Viking

Member-

Posts

4,922 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

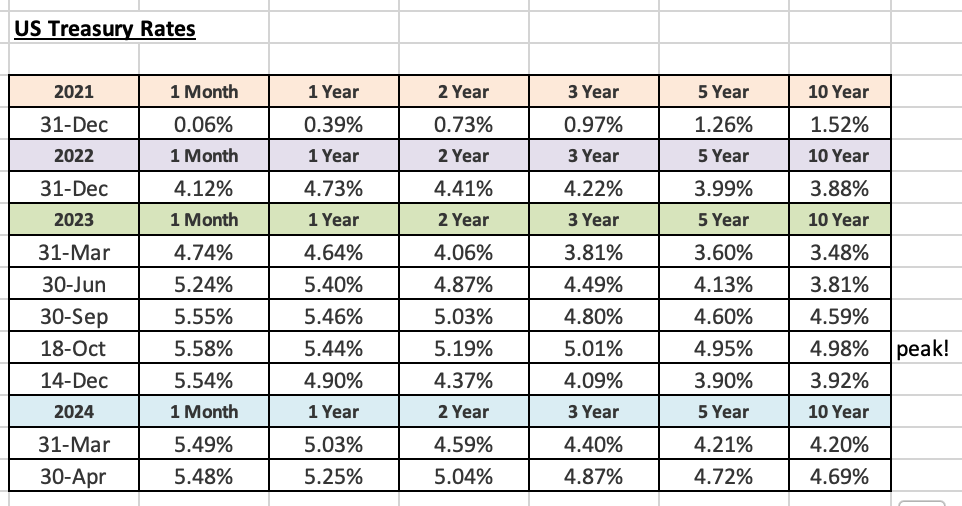

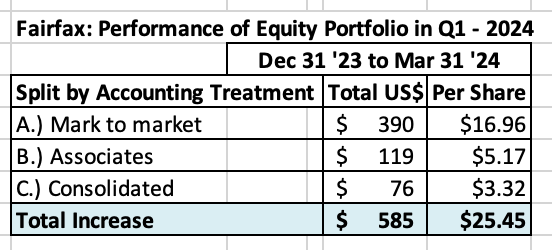

Q1 Earnings: Answers to questions Overall, it was a boring, solid quarter. 1.) How are they allocating new capital? What did Fairfax do with $1 billion notes offering that was completed the end of March? A: Stay tuned. Cash increased to $2.5 billion. It is earning +5% so perhaps Fairfax feels no urgency to deploy it quickly. 2.) Impact of change in interest rates on reported results? A: this was about a $125 million headwind. This was higher than I expected; although I do expect the puts and takes to roughly balance out over time. "The benefit of the effect of increases in discount rates on prior year net losses on claims of $192.3 million partially offset net losses recorded on the company’s bond portfolio of $318.8 million." 3.) What is interest and dividend income? Q4, 2023 = $536.4 million Q1, 2024 = $589.8 million = a run rate of $2.36 billion for 2024 (up from $1.9b in 2023). A: Increased $53 million from last quarter. Much more than I was expecting. Is Fairfax’s investment in Kennedy Wilson’s debt platform continuing to grow? A: Yes. It increased by $160 million in Q1. 4.) Insurance What is growth in net premiums written? GIG + organic? A: Solid increase of 11.2% (5.3% was GIG) What is CR? Is it below 94%? A: Solid 93.6% (was 94.0% in Q1, 2023) What is level of reserve releases? Trend? A: TBD Brit update: ex Ki, CR was 90.2% in Q1. Importantly, company is growing top line again, as net premiums written increased 6.5% in Q1. Continuing solid performance we saw in 2023. 5.) What is share of profit of associates? A: Total of $127.7 was lower than expected. $28.6 million loss from Helios. Seasonality. Not concerned. "Consolidated share of profit of associates of $127.7 million principally reflected share of profit of $79.3 million from Eurobank, $36.0 million from EXCO Resources and $34.8 million from Poseidon, partially offset by share of loss of $28.6 million from Helios Fairfax Partners." 6.) Equities: What are investment gains from equities? A: Equities booked a $275 million gain. About what I expected (a little lower based on my tracking model but it does not capture everything Fairfax owns). For Associate holdings, what is the excess of market value to carrying value? Q1, 2024 = $1,185.6 million = $52/share 7.) Is there any adverse development for runoff? More broadly, what are the results for runoff/life bucket? A: Results were roughly as expected. 8.) What is book value per share? This increased a smaller amount than I expected; normal range. The dividend payment in January will dent this by $15/share. Q1 = $945.44 (2023YE = $939.65) 9.) Other notes: Shares Outstanding During the first quarter of 2024 the company purchased 240,734 of its subordinate voting shares for cancellation at an aggregate cost of $260.3 million ($1,081/share). Fairfax is now buying back shares at a premium to book value. They continue to see this as an attractive price to pay. At March 31, 2024 there were 22,831,173 common shares effectively outstanding. Interest expense Was $151.5 million in Q1; about $20 million more than I expected. And it does not include a full quarter of the $1 billion in new borrowings that closed in late March (while this is being held, the interest being earned will show up in interest income). Comprehensive income Unrealized foreign currency translation losses were $228.4 million in Q1. Yes, the US$ was very strong.

-

What were the key drivers of Berkshire Hathaway’s success when the company was in its prime? I have ranked the key drivers by importance. Did i get the list right? What is missing? Did i get the order right? If not, what is the new order? 1.) Buffett the man is a genius. As an investor. He has also been a very good manager. 2.) Control - Buffett has voting control. Gave Buffett free rein to run the company as he saw fit Without this, Berkshire Hathaway never would have evolved as it did 3.) Capital allocation skills of management. Primarily Buffett, but also includes Charlie Munger, Ajit Jain, Greg Abel etc. Value investing framework: shifted over the years (as Berkshire Hathaway grew in size) from deep value to quality at a reasonable price 4.) Insurance Float Provides a low cost, stable and growing source of funds/capital that Buffett used to make many outstanding investments. When combined with 3.) magnified returns. Float loses its value when interest rates are very low, like they were from 2010-2020. Float increases greatly in value when interest rates are high like they are today. 5.) Long term focus Fits hand and glove with the ‘buy and hold’ value investing framework. Investments: able to take advantage of market volatility. Also fits hand in glove with the P/C insurance cycle - which can run in 15 year cycles (hard to soft and back to hard). 6.) Invest a significant portion of the investment portfolio in equities. Embrace volatility Earn a much higher return, compared to a bond only portfolio. 7.) Culture Insurance and investments - operations decentralized Capital allocation - managed by Buffett / small corporate office 8.) Businesses generated enormous cash flow. Both insurance and investments: was reinvested well, creating new income streams. Virtuous circle. 9.) The company was small. capital allocation decisions made had a relatively quick and material impact on the performance of the company 10.) Power of compounding Attributes 1 to 9 - all happening at the same time - is a very powerful elixir, especially if it can be maintained for decades. time is the friend of the wonderful business 11.) Favourable external environment There was lots of volatility in financial markets. This provided continuous supply of opportunities to deploy large amounts of capital at very attractive rates of return.

-

@Xerxes you have a wicked sense of humour. I laughed out loud when i read your post and saw the picture.

-

Comparing Berkshire Hathaway with Fairfax Financial - some thoughts. When Buffett first bought AMEX and Coca-Cola were they viewed at the time like they were brilliant investments? No, of course they weren’t. It often takes a decade or longer - after the purchase - to evaluate/appreciate a brilliant capital allocation decision. Example 1 From 2018-2023, Fairfax invested $2 billion and now owns 15.5% of a high quality company. The average price paid that was about 1/3 of its current intrinsic value (conservatively valued). They bought high quality at an exceptionally low price. And they backed up the truck - $2 billion is a lot of money (at the time, common shareholders equity was around $13 billion). But the story gets even better. In late 2020/2021, Fairfax got exposure to another 7.5% of the very same high quality company. This time they paid about 28% of current intrinsic value. In total, they ‘purchased’ about 23% of this company, paying on average about 30% of current intrinsic value. This investment is poised to compound at mid to high teens in the coming years. Hello people… have you been paying attention? (Yes, the company they bought is called Fairfax.) Example 2 In Q4 2021, Fairfax sold most of their corporate bonds and dropped the average duration of their fixed income portfolio to 1.2 years. In Q4 2023 they extended the average duration of their fixed income portfolio to +3 years. What they did with their fixed income portfolio saved the company $3 billion? (or more?) in unrealized bond losses. Because duration was so short, the earn through from spiking interest rates was immediate in 2022 and 2023. Today they are earning $2 billion in interest income and it is now largely locked in for the next 4 years. They protected their balance, pivoted and are now earnings record interest and dividend income - the highest quality income stream a P/C insurer can have. Fairfax’s financial profile (and future) has been permanently changed (improved) as a result of these actions. Ask AM Best if you don’t believe me. The parallels with a much younger Berkshire Hathaway “History does not repeat itself, but it rhymes.” Mark Twain Investors waiting for Fairfax to buy ‘Coke’ or ‘American Express’ in 2024 will likely be sorely disappointed. For two reasons: 1.) Buffett’s brilliance wasn’t buying Coke or American Express. It was exploiting the set of circumstances that existed at the time, which served up Coke in 1988 and AMEX in 1990. 2.) Like Berkshire when it made its many brilliant moves, most investors probably won’t see it when Fairfax actually does it. How do I know this? Because Fairfax has been making exceptional capital allocation decisions for years now. For a couple of these they got out their elephant gun. And they still get no (little) credit. And that is because the company continues to be misunderstood. The moves Fairfax has been making continue to be grossly under appreciated. Just like when Buffett made his great investments, investors need more time to fully appreciate the brilliance of what Fairfax has executed in recent years. If lots of people on this board don’t see it… do you think the rest of the investor community does? That’s why the stock trades at 1.1x book value - crazy cheap. The key lesson for investors The world is different today - the set of circumstances is ever changing. Importantly, with normalized - higher - interest rates, volatility in financial markets is back. We had bear markets in stocks in 2020 and again in 2022. We had a historic bear market in bonds in 2022. And just look at what Fairfax has been doing. Most investors still can’t see what is right in front of their face. Because they are looking for the wrong thing. Active management can have a huge impact on financial results. Now most P/C insurance companies don’t actively manage their investment portfolio. Fairfax does. Fairfax today: 1.) They are run by a genius - yes, anyone who can compound book value at 18.4% for 38 years is a genius. What is Prem’s greatest strength? Perhaps his ability to attract and retain talent, beginning with the creation of Hamblin Walsa 38 years ago and continuing with the guys running insurance like Andy Barnard. 2.) They are family controlled - importantly, this allows for long term decision making. Along the same line, this also allows them to take full advantage of volatility, even if it takes some time to work out. 3.) They have Hambin Watsa - handles all capital allocation decisions. 4.) Capital allocation - They use a value investing framework. This appears to be evolving over time. Today, they appear to be placing more of a premium on management. And financial strength/profitability. ‘Quality at a fair price’ versus classic Graham ‘deep value’ type investing. 5.) They are highly levered to float. Its cost is better than free (they are actually getting paid to hold it) and it is growing in size. 6.) Culture - insurance and investments are run on a decentralized model. 7.) They invest a large part of their investment portfolio in equities. Most traditional P/C insurance companies stick to fixed income investments. 8.) They are still a small company - this gives them a very large opportunity set. 9.) They have their elephant gun out. 10.) They are able to move with speed. 11.) They have been generating an enormous amount of cash the past couple of years and this is set to continue in the coming years (net earnings of around $4 billion per year?). 12.) They are on a hot streak - when it comes to capital allocation. 13.) And volatility - more normal financial markets - is back. So lots of opportunities will be coming in the future. 14.) Compounding - as always - sits ready to work its magic. This set-up looks an awful lot like a much younger Berkshire Hathaway. But what Fairfax does/how they execute will likely not look anything like what Berkshire Hathaway did back in the 1980’s. And that is because history does not repeat exactly. But it sometimes rhymes. And I think this might be one of those times. Today, Berkshire Hathaway is like an aging elephant. And Fairfax is like a lion in its prime. And the drought (zero interest rates) has ended - and the savannah is once again teeming with game.

-

For Berkshire (and Fairfax) i think the cash drag was more a problem when short term interest rates were effectively zero. Now that short term rates are much higher (3 month treasury is 5.4%) holding cash is no longer a drag on returns.

-

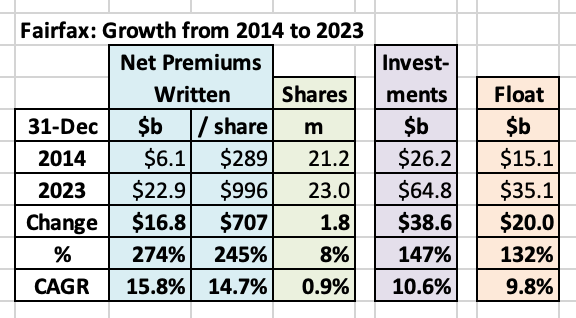

Fairfax of 10 years ago looks little like the Fairfax of today. So many ‘Fairfax pundits’ from 10 years ago do not recognize this change. There have been two game changers that have played out/accelerated over the past 4 years: 1.) capital allocation: the senior team at Fairfax has hit the ball out of the park the past 4 years. It is surfaced billions in shareholder value. 2.) the size of the increase in operating cash flow - and the fact it is largely locked and loaded for the next 4 years. As a result, Fairfax is now entering uncharted territory as a company (for it). We are all still learning what baseline earnings are. The financial positioning/quality of the company has improved markedly. The bond ratings agencies (AM Best - insurance specialists) are ahead of the equity analysts in this regard - which is surprising (to me at least). The people who are likely at the biggest disadvantage when it comes to Fairfax today are those who believed in the company and then bailed in 2018 to 2020 (stop the pain). And the detractors / haters. These investors/groups have the most to unlearn. ————— Fairfax’s business and its future prospects have undergone a paradigm shift the past 4 years. One that many smart people don’t fully grasp today. “The disadvantage of a mind-set is that it can color and control our perception to the extent that an experienced specialist may be among the last to see what is really happening when events take a new and un-expected turn. When faced with a major paradigm shift, analysts who know the most about a subject have the most to unlearn. This seems to have happened before the reunification of Germany, for example. Some German specialists had to be prodded by their more generalist supervi- sors to accept the significance of the dramatic changes in progress toward reunification of East and West Germany.” Page 5, Psychology of Intelligence Analysis by Richards J. Heuer, Jr. PDF copy of the book can be downloaded for free: https://www.ialeia.org/docs/Psychology_of_Intelligence_Analysis.pdf

-

@dartmonkey , i think there are 2 keys when comparing Fairfax and Berkshire today: 1.) leverage: Fairfax is much more levered to float. All things being equal, that should contribute to outperformance. 2.) size: Fairfax is much smaller. The opportunities available to it are much larger. AND the impact of good decisions will have a much quicker and larger impact on reported results. For proof, all you have to do is look at capital allocation at Fairfax and Berkshire Hathaway over the last 4 years. There is no comparison. That is not being critical of Berkshire Hathaway - it is an aging elephant.

-

Q1 Earnings Preview. Below are a few of the things i will be watching for when Fairfax reports after markets close on Thursday. Anything missing from my list? 1.) How is Fairfax allocating new capital? What did Fairfax do with $1 billion notes offering that was completed the end of March? Fairfax also received a $175 million dividend payment from Brit later in March. Fairfax has some pretty big cash outlays in Q1: Dividend ($15/share) = $375 million Stock buybacks = $125 million? 125,000 shares @ $1,000/share? Do we see Fairfax buy back another chunk from one of their minority partners in Brit, Allied or Odyssey? 2.) Impact of change in interest rates on reported results? US Treasury rates 2 years + out on the curve moved about 30 basis points higher in the quarter. This will be a headwind to fixed income (resulting in unrealized investment losses) but will be a tailwind to IFRS 17 reporting (resulting in a benefit). How will it all shake out? Not sure - but not concerned. I think Fairfax’s average duration is about as follows: Fixed income = 3 years Insurance liabilities = 4 years More importantly, the significant increase in bond yields since Dec 31, 2023 is giving the fixed income team at Fairfax another juicy opportunity to extend duration at pretty attractive rates. Bond yields 3 years and further out have increased about 70 basis points over the past 4 months. Bond yields are only 15 to 30 basis points from the highs they reached in mid-October 2023. 3.) What is interest and dividend income? Interest and dividend income came in at $536.4 million in Q4. Is it still increasing quarter over quarter? The Q1 number x 4 will provide the best estimate for full year interest and dividend income. Is Fairfax’s investment in Kennedy Wilson’s debt platform continuing to grow? 4.) Insurance What is growth in net premiums written? GIG + organic… What is CR? Is it below 94%? What is level of reserve releases? Trend? Commentary on hard market? 5.) What is share of profit of associates? Eurobank? Chug, chug, chug? Poseidon? Do we see green shoots yet? 6.) Equities What are investment gains from equities? The equities I track suggests mark to market gains of $390 million in Q1. For Associate holdings, what is the excess of market value to carrying value? This is value that is being created by Fairfax that is not being captured in book value. 7.) What is book value per share? The dividend payment in January will dent this by $15/share.

-

@SafetyinNumbers I did not understand Fairfax's approach to using their own equity. You taught me this. Fairfax really tries to take advantage of Mr. Market's mood swings - when the shares are valued high they issue and when the shares are valued low they buy back. Especially pre-2000. This is also something they do with their equity and insurance holdings. I think it stems from having a basic value investing framework in how they do everything. Something to keep in mind moving forward.

-

@Xerxes point taken. One of the things i love about investing is important things can meaningfully change over time. That is why getting anchored to a narrative (as an investor) can be so detrimental. It often takes 5 years or longer to properly evaluate the meaningful capital allocation decisions. Sometimes, what looks like a poor decision in the short term looks brilliant and few years later. I think a big factor is simply being in the game. Being in the game allows you to capitalize on opportunities. Luck also is a factor. Sometimes Mr Market will let you flip a poor decision into a good decision. But the most important factor is execution - at the end of the day the management team has to execute well over time. What cracks me up with so many Fairfax detractors (haters?) is they gave up following the company years ago. So their views on the company are completely stale dated/wrong. So much at Fairfax has changed (insurance and investments) - and they don’t see it… because they refuse to do the work/look at things with an open mind. Of course, that kind of thinking is what has given us all such a home run with Fairfax over the past 4 years. So i am actually very thankful to Fairfax’s many detractors/haters… couldn’t have done it without you!

-

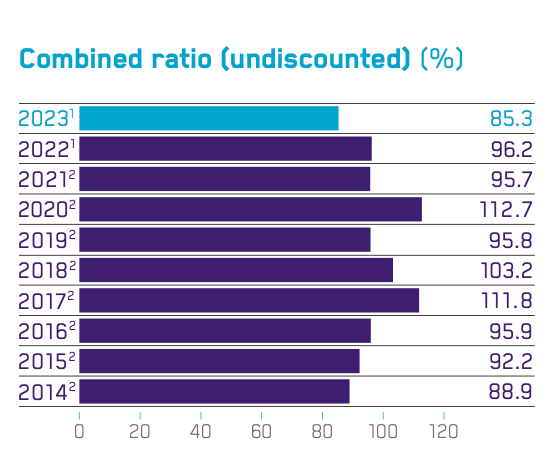

Brit Insurance publishes its own financial reports. These reports provide a wealth of information on the company: Brit 2023AR: https://www.annualreports.com/HostedData/AnnualReports/PDF/LSE_BRE_2023.pdf Brit Web Site: https://www.britinsurance.com Ki Web Site: https://ki-insurance.com ————— For Fairfax’s various insurance operations, the ‘surprise performance award’ for 2023 goes to Brit. Importantly, the surprise this year was a very good one for Fairfax shareholders. In 2023, Brit delivered group profit after tax of $895.4 million. This is a monster number. Insurance operating results (ex discounting) = $405.7 million; CR = 85.3 Investment return = $394 million = 6.2% Gain on sale of Ambridge = $259.1 million Dividends paid During 2023, Brit paid dividends totalling of $413.6m (2022: $18.7m) in accordance with the Brit Limited shareholders’ agreement. Class A shareholders (OMERS) = $40.6m (2022: $18.7m) Class B shareholders (Fairfax) = $373.0m (2022: $nil) Despite this payment, Brit’s “capital position remains strong, with a surplus over management entity capital requirements of $1,050.5m or 54.5% (2022: $709.8m or 39.9%).” Source: Brit’s 2023AR On 21 March 2024, interim dividends of $187.9m were declared, of which: Class A shareholders (OMERS) = $12.9m Class B shareholders (Fairfax) = $175.0m A total of $601.5 million has been paid in dividends by Brit over the past 15 months. Other Notes: “Highly successful third year of trading for Ki, recording insurance premium written of $877.0m (2022: $834.1m), a combined ratio after discounting of 83.2% (2022: 91.1%) and an undiscounted combined ratio of 89.4% (2022: 95.0%).” Source: Brit’s 2023AR Why was Brit the recipient of the ‘surprise performance award’ in 2023? Over the 2 years of 2017 and 2018, Brit had an average combined ratio of 107.5%. Pretty bad. However, the company was executing an improvement plan and in 2019 the CR improved to 95.8%. But Brit was hit especially hard by Covid in 2020 (due to legal rulings in the UK) and the CR jumped to 112.7% in 2020. In 2023, Brit successfully executed a plan to reduce its catastrophe exposure and exit underperforming businesses. The CR in 2023 was a stellar 85.3%. It will be interesting to see how Brit does in 2024. Let’s hope they can continue the strong performance. Context As a reminder, Brit was purchased by Fairfax in 2015 for a total of $1.657 billion. So the fact the company earned $895.4 million in 2023 is significant. Ownership Structure of Brit at December 31, 2023 At December 31, 2023, Fairfax owned 86.2% of Brit and OMERS owned the remaining 13.8%. Below is my understanding of how the partnership agreement with OMERS works. My notes are based on Jen Allen’s comments made on Fairfax’s 2023YE conference call. She was referencing Odyssey and my assumptions is the Brit/OMERS deal is structured in a similar manner: The shares are classified as equity under IFRS. Fairfax has no obligation to redeem those shares. Fairfax has a call option - this gives Fairfax the option to buy back OMERS stake at a specified price within a specific time period. “Fairfax has the option to purchase OMERS’ interest in Brit at certain dates from October 2023.” Source: Brit’s 2023AR OMERS does not have the right to put the shares back to Fairfax, and Fairfax is under no obligation to exercise its call options. After Fairfax’s call options expire, a minority investor may IPO their shares or, failing that, request sale of the operating company with a priority on the proceeds. OMERS receives a dividend payment each year. The current deal with OMERS was struck in 2021. Fairfax was paid $375 million and OMERS received an ownership interest of 13.8% in Brit. In Fairfax’s 2023AR, under ‘non-controlling interests,’ OMERS 13.8% stake in Brit has a carrying value of $881.2 million (2022: $736.4 million). What will it cost Fairfax to take out OMERS and what will the accounting look like? I am not sure how the accounting will work when Fairfax takes OMERS out. When Fairfax bought a chunk of Allied World back in 2022 there was a sizeable write down to equity (see quote below). Perhaps we see something similar here. Do other board members have thoughts? From Fairfax’s 2023AR: “On September 27, 2022 the company increased its ownership interest in Allied World to 82.9% from 70.9% for total consideration of $733.5, inclusive of the fair value of a call option exercised and an accrued dividend paid, and recorded a loss in retained earnings of $163.3 in net changes in capitalization in the consolidated statement of changes in equity.” The value of the call options for Fairfax at Dec 31, 2023: In ‘Other Assets’, the value of ‘call options on non-controlling interests’ = $306.6 million (2022: $167.4 million). This total is for Brit, Allied World and Odyssey. See quote below for more information. From Fairfax’s 2023AR: “Comprised of call options on the non-controlling interests in Allied World, Brit and Odyssey Group, which expire in 2026, 2027 and 2029, respectively. At certain dates subsequent to expiry of a call option, the non-controlling interests may request an initial public offering of their shares, the structure, process and timing of which will be controlled by the company; in certain circumstances, the non-controlling interests may request a sale of the respective operating company to a third party.” ————— From page 1 of Brit’s 2023AR - the page was titled ‘2023 - A Record Result’ ------------ -----------

-

@gamma78 i think Prem was referring to GIG. When Fairfax was the minority partner (44%) it did not manage the float. Today Fairfax is the controlling shareholder (+90%) and now manages the float. For GIG it will be interesting to see how this impacts the yield earned on the portfolio over time. Fairfax has minority partners in Odyssey, Allied and Brit. But Fairfax is the controlling shareholder in all three and manages the float.

-

@wondering there are so many interesting storylines regarding what has happened at Fairfax, especially over the past 4 years. With hindsight, the fact that the shares got so undervalued and stayed so undervalued for years was a massive gift. Fairfax knew shares were wicked cheap and absolutely backed up the truck. This allowed them to buy back the 5 million shares they issued to buy Allied World at almost the same price that they were issued at 5 years earlier. Even though the company was clearly worth much, much more (hence why Fairfax backed up the truck). This doesn’t include the 1.96 million FFH-TRS shares that Fairfax has exposure to. Imagine if Fairfax actually buys these back in 2025 or 2026. I have never viewed this as something they would do (given the amount it would cost). But some pretty smart people that i was talking to at the Fairfax AGM thought this is a real possibility. If Fairfax can buy these 1.96 million shares from the counterparties (Canadian banks) and not have to pay a premium then this might happen. I am not sure the mechanics of a TRS. But by 2025 or 2026 Fairfax will likely be swimming in cash as the insurance subs won’t need it for growth (as the hard market will likely be over). Another opportunity for Fairfax will be to take out their minority P/C insurance partners. Imagine a Fairfax at the end of 2027 where effective shares outstanding are under 20 million and all the minority P/C insurance partners have been taken out. The amount of per share earnings that accrue to common shareholders would get three big boosts: 1.) higher total earnings 2.) much lower share count 3.) elimination of minority interests in P/C insurance This is not my base case. But it is interesting to think about…

-

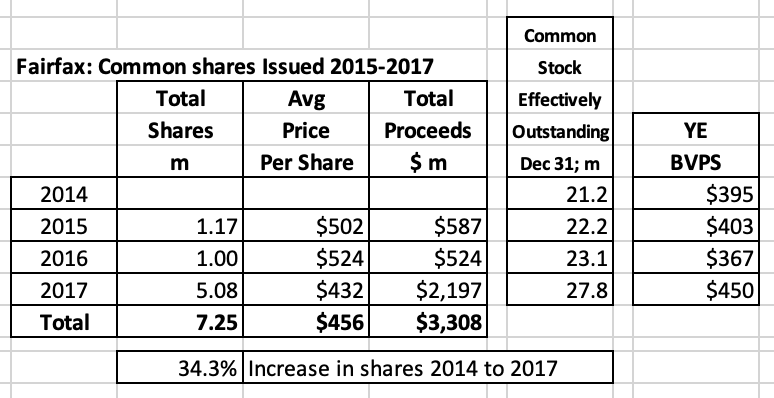

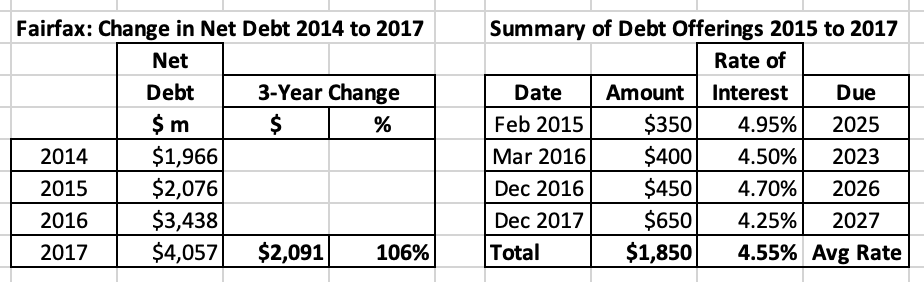

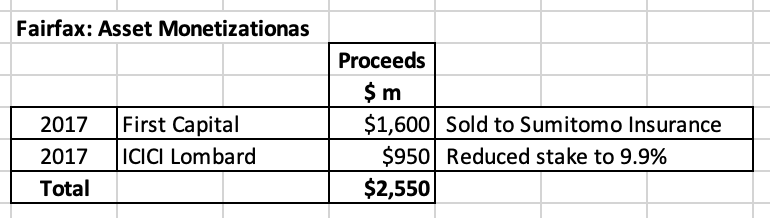

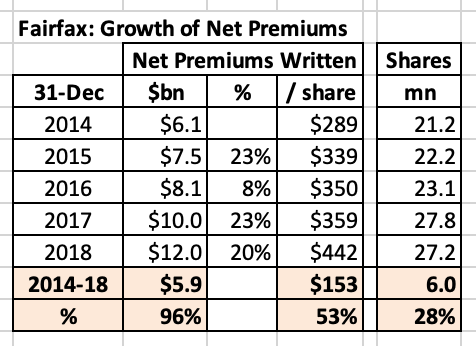

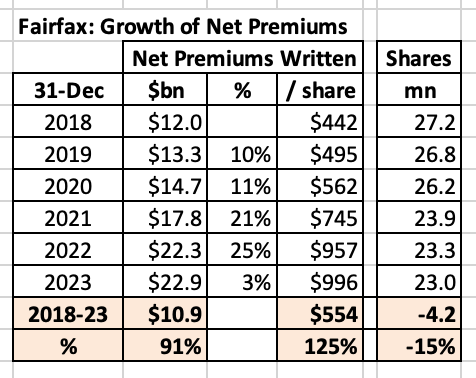

P/C Insurance - Growth by Acquisition - A Review of 2015 to 2017 Capital allocation is the most important responsibility of a management team. Why? Capital allocation decisions are what drive the long-term performance of a company and important metrics like reported earnings, growth in book value and return on equity. In turn, these metrics drive the multiple given to the stock by Mr. Market - and finally the share price and investment returns for shareholders. When done well, capital allocation does two important things: Delivers a solid return. Improves the quality of the company. Therefore, the fundamental task of an investor is to determine if management, over time, is making intelligent decisions regarding capital allocation. How good is Fairfax at Capital allocation? This is where the story gets really interesting. Fairfax has compounded book value per share at a compound annual growth rate of 18.4% over the past 38 years (since 1985). This performance puts the company in the top 1% of all publicly traded equities over this time span. Their long term record when it comes to capital allocation is exceptional. But what about today? There is a narrative today that Fairfax can’t be trusted - the gang at Hamblin Watsa are a bunch of ‘cowboys’ - when it comes to capital allocation. This view is based largely on the disastrous ‘equity hedge’ trade that Fairfax put on from 2010 to 2016. From 2010 to 2016, I probably would have agreed with this view. Also in 2017. And probably even in 2018. But by 2019, it was clear the Fairfax super tanker was slowly starting to get back on track with its capital allocation decisions. In late 2020 the last of the short positions was removed - and Fairfax publicly promised it would no longer hedge/short market indices or individual stocks. Mistakes are going to be made when playing this game. Even Buffett has made his share of big mistakes: 1965: buying Berkshire Hathaway itself. 1987: buying Solomon preferred shares ("What we do have a strong feeling about is the ability and integrity of John Gutfreund, CEO of Salomon Inc. Charlie and I like, admire and trust John." WB 1987) 1993: buying Dexter Shoe Company; compounded by paying for it with Berkshire stock. 1998: buying General Reinsurance; compounded by paying for it with Berkshire stock. So, yes, Fairfax messed up badly with the equity hedges from 2010 to 2016. But they have admitted and learned from their mistake (and long ago exited the position). And the team at Hamblin Watsa is once again executing exceptionally well when it comes to capital allocation. Well, for those who are paying attention. Below are a few of the larger examples of what the team at Fairfax has done when it comes to capital allocation over the past four years: 2020 to 2023: ex-SIB in 2021, effective shares outstanding reduced by 1.8 million at average cost of about $465/share. 2020- 2021: initiated FFH-TRS - giving it exposure to 1.96 million Fairfax shares at a cost basis of $373/share. 2020 & 2021: sale of European runoff insurance operations for $1.3 billion plus $236 million CVR. 2021: reduced average duration of fixed income portfolio to 1.2 years in Q4, which protected balance sheet (saved billions in unrealized losses). 2021: SIB stock buyback - 2 million Fairfax shares at $500/share. 2022: sale of pet insurance for $1.4 billion - resulting in $1 billion gain after tax. 2022: sale of Resolute Forest products for $626 million plus $183 million CVR; sold for a premium at the top of the lumber cycle. 2023: increased average duration of fixed income portfolio to +3 years in Q4 2023 - locked in $2 billion in interest income for the next 4 years. These transactions all delivered significant value to shareholders. They also highlight the many levers at the disposal of the management team at Fairfax. Fairfax has many more levers to pull to drive shareholder value than traditional P/C insurance companies. My view is that Fairfax is best-in-class among P/C insurers when it comes to capital allocation. That is what the facts and the fundamentals of the business tell me. I follow facts and fundamentals when I invest. It often takes years to properly evaluate the decisions made by a management team (that 'facts' thing). Capital allocation - Growth by acquisition - 2015 to 2017 “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Warren Buffett From 2015 to 2017, Fairfax executed on a bold plan to significantly grow the size of their international P/C insurance footprint. That is what we are going to review today. What was the cost? What did Fairfax do? How did it work out? How is the company positioned today? Enough time has passed that we can now properly evaluate the decisions and performance of the management team at Fairfax. What was the total cost? Over the three year period from 2015 to 2017, Fairfax made a total of 11 different purchases of insurance companies. The total cost was $7.6 billion. The three biggest purchases were Allied World ($4.9 billion), Brit ($1.7 billion) and Eurolife ($361 million). What did Fairfax do? The acquisitions dramatically built out Fairfax’s international P/C insurance footprint. While also strengthening its US and Canadian operations. Lloyds of London/UK - Brit Asia (Sri Lanka, Vietnam, Malaysia, Indonesia) Greece - Eurolife Eastern Europe - AIG Latin America - AIG South Africa - Zurich Allied World - Bermuda India: 2017 was also the year Fairfax made a bold move with the strategic positioning of its P/C insurance business in India. It pivoted from ICICI Lombard to Digit, in what has become a brilliant move. We will not include this move in this post. But this move (and the timing) does fit the ‘built out the international P/C insurance platform’ theme. The timing of the purchases To state the obvious - the timing of an acquisition is very important. In general, the worst time to buy an insurance company is probably at the end of a hard market. Profitability and stock prices are at peak levels. And a big premium will likely need to be paid. There is little margin of safety. The best time to buy an insurance company is in a soft market. Profitability and stock prices are usually at more acceptable levels. The premium is reasonable. There is more of a margin of safety. With hindsight, 2015-2017 was the perfect time to buy P/C insurance companies. At the time, P/C insurance was in a soft market - not great for underwriting profit. And interest rates were low - not great for investment results. As a result, well run P/C insurance companies were available for purchase at reasonable prices. The evolution of a value investor - quality at a fair price “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.” Warren Buffett Fairfax are value investors. It permeates everything they do (both insurance and investments). However, Fairfax is also a 38 year old company - it has evolved and changed in important ways. In the past, Fairfax’s style could be best described as ‘deep value.’ Today, Fairfax’s style could perhaps be best described as ‘quality at a fair price.’ This is becoming more apparent with how Fairfax has been managing their equity investments over the past 6 years. Of interest, ‘quality at a fair price’ has been in place on the insurance side of Fairfax since the Zenith acquisition back in 2010. Importantly, from 2015-2017, Fairfax paid up a little to buy decent to good insurance companies. Allied World, the largest purchase by far at 64% of the total, was a well run insurance company. Fairfax’s shift to ‘quality at a fair price’ is not yet well understood by investors. This shift will have an important impact not only on Fairfax’s future earnings (more predictable) but also on their volatility (lower). The size of the purchases “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” Warren Buffett Let’s put $7.6 billion into perspective. At the end of 2014, common shareholders’ equity at Fairfax was $8.36 billion. Net premiums written were $6.1 billion. At the time, spending $7.6 billion on 11 different P/C insurance acquisitions was an extremely aggressive move by Fairfax. They were acting with conviction. How did Fairfax come up with the money? But remember, this was also the time when Fairfax’s investment portfolio was underperforming (booking significant losses from equity hedges/short positions). So, Fairfax did not have a lot of spare cash just lying around. How do you go on an acquisition spree when you are short on cash? This highlights one of the greatest and under appreciated strengths of the management team at Fairfax. They are very creative/resourceful in finding solutions to challenges. Fairfax came up with the cash for its insurance acquisitions in four basic ways: 1.) Equity: From 2015-2017, Fairfax raised $3.3 billion from issuing common shares. The total share count increased 34.3%. The average issue price was about $456/share. Shares were issued (on average) at a small premium to book value. 2.) Debt: From 2015-2017, net debt at Fairfax increased by $2.1 billion. From 2015 to 2017, Fairfax did 4 separate debt offerings, raising a total of $1.85 billion at an average rate of interest of 4.55% with an average maturity of about 9 years. Looking back, due to the very low rates, this was an ideal time to use debt. 3.) Asset monetizations: Fairfax sold First Capital at a premium valuation and realized a gain of $900 million after tax. As part of its strategic shift in India, Fairfax also sold down its position in ICICI Lombard which resulted in a gain of $950 million after tax (including gain on 9.9% stake still owned). Fairfax bought low and at the same time sold high. The First Capital transaction deserves a special shout-out. Most people didn’t even know Fairfax owned this business, let alone that it could be sold for such a large sum. And as we mentioned earlier, the pivot in India was a second brilliant move. The next time you run into a Fairfax detractor, ask them if they have ever heard of First Capital. And then ask them what they think of Fairfax’s pivot with their P/C insurance business in India in 2017 (selling ICICI Lombard, booking a $1 billion gain after tax, and seeding Digit, which has since increased in value by $2 billion). Facts matter. 4.) Minority partners: Fairfax brought in minority partners who contributed a significant portion of the up-front purchase price. For the three big acquisitions, partners contributed $2.3 billion (33%) of the $6.9 billion total. The big benefit of using minority partners is it allowed Fairfax, when the time was right, to buy more (control positions) for less (up front money). This strategy can be especially important/beneficial if you are a little short on cash when the opportunity is ripe. A P/C insurer using minority partners, like Fairfax did, was unheard of at the time. It was classic capital allocation by Fairfax - very unorthodox but highly effective. Eight years later, most investors still do not understand or appreciate the significance of this move. But as Fairfax continues to take out its minority partners in the coming years - and earnings available to common shareholders magically pops higher - the brilliance of what Fairfax has accomplished will come into better focus for investors. How much did Fairfax’s P/C insurance business grow from 2014 to 2018? From 2014-2018, P/C insurance was in a soft market. As a result, most P/C insurers experienced tepid growth in their top line numbers. As a result of its many acquisitions, Fairfax was able to double net premiums written (NPW) from $6.1 billion in 2014 to $12 billion in 2018. Due to a 28% increase in the share count, NPW/share increased by 53%. How much did Fairfax’s business grow from 2018 to 2023? P/C insurance began its hard market in late 2019. Hard markets are the best of times for insurance companies. However, they happen very infrequently - the last hard market was 2002-2007. Driven primarily by organic growth, Fairfax was able to almost double NPW from $12 billion in 2018 to $22.9 billion in 2023. Due to a 15% decrease in the share count, NPW/share increased by 125% to $996/share. Summary Net premiums written at Fairfax have increased from $6.1 billion in 2014 to $22.9 billion in 2023, an increase of 274% which is a CAGR of 15.8%. From 2014 to 2018, growth was driven primarily by acquisitions. From 2018-2023, growth was mostly organic. Fairfax has been able to substantially increase the size of its insurance business over the past 9 years. As a result of the significant growth in Fairfax’s insurance business, float has grown to $35 billion and total investments has increased to $65 billion. And with the spike in interest rates, the value of float and investments has also increased significantly. As a result, Fairfax delivered record net income in 2023. And the outlook for earnings in the coming years has never looked better. Fairfax’s insurance and investment businesses have never been better positioned than what they are today. Capital allocation We come full circle. Thanks for hanging in there - this has been a long post. But Fairfax’s story needs to be told. Fairfax continues to be misunderstood and under appreciated both as a company and as an investment. This will only change as more people come to understand the facts. The genesis of the exceptional positioning that Fairfax finds itself in today was its aggressive acquisition phase from 2015-2017 where it significantly expanded its global insurance platform. Perfectly timed - right before the onset of the hard market. Perfectly sized. Buy quality at a fair price. Creative with the execution - inclusion of minority partners. Did Fairfax’s aggressive P/C insurance expansion from 2015-2017: Deliver a solid return? Yes. Improves the quality of the company? Yes. Fairfax gets an ‘A’ grade when it comes to capital allocation for what it has accomplished with this set of decisions. Fairfax’s capital allocation record in recent years has been exceptional - this is just another in a long list of examples. Record earnings + best-in-class capital allocation team = great set-up for Fairfax shareholders. One more thing… And this good news story is not over yet. That is because Fairfax has set the table perfectly for its next big move: the takeout of its minority partners in its P/C insurance businesses (Brit, Allied World and Odyssey) over the next couple of years. Low risk. Nicely accretive to earnings. That will be the subject of a future post.

-

Looks like a very smart use of Hellenic Bank’s significant excess capital. Should be lots of synergies and cross selling opportunities. Valuation: “Hellenic Bank would acquire 100% of CNP Cyprus Insurance Holdings for a total consideration of €182m (corresponding to 1.0x CNP CIH book value).” https://www.cnp.fr/en/the-cnp-assurances-group/newsroom/press-releases/2024/cnp-assurances-has-entered-into-exclusive-negotiations-for-the-sale-of-its-subsidiary-cnp-cyprus-insurance-holdings-to-hellenic-bank-public-company

-

@nwoodman What Sokol said at Fairfax's AGM was, IMHO, one of the most important pieces of new information to come out of the entire event. Poseidon is Fairfax's third largest equity holding (with a value of +$2 billion), after Eurobank and FFH-TRS. Poseidon's performance in 2023 was disappointing (share of profit of associates of $150 million), compared to the guidance Atlas provided in their investor day back in March of 2022. However, it appears performance should improve markedly in 2024 and the coming years. "So the ships we're delivering this year, if you wanted to duplicate them, a, it would take you 2 years, but also you'd pay a 30% premium. So we have a build-in margin that is purely good fortune from our perspective, but nonetheless, you take it when it comes along. So that's where we are. Now that's going to show some pretty dramatic improvement in economics this year. We'll probably see revenues up around 25%, EBITDA north of 35% and net income above 20% growth from '23 through '24, but that's just a function of these ships coming on." David Sokol "...your investment should go up about 50% this year just based on the increased cash flow of the business" David Sokol This is big news. And something to monitor moving forward as Fairfax reports quarterly results. ---------- Below is the guidance Atlas provided in March of 2022.

-

Interesting take on gold at the 12:26 mark of the interview. Nick says gold is moving higher primarily because the US government has weaponized the US$. He says that sanctions on Russia have taught other countries (like China) that it would be foolish for them to have all their US$ on a ledger in the US or Europe. There are very few assets that can be priced in US$ and stored anywhere (like in your own country). Once the gold is in their country it is safe from sanctions. He said pre-2020, central banks used to buy about 10% of gold. This has doubled - to about 20% today. This is causing higher prices. Nick said central banks slowed down purchases in recent months but the market is now front running the fact that central banks will keep buying gold (at some point). He said central banks have to keep buying (they don’t have a choice) so they will come back at some point. He does not think the recent move in gold is due to concerns about inflation.

-

@SafetyinNumbers , the short answer is i am not sure. On their calls, WRB typically tries and stay very top line. They are going to make a lot of money over the next 2 years. The analysts want to get into the weeds. So it appears the analysts found some things in the weeds that they don’t like. WRB might have done some reserve strengthening from 2019 and prior years? It appears the total insurance market is softening… yet WRB guided to 10 to 15% growth for 2024 (‘trust us’)? The average duration of the fixed income portfolio is only at 2.5 years?

-

@dartmonkey here is what was said near the end of the Q1 conference call. I think Rob’s comments at the end of the conversation were meant to be in jest… Brian Meredith Yes, thanks. Hi, good morning. Two questions. Rich, I'm just curious, could you just give us the actual income that you generated from the Argentina inflation bonds in the quarter? Just so I don't have to do the math. Rich Baio Rob, I'm not sure we've then generally given that level of detail. I'm not sure if... Brian Meredith I can back into it with what you said in the yield, but I just wanted to know what the actual number was. Rich Baio Why don't we take it offline? Rob Berkley Yes, Brian, he's just going to check with an attorney and call you back. How about that? Brian Meredith Okay, fair.

-

WR Berkely reported Q1 results this morning. Results looked good to me. But clearly Mr Market wasn’t happy - the stock is currently down 6%. 2024 is shaping up to be a decent year for the overall insurance market. My guess is we are approaching the tail end of the hard market in the overall P/C insurance market. As a result, i think we see lots of volatility with insurance stocks as they report results. We are also approaching hurricane season, which tends to be a volatile period for P/C insurance stocks. Chubb reports results tomorrow (Wed). Here are some notes from WRB’s conference call: - “the business is firing on all cylinders”; both investments and insurance - “enthusiastic about 2024 and the groundwork laid for 2025” - “better than average chance we can grow top line 10-15% in 2024” ; lots of variability by business line. - top line growth in net premiums written was 10.7% - increase in rate was 7.8%, above loss cost trend in aggregate. - 80% renewal ratio - “record investment income and Q1 underwriting profit” - fixed income book yield = 4.2% (excluding Argentina transaction) and new money rate is currently 5.25% to 5.5%. - “earnings power of business has considerable upside from here” - fixed income duration extended from 2.4 to 2.5 years. - “average life of reserves is just under 4 years” - adverse development from soft market from 2019 and prior years should largely be in rear view mirror. - share buybacks: do not buy back stock blindly; only when they feel it offers good value. They did not buy back any stock in Q1.

-

Canfor (CFP.TO) at C$14.35. Time to scratch my (monthly?) lumber itch. Market cap is $1.7 billion. Net debt is a positive $300 million (net cash position). So enterprise value is about $1.4 billion. They also have +$900 million of duties on deposit. This is worth something. The stock is selling off aggressively because interest/mortgage rates have moved higher.

-

@MMM20 It is interesting how everyone views Fairfax’s equity portfolio. Mostly, people seem to view it through the prism of their own investing framework. The reason i like their current equity portfolio so much is more because of a relative perspective: 7 years ago it was stuffed full of underperforming holdings; or holdings with a poor outlook. That is no longer the case (or much less the case). As a result, i expect it to perform much better compared to the portfolio that existed 7 years ago.

-

@Dinar If Fairfax has performed so poorly on the investment side, how did they compound book value at 18.4% over 38 years? Insurance/underwriting?

-

@MungerWunger given my visibility on this board and Twitter when it comes to Fairfax, i am hesitant to post on position size. For a whole bunch of reasons. But let me try and answer in a different way. My goal is to get my Fairfax weighting down to 33% of my total portfolio - it is higher than that today. Context is important when discussing weightings. Today, i own no real estate. I do not have a day job. All i have are financial assets. So having even 33% in one stock is probably a dumb idea. Most of my financial assets are held in tax free accounts - so i can move in and out of positions easily with no tax consequences. I also sometimes flex my stock positions up and down to take advantage of volatility. As an example, i doubled my small Canfor position today when the stock fell to C$14.55. I was adding to my Telus and BCE positions 2 weeks ago when they sold off. When these stocks move higher i will likely sell some and reduce my position size. So my position weightings will bounce around depending on volatility. Why 33% for Fairfax? That feels like a reasonable position size given its prospects today (which i like a lot). But i remain open minded. Importantly, I might change my mind tomorrow. If Fairfax starts to allocate capital in a way that i do not like i might shrink my allocation. Or when i get to 33% i might decide that my weighting is still too high (i use my gut to help me with position size - so i won’t know until i get there). Or i might decide my weighting is too low. Perhaps something else happens (my health? … knock on wood) that causes me to want to reduce my position size. Perhaps another investment i understand really well gets even cheaper than Fairfax and i decide to shift some funds. One more example: In Q1 2020 when Covid was coming (and before equity markets crashed), i moved 100% of my portfolio to cash. Bottom line: lots of variables are at play that determine position size for me - for all my holdings. The important thing is people need to do find an investment strategy that fits their personal situation and how they are wired. Position size of any one holding is part of this. And concentration is usually a terrible idea for most investors. ————— Broad based index funds are now 30% of my portfolio (XIC, VO and VOO - 1/3 in each). I am really enjoying this 2H 2023 decision. My goal is to get my index fund weightings to over 50% over the next year or two. I want to get a big chunk of my portfolio into ‘set and forget’ mode. As i get older i am shifting from ‘build wealth’ to ‘preserve wealth’. Index funds today seem like a good option. Getting started with index funds also seems to make sense from an estate planning perspective (my spouse is not a financial person). And i have suggested to my kids that they invest exclusively through index funds (when i am not around to help them out).

-

@petec perhaps were you and i differ: i agree with you that rising interest rates was a big opportunity for Fairfax. But opportunity means nothing without proper execution. And the execution at Fairfax has been excellent. And as a result we now have $2 billion a year of interest income. I think it is incredibly difficult to do what Fairfax did with their fixed income portfolio over the past 3 years. 1.) they took the average duration down to 1.2 years in Q4 2021. Sold a bunch of corporate bonds at a yield of 1%. 2.) they were then super disciplined as interest rates started to rise - they waited all through 2022. It wasn’t until Q1 2023 that they started to meaningfully extended the average duration (to 2.5 years). And having the discipline to wait until Q4 to get really aggressive extending duration (to 3 years) was, in hindsight, sheer brilliance. I remember when everyone thought the 10 year US Treasury yield would peak at 3%. The fact the fixed income team did not meaningfully extend duration earlier and at much lower yields is amazing.