Viking

-

Posts

4,689 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

7 hours ago, Spekulatius said:

The Saudis cut and the Russian flood:

@Spekulatius you certainly have been correct with your scepticism over the last year of how sustainable higher prices were. Note taken. Looks like demand from China is lower than expected. And supply from Russia and rest of world is higher than expected. We will see if demand picks up 2H.

Energy is still a core holding for me, although a smaller position than it was a few months ago. Suncor continues to be my largest position. I was adding Baytex (small amount) the last couple of days… lots of selling last week by US holders after Ranger close… stock got killed.

I do like listening to Arjun Murti (depth to what he has to say, with focus on return on capital); Eric Nuttall can be fast forwarded, especially if you have heard him talk before. Bottom line, lots of oil companies are still very profitable even at $70 oil. Arjun actually likes low oil prices… he thinks that could extend the high margins/returns for longer. We will see.

-

5 hours ago, John Hjorth said:

“Never underestimate the Russians' willingness to deceive themselves" - tells everything about what decades - or rather centuries of dictatorship do to a population's ability to think independently. In totalitarian regimes, not thinking about politics becomes a way of survival.

PS for natural reasons I can't share my friend's name. But he is not in Russia anymore. In fact, virtually none of my Russian friends or acquaintances are. Those who can still think are long gone. They will not give up thinking independently, and then they cannot live in Russia."

@John Hjorth thanks for posting. I do not find it depressing. And that is because Russia is providing the Western world with a real-time teachable moment. Sometimes knowing what you want is as simple as knowing what you don’t want. Russia is quickly devolving into a hellhole. Totalitarian political culture can be a bitch. Blows me away that there are still apologists out there for that regime. -

11 minutes ago, SafetyinNumbers said:

Thanks for highlighting Viking!

Do you have the current $/share invested in Greece? I think it’s a pretty decenf percentage of the market cap even though a small percentage of assets given the float leverage.

@SafetyinNumbers here are some approximate numbers:- Eurobank $1.9 billion

- Grivalia Hospitality $400 million

- Mytilineous $300 (including exchangable bonds)

- Pratkiter? (Paid $29 million in 2014 - Home Depot type business)

- Eurolife? (Paid about $360 million for 80%; Eurobank owns 20%)Fairfax’s equity holdings total around $15.7 billion, so their Greek equity holdings of $2.6 billion are about 17% of the total... a significant number.

-

As expected. 4 more years. This should allow conservatives/New Democracy to make significant further progress in reforming the Greek economy. Very good news for Fairfax’s significant Greek holdings (Eurobank, Mytilineous, Grivalia Hospitality, Praktiker and Eurolife).

—————Greek conservatives storm to victory in repeat election

ATHENS, June 25 (Reuters) - Greece's conservative New Democracy party stormed to victory in a parliamentary election on Sunday with voters giving reformist Kyriakos Mitsotakis another four-year term as prime minister.

With most votes counted, centre-right New Democracy was leading with 40.5% of the vote and 158 seats in the 300-seat parliament, interior ministry figures showed.

It was more than 20 points clear of Syriza, a radical leftist party that won elections in 2015 at the peak of a debilitating debt crisis and ran the country until 2019, when it lost to New Democracy.

-

14 hours ago, Gregmal said:

It’s not “fake” but my god we ve been hearing about all these super big deals with massive global implications and major incoming consequence from all the usual suspects since February of last year. And the result? Nada. Wheat futures are volatile. Lol big deal. -30% oil prices? People have been trying to scream “HUGE STORY” with this Russia/Ukraine thing, for reasons I don’t quite understand, and as someone who is just looking at investment angles…find it both annoying and bizarre.

You might want to ask a European if Russia’s invasion was a big deal (game changer) or not. My guess is many would disagree with your take. Energy supply to Europe has been changed forever. Cheap and abundant energy is the core building block of every society. Europe having the warmest winter on record was an important factor - an awesome development. The UK is an inflation shit show right now. High energy prices are now bleeding though to wage spiral. Finland is not part of NATO. The Ukraine war is not over.

And we just learned how fragile (and messed up) Russia is. I’m not sure if your aware, but they have a few nuclear weapons… that is a fat tail risk (getting fatter). Not an issue until it is - i’m not sure but i have heard that nuclear weapons can really be a bitch when they are used. Now we can pretend that this risk does not exist… but this isn’t a Disney movie.

Russia invading Ukraine has also ‘informed’ the rest of the world on China (multinational companies understand what is coming) and this is accelerating de-globalization. Totalitarian governments and liberal democracies are like dogs and cats… I think the US (and everyone else in the West) is looking to on-shore important stuff - like chip production (FYI, not the potato kind).

Remember, prices cycle up. And down. And then back up… Perhaps we never see $100 oil again. Possible.

I could go on. But Russia’s invasion of Ukraine did change the world - economically, politically and militarily. And it is still early days. It will take years (a decade or more?) to fully understand how much. Now i will agree that someone living in rural America or Canada is not being impacted all that much. To them it is probably looking like a big nothing burger.

Please note, this is not a doom and gloom summary. I continue to be very optimistic. Change is inevitable and usually a good thing (over time). The West will continue to improve the standard of living for its people. That’s why so many people desperately want in.

-

1

1

-

-

28 minutes ago, Gregmal said:

So another hyped up, American media created cocktail, that turns out impotent. Nice.

Really? You might want to look at any news service in the world right now… China, middle east etc… their lead story? Shit show in Russia. Nothing to do with the American media. Bit you can believe that if it makes you feel better

Impotent? Describes what Russia is being reduced to…

-

So is the threat from Wagner sufficient to force Russia to pull troops from Ukraine? Wagner exiting from Ukraine must be a significant development… they claim to have 25,000 troops. If the Wagner threat is real it makes sense to me Russia would prioritize putting down Wagner over empire building in Ukraine. Hopefully there is a way for Ukraine to exploit the current turmoil in Russia.

I am already thinking ahead to Monday and how financial markets will open; especially oil. Yes, lots will likely change over the next 48 hours. Crazy times.

—————

We have yet another example of just how badly Putin miscalculated when he decided to invade Ukraine. It is looking more and more like one of the great blunders / catastrophes of the post WWII era. And it might end up costing him his job.

-

How do they all coordinate reporting not just the what (event) but also the message? All at the same time? Australia, Canada, Denmark, New Zealand, USA, France, Japan, Germany… and 20 or 30 more counties? Are they really that smart?

You lump them all together (‘our media’) and that i do not understand.

-

25 minutes ago, changegonnacome said:

The absense of news is a clue to how things are going. Omission is how our media filters information. Its certainly less horrible than the outright nonsense seen in other countries like Russia - we are lucky in that 'our' press is indeed the most free but its not immune to shaping the news around narratives/audiences/advertisers......Ukraine struggling to make headway with the offensive, after all our support and rhetoric, is counter to the narrative, fails to sell papers/clicks which loses you advertisers.

Our media aren't scumbags - but if/when things start going badly for the Ukrainians I would expect that we wouldn't hear about contemporaneously & in 'real-time' but rather a little after the fact and only when its hard to ignore. I would expect a little exaggeration too on Ukrainian successes. I think when you put that filter on things we are lucky to have a press/media as good as we do.

@changegonnacome Sorry, i am as dumb as a stump. Who is ‘our media’ you are referencing? Can you please list exactly who it is you are talking about?And how, exactly, do they coordinate their news stories, especially breaking news?

Do they all go to some school where they are taught to do what you suggest? Or is there some secret book that lays everything out?

-

8 hours ago, Jaygo said:

Hi Viking.

are you doing this through an etf?

@Jaygo No ETF; i want to control which stocks and weighting. I am using the shotgun approach:- telecom: Telus, Bell, Rogers

- Can banks: BNS, CM, Canadian Western & Laurentian. They are the cheapest right now with the highest dividend yield. Will add the other big banks if/when they sell off.

- Can pipeline stocks: Enbridge, TC Energy, Pembina- REITs: these i am still learning about… very small positions as i learn more. Primaris, Chartwell, Roican, European Residential.

i am weighting telecom and Canadian banks higher than pipelines and reits as i think they offer higher total return potential (dividend plus capital gains). Also, i am weighting my positions based on how cheap i think they are.

I will also add to names on weakness: increase position about 30% for every 2.5% they fall from here. I would love to double my position in every holding if they fell another 8-10%.

I am about at an 8% weighting in the names above (in total). I would be happy increasing to a 20% weighting on a 10% sell off (from current levels).

i am also looking into Freehold Royalties, Chemtrade Logistics, Gibson Energy. I held Dexterra but sold it after it popped 10%. Anything with a high dividend yield.

As i add new names of companies i have not followed i am doing more due diligence and trying to find the better managed in a sector.

Please let me know of any other high dividend stocks that you like / think look interesting. Especially stuff that is out of favour due to rising rate fears.

—————

i could also include the following as they also have very good yields. But these also have big capital appreciation potential over the next couple of years (i hold them more for the capital appreciation).

- US banks: Citi, MTB, BAC (4% weighting)

- energy: Suncor (7% weighting)

—————

i am stuffing the basket of high dividend payers mostly in my big LIRA which i will be converting shortly to a LIF. I like the idea of potentially having a dividend yield on the LIF (6%) that is similar to my max withdrawal rate (6.7%). Kind of like putting that income stream on autopilot… forever (as the account balance still continues to grow due to modest growth in stock prices). I need to start draining my LIRA given its size.

I know the dividend stuff should probably be in my taxable account, given the very favourable tax treatment. But i like to keep my best total return ideas (like Fairfax right now) in my taxable accounts (capital gains also gets very favourable tax treatment in Canada). I also want to limit my trading in taxable/TFSA accounts so Revenue Canada does not deem me a ‘professional trader’; they don’t care how much you trade in RRSP/LIRA/LIF accounts. Makes sense for me. And has worked out very well the past few years given Fairfax has been a double. My RRSP/LIRA accounts are much larger than my taxable accounts - so strategically i want to grow my taxable accounts as fast as possible and start draining my tax-free accounts.

-

Interest rate sensitive stocks in Canada are cheap again. Re-establishing positions in a collection of these: big banks, telecom, pipelines, energy, reits. Average dividend yield is around 6%.

-

31 minutes ago, cubsfan said:

Sounds like we ought to pack up our toys and let the Europeans and Asians fend for themselves!

The incredibly high living standard the US enjoys today is largely the result of the global world order it imposed/built/lead after world war II (with, of course, lots of help along the way from other nations). This positioning allows US companies dominate the world (economically) - China and Russia exempted (perhaps India too).If the US retreats, the void will simply be filled by China/Russia/totalitarian regimes. Shrinking your empire is never a good choice - it is usually catastrophic. That is, after all, what the Soviet Union did in 1991. Reversing a bad decision is pretty much impossible (Putin is learning that lesson today).

-

1

1

-

-

“They say ‘you don’t know what you’ve got until it’s gone.’ The truth is, you knew exactly what you had. You just didn’t think that you were going to lose it.” ~Unknown

One of my great fears raising three children is they would grow up with an entitled attitude. Being born in Canada they are living in one of the greatest countries in the world - an 8 out of 10 situation. But if they think its a 3 out of 10 situation then all they will do is bitch and complain about everything all their life. What a waste. (And not just their life..l but the lives of those around them.)

i also try and teach them to have working brains. Think for themselves. It is not that difficult to understand important issues given all the great worldwide information sources out there today. Most importantly, avoid the conspiracy theory rabbit hole - over time that stuff will turn your brain to jelly (that is actually my sons line).

i also try and teach them that actions have consequences. Mistakes are a part of life. They need to own the consequences of their decisions. Most importantly, don’t play the victim card.

And of course, perspective is the key to most things. I ask my 2 daughters… would their life be different it they lived in a country like Afganistan? Its population is about the same as Canada’s. Education? Marriage? Occupation?

With all its faults, living in Western liberal democracies is a gift. That gift exists because of the hard work and sacrifice of the generations who came before. I tell my kids to appreciate the gift they have been given and live their life to the fullest.

-

The Big Short - Fairfax Edition

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” Stan Druckenmiller

In the book/movie, ‘The Big Short’, bestselling author Michael Lewis profiles three firms who made a financial killing from the bursting of the US housing bubble in 2008. How did they do it? They bought credit default swaps (CDS) in 2005 and 2006. Lewis describes it as “One of the best trades in Wall Street history.”

From ‘The Big Short’: “It’s been called the worst financial crisis in modern times. Certainly the largest financial disaster in decades in this country, and perhaps the end of an era in American business. In the end, Lewis Ranieri’s mortgage-backed security mutated into a monstrosity that collapse the whole world economy. And none of the experts and leaders or talking heads had a clue it was coming…. But there were some who saw it coming. While the whole world was having a big old party, a few outsiders and weirdos saw what no one else could… These outsiders saw the giant lie at the heart of the economy. And they saw it by doing something the rest of the suckers never thought to do. They looked.”

The three firms profiled in ‘The Big Short’ were: Scion Asset Management (Dr. Micheal Burry), FrontPoint Partners (Steve Eisman) and Brownfield Capital (Charlie Gellar and Janie Shipley). A small Canadian P&C insurer could also have been included in Lewis’ book as a 4th participant. Yes, Fairfax Financial.

What was the trade?

They bought a financial derivative called a credit default swap.

In ‘The Big Short’, a large investor in Burry’s fund at Scion summed up the trade perfectly: “In other words, we lose millions until something that has never happened before happens?” Burry replied: “That’s right.”

From Fairfax’s 2005AR, Prem’s Letter: Just a brief overview for you on our credit default swaps, which are 5-year to 10-year fixed income derivatives, which fluctuate with credit spreads, that we have purchased from major banks. Here is an example. To purchase a 5-year $100 million credit default swap on a company that sells at a 30 basis point spread over treasuries, one has to invest 150 basis points (30 basis points/year × 5 years), so $1.5 million purchases protection on an underlying $100 million of credit exposure of the chosen company over the next five years. The maximum loss to the purchaser in 5 years is $1.5 million if the credit spread stays at 30 basis points or tightens even further. On the other hand, if the credit spread on this company doubles to 60 basis points, the credit default swap can be worth as much as $3 million, and if the company goes bankrupt, that swap can be worth up to $100 million. We have a diversified list of companies, mainly financial institutions, with respect to which we have paid approximately $250 million to purchase protection on underlying credit exposures. Accounting rules require these credit default swaps to be marked to market (similar to our S&P500 hedges) on a quarterly basis and the resulting valuation adjustment to be treated as a realized gain or loss.”

Credit default swap definition: “A credit default swap is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to receive a payoff if the asset defaults.” Wikipedia

A CDS is insurance on ‘something’. It offers a big payout (as much as 20 to 1) if that ‘something’ defaults/goes bust. Burry bought CDS on MBS. Fairfax bought CDS on a variety of financial and insurance companies.

Why did Fairfax do it?

Fairfax bought the credit default swaps as a hedge - to protect the "investment portfolios from a potential (though low probability) financial market disaster."

From Fairfax’s 2005AR: “The company has invested approximately $250 in 5-year to 10-year credit default swaps on a number of companies, primarily financial institutions, to provide protection against systemic financial risk arising from financial difficulties these entities could experience in a more difficult financial environment.”

When did Fairfax start buying?

Fairfax initiated their CDS position in 2005, investing $250 million. They were in about the same time as Burry (early). How did it go initially? Not very well. Like Burry, Fairfax booked large investment losses the first two years: $101.6 million in 2005, and another $76.4 million in 2006.

In The Big Short, a realtor describes the US housing market in 2006 as follows: “The markets in an itsy-bitsy little gully right now.”

But early in 2007, the US housing market began to quickly unravel and it just kept getting worse from there. Fairfax added to their CDS position in early 2007. During the rest of the year the CDS worm began to turn and by the end of 2007, Fairfax was suddenly sitting on a $1 billion gain. Then 2008 saw Fairfax book another $1 billion gain. Fairfax sold most of their CDS positions in 2008 and early 2009, locking in sizeable gains.

How much did everyone make over the life of the trade?

- Scion = $2.69 billion

- FrontPoint = around $1 billion

- Brownfield = $50 million ($80 - $30 million initial investment)

- Fairfax = 2.1 billion (original acquisition cost was $318 million).

For perspective, in 2008, common shareholders equity at Fairfax was only $4.9 billion.

I would love to hear the inside story of what actually happened at Fairfax from 2005-2009. It would make a great documentary. Some aspiring Canadian producer should get on it. The story would make a compelling addendum to ‘The Big Short’ (kind of like the recent documentary on YouTube titled ‘Luc Longley and the missing chapter of the Last Dance’).

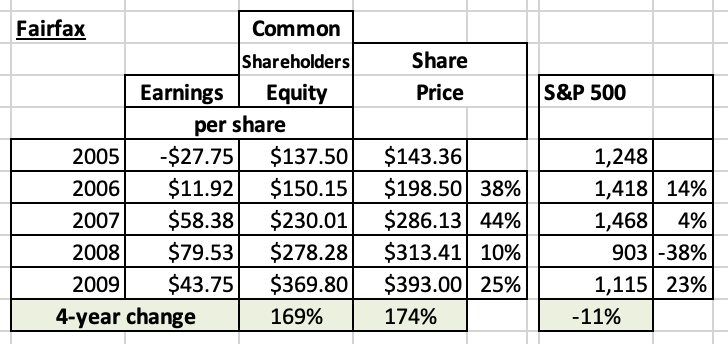

How did Fairfax’s share price perform?

Fairfax shareholders were big, big winners. For the 4 year period from 2005 to 2009, Fairfax shares increased 174%. During this same 4 year period, the S&P500 decreased 11%. So on a relative basis, from 2005-2009, Fairfax’s shares had close to 200% outperformance over the S&P500. Not too shabby.

Lots of Corner of Berkshire and Fairfax members made a killing on Fairfax stock over the 4 years from 2006-2009. In mid-2006, Fairfax’s stock briefly traded below $100. It traded over $300/share in early 2008.

And a few board members made their own trade of the century: they purchased Fairfax leaps (2006?) and made millions (at the time Fairfax was traded on the NYSE so derivatives were available).

What does all this mean for Fairfax today?

Does something that happened around 15 years ago matter all that much today? I am not sure.

Of interest, a few of the people who were deeply involved with the CDS trade are still with the company. However, Fairfax - the company - is a completely different animal today. Most importantly, its insurance business is much larger and of much higher quality. Its bond portfolio is positioned perfectly. And its equity portfolio is high quality. As a result, Fairfax will be generating record underwriting profit, record interest and dividend income, record share of profit of associates and solid investment gains in 2023, 2024 and 2025 - in short, the quality of the earnings stream Fairfax is generating today has never been better, and it is durable.

What is missing from my analysis?

The CDS trade was just one piece in the bigger picture of what Fairfax was doing at the time. Over the same time period, Fairfax also had significant equity hedges on (this time it worked). And in 2006, the dirty and viscous short campaign against Fairfax reached its climax (driving the stock briefly below $100 in June of that year). Not spending more time on ‘the bigger picture’ is perhaps the biggest flaw with my long-form posts. Readers need to keep this in mind.

—————

Here is a quick trip down memory lane of some of the more memorable economic and financial events:

- in 2006, house prices peak

- in early 2007, house sales collapse

- April 2007, New Century Financial Corporation, the largest subprime lender, files for bankruptcy

- Sept 2007, Fed cuts interest rates and the stock markets peak

- Jan 2008, Bank of America agrees to buy Countrywide (terrible decision in hindsight)

- March 2008, fire sale of Bear Stearns to JP Morgan

- Sept 2008, government nationalizes Fannie and Freddie

- Sept 2008, Lehman Brothers files for bankruptcy - the largest in US history

- Sept 2008, Fed bails out AIG (one days after Lehman bankruptcy)

- Sept 2008, big banks get bailed out with Troubled Asset Relief Program (TARP)

- Jun 2008 to March 2009, S&P500 falls 50%

- Nov 2008, Fed initiates quantitative easing - an effort to push down interest rates and boost economic activity

—————

From Fairfax’s 2009AR, Prem’s Letter

-

Mass timber certainly looks like a solid future opportunity. I think it will take many years to play out (10 or more years). In terms of who the players are today, i am not sure. I follow the 800 pound lumber giants but not the smaller niche players.

in terms of lumber, i think the secular story has not changed; if anything it is getting stronger. We are short housing stock in North America. Given high interest rates, we are once again under-building. So the supply shortfall is increasing. High interest rates is slowing demand in the short term - like it is supposed to.

My guess is once we get to the next economic expansion, housing is going to be one of the big engines of growth for the economy. Just like the big boom 2 year ago, lumber remains structurally challenged. Supply of lumber in BC will continue to shrink for the next 5 years at least (as the allowable cut shrinks due to mountain pine beetle infestation; provincial government is also toxic to big forest companies). Yes, we will see continued growth out of US South. But if US housing starts pop over 1.6 million i think we will once again have a very tight lumber market. Throw in record levels of forest fires for a few years… BC is tracking to have a record level of forest fires this year. Same in Alberta. And smoke from forest fires in Eastern Canada is causing issues in Eastern US. The risks are skewed towards lower supply. (I need to understand better what is going on with Russian production and supply/demand for Europe…)

i am a little surprised we are not seeing more consolidation right now. West Fraser has a pristine balance sheet (net cash of $800 million I think). They have the financial ability to make their next big transformative acquisition. I am wondering if their next big move is Europe. I think Canfor also has the cash to make a big purchase. Both West Fraser and Canfor (and privately held Tolko) need to continue to diversify away from BC; they are impacted the most from the pine beetle). The problem, of course, is price. Obviously, the sellers see the same thing i do - a big rebound in lumber prices in another year or two. Why sell on the cheap today?

Right now i am playing around a little with Interfor (small trades). Buy close to C$20 and sell for small gains.

I wonder if inflation does not remain sticky (3.5 to 4%). I see the risk to the economy as being to the downside over the next 6 months. I suspect, at some point, higher interest rates, QT and tightening credit conditions will work their black magic. Or perhaps we continue to muddle along like we currently are. Not high conviction. Lumber stocks are on my watchlist.

-

58, and looking to make the next 5 years the best 5 years.

@John Hjorth , discovering this board (2003 for me) has been life changing in so many ways. Yes, slow and steady wins the race. Having the odd ringer helps. For you it has been Berkshire. For me it has been Fairfax (at three different times now over the past 20 years).

Thank you @Parsad.

-

10 hours ago, John Hjorth said:

Yet again an absolutely awesome post just above by you, @Viking!,

Thank you very much, and thank you for all the hard work on FFH you have shared with us within the last few years or so here in this forum.

[I am one of those guys who got it wrong with FFH in the first place, meaning in the past, one had to be trading in and out of it, like you, @Crip1 and @bearprowler6 [among others, nobody forgotten here] have said, but I also really did not give up on FFH [likely because of modest position size] at any time, where a lot of other shareholders did.]

@John Hjorth and @jbwent63, you are welcome. Over the years, I have learned lots from others on this board (much of which makes it into my posts) so it really is a group effort.

FYI, I am doing less trading with Fairfax these days. Sentiment is improving (delivering stellar results will do that). And company fundamentals keep improving. So I do not want to get too cute with my position and have the stock run away from me.

Fairfax has a long history of being a very streaky stock - in both directions. The streaks can last for years and back-to-back +30% gains can happen.

Fairfax is an investors dream stock today. Stock is cheap. Show me another mid cap stock (large cap for Canada) trading at a 5 PE ($150 in earnings and $745 stock price). Earnings are real, high quality and durable (maybe $130 in 2024 and 2025). And company is positioned exceptionally well (it is not impaired). It makes no sense if you actually take the time to think about it.

And with Fairfax we are getting the trifecta, all happening at the same time:

1.) much higher earnings

2.) increasing multiple

3.) lower share count

Fairfax will be generating an obscene amount of earnings over the next three years. If they continue to make very good capital allocation decisions i think the stock price could double from current levels over the next three years.

—————

One possible path to a double in the share price over the next three years (June 2026):- $390 in earnings ($130/year average)

- multiple increases to 1.2 x BV

- share count reduced by 8%

-

Capital allocation is the most important responsibility of a management team. Why? Capital allocation decisions drive the long term performance of the company. Stuff like reported earnings, growth in book value and return on equity. And this in turn drives share price and investment returns for shareholders.

Capital allocation, when done well, does two fundamental things. It delivers a solid return and, over time, improves the quality of the company. Therefore, the fundamental task for an investor is determining if management, over time, is making intelligent decisions regarding capital allocation.

What is capital allocation?

Capital allocation is the process of determining how capital is raised, managed and disbursed by a company. Capital allocation decisions often play out with a lag, sometimes years in length. So an investor needs to take a multi-year approach with their analysis.

How does Fairfax do capital allocation?

Internal capabilities: Capital allocation at Fairfax is managed by the senior leadership team, lead by CEO Prem Watsa. Since 2010, the insurance business has been lead by Andy Barnard. The investment business is managed by the large team at Hamblin Watsa. The fixed income team is lead by Brian Bradstreet, who has been with Fairfax almost from day 1. The equities team is lead by Wade Burton, who joined Fairfax in 2009 from fund manager Cundill Investments, and Lawrence Chin, who also joined from Cundill in 2016. In India, Fairfax has Fairbridge, a boots on the ground investment team. Fairfax also leverages the knowledge of the CEO’s of its many equity holdings.

From Fairfax’s web site: “Since 1985, investments have been centrally managed for all of the Fairfax group companies by Hamblin Watsa Investment Counsel Ltd. (www.hwic.ca), a wholly-owned subsidiary of Fairfax. Hamblin Watsa emphasizes a conservative value investment philosophy, seeking to invest assets on a total return basis, which includes realized and unrealized gains over the long-term.”

Below is a slide from the Fairfax’s annual meeting held April 2023.

Fairfax has a large internal team with expertise across many different asset classes and geographies. They are a long-tenured group with experience managing through many different market cycles, including the high inflation period of the 1970’s. They are also a battle tested team. They have established a strong long term track record.

External capabilities: Fairfax has actively been cultivating relationships with a large network of individuals/companies in the investment world for decades. They have established partnerships and expertise across many different asset classes (real estate, private equity, commodities) and geographies (India, Greece, Africa, Middle East). These external partnerships have been an important source of ideas and diversification while also delivering solid returns to Fairfax over the years. This important external capability allows Fairfax to leverage the knowledge and skills of a much larger group of people and organizations.

Over decades, Fairfax has built out a large team and network of highly skilled internal and external capital allocators. In a world where active management is back, this has become a big tailwind for Fairfax. Fairfax is well positioned at exactly the right time.

In general, what are the basic capital allocation options available to management?

- reinvest in the business - grow organically: support slow and steady growth of existing operations.

- acquisitions/mergers/sales - higher risk, but can be transformative.

- pay down debt: most predictable option as cost of repaid debt is known.

- pay dividends: although tax-inefficient, usually indicates financially healthy, shareholder-friendly business.

- share buybacks: impactful, if purchased below intrinsic value, by improving per-share financial metrics: EPS & BVPS.

What has Fairfax done?

The management team at Fairfax has been extremely active on the capital allocation front. Every year they typically make between 5 to 10 meaningful decisions. So much has been happening on the capital allocation front it is hard for shareholders to keep up - especially understanding the impact on current and future business results. Below we are going to take a quick look at 15 of Fairfax’s bigger decisions made in recent years to see what we can learn.

Reinvest in the business:

1.) 2019-2022, hard market in insurance: Net written premiums increased 68% over the past three years from $13.3 million in 2019 to $22.3 million in 2022, an average increase of 19% per year. Fairfax is now delivering record underwriting profit of $1.1 billion (at 95CR).

2.) in 2017, seeded start-up Go Digit in India: at a cost of $150 million and a fair value today of $2.3 billion. This investment has turned into a home run, with a possible IPO coming in 2023 (more upside).

Acquisitions / sales: insurance:

3.) in 2017, purchased Allied World, with the help of minority partners, for $4.9 billion (1.3 x book value). Price paid was not an overpay. Net written premiums have increased from $2.37 billion in 2018 to $4.46 billion in 2022, an increase of 88% in 4 years. With the onset of hard market in 2019, the timing of this purchase was perfect.

4.) in 2017/2019, sale of ICICI Lombard for $1.7 billion: realized a $1 billion pre-tax investment gain. Due to regulations in India, Fairfax had to sell down its position in ICICI Lombard to be able to invest in Digit. Brilliant strategic shift of insurance business in India.

5.) in 2020/2021, sold Riverstone UK (runoff) for $1.3 billion (plus $236 million CVI). At a time when they needed the cash, Fairfax sold their UK run-off business at a much higher price than expected at the time.

6.) in 2022, sale of pet insurance business to JAB Holding Co. for 1.4 billion: realized a $1 billion after-tax gain. This sale was a home run for Fairfax as the sale price was far in excess of what anyone thought possible.

7.) in 2023, the pending purchase of Kipco’s 46% stake in Gulf Insurance Group for $860 million, payable over 4 years. Great strategic purchase will solidify Fairfax’s presence in MENA region for insurance.

Acquisitions/sales: investments

8.) in 2018, made initial investment in Poseidon/Atlas/Seaspan. Fairfax partnered with David Sokol (formerly Buffett’s heir apparent at Berkshire). Today Fairfax owns 45.5% stake valued at $2 billion. Poseidon is entering significant growth phase.

9.) in late 2018, purchased 13% of Stelco for $193 million. Fairfax partnered with Alan Kestenbaum. Investment has already delivered close to a 150% investment gain. Today, Fairfax owns 23.6% of Stelco (having invested no new money).

10.) in 2020/21, initiation of total return swap position giving exposure to of 1.96 million FFH shares at an average cost of $372/share. With Fairfax shares trading today at $745, this investment has already delivered an investment gain of +$750 million in 30 months. This has been another home run.

11.) in Dec 2021, reduced average duration of $37 billion bond portfolio to 1.2 years (as interest rates bottomed); followed by pivot in 2022/23 and extension of average duration to 2.5 years (after interest rates had spiked). Protected the balance sheet. And today the fixed income portfolio is delivering record interest income of more than $1.4 billion per year. This string of decisions over less than 24 months was nothing short of brilliant and delivered billions in gains to Fairfax shareholders.

12.) in 2020 and 2023, partnership with Kennedy Wilson. Phase 1, in 2020, was establishment of $3 billion real estate debt platform. Phase 2, in 2023, was purchase of $2 billion of PacWest loans yielding a fixed rate to maturity of 10%. Fairfax, through long term partner Kennedy Wilson, taking advantage of severe temporary market dislocation.

13.) in 2022, sold Resolute Forest Products for $626 million (plus $183 million CVR) at top of lumber cycle.

14.) in 2023, sold Ambridge Partners for $400 million: delivered a $255 million pre-tax investment gain.

Dividend: Fairfax has continuously paid a $10 dividend since 2011.

Share buybacks: Effective shares outstanding have decreased 16% over the past five years from 27.8 million in 2017 to 23.3 million in 2022, an average decrease of 3.2% per year.

15.) in 2021, re-purchased 2 million shares at $500/share. Fairfax’s book value is $803/share (Q1) and the stock is trading today at $745. This repurchase was another home run.

The list above captures only the largest capital allocation decisions made by Fairfax in recent years. We could easily add another 15 smaller examples of transactions that are also proving to be material to Fairfax.

For a more complete list, i have attached my Excel file to the bottom of this post. See tab 2 in the Excel file - titled ‘Moves’ - where I have document many of Fairfax’s moves for each year going back to 2010.

Important: asset sales are one part of capital allocation that really separates Fairfax from its peers. In selling an asset, Fairfax is essentially trading a stream of future cash flows for a lump sum today.

Why sell an asset? Sometimes another company - who is willing to pay up - values an asset at a much higher value than you do. The sale of the pet insurance business is a great insurance example of this. The sale of Resolute Forest Products is a great non-insurance example. There also can be important strategic reasons to sell an asset. Like if a sale allows the company to better focus on its other businesses - which should lead to improved results. The sale of APR to Atlas in 2019 is a good example of this. Asset sales have been an very important part of Fairfax’s capital allocation framework, realizing significant value for Fairfax and its shareholders over the years.

Is Fairfax’s capital allocation record perfect?

No, of course not. I see two notable misses:

- Taking until late 2020 to exit last short position and not exiting earlier.

- Not finding a way to unload Blackberry during the wallstreetbets mania that caused the stock price to spike for a very short period of time in 2021. Fairfax says they were unable to act due to being in a blackout period at the time.

Looking at everything they have done over the past 5 or so years, it is clear Fairfax has been executing exceptionally well.

Peter Lynch: “In this business, if you are good, you’re right 6 out of 10 times. You’re never going to be right 9 out of 10.” In recent years, Fairfax has been right with their capital allocation decisions at a rate much higher than 6 out of 10.

In Druckenmiller parlance, Fairfax has been on a multi-year ‘hot streak’. Or in Buffett parlance, Fairfax has been hitting the ball like Ted Williams the past couple of seasons.

Has Fairfax simply been lucky? Did Prem give the team at Fairfax a sip of ‘liquid luck’ back in 2018? Some luck likely has been involved. But I like this definition of luck: what happens when preparation meets opportunity. That describes what has happened at Fairfax beautifully: looks to me like they made their own luck.

So what did we learn?

Here are the words i would use to describe Fairfax’s approach to capital allocation:

- Flexible - use the full suite of options available

- Opportunistic - taking advantage of opportunities as they arise

- Countercyclical - act contrary to prevailing investment trends

- Speed - act quickly when necessary

- Conviction (position sizing) - go big when risk/reward is highly compelling/asymmetrical

- Creative - be open minded during the process

- Long term focus - generate above-market returns

- Strategic - make the company stronger - both insurance and investments

- Rational - capital goes to the best (risk adjusted) opportunities

- Equally capable in executing across both insurance and investment businesses

What has been the financial impact of Fairfax’s capital allocation decisions?

Operating Income:

Let’s start by looking at operating income given it is viewed by analysts as the most important part of an insurers total earnings. For the 5-year period from 2016-2020, operating income at Fairfax averaged $1 billion per year or $39/share. Compared to the 5-year averaged from 2016-2020:

- in 2021, operating income doubled to $1.8 billion or $77/share.

- in 2022, operating income tripled to $ 3.1 billion or $132/share

- in 2023, operating income is on track to quadruple to $3.8 billion or $167/share

- in 2024 and 2025, operating income is poised to grow even more, although at a slower rate.

The run rate for operating income is now 4 times larger than it was just a few short years ago. The reason? The spike higher is due in large part to the exceptional capital allocation decisions made by the management team at Fairfax, primarily over the past 5 years.

Investment Gains:

The other important part of earnings is investment gains. This lumpy part of earnings has historically been a strength for Fairfax - the pet insurance and Resolute sales in 2022, and the Ambridge Partners sale in 2023, being three recent examples. We should expect Fairfax to continue to deliver solid (but lumpy) investment gains moving forward.

My current estimate has Fairfax on track to deliver earnings of $150/share in 2023.

Return On Equity:

For the 5-year period from 2016-2020, ROE averaged 5.2% per year. For the period 2021-2023, ROE is tracking to average 14.2%. Given expected trend in operating earnings, this is likely a good target for 2024 and 2025 as well.

Driven by strong capital allocation decisions, all important financial metrics at Fairfax have been materially improving in recent years. This strong performance looks set to continue in 2023, 2024 and 2025 (as far out as our crystal ball looks).

How is the strategic positioning of Fairfax’s businesses?

Insurance

- Significant expansion by acquisition 2015-2017 - build out of global platform is complete.

- Significant expansion by organic growth 2019-2023 - hard market

- Ongoing bolt-on acquisitions, like Singapore Re, has further strengthened the business.

- Ongoing buy-out of minority partners, like Eurolife in 2021 and Allied World in 2022, has further strengthened the business.

- quality of insurance business has never looked better.

- delivering record net written premiums and record underwriting profit.

Investments - fixed income

- 2021: shortened duration of portfolio to 1.2 years and primarily government bonds in late 2021, to protect the balance sheet.

- 2023: extended duration to 2.5 years in Q1, to lock in much higher rates.

- 2023: capitalizing on dislocations in financial markets to lock in even higher rates - with Kennedy Wilson, purchased $2 billion in PacWest real estate loans yielding a fixed rate of 10%.

- positioning of fixed income portfolio has rarely looked better.

- delivering record interest and dividend income.

Investments - equities

- Total return swaps, giving exposure to 1.96 million Fairfax shares, looks well positioned.

- Eurobank - balance sheet is fixed, earnings are strong. Greece is expected to be a top performing economy in Europe.

- Poseidon / Atlas - is currently in rapid growth mode.

- India is expected to be a top performing global economy.

- rest of portfolio looks well positioned.

- quality of collection of equities owned has never looked better.

- delivering record share of profit of associates and sold investment gains.

Bottom line, the strategic positioning of each of Fairfax’s three engines (insurance, fixed income and equities) have all steadily improved over the past 5 years. In fact, in terms of quality they have never looked better. And it is extremely rare to have all three engines performing at a high level at the same time, like is happening today.

Conclusion

- strong management team.

- executing exceptionally well over the past 5 years.

- record financial results across all important metrics (EPS, growth in BV and ROE).

- both businesses, insurance and investments, are exceptionally well positioned.

Fairfax is nailing the dual core objectives from capital allocation:

1.) deliver good/great returns on capital deployed

2.) over time, improve the quality of each of the businesses - insurance and investments

As a result, i think we can fairly conclude that the management team at Fairfax have demonstrable best-in-class capital allocation skills. And not just within their peer group in P&C insurance.

Are Fairfax’s capital allocation abilities reflected in the price of its stock?

Given the glide path of operating earnings, total earnings are expected to be very strong in 2023, 2024 and 2025. A management team - with proven skills in capital allocation - is about to get… a record amount of free cash flow to allocate over the next three years.

Fairfax’s stock is trading today at $745/share (June 15, 2023). Book value is $803 (Q1, 2023). Earnings for 2023 are estimated to be $150/share (my estimate as of today).

- PE = 5 (2023E earnings)

- price to book value = 0.93

- return on equity is 17% (2023E earnings)

The stock is trading today at a historically low valuation (if you ignore the covid low). The stock price does not yet reflect the significant improvement in fundamentals that we are seeing.

Fairfax’s stock has dramatically outperformed the market over the past 29.5 months. Mr. Market is clearly warming to the Fairfax story. My guess is the outperformance by Fairfax will continue.

- Best-in-class capital allocators + record earnings + bear market + power of compounding + time = exceptional returns for shareholders.

-

6 hours ago, james22 said:

1. It's very, very hard to accept you can't beat the market if you're intelligent and work hard.

2. It's fantastically entertaining.

I played a lot of sports when i was younger. Not the most talented; still loved it. Over time got pretty good. Great physical and mental workouts. Strong relationships built over time. Continuous improvement. The competition was great. Lots of peaks and a few valleys. And it always felt great when your team won; especially the important games.

i love investing for many of the same reasons. Except with investing you are competing with the best. And the rewards, if you are good at it can be life changing - and not just for you but your entire family.

I have friends who have chosen to step away from investing in recent years. I am not there yet. I still love the game/competition too much - and, for an old guy, the pay is still pretty good.

-

12 hours ago, Munger_Disciple said:

@Viking One thing I would like to know is what % of FFH book value gets impaired in the case of a big (close to a worst case scenario) CAT event. Have you investigated it and do you have a reasonable estimate? As an example, Ajit estimated that BRK would lose a maximum of $15B across all lines of insurance business in the event of a horrible super CAT type situation.

@Munger_Disciple no, i have not done this type of analysis as i am not an in-the-weeds insurance guy. In the past, others on the board have modelled what % of total catastrophe losses Fairfax has tended to experience (to get a rough approximation of what their share might be to a once in a 100 year cat event). I think Fairfax has stated they are reducing Brit’s total exposure to cat losses (as that is the part of their business that has been underperforming). We also are seeing the mother of all hard markets in cat reinsurance, although it likely will not last long (as new capacity enters to due to the higher returns). -

1 hour ago, Munger_Disciple said:

@Viking In my mind, the key for concentration is that there must be almost 0 chance of ruin. I don't disagree that FFH has higher potential upside compared to BRK but it also has a much higher probability of downside. Prem can wake up one day and put in a crazy macro bet and stick with it for 10+ years despite huge losses for instance .....

. Plus it is impossible to ignore risk caused by FFH's much higher leverage, both operational and financial.

. Plus it is impossible to ignore risk caused by FFH's much higher leverage, both operational and financial.

I suppose the risk is a bit reduced in your case because you don't plan to keep FFH forever unlike a lot of BRK shareholders do with their holding.

@Munger_Disciple We all have our own investment tolerances. Fit is important. Clearly, Fairfax is not a fit for you, which is ok. There are thousands of different opportunities out there. For me, i am more than ok with the risks owning Fairfax. Their capital allocation decisions the past 5 years have been outstanding. They are absolutely schooling their other insurance peers in this regard. I think it is highly unlikely Fairfax puts on another ‘equity hedge’ type hedge/trade anytime soon. If they do something that i really don’t like, i will simply reduce my position.

Yes, Fairfax does run with more leverage than most peers. With record operating income (the more predictable kind of earnings) coming each of the next 3 years i am not concerned. But yes, something to monitor.

in terms of investments, their fixed income portfolio skewed highly to government bonds is best in class in terms of risk, with the exception of Berkshire. And their equity portfolio is perhaps the highest quality today (in terms of its holdings) it has been in a long, long time.

When i put it all together i continue to see Fairfax as a great investment opportunity. Stock is trading at 5 x 2023 earnings; 0.9 x BV; ROE of 18%. Despite the spike in the stock price, it is still wicked cheap.

And that is what makes a market

Best of luck with Berkshire - it is a great set-and-forget investment.

Best of luck with Berkshire - it is a great set-and-forget investment.

-

4 hours ago, Munger_Disciple said:

+1

Ironically I think it is easier to have a bigger allocation to BRK than FFH. In my mind, % concentration in a single stock/business should be more a function of how much downside risk there is, not so much how much upside potential it has. The lower the downside risk, the larger the allocation can be assuming the expected returns are acceptable.

The key to position size for me is how asymmetric the opportunity is. Very high return / low risk = back up the truck. That is my assessment of Fairfax today. Moderate return / yes, lower risk = Berkshire today.My guess is Fairfax will generate total investor returns of around 25% each year over the next couple of years. Berkshire will probably generate high single digit returns. In terms of risk, the chances of Fairfax blowing up are very small, absent a once in a 100 year catastrophe (probability is likely less than 1% or 2%). And other than a sudden catastrophe, i think i will be given some notice so that i will have time to re-size my position (like what happened with covid in Feb 2020, when investors were given a couple of weeks notice). Yes, the chances of Berkshire blowing up is even less.

Also, i do not keep my concentrated positions in place for long periods of time. Usually, the mis-pricing in the shares is corrected over a couple of years.

-

My guess is the Fed funds rate will average around 3.5-4% over the next 5 years. Of course two of the key variables will be inflation and economic growth. My guess is the Fed will have a hard time getting inflation to and keeping it at its 2% target. The future path of the economy is impossible to predict with and accuracy. As a result, i do not have a high degree of confidence in my forecasting ability looking 5 years out (my degree of confidence is actually quote low). And i am certainly not making any investment decisions today based on what i think the world will look like in 5 years time.

-

1 hour ago, steph said:

I am not sure we have to see this as a +5 billion loss. If they couldn't take the hedges and shorts they would have sold their entire equity positions because they were so bearish at the time. In my eyes the real loss is the difference between the performance of their equity positions and the shorts & hedges. And as such one could argue that it is the huge underperformance of their equities relative to the market that cost a lot of money.

I take the opportunity to thank you Viking for all the amazing work you to here.

@steph you nailed what is missing in my post - the ‘equity hedge/short’ trade was just one piece in the bigger picture of what Fairfax was doing at the time. Fairfax’s decisions are not made in a vacuum. That is perhaps the biggest flaw with my long form posts… they usually do not include an overlay of other important ‘big picture’ pieces. Readers need to keep this in mind.

India

in General Discussion

Posted

I don’t think India is the ‘solution to everything’. Rather, it is well positioned right now. Lots of tail winds. So this should lead to above trend economic growth in the coming years. India is a developing economy… so yes, lots of issues need to be sorted out. Just like every other country at a similar stage of development. Pakistan is a sovereign country so i am not sure how it compares to Taiwan. Bottom line, i hope India figures it out. Prosperity is a good thing.