glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

I wonder if this to fund another substantial issuer bid/share buyback?? I guess we will have to wait & see.

-

My guess - I would say yes on both

-

-

Agreed this has been one of the most disappointing investments - mgmt execution terrible - they said in Q3 they had enough cash to get to break even, but this Fairfax loan suggests otherwise that they need more cash. I would be worried if loan was unsecured or substantially more - but at $US60 mil I can digest that - yes I don't like it but reasons below why I think they made it. 1. capital raise would be very dilutive 2. a bank/alternative lender loan would put the bank/lender in charge of FDGE as main creditor - this way it puts Fairfax at front of the line as sole secured creditor if Farmers Edge needs to go into into any business restructuring in the future then they are in a better position to dictate terms. 3. based on their cash burn, provides FDGE with around 2 yrs of cash which hopefully gets them to breakeven, however, I haven't listened to the conference call so want to wait for that in terms of their projections on future revenues and cost structure to see what they are expecting. Also I noticed Wade Barnes was left off Prem's CEO list in the Annual report - so I was not surprised with CEO resignation.

-

I did this Chart (for convenience using only the Avg US 10 yr treasury yield not considering yield curve) - shows relationship between interest rates and Fairfax's pre-tax yield - interest & dividends. One thing that struck me was that interest income appears primary driver not dividend income sources https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart https://www.fairfax.ca/financials/annual-reports

-

just thinking about impact on Fairfax bvps growth - if you take out the period 2011-2016 when they had their equity hedges on and work out compounded book value growth over 30 years (1986-2010 & then 2017-2021) you get around 22.2% CAGR excluding dividends, compared to actual 18.2% CAGR over the 36 years. And I think over 2017 to 2020 they still had some individual shorts running off.

-

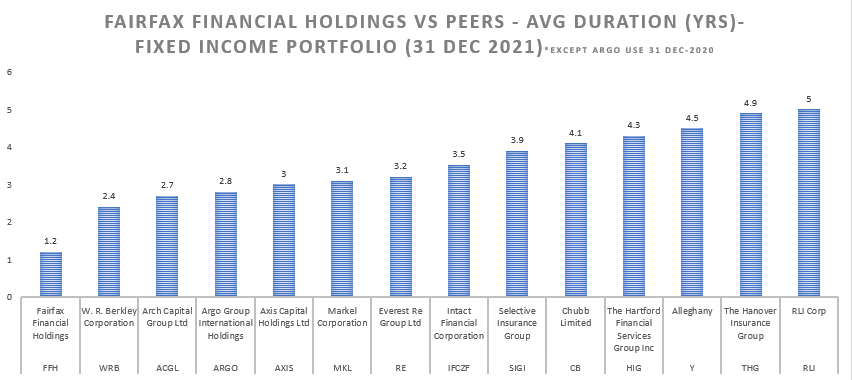

I think Markel, Berkshire, Fairfax have all said in different words over last few years that they think interest rates were too low given risks of inflation, credit risk etc. Berkshire & Fairfax are both shorter on duration in their fixed income portfolio than Markel (I couldn't find Berkshire's duration number but just looking at their balance sheet), although Markel still looks to be below the median duration level amongst peers. Markel did reduce duration from 3.3 to 3.1 yrs in 2021. Whether they are setting premium pricing, reserves or investing their portfolios, insurers have to form some type of judgement on expected levels of inflation, interest rates.

-

Berkshire acquired Alleghany at 1.26x BV https://www.cnbc.com/2022/03/21/warren-buffetts-berkshire-hathaway-agrees-to-buy-insurance-company-alleghany-for-11point6-billion.html I haven't looked into the details but my initial thoughts were WB is bullish on insurance & reinsurance space & he is prepared to pay a reasonable premium to book value

-

I was just thinking about the max dividend capacity of the insurance subs - its currently sitting at $2 bil. In 2021, they paid a dividend equal to around 27% of their 2020 dividend capacity. I just wonder given their approx 20% net premium growth rate , if that 25-30% area is what we should expect in 2022 or whether they could go for a higher dividend payment because this looks to be the primary avenue (short of FFH selling whole or part of a sub) that FFH will use to fund their share buybacks. If the hard market slows down & net premium growth rate turns into single digits, they could potentially get more aggressive on share buybacks.

-

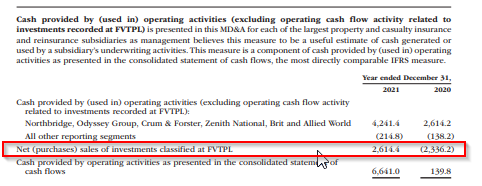

I would probably describe them as active portfolio managers - they have a mix of long-term strategic holdings & other non-strategic investments. They will be opportunistic - for example last year they were net sellers of equities & bonds & built up their cash & ST investments to 50% of their portfolio as at 31 Dec-21. I think that is just a function of them being unable to find enough value in both equity or bond markets & concern around inflation driving interest rates higher. After the stock market crash in March/April 2020, we added approximately $1.1 billion in common stocks. We have sold these positions for a gain of $620 million or 56%. During 2021, we sold $5.2 billion in corporate bonds, mainly acquired in March/April of 2020, at a yield of approximately 1%, for a gain of $253 million.

-

twocities I think the answer to your question is around how they manage liabilities/loss reserves. This is an extreme scenario but just to illustrate - in 2018, Argentina had mid 40s inflation rate, Fairfax's sub there had a CR in 120s as a result. But Fairfax I believe was able to still make a profit as it was able to invest in short-term rates at 40%. So having that flexibility by being short duration, if you believe inflation could go a lot higher can be important. I don't disagree that they should have invested more in intermediate bonds in 2018, so yes that was a missed opportunity - but at the same time we are looking in hindsight too. Fairfax have to brainstorming these 'what if' scenarios all the time & I think they will also make bets on different scenarios. Here is a good article on this subject The Inflation Specter Looms for Property/Casualty Insurers https://www.insurancejournal.com/news/national/2021/03/23/606467.htm

-

In 2018 they more than doubled their bond portfolio allocation & increased interest income 'Our interest and dividend income of $784 million was up from $559 million in 2017 as we moved from cash to 2 – 3 year treasuries and high quality corporate bonds – but we did not reach for yield!' (AR 2018) We do know that 1-3 year treasuries are yielding 100 bp more than they were at start of year. So straight away they have the play it safe, high quality, short term debt option on the table that will boost their interest income. Also we know the duration on their fixed income portfolio is 1.2 yrs at 31 Dec, so they have flexibility to redeploy their portfolio at higher rates within a short timeframe so we should see impact on interest income sooner. Plus we now have a lot more volatility in equity & credit markets, that is opening up opportunities in corporates. So I think key points here are their positioning & the fact we now have a higher rate environment that is more conducive to them increasing their interest income. There is generally a correlation between interest rates & P&C insurer P/B multiples, because lower interest rates lower interest income & contribute to lower returns on equity.

-

-

viking yes I think what this whole situation with Ukraine has really brought home the issue of security around supply chain for companies. I think companies will focus a lot on this going forward & that will mean potentially more investment flowing to companies in Countries that are in 'the West' or aligned with the West & so there are going to be opportunities in that space. So I think geopolitical considerations will take priority over lower cost production considerations. But that transition might need time & I notice that sanctions have been selective around certain commodity export from Russia but not others.

-

https://www.eurobankholdings.gr/-/media/holding/omilos/enimerosi-ependuton/enimerosi-metoxon-eurobank/oikonomika-apotelesmata-part-01/2022/fy-2021/4q2021-results-pr-en.pdf

-

Eurobank operating results for 2021 look solid, they exceeded 2021 guidance. Guiding for EPS of euro 0.14 in 2022 versus share price of euro 0.83 (fwd PE 6x) & P/TBV is 0.6 x. Obviously will be impacted by Ukraine situation even though they have little direct loan exposure. Still current valuation looks compelling IMHO. https://www.moneyreview.gr/business-and-finance/69767/eurobank-neo-epicheirisiako-schedio-kai-dianomi-merismatos-se-pososto-20-apo-to-2022/ In detail, the financial objectives of the new business plan for the period 2022 - 2024 provide: • Average increase in earnings per share of about 13% per year • Dividend distribution from the year 2022 at a rate of approximately 20% • Achieve a sustainable return on tangible equity of 10% per year. • Creation of at least 100 capital units per year from profitability to finance the development, distribution of dividends and the strengthening of the capital position. • Reduction of the non-performing loans ratio from 6.8% in 2021 to 4.8% in 2024, a goal reinforced by the low levels of net NPEs contributions of 400 million euros in 2022.

-

Attending and Participating at the Virtual Meeting The virtual meeting will take place on Thursday, April 21, 2022 at 9:30 a.m. (Toronto time) at https://web.lumiagm.com/407755318. Shareholders and duly appointed proxyholders who log in to the virtual meeting will be able to listen, ask questions and securely vote through a web-based platform, provided that they are connected to the internet and follow the instructions set out in this Circular. In order to participate in the virtual meeting, shareholders must have a valid 15-digit control number and proxyholders must have received an email from Computershare containing a username. To attend the Meeting, Registered shareholders, duly appointed proxyholders (including Non-Registered Holders who have duly appointed themselves as proxyholder) and guests (including Non-Registered Holders who have not duly appointed themselves as proxyholder) must log in online as set out below: Step 1: Go to https://web.lumiagm.com/407755318. Step 2: Follow the instructions below: Registered shareholders: Click “I have a login” and then enter your username and password “fairfax2022” (case sensitive). Your username is the 15-digit control number located on your form of proxy or in the email notification you received from Computershare. If you use your control number to log in to the Meeting, any vote you cast at the Meeting will revoke any proxy you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote at the Meeting. Duly appointed proxyholders (including Non-Registered Holders who have duly appointed themselves as proxyholder): Click “I have a login” and then enter your username and password “fairfax2022” (case sensitive). Proxyholders who have been duly appointed and registered with Computershare as described in this Circular will receive a username by email from Computershare after the proxy voting deadline has passed. Guests (including Non-Registered Holders who have not duly appointed themselves as proxyholder): Click “I am a guest” and complete the online form. Non-Registered Holders who have not appointed themselves as proxyholder must attend the meeting as guests. Registered shareholders and duly appointed proxyholders may attend, ask questions and vote at the Meeting. Non-Registered Holders who have not duly appointed themselves as proxyholders and guests may attend and ask questions at the Meeting, but will not be permitted to vote. We recognize the importance of shareholders being able to ask questions in a virtual meeting format. At the virtual meeting, Registered shareholders and duly appointed proxyholders, regardless of geographic location, will be able to participate and have an equal opportunity to ask questions, and vote in real time at the Meeting, provided they are connected to the internet and have logged into the online platform accessible at https://web.lumiagm.com/407755318. Shareholders attending virtually may ask questions during the Meeting by typing and submitting their question in writing by selecting the messaging icon button from within the navigation bar. Type your question within the chat box at the 30 bottom of the messaging screen. To submit your question, click the send button to the right of the text box. Questions submitted via the Lumi online platform that relate to the business of the Meeting are expected to be addressed in the question-and-answer section of the Meeting. Such questions will be read by the Chair of the meeting or a designee of the Chair and responded to by a representative of Fairfax as they would be at in-person shareholders meetings. Questions submitted via the Lumi online platform will be moderated before being sent to the Chair of the Meeting. This is to avoid repetition and to ensure an orderly meeting. The Chair of the Meeting will decide on the amount of time allocated to each question and will have the right to limit or consolidate questions and to reject questions that do not relate to the business of the Meeting or which are determined to be inappropriate or otherwise out of order. Questions can be submitted at any time as prompted by the Chair during the Meeting until the Chair closes the session. It is anticipated that shareholders attending the Meeting virtually will have substantially the same opportunity to ask questions on matters of business before the Meeting as those shareholders who are attending the Meeting in person.

-

93,000 shares bought back (around $46 mil approx) b/w 1 Jan to 3 Mar-22 - hopefully they can increase it. At December 31, 2021 there were 23,865,600 common shares effectively outstanding. At March 3, 2022, Fairfax had 23,024,111 subordinate voting shares and 1,548,000 multiple voting shares outstanding (an aggregate of 23,772,881 shares effectively outstanding after an intercompany holding).

-

Just looking through AR 2021 - you can see what Fairfax are saying (on 3Q'22 call) that they have de-risked their catastrophe exposure - 2017 was a bit higher but similar to 2021 in terms of insured catastrophe losses. Looking at catastrophe losses as % of net premium written, it looks to have been reduced by nearly 50%.

-

this interview is worth listening too - analyst Michael Nance has spent a lot of time on the ground in Ukraine and with their defence forces & studying tactics - his perspective is interesting unlike most Western analysts he actually thinks Ukraine has a chance of beating Russia. Now this is not in interview but just a few thoughts I have - I am actually more in the camp of economically sustainable & targeted sanctions (rather than just complete blanket sanctions that are hurting a lot of Russian people who have absolutely no say over what Putin is doing) & focusing energy on helping Ukraine to resist & defeat the Russians is the better strategy. Putin needs to be defeated in the field IMHO - that will be more destabilising for his leadership & it will also act as a greater deterrent on future conflict. Sanctions were tried after Crimea & it didn't stop Putin having another go!

-

I think the issue being raised here is primarily to do with cash flow - Fairfax will need to put money aside that will prevent Fairfax putting funds to best effect eg share repurchases. Effectively Fairfax's hands will be tied. But why do we think OMERS etc are in a hurry to get paid? the point has been made that OMERS are getting a good deal here. Why couldn't these 'call' options be extended for another few years? Or OMERS stake sold to another party/partner that Fairfax wants to work with? or Fairfax raises funds via a share issue above BV? Or Fairfax actually sells one sub? Another option as well could be one of Fairfax's subs buys the minority interest in Brit. So money would not need to come from the Holdco. This is not common, just Zenith & TRG where this has occured. I think there are multiple options on the table - Fairfax can get creative when they need to - their track record is there. OMERS & CPPIB had no issue investing $1bil last year - even though their Brit, Allied stakes had not been bought back. When Fairfax sold Riverstone Europe, they made the point that OMERS was keen to redeploy money into a minority interest in Brit. Why did they do that? And OMERS have also invested into Anchorage. For me it appears that OMERS like working with Fairfax & are keen to partner on deals & keen to put their money to work at every opportunity. So I would frame the issue in that way, rather than OMERS need to be paid back by this date or else OMERS won't want to partner with Fairfax in the future. Also I would make point above I made that there are multiple ways Fairfax could do this, that would not impact their ability eg to buyback shares.

-

With 8% priority dividend for Allied World - could we look at it from a tax point of view - I am not a tax expert so if I am completely missing something then please call me out - Allied world is based in Bermuda which I believe has a nil corporate tax rate but it looks like that could change to 15% in line with global minimum tax rate proposals - anyway my point is at time that Allied world deal was done & up until now, Fairfax's sub Allied World has been a beneficiary of this lower tax rate regime, allowing a higher after tax return for Fairfax & so in a way this has subsidised that priority dividend to OMERS etc - just a thought anyway.

-

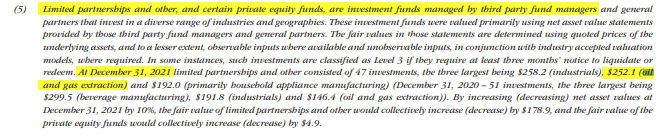

yes Viking, I also noticed that Fairfax has a $252 mil investment in oil & gas extraction business as well via their LPs/PE funds with 3P managers ( could be via BDT or other)

-

I think there are different ways to think about it - they could issue equity (rather than debt) in FFH at a decent premium to BV & buyback minority interests at some future date - they do have a track record of buying back stock below BV & issuing stock above BV. - they want $1.5 bil at Holdco, so if they do buyback minorities I think more likely from FCF or selling equity. - in a hypothetical situation owning 70% of 3 insurers with say 10 bil in float (effectively owning 7 bil in float) might make more sense than owning 100% of 1 insurer with 5 bil in float - in terms of thinking about capital allocation - not breaking down the individual subs numbers here. But the flipside is they have to pay priority dividends - I am sure they have done the numbers on this. - They have option not obligation to buyback sub minorities- - we are guessing what they might do & at what price or %- they didn't buyback Allied minorities with the proceeds from Odyssey - so clear intent to maximise shareholder return at each turn.

-

I am looking at the AR now 'In addition, the non-controlling interests in Allied World, Odyssey Group and Brit have a dividend in priority to the company' Odyssey deal (like Brit etc) has a priority dividend - no information on the dividend % that I can see??