glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

ok - not sure about Vanguard but IB does

-

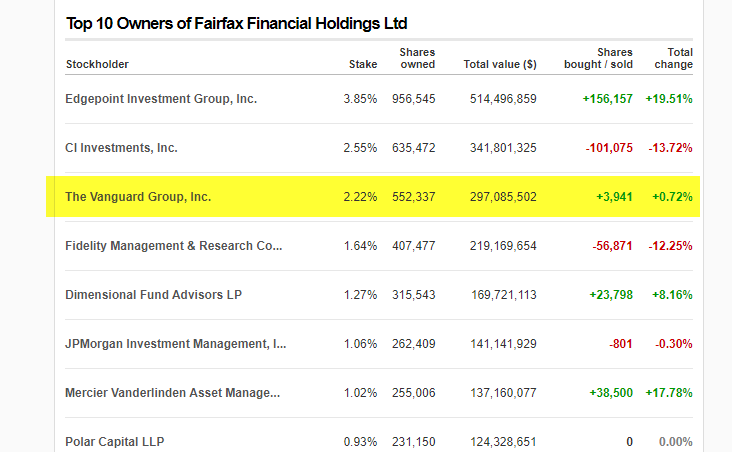

ok - are you talking about the FRFHF - OTC US listed shares? I would assume a US investor with a Vanguard personal account could still buy Canadian stocks including TSX listed ie FFH.TO , or am I wrong?

-

-

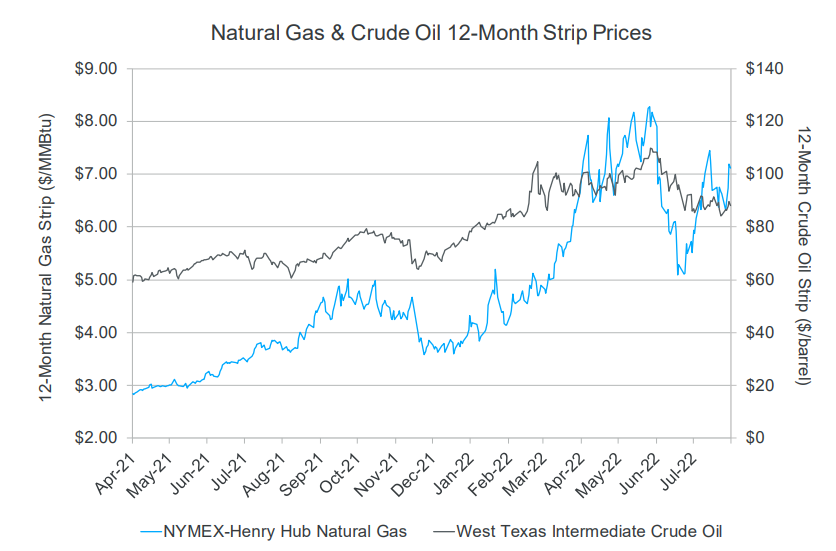

nwoodman I don't have current financials but we expect most of their hedges roll off in 2022 & they can lock in future production at higher price levels based on 12-month avg strip prices (futures) for crude oil & natural gas which have had a decent move up (see below). So pricing is looking constructive for 2023 revenues, if they can get their production volume up as well that could give them more revenue upside. https://assets.engieimpact.com/ENGIE-Impact-Market-Watch-8-16-2022.pdf?mtime=20220816144946&focal=none&utm_source=Programs+Marketing+1&utm_medium=email&utm_campaign=7013c000001ofvDAAQ

-

M&A in Oil & Gas space (might be useful to compare to Exco resources) https://worldoil.com/news/2022/8/10/devon-energy-to-spend-1-8-billion-to-buy-validus-energy-expand-in-eagle-ford/

-

viking I think they increased the CV when they exercised the warrants, so at Jun-22 the CV (excl Riverstone) is $1336 If deal goes ahead, Fairfax exchanges their Atlas shares at the merger price for BidCo shares.

-

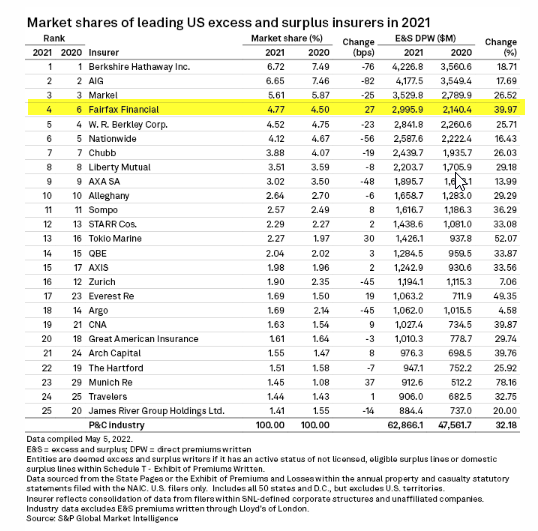

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/most-top-e-s-insurers-see-market-shares-decline-in-2021-premiums-rise-yoy-70287307

-

My view earnings are tied to ROE, so tied to rate of BV growth & what BV multiple you would apply. I think if you look at insurers that have higher P/B values, generally speaking they are focused in specialty insurance/E&S & as a result they tend to have lower combined ratios (than their peers). Higher underwriting profit combined with decent investment returns has allowed these insurers to generate decent operating earnings along with higher ROE/growth in BV. Two examples of specialty focused insurers I can think of would be RLI P/B 3.7x approx (adjusting for Maui Jim sale) & WR Berkley P/B 2.8x. During this hard market, Fairfax has been growing out its US E&S business - in fact it has close to doubled its market share in the last 5 years - from #11 in 2016 with 2.4% market share Up to #4 in 2021 with 4.7% market share - its E&S DPW has quadrupled over that time. If you look at how Fairfax's underlying combined ratio has trended in recent years, it has been trending down & Fairfax's insurance operating earnings trending up. Both favourable trends IMHO when we think about what BV multiple to use.

-

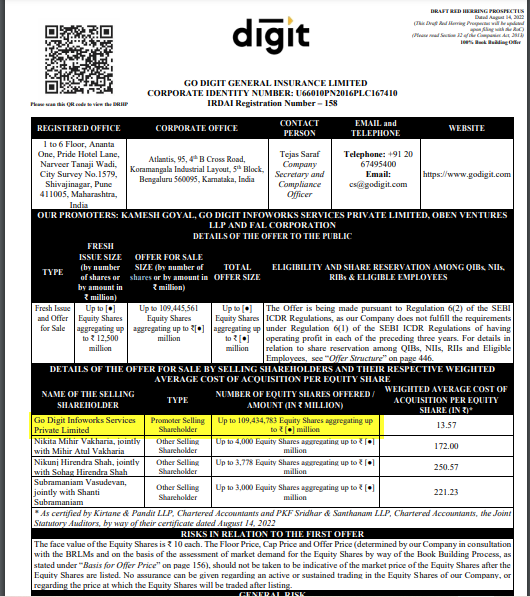

Here is the Digit IPO Draft Prospectus lodged today https://www.axiscapital.co.in/uploads/equity_documents/dhrp/go-digit-general-insurance-limited.pdf In Apr-22, Go Digit Infoworks (through which Fairfax owns its stake) had approx 729 mil shares out of total of 838 mil shares in Digit. The draft prospectus has Go Digit Infoworks proposing to sell up 109 mil shares. (These amounts could change - its just a draft!) https://www.reuters.com/markets/deals/fairfax-backed-digit-insurance-files-draft-papers-india-ipo- 2022-08-16/

-

13F new additions BAC 80mil OXY 52 mil https://www.sec.gov/edgar/browse/?CIK=915191&owner=exclude

-

https://www.albawaba.com/business/pr/gulf-insurance-group-announces-net-profit-kd-15-million-us-489-million-27-growth-first

-

https://www.cnbctv18.com/business/companies/fairfax-backed-go-digit-insurance-to-file-ipo-drhp-this-week-say-sources-14470762.htm No prospectus filed yet - but its worth keeping an eye on

-

Fairfax are paying around 126 mil priority dividend on co-investors investment of 1584 mil = 8% dividend (vs interest on notes of 5.63% - so saving here) But then the question is what will the buyout price be?

-

viking it looks like the purchase price is being funded by Fairfax affiliates (?) using equity & debt - details are not clear at this stage! The Proposed Transaction would be financed by equity proceeds contributed by members of the Buying Group and debt financing, and would not be subject to any financing condition.

-

I noticed in Q2 interim - may be to free up up funds (cash flow) for this Recipe acquisition? Subsequent to June 30, 2022, AVLNs with a guaranteed value of approximately $543 were amended such that the underlying securities must be purchased by or sold at the direction of Hamblin Watsa prior to the end of 2023. The remainder of the AVLNs are unchanged and their underlying securities must be purchased by or sold at the direction of Hamblin Watsa prior to the end of 2022.

-

Pursuant to the terms of the Proposed Transaction, the Purchaser will acquire all of the Shares, other than those Shares owned by Fairfax or its affiliates and a maximum of 4,000,000 MVS owned by CHL, for a purchase price of $20.73 per Share, payable in cash. The Buying Group is comprised of certain affiliates of Fairfax. The Proposed Transaction would be financed by equity proceeds contributed by members of the Buying Group and debt financing, and would not be subject to any financing condition.

-

Atlas won't lose its neutrality IMHO as long as ONE is not the controlling shareholder & the charters that Atlas does with ONE are on similar commercial terms to other shipping liners. These charter rates are also being made publicly available, so they are visible to everyone.

-

These look like commitment limits - actual transaction value may be less

-

So these appear to be the equity financing commitment limits made to BidCo ( i only just saw link so need to read through) David Sokol $30 mil Washington Family $175mil ONE $1.4 Bbil https://www.sec.gov/Archives/edgar/data/0001794846/000119312522213659/0001193125-22-213659-index.htm @Viking

-

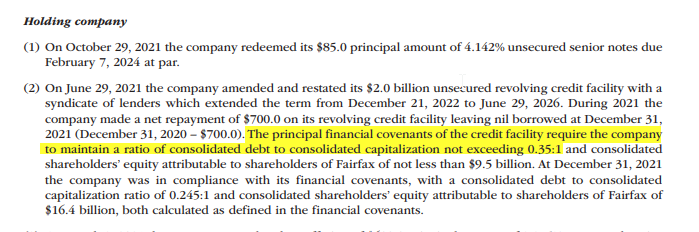

It will be interesting to see what structure this ATCO offer could take. I don't think that Fairfax can consolidate Atlas Corp - Why? because of the financial covenants on their revolving credit facility restrict their consolidated debt to consolidated capital to 35% & consolidating Atlas Corp will take this ratio to 36% (up from 28% at Jun-22) (my workings below but do your own dd) Fairfax Jun-22 total debt 7.7 total equity 19.7 total capital 27.4 Atlas Corp Mar-22 total debt 5.6 total equity 4.3 total cap 9.9 Consolidated total debt 13.3 total equity 24.1 total capital 37.4 Consolidated total debt/total capital = 36% (exceeds 35% limit)

-

I think for Fairfax there is strategic rationale here that Atlas with ONE as a co-shareholder raises the value of Atlas - ONE is largest customer 24% of vessels under lease - so this cements that customer relationship - logical for ONE to do more future charters via Atlas in which it has co-ownership - growth opportunity - ONE made 16.7 bil in 2021 - potentially provides atlas with deep pocketed partner if they want to go on acquisition path Still unclear what % ONE or other partners want to buy so offer vague here??

-

interview re BIAL - will be able to handle 60 mil passengers (T1 36 mil plus T2 25 mil )after T2 completed - not sure how quickly they will scale up to 60 mil after T2 opens- that part of the interview requires a subscription ...arghh https://airwaysmag.com/bangalore-kempegowda-airport/

-

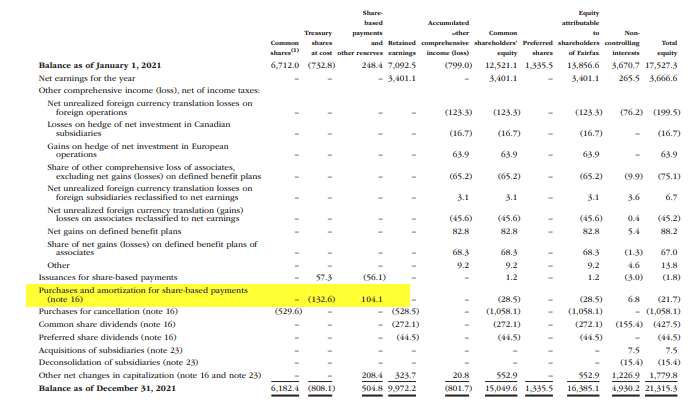

actually these restricted share-based payment awards (RSAs) were 567K at end of 2016, so increase for 2017 was 122k not 689k. Thinking holistically about the business, Fairfax needs to incentivise & retain management/staff & RSAs also help align management & shareholder interests over the long term. The financial results are really the litmus test on whether these types of remuneration arrangements are effective - so you have to evaluate against the financial performance (insurance & investment results) of the business over the last few years & ask the question has it been a win/win for Fairfax? Worth considering that these share based awards have long vesting periods of up to 15 years (in other companies it may typically be closer to 3-5 years) & these Fairfax awards are also subject to performance hurdles eg underwriting profit - here is one for Allied World https://www.sec.gov/Archives/edgar/data/915191/000094787122000815/ss1199327_ex9901.htm The amortisation of share-based compensation for Fairfax was 104 mil pre-tax in 2021. To offset the dilution on these share awards Fairfax has been repurchasing shares on an ongoing basis including in 2021 - this is a cash cost to Fairfax . Looking at the share-based comp expense in 2021, I estimate it might have reduced BVPS growth by approx $4-$4.50 or bit under 1% in 2021.

-

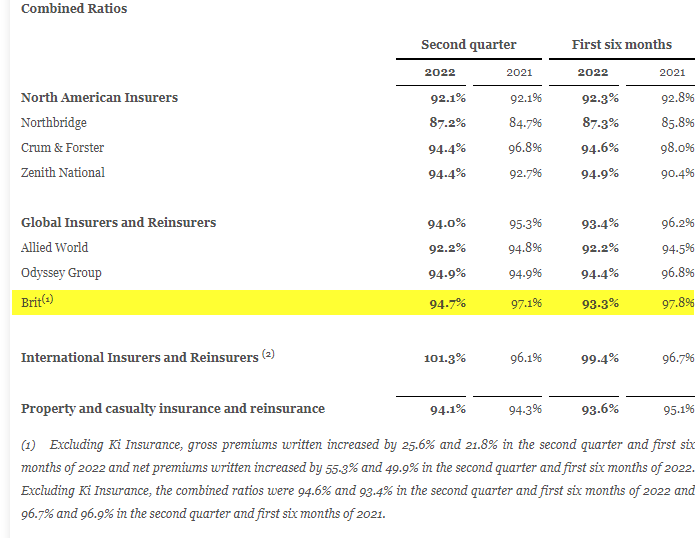

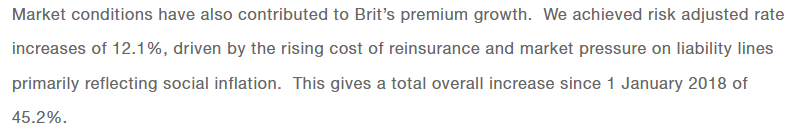

Just looking at 2Q & 1H'22 results & I don't want to speak too soon with business end of the year (ie hurricane season) upon us - but Brit results continue to improve with decent premium growth & better combined ratios Brit managed rate increases close to 12% in 1H driving premium growth Brit's (20% owned) Insurtech Ki continues to scale quickly with significant premium growth (Ki wrote close to 400 mil for 2021 calendar year) & its combined ratio has improved close to break even in 2Q & 1H'22.