glider3834

Member-

Posts

980 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

viking yes I think what this whole situation with Ukraine has really brought home the issue of security around supply chain for companies. I think companies will focus a lot on this going forward & that will mean potentially more investment flowing to companies in Countries that are in 'the West' or aligned with the West & so there are going to be opportunities in that space. So I think geopolitical considerations will take priority over lower cost production considerations. But that transition might need time & I notice that sanctions have been selective around certain commodity export from Russia but not others.

-

https://www.eurobankholdings.gr/-/media/holding/omilos/enimerosi-ependuton/enimerosi-metoxon-eurobank/oikonomika-apotelesmata-part-01/2022/fy-2021/4q2021-results-pr-en.pdf

-

Eurobank operating results for 2021 look solid, they exceeded 2021 guidance. Guiding for EPS of euro 0.14 in 2022 versus share price of euro 0.83 (fwd PE 6x) & P/TBV is 0.6 x. Obviously will be impacted by Ukraine situation even though they have little direct loan exposure. Still current valuation looks compelling IMHO. https://www.moneyreview.gr/business-and-finance/69767/eurobank-neo-epicheirisiako-schedio-kai-dianomi-merismatos-se-pososto-20-apo-to-2022/ In detail, the financial objectives of the new business plan for the period 2022 - 2024 provide: • Average increase in earnings per share of about 13% per year • Dividend distribution from the year 2022 at a rate of approximately 20% • Achieve a sustainable return on tangible equity of 10% per year. • Creation of at least 100 capital units per year from profitability to finance the development, distribution of dividends and the strengthening of the capital position. • Reduction of the non-performing loans ratio from 6.8% in 2021 to 4.8% in 2024, a goal reinforced by the low levels of net NPEs contributions of 400 million euros in 2022.

-

Attending and Participating at the Virtual Meeting The virtual meeting will take place on Thursday, April 21, 2022 at 9:30 a.m. (Toronto time) at https://web.lumiagm.com/407755318. Shareholders and duly appointed proxyholders who log in to the virtual meeting will be able to listen, ask questions and securely vote through a web-based platform, provided that they are connected to the internet and follow the instructions set out in this Circular. In order to participate in the virtual meeting, shareholders must have a valid 15-digit control number and proxyholders must have received an email from Computershare containing a username. To attend the Meeting, Registered shareholders, duly appointed proxyholders (including Non-Registered Holders who have duly appointed themselves as proxyholder) and guests (including Non-Registered Holders who have not duly appointed themselves as proxyholder) must log in online as set out below: Step 1: Go to https://web.lumiagm.com/407755318. Step 2: Follow the instructions below: Registered shareholders: Click “I have a login” and then enter your username and password “fairfax2022” (case sensitive). Your username is the 15-digit control number located on your form of proxy or in the email notification you received from Computershare. If you use your control number to log in to the Meeting, any vote you cast at the Meeting will revoke any proxy you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote at the Meeting. Duly appointed proxyholders (including Non-Registered Holders who have duly appointed themselves as proxyholder): Click “I have a login” and then enter your username and password “fairfax2022” (case sensitive). Proxyholders who have been duly appointed and registered with Computershare as described in this Circular will receive a username by email from Computershare after the proxy voting deadline has passed. Guests (including Non-Registered Holders who have not duly appointed themselves as proxyholder): Click “I am a guest” and complete the online form. Non-Registered Holders who have not appointed themselves as proxyholder must attend the meeting as guests. Registered shareholders and duly appointed proxyholders may attend, ask questions and vote at the Meeting. Non-Registered Holders who have not duly appointed themselves as proxyholders and guests may attend and ask questions at the Meeting, but will not be permitted to vote. We recognize the importance of shareholders being able to ask questions in a virtual meeting format. At the virtual meeting, Registered shareholders and duly appointed proxyholders, regardless of geographic location, will be able to participate and have an equal opportunity to ask questions, and vote in real time at the Meeting, provided they are connected to the internet and have logged into the online platform accessible at https://web.lumiagm.com/407755318. Shareholders attending virtually may ask questions during the Meeting by typing and submitting their question in writing by selecting the messaging icon button from within the navigation bar. Type your question within the chat box at the 30 bottom of the messaging screen. To submit your question, click the send button to the right of the text box. Questions submitted via the Lumi online platform that relate to the business of the Meeting are expected to be addressed in the question-and-answer section of the Meeting. Such questions will be read by the Chair of the meeting or a designee of the Chair and responded to by a representative of Fairfax as they would be at in-person shareholders meetings. Questions submitted via the Lumi online platform will be moderated before being sent to the Chair of the Meeting. This is to avoid repetition and to ensure an orderly meeting. The Chair of the Meeting will decide on the amount of time allocated to each question and will have the right to limit or consolidate questions and to reject questions that do not relate to the business of the Meeting or which are determined to be inappropriate or otherwise out of order. Questions can be submitted at any time as prompted by the Chair during the Meeting until the Chair closes the session. It is anticipated that shareholders attending the Meeting virtually will have substantially the same opportunity to ask questions on matters of business before the Meeting as those shareholders who are attending the Meeting in person.

-

93,000 shares bought back (around $46 mil approx) b/w 1 Jan to 3 Mar-22 - hopefully they can increase it. At December 31, 2021 there were 23,865,600 common shares effectively outstanding. At March 3, 2022, Fairfax had 23,024,111 subordinate voting shares and 1,548,000 multiple voting shares outstanding (an aggregate of 23,772,881 shares effectively outstanding after an intercompany holding).

-

Just looking through AR 2021 - you can see what Fairfax are saying (on 3Q'22 call) that they have de-risked their catastrophe exposure - 2017 was a bit higher but similar to 2021 in terms of insured catastrophe losses. Looking at catastrophe losses as % of net premium written, it looks to have been reduced by nearly 50%.

-

this interview is worth listening too - analyst Michael Nance has spent a lot of time on the ground in Ukraine and with their defence forces & studying tactics - his perspective is interesting unlike most Western analysts he actually thinks Ukraine has a chance of beating Russia. Now this is not in interview but just a few thoughts I have - I am actually more in the camp of economically sustainable & targeted sanctions (rather than just complete blanket sanctions that are hurting a lot of Russian people who have absolutely no say over what Putin is doing) & focusing energy on helping Ukraine to resist & defeat the Russians is the better strategy. Putin needs to be defeated in the field IMHO - that will be more destabilising for his leadership & it will also act as a greater deterrent on future conflict. Sanctions were tried after Crimea & it didn't stop Putin having another go!

-

I think the issue being raised here is primarily to do with cash flow - Fairfax will need to put money aside that will prevent Fairfax putting funds to best effect eg share repurchases. Effectively Fairfax's hands will be tied. But why do we think OMERS etc are in a hurry to get paid? the point has been made that OMERS are getting a good deal here. Why couldn't these 'call' options be extended for another few years? Or OMERS stake sold to another party/partner that Fairfax wants to work with? or Fairfax raises funds via a share issue above BV? Or Fairfax actually sells one sub? Another option as well could be one of Fairfax's subs buys the minority interest in Brit. So money would not need to come from the Holdco. This is not common, just Zenith & TRG where this has occured. I think there are multiple options on the table - Fairfax can get creative when they need to - their track record is there. OMERS & CPPIB had no issue investing $1bil last year - even though their Brit, Allied stakes had not been bought back. When Fairfax sold Riverstone Europe, they made the point that OMERS was keen to redeploy money into a minority interest in Brit. Why did they do that? And OMERS have also invested into Anchorage. For me it appears that OMERS like working with Fairfax & are keen to partner on deals & keen to put their money to work at every opportunity. So I would frame the issue in that way, rather than OMERS need to be paid back by this date or else OMERS won't want to partner with Fairfax in the future. Also I would make point above I made that there are multiple ways Fairfax could do this, that would not impact their ability eg to buyback shares.

-

With 8% priority dividend for Allied World - could we look at it from a tax point of view - I am not a tax expert so if I am completely missing something then please call me out - Allied world is based in Bermuda which I believe has a nil corporate tax rate but it looks like that could change to 15% in line with global minimum tax rate proposals - anyway my point is at time that Allied world deal was done & up until now, Fairfax's sub Allied World has been a beneficiary of this lower tax rate regime, allowing a higher after tax return for Fairfax & so in a way this has subsidised that priority dividend to OMERS etc - just a thought anyway.

-

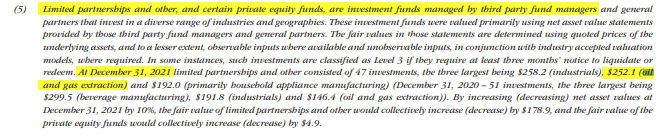

yes Viking, I also noticed that Fairfax has a $252 mil investment in oil & gas extraction business as well via their LPs/PE funds with 3P managers ( could be via BDT or other)

-

I think there are different ways to think about it - they could issue equity (rather than debt) in FFH at a decent premium to BV & buyback minority interests at some future date - they do have a track record of buying back stock below BV & issuing stock above BV. - they want $1.5 bil at Holdco, so if they do buyback minorities I think more likely from FCF or selling equity. - in a hypothetical situation owning 70% of 3 insurers with say 10 bil in float (effectively owning 7 bil in float) might make more sense than owning 100% of 1 insurer with 5 bil in float - in terms of thinking about capital allocation - not breaking down the individual subs numbers here. But the flipside is they have to pay priority dividends - I am sure they have done the numbers on this. - They have option not obligation to buyback sub minorities- - we are guessing what they might do & at what price or %- they didn't buyback Allied minorities with the proceeds from Odyssey - so clear intent to maximise shareholder return at each turn.

-

I am looking at the AR now 'In addition, the non-controlling interests in Allied World, Odyssey Group and Brit have a dividend in priority to the company' Odyssey deal (like Brit etc) has a priority dividend - no information on the dividend % that I can see??

-

Riverstone Europe/Barbados sale proceeds went to Holdco, Fairfax did have option to repurchase their equity positions (in Riverstone Europe) which I think they would do through their subs not the Holdco & they would need around $1,2 bil & they look to have the cash in their insurance subs to do it . I don't think there was an option for Fairfax to buyback their European run-off business - they have kept the US run-off business which I think was a strategic move.

-

Yep Prem has promised us lumpy returns! - most European banks, including Eurobank, are really taking it on the chin recently due to Ukraine conflict/risk around Russia exposures - I believe Greek banks have limited direct exposure to Russia but now there is economic uncertainty around impact (higher energy costs etc) on Greece - but on the flipside Eurobank looks cheaper now at just 60% of TBV- an opportunity for Fairfax to raise its stake a bit more?? Also I think given Fairfax's current share price, another opportunity is there now for them to buyback their stock - NCIB or maybe another SIB perhaps?

-

+1 Still digesting - just flagging this one which I haven't seen before (or maybe I missed it) it looks like an Asia focused version of BDT 'Since 2008 we have been investing with founder Kyle Shaw and his private equity firm ShawKwei & Partners, which takes significant stakes in middle-market industrial, manufacturing and service companies across Asia, partnering with management to help improve their businesses. We have invested $398 million in two funds (with a commitment to invest an additional $202 million), received cash distributions of $198 million and have a remaining value of $374 million at year-end. The returns to date are primarily from our investment in the 2010 vintage fund, which increased 46% in value in 2021 and has produced a compound annual return of approximately 16% since 2010. The 2017 vintage fund has drawn about 50% of committed capital to date, with a much-improved outlook for new deals, including its recent acquisition of CR Asia Group.' Also I got my estimate of closing market value of Exco Resources wrong - Fairfax have marked it up by only 12% to $267 mil from $238 mil. I thought it would be marked up higher - Chou Funds increased their stake by higher percentage - different valuation method perhaps or maybe Chou Funds have increased their shares held/cost base which they didn't break out in quarterly reports? Anyway positive that Exco increased their total proved reserves by 85% in 2021.

-

I think Prem & Fairfax did a big energy deal, I would bet that its more than likely going to happen through David Sokol/Atlas with Fairfax chipping in capital if needed. If they do a banking deal in Europe, its probably going to happen via Eurobank - here is a recent one in Dec-21 https://www.eurobank.gr/en/group/grafeio-tupou/etairiki-anakoinosi-28-12-21 Also it was interesting that Fairfax sold two of their direct owned IIFL India holdings and bought shares in Fairfax India - I think this was in part an opportunistic move as Fairfax India shares are cheap but also IMHO because unless its a future insurance deal then most of their future India deals (with exception of Quess or Thomas Cook sector related deals) I suspect will happen via Fairfax India

-

so I think Fairfax's thinking on Farmers Edge is that crop insurance is being increasing digitalised so data now (like in most industries) is critical to underwriting. However, whether they should have invested so heavily in a pre-profit, insurtech start up is the question. Crop insurance is Hudson insurance (Odyssey) largest business & they are recently partnering with Farmers Edge https://odysseygroup.com/news/unique-digital-infrastructure-creates-new-connectivity-in-crop-insurance/ They haven't executed & missing your forecasts post IPO is something you just don't do. My impression from last CC is they have enough cash now to get to break even - lets hope so!

-

viking yes I think this echoes Prem's comments in the 2020 AR 'As you know, we are building Fairfax for the next 100 years (long after I am gone, I think!!). Recently, I came across two books on long lived companies: ‘‘The Living Company, Habits for Survival in a Turbulent Business Environment’’ by Arie de Geus, and ‘‘Lessons from Century Club Companies, Managing for Long Term Success’’ by Vicki Tenhaken. They both make the point that companies that have survived for over 100 years have four characteristics: 1. They are sensitive to the business environment, so that they always provide outstanding customer service. 2. They have a strong culture - a strong sense of identity that encompasses not only the employees but also the community and everyone they deal with. Managers are chosen from the inside and considered stewards of the enterprise. 3. They are decentralized, refraining from centralized control. 4. They are conservatively financed, recognizing the advantage of having spare cash in the kitty. Fairfax has many of these characteristics and we continue to build our company for the future.'

-

Share price close to US$467 BVPS US$630 at 31 Dec-21 Will have a loss on equity positions since 31 Dec (hard to quantify $s still waiting for AR 2022), but I think this can also be offset by Q1 net operating income & Digit revaluation still to come. So I would estimate P/BV in 0.74 to 0.76 range - so still looks cheap IMHO

-

viking I think its worth isolating the 'float per common share' - to back out the float % that belongs to minority interests in the insurance subs (eg Brit, Allied) Then we can compare float per share with other insurers that have 100% owned insurer subs. I think Fairfax reports total float & float per share for ease of reporting and because they are consolidating those subs where they have control and/or majority ownership.

-

Just following on from interesting discussion on Fairfax's capital allocation/equity investment strategy and whether they have pivoted in any way. I think they have pivoted around focusing more on internal rather than external opportunities which also provides lower risk IMHO. I think if we were looking for a common thread - Fairfax has been very focused on their existing holdings/subs - no major new acquisitions from 13Fs in last year or so - but more focus on optimising/maximising value from existing investments both in insurance and non-insurance . To use a cricket analogy - not trying to swing for the fence (hit a 6) on every ball, but just take lots of easier 1s & 2s. Their largest cash outlays have been on their own undervalued stock - equity swaps & $1 bil share repurchase. A lower risk approach. They won't short any more - again a lower risk approach. So I don't think Fairfax are changing the types of equity investments they are making or we might expect them to make in the future & which has driven most of their book value growth per share over time - they are value investors - but if they are going to make new acquisitions, they appear to be looking to internal opportunities (existing positions/investees) first - Kennedy Wilson investment recently is a good recent example or recent purchase of Fairfax India shares. And also on the insurance side, the focus is on growing premium organically - again lower risk. FFH have also been increasing in FFH ownership (incl Riverstone) in non-insurance investees (post buybacks) Fairfax India 41.8% (current) , 34.5% (Dec-20) Eurobank 32.2% (Sep-21) , 30.5% (Dec-20) Stelco 17.8% (Feb-22) , 15% (Dec-20) Worth noting too Resolute has new share repurchase plan up to 10 mil shares, which could increase FFH's ownership from 38.6% to 43.4% approx. And there is another Sunday ramble from me Looking forward to Prem's shareholder letter next week too!

-

lets hope not! Actually Fairfax added to their Eurobank stake in Q3 & took it to around 32% - Eurobank sold off pretty hard today, along with other financial stocks in Europe & globally, but I think eventually things will settle down

-

Yes fair enough - I probably should have said Speculative tech valuation bubble - i was thinking more about his Dec-20 interview where he pointed to valuations of ZM, SPOT, PTON

-

Yes makes complete sense - KW have a great track record Fairfax could become a liquidity provider this year & if this volatility keeps up it could offer some big opportunities for them in fixed income/equity side - they couldn't be in a better position honestly with just over 50% of their portfolio in cash/ST investments - Prem has finally been proved dead correct with this tech correction finally coming to play - I just wish they had reduced their BB holding which has sold off YTD ( that is my only criticism) although that looks to be offset from their gains on Eurobank - otherwise the rest of their portfolio positioning looks ok

-

Looks like a good move - 13 mil warrants provide potential upside