Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@valuesource The big difference I see at Fairfax today compared to 2 years ago is the size of future earnings for all important buckets is materially higher: underwriting profit + interest & dividends + share of profit of associates + investment gains (this is the most volatile). When I worked at Kraft and Saputo I used to spend weeks every fall building the next years annual business budget for the business I was managing at the time. My experience was if you get the 'big rocks' right your final forecasted numbers tend to be quite accurate (all the pieces move around but the final number comes in remarkably close at the end of the following year). To get the 'big rocks' right the key was quantifying the puts and the takes (the changes - the big business gains and losses, new products etc). I try and do the same logical build with Fairfax. Everyone can see my building blocks. And therefore can make adjustments as they see fit. I am constantly making adjustments to my Fairfax estimates - it is, after all, simply an educated guess. As new news becomes available, the estimates change. What is nice with Fairfax is interest and dividend income is now the biggest component of earnings. The run rate at Dec 31, 2022 was $1.5 billion and I expect this number will be higher when Fairfax reports Q1 results. This bucket is pretty predictable quarter to quarter and should provide a nice anchor to reported results.

-

@hobbit thanks for posting. Do you have any thoughts? 1.) is IDBI worth pursuing? 2.) what would the approximate cost be? - my assumption is FIH would need partners. 3.) how does FIH pay for it? Without current shareholders getting thrown under the bus? - or could they fund it by contributing CSB and cash ($300 million or so?) and parters pony up the rest? Is it possible for Fairfax India to do a capital raise? With shares trading at around $13 and BV at $19? Or do we see Fairfax India sell some more of the companies they currently hold? ————— Do you have any thoughts on Anchorage? Will we see something happen on this front in 2023?

-

@Munger_Disciple When i put together my forecasts for Fairfax (any company) i tend to look one or perhaps two years out. Too many variables change to try and look out 3 years and more with any precision. My current estimate is for Fairfax to achieve a 95 CR in 2023 and 2024. Same as what my estimate was for 2022. With most forecasts i usually start with the trend and then incorporate new news. Each quarter i tweak my estimate based on actual results. Too aggressive? We will see. As i get new news i will adjust my estimate. The average the past 10 years has been 95.7 and the average the past 2 years has been 94.9 (and cat losses have been quite high the past 2 years). We are still in a hard market (yes, it is slowing). Reinsurance hard market looks like it just started (property cat) - this could be very beneficial for Odyssey. We will find out with Q1 results more on this front. Fairfax continues to improve as an underwriter. Brit has been a problem in recent years and Fairfax has said they will be significantly reducing cat exposure for Brit in 2023. I think Andy Barnard has done a fantastic job over the past 10 years, including integrating all the large purchases. In terms of using a 95CR in my previous post… it was just used as a random example. I was trying to show the change in underwriting profit over 13 years.

-

Below is a 13 year history of a few key metrics for Fairfax. What are the key take-aways? 1.) Fairfax's most important business, insurance, has grown 420% (350%/share). This is a crazy amount of growth. And has vaulted Fairfax into the top 20 of global P&C insurers. 2.) Fairfax's second most important business, investments, has grown 160% (125%/share). Not as impressive as the growth in the insurance business, but solid. What is the math? Let's assume a 95CR and a 6% return on investments: underwriting + investments = total (millions) 2009 $214 + $1,276 = $1,491 = $75/share 2022 $1,114 + $3,329 = $4,442 +200% = $190/share +156% 3.) Fairfax's book value has increased 78% over the past 13 years. 4.) Fairfax's share price has increased 52% over the past 13 years. It doesn't look to me like Fairfax's BV or share price over the past 13 years have kept up with the increase in intrinsic value. --------- Yes, I am ignoring the significant increase in net debt. For reference, interest costs at Fairfax will run about $500 million in 2023. I am also ignoring minority interests (Odyssey, Allied and Brit). Cost of $200 million per year (8% of $2.5 billion)? Thoughts?

-

Book value is one of the core measures used by investors and analysts to value an insurance company. The rule of thumb is a P&C insurer is cheap when trading at a P/BV approaching 1 and it is expensive when trading at a P/BV approaching 2. Book value is an easy, and blunt, instrument. But it is what most people usually use as their 'north star'. How To Value An Insurance Company https://www.investopedia.com/articles/investing/082813/how-value-insurance-company.asp In 2019, in a shocker of a move, Buffett abandoned using book value as a measure for investors to use to value Berkshire Hathaway. ————— After 54 years, Warren Buffett abandons a valuation measure that gained 1,091,899% for Berkshire Hathaway shareholders https://ca.finance.yahoo.com/news/warren-buffett-abandons-book-value-154954927.html For Buffett, book value no longer provides the value that it once did for shareholders trying to understand Berkshire’s business for three key reasons. “First, Berkshire has gradually morphed from a company whose assets are concentrated in marketable stocks into one whose major value resides in operating businesses,” Buffett writes. “Charlie and I expect that reshaping to continue in an irregular manner. “Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mis-mark that has grown in recent years. “Third, it is likely that — over time — Berkshire will be a significant repurchaser of its shares, transactions that will take place at prices above book value but below our estimate of intrinsic value. The math of such purchases is simple: Each transaction makes per-share intrinsic value go up, while per-share book value goes down. That combination causes the book-value scorecard to become increasingly out of touch with economic reality.” ————— Book Value: a couple of definitions: The book value of a company is the net difference between that company’s total assets and total liabilities, where book value reflects the total value of a company’s assets that shareholders of that company would receive if the company were to be liquidated. Common shareholders get whatever is left over after the corporation pays its creditors, preferred shareholders and the tax man. In simplified terms, it's also the original value of the common stock issued plus retained earnings, minus dividends and stock buybacks. Keep in mind that book value and BVPS do not consider the future prospects of the firm - they are only snapshots of the common equity claim at any given point in time. https://www.investopedia.com/terms/b/bookvalue.asp ————— So what does this have to do with Fairfax? I am wondering if book value has become a pretty poor measure to use today to value Fairfax. For three reasons: 1.) over the past 13 years, earnings at Fairfax have been ‘scrambled’ repeatedly by a number of ‘one-time’ events (big losses). This resulted in low retained earnings for most of the past 13 years which in turn has stunted growth in common shareholders equity/book value. 2.) the causes of the ‘big losses’ largely no longer exist; that is why I referred to them as 'one-time' events. Future earnings will be higher and will increase retained earnings and grow common shareholders equity/book value. 3.) future prospects (which book value does not consider) for Fairfax have rarely looked better: insurance, fixed income investments and equity investments are all poised to perform at a high level all at the same time.

-

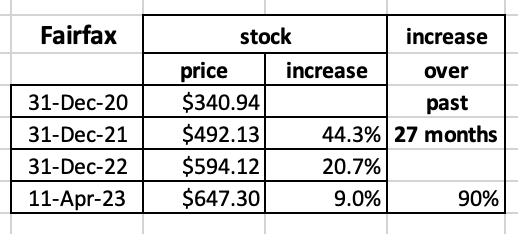

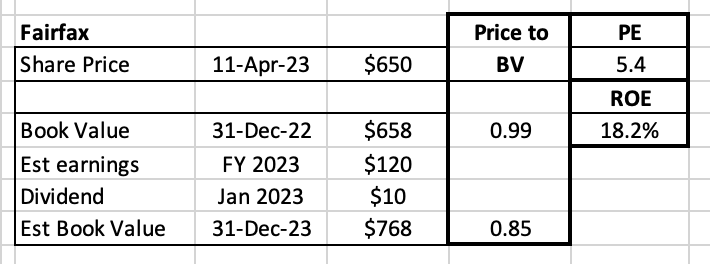

I continue to believe that Fairfax is a misunderstood company. With an increase of 90% in its price over the past 27 months, yes, the stock is up significantly. After such a big move, surely the stock is now fairly valued, and probably even overvalued. Right? Wrong. I think the stock remains dirt cheap. How can this be? 1.) the stock got historically cheap in 2020 - the starting point matters, and this was a very low starting point. 2.) despite significant mis-steps over the past 13 years, Fairfax has been executing well, especially over the past 5 years: - Insurance: Fairfax has quietly grown into a well run top 20 global P&C insurer. - Investments: Fairfax has a $38 billion fixed income portfolio that is likely best-in-class positioned for the current interest rate environment. Its $16 billion equity portfolio has improved in quality in recent years and has held up up well in the current bear market. So we have this wickedly good set up today where Fairfax, the company, has been firing on all cylinders and delivering very good results for a few years. And it is poised to continue this strong performance over the near term. And yet the stock remains very cheap. So what is the disconnect? I see two: - The primary tool investors use to value insurance companies, book value, is understated for Fairfax. Perhaps significantly so. - Investor sentiment (the multiple), while improving, is still near historically low levels. I think most people can understand why sentiment is poor. But how can book value be understated? I will try and explain my thinking in more detail in my next post (in another day or two). ————— What is Fairfax’s current valuation? My guess is Fairfax should be able to earn US$120/share in 2023 ($37/share in Q1) and another $120/share in 2024. I don’t think these are particularly aggressive estimates. This would result in Fairfax delivering an 18% ROE in 2023. The stock is currently trading at: - 1 x trailing BV (Dec 31, 2022) and 0.85 x forward BV (Dec 31, 2023) - 5.5 x est 2023 earnings On either valuation metric, P/BV or PE, Fairfax’s stock price looks very cheap, especially when compared to an expected 18% ROE.

-

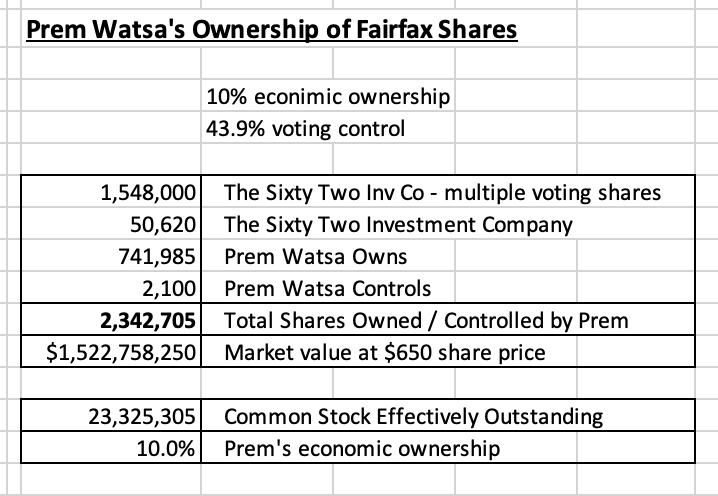

What is Prem’s ownership position in Fairfax today? 10% economic interest valued at $1.52 billion ($650/share on April 6). 43.9% voting interest. What does the mean? Prem is firmly in control of Fairfax. Two of his children serve on the board: Christine McLean and Ben Watsa. ————— How much does Prem get paid by Fairfax? 1.) Salary: $600,000/year. this salary has stayed the same for decades 2.) Stock-based compensation: unlike other executives at Fairfax, Prem does not earn any stock based compensation. For companies of Fairfax’s size this is a pretty unique compensation package. And looking t it strictly from a compensation perspective, this is a smoking hot deal for shareholders. ————— On June 15, 2020, Prem Watsa announced he had purchased 482,600 shares of Fairfax at a total cost of $148.95 or $308.64/share. With shares closing on April 7, 2023 at $650, Prem has made a paper gain of $165 million = + 110%. Not too shabby over 34 months. Prem is a value investor and he certainly nailed this purchase. The significant size of the purchase was surprising, given how much Fairfax stock he already owned. Fairfax shares bottomed out at $250 in May of 2020. Of interest, book value bottomed out at $442/share at March 31, 2020. The share price dropped to the $260 level in October of 2020. Shares were trading at prices last seen in 2007. For long term investors in Fairfax these were the darkest of days. Many capitulated and sold their shares. The sentiment index in Fairfax was flashing ‘extreme fear’. ————— Prem Watsa Acquires Additional Shares of Fairfax - https://www.fairfax.ca/news/press-releases/press-release-details/2020/Prem-Watsa-Acquires-Additional-Shares-of-Fairfax/default.aspx Mr. Watsa commented as follows in connection with this purchase: “At our AGM and on our first quarter earnings release call, I said that our shares are ‘ridiculously cheap’. That statement reflected my recognition that in the 35 years since Fairfax began, I have never seen Fairfax shares sell at a bigger discount to their intrinsic value than they have recently. I have now backed up my strong words by purchasing close to US$150 million of Fairfax shares in the market over the last few days, as I believe that this will be an excellent long term investment.”

-

The S&P is trading today where it was trading 2 years ago. That is not a great 24 month return. US inflation was 4.7% in 2021 and 8% in 2022. I think that means $1,000 invested 2 years ago is now worth $877 = - 12.3% real return. How is 2023 looking? Impossible to know. But stocks sometimes go sideways for years and years. In a high inflation environment that is not a recipe for success. What is an investor to do? Find a strategy that fits how you are wired; let’s you sleep well at night; is going to deliver the risk adjusted returns you are targeting. Buy and hold of a majority of my portfolio (for very long periods) is not a fit for me. It sounds like it is a great fit for lots of board members. That is great. My view is there is no right or wrong way. Two people can do very different things and they can both be right and very successful at the same time. I hope all investors on this board hit the ball out of the park this year.

-

That is not what the Bank of Canada is doing. Unlike the Fed, the BofC is on pause. They are in the ‘pray we have tightened enough’ stage. Because if they have not tightened enough and inflation gets entrenched in the Canadian economy they risk losing credibility. Once inflation expectations get unanchored then we are back into a 1970’s type situation. I have no idea how this plays out. Lots at stake.

-

I don’t think the Bank of Canada thinks they are stuck. They have shown their hand. They are ok with elevated inflation. They need elevated inflation and low interest rates because that is how you solve a debt bubble (over a number of years). The problem the Bank of Canada has is if, over time, they lose credibility - and people start to lose confidence in the economic system. Negative real interest rates + unprecedented fiscal spending (big government is back) + rising taxes is not a recipe for success on the inflation front. It really does look like we are headed for a 1970’s type situation, at least when it comes to inflation. This could well play out over the next 5 or so years. I am not all doom and gloom… the current set up just makes no sense to me. Personally, i am avoiding sectors awash in debt (unless its locked in at low rates for the medium to long term). if inflation remains elevated the Bank of Canada will be forced to increase interest rates. If the Bank of Canada loses credibility then we really are screwed. Not my base case. Just not sure how all the wage increases and spending gets inflation back down to anything around the targeted 2% level. The wild card is a recession… but i don’t see that as likely… employment is too strong. Interesting times.

-

@giulio nice summary. I think we might see Fairfax continue to take out minority interests in 2023. Your summary of the cost of doing so was helpful. It will be fun to watch what they do with all the free cash flow they are generating.

-

Well i am so happy that that inflation thing is just going to be transitory. For sure it is going to be coming way down over the next year to the Bank of Canada’s 2% target. 5 year bond yields are back down to UNDER 3% - the 5 year Canada bond closed today at 2.87%. WOW! ————— What else did we learn? 1.) BC minimum wage is increasing 6.9% to $16.75/hour. 2.) property taxes increased 10.7% this year 3.) Federal, Provincial and Municipal governments are all spending record amounts in new budgets. 4.) OPEC just cut supply to keep oil prices higher. 5.) BC has a significant housing shortage… and Canada’s population increased 1 million in 2022 and we are going to have record high immigration the next few years. This suggests to me housing costs/rent prices will continue higher. 6.) Many Canadians are sitting on record amounts of wealth driven by real estate boom of past 10 years. Consumer spending will likely hold up well despite higher interest rates. ————— My read is the inflation genie is officially out of the bottle. That 1970’s Show is coming to a theatre near you…

-

My understanding is GIG is an Associate holding and it is equity accounted. I don’t think it is included in Fairfax’s ‘Investments in Associates’ on their balance sheet. Perhaps because it is an insurance holding? Or perhaps because the stock is so thinly held/traded. From my perspective, the increase in market value of GIG is interesting but has little relevance in terms of what Fairfax reports. It is on my spreadsheet but i don’t include it in any of my totals. Fairfax India is similar to GIG. It is an Associate holding and it is equity accounted. I don’t think it is included in Fairfax’s ‘Investments in Associates’ on their balance sheet (it is broken out separately). My tracker includes Fairfax India, but this is not consistent with how Fairfax reports things. Another anomaly are the remaining equity positions that were part of the Riverstone Europe sale. My tracker tries to capture everything that Fairfax ‘owns’… even the Riverstone Europe stuff… and i’m not sure exactly how Fairfax reports the changes in value of those holdings quarter to quarter. There are also lots of holdings my tracker doesn’t cover (limited partnerships and other holdings) = $3.6 billion = 24% of total ‘equity’ holdings. Bottom line, my tracker is designed to capture directionally (and very roughly) what is going on with Fairfax’s equity portfolio each quarter. My estimates tend to be on the low side - to what is actually reported by Fairfax each quarter. ————— Of interest, with Allied being taken private, it will become more opaque in terms of market value. Same with Recipe and Grivalia Hospitality. These 3 holdings represent about 20% of Fairfax’s equity holdings.

-

Finland joining NATO is just one of many examples of how badly Putin / Russia mis-calculated - it has been catastrophic for Russia. There is no way to put lipstick on this pig. Prior to Russia’s invasion of Ukraine, Finland had never seriously considered joining NATO (please correct me if i am wrong). With Finland, Russia had a buffer along its northern border. No longer. Russia is much worse off. NATO is also now much stronger as an organization. Larger, with Finland and likely Sweden. With a renewed sense of purpose. And with military spending at NATO countries spiking in the coming years. Putin has made NATO a much more formidable adversary for Russia.

-

With the quarter coming to a close, my guess is Fairfax will earn about $37/share in Q1. That would put March 31 book value at US$685 = $658 + $37 - $10 div. Shares are trading today at $665 = 0.97 x BV. Fairfax also will see about a $300 million gain in the market value of its associate common stock holdings (equity accounted) in Q1. This will put the market value of associate holdings at about $575 million over carrying value (about $25/share pre-tax). This is not captured in book value. I am assuming the sale of Ambridge did not happened in Q1. When this sale closes, likely in Q2, Fairfax will book a $275 million pre-tax gain (about $10/share after tax). Fairfax also telegraphed that reported BV will be increasing as a result of shifting to IFRS-17 reporting when they release Q1 results - due to how currently elevated interest rates are accounted. Fairfax said the increase in BV will be 'material'... not sure what that means (in terms of how much). I am not expecting much in the way of share buybacks in Q1. The dividend is paid in Q1 and this is about a $250 million use of cash (common and preferred). Fairfax is now generating significant cash flow in underwriting profit and interest and dividend income each quarter (est $700 million in Q1). The sale of Resolute for $625 million also closed in Q1. The sale of Ambridge will bring in more ($275 million cash and $125 million promissory note). It will be interesting to see what Fairfax does with the all the cash. When I weave it all together: Fairfax looks poised to report a very good Q1. More importantly, 'the story' at Fairfax continues to get better. Shares continue to look cheap. My current estimate is Fairfax will earn about $122/share in 2023 = P/E of 5.5 ($665/$122). My 2023 year-end BV estimate is $770 = forward P/BV multiple = 0.86 Assumptions: 1.) underwriting profit = $330 million = flat to PY. My guess is net premiums earned will come in +10% to PY. CR will be a little higher than 2022 (when it was a stellar 93.1). 2.) interest and dividends = $350 million. Q4 2022 came in at $314 million. Fairfax said current run rate is $1.5 billion per year. 3.) share of profit of associates = $200 million. Slightly higher than PY. 4.) life ins & run-off = - $25 million. A little more than PY. 5.) other (revenue - expenses) = $50 million. Expect increase in ownership of Recipe to start to move the needle here in 2023. 6.) interest expense = $125 million. Same as Q4, 2022. 7.) corporate overhead = - $80 million. Same as PY. (no idea) 8.) net gains = $500 million. Equity gains = $375-$400 and bond gains = $100-$150 million. Mostly unrealized. 9.) income taxes = - $228 million. 19%? Guess. 10.) non-controlling interest = $110 million? Guess.

-

Well, a bit of a shocker… Looks like OPEC wants higher oil prices. OPEC+ Makes Surprise 1 Million-Barrel Oil Production Cut - https://www.bloomberg.com/news/articles/2023-04-02/saudi-arabia-makes-surprise-500-000-barrels-a-day-oil-output-cut?srnd=premium-canada Saudi leads cartel with its own 500,000 supply reduction Members including Iraq, Kuwait, UAE, Russia also contribute OPEC+ announced a surprise oil production cut that will exceed 1 million barrels a day, abandoning previous assurances that it would hold supply steady to maintain a stable market. That’s a significant reduction for a market where — despite the recent price fluctuations — supply was looking tight for the latter part of the year. Oil futures weren’t trading when the cut was announced on Sunday, but the inevitable price reaction could add to inflationary pressures across the world, forcing central banks to keep interest rates higher for longer and amplifying the risk of recession. Saudi Arabia led the cartel by pledging its own 500,000 barrel-a-day supply reduction. Fellow members including Kuwait, the United Arabia Emirates and Algeria followed suit, while Russia said the production cut it was implementing from March to June would continue until the end of the 2023. The initial impact of the cuts, starting next month, will add up to about 1.1 million barrels a day. From July, due to the extension of Russia’s existing supply reduction, there will be about 1.6 million barrels a day less crude on the market than previously expected.

-

Here is the bull case for investing in India. Prem provided the link in his annual letter. ————— From Prem’s letter: “As I was writing this to you, Mr. Athappan sent me a video by Deepak Bagla, Managing Director and CEO of Invest India, who describes the amazing transformation taking place in India. It is breathtaking and prompted me to include it in this letter! (www.youtube.com/watch?v=45PrXujlQCo)”

-

In the 'Fairfax Stock Positions' thread, I estimated Fairfax's equity portfolio is up about $680 million in Q1. About $375 million is mark-to-market = $16/share pre-tax. What about Fairfax's bond portfolio? I am thinking we might see Fairfax post a sizeable unrealized gain in the bond portfolio in Q1. Why? Bond yields, further out on the curve (3 to 5 year) are down about 40 basis points in Q1 (Dec 31 compared to March 31) and we know Fairfax was buying bonds of this duration in 2022. And this likely continued in Jan and Feb of 2023 as interest rates spiked. How big will the unrealized gain be? I am not sure. $100 million? $200 million? I know other posters on the board have a much better handle on this than i do... please feel free to chime in with your thoughts. ---------- Here is what the company had to say about interest rate risk in the 2022 AR (page 106). The change in sensitivity to rising and declining interest rates increased materially in one year. ---------- Below is the fixed income maturity profile for Fairfax (page 63 of AR). About $20 billion of Fairfax's total $30 billion fixed income portfolio will be marked at a lower interest rate March 31 (compared to Dec 31). An offset will be the impact of slightly higher interest rates on the $9 billion that is due on 1 year or less. ---------- I am looking at this largely through the lens of US Treasuries. Fairfax's bond portfolio is pretty diverse with Foreign government bonds, corporates etc. My analysis and thinking above is very top line and more directional than anything. It is not meant to be precise. Fairfax has also said repeatedly they expect the $1 billion in unrealized bond losses that were reported in 2022 to largely reverse over the near term. This should also be a tailwind in 2023, especially if we see interest rates head lower.

-

I have updated my equity spreadsheet for Fairfax to March 31, 2023. The equity portfolio that I track is up about $680 million in Q1. This gain is not surprising as equity markets are up nicely in Q1. Of the total increase, about $375 million is mark-to-market (about $16/share pre-tax). For a whole bunch of reasons, earnings for Q1 look very good; I'll have my Q1 earnings update for Fairfax out in another day or so. Big movers in Q1: 1.) Eurobank +$234 million 2.) FFH TRS +$139 million - mark-to-market 3.) Stelco +$78 million 4.) Fairfax India +$75 million 5.) Mytilineos +$63 million - mark-to-market Importantly: 1.) Resolute Forest Products sale closed in Q1. I will remove Resolute from the list after Fairfax reports Q1 results (in May). 2.) Altas take-private has closed in Q1. This is Fairfax's largest equity holding at $2 billion = 13% of total equity portfolio. With recent take-private transactions (Recipe in Q4) moving forward we will see much lower volatility in the equity portfolio from a reporting perspective. ----------- For board members who might not know... my spreadsheet attached below has a number of tabs you might find useful: Tab 1: FFH 23 = where I track Fairfax's various equity holdings Tab 2: Size = equity weightings - not completed (in process) Tab 3: Moves = various purchases/sales Fairfax has made going back to 2010 Tab 4: 2023 Earnings Estimate = with history back to 2016 Tab 5: Premiums = net premiums written going back to 2014 - also includes losses from equity hedges and CPI positions (2010 to 2020) Tab 6: Interest = interest and dividends going back to 2010 Tab 7: Associates = Associate holding and earnings going back to 2017 There are other tabs... most of which have not been updated in a while. Fairfax Equity Holdings March 31 2023.xlsx

-

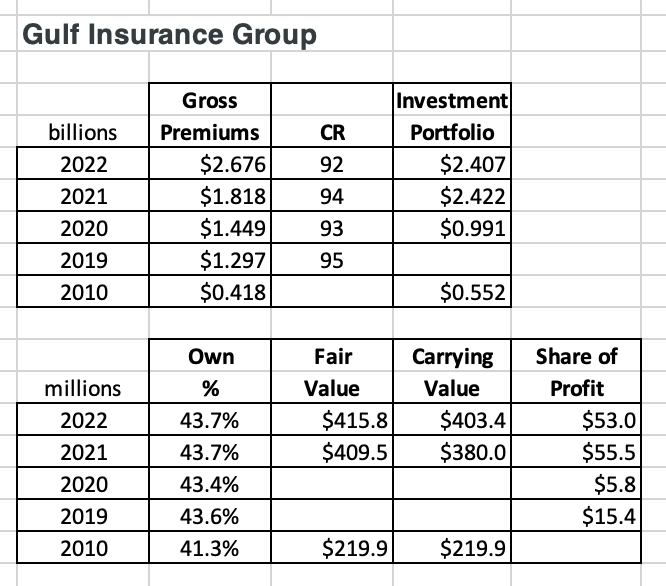

Gulf Insurance Group (GIG) just finished an outstanding year in 2022. @glider3834 thanks for the 'heads up'. GIG's acquisition of AXA Gulf operations in 2021 is looking like a very good purchase (cheap price, quality businesses, solid strategic fit). ————— But before we dig in a little on GIG, let’s take a step back. One thing that makes Fairfax very different from many of its P&C insurance peers is the scale and size of its international insurance operations. Why go international? One of Prem’s early mentors was John Templeton. Templeton was an investor in Fairfax and he and Prem had a close relationship. John’s great niece, Lauren Templeton, sits on Fairfax’s board today. https://www.brokenleginvesting.com/ultimate-guide-john-templeton-investing/ ————— In 2010, Fairfax invested $217 million for a 41.3% interest in Gulf Insurance. Fairfax partnered with KIPCO (Kuwait), the controlling shareholder of Gulf Insurance. Who is KIPCO? Kuwait Projects Company (Holding) – KIPCO – is a holding company that focuses on investments in the Middle East and North Africa. It’s strategy of acquiring, building, scaling and selling companies in the MENA region has worked successfully for over 30 years. https://kipco.com GIG became the vehicle for Fairfax to grow its insurance business in the MENA region (Middle East North Africa). The growth for the next 10 years was largely organic. Late in 2020, as the world was struggling with covid, GIG opportunistically agreed to purchase the insurance operations of AXA Gulf & Yusuf Bin Ahmed Kanoo for $475 million. This purchase almost doubled the size of GIG (it was a big, bold move). Parent AXA was looking to re-build its capital levels due to losses experienced from covid. The purchase closed in Sept of 2021. Fairfax did invest new money in GIG (as did KIPCO) in 2021 to keep its ownership in GIG steady at 43.7% (not sure exactly how much they spent). 2022 was the first full year of results for GIG post acquisition. How did they do? Very well. net profit = US$125 million (Fairfax’s share = $55 million) net profit increased $48.4 million from 2021, due to improvement in underwriting and investments performance results gross written premiums = $2.7 billion = +52% vs PY dividend = 54 fils/share = US$0.175/share (up from 40 fils paid in 2021?) https://www.gulfinsgroup.com/Renderers/Showmedia.ashx?Id=72136334-9e40-4a0b-829f-5ba8afaad28e&download=false The shares of GIG are publicly traded. However, they are thinly traded, with Kipco and Fairfax owning together something like 95%(?). Shares recently increased in price from 105 fils to 142 fils, which puts total market cap of GIG at $1.3 billion at March 31. Seems reasonable for a growing business that is earning $125 million/year. Fairfax’s stake has increased in value over the past quarter to $570 million (March 31) from $400 million (Dec 31) - assuming the current share price is accurate. Fairfax has a carrying value for GIG of $403.4 million (Dec 31, 2022) versus $380 million (Dec 31, 2021). Dividend payment to Fairfax in 2023 will be = $0.175/share x 123 million = $21.5 million It appears GIG has become a permanent holding for Fairfax. ————— ————— Prem’s Letters in Past Annual Reports 2022 Gulf Insurance Group had another excellent year led by CEO Khaled Saoud Al-Hasan and GIG Gulf CEO Paul Adamson. 2022, the first full year with GIG Gulf results, produced gross premiums of over $2.5 billion and a combined ratio of approximately 92%. We have a wonderful partnership with Kipco, led by CEO Sheikha Dana, in the ownership of Gulf Insurance. Bijan (Khosrowshahi), along with Jean Cloutier, have been deeply involved with Gulf Insurance Group in the Middle East as well. After the acquisition of AXA Gulf (now GIG Gulf) in 2021, Gulf Insurance is one of the most prominent players in the region. Led by Khaled Al-Hasan, with Paul Adamson running GIG Gulf as a standalone unit, Gulf Insurance will be an increasingly important contributor to Fairfax. ————— 2021 I mentioned this to you in last year’s annual report but it bears repeating. We have had a wonderful partnership with Kipco in the ownership of Gulf Insurance Group (GIG) in Kuwait. GIG is run by Khaled Saoud Al- Hasan, until just recently under the chairmanship of Faisal Al-Ayyar, the CEO of Kipco. GIG had $1.8 billion (including four months of AXA Gulf) in premiums in 2021, more than 3 times the premiums in 2010 when we became a partner (our interest is 44%). Khaled has an outstanding track record with an average combined ratio of 95%, with excellent reserving. As mentioned last year, GIG acquired AXA Gulf (now GIG Gulf) on September 7, 2021, which had $1 billion in premiums in 2021 and a combined ratio of 93%. The new GIG, operating in 13 countries with $2.6 billion in gross premiums, will be a force to be reckoned with. Paul Adamson and his team have done an outstanding job at AXA Gulf. From Fairfax, Bijan Khosrowshahi, Jean Cloutier and Quinn McLean have been very involved in the success of our partnership with GIG. It is with great regret that I have to announce that our partner, Faisal Al-Ayyar, has recently retired after a stellar 30+ year career with Kipco. He has been a wonderful friend and partner to Fairfax and myself and we will miss him greatly. We wish Faisal and his family much happiness and good health in his retirement. Sheikha Dana is the new CEO of Kipco and our partner at GIG. We look forward to working with her in the years to come. Working closely with Fairfax Latam and Colonnade, Bijan Khosrowshahi has provided valuable experience and insights that have been a significant factor in the success of these operations. Bijan, along with Jean Cloutier, has also been intimately involved with GIG in the Middle East. We own 44% of GIG, alongside Kipco. In 2021, GIG completed the acquisition of AXA Gulf, vaulting the combined operations well over the $2.5 billion gross premium mark. AXA Gulf (now GIG Gulf ) will operate on a decentralized basis within GIG, and will continue to be managed by Paul Adamson. We are thrilled to welcome Paul and his colleagues into the greater Fairfax family. During 2021 the company exercised judgment in determining it had significant influence over Gulf Insurance pursuant to arrangements related to its sale of RiverStone Barbados as described in note 6. On February 8, 2021 the company entered into an arrangement to purchase (unless sold earlier) certain portfolio investments owned by RiverStone Barbados as described in note 23 and subsequently commenced applying the equity method of accounting to its interest in Gulf Insurance pursuant to that arrangement. Investing activities for the year ended December 31, 2021 Purchases of investments in associates of $175.4 primarily related to increased investments in Gulf Insurance, HFP and a Fairfax India associate. ————— 2020 Last year, I discussed our wonderful partnership which we entered into in 2010 with Kipco in Kuwait through its Vice Chairman Faisal Al-Ayyar. The performance of Gulf Insurance Group (‘‘GIG’’), run by Khaled Saoud Al Hasan, has been excellent, tripling gross premiums to $1.4 billion with a combined ratio of 95% since 2010. On November 30, 2020, the company announced the acquisition of AXA’s operations in the Gulf region. This will add over $900 million in gross premiums written with a combined ratio running below 95%, providing GIG access to new markets in Oman and Qatar and increasing its operations in Saudi Arabia, Bahrain and the UAE. We are very excited about the tremendous long term opportunity this presents for GIG. We welcome Paul Adamson and the AXA Gulf Group employees to our partnership with Kipco. ————— 2019 Gulf Insurance Group (‘‘GIG’’) is a wonderful partnership we entered into in 2010 with Kipco in Kuwait through its Chairman, Faisal Al-Ayyar. GIG, run by Khaled Saoud Al-Hasan, operates in 11 countries in the Middle East. In 2019 it wrote $1.3 billion in gross premiums and had a combined ratio of 95%. Since we acquired our interest, Gulf has had an average combined ratio of 95% and gross premiums have almost tripled. ———— 2010 Gulf Insurance consolidates our interests in the Middle East In 2008 we mentioned to you that we had purchased approximately a 20% interest in Arab Orient run excellently by Isam Abdelkhaliq and controlled by Karim Kabariti (Chairman of Jordan Kuwait Bank). Through Karim we met Faisal Al Ayyar, Vice Chairman of Kipco, the controlling shareholder of Gulf Insurance and Jordan Kuwait Bank and the ultimate controller of Arab Orient. Under Faisal’s leadership, Kipco has had an outstanding track record over the past 20 years, increasing shareholder value by building businesses with an Arab world focus. Kipco’s book value per share has compounded by 16% per year over the past 13 years and the stock price has followed suit. We paid $217.1 million for a 41% interest in Gulf Insurance, with Kipco having a 43% interest, and Gulf Insurance purchased our shares of Arab Orient at our cost of $11.2 million to increase Gulf’s ownership of Arab Orient to 89%. Gulf Insurance, which has been in business since 1962, operates in seven countries in the Middle East and North Africa and is the premier property and casualty company in the region. In 2010, Gulf Insurance wrote $417.6 million in gross premiums and earned $33.2 million, with a consolidated investment portfolio of $552.0 million; its combined ratio has averaged 94% over the past ten years. We are excited to be partners with Faisal and his management team at Kipco and our team of Bijan Khosrowshahi, Jean Cloutier and Steve Ridgeway look forward to working with Khaled Saoud Al-Hasan, the CEO of Gulf Insurance, and the presidents of the seven insurance companies belonging to Gulf Insurance. We continue to separately own a 20% interest in Alliance Insurance Company in Dubai, led by Wisam Al Haimus. Wisam had another outstanding year with a combined ratio of approximately 74% in 2010. Investment in Gulf Insurance On September 28, 2010, the company completed the acquisition of a 41.3% interest in Gulf Insurance Company (“Gulf Insurance”) for cash consideration of $217.1 (61.9 million Kuwaiti dinar) inclusive of a 2.1% interest in Gulf Insurance which the company had previously acquired for cash consideration of $8.5 (2.0 million Kuwaiti dinar). Subsequent to making its investment, the company determined that it had obtained significant influence over Gulf Insurance and commenced recording its 41.3% interest in Gulf Insurance using the equity method of accounting. The equity accounted investment in Gulf Insurance was reported in the corporate and other reporting segment. Following the closing of this transaction, the company sold its ownership interest in Arab Orient Insurance Company (“Arab Orient”) to Gulf Insurance for proceeds equal to the original cost paid to acquire this investment. Gulf Insurance is headquartered in Kuwait and underwrites a full range of primary property and casualty and life and health insurance products in the Middle East and North Africa. ========== Acquisition of AXA Gulf & Yusuf Bin Ahmed Kanoo Gulf Insurance Group CEO Khaled Saud Al-Hassan said in an interview with “Al Arabiya” today, Tuesday, that the acquisition of the entire stake in “AXA Gulf” by Gulf Insurance is part of the group’s strategy to increase revenue and its presence in the Arab region. He added that Gulf Insurance is currently present in 11 countries and its revenues totaled $ 1.5 billion in 2020, and the acquisition is part of the board’s policy for regional expansion and leadership in Arab insurance markets. operations and net profit. Gulf Insurance Group CEO explained that Gulf Insurance Group is present in countries including Egypt, Algeria and Turkey, as well as other Arab markets, and these countries account for 50% of the group’s total revenues and Kuwait accounts for the remaining percentage. Khaled Saud Al-Hassan indicated that the acquisition of AXA Gulf will increase the group’s revenues to $ 2.5 billion, making it the largest player in the Arab insurance market and is present in 13 countries, adding Qatar, Oman and Abu Dhabi after the acquisition, in in order to serve customers and shareholders. - https://asumetech.com/gulf-insurance-in-al-arabiya-the-acquisition-of-axa-brings-revenues-to-2-5-billion-dollars/ —————

-

@wondering i think there are segments within ‘commercial’, like office, that could really struggle moving forward. i am no expert Blockworks has a second YouTube video out today on commercial real estate that i have not listened to yet.

-

The bull story for Fairfax in 2022 was driven primarily by their short duration bond portfolio and rising interest rates. Interest income increased every quarter in 2022 and this will continue in 2023: 2021 = $568 million in interest income 2022 = $874 million 2023 = $1.4 billion (my current estimate) The recent US banking panic has brought the interest rate risk in owning a bond to the forefront. The next shoe to drop is likely going to be credit risk - specifically commercial real estate. Fairfax was perfectly positioned to thrive with rising interest rates. How is Fairfax positioned from a credit risk perspective? It looks like Fairfax is, once again, very well positioned. Why? The vast majority of Fairfax's fixed income portfolio is invested in cash/short term/government securities. Other P&C insurers are primarily invested in corporates and MBS (see RBC chart at bottom of post). Fairfax's Fixed Income Portfolio: cash/short term................ $10.4 bill 26% sovereign government..... $19.0 48% Can provincial / US state... $0.5 1% Corporate & Other............... $7.0 18% 1st mortgage loans............. $2.5 6% 60% loan-to-value Total................................... $39.4 Credit Risk At December 31, 2022, 80.1% (December 31, 2021 – 65.1%) of the fixed income portfolio’s carrying value was rated investment grade or better, with 60.6% (December 31, 2021 – 39.1%) rated AA or better (primarily consisting of government bonds). At December 31, 2022 the fixed income portfolio included the company’s investments in first mortgage loans of $2,500.7 (December 31, 2021 – $1,659.4) secured by real estate predominantly in the U.S., Europe and Canada, with a weighted average loan-to-value ratio of approximately 60%, reducing the company’s credit risk exposure related to these investments. Refer to note 24 (Financial Risk Management, under the heading “Investments in Debt Instruments”) to the consolidated financial statements for the year ended December 31, 2022 for a discussion of the company’s exposure to the credit risk in its fixed income portfolio. ---------- Most P&C insurers have +50% of their fixed income portfolio invested in corporate bonds and MBS; some are as high as 60-70%. These same insurers saw the value of their fixed income portfolios fall dramatically in value in 2022 due to rising interest rates.

-

Is Concentration a better strategy than Buy and Hold?

Viking replied to Viking's topic in General Discussion

@Spekulatius i agree highly concentrated portfolios, if given enough time, stand a pretty good chance of blowing up. However, there are exceptions to every rule. Here is a real life example. Steve Jobs passed away late in 2011. Apple stock did well until Sept 2012 where it peaked out at $25 (split adjusted). But from Sept 2012 to June 2013, Apple stock continued to fall all the way to $14 = 45% decline from its high. Why? The narrative around the company completely changed. Android was generating a lot of buzz. Samsung was riding the wave (holding their own glitzy Galaxy events). And the world decided that with Steve Jobs no longer around that Apple was about to pull a RIM/Blackberry and Nokia and be the next smartphone maker to disappear. Except Apple’s business was growing like stink… yes, there were ebbs and flows… and the odd mis-step… but the business was growing nicely. Its ecosystem was starting to take hold (IOS and iPods, iPad, iPhone and Macs). I asked my kids… did their network of friends own iPhone’s or Samsung devices? 80% were iPhone (even their South Korean friends owned Apple). Earlier in 2012 we made the plunge as a family into Apple products: Mac - goodbye Intel/Microsoft, multiple iPhones, multiple iPads, multiple iPods. What i learned quickly was the customer service at Apple was exceptional. And the products worked very well - and they worked well together. I started to fully appreciate power of the network effects. I started buying Apple stock in Q4 2012. And every month the stock kept falling. But my read was the story at Apple was actually getting better. So i kept buying more every month (getting more concentrated). The stock kept falling, the story kept getting better and i kept buying. By year-end i was 100% invested in Apple. All during this time i was probably spending 20 hours a week researching Apple and the industry. Month after month. June 2013 was the bottom in the stock. From that point the stock went pretty much straight up for the next 20 months to $33. i did my usual thing on the way up… i lightened up and locked in solid gains. What exactly was the risk i took in Dec 2012 when i went all-in? Was Apple going to blow up like RIM/Blackberry and Nokia? No. Was Android operating system going to replace IOS? No. Was Samsung devices going to replace Apple devices? No. China was also just starting to take off as a smart phone market and the open question was whether affluent Chinese would prefer an American (Apple) or South Korean (Samsung) device as a STATUS SYMBOL. Of course they chose American (understanding a little history helped here). What happened with ‘Apple the stock’, was investors temporarily lost their collective minds. From my perspective their are unique times when a concentrated portfolio makes sense. But only for short periods of time. I will admit being 100% invested in Apple did weigh on me at times. Here is the really interesting thing: If there was a learning from my Apple experience it is probably that i never should have sold a share. I was completely out of the stock by 2016 (right around the time Warren Buffett STARTED buying shares in Apple). Would have delivered me a better return. And saved me a bunch of time. Would owning a 100% position in Apple stock for the past decade really be more risky than owning ‘an average’ small business? Some good did come out of selling my Apple position much too early. I sold Apple because it had gone up a lot in price. Peter Lynch says you should sell a stock primarily because the story changes / gets worse; NOT simply because it has gone up a lot in price. Makes sense. Since selling Apple i think i have been more patient holding winning positions. Fairfax is a good recent example of this - i have owned a core position for about 18 months. Yes, Fairfax stock is way up the past 18 months. But the story has also improved dramatically. -

In 2022, with underwriting income of $389 million, the top performing insurance sub at Fairfax was Allied World. Fairfax purchased Allied World back in 2017 for $4.9 billion (1.3 x book value). Fairfax made a number of acquisitions in 2015 (Brit), 2016 (international) and 2017 (Allied) and Allied was, by far, the largest. To fund the purchase of Allied, Fairfax (67.4%) partnered with OMERS, AimCo and 2 other investors (32.6%). In 2022, Fairfax's largest 'investment' was the $733 million spent to increase its ownership in Allied from 70.9% to 82.9%. Fairfax has the option to purchase the remainder of Allied World from the minority partners until September of 2024. Given Allied World's strong performance and solid future prospects, my guess is Fairfax will want to continue to increase its ownership in Allied World in 2023. My estimate is Fairfax will be able to generate in excess of $2.7 billion in 2023 from underwriting income and interest and dividend income - so it should generate the cash to buy back another significant portion of Allied World. Increasing its ownership in Allied World is a significant win for Fairfax shareholders as they will own a larger percentage of Allied's growing earnings. Some on this board have described buying out minority shareholders is like Fairfax doing a share buyback of its own stock. It is a low risk / high return use of capital for Fairfax. ---------- To partially fund its purchase of Allied World in 2017, Fairfax issued a little over 5 million shares at $433/share. From 2018 to 2022, Fairfax repurchased 4.4 million shares at an average cost of $464/share. Fairfax has been very opportunistic in recent years buying back shares at very attractive prices. As a result, the significant dilution caused by the Allied World acquisition has almost been entirely reversed. And Fairfax now owns a larger stake in a company that has more than doubled in size over the past 5 years. The acquisition of Allied World in 2017 was very opportunistic: the company was purchased at 1.3 x book value and right before the onset of a hard market (which began in late 2019 and continues in 2023). Bringing in minority partners to help fund the purchase was very creative. I must admit i still do not understand all the puts and takes of the deal with OMERS/AimCo - they carry a high cost (8% dividend?) but allow Fairfax the ability to increase its ownership when it has the cash. ---------- How much would Allied World be worth today as a stand alone company? Net written premiums (2023 est) = $4.9 billion x 95% CR = $245 million Investment portfolio (Dec 31, 2022) = $11.5 billion x 5% avg return= $575 million ---------- It should be remembered the purchase of Allied World did not start out well. The deal closed in July of 2017. And then 3 major hurricanes hit the US. In the 2H of 2017, Allied World booked a $600 million pre-tax loss at Fairfax. Ouch! ---------- From Prem's 2022 letter: "Allied World produced $389 million of underwriting profit in 2022 from a combined ratio of 91%, also its best performance as a Fairfax company. After growing net premiums written 14% last year, Allied is now double in size from when we purchased it in 2017. Allied’s expense ratio continued to decline in 2022, now running at an industry leading 20%. Lou Iglesias and his management team have done an outstanding job aggressively expanding over the last several years in the market segments which experienced the strongest growth." ---------- ---------- From 2022AR: “On September 27, 2022 the company increased its ownership interest in Allied World to 82.9% from 70.9% for total consideration of $733.5, inclusive of the fair value of a call option exercised and an accrued dividend paid, and recorded a loss in retained earnings of $228.1 in net changes in capitalization in the consolidated statement of changes in equity. The decrease in carrying value of Allied World’s non-controlling interests primarily reflected the company’s increased ownership interest in Allied World, dividends paid and the non-controlling interests’ share of Allied World’s net loss. On April 28, 2022 Allied World paid a dividend of $126.4 (April 28, 2021 – $126.4) to its minority shareholders. The company has the option to purchase the remaining interests of the minority shareholders in Allied World at certain dates until September 2024.” ---------- From 2017AR: "Acquisition of Allied World Assurance Holdings AG: On July 6, 2017 the company completed the acquisition of 94.6% of the outstanding shares of Allied World Assurance Company Holdings, AG (‘‘Allied World AG’’) for purchase consideration of $3,977.9, consisting of $1,905.6 in cash and $2,072.3 by the issuance of 4,799,497 subordinate voting shares. In addition, Allied World AG declared a special pre-closing cash dividend of $5.00 per share ($438.0). Contemporaneously with the closing of the acquisition of Allied World AG, Ontario Municipal Employees Retirement System (‘‘OMERS’’), the pension plan manager for government employees in the province of Ontario, Alberta Investment Management Corporation (‘‘AIMCo’’), an investment manager for pension, endowment and government funds in the province of Alberta, and certain other third parties (together ‘‘the co-investors’’) invested $1,580.0 for an indirect equity interest in Allied World AG. The remaining 5.4% of the outstanding shares of Allied World AG were acquired on August 17, 2017 for purchase consideration of $229.0, consisting of $109.7 in cash and $119.3 by the issuance of 276,397 subordinate voting shares, in a merger transaction under Swiss law pursuant to which Allied World Assurance Company Holdings, GmbH (‘‘Allied World’’) became the surviving entity. This merger resulted in the co-investors holding an indirect ownership interest in Allied World of 32.6%. The co-investors will have a dividend in priority to the company, and the company will have the ability to purchase the shares owned by the co-investors over the next seven years. Allied World is a global property, casualty and specialty insurer and reinsurer." “As you can see, while this acquisition increased our gross premiums, investment portfolio and common equity by about 30%, our shares outstanding grew by only 22%. Although we issued the Fairfax shares at a 6% premium to book value while we purchased Allied World at a 32% premium to book value, we are confident that the high quality of Allied World, let by Scott Carmilani, will make this an excellent acquisition for us, but we were not pleased at issuing our shares at only a 6% premium to book value.” "Allied World became part of the Fairfax group in 2017, and it sure entered with a bang! As a prominent writer of catastrophe risk, Allied World was not spared the worst of the losses in the second half of the year. At Fairfax, we were unfortunately deprived of Allied World’s favorable results from the first half of the year. Hence, for the six months Allied World’s results are included in Fairfax, its combined ratio was an unpleasant 157%. As we turn the page into 2018 and beyond, we expect big things from Allied World, carrying on the consistent excellence of every one of the 15 pre-2017 years since it began. Scott Carmilani and his team are savvy operators, and they give us a prominent presence in markets in which we have heretofore had a limited presence." -------- Link to video: overview of Allied World (from company's web site) https://alliedworldinsurance.com/wp-content/uploads/sites/2/2023/01/Our-Culture-2023.mp4

-

SU. Looks like financial panic is abating. So oil, which got absolutely crushed over the past 2 weeks, is popping higher... makes perfect sense Oil stocks, like SU, look crazy cheap.