Viking

Member-

Posts

4,930 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@Haryana yes, my July 11 comments was discussing my holdings of Fairfax and Fairfax India. At the time i was 100% Fairfax and 0% Fairfax India. And yes, at the time, i had other investments. Sorry for the confusion.

-

@Haryana to be clear, i did not move from zero to 30% cash. I always have a cash balance that i flex up and down depending on the opportunity set. My ‘way overweight’ position in Fairfax has not changed the past couple of months - I continue to think the stock is still wicked cheap (despite hitting all times highs). ————— Posted on Tuesday: “Cash. It has been a great year. Time to get more defensive. Lock in gains. Back up to 30% cash. Get paid close to 5% risk free to sit in the weeds and wait and see what Mr Market pukes up next. The move higher in bond yields is what i am watching right now. How high can they go?” “i am not turning bearish. Or bullish.”

-

When it comes to pay, you get what you are able to negotiate. If you have leverage, you earn more. If you have no leverage you earn less. From my perspective, there is no ‘right’ or ‘wrong’ amount. In a tighter labour market, like today, it makes sense labour has a little more leverage (in general) and therefore will attempt to extract more. No idea how it all plays out.

-

Balanced summary of how messed up Canadian / Indian relationship is. - https://www.theglobeandmail.com/opinion/article-the-real-reasons-canadas-relationship-with-india-is-broken/#comments

-

This graph illustrates beautifully the difference in the impact of rising interest rates on home owners with a mortgage in Canada and the US. Canadian mortgage holders are being impacted much more quickly than those in the US. And that makes perfect sense given borrowers here have interest rates that are variable or fixed for only 1 year, 2 year, 3year, 4 year or 5 year (mortgages can be amortized for up to 30 years). Current mortgage rates in Canada are now about 6.2% for a 5 year and higher (for shorter terms). So every year about 20% of borrowers in Canada are now resetting to 6.2% or higher from their old rate which is probably around 3% = double the interest cost. Hard to see how this does not have an impact on consumer spending / the broader economy over time. The key is how long interest rates stay elevated. On that front, inflation surprised everyone and ticked higher again a couple of days ago. Source: https://x.com/asif_h_abdullah?s=21

-

@Sweet i am not sure the names you are speaking of. Note, i am after 15-20% per year returns over the next year in the sector (not 100% in 12-24 month type returns). I follow Suncor closely. With their windfall profits from energy the past 2 years they have been: 1.) paying down debt aggressively. 2.) buying back stock aggressively (i think 6 or 7% of shares outstanding per year) at very low prices. 3.) paying a good dividend (4.4% yield today). In another 6 months or so they will likely hit their net debt target. At that point, most of the free cash flow will go to share buybacks and probably a higher dividend The company recently announced a 10% reduction in total workforce that will save it about $400 million per year. The new CEO is laser focussed on making Suncor a simpler, more focussed company. He also looks to be VERY shareholder friendly. Bottom line, i think there are some pretty compelling opportunities in the energy sector (still). Not as cheap as 2020. But the comlanies are in much better shape (their balance sheets). And the outlook for energy is also much better - oil is at $90 and my guess is it goes higher from here. OPEC (Saudi’s) appear back in control of the oil market. The US has played its SPR card. I’m not a conspiracy guy… but the Saudi’s and Biden/Democtrats clearly hate each other. What will higher oil prices do you Biden’s chances of reelection in 2024? I think the Saudi’s are VERY motivated to keep prices high for the next year. Russia probably as well - want to get the upper hand in the Ukraine war? Get Trump elected. Geopolitics sometimes matters.

-

You can’t make this stuff up. We haven’t even reached peak coal usage yet. Peak oil or gas? Global Coal Use Set to Stay at Record Levels This Year, IEA Says “Lower natural gas prices in the US are also encouraging a move away from coal, the IEA’s report said.” https://www.bloomberg.com/news/articles/2023-07-27/global-coal-use-set-to-stay-at-record-levels-this-year-iea-says

-

This post was the first made on this thread back in 2020. @james22 freaking brilliant call. Just as relevant today? Eric Nutall is not my favourite oil analyst… but i do like his chart (i prefer Arjun Murti and Josh Young).

-

I heard this on a podcast a while back (not sure which one). I did a quick search online and found the following article: “For a typical wood-frame condo development in Vancouver, the fees represent 29.25 per cent of the unit’s final purchase price.” - https://biv.com/article/2023/07/government-fees-inflate-risk-uncertainty-bc-builders#:~:text=Municipal fees account for the,is attributed to regional fees. “Government fees imposed on a project can range from those that cover infrastructure-related needs (DCCs and development cost levies), community contributions that will offset density (CACs), a federal goods and service tax (GST), building and development permits, property transfer taxes and the speculation and vacancy tax. “ In Vancouver, there is also the additional empty homes tax and a public art fee, according to a February 2023 Urban Development Institute, Pacific Region report. “The total cost of government fees represents 32.72 per cent of rent that the end-user pays in a typical wood-frame, purpose-built rental development in Vancouver. “Municipal fees account for the majority of this total at 44.27 per cent; federal and provincial fees account for 28.39 and 24.15 per cent, respectively. The remaining 3.18 per cent is attributed to regional fees. For a typical wood-frame condo development in Vancouver, the fees represent 29.25 per cent of the unit’s final purchase price.”

-

My guess is the Canadian big banks will be fine. Unless we have a bit of a crash in the housing market (driven by economic recession - and an increase in unemployment). Not likely, from my perspective but possible. I think the big Canadian banks are cheap. They are a regulated oligopoly - they have morphed into a utility type of investment. For example, the returns for investors (as a basket) have tracked close to the dividend yield for the past 5 years. At current prices (20% off highs) probably a decent entry point - unless Canada has a hard landing like the US in 2008. Part of the challenge today is the data on housing is very poor. The lending process is a mess. The pandemic turned everything on its head. The government (federal and provincial) have been asleep at the wheel in terms of spike of permanent / nonpermanent residents. Taxes (as a % of selling price) on a new build has gone from 10% eight years ago to 30% today (didn’t matter when prices were going up 8% per year. Zoning (controlled my minipitailites) is archaic and driven by NIMBY - not in my backyard. Oh, and interest rates are about 6.25% and new buyers have to have the income to qualify at and 8.25% rate (called a stress test). The average price of a detached house in greater Vancouver is $2.4 million. The average price for a condo/apartment is $800,000. The average salary in Vancouver is $69,000 (25% of this will go to income taxes). At a 8.25% qualifying mortgage rate the math doesn’t work (my attempt at humour).

-

@SharperDingaan you highlight the thing i have never understood. How can Canada have a housing crisis (driven partly by lack of supply) when it was in a multiyear construction boom of epic proportions? I hope that you are right and there are a lot of units sitting empty that will now be put now to productive use.

-

@John Hjorth despite my post above, i am optomistic. The fact we have a crisis (in Vancouver/Toronto) the politicians now have the cover they need to do what needs to be done. Vancouver had lots of land… we just need to densify the downtown areas (imagine if Manhattan or downtown Copenhagen only allowed single family homes to be built with big yards?). And we are beginning to see real change and my guess is we are just getting started: - zoning rules have changed in Vancouver from a single family bias to a multi family bias. - Federal and provincial governments are implementing new policies to try and stimulate supply of multifamily buildings @SharperDingaan i never thought about the supply of workers shifting from building condos to building affordable multifamily units (being encouraged by governments). perhaps the pivot can happen a little more quickly than i initially thought. Address is also from the demand side: This is the quicker way to address the problem. My guess is we also will get a slowdown in the number of foreign students/immigration/foreign workers. As better information/stats becomes available the federal/provincial governments are going to be forced to do something - or they will likely get hammered in the next election. Who loses? My guess is the people who have too much debt. So anyone who bought in the past 5 years and are carrying a big mortgage. Maybe 10% of homeowners today, so in the big scheme of things not a big number. The fundamental issue is prices are simply too high. IF interest rates stay elevated, my guess is we will see price slowly come down (over a couple of years. Maybe 10 or 15% in nominal terms. Factor in inflation and you get a 25% correction in real terms over a 3 year period. Nothing catastrophic. The market will find a new equilibrium.

-

I think the last true hard market in PC insurance was around 2004. That suggests the insurance cycle can run in a 20 year cycle from hard to soft and back to a hard market. At the same time, you also have an interest rate cycle. Interest rates peaked in 1980 and the trough was 2020. That 1/2 cycle in rates was 40 years. What does this tell us about how to value Fairfax today? I am pretty sure the two are linked. But i have no idea how to overlay that linkage to how i value Fairfax. Perhaps management is the key. Good management teams will usually thrive over time. Bad management teams will usually struggle/fail. And cycles will happen like they always do.

-

My understanding is the move in bond yields the past month or so is being driven primarily by supply / demand dynamics. Supply is vastly outstripping demand. And I think this is expected to continue the rest of this year. Higher interest rates. Oil over $90. Something to monitor... Historically speaking, if this lasts for any length of time, it usually starts to create some stress. And I am in Canada, and high interest rates are a completely different animal here - this is like impacting my assessment big time.

-

Cash. It has been a great year. Time to get more defensive. Lock in gains. Back up to 30% cash. Get paid close to 5% risk free to sit in the weeds and wait and see what Mr Market pukes up next. The move higher in bond yields is what i am watching right now. How high can they go? i am not turning bearish. Or bullish.

-

@Crip1 well said. What are your thoughts about the interplay between underwriting profit and investment returns? Are they linked? Can we put numbers to each? At the end of the day, publicly traded P/C insurance companies need to make a 8-10% ROE over time. The CEO’s want to hit their bonus payouts and also keep their jobs. As a result, i think CR and investment results are linked. Let’s assume fixed income yields stay at the elevated levels we are seeing today. Can a 100 CR get a company to a 10% ROE? Maybe Fairfax today because of the leverage they have with float. But i think most P&C insurers would struggle to deliver an ROE of close to 10%. Given most have taken a capital hit on their fixed income portfolios due to rising interest rates i just don’t see a big or rapid turn to a soft insurance market. Bond yields are still too low. And insurance companies lots of near term risks they need to build into their models when pricing (elevated catastrophe losses, reinsurance costs, inflation etc).

-

@Munger_Disciple to be clear, i may have a lot of conviction in my estimate for 2023. I have never said any estimate is ‘in the bag’. That, of course would be idiotic. As we move to 2024, the estimate gets less clear. 2025 even less. And i don’t even attempt to forecast 2026 as there are too many moving parts. You have built an estimate… i have built an estimate. We both have provided our logic. Discussing the build is how we learn. I appreciate the opportunity to debate. ————— Below is what i said in my response to you two days ago What is the major flaw with my estimates? Am I being way too optimistic? Perhaps. But my problem the past 3 years is I have been way too pessimistic with my forecasts - they have consistently been way too low. I lean heavily on what I think i know today. I only go out max 3 years with my forecasts. And I admit my year-3 forecast is not as clear as my year-1. As new news comes in I update my forecasts. Quickly. If bad news starts to pour in I will take down my estimates. Same if the opposite happens and good news comes in - I'll take up my estimate. So far, I have only been making upward revisions. Another flaw with my forecasts is I do not incorporate compounding in very well. So my estimates in 2024 and 2025 for asset growth is too low. Higher assets likely means higher earnings. This is a big reason I think my forecasts are mildly conservative (overall).

-

When it comes to housing, Canada is facing the perfect storm. 1.) First we blew a housing bubble that is probably bigger than the the US housing bubble that popped in 2008. So we have crazy high prices. 2.) All mortgage rates here are variable, with crazy low teaser rates. Those teaser rates are now resetting, with most resetting in 2024 and 2025. The parallels with US housing in 2006-2007 are frightening. 3.) Bubble high real estate prices + 6% mortgage rates = $3,000/month to rent a one bedroom. That is the math for a new investor. Rents on new rental units coming to market have doubled in the past 2 years. 3.) Rents in Vancouver are controlled by the government. Same for older housing stock in Toronto. So in the same building two of the exact same units can rent for $1,500/month and $3,000/month. So no renters can afford to move today - your rent is going to double if you do. The rental market is effectively frozen. 4.) Supply always has been tight and vacancy rates in Vancouver and Toronto have always been extremely low (2% or less). 5.) Demand - the number of international students has increased in recent years from a run rate of 200,000 per year to about 800,000 today. The net add has been 600,000. Why the increase? International students pay up to 6x the amount for tuition compared to a Canadian student. International students are driving the budgets of universities now. The provincial/federal governments usually fund education but international students have now become the golden goose for most institutions. Provinces and feds love it because they can spend $ on other priorities. Of course, no one asked if we have the housing to support an increase of 600,000 people. - the Federal government also decided recently to boost immigration to 500,000 per year. GDP/capita has been falling for years in Canada. Fix? More people. Total GDP grows (easy way to paper over the problems under the surface). - temporary foreign workers. We also have a shortage of workers so we have also been bringing in 200,00 or so foreign workers each year. When you add the three together… Stats Canada just admitted they have undercounted the number of new people coming to Canada by 1 million people. 6.) Supply. The Bank of Canada is trying to slow the economy to get inflation under control. How? Higher interest rates. This lowers activity in interest rate sensitive parts of the economy, primarily housing. And it is working. New building permits are down a lot. New construction is slowing. Fewer units will be coming to market looking out a couple of years. So we have a really messed up situation. Market was already super tight. Supply is constrained. Demand is through the roof and growing - the governments are not changing any of the rules (students, immigration, foreign workers) - at least as of today. Housing looks like it is going to be the dominant issue in this country moving forward.

-

Below are a few quotes from the article. The tide is going out in Canadian real estate and we are beginning to understand who has been swimming naked. The additional problem for real estate investors in Vancouver is rent increases are dictated by the provincial government (2% in 2023, 1.5% in 2022). Older housing stock in Toronto is rent controlled (i think). If rates stay high (which is what it looks like) a lot of ‘investors’ in Vancouver/Toronto are going to learn that leverage can be a bitch: 1.) much higher interest rates - variable rate mortgage 2.) falling housing prices 3.) limited ability to increase rents “The problem facing Canada’s real estate investors, whether they’re buying a new property or they have a floating-rate mortgage on one they already own, is that the math simply doesn’t work at today’s interest rates. Modeling by the Bank of Montreal shows that in Toronto, anyone using a mortgage with a standard 20% down payment to buy a rental property at today’s prices, charging today’s rents, would be signing up to lose about C$1,000 (roughly $738) each month. These cashflow calculations have been negative since 2016, but investors were generally willing to overlook that because part of those payments were paying down the mortgage’s principal, thus building equity in the investment. But in the last year, the cashflows have gone so deeply negative, it even offsets those equity gains, the BMO modeling shows.“ “Rental amounts aren’t going up fast enough to cover for the huge increase in interest rates,” he said. “Effectively what we do is we flush out all the people who are holding their breath. That’s what we’re starting to see here.”

-

For those who are looking to follow oil more closely the podcast below is done daily with different guests. Some are quite good. I wonder if oil is going to be the big story for the rest of 2023. If oil keeps going higher and busts through $100 it is going to have significant consequences on some things. Like inflation. And interest rates. Higher for longer is looking more and more likely every day. Up here in Canada, i think we might be seeing things starting to crack in the economy due to higher interest rates. We have had a monster housing bubble and everyone here has essentially what is a variable rate mortgage with a teaser rates that all going to reset over the next 30 months. Borrowers are going from 3ish % to over 6% when they renew. A segment of the population is screwed (those who bought high in recent years and have a big mortgage). It is worse for investors (who bought recently). In Vancouver, the rental market is rent controlled. So your mortgage skyrockets higher and the government allows you to increase rent a maximum of 2% in 2022. Housing inventory is starting to move higher in Toronto and Vancouver - this will be something to watch in the coming months. My favourite line in the video below was something like “i got duped by the fallacy of peak oil decades ago. The new fallacy that will be disproven in another decaade? That demand for oil will peak soon.” If you watch the video start at the 7 minute mark…

-

@blakehampton If you haven’t, I would read Chapter 8 of the Intelligent Investor. “Does the current economic situation particularly stand out to you, or is a mass feeling of uncertainty simply inevitable when it comes to markets?” Volatility is your friend. Especially if you are young. I think people in their 40’s are young (in investing years). If you are young you should pray for armageddon. Falling stock markets are a gift. The bigger the decline the better. You buy more with the same amount of dollars. When you are really old, that is when you want strong equity markets. Of course you are not going to be able to time the bottom. My point is, on big declines, find money (bring forward contributions - borrow short term from family etc). Buffett suggests you should buy stocks like you buy groceries - lower prices are better. Training your brain is one of the keys to successful investing. Watch CNBC less. Read @dealraker posts about buy and hold. http://csinvesting.org/wp-content/uploads/2012/07/mr-market-by-ben-graham_final.pdf

-

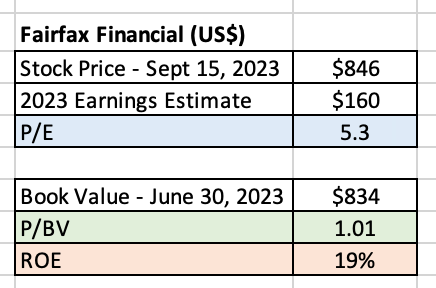

@StubbleJumper Yes, i agree that @Munger_Disciple and i are both coming at this from very different perspectives. But sorry, i can’t reconcile the two estimates - they are simply too far apart. They both can’t be right (or even close). If Fairfax earns $160/share each of the next three years there is no way the shares are worth anything close to $845/share today. Anyways, i love the debate. But time to get some sleep

-

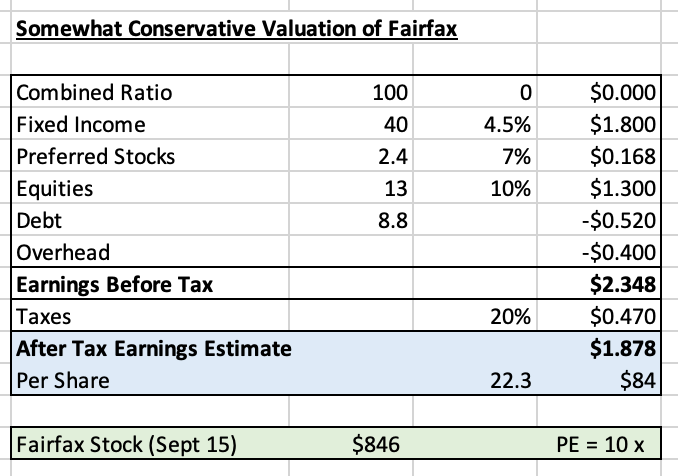

To help investors value a stock, Warren Buffett tells the story of Aesop: "a bird in the hand is worth two in the bush." According to Buffett, investors need to determine 3 things: How many birds are in the bush? When are you going to get them out? How sure are you? The prevailing interest rate is also important: If interest rates are 15%, then two birds out in 5 years makes sense. If interest rates are 3%, then two birds out in 20 years makes sense. ----------- @Munger_Disciple Thanks for taking the time to put together an earnings estimate for Fairfax. It is great to get different perspectives. When I read your estimate above I immediately thought: "two birds in the hand are worth one in the bush." Of course, I know this was not what you are trying to say. But that was my take-away from your estimate. Let me explain. Let's start with your estimate: Now let's pivot to my current estimate for 2023. My current estimate is Fairfax will earn $160/share in 2023. We are almost 9 months into the year. Yes, something bad could happen. But something good could also happen. My view is the tail risks to my forecast (too high or too low) are about equally distributed. So I think $160 is a reasonable number. What about 2024? I am at earnings of $166/share for 2024 and $174 for 2025. I think my 2024 and 2025 estimates are mildly conservative. Let's compare out two numbers: You are at $84/share and I am at $160/share. You are 1/2 of my number. That is a big difference. So what explains the difference? Let's compare our estimates. 1.) Underwriting: Your CR is 100 and mine is 94.5 for 2023 and 95 for 2024. Your rationale: You say Warren Buffett's goal is 100. My rationale: That is where Fairfax is currently tracking (the last 3 years). Yes, we likely are late in the hard market. But everything I read suggests the hard market is likely to continue into 2024. Reinsurance (property cat) just started its hard market. Will Fairfax's CR trend higher in the coming years? Probably. I am modelling 94.5, 95 and 95.5 from 2023-2025. Over time, as I get new information I will adjust accordingly. Bottom line, Fairfax is tracking to earn $1.27 billion in 2023. Taking that to zero today and every year into the future just seems bizarre to me. PS: Warren Buffett also thinks float is better to have than an equal amount of equity. 2.) Fixed Income: $40 billion earning 4.5%. We are pretty close here. The difference is compounding. My guess is the fixed income portfolio will grow in total size at 8-10% per year the next couple of years: Top line growth: increased premiums (currently running at 8%) will grow float GIG acquisition will boost total investments Earnings: 4.5% yield will deliver earnings of $1.8 billion pre tax My point is the $40 billion will likely be $50 billion by the end of 2025. I also think the yield will be closer to 5% in 2024. Bottom line, ignoring the power of compounding gives you a lower number here. 3.) Preferred stock $2.4 billion = $170 million. I don't break out preferred stock as a separate line item. Let's assume we are on the same page here (it is a small number) 4.) Equities/derivatives. You are $13 billion at 10% = $1.3 billion. We are off quite a bit here. My tracker has this bucket with a value of $16.9 billion today. This includes some preferred stock ($850 million). I also value the FFH-TRS at notional ($1.6 billion). For this bucket I am at $2.4 billion for 2024 and growing in future years: Mark to market gains on portfolio of $8 billion = $800 million (10%). The FFH-TRS is driving this bucket (every $100 move in FFH = $200 million). Dividends = tracking around $140 million per year (includes preferred stock) Share of profit of associates on portfolio of $6 billion = tracking around $1.15 billion. Yes, close to 20%. This is a build of the current trend of the companies included in this bucket, driven by Eurobank. Associates - YOY change in fair value vs carrying value = $100 million. Although not captured in book value, this is value creation for shareholders. Operating companies (Recipe, TCI, Dexterra etc) pre-tax earnings: $150 million. Investment gains (sales/revaluation) = $250 million (lumpy) Let's take $170 million off my number to account for preferred stock already counted in 3 above. That brings my equity number to $2.23 billion. What will cause my number to fall by $900 million to your number of $1.3 billion? An economic depression? I think my equity/derivative number is going to grow by 10% per year. Like underwriting, we are miles apart here. 5.) Corporate + Interest expense = $400 + $520. We are the same here. Summary: Two buckets explain most of the difference in our forecasts: Underwriting: you are $1.2 billion below me Return equity/derivative portfolio will deliver: you are $900 million below me It looks to me like you are also assuming Fairfax stops growing today: assets, liabilities, equity. Fairfax will likely grow its assets significantly in the coming years (organic growth + earnings reinvested). Growth in float will also increase liabilities. And shareholders equity will be increasing (earnings). The power of compounding at Fairfax could be significant the next couple of years (larger in size than anything we have seen). My current estimate has Fairfax earning $3.7 billion in 2023 and a total of $11.3 billion 2023-2025. That is more than 50% of current shareholders equity. It is a huge number. This is likely coming in the next 10 quarters (2 have already been delivered) - not the next 10 years. How many birds are in the bush? $3.7 billion per year and growing. When are you going to get them out? One is coming every year (a little plumper). How sure are you? Its in line of sight. Today, Fairfax shareholders currently have one bird firmly in one hand (2022) and the second bird is just about to land in the second hand (2023). The third one is getting ready to take flight. It looks to me like your analysis assumes away 1/2 of the birds - it just pretends they don't exist. Hence my analogy of "two birds in the hand are worth one in the bush" kind of logic. What is the major flaw with my estimates? Am I being way too optimistic? Perhaps. But my problem the past 3 years is I have been way too pessimistic with my forecasts - they have consistently been way too low. I lean heavily on what I think i know today. I only go out max 3 years with my forecasts. And I admit my year-3 forecast is not as clear as my year-1. As new news comes in I update my forecasts. Quickly. If bad news starts to pour in I will take down my estimates. Same if the opposite happens and good news comes in - I'll take up my estimate. So far, I have only been making upward revisions. Another flaw with my forecasts is I do not incorporate compounding in very well. So my estimates in 2024 and 2025 for asset growth is too low. Higher assets likely means higher earnings. This is a big reason I think my forecasts are mildly conservative (overall). 20% growth in ROE is a double in 3.6 years (about). I think Fairfax might be able to do that. Looking out 4 years, a double in shareholders equity should result in much higher earnings - Fairfax's track record with capital allocation has been excellent since 2018. Soft market in insurance? Bear market in stocks? Of course both will happen at some point in the future. Just like they have in the past. And good companies will benefit. And bad companies will fall by the wayside. P/C insurance was in a soft market from 2014-2017. In the last 6 years we have had 3 bear markets in stocks and the biggest bear market ever in bonds. Over the past 3 years Fairfax has thrived. And they didn't have the earnings/cash flow they do now. My guess is Fairfax will be just fine. But I remain open minded.

-

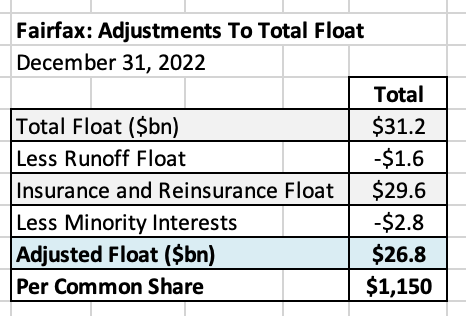

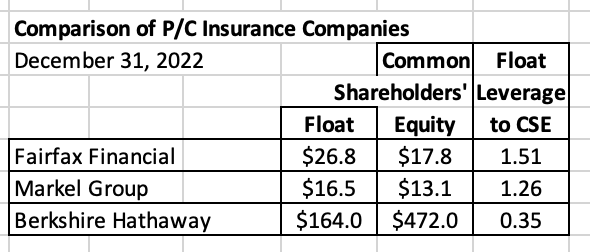

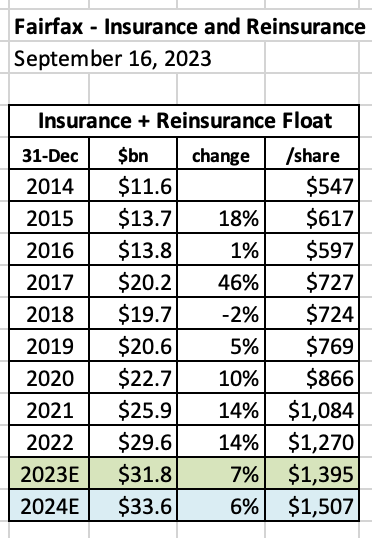

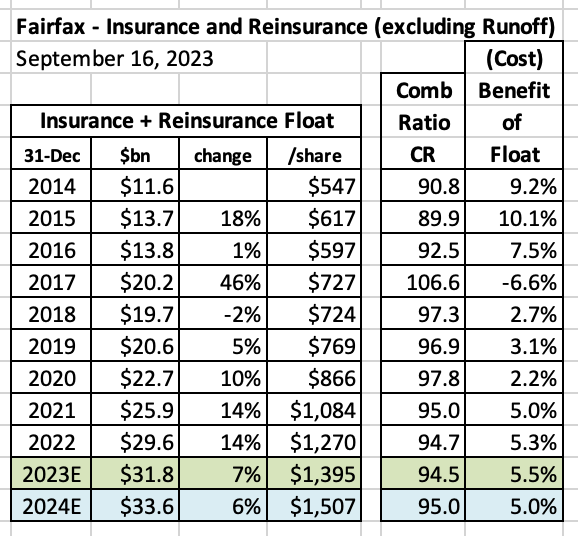

Fairfax Financial and Float - A Deep Dive In my last post i reviewed P/C insurance float, largely through the writings of Warren Buffett - a pretty knowledgeable guy on the subject. In this post we are going to pivot and apply what we learned to Fairfax Financial. Fairfax and Float: Summary of the topics we will explore: A short review of financial leverage Size of float Leverage provided by float Growth of float Cost of float Returns achieved on float Summary ---------- A short review of financial leverage Balance Sheet: Assets = Liabilities + Equity To grow (increase assets) a company can issue a liability like debt (borrow) or equity (shares). Borrowing (a liability) is simply a way to use ‘other peoples money’ to finance growth / business activities. Using borrowed money to grow/invest is a financial strategy referred to as leverage. Why use leverage to grow? To increase the return on equity. If equity stays constant but a firm can grow assets, which in turn grows earning, that will result in higher return on equity. What is the rub? There is a cost to borrow, which is the interest rate charged on the loan. And today, with interest rates elevated, the cost is very high. What does this have to do with P/C insurance companies? P/C insurance companies are unique animals. Through the course of their business operations they generate something called float. Float is the money held by insurance companies when they receive premiums that has not yet been paid out to claimants. Like debt, float is ‘other peoples money’ so it is technically a liability. Like debt, float can be used to purchase investments on the asset side of the balance sheet. The investments purchased with float will then grow total earnings, which results in a higher return on equity for the company. Growing float (L) = growing investments (A) = growing earnings (E) = higher return on equity (ROE). What is the rub? There is a cost to float and it is determined by underwriting (combined ratio). If an insurer is able to generate an underwriting profit over time, the cost of float is free (actually better than free… the ‘cost’ is a benefit). So P/C insurance companies have the ability to use float (leverage) as a low cost way to boost return on equity (ROE). Let’s now see how all of this applies to Fairfax. ---------- How much float does Fairfax have? At December 31, 2022, Fairfax had $31.2 billion in total float. However, to make our analysis more meaningful, we need to make 2 adjustments to this number: Remove float from runoff - Fairfax separates runoff when reporting underwriting results so to be consistent we will remove runoff float from our analysis. So in this post we will only be looking at float for insurance/reinsurance at Fairfax. remove minority interests - small amounts of Allied World, Odyssey, Brit and International are owned by minority shareholders. We also adjust float to account for this. By removing the share of float that accrues to minority shareholders we are left with the amount of float that accrues to Fairfax’s common shareholders, which is really the number we care about. After making the 2 adjustments outlined above, at December 31, 2022, Fairfax had $26.8 billion in float working for common shareholders (i am going to call this ‘adjusted float’ in the remainder of this post.) Adjusted float was $1,150/share. Given the growth in Fairfax’s insurance business in 2023, ‘adjusted float’ today is likely well over $1,200/share. Of interest, Fairfax’s share price closed at $846 on Friday (Sept 15). Now that we know the size of Fairfax’s float, let’s now look at it in relation to Fairfax’s total balance sheet. ---------- What is the leverage provided by Fairfax’s adjusted float? Common shareholders’ equity at Fairfax was $17.8 billion at Dec 31, 2023. As we just learned above, adjusted float is $26.8 billion. Float is 1.5 x bigger than common shareholders’ equity. The leverage is 1.5 times (adjusted float of $26.8 / common shareholders’ equity of $17.8). That means every 1% gain just from float will result in a 1.5% gain in common shareholders’ equity (ROE = 1.5%) So if float delivers an 8% return to Fairfax that will boost common shareholder’s equity by 12% (deliver an ROE = 12%) all by itself. How does Fairfax’s adjusted float and leverage compare to other P/C insurance companies? Fairfax (at 1.51 times) has more leverage from float than Markel (at 1.26 times). For interest, I also included Berkshire Hathaway. Leverage is much smaller for Berkshire Hathaway (at 0.35 times) compared to Fairfax and Markel and this makes sense given the significant growth of BRK’s non-insurance businesses over the years. Note: my float number for Markel above is an estimate. Markel does not provide a float number. Float isn’t even mentioned in their annual report, which seems strange given its importance to the returns of the company. ---------- How much has total float grown in recent years at Fairfax? Please note, in this section we will use the float numbers for insurance/reinsurance (runoff is excluded). However, i did not separate out minority interests. It would have been a lot of work and it wouldn’t have materially changed the conclusions (the growth numbers) - which is what we care about here. The float of insurance/reinsurance at Fairfax has been growing rapidly for many years: 2014 to 2022 (8 years): total float grew 155% or at a compound growth rate of 12.4% per year. 2015-2017 growth was fuelled primarily by acquisitions (Brit, international, Allied World). 2020-2022 growth was fuelled primarily by organic growth (hard insurance market). 2023 and 2024 should see solid growth in float driven by continuation of the hard market and the GIG acquisition. The management team at Fairfax has done a fantastic job of growing float over the past 8 years. And the prospects for continued growth are strong. What is the cost of float? What is the trend? Like borrowing money, float is a liability. Like all leverage (i.e. debt), float can be both good or bad - and this depends on the cost paid over time to hold the float. The ‘cost’ of float is measured by looking at underwriting results and the combined ratio. Fairfax excludes runoff when it reports underwriting results and the combined ratio (CR) so we can use their numbers in this section. Summary: From 2014-2022 the CR averaged 95.7 From 2018-2020 the CR ticked higher and averaged 97.3 From 2021-2022 the CR ticked lower and averaged 94.7 For 2023 my current estimate for the CR is 94.5 Fairfax has consistently earned an underwriting profit on its adjusted float. That is a big deal. It means that is has been able to secure $26.8 billion in adjusted float on very favourable terms. In fact the ‘cost’ of float is better than free - it is a benefit. I know, that is crazy - but it is true. This is why Buffett has said in the past that he views float as being more valuable than a similar amount of equity. That statement is a real mind bender. What is driving the improvement in the combined ratio? My guess is two factors are driving the improvement: The hard market in insurance (that began in Q4, 2019) resulting in higher prices and better terms and conditions. Slow incremental improvement in the quality of Fairfax’s collective insurance businesses (resulting in better underwriting) driven by Andy Barnard and the leaders of the various insurance companies. So float has been growing at 12.4% per year for the past 8 years. And the ‘cost’ has actually been better than free - a ‘benefit’ - over the same time frame. But the story gets even better. Why? Return. ---------- What is the return Fairfax has been earning on its float? Fairfax has $26.8 billion in adjusted float that is fully invested and earning a return for Fairfax shareholders. For reference, the total investment portfolio at Fairfax was about $55.5 billion at Dec 31, 2022. Adjusted float of $26.8 billion represents 48% of total investments. It is significant. In this section we are going to look at Fairfax’s return on total investments (a number we have a fair bit of confidence in). We are not going to try and break out Fairfax’s returns specific to float (which is a part of total investments). Again we are coming at this analysis at a very high level. If we subscribe a lower than average return to float (by assuming it is more skewed to short term fixed income investments) we would then need to attach a much higher return to Fairfax’s non-float investments to get to the correct average number. Instead, we are going to keep our analysis simple and use Fairfax’s average return on total investments as a very rough estimate for what is being earned on adjusted float. From 2018-2022, Fairfax’s return on total investments averaged about 5.1% per year. Not surprisingly, the big drag was the fixed income portfolio. Fairfax’s interest and dividend income (a reasonable proxy for the return on the fixed income portfolio) delivered an average return of about 2.3% from 2014-2022. Today? In 2023, Fairfax is tracking to earn an 8.6% return on its total investment portfolio. That is 69% more than the average of 5.1% of the past 5 years (2018-2022). That is a meaningful increase (big understatement!). What are the biggest drivers of the increase in total return? Interest and dividend income, which is estimated to deliver a return of 4.5% in 2023. My current guess is interest and dividend income will increase to about 5% in 2024, which is more that double its run rate from 2014-2022. Equity markets have also rebounded YTD in 2023. Since 2018, very good capital allocation decisions - with the benefits increasingly showing up in reported results. What about future returns? Fairfax has extended its fixed income portfolio from 1.2 years at Dec 31, 2021 to 2.4 years at June 30, 2023. This locks in higher interest rates for the next couple of years. It seems reasonable to expect the management team at Fairfax to continue to make good capital allocation decisions. Bottom line, Fairfax looks well positioned to continue to deliver strong investment returns moving forward. My current estimate has Fairfax earning a return of more than 8% on its investments in each of 2023, 2024 and 2025. Ok. Let’s try and summarize everything. ---------- What have we learned about Fairfax and its float? ‘Adjusted float’ is $26.8 billion. It has been compounding at better than 10% per year for the past 8 years. ‘Cost’ of float is actually a benefit and the benefit has increased in recent years. The average return Fairfax is earning on its total investments is currently tracking to be 8.6% in 2023, up from an average of 5.1% from 2018-2022. When looking at float, all three of the most important metrics are moving to the benefit of Fairfax and its shareholders. It is large and increasing in size. It is being obtained at a very favourable cost - better than free. And the return being achieved on its investments has spiked and the higher number looks sustainable. So how does float fit into Fairfax’s valuation today? This is where things get interesting. Fairfax’s stock is trading today at $846 which is about the same as book value ($834 at June 30, 2023). Mr. Market is saying that Fairfax is worth a little more than book value = common shareholder’s equity = $19.4 billion at June 30, 2023. Mr Market appears to be assigning little value to the adjusted float that Fairfax has of $26.8 billion ($1,150/share) at Dec 31, 2022. Assigning a very low value to adjusted float might have made some sense when interest rates were very low. But in the current environment, where interest rates are high and likely to stay high, this makes no sense. This perhaps explains why Fairfax trades at a PE of 5.3 x 2023E earnings (my current estimate of $160/share). Perhaps Mr Market does not yet appreciate how large the increase in earnings from adjusted float is likely to be in the coming year(s) and the impact that will have on ROE at Fairfax (at 1.5 x leverage). What did Fairfax have to say about float in its most recent annual report? Fairfax 2022AR: “For our stock price to match our book value’s compound rate of 17.8%, our stock price in Canadian dollars should be $1,375. And our intrinsic value exceeds book value, a principal reason being that our insurance companies generate huge amounts of float at no cost. This is the reason we continue to buy back our shares as we continue to think they are very cheap.” Fairfax has resumed buying back stock in August and September.

-

Because Fairfax has extended duration to 2.4 years I don't think where interest rates go in 12-24 months matters all that much anymore. My view is the management team will navigate their way though it - just like they have since 2018. Extreme volatility has been very good for the team at Hamblin Watsa and Fairfax shareholders. Active management is able to take advantage of the extreme dislocations when they happen. The $2 billion PacWest loan purchase (expected to deliver a total return of 10%) being the most recent example.