Viking

Member-

Posts

4,920 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Does being full-time investors help you getting better return?

Viking replied to alertmeipp's topic in General Discussion

@Redskin212 , your post beautifully highlights one of the key realities of personal finance (of which investing is but one part) - it is constantly changing. This requires life-long learning. I am in the same boat as you… i am entering a different life stage. At the same time, my personal financial situation has also materially changed in recent years - for the better. As a result, my situation is now more complex. That is not a bad thing - it is what it is. But there are many new things that i now need to learn. It doesn’t stress me out. My approach is to start learning - a little better every day. I find keeping things (relatively) simple is important (for me). I am starting with the big rocks - the most important things. I am trying things and then keep learning/modifying. I can see how lots of people get overwhelmed. -

Does being full-time investors help you getting better return?

Viking replied to alertmeipp's topic in General Discussion

@Junior R 2020 was actually a disappointing year for me. I think i finished the year up about 15%. Yes i nailed Covid coming (going to 100% cash). I also deployed my cash well… into the perfect long term portfolio (mostly large cap US tech). And then i sold it all after I got a quick high single digit return - thinking i would be able to buy it all back on the next big pullback. Which of course never happened. But i got bailed out later in the year when Sanjeev (and a few others) kept posting about how cheap Fairfax was. For some reason, Fairfax never participated in the big run up in stocks that happened over the summer of 2020. So i jumped back into Fairfax in October. And when the vaccine news came out (early November) i backed up the truck. I was also tracking Fairfax’s stock portfolio back then and i could see a massive gain was building - it just hadn’t been reported yet. So my mistake (not holding my ‘perfect’ portfolio) actually sewed the seeds of my big Fairfax purchase. Had i held on to my ‘perfect’ portfolio i am not sure i would have invested in Fairfax at all at the time. And with hindsight, my oversized Fairfax position kicked my ‘perfect’ portfolio in the teeth return wise since 2020. So it actually worked out pretty well in the end. The key is to not give up - to keep at it. -

Does being full-time investors help you getting better return?

Viking replied to alertmeipp's topic in General Discussion

@Junior R , my memory is not as good as it used to be. What i remember about the late 1990’s period is .com stocks ruled. Anything considered ‘old economy,’ irrespective of fundamentals, was considered to be garbage. So they traded a crazy low valuations (supply and demand at work). Lots of these stocks had great dividends. I owned a big position in Canadian bank stocks - great prospects and large dividends. I think that was the last time I owned a sizeable position in Berkshire Hathaway. And this was the last time i actually owned bonds in any of my portfolios. In terms of which bear market was my ‘best one’ i am not sure. I really hate to lose money. So the fact i was able to side-step each bear market was really the most important thing to me - that ‘don’t lose what you got’ thing. The most important thing is… be as rational as possible. And think for yourself - the crowd is always very wrong at inflection points (it has to be by definition). -

Does being full-time investors help you getting better return?

Viking replied to alertmeipp's topic in General Discussion

@Milu my big mistake over the past 20 years when investing has been to be way too cautious as we come out of bear markets. -

Does being full-time investors help you getting better return?

Viking replied to alertmeipp's topic in General Discussion

@Redskin212 and @Milu this might sound a little bizarre, but I simply pull money out of my accounts as I need it. What likely makes this doable is I like carrying a cash balance (for the optionality). There is the odd time where I am fully invested and I have to sell a security - but it has not been a big enough issue over the years that I think I need to change my process. Bottom line is my process works for me. Now I should note that up until couple of years ago, all of my investments were in tax free accounts. This allowed me to buy/sell without having to think about taxes. I only had to think about taxes as I was withdrawing money needed to cover living expenses (pretty simple). Over the past 4 years, my financial situation has changed quite a bit - now a chunk of my net worth is in taxable accounts. As a result, my withdrawal strategy is evolving (which account). In recent years, my strategy was focussed on minmizing taxes paid. This year I shifted to more aggressively pulling money from my tax-free accounts (LIF's and RRSP's) as they are actually getting too big. I am seeding my 3 kids tax-free accounts (FHSA, TFSA) and have decided to pull the funds primarily from my tax-free accounts - the tax bill is large but I don't care. It is crazy how fast the kids accounts are growing. By the time they are 25 years old each kid could have $200,000 stuffed mostly into tax free accounts compounding tax-free for the rest of their lives. So I am happy to pay a little tax today on money I don't need to put my kids in that position. ---------- Importantly, I have avoided the big bear markets of the past 25 years: - 1999 .com bubble: I owned the boring old economy stuff that actually did pretty well. - 2007/08 US housing bust: I owned an oversized position in Fairfax who was sitting on massive CDS gains. - 2020 Covid: I went to 100% cash before the stock market crashed. - 2022: Once again owning an outsized position in Fairfax worked like magic. -

Does being full-time investors help you getting better return?

Viking replied to alertmeipp's topic in General Discussion

I have been ‘investing’ full time since i turned 40 (I am 59 today). Here are some quick thoughts: 1.) I love it (investing). Always have. There isn’t anything else (when it comes to work) that i would rather do. I have always put in the time. 2.) To do it full time you actually have to be good at it - over the long run good. 3.) With hindsight, I had an ace in the hole for the past 20 years - Fairfax. This has been a big, big help. 4.) My investment returns did improve being able to devote 100% of my work time to investing. (My prior corporate job was super busy.) 5.) Until recently, I never approached the pivot from ‘day job’ to 100% investing as a permanent change. Mostly because when i started i didn’t have nearly enough. So i fully expected that i would need to find a new full time ‘real job’ a few years down the road. Except i was able to generate big enough returns that i never had to go back to a regular day job. 6.) My goal at the start of each year has been to make +8% per year. Modest but doable. My long term average annual return has been about 20%. I still have an 8% target at the start of each year. This helps to keep my stress level low. 7.) Spouse matters. Mine has always completely stayed out of my hair. Managing investments has always been a blue job in our house. Not pink. And definitely not purple. 8.) The biggest benefit of pulling the plug on my day job at 40 was the opportunity to spend more quality time with my family. At the time, my kids were 5, 3 and 2 years old. The last 20 years has been an absolute dream - from a family perspective. The five of us went out for Dim Sum today… still special. Best of luck with whatever you decide. -

+1

-

Thanks to everyone for wading in. Below is my current attempt to value Fairfax's ownership in Go Digit General Insurance. It doesn't seem to square with how Fairfax values its stake in 'Digit' so I view my summary as a work in progress (it likely contains errors). Part of the challenge is Digit can mean many different things - Go Digit General Insurance, Go Digit Infoworks. And then we have the CCPS. And other businesses like life insurance part of 'Digit'. Bottom line, as I learn more (from Fairfax and others on this board) I will keep updating my model (like everything else I do related to Fairfax). So please take my summary below with the usual 'grain of salt.' And please continue to point out errors (with corrections, if you have them).

-

@nwoodman does your summary include the value of the compulsory convertible preferred shares in Digit that Fairfax owns? These increased in value in Q2 (from year end). From Fairfax’s Q2 earnings release: “On May 23, 2024 Digit Insurance, the general insurance subsidiary of the company's investment in associate Digit, completed an initial public offering comprised of an issuance of new equity and an offer for sale of existing equity shares held by Digit and other shareholders, which valued Digit Insurance at approximately $3 billion (249.5 billion Indian rupees or 272 Indian rupees per common share). As a result of the initial public offering and the increase in the fair value of the company's investment in Digit compulsory convertible preferred shares at June 30, 2024, the company recorded a total pre-tax benefit of $149.9 related to its investment in Digit.” “The pre-tax gain to common shareholders' equity was comprised of: (i) a gain of $106.3 recorded in net changes in capitalization in the consolidated statement of changes in equity on the company's 49.0% equity interest in Digit (related to Digit's equity interest in Digit Insurance decreasing from 83.3% to 73.6%, resulting in the recognition of a dilution gain for the excess of fair value over the carrying value of Digit Insurance on the offer for sale and a dilution gain on new equity issuance), and (ii) a net gain on investments in the consolidated statement of earnings of $43.6 on the company's holdings of Digit compulsory convertible preferred shares. Digit Insurance's common shares are now traded on the BSE and NSE in India and closed at 338 Indian rupees per common share on June 30, 2024.”

-

Go Digit General Insurance completed their IPO on May 23, 2024 at a price of INR 272/share. This valued the company at about US$3 billion. At June 30, Digit's share price closed at INR 338. This valued Digit at $3.7 billion. As of today, Digit's share price closed at IRR 373.90. This values Digit at $4.1 billion. So over the past 3 months Go Digit General Insurance has increased in market value by about $1.1 billion. Not too shabby. Now what exactly does this mean for Fairfax? Fairfax owns a significant amount of Digit. So the market value of Fairfax's position is up, and by a lot. How much exactly? Not being an accountant, I am not sure. Is it possible to estimate Fairfax's ownership position in Go Digit General Insurance? Is 65% too high? Or too low? Or is this the wrong way to look at Fairfax's current ownership position (too simplistic)? Perhaps others can wade in and provide an estimate/some clarity. How much of the value creation that has happened at Digit over the past 3 months has been captured captured in Fairfax's current book value? Again, I am not sure. But my guess is there is likely a sizeable gap building up (between market value and carrying value). I do find Fairfax's ownership structure with Digit to be confusing. And as @glider3834 has pointed out in the past, Digit also has a early-stage life insurance business that is worth something. Bottom line, I like that Digit General Insurance is now a publicly traded entity. This will allow us to use a market price to value the business. I also look forward to when Fairfax's ownership position has been simplified/clarified.

-

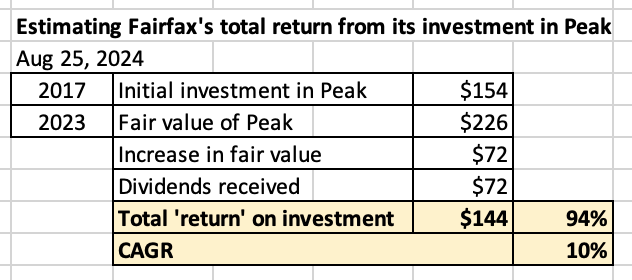

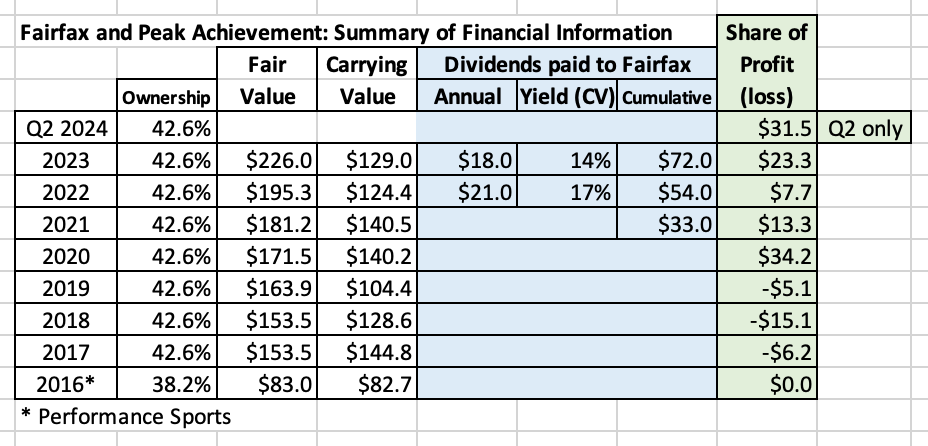

Peak Achievement (Bauer, Easton/Rawlings & Maverick) In February of 2017, Fairfax partnered with Paul Desmarais III and his team at Sagard Capital to purchase Performance Sports out of bankruptcy. The new company was re-named Peak Achievements. Fairfax paid $154 million for a 42.6% equity and 50% voting interest in Peak. At the time of purchase, Performance Sports housed three of the top sports brands in North America: Bauer - the leading brand in hockey Easton - the #3 brand in baseball Maverik - a leading brand in lacrosse In 2020, Peak partnered with Rawlings’ controlling shareholder, Seidler Equity Partners, and merged Easton with Rawlings. Peak received a payment of $65 million and a 28% interest in Rawlings. In Q2-2024, Peak sold its 28% stake in Rawlings. The sale amount was not disclosed; share of profit of associates for Peak in Q2-2024 was a significant $31.5 million. It should be note that Covid in 2020 and 2021 hit sports manufacturers especially hard. Is Peak up for sale? There are fresh reports that Bauer is now up for sale (or do they mean Peak?). From the article in the Globe & Mail: “Sagard and Fairfax acquired Bauer out of bankruptcy in 2017 for US$575-million and are targeting a US$800-million exit, according to one of the sources. Bauer’s EBITDA is just more than US$100-million annually, the source said. “In early August, Bauer’s advisers received expressions of interest from 11 potential buyers and moved to the next stage of the sale process with eight players, including several U.S. private equity funds, according to the source, and several bidders for Bauer also looked at CCM. “Bauer set a Sept. 16 deadline to move forward with a maximum of four bidders, and plans to be in the final round of negotiations with one buyer by the end of October, the source said.” https://www.theglobeandmail.com/business/article-ccm-bauer-true-hockey-sale/#:~:text=Sagard%20and%20Fairfax%20acquired%20Bauer,to%20one%20of%20the%20sources. Financial overview In February of 2017, Fairfax paid $154 million for a 42.6% stake in Peak. Over the subsequent 6.80 years (to December 31, 2023), Fairfax has received total dividend payments from Peak of $72 million. Given the sale of Rawlings in Q2, we could see an outsized dividend payment to Fairfax in 2024. Assuming the fair value estimate for Peak is accurate, Fairfax has earned a total return of about 94% on its investment over the past 6.8 years (to Dec 31, 2023) = CAGR of 10%. Summary Despite Covid related challenges in 2020/2021 (bad luck), over the past 6.8 years, Peak has developed into a solid business/investment for Fairfax. If the company is sold in the coming months at a premium to ‘fair value’ it would likely become a very good investment for Fairfax. Summary of financial information provided by Fairfax ————— Notes from Fairfax annual and quarterly reports: 2024 Q2 Report Consolidated share of profit of associates of $221.4 in the second quarter of 2024 principally reflected share of profit of $126.1 from Eurobank, $66.5 from Poseidon and $31.5 from Peak Achievement (principally reflecting its sale of Rawlings Sporting Goods), partially offset by share of loss of $39.0 from Sanmar Chemicals Group. 2023AR Fairfax continues to jointly own Peak Achievement with our partner, Sagard Holdings. Peak’s core brands are Bauer, the leading hockey brand, and Maverik, a leading lacrosse brand. Peak also owns a minority investment in Rawlings, which is the number one brand in baseball. Fairfax paid $154 million for its stake in Peak in 2017. Since that time, EBITDA has increased steadily in the hockey and lacrosse businesses, and Fairfax has received $72 million in dividends. Hockey participation growth continues post-pandemic and exciting developments such as Bauer’s partnership with the new Professional Women’s Hockey League are expected to drive incremental girls’ participation. More to come under CEO Ed Kinnaly’s leadership, with opportunities in direct-to-consumer, apparel and training. We carry Peak on our balance sheet at less than 5x free cash flow. 2020AR Fairfax continues to jointly own Peak Achievement with our partner, Sagard Holdings led by Paul Desmarais III. Peak’s core assets are Bauer, the leading hockey brand, and Easton, the number three manufacturing player in baseball. During 2020 Peak merged Easton with Rawlings, the clear number one manufacturer in baseball. The transaction resulted in $65 million cash paid to Peak, while retaining a 28% stake in Rawlings. Peak is now partnered with Rawlings’ controlling shareholder, Seidler Equity Partners. Fairfax recognized a $15 million gain on the sale of Easton which closed just before year end. 2017AR On March 1, 2017 the restructuring of Performance Sports Group Ltd. (‘‘PSG’’) was substantially completed after all of the assets and certain related operating liabilities of PSG were sold to an intermediate holding company (‘‘Performance Sports’’) co-owned by Fairfax and Sagard Holdings Inc. The company’s $153.5 equity investment in Performance Sports represents a voting interest of 50.0% and an equity interest of 42.6%. On April 3, 2017 Performance Sports was renamed Peak Achievement Athletics Inc. (‘‘Peak Achievement’’). 2016AR Also, early in 2017 we partnered with Paul Desmarais III and his excellent team at Sagard Capital to purchase Performance Sports. Performance Sports is the owner of the leading names in hockey, baseball and lacrosse equipment: Bauer, Easton and Cascade. ————— Performance Sports Group completes sale of substantially all of its assets to investor group led by Sagard and Fairfax Financial (article from Feb 27, 2017) https://www.torys.com/en/work/2016/10/52382aeb-7e85-42dd-903c-309be9bb261a

-

@Munger_Disciple The key to your analysis are three numbers: 1.) $600 billion loss event 2.) 2% chance of happening 3.) $ impact on any single insurance company As I said earlier, I have no idea how accurate each of these numbers are for a company like Fairfax. It would simply be a wild guess. Buffett may say he thinks there is a 2% chance of a $600B loss event... Lots of what Buffett says is marketing - so I am not sure I would take even what he says on this topic for gospel. Anyways, it is a really interesting topic. But I will sign off for now

-

@Munger_Disciple , here is another way to look at tail risk... I live in Vancouver. There is a very good chance that we will get hit with an earthquake at some point in the future - we just don't know when and how big. So knowing this, is it rational for a person to live in Vancouver? Perhaps a better example is hurricane risk in Florida - or in many parts of the US. Lots of really bad hurricanes are coming in the next 50 years. we just don't know exactly where they are going to hit and when. Is the rational solution to move to a different part of the US? Again, the problem I have is I just don't know how to create something actionable from what I think I 'know.' If there is a 1% or even a 2% risk (timing of which is unknown), does that mean the investment should be avoided? Perhaps the answer is that ultimately there are no risk free investments (including Berkshire Hathaway). And perhaps this opens up the element of luck and its influence on investment returns. This is a really interesting topic.

-

@Munger_Disciple , the challenge I have with 'tail risks' like the one scenario you mention above is I have no idea how to model them into my valuation for the company. What you are discussing is not specific to Fairfax - it is a risk to the entire P/C re/insurance industry. TODAY, NO P/C INSURANCE STOCKS HAVE YOUR SCENARIO FACTORED INTO THEIR STOCK PRICE. One of the biggest reasons I like Fairfax so much today is relative valuation - it trades at a much cheaper valuation than all peers. Despite having: 1.) the best 5 year track record (growth in BVPS) 2.) the best management team (in terms of capital allocation) 3.) the best near-term earnings outlook Given the exceptional near-term outlook for the company I am willing to overlook the risk of $600B loss event. It really is an interesting thought exercise - not specific to Fairfax, but all P/C insurance stocks. Does it really mean they are all uninvestable for a rational investor? If so, why is Buffett loading up on Chubb? They would get killed if we had a $600B loss event. Is Buffett not thinking clearly?

-

Lots of interesting posts in this thread. My largest equity buy the past 3 months was; 1.) increased my Fairfax position by 20% at average cost of C$1,485 on Aug 2. Fairfax delivered better than expected results and the stock sold off about 8% over 2 or 3 days. 2.) increased my Fairfax position by another 20% at an average cost of about C$1,445 on Aug 7. When including the gain from the recently announced sale of Stelco and the excess of FV over CV of the equity holdings, Fairfax was trading at close to 1 x BV - crazy cheap. With the spike in Fairfax's share price over the past 2.5 weeks I have sold 75% of the shares I added. The average gain was about 7% - that is what I am targeting with these types of trades so I often sell early. I did something similar when Fairfax sold off aggressively in early Feb (when Muddy Waters published the 'report' of a UFO sighting). I find 'flexing' my position size (up and then back down) in my best ideas can be a good way to get a little extra return out of my best ideas. This strategy works best when a stock is very volatile - and it looks like volatility in Fairfax is picking up a little. This strategy worked very well for me with Fairfax when it traded on the NYSE from 2003 to 2009 (Fairfax delisted from NYSE in 2009). I only 'flex' in my tax free accounts (RRSP, LIF, RESP etc). I will do it very selectively in my TFSA account. So my 7% short term gain in Fairfax has no tax consequences. I keep about 25 to 30% of my portfolio for tactical opportunities like this. My goal with this portion of my portfolio is to simply earn a modest 8 to 10% over a year - no pressure. When not invested it sits is cash and earns 3.5% to 4%. I love having cash on hand when Mr. Market gets irrational, like it did a couple of weeks ago. My experience (over 20 years of investing) is a couple of wonderful opportunities that fall in my circle of competence will present themselves each and every year - I just don't know in advance what they will be. But that's ok with me.

-

I am in the process of getting back up to speed on Poseidon. With profitability at the company spiking (as the new-builds come on line) and interest rates come back down my guess is this investment is poised to outperform (perhaps significantly) in the coming years. This is Fairfax's 3rd largest equity holding (after Eurobank and FFH-TRS) so this would be very good news for Fairfax and its shareholders. I have a question for board members: What type of an investment is Poseidon (well really Seaspan)? What other company is it mostly like? It is in the containership industry. But from a functional perspective, with its contracted/stable long term cash flow business model, is Poseidon (the Seaspan part) in practice more a utility-like business? Is Poseidon (the Seaspan part) kind of like Fairfax's equivalent of Berkshire Hathaway's Mid-American energy? Not an exact match of course. My guess it's not a fluke that Sokol, who was the architect of Mid-American Energy when he has at Berkshire Hathaway, chose Seaspan/Atlas as his next act. Are the two businesses more similar than is generally recognized? Anyways, how do other board members view this investment?

-

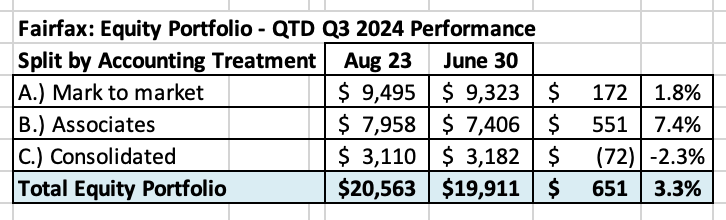

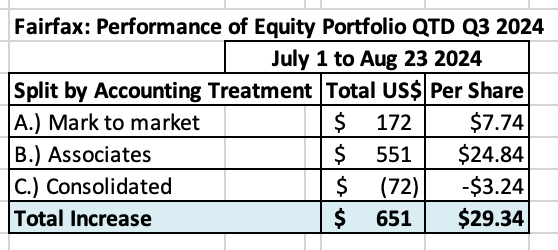

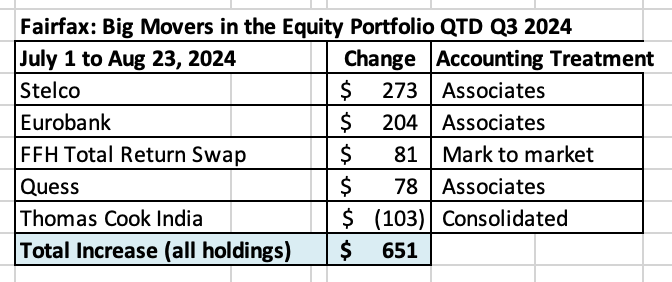

Change in value of Fairfax’s equity portfolio QTD (July 1 – Aug 23) 2024 Fairfax’s equity portfolio (that I track) increased in value QTD in Q3 (to Aug 23) by about $650 million (pre-tax) or 3.3%, which is a solid result. It had a total value of about $20.6 billion at August 23, 2024. After being a headwind in 1H 2024 (US$ strength), currency flipped to being a tailwind in Q3 (US$ weakness). Notes: I include the FFH-TRS position in the mark to market bucket and at its notional value. I also include warrants and debentures that Fairfax holds in the mark to market bucket. My tracker portfolio is not an exact match to Fairfax’s actual holdings. It is useful only as a tool to understand the rough change in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 46% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 54% are Associates and Consolidated holdings. Over the past couple of years, the share of the mark to market holdings has been shrinking. This means Fairfax's quarterly reported results will be less impacted by volatility in equity markets. Split of total gains by accounting treatment The total change is an increase of about $650 million = $29/share The mark to market change is an increase of about $172 million = $8/share. The change in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports each quarter. What were the big movers in the equity portfolio Q1-YTD? Stelco is up $273 million. Fairfax will book an estimated pre-tax gain of $390 million on the sale of its 13 million shares in Stelco. The sale is expected to close in Q4 2024. Eurobank is up $204 million. Currency is a tailwind QTD (strong Euro). The FFH-TRS is up $81 million and is now Fairfax’s second largest holding at $2.2 billion. Quess continues its big move higher, and is up another $78 million. Market value of $447 million now exceeds carrying value of $432 million. Thomas Cook India, down $103 million, gave back some of its recent gains. Market value of $767 million significantly exceeds carrying value of $214 million. Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $2.0 billion pre-tax ($88/share), up about $300 million QTD. The 'excess' of FV to CV has been materially increasing in recent years. This is one good example of how book value at Fairfax is understated. Excess of FV over CV: Associates: $1.3 billion = $59/share Consolidated: $656 million = $30/share Equity Tracker Spreadsheet explained: We have separated holdings by accounting treatment: mark to market, associates – equity accounted, consolidated, other Holdings – total return swaps. We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. This spreadsheet contains errors. It is updated as new and better information becomes available.

-

+1. The P/C insurance model pioneered by Buffett (leverage float) is simple to understand. And difficult to execute well.

-

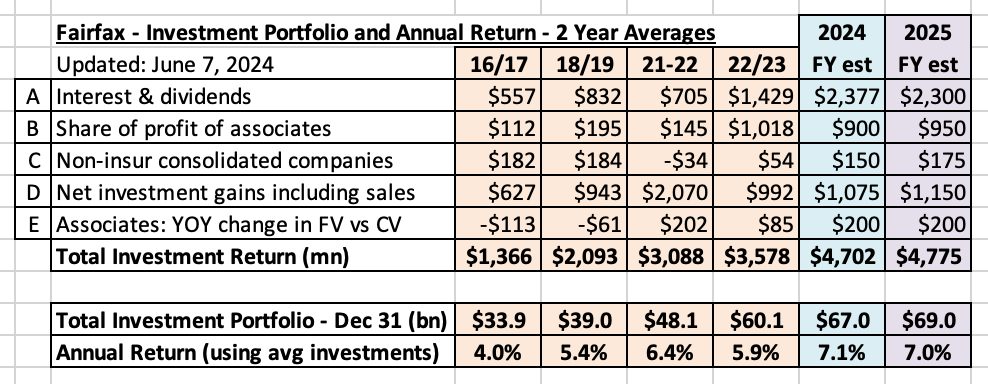

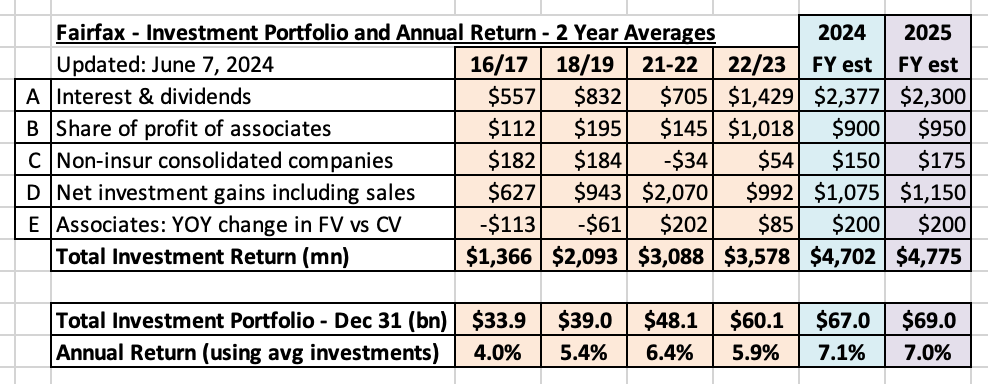

For board members who think 5% is a good 'normalized' return to use for Fairfax for its investment portfolio... let me stir the pot a little. From 2016 to 2022, Fairfax had four severe headwinds battering its investment portfolio: 1.) Zero interest rates 2.) Significant losses from the equity hedge/short positions 3.) An equity portfolio that was stuffed with shitty companies 4.) Historic bear market in bonds in 2022. Despite these 4 significant headwinds, from 2016 to 2022, Fairfax still earned an average return of about 5.4% on its total investment portfolio. Today, none of those headwinds exist. Some have been eliminated (equity hedge/short). And others have reversed and become tailwinds: 1.) Interest rates have normalized to much higher levels. It is highly unlikely they return to the lows of a few short years ago. 2.) Fairfax's equity portfolio has been fixed and is much higher quality (in terms of earnings power). My guess is a 5.4% return on the investment portfolio was a trough (smoothed) number for Fairfax. Today, Fairfax is earning about 7% on its investment portfolio. If we continue to get a few large asset sales in the coming years (likely, given what we have seen the past 10 years) then I think 7% is a reasonable baseline estimate to use looking out the next 3 to 5 years. and yes, the results will be volatile from year to year. Here is the data for each year (from which the averages in the above table were calculated).

-

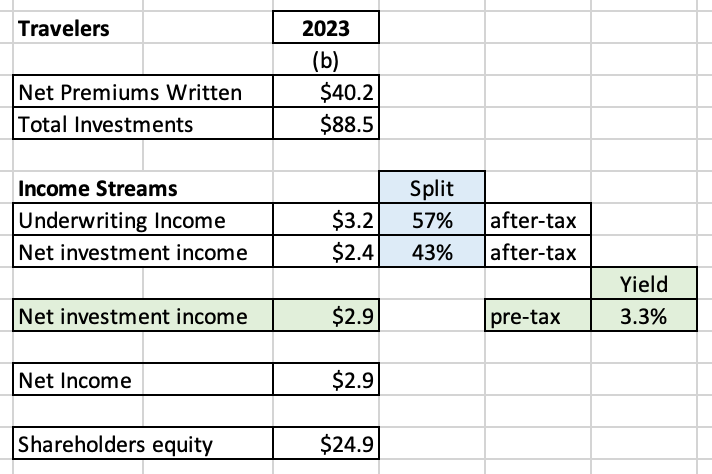

@73 Reds , to better understand some of the variables at play, let's look a Travelers 2023 numbers and compare them to Fairfax. When looking at Travelers 2023 numbers two things jump out: Underwriting income represents 57% of their income streams (like most P/C insurers, they only have 2 income streams). The yield (pre-tax) on their investment portfolio is about 3.3% (using the YE value of investment portfolio). Travelers is earning peanuts on its $88.5 billion investment portfolio - about 3.3%. It is expected to increase a small amount in 2024 ($200 million, which will bump the average yield to about 3.5%). This is because they are investing solely in fixed income. And it looks to me like they match the duration of their fixed income portfolio with their insurance liabilities. Now compare Travelers to Fairfax. Fairfax is earning about 7% on its investment portfolio - double what Travelers is earning (see the chart at the bottom of the post). That is a massive gap. Fairfax is earning much, much more on their investment portfolio for a couple of reasons: 1.) They do not restrict their investments to bonds/fixed income. 2.) They are an active manager - they look to exploit dislocations/volatility (wherever it shows up). 3.) They are very good at what they do. Comparing Fairfax and Travelers you really get some good insight into the power and value of the business model Fairfax that is successfully executing today. Below is a summary of investment returns for Fairfax. The returns have been smoothed over 2 year intervals to smooth out the annual volatility and make it easier to understand.

-

I have completed another update of my book/collection of posts on Fairfax. It contains lots of updates since the last version was published 2 months ago. The big change is the chapter on asset sales - all of my recent posts (over about a month) have been added. All other new posts from the past couple of months have also been added. Go to the first post at the top of this thread to access the updated PDF and Excel documents. I don't re-read the entire document when I post updated versions. If you see any big errors please let me know. The document now almost 500 pages. My goal is not size - but I will continue to add material that I think adds value for those interested in learnings more about Fairfax. Please note, not everything in the book has been brought up to date. That would have required a couple of months of work… and by the time it was done, much of it would be out of date again. My current plan is to keep updated parts of the document as time goes by. It continues to be a working document for me. The bottom line, this document should be a much better resource for board members / investors than what existed before. I hope you find it useful.

-

@Maverick47 when it comes to P/C insurance, I wonder if the overall market is a little more rational today than in the past. I look at all the shitty P/C insurance companies that Fairfax has purchased over the past 38 years - these have ALL been turned around. This does not mean there is not fierce competition. So we will see.

-

@nwoodman, I completely agree. “Ultimately Fairfax will turn out to be an OK or great investment based on their capital allocation, same as Berkshire. This means “don’t lose capital”.” Fairfax is a good underwriter and at a 95CR, underwriting income still only represents about 20% of their various income streams. About 80% comes from investments. So yes, Fairfax is levered much, much more to investments. I think underwriting income is something like 45% of the income streams for most P/C insurers, with investments driving the other 55% (mostly interest income). So Fairfax is also much more levered to the investment side of the business than peers. This also means earnings at Fairfax are impacted much less by the insurance cycle than other P/C insurance peers. My guess is this is not well understood by Mr Market.

-

@nwoodman I thought this would be interesting to dig into a little: “I am in the combined ratios revert to 100 camp.” Now i should say… i am not a P/C insurance guy. So i look forward to feedback from others who know much more than me on this topic. There is a lot of discussion on the board about Fairfax’s CR normalizing to 100 because ‘that is what always happens to P/C insurance.’ When i look at ‘P/C insurance’ I don’t see a homogenous business. Rather, i see a collection of very different businesses: - Personal lines or commercial? - Reinsurer or primary insurer? - Standard or specialty? - Is the business skewed to short tail (property or auto) or long tail (professional liability or workers comp)? And then you have to overlay lots more important factors: - geographies (US, UK, Europe, MENA, India…. Etc). This is a big one (getting bigger for Fairfax.) - reserving history The bottom line, I don’t think there is a ‘P/C insurance market.’ It looks to me like there are many (hundreds?) of P/C insurance markets. Especially for a global company like Fairfax. As a result, I think it highly unlikely that global insurance markets enter a synchronized soft market. instead, maybe we get rolling soft markets? A good example is workers comp in the US. I think it has been in a soft market for the past 5 years. This is significant business for Fairfax that looks poised to start to grow again in the coming years (just not sure when). Intact Financial just warned about outsized catastrophe losses in Canada in Q3. They are the 800lb gorilla here - perhaps this extends the hard market another year here in Canada. Bond yields have come way down in recent months. Central banks are easing - so yields could move even lower in the coming months/year. Many insurers were not able to roll a significant amount of their portfolio into longer dated bonds at peak rates (perhaps they missed the window). Lower bond yields moving forward will likely result in more discipline from most P/C insurers (they will need a solid CR to deliver the ROE expected by Wall Street). WR Berkley keeps getting asked on conference calls if the ‘hard market’ is over. They keep saying the P/C insurance market (in the US) is splintering into ‘markets’, each with its own cycle (some soft, some hard and others in between). Now we could get a really bad year for catastrophes and Fairfax’s CR might temporarily pop over 100 for that year. Perhaps we get two of these in a row - anything is possible. But do we get 4 or 5 years in a row? Never say never, but that seems highly unlikely. Why? Because Fairfax looks too diversified (line of business, geography etc). The diversification is beneficial not just in terms of catastrophe exposure. It is also really beneficial in terms of the insurance market cycle (does India’s auto market run lock step with that of the US)? The other really big factor is reserving. We could see reserve releases in the coming years surprise to the upside (especially if inflation comes down hard and stays low for years) - this might actually drive CR’s even lower for Fairfax (into the low 90’s, like we saw a decade ago). Not my base case. But not crazy talk either. Bottom line, i think we have pretty good line-of-sight as to what a ‘normalized’ CR is for Fairfax in today’s environment. But 4 or 5 years from now? I don’t have a strong opinion. But that is the same for all P/C insurers (not just Fairfax). Now it could be that i am completely out of my league - i have not owned Fairfax through a brutal hard market. So my view might simply be like a Disney movie. So i will continue to closely monitor the situation. What i do care deeply about: Is Fairfax a disciplined underwriter? How disciplined/good are they? I think the insurance cycle in the US will matter for Fairfax’s stock price (and all P/C insurers). If we get word that the hard market in the US has ended and P/C insurers are losing their discipline my guess is ALL P/C insurance companies will get taken out behind the woodshed. Which would probably give Fairfax the opportunity to buy back all the shares they want at very attractive prices. What i love about Fairfax right now is their flexibility/optionality - ability to flip the script - to actually benefit from what looks like a bad thing.

-

@73 Reds sorry, i have not spent any time on what you ask. What i do know is they have been actively reducing their exposure to the catastrophe part of the business in recent years (primarily at Brit i think). I know other board members have posted on this topic in the past so hopefully they will chime in with their thoughts. ————— Here is an exchange during the Q&A from Fairfax’s Annual Meeting this year: Unknown Shareholder …my question is for Mr. Clarke, if he can answer. As a layman investor, I believe that, if a hurricane 5 catastrophic event happens to direct hit to Miami City, that might be a $500 billion event. I wonder if you agree with me. And Fairfax cost will be 1%. That's what I believe as a layman investor. And if this even happens twice in a row in 2 years, how Fairfax can see their balance sheet... V. Watsa So before Peter answers. That's exactly right. We look at stuff like that. And if it happens, how are we going to survive that? So the big [ plus ] on these events is their limits, right? And so we really focus on the worst case events, from mainly Odyssey and Allied, but Peter? Peter does all the modeling and looking at it all the time. Peter? Peter Clarke Sure. Yes, no, as Prem said, we're focused on our catastrophe exposure, of course. And it starts with our insurance operations. The #1 thing is they have to manage their risk appetite within their capital base, but on top of that, we do a lot of work at the Fairfax level aggregating the exposures. And we really look at PMLs. So this is your probable maximum losses. And over the last 3 or 4 years, from our premium growth, we've benefited greatly from the diversification we now have within that 30 billion of premium that we write. And we can really absorb -- we can absorb significant catastrophes and still show an underwriting profit. Like the last couple of years -- this past year, cat losses were marginally down, so we had a fairly good year, but the year before that, we had probably -- I think we had 1.3 billion of losses, and over 1 billion the year before, and still posted underwriting profit. So as our premium base got bigger, we have more margin in the business for catastrophe losses, but our exposure has stayed relatively flat. So we do look at it. Northeast wind is one of our largest exposures. Southeast hurricane wind again is another one, so we're all -- we're on top of that. We look at it all the time and starts with our companies, yes. We have a team at the head office that we look at it. And of course, he's all into the details as well, so... V. Watsa That's the one risk that can destroy our company, so we are all focused on it all the time. You mentioned Miami. Of course, Houston, California earthquake, right, those are all big item, but one that you worry about -- there's a windstorm coming along, what he was saying, northeast wind. It's coming along the coast and hitting New York, rarely happened. It's happened once or maybe twice. Coming along -- it doesn't come into the -- it doesn't come inland, comes along and then comes into New York, which would be the -- we think, the worst one, and -- but we look at all of that all the time. So your question is a good one. That's something you have to do. You have to survive, stuff like that.