Viking

-

Posts

4,689 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

45 minutes ago, LC said:

Do we know who the swap counterparty is? I'd imagine a Canadian bank?

Good question. I am not sure who it is. Given Fairfax’s experience with the CDS during the housing crash my guess is they have thought this risk through pretty well. -

The table is set for the total return swaps (TRS-FFH) to become one of Fairfax’s best investments ever. It has delivered about $750 million in investment gains since inception (over the last 30 months). And i think it can deliver $1.5 to $2 billion in additional gains over the next 5 years. That would put total gains at $2.2 to $2.7 billion over a 7 year period. Not too shabby.

“We think this will be a great investment for Fairfax, perhaps our best yet!” This is what Prem said in his letter in the 2020 annual report when first describing this investment. Clearly, Fairfax was thinking big when they made this investment.

The genius of this single investment is still lost on most investors. Probably because the TRS is a non-traditional type of investment. So it is largely ignored by investors in their analysis of the company and its potential impact on future earnings.

Well lets do a bit of a deep dive on this investment to better understand just what the freak i am talking about.

What is the TRS-FFH investment?

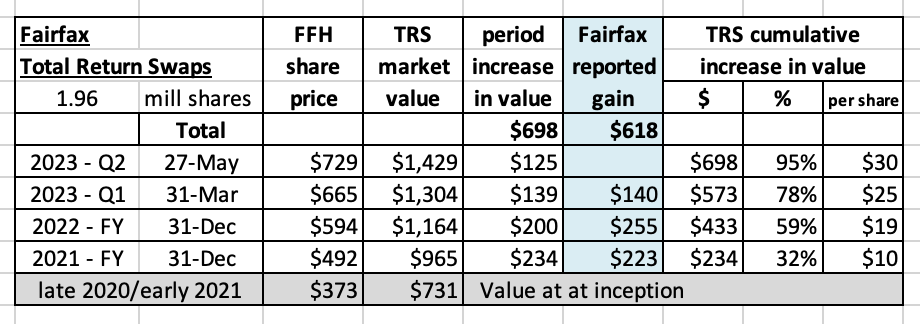

In late 2020 and early 2021, Fairfax purchased total return swaps giving it exposure to 1.96 million Fairfax shares with an average notional amount (cost) of US$373/share.

At the time, Fairfax had about 26.2 million effective shares outstanding so this investment represented about 7.5% of the company’s shares. Effective shares outstanding at the end of Q1, 2023, have dropped to 23.2 million so this investment now represents about 8.4% of the company’s shares.

Fairfax’s equity portfolio is about $15 billion in size. The TRS-FFH position currently has a market value of $1.43 billion = 9.5% of the total equity portfolio. This is Fairfax’s third largest equity position, behind Atlas ($2.04 billion) and Eurobank ($1.95 billion). Bottom line, this investment is a very large one for Fairfax.

Why did Fairfax make this investment?

Fairfax's stock was trading at a crazy cheap valuation in late 2020. It was, by far, the best investment opportunity available to Fairfax at the time. To state the obvious, it was an investment they understood very well. So it was a very low risk and very high return opportunity.

Prem’s Letter 2020AR: “Throughout much of last year (2020) following the pandemic-induced market plunge, I made public statements to the effect that our belief was that Fairfax shares were trading in the market at a ridiculously cheap price. In the summer I backed that up by personally purchasing close to $150 million of shares. Additionally, following our value investing philosophy, since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet!”

Prem’s answer to question from Mark Dwelle (RBC) on the Q4 2020 conference call held in Feb 2021:

Mark Dwelle: “My second question relates to executing the total return swap with respect to Fairfax shares. I guess, I was just curious why you pursue that structure, rather than just buying back the stock, if you felt like that was the good opportunity? I mean, is this a capital constraint that you couldn't really buy back that much?”

Prem Watsa: “We have to be careful, right? So not so much -- yes, we have to be very careful in terms of how much we can buy back. When we looked at Fairfax as a stock price and looked at everything else that we could buy, which is not over return swap on Fairfax. Right now, we paid US$344 per shares, our book value is $478. I mean, if you want the math, just on our book value basis, we'd have about $200 million gain. And Fairfax stock price for book value is worth another 200 million. We just think it's a terrific investment and our total return swap structure was a very good way for us to do it. And so we did it.”

Why TRS-FFH versus simply buying back stock?

Fairfax did not have the cash at the time to buy back a significant amount of Fairfax stock directly.

Again, from the Q4 2020 conference call:

Mark Dwelle: “I don't disagree with you that it was a good a good strike price, I guess it was really -- the form of the transaction rather than just actually buying the shares, using a derivative instead is just -- it's a little bit unusual. I haven't usually seen that with most of the companies that I've followed. So that was really my main question.”

Prem Watsa: “Yes, so, Mark, our point is just that we wanted to keep up -- we could -- where you have more than $1 billion in cash and the only company once -- or almost have down $375 million, we just wanted to be financially sound, and in all ways, as opposed to use that cash at this point in time.”

This investment demonstrates Fairfax’s management team at their best:

- Rational: best available opportunity

- Opportunistic: buy when the stock was crazy cheap

- Creative: didn’t have the cash to do a buyback. Hello TRS.

- Conviction: wanted to buy a significant stake. Hello TRS (leverage).

Simply a brilliant investment - especially given the circumstances.

How is the investment performing?

From Jan 1, 2020 to March 31, 2023 (9 quarters) the investment has resulted in cumulative investment gains of $618 million. And so far in Q2, 2023, the investment is up another $125 million. This puts cumulative investment gains close to $750 million, which is a 100% gain in less than 30 months. The S&P500 is up 12% over the same time period. So, I would grade this investment A+.

What is the outlook for this investment?

This is where things get really interesting for shareholders. This investment is poised to spike much higher in the coming years.

Let’s make 2 assumptions:

- Fairfax will grow book value at an average compound rate of 14% over the next 5 years (2023 to 2027). For reference, i have Fairfax earning $150/share in 2023 = almost a 20% increase in book value.

- Fairfax stock will trade at 1.1 x book value in 5 years time (end of 2027). As Fairfax delivers a mid-teens growth in book value it is natural to assume Mr Market will reward the company with a 1.1 x multiple to book value.

I view these two assumptions as being a reasonable base case.

If Fairfax grows BV by 14% each of the next 5 years and Mr Market rewards it with a 1.1 x multiple at the end of those 5 years (2027) its share price will be $1,614. The TRS-FFH will be worth $3.1 billion and the investment gain will be $2.4 billion (from 2021-2027).

In the table above i have done three scenarios - conservative (1 x BV), base case (1.1 x BV) and aggressive (1.2 x BV). The gain in the TRS-FFH investment ranges from $2.1 to $2.7 billion.

What are the catalysts to the investment thesis?

There are a number of catalysts to this investment. Despite the run up over the past 30 months, Fairfax’s stock price is still dirt cheap. This means the value of the TRS-FFH is understated today. Having a low starting point matters greatly when calculating future returns for an investment.

Three catalysts:

- record, consistent free cash flow: largely locked and loaded for the next three years

- lower share count: average decline of 3% per year is likely a good estimate

- growing multiple to book value: over time, Mr Market will come to understand and appreciate the Fairfax story

All three happening together will drive Fairfax’s stock price higher - which of course means the value of the TRS-FFH investment will also be driven higher.

A note on share buybacks

Capital allocation is one of the most important decisions for a management team. Fairfax has said they believe their stock is very undervalued. They have also said that as the hard market in insurance slows they will look to use excess capital to buy back their stock more aggressively.

Fairfax is highly motivated to drive the share price higher. Every $100 increase in the share price = $200 million before-tax investment gain. The TRS-FFH investment makes share buybacks an even more compelling capital allocation decision for Fairfax.

Conclusion

The table is set for Fairfax to earn as much as $2.7 billion on its TRS-FFH investment (2021 to 2027). Investors, as per usual, are not looking forward and connecting the dots. As a result, they are grossly underestimating the size of gains that are coming.

Cheap share price + Record cash flow + End of hard market + Increasing buybacks = much higher stock price = significant gains for TRS-FFH

==========

Is the TRS-FFH investment like a buyback?

The TRS-FFH is the next best thing to doing a big buyback.

Buybacks are powerful because they improve per-share financial metrics: EPS & BVPS.

- Buybacks lower the denominator (per share). If the buyback is large and sustained - so that it actually pushes up the price of the share price over time - the TRS position will gain significantly in value.

- At the same time, the TRS- FFH investment increases the numerator (earnings and book value).

Investors get a double benefit.

==========

Education: Total Return Swap

The other major benefit of a total return swap is that it enables the TRS receiver to make a leveraged investment, thus making maximum use of its investment capital. Unlike in a repurchase agreement where there is a transfer of asset ownership, there is no ownership transfer in a TRS contract.

This means that the total return receiver does not have to lay out substantial capital to purchase the asset. Instead, a TRS allows the receiver to benefit from the underlying asset without actually owning it, making it the most preferred form of financing for hedge funds and Special Purpose Vehicles (SPV).

There are several types of risk that parties in a TRS contract are subjected to. One of these is counterparty risk. When a hedge fund enters into multiple TRS contracts on similar underlying assets, any decline in the value of these assets will result in reduced returns as the fund continues to make regular payments to the TRS payer/owner.

If the decline in the value of assets continues over an extended period and the hedge fund is not adequately capitalized, the payer will be at risk of the fund’s default. The risk may be heightened by the high secrecy of hedge funds and the treatment of such assets as off-balance sheet items.

Both parties in a TRS contract are affected by interest rate risk. The payments made by the total return receiver are equal to LIBOR +/- an agreed-upon spread. An increase in LIBOR during the agreement increases payments due to the payer, while a decrease in LIBOR decreases the payments to the payer. Interest rate risk is higher on the receiver’s side, and they may hedge the risk through interest rate derivatives such as futures.

==========

Q1 2020 Conference Call

Prem: "They are one year swaps and we've historically been able to extend it for as long as we like."

Mark Dwelle: "My second question relates to executing the total return swap with respect to Fairfax shares. I guess, I was just curious why you pursue that structure, rather than just buying back the stock, if you felt like that was the good opportunity? I mean, is this a capital constraint that you couldn't really buy back that much?"

Prem Watsa: "We have to be careful, right? So not so much -- yes, we have to be very careful in terms of how much we can buy back. When we looked at Fairfax as a stock price and looked at everything else that we could buy, which is not over return swap on Fairfax. Right now, we paid US$344 per shares, our book value is $478. I mean, if you want the math, just on our book value basis, we'd have about $200 million gain. And Fairfax stock price for book value is worth another 200 million. We just think it's a terrific investment and our total return swap structure was a very good way for us to do it. And so we did it."

Mark Dwelle: "I don't disagree with you that it was a good a good strike price, I guess it was really -- the form of the transaction rather than just actually buying the shares, using a derivative instead is just -- it's a little bit unusual. I haven't usually seen that with most of the companies that I've followed. So that was really my main question."

Prem Watsa: "Yes, so, Mark, our point is just that we wanted to keep up -- we could -- where you have more than $1 billion in cash and the only company once -- or almost have down $375 million, we just wanted to be financially sound, and in all ways, as opposed to use that cash at this point in time."

==========

Q1-2023 News Release

At March 31, 2023 the company continued to hold equity total return swaps on 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 million (Cdn$935.0 million) or approximately $372.96 (Cdn$476.03) per share, on which the company recorded $139.8 million of net gains in the first quarter of 2023.

==========

2022AR

Long equity total return swaps

During 2022 the company entered into $217.4 notional amount of long equity total return swaps for investment purposes. At December 31, 2022 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount of $1,012.6 (December 31, 2021 – $866.2), which included an aggregate of 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn$476.03) per share at December 31, 2022 and 2021. During 2022 the long equity total return swaps on Fairfax subordinate voting shares produced net gains of $255.4 (2021 – $222.7). Long equity total return swaps provide a return which is directly correlated to changes in the fair values of the underlying individual equities.

During 2022 the company received net cash of $238.2 (2021 – $439.6) in connection with the closures and reset provisions of its long equity total return swaps (excluding the impact of collateral requirements). During 2022 the company closed out $63.0 notional amount (2021 – $1,876.7) of its long equity total return swaps and recorded net realized losses on investments of $8.1 (2021 – net realized gains of $243.0).

==========

2021AR

For our stock price to match our book value’s compound rate of 18.2%, our stock price in Canadian dollars should be $1,335. And our intrinsic value exceeds book value, a principal reason being that our insurance companies generate huge amounts of float at no cost. This is the reason we continue to hold total return swaps with respect to 1.96 million subordinate voting shares of Fairfax with a total market value of $968 million at year-end.

—————

Equity total return swaps – long positions

During 2021 the company entered into $753.6 notional amount of long equity total return swaps for investment purposes which included long equity total return swaps on an aggregate of 969,460 Fairfax subordinate voting shares with an original notional amount of $403.3 (Cdn$508.5) or approximately $416.03 (Cdn$524.47) per share, all of which remained open at December 31, 2021. At December 31, 2021 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount at December 31, 2021 of $866.2 (December 31, 2020 – $1,746.2), which included an aggregate of 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn$476.03) per share. These contracts provide a return which is directly correlated to changes in the fair values of the underlying individual equities.

During 2021 the company received net cash of $439.6 (2020 – $207.4) in connection with the closures and reset provisions of its long equity total return swaps (excluding the impact of collateral requirements). During 2021 the company closed out $1,876.7 notional amount (2020 – $878.8) of its long equity total return swaps and recorded net realized gains on investments of $243.0 (2020 – $216.7).

==========

2020AR:

Throughout much of last year following the pandemic-induced market plunge, I made public statements to the effect that our belief was that Fairfax shares were trading in the market at a ridiculously cheap price. In the summer I backed that up by personally purchasing close to $150 million of shares. Additionally, following our value investing philosophy, since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet!

Investment returns are very sensitive to end date values, so with a stock price of only $341 per share at the end of December 2020, our five and ten year and longer returns have been affected. We expect this to change as Fairfax begins to reflect intrinsic values again. Nothing that a $1,000 share price won’t solve!

—————

Amounts recorded in net realized gains (losses) include net gains (losses) on total return swaps where the counterparties are required to cash-settle monthly or quarterly the market value movement since the previous reset date notwithstanding that the total return swap positions remain open subsequent to the cash settlement.

—————

During 2020 the company entered into $1,906.9 notional amount of long equity total return swaps on individual equities for investment purposes following significant declines in global equity markets in the first quarter of 2020. Included in those contracts were long equity total return swaps on an aggregate of 994,695 Fairfax subordinate voting shares with an original notional amount of $329.2 (Cdn$426.5) or approximately $330.95 (Cdn$428.82) per share, all of which remained open at December 31, 2020. Subsequent to December 31, 2020 the company entered into long equity total return swaps on an additional 413,169 Fairfax subordinate voting shares with an original notional amount of $155.7 (Cdn$198.5). At December 31, 2020 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount at December 31, 2020 of $1,746.2 (December 31, 2019 – $501.5). These contracts provide a return which is directly correlated to changes in the fair values of the underlying individual equities. During 2020 the company received net cash of $207.4 (2019 – paid net cash of $34.5) in connection with the closures and reset provisions of its long equity total return swaps (excluding the impact of collateral requirements). During 2020 the company closed out $878.8 notional amount of its long equity total return swaps and recorded net realized gains on investments of $216.7. During 2019 the company did not initiate or close out any long equity total return swaps.

-

What is board members assessment of the quality of Fairfax's management team? I am interested to learn what the COBF mob thinks.

After you vote can you provide a brief comment: What 3 things influenced your vote the most? I want to keep things pretty vague so we get as much original thinking as possible.

-

Great discussion on all topics related to Ukraine. Gets to the core of many issues.

-

Looking out 4 and 5 years certainly is a challenging exercise. At a very high level, here are what i think are some of the the key metrics:

1.) net premiums earned?

2.) CR?

3.) size of investment portfolio?

4.) rate of return on investment portfolio?

5.) shares outstanding? (I would model this to drop by 2% per year on average for the next 5 years given the significant amount of cash coming in each year and how cheap the shares are).

The CR and the rate of return will have to sum to a number that allows an insurance company to earn an acceptable ROE = min 10-12%. This is not specific to Fairfax.

So the only way the ‘normalized’ CR goes to 98% is if the return on investments is high, perhaps 7 or 8% (i haven’t run the numbers). Likewise, if the ‘normalized’ return on investments is 3% then the CR will need to be under 95%. Yes, you could get very short periods where strange things happen… but that is not ‘normalized’, but more likely a bull or bear scenario.

Insurance companies (as a group) will need to earn an acceptable ROE on average over the medium term. Otherwise investors will exit and their share prices will crater. No CEO will let that happen (for a ‘normalized’ or extended amount of time). Super low share prices (over an extended period) would likely lead to the next great consolidation of the industry.

-

On 5/22/2023 at 2:26 PM, Parsad said:

Looks like FFH analyst estimates range from $790 USD to $1,346 USD. So roughly $1,050 CDN to $1,790 CDN. Pretty wide range, but I think that lower estimate marks the bottom of where shares should be trading.

https://finance.yahoo.com/news/analysts-just-cut-fairfax-financial-120606487.html

Cheers!

On May 12, RBC increased their price target for FFH from US$775 to US$875.

"Our view: Q1 results were solid all around with continued top-line growth, low 90s combined ratios, modest cat losses and continued strong growth of investment and associate income. Management has taken steps to lock in investment income for the next couple of years and combined with a still very favorable underwriting environment provides unusually high visibility to Fairfax earnings. With shares still trading at a discount to book value (even after solid gains last year) we continue to find Fairfax shares as among the most attractive opportunities in the P&C insurance space. We remain at Outperform."

What I found especially interesting with the RBC report is they are politely telling investors to get their head out of their asses when it comes to looking at Fairfax's business today. It is not your fathers Fairfax. Their investment portfolio is best in class. And their underwriting is good. And this is how sentiment changes... slowly over time...

"Investment income/investment positioning: ...Naturally there can be offsets from non-fixed income results and any related impairments but we think the investment positioning here is actually contrary to what many investors might expect. Which is to say normally investors view Fairfax as having a portfolio with a lot of complex exposures. While there is some truth to this on the equity and associate side of the book, that comprises only 25% of the portfolio – the remaining 75% of cash and fixed income is much more conservative than the average investment portfolio and this isn’t reflected in current valuations, in our view."

"Combined ratio/premium growth: ...As we noted last quarter we think underwriting is an under-recognized strength of Fairfax."

-

China’s model (political/economic) is simply not compatible with the West’s model. We have two different value systems. China played nicely for decades because they needed to take advantage of the West’s stupidity to accelerate their economic development (capital, technology transfer etc).. It worked brilliantly. Bottom line… China is a wolf… increasingly in wolf’s clothing. (It used to be in sheep's clothing.) Leadership in the West finally gets it. We are at economic war with China. And it is only going to get worse. War is a big word but it is accurate. What do you do when you are at war with someone… do you sell them advanced chips? Think about what that means.

China’s model:1.) keeping the communist party in power is the fundamental rule… EVERYTHING in life and society in China (and their interests abroad) exits to serve the CCP. Life. Laws. All subservient to the CCP.

2.) rule of law does not exist… see #1…

3.) individual rights do not exist… see #1…

People can be thrown in jail and your life’s possessions can be confiscated at the pleasure of the CCP. No reason necessary.

Businesses exist to serve the CCP. This includes foreign firms operating in China.

4.) freedom of the press does not exist… see #1… the press exists to serve the CCP (that propaganda thing).

5.) China’s interests abroad… also exist to serve the CCP. This is important.

- Chinese living abroad are tools of the CCP (just look at the China’s active involvement in Canadian elections, on site at universities, actively targeting families of Chinese Canadians who are anti-CCP).

it is simply the way the world works. The Disney movie is over.

—————Watch this video if you want to better understand the reality of living under the CCP/communist model of China. It is chilling. With all its flaws, living in a liberal democracy (of the West) is a wonderful gift. But liberal democracies are NOT the normal way. They are fragile. And can disappear if we do take it for granted and do stupid things.

—————-

Companies are figuring it out. Apple deciding to shift 25% of iPhone production to India is a seismic event. The Chinese economy has serious issues… they are still dealing with an epic property bubble.

-

On 5/17/2023 at 11:16 PM, glider3834 said:

Grivalia Hospitality

Grivalia appears to have had operating loss in Q1'23 but it looks like they are still in build out phase - they are aiming for completion on three projects

According to Chryssikos, the third (three?) projects under construction will open as pilot operations very soon; Avantmar in June; the Glyfada project in early August; and the Voula Project in early 2024.

but have additional ones planned, so I assume once they ramp up there would be revenue contribution there.

https://www.ekathimerini.com/economy/1210801/aiming-for-wealthy-guests/

'For the Grivalia CEO, there is a great market for 5- and 6-star resorts in Greece. Demand is high and, so far, supply is low. And the targeted cliented is high value: people with considerable disposable income who are going to spend large sums that will benefit the whole tourism ecosystem.'

@glider3834 this part got my attention: “When the five planned projects are completed, Grivalia’s value, currently nearly €1 billion, will reach €1.5 billion, says Chryssikos.”I am not sure what exactly Chryssikos is referencing. Fairfax owns 78% of Grivalia Hospitality with a carrying value/market value = $410 million (Dec 31, 2022).

The cost to develop and run these properties must be staggeringly high. Grivalia Hospitality will likely bleed significant sums of money until more locations are open and generating significant revenue. Interesting investment. Chryssikos has had the Midas touch for Fairfax when it comes to real estate in Greece. And we know Fairfax loves to bet heavily on winning horses…

-

How are Fairfax's equity holdings (that I track) doing at about the 60% mark for the quarter? They are up about $500 million = $22/share pre-tax.

- mark to market = +$130 million

- associate = +$370 million

- consolidated = flat

Big movers?

- Eurobank = +$430 million

- FFH TRS = +$105 million

- Stelco = ($88 million)

Bottom line, after a very strong Q1, the equity holdings are trending very well in Q2. Eurobank today has a market cap of $1.97 billion. Atlas is at $2.04 billion. As @glider3834 predicted not that long ago, Eurobank could shortly become Fairfax's largest equity investment.

----------

I updated my spreadsheet to capture the changes from the Q1 13F. I also re-ordered the ranking of the holdings by size.

-

On 5/22/2023 at 11:32 AM, Viking said:

After the US and Canada, India is Fairfax’s most important geography. In a world starved for growth, India is expected to be one of the fastest growing economies over the next decade. Morgan Stanley is projecting an economic boom in India (see below). Fairfax has repeatedly said they believe India is best country to invest in today. So, we should expect India to increase in importance for Fairfax investors in the coming years.

I thought it would be interesting to do a bit of a deep dive on India and Fairfax. Over the next few days I am planning to post on a number of topics:

1.) India: the big picture

I will then zoom into Fairfax and India

2.) Summary of current investments in India

3.) History: Insurance investments

4.) History: Non-insurance investments

5.) People

6.) Summary

-----------

1.) India: the big picture

India is exceptionally well positioned today:

- demographic tailwind: India has the largest population in the world, and it is very young with a median age of 28.2 years (China’s is 39). This should drive higher domestic consumption.

- regulatory tailwind: India has a pro-business government - ease of doing business in India is improving greatly. This should drive investment spending.

- geopolitical tailwind: companies are aggressively looking to diversify supply chains away from China - Apple’s plans to shift 25% of iPhone production to India being just one example

Many important building blocks are in place. This should result in very strong economic growth for India over the next decade. India looks positioned to finally realize its vast potential - it is no longer just a dream.

------------

Morgan Stanley: “India’s Impending Economic Boom: India is on track to become the world’s third largest economy by 2027, surpassing Japan and Germany, and have the third largest stock market by 2030, thanks to global trends and key investments the country has made in technology and energy.”

The Future of India (this video was mentioned by Prem in his letter in the 2022AR)

Deepak Bagla, Managing Director & CEO, Invest India

----------

2.) Summary of Fairfax’s current investments in India

Fairfax's business model has much more of an international focus than most of its P&C insurance peers. This is true for both insurance and non-insurance investments. India is Fairfax's most important international market.

Fairfax does a good job of summarizing for shareholders all of their investments in India each year in the annual report. Below is the summary provided in the 2022AR. Key take-aways:

- Insurance investments (Digit) fair value = $2.3 billion

- Non-insurance investments fair value = $1.5 billion

Fairfax has a total of about $15 billion in equity investments. At Dec 31, 2022, non-insurance investments in India of $1.5 billion represented about 10% of Fairfax’s total.

----------

3.) A short history of Fairfax’s insurance investments in India

Fairfax began its insurance journey in India in 2000. That was the year the government in India opened up the property and casualty insurance industry to foreign investment. Fairfax partnered with ICICI Bank, a large private bank in India, and created a joint venture called ICICI-Lombard. Fairfax invested $10 million for an interest of 26% in the new venture, the maximum allowed by Indian law at the time.

ICICI-Lombard experienced rapid growth in the years that followed and by 2006, they had become the largest private general insurance company in India with a 12.5% market share. Over the years Fairfax made numerous capital infusions to support the growth of ICICI-Lombard and maintain their ownership at 26%.

In 2015, the Indian government allowed foreign ownership in insurance companies to increase to 49%. That year Fairfax purchased an additional stake of 9% in ICICI-Lombard from ICICI Bank for $234 million; this increased Fairfax’s ownership in ICICI-Lombard to 35%.

In 2017, ICICI Bank decided it was time to take ICICI-Lombard public. ICICI Bank wanted to maintain ownership of at least 55% (to maintain control). Indian law required the public to own at least 25% of an IPO. This meant Fairfax would need to reduce its position to a ‘mere’ 20%.

Solution? Fairfax decided it was time to start their own P&C insurer in India. So, they partnered with Kamesh Goyal and brought start-up Digit into the Fairfax family. What a gutsy call this was at the time.

Indian law does not permit ownership of 10% or greater in more than one insurance company so an agreement was struck with ICICI Bank for Fairfax to reduce their interest in ICICI-Lombard to below 10%. In 2017, Fairfax reduced their equity interest in ICICI-Lombard from 35% to 9.9% and booked an after-tax gain of $930 million. Fairfax sold their remaining position in ICICI-Lombard in 2019 for $729 million and booked another $311 million gain. My guess is Fairfax earned more than $1.15 billion after-tax from its 20-year investment in ICICI-Lombard. Impressive value creation for shareholders.

Digit is now the property and casualty insurance engine for Fairfax in India. Growth has been rapid. In 2019, three private equity firms purchased 10% of Digit for $91 million; this valued the company at $858 million. In 2021, Digit raised another $200 million; this capital-raise valued the company at $3.5 billion. In 2021, Fairfax recorded a net unrealized gain of $1.4 billion on its investment in Digit compulsory convertible preferred shares (CCPS). Additionally, “The company anticipates recording additional gains of approximately $400 upon consolidating its investment in Digit, which is subject to regulatory approvals permitting the company to increase its 49.0% equity interest in Digit to a control position.” Fairfax is still waiting for final approval from Indian regulators (yes, this is understated… buy i am trying to keep this summary short).

From Prem’s Letter in the 2022AR: “Digit, led by Kamesh Goyal, had another strong year: after only five years since its inception, premiums are over $900 million, up 50% over the last 12 months in local currency, and with the benefit of investment income it had another profitable year. Digit entered the Fortune India magazine’s ranking of India’s 500 largest companies by total revenue during the year at 398th on the list – we expect that will move up going forward! Digit is exploring an IPO in 2023 which would fund future growth.”

At December 31, 2022, Digit had a cost of $154 million and a fair value of $2.28 billion = a compound annualized return of 79.5%. Fairfax looks exceptionally well positioned to grow in insurance in India with Digit.

The beginning of my deep dive into Fairfax and India is linked above. The remaining pieces are contained below.

4.) A short history of Fairfax’s non-insurance investments in India

Fairfax’s first large non-insurance investment in India was Thomas Cook India in 2012. Modi’s election in 2014 led to Fairfax’s next big move - the creation of Fairfax India in 2015. As a result, we are going to split this short history into two buckets: Thomas Cook India and Fairfax India.

Thomas Cook India

In 2012 Fairfax purchased 87.1% of Thomas Cook India (TCI) for $172.7 million. This was Fairfax’s largest single purchase in India and the start of much more to come. At that time, Thomas Cook was designated the vehicle for Fairfax’s future non-insurance investments in India.

- In early 2013, TCI purchased 74% of IKYA - renamed Quess - (Founder CEO - Ajit Isaac) for $47 million.

- In 2014, TCI purchased Sterling Resorts for $140 million.

- In 2015, TCI purchased Kuoni India for $32.5 million and Kuoni Hong Kong for $47.9 million.

In 2017, Thomas Cook India sold 5.4% of Quess for $97 million. Thomas Cook India completed its spin-off of Quess (which became a stand alone company) in December of 2019. Fairfax’s direct ownership in Quess was 32% (at Dec 2019: cost = $33 million; market value $332 million; carrying value = $704 million).

----------

Prime Minister Narendra Modi’s election in 2014 caused an important change in Fairfax’s strategy with its investments in India. Given Modi’s election (and expected ‘business friendly policies’), Fairfax decided to accelerate the pace of its investing in India. However, Thomas Cook India’s resources were a constraint on growth. What to do? Fairfax made a significant pivot and decided to launch Fairfax India.

From Prem’s Letter 2014AR: “Mr. Modi’s election led us to rethink the investment opportunities in India and our ability to fund them. While we have $26 billion in investments at Fairfax, regulatory constraints limit our ability to invest significant amounts in India. Given our excellent long term track record investing in India, our very significant on the ground resources with Harsha Raghavan at Fairbridge, Madhavan Menon at Thomas Cook India, Ajit Isaac at Quess (the new name for IKYA), Ramesh Ramanathan at Sterling Resorts and also S. Gopalakrishnan, the long serving head of investments at ICICI Lombard, we felt it was appropriate to create a new public company, Fairfax India, to invest in India.”

Fairfax India

In 2015, the Fairfax India IPO raised $1.1 billion, $300 million from Fairfax (28% equity ownership and 95% of voting control at inception). In 2017 Fairfax India raised an additional $500 million; Fairfax participated and owned 30.1% of equity interest and 93.6% of the voting rights. Today, Fairfax owns 41.9% of Fairfax India.

Company Profile: “Fairfax India Holdings Corporation is an investment holding company publicly traded on the Toronto Stock Exchange whose investment objective is to achieve long-term capital appreciation, while preserving capital, by investing in public and private equity securities and debt instruments in India and Indian businesses or other businesses with customers, suppliers or business primarily conducted in, or dependent on, India.”

Fairfax India overview - powerpoint presentation from AGM on April 20, 2023

From Prem’s Letter in 2022AR: “Since Fairfax India began, it has completed investments in 12 companies and exited one (14 currently as one has been split into four listed entities), all sourced and reviewed by Fairbridge, Fairfax’s wholly-owned sub-advisor in India. Fairbridge does outstanding work under the excellent leadership of CEO Sumit Maheshwari, supported by its Director Anish Thurthi, Vice President Sheetal Sancheti and analysts Jinesh Rambhia, Ramin Irani and Chinar Mathur. Fairfax India’s Mauritius subsidiary, FIH Mauritius Investments, ably led by its CEO Amy Tan, supported by its Vice President Vishal Mungur and its independent Board of Directors, is an integral part of the investment process. Also, since Fairfax India began, Deepak Parekh, both as a trusted advisor and a member of the Board of Directors, has provided us with invaluable advice on almost all of its transactions.”

“All of Fairfax India’s investments are in outstanding companies with a history of strong financial performance, led by founders and management who are not only excellent but also adhere to the highest ethical standards.“

Bangalore International Airport Limited (BIAL)

- Fairfax’s India’s largest and most important investment is Bangalore International Airport Limited (BIAL). At Dec 31, 2022 Fairfax had invested a total $653 million in BIAL which at that date had a fair value of $1.2 billion. Fairfax India just announced an additional purchase of 3% of BIAL from Siemens for $75 million and agreed to acquire an additional 7% later in 2023 (taking their ownership to 64%) for $175 million. This would take Fairfax India’s ownership in BIAL to 64%.

- “As I have said many times in past annual reports, the crown jewel (and largest) of Fairfax India’s investments is the Bangalore International Airport, run by Hari Marar. In 2022, Hari and his team did the impossible – they built the most beautiful airport in the world (Terminal 2 or T2) in a record four years, of which two were interrupted by COVID! In my mind, there is no airport in the world like T2 and it will be an inspiration for travellers arriving in Bangalore, the state of Karnataka and India. It will show the world anything is possible in India.”

Fairfax India’s performance:

Fairfax India’s Anchorage IPO:

- From Fairfax India’s 2022AR: “In June 2019, Fairfax India created a 100% owned subsidiary in India named Anchorage Infrastructure Investments Holdings (Anchorage). It is intended that this company will be Fairfax India’s flagship investment vehicle for airports and other infrastructure investments in India and that all the shares it owns in Bangalore International Airport (BIAL) will eventually be transferred to Anchorage.”

- “In September 2021, Fairfax India, as previously agreed, transferred 43.6% out of the 54% that it owns in BIAL to Anchorage and OMERS (the pension plan for municipal employees in the Province of Ontario, Canada) invested $129.2 million to acquire from Fairfax India an 11.5% interest on a fully diluted basis in Anchorage. This resulted in OMERS indirectly owning approximately 5% of BIAL. At that time, this transaction valued 100% of BIAL at $2.6 billion.“

- “Fairfax India intends to complete an IPO of Anchorage, although we did not move forward on this in 2022 as we are awaiting regulatory approvals.

- Once Anchorage is listed, the proportion of the publicly listed investments in Fairfax India will increase from the current 39.2% to 79.8% of the overall portfolio.”

Summary

Over the past 11 years, Fairfax has dramatically increased the number and size of its equity investments in India. It holds some of these investments directly. More recent investments are held primarily though Fairfax India, of which BIAL is the largest single holding. Anchorage is poised to be a growth vehicle for Fairfax India in the coming years.

----------

List with press releases of most of Fairfax’s and Fairfax India’s transactions in India:

----------

5.) People

The CEO of Fairfax, Prem Watsa, was born and raised in India. Since at least 1995, Fairfax has had important resources allocated to India. In 2011, this commitment increased considerably with the creation of Fairbridge Capital which provides Fairfax with significant ‘boots on the ground’ resources in India.

Chandran Ratnaswami

Chandran is one of the true heroes of this story. He was hired by Fairfax in 1995. Currently a Senior Managing Director at Hamblin Watsa (responsible for East Asia), he is also CEO of Fairfax India. His fingers are all over Fairfax’s investments in India for the past 28 years.

Here is what Prem had to say in Fairfax’s 2017AR: “In 1995, Chandran Ratnaswami joined us to build our international insurance and common stock investments, particularly in India. I said then, ‘‘this may be an acorn for a future oak tree.’’ Well what an oak tree Chandran has developed! We, with ICICI Bank, created the largest non-government-owned property and casualty insurance company in India from scratch, managed an Indian investment portfolio with outstanding results for over 20 years, created Fairbridge with Harsha Raghavan as Managing Director, acquired a 77% interest in Thomas Cook India which then acquired Quess and Sterling Resorts, and finally created Fairfax India which now has a market value of $2.5 billion. Chandran was intimately involved with all of these activities and serves on most of the Boards of our Indian companies.”

Fairbridge Capital:

Established in 2011, Fairbridge is a subsidiary of Hamblin Watsa that researches and advises on Fairfax’s and Fairfax India’s investments in India.

From the Fairbridge Capital web site: “Fairbridge takes a long-term value approach towards acquisitions and investments in the Indian region. We focus on long-term capital appreciation through a flexible and value-oriented approach, underpinned by our guiding principles, including integrity, transparency and responsiveness in all our dealings. Our permanent capital base enables us to execute unique set of transactions; by taking a very long-term view, combined with the ability to execute highly flexible and creative deal structures.”

Fairfax also leverages the knowledge and expertise of the various founder/CEO’s of the companies it controls in India, like Thomas Cook (Madhaven Menon), Quess (Ajit Isaac) and others.

----------

Fairfax has been building out its ‘people’ capabilities in India for decades. Most importantly, it has a dedicated team, Fairbridge Capital, with deep local knowledge that is able to act as opportunities present themselves.

----------

6.) Summary

Fairfax’s investing strategy in India:

- Insurance: all insurance investments will be held at Fairfax.

- Legacy non-insurance investments, Thomas Cook and Quess, will remain at Fairfax.

- Most new non-insurance investments will be held at Fairfax India.

What have we learned about Fairfax and India?

- deep understanding of the country

- government deregulation is a significant driver of opportunity

- partner with strong founder/owners

- decentralized ownership structure

- supportive / very good partner

- long term focus

- strategic

- adaptive

- opportunistic

- entrepreneurial

- diversified

From the very beginning, Fairfax has excelled with both its insurance and non-insurance investments in India. This success is due primarily to the people talent Fairfax has amassed at Hamblin Watsa and Fairbridge Capital. It is like Fairfax has been quietly building out its capabilities in India… preparing and waiting for the right moment… and it appears that right moment may have arrived. If India is the top performing global economy over the next decade, Fairfax certainly looks very well positioned to capitalize on that growth.

Zig Ziglar quote: “Success occurs when opportunity meets preparation”

-

After the US and Canada, India is Fairfax’s most important geography. In a world starved for growth, India is expected to be one of the fastest growing economies over the next decade. Morgan Stanley is projecting an economic boom in India (see below). Fairfax has repeatedly said they believe India is best country to invest in today. So, we should expect India to increase in importance for Fairfax investors in the coming years.

I thought it would be interesting to do a bit of a deep dive on India and Fairfax. Over the next few days I am planning to post on a number of topics:

1.) India: the big picture

I will then zoom into Fairfax and India

2.) Summary of current investments in India

3.) History: Insurance investments

4.) History: Non-insurance investments

5.) People

6.) Summary

-----------

1.) India: the big picture

India is exceptionally well positioned today:

- demographic tailwind: India has the largest population in the world, and it is very young with a median age of 28.2 years (China’s is 39). This should drive higher domestic consumption.

- regulatory tailwind: India has a pro-business government - ease of doing business in India is improving greatly. This should drive investment spending.

- geopolitical tailwind: companies are aggressively looking to diversify supply chains away from China - Apple’s plans to shift 25% of iPhone production to India being just one example

Many important building blocks are in place. This should result in very strong economic growth for India over the next decade. India looks positioned to finally realize its vast potential - it is no longer just a dream.

------------

Morgan Stanley: “India’s Impending Economic Boom: India is on track to become the world’s third largest economy by 2027, surpassing Japan and Germany, and have the third largest stock market by 2030, thanks to global trends and key investments the country has made in technology and energy.”

The Future of India (this video was mentioned by Prem in his letter in the 2022AR)

Deepak Bagla, Managing Director & CEO, Invest India

----------

2.) Summary of Fairfax’s current investments in India

Fairfax's business model has much more of an international focus than most of its P&C insurance peers. This is true for both insurance and non-insurance investments. India is Fairfax's most important international market.

Fairfax does a good job of summarizing for shareholders all of their investments in India each year in the annual report. Below is the summary provided in the 2022AR. Key take-aways:

- Insurance investments (Digit) fair value = $2.3 billion

- Non-insurance investments fair value = $1.5 billion

Fairfax has a total of about $15 billion in equity investments. At Dec 31, 2022, non-insurance investments in India of $1.5 billion represented about 10% of Fairfax’s total.

----------

3.) A short history of Fairfax’s insurance investments in India

Fairfax began its insurance journey in India in 2000. That was the year the government in India opened up the property and casualty insurance industry to foreign investment. Fairfax partnered with ICICI Bank, a large private bank in India, and created a joint venture called ICICI-Lombard. Fairfax invested $10 million for an interest of 26% in the new venture, the maximum allowed by Indian law at the time.

ICICI-Lombard experienced rapid growth in the years that followed and by 2006, they had become the largest private general insurance company in India with a 12.5% market share. Over the years Fairfax made numerous capital infusions to support the growth of ICICI-Lombard and maintain their ownership at 26%.

In 2015, the Indian government allowed foreign ownership in insurance companies to increase to 49%. That year Fairfax purchased an additional stake of 9% in ICICI-Lombard from ICICI Bank for $234 million; this increased Fairfax’s ownership in ICICI-Lombard to 35%.

In 2017, ICICI Bank decided it was time to take ICICI-Lombard public. ICICI Bank wanted to maintain ownership of at least 55% (to maintain control). Indian law required the public to own at least 25% of an IPO. This meant Fairfax would need to reduce its position to a ‘mere’ 20%.

Solution? Fairfax decided it was time to start their own P&C insurer in India. So, they partnered with Kamesh Goyal and brought start-up Digit into the Fairfax family. What a gutsy call this was at the time.

Indian law does not permit ownership of 10% or greater in more than one insurance company so an agreement was struck with ICICI Bank for Fairfax to reduce their interest in ICICI-Lombard to below 10%. In 2017, Fairfax reduced their equity interest in ICICI-Lombard from 35% to 9.9% and booked an after-tax gain of $930 million. Fairfax sold their remaining position in ICICI-Lombard in 2019 for $729 million and booked another $311 million gain. My guess is Fairfax earned more than $1.15 billion after-tax from its 20-year investment in ICICI-Lombard. Impressive value creation for shareholders.

Digit is now the property and casualty insurance engine for Fairfax in India. Growth has been rapid. In 2019, three private equity firms purchased 10% of Digit for $91 million; this valued the company at $858 million. In 2021, Digit raised another $200 million; this capital-raise valued the company at $3.5 billion. In 2021, Fairfax recorded a net unrealized gain of $1.4 billion on its investment in Digit compulsory convertible preferred shares (CCPS). Additionally, “The company anticipates recording additional gains of approximately $400 upon consolidating its investment in Digit, which is subject to regulatory approvals permitting the company to increase its 49.0% equity interest in Digit to a control position.” Fairfax is still waiting for final approval from Indian regulators (yes, this is understated… buy i am trying to keep this summary short).

From Prem’s Letter in the 2022AR: “Digit, led by Kamesh Goyal, had another strong year: after only five years since its inception, premiums are over $900 million, up 50% over the last 12 months in local currency, and with the benefit of investment income it had another profitable year. Digit entered the Fortune India magazine’s ranking of India’s 500 largest companies by total revenue during the year at 398th on the list – we expect that will move up going forward! Digit is exploring an IPO in 2023 which would fund future growth.”

At December 31, 2022, Digit had a cost of $154 million and a fair value of $2.28 billion = a compound annualized return of 79.5%. Fairfax looks exceptionally well positioned to grow in insurance in India with Digit.

----------

Next: 4.) A short history of Fairfax’s non-insurance investments in India

-

I don’t think you can compare Berkshire with pretty much any company out there today. It is a unique company. And it is also being managed in a strange sort of way - primarily wealth preservation. It is not the same company it was 20 or more years ago. The CEO is in his 90’s. I view Berkshire as a bond-like substitute. It will probably provide a return similar to the S&P500 over time.

Fairfax is a completely different set up. The company was until very recently a hated stock. As a result it got wicked cheap. It is still crazy cheap. My guess is it will earn $150/share in 2023. With shares trading at $729, that is a PE under 5. Lets use $120/share as a normalized run rare for earnings the next few years… that puts the PE at… 6x. Really? That only makes sense if Fairfax has a shitty insurance business, poorly managed investments and sub-par management team. And that, of course, is completely wrong.

The size of the insurance business has increased in size 4x in last 9 years, from $6 billion in 2014 to $24 billion in 2023E. Digit has been a home run. Fairfax are also good underwriters. Fairfax has done a stellar job managing their insurance businesses over the past 9 years.Fairfax’s fixed income portfolio is best in class right now. They just completed a historic pivot (in how they managed the duration). Duration is getting pushed out. And 80% of it is in government securities (very high credit quality).

The TRS on FFH shares was a brilliant purchase and one that will earn Fairfax well over $1 billion. Eurobank is firing on all cylinders… it just released its Q1 report and is projecting to earn Euro 0.22/share in 2023 after earning 0.18/share in 2022. Fairfax is exceptionally well positioned in India. They also look very well positioned in energy/commodities. Fairfax’s equity portfolio has never looked better.

The management team at Fairfax has been hitting the ball out of the park for years. They are a best in class group. .

For the current positioning of the insurance business and investments, given the quality of the management team, and given the quality of earnings that are coming, Fairfax remains historically undervalued.

The ‘narrative’ surrounding the company is simply wrong. It is slowly changing - as Fairfax continues to deliver outstanding results.

-

1

1

-

-

13 hours ago, keegomaster said:

You make a compelling argument. My question is what are the potential scenarios (optimistic, pessimistic, realistic) after three years? What normalized level of earnings could we expect? From the Q1 conference call, and Jen's comments, it seems like earnings will be more susceptible to interest rates due to IFRS 17.

@keegomaster other than very top-line, I do not spend a lot of time thinking about what might happen in 4 years and further out. For any company… not just Fairfax. There are simply too many moving parts to be able to have a strong opinion about granular things looking that far into the future. Who predicted 4 years ago that interest rates would spike to 5% in the US? No one. Who predicted in 2015 that a hard market in insurance would start in 2019? No one.

What you are really asking is:

1.) do you trust management?

2.) how good is management?

And today i do trust management at Fairfax. And for the past couple of years their decision making and execution has been best in class in the P&C industry. (Time to state the obvious.)

Looking out 4 years, i expect total earnings at Fairfax to continue to grow. There will be puts and takes. Perhaps underwriting profit flatlines or even declines (if we get a full-on soft market). That will be made up elsewhere. Fairfax will be investing billions in each of the next three years. Those new investments will create significant additional value for shareholders looking out to year 4.

In short, the management team will do what they are supposed to do: allocate capital well and grow value for shareholders.

-

Fairfax Financial: 'The big fish that got away’

Investors have lots of regrets. Missed opportunities. 'The big fish that got away.' Like not buying Fairfax (or selling your position) at US$492 on Dec 31, 2021. On Friday, FFH shares closed at US$690. That is a 40% increase in 15.5 months. Fairfax also paid out two $10 dividends.

How has the S&P500 performed since December 31, 2021? It is down 13%. Yikes! That makes Fairfax’s performance even better!

But guess what? Fairfax is actually a better buy today (at US$690) than it was on Dec 31, 2021 (at $492). As we digest Q1 results, the big fish is back and once again taunting investors…

How can this be? It’s not that complicated if you believe the following: a stock is worth the present value of the cash flows that are expected to be generated in the future.

To prove our preposterous claim we need to answer three questions (we are going to keep things very top line… to make it as easy as possible to follow):

1.) what did investors expect future operating cash flows to be for Fairfax at Dec 31, 2021 when shares closed at $492?

2.) what actually happened with the business over the past 15.5 months?

3.) what do investors expect future operating cash flows to be for Fairfax at May 13, 2023 when shares closed at $690?

-----------

1.) what did investors expect future operating cash flows to be for Fairfax at Dec 31, 2021 when shares closed at $492?

- Fairfax earned $1.8 billion in operating income in 2021 (see table below) or $77/share pre-tax.

- investors expected this to increase to perhaps to $2 billion in 2022, with modest growth thereafter.

- that was the level of operating earnings that were built into Fairfax’s stock price of $490 at December 31, 2021.

2.) what actually happened with the business over the past 15.5 months? For this part, we are only going to look at three asset sales by Fairfax:

- in June 2022, Fairfax sold its pet insurance business for $992 million after-tax = $40/share

- in July 2022, Fairfax sold Resolute Forest Products at the top of the lumber cycle for $625 million plus $180 million CVR. Dec 31, 2021, Resolute had a carrying value of $276 million. With the sale, Fairfax crystallized $350 a million gain (plus $180 CVR). Let’s say this was a $10 after-tax gain (let's be conservative).

- in January 2023, Fairfax sold Ambridge Partners for $400 million plus $100 million performance incentive. Pre-tax gain will be $255 million (plus present value of performance incentive). The deal closed in May. Let’s say this is another $10/share after-tax gain.

These three transaction delivered an unexpected $60/share after-tax gain for Fairfax shareholders. This $60 was a one time gift for shareholders. Totally unexpected. Like finding a pile of gold in your back yard.

3.) what do investors expect future operating cash flows to be for Fairfax at May 13, 2023 when shares closed at $690?

- Fairfax earned $3.1 billion, or $132/share pre-tax, in operating income in 2022. This was much more than expected at the start of the year.

- Fairfax is poised to earn $3.8 billion in operating income in 2023, or $167/share pre-tax. Nobody thought this was remotely possible Dec 31, 2021.

- This is more than double what Fairfax earned in 2021, or an increase of $90/share pre-tax. Think about that. Double.

- And Fairfax is poised to earn $3.8 billion in operating income in 2024 and 2025.

What happened?

- underwriting profit beat expectations: hard market is lasting longer than expected. In 2022, Fairfax grew net premiums written by 25% and delivered a better than expected CR of 94.7.

- interest and dividend income: interest rates spike much higher than expected. And Fairfax just locked in higher rates moving from 1.2 year average duration Dec 31, 2021 to 2.5 years at March 31, 2023.

- share of profit of associates: earnings from Fairfax’s collection of associate holdings increased much more than expected. This is expected to grow further in the coming years.

- all three 'buckets' are delivering much more earnings than expected - new records every year. Especially interest and dividends and share of profit of associates.

Most importantly, 2023 operating earnings of $3.8 billion are expected to be the new baseline for Fairfax moving forward. 2024 and 2025 operating earnings should be able to grow from 2023 levels. In short, $3.8 billion in operating earnings will be D-U-R-A-B-L-E. This is the critical point that I think many investors are missing today.

So Fairfax’s stock price went up $200 over the past 15.5 months. Three unexpected asset sales delivered $60 after-tax to shareholders. That leaves us with $140. How much is an increase in operating earnings of $1.9 billion ($90/share pre-tax = $70/after-tax) worth to shareholders? Is it worth $140/share? It is worth much, much more than that. Because it is durable.

What is the better buy?

A.) Fairfax at $490/share at Dec 31, 2021 - knowing what was known then.

B.) Fairfax at $690/share at May 13, 2023 - knowing what we know now.

My choice is B. And it’s not even close.

Just like December 31, 2021, that big fish (called Fairfax) is once again staring investors right in the face. And guess what? It’s probably going to slip away from most investors for a second time. And in another couple of years they will think back to today and kick themselves. And the story of ‘the big fish that got away’ will get even bigger.

-

Fairfax full-year 2023 earnings update

What did we learn from Fairfax's Q1 earnings? The story continues to get better. As a result, I am bumping up my 2023 full-year earnings estimate to US$150/share (from $130/share made back in Feb).

- 2023YE BV = US$904 = $764 + $150 - $10

- Stock price May 12, 2023 = $690

- Fairfax trades today at a PE of 4.6 and P/BV = 0.76 (2023YE)

IFRS-17: it will take me a while to better understand how IFRS-17 will impact Fairfax’s results moving forward. If i have messed up with my numbers below please let me know.

Assumptions:

-

underwriting profit = $1.2 billion

- top line grows at 8-10% and CR = 95

- assumptions: an average year for catastrophes; small tailwind from hard market; reserve releases similar to 2022.

-

interest and dividends = $1.5 billion

- average duration was increased in Q1 from 1.6 to to 2.5 years. This locks in $1.5 billion for 2023, 2024 and 2025.

-

Share of profit of associates = $1.1 billion

- Q1 was a positive surprise at $334 million

- Eurobank was the standout in Q1, coming in at $94 million.

-

IFRS-17: Effects of discounting and risk adjustment

- Q1 was $310 million

- I will update this number each quarter as we get results.

- Life Insurance and Run-off = similar to 2022

-

Other (non-insurance consolidated companies) = $75 million

- This was a disappointment in Q1, coming in at - $68 million.

-

Interest expense = $500 million

- Q1 was $124 million

- Corporate overhead and other = similar to 2022

-

Net gains on investments = $1.1 billion

- $771 million in Q1 (stocks = $410; bonds $319 million)

-

Other gains = $555 million

- Ambridge sale = $255 million gain (May)

- GIG gain = $300 million (2H)

- Income tax = guess (19%?)

- Non-controlling interests = guess (11%?)

-

Effective share outstanding March 31, 2023 = 23.23 million

- purchased in Q1 a total of 156,685 shares for $100 million (US$638/share)

Notes:

- Underwriting profit: includes insurance and reinsurance; does not include runoff or Eurolife life insurance.

- Interest and dividends: includes insurance, reinsurance and runoff.

-

On 5/10/2023 at 3:40 PM, Viking said:

With the Fairfax Q1 report set to be released after markets close on Thursday here are a few of the things i will be watching.Insurance:

1.) what is top line growth? Over or under 10%?

what increases is reinsurance seeing? Especially at Odyssey?

2.) what is the CR? Over or under 95?

- some insurers are reporting elevated cat losses in Q1 compared to PY.3.) update on hard market. What is outlook for 2023?

Fixed income portfolio4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income?

- Run rate was $950 million end of Q2, $1.2 billion the end of Q3 and $1.5 billion the end of Q4.

5.) did average duration of bond portfolio get pushed out closer to 2 years?

- 1.2 years at end of Q2 and 1.6 years at end of Q4.

- this is a big deal. If Fairfax is able to push duration out to 2 (or more) years then investors will get more comfortable that $1.5 billion will be durable for years. That could be a game changer for Fairfax - that should lead to multiple expansion.

6.) given fall in interest rates in March, do we see mark to market gains in fixed income?

- if duration was pushed out in Q1 then this could be a big number (given how much rates came down in March).

Equity Portfolio

7.) what is amount of mark to market gain?

8.) Resolute closed in Q1. Proceeds were $625 million. Will be used for?

Other

9.) share of profits of associates?

10.) Book value?

11.) share buybacks during quarter?

12.) what is net debt?

13.) capital allocation priority moving forward?

Updates/Commentary:

14.) Ambridge Partners: $400 million sale. On track?15.) GIG purchase of Kipco’s 46% stake: timing on close?

16.) Digit IPO: timing update?

—————

I am estimating Fairfax will earn $122/share in 2023. After we see Q1 results, does this number need to change?

Below are the answers to the questions i posed before Q1 results were released. Great start to the year.

Insurance:

1.) what is top line growth? Over or under 10%? Answer: 6%

- growth is slowing; but still solid.

2.) what is the CR? Over or under 95? Answer: 94

- like other insurers, sightly elevated cat losses in Q1.

3.) update on hard market. What is outlook for 2023?

- positive outlook overall.

Fixed income portfolio:

4.) what kind of increase do we see in interest income? $382 million

- Run rate for interest and dividend income looks to have levelled off at $1.5 billion.

5.) did average duration of bond portfolio get pushed out closer to 2 years? Yes. Got to 2.5 years.

- $1.5 billion in interest and dividend income is likely for 2023, 2024 and 2025.

6.) given fall in interest rates in March, do we see mark to market gains in fixed income? Yes. $319 million gain.

Equity Portfolio:

7.) what is amount of mark to market gain? $410 million

- My estimate was around $300 million.

8.) Resolute closed in Q1. Proceeds were $625 million. Likely used to purchase longer dated treasuries.

Other:

9.) share of profits of associates? $334 million.

- surprisingly high. Lead by Eurobank at $94 million.

- tracking at more than $1.1 billion for 2023, which would be a record.

10.) Book value? $803 (including IFRS-17)

- Dec 31 BV (old) = $658/share

- Dec 31 BV (IFRS-17) = $764/share (+$106 vs old)

- March 31 BV (new) = $764 + $49 (earnings) - $10 (dividend) = $803/share

11.) share buybacks during quarter? Yes.

- At March 31, 2023, effective common shares outstanding = 23.2 million.

- At Dec 31, 2022, effective common shares outstanding = 23.3 million.

12.) what is net debt? No material change from Dec 31, 2022.

13.) capital allocation priority moving forward?

- strong financial position

- support growth of insurance subs

- share buybacks

Updates/Commentary:

14.) Ambridge Partners: sale close in May. Gain = $255 million.15.) GIG purchase of Kipco’s 46% stake: should close in 2H; will result in $300 million gain.

16.) Digit IPO: timing update? Working on getting regulatory approvals. IPO will happen when market conditions are supportive.

—————

Is Fairfax on glide path to earn $2.4 billion from underwriting income + interest and dividend income in 2023? Yes. New estimate = $2.6 billion.

—————

-

1

1

-

I just added to my overweight position in Fairfax.

I am updating my earnings estimate for 2023 and i think it will come in around US$140-$150/share. Stock is trading at $692. BV is $803.

- PE is under 5 x 2023E earnings.

- P/BV is 0.86

- ROE = 17.4%

With the average duration of the bond portfolio getting pushed to 2.5 years we now know interest and dividend income will be $1.5 billion in 2023, 2024 and now 2025. Importantly, it is also perfectly positioned for a US recession, with 80% in government bonds and a small 14% in corporate bonds that are short term. When credit spreads blow out Fairfax is ready to shift into higher yielding longer duration corporates bonds. Smart buggers.

Share of profit of associates was over $300 million. This puts it on a run rate of better than $1.1 billion in 2023. My guess is we should see $1.2 billion in 2024 and $1.3 billion in 2025. Eurobank is on fire. Wait until Atlas gets going.

Insurance continues to grow nicely. The hard market in property cat is picking up steam. The top line growth is slowing and my guess is this is because Fairfax is prioritizing profitability - something we all want to see. This should keep their CR in the mid 90’s moving forward. This will lock in underwriting profit of more than $1 billion per year moving forward. And insurance results (top and bottom line) will get a nice boost when the GIG transaction closes and their results get added to the international bucket.

Ambridge gains of $255 million are coming in Q2. GIG gain of $300 million is coming in 2H.

In terms of capital allocation, it was nice to see Fairfax buying stock in Q1 ($100 million). They also paid out $250 million in the quarter for the $10 dividend. I would expect Fairfax to keep buying back stock in Q2 - spending perhaps $150-$200 million.

Growing earnings and lower share count is a great one-two punch for investors. I think we will also get - slowly and over time - multiple expansion as more investors come to understand the new Fairfax. And then we will have the trifecta: growing earnings + lower share count + higher multiple.When i weave it all together, the Fairfax story continues to get markedly better. My usual approach would be to lock in big gains. Instead, i decided to channel my Peter Lynch and buy more. I decided to water my flowers (not pull them).

Over the past 5 years Fairfax has morphed right in front of our eyes from an ugly caterpillar and transformed itself into a beautiful butterfly. Time is the friend of the wonderful business. And yes, after a lost decade, i think we can today call Fairfax ‘a wonderful business’.

-

7 minutes ago, Xerxes said:

Outrageous !!!

Prem promised to never short any markets again. And here he is loading up on treasury forward contracts, effectively betting on the bear against the bond market.

This breach must be tabled at the call tomorrow. We were told that these bearish activities have stopped.

i think they simply want to keep buying longer dated treasuries in Q2 and Q3 as bonds mature - and still be able to get Q1 yields: “where the contracts held will provide an investment opportunity to buy U.S. treasury bonds as other fixed income investments mature.” Very smart. Creative. Opportunistic. -

Where to start... There is so much to digest from Fairfax's Q1 earnings release. But of course there is one thing that dwarfs everything else - and that is what they did with the fixed income portfolio. What Fairfax has done with their fixed income portfolio over the last 18 months will go down as one of their best investment decisions ever (well, string of decisions).

- in Q4 of 2021, as interest rates approached zero, Fairfax shortened their fixed income portfolio to an average duration of 1.2 years. They nailed the move to shorter duration. Most P&C insurers were around 4 years.

- in 2022, interest rates spiked. During 2022 Fairfax extended the average duration of their fixed income portfolio to 1.6 years.

- and in Q1 of 2023, as interest rates topped out, we just learned the crazy bastards at Fairfax extended the average duration to 2.5 years. That is nuts. They just nailed the move to longer duration.

This now locks in $1.5 billion in interest and dividend income for 2023, 2024 and 2025 - just what Prem said at the AGM. He telegraphed this move. This gives Fairfax earnings much greater predictability for years into the future. Ratings agencies will love this. Analysts love this. This is a big input into the multiple that the shares should trade at.

So we now know what Fairfax was spending most of their money on in Q1: extending the duration of their fixed income portfolio. How did they do this? In Q1, Fairfax sold $5.3 billion of bonds due in 1 year or less and after 1 year through 3 years. They booked a loss on these sale of $332 million. Think about that. And then they proceeded to buy $7 billion of longer dated treasuries (mostly 3 to 5 years, but also 5 to 10 years). Fairfax saw a fat pitch... and knocked the ball out of the park.

And how does Fairfax's balance sheet look?

- at Dec 31, 2022 Fairfax was sitting on a $967 million loss on their bond portfolio (see below).

- at March 31, 2023, three short months later, Fairfax is now sitting on a $210 million loss. And given the move in interest rates so far in Q2, Fairfax is likely sitting on gains in its bond portfolio today.

As the US heads into a likely recession, what about credit quality?

- "Our fixed income portfolio is conservatively positioned with effectively 80% of our fixed income portfolio in government bonds and only 14% in primarily short-dated corporate bonds." Freaking brilliant!

When looking at fixed income portfolios, Fairfax is best in class among P&C insurers (and it's not even close). Well done to the fixed income team at Fairfax.

----------

One more thing... what are 'US treasury bond forward contracts'? Fairfax entered into notional amount of $2.985 billion of these... cha ching!

"U.S. treasury bond forward contracts: During the first quarter of 2023 the company entered into forward contracts to buy U.S. treasury bonds with a notional amount at March 31, 2023 of $2,984.7 (December 31, 2022 - nil) where the contracts held will provide an investment opportunity to buy U.S. treasury bonds as other fixed income investments mature. These contracts to buy U.S. treasury bonds have an average term to maturity of less than six months and may be renewed at market rates."

----------

- Investors can speculate on future prices and use a fixed income forward contract to lock in the price today for a profit. For example, an investor may believe that interest rates will drop... which will cause the bond to increase in value.

- Therefore, they enter a fixed income forward contract to buy the bond in the future and lock in the delivery price today. If the speculation proves right, the investor could buy the bond in the future for cheaper than its market value.

- https://corporatefinanceinstitute.com/resources/fixed-income/fixed-income-forward-contract/

----------

-

The sale of Ambridge just closed. Proceeds are $400 million (with the opportunity to receive another $100 million subject to 2023 performance targets) and will result in a sizeable realized gain of $275 million for Fairfax. This gain will increase Q2 after tax earnings by +$10/share.

With the recent closing of both Resolute and Ambridge deals, Fairfax has received proceeds of about $1 billion. This is a significant amount of money. At the same time, Fairfax is also earning a record amount of operating earnings (around $675 million per quarter). It will be interesting to see what new investments Fairfax makes.

The sale of Ambridge is yet another example of Fairfax being opportunistic. This time with the sale of an asset at a premium valuation. Well done.

----------

Brit purchased 50% of Ambridge in 2015 (shortly after Fairfax purchased Brit) for $29 million. Brit purchased the remaining 50% in 2019 for $46.6 million. In 2021, Brit combined their US operations with Ambridge.

---------

Of interest, Fairfax purchased Brit for $1.657 million in 2015. Ambridge is being sold for $400 million (with the opportunity to receive another $100 million subject to 2023 performance targets).

---------

FFH 2022 AR: Sale of Ambridge Group by Brit

On January 7, 2023 Brit entered into an agreement to sell Ambridge Group,