Viking

Member-

Posts

4,923 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

RIP Charlie. The wisdom that Warren and Charlie shared over the years has been life changing for me and my family. I will not forget Charlie. My wife, who does not follow investing, knows who Charlie Munger is/was. The man touched so many lives - and in such a positive way.

-

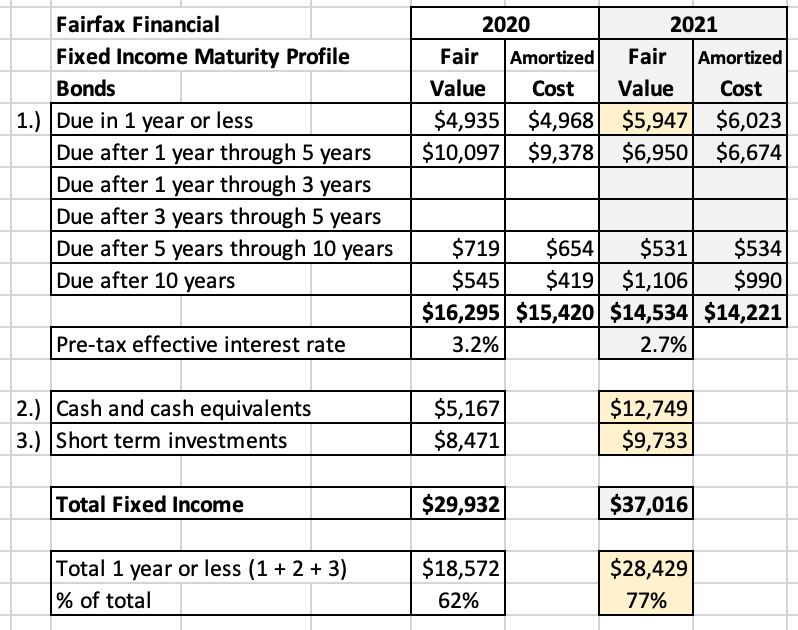

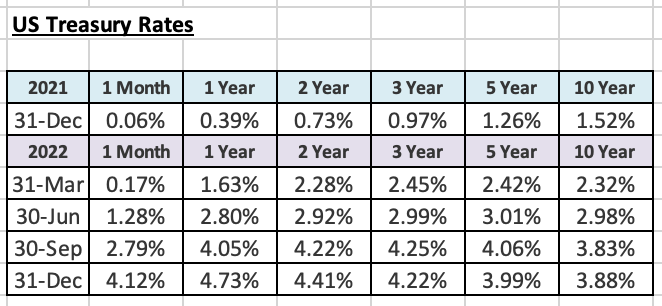

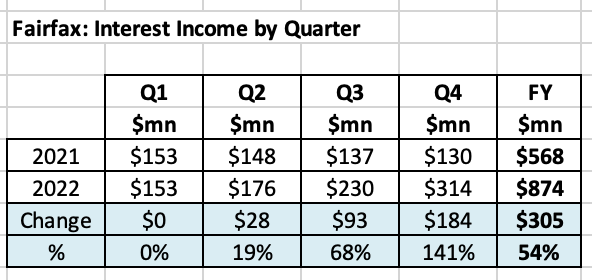

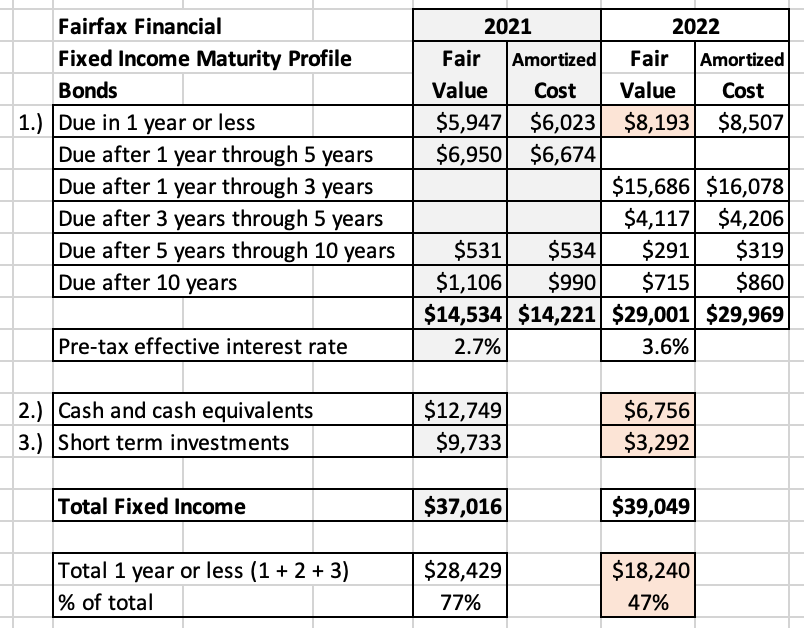

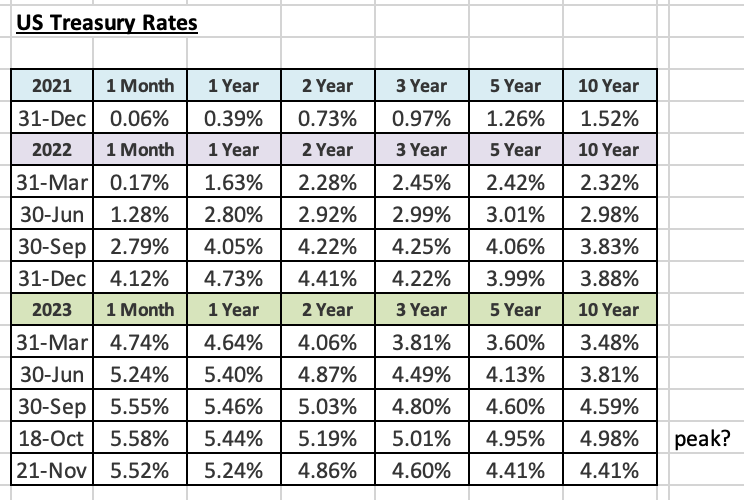

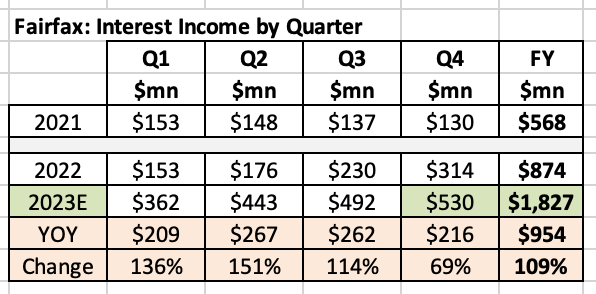

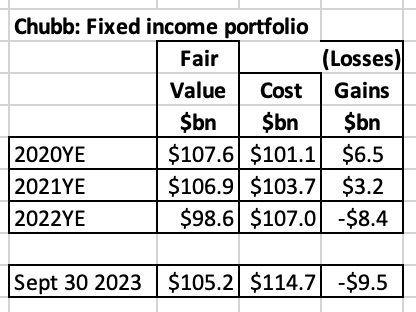

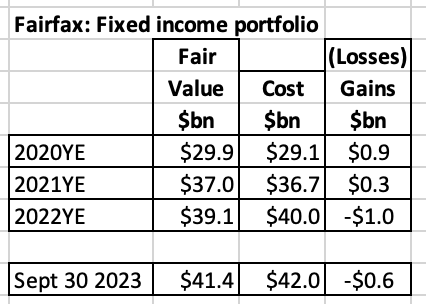

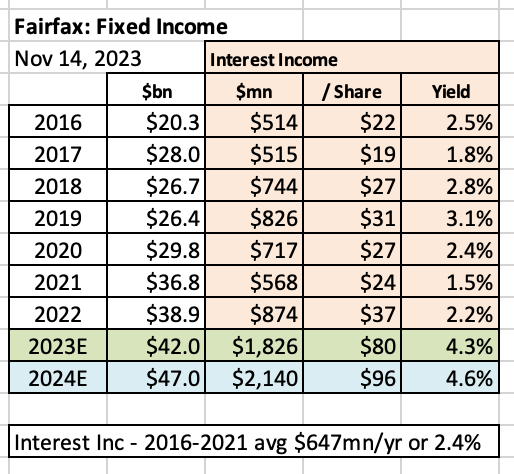

Below is the promised follow up to my initial post on fixed income. This post takes a deep dive into fixed income at Fairfax. ----------- The Genius of the Fixed Income Team at Fairfax We are learning in real time the genius of the fixed income team at Fairfax. Genius is a big word, but I think it applies in this case. The team at Fairfax has been putting on a clinic for the past 3 years - demonstrating in real time the significant value that active management can add to a fixed income portfolio. We are going to look at what Fairfax has done the past 3 years in three parts: Part 1: Late 2021 - Getting even more defensive Part 2: 2022 - Start extending duration Part 3: 2023 - Being opportunistic and going on the offensive Part 1: Late 2021 - Getting even more defensive The big picture We are taught the way to get rich in investing is to buy low and sell high. But sometimes the opposite can also work: sell high and then buy low. In 2020 and 2021, the 40-year historic bond bubble reached its blow-off-top. Bond yields reached all-time lows and conversely bond prices reached all-time highs. Mr. Market was feeling positively euphoric when it came to fixed income investments - especially those that were long dated. What was a value investor to do? Why sell your long dated bonds of course. Below are details of 3 moves Fairfax made in late 2021: 1.) Significant sales of corporate bonds at very low yields, locking in large, realized gains: “During 2021, we sold $5.2 billion in corporate bonds, mainly acquired in March/April of 2020, at a yield of approximately 1%, for a gain of $253 million.” Fairfax 2021AR The question to ask here is who was on the other side of this trade? Who was buying corporate bonds at a 1% yield in late 2021? 2.) The duration of the portfolio was shortened, and the composition of portfolio was shifted to higher quality holdings, mostly treasuries: “At the end of 2021, our fixed income portfolio, inclusive of cash and short-term treasuries, which effectively comprised 72% of our investment portfolio, had a very short duration of approximately 1.2 years and an average rating of AA-.” Fairfax 2021AR Most P/C insurance companies match the duration of their insurance liabilities with the duration of their fixed income investments - which is around 4 years. So Fairfax going to an average duration of 1.2 years with its fixed income portfolio was a significant difference compared to peers. Fairfax's move to mostly government bonds was also significant and another big difference compared to peers. 3.) Part of the fixed income portfolio was hedged to protect against rising interest rates: “To economically hedge its exposure to interest rate risk (primarily exposure to certain long dated U.S. corporate bonds and U.S. state and municipal bonds held in its fixed income portfolio), the company held forward contracts to sell long dated U.S. treasury bonds with a notional amount at December 31, 2021 of $1,691.3 (December 31, 2020 – $330.8)." Fairfax 2021AR Fairfax did not sell all of its long dated bonds. It hedged some of its remaining exposure to provide added protection. Summary In late 2021, near the peak of the bond bubble, Fairfax ‘sold high’ and went extremely short duration with their massive fixed income portfolio of $37 billion. This positioning protected the company from the interest rate risk. It also protected them from inflation risk. Fairfax also shifted the vast majority of its fixed income portfolio to high quality government bonds, which protected the company from credit risk. In summary, by late 2021, Fairfax’s fixed income portfolio was very defensively positioned. The team at Fairfax did all of this months before the Fed (and other global central banks) unleashed hell on fixed income markets. With hindsight, Fairfax's timing was close to perfect. (It should be noted that Fairfax had been cautious on fixed income - expressed as low duration - since late 2016.) Does value investing also apply to fixed income? What Fairfax did was a good example of value investing. Long duration bonds, with crazy low yields in 2020 and 2021, provided no margin of safety. Especially later in 2021 when it was clear that the economy was expanding and inflation was quickly becoming a big problem. Passive management versus active management Most P/C insurers have a policy of blindly matching the duration of their insurance liabilities with the duration of their fixed income portfolio. So in 2020 and 2021, other P/C insurers were busy buying 3 and 4 year bonds at historically low yields - they were buying at nose-bleed bubble high prices. Matching duration was the religion of the day. Yield did not matter. This had been a winning strategy in a zero interest rate world - where interest rates and bond yields only ever went down. The problem with this strategy is it completely ignored interest rate risk and inflation risk. When the greatest bear market in history came lumbering along it crushed the value of fixed income portfolios of most P/C insurers. This in turn crushed the book value of most P/C insurers. Not Fairfax. But we are getting a little ahead of ourselves. Back to late 2021. Fairfax ended 2021 with 77% of its fixed income portfolio in ‘cash’, ‘cash equivalents’ and ‘bonds of 1 year or less’. This was $28.4 billion of its $37.0 billion fixed income portfolio. This was a ‘high conviction’ move for Fairfax. (The increase in the 'Due after 10 years' bucket was due to the consolidation of Eurolife.) Having a short duration portfolio at the end of 2021 had two key benefits: It protected the balance sheet from interest rate risk - a rapid increase in interest rates would cause the value of bonds to plummet. This would then cause book value to fall. Long duration bonds were especially vulnerable. It provided valuable optionality - this would allow Fairfax to quickly take advantage of rising interest rates and dislocations in credit markets. Part 2: 2022 - Start extending duration The big picture The big economic news in 2022 was the spiking of inflation and the subsequent aggressive tightening by the Fed and global central banks. This in turn caused interest rates to spike, especially short term interest rates. The greatest bond bear market in history accelerated as the year progressed. Fairfax’s fixed income portfolio had an average duration of 1.2 years at Dec 31, 2021. With such a low duration portfolio, as interest rates spiked higher Fairfax saw interest income quickly increase. Interest income bottomed out at $130 million in Q4, 2021. A year later, in Q4, 2022, interest income increased to $314 million, an increase of 141%. The earn-through from higher interest rates was happening very fast for Fairfax. What did Fairfax do in 2022? In 2022, Fairfax started extending the average duration of their fixed income portfolio - from 1.2 years at the end of 2021 to 1.6 years at the end of 2022. Bonds at the short end of the curve (1-year to 3-year) offered the highest yield and this is where Fairfax bought aggressively. Fairfax ended 2022 with 47% of its fixed income portfolio in ‘cash’, ‘cash equivalents’ and ‘bonds of 1 year or less’. This was down significantly from 77%, where it ended 2021. Part3: 2023 - Being opportunistic and going on the offensive The big picture in 2023 The big news in 2023 was that aggressive tightening by global central banks continued. This was unexpected. This in turn caused interest rates to spike even higher. The unexpected and historically rapid increase in interest rates also started to cause some dislocations in financial markets. Silicon Valley Bank and Signature Bank both went under in April. This created opportunities in credit markets. In October of 2023, we saw long bond yields spike to 15-year highs. This provided an opportunity for short duration fixed income portfolios to extend duration. What did Fairfax do in 2023? 1.) Fairfax was very opportunistic with the dislocation that hit regional banks in the US in March/April. In March of 2023, Silicon Valley Bank went bankrupt. This was the second largest bank failure in US history. There was a run on the bank (depositors wanted their money) and SVB did not have it - the money was locked up in low-yielding long-dated US treasuries. To meet customer withdrawal requests, SVB was forced to sell its long-dated treasury holdings - and it was forced to book billions in losses. This then resulted in more customer withdrawal requests. To stop the vicious feedback loop, SVB was forced to declare bankruptcy and regulators from the Fed stepped in and closed the bank. Signature Bank was also shut down at the same time by regulators. A full blown financial crisis had emerged with regional banks being at the epicentre. The cat pounces As we have discussed, having a very high quality, low average duration fixed income portfolio provides important optionality. Wonderful opportunities that come up unexpectedly can be seized. Many regional banks were forced to strengthen their balance sheets. To raise liquidity, PacWest Bancorp sold $2.6 billion in real estate construction loans to Kennedy Wilson. They were sold at a $200 million discount. KW’s parter on the deal was Fairfax. “During the first nine months of 2023 the company, in partnership with Kennedy Wilson, has completed net purchases of $2.0 billion of first mortgage loans acquired from Pacific Western Bank; the average annual return on the capital deployed with the loans is expected to exceed 10%.” Fairfax Q3 Interim Report Fairfax was able to invest $2 billion of its fixed income portfolio at an expected annual return of 10%, or $200 million. Outstanding. This deal also highlights another strength of Fairfax: the many partnerships it has built out over the years with many different external capital allocators. This deal was only possible because of the close relationship that Fairfax has with Kennedy Wilson - cultivated over the past 13 years. 2.) In 2023, Fairfax continued to push out the average duration of its fixed income portfolio. They did this in two stages: first, in Q1 and again in October. In Q1, 2023, the average duration of Fairfax’s fixed income portfolio was pushed out from 1.6 years to 2.4 years. This was a double from what it was 15 short months previously, at Dec 31, 2021. It is instructive to look at the significant change in Fairfax’s fixed income holdings over the past two years. You can see the shift to longer duration holdings. 3.) In Sept/Oct 2023, bond yields unexpectedly spiked higher - but this time it was further out on the on the curve - 5-year, 10-year and 20-year bonds. We just learned on the Q3, 2023 conference call that in October, Fairfax has extended the average duration of its fixed income portfolio from 2.4 years to 3.1 years. “Recently, in October, during the spike in treasury yields, we have extended our duration to 3.1 years with an average maturity of approximately 4 years, and yield of 4.9%.” Prem Watsa - Fairfax Q3, 2023 Conference Call We will have to wait until Q4 earnings are released to get more complete details of what bonds Fairfax has purchased. This is a significant development for Fairfax and its shareholders. What does all this mean for interest income at Fairfax? Interest income was a record of $874 million in 2022. In 2023 it is forecasted to total $1.8 billion, an increase of $950 million or 109%. The earn-through has been very fast for Fairfax - much quicker than most P/C insurers. My guess is Fairfax is currently earning about $500 million per quarter in interest income. And with the extension of duration, Fairfax has locked much of this in for years. For perspective, Fairfax earned $568 million in interest income for the entire year in 2021. What have we learned in this post? Capital allocation is the most important responsibility of a management team. Fixed income is by far the largest part of Fairfax’s investment portfolio. Over the past 3 years, the fixed income team has superbly navigated Fairfax (and Fairfax shareholders) through the greatest fixed income bubble top and subsequent bear market in history. This is yet another example of the outstanding performance we have seen from the management team at Fairfax in recent years. They sold high - locked in nice gains and, most importantly, they avoided billions in losses. They protected the balance sheet. And then they bought duration on the cheap. They have also been very opportunistic, taking advantage of the high volatility in fixed income markets. And they did all this with a $40 billion portfolio. Importantly, the fixed income portfolio at Fairfax looks to be very well positioned today. Fairfax has significantly pushed the average duration out - the table is now set for Fairfax to earn in the range of $2 billion in interest income in each of the next 3 years. The portfolio is also very high quality - heavily weighted to government bonds. Fairfax now likely owns the best ‘risk-adjusted return’ fixed income portfolio in the P/C insurance industry - it is both high yield and very high quality. And Fairfax is well positioned to continue to exploit continued volatility in fixed income markets. In short, the fixed income team at Fairfax has just delivered a master-class in value investing and the benefits of active management. I think it is safe to say their performance has been best-in-class among P/C insurance companies. This is just another meaningful example of ‘the story’ for Fairfax continuing to get better. “What the fixed income team at Fairfax has just accomplished is nearly impossible. And that is why they did it.” This sounds to me like something Charlie Munger would say - RIP. ————— Can we quantify the benefit to Fairfax and its shareholders? The benefits have come in two ways. The first has been the significant losses that have been avoided - let's call that balance sheet protection. The second is the significant and rapid increase in interest income. 1.) Balance sheet protection One way to quantify the value here is to look at book value per share and compare Fairfax to other P/C insurance companies. How did Fairfax fare compared to peers? I did this in my previous post so let's try another approach here. Over the past three years, as the bear market in bonds was raging, many P/C insurers saw the value of their fixed income portfolios decline by double digit amounts. As an example, from Dec 31 2020 to Sept 2023, Chubb has seen a swing of $16 billion in the value of its $105 billion fixed income portfolio (from an unrealized gain of $6.5 billion at Dec 31, 2020, to an unrealized loss of $9.5 billion at Sept 30, 2023). This is a 15.2% swing in value for the fixed income portfolio. What about Fairfax? From Dec 31, 2020 to Sept 2023, Fairfax has seen a swing in value of $1.5 billion in the value of its $41 billion fixed income portfolio (from an unrealized gain of $900 million to an unrealized loss of $600 million). As we learned above, Fairfax was aggressive in selling corporate bonds in 2021 locking in a gain of $250 million. So its swing in value can be reduced to $1.25 billion. This is a 3% swing in value. What if Fairfax had experienced the same swing in value as Chubb = 15.2% Chubb is a good comparable and likely similar to what has been experienced by many P/C insurers. On a $35 billion portfolio, a 12% swing in value would have equated to $4.2 billion. (Let’s be conservative and use 12% and not Chubb’s 15%.) Fairfax saw an actual swing in value of $1.25 billion so the difference is about $3 billion (before taxes and minority interests). To be even more conservative, let’s cut this number by 33%, which gives us $2 billion. The bottom line is Fairfax's decision to go extremely low duration in 2021 has benefitted the company in a big way. It protected the balance sheet. I think the benefit can be conservatively measured to have been in the billions. 2.) What was the increase in interest income Interest income at Fairfax averaged about $650 million per year from 2016 to 2021. Fairfax is on track to earn more than $1.8 billion in 2023 and more than $2 billion in 2024. This is an increase of $1.3 billion or 200% over the trend from 2016 to 2021. What is a new annual income stream of $1.3 billion worth? This is $58/share (yes, it is pre-tax and before minority interests). Summary The benefits to Fairfax (and Fairfax shareholders) of how the company has managed its fixed income portfolio over the past 3 years can be measured in the $billions. It is impossible to come up with a precise number. What we do know is the value creation has been significant. What do you think? ————— Narrative My guess is most investment professionals have a strong opinion about Fairfax. Ask these same people to explain to you what Fairfax has done with their fixed income portfolio over the past 3 years and my guess is only 1 in 10 would be able to provide an accurate/satisfactory answer. That partly explains why narratives on a company can be completely wrong at times. Most investment professionals don't follow companies all that closely. Usually, they don't need to. But the fundamentals matter. Eventually the investment professionals (and small investors) do figure it out. And the narrative slowly gets updated (and brought closer to reality). And the stock price as well. —————- Family control At the Fairfax AGM this year (April 2023), a bunch of Fairfax shareholders met at the Keg one night for dinner and Ben Watsa came by for a visit and to say a few words. He commented about the positioning of the fixed income portfolio in 2021 (very low duration) and suggested this might be a good example for Fairfax shareholders of the benefit of family control. With family control, it is easier for Fairfax to accept quarterly volatility and instead run the business with a long term focus. (Please note, these are my words and not Ben's.) What do Fairfax, Berkshire Hathaway, Markel and WR Berkley all have in common? They are all P/C insurers (float is a beautiful thing). They all have exceptional long term track records of compounding shareholder value. And they are all family controlled. The last point might be the most important.

-

“hellavu high price for Russia” I agree. Ukraine has been a catastrophe for Russia. Perhaps we learn in 50 years that Putin was a double agent - really working for the West. He single-handedly: 1.) brought NATO back from the dead 2.) convinced Finland and Sweden to join NATO 3.) convinced every European country on Russia’s border to re-arm itself to the teeth 4.) destroyed Russia’s economy - likely for generations - lowering the standard of living for all its people 5.) convinced hundreds of thousands of young Russian men to flee the country (to avoid getting conscripted). 6.) killed/injured hundreds of thousands of Russian men - with 5.) creating a demographic time bomb that will go off in about 20 years. 7.) accelerated Russia’s decline as an empire. 8.) has made the country prostrate itself to China (from an economic perspective). I could go on. Hard to put lipstick on this pig…

-

@TwoCitiesCapital , I agree with your comments. Fairfax India has been buying back shares for years at low prices. Are these not largely the shares that will be used to pay the performance fee to Fairfax? Fairfax India should keep buying shares when they are trading this much below BV. The good news for investors buying Fairfax India shares today is they are unambiguously cheap. They own quality companies. The prospects for Fairfax India - and India - are bright. Possible catalysts are out there. The big one is a possible Anchorage IPO. The biggest problem i see with Fairfax India is liquidity. I can’t buy shares without moving the price. There is no way an institutional shareholder can invest in Fairfax India. My guess is any remaining institutional holders would love to exit (and that is what we saw early last year). As a result, absent some big catalyst, I think Fairfax India is destined to remain a frustrating stock to own. Not for those buying today. But for shareholders who bought when it traded above BV and still hold their shares. As it is configured today, I think the only ‘fix’ is for Fairfax to take it private. This makes more sense after Fairfax hits is ownership limit (about 50%)? Fairfax has been able to materially grow its stake in Fairfax India at exceptionally low prices. Fairfax has always been a head scratcher for me (in terms of how the stock trades). Great company.

-

Looking back at my 30 years of investing my biggest errors (if they can be called that) were selling my big winners too soon. But my returns have been pretty good so i am not sure if they could be called errors - i found other good investments. Another way to look at it: it takes me a long time to find a big winner. For me, they only come along about every 5 years. It takes an enormous amount of work. So when you find one it makes sense to be patient. I am not in a hurry with Fairfax. Psychology is the most difficult part of investing.

-

Canada has been taking a hard turn left under the federal Liberals… entrepreneurs are exploiters… businesses exist to pay taxes. Government regulation of the economy is increasing. Not a model, IMHO, that will surpass the US. The Liberal ‘experiment’ of ramping immigration/foreign workers/international students boosted Canada’s population by over 1 million last year. Total population of Canada is 40 million. The problem? We have a severe shortage of housing. And the economy here is slowing more than in the US (the Canadian mortgage market resembles that of the US in 2006 - and the low teaser rates are now expiring - so higher interest rates are slowing aggregate demand). The severe housing shortage looks like it is becoming THE political issue. It will take +5 years for the supply problem to be addressed. The crazy high number of newcomers is spiking demand. Many Canadians (who are pro immigration) are questioning if this is the right time to be bringing in record numbers of people into the country. We will see. I don’t think any of this affects Fairfax. If Fairfax grows insurance it will likely be outside of Canada. Given Canadas hard move left (and attitude towards businesses), I am not sure it is a great place to invest in today. There will be a Federal election in 2025 - if the Conservatives are elected we would see a shift to the right.

-

@Maverick47 thanks for the feedback. What really jumps out at me is how much Fairfax was under-earning in recent years on their fixed income portfolio (looking only at interest income). I haven’t factored in investment gains, so only looking at interest income does understate what they were actually earning on their fixed income portfolio. Regardless, i am looking forward to learning in the coming years how much Fairfax is able to earn on its fixed income portfolio. In the current high inflation / higher for longer interest rate world, think active management matters more than most investors realize. Not just in terms of fixed income, but also from a total investment portfolio perspective.

-

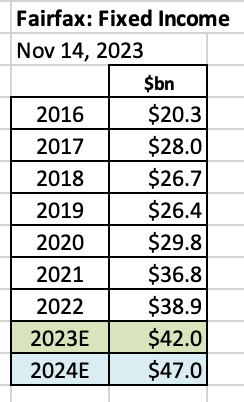

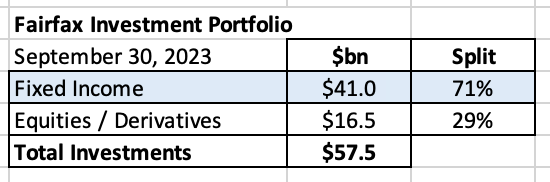

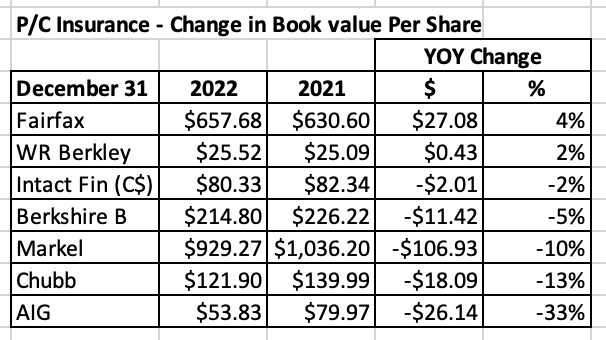

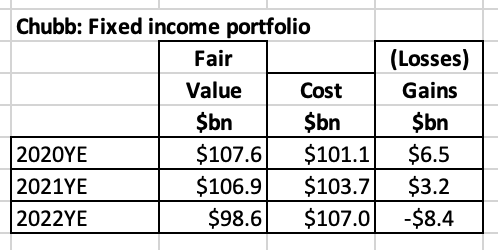

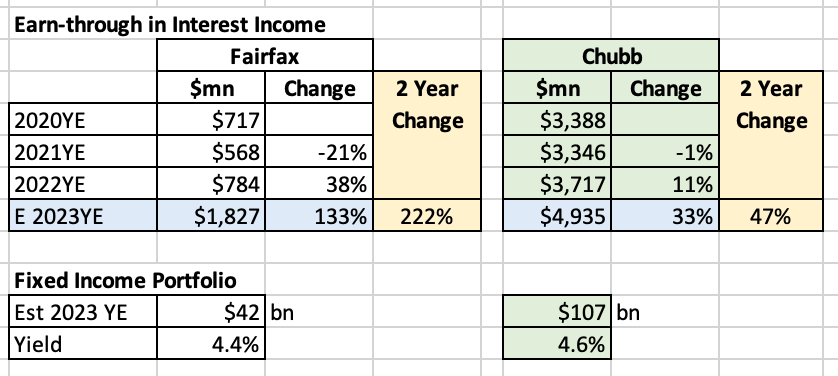

This is a long post. Fixed income is an under followed and under appreciated part of Fairfax. This post is broken into 3 parts: Part 1: an introduction to the fixed income portfolio of Fairfax Part 2: fixed income - some basics Part 3: what does all this mean for P/C insurers? Part 1: An Introduction to the Fixed Income Portfolio of Fairfax The team: how does Fairfax manage fixed income? All investments at Fairfax are managed through Hamblin Watsa. “Hamblin Watsa Investment Counsel, a wholly-owned subsidiary of Fairfax Financial Holdings Limited, provides global investment management services solely to the insurance and reinsurance subsidiaries of Fairfax.” Source: Hamblin Watsa website Within Hamblin Watsa, the team that manages the fixed income portfolio is lead by Brian Bradstreet. Brian has been with Fairfax for 36 years - from the very beginning. Is the team any good? Under Brian’s leadership, the fixed income team at Fairfax has done an exceptional job over the decades of managing Fairfax’s fixed income portfolio. They have a very good long term track record. I think we can say the fixed income team is a competitive advantage for Fairfax compared to peers. This is important because fixed income is by far the largest piece of Fairfax’s total investment portfolio. (As an aside, it was Brian Bradstreet who brought the CDS opportunity to Fairfax’s attention just as the housing bubble was getting going in the US. By 2009, that investment had made Fairfax $2 billion in profit. Not too shabby.) How big is Fairfax’s fixed income portfolio? Fairfax has an investment portfolio of about $57.5 billion. Of this total, about $16.5 billion or 29%, is invested in equities. The vast majority, about $41 billion or 71%, is invested in fixed income securities. When investors talk about Fairfax and investments, they usually focus exclusively on the equity holdings. The fixed income part of Fairfax is rarely discussed - even though it is the much larger part of the total investment portfolio. Well, this is changing. Why? Follow the money… Has the fixed income portfolio been growing in size? The fixed income portfolio at Fairfax has increased from $20.3 billion at Dec 31, 2016 to an estimated $42 billion at Dec 31, 2023. The increase is $21.7 billion, or 107%. The CAGR from 2016 to estimated 2023 is 11%. With the expected closing of the GIG acquisition in Q4 and the continuation of the hard market we should see similar growth in 2024. How much does Fairfax earn on its fixed income portfolio? The returns that Fairfax earns in its fixed income portfolio come primarily in two ways: Interest income Investment gains (losses) - realized and unrealized Fairfax actively manages its fixed income portfolio and has generated meaningful realized investment gains over time. However, to keep our analysis simple (and this post to a reasonable length), we are going to focus here on the largest bucket, interest income. The historical returns for interest income Interest income averaged $647 million per year from 2016-2021. From this average, it increased to an estimated $1.8 billion in 2023 or +182%. It is forecasted to increase further in 2024 to about $2.1 billion (my latest estimate). The average yield on the fixed income portfolio from 2016-2021 at Fairfax was about 2.4%. The yield has almost doubled to an estimated 4.3% in 2023 and 4.6% in 2024. Summary Fixed income investments are managed by a very capable team at Fairfax, lead by Brian Bradstreet. The fixed income portfolio has more than doubled in size from 2016 to 2023. At the same time the yield Fairfax is earning on its fixed income portfolio has almost doubled (from the average from 2016-2021). As a result of these two doubles (size and rate of return), interest income has spiked higher to about $2 billion per year (the current run rate). Interest income is now the largest income stream at Fairfax. This is important because this source of income is considered to be very high quality by investors and analysts. It is considered to be high quality because it is relatively predicable and durable. What happened to spike interest income so much? In short, over the past 2 years the fixed income team at Fairfax delivered a clinic in value investing and active management. But before we explore this further, let’s first cover off some bond basics. Part 2: Fixed Income - Some Basics Fixed income investing is very different from equity investing. Let’s spend a few minutes and review a few things that are relevant to our analysis. The greatest bull market in history. From 1981-2020, bonds experienced the greatest bull market in history. It began in September 1981, when the interest rate on the 10-year US treasury peaked at around 16%. It ended 40 years later, in June 2020, when the interest rate on the 10-year US treasury bottomed at 0.65%. Ever falling interest rates was an incredible 40-year tailwind for fixed income investors (actually, all investors - equity, real estate etc). The bull market lasted so long some of the risks of owning bonds, like interest rate risk, receded into the shadows…. largely forgotten by fixed income investors. But everything changed in early 2022. The scourge of double digit inflation escaped from its cage and was wreaking havoc on the global economy. The Federal reserve and other central banks began a historic tightening cycle and in the process unleashed hell on bond markets. The greatest bond bear market in history From 2021-2023, bonds experienced the greatest bear market in their history. The interest rate on the 10-year US treasury - that had bottomed at 0.65% in 2020 - hit a 15 year high of 4.98% in October 2023. The relentless move higher in interest rates over the past 2 years has caused the value of fixed income portfolios to crater. Where are the losses hiding? The massive losses are sitting on the balance sheets of central banks, pension funds and financial institutions all over the world. And yes, P/C insurance companies. ————— The Worst Bond Bear Market in History October 13, 2023 by Ben Carlson https://awealthofcommonsense.com/2023/10/the-worst-bond-bear-market-in-history/ “One of the strange parts about living through the worst bond bear market in history is there doesn’t seem to be a sense of panic. If the stock market was down 50% you better believe investors would be losing their minds. Yes, some people are concerned about higher interest rates but it feels pretty orderly all things considered. “So why aren’t people freaking out about bond losses more? “It could be there are more institutional investors in long bonds than individuals. There are lots of pension funds and insurance companies that own these bonds. “It’s going to take a very long time for investors to get made whole but you can hold these bonds to maturity to get paid back at par.” ————— Active management matters again As the bear market in bonds clawed its way though fixed income portfolios, a few P/C insurance companies were much better prepared than others. To understand who the relative winners and losers were/are it is helpful to first review the risks of investing in bonds. A review of some of the risks of investing in bonds Interest rate risk - rising interest rates cause bond prices to fall. Duration matters a lot with this risk. Spiking interest rates impact long duration bond portfolios much more than short duration portfolios. Credit risk - the risk the issuer may default on one or more payments. Market dislocations / recessions matter a lot with this risk - events that cause credit spreads to blow out. Commercial real estate (in particular office) has taken a beating over the past year. Inflation risk (purchasing power risk) - the risk that inflation is higher than the total return received on the bond. Unexpected inflation is what matters with this risk. Especially if the inflation is high and persists for years. Reinvestment risk - the risk that at maturity, the proceeds will be reinvested at a lower rate than the bond was earning previously. Part 3: What does all this mean for P/C insurers? To state the obvious, how fixed income portfolios were structured in 2020 / 2021 - when interest rates bottomed - has determined how the bear market in bonds has impacted individual P/C insurers. The two key metrics were: duration credit quality So far, the clear winners have been the P/C insurers that had fixed income portfolios in 2021/2022 that were low duration. (If we get an economic slowdown / recession then credit quality will likely also become an important factor.) Interest rate risk “Only when the tide goes out do you discover who's been swimming naked.” Warren Buffett Most P/C insurers match the duration of their insurance liabilities with the duration of their fixed income portfolio. So, in 2020/2021, many P/C insurers had an average duration in their fixed income portfolios of about 4 to 4.5 years. As a result of spiking interest rates in 2022, most P/C insurers saw the value of their fixed income portfolio plummet. This in turn caused book value to crater. This happened despite earning a strong underwriting profit in 2022. Let’s look at one P/C insurer to better understand what happened Chubb is viewed by many investors/analysts as being one of the better run P/C insurers. At the end of 2020, Chubb’s fixed income portfolio of $107.6 billion was sitting on an unrealized gain of $6.5 billion. Interest rates started to rise in 2021 and at year-end the fixed income portfolio was sitting on a smaller gain of $3.2 billion. In 2022, interest rates spiked higher. At the end of 2022, Chubb was suddenly sitting on a loss of $8.4 billion. Holy shit batman! The two year change in the fair value of Chubb's fixed income portfolio was a staggering swing in value of $14.9 billion (from a gain of $6.5 to a loss of $8.4 billion). As a result, despite earning a strong underwriting profit, book value at Chubb got crushed in 2022. To put this in context, from 2020 to 2022, Chubb earned an average of $3.5 billion per year in interest income from its fixed income portfolio. So a $14.9 billion swing in value over 2 years is a big deal. How did Fairfax manage to increase book value in 2022? In terms of book value growth in 2022, Fairfax was a clear outlier. Why? In late 2021 Fairfax reduced the average duration of their fixed income portfolio to 1.2 years (more on this in my next post). As a result it was not impacted by spiking interest rates nearly as much as other P/C insurers. Did any other P/C insurers have extremely low duration? Yes. Berkshire Hathaway had very low average duration (my guess is their loss in book value in 2022 was due in part to mark-to-market losses on their equity portfolio). WR Berkley also deserves a shout-out as their average duration at December 31, 2021, was 2.4 years, which was much lower than the average. As a result, in addition to Fairfax, WR Berkley was one of the few P/C insurers who were able to deliver an increase in book value in 2022. How should we think about these losses? Yes, big unrealized losses sounds scary. But P/C insurers have said they will simply hold the bonds until they mature. Unless there is an unexpected liquidity need (perhaps like a 1-in-100 year catastrophe) it is unlikely we are going to see forced sales. So if the losses will not be realized are they really a problem? Given the sizeable impact to book value there may be regulatory implications - insurance regulators and credit rating agencies are likely paying close attention. Perhaps the more important question is how long are some P/C insurers going to have to sit on those (shit) low yielding bonds they are holding? The key is duration. P/C insurers with fixed income portfolios with an average duration of 4 or 5 years are likely going to need another couple of years to get the (shit) low yielding bonds off their books. Low yielding bonds - means low interest income - means lower earnings. P/C insurers with a low duration portfolio have a big earnings advantage for the next couple of years over P/C insurers with longer duration fixed income portfolios. We will discuss this more below. Inflation risk Expected inflation is generally not a problem. Unexpected inflation, if it is high and persistent, can be a big problem for P/C insurance companies. And guess what we have had for the past 2 years? Unexpected high (double digit) inflation. Why is unexpected inflation an issue? Because most P/C insurance companies are sitting on tens of billions in insurance liabilities. P/C insurers get paid a fixed amount up front when they write an insurance policy. When they price the policy, they have to guess at its cost. After doing all this, they hope to make a profit. Unexpected inflation is a big problem for P/C insurers. It means costs are likely going up more than expected. This is especially problematic for long tail lines of business. Because those higher than expected losses keep happening for years into the future. And if you also have a long duration fixed income portfolio - and, at the same time, you are stuck with (shit) low yielding bonds - well, your problems are even worse. High unexpected inflation and a long duration / low yield fixed income portfolio is not a good combination for the profitability of a P/C insurer - it has the potential to squeeze earnings for years. Perhaps this partly explains why the hard market that started in late 2019 kept going strong in 2023 and looks set to continue strong into 2024 - despite repeated predictions of its imminent demise. Reinvestment opportunity (not risk) The increase in interest rates the past 18 months has been historic in amount and speed. P/C insurers are seeing interest rates today - across the curve - at 15 year highs. P/C insurers with shorter duration fixed income portfolios have been able to capture the spike higher in interest rates much more quickly than P/C insurers with longer duration portfolios. We can see this by looking at the trend in interest income for the last 2 years. Fairfax is estimated to see interest income increase 133% in 2023 and 222% over the past 2 years. Chubb, on the other hand, is estimated to see interest income increase 33% in 2023 and 47% over the past two years. The speed of the earn-through for Fairfax is more than 4 x that of Chubb. It is also interesting to note that the yield on both Fairfax’s and Chubb’s fixed income portfolio now looks remarkably close. What is very different, however, is what they hold in their respective fixed income portfolios. Credit Risk The one risk I have not discussed is credit risk - the risk the issuer may default on one or more payments. Fairfax’s fixed income portfolio is stuffed mostly with government bonds. High quality. Chubb? Very different. The yield on Fairfax’s and Chubb’s fixed income portfolio might be similar. However, the credit risk (made up of the holdings in each of the two portfolios) looks very different to me. Which portfolio is more risky? Which portfolio should perform better it we see an economic slow down? This post is long enough already… I’ll let you answer those two questions on your own. Conclusion The historic bear market in bonds has crushed the value of fixed income portfolios of many P/C insurance companies - in turn this has cratered book value. But a few odd ducks were prepared - Fairfax, Berkshire Hathaway and WR Berkely. On a relative basis, over the past 24 months, P/C insurers with low duration fixed income portfolios have been the clear winners over P/C insurers with long duration fixed income portfolios. Fairfax was exceptionally well prepared. Short duration portfolios protected book value. And the earn-through from higher interest rates (in the form of spiking interest income) has been much quicker - which is boosting profitability - compared to long duration peers. Having a short duration portfolio has also provided valuable optionality - it allows P/C insurance companies to be opportunistic should we see any dislocations in financial markets (like April of 2023, and the crisis that hit regional banks in the US). In my next post (coming next week), I will take a closer look at what the team at Fairfax has done with their fixed income portfolio over the past 2 years. What can we learn about Fairfax and their fixed income team? Does value investing also apply to bonds? Does active management matter? ————— Background Information: How P/C insurance companies account for their bond holdings is important for investors to understand. Most bonds at most P/C insurance companies are held in the ‘available-for-sale’ bucket. This means that unrealized losses do not show up in earnings (or ROE calculations). However, these unrealized losses are real - instead they show up in ‘other comprehensive income’ and book value. How an Available-for-Sale Security Works https://www.investopedia.com/terms/a/available-for-sale-security.asp#:~:text=Available%2Dfor%2Dsale%20(AFS,a%20ready%20market%20price%20available. “Available-for-sale (AFS) is an accounting term used to describe and classify financial assets. It is a debt or equity security not classified as a held-for-trading or held-to-maturity security—the two other kinds of financial assets. AFS securities are nonstrategic and can usually have a ready market price available. “The gains and losses derived from an AFS security are not reflected in net income (unlike those from trading investments) but show up in the other comprehensive income (OCI) classification until they are sold. Net income is reported on the income statement. Therefore, unrealized gains and losses on AFS securities are not reflected on the income statement. “Net income is accumulated over multiple accounting periods into retained earnings on the balance sheet. In contrast, OCI, which includes unrealized gains and losses from AFS securities, is rolled into "accumulated other comprehensive income" on the balance sheet at the end of the accounting period. Accumulated other comprehensive income is reported just below retained earnings in the equity section of the balance sheet.”

-

@Hamburg Investor thanks for taking the time to write a thoughtful post. - yes, calling what Fairfax does ‘macro bets’ is not entirely accurate. But i also think Fairfax’s explanations can also be messy - like their reasoning for exiting the equity hedges in late 2016. - i do think Fairfax has moats - how else do you compound BV at such a high rate for 4 decades if you don’t have at least a few sustainable competitive advantages over most other P/C insurers? (Especially when you include the significant losses from the equity hedges.) - what are the moats? Family control is likely one. The insurance business is likely another (today). Capital allocation might be the largest moat. - capital allocation: what Fairfax does today is unique in the P/C industry. In comparison, Markel plays checkers and Fairfax plays chess. This is not to say Markel is bad. Fairfax has spent decades building out their capabilities. - i think capital allocation might be the thing most mis-understood part of Fairfax today. They use such a diverse array of strategies. And a chunk of the value being created is hidden from view (and book value). We find out when Fairfax surfaces the value - like when they sold pet insurance. - i also think in a higher interest rate (high volatility) world active management matters again. Fairfax has been building a diverse team at Hamblin Watsa for this exact moment. Returns moving forward could surprise to the upside. - the power of compounding will also be something to watch in the coming years. Its possible we get some Berkshire type of magic. I think about Berkshire and holding a stock long term (buy and forget about it possibly for decades). And then i think about Fairfax and i can’t square the circle. What Fairfax does to be successful - with investments - just seems to take so much work year-in and year-out. Will fixed income continue to rock when Brian Bradstreet is gone? Will insurance continue to rock when Andy Barnard is gone? My Christmas wish for Fairfax is that they continue to make the business model more self-sustaining. I think this is the direction they have been going for the last 5 years. I think we can see this with insurance. I think we are seeing that with the equity holdings - Fairfax has been moving up the quality ladder over the past 5 years. The fixed income portfolio looks locked and loaded for years (with average duration getting pushed out to 3.1 years). So with insurance/investments we might have just arrived in 2023 at ‘new Fairfax’ - a more predictable self-sustaining P/C insurance company. Chug, chug, chug. The big question for me is what are normalized earnings for ‘new Fairfax’. I keep throwing $150/share out there. But i think this could be way low moving forward. Capital allocation will be key. Active management will be another. I also wonder what hidden assets are sitting on Fairfax’s balance sheet that will be monetized moving forward. BIAL is a jewel. As is Digit. Fairfax India (and Fairfax’s capabilities there) are grossly undervalued. Fairfax has a bunch of things that are chugging away… I expect more large realized gains are coming - and these are not built into anyones models today (including my $150/share estimate). Great time to be a Fairfax shareholder. I am doing my best to listen to @bearprowler6 - the big money is made by sitting on your hands and doing nothing. His posts remind me of this quote: “It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.” ― Edwin Lefèvre - Reminiscences of a Stock Operator

-

+1

-

I think the discussion of ‘moat’ for Fairfax also needs to include the flip side: ‘what are the big risks of investing in Fairfax.’ I am talking about stuff that is largely in management’s control. My number 1 risk is trust in the senior management team. Will they make another big macro bet that sets the company back 5 or more years? The phenomenal success Fairfax experienced with CDS/equity hedge bets from 2005-2009 likely set stage for the terrible equity hedge/short strategy from 2010-2016. Hubris set in and Fairfax was punished by the investing gods. Given the success Fairfax has been having the past couple of years, do we see a repeat at Hamblin Watsa? Does hubris set in again? This highlights what i think might be a fundamental flaw in Fairfax’s business model: too much macro thinking. When it works, it is a beautiful thing. When it doesn’t work, especially given the size of the company today, it will be ugly. Given its massive size today, do we see Fairfax fine-tune its business model to rely less on big macro bets?

-

@ander What is fair value for Fairfax today? Great question. I am not sure what Fairfax’s answer would be. My guess is we will get an update from Fairfax in the 2023AR when it is released in early 2024. What do i think? The key for me is earnings. I view Fairfax as a turnaround that grossly under earned for years. Those low earnings got anchored in investors psyche (messed them up) and this likely remains to this day. We have been learning the past couple of years what the true earnings power of Fairfax and its collection of assets really is. What complicates things is: 1.) we have seen crazy volatility in financial markets the past 5 years - with 3 different bear markets in stocks and an epic bear market in bonds. 2.) the management team at Fairfax has been executing exceptionally well. How much of this is one-time in nature and how much is sustainable moving forward? 3.) the spike in bond yields and Fairfax extending duration is a big deal. As i have posted many times, i think ‘normalized’ earnings for Fairfax today is about $150/share. With the stock trading at $900 this gives a PE of 6. That tells me shares are exceptionally cheap. EPS of $150 delivers an ROE in the high teens. P/BV is about 1. Yes, this is IFRS BV, which is higher than GAAP BV. But regardless the multiple is low. Looking at ROE and P/BV it looks to me like Fairfax is cheap. How cheap? Hard to say… because i think BV is messed up and likely understated… Of the two ways to look at Fairfax, today i trust EPS the most. Given the size of earnings, capital allocation will be very important the next couple of years. The risk / reward today looks pretty compelling to me. But we all need to do our own analysis (to own it or not) and find the right fit (position size).

-

If Fairfax reduced its TRS position (simple exit of the position with no explanation) at around current prices it would make me question how cheap the shares really are. If Fairfax thought the shares were very cheap today would they exit the TRS position? No, i don’t think so. I could see Fairfax exiting the TRS position when they feel shares are close to fair value (by close i mean within 10%). ————— From a capital allocation standpoint my big surprise this year is the minimal buybacks we are seeing from Fairfax. At least compared to the past 5 years. Clearly, Fairfax is seeing better opportunities doing other things. I am not complaining. Fairfax shares are up significantly over the past 2 years. ————- If we saw Fairfax exit the TRS position and stop buying back stock it would likely tell me they no longer see their shares as being very cheap (perhaps just cheap). ———— And if we saw Fairfax make a big acquisition by issuing new shares at current prices… Well, that would tell me Fairfax saw their shares as being fully valued, and perhaps even over valued.

-

”Does Fairfax have an endurable moat?” This is a great question and one that i have not actually thought much about. I would love to hear what others think. @Hamburg Investor Here is my question to you: Do you think Fairfax will continue to make big macro bets moving forward?

-

@bearprowler6 your comment surprised me. The size of the purchase was very small. The ‘report’ calls it a sizeable addition? It added 0.003% to Fairfax’s position. It was a $450,000 purchase - tiny in size. Regardless, Blackberry is also in the process of being sold. Fairfax understands the company better than most. It probably IS good value at $3.52/share. Will Fairfax play around with their position size pre-sale? Perhaps. Like Farmers Edge, IMHO we need more information before we rush to judgement. ————— “On November 13, 2023, Prem Watsa (Trades, Portfolio), through Fairfax Financial Holdings, made a notable addition to its investment in BlackBerry Ltd (NYSE:BB). The transaction involved the acquisition of 129,000 shares at a price of $3.52 per share, increasing the total holdings to 46,853,700 shares. This move had a 0.03% impact on the portfolio, adjusting the position to 10.77% and marking a significant vote of confidence in the company's prospects.”

-

I agree. And I do not understand all the anger with the posts on Farmers Edge. Can anyone explain to me what Fairfax is doing and more importantly why they are doing it? What are the financial impacts? Clearly more information is needed to properly assess this announcement. My initial read is this is a nothing burger. But i remain open minded. Yes, Farmers Edge was a terrible investment. It has been clear for at least a year that the end of this investment is near. Sayonara.

-

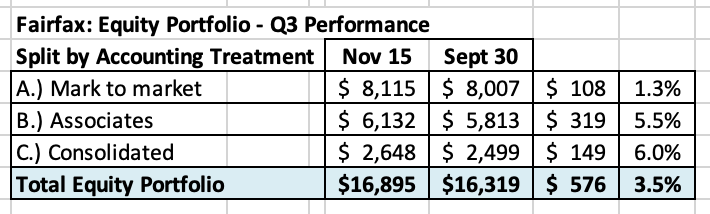

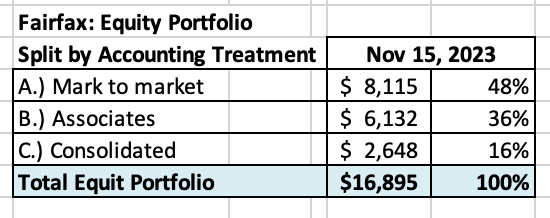

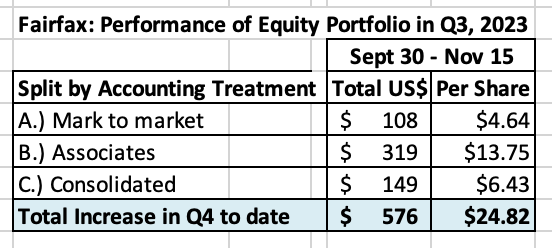

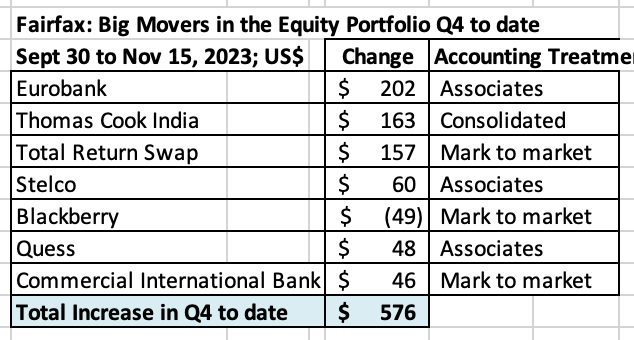

What was the change in the value of Fairfax’s equity portfolio at the half-way mark in Q4 (to Nov 15)? Fairfax’s equity portfolio (that I track) has a total value of about $16.9 billion at Nov 15, 2023 (midway through Q4). This is an increase of about $576 million (pre-tax) or 3.5% from September 30 to November 15, 2023. The increase in the quarter works out to about $25/share. My Excel tracking file is attached at the bottom of this post for those who are interested. In the first 6 weeks of Q4, currency has been a bit of a tailwind. Please note, I include holdings like the FFH-TRS position in the mark to market bucket and at its notional value (which was $1.765 billion at Nov 15). I also include debentures and warrants that are in the money in this bucket. To state the obvious, my tracker portfolio is not an exact match to Fairfax’s actual holdings. It also does not capture changes Fairfax has made to its portfolio during the quarter. As a result, my tracker portfolio is useful only as a tool to understand the probable directional movement in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 48% of Fairfax’s equity holdings are mark to market and will fluctuate each quarter with changes in equity markets. The other 52% are Associate and Consolidated holdings. Split of total gains (losses) by accounting treatment The total change is increase of $576 million = $25/share The mark to market change is increase of $108 million = $5/share. Only changes in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio? Eurobank was up $202 million and it is now a $2 billion position for Fairfax. Thomas Cook India was the star performer in Q3 and continued its strong performance 6 weeks into Q4, up $163 million. With a market value of $645 million, TCI is now Fairfax’s 5th largest equity position. The FFH total return swap position (giving exposure to 1.96 million Fairfax shares) continues to perform exceptionally well. This position is up another $157 million or more than $1 billion since it was initiated in late 2020. Below is a copy of my Excel spreadsheet (next 2 pages) if you want a closer look. For Associate and Consolidated holdings, the excess of fair value to carrying value is about $874 million or $38/share (pre-tax). Book value at Fairfax is understated by about this amount (less the tax impact). What is the split? Associates: $505 million = $22/share Consolidated: $369 million = $16/share Equity Tracker Spreadsheet explained: The summary below attempts to track all equity holdings at Fairfax. Each quarter we update the spreadsheet to capture any ‘new news:’ purchases and sales. We have separated holdings by accounting treatment: Mark to market Associates – Equity accounted Consolidated Other Holdings – derivatives (total return swaps), debentures and warrants We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$ so non-US holdings have their values adjusted for currency. Important: the list is not complete. Some information we only get once per year when Fairfax published their annual report. Fairfax makes changes to their portfolio each quarter. Fairfax Nov 15 2023.xlsx

-

Not sure if this has been posted already… looks like Prem is elephant hunting. Am i reading this right that this is not Fairfax - but Prem on his own? The partners on this proposed deal are interesting. Pierre Lasonde is a partner with Fairfax in Foran Mining. Kestenbaum is, of course, the CEO of Stelco. If you wanted to partner with stars, it would be difficult to find two better than Lassonde and Kestenbaum. Here is a write up on Lassonde: https://latinmines.com/pierre-lassonde/ ————— Pierre Lassonde ‘mystified’ by Teck choice of Glencore bid for coal unit - https://www.theglobeandmail.com/business/article-pierre-lassonde-mystified-by-teck-choice-of-glencore-bid-for-coal-unit/ Veteran mining entrepreneur Pierre Lassonde said on Wednesday that he is “mystified” by Teck Resources’s decision to sell its coal unit to a Glencore-led consortium for $9-billion because his group bid the same price. “We put together an offer that was very, very competitive, it was in the best interest of Teck shareholders, Canada … the employees,” Mr. Lassonde said in an interview. “And it was a holistic solution with the same price tag.” On Tuesday, Teck agreed to sell its steelmaking coal unit to the group led by Switzerland-based Glencore. Mr. Lassonde said his consortium included Fairfax Financial Holdings founder Prem Watsa and Stelco Holding CEO Alan Kestenbaum, both in their individual capacities. Their offer was credible and comparable to what Teck’s board accepted from Glencore, he said.

-

Great news: Fairfax is (finally) materially shrinking their exposure to Blackberry. $200 million that has been dead money for a decade is now going to be re-invested into something that should now earn an acceptable return. Perhaps they extended some of the debenture to assist the company with the sales process? No idea. Blackberry is one of the few legacy equity ‘problem children’ that Fairfax has left to fix. Fairfax just reduced its exposure to Blackberry by about 40%. A step in the right direction.

-

Initiated a starter position in Saputo (SAP.TO). Looks like we might be getting capitulation in the shares. A former high flyer that has crashed back down to earth. Shares are trading at 2014 levels. Another turnaround play. Family controlled business. Time to get back up to speed on the company. Also bought a little Linamar (LNR.TO).

-

@vinod1 with earnings growth of 5% are you not essentially saying Fairfax’s capital allocation will be poor moving forward? Part of the reason I am so optimistic on Fairfax today is: 1.) the cash flows are front loaded. We know with a fairly high confidence level that they are going to deliver record operating earnings 2023-2025. Buffett teaches us when valuing a company the TIMING of future cash flows is exceptionally important (the sooner the better - the higher the valuation a company should get). 2.) the opportunity set to deploy capital is very good today and i suspect is about to get even better: and Fairfax has +$3.5 billion that will be re-invested each year moving forward in a very good investment environment. Bond yields are at 15 year highs. Small cap stocks are trading at bear market lows. If we get a recession all equities will go on sale (and already cheap equities will get stupid cheap). When it comes to capital allocation today, Fairfax is like a major league hitter getting lobbed softballs. As a result, I will be surprised if earnings growth is 5% per year moving forward. You also bring up ‘one time’ losses. Fairfax’s results will be volatile. Especially if we get a recession (no idea if this happens). My view is volatility is a good thing for Fairfax - smoothing results out over a couple of years. The TRS-FFH purchase in late 2020/early 2021 is a great example. They masterfully took advantage of extreme volatility in Fairfax shares - extreme pessimism. Another great example was selling corporate bonds and shifting to government bonds and shortening duration to 1.2 years in late 2021. They sold at the top of the fixed income bubble. The extension of their fixed income portfolio to 3.1 years in October looks exceptionally well timed. Selling Resolute at the top of the lumber cycle? Brilliant. Selling pet insurance for $1.4 billion…. Nuts. Lots of these decisions are $1 billion decisions… they are ‘needle movers’ for Fairfax and its shareholders. Fairfax investors fear volatility. I think they might have it backwards. Especially given how Fairfax is positioned today (strong balance sheet and record operating earnings). Investors in Fairfax should be praying for volatility. With both insurance and financial markets. Thriving in volatile markets - this looks to me like it is likely a significant competitive advantage for Fairfax today compared to peers.

-

@StubbleJumper we are not that far apart. I do appreciate the opportunity to discuss and debate. I sometimes will take a bit of an extreme view to create the opportunity for push back. I wonder if we are going to learn that Fairfax was criminally under earning on its assets from 2010-2020. And that its earnings power is much higher than anyone imagined. Which just means the returns being generated today are not as abnormally high as they look. Just a theory… we will know more in a few years. i also wonder what the value of active management is today (in terms of alpha - returns in excess of a benchmark). Howard Marks comments in his most recent memo that cost of capital matters again - it didn’t from 2008-2021. Another theory i have is the alpha being delivered by Fairfax’s management team is much higher than investors realize. They look ideally positioned to benefit from the current high interest rate / volatility environment - and much better than peers (including BRK). Again, we will know more in a few years. I also wonder about the quality of the underwriting and the insurance business. It looks to me like Fairfax might be slowly moving up the quality scale (compared to peers). Not elite. But better than they were. Another crazy theory. All three ‘theories’ likely impact my view of Fairfax’s earnings potential over the next 5 years. We will see.

-

@StubbleJumper why do you think 1.) a 95-96CR is not sustainable over the next 5 years? What if Fairfax IS becoming a better underwriter? 2.) interest rates today are ‘favourable’? What if interest rates are simply back to normal? 3.) power of compounding is dead? it also appears you think Fairfax (and its equity holdings) will not invest record earnings well moving forward… $3.5 billion per year in earnings is a big number… it could deliver $350 million ($15/share) in incremental earnings to Fairfax each year if it is invested wisely. 2023 + 2024 + 2025 - year after year etc. You appear to be completely discounting the power of compounding looking forward… Yes, the hard market will end at some point. Yes that will slow top line organic growth. But why does that mean CR has to immediately increase to 100 or higher? Yes, interest rates have increased from when they were zero. Why do we think they will be going back there? People are anchored to the financial regime from 2008-2021. What if the next 10 years is different? Maybe we ARE in a structurally higher inflation environment. Which suggests we are also in a higher interest rate environment. Cost of capital matters again. Active management matters again. Since 2018, Fairfax has excelled with active management. Why do we think they are all of a sudden going to get stupid? Do i know how the future is going to unfold for Fairfax? No, of course not. I see a range of outcomes - some good and some bad. With a ‘baseline’ forecast i try and find the middle ground in the forecast. Some items will be too high; some will be too low. I also try to work with facts as much as possible. Do i know how the insurance cycle is going to work out? Ot the economy? Or interest rates? Macro? I have no idea. So why would i assume it all turns against Fairfax? My guess is there will be both puts and takes. What i see on the board is lots of pessimism. But no balance. No discussion of what might go better than expected. So i view people on the board as being too bearish in their outlook for Fairfax’s earnings moving forward. i don’t equate bearish with being conservative. Conservative would include a more balanced discussion of positives and negatives. I enjoyed listening to Howard Marks most recent memo: Further Thoughts on Sea Change - https://www.oaktreecapital.com/insights/memo/further-thoughts-on-sea-change ————— PS: look at Eurobank. Look at the turnaround at this company the past 5 years. Look at what it is earning today (a record amount) and what it is doing with those earnings (purchase of Hellenic Bank). My guess is EPS will increase 20% in 2024. They likely will be instituting a dividend in 2024 and payments to Fairfax could be $80-$90 million. This will increase total dividends received by Fairfax by 50%. It is meaningful. Not built into my $150 ‘normalized’ number. Digit? Do people think we are done with this investment? My guess is it is likely to deliver significant incremental value to Fairfax shareholders moving forward. GIG is a great real time example. This purchase will increase top line. And float. And investments. Fairfax is done after the GIG acquisition? Because we don’t know with certainty what they are going to do we assume they are going to do nothing? These are just three quick examples. Fairfax has so many levers to pull to drive value for shareholders moving forward with insurance and investments. My guess is they are going to continue to execute well. But i remain open minded.

-

Is the US economy set for another Roaring ‘20s?

Viking replied to james22's topic in General Discussion

@Jaygo I look back 40 years ago to when i was a teenager. Quality of life for the average person in Canada today is much, much better in my opinion. Much has changed so there are big winners and losers. As i age out, the losers are much easier to see than the winners… so it is natural to feel that we collectively are worse off. So what is better? Education is infinitely better and cheap. Health care is better. Women have much more opportunity. Net worth of anyone who owns real estate is through the roof (most Canadian families). These are just a few examples that quickly come to mind. I remember the recession in the early 1980’s (I was a teenager trying to find a job). GDP declined 3.2%. Inflation was +10% and the unemployment rate peaked out at 12%. All the hand wringing today about the current economy/situation cracks me up a little… it reminds me of the scene in Crocodile Dundee. Perspective is important. My view is what doesn’t change over time is the opportunity for people to live a great life (here in Canada). Every generation, the model to live a successful life changes in important ways. And every generation 20% of young people figure it out and earn/live a great life; 20% crash and burn and 60% are going through the motions. My guess is it was the same 100 years ago. And the same 200 years ago. I tell my kids they should want to be in the 20% that lives a great life. The rub is the model of the past generation here in Canada (real estate) probably will not work for them - they need to figure out the new model. Your future reality is (usually) the sum of the choices you make. Personally, i think a great current opportunity for young people is to take advantage of all the tax free accounts being offered by the government… tax free compounding (plus low fee self-directed accounts and low fee ETF’s) starting in your early 20’s is a lay-up in terms of achieving financial independence - in about 20-25 years if you work at it (knowledge/skill/desire). -

@Spekulatius i think the fundamental problem for Fairfax is there is no consensus among analysts/investors of what the normalized earnings power is for Fairfax today. This in turn makes it impossible to come up with an intrinsic value. I think normalized earnings for Fairfax is about $150/share. And this should grow nicely in the coming years. Lots of people on this board think earnings this year at Fairfax are unsustainably high (and my $150 estimate is ‘peak earnings’). Lots of analysts agree - some are forecasting EPS to fall at Fairfax in 2024. Do they think Fairfax is going to destroy capital moving forward (mal-invest record earnings)? I think the biggest issue with valuing Fairfax today is the historical numbers are grossly understated and full of noise. 2023 is the first year where we are getting an accurate picture of what the different income streams at Fairfax can generate moving forward. It makes sense investors will need to see 2 or perhaps 3 years of growing earnings to ‘believe’ they are real and sustainable. Over time, as more investors come to understand the true earnings power of Fairfax the stock will get valued more appropriately. I suspect the narrative (story) will also continue to improve moving forward. When Fairfax stock is trading at 1.1 x BV, my guess is the analyst at RBC will increase his target to 1.1 or perhaps even 1.2 x BV. And he will have a couple of really good reasons justifying the re-rating…