Viking

Member-

Posts

4,923 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Thanks for the heads up. This one looks large enough. I’ll likely add it tomorrow

-

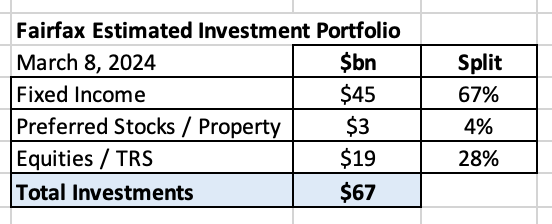

As of March 8, 2024, my guess is Fairfax has an investment portfolio that totals about $67 billion, with the split being roughly as follows: In this post we review the holdings in the equities ‘bucket.’ To value a holding, we normally use current ‘market value,’ which is the stock price at March 8, 2024, multiplied by the number of shares Fairfax owns. For private holdings we use Fairfax’s latest reported market value, which was Dec 31, 2023. Derivative holdings, like the FFH-TRS, are included at their notional value. Additional notes: Mytilineos *: includes exchangeable bonds John Keells *: includes convertible debentures What holdings are missing from my list below? AGT Food Ingredients and new purchase Meadow Foods (2023) are two that come to mind. I just have no idea what they are worth. Let me know if you have an estimate. Ok, let’s get to the fun part of this post. What are some of the key take-aways? Below are mine. What are yours? 1.) Fairfax has a pretty concentrated portfolio The top 3 holdings make up 36% of the total The top 10 holdings make up 56% of the total 2.) Steady improvement in quality of the top holdings over the past 6 years: What happened? New money has been invested at Fairfax very well (FFH-TRS, buying more of existing holdings) Some high quality businesses have continued to execute well (Fairfax India, Stelco) Some businesses, after years of effort, have turned around (Eurobank). Some businesses that were severely affected by Covid have emerged stronger (Thomas Cook India, BIAL) Some businesses were restructured/taken private (Exco, AGT) and are now performing much better. Some low quality businesses were sold/merged/wound down (Resolute Forest Products, APR, Fairfax Africa). Some low quality businesses have shrunk in size due to poor results (BlackBerry, Farmers Edge, Boat Rocker). The important point is the quality of Fairfax’s largest holdings have steadily been increasing. And this should result in higher overall returns from the equity portfolio in the coming years. 3.) What rate of return should this collection of equity holdings be able to deliver in 2024? 12% return x $19 billion = $2.3 billion share of profit of associates ($1.05 billion) dividends ($200 million) ‘other’ consolidated non-insurance co’s ($100 million) investment gains ($650) for associate holdings, change in excess of carrying value to market value ($300 million) This looks like a reasonable target for 2024, looking at the solid prospects/earnings profiles of the current holdings. 4.) A slow shift away from mark-to-market holdings. Today, less than 50% of the total portfolio is held in the mark-to-market bucket. Back in 2019, my guess is closer to 80% of the total portfolio was held in the mark-to-market bucket. This shift should have the effect of smoothing Fairfax’s reported results moving forward, especially during bear markets. As a reminder, in Q1, 2020, Fairfax had $1.1 billion in unrealized losses (when the equity portfolio was much smaller). As more holdings shift to the ‘Associates’ and ‘Consolidated’ buckets, it is the trend in underlying earnings at the individual holdings that will matter to Fairfax’s reported results and not a stock price - earnings are much more consistent than a stock price. Lower volatility in reported earnings should help Fairfax’s valuation (as volatility is considered bad by Mr. Market). This shift will also start to create a Berkshire Hathaway problem for Fairfax: over time book value will become an increasingly poor tool to use to value Fairfax. Why? The value of the ‘Associates’ and ‘Consolidated’ companies captured in book value each year will fall short of the increase in their true economic value. Fairfax India is a good example of this today. Eurobank is a holding to watch moving forward. Bottom line, Fairfax looks very well positioned today. But the story gets better: like the past 6 years, I expect the quality of Fairfax's equity holdings to continue to improve in 2024. That will improve future returns. And, like a virtuous circle, the growing cash flows will be re-invested growing the companies even more. Thoughts? Am I missing something? What number below is most wrong? Why?

-

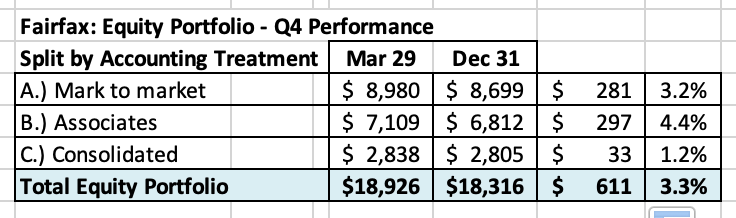

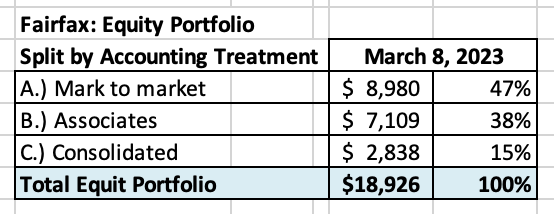

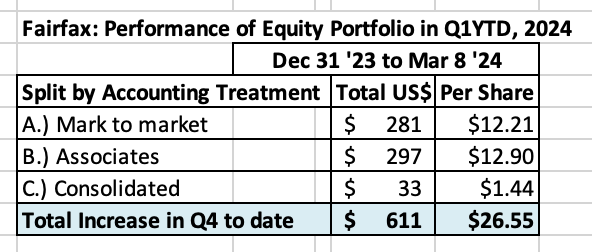

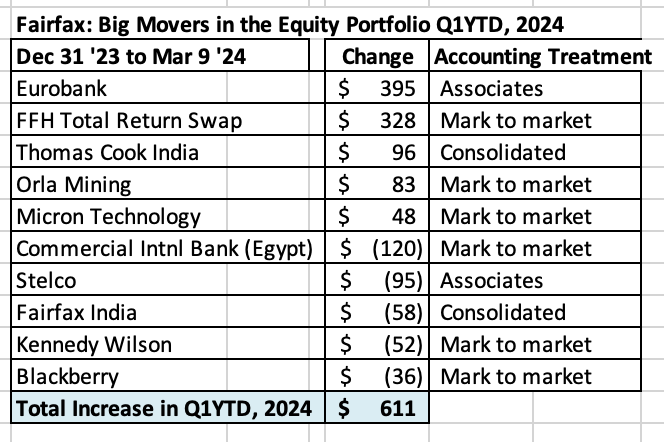

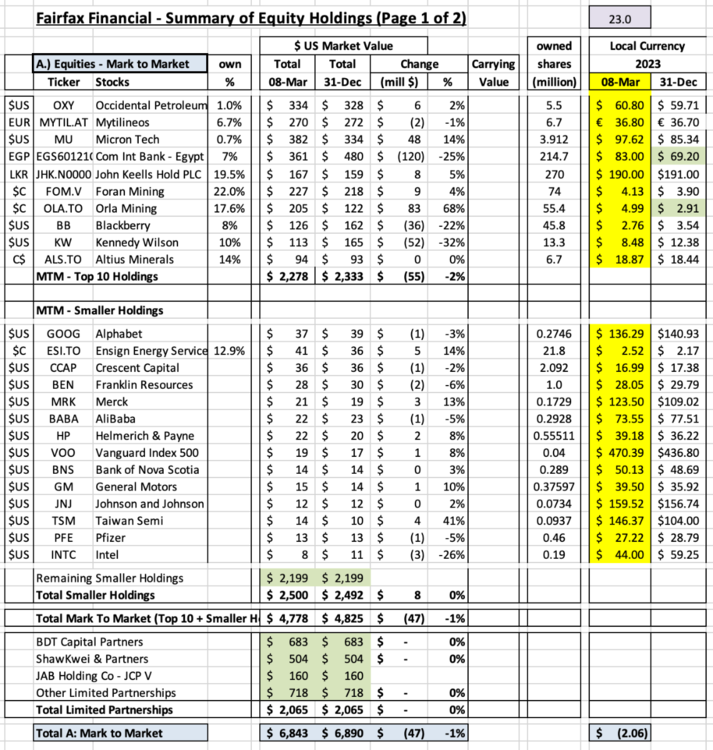

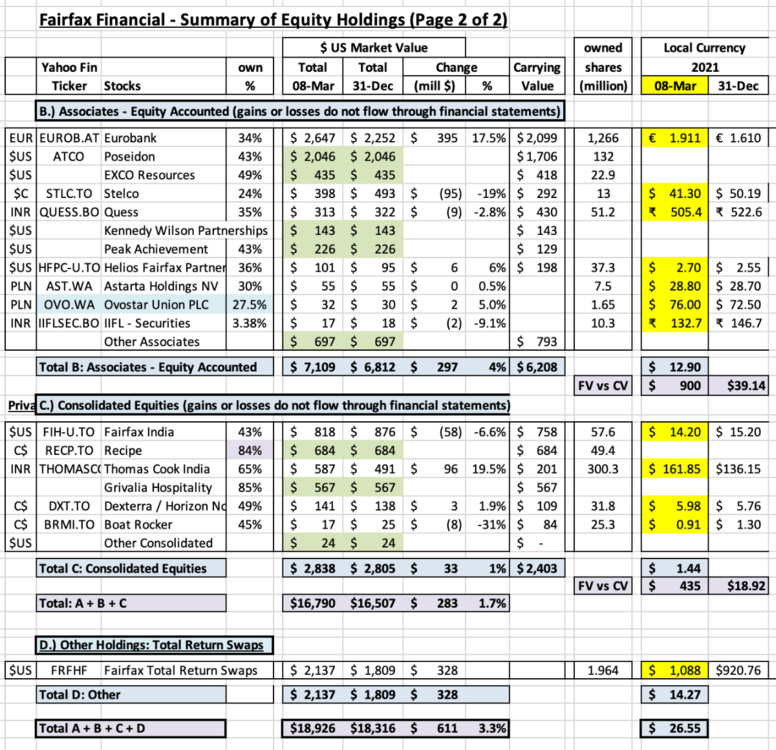

Now that Fairfax's annual report is out I am able to update a few things. I thought I would start with the equity holdings. The AVLN position (from the Riverstone UK sale) was completely exited by year end 2023. As a result, the significant noise from this holding has been eliminated. We now have a clear view of exactly what Fairfax's position is in its various equity holdings. I wonder how much Fairfax spend exiting the AVLN position in 2023? My guess is it was a significant use of cash. ---------- What was the change in value of Fairfax’s equity portfolio to March 8, 2024? March 8, 2024 Fairfax’s equity portfolio (that I track) had a total value of about $19 billion at March 8, 2024. This is an increase of about $611 million (pre-tax) or 3.3%. I include the FFH-TRS position in the mark to market bucket and at its notional value. My tracker portfolio is not an exact match to Fairfax’s actual holdings. My summary has been updated to include information from Fairfax’s 2023 annual report. My tracker portfolio is useful only as a tool to understand the rough change in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 47% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 53% are Associate and Consolidated holdings. Over the past couple of years, the share of the mark to market portfolio has been shrinking. This means Fairfax's quarterly results will be less impacted by volatility in equity markets. Split of total gains by accounting treatment The total change is an increase of $611 million = $26.55/share The mark to market change is an increase of $281 million = $12.21/share. The change in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio Q1-YTD? Eurobank is up $395 million and it is now Fairfax’s largest equity holding at $2.6 billion. The FFH-TRS is up $328 million. This position is now Fairfax’s second largest holding. Thomas Cook India is up 96 million. TCIC continues its strong performance. Commercial International Bank is down $120 million. Egypt devaluated its currency 40% on March 7. Well run bank. Country is an economic mess. Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1,335 million or $58/share (pre-tax). Book value at Fairfax is understated by about this amount. Associates: $900 million = $39/share Consolidated: $435 million = $19/share Equity Tracker Spreadsheet explained Holdings have been separated by accounting treatment: mark to market, associates – equity accounted, consolidated, other Holdings – total return swaps. We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. This spreadsheet contains errors. It is updates as new and better information becomes available. Fairfax Mar 8 2024.xlsx

-

I just listened to the Eurobank 2023 YE conference call. Their aggressive actions the past 3 years have positioned the bank exceptionally well. They are being very conservative with their estimates for 2024-2026. They have so many catalysts to boost earnings over guidance in 2024 and future years. The management team is laser focussed and is executing very well. Why is Eurobank being so conservative? 1.) They need to get the Hellenic Bank acquisition approved by regulators. Status quo is the best way to do this. Cypress is a different country… and local people tend to be very protective of critical institutions like banking. 2.) Once approved, Eurobank will need to make a mandatory tender offer for the @45% of Hellenic Bank they do not own. So obviously Eurobank doesn’t want to drive the acquisition price even higher (by announcing big cost and revenue synergies prematurely). Once Cypriot regulators approve the deal and after they own as much of the company as they can get - only after this happens - will Eurobank management more freely communicate on cost and revenue synergies. At least that is how things look to me. They are keeping their head down for now. Smart. On the dividend, Eurobank expects to get confirmation from the regulator in May. They provided an estimate of €0.09/share. Fairfax owns about 1.224 billion shares. €0.09 x 1,224 million shares = €110 million = US$120 million. That would be a material increase in total dividends received by Fairfax (from all sources) - perhaps an increase of about 80%. It would also be a material increase to ‘interest and dividends’ (from all sources) of about 5% - significant. In Fairfax’s 2021 Annual Report, Prem mentioned that the average cost of Fairfax’s position in Eurobank was US$0.94/share = $1.1 billion. Fairfax made their first investment in Eurobank in Dec 2014. So, about 9 years later Fairfax could be getting a dividend yield of about 11% (from its cost base). And as @nwoodman pointed out earlier, this could increase quite a bit in the next couple of years. The Eurobank acquisition has delivered other significant benefits to Fairfax over the years - like their 80% ownership of Eurolife (Eurobank stills owns 20%). I don’t have a strong opinion on how Grivalia Hospitality is going to work out (Eurobank and GH management still owns 21.5%). But anything George Chryssikos has touched has worked out very well for Fairfax and its shareholders. Link to Eurobank’s conference call: https://www.eurobankholdings.gr/en/investor-relations/financial-results-pages/financial-year-2023 PS: my share count is different from @nwoodman . I will update my numbers after Fairfax releases their annual report.

-

What a simply amazing year for Eurobank. Transformational. Their website is painfully slow right now? Below is a link to their full year results presentation. I think Eurobank is sandbagging their 2024 estimates. And that is the sign of a strong management team - underpromise and overdeliver. That is the same playbook they used in 2023 and 2022. They do not feel any pressure to be overly aggressive with financial targets. I am looking forward to seeing details of what the 25% payout (of 2023 baseline earnings) will look like - what the split is between dividend and stock buybacks. Eurobank is a $2.5 billion position for Fairfax today. A 15% return = $375 million; 20% = $500 million. This investment has quickly turned into a home run for Fairfax. And i think it is just getting started. A double in the stock price over the next 4 years is not a crazy target. https://www.athexgroup.gr/documents/10180/7345283/64_1619_2024_Greek_+English_3.pdf/eb92609a-213d-4272-91a7-435f35389bb4

-

I would expect any help that comes from Fairfax India will be structured in a way that is very beneficial to Fairfax India. Perhaps a similar playbook to how Fairfax helped out Thomas Cook India during Covid and John Keells during Sri Lanka’s economic crisis. A couple of years later, both of those incremental investments have worked out very well for Fairfax shareholders. It’s almost like a kind of vulture investing… except in a situation you understand exceptionally well. Fairfax’s ownership in IIFL Finance has come down quite a bit over the past couple of years. Fairfax sold all of their direct ownership position. And in Q4 2023, Fairfax India sold a big chunk of their stake (i think it raised around $150 million). Fairfax also exited their direct holding in sister company IIFL Wealth. And i think Fairfax India has sold down their position quite a bit as well.

-

@gfp Thanks. My master has been updated. My math says they have spent about US$61 million in Jan/Feb adding to their Orla position. It is about a $183 million position today.

-

@giulio that is a great article. I will update my spreadsheet to capture the new news. I really appreciate you (and everyone) pointing out things i have missed. Great community.

-

@dartmonkey i made the correction. Thanks for pointing it out (accuracy is important). I think lots of investor are very happy to see Fairfax significantly shrinking its investment/involvement in Blackberry. Moving in the right direction.

-

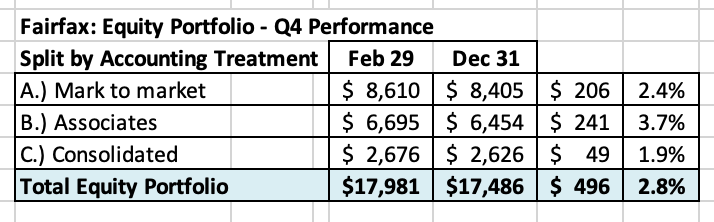

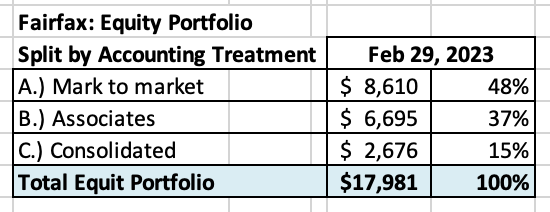

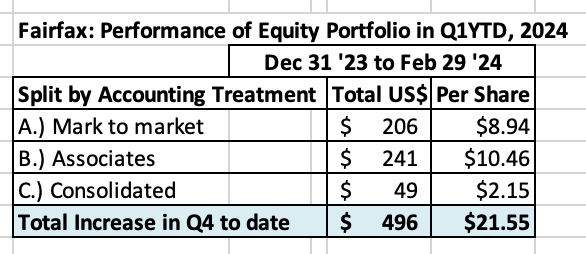

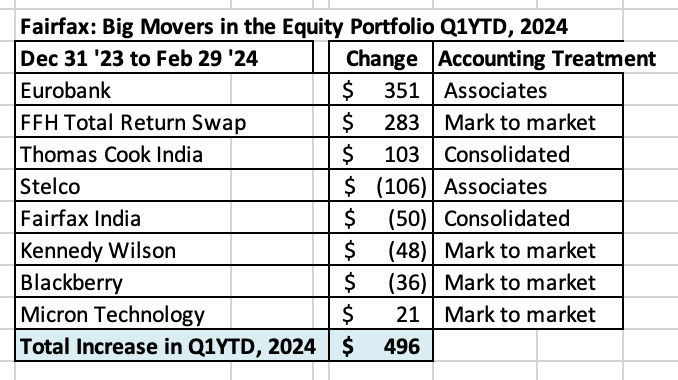

What was the change in the value of Fairfax’s equity portfolio to Feb 29, 2024? Fairfax’s equity portfolio (that I track) had a total value of about $18 billion at February 29, 2024. This is an increase of about $496 million (pre-tax) or 2.8% from December 31, 2023. The increase two months into Q1 works out to about $21.45/share. I include holdings like the FFH-TRS position in the mark to market bucket and at its notional value. I also include debentures and warrants in this bucket. My tracker portfolio is not an exact match to Fairfax’s actual holdings. My summary contains no information from Fairfax’s 2023 annual report, as it has not been released yet. As a result, my tracker portfolio is useful only as a tool to understand the likely directional movement in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 49% of Fairfax’s equity holdings are mark to market - this includes 'A.) Mark to Market' and 'D.) Other Holdings' - and will fluctuate each quarter with changes in equity markets. The other 51% are Associate and Consolidated holdings. Over the past couple of years the share of the mark to market portfolio has been falling. This means Fairfax's quarterly results will be less impacted by volatility in equity markets. That is an important development. Split of total gains by accounting treatment The total change is an increase of $496 million = $21.55/share The mark to market change is increase of $206 million = $8.94/share. Only changes in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio Q1-YTD? Eurobank was up $351 million and it is now Fairfax’s largest equity holding at $2.5 billion. Eurobank reports results March 7. It will be interesting to see if they initiate a dividend. The FFH-TRS was up $283 million. This position is now Fairfax’s second largest holding. The investment is up a total of $1.356 billion over the last 3 years, which is a gain of 185%. Simply an amazing investment. Thomas Cook India delivered a very strong Q4 to cap off a stellar 2023. Fairfax’s position was up $103 million. People are travelling again in India! Kennedy Wilson was down $48 million. The company has been hit hard by concerns in office real estate segment. The value to Fairfax from this holding is not its equity exposure. The value is the extensive partnership the two companies have established over the past 12 years, most recently in significantly expanding the real estate debt platform. I wonder if Fairfax does not use the current weakness in KW's share price to materially and opportunistically increase its stake in the company in 2024. That was the playbook Fairfax used with a number of holdings that were negatively impacted by Covid in 2020 - and these incremental investments have worked out extremely well for Fairfax a couple of years later. Blackberry continues to shrink in size, down $36 million. Blackberry is now a $130 million position = 0.21% of Fairfax’s $60 billion investment portfolio. In Q1, Fairfax also ended its $150 million debenture investment in Blackberry and Prem resigned from Blackberry’s board. The debenture was a $500 million dollar position in Sept 2020. This is another good example of Fairfax exiting from a poorly performing legacy investment (financially and also in terms of involvement from the management team). Capital at Fairfax continues to shift to better opportunities. The clean-up of poorly performing equity investments looks largely completed – understanding that there will always be a few underperformers. Excess of fair value over carrying value (not captured in book value) Carrying value in this section is understated by quite a bit as it does not capture Q4, 2023. I will update this once the annual report is released. For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1.445 billion or $62/share (pre-tax). Book value at Fairfax is understated by about this amount (less the tax impact). Below is the split. Associates: $1.048 million = $45/share Consolidated: $397 million = $17/share Below is a copy of my Excel spreadsheet (next 2 pages) if you want a closer look. Equity Tracker Spreadsheet explained: The summary below attempts to track all equity holdings at Fairfax. Each quarter the spreadsheet is updated to capture any ‘new news:’ purchases and sales. We have separated holdings by accounting treatment: Mark to market Associates – Equity accounted Consolidated Other Holdings – derivatives (total return swaps), debentures and warrants We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. Important: the list is not complete. Some information we only get once per year when Fairfax published their annual report. Fairfax also makes changes to their portfolio each quarter. Fairfax Feb 29 2024.xlsx

-

Berkshire Hathaway has been one of the great investments of the past 60 years. We all knew Buffett was a genius. The business model was genius (using float from P/C insurance operations as cheap leverage). The company (outside of Buffett) was well managed. So why did so many people not get rich from owning Berkshire stock? What were the main reasons investors missed out on making big money? I have been asking myself this question recently. I have followed Berkshire Hathaway more than most over the past 30 years. i owned shares a number of different times in the past and have done ok with it as a trade. But i missed out on making the big money. I would appreciate hearing what others have to say. Did you nail your investment in Berkshire Hathaway? What enabled this? Or more likely, did you miss out on making a killing in Berkshire Hathaway? What did you do wrong? My obvious error was not owning a concentrated position and holding for decades. But that explanation doesn’t really explain anything that is useful. I think my big errors were: 1.) not understanding the power of compounding - in a Berkshire Hathaway context. My expectations of the future returns for BRK were much too low (how fast new income streams could be created from retained earnings). This led me to mis-value the stock. 2.) being too much of a market timer / trader - happy to take a quick short term gain. The reason i think about this question so much is I do not want to make the same mistake with Fairfax.

-

Buffett is a master communicator. He just lowered the expectations bar significantly for the future returns for two of Berkshire’s largest businesses - railroad and energy. This will be a big, big benefit to Abel when he takes over. Just imagine the outcry if Abel has said this post Buffett?

-

With the size of earnings at Hellenic Bank, it must be disappointing for minority shareholders to not get a big dividend payout right away. With all the cash building at Hellenic Bank, does this mean Hellenic will actually be able to fund a big piece of the takeout of the minority partners? W ————— Banking in Cypress is a duopoly with Hellenic Bank and Bank of Cypress with something like 80% share in most important categories when combined? Here are the results from Bank of Cypress - also outstanding. https://www.stockwatch.com.cy/en/article/trapezes/bank-cyprus-posts-almost-eu05-billion-net-profit-2023

-

My math says Eurobank paid an average of €1.78 to acquire 55.3% of Hellenic Bank over the past couple of years (awaiting regulatory approvals to become majority owner). In 2023, Hellenic Bank earned €0.88/share. Tangible book value at Hellenic Bank is €3.54/share at Dec 31, 2023, up 35% year over year. This is looking like a great investment by Eurobank. - https://www.hellenicbank.com/-/media/hbc/announcements/2024/february/12m2023/commentary-en.pdf

-

@Hamburg Investor Yes, i like to look at Fairfax in lots of different ways. None on their own are perfect. But looked at together, i think it is possible to sketch a pretty accurate picture of the company and its valuation. One of the lesson’s for me with Fairfax over the past couple of years is how long it takes for narratives to change for companies. Even when the facts are clearly saying something quite different. This is actually good news for investors. In situations where fundamentals are improving faster than what is being reflected in the narrative it means you have lots of time to learn and get your position size right.

-

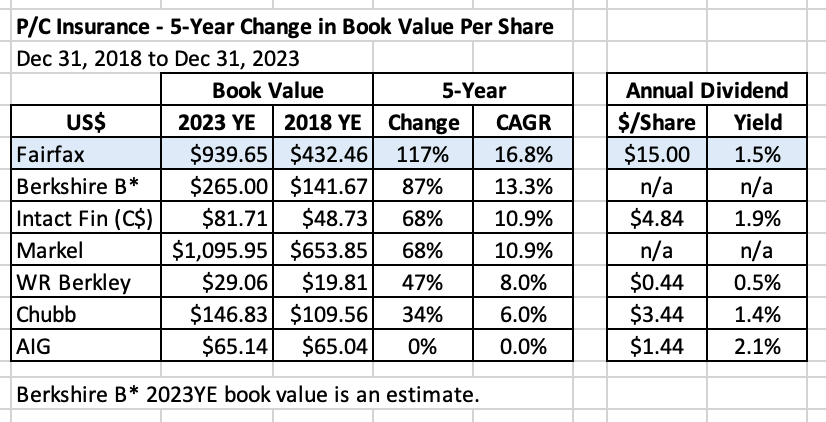

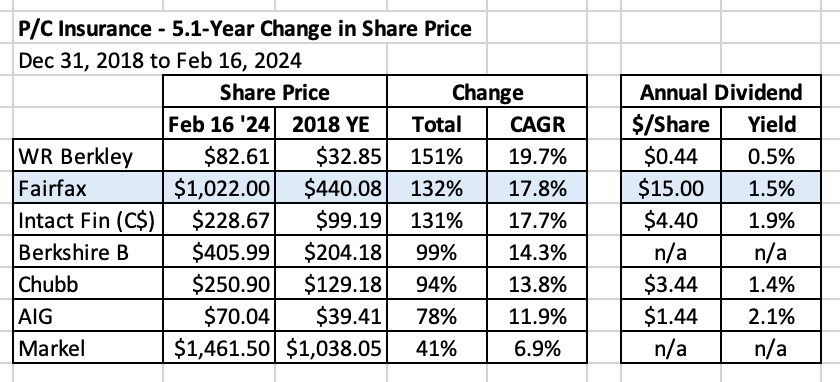

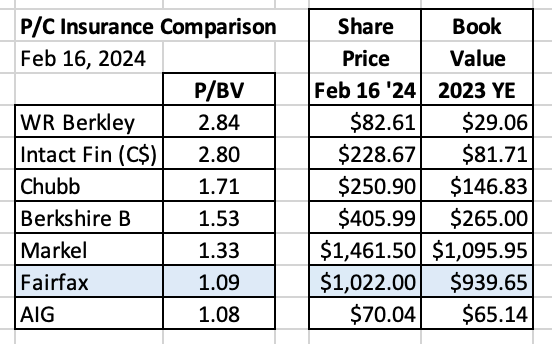

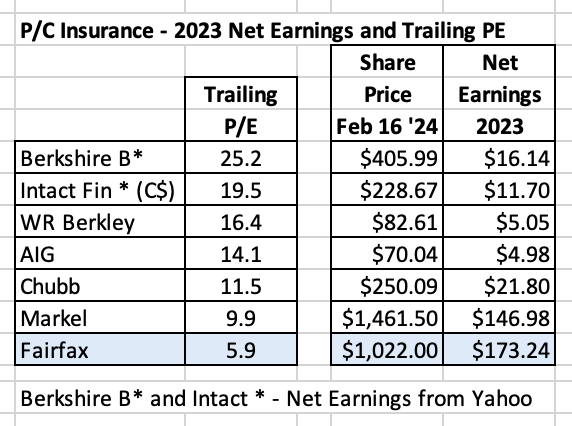

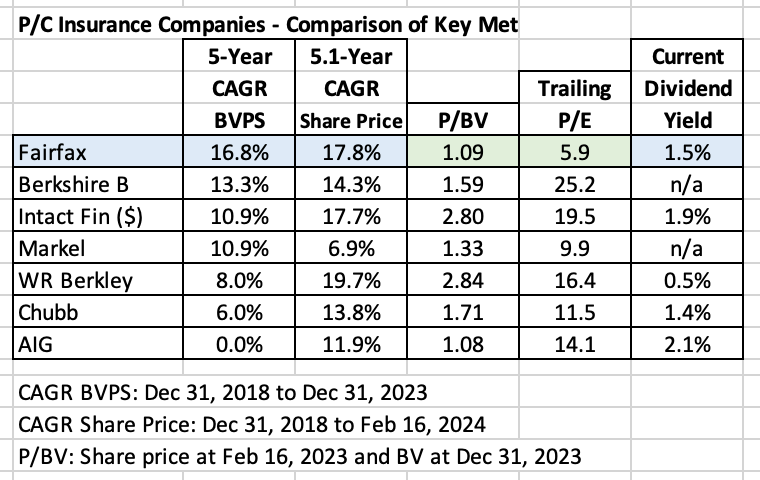

How Does Fairfax’s Valuation Compare to Other P/C Insurers? There are lots of methods an investor can use to value a company and its stock price. In this post, we are going to use a method called ‘relative valuation.’ We are going to try and see what we can learn about Fairfax’s current valuation by comparing the company to a group of other P/C insurers. We are going to keep the analysis very top line. In terms of time-frame, we are going to use the last 5 years. This is a good length of time to get a reading on the performance of the management teams for each company. And it also smooths out the impact of large short term events like catastrophes, Covid and the big swing in interest rates. Who are we going to look at? Below is the list of the seven P/C insurers we will compare (listed in alphabetical order): AIG: the fallen star; a turnaround play today. Berkshire Hathaway: historically, the gold standard; now more of a conglomerate than P/C insurer. We include it for fun. Chubb: big, traditional insurer; international in scope. Fairfax Financial: a turnaround play; about 30% of investments are in equities; international in scope. Intact Financial: largest P/C insurer in Canada; expanding globally. Markel: baby Berk; US focus WR Berkley: traditional insurer; US focus To state the obvious: all P/C insurance companies have unique business models. Berkshire Hathaway has not released Q4, 2023 results so for them I have used an estimate for 2023YE book value and 2023 EPS. ————— The most important metric used by investors and analysts to value a P/C insurance company is book value. Yes, it has its flaws. However, it is a good place to start. 5-Year Change in Book Value “In other words, the percentage change in book value in any given year is likely to be reasonably close to that year’s change in intrinsic value.” Warren Buffett We are going to look at the change in book value for the 5-year period from Dec 31, 2018 to December 31, 2023. We have sorted the results in the table below from the best to the worst performers. So which company has increased BVPS the most? Fairfax Financial. Fairfax has increased BV by 117% over the past 5 years, a CAGR of 16.8%. Were you expecting that? I bet you weren’t expecting that. The second surprise is the size of the outperformance by Fairfax over all peers. For example, Fairfax’s BV CAGR is 10% better than that achieved by Chubb - that is serious outperformance. Don’t get me wrong, Chubb is a quality company. In the quote above, Warren Buffett suggests investors should use the annual change in book value as a rough approximation of the change in intrinsic value for a company. Using Buffett’s quote as a guide, I think we can safely say that Fairfax has increased intrinsic value over the past 5 years at a much faster pace than its P/C insurance peers. Note: five of the seven companies pay a dividend (and WR Berkley has also paid special dividends). Why has Fairfax’s performance been so strong? The management team at Fairfax has been executing exceptionally well over the past 5 years. Especially when it comes to capital allocation. I recently wrote a long post on this topic so I am not going to repeat it here. How have shareholders been rewarded? 5.13-Year Change in Share Price We are going to look at the change in the share price for the 5.13-year period from Dec 31, 2018 to February 16, 2024. Once again, we have sorted the results in the table below from the best to the worst performers. Which company has seen their share price increase the most? Three companies are bunched together as the top performers - WR Berkley, Fairfax Financial and Intact Financial. Including dividends, these three companies have delivered a CAGR of around 20% to investors over each of the past 5.13 years. That is outstanding. Berkshire Hathaway, Chubb and AIG can be grouped in the next performance band. Including dividends, they have delivered a CAGR of about 14% which is quite good. And Markel has been the clear laggard with a CAGR of about 7%. Another key takeaway is the performance of the group as a whole has been very good. Six of the seven companies listed have delivered a very good return to investors over the past 5.13 years. For reference, over the same 5.13 years, the S&P500 increased 100%, which was a CAGR of 14.4% (not including dividends). Now let’s put book value and share price together and see what we can learn about valuation. Current Price to Book Value (P/BV) At 2.8, Both Intact and WR Berkley trade at the highest P/BV multiple. This is not surprising given they also saw the biggest increases in share price over the past 5 years. Does anything in the chart below jump out? Yes. Fairfax looks out of place. Fairfax has been compounding book value at the highest rate over the past 5 years. So how can it also be trading at the lowest P/BV (i.e. the cheapest) valuation? That makes no sense. Let’s look at another valuation measure and see what it tells us. Price to Earnings Ratio (PE) To keep things simple, I used reported EPS from 2023 for each of our seven companies. For Berkshire, who has not yet reported, I took the estimate from Yahoo Finance. For Intact Financial, who reported restructuring charges in Q4, I was generous and used the 2023 number in Yahoo Finance (which looks like it nets out the restructuring charges). Does anything in the chart below jump out? Yes. Fairfax looks out of place (again). Fairfax has been compounding book value at the highest rate over the past 5 years. So how can it also be trading at the lowest PE (i.e. the cheapest) valuation? That makes no sense. So what can explain the disconnect between Fairfax’s past performance (top-tier) and its valuation (bottom tier)? To be fair, as we learned earlier in this post, Fairfax’s stock price has been one of the top performers over the past 5 years. So investors clearly have been warming to the company. However, even with the strong performance in recent years, the stock’s valuation continues to be at the bottom when compared to peers. Why is that? Lack of understanding of the company. Fairfax is still not a well understood company. Few investors (or analysts) have followed it in recent years. Yes, this is changing. But it will take time for people to get back up to speed with the company. Fairfax is also a turnaround. And turnarounds are exceedingly hard to value - especially at the point when their business results hockey stick and turn higher. The interesting thing with Fairfax though is the turnaround was actually completed back in 2021. But because the company was not followed back then pretty much no one noticed (well, except for a bunch of investors on the investing forum ‘Corner of Berkshire and Fairfax’). Operating earnings and the future. Over the past 5 years, Fairfax has quietly completed one of the of great turnarounds in recent Canadian business history. Operating earnings at Fairfax have exploded - and that is not hyperbole. Operating earnings averaged $1 billion ($39/share) at Fairfax for the 5-years from 2016 to 2020. In 2023, operating earnings were $4.4 billion ($193/share). Per share, operating earnings have increased 395% over their baseline from just a couple of years ago. Importantly, this new level of operating earnings, around $200/share, is sustainable. This was discussed on Fairfax’s Q4 conference call. Operating earnings are considered the highest quality type of earnings a P/C insurance company can deliver. Think about what this new development means for Fairfax’s future results - earnings, ROE, book value and multiple. What did we learn in the post? Warren Buffett tells us that the change in book value per share is a good approximation for change in intrinsic value. Over the past 5 years, Fairfax has delivered a cumulative increase in BVPS of 117%, which is a CAGR of 17.8%. Simply outstanding. This is best-in-class performance compared to peers. We also learned that operating earnings have spiked at Fairfax by close to 400% over the past 3 years from $39/share to about $200/share today - and that the higher amount is durable. This suggests Fairfax should be able to continue to deliver top-tier performance when compared to peers in the coming years. We also learned that Fairfax currently has the cheapest valuation - its P/BV is 1.09 and its PE is 5.9. Fairfax’s valuation is significantly below peers. So an investor today is able to buy the top performing P/C insurance company - with among the best future prospects - at the cheapest valuation. In short, the risk/reward set-up for Fairfax has rarely looked better. I think that guy in Omaha would call Fairfax a very fat pitch. "The way of the successful investor is normally to do nothing -- not until you see money lying there, somewhere over in the corner, and all that is left for you to do is go over and pick it up." Jim Rogers

-

@Cigarbutt thanks for your post. I am not an insurance analysts so i really appreciate the detail you provided in your post. Rather, i am a generalist and i develop a thesis (perspective) based on what i learn over time. And than i constantly adjust my thesis as i get new information. I remember when Fairfax was buying up all the international insurers in 2015 and 2016 and thinking ‘old Fairfax’ buying shitty insurance companies… Yes, my ‘thesis’ at the time was completely wrong. The reality is Fairfax built out their international platform at the perfect time… AIG and others were looking to shed P/C insurance assets. Great strategic move for the company. The fact they were able to do this when they were bleeding money from the equity hedge/short positions is pretty amazing. Fast forward to today and international is delivering a solid underwriting profit and looks poised to possibly be a growth engine in insurance for Fairfax in the coming years.

-

Not sure if this has been posted before (it is from Feb 14). Great take-down of MuddyWaters. MUDDY WATERS ATTACKS FAIRFAX WITH UNFAIR FACTS https://iansbnr.com/muddy-waters-attacks-fairfax-with-unfair-facts/

-

Great conversation @StubbleJumper and @Cigarbutt . I think trying to model ROE more than 5 years out is largely a fools errand (i.e. the next 10 or 15 years). However, i think ROE can be modelled over the next 3 years and perhaps over the next 5 years with some accuracy. This is true for any company, including Fairfax. My guess is Fairfax has an excellent opportunity to deliver 15% ROE (on average) for each of the next 5 years. Why? 1.) As Buffett teaches us with the Aesop fable, the size, timing and certainty of cash flows are the three key variables. Fairfax will be earnings an enormous amount over the next 5 years ($20 billion?) - and we now have a high degree of certainty on this. 2.) Fairfax is on a 6 year ‘hot streak’ when it comes to capital allocation. Financial markets have experienced wicked volatility over the past 4 years - active management matters a lot in this environment. Please re-read 1.) and add the effects of compounding. 3.) It looks to me like Fairfax has been upgrading the quality of its insurance businesses. This suggest underwriting profit is likely to surprise to the upside moving forward (like it has in 2022 and 2023). 4.) Fairfax has been aggressively upgrading the quality of their massive $17 billion equity portfolio for the past 6 years and the benefits of this are just starting to hit earnings. Historical numbers don’t help with this bucket - they misinform an investor. 5.) Fairfax’s $43 billion fixed income portfolio is perfectly positioned for the next few years and the benefits of this are flowing into earnings. 6.) Fairfax has been incubating holdings on its balance sheet for years (and decades). These will be monetized at the appropriate time and the company will book significant one time gains. Lumpy. But lumpy doesn’t mean they don’t exist. None of the 6 points above are being reflected in the current multiple. I think that’s crazy. As an investor, i love it. If you want to look out more than 5 years you are really making a call on management and their capital allocation skills. Are they good? If so, how good? Today most people on this board are now saying “yes, earnings look good for the next 3 or 4 years BUT it can’t possibly continue over the long term.” With the stock trading so cheaply today it suggests Fairfax’s ROE will be poor in 2024, 2025, 2026 and every year after. IMHO, that is a massive disconnect from reality.

-

On the valuation front, i continue to think that Fairfax today is still crazy cheap. 1.08 x BV and a ‘normalized’ trailing PE of around 6.4 Over the past 3 years what was the big miss from investors? Investors grossly underestimated the rapidly improving earnings power of the company. What is the big miss from investors today? It looks to me like investors are now grossly underestimating the power of compounding over time. Compounding is probably the most important concept in investing. The fact it is getting zero attention when people discuss Fairfax tells me volumes about investors mindsets. You also see it in analysts forward estimates (pretty much all have earnings falling at Fairfax in the coming years). And i love it. ————— Most investors missed investing in Berkshire Hathaway 30 or 40 years ago. They knew what Berkshire Hathaway was earning. And they knew Warren Buffett was an above average capital allocator. What was probably the biggest single reason they didn’t invest (or sold their shares too soon)? They didn’t understand the power of compounding.

-

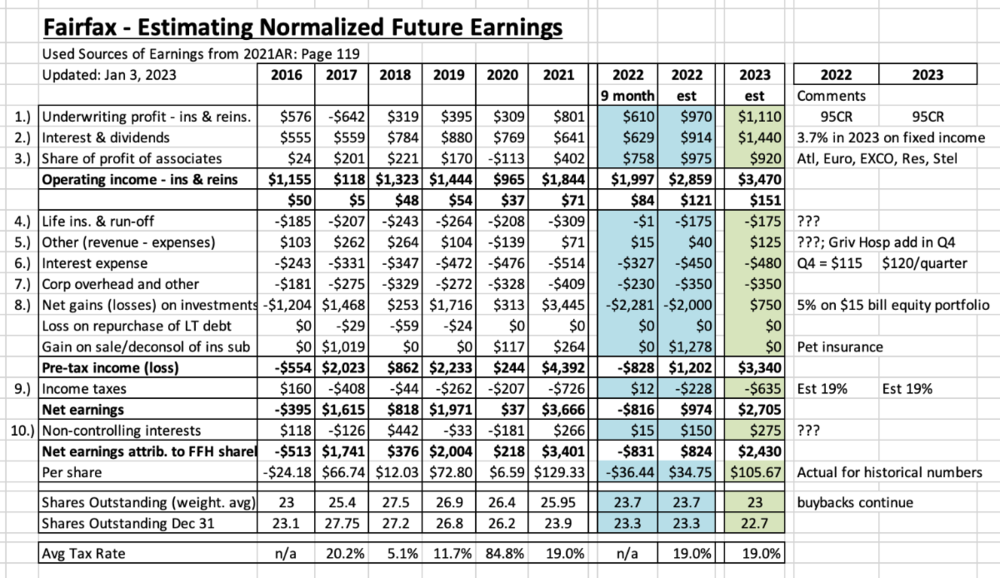

It can be useful to look into the past. 13 short months ago i put together my estimate for 2022YE. It was dominated by investment losses (bonds and equities). Thank god for the pet insurance sale. The more interesting forecast on the chart below is the estimate for 2023. At the time it looked crazy high. And of course, it has now been proven to have been crazy low. What are some of the lessons looking back on the 2023 forecast? 1.) Valuing a turnaround is tough. 2.) It is important to keep an open mind - when the facts change… update the model. 3.) Don’t get trapped by dogma (things that ‘have to happen’).

-

The interesting thing to me is a few short years ago lots of people invested in Fairfax more for the investment gains not operating income. Now it has flipped and the focus is on operating income (which is not a bad thing). The funny thing is the investments/insurance holdings have never been better positioned. At the same time, we are seeing record earnings getting reinvested each year into new income streams. This suggests to me that investment gains will be very robust moving forward.

-

Q4 Earnings Review. Summary: great quarter and an amazing year. Here are the answers to the questions I asked on Wed: 1.) What is the size of the bond gains in Q4? $997 million - yes, a very big number 2.) What is the size of IFRS 17 impact? TBD - but not a concern. 3.) What is the average duration of the fixed income portfolio? Over the year, spent $11.7 billion on US treasuries with maturities between 5 and 7 years. We will need to wait until the AR is released to get specifics. 4.) What is interest and dividend income for Q4? Interest and dividends were $536.6 million, up from $512.7 in Q3. Pace of increase is slowing. GIG will be a tailwind in 2024. If Eurobank initiates a dividend this would provide a big tailwind to dividend income. I think Eurobank reports results in early March. 5a.) What is premium growth in Q4? Net premiums written down 5.5% in Q4 and up 3.5% for 2023. The shortfall in Q4 was driven by Odyssey exiting a quote share contract (low margin). And Brit continuing to exit its property cat exposure. Both moves were made to improve future profitability. People are looking for tangible evidence of actions Fairfax has been taking to improve the quality of their P/C insurance business… we'll, I think they have it. 5b.) What is the Q4 and YE combined ratio? The CR was 89.9% in Q4 and 93.2% for 2023. Do we see reserve releases? Yes. Favourable of $309.6 million for 2023 versus $196.2 million for 2022. 6.) What is share of profit of associates? Q4 came in at $127.7, lighter than I expected. We will see details in the AR. Full year was $1.02 billion. 7a.) What are investment gains from equities? Equity gains were $370.2 million in Q4 and $1.2 billion for 2023. 7b.) For equities, what is the excess of market value to carrying value? For all of Fairfax’s non-insurance holdings the excess of FV over CV was $1 billion, up from $310 million in 2022. What is status of RiverStone Barbados AVLN’s? Details to come in the AR. 8.) How does the closing/consolidation of Gulf Insurance Group impact financials? Do we see an investment gain booked of around $290 million? Yes 9.) What is the size of adverse development for runoff? Prior year reserve development for run-off came in at $259.4 million. 10.) What is year-end share count? Common shares effectively outstanding at Dec 31, 2023 = 23.0 million 11.) What is year-end book value per share? BV at Dec 31, 2023 = $939.65/share versus $762.28 at Dec 31, 2022.

-

Exited by CFP.TO position (C$16.40). Nice gain. If stock falls back under C$15 happy to buy back. Trades like this are done in a tax free account.

-

At first blush, splitting Quess into three companies makes so much sense. Quess is a massive company with very different verticals. This resembles the IIFL split into 3 separate companies (finance, wealth and securities) in 2019 and that has worked out exceptionally well for shareholders. Let’s hope the same happens with Quess. Another tailwind for Fairfax’s equity portfolio, although the timing looks like in will likely be 1H 2025. That’s OK - we are not in a hurry. This is another example of Fairfax providing great support for a holding. It is all about getting them in the best position possible to be successful moving forward. Fairfax has been doing a great job of doing this with their equity holdings over the past 6 or so years. And as a result, the quality of the group of equity holdings as a whole continues to improve.