Viking

Member-

Posts

4,920 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@nwoodman I was lucky to get a copy of the book at this years AGM (at the silent auction/dinner the night before the AGM). The book does an outstanding job of walking the reader through Fairfax's first 25 years of existence. I understand Fairfax pretty well. This book added much more depth to my knowledge. Lots of great information on the key people at Fairfax (some of whom are still there), including where they got their start/training. It really is a crazy (amazing) story. It is unfortunate there is not a digital copy available for people to read/easily access. I really liked learning about the importance of Markel to Fairfax's start and first few years. It is interesting to compare the two companies today. Fairfax not only caught Markel, but has blown right by them in terms of all key metrics. Most importantly, Fairfax looks much better positioned than Markel today (people, structure, execution, results, prospects).

-

It is not surprising to see global wealth continue to motor higher. Looking at Canada, my guess is the increase in 'wealth' over the past 20 years has likely been epic. 1.) We have had a housing bubble. Most households in Canada own (not rent) so the housing boom has created an enormous amount of wealth for an enormous number of people. 2.) At the same time, stock markets have also performed exceptionally well. Lots of Canadians have also seen a significant increase in the value of their financial assets. 3.) Canada also has a national pension plan (CPP) that has significantly increased in value. Another wealth driver for Canadians. Bottom line, a very large number of Canadians have seen their wealth increase materially over the past 20 years. This will have important positive impacts on the economy moving forward - that I don't think are fully understood today. And the wealth transfer that will be happening over the next 10 to 20 years will be epic. This will also have important impacts on the economy.

-

@mananainvesting, I can't actually answer that question. My answer would be gibberish. Because it would lack important context about my personal situation (my specific reasons for selling). With Fairfax I have a large core position. I then flex this core position up and down. Sometimes by quite a bit. What I do with the flex part of my portfolio primarily depends on what Mr. Market does. But even the sizing of my core position can fluctuate up and down. Again, depending on the facts and fundamentals at Fairfax. And what is going on in the general market (what do other opportunities look like). And what is going on in my head. And taxes are becoming an important factor for part of my Fairfax position (a very good problem). A couple of new wrinkles for me this year are retirement and estate planning considerations. I will be 60 next year so these two topics have been becoming more important to me (I am at the learnings stage). On the retirement angle, I am beginning to think I probably should have 2 or 3 years of living expenses socked away in a cash type account (thanks to comments from others of this board recently). This is not a big deal, but it likely means I will reduce the weightings of all of my individual holdings. On the estate planning angle, if I am ever hit by a bus my family needs to know what to do with all of the different investment portfolios (we are all hit by the Father Time bus eventually). A year ago I started to shift part of our portfolios into broad based ETF/index funds (mostly XIC.TO and VOO). A year later, I love how I feel about it - so much so that I have shifted more into ETF/index funds. This is providing my family with a clear roadmap of what to do the day I am no longer around (or able) to manage our investments. In recent years, taxes have also become an important factor for me. I may sell a chunk of Fairfax in a non-registered account to lock in a large gain for tax purposes. I also have some philosophical things rattling around in my head. I like reading Morgan Housel's stuff. His view is at my age I should be focussed on 'preservation of capital' not maximizing 'return on capital.' Buffett (or Munger) have said a similar thing: 'why would you risk what you need for what you don't need'. Does it make sense for me to have a concentrated position in a stock given my current situation (I have enough)? I also change my mind a lot. At the margin. I like to try things. And then wait and see how I feel afterwards. Was it a good decision? or not? My price target might change next week (it might go up and it might go down). Anyways, this post is probably reading like the writing of a complete nut job. All I can say is it has worked for me for 25 years

-

Over the past 4 years, we have been learning a few things that we did not know about Fairfax: 1.) Their business model is unique in P/C insurance and very powerful when management is executing well. 2.) Their management team is very good. And they have been executing exceptionally well for the past 6 or 7 years. 3.) Their P/C insurance operations are very good. Much better than most people think. 4.) After 6 years of hard work, they have largely fixed the problems that existed in their equity portfolio. A headwind has flipped and become a tailwind. 5.) Record earnings (continuously, over many years) + excellent capital allocation (like Fairfax has been doing) + compounding = significant increase in intrinsic value. The question that i have not seen answered anywhere (in any great detail) is just what is this company actually worth today? The problem is most answers to this question lean heavily on past results. To get a proper answer, the answer needs to be focussed primarily on the future. IMHO, record earnings, excellent capital allocation and compounding provide the best clues. (If intrinsic value compounds at mid-teens average per year over the next couple years, how likely is it that EPS will decline over that same time horizon?) Most analysts are raising their P/BV multiple in lock step with the stock price moving higher. So they don’t look stupid. Well, everyone except Morningstar, that is (and there are no words to describe their Fairfax ‘analysis’ - it is borderline criminal it is so bad).

-

A question for board members. When Fairfax takes Peak Achievement private (expected in Q4) will they mark up their 43% stake to reflect the purchase price? If so, this should drive a meaningful realized investment gain in Q4. Fairfax's carrying value for its 43% position in Peak Achievement is $129 million. At June 30, it had a fair value of $226 million. The sale price for 100% of Peak has not been disclosed. Some reports suggested Peak was being shopped for $800 million. A post on Twitter suggests the final sale price (likely including debt) values the company at $1 billion. ----------- Fairfax is 'sitting' on about $2 billion in unrealized investment gains today. This figure has been growing rapidly over the past 4 years. As Fairfax harvests this value in the coming years it will be incremental to analysts EPS earnings forecasts. How Fairfax harvest this value will vary. Sometimes it will be an outright sale like Stelco. Other times it will be change in their ownership stake, like Peak Achievement (if I am understanding things correctly).

-

@dartmonkey, when putting together my summary of Fairfax's equity holdings: 1.) I start with the summary Fairfax provides in their annual report each year. This provides a great deal of information (all the different buckets and sub-buckets). 2.) Then layer in holdings that we know about but that Fairfax did not have in the annual report (these amounts will be subtracted from the sub totals so they do not get counted twice). 3.) Then incorporate new news each quarter: 13F, Fairfax announcements etc. When each annual report comes out I start at the beginning again. ---------- As you rightfully note, there are holdings worth billions in value that we know little about (what the holdings are and how they are doing over the year). --------- As a result, my estimate (tracking spreadsheet) is usually light when it comes to estimating actual reported gains and losses from investments.

-

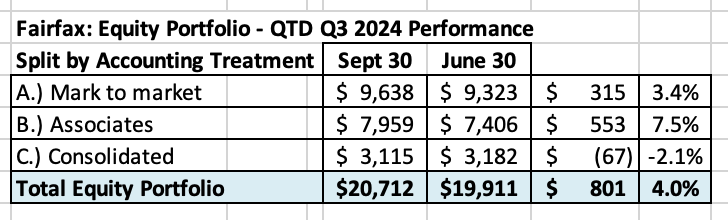

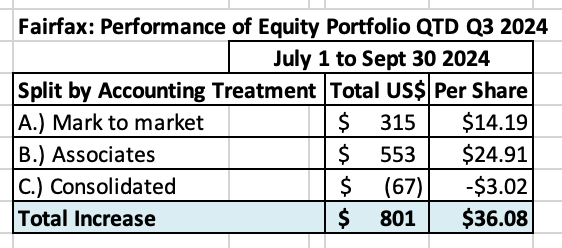

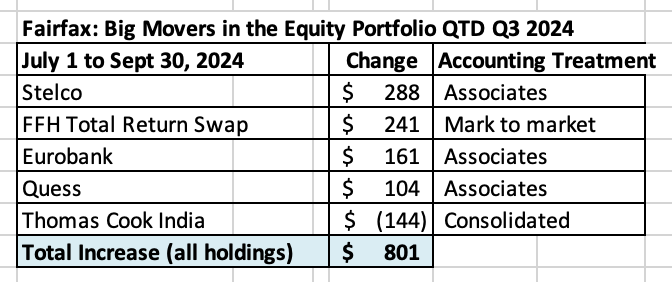

Estimate of change in value of Fairfax’s equity portfolio in Q3 - 2024 Fairfax’s equity portfolio (that I track) increased in value in Q3, 2024 by about $800 million (pre-tax) or 4.0%, which is a solid result. It had a total value of about $20.7 billion at September 30, 2024. After being a headwind in 1H 2024 (on US$ strength), currency flipped to being a tailwind in Q3 (on US$ weakness). Notes: I include the FFH-TRS position in the mark to market bucket and at its notional value. I also include warrants and debentures that Fairfax holds in the mark to market bucket. My tracker portfolio is not an exact match to Fairfax’s actual holdings. It is useful only as a tool to understand the rough change in Fairfax’s equity portfolio (and not the precise change). My equities tracker does not include the change in value of Digit, Fairfax's P/C insurance company in India that is now publicly traded. The total value of Digit increased about $400 million in Q3. This amount needs to be adjusted to reflect Fairfax's ownership stake. Split of total holdings by accounting treatment About 47% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 53% are Associates and Consolidated holdings. The Sleep Country and Peak Achievement (Bauer) acquisitions (which are expected to close in Q4) will significantly increase the consolidated bucket of holdings. Over the past couple of years, the share of the mark to market holdings has been shrinking. This means Fairfax's quarterly reported results will be less impacted by volatility in equity markets. Split of total gains by accounting treatment The total change is an increase of about $800 million = $36/share (pre-tax) The mark to market change is an increase of about $315 million = $14/share. This does not include the gain on the sale of Stelco when it closes (expected in Q4). The change in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports each quarter. What were the big movers in the equity portfolio Q1-YTD? Stelco is up $288 million. Fairfax is expected to book an estimated pre-tax gain of $390 million on the sale of its 13 million shares in Stelco. The sale is expected to close in Q4 2024. The FFH-TRS is up $241 million and is now Fairfax’s second largest holding at $2.5 billion. Eurobank is up $161 million. Currency has been a tailwind in Q3 (strong Euro). Quess continues its big move higher, and is up another $104 million. Market value of $473 million now exceeds carrying value of $434 million. Thomas Cook India, down $144 million, gave back some of its recent gains. Market value of $726 million significantly exceeds carrying value of $218 million. Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $2.0 billion pre-tax ($89/share). The 'excess' of FV to CV has been materially increasing in recent years. This is a good example of how book value at Fairfax is understated. Excess of FV over CV: Associates: $1.3 billion = $59/share Consolidated: $661 million = $30/share Equity Tracker Spreadsheet explained We have separated holdings by accounting treatment: Mark to market Associates – equity accounted Consolidated Other Holdings – total return swaps and warrants and debentures The value of each holding is calculated by multiplying the share price by the number of shares. All holdings are tracked in US$, so non-US holdings have their values adjusted for currency. This spreadsheet contains errors. It is updated as new and better information becomes available. Fairfax Oct 1 2024.xlsx

-

Did the conflict in the middle east not just get kicked up another notch? It looks like Israel has decided the Hezbollah threat in Lebanon needs to be addressed. Are we learning the emperor has no clothes (Iran and its proxies / those who want Israel to disappear)? Or is this simply the ‘calm’ before the storm? It is interesting that financial markets appear to be ignoring the wars in middle east.

-

@John Hjorth your comment gets at political culture. Russia has never had a democratic political culture (they tried for a brief time and not surprisingly it was a catastrophe). Democratic political cultures are not the norm - autocracies are the norm (I am including autocracies masquerading as democracies here). So I am not sure Russia will ever get one.

-

I think that might be the real lesson here. Buying Fairfax India at book value (or at a premium)g it appears there was little margin of safety. The emotional toll has also been significant for some long term holders. The stock today has a margin of safety. Importantly, a new investor also does not carry the emotional baggage of some long term investors. It really is an interesting case-study. Importantly, the most important chapters of the story are still being written (like BIAL) or have yet to be written.

-

@ICUMD At the end of the day we need to be as rational as possible. If your analysis told you it was the time sell and move on then that is the right decision for you. Here is my take on Fairfax India. I think the stock is cheap. I also think there is a good chance that significant ‘hidden’ value will be realized when the BIAL IPO happens. The issue with Fairfax India is when the value will be realized by Fairfax India and Fairfax. Not is the value actually there. As a result, i view Fairfax India not as a speculation but primarily as a timing play. For patient investors, the risk/reward looks pretty attractive. Do I own Fairfax India shares today? No. That is primarily because I am way overweight Fairfax. However, i have owned Fairfax India many times in the past as a short term trade. I usually have kept my position size modest. ————— The key is what is the value of the collection of assets that Fairfax India owns? And what has it done over the past 5 years? I think BIAL is the real deal. Coiled springs usually (eventually) get released.

-

@UK good for you. Well done. Concentration is a hugely important topic. And definitely not one size fits all - probably because so many things go into the calculation. Everyone really needs to figure this out for themself. When i was younger, i would sometimes go 100% with one stock (only for a short period of time). But only if it was something I understood exceptionally well. That just kept going down - so over time my position size would get quite large (as i would keep adding). The last time i did this with a stock was with Apple in 2013. I also have core positions that i will flex up and down depending on what Mr. Market does. So this makes it difficult to give definitive numbers on position sizes (targets or actuals). That is what i was doing with Apple - but the story kept getting better and the stock kept getting cheaper - so i kept adding. Probably a really stupid thing to do. The flexing is temporary and allows me to take advantage of short term volatility in my very best ideas while i am waiting for the longer term thesis to play out. Fairfax is my biggest position today (it has been for the past 4 years) and i have flexed it up and back down twice this year (on both sell offs). My goal is to have no one position at more than about 33% of my total portfolio. Fairfax is over that today (I don’t want to give an exact number because it changes). After Fairfax, my biggest holdings are 3 index funds - VOO, VO and XIC). My goal is to build these up to about 40% of my total portfolio (roughly equal weights). I also like cash - i am ok going up to 20%. I love the optionality of cash. I went 100% cash in Feb 2020 when Covid was bearing down - i didn’t like the risk/reward and all my investments at the time were in tax free accounts (so there were no tax issues). The rest of my portfolio is a bunch of misc stuff that i will flex up and down depending on a bunch of different factors. Not sure if that answers your question. It probably raises more questions than it answers. And be warned - i might change my mind tomorrow (to anything written above). I mean this seriously. Mr Market can do some really crazy things. And i will remain open minded and be opportunistic. I also think i have been very lucky over the years, especially over the past 20 years… none of my concentrated positions have blown up on me. This could have easily happened (for any number of reasons). Now i don’t get highly concentrated that often. When i do, it is only with stuff i think i understand very well. And i generally don’t keep positions extremely concentrated for long. So i think it is probably time to tweak this part of my investment process/framework. Morgan Housel has written about how most investors are not able to evolve as they age from ‘grow capital’ to ‘preserve capital.’ That is what i am trying to use ETF/index funds for in my portfolio - the set and forget / preserve capital part. The rest is my ‘grow capital’ part.

-

@Haryana that is a good catch. When i write my posts sometimes i get lazy with my metrics. So sometimes i default to what is easy to find. I typically just use Yahoo Finance or company reports for my data. I wonder if i should subscribe to a paid service so it would be easier to pull more inclusive data points. Do others on the board subscribe to any paid services for data collection / graphs etc? Do board members have any recommendations?

-

Here are some comments on the FFH total return swaps. 1.) Fairfax holds them as an investment - at least that is what they have said in the past. If they still own them, that suggests they still like the risk / reward trade off. And it is probably heavily skewed in a favourable way. Given the risks, why hold them otherwise? For those who think Fairfax should sell… can you also indicate what you think fair value is for Fairfax’s stock? When i was at Fairfax’s AGM this year my question for other attendees was “What is a reasonable P/BV for Fairfax?” Consensus was Fairfax should trade at a minimum P/BV of 1.5x. Book value of Fairfax today is $980/share. Q3 earnings should come in around $40 (with the Stelco gain) which means ‘real time’ BV at Sept 30 = $1,020. 1.5x BV = $1,530. Stock closed today at $1,211, which is significantly below $1,530. We also know book value is understated. Excess of FV over CV is large. Other assets like BIAL are also likely significantly undervalued in reported BV. As a result, US$1,600 or even $1,700/share might represent a reasonable fair value for Fairfax today. 2.) Fairfax is aggressively buying back stock. They have been doing this for the past 7 years. But the pace of buybacks has picked up in 2024. This is likely because the hard market is slowing. What will the insurance subs do with the excess capital? Send it to Fairfax who will buy back stock. 3.) Fairfax has very robust cash flow. Fairfax is also earning about $2.5 billion in interest income. A $2 billion number is largely locked in for the next couple of years. This is just one income stream. There are many more income streams. Fairfax also could sell assets. Even if adversity hits, Fairfax should have pretty robust cash flow. 4.) Fairfax appears to be the marginal buyer of its stock this year. what determines the value of Fairfax’s stock? By buying back stock Fairfax is driving value in two ways: - buying stock at prices well below intrinsic value. - significantly increasing earnings via gains from the TRS. The value creation from this one-two punch over the past 4 years has been significant. My guess is there is more to come - and perhaps much more. Again, it all comes down to what you think Fairfax’s stock is worth. When Fairfax made the TRS investment at the end of 2020/beginning of 2021, Prem said he felt it would become one of Fairfax’s best-ever investments. And it has - in 3.5 short years. Remember - how do you make the big money? Patience.

-

@TwoCitiesCapital , at the end of the day, over time ROE for P/C insurance companies is driven by two things: - underwriting profit - total return on investments All publicly traded P/C insurance companies need to deliver an acceptable ROE over time. Or the CEO / senior team gets fired. Most publicly traded P/C insurance companies invest primarily in bonds. If bond yields are low then underwriting profit needs to do more of the heavy lifting - drive a larger share of earnings. This is over time. Lots can happen in a given year - or over a couple of years. In terms of trying to explain what happened in the past - the short answer is its complicated. There are lots of other factors also involved like reserve levels, region, line. Some are company specific like reserve levels (and reserve releases). So we will see what happens moving forward. Bottom line, my guess is much lower bond yields will simply put more importance on earning an underwriting profit. My point is more that this is a dynamic process. A negative in one area often shows up as a positive in another important area. And vice versa. How it plays out is impossible to know. So the key is to not get too pessimistic or too optimistic - and to closely monitor the situation. Most importantly, decisions should be based as much as possible on facts and not fears.

-

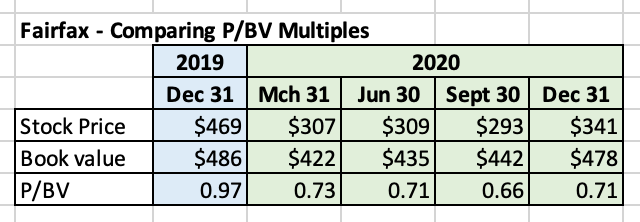

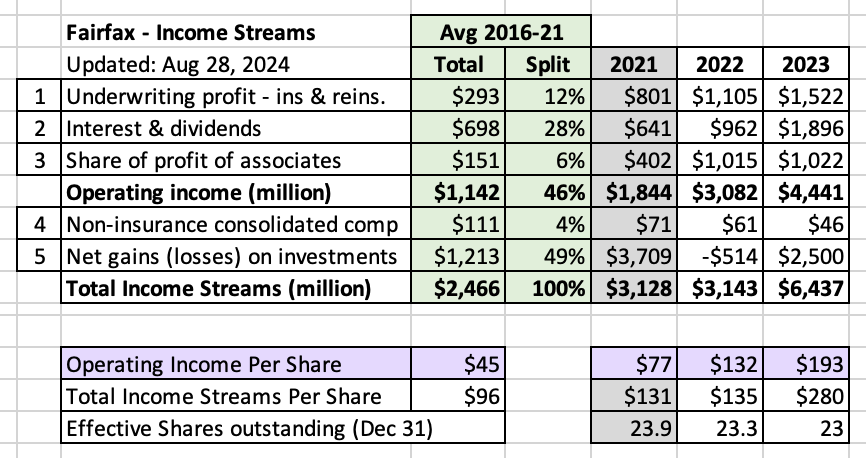

On Saturday I posted Part 1 (lessons 1 to 4). It is linked above for those who have not read it. Here is the conclusion, Part 2 (lessons 5 to 8). Fairfax Financial - 8 Lessons Learned Over the Past 4 Years Lesson 5.) Value investing works - really well. "The three most important words in investing are margin of safety.” Warren Buffett What is margin of safety? Buy something for less than it is worth. This investment framework works so well for 2 simple reasons: If you are right, you can make a lot of money. If you are wrong, your downside is protected. And the bigger the discount (margin of safety) the better. “It is extraordinary to me that the idea of buying dollar bills for 40 cents takes immediately with people or doesn't take at all.” Warren Buffett What is a good way to value an insurance company? By using book value. What was Fairfax’s price/book value multiple in 2020? At the end of 2019, Fairfax traded at a P/BV = 1x. At the time, Fairfax was out of favour as an investment - and this was reflected in its very low P/BV multiple. After Covid hit, Fairfax sold off aggressively. From March to December of 2020 it traded at a P/BV multiple of about 0.7x and there were times when it traded below 0.6x. That was a historically low valuation for Fairfax. What was a rational investor to do? Buy the stock, of course. Fairfax was a textbook value investment in 2020. Buying Fairfax was a pretty easy decision. The difficult decision in 2020 was position size - how much should an investor buy? ————— Lesson 6.) Sizing a position is critically important to long term investment performance “Sizing is 70% to 80% of the equation. Part of the equation is seeing the investment, part of the investment is seeing myself in a good trading rhythm. It’s not whether you’re right or wrong, it’s how much you make when you’re right and how much you lose when you’re wrong,” Stan Druckenmiller https://moneyweek.com/investments/investment-strategy/605020/stan-druckenmiller-position-size-really-matters In 2022, Warren Buffett said that 12 investment decisions - one about every 5 years - is what has delivered much of Berkshire Hathaway’s outperformance over the years. “In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so... Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years.” Warren Buffett - Berkshire Hathaway 2022AR Truly great investment opportunities come along very infrequently - Buffett found about two each decade. And he is really good at this game. Guess how many an average investor are going to find? These are investments that: you understand better than almost everyone else. are trading at a very cheap valuation. When you find one of these you need to take full advantage - and get the position size right. Getting this right is what allows an investor to outperform the market averages over time. Concentrating a position does a couple of important things for an investor: It focusses the mind (that ‘skin in the game’ thing). It results in a higher purchase threshold (reserved for best ideas). Of course this strategy only works if you are right. Concentration is a great example of how the theory part of investing is incredibly simple. And the practice/execution part is incredibly difficult. Is concentration not a risky think to do? I like Buffett’s definition of risk: “Risk comes from not knowing what you are doing.” Warren Buffett Fairfax For much of 2020, Fairfax was trading at a historically low valuation of 0.7 x BV (even going as low as 0.6 x BV). This means the stock was trading at the largest ‘margin of safety’ in the company’s history. Later in 2020, Fairfax’s investments had stabilized (cyclical stocks rebounded) and its insurance business was growing nicely (hard market). Yes, this was a great time to buy the stock. But more importantly, it was the perfect time to back up the truck and build out a concentrated position. With Fairfax, investors got one of those ‘punch card’ moments that Buffett has often talked about in the past. —————- Back in 2020, Sanjeev’s was saying much of the same thing. Below is one of his posts from May 14, 2020: “What I can provide you is perspective, my rational assumptions and how I came to my conclusions. Yes, I've seen this rodeo before...including with Fairfax. Amazing what 22 years of investing teaches you, especially over this last generation where we've incredibly seen compressed cycles of 50% drops in the market 3 times...1999/2000, 2008/2009 and 2020/2021. “You generally get one of those cycles every other generation...we've seen three in one generation. Is that due to the internet? Computer trading? ETF's? Massive amounts of competition by hedge funds, private equity, pensions, etc? Recklessness in financial instruments, by the Fed, IMF? Distortions in monetary policy? Maybe a combination of all them! “All I know is that I've been given 3 massive swings at the bat in one generation...300% gains over several years. This is probably the last one before I retire, and I'm going big! I expect the stuff I'm buying today to be up 300% or better from my current cost over the next 5-7 years.” https://thecobf.com/forum/topic/17401-fairfax-2020/page/12/#comment-401311 —————- Lesson 7.) Following the fundamentals - this is what should have kept an investor in Fairfax “You’re not buying a stock, you’re buying part ownership in a business. You will do well if the business does well. And if you didn't pay a totally silly price.” Warren Buffett “What possible assurance do you have that (a stock you own) will go up in price? And if you are buying, how much should you pay? What you’re asking here is what makes a company valuable, and why it will be more valuable tomorrow than it is today. There are many theories, but to me, it always comes down to earnings and assets. Especially earnings.” Peter Lynch - One Up On Wall Street OK. So you discovered a great investment. You bought it. And then you sized it properly - made it a significant position. What do you do next? You own a piece of a business. So the next thing you do is you closely monitor how the business is performing: Financials/earnings Management Insurance industry Financial markets Prospects You monitor the fundamentals of the business. Are they improving? Staying the same? Or deteriorating? ————— "If past history was all that is needed to play the game of money, the richest people would be librarians." Warren Buffett Monitoring the fundamentals is even more important for a turnaround play. And that is what kind of investment Fairfax was back in 2020. What happened with Fairfax? In 2021, the fundamentals of the company got better. Much better. Why? Three things were happening at the same time: Driven by the hard market, the insurance business was growing rapidly. Cyclical stocks (Fairfax has lots in their portfolio) spiked higher. The management team began executing exceptionally well in terms of capital allocation. Headwinds had flipped to tailwinds. Also, by 2021, Fairfax had fixed its investing framework. The turnaround was turning around - and quickly. The fundamentals of the business continued to improve in 2022. And again in 2023. A decade long headwind - low interest rates - turned into a tailwind when interest rates spiked. By the end of 2023, the turnaround was complete. Truth be told, it was probably complete the end of 2022. What happened to earnings? Earnings spiked higher. Importantly, the increase in earnings was being driven by spiking operating income. Operating income at Fairfax averaged $1.1 billion/year ($45/share) from 2016 to 2021. In 2023 it was $4.4 billion ($193/share). Per share, operating income increased by 329%. That is a simply amazing increase over a 3 year period. What about the stock price? The stock price spiked higher. What about the valuation of the stock? This is where the story gets even more interesting - and a little nuts. Mr Market was focussed on Fairfax’s stock price. Those who followed the company closely were focussed on fundamentals/earnings. Fairfax’s stock went up lots. But so did Fairfax’s fundamentals. As a result, the valuation gap wasn’t shrinking by all that much. As a result, the stock continued to be undervalued. Following the fundamentals closely is what likely stopped many investors in Fairfax from selling their shares after a quick gain. This gets to our next lesson. ————- Lesson 8.) Patience is how you make the big money. “And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine - that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money...” Reminiscences of a Stock Operator “Be patient. The stocks that have been most rewarding to me have made their greatest gains in the third or fourth year I owned them. A few took ten years.” Peter Lynch “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” Peter Lynch How many investors sold their Fairfax shares for a quick small gain in 2021. Or 2022. Or 2023? Or 2024? Most of the investors that sold Fairfax over the past three years have likely missed out on making the big money. What is the hardest thing in investing? Holding winners might be the hardest thing for an investor to do. Holding big winners… well, that is almost impossible. So guess what? Most investors have few if any big winners. As a result they usually underperform the market averages. Why is this? Monitor (following the fundamentals) and patience (hold your winners) are often contradictions. Because monitor often results in action. Your brain just can’t help itself - it’s busy computing and… well, it’s decided you need to do something… anything! It needs you to act on what it think it knows. And then your gut gets involved - it doesn’t want to be ignored or left out. So it starts telling you do something as well (sometimes it is screaming). As a result, winning positions usually get sold way too early. The reasons always make sense at the time. Do nothing? Ignore what both your brain and gut are telling you? Now that is hard. Pretty much impossible for most investors. This process gets even harder for big positions - because you monitor your big positions even more closely (so your brain and your gut have even more to say). Selling a big winner way too early can be disastrous to an investors long term results. Because they come along so infrequently. So what is an investor to do? Be as rational as possible. And here we are, back at the start of our story (see ‘Lesson 1: Investors need to be rational at all times with their investments') Where does Fairfax go from here? Fairfax has already been a 3 bagger for many members of Corner of Berkshire and Fairfax. Are we done? I don’t think so. Fairfax continues to trade at a valuation (P/BV) that is well below that of its P/C insurance peers. We also know Fairfax’s book value is understated (one reason is the excess of FV over CV) - so this makes it even cheaper. Earnings are strong (near record highs). When it comes to capital allocation, the management team at Fairfax has been best in class over the past 5 years. Bottom line, stock still looks cheap and its prospects look solid. But don’t take my word for it. It looks like Fairfax has repurchased and retired another 61,000 of their shares in August. They are on pace to reduce effective shares outstanding by more than 1 million in 2024. Fairfax are value investors - they only buy back shares if they think they are trading at a discount to their intrinsic value.

-

+1 With Fairfax people tend to spend a lot of time thinking about lots of bad things that might happen. They don’t spend an equal amount of time thinking about good things that might happen. Therefore their ‘analysis’ tends to be skewed one way. Is that simply being ‘conservative.’ I am not sure that is how i would characterize it.

-

You pose good questions. The answer to each is 'it depends.' Each of those things could be both good or bad (or some combination) for Fairfax. Here are some thoughts: 1.) A soft market in insurance will give Fairfax the opportunity to re-deploy capital to better opportunities. Fairfax is not like other P/C insurers in this regard - they have more good options. 2.) Lower rates will likely extend the hard market in insurance. What will cause lower rates? A recession? This might give Fairfax the opportunity to shift to corporates. If lower rates cause volatility in financial markets Fairfax could be a big winner. As I have said before, they have made their best investments over the past 4 years when volatility was high. 3.) Equity market drawdown - Fairfax's mark to market exposure to a fall in equity markets is much less today than in past years - the majority of their equity holdings are now associate/consolidated. In the 2020 and 2022 they used the sell off in equity markets to buy lots of what they already owned on the cheap (Fairfax, Recipe take-out, small purchases of Fairfax India, investments in Thomas Cook India and John Keells etc). The silver lining are stock buybacks. I think this might be the key to understanding Fairfax as an investment today. Fairfax wants to buy back a bunch of shares. They should have the cash for the next couple of years. A low stock price? That is called a big, big opportunity. And would be very beneficial for long term shareholders. I don't expect the Disney version of the Fairfax movie to keep playing out indefinitely... I don't think the last 4 years are the new normal (where everything goes close to perfect for the company). However, I am also not going to go to the other extreme and assume that management is suddenly going to start to mess up again (and deliver returns like the 2010 to 2020 period). My guess is we will likely get something in between moving forward - which should be very good for shareholders. So we will see

-

So here is my question. Fairfax are value investors. They are able to value Fairfax better than anyone. Historically, they usually buy back shares when they are cheap. They have been buying hand over fist this year. They are on pace to reduce effective share outstanding by more than 1 million in 2024. Given the hard market in insurance is nearing its end - the insurance subs will likely be generating a significant amount of excess capital moving forward. It is likely that Fairfax will continue to prioritize stock buybacks over the near term. The stock is not very liquid. Knowing this, why would an investor sell their shares right now?

-

Here is a summary of Fairfax's largest equity holdings from June 30, 2024. Given its proposed sale, Stelco has jumped into the top 7 (and will be replaced by Sleep Country). Quess has been on fire QTD so it is now a larger position than OXY (CIB too?).

-

@73 Reds Here is perhaps another way to look at it. If an investor buys a stock and then the ‘story’ changes for the worse (for whatever reason) and they choose not to sell that investment. And then it drops precipitously in value 5 or 10 years later. Who is primarily to blame? Is it: 1.) management of the company? 2.) or the investor - for not selling as soon as they knew the story had changed? My view is the blame primarily rests with the investor.

-

@73 Reds Thanks for the comment - it is great to get the opportunity to discuss/debate. My point was more about the importance of trying to be as rational as possible as an investor at all times - especially during times of great stress. As opposed to letting emotion be the primary driver the investment decision. As we all know, in practice, that is an exceptionally difficult thing to do. Lots of investors fail. In 2020 when Fairfax was trading for most of the year at a P/BV of 0.7 (and as low as 0.6x) even after financial markets had rebounded - that had nothing to do with rational, fact based analysis. Concerns about management? Truth be told, Fairfax fixed their biggest issue (dragging down their long term performance) back at the end of 2016 when they removed the equity hedge. That was public knowledge. And it was possible to see the improvements they were making in their investing framework by late 2019. I did a ‘Top 10’ on Fairfax at the end of 2019 and at the time i titled it ‘the supertanker is turning’. So why did Fairfax get so cheap and stay so cheap for most of 2020? I don’t think there is a reason based in rational analysis. Fear (not greed) was driving most investors investment decisions back then (when it came to Fairfax). This bias against the company persisted into 2023. The time to sell Fairfax was back in 2012/2013. Not 2020 after it had fallen to 0.7x P/BV. That was the time to buy - and hand over fist.

-

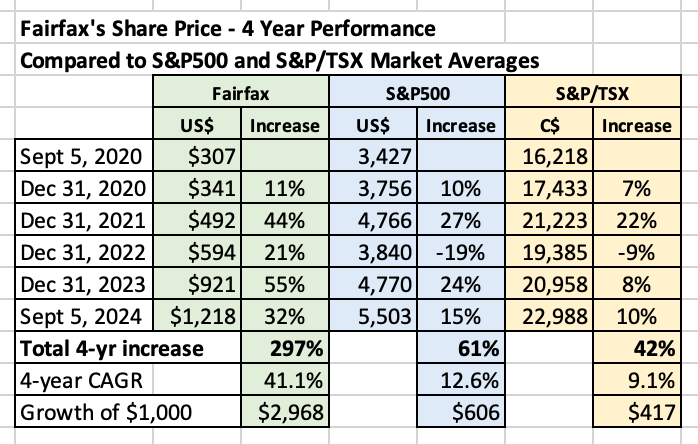

Fairfax Financial - 8 Lessons Learned Over the Past 4 Years “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” Jesse Livermore Reminiscences of a Stock Operator What it takes to be a successful investor has not changed very much over the years. That is because capitalism is a wonderful economic system - our standard of living continues to improve. And human nature has not changed - people will continue to act like they always have. Learning from the past is an important way for an investor to get an edge - it can give you a preview of what is likely to happen again in the future. The Fairfax story The last 4 years has been an amazing time to be invested in Fairfax. The company is executing one of the great comebacks in recent Canadian business history - both in terms of business and share price performance. It is both an interesting and instructive story. As investors, what can we learn from Fairfax’s improbable transformation/performance over the past 4 years? That is the question we will explore in this post. But first let’s do a quick review of a very important performance measure. ————— How has Fairfax’s stock performed? Fairfax’s stock is up 297% over the past 4 years. That is a CAGR of 41.1%. $1,000 invested in Fairfax 4 years ago would be worth $3,968 today, an increase of $2,968. That is a crazy good. How does Fairfax’s performance compare to the market averages? The S&P500 is up a total of 61% over the past 4 years. The S&P/TSX is up a total of 42% over the past 4 years. Fairfax’s outperformance of the market averages in the US and Canada has been breathtaking. How does Fairfax’s performance compare to P/C insurance peers? P/C insurance companies, as a group, have significantly outperformed the broad market averages over the past 4 years. The big winner of the 6 companies compared below has been Fairfax - their performance has trounced P/C insurance peers over the past 4 years. Fairfax’s CAGR is about 2x that of peers. The big laggard (of the 6 companies compared below) has been Markel. Fairfax’s performance over the past 4 years - in absolute and relative terms - has been epic. —————- "What we learn from history is that people don't learn from history." Warren Buffett With that warning from Buffett, let’s get back to our original question. Let’s try and be inquisitive and open minded… As investors, what can we learn from Fairfax’s improbable transformation/performance over the past 4 years? Below are 10 lessons that come to mind for me. What do other posters think? Am I way off base? I do like to stir the pot. Do you see anything missing? Please chime in. ————— Lesson 1: Investors need to be rational at all times with their investments Investing (buying stocks) is not like getting married. Or like joining a club/clique (sorry Tom Gaynor). Ideally, we are able to buy stocks and hold them forever. But that is just not realistic for most stocks. And that is because shit happens. Facts change. Fundamentals / earnings change. Sometimes management teams lose their way. A great investment can become a terrible investment. But unlike marriage, exiting a broken stock is an easy thing for an investor to do. When should an investor sell an investment? According to Peter Lynch, a pretty smart guy, an investor should sell an investment when the story / fundamentals take a turn for the worse. Pretty simple. The Fairfax ‘story’ Over its long history, a person usually invested in Fairfax because of their investing skills - not because of the quality of their P/C insurance business. (Yes, that has changed today.) But something important happened at Fairfax from 2010 to 2020. Fairfax lost its way with its investing framework: The ‘equity hedge/short’ strategy was a disaster, costing the company an average of $494 million/year from 2010 to 2020. The issue with this ‘position’ was its size (massive) and duration (largely in place for 11 years). The equity purchases made from 2014 to 2017 were also largely a disaster. This caused earnings at the company to stagnate. And the stock went sideways from 2010 to 2020. During this time, the S&P500 went up 200%. Measured in terms of opportunity cost, Fairfax investors ‘lost’ a significant amount of money from 2010 to 2020. This, of course, violated Warren Buffett’s rule #1 (when investing) which is ‘don’t lose money.’ What was the learning - looking back, what should a rational investor have done? By about 2012/2013 it was clear that Fairfax had lost its way on the investing side of the business. As a result, the Fairfax ‘story’ had changed significantly - and for the worse. The correct course of action for an investor back in 2012/2013 was to sell their Fairfax stock - and move on. This course of action would have saved many investors years of anguish and massive underperformance. This does not mean that an investor could never again invest in Fairfax. Like any other opportunity, what an investor did in the future would depend on their assessment of the opportunity (fundamentals, management, prospects, valuation etc). Again, an investor needs to be as rational as possible at all times. Now i am looking at things from the perspective of a small investor. If i do a good job with my investments my family eats. If i do a shitty job my family doesn’t eat. As a result, i need to be very rational at all times with my investment decisions. The silver lining "The most important thing to do if you find yourself in a hole is to stop digging." Warren Buffett Fairfax’s problems were self inflicted. Therefore, the ‘fix’ was also in their control. So the situation was not hopeless. It deserved to be monitored. If Fairfax was able to fix its investing framework then it might make sense for an investor to buy shares. Logic, not hope, should drive the investment decision. But given the stocks exceptional run the past 4 years, doesn’t this mean buy and hold was - with hindsight - the correct course of action to have taken with Fairfax? No. Selling back in 2012/2013 was still the correct course of action. And that is because back then Fairfax had lost its way with its investing framework. And back in 2012/2013 (and over the next couple of years that followed) it was clear that Fairfax did not yet recognize that they even had a problem. Fairfax did not start righting their investing framework until late 2016 when they finally exited the equity hedges. By 2018 they were making much better decisions with new equity purchases. The final ‘fix’ was made at the end of 2020, when they exited the last of their short positions. It still took another couple of years for Fairfax to clean up the many problem children that were still residing in their equity portfolio. As a result, it was only around 2021 that investors started to trust that Fairfax had indeed righted the ship and fixed their investing framework. That was a full 7 years after it was pretty clear that Fairfax had a problem. And back in 2012/2013 it was not a given that Fairfax would actually fix anything. This could have easily gone the other way - with their investments, Fairfax could have continued to go down their old disastrous path. Long term shareholders have been very lucky with how their investment in Fairfax has played out over the past 4 years - not smart. Yes, Fairfax was able to execute a successful turnaround. But that is not what usually happens. There is also an important lesson here for Fairfax Fairfax wants to attract long term shareholders - that was pretty apparent during the Q&A sessions at the AGM this year. If this is the case, then Fairfax needs to hold up its end of the bargain - they need to run the business in a way that attracts/aligns with long term shareholders. When it comes to the type of shareholder base they have, companies generally get what they deserve. ————— Lesson 2: Financial markets sometimes get it completely wrong - for years "The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd." Warren Buffett Pretty much everyone got Fairfax wrong 4 years ago. Who got Fairfax the most wrong? The haters. Their hate stopped them from being rational. It stopped them from looking at the company objectively. As a result, they likely did not invest in Fairfax at all. So they missed out on one of the great investments of the past 4 years. The haters are a pretty quiet bunch these days. But they were out in full force in 2020. But even many of those who were positive on Fairfax 4 years ago were also very wrong. They grossly underestimated the opportunity. As a result they likely did not size their position properly. And many likely sold their position much too soon. Who got Fairfax the most right 4 years ago? Some lucky guy named Prem Watsa who invested $150 million in Fairfax at US$308/share in June of 2020 at pretty much the bottom. If only he had not kept his investment (and his rationale) secret… we all could have learned and benefitted from what he knew! Of course, Prem did tell investors what he was doing and why. Prem nailed it. And we all completely ignored him. (I guess this also explains why he is a billionaire and we are not!) From Fairfax’s press release on June 15, 2020: Mr. Watsa commented as follows in connection with this purchase: “At our AGM and on our first quarter earnings release call, I said that our shares are ‘ridiculously cheap’. That statement reflected my recognition that in the 35 years since Fairfax began, I have never seen Fairfax shares sell at a bigger discount to their intrinsic value than they have recently. I have now backed up my strong words by purchasing close to US$150 million of Fairfax shares in the market over the last few days, as I believe that this will be an excellent long term investment.” ————— Be careful who you listen to Who and what you let into your brain is super important. It is crazy how easily an investor can get messed up by their ‘information’ sources. Bad analysis and faulty logic can pollute rational thought / actions - once it gets into your head/thought process it can be very difficult to remove. Ignore the haters As we learned in lesson #1, successful investing is centred on being rational. Haters don’t care about fundamentals/earnings, management, prospects or valuation. Haters are blinded by the facts, especially at inflection points. The problem is the haters usually say things with a lot of conviction - and the old (wrong) narrative makes so much sense. This makes their views sound very persuasive at the time. Back in 2020, the haters were out in full force. What were they saying? ‘Prem is an idiot.’ Or something similar. Their ‘analysis’ was exclusively rear-view mirror in nature. The positive changes happening at the company didn’t matter. The improving fundamentals / earnings didn’t matter. This leads into our next lesson. ————— 3.) The Corner of Berkshire & Fairfax is an amazing resource for investors. "You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital." Warren Buffett Having the opportunity to hang out with, learn from and debate with many other successful investors from all walks of life and all over the world is amazing. Being able to do so for 20 years is priceless. The Corner of Berkshire and Fairfax (CofBF) has been sprinkling pixie dust on its members for more than 20 years. Thank you Sanjeev for running this wonderful investment forum. And when it comes to Fairfax, there is no better resource for investors out there. The analysis provided by board members over the years (20 and counting) has been simply outstanding. And for the past 4 years, members of CofBF have had a front row seat to Fairfax’s amazing turnaround. Out of favour = under-followed The fact that sentiment in Fairfax got so bad back in 2020 was actually a big help in this regard. Pretty much no one was following the company back then. At the same time, the old narrative surrounding the company was completely wrong. That is a wonderful set up for an independently thinking, open-minded investor. When it came to Fairfax as investment, this gave CofBF board members a massive information advantage over the entire investment community. This advantage has persisted for years. But seeing an opportunity is not enough. ————— 4.) Knowledge without action often results in the biggest mistakes for investors. “The most extreme mistakes in Berkshire's history have been mistakes of omission. We saw it, but didn't act on it. They're huge mistakes — we've lost billions. And we keep doing it. We're getting better at it. We never get over it.” There are two types of mistakes: 1) doing nothing; what Warren calls “sucking my thumb” and 2) buying with an eyedropper things we should be buying a lot of.” Charlie Munger To make money an investor can’t just read/study and sit in cash. At some point in time they have to act on what they have learned and buy something. And they need to size their position properly (more on this later in the post). Sanjeev (and others) were pounding the table very loudly on Fairfax during the entire summer of 2020. At the time, they provided lots of great analysis in support of their views. The opportunity in Fairfax was gift wrapped for the members of the Corner of Berkshire and Fairfax. For a trip down memory lane, below are links to a couple of threads from 2020 with Sanjeev (and a few others) pointing out how cheap Fairfax had gotten - with pushback from lots of others. In the second link, Sanjeev suggests Fairfax could return 300% over a 5-7 year time frame. It got there in 4 years. https://thecobf.com/forum/topic/18079-remember-this-quote/#comment-411701 https://thecobf.com/forum/topic/17401-fairfax-2020/page/12/#comment-401311 What is interesting is how fast the general stock market bounced back in 2020 - by August the S&P500 took out its pre-Covid high (reached in February) and was back at all-time highs. In February of 2020, Fairfax was trading at $475/share. From March 17 to November 13, 2020, Fairfax traded below $320/share. Investors had about 8 months to do their research, get comfortable with the story and still buy Fairfax at a historically cheap valuation. Fairfax did not take out its pre-Covid (February) high until December of 2021. It stayed cheap for years. But how many board members actually invested in Fairfax in 2020? Or 2021? Or 2022? Or 2023? Not acting on what you know - Buffett calls that ‘thumb sucking.’ My guess is when it comes to Fairfax, there has been a lot of thumb sucking going on the past 4 years. What about me? What was I doing? All through the summer I was listening to Sanjeev and others on the board - I just wasn’t doing anything about it (that ‘thumb sucking’ thing). That changed in late October 2020, when I re-established a position in the stock. I got very lucky with my timing. Not surprisingly, that is also when my posting on Fairfax started to increase. https://thecobf.com/forum/topic/17401-fairfax-2020/page/26/#comment-422165 —————- To be continued: The final 4 lessons will come in my next long-form post which should be completed in the next week.

-

My next long-form post on Fairfax will be a 4 year anniversary post - lessons learned. To set the table, here is a post I just put up on Twitter. There is a narrative that to be successful, an investor HAS TO own big tech. Because over time, big tech outperforms everything else. Maybe not. Our mystery stock has trounced big tech over the last 4 years. Who is it? I’ll give you a hint... $FFH.TO $FRFHF $GOOG $MSFT $AAPL $META $AMZN