-

Posts

15,104 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I think this offshore trend extends all the way from Venezuela to Brazil. $APA / Total already have several gushers in Suriname next to Guyana. PBR intends to drill in Brazillian offshore waters there. This will probably be a monster exploration area similar to shale in the USA. Opec better watch out or try to get this countries into their fold but in a way it wont matter, because for these countries, drilling for these resources is a no brainer.

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

Let me guess - the liver went first: https://www.cnn.com/2023/11/30/entertainment/shane-macgowan-death-scli-intl -

Small add to $CPNG for $15 and change.

-

@RedLion I don't know where you live but when i lived in Santa Rosa, I loved making trips around Alexander valley (Dry Creek road) and try the vineyards that are chained around that Road. One of the largest is Alexander Valley vineyard which has a tasting room and a complete range from $20-$60 priced wines which are a good value, imo. I also liked the Russian River valley for similar reasons. Got a friend working the Porter Creek vineyard tasting room which is more boutique and according to her, the wines are very very good, but also pricier.

-

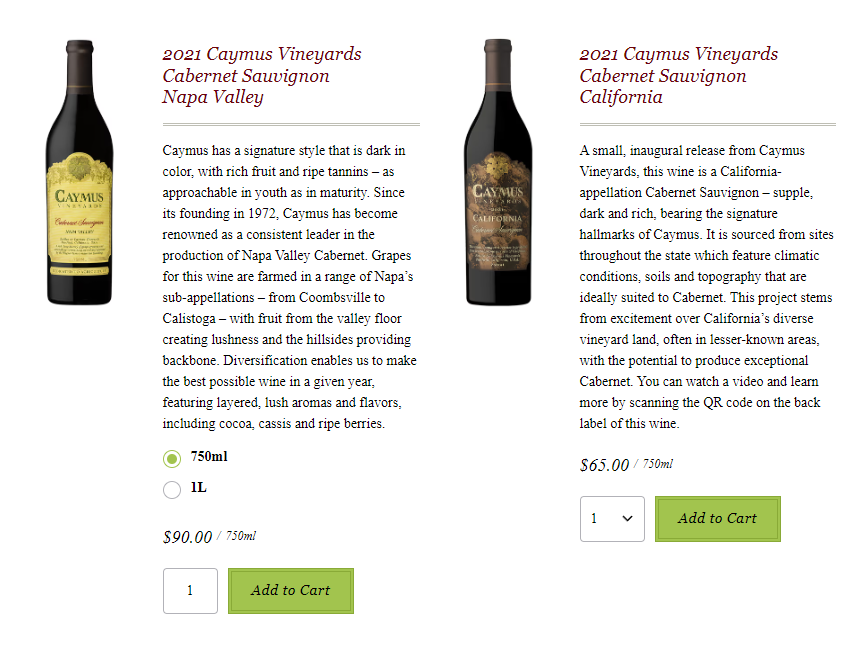

Seems expensive for $90/ bottle but even more egregious is selling $65 Bottles with "California" appellation. "California" means the grapes are coming from Central Valley - Ouch. I can buy good bottles of Cabernet for <$20 with Grapes from Sonoma county. You can't make great wine with crappy grapes (at least that's what my dad told me who was a winemaker).

-

ultimately the value of the sports teams depends on the revenues they can pull in, which is mostly from media/TV income. Even billionaires don't like losing money on an trophy assets even if it comes with an ego booster. So far media revenue has been rising quickly even though expenses matched the rise in income but I think eventually that revenue increases will subside since the ecosystem with streamers and cable isn't exactly healthy.

-

Probability that covid will become endemic

Spekulatius replied to LearningMachine's topic in General Discussion

Every epidemic becomes endemic or the host dies out, so that was never in question. What was questionable is what happens until the epidemic becomes endemic. -

Biggest risk is that the tax code changes and the intangibles paid for the team cannot be written off any more. If this happens, team values immediately would take a huge hit.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Imagine being worth $8.8B and then coming up with this low life scheme to squeeze out the last few hundred million $ from the remaining 20% of the business they agreed to sell already. WEB misjudged the character of the sellers here. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

I don't think they have $330M in FCF. They have gotten a loan to pay for these. BRP has roughly ~$1.3B in debt and expect to pay $120M in interest next year. Their "FCF" does not include the cash earnout payments, so I think the absolute amount of debt will increase slightly. They may show lower leverage if their EBITDA continues to increase. -

Charlie leaves behind a rich legacy.

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

Yeah FCF not containing earnouts which are cash payments was probably something that soured investors on the stock. This will continue until Q1 2025 according to the CC transcript. They have $332M in remaining earn outs to pay (relative to a $1.1B market cap), which puts considerable strain on their real cash flow. All the stated numbers don't contain this cash outflow. This could be interesting down the road if they get closer to working through the earnouts in late 2024, assuming the numbers come in as expected. Right now, they are seeing the limits of their acquisition driven business model. -

Well if someone would replace google search with something better on your iphone - would you miss it? maybe. Same with google maps - Apple maps has improved to the point where it is almost as good. So most tech moats don't have the longevity that people think they have. the above isn't a theoretical exercise either since google pays Apple dearly to be the default search engine and Apple maps already exists. So Apple could very well change their mind and attack the moat with their own search or replace with Google (AI enhanced) search for example. I don't think the tech moats have the longevity that people think they have. Lot's of tech moats have disintegrated lately -Paypal, Intel, Cisco are fairly recent examples. I believe with tech it's much more about having great and forward looking management in place then the tech moat itself. When you look at history, each tech moat is probably seriously challenged every 10 years or so and it depends on management if they keep the moat intact or even develop new moaty business or not.

-

Bernanke never helicoptered money. Bernanke gave money to banks by the way of easy credit (TARP) but never sent checks to the average Joe which is what helicopter money means. That happened during the pandemic under Trump and a Biden. We can argue if it was necessary or not but the money kept flowing after the pandemics was essentially over and that caused inflation.

-

BILD is not a credible source, they just make stuff up and have been doing this for 50 years at least. Right now General Winter is going to slow everything down. Russia may have 4 x the soldiers, but they are also losing 4x the soldier right now, probably about 200k casualties/ year. Sure they can keep it up for a couple of years but their economy and demographic damage borders on ruin. Next year, they have to combat a Ukrainian Air Force bolstered by F16’s. Ammo won’t be an issue then either, there is enough production online by then to keep up with consumption.

-

From the above $JACK looks interesting when I looked at them recently. I had no idea before checking them out that they were buying back that much shares. I found them when I ran variations of my cannibal screen in Tikr.

-

Money for nothin is western decadence. Chinese stimulus means the under employed get sent to salt mines (or perhaps rare earth mines) with some regular whipping until morale improves.

-

Happy Thanksgiving to Our American Members!

Spekulatius replied to Parsad's topic in General Discussion

Fondue bourgignonne uses oil , Swiss fondue uses cheese and a German fondue uses broth, which is basically what we use in our hotpot, just with different (Asian) flavors. It’s great for a family and/or friends get together. -

what is invested capital exactly and is it static?

Spekulatius replied to scorpioncapital's topic in General Discussion

I think the easiest way is to take the entire balance sheet and subtract anything that’s isn’t necessary to run the business (excess cash, excess investments ) - that’s your invested capital. You can calculate this from both sides (asset or liability side) of the balance sheet. -

Happy Thanksgiving to Our American Members!

Spekulatius replied to Parsad's topic in General Discussion

Yes, this is hotpot. We got various meats, Chinese mushrooms, fish cakes and fish and veggies/salad to boil. It has been a family tradition for us on Thanksgiving. Had ours a day early because my wife is on call on Thanksgiving (although no call yet ) -

Happy Thanksgiving to Our American Members!

Spekulatius replied to Parsad's topic in General Discussion

-

The much simpler solution for me would be just to distribute the Porsche 911 owned by VW to shareholders. Problem solved.

-

Richest 1% Emit As Much Carbon As 5 Billion People

Spekulatius replied to Parsad's topic in General Discussion

This is based on questionable methodology. Note they seem to be counting emissions from investments. What that means is that if you buy an oil stock for example, the proportional carbon emissions from this oil business count towards your carbon footprint. No doubt that this results in the majority of Carlos Slim’s or Bill Gates carbon footprint. So if you had large investments, you could live like a Hermit crab in cave in a mountain with no electricity and you would have a large carbon footprint by that methodology. This makes no sense to me. -

It was either that , or MSFT takes their employees and leaves a worthless shell, which would probably been acquired by MSFT resulting in the same outcome. MSFT owns this thing either way, that much is clear.

-

@John Hjorth - yes the loss on PAH3 is moderate, but still stings. The reason for the sale is that I am more and more concerned about the Chinese competition affecting Porsche as well. The VW business certainly is affected, not just in Chine, but also soon in Europe. There just is too much competition with cars. I am now poking around putting the funds to work into something similar like Daimler Truck, AGCO or CNHI where there is less competition and the stocks are almost as cheap. All those have issues with cyclicality though. (FWIW, I own a little of CNHI already)