But the simple truth is lots of well run companies also pay a modest dividend. Lots of P/C insurers pay a dividend. Are they all idiots? I don’t think so. Fairfax is still trying to repair its image. This effort is going to take years. They are going to need to execute very well in the coming years. They are going to need to be rational. Increasing the dividend from $10 to $15 signals Fairfax is very bullish about its future - and that will be cheered my most investors. Well done Fairfax!

-

@This2ShallPass, I have a question. Can you explain what you mean by “wrong” when you say: “What could go wrong w Fairfax?” I look at risks as kind of being across three dimensions: 1.) time - short term (next two years) and longer term (3 and more years) 2.) internal - under Fairfax’s control 3.) external - not under Fairfax’s control Some events could be short term negative for the company’s stock price and be good for the company longer term (looking out a few years). For example, the dramatic fall in Fairfax’s stock price in 2020/2021 (outside of managements control?) ended up being a gift for long term shareholders (it allowed management to put on the FFH-TRS position - 1.96 million shares at $373/share - and buy back 2 million shares at $500/share). ————— The biggest near term risk to the stock price that i see is skittishness of Fairfax investors. The wounds inflicted by the past have not yet healed. It will take more time. As a result, at the first sign of trouble (real or not), we could see investors panic and Fairfax shares could get hit hard. Just another buying opportunity? Probably. But it will depend on what the trigger is. IFRS 17 accounting is a near term risk for me (for reported earnings). It is new and i do not understand how it impacts Fairfax’s quarterly results (i don’t yet have a feel for its overall impact to results). Interest rates in Q4 have moved dramatically further out on the curve. What will the IFRS 17 impact be? I am not sure, other than i expect it to be a headwind to earnings. Do losses from runoff accelerate? Losses have been running around $200 million for a few years now. Do they accelerate (inflation)? Or not? This is becoming a smaller part of Fairfax (helps when your insurance business grows like stink over a decade). Reserving in general is a watch out, not just for Fairfax, but for the industry. Another risk: lower interest rates + end of hard market could result in investors aggressively selling off P/C insurance stocks and rotating into other sectors. I think this has been happening a little over the past month or so. This is more of a P/C insurance risk than a Fairfax specific risk. Sorry, i am rambling…

-

@SafetyinNumbers thanks for the input/help. I have edited my summary to include this.

-

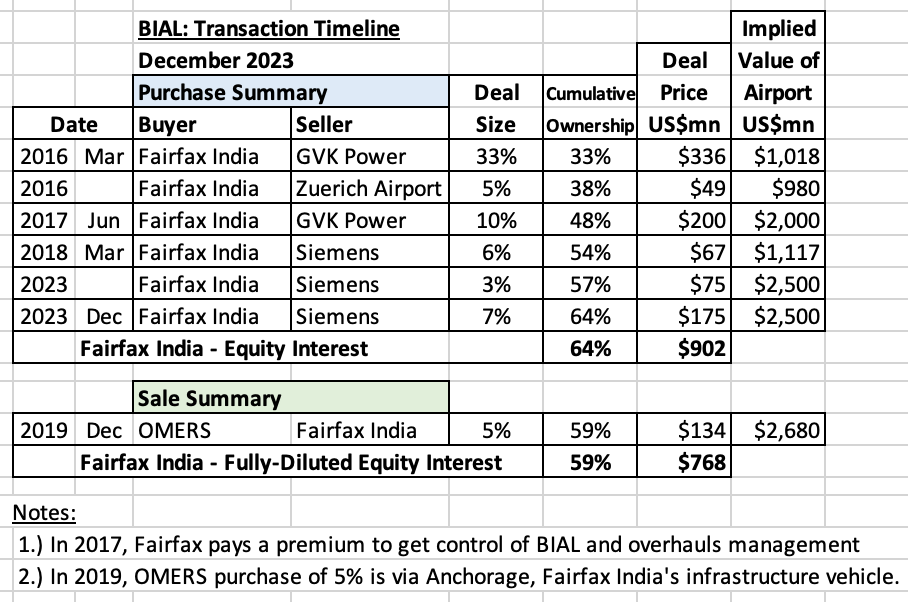

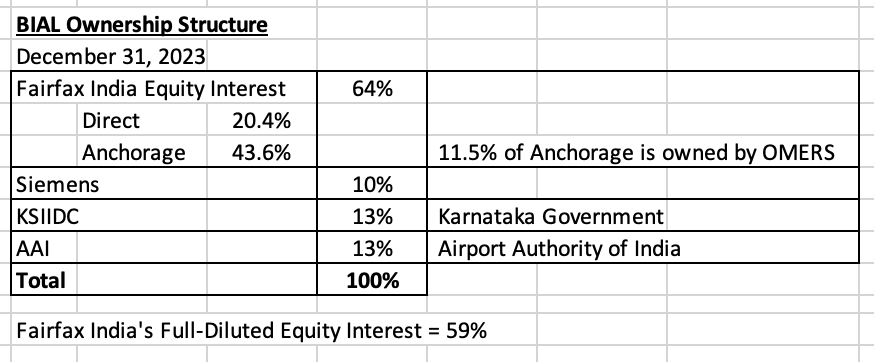

Bangalore International Airport Limited (BIAL) What is Fairfax’s 4th largest equity holding? At December 31, 2023, with a value of about $630 million, it looks to me like it is BIAL. BIAL is owned entirely within Fairfax India so it tends to get ignored as a core holding at the Fairfax (parent) level. But the fact it is ignored does not mean it does not exist. For good reason, Prem calls BIAL the ‘crown jewel’ of Fairfax’s various equity holdings in India. BIAL is a very high quality asset - it is a trophy asset (very hard to secure a control position). It is well managed. And it looks exceptionally well positioned to benefit from the expected growth of the economy in India in the coming decades. So, in this post, let’s shine a light on this important holding to see what we can learn. There are so many interesting layers to this story. What is missing? Is my logic faulty? Who is BIAL? The best place to go to get information on BIAL is Fairfax India’s web site (start with the Q3 Interim Report and the 2022 Annual Report): https://www.fairfaxindia.ca Here is how Fairfax India described BIAL in their Q3, 2023 Interim Report: “Bangalore International Airport Limited ("BIAL") is a private company located in Bengaluru, India. BIAL, under a concession agreement with the Government of India until the year 2068, has the exclusive rights to carry out the development, design, financing, construction, commissioning, maintenance, operation and management of the Kempegowda International Airport Bengaluru ("KIAB") through a public-private partnership. KIAB is the first greenfield airport in India built through a public-private partnership.” Fairfax India - Q3 Interim Report KIAB (also know as BLR Airport) is the third largest airport in India and the largest airport in south India. Bangalore, the centre of India’s high-tech industry, is known as the ‘Silicon Valley of India’. KIAB was recently voted best domestic airport in India (go to the bottom of this post for a link to the article). The History And Rise Of Bangalore International Airport https://simpleflying.com/bengaluru-airport-history/ A review of the fair value of the assets owned by Fairfax India Fairfax India owns assets with a fair value at Sept 30, 2023 of $3.38 billion. In Q4, Fairfax India increased is ownership in BIAL by 7% (at a cost of $175 million) and sold down its position in IIFL Finance by 27%. Including these two recent transactions, BIAL represents about 47% of all assets in Fairfax India. BIAL is a massive holding for Fairfax India. Fairfax owns 42.8% of Fairfax India. This puts the fair value of Fairfax’s stake in Fairfax India at about $1.45 billion. What is the math that gets BIAL to a $631 million valuation for Fairfax? As we mentioned earlier, Fairfax does not own BIAL directly - its position is held entirely through Fairfax India. Estimating the total value of BIAL: At September 30, 2023, Fairfax India held an equity interest in BIAL of 57% with an estimated fair value of $1.408 billion. This values 100% of BIAL at $2.6 billion. In Q4, Fairfax India purchased another 7% BIAL from Siemens for $175 million; this transaction values 100% of BIAL at $2.5 billion. Given this is the most recent transaction, this is the number we will use to value Fairfax’s stake. Estimating the fair value of Fairfax’s stake in BIAL: As of December 31, 2023, Fairfax India owned 59% of BIAL (on a fully-diluted equity basis). Fairfax owns about 42.8% of Fairfax India. Therefore, Fairfax owns about 25.25% of BIAL (59% x 42.8%), with a value of $631 million ($2.5 billion x 25.25%). This makes BIAL the 4th largest equity holding of Fairfax (after Eurobank, Poseidon and FFH-TRS). From Fairfax India’s Q3 interim report: “At September 30, 2023 the company held a 57.0% equity interest in BIAL (December 31, 2022 - 54.0%) and its internal valuation model indicated that the fair value of the company's investment in BIAL was $1,408,403 (December 31, 2022 - $1,233,747).” “At September 30, 2023 the company held 43.6% out of its 57.0% (December 31, 2022 - 43.6% out of its 54.0%) equity interest in BIAL through Anchorage. As a result, the company's fully-diluted equity interest in BIAL was 52.0% (December 31, 2022 - 49.0%). Refer to note 8 (Total Equity, under the heading Non-controlling interests) for further discussion on Anchorage.” How much did it cost Fairfax India to secure a 59% interest in BIAL? Fairfax India made their first purchase in BIAL in 2016. Since then they have made 5 more purchases. Over the past 8 years, Fairfax India has spent a total of $902 million for 64% of BIAL. In 2019, Fairfax India also sold a 5% interest to OMERS for $134 million. The sale was made via Anchorage (a subsidiary of Fairfax India). Fairfax India’s fully-diluted equity position in BIAL (of 59%) cost a total of $768 million. What has been the return on the 8-year investment in BIAL? The fair value of Fairfax India’s 59% stake in BIAL is about $1.475 billion. Its cost is $768 million. The simple return is about $707 million. As reported by Fairfax India, the CAGR on this investment since inception has been 12.8% (to Sept 30, 2023). What is the carrying value of Fairfax India at Fairfax? This is where things get even more interesting. At December 30, 2022, Fairfax had a carrying value for all of Fairfax India of $630 million (58.4 million shares x $10.78/share) - that is what is reflected in Fairfax’s book value. (Of interest, my math says the total cost to Fairfax since late 2015 of its various investments in Fairfax India has been about $535 million. So, carrying value for Fairfax India is slightly higher than Fairfax's cost basis? For an asset that has increased significantly in value of the past 8 years? That is something we will review in a future post.) Carrying value significantly understates the value of Fairfax's stake in Fairfax India today. BIAL represents about 47% of Fairfax India. This gives us a ball-park estimate for the carrying value of BIAL at Fairfax today of about $300 million ($630 million x 47%). Summary: Fairfax’s 25.25% interest in BIAL has a fair value of about $630 million and a carrying value of about $300 million. That is a significant difference. And as the value of BIAL grows in the coming years, that difference will likely grow even larger. The very low carrying value of Fairfax India (including BIAL), is one good example of how the book value of Fairfax today is significantly understated. Management In 2017, Fairfax India paid up to get a controlling position in BIAL. They quickly overhauled management and installed Hari Marar as Managing Director and CEO. BIAL is exceptionally well managed. BIAL is a great example of the strong management team at Fairfax India. From Fairfax India’s 2017AR: “In July 2017 Fairfax India acquired the final 10% of BIAL owned by GVK for $200 million, the higher price being justified by this purchase enabling Fairfax India and the other remaining shareholders to reconstitute BIAL’s Board, to appoint the best qualified person as BIAL’s CEO, and generally to allow it to be managed according to Fairfax India’s standards of corporate governance and guiding principles. “Subsequently, three new directors with expertise in airport and airline management and finance were appointed to the Board of BIAL, and Hari Marar, the former COO of BIAL, was appointed as its new Managing Director and CEO.” Since taking over in 2017, the management team at BIAL has done an exceptional job. See 'recent news' articles below for some current examples. Conclusion BIAL has been a solid investment for Fairfax India. Over the past 8 years, it has grown into the 4th largest equity holding of Fairfax. It has a carrying value that is less than half of its fair value. BIAL is a very high quality asset. It is also exceptionally well managed. It is also perfectly positioned to benefit from India's growth in the coming years and decades. The runway for this investment is very long. Most importantly, Fairfax (via Fairfax India) has a control position in this very rare asset. That is almost priceless - and likely the reason Prem calls BIAL a ‘crown jewel’ asset for Fairfax. ————— Recent news: Dec 2023: Bengaluru airport to roll out its master plan with renovation of T1, new place for T3 by 2030 https://indianexpress.com/article/cities/bangalore/bengaluru-airport-master-plan-renovation-9049746/# Dec 2023: BLR Airport Secures ‘Best Domestic Airport’ Title https://www.bengaluruairport.com/corporate/media/news-press-releases/blr-airport-secures-best-domestic-airport-title-at-travel-leisure-india-s-best-awards----- Dec2023: BLR Airport’s Terminal 2 earns UNESCO’s recognition as one of the 'World’s Most Beautiful Airports' https://www.bengaluruairport.com/corporate/media/news-press-releases/terminal---earns-unesco-s-recognition-as-one-of-the-world-s-most-beautiful-airports-and- Dec 2023: Bengaluru airport most profitable in India in FY23 https://www.moneycontrol.com/news/technology/bengaluru-airport-most-profitable-in-the-country-in-fy23-ahmedabad-incurs-highest-losses-11859721.html# ————— Ownership structure of BIAL Fairfax open to acquiring AAI’s 13% stake in Bangalore Airport: Hari Marar https://www.thehindubusinessline.com/economy/logistics/fairfax-open-to-acquiring-aais-13-stake-in-bangalore-airport-marar/article67466405.ece ————— Prem’s Letter, Fairfax 2022AR: “While the book value per share of Fairfax India is $19.11 per share, we believe the underlying intrinsic value is much higher. Given the low market price for its shares, Fairfax India has taken the opportunity in the last four years to buy back 15.1 million shares for $194 million at an average price of $12.84 per share, including the three million shares it bought in 2022 for $36 million or an average price of $12 per share.” ————— Fairfax India Q3, 2023 Interim Report: Details of BIAL and Anchorage Subsidiary “Non-controlling Interests: In 2019 the company formed Anchorage as a wholly-owned subsidiary of FIH Mauritius, intended to provide investment related services to support the company in investing in companies, businesses and opportunities in the airport and infrastructure sectors in India. On September 16, 2021 the company transferred a 43.6% equity interest in BIAL from FIH Mauritius to Anchorage and subsequently sold 11.5% (on a fully-diluted basis) of its interest in Anchorage to OMERS for gross proceeds of $129,221 (9.5 billion Indian rupees). Upon closing of the transaction, the company's ownership in BIAL was comprised of 10.4% held through FIH Mauritius and 43.6% held through Anchorage, representing effective ownership interest of 49.0% on a fully-diluted basis. “At September 30, 2023 the company continued to hold 43.6% out of its 57.0% (December 31, 2022 - 43.6% out of its 54.0%) equity interest in BIAL through Anchorage. As a result, the company's fully-diluted equity interest in BIAL was 52.0% (December 31, 2022 - 49.0%).” ————— A history of financial transaction at BIAL Timeline for BLR Airport

-

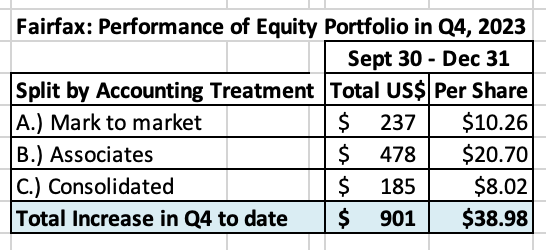

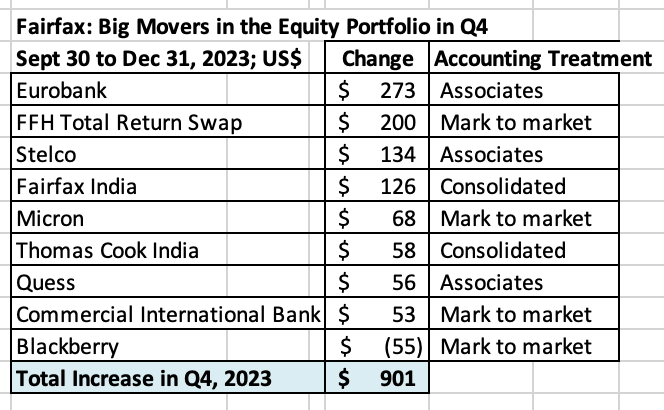

What was the change in the value of Fairfax’s equity portfolio in Q4, 2023? Fairfax’s equity portfolio (that I track) has a total value of about $17.5 billion at December 31, 2023. This is an increase of about $901 million (pre-tax) or 5.4% from September 30. The increase in the quarter works out to about $39/share. Currency, which has been a headwind for the past couple of years turned into a tailwind in Q4. Please note, I include holdings like the FFH-TRS position in the mark to market bucket and at its notional value. I also include debentures and warrants in this bucket. To state the obvious, my tracker portfolio is not an exact match to Fairfax’s actual holdings. It also does not capture changes in the value of private holdings – which are significant. It also does not capture changes Fairfax has made to its portfolio during the quarter that are not reported. As a result, my tracker portfolio is useful only as a tool to understand the likely directional movement in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 49% of Fairfax’s equity holdings are mark to market - this includes 'A.) Mark to Market' and 'D.) Other Holdings' - and will fluctuate each quarter with changes in equity markets. The other 51% are Associate and Consolidated holdings. Split of total gains by accounting treatment The total change is an increase of $901 million = $39/share The mark to market change is increase of $237 million = $10/share. Only changes in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio in Q4? Eurobank was up $273 million and is now Fairfax’s largest equity holding - a $2.1 billion position for Fairfax. The shares still look like they are dirt cheap, closing the year at €1.61. This holding looks primed to have another good year in 2024. The FFH-TRS was up $200 million. This position is up a total of $1.07 billion over the last 3 years, which is a gain of almost 150%. Simply an amazing investment. Stelco was a strong performer, up $134 million. It will be interesting to see if we get more consolidation in the North American steel industry in 2024. Fairfax India (finally) got some love from investors in Q4 and was up $126 million. This high quality holding continues to fly under the radar of most investors. International holdings - Thomas Cook India, Quess and Commercial Industrial Bank – all had strong gains in Q4 Blackberry was the biggest under-performer, down $55 million. In Q4, Fairfax significantly reduced the size of its investment in Blackberry by reducing the debenture position from $365 to $150 million. The stock position is worth a total of $165 million. Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1.0 billion or $45/share (pre-tax). Book value at Fairfax is understated by about this amount (less the tax impact). What is the split? Associates: $668 million = $29/share Consolidated: $348 million = $15/share Below is a copy of my Excel spreadsheet (next 2 pages) if you want a closer look. Equity Tracker Spreadsheet explained: The summary below attempts to track all equity holdings at Fairfax. Each quarter the spreadsheet is updated to capture any ‘new news:’ purchases and sales. We have separated holdings by accounting treatment: Mark to market Associates – Equity accounted Consolidated Other Holdings (also mark to market) – derivatives (total return swaps), debentures and warrants We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. Important: the list is not complete. Some information we only get once per year when Fairfax published their annual report. Fairfax also makes changes to their portfolio each quarter. Fairfax Dec 31 2023.xlsx