Viking

Member-

Posts

4,922 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@modiva I included the numbers since inception because those are the numbers that Fairfax has actually delivered. Having said that, i did not include those numbers to suggest that is the performance that they will deliver (across all metrics) moving forward. I think Fairfax can deliver mid to high teens growth in BV in the coming years. Float? No, not that high. I do think the numbers Fairfax delivered from 2010-2020 are artificially low. If we think it makes sense to throw out the numbers from the early years (because they are artificially high) then i think it might also makes sense to throw out the numbers from 2010-2020. The numbers from 2010-2020 contain so much noise (like $5.4 billion in losses from the equity hedge/short positions that won’t be repeated in the future) that it affects their usefulness as a baseline to project what might happen in the future. But i do get your point.

-

@bluedevil I agree. This is another very important piece of the Fairfax puzzle. @SafetyinNumbers has pointed this out to me numerous times in the past. This topic would make a great future post - there are so many interesting angles to it. Here are two angles i find interesting. The overarching theme to this topic is how Fairfax views financial markets. 1.) Fairfax aggressively exploits its share price. Issue shares when the stock is at a high valuation. Aggressively buy shares back when the stock is at a low valuation. It this context, high volatility in the stock price has been a very good thing for Fairfax. But what about those investors buying Fairfax stock issued at high valuations? Of course Fairfax is simply doing what Ben Graham teaches: use Mr Market to your advantage. He is there to be exploited - take advantage of his irrationality/extreme mood swings. But at the same time, Prem/Fairfax appears to want to attract long term shareholders. And most investors - even those who expect to hold for the long term - do not appreciate extreme volatility, especially of it is stretched out over many years. Now contrast this with how Berkshire Hathaway operates. Now as a Fairfax shareholder, i love what Fairfax does. But i wonder if it fits the ‘we want long term shareholders’ mantra. 2.) There is a second angle to this. Fairfax takes a similar approach with its equity and insurance holdings. Sell stakes when they can fetch a high valuation. Buy them back when they can be re-purchased at a low valuation. Minority shareholders need to have their eyes wide open here. Again, i like what Fairfax does - it tends to build lots of value for Fairfax. But i wonder as Fairfax gets larger/more visible if it ‘tweaks’ this part of its business model. What do others think?

-

@Maverick47 I really appreciate (and enjoyed reading) your story. Thanks for sharing. My earlier post took me about 8 months to write (for all the different ideas to come together). Buffett's 'float' model includes so many interesting layers. I am still digesting all of them. (One miss from my write-up is how 'type of insurance written' is likely another important piece of the puzzle). I am an outsider... I have never worked in P/C insurance or in investment management. So this topic does not come naturally / intuitively to me. So I do appreciate when people from inside the P/C insurance world comment. It helps me to understand if I am on to something. And how I need to revisit my thinking. Yes, when I post I do try and be 'thought provoking.' I try and have an opinion. And I like to sometimes exaggerate to make a point. And I try and keep things interesting for the reader. The goal is to develop a thesis on an idea. Stay inquisitive. Keep learning. And course correct over time. This board provides a wonderful platform to do this.

-

@gamma78 Great point. But I would add a caveat. Sometimes management loses their way - for extended time periods (a decade or longer). And when they do lose their way, it is not a given they will actually get the train back on the tracks. When this happens 'buy and hold' can be a terrible strategy. Therefore, it is important for investors - when they invest in individual companies - to be rational and do so with their eyes wide open. This applies equally to investments that are family controlled and those that are not family controlled. My strategy with Fairfax over the past 21 years has been to own it when the company is managing its business (insurance and investments) in a way that fits with how I am wired. There have been long periods when what Fairfax was doing was not a good fit for me. So I shifted to other investments that were. I love what Fairfax has been doing the past 5 years. I love how the company is positioned today. And I think the table is set for them to do something special over the next 5 years (perhaps longer). But I will continue to be rational and monitor what they are doing. This strategy has served me very well over the years. It is not Fairfax specific - it is how I manage all of my investments.

-

Fairfax’s Secret Sauce Fairfax has compounded BVPS at 18.9% over the past 38 years. The share price has compounded at 18.3% over the same time frame. These calculations are in US$ and include dividends. Importantly, Fairfax’s performance has been very strong over the past 3 years. Fairfax’s outstanding performance is not some numerical/statisitical aberration - some relic of the distant past. When compared to the universe of US listed companies since 1985, Fairfax’s compound return (18.3%) puts it in the top 1% of all companies. Fairfax calculates the numeric ranking at #17. That is an amazing stat. Note: All slides used in this post are from Prem's presentation at Fairfax's AGM held on April 11, 2024. https://www.fairfax.ca/wp-content/uploads/Fairfax-AGM-2024.pdf This leads to 3 very important questions: What caused Fairfax’s significant outperformance over the past 38 years? Are the factors/conditions that led to this outperformance still in place? What does this mean for the future performance of Fairfax? Let’s start by exploring the first question. What caused Fairfax’s significant outperformance over the past 38 years? How did Fairfax achieve and sustain such a high level of performance? Was Fairfax’s incredible performance just luck? Did Fairfax’s performance have little to do with ability/skill and effort? Was Fairfax simply in the right place at the right time - a benefactor of good fortune? Timeframe is the key to answering this question. If Fairfax’s strong performance had happened over a short time period (like 5 or 10 years) then perhaps we could attribute it primarily to luck. But +18% for 38 years? That level of outperformance over that timeframe can’t be attributed to luck. The timeframe is too long. Does Fairfax have a moat? A moat refers to sustainable competitive advantages that a company has that allow it to ward off the competition while continuing to grow its business and profitability over time. Most investors would probably say that Fairfax does not have a moat. Why? Well, when it comes to Fairfax most everyone knows 2 things: Insurance: Fairfax is not very good at insurance. Average at best. Investments: And Fairfax is also not very good at investments. ‘Cowboys’ might be a good way to describe them. But if it’s not luck and it’s not skill then what explains Fairfax’s exceptional long term performance? We come full circle and back to our original question. How was Fairfax able to achieve and sustain such a high level of outperformance? I think Mark Twain might have the answer. “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.“ Mark Twain The obvious answer is that Fairfax does indeed have a moat - sustainable competitive advantages. The fact that most investors don’t know what they are doesn’t mean they don’t exist. Instead, it provides great insight into how misunderstood Fairfax continues to be. And if the company is this misunderstood do you think it is fairly valued? Probably not. So as painful as this might be for some, let’s explore this further. What are Fairfax’s sustainable competitive advantages? I have come up with five. Please share your thoughts. 1.) Prem Watsa Brilliant founder. Fairfax would not exist without Prem. Exceptional leader. This was on full display during Covid. High integrity (internally and externally). Greatest strength? The ability to attract and retain talent (at both insurance and investment operations). His age (73) is a concern (he was born in Aug 1950). However, his health (physical and mental) appears good. Importantly, Prem has started to shed some responsibilities. And Fairfax has a deep bench of talent. Prem has been a sustainable competitive advantage for Fairfax. How ‘sustainable’ is this advantage moving forward? Yes, that is debatable. Prem’s age is not a concern for me today. But it is a risk. So it is something to monitor. 2.) Family Control - this facilitates building shareholder value over the long term Most publicly traded companies are slaves to hitting ‘expected’ quarterly results. This can be especially troublesome for P/C insurers. Being family controlled allows Fairfax to focus on building shareholder value over the long term. Having a long term focus is a critical ingredient in the successful operation of both business engines of insurance and investments. It allows Fairfax to accept, ride out and exploit volatility. Long term focus: Insurance: allows for the proper management of the insurance cycle. Importantly, it supports the discipline to walk away from unprofitable business in a soft market (that might last for years). Investments: allows for the investment in assets that will generate higher returns (like equities). Volatility is something to be exploited. Most traditional P/C insurers have the bulk of their investment portfolios (+90%) allocated to bonds. Fairfax invests in a wide array of assets (including equities). This gives Fairfax the ability to generate a higher return on its investment portfolio over time. This provides Fairfax with a structural advantage when compared to other traditional P/C insurers who invest primarily only in bonds. Fairfax - Berkshire Hathaway - Markel - WR Berkley P/C insurance has been a wonderful vehicle to use to build great wealth for shareholders over the long term. Fairfax, Berkshire Hathaway, Markel and WR Berkley are four P/C insurance companies that have produced exceptional long term track records. What else do they have in common? They all are family controlled. I don’t think that is a fluke. Fairfax, Berkshire Hathaway and Markel have something else in common: a significant portion of their investment portfolio is invested in equities. For these three companies, this is another important ingredient that has contributed to their exceptional long term performance. 3.) Fairfax’s Structure Below are three important parts of Fairfax’s structure: Small corporate head office - low overhead This keeps corporate costs low. Also, Prem’s annual salary of C$600,000 (with no stock options) is crazy low. Insurance companies: decentralized and run by their presidents. This structure has enabled the long term, successful growth of the P/C insurance operating companies. Fairfax’s insurance operations have exploded in size. And over the past 15 years they have also markedly improved in terms of profitability / quality. Capital allocation (acquisitions/investments): centralized at Fairfax’s head office / Hamblin Watsa. Allows Fairfax to allocate capital to the best opportunities (within the entire company) on a tax-efficient basis. Successfully utilizes a value investing framework. Partner with strong founders/management teams; financially sound organizations. Want to be passive investors (not a turn around shop). Over the past 6 years the team at Fairfax has been executing exceptionally well. Capital allocation - external relationships - deal flow Over the past 38 years, Fairfax and Hamblin/Watsa has built and cultivated an extensive (worldwide) and diverse (across sectors) network of relationships with external businesses / capital allocators. Fairfax has earned the reputation of being a trusted partner. Generates a steady amount of deal flow. Recent examples? In 2023, GIG and PacWest transactions. Fairfax has built a organizational structure that is similar to the one that Berkshire Hathaway has successfully employed for the past 55 years. It works really well. 4.) Float / Leverage With its insurance business, Fairfax produces an enormous amount of float - $35 billion at December 31, 2023. Float is technically a liability. What is the cost of this float? Fairfax has well run insurance companies. As a result, they produce a sizeable underwriting profit most years. This means Fairfax actually gets paid a significant amount to hold its float. Is Fairfax able to invest the float? Yes. And keep the investment return generated? Yes. With the spike in interest rates, Fairfax is now earning more than 7% on its total investment portfolio. So Fairfax has a $35 billion liability called float. They actually get paid a significant sum to hold this liability (underwriting profit was $1.5 billion in 2023). And they are able to invest the $35 billion and keep the return they generate (7% = $2.5 billion). Fairfax is generating about $4 billion per year, or $177/share, just from its insurance operations and $35 billion in float. But the story gets even better. Float at Fairfax has been growing like a weed - it has compounded at 18% over the past 38 years. And it should continue to grow in the future. It is important to note that earnings from float are in addition to earnings that Fairfax generates from its equity - funds provided by shareholders and retained earnings. Low cost and growing float is an extremely powerful combination. Just ask Warren Buffett. Float was the engine that propelled Berkshire Hathaway’s phenomenal growth in the 1980’s and 1990’s. 5.) Culture ‘Culture eats strategy for breakfast.’ Peter Drucker What does that mean? “…no matter how great your business strategy is, your plan will fail without a company culture that encourages people to implement it.” Corporate Governance Institute For successful organizations culture and strategy are two sides of the same coin - they are aligned with each other. Fairfax has a very strong culture. And it is aligned with its strategy. It has been carefully honed over the past 38 years. It has been forged in the fires of adversity. Its biggest champion has been Prem. A couple of examples: Insurance: What to do in a soft market? Write less business. Even at the expense of short term results (lower top line). Even if it persists for years. Zenith is a great example of this today. Investments: What to do when volatility hits? Do the opposite of what Mr. Market is likely doing. Don’t panic. Look for bargains. Get creative. Exploit the situation. In recent years, Fairfax is littered with great examples of this. The fact that Fairfax has had very little turnover suggests that its culture is aligned with the values/beliefs of its employees. All companies make mistakes. Successful companies embrace and learn from their mistakes. And use them to become stronger companies. Mistakes Made Over its 38 year history, Fairfax has made two big mistakes: Insurance: the acquisitions of Crum & Forster and TIG in 1998/1999. Investments: equity hedge/share positions (2010-2020) + poor equity purchases 2014-2017. Importantly, the mistakes made were solvable. The poor insurance acquisitions resulted in what Prem called the ‘biblical seven lean years’ for Fairfax from 1999 to 2005. And the poor equity investments resulted in a lost decade for Fairfax shareholders (2010-2020). But here is the silver lining for investors: each mistake drove Fairfax, over time, to make important and meaningful internal changes. These changes make Fairfax a much stronger company today. Insurance: the C&F and TIG fiasco taught Fairfax that they needed to re-think their approach to P/C insurance. Regarding acquisitions, they needed to flip from the Ben Graham ‘cigar butt’ approach to ‘quality at a fair price’ approach. They also needed to improve the quality of their owned P/C insurance businesses. As part of this evolution, in 2011 Andy Barnard was appointed President and COO of Fairfax Insurance Group to oversee all of Fairfax’s insurance operations. Fast forward to 2024. Fairfax’s collection of P/C insurance companies are now high quality. They have never been better positioned. Investments: Fairfax’s string or poor investments from 2010-2020 taught Fairfax that they needed to: End the equity hedge / short program. Equity hedges were exited in late 2016. The final short position was exited in late 2020. Fairfax publicly committed that it would no longer short indexes or individual stocks. Modify the stock selection framework used at Hamblin Watsa. With its new equity purchases Fairfax put more of a premium on partnering with founders/strong management teams and companies in a strong financial position. Since 2018, with new equity purchases, the team at Fairfax/Hamblin Watsa has been executing very well. It has also done a great job of exiting/fixing past mistakes. Fast forward to 2024. Fairfax’s equity holdings are lead by strong management teams. They are in strong financial positions and have solid prospects. Fairfax has never been better positioned. Mistakes made summary Each of the mistakes described above that were made by Fairfax were significant. They caused the performance of the company (and its stock) to suffer - for extended periods of time. But the mistakes made also taught Fairfax important lessons that led to substantive internal changes. Those changes have made Fairfax’s two economic engines - insurance and investments - stronger and more resilient. Each time, the mistake made provided the impetus for Fairfax to grow and improve as a company. Are the factors/conditions that led to Fairfax's outperformance over 38 years still in place? In 2023 Fairfax delivered the best year of earnings in its history. Results are being driven primarily by high quality operating income. Its two business units, insurance and investments, have never been better positioned. This suggests the factors/conditions that led to Fairfax’s outperformance in the past are indeed still in place. What does this mean for the future performance of Fairfax? Fairfax has compounded BVPS at 18.9% and the share price at 18.3% (US$ and including dividends) over the past 38 years. What has allowed that to happen over such a long time frame? Fairfax’s ‘secret sauce’ is made with the following ingredients: Prem Watsa - founder led Family control - allows long term focus Structure - small H/O, decentralized insurance subs, centralized capital allocation Float - low cost and growing Strong culture - aligned with strategy; aligned with employees beliefs and values Importantly, each of Fairfax’s sustainable competitive advantages all complement each other. The total value they deliver is much greater than the sum of the individual parts. The future With some trying years behind it, Fairfax has matured as a company. It now has a well run, profitable global P/C insurance business. At the same time it has an experienced well run investment operation. Fairfax’s collection of sustainable competitive advantages has never been stronger. The company looks like it is just entering its prime. The interesting thing is Fairfax is still a small company (relatively speaking). It still has a lot of growth ahead of it. It looks today an awful lot like a much younger Berkshire Hathaway (1980’s/1990’s version?). This bodes well for Fairfax’s future results. ————— The P/C insurance model: Why isn’t everyone doing it? Fairfax’s collection of insurance businesses and investments has created a virtuous circle of growth. The insurance businesses generates an underwriting profit. The investments (significantly augmented by float from insurance) generate more profits. The profits are then re-invested to grow insurance (which grows float further) and investments. Importantly, new money goes to best opportunities. This results in profits being compounded at high rates of return. Executed over many years - this results in exponential growth. If the model used by Fairfax, Berkshire Hathaway and Markel is so good (leverage P/C insurance and invest in equities) why isn’t more companies doing it? It is exceptionally difficult. And it takes a long time. P/C insurance is, relatively speaking, a small industry. P/C insurance is largely a commodity - it is a very competitive industry. It takes decades to build out/scale a P/C insurance company. Capital allocation (something other than bonds) is very difficult to do well over the long term. Volatility is a feature of the insurance industry, not a bug. Does this sound like a business Wall Street would be interested in? Wall Street hates volatility and thinks only in the very short term. If you are looking to get rich quick you would have to be an idiot to pick P/C insurance as your vehicle. As a result, only a few companies have been able to replicate Warren Buffett’s very successful model. Fairfax is one of them.

-

@nwoodman Freaking amazing. Ok… i guess that might have been a better decision than attending the Fairfax AGM this year.

-

@wondering thank you for posting the link. Fokion provides an excellent and concise summary of Eurobank: past, present and future. There is also a link to his presentation in the notes: https://www.ivey.uwo.ca/media/hznli5um/keynote-fokion-karavias.pdf

-

Fairfax Announces the Passing of Ramaswamy Athappan

Viking replied to Parsad's topic in Fairfax Financial

Mr. Athappan was one of the founding members of the $1 billion club at Fairfax - individuals who have built enormous value for Fairfax and its shareholders over the years. "Mr. Athappan was an exceptional leader with an incredible track record of success." In 2017, Fairfax sold First Capital for $1.7 billion and booked a $1 billion gain after-tax. The amount Fairfax received from this sale was a complete shocker at the time. First Capital was an insurance business based in Singapore that in 2016 had shareholders’ equity of $473 million and gross premiums written of $384 million. CR was 86.4% and underwriting profit was $41 million. The story of how Mr Athappan built First Capital is an epic tale. And it highlights beautifully so much of what Fairfax actually does right (that still gets very little attention today). Pick the right partner/founder. Decentralized corporate structure. Nurture. Loyalty. Patience. Let compounding work its magic. Here is what Prem had to say in his 2017 Shareholder Letter: "...Mr. Athappan has had an incredible record with us in building First Capital. We provided $35 million in 2002 to let him establish First Capital; 15 years later, with no additional capital having been added, he had grown First Capital to be the largest P&C company in Singapore and with the Mitsui Sumitomo deal, gave us back $1.7 billion. That’s a compound rate of return of approximately 30% annually. A fantastic track record by Mr. Athappan!” Mr Athappan has his fingerprints all over many of Fairfax’s many insurance acquisitions in Southeast Asia over the past 20 years. As a result, Fairfax has built out a significant platform in a very important region that should continue to grow nicely in the coming years. Below Prem explains why Fairfax agreed to sell First Capital: “For the past two years, Mr. Athappan has come to me saying that he had taken First Capital as far as he could in the commercial property and casualty business in Singapore and that he needed a partner like Mitsui with a brand name to build the personal lines business. I refused him twice as I really did not want to sell First Capital. His continued persistence, his position as the founder of the company, and the fact that he would continue to run Fairfax Asia and First Capital and we would have a 25% quota share in the business of First Capital going forward persuaded us, with unanimous support from our officers and directors, to form a global alliance with Mitsui Sumitomo Insurance Company and sell First Capital to them. We worked very closely with Matsumoto san, the Senior Executive Officer of International Business of Mitsui Sumitomo, and his team, and the partnership is going very well. Through our cooperation agreement with Mitsui Sumitomo, we have been working together on a number of fronts including opportunities on reinsurance, shared business and products and innovation to name a few. We are very excited to be a partner with Mitsui Sumitomo. Total proceeds from the sale of First Capital were $1.7 billion, resulting in an after-tax gain of $1.0 billion. I do want to emphasize that we agreed to this global alliance and sale only because of its truly unique circumstances and we do not see this being repeated! Our companies are not for sale, period!” -

@nwoodman you nailed so many important points in your post: 'right investing framework' 'patience' the incredible value of Fairfax's 'network' - slowly built up over decades 'deal flow is in very good shape' - despite what detractors think, Prem's phone is ringing luck is when preparation meets opportunity - Roman philosopher Seneca And yes, it has been fascinating to watch everything play out over the past 3 years. Almost bizarrely so. But i think you last point is the best: 'the investment model has evolved from the crappy turnaround to those more consistent with idea of the “100 year company’’. Your point gets to the core of how Fairfax should be valued today - and what its intrinsic value is. I don't think this point is fully understood or recognized by most investors, including a large swath who currently own the shares (I don't mean to be disrespectful when I say this). So I will continue to bang on the drum PS: But just to show a little humility, I am still trying to figure out what Fairfax's intrinsic value actually is. The problem is the story just keeps getting better. The past three years, I feel a little bit like a dog chasing his tail. Although I will say I have been having a lot of fun!

-

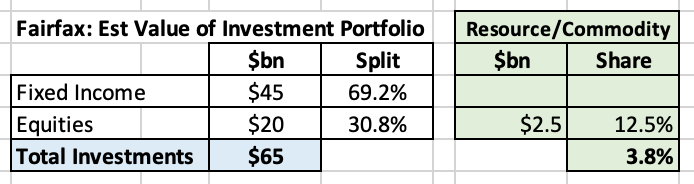

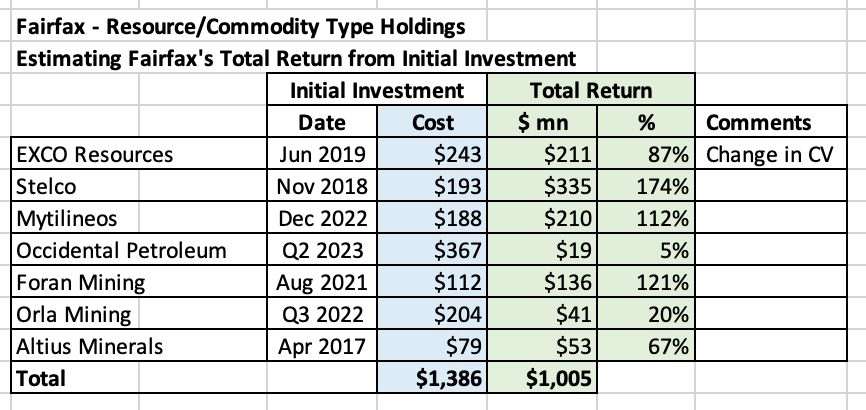

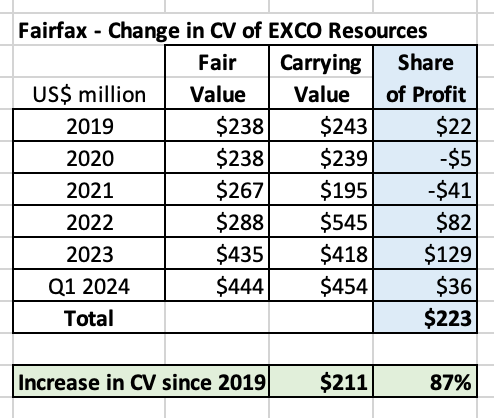

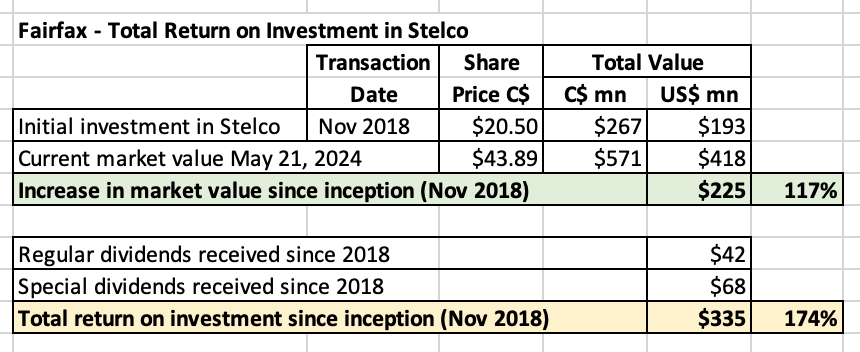

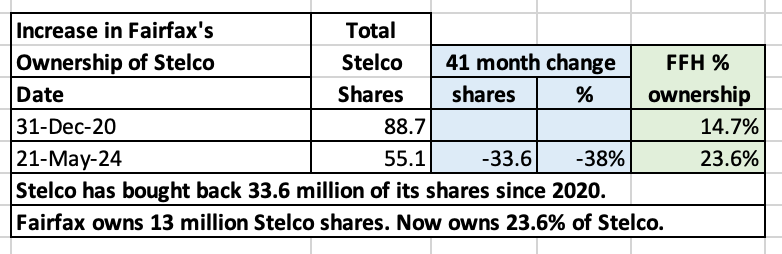

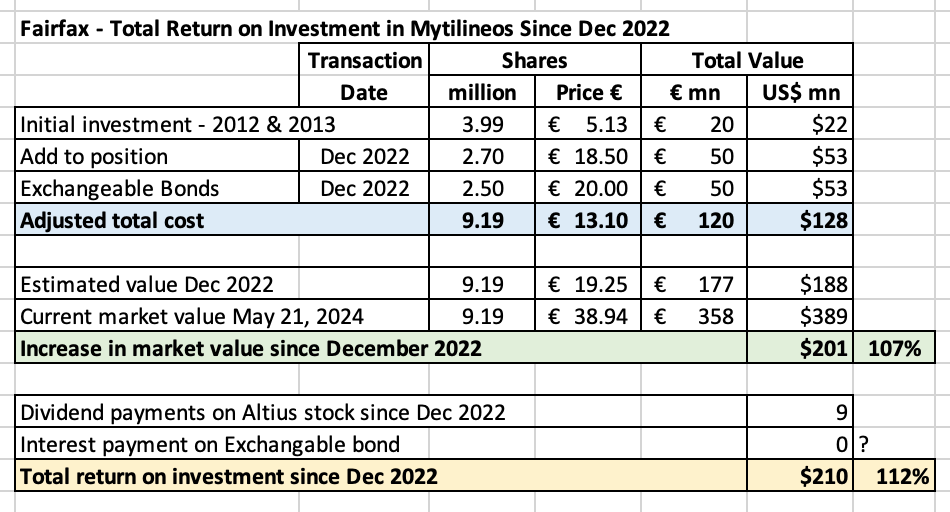

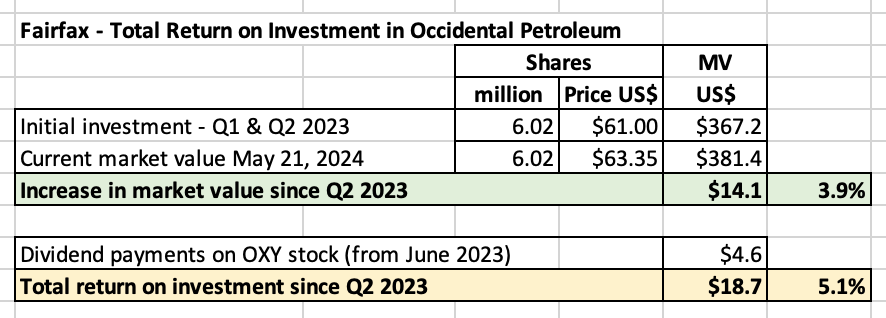

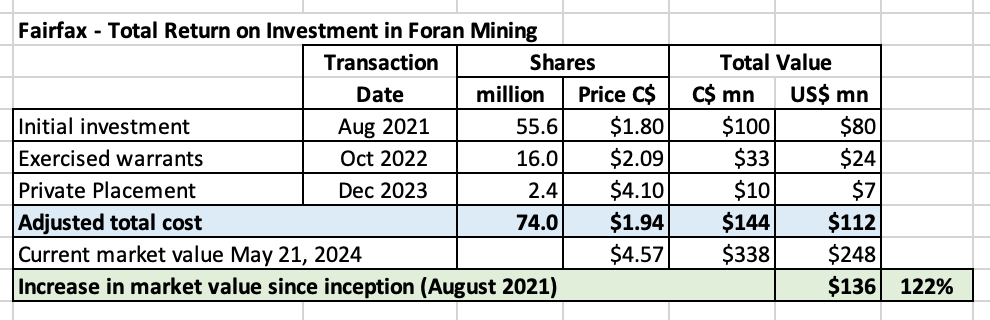

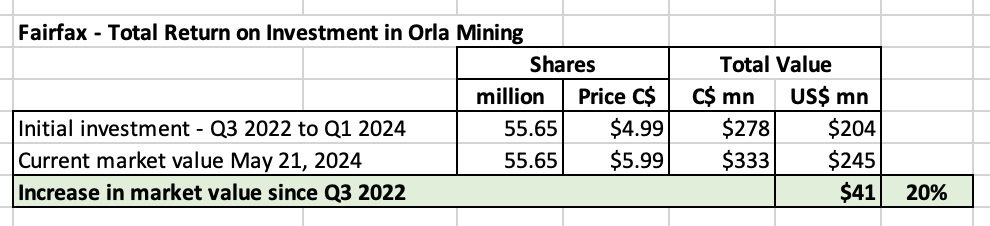

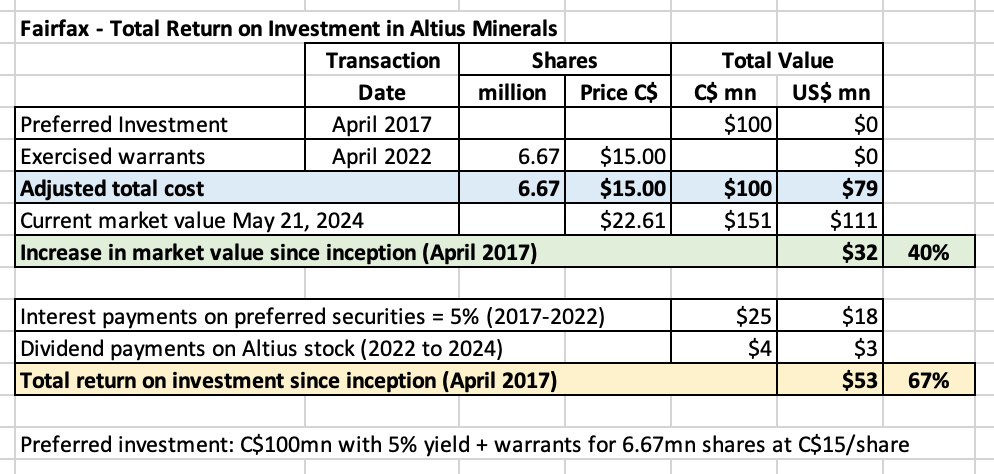

A Review of Fairfax’s Resource/Commodity Holdings Fairfax holds a number of different resource/commodity stocks in its equity portfolio. Let’s do a review of this interesting and important collection of holdings. Fairfax holds a total of 10 positions (that we have been able to identify) with a market value of about $2.5 billion. The largest weighting is oil and gas, at about 45%. The remaining 55% is diversified across copper, gold, other metals, energy and potash. Context Fairfax has a total investment portfolio of about $65 billion. Its resource/commodity holdings represent about 3.8% of the total. Fairfax’s has an equity portfolio that is about $20 billion in size. Resource/commodity holdings represent about 12.5% of the equity portfolio. Bottom line, Fairfax’s has a modest weighting to resource/commodity stocks. Why hold resource/commodities stocks? 1.) As an investment Fairfax is a value investor. Their style of value investing is pretty broad - they go to where they find the most value. 2.) As a hedge Inflation: When inflation is rising commodity prices usually also go up. As a result, commodities can serve as a good inflation hedge. Bet on the jockey/partnering with outstanding investors: It should be noted that Fairfax is not blindly throwing darts with their resource/commodity investments. They are partnering with other highly successful people / investors - some of whom have extraordinary long term track records. Stelco - Alan Kestenbaum (CEO) Occidental Petroleum - Warren Buffett (largest shareholder) Foran Mining and Orla Mining - Pierre Lassonde - ‘recognized as one of Canada’s foremost experts in the area of mining and precious metals.’ Co-founded Franco-Nevada in 1985. Jurisdiction The vast majority of the production for Fairfax’s resource/commodity investments is located in North America. This is a much lower risk jurisdiction than other parts of the world. My guess is this is not a fluke. Fairfax detractors Lots of investors will look at Fairfax’s resource/commodity holdings and quickly conclude that they are terrible investments. Why are they terrible investments? Because they are resource/commodity investments. And everyone knows resource/commodities are terrible investments. The interesting thing is critics don’t actually follow the specific companies that Fairfax has invested in. They don’t know who Fairfax is partnered with. And they don’t know how the holdings have been performing for Fairfax. So their opinion is not based on any of the pertinent facts. It is primarily based on emotion. And that gets to the crux of why consensus opinion has been so wrong on Fairfax over the past 4 years. Investment ‘analysis’ and decisions that are based primarily on emotion rarely work out well - especially over time. What are the facts? How have Fairfax’s commodity holdings been performing in recent years? Very well. Sorry detractors… but the facts are the facts. In recent years, Fairfax’s various resource/commodity holdings have generated a total return of over $1 billion. And a number of the holdings have been home run investments. This group of holdings has been a strong tailwind to Fairfax’s reported results over the past 2.5 years. Of interest, the $1 billion total return does not include Resolute Forest products. In 2022 Fairfax sold Resolute Forest Products at the top of the lumber cycle for $626 million (plus $183 million CVR - tied to potential refund of lumber duties on deposit). At December 31, 2021 Fairfax had a carrying value for RFP of only $276 million - the sale resulted in a significant gain for Fairfax. Importantly, each of Fairfax's resource/commodity holdings are well managed and very well positioned for the future. Bottom line, Fairfax owns resource/commodity holdings as a part of a larger strategy to build long term value for shareholders. "In this business, if you're good, you're right six times out of ten. You're never going to be right nine times out of ten." Peter Lynch Well, based on Peter Lynch's rule of thumb, the team at Fairfax looking pretty good with its execution in recent years. ========== Let’s review each of the individual holdings in a little more detail. EXCO Resources EXCO Resources is a privately held investment. The company emerged from bankruptcy in 2019. At December 31, 2019, EXCO had a carrying value of $243 million at Fairfax. From 2019 to Q1 2024, Fairfax’s ‘share of profit’ from EXCO has been $223 million. As a result, at Q1 2024, the carrying value EXCO has increased to $454 million, an increase of $211 million or 87% from 2019. Stelco In November 2018, Fairfax invested US$193 million for a 14.7% stake in Stelco. Fairfax’s investment has increased in value by $335 million or 174% over the past 5.5 years. Fairfax’s ownership stake in Stelco has also increased from 14.7% to 23.6%. This has happened despite the fact Fairfax has not purchased any additional shares. Stelco has repurchased 38% of shares outstanding over the past 3.5 years. The CEO of Stelco, Alan Kestenbaum, is a rock star. M&A activity looks to be heating up in the North American steel sector: Japanese steelmaker, Nippon, agreed in December 2023 to acquire US Steel - offering a 40% premium. Mytilineos Fairfax first invested in Mytilineos in 2012 and 2013. In December 2022 they significantly increased the size of their position (more than doubled it). We will look at Fairfax’s return since they added to their position. In December 2022, Fairfax’s investment in Mytilineos had a market value of about $188 million. Fairfax’s investment has increased $210 million or 112% over the past 18 months. Occidental Petroleum Fairfax built out the majority of their position in Occidental Petroleum in Q1 and Q2 and 2023. Using the average prices supplied in the 13F releases as a guide, my guess is Fairfax’s built out its position in OXY at a total cost of about $367 million ($61.00/share). Since Q2 of 2023, Fairfax’s investment has increased in value by about $18.7 million or 5.1%. Foran Mining Beginning in Aug 2021, Fairfax has invested a total of $112 million in Foran Mining. The investment today has a market value of $248 million. Fairfax’s position has increased in value by $136 million or 122% over the past 33 months. This investment is a play on copper. And it is still in the very early innings (their copper mine has not yet begun production). The set-up for this investment looks excellent. Orla Mining Orlas is Fairfax’s newest resource/commodity investment. Fairfax built up their position in Orla from Q3 2022 to Q1 2024, spending about $204 million. The investment today has a market value of $245 million. The return on Fairfax’s investment has been about $41 million or 20%. Limited Partnership In their 2023AR, Fairfax reported limited partnerships - oil and gas extraction - with a value of $235.3 million. During the 2023 year-end conference call Fairfax also mentioned they had an investment in Waterous Energy. The fact Fairfax mentioned Waterous suggests it is a sizeable holding. Waterous Energy holds a big position in - and is the engine behind - Strathcona Resources, the 5th largest oil and gas producer in Canada. Connecting the dots, there is speculation that Strathcona is the mystery ‘oil and gas extraction’ holding with a value at Dec 31, 2023 of $235.3 million. Perhaps we get clarity from Fairfax on this holding in the future. Altius Minerals - a royalty company In April 2017, Fairfax invested C$100 in preferred securities in Altius Minerals. In 2022, Fairfax exercised the warrants and Altius redeemed the preferred securities. The investment today has a market value of $111 million. Fairfax has also received $21 million in interest and dividend payments. The total return on Fairfax’s investment has been $53 million or 67% over the past 7 years. =========== Company Presentations / Overviews Stelco: Q1 2024 Earnings Call Presentation https://s201.q4cdn.com/143749161/files/doc_earnings/2024/q1/presentation/Q1-2024-Earnings-Presentation-FINAL.pdf Mytilineos: Corporate Presentation October 2023 https://www.mytilineos.com/media/fpxfna55/mytilineos_corporate_presentation_october_2023.pdf Occidental Petroleum: Q1 2024 Earnings Call Presentation https://www.oxy.com/siteassets/documents/investors/quarterly-earnings/oxy1q24conferencecallslides.pdf Foran Mining: Corporate Presentation May 2024 https://foranmining.com/wp-content/uploads/2022/09/Foran-Corporate-Presentation.pdf Orla Mining: Q1 2024 Update https://orlamining.com/site/assets/files/6008/ola_may_q1_2024.pdf Altius Minerals: Corporate Presentation April 2024 https://altiusminerals.com/_resources/presentations/corporate-presentation.pdf?v=0.510 Strathcona Resources: Corporate Presentation May 2024 https://www.strathconaresources.com/wp-content/uploads/2024/05/Strathcona-Corporate-Presentation_May_vFF.pdf EXCO Resources this is a private holding so there is limited public information available on the company. ————— Pierre Lassonde: The Founding of Franco-Nevada with James Connor https://youtu.be/YMWeAbZQSEE?si=H7ZshbgglmKxycTF At 2 minute mark, Pierre talks about optionality. Price optionality is well understood. Land optionality is not understood and not calculated. Source of enormous wealth creation for investors.

-

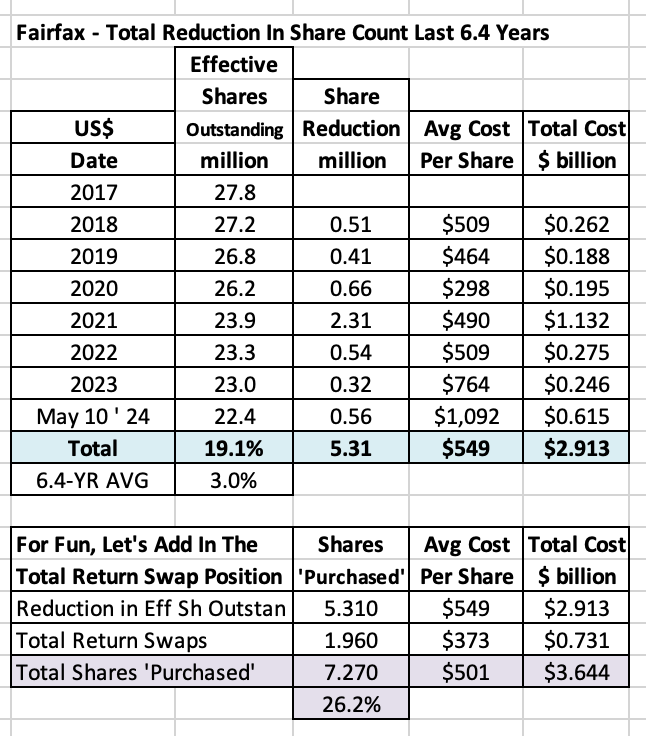

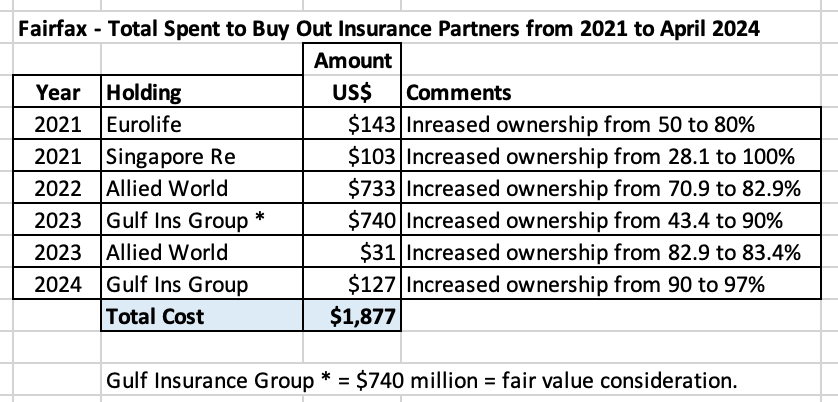

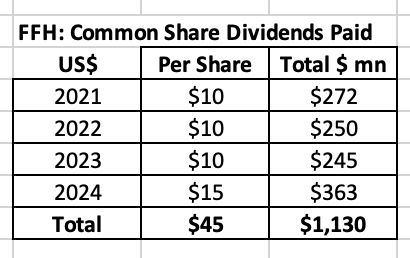

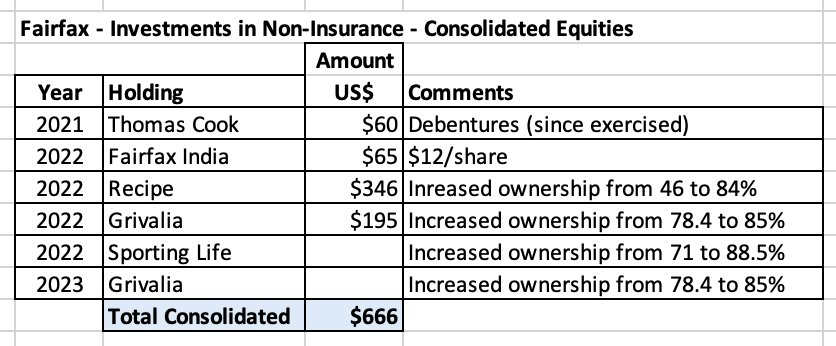

How to be a good investor / capital allocator: Part 2 For Part 1 - scroll up to read the previous post ‘Look at the cannibals’ One of Charlie Munger’s investing strategies was to look for ‘financial cannibals.’ This referred to companies that were buying back a large amount of their own stock over long periods of time. Of course, the price paid for the stock was important. Buying back large amounts of stock at cheap prices creates extraordinary value for shareholders. The math: (Important: Net earnings attributable to non-controlling interests (minority shareholders) is not part of EPS calculation. We will come back to this later.) Assuming net earnings stays the same, a lower share count will result in an increase in EPS. And if net earnings grows (numerator increases) at the same time the share count is reduced (denominator decreases) then EPS will increase even more. This becomes quite a powerful combination if it can be sustained over many years. This strategy can work so well because it checks all three boxes of a successful capital allocator: circle of competence - the management team has a big edge here - it understands the company/business better than anyone else. margin of safety - the management team also has a a big edge here - it understands the intrinsic value of the company better than anyone else and how it compares to the market price. concentration - when shares get wicked cheap (intrinsic value is much greater than the market value) management can buy back shares in volume. “…what those (prosperous) companies had in common was they bought huge amounts of their own stock and that contributed enormously to the ending record. Lou, Warren, and I would always think the average manager diversifying his company with surplus cash that’s been earned more than half the time they’ll screw it up. They’ll pay too high a price and so on. In many cases they’ll buy things where an idiot could see they would have been better to buy their own stock than buy this diversifying investment. And so somebody with that mind-set would be naturally drawn to what Jim Gibson used to call “financial cannibals,” people that were eating themselves.” Janet Lowe - Damn Right: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger Fairfax: Record earnings and capital allocation Today Fairfax is generating a record amount of earnings. And given their sources (high quality), very high earnings are expected to continue for the next 3 or 4 years. This means Fairfax will be generating and allocating a record amount of capital over the next 4 years. Like all companies, Fairfax has three basic options when it comes to capital allocation: Re-invest in the business (organic growth or acquisitions) Buy back stock Pay a dividend What exactly will Fairfax do? Of course, this is the rub. The answer is we don’t know exactly what Fairfax will do. What Fairfax does will depend on a number of factors (internal and external). So when it comes to future capital allocation decisions, investors will need to trust the management team at Fairfax. Should we trust the management team at Fairfax? Will they be rational? Will they allocate capital in a way that it builds long term shareholder value? To help answer these questions we need to look into the past. But how far back do we need to go? Given Fairfax’s colourful history, this is a really interesting question. My view is investors should focus primarily on the past 5 years, with emphasis given to the past 3 years. Let’s start by looking at what Fairfax has been doing so far in 2024. And then let’s zoom out and look at what they have been doing over the past 4 years. What has Fairfax been doing on the capital allocation front so far in 2024? With three different activities, over the first 4.5 months of 2024, Fairfax has allocated $1.1 billion of capital. That is a significant number. 1.) Share buybacks = $613 million To May 10, Fairfax has reduced effective shares outstanding by 561,102 or 2.44%. The total cost was $613 million or $1,092/share. Book value at March 30, 2024 was $940/share. The shares were taken out at 1.15 x BV which is a very low valuation given the quality of Fairfax and its very strong earnings outlook over the next couple of years. It should be noted that Fairfax’s book value does not capture the excess of fair value (FV) over carrying value (CV) for the associate equity holdings of $1.2 billion pre-tax (about $50/share). “At March 31, 2024 the excess of fair value over carrying value of investments in non-insurance associates and consolidated non-insurance subsidiaries was $1,185.6 million.” Fairfax Q1 2024 Earnings Release If we include the excess of FV over CV ($35 after-tax) and expected 2024 earnings (US$140/share - current estimate at Yahoo Finance), Fairfax is buying back its shares at less than 1 x estimated 2024YE BV. That is very cheap. Lowering the share count boosts earnings per share. Share buybacks, when done at attractive prices, is a very shareholder friendly action. 2.) Take out minority interest in insurance companies = $127 million In April of 2024, Fairfax increased its stake in Gulf Insurance Group (GIG) from 90% to 97.1% “Subsequent to March 31, 2024, the company completed a mandatory tender offer for the non-controlling interests in Gulf Insurance and increased its equity interest from 90.0% to 97.1% for cash consideration of $126.7.” Fairfax Q1 2024 Interim Report Taking out minority partners means ‘net earnings attributable to non-controlling interests’ (minority shareholders) decreases. And ‘Net earnings attributable to shareholders’ increases. Taking out a minority partner means Fairfax shareholders are now entitled to receive a larger share of the future earnings at GIG. Like a share buyback, this activity also boosts earnings per share. 3.) Dividend = $363 million On January 3, 2024, Fairfax increased the dividend from $10 to $15/share, an increase of 50%. At the time Fairfax shares were US$914. The $15 dividend provided a yield to shareholders of 1.6%. “Given Fairfax’s substantial growth since it inaugurated a US$10 per share annual dividend 14 years ago, and given Fairfax’s current position of foreseeing strong earnings for the next few years based on insurance company underwriting income, locked-in interest and dividend income and income from associates, we felt it was appropriate to raise our annual dividend this year to US$15 per share, and we believe that this should be a sustainable level,” said Prem Watsa, Chairman and Chief Executive Officer of Fairfax.” Fairfax New Release January 3, 2024 Dividend payments provide an income stream for investors that can be reinvested to compound returns over time. Paying a consistent and growing dividend is seen as a sign of financial strength for a company. It is important to note that Fairfax is has been making many more capital allocation decisions than just the three highlighted above. Importantly, they continue to grow their P/C insurance operations in the current hard market. And they continue to actively manage their large fixed income and equity investment portfolio. Summary With these three activities highlighted above Fairfax allocated $1.1 billion of capital in the first 4.5 months of 2024. Investors want to see Fairfax grow earnings per share over time. Share buybacks reduce the denominator. Buying out minority shareholders increases the numerator. One of these activities would have been good. Both of these happening at the same time is even better - resulting in even larger EPS growth. And paying a dividend allows an investor, should they choose, to buy more shares - and increase their ownership share in the company even more. All three of these activities are very shareholder friendly - each delivers a solid return for shareholders. Importantly, they are also very low risk. Fairfax is also exercising good ‘plate discipline’ - with these capital allocation decisions they are swinging at pitches that are in their sweet spot. Each of these are what I would call ‘solid single’ types of investments. They move the runners around the bases. And of course, that is how you win the game. Importantly, the management team at Fairfax is acting rationally and building long term shareholder value with these decisions. This bodes well for the future. What if we look at each of these decisions - but over a slightly longer time horizon? When we look out a couple of years we see ‘cannibal investing’ at its best. Stock buybacks Over the past 6.4 years, Fairfax has spent $2.9 billion and reduced effective shares outstanding by 19.1%. That is a massive reduction in the share count. The average cost was $549/share. Book value at Dec 31, 2024 was $940/share. Intrinsic value is likely north of 1.4 x BV = $1,300. Bottom line, shares were repurchased at a price that was well below intrinsic value. For fun, let’s add in the total return swap position - giving Fairfax exposure to 1.96 million Fairfax shares at an average cost of $373/share. Over the past 6.4 years, Fairfax repurchased/got exposure to 26.2% of shares outstanding at an average cost of $501/share. These purchases have been very accretive for long term shareholders. This is a great example of superior capital allocation. These string of transactions will likely go down as one of Fairfax’s greatest investment decisions (to aggressively take out/get exposure to shares). Buying out minority partners Insurance Holdings Over the past 3.4 years, Fairfax has spent $1.9 billion to take out its partners and increase its ownership stake in its existing P/C insurance businesses. There were two big moves: 1.) In 2022, significantly increasing its ownership in Allied World from 70.9% to 83.4%. 2.) In 2023/24, obtaining a control position and increasing its ownership in Gulf Insurance Group from 43.4% to 97.1%. This move solidifies Fairfax’s position in the rapidly growing Middle East North Africa (MENA) region. These are quality P/C insurance companies. These decisions are very low risk and deliver a solid return to shareholders. Taking out minority partners is a solid way for Fairfax to grow ‘net earnings attributable to Fairfax shareholders.’ Price paid matters: I think the take-out price that Fairfax will eventually pay is largely set when the initial deal is struck with the minority partners in the insurance businesses. This provides Fairfax with some degree of certainty - and it provides the minority partners with an acceptable return over the life of the transaction. Do I have this generally right? I would appreciate hearing what others think on this topic. Non-insurance Consolidated Equities Over the past 3.4 years, Fairfax has spent $700 million to increase the size of its collection of consolidated equity holdings. This is slowly growing another income stream for Fairfax - one that is unrelated to its insurance business. This makes Fairfax a stronger, more financially resilient company. It will be interesting to see if Fairfax continues to grow this bucket of holdings in the future. Dividends Over the past 4 years, Fairfax has paid a total of $1.13 billion in dividends on its common shares. Summary Buying back shares on the cheap: over the past 6.4 years, Fairfax has spent $2.9 billion and reduced effective share outstanding by 19.1%. Buying out partners in its consolidated insurance and non-insurance holdings: over the past 3.4 years, Fairfax has spent $2.5 billion taking out minority partners in its insurance and non-insurance businesses. When it comes to capital allocation, for years now Fairfax has been a ‘financial cannibal.’ The kind that Charlie Munger would have really liked. Over the past 4 years, Fairfax has also paid out $1.1 billion in dividends. These are funds investors can reinvest to compound returns even more over time. But the Fairfax story gets better. Thats not all Fairfax has been doing with capital allocation over the past 4 years. Its has also been: Aggressively organically growing its P/C insurance business - taking full advantage of the hard market that started in late 2019. Selling assets at premium valuations - pet insurance, Resolute Forest Products, Ambridge Parners - for +$2 billion. Fixed income team navigated greatest bond bull / bear market in history. Protected balance sheet. Now earning record interest income. Dramatically improved the overall quality of their equity portfolio. Exited many poor investments. Merged others with stronger companies. New investments have been performing well. Some legacy investments have turned around. Group has never been better positioned. As a result of all of Fairfax’s capital allocation decisions, earnings at Fairfax have spiked higher. At the same time, the share count has come down meaningfully. Earnings per share have increased dramatically. What have we learned about the management team at Fairfax? The management team at Fairfax has been acting very rationally with their decisions - over many years. They have been swinging at pitches that are in their sweet spot - that are in their circle of competence. They have been scaling/concentrating their best opportunities appropriately. Their decisions have been building an enormous amount of shareholder value. When it comes to capital allocation, Fairfax’s track record in recent years has been outstanding. The team at Hamlin Watsa has been hitting the ball like Ted Williams. Not only have they been hitting for a very high average, but many of their decisions have been the financial equivalent of a home run. This is very encouraging for Fairfax shareholders. Guess what Fairfax is going to do in the future? Fairfax continues to have many good options in front of them: Buy back Fairfax stock - it still very cheap Buy out minority partners in its insurance operations (Eurolife, Brit, Allied World, Odyssey) - the table is set. Of course, Fairfax will also continue to do all the other regular things: Organically grow its P/C insurance business. Actively manage its fixed income and equity investment portfolio. Pay a modest dividend. And Fairfax will be opportunistic and take advantage of volatility in financial markets. As a result, we should see earnings continue to grow. And share count continue to shrink. And, like the past 4 years, this should result in much higher earnings per share. As we said earlier, we don’t know exactly what Fairfax will do in the future. It will depend on a number of factors (internal and external). But with their actions over the past 4 years they certainly have earned our trust. With record earnings coming over the next 4 years, Fairfax is in a great position - the set-up for Fairfax shareholders has never looked better. In 2024, Fairfax has entered a new phase in its evolution as a company - the 'wonderful business' phase. And as Buffett teaches us: “Time is the friend of the wonderful business...”

-

Capital allocation - Circle of Competence - Margin of Safety - Concentration In this section we are going to explore the topic of capital allocation. Capital allocation is the most important responsibility of a management team. Why? Capital allocation decisions are what drive the long-term performance of a company and important metrics like reported earnings, growth in book value and return on equity. In turn, these metrics drive the multiple given to the stock by Mr. Market - and finally the share price and investment returns for shareholders. When done well, capital allocation does two important things: Delivers a solid return. Improves the quality of the company. Therefore, the fundamental task of an investor is to determine if management, over time, is making intelligent decisions regarding capital allocation. How to be a good investor / capital allocator Being a good investor is the same thing as being a good capital allocator. Warren Buffett is a great teacher. In his 1996 shareholder letter, Buffett succinctly lays out what an investor needs to do to be successful. This is the same approach that Berkshire Hathaway has followed - quite successfully - for decades. We have included Buffett’s full quote below. In his framework, Buffett introduces the concept of ‘circle of competence.’ Given its importance, we will explore it more fully in the next section. Warren Buffett - 1996 Shareholder Letter “Let me add a few thoughts about your own investments. Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals. “Should you choose, however, to construct your own portfolio, there are a few thoughts worth remembering. Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word "selected": You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital. “To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices. “Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards - so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value. “Though it's seldom recognized, this is the exact approach that has produced gains for Berkshire shareholders: Our look-through earnings have grown at a good clip over the years, and our stock price has risen correspondingly. Had those gains in earnings not materialized, there would have been little increase in Berkshire's value.” ————— Mental model: circle of competence A mental model is simply a framework that helps us understand how something works. Mental models guide our behaviour and they help us solve problems. “The more models we have, the better able we are to solve problems. But if we don't have the models, we become the proverbial man with a hammer. To the man with a hammer, everything looks like a nail. If you only have one model, you will fit whatever problem you face to the model you have” Charlie Munger To guide investors, Warren Buffett introduces the concept of ‘circle of competence’ as a foundational mental model. What is it? ‘Circle of competence’ is a subject area when you have an edge. It is a match with your skills and experiences. To be successful at investing, stick to areas where you know more than other people. This might sound obvious. Few actually do it. It allows you to answer the 3 fundamental questions: Do you understand the business? Is it run by competent management? Does it sell for a price that is attractive? Let’s revisit Buffett’s quote: “You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.” Warren Buffett 1996 Shareholder Letter Buffett highlights a number of important points: Self awareness: You have to know what your circle of competence is. The size of the circle is not very important. Importantly, it can be expanded over time. Knowing the boundaries is ‘vital’. This is knowing what to avoid. In the HBO documentary linked below, Buffett expands on ‘circle of competence’ and provides additional insight: Patience: wait for the right opportunity - one that is in your ‘sweet spot.’ Think independently: don’t let the mood of Mr. Market influence what you are doing. HBO Documentary: Becoming Warren Buffett (30:30 minute mark) https://youtu.be/2Q5zhl4YVo8?si=A5RY0o3ivBfbPHYz “I was genetically blessed with a certain wiring that is very useful in a highly developed market system that has lots of chips on the table where I happen to be good at that game “Ted Williams wrote a book called the science hitting. In it he has a picture of himself at bat and the strike zone broken into 77 squares. He said if he waited for the pitch that was really in his sweet spot he would bat 400 and if he had to swing at something in the lower corner he would probably bat 235. “In investing I’m in a no-called strike business, which is the best business you can be in. I can look at 1000 different companies and I don’t have to be right on every one of them or even 50 of them. So I can pick the ball i want to hit. “The trick with investing is to sit there and watch pitch after pitch go by and wait for the one that is right in your sweet spot. If people are yelling ‘swing you bum!’ Just ignore them. “There is a temptation for people to act far too frequently in stocks simply because they’re so liquid. “Over the years you develop a lot of filters. I do know what is called my circle of competence. So i stay within that circle. I don’t worry about things that are outside of that circle. Defining what your game is… where you’re going to have an edge… is enormously important.” ————— Margin of safety “If you were to distil the secret of sound investment into three words we venture the motto, margin of safety.” Ben Graham The Intelligent Investor - Chapter 20 Margin of safety is one of the most important principles/concepts in investing. It is defined as the difference between a stock’s price and its intrinsic value. Buying a stock with a large margin of safety does two things at the same time: Limits the downside risk. Provides a high return opportunity. Circle of competence and margin of safety Only invest in opportunities that: fall within your circle of competence. can be purchased at prices that provide a margin of safety "If you understood a business perfectly — the future of a business — you would need very little in the way of a margin of safety," Warren Buffett - 1997 Berkshire Hathaway Annual Meeting ————— Concentration "Diversification may preserve wealth, but concentration builds wealth." Warren Buffett “If you can identify six wonderful businesses, that is all the diversification you need. And you will make a lot of money. And I can guarantee that going into a seventh one instead of putting more money into your first one is gotta be a terrible mistake. Very few people have gotten rich on their seventh best idea. But a lot of people have gotten rich with their best idea. So I would say for anyone working with normal capital who really knows the businesses they have gone into, six is plenty…” Warren Buffett - Talk at Florida University 1998 (1:05:30 mark) https://youtu.be/2MHIcabnjrA (great 90 minute video) A key part of Berkshire Hathaway’s long term success has been holding a concentrated portfolio of investments. Circle of competence and concentration Only investing in his ‘circle of competence’ gives Buffett conviction - and allows him to concentrate in his best ideas. This further improves Berkshire Hathaway’s long term returns. ————— Circle of competence, margin of safety and concentration Circle of competence, margin of safety and concentration are concepts that are inter-related and synergistic. Combined, they provide results that are far more powerful than those that could be achieved on their own. (1 + 1 + 1 = 5) Circle of competence = good returns Circle of competence + margin of safety = better returns Circle of competence + margin of safety + concentration in best ideas = best returns Key take-away: of the three, circle of competence is perhaps the most important component. It is the lynchpin. It is what allows the other two components to work their magic. ————— As he told us earlier, this has been the approach that Buffett has been using with great success to grow Berkshire Hathaway for decades. This also gives investors a blueprint to evaluate the capital allocation skills of management teams at other companies. Let’s now apply what we have learned. Let’s look at the capital allocation decisions of Fairfax Financial. We are also going to explore something Charlie Munger called ‘cannibal investing.’ Part 2 should be out in the next couple of days.

-

@nwoodman thanks for the updates. Much appreciated. I am liking this company more and more (and i already liked it a lot). Underpromise and overdeliver. Very well run. Continie to execute exceptionally well.

-

Do we know if this is a Buffett purchase? Or one of the lieutenants? Regardless, it is a vote of confidence for the P/C insurance sector. It makes sense that if Buffett wanted to play the sector he would pick someone like Chubb - one of the largest by market cap/liquidity. I think P/C insurance falls in Berkshire Hathaway's circle of competence. Anyone have any stock recommendations for P/C insurance? Asking for a friend... Getting a Berkshire Hathaway 'seal of approval' is just another tailwind for the P/C insurance sector.

-

I think this is a great point. Especially if Fairfax wants to remain primarily a P/C insurer (and not morph into a conglomerate). Aggressively buying back undervalued shares as the hard market ends is such a good decision/use of excess capital. It also means Fairfax/Prem is not focussed on empire building. Fairfax is instead clearly focussed on making decisions that build long term shareholder value. Very encouraging.

-

I like how Peter Lynch looked at insider buying/selling. "insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise." He viewed the buying as a useful input when valuing a company. Usually, insiders only buy for one reason: they think their stock offers very good value. On the other hand, insiders sell for many reasons. As a result, insiders selling tends not to be a useful input when valuing a company. The fact that Fairfax has been able to buy back a significant number of shares the past 4.5 months and has not had to pay a big premium is a big win for shareholders. Thank you Prem

-

Here is another way to look at the multiple Fairfax has been buying back shares for. In 2021, with the SIB, they paid a multiple of 0.9 x BV. Today they are paying a multiple of 1.15. The multiple on the stock has increase 0.25 x. Fairfax is a very different company today than it was in 2021. Most importantly, operating earnings have increased from $1 billion (average from 2016-2020) to $4.5 billion today. The size and quality of Fairfax's income streams has increased dramatically. Clearly, the company deserves to trade at a much higher P/BV multiple today compared to 2021. Perhaps the increase in multiple it deserves to trade at is 0.25 x. If so, then Fairfax today is buying back stock at the same (low) valuation that it was back in 2021. Anyways, I don't mean to beat this topic to death... just trying to think about it in different ways...

-

@StubbleJumper Your post has a bunch of really interesting angles to it. Below are some thoughts. As per usual, I like to stir the pot a little to hopefully generate some good discussion. And estimating 'intrinsic value' at a point in time is a really important topic. Below I bolded the part in your earlier comment that got my attention. @StubbleJumper “The value of my personal shares is independent of the size of the float. My portion of FFH's future cash flows is X/total shares outstanding. So, when 250k shares are retired, my portion of FFH's future cash flows goes up. That part is not optics. The part that might make it mostly optics is the price paid. Continuing shareholders are only better off after a repurchase if the shares were repurchased at a price that is less than intrinsic value. When FFH conducted the SIB a couple of years ago and bought back a boat-load at US$500, it was quite obviously the case that those repurchases were undertaken at a price lower than IV. But, a repurchase price of US$1,100 is probably much closer to IV and the benefit to continuing shareholders is much more limited. As an example if IV is actually US$1300 or $1400, we continuing shareholders collectively benefit by 275k*US$200 or 300...less than five bucks a share?). It's not nothing, but it doesn't move the needle all that much.” Intrinsic value is a tough thing to estimate. When Fairfax did its SIB in late 2021 did investors at the time think Fairfax was buying shares below intrinsic value? I am not so sure. It is clear today that Fairfax got a steal of a deal. With the buybacks so far in 2024, is Fairfax buying shares below intrinsic value? It appears investors think Fairfax is buying back shares today at a price that is close to intrinsic value. Just like 2021, I am not so sure that investors are getting it right. Why? Fairfax is a completely different company today than it was in late 2021 - especially when you focus on earnings. And future earnings is the critical input when calculating intrinsic value. Here is what Prem had to say at the Fairfax AGM. He said this at the very beginning of his slide presentation. “Fairfax -- and I've said it in our annual report, said it last year. I'll say it again. Fairfax has been transformed since 2017. Even we couldn't see it. If you had asked me 3 years ago, 4 years ago, I couldn't see that. Our premiums have gone up… The float has gone up, the investment portfolio, common shareholders' equity. Underwriting profit, because of this expansion in a hard market… interest and dividends… it's running at about $2 billion. … operating income of $4 billion that we can see for the next 4 years. The company has been transformed. And …because of this transformation, the intrinsic value of the company has gone up significantly.” Let me try and explain my thinking in a little more detail. Part 1 I think it is useful to dial back to November 2021. At that time, what were the facts? On December 17, 2021, Fairfax announced the SIB: to repurchase 2 million shares at $500/share, with the offer expiring on Dec 23, 2021. Of interest, at Sept 30, 2021, book value was $562. Fairfax’s SIB was made at about 0.9 x BV. https://www.fairfax.ca/press-releases/fairfax-announces-us1-0-billion-substantial-issuer-bid-and-sale-of-9-99-minority-stake-in-odyssey-group-2021-11-17/ On Nov, 16, 2021, the day before they announced the SIB, Fairfax shares closed at US$432.49. For the next month (mid Nov to mid Dec), Fairfax shares traded in a band between $440 and $460/share, well below the $500/share SIB price. Fairfax shares traded below $500/share for much of Q1, 2022. This tells me that most investors likely felt Fairfax was buying back shares in Dec 2021 at a small premium to IV. In fact, a year later, in October of 2022, Fairfax share traded briefly below $450 - a price significantly below the SIB from the previous year. Today - 30 months later - it is now obvious to investors that Fairfax’s SIB was executed at a price that was well below intrinsic value. The key take-away is this - when the SIB was executed in 2021 most investors got it completely wrong. My guess is most investors - at a point in time - have no idea what Fairfax’s actual intrinsic value is. Yes, those are fighting words. Why do I think that? Intrinsic value is a theoretical concept and a wickedly difficult thing to estimate (just ask Buffett). Especially for a company like Fairfax where so much important stuff is going on under the hood. Instead, most investors simply focus on Fairfax’s current stock price and go from there (and make the buy, sell or hold decision based on what the animal entrails tell them at a given point in time). Look at the commentary on this board when it comes to Fairfax… how much of the commentary is based primarily on a valuation framework and how much of the commentary is primarily based on where the stock price is trading? To be fair, Fairfax’s stock price has been a rocket ship to the moon the past 4 years. But intrinsic value has also been on a rocket ship to the moon. Which has gone up more? Now that is a great question. So let’s explore that a little bit next. Part 2 Fairfax is not the same company today that it was in December 2021. Its insurance business is much larger and is more profitable. Its fixed income portfolio is much larger and earning a much higher average yield. Its equity holdings are much higher quality and performing much better. Fairfax has also been best-in-class with its capital allocation decisions the past 30 months (compared to there P/C insurance companies). The magnitude of the change has even caught Fairfax by surprise. This is what Prem told us loud and clear at the AGM this year (see quote above). As a result, operating earnings have spiked higher over the past 30 months. From 2016-2020, operating earnings at Fairfax averaged $1 billion per year. Importantly, this was the reference point for investors in Fairfax in November 2021. This is likely what they were using as their core input when calculating intrinsic value. Today, operating earnings are in the $4.5 billion range. This is a 350% increase from the 2016-2020 average. This level of operating earnings is sustainable moving forward - in fact, it should actually grow nicely over time (as record earnings get re-invested by the top-notch capital allocation team at Hamblin Watsa, creating larger/new income streams). Of interest, book value has increased from $562 at Sept 30, 2021, to $940 today (March 31, 2024). Book value has increased 67% over the past 30 months. And operating earnings have increased 350%. Back in Dec 2021, Fairfax paid 0.9 x BV ($500/$562) to repurchase 2 million shares. Fast forward to today. So far in 2024, Fairfax has reduced effective shares outstanding by 605,000 or 2.6%. The total cost was $688 million or $1,090/share. Book value is $940/share so shares were purchased at a slight premium to BV of 1.15 x. Compared to the SIB in 2021, does this mean Fairfax is now buying back shares at less of a discount to intrinsic value? Or at a price that is closer to intrinsic value? Of course, the answer is - it depends. It depends on whether or not Fairfax is the same company that it was in late 2021. We know that Fairfax is not the same company. It has been transformed in recent years. Operating earnings have increased 350%. Fairfax’s earnings have improved dramatically in size and quality. Higher quality means the company should now trade at a higher multiple than it did in December 2021. Is 1.15 x BV the right multiple? No, of course not. It is much too low for a company of Fairfax’s quality. But investors won’t see it today. But guess what? It will likely be obvious to investors 30 months from now. Over the next three years, my guess is Fairfax will earn a total of somewhere between $450 to $500/share ($150 x 3 plus some growth). At the end of 2026, this would put book value at around $1,400/share. Let’s assume Fairfax should be valued at a P/BV multiple of 1.3 x. This is a low multiple for a company of Fairfax’s quality. This would put the share price at about $1,800 in 3 years time (early 2027). I view this estimate as a a reasonable baseline - could be a little higher or it could be a little lower. If this is how things play out, buying back shares today around $1,100/share will look like a steal in 3 years time (if the shares are trading at that time at around $1,800). In three years time, when investors look back to evaluate Fairfax’s repurchase of shares in 2024, my guess is they are going to conclude that Fairfax was able to buy them back at a price that was well below intrinsic value. Just like their evaluation today of the repurchase that Fairfax did in December 2021. With hindsight it will be obvious to everyone. But today? Few can see it. And that is what I love about investing. ---------- PS: what is the appropriate P/BV multiple for Fairfax? What if it is 1.5 x ? It would be great to come back to this discussion in three years time... Fairfax are value investors - and they are very good. They are aggressively buying back Fairfax stock today. That tells you loud and clear what they think about Fairfax's current valuation. And they understand the company - and its future prospects - very well.

-

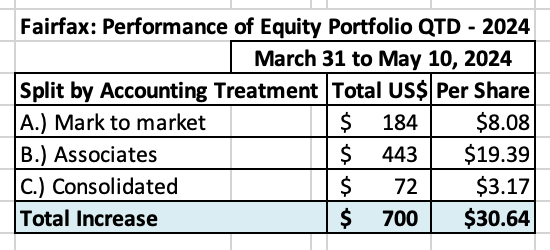

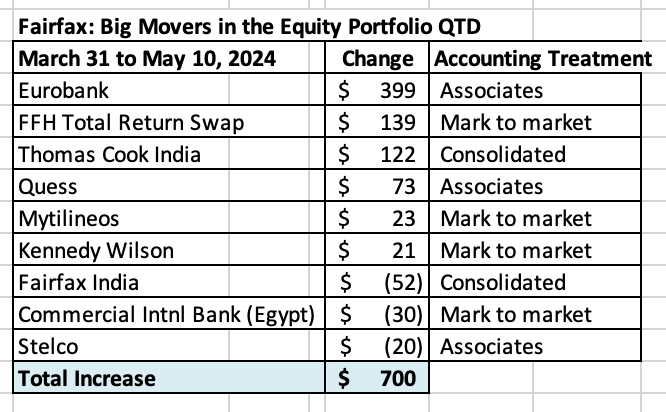

Change in value of Fairfax’s equity portfolio in Q1 - 2024 Fairfax’s equity portfolio (that I track) had a total value of about $20.4 billion at May 10, 2024. So far in Q2 it is up about $700 million (pre-tax) or 3.5%, which is a solid start to Q2-2024. As per usual, please let me know if you see any errors FYI, I include the warrant and debentures in the total. The Excel file is attached at the bottom of the post. I include the FFH-TRS position in the mark to market bucket and at its notional value. I also include warrants and debentures that Fairfax holds in the mark to market bucket. My tracker portfolio is not an exact match to Fairfax’s actual holdings. My summary has been updated to include information from Fairfax’s Q1-2024 earnings report. My tracker portfolio is useful only as a tool to perhaps understand the rough change in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 49% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 51% are Associate and Consolidated holdings. Over the past couple of years, the share of the mark to market portfolio has been shrinking. This means Fairfax's quarterly results will be less impacted by volatility in equity markets. Split of total gains by accounting treatment The total change is an increase of about $700 million = $30.64/share The mark to market change is an increase of $184 million = $8.08/share. The change in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio Q1-YTD? Eurobank is up $399 million and it is Fairfax’s largest equity holding at $2.84 billion. The FFH-TRS is up $139 million and is Fairfax’s second largest holding at $2.26 billion. Thomas Cook India is up $108 million. TCIC continues its strong performance. Quess is up $73 million. Market value is $393 million (carrying value is $432 million). Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1.676 billion or $73/share (pre-tax). Book value at Fairfax is understated by about this amount. Associates: $1,052 million = $46/share Consolidated: $624 million = $27/share Equity Tracker Spreadsheet explained: We have separated holdings by accounting treatment: mark to market, associates – equity accounted, consolidated, other Holdings – total return swaps. We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. This spreadsheet contains errors. It is updates as new and better information becomes available. Fairfax May 10 2024.xlsx

-

@Mystery Guest , I think you might be on to something. Fairfax compounded book value at 18.4% for 38 straight years. That is a phenomenal track record. To call the company ‘no-moat’ is, of course, idiotic. Obviously, there is a moat hiding in there somewhere.

-

I do not follow Fairfax India as closely as i follow Fairfax. The big near term issue that i see is IIFL Finance - but this has been out there for months now so it should not have come as a surprise when Fairfax India reported results. What did surprise me is the explanation of the current issues the founder of IIFL, Nirmal Jain, gave at the Fairfax India AGM (see quote below). The answer he gave might come across as funny to an audience in India. I don’t think it’s the right kind of humour to use when explaining a serious problem to an audience in North America. Hopefully Fairfax uses this as an example internally of probably what not to do in the future. —————- “So RBI does (our) audit, and they've been doing it for the last 16 years of our company's existence. And this year, they found a few lapses. And based on that, we're a bit surprised because the order came, which was a complete embargo on our gold loan business. And of course, there were lapses. So I can't say that it's something which is -- we are doing everything which was in full compliance of their master circular. “But many of these things that we are doing were also industry practice. So maybe I can give analogy. I mean I don't know many of you would have traveled to India there, the traffic rules are hardly followed. The people obviously. Now -- but if you are in Canada, U.S. everywhere, then you see that even if the other side is empty and there's a 3-mile traffic jam, people still won't break the lane because somewhere -- some point in time, regulators enforce the regulations very strictly. “So what happens that in traffic police officer catch hold of somebody and sort of make him an example. And if we have a view, then I don't think that we can really crib about it, but I'll just talk about it that what happened and how we are going to overcome.”

-

@gamma78 and @valueinvesting101 great comments. Thanks for chiming in. I do find it interesting how aggressive Fairfax has been since 2018 in buying back Fairfax’s stock. Yes, Fairfax got the stock at a crazy low price. But this also has the effect of shrinking the size of the company. I like this - as we have learned with Berkshire, ever-increasing size eventually becomes a constraint on returns. Keeping Fairfax small (relatively) should help Fairfax deliver above average returns moving forward. Great points on India. Is the set-up today in India like the US back in the 1950’s? Buy a basket of ‘quality at a fair price’ and hang on for decades? Interesting idea. I have been a little bit surprised how quiet Fairfax has been in India the past couple of years. Their playbook there has been monetizing assets, increasing their ownership of BIAL and building cash. Like a spring getting loaded?

-

some quick thoughts: Wade’s summary was short, concise and well done. Investment portfolio is $65b; $46 fixed income and $19b equity Grivalia Hospitality - George K estimates One and Only development is worth entirety of GH carrying value. Kennedy Wilson debt platform is at $4.8b? and yield is 8.25% As fixed income matures, Fairfax has been leaving at short end, which is shortening avg duration a little. Allied World - reinsurance increased double digit Eurobank - share of profit of associates was $79 million; this included $45 million in one offs (adj due to sale of sub etc); underlying was $124 million, which was $30 million more than prior year. GIG ownership was increased in April from 90 to 97.1 at a cost of $127 million (mandatory tender offer) FFH-TRS: think its a great investment (shares still offer good value) Insurance: continue to see opportunities. Price increases exceed loss cost trends. Insurance subs have $3 billion in dividend capacity; paid $451 million to hold co in Q1. Expense ratio ticked higher in Q1: inclusion of GIG (has higher exp ratio), bus mix, investments in technology

-