Viking

Member-

Posts

4,926 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@73 Reds I completely missed the big money when looking at Berkshire Hathaway over the years. Why? Largely because of what you so eloquently posted above - “yet-to-be-had ideas and acquisitions.” I way underestimated the P/C insurance model and the value that Buffett would generate over time from Berkshire Hathaway’s earnings and the power of compounding. I am trying to not make the same mistake a second time - this time with Fairfax. And that is another one of the things that i love about investing - the ability to apply lessons from the past to the present.

-

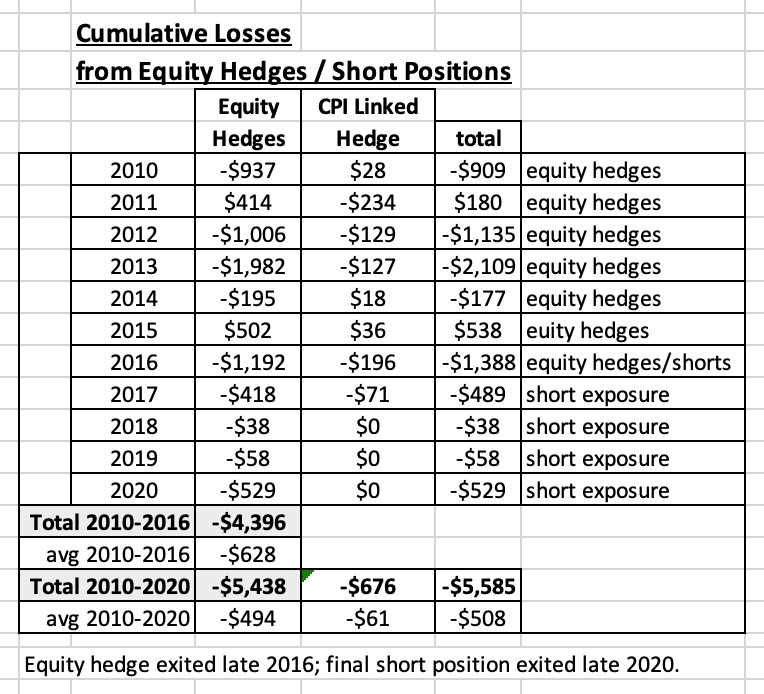

When I evaluate Fairfax's investment decisions, my watch out is an 'equity hedge/short' type decision. Something really big. From 2010 to 2020, Fairfax's equity hedge/short positions cost the company a total of $5.4 billion in losses = an average of $494 million per year. The equity hedge position was removed in late 2016. This position was the big issue. From 2010 to 2016, the equity hedge/short positions cost Fairfax a total of $4.4 billion in losses = $628 million per year. The last short position was removed in late 2020. From 2017-2020, the short positions cost Fairfax a total of $1.04 billion = $261 million per year. Exiting the equity hedge position in 2016 was a massive win for shareholders. Exiting the last short position in late 2020 was a big win for shareholders. The bottom line, at the start of 2021, the chains of the equity hedge/short positions had been completely removed from the company. It was like a $494 million annual expense that the company paid from 2010 to 2020 had been removed and Fairfax became $494 million 'more profitable' every year moving forward. The crazy thing is this 'investment' only stunted Fairfax's growth from 2010 to 2020. It really was amazing what Fairfax was able to still accomplish from 2010 to 2020 - especially the significant build out of their P/C insurance business. (The many shitty equity holdings on the books at the time was another headwind - making Fairfax's performance even more impressive.) What this shows is the incredible earnings power that exists within Fairfax - that P/C insurance (float) + active management of the investment portfolio (equities etc). Of course, 2010 to 2020 was a lost decade for Fairfax shareholders. So I am not trying to sugar coat what happened when it comes to the share price. No equity hedge/short positions. The equity portfolio has been cleaned up. The future looks bright - I can't wait to see what the Fairfax team can deliver in the coming years. What does it mean for today? Sleep Country has been a hot topic among board members - I sense lots of angst. To be honest, I don't understand all the angst. 1.) The management team at Fairfax has been executing exceptionally well since 2018. This is a long enough time for me - they have re-earned a certain amount of trust. 2.) We have no visibility into why they bought Sleep Country. There likely were many factors involved (P/C insurance capital levels, taxes, strategic fit within investment portfolio, strategic fit within total company, valuation, future prospects etc) - and we are largely in the dark. And no, I do not expect the management team at Fairfax to have to 'justify' every decision they make to investors. 3.) Sleep Country is a small purchase. It represents about 2% of Fairfax's investment portfolio and 6% of its equity portfolio. 4.) Sleep Country looks to be well managed. It is a strong franchise (in Canada - and I know this is hard for those outside of Canada to understand). It is profitable. The issue is some don't think it will earn enough (to justify the purchase price). Today, do I love the Sleep Country purchase? No. But do I dislike it? No. The bottom line, it is a non-issue for me - if Fairfax thinks this is a good decision, given their track record since 2018, I am ok with it. Done. Obesssing about small potatoes (Sleep Country) runs the risk of me losing sight of the bigger picture of why I am invested in Fairfax - I try and be careful about what (and how much) I let into my head. My watch out for Fairfax and their investments is an equity/hedge short type of decision that I don't like. Something that costs them +$500 million per year - for years. That WILL get my attention. The power of Fairfax's business model today is VERY IMPRESSIVE. Given the level of earnings, they are going to be making lots of billion dollar decisions in the coming years. They are going on the offensive. I can't wait. And I am going to try and be open minded when we learn what they are doing...

-

@73 Reds thanks for the feedback. I am going to dig into the 'company specific' part of your comment with my next post. My guess is lots of Fairfax's current shareholders are still seeing the ghosts of Fairfax's past. This will lead them to manufacture 'company-specific' issues that don't actually exist (and lead them to sell their position). This is one of the reasons why I expect Fairfax shares to be more volatile going forward (particularly to the downside). And as I said, that will likely provide Fairfax with a wonderful opportunity to take out a meaningful amount of shares in the coming years. "know what you own" - bingo! That is the key that unlocks the treasure chest.

-

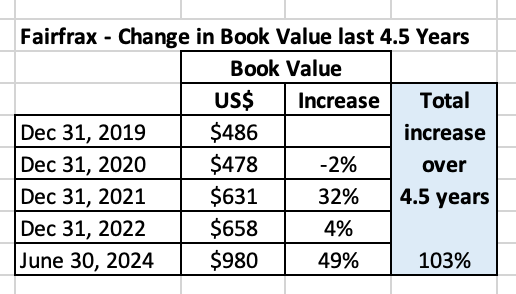

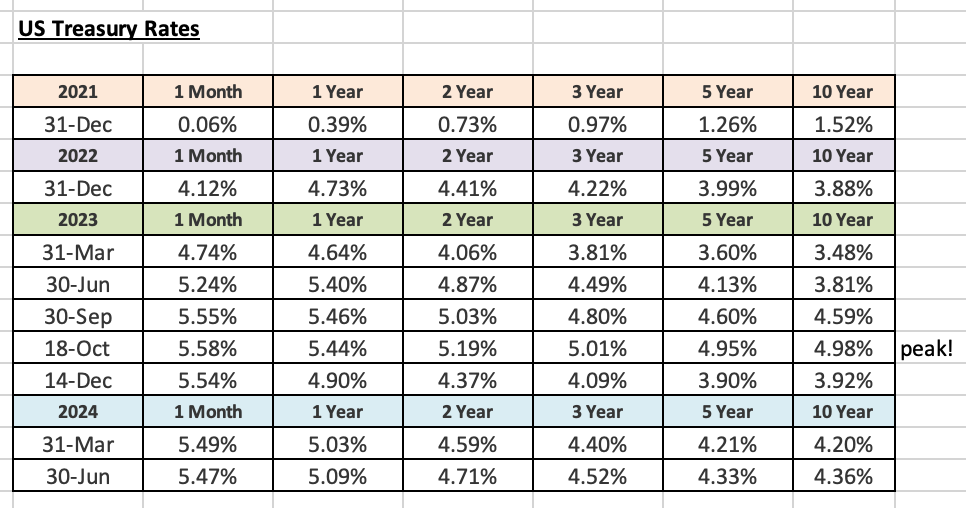

Financial Market Volatility - is it good or bad for Fairfax? (And no, this is not a trick question.) “Everyone has a plan until they get punched in the mouth.” Mike Tyson After a long absence, volatility in financial markets is picking up. The next bear market in stocks is coming - we just don’t know when or how nasty it will be. A big chunk of Fairfax’s investment portfolio is in equities (25% to 30%). Therefore, extreme volatility has to be bad for Fairfax… right? Well, maybe not. In this post we will dig into the volatility thing to see what we can learn. We will look at volatility in two very different ways: 1.) Fairfax’s ability to profit from volatility. 2.) The impact of volatility on Fairfax’s short term reported results. Given the importance of the topic, we are going to break our analysis into two posts. Part 2 should be published in the next couple of days (I have some family in town so it might be delayed). ————— Volatility - Part 1: Fairfax’s ability to profit from volatility Introduction Is extreme volatility in financial markets good or bad for a Fairfax investor? Active management matters again How has Fairfax performed aver the past 4.5 years? Volatility - Part 2: The impact of volatility on Fairfax’s short term reported results. 'New Fairfax' To come in the next couple of days. ————— Introduction Wall Street defines risk in terms of volatility - the higher the volatility, the greater the risk. Warren Buffett thinks how Wall Street looks at risk/volatility is nuts. Buffett defines risk very differently - he defines it in terms of permanent loss of capital. Importantly, Buffett’s definition is also largely focussed on the long term. Buffett looks at volatility through the lens of Mr. Market - he views volatility over the short term as opportunity. Volatility is something to be exploited by an investor. And extreme volatility? Well, that is usually where you find the really fat pitches (that ‘back up the truck’ thing). Fairfax and volatility If history can be used as a guide, long term shareholders of Fairfax should be praying for a shitstorm in the coming months (in the markets in general) and for the company’s stock to get taken out behind the woodshed. Volatility in Fairfax's stock price (in both directions) has historically been a gift for long term investors. Now don’t get wrong… I loved the relentless move higher in the share price that we have seen since October 2022, when the stock was trading at $450. We saw an increase of +150% in 22 months. Fairfax’s stock was like a goat climbing straight up a steep mountain. But investing isn’t a Disney movie. Nothing goes straight up forever. Given its dramatic move higher, Fairfax will likely trade more like a regular stock moving forward. And the average stock fluctuates about 50% (lows to highs) over the course of a year. As of today (August 7, 2024), Fairfax’s stock is down about 11% over the past week or so. ‘Investors’ are trying to read the animal entrails to determine what is going on (what is causing the short term volatility). Me? I have no idea what is causing the sell off. But I love it. Why? That is what we will explore in this post. ————— Is extreme volatility in financial markets good or bad for a Fairfax investor? Now this is a great question. With lots of interesting layers. How you answer this question really depends on your time frame: Are you a short term or a long term investor in Fairfax? For example, if Fairfax’s stock dropped 20% - well, that would likely be a terrible result for a short term trader(note I did not say investor). Who wants to own a stock as a short term investment that drops 20%? No one. But is a 20% drop in Fairfax’s share price bad for a long term investor? No, I don’t think it is. But more than that, given the current set-up, I think it would likely end up being a very good thing for a long term investor. Why? Because Fairfax would be able to take out a meaningful number of shares at a very low price. Today Fairfax is generating a record amount of free cash flow. And as the hard market in P/C insurance slows, the P/C insurance subsidiaries are generating excess cash - and they are now sending it to Fairfax (as growth in P/C insurance is slowing). Fairfax is all cashed up. And this look like the case for the next 3 years or so (3 years is as far out as our crystal ball can see). What will Fairfax be doing with all that cash? On the Q2, 2024 conference call Fairfax provided an update on their capital allocation priorities: Priority #1 - maintain a strong financial position. Priority #2 - buying back a meaningful amount of stock (that Henry Singleton thing we wrote about last week). Priority #2 used to be funding the growth of the P/C insurance companies (this has been the case since late 2019). With the hard market slowing this is no longer the case. This is a big change in priorities. So far in 2024, Fairfax has reduced effective shares outstanding by 820,000 (3.5%) at an average price of US$1,098/share. Fairfax are value investors. As a result, they only buys back shares when they can be purchased at a discount to their intrinsic value. So Fairfax thinks its shares trading at $1,100 are cheap. Fairfax’s stock closed today at $1,050. It is down 11% over the past week (after hitting an all-time high of $1,178 on July 31, 2024). If it continues to fall from here, Fairfax will get a wonderful opportunity to take out a meaningful number of shares at a very low price. Buying back a meaningful quantity of shares on the cheap is a great ‘use of capital’ for long term shareholders. When it comes to share buybacks, the lower Fairfax’s share price goes the better. The timing of buybacks Does this mean Fairfax is going to buy back a massive amount of shares in Q3, 2024? No, of course not. They might. And they might not. It is impossible to predict how many share Fairfax will repurchase in any given quarter. Fairfax has lots of good uses for its free cash flow. But i think it is a good bet that if Fairfax’s shares remain at a very low valuation that Fairfax will buy back a meaningful quantity over the next 12 to 24 months. Of course, this assumes the long term fundamentals of Fairfax’s business are not deteriorating. And I don’t think they are. But there is much more to this story - it gets even better. —————— Active management matters again When it comes to capital allocation, Fairfax is an ‘active manager.’ And they use all the tools in the capital allocation toolkit (sources and uses of cash). As we learned from Warren Buffett, fat pitches usually come at times of extreme volatility. Over the past 4 years we have had 2 bear markets in stocks (2020 and 2022) and an epic bear market in fixed income (2022/2023). How did Fairfax perform over the past 4.5 years - when Mr. Market was panicking? Fairfax made many of their best investments in ‘shit storm’ type of environments: In 2020, initiated the TRS position (getting exposure to 1.96 million Fairfax shares) at $373/share). In 2021, took the average duration of their fixed income portfolio to 1.2 years. In 2021, bought back 2 million Fairfax shares at $500/share. In 2022, took Recipe private at a very attractive price. In 2023, invested $4 billion (with Kennedy Wilson) in PacWest real estate loans (with a total return of about 10%). In 2023, extended the average duration of their fixed income portfolio to about 3 years. Fairfax also made many smaller moves from 2020 to 2022, taking advantage of very low prices, to increase their ownership in well run companies they already owned (including Fairfax India, Thomas Cook India and John Keells). The bottom line, over the past 4.5 years Fairfax has been able to exploit periods of extreme volatility, making many outstanding investments that have generated wonderful returns for Fairfax and its shareholders over time. Importantly, Fairfax was able to do this when they were cash poor. That is no longer the case. Fairfax is currently generating a record amount of free cash flow - and this looks set to continue for the next 3 years (as far out as my crystal ball looks). Now when the stock market sells off 20% it generally doesn’t feel great. And we will not know in advance with certainty what moves Fairfax will be making. But if history is any guide, extreme volatility in financial markets will likely provide Fairfax with many wonderful opportunities that they can aggressively exploit. As I said earlier, long term Fairfax shareholders should welcome extreme volatility and the opportunities it presents to Fairfax - this is often when Fairfax makes its best investments. ————— How has Fairfax performed aver the past 4.5 years? We can evaluate management by looking at a simple, yet highly instructive, metric: increase in book value per share. Change in book value per share (BVPS) As a reminder, we had bear markets in stocks in 2020 and 2022 and a historic bear market in bonds is 2022/23. This should have been terrible for Fairfax shareholders... right? This is Fairfax after all... Despite the extreme volatility in financial markets over the past 4.5 years, Fairfax was able to increase BVPS by 103%. Impressively, the volatility was heavily skewed to the upside (the biggest annual decrease in BVPS was only 2%, in 2020). Given the volatility in financial markets over the past 4.5 years, are these the annual or total results you would have expected for Fairfax? No, of course not. Fairfax’s performance over the past 4.5 years was much, much better than expected. I think there is an important lesson to be learned from this - extreme volatility is not the devil that many Fairfax watchers think it is. Change in share price In 2020, Fairfax’s share price was down 28%. This was what I like to call ‘old Fairfax.’ Fairfax had just started executing its turnaround but it was not yet recognized by Mr. Market. Sentiment in Fairfax hit rock bottom in 2020. But look at what happened to Fairfax in 2021, 2022, 2023 and so far in 2024. Fairfax’s absolute and relative performance has been outstanding (putting it lightly). The management team at Fairfax has been executing exceptionally well - among other things, they have been feasting on extreme volatility in financial markets. And this strong performance is being rewarded by Mr. Market. ----------- Part 2: The impact of volatility on Fairfax’s short term reported results To come in the next couple of days...

-

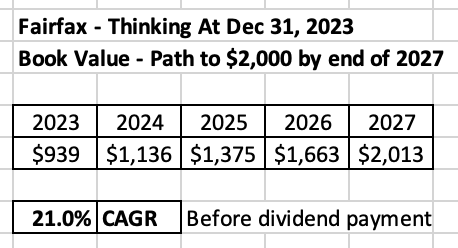

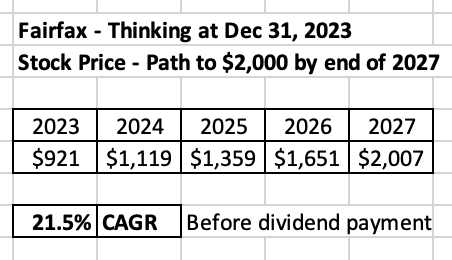

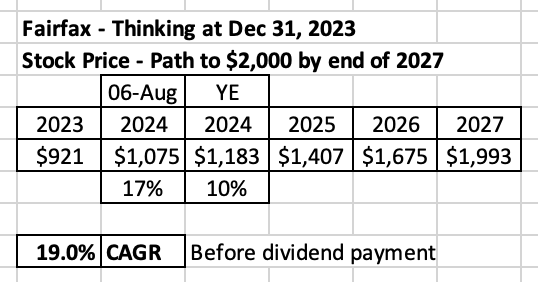

@Haryana, here is how I was thinking back in December. The question asked was pretty straight forward: "Will Fairfax book value or share price touch US $ 2000 before 2027 end." I voted "no." The book value part was the easiest. Fairfax would need to compound book value by about 22.5% (21% plus 1.5% to account for the dividend). That was higher than my base case back then. What about the stock price? This was a little harder. But not much. The share price would need to compound by about 23% per year (21.5% plus 1.5% to account for the dividend). That was higher than my base case back then. I do expect multiple expansion to happen (that is why it was harder). Where do we sit today regarding the share price? If we assume a 10% return for the last 5 months of 2024, the share price will still need to compound at about 20.5% from 2025-2027 (19.0% plus 1.5% to account for the dividend). That is still higher than my base case. What is my base case? From where we are today, I think Fairfax can deliver a CAGR of 15% over the next 4 years (including the dividend). If the stars align (a couple of large asset sales, continued multiple expansion, no big negative surprises etc) we could see a double in the share price over the next 4 years (including all dividend payments). BUT I DON'T FOCUS ON LOOKING OUT THAT FAR. My focus is on the next year or two - because that is what I can see with the most clarity. Looking a couple of years out, it really comes down to management - and i really like what the management team at Fairfax has been doing since 2018. So i am pretty optimistic about Fairfax’s prospects looking out 4 or 5 years into the future.

-

@Thrifty3000 This post is not directed at you When it comes to Fairfax, I find investors: 1.) get anchored to what happened in the past (especially the recent past). 2.) get anchored with apparent self-truths that aren’t actually truths. They then use those two faulty frameworks as important inputs into their valuation. And then they only apply it to Fairfax (not to peers). ————— 1.) Portfolio yield - Fairfax is earning a little over 7% today. I keep hearing how that is crazy high and it has to come back down - by a lot. What is the logic? Because it is too high. 2.) Combined Ratio - Fairfax is delivering a combined ratio of 94 to 95%. This has to revert to something closer to 100. What is the logic? Because insurance markets are competitive - because it is too low. The truth is… it is really all about probability distributions. - We can have a pretty good idea what might happen over the next 12 months. - We can have a good idea what might happen over the next 24 months. - We can have an idea what might happen over the next 36 months. Looking out 4 years or more for ANY P/C insurance company? There are too many variables to really have strong view.

-

@TB When you say ‘Threats to the thesis playing out’ what is the time-frame you are using for the following: b) Weaker stonk markets in India and the US. ————— Anything can happen over a one or even two way period. That is only a ‘threat’ if you are a short term trader. ————— Fairfax has made their best investments when the shit was hitting the fan and Mr Market was losing their mind. Long term Fairfax shareholders should be praying for volatility. And, unlike the past, Fairfax now has record free cash flow raining down (and the insurance subs are generating excess capital) - this should enhance their ability to exploit volatility.

-

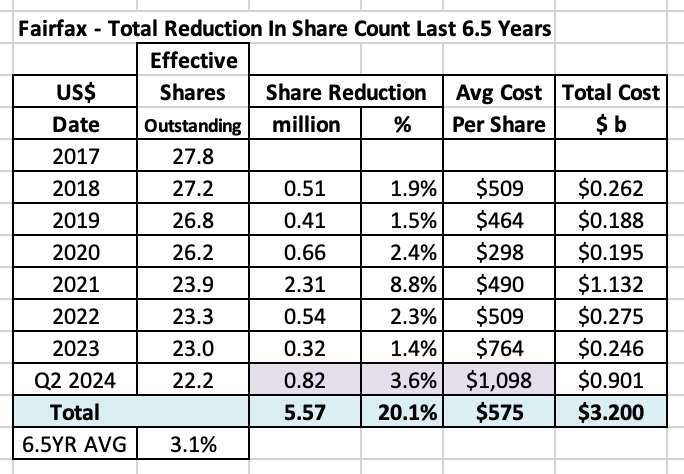

Great summary. Buffett says the most important thing in valuing a company is certainty. As you point out, we have that with Fairfax's free cash flow over the next 3 to 4 years. And it is a BIG and growing number. What do investors think? When it comes to Fairfax, they don't care about the next 3 or 4 years. Or the earnings. Or that fact Fairfax is allocating capital exceptionally well. Instead, they say... 'This is Fairfax!' And because it is Fairfax, they create new mental roadblocks - things that could go wrong. The new 'worry?' 'What will earnings be in 2027 or 2028?' 'With interest rates coming down over the past week, earnings at Fairfax are going to get killed in 3 or 4 years...' Really? I love it. It just means Mr Market is going to get Fairfax completely wrong - again. This will allow Fairfax to continue to buy back a significant number of shares at a low valuation. And that is a beautiful thing for long term shareholders. Long term shareholders already own 20% more of Fairfax (based on the stock bought back over the past 6.5 years). It looks to me like Fairfax is putting its foot down on the buyback accelerator - buybacks might continue at a very high level for the next couple of years. My guess is Mr Market can't wait to unload their Fairfax shares (that 'it's never a bad idea to take profits' thing). And this will allow Fairfax to continue to take out a meaningful quantity of shares at a low valuation. It really is a crazy good set up.

-

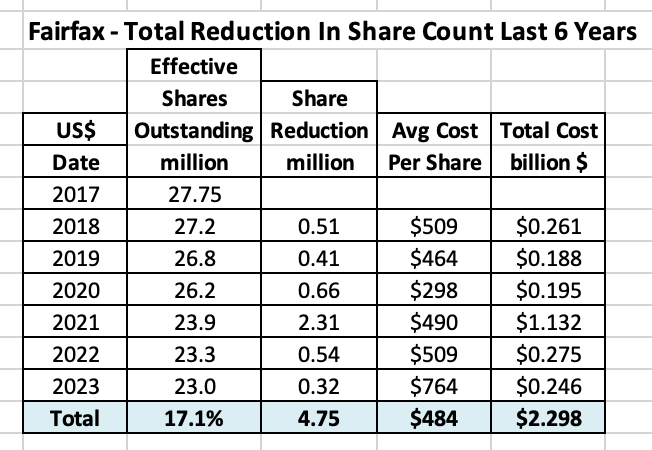

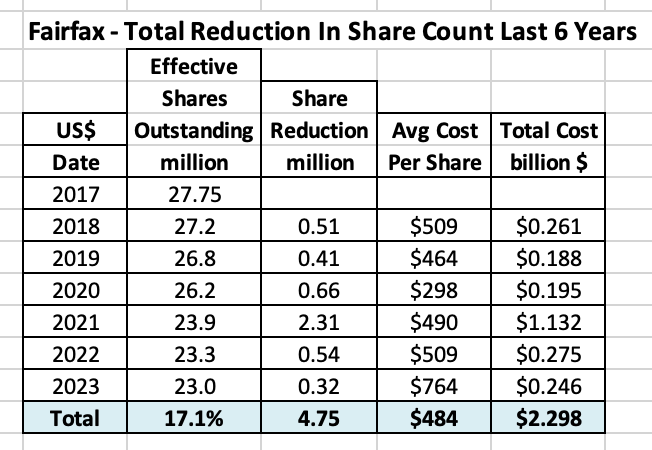

Perhaps the most important thing we learned from Fairfax's Q2 results (and subsequent conference call) concerned stock buybacks. Summary: Over the past 6.5 years, the size and profitability of Fairfax has increased dramatically. Fairfax has also been aggressively buying back a significant number of shares at a very low valuation. As a result, Fairfax shareholders now own 20% more of Fairfax’s much larger and much more profitable P/C insurance / investment operation. And it appears the company is putting its foot on the stock buyback accelerator... The big picture Three factors drive stock returns over the long term: Earnings Multiple Shares outstanding The last factor is often ignored by investors. Capital allocation Capital allocation is the most important function of a management team and stock buybacks are one of many options that are available. Share buybacks can be very beneficial for shareholders if they are done in a responsible manner (purchased at attractive prices) and sustained over many years. It is counterintuitive, but for long term shareholders a low share price can be a big benefit - if the company is buying back shares and in a significant quantity. Especially if it persists for years. How does Fairfax approach buybacks? Prem laid out Fairfax’s strategy regarding share buybacks in the 2018 annual report: “I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years.” Prem Watsa – Fairfax 2018AR Fairfax approaches share buybacks from the framework of a value investor: buy back shares when they are cheap and back up the truck when they are really cheap. What has Fairfax been doing in recent years? Fairfax’s year-end ‘effective shares outstanding’ peaked in 2017 at 27.75 million. Fairfax issued a total of 7.2 million shares in 2015, 2016 and 2017 to help fund its aggressive international expansion in insurance. The new shares were issued at an average price of about $462/share. At June 30, 2024, the ‘effective shares outstanding’ at Fairfax had fallen to 22.2 million shares. Over the last 6.5 years (2018-Q2 2024), Fairfax has reduced its share count by approximately 5.57 million shares or 20.1%. The average price paid to buy back shares was about $575/share. That is a significant reduction in shares outstanding. Did Fairfax get good value with its buybacks? The average price paid for the shares repurchased by Fairfax over the past 6.5 years is slightly higher than the price that shares were issued at from 2015-2017. Fairfax’s book value at June 30, 2024 was $980/share. Fairfax’s intrinsic value is well above its book value. Fairfax has been able to buy back a significant number of shares at a very attractive average price – at a significant discount to book value and intrinsic value. Is Fairfax done with buybacks? In 1H 2024, Fairfax reduced effective share outstanding by 820,000 shares or 3.6%. That is significantly more than the average for the past 6.5 years of 3.1% (that is the annual increase). So far in 2024, Fairfax is buying back stock at 2 times the average pace from the past 6.5 years. Why is the pace of buybacks picking up? Likely for three key reasons: Robust cash generation: Fairfax is generating an enormous amount of free cash flow. The hard market in P/C insurance is slowing: The P/C insurance companies no longer need capital to grow. In fact, the opposite is happening – the P/C insurance businesses are generating excess capital, which is being sent to Fairfax. Cheap stock: Fairfax’s stock trades at a big discount to its intrinsic value (and peers). For the stock repurchased in 1H 2024, Fairfax has paid an average price of $1,098/share. This price is a slight premium to current book value ($980/share). Importantly, book value does not include the following: “At June 30, 2024 the excess of fair value over carrying value of investments in non-insurance associates and consolidated non-insurance subsidiaries was $1,514.5 million.” This is about $68/share pre-tax. “The company's current estimated pre-tax gain on sale of its holdings of approximately 13 million common shares of Stelco is approximately Cdn$531 million (US$390 million)…” Bottom line, in 2024 Fairfax has been buying back shares at around 1x 2024 year-end ‘adjusted’ book value (if we include the two items above). That is great value. On Fairfax’s Q2 conference call, Peter Clarke suggested that Fairfax would continue to be aggressive with stock buybacks. Over the past 6.5 years, the size and profitability of Fairfax has increased dramatically. Fairfax has also been aggressively buying back a significant number of shares at a very low valuation. As a result, Fairfax shareholders now own 20% more of Fairfax’s much larger and much more profitable P/C insurance/investment operation. This is just another example of the outstanding job the management team at Fairfax has done when it comes to capital allocation.

-

This is Fairfax. We have been spoiled the past 18 months - that price action (pretty much straight up) is not normal. My guess is perhaps the stock is simply trading more along normal / volatile lines.

-

What is your top 3 business/finance/investing books you've read?

Viking replied to schin's topic in General Discussion

I think establishing an investing framework that; you are good at works is the most important thing when it comes to investing. In this regard, here are my 3 favourite books; 1.) Graham - The Intelligent Investor: Mr. Market and margin of safety 2.) Lynch - One Up on Wall Street: full of good stuff 3.) Malkiel - Random Walk Down Wall Street: for those who want the big picture (I don't agree with Malkiels conclusions) Steal the stuff that works for you. And then keep reading and learning... the rest of your life -

I hope the stock is selling off today because people are concerned about Fairfax's earnings in 2026 or 2027. Do people seriously think we are returning to a zero interest rate world? We might be. But I doubt it. Perhaps we get a growth slow down over the next year. And that causes global central banks to drop interest rates over the next year. But low rates will stoke economic growth. And I think secular forces are still inflationary: - very high government (deficit) spending - deglobalization - energy transition - geopolitical uncertainty / wars So my guess is we get a big head fake over the next year. Where people think inflation is licked. Rates go low and animal spirits kick in with a vengeance again. Only to re-kindle inflation. It might take 18 to 24 months to play out. What does this mean for Fairfax? We know they are locked and loaded for the next 2 or 3 years. After that? Who the hell knows? Good luck trying to invest today based on where you think interest rates might be in 3 years and what Fairfax will have done in the interim period. As investors, we typically want predictability and 'stability.' What I do know is volatility is usually very good for Fairfax. It provides them with great opportunity - and their execution in recent years has been stellar. It is very counter intuitive. Fairfax has a very unorthodox style / way of doing things. Mr. Market will find something they don't like (doesn't have to look hard with Fairfax.) It results in lots of volatility in the share price. If the share price stays low Fairfax will have the opportunity to take out a meaningful number of shares at a low valuation. And Fairfax has the cash. That is a wonderful set-up for long term shareholders. In the past, when Fairfax's shares sold off the company did not have the free cash flow to take out a meaningful number of shares. That is no longer the case. They are swimming in cash and they don't have a good alternative use for it.

-

Looks like volatility in Fairfax's share price is back. Love it. Fairfax's stock is currently trading at US$1,070. Book value at June 30 was $980/share. At June 30, Fairfax is sitting on non-insurance companies gains= $68/share pre tax They also will book a nice gain (incremental $300 million pre-tax?) when the Stelco sale is approved in Q4. Let's round the above two items to $60 after-tax. That puts adjusted book value at about $1,040. Fairfax's stock is trading today at a hair over 'adjusted' book value. The company is firing on all cylinders. They just released a great earnings report. They are positioned to do very well in the coming years. And they just told us that with the hard market slowing the insurance subs are generating excess capital that is being returned to Fairfax. They also just told us they think their shares are cheap and they will continue to buy them back. That is called shooting fish in a barrel. PS: Long term Fairfax shareholders are the big winners. From a capital allocation perspective, Fairfax has prioritized stock buybacks. The lower the share price the better.

-

I think you are just messing around…

-

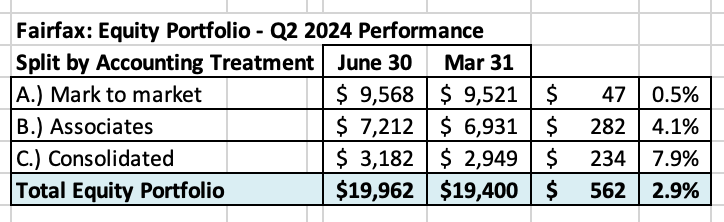

What a great quarter of results. Fairfax delivered across all key metrics: Underwriting. Interest and dividend income. Share of profit of associates. Excess of FV over CV is $1.5 billion, up from $1 billion at Dec 31. This is $500 million (pre-tax) in value creation that is NOT captured in earnings (and $1.5 billion pre-tax that is not captured in book value). Estimated pre-tax gain of $390 million from Stelco sale should be coming in Q4. Effective shares outstanding reduced by more than 800,000 in 6 months? WTF? Love it. I need to better understand the impact of buying back stock at a slight premium to book value. Currency continues to be a headwind; about $200 million hit to book value in 1H 2024. That will likely reverse at some point (Trump election win?). Tax rate in the quarter looks higher than trend… ??? Let’s see what we learn on the conference call in the morning.

-

I was a very happy shareholder the day the deal was announced - i had my biggest one day gain in my portfolio to that point. A very big chunk of my portfolio was in ORH when Fairfax took ORH private. And one of the reasons i was so heavy at the time was there was a good chance that Fairfax was going to take it out. I think i was banging the table pretty hard on the opportunity. Not every shareholder is buy and hold But that was back in the day when i was a trader. Today i am an investor (wink, wink…)

-

@cwericb This is a really interesting topic. Fairfax has a value investing framework with everything that it does - with both insurance and investments. This means you buy low and sell high. It also means you opportunistically take advantage of Mr Markets frequent mood changes. As a Fairfax shareholder i want them to do this. When Fairfax took Recipe private they paid a 50% premium to where the stock was trading at the time. Now i think Fairfax got a good price. But at the time, i thought Recipe shareholders got a very good price. Poseidon is another interesting example. My guess is lots of Atlas shareholders were not happy with the takeout price. But did they get screwed? It might look like it in a few years when Fairfax starts to monetize its position. I think taking Atlas private has been a BRILLIANT move for Fairfax shareholders. I think it is much easier/better to operating Atlas as a private company - out of the public market spotlight. Especially given everything that has happened over the past 2 years (freight rates plummeting, interest rates spiking, freight rates spiking). Importantly it has removed an enormous amount of volatility from Fairfax’s reported results - that is a topic that deserves its own post. There are also the examples of when Thomas Cook India (Covid) and John Keells (currency crisis) needed cash infusions. Fairfax stepped up but demanded its pound of flesh (restructuring and increased ownership on very favourable terms). Early in 2022, Fairfax and Fairfax India took out a large player at $12/share - a criminally low price. Sorry for my rambling post. My point is over the past 5 years Fairfax has spent an enormous amount of money increasing its ownership in companies it already owns (including its own stock). Sometimes it flexes its position up and then back down (Thomas Cook India, Quess). Their moves have built enormous value for Fairfax shareholders. I hope they keep doing what they have been doing.

-

Fairfax Q2 Earnings Preview Below are a few of the things i will be watching for when Fairfax reports after markets close today. Anything missing from my list? 1.) Digit IPO How does Fairfax have the position marked? Has Fairfax been able to sort out its final ownership position out with regulators? 2.) Insurance What is growth in net premiums written? GIG + organic… What is CR? What is level of reserve releases? Commentary on hard market? Cyber? 3.) Interest and dividend income Is it still growing? Interest and dividend income was $589.8 in Q1 2024 (and $536.4 million in Q4 2023). Is Fairfax’s investment in Kennedy Wilson’s debt platform continuing to increase in size? 4.) What is share of profit of associates? Eurobank? Chug, chug, chug? Poseidon? Are we seeing green shoots? 5.) Equities What are investment gains from equities? The equities I track suggests mark to market gains will be small in the quarter (see next point). Please note, mark to market equities in Fairfax India jumped quite a bit in Q2 - this should be a tailwind (it was a headwind in Q1). This is not captured in my model. For Associate holdings, what is the excess of market value to carrying value? This is value that is not being captured by book value. 6.) Capital allocation Asset sale / purchase: any commentary? Sale of Stelco. A nice investment gain is coming in Q3. Purchase of Sleep Country. Update on effective shares outstanding Under 22.4 million? 275,000 purchased from Prem in Q2. any commentary? Do we see Fairfax buy back another chunk from one of their minority partners in Brit, Allied or Odyssey? 7.) What is book value per share? The dividend payment in January will dent this by $15/share. 8.) Impact of change in interest rates on reported results? US Treasury rates closed out Q2 very close to where they closed out Q1. There will be two impacts: Fairfax’s fixed income portfolio IFRS 17 reporting How will it shake out? Not sure - but not concerned.

-

Why would Fairfax want to take Fairfax India private (buy out existing shareholders)? I can think of one good reason - Fairfax gets a deal. Now if Fairfax gets a deal i am not sure how Fairfax India investors also get a deal (or at least feel like they are getting one). Other than ‘good deal,’ I am having a hard time coming up with a good reason why Fairfax would want to take Fairfax India private: 1.) Fairfax already controls it. 2.) Fairfax owns 42.5% of the company. 3.) Fairfax India is very well managed. 4.) The performance of Fairfax India has been very good - measured as growth in book value. 5.) Fairfax India owns a jewel of an asset (BIAL) which represents more than 50% of Fairfax India’s total value. Fairfax India has been an exceptional investment for Fairfax. 1.) Fairfax has increased its ownership in Fairfax India from 28.1% to 42.5% at a very low average cost. That is an increase of 50% since inception. 2.) As i said earlier, the BV of Fairfax India has increased materially since inception. This is a double win for Fairfax. Future prospects for Fairfax India look very good. 1.) BIAL looks ideally positioned. 2.) An Anchorage/BIAL IPO is planned. 3.) IDBI rumours continue to swirl (what that acquisition would look like i have no idea). 4.) India’s economy looks set to rip in the coming decade. Why does Fairfax need to do anything? Especially if they have to pay fair value?

-

@nwoodman thanks for sharing. The management team at Eurobank continues to underpromise and overdeliver. As you pointed out they raised full year guidance initially provided in March. The updated guidance is below. https://www.eurobankholdings.gr/-/media/holding/omilos/grafeio-tupou/etairikes-anakoinoseis/2024/2q2024/2q2024-results-presentation.pdf

-

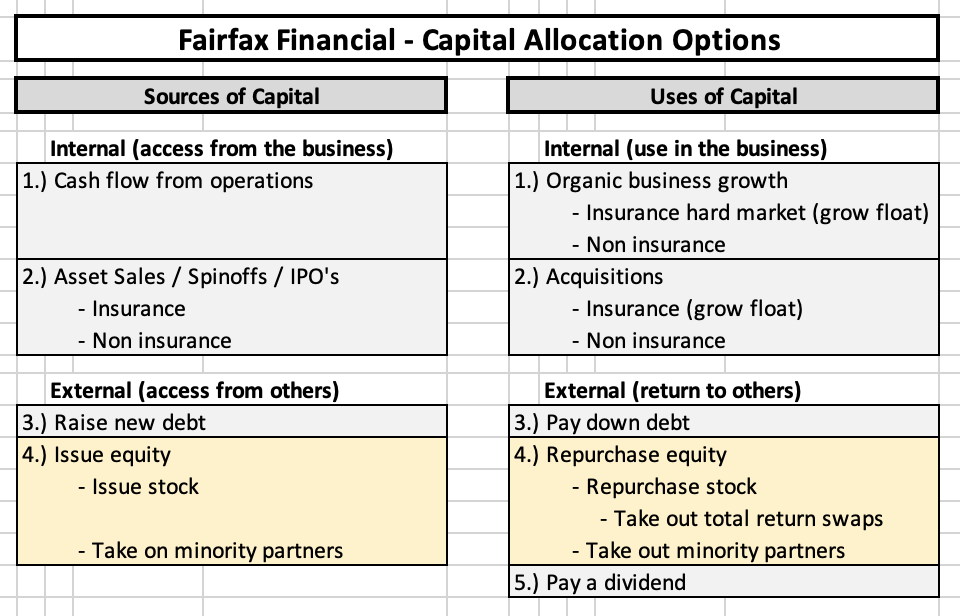

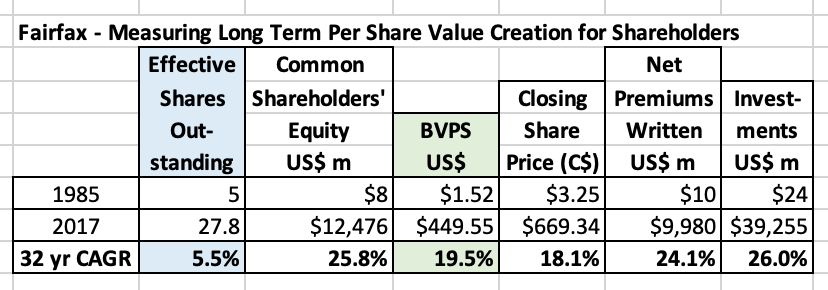

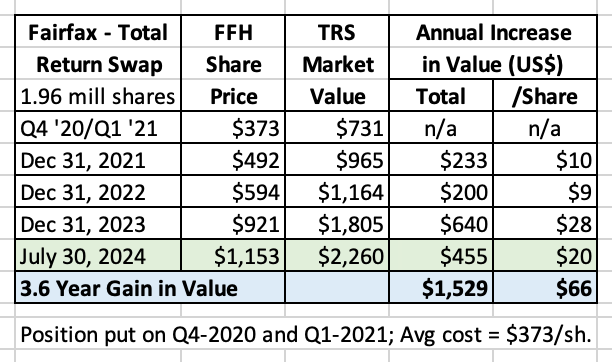

Fairfax - The Influence of Henry Singleton “History never repeats itself, but it does often rhyme.” Mark Twain In my last post I did a short review of Henry Singleton. He has been an important influence/mentor to Fairfax. Today we are going to try to connect some of the dots. We are going to focus on capital allocation and one tool in the capital allocation toolbox - shareholders’ equity. And how, when it is used properly, it can build significant long term per share value for shareholders. But remember… when comparing the present with the past we will never find an exact ‘repeat.’ That is not the point/objective of doing this exercise. However, if we look closely, we can find important examples of where the present does indeed ‘rhyme’ with the past. And that, in turn, can help improve our understanding of Fairfax - what they are doing and what they might do in the future. --------- Link to my previous post on Henry Singleton https://thecobf.com/forum/topic/20517-fairfax-2024/page/65/#comment-572533 ---------- Let’s start with the big picture A CEO has two basic responsibilities: Operations (run the business) Allocate capital When allocating capital, the basic choices available to the management team at Fairfax have been captured in the table below. In this post, we are going to focus on one tool in the capital allocation toolbox - shareholders’ equity - both as a source of capital (issuing stock) and as a use of capital (repurchasing stock). Shareholders’ equity The playbook of how a management team can use shareholders’ equity to drive long term per share value for shareholders is pretty simple: Issue stock when it is overvalued - and buy assets that are undervalued. Buy back stock when it is undervalued. Be aggressive at extremes (overvaluation and undervaluation). Keep doing both as long as conditions remain favourable. There are two key reasons this strategy works so well: Mr. Market’s behaviour can very irrational at times - and it can persist for years. The management team knows what the intrinsic value of the company is - it has a big information advantage over Mr. Market. The proper execution of this strategy over time can lead to extraordinary results for long term shareholders. Henry Singleton taught us this when he ran Teledyne. ————— Fairfax Financial - Shareholders’ Equity - A 38-Year Journey Let’s review how Fairfax Financial has used shareholders’ equity over their 38 year history to see what we can learn. We will break our analysis into two time-frames: Phase 1 - 1985 to 2017 - Building out the P/C Insurance Platform Phase 2 - 2018 to today - Optimize the Operating Businesses and Aggressively Shrink the Share Count Phase 1 - 1985 to 2017 - Building Out the P/C Insurance Platform In 1985, the year it was founded, Fairfax began its journey with 5 million shares outstanding. From 1985 to 2017, Fairfax: Issued 29.5 million shares Repurchased 6.7 million shares As a results, effective shares outstanding at the end of 2017 were 27.8 million (5 + 29.5 - 6.7) - they increased by a total of 22.8 million over the previous 32 years. Over the first 32 years of their existence (from 1985 to 2017), share issuance was used aggressively as a source of cash - and this cash was used to grow Fairfax’s global P/C insurance platform. From 1985 to 2017, Fairfax issued a total of 29.5 million shares. Shares were generally issued at a premium to book value (sometimes a significant premium). Proceeds were used to buy other P/C insurance companies trading at a much lower valuation. Bottom line, looking at share issuance in aggregate, Fairfax got good value. Share buybacks have also been a meaningful use of cash for Fairfax. From 1985 to 2017, Fairfax repurchased a total of 6.7 million shares. Repurchases were 22% of issuance - over the years, for every 5 shares that were issued, Fairfax repurchased 1 share back. Share were generally repurchased when Fairfax’s stock was trading at a discount/on sale. Like with share issuance, Fairfax got good value when they repurchased shares. So in general, Fairfax issued stock when its shares were trading at a high valuation and used the cash to buy P/C insurance companies that were trading at a much lower valuation. Fairfax also bought back modest amounts of stock at times when its shares were trading at a low valuation. This looks like it was textbook application of the principals of what a management team should do. Is there a way we can actually measure how successful this strategy has been? Yes. We can look at the change in long term per share book value (BVPS). From 1985 to 2017, Fairfax increased: the share count at a CAGR of 5.5%. common shareholders equity at a CAGR of 25.8%. BVPS at a CAGR of 19.5%. Using its stock to drive the growth of its P/C insurance platform resulted in enormous long term per share value creation for shareholders. From Fairfax’s 2017AR: ————— An important strategic change in 2017 With the purchase of Allied World in 2017, Fairfax officially completed the aggressive 32-year build out of their global P/C insurance platform. Moving forward, Fairfax would be focused on two things: Continue to do smaller bolt-on P/C insurance acquisitions. Optimize its existing insurance operations and investment portfolio. Truth be told, Fairfax got to work optimizing its insurance operations back in 2011, when Andy Barnard was appointed President and COO to manage Fairfax’s total insurance business. When it comes to investments, fixed income has always been a strength of Fairfax. The issue at Fairfax in 2017 was its equity portfolio - it was stuffed full of underperforming companies, many of which were significant cash drags (they were not delivering cash to Fairfax - they needed cash from Fairfax). By optimizing the insurance operations and investment portfolio Fairfax would be able to improve the ‘cash flow from operations,’ the most important source of cash. What was the company planning on doing with the future free cash flow? In the 2017AR, Prem told investors what was to come - Fairfax intended to get much more aggressive with share buybacks. “Henry Singleton, at Teledyne, reversed this trend (of growing share count), as you know, and over the next ten years we expect to do the same - use our free cash flow to buy back our shares!” At the time, Prem was laughed at (pretty loudly) for what he said. Let’s look at what has happened at Fairfax since then. Phase 2 - 2018 to Today - Optimize the Operating Businesses and Aggressively Shrink the Share Count What did Fairfax do? 2018-2023: Aggressively reduce the share count Effective shares outstanding at Fairfax peaked at 27.75 million in 2017. Over the past 6 years (to December 31, 2023), Fairfax reduced effective shares outstanding by 4.75 million, or 17.1%, at an average cost of $484/share. From 2018 to 2023, Fairfax was able to repurchase a significant amount of shares at a very low valuation. This is a great example of exceptional value creation by the management team at Fairfax. What does this do to the important per share metrics? Here is Prem’s slide from Fairfax’s AGM in April 2024. Before moving on, we are going to take a minute to review a couple of things Fairfax did in 2020 and 2021. Because they provide some great insight into how Fairfax thinks about and executes capital allocation. ————— Classic Fairfax - Turning Lemons into Lemonade Fairfax’s share price got historically cheap in 2020/2021. I won’t get into the reasons as to why that happened (I have covered that topic in detail in many past posts). 2020 and 2021 was a great time for Fairfax to buy back a meaningful amount of its stock. The problem Fairfax had at the time was they were cash poor. What to do? Classic Fairfax - get creative. Fairfax made two brilliant moves in late 2020 and 2021. 1.) Fairfax Total Return Swap In late 2020/early 2021, Fairfax established a position in a total return swap giving it exposure to 1.96 million Fairfax shares at an average price of $373/share. Although not technically a buyback, establishing this position serves as the next best thing. This position gave Fairfax exposure to 7.5% of its effective shares outstanding (26.2 million at Dec 31, 2020). That is a massive position. 2.) Dutch Auction In late 2021, Fairfax executed a dutch auction and repurchased 2 million Fairfax shares at $500/share. To fund the repurchase, Fairfax sold a 9.99% equity stake in their largest P/C insurance company Odyssey Group to CPPIB and OMERS for proceeds of $900 million. This was a wicked smart way to quickly source a significant amount of cash from trusted, external sources. In turn, this allowed Fairfax to capitalize on a short term opportunity (share price trading at crazy low price). https://www.fairfax.ca/press-releases/fairfax-announces-us1-0-billion-substantial-issuer-bid-and-sale-of-9-99-minority-stake-in-odyssey-group-2021-11-17/ How have these two moves worked out? 1.) The FFH-TRS position is up $1.5 billion over the past 3.6 years (before carrying costs). This has turned into one of Fairfax’s best ever investments. 2.) Fairfax’s book value is $945 at March 31, 2024. Buying back 2 million shares at $500/share only 2.5 years ago was a steal of a deal for Fairfax and its shareholders. Both of these moves executed by Fairfax scream Henry Singleton. They were: Very creative - establishing TRS and selling 9.99% of Odyssey to external partners. Very rational - Fairfax’s stock was trading at a historically low valuation. Highly opportunistic - seize the moment. Executed in scale. Both of these moves were of a significant size. Very unconventional - both were classic Fairfax moves. Most impressively, these two deals were executed at a time when investors in Fairfax were literally ‘freaking out.’ But the management team at Fairfax was not ‘freaking out.’ Instead, the management team at Fairfax saw the opportunity and made two outstanding investments - the temperament the senior management team displayed during these dark times shows, among other things, great character. This should speak volumes to investors about the quality of the management team in place at Fairfax. This bodes well for the future. It should also be noted that before Fairfax made either of these two investments, Prem told Fairfax shareholders very loudly that he thought Fairfax’s shares were dirt cheap. In June of 2020 he purchased $149 million in Fairfax shares at an average price of $309/share. https://www.fairfax.ca/press-releases/prem-watsa-acquires-additional-shares-of-fairfax-2020-06-15/ ————— OK, let’s circle around and get back on track. Has Fairfax continued to buy back its shares in 2024? My guess is when Fairfax reports Q2 results later this week, effective shares outstanding will come in at less than 22.4 million at June 30, 2024. Fairfax is on track to reduce effective shares outstanding by 1 million in 2024. This is at a much higher pace than we have seen in recent years. Why is the pace of buybacks picking up in 2024? I can think of two reasons: 1.) Low valuation: Fairfax’s stock continues to trade at a cheap valuation - its valuation is well below that of peers. 2.) Record free cash flow: Fairfax is now generating a record amount of free cash flow. It is coming from two sources: Record cash flow from operations (primarily operating income) Significant cash from asset sales Since 2018, Fairfax has been working hard at optimizing its cash flow from operations. Importantly, the equity portfolio has been fixed. All three of Fairfax’s economic engines are now performing at a high level at the same time - and they have never been positioned better for the future: Insurance Investments - fixed income Investments - equities Asset sales have historically been an important source of cash for Fairfax (and investment gains). This strength of Fairfax continues. The most recent example was the just-announced sale of Stelco. In 2023, it was the sale of Ambridge. In 2022 it was the sale of pet insurance and Resolute forest Products. All four sales were executed with the buyers all paying a premium price. As a result, Fairfax is generating record free cash flow. And this looks set to continue in the coming years. Summary From 1985 to 2017, Fairfax was focussed on building out its global P/C insurance footprint. To fund this growth, Fairfax used its stock - usually issued when the stock was trading at a premium valuation. In 2017, with the Allied World acquisition, Fairfax was officially done building out its global P/C platform. The focus of the company shifted to optimizing the cash flow from the insurance operations and investment portfolio. From 2018 to today, Fairfax has reduced effective shares outstanding by more than 19%. Fairfax was very opportunistic and shares were repurchased at a very low valuation. Over the past 38 years, Fairfax has put on a clinic on how to use shareholders’ equity to build long term per share value for shareholders. Henry Singleton would be proud of what they have been able to accomplish. But the Fairfax story is still being written. Free cash flow at Fairfax has exploded over the past three years. The size and certainty of future earnings have both markedly improved at Fairfax in recent years. Buffett teaches us that certainty is the key variable to properly value an investment. At the same time, Fairfax’s management team is best in class among P/C insurance companies - measured though the growth in book value per share over the past 5 years. Fairfax continues to trade at a significant discount to P/C insurance peers. Given what we know, this makes no sense. And if we know it, I think it is safe to say that Fairfax knows it. As a result, like Henry Singleton, it would not surprise me to see Fairfax continue to buy back a meaningful amount of Fairfax’s stock in the coming years. After all, Prem told us what the plan was all the way back in 2017. PS: This post is long. Thanks for hanging in there and making it to the end. As I was writing, it became clear to me that the influence of Henry Singleton on Fairfax goes far beyond just shareholders' equity (issuing stock at a premium valuation and then buying it back at a low valuation). Henry Singleton's influence on Fairfax was likely much bigger - how to structure the company, how to run the operations (focus on cash generation) and how to think about capital allocation (be rational, use all the tools in the toolbox, be creative, go big, don't be afraid to be unconventional etc). And to focus on building long term per share value for shareholders.

-

@Gamma78 I am not sure buying back stock will close the valuation gap. Look at Henry Singleton… he was able to buy back stock at favourable prices for a decade. Look at Berkshire Hathaway… they could have bought back meaningful amounts of stock many times over the past 50 years at good prices. There are two questions that need to be answered: 1.) what is causing the valuation gap for Fairfax (versus peers)? 2.) will stock buybacks cause the valuation gap to close? What is causing the valuation gap for Fairfax (versus peers)? - complexity of business model Fairfax uses. Lots of people don’t understand it. - non-traditional business model Fairfax uses. Lots of people don’t like it. Just look at the blowback on the board from the Sleep Country acquisition. - not Berkshire Hathaway. Lots of investors will not be happy with Fairfax until they become a clone of Berkshire Hathaway. - hangover from past mistakes. Trust, once lost, is slow to rebuild. There are more. What do other people think? Will stock buybacks cause the valuation gap to close? - buybacks will likely stop the stock from getting crazy cheap. - i am not convinced buybacks on their own will get Fairfax’s stock to more fair valuation (like 1.5 x BV). - investors/analysts are underestimating the size of earnings and the impact of reinvestment and compounding over time - so they are continue to undervalue Fairfax today. It’s like the movie Groundhog Day playing out each year. As a result, like 2024, i think Fairfax in the coming years will be able to continue to buy back a meaningful amount of stock at a great price. They could reduce effective shares outstanding by 1 million in 2024 at a price of about 1 x year end BV. That is crazy. This is really a best case scenario for long term shareholders of Fairfax. It’s like shooting fish in a barrel. Growing earnings. Materially lower share count. Like a goat going up a mountain, the important per share metrics will keep moving higher. Could investors fall in love with Fairfax again? Yes. Of course this could happen. But Fairfax will need to continue to execute well. And even then, given their style of investing, it will likely take a couple of years.

-

Poseidon is starting to look interesting to me again. The moat for this company is likely its ownership structure (collection of solid owners). Fairfax’s initial investment was likely a bet on the jockey - Sokol. The near term set-up looks interesting: - monster phase of new-build expansion strategy is almost done. - shipping rates once again are very high - so renewal rates should be solid. And perhaps this helps lock in longer average duration on leases. - interest rates easing - perhaps this helps them get their debt situation/profile optimized for the next 3 to 5 years. It looks like Poseidon’s business has stabilized. Sokol talked a good game at the Fairfax AGM. Perhaps we start to see a small tailwind develop for earnings. I wonder what Sokol has planned next for Poseidon.

-

I think share buybacks are an important input. Fairfax is open/keen to buy back stock - and a significant amount. Especially in their current phase as a company - they are likely done with big P/C acquisitions and they have robust/record free cash flow. Fairfax has reduced effective shares outstanding by about 19% over the past 6.5 years (since share count peaked in 2017). Effectively they are aggressively shrinking the size of the company. My guess is Fairfax could continue to trade at a discount to peers for years (due to complexity of business, etc). If this happens, Fairfax will have a the opportunity to continue to buy back a meaningful amount of stock over the next couple of years (3% per year). Long term shareholders of Fairfax should be praying that the stock stops going up so much Over a decade this strategy really starts to add up. One big benefit is it keeps the company small. And that makes it easier to outperform - it keeps the opportunity set large. And the impact from good decisions can be material. ————— I also don’t think Fairfax wants to become a conglomerate. It wants to have some wholly owned non-insurance businesses. Cash cows. Like Recipe and Sleep Country. This provides a steady income stream for the company that is not tied to the insurance cycle. And it provides assets that could likely be quickly liquidated at a fair price should the need ever arise. But i don’t think Fairfax wants to aggressively grow the company in the conglomerate direction. ————— This all suggests to me that Fairfax will not likely follow in Buffett’s footsteps in terms of capital allocation (in a big way) at least over the next couple of years. I see Fairfax doing more of the same (what we have seen from them since 2018). The one caveat is if we get a big stock market sell off - at the same time Fairfax is flush with cash. Back in 2008? I think they loaded up with large cap ‘quality’ US stocks - only to sell a couple of years later (for a very nice gain) because they needed cash to offset the losses from the equity hedge/short position (with hindsight, they sold their positions way too early - they admitted this in one of the later annual reports). —————- i think effective shares outstanding will be less than 22.4 million at Q2, 2024. We will know in a couple of days.