Viking

Member-

Posts

4,651 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

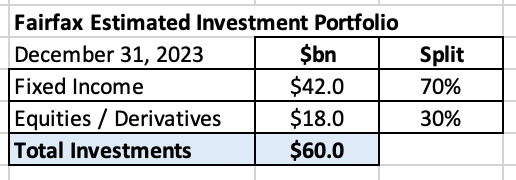

As of December 31, 2023, my guess is Fairfax has an investment portfolio that totals about $60 billion, with the split being roughly as follows: In this post we review the holdings in the equities ‘bucket.’ To value a holding we normally used current ‘market value,’ which is the stock price at Dec 31, 2023, multiplied by the number of shares Fairfax owns. For private holdings we use Fairfax’s latest reported market value (sometimes carrying value). Derivative holdings, like the FFH-TRS, are included at their notional value. Where we have done something ‘funky’ we provide an explanation (see ‘additional notes’ below). We have attempted to capture a value for each holding that we feel roughly reflects its ‘intrinsic’ or actual economic value to Fairfax. For Fairfax India and Recipe, some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. We used share counts that reflect what we think Fairfax actually owns/controls. (I think some Poseidon shares are also included in this note but I am not sure so I did not make an adjustment for this - so the Poseidon position below might be understated by about 9%). Additional notes: Atlas: $2,100 = 2,046 FV at Q3 + $50 Q4 earnings (likely low) Fairfax India: $1,220 = $20.89 BV at FIH.U x 58.4 million shares Recipe: $900 = ($17.25 CV at Dec 31, 2022 x 49.4 million shares) + $50 million (2023 earnings est) AGT Food Ingredients: $350 million. A guess; probably low. EBITDA was C$150 million in 2022. Mytilineos: includes exchangeable bonds John Keells: includes convertible debentures Ok, let’s get to the fun part of this post. What are some key take-aways? Below are mine. What are yours? 1.) Fairfax has a pretty concentrated portfolio The top 5 holdings make up 45% of the total The top 15 holdings make up close to 70% of the total 2.) Steady improvement in quality of the top 15 holdings over the past 6 years: What happened? New money has been invested at Fairfax very well (FFH-TRS, buying more of existing holdings) Some high quality businesses have continued to execute well (Fairfax India, Stelco) Some businesses, after years of effort, have turned around (Eurobank). Some businesses that were severely affected by Covid have emerged stronger (Thomas Cook India, BIAL, Recipe?) Some businesses were restructured/taken private (EXCO, AGT) and are now performing much better. Some low quality business were sold/merged/wound down (Resolute Forest Products, APR, Fairfax Africa). Some low quality businesses have shrunk in size due to poor results (BlackBerry, Farmers Edge, Boat Rocker). The important point is the quality of Fairfax’s largest holdings have steadily been increasing. And this should result in higher overall returns from the equity portfolio in the coming years. 3.) What rate of return should this collection of equity holdings be able to deliver in 2024? 12% return x $18 billion = $2.16 billion (made up of share of profit of associates + dividends + ‘other’ consolidated non-insurance co’s + investment gains) This looks like a reasonable target for 2024, looking at the solid prospects/earnings profiles of the top 15 holdings (with a 70% weighting). 4.) A slow shift away from mark-to-market holdings. Today, less than 50% of the total portfolio is held in the mark-to-market bucket. Back in 2019, my guess is closer to 80% of the total portfolio was held in the mark-to-market bucket. This shift should have the effect of smoothing Fairfax’s reported results moving forward, especially during bear markets. As a reminder, in Q1, 2020, Fairfax had $1.1 billion in unrealized losses (when the equity portfolio was much smaller). As more holdings shift to the ‘Associates’ and ‘Consolidated’ buckets, it is the trend in underlying earnings at the individual holdings that will matter to Fairfax’s reported results and not a stock price - earnings are much more consistent than a stock price. Lower volatility in reported earnings should help Fairfax’s valuation (as volatility is considered bad by Mr. Market). This shift will also start to create a Berkshire Hathaway problem for Fairfax: over time book value will become an increasingly poor tool to use to value Fairfax. Why? The value of the ’Associates’ and ‘Consolidated’ companies captured in book value each year will fall short of the increase in their true economic value. Fairfax India is a good example of this today. Eurobank is a holding to watch moving forward. Bottom line, Fairfax looks very well positioned today. But the story gets better: like the past 6 years, I expect the quality of Fairfax's equity holdings to continue to improve in 2024. That will improve future returns. And, like a virtuous circle, the growing cash flows will be re-invested growing the companies even more. Thoughts? Am I missing something? What number below is most wrong? Why?

-

+1 Fairfax needs to re-build investor confidence. That is extremely important. Increasing the dividend is a no-brainer way to do that (yes, just one of many things that need to happen). And a material - 50% - increase in the dividend is even better (as long as it is sustainable… which it is in this case). Three things drive a share price: 1.) earnings 2.) multiple 3.) share count The spike higher in Fairfax’s shares the past three years has been driven by a spike in earnings and a rapid decrease in the share count. Multiple expansion HAS NOT HAPPENED. Yet. I think it will. But to get multiple expansion the management team will need to keep doing what they are doing - delivering solid results and communicating well. Multiple expansion is rocket fuel to a share price.

-

@nwoodman i agree. There are a number of catalysts that might come to fruition in 2024 for Fairfax in India: 1.) Digit IPO - surface value in Digit 2.) Anchorage IPO - surface value in BIAL 3.) NSE and Seven Island Shipping IPO’s - surface value in Fairfax India There were also the rumours of Fairfax making a bid for IDBI Bank.

-

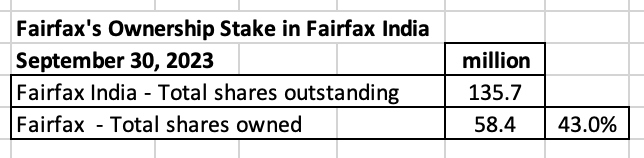

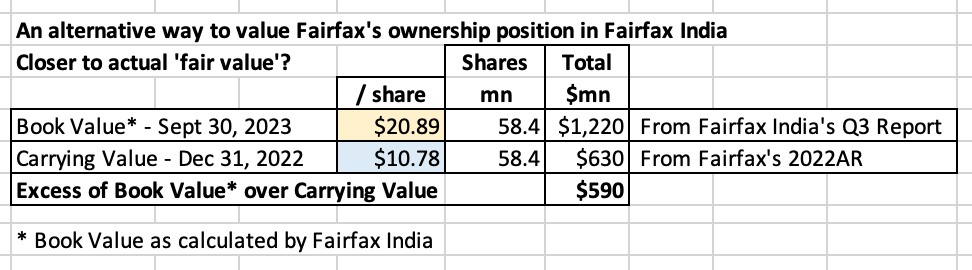

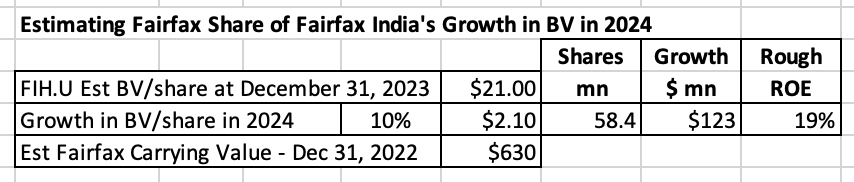

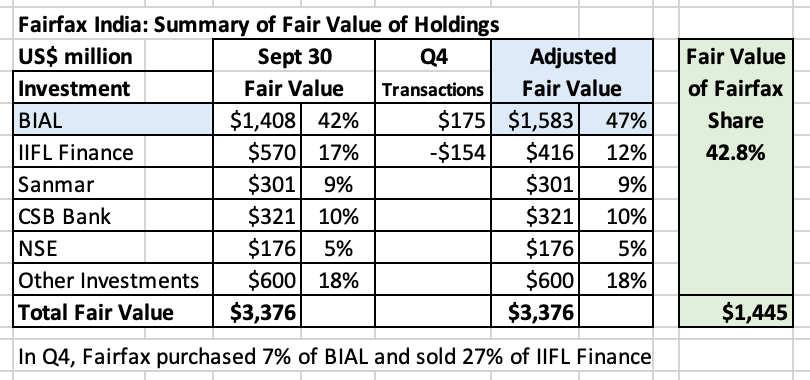

Fairfax India was launched in 2015. It has grown into a wonderful business for Fairfax. Solid collection of assets. Very well managed. Very good track record. Well positioned for the future. In this post we are going to get into the weeds of how Fairfax India is valued by its parent, Fairfax. Let me know if you think i have messed up with my math/logic/assumptions… that is how we all learn. How much of Fairfax India does Fairfax own? When Fairfax India was launched in 2015, Fairfax owned 28.1%. My math says Fairfax now owns 43.0% of Fairfax India, which is an increase of more than 50% over the past 8 years. Fairfax India is also now a much larger company - common shareholders equity has increased from $1 billion at inception in 2015, to $2.8 billion at Sept 30, 2023, which is an increase of 180%. So today, Fairfax owns 50% more of a company that has increased in size by 180%. That sounds great. But what does the math look like? How many shares of Fairfax India does Fairfax actually own? It can be a little confusing to understand exactly how many shares of Fairfax India that Fairfax actually owns. This is because some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. On Feb 16, 2022, when they added to their position, Fairfax confirmed they ‘beneficially owned, and/or exercised control or direction over’ a total of 58.4 million shares of Fairfax India. I am assuming that is the number of shares they ‘own’ today. A short history of the growth of Fairfax’s ownership of Fairfax India (total shares and %) can be found at the bottom of this post. Market value and carrying value What is the market value that Fairfax uses to value its stake in Fairfax India? To determine market value, Fairfax uses Fairfax India’s stock price, which at Dec 31, 2023, was $15.20/share. This gives a total market value to Fairfax’s position of $888 million. What is the carrying value that Fairfax uses to value its stake in Fairfax India? Carrying value is important. This is the value that finds its way into book value. And, as we know, book value is the ‘holy grail’ use by investors to value P/C insurance companies. In the 2022AR, Fairfax said the carrying value for their investment in Fairfax India was $10.78/share, or $630 million (using my share count of 58.4 million). What is the excess of market value over carrying value? It appears Fairfax’s book value is understating the market value of its stake in Fairfax India by about $250 million. (Yes, i know my dates are messed up… directionally, it appears Fairfax India’s carrying value at Fairfax is low). OK. Are we done? No. There is a wrinkle. Fairfax India’s stock price is a terrible measure to use to value Fairfax’s stake in Fairfax India. And that is because Fairfax India’s stock price trades at a severe discount to the fair value of the collection of companies that it owns. My guess is accounting standards require Fairfax to report carrying value and market/fair value the way they do. What should we do? Fairfax India has very good disclosures. We should simply use Fairfax India’s book value - that is the best measure of what the collection of assets they own are actually worth. What is the value of Fairfax’s stake if we use Fairfax India’s book value? Fairfax India has a book value of $20.89/share (at Sept 30, 2023), which puts the value of Fairfax’s stake at $1.22 billion (using my share count of 58.4 million). It appears Fairfax’s book value is understating the value of its stake in Fairfax India by about $590 million. That is much larger than our previous estimate of $250 million. If we use a fair value of $1.22 billion, this suggests Fairfax India is Fairfax’s 4th largest holding, along with Eurobank, Poseidon and FFH-TRS. These 4 holdings represent about 40% of Fairfax’s total equity exposure. What does Prem think about Fairfax India’s reported book value? Prem thinks that Fairfax India’s intrinsic value is ‘much higher’ than its reported book value. If Prem is right, then the value of Fairfax’s stake in Fairfax India is worth even more than $1.22 billion. Below are Prem’s comment from Fairfax’s 2022AR: Growth prospects Fairfax India reported a book value of $20.89/share at Sept 30, 2023. My guess is it will be well over $21 at Dec 30, 2023. Let’s assume Fairfax India grows BV/share at 10% in 2024, which would be $2.10/share. This would put Fairfax’s share of growth in BV at $123 million ($2.10/share x 58.4 million shares). This would also deliver a (very rough) high teens ROE. Is 10% growth in BV/share an aggressive assumption? No, I actually think it will prove to be conservative. Why? BIAL is now 47% of total investments at Fairfax India. Its value has gone sideways for the past 3 years - as a result of Covid. However, the airport is beginning its next significant growth phase (as second runway and recently completed Terminal 2 ramp up). An Anchorage IPO in 2024 could unlock significant value that has been building at BIAL. Two other private holdings in Fairfax India also might see IPO’s in 2024: NSE and SIS, which would likely unlock more value for Fairfax India. The remaining holdings of Fairfax India are well run companies and should continue to increase in value. If my rough math is accurate, Fairfax’s stake in Fairfax India is poised to grow in value by about $123 million in 2024. Some of this value will show up in the ‘share of profit of associates’ bucket. However, like the past 8 years, a large part of the value will likely not show up in Fairfax’s reported results. As a result, the gap between fair value and carrying value will continue to widen. Conclusion Since being launched in 2015, Fairfax India has quietly been growing like a weed. It is a great example of exceptional long term value creation by the team at Fairfax/Fairfax India/Fairbridge. However, the value creation has largely not been reflected/captured in Fairfax’s accounting results - especially book value. Fairfax India is a great example of how book value at Fairfax is understated. There are likely more examples. —————- Warren Buffett on book value Warren Buffett in 2018 decided to no longer publish the book value for Berkshire Hathaway as he felt it was no longer a useful tool for investors to use to value Berkshire Hathaway’s share price. I wonder how much longer book value will serve as a useful tool for investors to value Fairfax’s share price. “Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mis-mark that has grown in recent years.” —————- Fairfax India: Summary of ‘total existing Indian investments’ At Sept 30, 2023, Fairfax India held total investments with a fair value of $3.376 billion. If we adjust for Q4 transactions (increase in BIAL and decrease in IIFL Finance): BIAL (manages BLR Airport) = 47% All other holdings = 53% Fairfax India Shareholders equity = $2.833 billion Debt = $500 million —————- A short history of Fairfax’s investment in Fairfax India Fairfax India was launched in 2015. At inception, Fairfax invested a total of $300 million ($10/share) for a 28.1% ownership position. Fairfax India did a second capital raise in January 2017 (at $11.75/share) and Fairfax participated to keep its ownership position of similar size (it was 30.2% at the end of 2017. Fairfax has also received two performance fees in shares of Fairfax India (2018 and 2021). Today Fairfax owns 58.4 million shares of Fairfax India. My rough math says they paid a total of $539 million or an average of $9.23/share. Share count at Fairfax India peaked at 152.9 million at December 31, 2018. Since that time, the share count has come down 11.2% to 135.7 million. With the stock trading well below book value, Fairfax India has been taking out shares on the cheap. Smart. With Fairfax’s share count going up and Fairfax India’s share count coming down, Fairfax has increased its ownership interest in Fairfax India from 28.1% in late 2015 to 43.0 at Sept 30, 2023. That is an increase of more than 50% over the past 8 years. That is a meaningful increase. ————— Summary of Fairfax India’s exceptional track record (at Sept 30, 2023) CAGR of ‘Total existing Indian Investments’ = 13.0% CAGR of ‘Total monetized Indian Investments’ = 17.5% From Fairfax India's Q3 Interim Report - Page 32 - https://www.fairfaxindia.ca/wp-content/uploads/FIH-2023-Q3-Interim-Report-Final.pdf ————— Summary of key metrics for Fairfax India (from 2022AR)

-

@petec as i was working through my BIAL post it became clear to me that i needed to do a valuation post on Fairfax India. It should be out this weekend. Another layer of complexity with Fairfax India (and Recipe) is some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. Fairfax reports they ‘beneficially owned, and/or exercised control or direction over’ these shares so they should be included as shares Fairfax ‘owns’ today. I think the shares being held in the ‘asset value note’ are slowly shrinking - hopefully this continues in Q4 (yes, Fairfax will need to spend some $ to buy the shares). The ‘asset value note’ looks to me like another example of Fairfax using leverage to boost returns. The FFH-TRS is another example. When i do my next size ranking of Fairfax’s equity holdings i am going to try and include the positions held in the ‘asset value note’ and Fairfax India at fair value (i will use Fairfax India’s reported book value). I might also take a stab at some private holdings like AGT and Bauer. This will increase the size of the equity bucket. And likely boost estimates of the returns from the equity bucket.

-

I love the 50% increase in the dividend to $15 (it had been at US$10 forever). Fairfax has paid a dividend for many years - and it is not going to stop (now that would be an idiotic thing to do). The fact Fairfax modestly increased the dividend should also not come a surprise to anyone. As was mentioned upthread, the payout ratio remains very low at 9% ($15 / $170 earnings in 2023). Yes, the increase of 50% looks dramatic - but let’s be honest, the amount is small potatoes in the big scheme of things ($5 for a company that is likely earning $170). Total shareholder return at Fairfax (buybacks + dividends) has been very high at Fairfax for the past 5 years. Fairfax HAS delivered on the share buyback front - especially if you include the FFH-TRS position. Capital allocation, in general, has been excellent. I can understand that some investors might not like dividends. There is an easy answer - stick to stocks that don’t pay a dividend. But the simple truth is lots of well run companies also pay a modest dividend. Lots of P/C insurers pay a dividend. Are they all idiots? I don’t think so. Fairfax is still trying to repair its image. This effort is going to take years. They are going to need to execute very well in the coming years. They are going to need to be rational. Increasing the dividend from $10 to $15 signals Fairfax is very bullish about its future - and that will be cheered my most investors. Well done Fairfax!

-

@This2ShallPass, I have a question. Can you explain what you mean by “wrong” when you say: “What could go wrong w Fairfax?” I look at risks as kind of being across three dimensions: 1.) time - short term (next two years) and longer term (3 and more years) 2.) internal - under Fairfax’s control 3.) external - not under Fairfax’s control Some events could be short term negative for the company’s stock price and be good for the company longer term (looking out a few years). For example, the dramatic fall in Fairfax’s stock price in 2020/2021 (outside of managements control?) ended up being a gift for long term shareholders (it allowed management to put on the FFH-TRS position - 1.96 million shares at $373/share - and buy back 2 million shares at $500/share). ————— The biggest near term risk to the stock price that i see is skittishness of Fairfax investors. The wounds inflicted by the past have not yet healed. It will take more time. As a result, at the first sign of trouble (real or not), we could see investors panic and Fairfax shares could get hit hard. Just another buying opportunity? Probably. But it will depend on what the trigger is. IFRS 17 accounting is a near term risk for me (for reported earnings). It is new and i do not understand how it impacts Fairfax’s quarterly results (i don’t yet have a feel for its overall impact to results). Interest rates in Q4 have moved dramatically further out on the curve. What will the IFRS 17 impact be? I am not sure, other than i expect it to be a headwind to earnings. Do losses from runoff accelerate? Losses have been running around $200 million for a few years now. Do they accelerate (inflation)? Or not? This is becoming a smaller part of Fairfax (helps when your insurance business grows like stink over a decade). Reserving in general is a watch out, not just for Fairfax, but for the industry. Another risk: lower interest rates + end of hard market could result in investors aggressively selling off P/C insurance stocks and rotating into other sectors. I think this has been happening a little over the past month or so. This is more of a P/C insurance risk than a Fairfax specific risk. Sorry, i am rambling…

-

@SafetyinNumbers thanks for the input/help. I have edited my summary to include this.

-

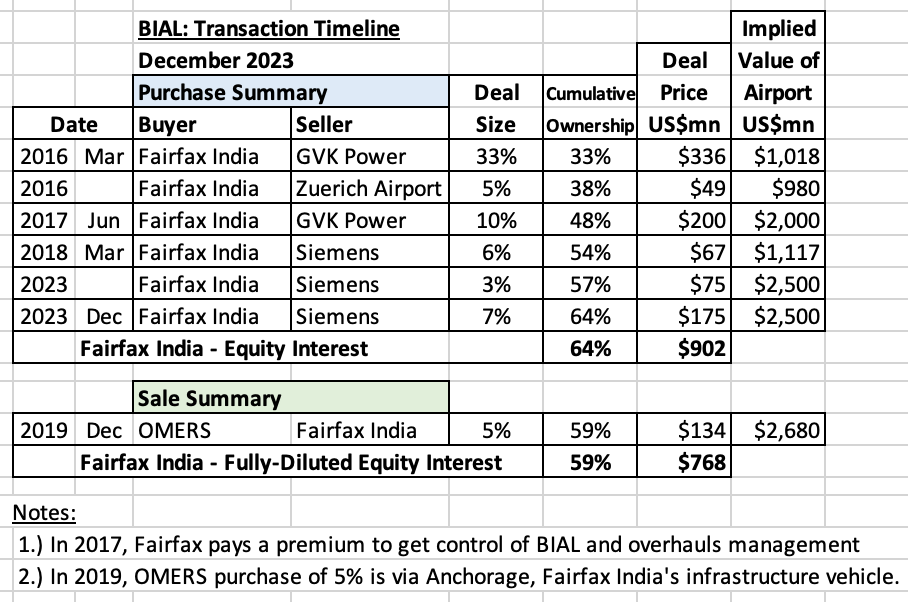

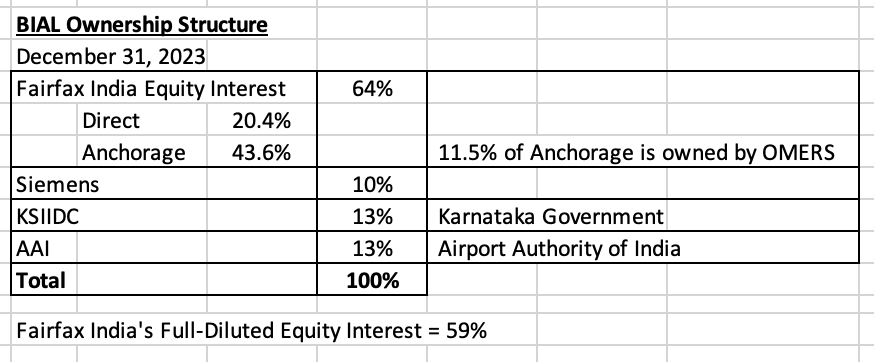

Bangalore International Airport Limited (BIAL) What is Fairfax’s 4th largest equity holding? At December 31, 2023, with a value of about $630 million, it looks to me like it is BIAL. BIAL is owned entirely within Fairfax India so it tends to get ignored as a core holding at the Fairfax (parent) level. But the fact it is ignored does not mean it does not exist. For good reason, Prem calls BIAL the ‘crown jewel’ of Fairfax’s various equity holdings in India. BIAL is a very high quality asset - it is a trophy asset (very hard to secure a control position). It is well managed. And it looks exceptionally well positioned to benefit from the expected growth of the economy in India in the coming decades. So, in this post, let’s shine a light on this important holding to see what we can learn. There are so many interesting layers to this story. What is missing? Is my logic faulty? Who is BIAL? The best place to go to get information on BIAL is Fairfax India’s web site (start with the Q3 Interim Report and the 2022 Annual Report): https://www.fairfaxindia.ca Here is how Fairfax India described BIAL in their Q3, 2023 Interim Report: “Bangalore International Airport Limited ("BIAL") is a private company located in Bengaluru, India. BIAL, under a concession agreement with the Government of India until the year 2068, has the exclusive rights to carry out the development, design, financing, construction, commissioning, maintenance, operation and management of the Kempegowda International Airport Bengaluru ("KIAB") through a public-private partnership. KIAB is the first greenfield airport in India built through a public-private partnership.” Fairfax India - Q3 Interim Report KIAB (also know as BLR Airport) is the third largest airport in India and the largest airport in south India. Bangalore, the centre of India’s high-tech industry, is known as the ‘Silicon Valley of India’. KIAB was recently voted best domestic airport in India (go to the bottom of this post for a link to the article). The History And Rise Of Bangalore International Airport https://simpleflying.com/bengaluru-airport-history/ A review of the fair value of the assets owned by Fairfax India Fairfax India owns assets with a fair value at Sept 30, 2023 of $3.38 billion. In Q4, Fairfax India increased is ownership in BIAL by 7% (at a cost of $175 million) and sold down its position in IIFL Finance by 27%. Including these two recent transactions, BIAL represents about 47% of all assets in Fairfax India. BIAL is a massive holding for Fairfax India. Fairfax owns 42.8% of Fairfax India. This puts the fair value of Fairfax’s stake in Fairfax India at about $1.45 billion. What is the math that gets BIAL to a $631 million valuation for Fairfax? As we mentioned earlier, Fairfax does not own BIAL directly - its position is held entirely through Fairfax India. Estimating the total value of BIAL: At September 30, 2023, Fairfax India held an equity interest in BIAL of 57% with an estimated fair value of $1.408 billion. This values 100% of BIAL at $2.6 billion. In Q4, Fairfax India purchased another 7% BIAL from Siemens for $175 million; this transaction values 100% of BIAL at $2.5 billion. Given this is the most recent transaction, this is the number we will use to value Fairfax’s stake. Estimating the fair value of Fairfax’s stake in BIAL: As of December 31, 2023, Fairfax India owned 59% of BIAL (on a fully-diluted equity basis). Fairfax owns about 42.8% of Fairfax India. Therefore, Fairfax owns about 25.25% of BIAL (59% x 42.8%), with a value of $631 million ($2.5 billion x 25.25%). This makes BIAL the 4th largest equity holding of Fairfax (after Eurobank, Poseidon and FFH-TRS). From Fairfax India’s Q3 interim report: “At September 30, 2023 the company held a 57.0% equity interest in BIAL (December 31, 2022 - 54.0%) and its internal valuation model indicated that the fair value of the company's investment in BIAL was $1,408,403 (December 31, 2022 - $1,233,747).” “At September 30, 2023 the company held 43.6% out of its 57.0% (December 31, 2022 - 43.6% out of its 54.0%) equity interest in BIAL through Anchorage. As a result, the company's fully-diluted equity interest in BIAL was 52.0% (December 31, 2022 - 49.0%). Refer to note 8 (Total Equity, under the heading Non-controlling interests) for further discussion on Anchorage.” How much did it cost Fairfax India to secure a 59% interest in BIAL? Fairfax India made their first purchase in BIAL in 2016. Since then they have made 5 more purchases. Over the past 8 years, Fairfax India has spent a total of $902 million for 64% of BIAL. In 2019, Fairfax India also sold a 5% interest to OMERS for $134 million. The sale was made via Anchorage (a subsidiary of Fairfax India). Fairfax India’s fully-diluted equity position in BIAL (of 59%) cost a total of $768 million. What has been the return on the 8-year investment in BIAL? The fair value of Fairfax India’s 59% stake in BIAL is about $1.475 billion. Its cost is $768 million. The simple return is about $707 million. As reported by Fairfax India, the CAGR on this investment since inception has been 12.8% (to Sept 30, 2023). What is the carrying value of Fairfax India at Fairfax? This is where things get even more interesting. At December 30, 2022, Fairfax had a carrying value for all of Fairfax India of $630 million (58.4 million shares x $10.78/share) - that is what is reflected in Fairfax’s book value. (Of interest, my math says the total cost to Fairfax since late 2015 of its various investments in Fairfax India has been about $535 million. So, carrying value for Fairfax India is slightly higher than Fairfax's cost basis? For an asset that has increased significantly in value of the past 8 years? That is something we will review in a future post.) Carrying value significantly understates the value of Fairfax's stake in Fairfax India today. BIAL represents about 47% of Fairfax India. This gives us a ball-park estimate for the carrying value of BIAL at Fairfax today of about $300 million ($630 million x 47%). Summary: Fairfax’s 25.25% interest in BIAL has a fair value of about $630 million and a carrying value of about $300 million. That is a significant difference. And as the value of BIAL grows in the coming years, that difference will likely grow even larger. The very low carrying value of Fairfax India (including BIAL), is one good example of how the book value of Fairfax today is significantly understated. Management In 2017, Fairfax India paid up to get a controlling position in BIAL. They quickly overhauled management and installed Hari Marar as Managing Director and CEO. BIAL is exceptionally well managed. BIAL is a great example of the strong management team at Fairfax India. From Fairfax India’s 2017AR: “In July 2017 Fairfax India acquired the final 10% of BIAL owned by GVK for $200 million, the higher price being justified by this purchase enabling Fairfax India and the other remaining shareholders to reconstitute BIAL’s Board, to appoint the best qualified person as BIAL’s CEO, and generally to allow it to be managed according to Fairfax India’s standards of corporate governance and guiding principles. “Subsequently, three new directors with expertise in airport and airline management and finance were appointed to the Board of BIAL, and Hari Marar, the former COO of BIAL, was appointed as its new Managing Director and CEO.” Since taking over in 2017, the management team at BIAL has done an exceptional job. See 'recent news' articles below for some current examples. Conclusion BIAL has been a solid investment for Fairfax India. Over the past 8 years, it has grown into the 4th largest equity holding of Fairfax. It has a carrying value that is less than half of its fair value. BIAL is a very high quality asset. It is also exceptionally well managed. It is also perfectly positioned to benefit from India's growth in the coming years and decades. The runway for this investment is very long. Most importantly, Fairfax (via Fairfax India) has a control position in this very rare asset. That is almost priceless - and likely the reason Prem calls BIAL a ‘crown jewel’ asset for Fairfax. ————— Recent news: Dec 2023: Bengaluru airport to roll out its master plan with renovation of T1, new place for T3 by 2030 https://indianexpress.com/article/cities/bangalore/bengaluru-airport-master-plan-renovation-9049746/# Dec 2023: BLR Airport Secures ‘Best Domestic Airport’ Title https://www.bengaluruairport.com/corporate/media/news-press-releases/blr-airport-secures-best-domestic-airport-title-at-travel-leisure-india-s-best-awards----- Dec2023: BLR Airport’s Terminal 2 earns UNESCO’s recognition as one of the 'World’s Most Beautiful Airports' https://www.bengaluruairport.com/corporate/media/news-press-releases/terminal---earns-unesco-s-recognition-as-one-of-the-world-s-most-beautiful-airports-and- Dec 2023: Bengaluru airport most profitable in India in FY23 https://www.moneycontrol.com/news/technology/bengaluru-airport-most-profitable-in-the-country-in-fy23-ahmedabad-incurs-highest-losses-11859721.html# ————— Ownership structure of BIAL Fairfax open to acquiring AAI’s 13% stake in Bangalore Airport: Hari Marar https://www.thehindubusinessline.com/economy/logistics/fairfax-open-to-acquiring-aais-13-stake-in-bangalore-airport-marar/article67466405.ece ————— Prem’s Letter, Fairfax 2022AR: “While the book value per share of Fairfax India is $19.11 per share, we believe the underlying intrinsic value is much higher. Given the low market price for its shares, Fairfax India has taken the opportunity in the last four years to buy back 15.1 million shares for $194 million at an average price of $12.84 per share, including the three million shares it bought in 2022 for $36 million or an average price of $12 per share.” ————— Fairfax India Q3, 2023 Interim Report: Details of BIAL and Anchorage Subsidiary “Non-controlling Interests: In 2019 the company formed Anchorage as a wholly-owned subsidiary of FIH Mauritius, intended to provide investment related services to support the company in investing in companies, businesses and opportunities in the airport and infrastructure sectors in India. On September 16, 2021 the company transferred a 43.6% equity interest in BIAL from FIH Mauritius to Anchorage and subsequently sold 11.5% (on a fully-diluted basis) of its interest in Anchorage to OMERS for gross proceeds of $129,221 (9.5 billion Indian rupees). Upon closing of the transaction, the company's ownership in BIAL was comprised of 10.4% held through FIH Mauritius and 43.6% held through Anchorage, representing effective ownership interest of 49.0% on a fully-diluted basis. “At September 30, 2023 the company continued to hold 43.6% out of its 57.0% (December 31, 2022 - 43.6% out of its 54.0%) equity interest in BIAL through Anchorage. As a result, the company's fully-diluted equity interest in BIAL was 52.0% (December 31, 2022 - 49.0%).” ————— A history of financial transaction at BIAL Timeline for BLR Airport

-

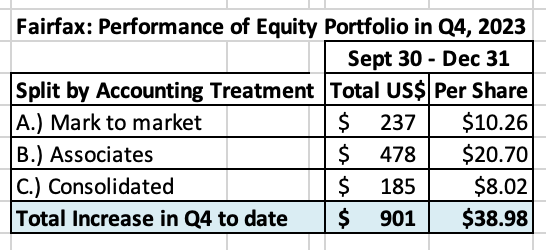

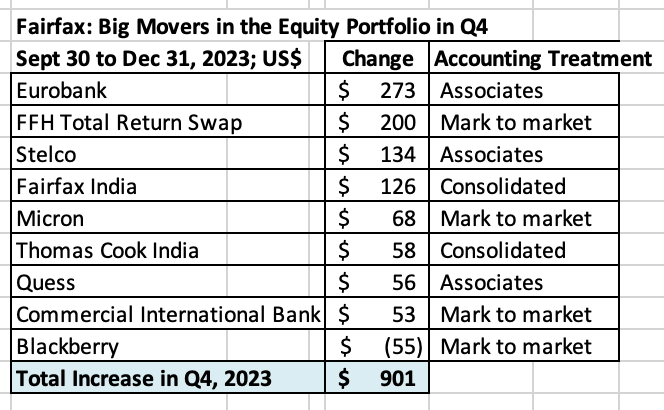

What was the change in the value of Fairfax’s equity portfolio in Q4, 2023? Fairfax’s equity portfolio (that I track) has a total value of about $17.5 billion at December 31, 2023. This is an increase of about $901 million (pre-tax) or 5.4% from September 30. The increase in the quarter works out to about $39/share. Currency, which has been a headwind for the past couple of years turned into a tailwind in Q4. Please note, I include holdings like the FFH-TRS position in the mark to market bucket and at its notional value. I also include debentures and warrants in this bucket. To state the obvious, my tracker portfolio is not an exact match to Fairfax’s actual holdings. It also does not capture changes in the value of private holdings – which are significant. It also does not capture changes Fairfax has made to its portfolio during the quarter that are not reported. As a result, my tracker portfolio is useful only as a tool to understand the likely directional movement in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 49% of Fairfax’s equity holdings are mark to market - this includes 'A.) Mark to Market' and 'D.) Other Holdings' - and will fluctuate each quarter with changes in equity markets. The other 51% are Associate and Consolidated holdings. Split of total gains by accounting treatment The total change is an increase of $901 million = $39/share The mark to market change is increase of $237 million = $10/share. Only changes in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio in Q4? Eurobank was up $273 million and is now Fairfax’s largest equity holding - a $2.1 billion position for Fairfax. The shares still look like they are dirt cheap, closing the year at €1.61. This holding looks primed to have another good year in 2024. The FFH-TRS was up $200 million. This position is up a total of $1.07 billion over the last 3 years, which is a gain of almost 150%. Simply an amazing investment. Stelco was a strong performer, up $134 million. It will be interesting to see if we get more consolidation in the North American steel industry in 2024. Fairfax India (finally) got some love from investors in Q4 and was up $126 million. This high quality holding continues to fly under the radar of most investors. International holdings - Thomas Cook India, Quess and Commercial Industrial Bank – all had strong gains in Q4 Blackberry was the biggest under-performer, down $55 million. In Q4, Fairfax significantly reduced the size of its investment in Blackberry by reducing the debenture position from $365 to $150 million. The stock position is worth a total of $165 million. Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1.0 billion or $45/share (pre-tax). Book value at Fairfax is understated by about this amount (less the tax impact). What is the split? Associates: $668 million = $29/share Consolidated: $348 million = $15/share Below is a copy of my Excel spreadsheet (next 2 pages) if you want a closer look. Equity Tracker Spreadsheet explained: The summary below attempts to track all equity holdings at Fairfax. Each quarter the spreadsheet is updated to capture any ‘new news:’ purchases and sales. We have separated holdings by accounting treatment: Mark to market Associates – Equity accounted Consolidated Other Holdings (also mark to market) – derivatives (total return swaps), debentures and warrants We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. Important: the list is not complete. Some information we only get once per year when Fairfax published their annual report. Fairfax also makes changes to their portfolio each quarter. Fairfax Dec 31 2023.xlsx

-

+35% for the year. The driver was Fairfax - simply an amazing year. I also had lots of single base hits - the volatility made trading around positions work really well (oil, US banks, retail etc). The run the last three years with Fairfax has been epic (at least that is how my kids would likely describe it). The crazy thing is i think Fairfax has lots left in the tank (it continues to be my largest holding by far). I have also started to diversify my portfolio. I now hold 25% in index funds: XIC.TO, VOO and VO. About 1/3 in each. My total portfolio is now of a size that i want to put a big chunk of it on ‘set and forget’. My plan is to grow the index portions to +50% in the coming years. Part of that is wealth preservation - versus going for maximum return. Historically, my strength has been avoiding bear markets. My weakness the past couple of bear markets is being too cautious coming out of them. Index funds are a nice solution: lock in the gains and stay invested. Today, other than Fairfax, i don’t have any ‘strong conviction’, table pounding, ideas. A little surprising - to me at least. I see lots of cheapish things but not much that i think will materially outperform an index. So i am happy to increase my allocation to index funds because i am bullish on the economy and stocks in general in the coming years. Of course, all of this could change. And that is what i love about investing.

-

@Ross812 from my perspective the big unknown with Fairfax is asset sales/monetizations/revaluations. Will be get one big one - +$500 million - over the next 4 years? Two big ones? Or do we get a number of smaller ones - $250 million to $500 million - like the 2 we saw in 2023 (Ambridge and GIG). - Digit IPO and getting to 74% ownership - Anchorage IPO - BIAL - Stelco - does it get taken out? - AGT Food Ingredients - delivered +$100 million in EBITDA in 2022 (if i remember correctly). Time to spin out? - Foran Mining - will we need more copper in about 2 years? I could go on. Fairfax has lots of levers to pull to surface significant value. Bottom line, one or two big moves here (or a number of smaller moves) would really move the needle in terms of BV growth, which would likely pop the stock price. What i like about Fairfax today is most investors expect zero in their earnings estimates / valuation models for big gains. I don’t build them into my models (until they are announced) - hence why i think my estimates will likely prove to be conservative.

-

@bargainman my strategy has been to invest in Fairfax only when i am in agreement/aligned with the general positioning of their investment portfolio. As i have stated before, I like what they have been doing since about 2018 (in aggregate).

-

@bargainman I have looked at Fairfax in lots of different ways over the years but i have never attempted that type of analysis - there are so many important moving/unknown parts i am not sure it can be done in a quality way. One of the challenges is we have incomplete information - Fairfax has lots of equity investments that are of significant size that we know nothing about. Fairfax is also very active - positions change. Part of the analysis would need to include dividends. And what do you include? Do you include the TRS-FFH? How do you value a company like AGT Food Ingredients? Or Bauer Hockey? Or the significant private equity holdings? The other question: what benchmark should be used? S&P500, which is dominated by 7 or 8 companies? At the end of the day, from my perspective, what really matters is total return on the total investment portfolio. And how does Fairfax’s performance compare to peers? That we can take a stab at. My math says Fairfax is tracking to earn 8.1% in 2023. And my estimate is for Fairfax to earn around 7.2% in 2024 and 2025. My estimates for 2024 and 2025 assume zero from large asset sales / revaluations - which i think will be wrong. My guess is Fairfax will continue to monetize/revalue some assets in the coming years so 7.2% will likely be more like 7.5% or higher. My guess is Fairfax is earning best-in-class total returns on its total investment portfolio when compared to other P/C insurance companies (most of whom are likely earnings in the 4 to 5% total return range). And I expect the large outperformance by Fairfax to persist in the current environment (where active management matters once again). ————— Another approach would be to look at Fairfax’s largest equity investments. The big three are Eurobank, Poseidon and FFH-TRS. These three holdings represent about 33% of Fairfax’s equity holdings. If you look at Fairfax’s top 12 holdings, that would get you to about 60% of their equity holdings. That might be a pretty good proxy for how the total equity portfolio was performing.

-

@Spekulatius i agree that we will see some tailwinds turn into headwinds in the coming years. At the same time we will see some headwinds turn into tailwinds. Insurers are in the capital management business - and the well run companies will make adjustments. Fairfax likely has more options than any other P/C insurer. I think the relationship between CR and interest rates is way more complicated than people think. Why? 1.) there is no insurance market. There are many insurance markets. Workers comp is still in a soft market - its hard market is likely coming. Personal (auto) has been a terrible business in recent years - and it is a very large market. Reinsurance (property cat) looks to be in a hard market. This is just for the US. Each region of the world also has its own unique characteristics. All these lines and regions have their own unique insurance cycle. Sometimes they line up and other times (like now) they do not. WR Berkley talked about this on one of their conference calls this year. 2.) interest rates are not having a significant impact on investment portfolios today. The Swiss Re Institute released a comprehensive study recently and they are projecting portfolio returns to tick modestly higher in both 2023 and 2024. Most P/C insurers were not positioned like Fairfax was in 2021 - so they are not seeing a spike in interest income. If interest rates go lower in 2H 2024 most insurers will likely have missed the big move higher. I also think the whole CR/interest rate discussion matters way less for Fairfax compared to traditional P/C insurers. 3.) For Fairfax, today only 20% of their various income streams comes from underwriting profit and 80% comes from other sources (40% from interest and dividends, 20% from share of profit of associates and 20% from mark to market equities and investment gains). Underwriting profit is a much more important income stream for traditional P/C insurers. So even if the CR at Fairfax declines slightly in the coming years (this is not a given), given its small relative size, it will likely have a small impact on Fairfax’s total earnings - the total $ decline will likely easily be absorbed by another income stream. 4.) everyone is laser focussed on interest income today. Guess what rarely gets discussed? Equities/non-interest bearing investments. Even at Fairfax. Why? Equities have been in a bear market - pretty much everything ex the magnificent seven. This will reverse. And when it does Fairfax will likely see some big gains from its equity portfolio - likely +$2 billion in one year. And to really blow your mind (love the Matrix movie), try and forecast these individual buckets with precision looking out 3 or 4 years.

-

Ho Ho Ho! To everyone on the board: may your holiday season be filled with joy, laughter, and cherished moments with family and friends.

-

@petec i build my forecasts from the bottom up. You can see all my assumptions for 2024 and 2025. After 2025? Looking out 3 years or more i do not have any hard numbers. But for operating income, $200/share looks to me like a reasonable baseline to use. There will be lots of important puts and takes: - share count: will likely come down, perhaps meaningfully (i think 2% per year is meaningful if sustained over many years) - minority interest: Fairfax will likely continue to take minority partners out - leverage: Fairfax will likely continue to use leverage. The GIG acquisition includes a sizeable ‘promissory note’ All three of these things will meaningfully impact the $200/share number looking out 5 years (and how much accrues to Fairfax shareholders). - net written premiums: my guess is this will continue to grow. Even if hard market ends? Yes. How? No idea, but GIG acquisition might provide a clue. - size of fixed income portfolio: i expect this to continue to grow. $55 billion is not a crazy number looking out 5 years (it is $41 billion today). - dividends: Eurobank could increase this by 50% in 2024. This bucket should grow nicely each year moving forward. - share of profit of associates: Stelco is delivering close to zero today. Guess what it will deliver in the next steel up-cycle? Earnings at Poseidon/Atlas have been a mild headwind (underperforming); my guess is this will flip to a tailwind. More holdings will likely be coming into this bucket which would be another tailwind. The Hellenic Bank acquisition should be a big tailwind for Eurobank. Now you asked about interest rate and CR. I don’t have a strong opinion about either. Perhaps rates move lower looking out 3 years. Or perhaps interest rates move higher again (perhaps we get a resurgence in inflation in 2H 2024 or 2025), which gives Fairfax the opportunity to lock in high rates for longer in another year or two. Or perhaps we get an event that causes credit spreads to blow out (like what happened to the regional banks but on a larger scale), and Fairfax flips to higher yielding corporates. Perhaps the hard market continues to chug along. When the hard market ends perhaps it just goes sideways for 4 or 5 years (which i think is what usually happens). Perhaps Fairfax takes a bunch of the excess capital and buys back a bunch of stock and takes out some minority partners. Crisis and opportunity are different sides of the same coin. And Fairfax has excelled since 2018 at exploiting this relationship. I expect this to continue… i just can’t provide any details today of what they are going to do in 3 or 4 years time. You said in an earlier post that you felt the increase in interest rates was the primary driver of the increase in earnings at Fairfax. I couldn’t disagree more. My view is the biggest driver of earnings at Fairfax today are the collective decisions being made by the management team at Fairfax. Their many capital allocation decisions, some going back all the way to 2014. Fairfax’s future results (including where operating income/share goes) depends primarily on the decisions the management team has made and will make moving forward. External factors (the path of interest rates and the insurance cycle) matter, but much less. This is where Fairfax differs from most other P/C insurers.

-

@steph there are lots of things that could happen that would impact my earnings estimates. Some are bad. Some are good. Time frame also matters: short term or long term - some things will be short term negative and long term positive (and the opposite). A really bad year for catastrophe losses in 2024 would likely extend the current hard market - so it might be a positive looking out 2 or 3 years. If Fairfax’s stock sold off aggressively this would give the company the opportunity to buyback a meaningful amount of shares on the cheap - which would be a big positive looking out 2 or 3 years. Bottom line, we know all of my estimates will be wrong. What we don’t know is if they will be too high or too low - and by how much. Especially over a couple of years. And that is the fun/interesting part of investing.

-

Operating income at Fairfax averaged around $40/share from 2015-2018. During this time, Fairfax was experiencing big losses from equity hedges and its new equity purchases were pretty terrible (APR, Farmers Edge, Fairfax Africa, AGT, Exco bankruptcy etc). Insurance was a tough business. Interest rates were low. Over this same timeframe, Fairfax’s stock price averaged around $525. That is what investors felt all the above was ‘worth.’ In 2024, operating income at Fairfax could come in around $200/share. This number is sustainable. That is 5 times higher. That is a massive increase in quality earnings. Capital allocation has been MUCH better from 2018-2023. Actually, it has been exceptional. Interest rates are much higher (even at current levels). Insurance has been in a 4 year hard market - and the business is now twice the size. Fairfax’s stock price today is $890, up a ‘whopping’ 70% from its average 2015-2018. Do people seriously think Fairfax is close to being fully valued today at $890? It appears we are at the ‘wall of worry’ phase with Fairfax. All the hand wringing on this board is probably a pretty bullish set up for the stock. I keep coming back to this… the key is earnings. And what a ‘normalized’ level is for Fairfax. There is no consensus on what this number is today. IF the number is (as i suspect) $150/share then Fairfax is still crazy cheap. If correct, Fairfax should be able to grow this by 8-10% per year over the next couple of years (with volatility). And with this, we should see modest multiple expansion. With very modest assumptions it is fairly easy to get a double in Fairfax’s stock price over the next 3 to 3.5 years. How? 1.) 2023YE BV = $925 2.) modest earnings growth each year - 2024 = $165 (lets be conservative here). - 2025 = $175 - 2026 = $185 3.) 2026BV = $1,450 (ignore dividends) 4.) modest multiple expansion to 1.2 x BV = $1,740 = double from current stock price. That would be a CAGR of 25%. Pretty good. What if earnings increase at more than $10/year? Likely in my view. What if the multiple goes to more than 1.2 x BV? Also likely. Well, your 25% CAGR gets even better. What are board members currently getting most wrong about Fairfax? 1.) what baseline earnings are today 2.) how good Fairfax is at capital allocation 3.) the impact record earnings and the magic of compounding will have on the trajectory of earnings over the next couple of years.

-

My mistake - edit has been made

-

@Hamburg Investor if i understand your question correctly, i think Prem is trying to provide a shorthand way to value Fairfax (this is just a guess): CR + Total return on investment portfolio = possible ROE = way to value Fairfax. Here is a link to an old writeup on Fairfax from 2019 that discusses this relationship. - https://www.woodlockhousefamilycapital.com/post/the-horse-story “Moreover, I think the assets collectively could generate a ~10%-type ROE. Watsa has made a public goal of hitting 15%. (FFH’s ROE was 15% in the second quarter, thanks to investment gains). He says a 95% combined ratio and a 7% return on FFH’s investments gets to a 15% ROE. “But in a low-interest rate environment, and given a large bond portfolio, a 7% return seems unlikely. But possible. Sustaining a double-digit ROE is key. (FFH can reach 10% by following a number of roads. For example, one road requires a ~95% combined ratio and ~5% return on its portfolio. That seems do-able.) “Anyway, a consistent 10% would grow book value at a decent clip and then you’d likely get an additional lift from the valuation even if the stock moved just to 1.2x book. As RayJay reports, a comparable set of North American insurers with an 11% ROE trades for 1.7x book value per share.”

-

@Xerxes i really enjoy the back and forth. Writing is a great way to think and get ones thoughts straight. Here is a good thought exercise. Go back to Fairfax version 2019. Look at all the important metrics. Now look at Fairfax 2023 and look at those same metrics. Importantly, look at all the decisions made each year from 2019-2023. The company is unrecognizable today to the company that existed 4 years ago. But here is the key: Fairfax did all of this when they had much lower earnings! Today Fairfax is earning gobs of money that is sustainable. Do people seriously think Fairfax in 2027 is going to resemble the Fairfax of 2023? Seriously?

-

That only makes sense if Fairfax puts the earnings under a mattress. Or if they allocate capital in a value destructive way. With each passing year, this is looking less and less likely.

-

@OCLMTL great add. I think what you are getting at is the power of compounding - earnings on earnings. It cracks me up that we have a bunch of value investors on this board who seem to be ignoring this ‘8th wonder of the world’ when they look at Fairfax and the significant earnings that is rolling in each quarter. Yes, we don’t know exactly what Fairfax is going to do. But does this mean we assign it a value of zero? Expecting Fairfax to earn 10% on reinvested earnings (on average) makes sense to me. Related, the size and timing of earnings matter. A lot. Well, at least that’s what Buffett says. Companies that get the cash flow up front are supposed to be valued higher. Especially if it outsized. Fairfax has been generating record operating earnings starting back in 2022. New record in 2023. Likely a new record in 2024. Outlook for 2025 and 2026 is good. This is a massive amount of earnings coming over a 5 year period. This pile of gold has been/will be reinvested each year. Those investments are/will grow new earnings streams. Which, over time, will grow into rivers. So in 5 years time guess what? The idea that earnings at Fairfax will flatline at $150/share for the next two years and then drop from there makes no sense to me. At least based on what we know today.

-

In terms of return on their total investment portfolio, I have Fairfax tracking at 8.2% for 2023. And 7.2% for 2024 and 2025. For both 2024 and 2025 i am modelling nothing for large realized gains: items like selling pet insurance or Ambridge. Or revaluing of GIG (this should drop into 2023). I think it is highly likely Fairfax will do something meaningful to surface value in 2024 or 2025. So i think my 7.2% estimate is conservative. What about 2026? And further out? That is simply a bet on management. And their capital allocation skills. Fairfax has been putting on a clinic the past 5 years when it comes to capital allocation. Volatility is a tailwind for Fairfax - not a headwind. Why do people expect they are going to all of sudden get stupid? From my perspective that approach is not being conservative.