Viking

-

Posts

4,689 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

4 hours ago, hardcorevalue said:

no change in the stock price over 8 years.

-30% since 2017.

I get the discount has gone down but wow this has been pretty terrible returns for shareholders.

not sure that the anchorage ipo (which never comes) will close the discount

kind of frustrating supporting fairfax on this one.

@hardcorevalue i am not sure how long you have followed Fairfax India. The stock has just had an amazing run higher from $9.65/share a year ago to over $14/share recently. Yes, since December the stock has moved mostly sideways.

I have followed Fairfax India for years. I have no idea how the stock trades. I do think Fairfax India has an exceptional management team. They continue to make good decisions and build value for shareholders. I own some shares (not a big position).

Where will the stock go from here? I have no idea. But my guess is in 5 years time shareholders will probably do well (from current levels) - and possibly very well. But week to week or month to month (and perhaps year to year) the sideways movement is hard to make and sense of (for me anyways). So i don’t try.

-

What is the best way to value Fairfax today?

Peter Lynch: “What possible assurance do you have that (a stock you own) will go up in price? And if you are buying, how much should you pay? What you’re asking here is what makes a company valuable, and why it will be more valuable tomorrow than it is today. There are many theories, but to me, it always comes down to earnings and assets. Especially earnings.” One Up On Wall Street

----------

Fairfax has been an exceptionally difficult company for investors to value for the past three years. And especially right now (given the sharp rise in the stock price). Even investors who have followed the company closely for many years are having a hard time. New investors don’t stand a chance.

Mr Market is saying Fairfax has a fair value today of $827/share (that is where it closed Sept 1, 2023). I think the stock is still wicked cheap. Others on this board feel the stock is only mildly cheap.

What is the fundamental problem?

There is no consensus of what level of earnings the collection of assets that Fairfax currently owns can deliver on a regular basis moving forward. Or what to expect for the next 3 to 5 years.

Most investors prefer to use book value as their primary tool to value Fairfax. It is an insurance company after all. And using book value is supposed to be the proper way to value an insurance company. Using book value also conveniently allows an investor to largely ignore earnings (coming up with an estimate). And given the lack of consensus around earnings for Fairfax… well isn’t that a good thing?

Well, easy and good are not the same thing.

What is the best way to value Fairfax today?

Just like any job, we need to pick the right tool. To do this we need to answer the following question.

Is Fairfax an insurance company or a turnaround play?

No, this is not a trick question. The answer, of course, is that Fairfax today is both. But we are talking here about how to value Fairfax as a company.

My view is that today Fairfax should be valued primarily through the lens of a turnaround play. Not as an insurance company.

Does it make that much of a difference?

It makes a huge difference.

Using book value (P/BV and ROE) to value insurance companies with relatively consistent financial results over a 5 or 10 year period makes a lot of sense. But using book value (P/BV and past ROE) as the primary measure to value a turnaround like Fairfax makes little sense especially when they are still in the middle of the earnings part of the turnaround.

The problem with book value (P/BV and ROE) is it is a ‘rear view mirror’ valuation measure - it does a great job of telling you what has happened. And for lots of insurance companies what ‘has happened’ is likely to continue to happen in the future. So using book value (P/BV and ROE) as a primary valuation tool makes sense.

But for a turnaround like Fairfax, where a massive amount of change is happening - which is leading to much higher earnings - focussing primarily on the past is going to mess investors up. It is going to cause them to way under estimate future earnings. This in turn is going to cause them to under value the company. And that is going to lead to poor investment decisions.

A lot of investors who follow Fairfax are probably wondering how they missed the big move in the stock over the past 31 months (since Jan 1, 2021). My guess is the key issue is too much ‘rear view mirror’ analysis and not enough ‘looking out the front windshield’ analysis. The difference between valuing a stodgy insurance company versus valuing a turnaround.

How should an investor value a turnaround?

Let’s look to Peter Lynch for some insight. Peter Lynch loved turnarounds. It was one of the 6 buckets he used to classify his stock investments. Classifying stocks properly at the beginning of the process is critical. Because the classification determined the proper method to use to analyze the stock.

To value a turnaround it is critical to:

- First, understand what went wrong.

- Second, confirm that whatever went wrong has indeed been fixed.

- Third, focus in on evaluating the assets and estimating the trajectory of future earnings.

What went wrong at Fairfax?

Fairfax has three economic engines: insurance, investments - fixed income and investments - equities/derivatives.

Fairfax’s insurance business has been a solid performer over the past decade. And their investments - fixed income economic engine has also performed well. The issue at Fairfax was the investments - equities/derivatives engine.

The good news for Fairfax was the solution to their poor performance was fully within their control. They just needed to stop doing some really dumb things (putting it politely) in one part of the company.

What was the fix?

To right the ship in the equities/derivatives engine, Fairfax did a few things:

1.) end the equity hedge/shorting strategy. The equity hedge positions were exited in late 2016. The final short position was sold in late 2020. Done.

2.) make better equity purchases. This started in 2018. Done.

3.) fix poorly performing equity purchases from 2014-2017. This started in 2018 and looks like it was completed in 2022. Done.

But Fairfax didn’t stop here. They did even more:

4.) since 2020, they have made at least one brilliant decision each year:

- Late 2020/early 2021: initiated the FFH total return swap position, giving exposure to 1.96 million Fairfax shares at $373 share (resulting in a $900 million pre-tax gain to date)

- Late 2021: buying 2 million Fairfax shares at $500/share (book value is currently $834/share and intrinsic value is likely well over $1,000).

- June 2022: sale of pet insurance business for $1.4 billion (resulting in a $992 million after-tax gain).

And the insurance gods have also been smiling on Fairfax:

5.) a hard market in P&C insurance started in Q4, 2019. And it looks like it will continue into 2024.

And if all that wasn’t enough, the macro gods also decided to smile on Fairfax, delivering to the company their biggest gift yet:

6.) after dropping interest rates to close to zero in late 2021 they pivoted and spiked rates to more than 5% in 2023. Fairfax navigated their $38 billion fixed income through the treacherous storm perfectly - and the gold ($billions) is literally raining down today.

So Fairfax not only stopped doing dumb things, they also started hitting the ball out of the park. At the same time both the insurance and macro gods started smiling on the company.

Each of these things on their own has causing earnings to grow significantly over their historical trend. Stacked one on top of the other - well earnings have exploded higher.

In short, the turnaround at Fairfax that began back around 2018 now looks complete. But importantly, the lift to earnings will likely take a few more years to fully play out.

What is happening to earnings at Fairfax

We are going to focus on operating income given this is considered the high value part of earnings for an insurance company. Operating income averaged $1 billion ($39/share) each year for 5 years from 2016-2020. From this base it has:

- Doubled to $1.8 billion in 2021.

- Tripled to $3.1 billion in 2022.

- Is on pace to quadruple to $4.3 billion in 2023.

- Is estimated to be $4.7 billion, or $207/share, which would be a quintuple from $39/share (average from 2016-2020).

How would an investor focussed primarily on book value have seen any of this coming? The answer is easy… they would have completely missed it. They probably still are.

What are we learning about Fairfax’s collection of assets?

Beginning as far back as 2021, investors were getting glimpses that something good was happening at Fairfax. In 2022, is was obvious that ‘new Fairfax’ had arrived - but the good news was masked in the top line results by the bear market in financial markets and the large unrealized losses in fixed income and equities. But the change was obvious to those of us who followed the company closely. In 2023, the story continues to improve. And 2024 looks even better.

What we are learning is Fairfax was significantly under earning on its collection of assets for much of the past decade. But all the shackles that were holding earnings down have now been removed. Management is executing exceptionally well. For the first time in the company's history, the three economic engines are all delivering record results at the same time: insurance, investments - fixed income and investments - equities/derivatives.

Investors are just starting to get a look at what the true earnings power of Fairfax is on a go forward basis. And the total number is far higher than anyone dreamed possible.

So what is the valuation of Fairfax today?

Board members probably wonder why I have been so focussed on earnings in my analysis of Fairfax the past two years. Well, now you know why. I view Fairfax currently as a turnaround type of investment - and a heavy focus on earnings and assets is the only rational way to analyze the company today.

It’s not that I don’t pay attention to book value. I do. I just have never trusted how useful it is a tool to value Fairfax today or to help me better understand its earnings power as a company.

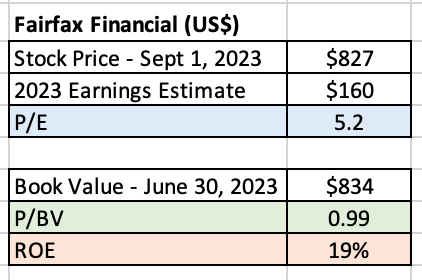

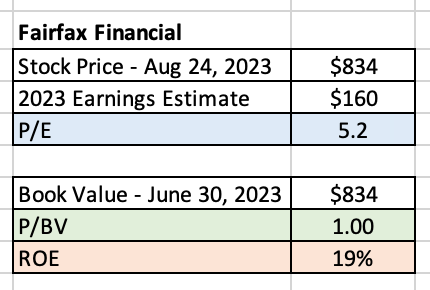

My current estimate is Fairfax will earn $160/share in 2023. I think that is a good baseline to use for earnings moving forward. If my analysis is right then that means Fairfax is trading at a PE of 5.2 x E2023 'normalized' earnings. Yes, that is nuts.

What does the future hold?

Peter Lynch: “Companies don’t stay in the same category forever. Over my years of watching stocks I’ve seen hundreds of them start out fitting one description and end up fitting another.” One up on Wall Street

Over the next couple of years we will all come to better understand Fairfax. And what its collection of assets are capable of delivering. What the true ‘normalized’ earnings power of the company is. At that point in time, the turnaround will long be over. And Fairfax will revert to being another predictable, boring old insurance company. And at that time, the valuation metrics (like book value, P/BV and ROE) generally used for valuing boring old insurance companies will again be appropriate to use for Fairfax.

If Fairfax is able to deliver strong earnings growth in the coming years the much improved results will slowly get baked into its historical numbers. That is when more traditional insurance investors will start to 'discover' how well managed Fairfax is. And how cheap the stock is. As this process plays out the P/BV multiple will likely expand significantly from 0.99 today to something more in line with peers, perhaps north of 1.3 (perhaps higher).

————-

Another reason Peter Lynch liked turnarounds:

Peter Lynch “The best thing about investing in successful turnarounds is that of all the categories of stocks, their ups and downs are least related to the general market.” One Up on Wall Street

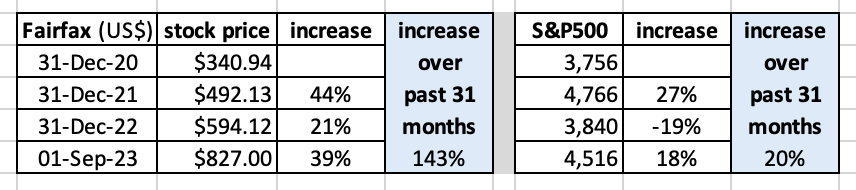

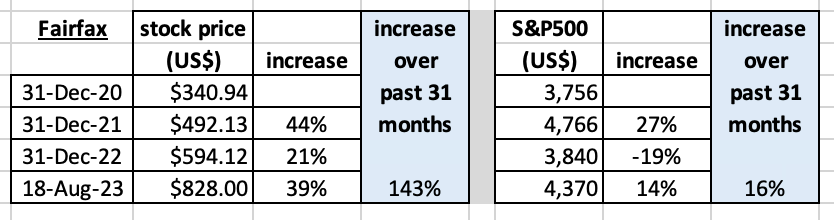

Fairfax is up 143% since January 1, 2021. S&P500 is up 20%. Fairfax’s outperformance over the S&P500 over the past 31 months has been an amazing 123%. Yes, that Peter Lynch is one smart dude.

—————

Peter Lynch on Turnarounds

“These are stocks that are battered down or they are hated companies, or they have been forgotten about. They are depressed in price but you have determined some one thing or a few things that have the potential for reversing this company’s fortunes independent of the industry getting better, or the economy getting better.

“You always have to do a balance sheet check on any company. This includes turnarounds. Do they have enough cash to make it through the next 12 months or the next 24 months? Do they have a lot of debt that’s due right now? These are important questions to answer.

“Make sure you understand and believe in the plan to restore corporate profits. It is all internal. They are doing something, either a new product, new management, cutting costs, getting rid of something. Something inside the company that allows them to improve themselves.

“Lots of turnarounds never happen, but a few winners can make up for a lot of losers. What’s important is to wait for the actual evidence of the turnaround occurring, not just the symptoms. (With) the turnaround, you have plenty of time. So just don’t buy on the hope. Wait for the reality. Turnarounds are so big it is worth waiting to get some real evidence.”

-

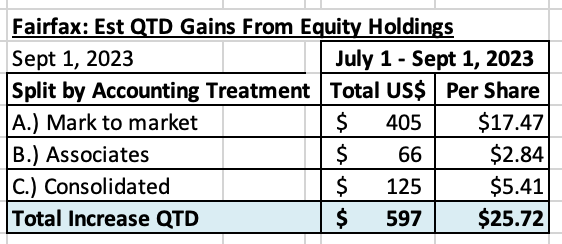

Fairfax's equity holdings (that I track) are up about $597 million so far in Q3 (9 of 13 weeks = 69%). Shaping up to be another quarter of solid performance. Split by accounting treatment can be seen below. I have attached my Excel file if you want a closer look.

Top Movers? All up this quarter:

- Thomas Cook India = $156 million

- FFH TRS = $154 million

- Eurobank = $110

- Broad based gains: 6 different equities are up more than $20 million

- Stelco = ($43) million: the largest decliner

-

1

1

-

2 hours ago, Thrifty3000 said:

How about the Travelers bond portfolio? Woof. Travelers has started inventing terms in their annual report like "core income" and "core book value" where they get to exclude unrealized portfolio losses! Ha ha. It appears this concept of "core" reporting is fairly new for Travelers (how convenient). Talk about moving the goalposts (after reaching for yield).

Lots of insurers are still sitting on large losses in their bond portfolio. The underwater fixed income securities are held in their held to maturity bucket so the losses have not flowed through the income statement. And the company line is ‘we will hold to maturity so it does not matter’. And that, of course is stupid. And makes no sense. Of course there are significant costs today for all companies that were buying fixed income duration in 2020 and 2021. Saying ‘it doesn’t matter’ is just a crafty psychological trick.

So you buy a 4 or 5 year bond in 2020 or 2021 at a 2.5% yield. Yes, an insurer can hold this bond to maturity. But you hold a fixed income instrument to make money.

1.) what is the real yield on all these bonds? With inflation running 4 or 5%? You are losing money (in terms of purchasing power) on a significant part of your fixed income portfolio. For years. These losses/positioning matter (just ask the ratings agencies).

2.) what is the opportunity cost? If you have a long duration portfolio of 4 or 5 years you also have a limited ability to reinvest at much higher rates.

This also means earnings for these insurance companies are messed up. If you don’t book the loss today, it effectively means your earnings in prior year periods is overstated. There is no free lunch. This also means historical ROE’s from most recent years are overstated.

In the current environment of much higher rates, Fairfax is a huge winner. Because of the actions of its management team. Their management of their fixed income portfolio has been best in class - and it is not debatable. My current estimate is Fairfax is tracking to deliver a return of 8.6% on its $56.5 billion investment portfolio in 2023 and better than 8% in both 2024 and 2025. That is going to blow insurance peers out of the water. Yes, Fairfax’s stock continues to trade at a severe discount to peers. Efficient markets once again demonstrating how inefficient they can be at times.

-

1 hour ago, gary17 said:

hi Viking - thanks for all this. makes sense.

For me FFH is cheap, but it does seem like they earn a low return on invested capital; they are only showing decent return on equity because it's a leveraged business. my high level observation.

Gary

@gary17 i have a question for your. Lets pretend Fairfax delivered an ROE of 15% per year on average for the past 5 years. This year they are on track to deliver an ROE of around 19%. Prospects for 2024 and 2025 look good (mid teens ROE). What multiples (PE and P/BV) would be reasonable to pay today? -

2 hours ago, newtovalue said:

hey Viking - great analysis as always!

one thing to ask you - i think we could assume the value of the investments would grow from $57.5BB.

Did you keep it flat to be conservative?

@newtovalue yes, my estimate for the investment portfolio is low and probably way low:

- 2023 = $56.5 billion

- 2024 = $57.5 billion

- 2025 = $58.5 billion

When the GIG acquisition closes that will cause a material increase to the investment portfolio. Continued organic growth in insurance will help as well. And as earnings roll in each quarter and are reinvested (further growing insurance and non-insurance buckets).

My estimates are pretty dynamic… constantly changing as we get new information. Some numbers will be high and others low. My goal is to get the direction and total reasonably close. So far most of my estimates have been too low and often by quite a bit. So i took things up a fair bit with my last set of revisions. We will know more when Fairfax reports Q3.

-

Fairfax’s $56.5 Billion Investment Portfolio: What Will It Earn in 2023 to 2025?

Fairfax has two income sources that drive earnings and growth in book value: underwriting and investments. Given their business model (use insurance/float to invest in non-insurance companies) about 20% of their income comes from underwriting and 80% of their income comes from investments. Given its outsized importance to Fairfax, let’s dig into Fairfax’s investment portfolio and try and determine what sort of return it will be able to generate moving forward. This will give us great insight into what Fairfax will earn. And this will enable us to better understand Fairfax’s current valuation.

How big is Fairfax’s investment portfolio? It is about $56.5 billion or $2,435/share.

Has it been growing in size? Yes. From 2018 to 2022 it increased:

- in absolute terms by 9.4% per year.

- per share by 13.5% per year.

What is the split today?

- Fixed income = $40 billion (71%)

- Equities/derivatives = $16.5 billion (29%)

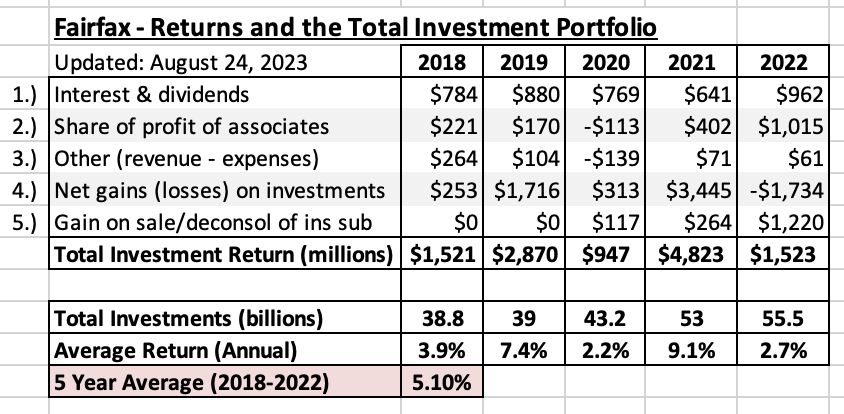

What did Fairfax earn on its total investment portfolio in the past?

Prem provided this information in his letter in the 2022AR (attached at the bottom of this post):

-

From 1986-2010, Fairfax earned an average of 9.7% on its investment portfolio.

- For the first 25 years of its existence, Fairfax’s secret sauce was its return on its total investment portfolio. In aggregate it was very good.

- From 2011-2016, Fairfax earned an average of 2.3%

-

From 2017-2022, Fairfax earned an average of 4.8%

- 2010-2020 was a lost decade for Fairfax shareholders. The issue was not the insurance side of the business. The investment side of the company completely messed up (the equities/derivatives part). The big mistake was the equity hedge/short position. There were also lots of poor equity purchases from 2014-2017.

Let’s focus on the last 5 years. What Fairfax did 10 years ago is interesting. What they did the past 5 years is much more helpful in understanding the current situation. (Please note, I am not sure of the exact build that Prem used to get to the averages that he put in his letter in the 2022AR. My build is outlined below. There will be differences. However, directionally, the comparisons should still be useful.)

- From 2018-2022, Fairfax earned an average of 5.1% from their investments (my build is detailed below).

-

Let’s overlay what happened in financial markets over this same time period:

- historically low interest rates from 2018 to the middle 2022 - this killed returns in the fixed income portfolio for much of the 5 year period.

- 3 different bear markets in stocks: 2018, 2020 and 2022.

- historic bear market in bonds in 2022.

Given the significant headwinds in financial markets from 2018-2022, the fact that Fairfax was able to deliver a total return of 5.1% each year (on average) is actually pretty impressive. What happened? Hamblin Watsa started to get their investing mojo back.

Note: IFRS: I am ignoring for now ‘Effects of discounting and risk adjustment’ = about $480 million to June 30, 2023.

What did the management team at Fairfax do from 2018-2022?

Internal:

- Ended equity hedge/shorting strategy. The final short positions (closed out in late 2020) resulted in total losses of $624 million from 2018-2020, or an average of $208 million over each of the three years.

- The equity holdings from 2014-2017 have mostly been fixed. Beginning in 2022, and lead by Eurobank, these holdings have gone from being a headwind to earnings (losing hundreds of millions every year in total) to now being a tailwind (making hundreds of millions every year in total). That is likely an improvement (swing) of +$500 million per year (my numbers are very rough and intended to be directionally accurate).

- Since 2018, new equity investments have been very good. They are, in aggregate, performing very well. These holdings are a growing tailwind to earnings. Chug, chug, chug.

External:

- Interest rates bottomed in late 2021: Fairfax sold $5.2 billion in corporate bonds (yielding 1%) and bought short term treasuries and reduced average duration to 1.2 years.

- Interest rates spiked in 2022 and into 2023: average duration has been extended to 2.4 years. I think they bought some Canadian corporate bonds in Q2, 2023...

- Covid bear market 2020: got exposure to 1.96 million Fairfax shares at $373/share. Bought back 2 million Fairfax shares in late 2021 at $500/share.

- Bear market 2022: spent billions buying more of companies it already owned often at bear market low prices.

The investment team at Fairfax has been putting on a clinic on the benefits of active management over the past 3 years. The extreme volatility we have seen the past three years has actually been a big tailwind to Fairfax and its investment portfolio.

This begs the question: would Fairfax perform better in a ‘safe’ environment or in a ‘shit storm’ environment? Over the medium term (3 year time horizon), i think they would actually do better in a ‘shit storm’ environment. Especially when you include the $3.7 billion in net earnings (much of it from high quality sources that could be reinvested opportunistically) that is likely to be rolling in each year moving forward. That would be ‘buy low’ on steroids. We are going to come back to this point later.

But we are getting ahead of ourselves a little.

How do things look in 2023?

Both equities and fixed income are poised to deliver very good results moving forward - and the table is set for this to last for years into the future. This is the part that most investors still do not get.

Why? The significant ‘internal’ drags that were holding down Fairfax’s returns from 2018-2022 are gone. And significant new tailwinds have emerged.

Equities:

- No more losses from the equity hedge/short trade.

- The equity purchases from 2014-2017 are now delivering very good returns.

- The equity purchases from 2018 to date continue to performing well.

- Importantly, Fairfax boosted their stakes in many companies they already own at bear market low prices. This will be a tailwind for future earnings.

- Covid headwinds have flipped to tailwinds at Recipe, Thomas Cook and BIAL.

Bottom line, the underlying earnings power of Fairfax’s $16.5 billion equity portfolio is finally fully delivering on its potential. It was already doing much better in 2022. All an investor had to do was look at share of profit of associates, which spiked to over $1 billion in 2022, to see the transformation of the companies captured in that bucket. But the improved performance in 2022 was masked by the general bear markets in bonds and stocks and the subsequent large unrealized investment losses that were reported.

Fixed income:

As good as the story is in equities, it is even better in fixed income. Going short duration of 1.2 years in late 2021 was, with hindsight, pure genius. Probably the best investment decision Fairfax has ever made in its history. Bond yields have since spiked higher. As a result, interest income has been spiking higher. It began picking up steam in 2022. But it has really got going in 2023. And 2024 is shaping up to be even better. And now Fairfax is extending duration.

The big increases in the returns in both the equity and fixed income portfolios is now spiking the return on Fairfax’s $56.5 billion total investment portfolio. Most importantly, the increase in earnings we are seeing in the equity portfolio (to higher quality) and the bond portfolio (to longer duration) make these higher earnings durable.

Ok. Enough talk. Show me the money!

What is the current estimate of what Fairfax might earn on its total investment portfolio in 2023?

My current estimate for Fairfax to generate an total investment return of about $4.5 billion in 2023, or a return of 8% on its total investment portfolio.

Assumptions to get to $4.5 billion in 2023:

We are already half way through the year in terms of reported results. And we are almost 2 months into Q3. So it is a pretty straight forward exercise to come up with reasonable estimates for the remainder of this year:

-

Interest and dividend income was $465 million in Q2. My guess is the current run rate is over $500 million per quarter so $1.9 billion for the year looks about right.

- $40 billion fixed income portfolio: my estimate for average yield in 2023 is 4.5%.

- Share of profit of associates was $603 million in 1H. My estimate of $1.1 billion for FY is likely low.

- Consolidated equities was -$36 million in 1H. This should reverse in 2H, driven by Recipe, Thomas Cook, Fairfax India and other holdings, and finish the year at $50 million.

- Net gains on investments was $450 million in 1H. I am estimating this to finish the year at $900 million.

- Gain on sales = Ambridge closed in Q2 and the GIG revaluation is expected to happen in 2H.

The assumptions above are hardly heroic. And they get us to an 8% return on the investment portfolio for 2023.

What is the current estimate for 2024 and 2025?

My forecast is for Fairfax to earn an average of 8% on its total investment portfolio in both 2024 and 2025. And I think this is a conservative number. Why?

- For all the reasons I outlined above: many of the tailwinds to the equity and fixed income portfolios that are just now fully flowing through to reported results and this improvement should continue into 2024, although at a slower pace.

- Significant net earnings rolling in: an estimated $3.7 billion per year (mostly high quality).

- A management team with proven best-in-class capital allocation skills.

- I am sandbagging my forecast for ‘net gains on investments’ for 2024 and 2025. I am going low with my estimate because, of course, i don’t know where they are going to come from.

Today, the management team at Fairfax has so many good options:

- Buy Fairfax stock trading at 5.2PE (to estimated 2023 earnings) and 1 x BV (which is well below intrinsic value).

- Shift from treasuries to high quality corporate bonds that are now yielding 6% to 6.5%.

- Given the increase in rates further out on the curve, continue to extend duration of the fixed income portfolio.

- Lots of equities are trading at low valuations (the run up in the market averages YTD in 2023 was largely driven by the ‘magnificent 7).

Bottom line, it would not surprise me if Fairfax delivers a return of better than 8% on total investments in each of 2024 and 2025.

What if my estimate of 8% on average over the next 3 years is approximately right?

An 8% return on investments equates to net earnings of about $160/share in 2023. ($160 in earnings also assumes a full year CR of 95). This level of earnings should grow nicely in the future. The stock is currently trading at $834. Book value is $834/share. An 8% average return on investments means the current share price is indeed crazy cheap - sorry to keep repeating this point… but it is what it is.

So what is it investors are missing?

The total earnings that Fairfax is currently delivering is so big that investors simply don’t believe it. Fairfax’s historical numbers and my estimates do not match up - not even close. It makes sense for most investors to believe that Fairfax’s numbers will revert back over time to their lower historical levels.

Investors also don’t believe that the high earnings number, if it actually happens in 2023, is sustainable. So even if a big number happens in 2023, well, it will be a fluke. They say “That baby’s coming down!” Why does the number have to come down in 2024? You pick the reason:

- ‘Interest rates are coming way down.’

- ‘An economic recession is coming.’

- ‘A stock market correction in coming.’

- 'In 2026 (you fill in the bad thing that has to happen).'

The pushback from investors is driven mostly by either disbelief or macro concerns. Nothing to do with Fairfax and what the company is actually doing or based on the results that it is currently delivering.

What is it Peter Lynch suggests that an investor should focus on when doing their research on a company? Facts and earnings. What about macro? He thinks investors who focus on macro are nuts.

Here is the really interesting thing… even if all of those scary macro things happen… I think they might actually make Fairfax’s future performance even better. Heads I win. Tails you lose. I love that type of bet.—————

From Prem’s letter in the 2022AR:

-

7 hours ago, tnp20 said:

This is a brilliant comment indeed. Many long time China commentators such as Michael Pettis, Eswar Prasad, George Magnus, Stephen Roach are saying the same thing...China has some really tough decisions on the economy and these are political decisions. They have already started back tracking on a lot of Xi nonsense....but it remains to be seen if they can go the whole hog. XI above all craves stability and control so they can not afford sustained poor economy as that would lead to delegitimizing CCP and riots in the streets.

Examples of back tracking...

(i) Houses are for living versus now loosening policy to stabilize housing

(ii) Punishing Private business/Entreprenuers that drive most of the innovation and jobs growth and favouring SOE versus now saying Private enterprises are equal to SOE and are vital to China's future.

(iii) Common prosperity crap versus now saying getting rich by being entrepreneur is to be encouraged as that drives growth and employment which benefits society.

(iv) Punishing capital markets versus now encouraging capital markets

SO far they are holding firm on major fiscal boost to kick start the consumption part of the economy but that may be coming and they may even mix old unproductive infrastructure spend just to meet the GDP target and a restless population.

To me questions and answers are obvious:-

(i) What do they need to do and why ? Avoid instability via economic crisis and malaise (unemployment) to keep CCP in power.

(ii) How can they do it ? Various new methods (new tech innovation & Consumption), new methods may take time and be slow but old methods (infrastrcuture ) are effective at boosting GDP and are fast acting but extremely wasteful - who cares about debt at this point, there is sufficient fiscal space for them to take on more debt (according to all the China followers )- forget local government debt, LGFV debt - central government has space - so just a left pocket, right pocket thing)

(iii) What if economy goes off rails ? Debt is not a problem - its all internal - they can keep pumping money in different areas until it turns ...

(iv) What is the right way to do it ? slow growth, transition, coordination, flexibility and vision

(v) What is the best way to play slow growth ? Be in fast growing sectors within the slow growth economy

(vi) Why invest in China at all when you can grow in fast growing sectors in US/West ? Yes by all means its not an either or, its an "and" story....China fast growers are at incredible valuation if you can get past geopolitics.

(v) What do I expect out of this ? At a minimum sugar high in about 12-24 months....and may be some long term wins because they are in the right space at the right time....

@tnp20 I think the guest in the podcast nailed it: Xi has destroyed the confidence of foreign investors. He gave the world a glimpse into what the CCP’s end game is (and it doesn’t include foreigners). He was too early. And now he has lost the ability to take advantage of stupid foreigners (well some of them anyways - Macron still seems keen). -

1 hour ago, Parsad said:

At today's prices, if I liquidate FFH, even with higher fair value prices for the insurance subs, I might get 1-1.2 times book after paying off the debt...at best!

If I liquidated Macy's today, just the store in Herald Square alone is worth more than the entire company. So forget the retail brick and mortar business, forget the online Macy's business, forget Bloomingdales, forget BlueMercury. Just selling the real estate will pay off the debt and get me what the market value of the company is.

Then if you look at it from a P/E basis...at current prices, I would get my money back from FFH in 8-10 years...whereas even with the lower earnings for this quarter as they liquidated 10% of their inventory, Macy's would give me my money back in 4-5 years.

I don't need Macy's to hit it out of the park. I just need Macy's to keep up with its peer group. If it can do that over the next couple of years, the market at some point will revalue it back up to around 10-12 times earnings. And if they manage to get a double, then it might get valued at 13-15 times earnings.

And what's the worst that could happen to Macy's in the next few years? Another pandemic? Tougher competition? Reduced consumption? They've plowed through all of that before.

I'm by no means saying people should sell Fairfax and buy Macy's. 25% of my portfolio is still Fairfax. But I'm certainly comfortable buying a chunk of Macy's based on P/E and liquidation value. I think it will return to fair value just like META did at some point.

Cheers!

Here is some constructive feedback:1.) my guess is Fairfax earns $160/share in 2023. That is a 5.2 PE. I expect earnings per share to grow in 2024 and 2025. So Macy’s is not cheaper today.

2.) liquidation value. My guess is if Fairfax started to sell off its many assets it would realize significant value for shareholders. Of course that isn’t going to happen so it is kind of a useless exercise. My question: is Macy’s going to liquidate parts of the company?

3.) management: the management team at Fairfax has been executing exceptionally well the past 5 years (best in class among insurance companies). They are going to be getting in the range of another $11.3 billion in net earnings over the next 3 years. I have no idea how good the management team at Macy’s is… but are they that good?

4.) insurance is in a hard market. Retail is… in a terrible market that might get worse ( although i did buy a little Aritzia recently).

Sanjeev, my read is you are significantly underestimating the current earnings power of Fairfax - like many of the posters on this board. And i love it. Stocks usually climb the wall of worry.

PS: i will admit i do not follow Macy’s… but i will do some reading on the weekend. Your banging of the table is what got me back into Fairfax in late 2020. And more recently you nailed META.

-

The evolution of Fairfax - the multiple streams of high quality income phase

Last week in my long-form post we learned that Fairfax’s operating earnings have spiked to a much higher base level.

- https://thecobf.com/forum/topic/19861-fairfax-2023/page/45/#comment-528496

Let’s broaden the discussion out a little bit. Let’s look at all of Fairfax’s sources of income. What are they? What is their quality? How are they changing?

Why does sources of income matter?

‘Quality earnings’: of all the sources of income, operating income are generally considered to be the highest quality for P&C insurance companies because the sources are considered to be predictable and durable. Companies that generate the majority of their total earnings from operating income are considered to be higher quality. As a result, the the stock prices of these companies usually trade at a premium valuation to peers.

If we understand sources of income and their trend that should provide us with another important piece of information to help us understand a company’s valuation, especially when compared to peers.

Fairfax has 5 streams of income:

- Underwriting profit

- Interest and dividend income

- Share of profit of associates (primarily Eurobank, Atlas, Exco, Stelco, GIG)

- Non-insurance subsidiaries (primarily Recipe, Fairfax India, Thomas Cook, AGT, Grivalia Hospitality, Dexterra)

- Net gains/losses on investments (mark to market equities, derivatives, fixed income, asset sales, including insurance)

The first three streams when added together give us all important operating income.

Let’s look at the average of these income streams over a 6-year period from 2016-2021 to see what we can learn:

Size: From 2016-2021, Fairfax generated in total an average of about $2.5 billion per year from the 5 income streams listed above. The total amount was quite volatile year-to-year.

Composition (split) of the average from 2016-2021:

- Net gains on investment was by far the largest income stream at 49% of the total.

- Interest and dividend income was the second largest bucket at 28%.

- Underwriting profit was the third largest largest at 12%.

- Share of profit of associates was 6%.

- Non-insurance subsidiaries was 4%.

- Operating income was a total of 46%, or less than half.

These splits fit the narrative of the company at the time (2016-2021):

The vast majority of income at Fairfax was being generated by ‘gains on investments’ and these gains had massive swings each year (up and down) so Fairfax’s reported results were quite volatile year to year. Lots of volatility year to year = low quality earnings.

From 2016-2021, Fairfax earned an average of $44/year. Book value averaged $474. Its stock traded around $500 during this time. Fairfax was valued at around 1.05 x BV and a PE of around 11.4. These multiples were well below peers.

Important: net gains/losses on investments - in the chart above an average number was input for each year from 2016-2021. Large negative annual numbers mess up the ‘split’ calculations. Importantly for our analysis, using an average number allows us to get a 6 year average that is a good representation of the split of the various income streams.

Let’s look at the income streams for 2022:

- We are going to look at 2022 on its own. 2022 was an anomalous year for global financial markets - we had the largest bear market in history in fixed income and, at the same time, a bear market in stocks. As a result, Fairfax had a $1.7 billion loss on investments in 2022. This was largely offset by a $1.2 billion gain from the sale of its pet insurance business (pre-tax). So the final loss on investments came in at only $514 million.

- Operating income spiked higher to $3.1 billion. This number on its own was now larger than the average of the total of all income sources from 2016-2021.

In 2022, the impact of rising interest rates has been fully reflected in Fairfax’s income statement and balance sheet. As a result, the fixed income portfolio/balance sheet has been largely de-risked from the impact of spiking interest rates.

At the same time, a significant shift in the composition of Fairfax’s income streams that started in 2021 accelerated in 2022 - each of the 3 components of operating income all increased to record levels in 2022.

Despite bear markets in both bond and stock markets, Fairfax was still able to deliver a total of $2.6 billion from its 5 income streams.

Let’s look at my estimates for the earnings streams for 2023-2025:

This is where things get really interesting. Especially when compared to 2016-2021.

Size: From 2023-2025, my estimate has Fairfax generating an average of $5.9 billion per year from the 5 income streams. This is an increase of 139% over the run rate of $2.5 billion from 2016-2021.

Composition (split) 2023-2025 compared to composition from 2016-2021:

- Interest income is now the largest single item at 36% up from 28%.

- Underwriting profit is up nicely to 21% from 12%.

- The big mover, though, is share of profit of associates which increased from 6 to 20%.

- Operating earnings are now 77% of the total. That is a massive increase from 46% from 2016-2021.

- Gains on investments are still a solid 20%. My estimate for this bucket of income is likely far too low - this is the one of the big reasons why I think my total earnings estimate for 2023-2025 will be proven to be too low.

- Non-insurance subsidiaries could grow significantly in the coming years. I think income of $400 million/year from this bucket (collection of companies) is attainable looking out a couple of years. Were this to occur, Fairfax would have a meaningful 5th income stream.

Conclusion:

Two stories are playing out simultaneously at Fairfax right now:

- a total earnings story - earnings are spiking.

- a quality of earnings story - the quality of earnings has improved dramatically in recent years

Importantly, the increases in both the size and quality of earnings is sustainable.

Having multiple sources of income does a couple of things for the company:

- provides important diversification across both insurance and investments.

- makes the whole company more resilient to both insurance and economic cycles.

- generates much more consistent cash flows over time allowing the company to be highly opportunistic with capital allocation.

This should make Fairfax a more valuable company. It should trade today at a valuation multiple more in line with peers (if not a premium to some).

What is reflected in Fairfax’s valuation?

Investors have been warming to the Fairfax story. The stock price has increased 145% over the past 31 months (since Dec 31, 2020). However, Fairfax currently trades at a 5.2 x multiple to my 2023 estimated earnings. It is also trading at about 1 x book value. These are very low multiples and much below peers.

This suggest to me that:

- Mr. Market is starting to understand the spiking earnings story at Fairfax.

- Mr Market does not yet understanding the much improved quality of earnings story at Fairfax.

And that is because multiple expansion has not yet happened at Fairfax. Mr Market does get things right over the medium term. My guess is as investors come to more fully understand ‘new Fairfax’ we will get multiple expansion in the coming years and Fairfax will trade at a multiple closer to peers. If this happens it would (along with continued growth in earnings and share buybacks) help power the price of the stock to much higher levels.

The hard market in insurance

There is a lot of hand wringing among investors today about the status of the hard market in insurance. When will it end? What will it mean for insurers? Do we get a sideways insurance market (not too hot or too cold)? Or do we a rapid descent into insurance hell - and a full-on soft market.

Underwriting profit makes up about 50% of total income for most insurers (with investments making up the other half - mostly from fixed income). So what happens to insurance pricing in the future will impact the financial results of most insurance companies in a significant way.

For Fairfax, as we have just learned above, underwriting profit only makes up about 20% of total income from expected sources. As a result, where insurance pricing goes in the future will impact Fairfax far less than its insurance peers.

Fairfax’s total earnings are now of a size, diversity and quality that maintaining strong underwriting profitability (perhaps mid-90’s CR) can be even more of the focus moving forward at the insurance operations. Unlike other insurance companies, Fairfax’s future will not be tied primarily to the insurance cycle. Its future will be tied to how well it does capital allocation. Capital allocation is increasingly becoming Fairfax’s competitive advantage.

The insurance business model used by Fairfax:

Fairfax uses the float of the insurance companies to buy non-insurance companies. These companies generate earnings. These earnings allow Fairfax to buy more insurance companies which increases float. This increase in float allows Fairfax to buy more non-insurance companies. Rinse and repeat…

As we have seen above, Fairfax is now generating a record amount of income from its 5 income streams. At the same times, the quality of income has never been better. As i stated in my post last week, through the flywheel effect, Fairfax has now achieved ‘breakthrough’.

My current estimate is Fairfax will generate a total of about $11.3 billion in net earnings (attributable to Fairfax shareholders) - mostly from high quality sources - over the next 3 years. Fairfax has never been better positioned as a company than it is today.

Fairfax has been trying to get to this exact place for 38 years. It has finally arrived. What we are witnessing in real time is the beginning of the next phase of Fairfax’s evolution as a company. It is reminiscent of a much younger Berkshire Hathaway. (Of course, Fairfax’s business model is uniquely its own.)

-

On 8/23/2023 at 11:23 AM, Spekulatius said:

Why do think birth rates will accelerate? Making this happen is not small feat and the youth unemployment suggests it will get worse near term.

Anyways, here is a good podcast on that matter:

The follow mentions 4 d's that impact the Chinese economy - demand, debt, demographics and decoupling.

Another interesting quote - The Chinese party thinks they are in charge of capital allocation for the Chinese economy.

So, no stimy checks, we build more infrastructure because they serve as monuments for the CCP as well.

@Spekulatius that is a great podcast on the current state of China. It was a very sober discussion - the CCP certainly looks like it has its hands full. I love the historical perspective the guest offers (so important when trying to understand China). i also found this comment at the end quite illuminating:“The fundamental tension… for years the CCP justified its control (of society) by promising economic growth so you have that social contract. But I think the difficulty is what if that control is coming now at the expense of economic growth. If a lot of the currently difficulties are in fact, a political economy problem then I think it raises that question and becomes extremely tricky for the CCP to actually navigate.”

The discussion around the massive sovereign wealth funds (China, Saudi Arabia etc) was also very interesting. They limit the autocratic regimes from doing anything crazy… because the significant assets they own in the West will simply get seized by Western governments. This would be another check on China potentially invading Taiwan.

-

1 hour ago, Haryana said:

just another article on the same

https://www.foodbev.com/news/fairfax-financial-to-acquire-significant-stake-in-meadow-foods/

"Terms of the transaction were not disclosed."

Meadow Foods web site: "MEADOW HAS GROWN OVER 30 YEARS INTO A £550M VALUE-ADDED INGREDIENTS BUSINESS SPECIALISING IN THE DAIRY, CONFECTIONERY, ICE CREAM, PREPARED FOODS AND PLANT-BASED INDUSTRIES."

Meadow Foods just completed an acquisition:

-

7 hours ago, petec said:

Sure - we are certainly not at the point of speculative excess yet. But the psychological pendulum has swung a long way from the pessimistic extremes. Maybe it's halfway through its swing. And it's closer to the point where you need things to go right to win, rather than things just not to go wrong.

All I think Parsad and I are saying is that this is not as easy a buy as it was at the lows, and a lot more is in the price, and as it continues to rise, we should all get more cautious not more excited.

@petec So you are saying psychology and price should drive an investors decision? Yes, a few people on this board are optimistic on Fairfax. And the stock price has gone up a lot. But really?

I think facts should be the primary driver of an investors decision. What are earnings going to be? What is their quality? How durable are they? How good is the management team at capital allocation?

Fairfax trades at a PE of 5.2. The earnings are high quality (mostly operating) and durable. The management team has been best in class ofr the past 5 years in terms of capital allocation. Those are the facts.

The stock trading at a 5.2PE suggests to me that investors in Fairfax are still VERY bearish. Yes, there are a few people posting positive things about Fairfax on this board - that is a tiny sample size. Go survey the institutional guys - my guess is they are still very bearish on Fairfax (and underweight with their holdings).

People are seriously arguing that Fairfax should trade at a 5.2PE because it will be earning too much over the next 3 years? The stock needs to be penalized because it is earning too much? I am sorry, that is crazy talk. You penalize a stock because it is underperforming. Fairfax really is becoming the Rodney Dangerfield of insurance.

If other insurance companies were trading at a 5PE i would get it. Every other quality insurance company trades at a PE of at least 10 and most are higher. Fairfax is the clear outlier. And based on the facts, that makes no sense to me.

-

33 minutes ago, petec said:

hIf we agree FFH's operating earnings are in large part rate-dependant, then we're straying into territory where I don't trust my opinions, and I don't assume that this level of earnings is sustainable.

@petec Why do you think FFH’s operating earnings are in large part rate-dependent? What do you see that is going to cause a big fall off in 2026 and later? Recession?

1.) underwriting income

2.) interest and dividend income

3.) share of profit of associates

Interest rates especially further out on the curve have been moving higher over the past 2 months. That is very bullish for Fairfax. That means interest and dividend income is likely going even higher as a significant amount of bonds likely mature each quarter and are reinvested likely at much higher rates. Fairfax’s fixed income portfolio has an average duration of 2.4 years (very low compared to peers). What if they extend this in 2H 2023 to 2.75 or even 3 years? They likely couldn’t extend duration in Q2 partly because they had to come up with $1.8 billion to buy the PacWest loans. But Q3? We will see.

My point is it looks to me like you are assuming rates come down rapidly over the next year and Fairfax gets caught flat footed (operating income falls dramatically in 2025 and later). My view is for every risk there will be opportunity. If we get a recession, yes, treasury rates will likely fall. But credit spreads will also likely widen out. And that will allow Fairfax to flip into corporates and higher yields. My point is i think you are thinking about downside risk. And not giving any credit for the value of active management being able to take advantage of the mouth watering opportunities that will present themselves.

-

8 hours ago, SafetyinNumbers said:

I chat with quite a few Fairfax holders and my impression is that many of them are looking for reasons to sell. I think it’s mostly to avoid drawdowns which might lead them to feel or worse look stupid. Especially to their bosses/clients if they are portfolio managers. Meanwhile, the index huggers just buy stock on VWAP so are price insensitive.

Personally, I think it makes little sense to consider selling until Fairfax trades at least 1.5x book value because that seems likely over the next 5 years given how underowned Fairfax is by Canadian PMs benchmarked to the S&P/TSX and how active shareholders like ourselves see very strong book value growth over the same period.

In the past three years, Fairfax has gone from 47bps in the index to 89bps. The shares outperformed the index by 170% but that was offset by growth in capitalization of the index and Fairfax’s share buybacks.

It’s already very hard for active PMs not to own Fairfax given how it’s crushed the index recently but given the built in growth that I think we all agree is highly probable, if the stock just stays at 1x BV, it’s weighting will go well above 100bps and the urgency to own it will increase.

It’s easy to think up narratives PM’s will use to justify paying up to 1.5x BV. They can point to comps like BRK, MKL that trade there. They can point to long term and recent ROE north of 15%. They can point to exposure to Greece and India in the equity portfolio and how cheap it is although that might be to justify paying 2x BV!

I really want to avoid selling too early because I think we could be in the first year of Fairfax’s 95-98 experience where ROE hit 20% four years in a row and the multiple went from 1.5x BV to > 3x BV. Fairfax also increased shares outstanding (Singleton like) by 33% which contributed to the growth in book value from $39 to $112.

These analogs are all pretty useless except they do show us what’s possible if not probable. It’s easy to hold or buy at 1x book value, it will be much harder north of 1.5x but I don’t have to worry about steeling myself until we get there. In 1995, the starting point was 1.5x BV. I don’t know if I would have been interested back then even if I had my knowledge now. That set of shareholders didn’t make it easy for the index huggers as the market cap grew from ~$800m to north of $7b. Maybe this set of shareholders is jaded enough given the last decade to hand over their shares easily but I’m trying to hold on to mine.

Of course, everyone should do whatever makes them comfortable. This is not investment advice. It’s just my thought process for which I welcome criticism.

@SafetyinNumbers Given the run that Fairfax has had the past 3 years, it does not surprise me that some investors are looking to lighten up, especially if Fairfax is now too big of a weighting in their portfolio. I call that a ‘first class’ kind of problem to have.

Personally, i think Fairfax is still ‘dirt cheap.’ I love the push back from others on this board who feel that Fairfax is no longer ‘dirt cheap.’ Sorry, you haven’t convinced me (yet) with your pushback. My read is earnings are going to be much more resilient looking out 3 or 4 years than you think. We will see in another 12-24 months who is right. And that is what i love about investing (and this board). We share ideas and discuss/debate. We all do our own analysis. We place our bets. And we live with the results. Hopefully we earn enough along the way to be able to keep playing the game. Best of luck to everyone.

-

13 hours ago, StubbleJumper said:

I'm not Pete, but I'll take a run at this.

If you want to value a security using PE as a metric, you need to do so on the assumption that earnings are neither unusually high nor unusually low and that they are sustainable for a prolonged period. A PE is essentially a mental short-cut for assessing the value of a perpetuity. To make the argument that a 5.2 PE is cheap and that the company should have a PE of, say, 12, you need to assume that the current excellent operating conditions for an insurance company will persist for many years on end.

To do this, you need to argue that FFH has some sort of special sauce that enables it to write a 94 CR while buying US treasuries yielding 5%, but nobody else can/will do so. So, in essence, the argument needs to be that $1 of capital in Crum or Odyssey can be used to write $2 of premium, the underwriting earnings will be 12 cents (94 CR) and riskless investment income will be 10 cents (a US Treasury yielding 5%), providing a slick return of 22% on that equity, BUT no other company can replicate that. No other company will see this, obtain new capital, expand their book of business, and competition will not push the CR rate up and squeeze FFH's books of business. If you can hammer out this argument in your own mind why FFH can do this and nobody else can/will, then your earnings are sustainable and you can simply slap some sort of market average PE onto current earnings to arrive at a valuation estimate.

Setting aside the argument about the sustainability of earnings, the comment saying, "And I think the stock looks fairly cheap on that basis" is in my view a reasonable and valid comment. You have quite rightly pointed out that FFH has locked in some fairly attractive investment returns for the next few years. You've done the arithmetic through to develop pro forma earnings estimates going forward 2.5 years and shown that there will be big earnings coming down the pipe, even if a guy gives a moderate haircut to underwriting profitability for 2024 and a massive haircut to underwriting profitability for 2025 (but, hey if they actually continue to write a 94 CR, so much the better!). If you do this, it is difficult to envisage a scenario where adjusted BV (after accounting for the excess of market over book for certain associates) doesn't hit $1,100 by Dec 31, 2025. If operating conditions in the insurance market continue to be as wonderful as they currently are, with a CR of 94 and a treasury of 5% being SIMULTANEOUSLY available, that Dec 2025 BV could be higher, but it seems to be a no-brainer that they'll make the $1,100 BV given that the returns on the fixed income portfolio are largely locked in. So, someone who doesn't buy the argument that FFH ought to currently trade at PE12x$180EPS=US$2,000+ can quite reasonably believe that it could trade at somewhere between 1x and 1.2x BV on Dec 31, 2025. With the shares currently trading at ~US$830, a price on Dec 31, 2025 of $1,100 to $1,300 is quite plausible and is fully consistent with the observation, "And I think the stock looks fairly cheap on that basis."

It really amounts to a bit of a differing view of just how far into the future you are comfortable to predict outstanding insurance results. I am assuming that we are at the peak of the insurance cycle and that conditions will deteriorate as capital enters the industry and companies competing to expand their books of business push the CRs higher (probably to slightly above 100 before it's all said and done). If it actually does work out that FFH can routinely obtain a 22% return on an incremental dollar of capital, so much the better. But, personally, I am unwilling to assume that today's wonderful insurance conditions will persist for a prolonged period. I would be happy in 10 years if I am wrong today!

SJ

@StubbleJumper My point with the PE in my post was to highlight that it is absurdly low for Fairfax right now. Fairfax's stock price today of $828 makes sense if Fairfax was earning about $80 per year (and assuming earnings grow modestly in the future). It is a well run P&C insurer so trading at a PE of 10 is hardly an aggressive multiple to attach.

My current estimate is Fairfax will earn $160 this year. And with slightly conservative assumptions, earnings will grow in 2024 and 2025. That is not in the same universe as $80 in earnings.

So a buyer of Fairfax's stock today at $828 is getting $80 in estimated 2023 earnings for free ($160-$80). That is one hell of a discount for something that might or might not happen in 2026 or later. It doesn't make any rational sense. It is too large.

Yes, my earnings estimate for 2023 might be a little high. And it also might be a little low. We are almost 8 months through the year.

My thesis is investors are way underestimating what a 'normalized' amount of earnings is for Fairfax today. Yes, the future is uncertain. There are risks. But there are also opportunities. Some income streams will face headwinds. At the same time other income streams will experience tailwinds.

-

41 minutes ago, petec said:

Viking your work is usually excellent but this statement is wrong.

Fairfax have absolutely done excellent work - I have argued this for a long time, and actually think it goes back decades, notwithstanding clear mistakes regarding the big short.

However, what's really driven the increase in operating earnings is the big shift in the macro backdrop - covid stimulus and then rising rates helped (in rough order) Atlas, then the broader economy, float income, and underwriting profits (because CRs are directly linked to interest rates, which control the amount of capital flowing into the industry). Eurobank's recovery is not entirely unrelated to this either.

Don't get me wrong: Fairfax's management made some great decisions in the down market to grow by acquisition (not writing more policy) and put themselves in a position to write record amounts of business and generate record amounts of float in the up market. They got roundly criticised for some of those decisions on this board (the Brit and Allied deals were evidence of Prem's towering ego, not his ability to make different decisions at different points in the cycle). I agree with almost every example you've given of good decisions on their part. But the fact is that if rates were still at 2019 levels, which they might well have been without covid, Fairfax's operating earnings wouldn't be at this level.

That said, I do think Fairfax's next 2-3 years look strong, and by then they will be so large in float terms that operating earnings will be far higher than historic levels regardless of rates. And I think the stock looks fairly cheap on that basis. It's my largest holding, but I trim on spikes these days.

@petec you are a night owl!

My view is the true anomaly was the period 2010-2020 and zero interest rates. Interest rates appear to be normalizing. This is causing the investment world to return to a more normalized environment… one where active management, when done well, matters (can deliver serious outperformance). Something Fairfax has historically been very good at. So i give the management team the benefit of the doubt for the very good decisions they have made in recent years.

The part of your comment i do not understand is: “And I think the stock looks fairly cheap on that basis.”

My estimate is the stock is trading at 5.2 x 2023 earnings. That is not ‘fairly cheap’… that is crazy cheap. Do you not think $4.3 billion is a reasonable estimate for operating earning for 2023?

Or is it more a weighting issue… where Fairfax is getting too big and you want to lighten up to rebalance your overall portfolio? Regardless of fundamentals or what the stock might actually be actually worth?

-

Fairfax and the Transition from Good to Great: The Flywheel Effect

Warning: Mr Market might be right. And I might be completely wrong. This post is not intended to be financial advice. It is intended to educate and entertain. Please contact your financial advisor before making any stock purchases.

Fairfax’s stock trades today at a PE of 5.2 (to my estimate of 2023 earnings).

Of course, it is not normal for a stock to trade at a PE of 5.2. The PE multiple for the S&P500 is currently 20. So Fairfax’s stock could double in price and it would still be trading at a 50% discount to the S&P500.

Fairfax’s PE of 5.2 screams that one of two things is clearly wrong:

1.) the price of the stock is way too low.

2.) the estimated earnings are way too high (and not ‘durable’)

Let’s take a look the stock price first.

Fairfax has been one of the best performing stocks over the past 31 months (since Dec 31, 2020). Over this time period, Fairfax is up 143% while the S&P500 is up 16%. Fairfax has outperformed the S&P500 by 127%. That is stellar outperformance.

After a run like that, Fairfax’s stock price must now be fairly valued - in fact, it might even be overvalued. Looks like we might have our answer to our question above. If the stock is fairly valued then that means the earnings estimate must be way too high.

Let’s take a look at earnings estimates.

After Fairfax released Q2 earnings, I updated my three year earnings estimate for Fairfax and came up with the following:

- 2023 = $160/share

- 2024 = $166/share

- 2025 = $174/share

My forecast is for earnings to go up each of the next 3 years. Clearly, my estimates must be too high. Right? I actually think they might prove to be conservative. Why? Because every forecast I have done for Fairfax for the past 30 months has proven, in hindsight, to be too conservative and usually by a lot.

Why have my estimates been too low? Because i have been consistently underestimating the management team at Fairfax and the earnings power of the collection of assets they have today. So i trust my earnings estimate looking out three years. A lot.

So what explains Fairfax’s current PE of 5.2?

Despite a 143% gain over the past 31 months, the stock price of Fairfax is still dirt cheap. Yes, that probably sounds like crazy talk.

How can a ‘still dirt cheap’ stock price be explained?

Operating earnings are the holy grail for insurance companies because it is made up primarily of predictable items. And these items tend to be durable. Let’s focus on this bucket of earnings at Fairfax and see what we can learn.

The average for total operating earnings at Fairfax from 2016 to 2020 was $1 billion per year ($39/share). But this dramatically changed beginning in 2021.

- in 2021, operating earnings doubled to $1.8 billion or $77/share (from 2016-2020 average)

- in 2022, operating earnings tripled to $3.1 billion or $132/share (from 2016-2020 average)

- in 2024, operating earnings are forecasted to quadruple to $4.3 billion or $185/share (from 2016-2020 average)

The increase in operating earnings at Fairfax has been like a goat climbing straight up the steep side of a mountain.

Let’s now do some historical comparisons to see what we can learn.

From 2016 to 2020, Fairfax’s stock price averaged about $500/share (I am ignoring the covid drop in 2020). Over this same 5-year period, operating earnings at Fairfax averaged about $1 billion per year ($39/share). So investors over this 5 year period thought $1 billion in operating earnings (let’s call that baseline earnings) at Fairfax was worth a stock price of about $500. Back then, Fairfax’s stock was considered to be fairly valued.

In 2023, operating earnings at Fairfax will be about $4.3 billion ($185/share). Operating earnings for 2023 are up 330% compared to the old 5-year baseline trend from 2016-2020, or 374% on a per share basis (the share count has come down over the past 5 years). Fairfax’s stock price closed Friday at $828. Fairfax’s stock price is up only 66% compared to the 5-year trend from 2016-2020.

So operating earnings per share at Fairfax have increased a staggering 374% over the 2016-2020 trend while the share price has increased a modest 66%. I think we just learned something useful. The increase in Fairfax’s stock price has not kept up with the increase in operating earnings. And ‘not kept up’ is a big understatement.

What is Mr Market missing?

Mr Market clearly is not understanding the new trajectory for operating earnings at Fairfax.

This is likely because Mr Market is still looking at Fairfax’s financial performance through the rear view mirror - focussing primarily on past reported results. That approach makes sense for most companies. But it makes no sense for Fairfax today. Because it completely misses (ignores) all the significant positive changes that have been happening at Fairfax over the past 5 or 6 years - the benefits of which are only just now fully flowing through to reported results.

The good news is Mr Market will eventually figure things out at Fairfax. Earnings are the key. And as Fairfax keeps reporting stellar results quarter after quarter, Mr Market will price Fairfax’s shares appropriately.

What is causing the massive increase in operating earnings?

What we are seeing today, with record operating earnings at Fairfax, is the cumulative effect of slow, organic (internal) change that has been happening at Fairfax for many years - a process of continuous improvement. It is the result of the conscious choices and actions being taken at all levels of the organization - senior management, the insurance operating companies, the investment team at Hamblin Watsa and the CEO’s of the various equity holdings. All parts of the organization are working in a disciplined way towards the same end purpose - the consistent delivery of solid results leading to the improvement of the long term performance of the company. It is the slow methodical process of doing what needs to be done.

For Fairfax the process also involved some soul searching - there were lessons that needed to be learned. Fairfax stopped doing the things that were not working (like the equity hedges and short positions). It got better with its new equity investments.

The improving operating earnings are also not due primarily to circumstance. But active management (taking advantage of circumstance) is an important part of Fairfax’s business model.

The record operating earnings we are seeing at Fairfax today is simply the end result of years of good decisions and hard work.

What is the new baseline for operating earnings at Fairfax today?

The level of operating earnings at Fairfax have likely reached an inflection point - a breakthrough of sorts - given their size. Significant sums are now being reinvested every year (billions). The seeds that are being planted will grow new streams of operating earnings for Fairfax in both insurance and investments in the coming years. Compounding will work its magic. Fairfax looks like it is now in that virtuous circle where success begets more success.

My estimate for operating earnings for 2023 is $4.3 billion and I think that is a reasonable number to use a new baseline for Fairfax moving forward. Why? Because all the inputs I use are reasonable and mildly conservative.

How durable is $4.3 billion in operating earnings?

My guess is it is quite durable. At least as durable as operating earnings at other insurance companies like WR Berkley, Markel or Chubb. Why wouldn’t they be? In fact, the management team at Fairfax has been best-in-class in terms of overall management of the business in recent years - this suggests that we should have more confidence in Fairfax’s future results than that for peers. I know, that is a very non-consensus view. But it is where logic takes me.

As I like to say, the once ugly caterpillar called Fairfax has magically transformed itself into a beautiful butterfly. What thing happened to cause the transformation? There was no one thing. It was a bunch of things. From the butterfly’s point of view, what happened was perfectly natural. Only to the outsider does it look like magic.

—————

Jim Collins, in his book Good to Great, has a concept called the ‘flywheel effect’ that describes very well what has been happening ‘under the hood’ at Fairfax for the past 5 or 6 years that has got the company to where it is today.

The flywheel effect: “The Flywheel effect is a concept developed in the book Good to Great. No matter how dramatic the end result, good-to-great transformations never happen in one fell swoop. In building a great company, there is no single defining action, no grand program, no one killer innovation, no solitary lucky break, no miracle moment. Rather, the process resembles relentlessly pushing a giant, heavy flywheel, turn upon turn, building momentum until a point of breakthrough, and beyond.”

—————

What are some of the decisions/actions made by Fairfax in recent years that have caused the Fairfax 'flywheel' to pick up more and more speed? To provide some context, we are going to separate the decisions/actions into Fairfax’s three economic engines:

- insurance

- investments - fixed income

- investments - equities/derivatives

Each on its own is driving earnings for Fairfax. Together, they help illustrate why Fairfax is delivering record operating earnings - and why the Fairfax flywheel has now likely reached ‘breakthrough’ speed.

Economic engine 1: insurance

- Turn 1: 2015-2017: rapid growth - driven by international expansion by acquisition

- Turn 2: 2017: strategic pivot in India - sold ICICI Lombard for significant gain ($950 million) and seeded Digit with an investment of $154 million that is now worth $2.3 billion..

- Turn 3: 2019-today: rapid organic growth - driven by hard market.

- Turn 4: 2022: increased ownership in Allied World from 70.9 to 82.9%

- Turn 5: 2023: increasing ownership in Gulf Insurance Group from 44% to 90%. Strategic; secures Fairfax’s position in MENA.

- Turn 6: ongoing: methodically improving quality of the insurance businesses. Resulting in improving CR.

Net written premiums have increased from $8.1 million in 2016 to an estimated $24.1 billion in 2023, an increase of 198%. At the same time, the combined ratio has improved from an average of 98 from 2016-2020 to an average of 95 the past three years. Much higher net written premiums and a lower CR has resulted in much higher (record) underwriting profit. Underwriting profit averaged $191 million per year from 2016-2020. It was $801 million in 2021, $1.1 billion in 2022 and is forecasted to be $1.3 billion in 2023. This increase is sustainable (with some volatility in both directions).

Economic engine 2: investments - fixed income

- Turn 7: Dec 2021: average duration of fixed income portfolio was reduced to 1.2 years. In 2021, sold $5.2bn in corporate bonds at a yield of 1% for a realized gain of $253 million (most were purchased in March/April 2020). Avoided billion in unrealized losses on $40 billion fixed income portfolio as interest rates spiked higher in 2022 and 2023 (protected the balance sheet).

- Turn 8: 1H 2023: average duration of fixed income portfolio extended to 2.4 years. This locks in more than $1.5 billion in interest income for each of the next three years (this estimate is low).

- Turn 9: 2020 and 2023: real estate debt platform partnership established with Kennedy Wilson. $4 billion portfolio is delivering an average return of about 9% total = $360 million, mostly in interest income.

Driven by the significant increase in the insurance business, the size of the fixed income portfolio at Fairfax has doubled in size from $20.3 billion in 2016 to $40 billion today. From 2016-2022, the average yield of the fixed income portfolio was 2.4% and today the average yield is 4.8%. As a result of the two doubles (portfolio size and rate of return), interest income is spiking higher. Interest income averaged $650 million per year from 2016-2021. It was $874 million in 2022 and is forecast to come in at $1.8 billion in 2023 and $2.1 billion in 2024. This increase is sustainable (with some volatility in both directions).

Economic engine 3: investments - equities / derivatives

- Turn 10: 2016: ending the ‘equity hedge’ in late 2016.

- Turn 11: 2020: closing out the final short position in late 2020

These two programs cost Fairfax an average of $494 million per year on average from 2010-2020. Ending these two programs eliminated what was essentially a $494 million annual expense for the company (meaning Fairfax became $494 million more profitable). Fairfax has also said multiple times that they have learned their lesson and that they will no longer short indices or individual stocks.

- Turn 12: 2014-2017: poor equity purchases - Fairfax made a string of poor equity purchases from 2014-2017.

- Turn 13: 2018-today: very good new equity purchases - Fairfax has been hitting the ball out of the park with their more recent new equity purchases.

- Turn 14: 2020- present: Fairfax also have been taking advantage of recent bear market low stock prices by adding significantly to many of the equity holdings they already own.

Fairfax has done a great job over the last 5 years fixing their poor equity purchases from 2014-2017. These holding were burning about $200 million per year in cash (losses/write downs/restructuring etc) and now they are all largely fixed and delivering solid returns for Fairfax shareholders. Eurobank is the shining star in this group. The equity purchases from 2018-today have been performing well. And Fairfax has been aggressively adding to positions in equities they already own - buying at bear market low prices.