-

Posts

15,099 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Adopting the USD instead of the Peso imo is already a very bad idea, imo.

-

Holding coal stocks forever probably won't yield great results. MP is going to do what he has been doing all along going for deep value bet's and churning them quickly. Regarding fee structure, one can't run an small international small cap value fund on 0.25-0.5%. I think 1% is the minimum I would expect and 2% while high isn't exactly unheard of either.

-

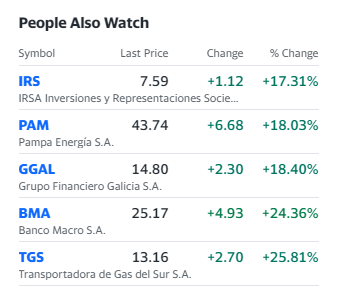

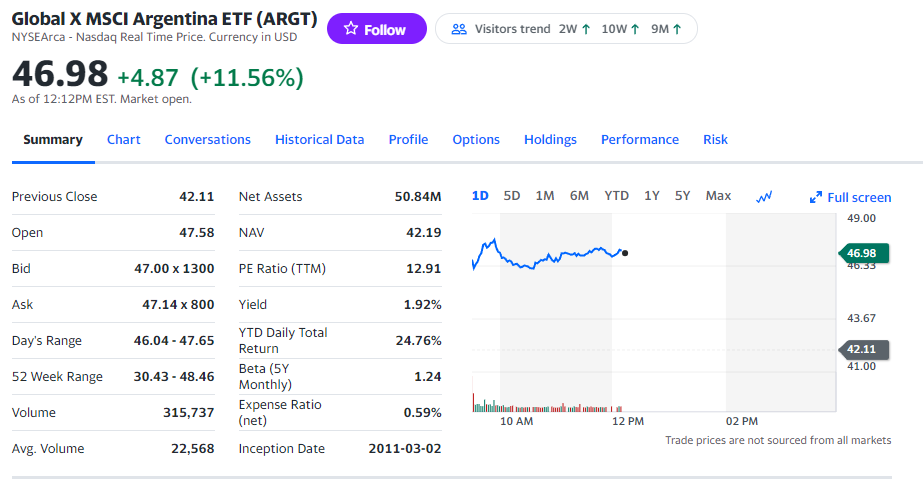

Argentinian stocks are up big time: A lot of bad takes on twitter that socialism is to blame but the former right wing governments weren't much better. hopefully Javier Milei can make a difference, but this won't be easy as the rot is deep.

-

Now this could get very interesting : https://www.wsj.com/world/americas/argentina-votes-for-new-president-to-confront-economic-crisis-99b73b86?mod=world_lead_story https://archive.ph/el0nv Javier Milei, a Self-Described Anarcho-Capitalist, Is Elected President of Argentina The libertarian outsider, who says he will upend years of free-spending populist rule, defeats ruling party candidate Sergio Massa

-

I recall this stuff having some quality issues a while ago: https://www.huffpost.com/entry/fireball-whiskey-recall_n_6067486

-

Archive.ph version of above article from Bloomberg. https://archive.ph/nU3Tg Clearly, the general tone from the meeting was “cold as ice”.

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I wasn’t that big of a fan of “Reptile” although I like Benicio de Toro’s work. “They cloned Tyrone “ was imo a way better movie released by Netflix. -

Full disclosure https://www.wsj.com/tech/cybersecurity/a-ransomware-gang-wanted-its-victim-to-pay-up-so-it-went-to-the-sec-803cf786?mod=tech_lead_story

-

ChatGPT sucks for math. Totally unusable unless you use it in combo with a math engine like Wolfram, but then why not just use the math engine by itself.

-

I am sort of sad to see him go though. He did have valid contrarian views in many cases. The biggest surprise for me was that he had only ~$200M in AUM left, not exactly big boy territory any more. I guess that was not enough to keep the lights on and that’s why he shut down his fund.

-

Chanos is quitting? Must be close to the top.

-

Suicide? It’s just a job. Worst case, he just going to resign. He can pick from a dozen better paying job with his experience and connections.

-

When you watch the meeting videos, it is clear that Biden and Xi dislike each other. Biden also does not give a diplomatic damn about calling a dictator what he is, make of it what you want. I guess the good news is that both side still talk, but there are very clear lines in the sand.

-

An index that tracks SP500 minus the Mag7

Spekulatius replied to rogermunibond's topic in General Discussion

I forgot who it was, but there was one podcast guest who suggested to value companies based on their "economic footprint" rather than market cap with metrics like revenue, equity, employees, profits etc and construct a value index that way. So far everything I have seen has underperformed market cap weighting so.... -

An index that tracks SP500 minus the Mag7

Spekulatius replied to rogermunibond's topic in General Discussion

Not scaleable. Imagine people buying such a vehicle in size, the smaller caps would probably increase way above the fair value. Even if people would dump a lot of money into an equal weighted index funds, it would lead to distortions for lower caps and small float stocks. It is amazing how well the simple low cost market weighted index fund works by harvesting essentially the wisdom of the crowds. I do agree with @TwoCitiesCapital that the most practical way of reducing the impact of the Mag7 is to buy an equal weighted index fund right now. -

Pretty good article on the recent market swings and narratives: https://www.wsj.com/finance/investing/whats-behind-the-markets-wild-overreactions-cae05ade

-

Does KW look good to you? It looks terrible with all that leverage and all those development projects. I had some unsecured bonds for a while and even felt uncomfortable holding them so ditched them for a small profit.

-

How Does the World’s Largest Hedge Fund Really Make Its Money?

Spekulatius replied to james22's topic in General Discussion

Seems to me that Ray Dalio ran a huge business very successfully so he must have done a few things right, be it salesmanship, macro calls, hiring the right employees or something else. His book "Principles" which I tried to read as a pdf is terrible imo and I don't recommending wasting time it. -

Sold some $STNE in my IRA. Around a 45% gain on the few shares I bought weeks ago. Go figure. Wish they all did so well.

-

Check out Bill Gates or WEB tax rates. The US tax system is very degressive once your income is not through working for somebody else any more. These guys own business and for larger business, the tax rates are at all time lows. Just check out the tax rate for any large business , it’s probably in the 15% range. Tax advantages galore for real estate (Trump tax reports are an example), private equity, venture capital etc.

-

Best trade was just to by the QQQ and chill. Ignore Powell, ignore doomsters, inflationista's or everyone else. Up ~45%.

-

MP basically has become the Dave Ramsey of stock investing.

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

Watching “ All the light we cannot see” on Netflix. Beautiful storytelling and great cast: -

the bank likely does not own your mortgage - certainly not if it is a conforming mortgage. The mortgage is owned by by some MBS fund with thousands of other mortgages packaged together. That construct makes it probably not feasible to buy out individual mortgages. Even if a bank does own your mortgage fully, i don't think they would buy it back because they would immediately realize a loss which would create a hit for their equity. Better to extend and pretend as this does not impair their capital (from a regulators perspective).

-

I know people who retired and own zero bonds. Most people were just holding cash or sometimes short term CD's, since bonds were yielding almost nothing. What was the point of holding bonds in 2021?