glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

https://www.athina984.gr/en/2021/12/01/mitsotakis-theloyme-na-einai-i-chora-mas-kainotomos-kai-protathlitria-stin-anaptyxi/

-

https://www.businesstoday.in/latest/story/fairfax-sells-32-stake-in-iifl-finance-for-rs-365cr-314148-2021-12-01

-

I just wanted to add a few thoughts here on my operating revenue estimates for 2022 Underwriting Profit - I think a 95-96 CR on 18 bil in net earned premium (10% increase on my 2021 estimated net premium of 16.5 bil) is reasonable which would put it at between 720 to 900 mil (what is really interesting here is every 1 CR point is equal to around 180 mil, so if we have a cat light year the underwriting profit could really blow out, but 95-96 CR would sit Fairfax in line with last 3 years CR in high 95s (excl covid losses) . Note: given the trend in their underlying CR is falling, as underwriting expenses ratio is lower on a higher net earned premium base, they could also surprise here assuming normal cat loss year. Interest & Dividend income - I am estimating 660 mil for 2021 (annualising based on 9mths to 30 Sep-21 of $495mil) & lets say 700 to 730mil for 2022 (expecting higher interest rates next year and potential lift in dividends) Profit from Associates - For all their associates, I think a number in the 500-600 mil area looks possible in 2022. I want to see the final Q4 results before drilling down on a more definite estimate/range. I am estimating around $457 mil in 2022 potentially to come from 5 key associates (Atlas,Eurobank, Resolute Forest, Quess, BIAL) which comprise 57% of $4.7 bil (mkt value) out of total of $8.2 bil of market value of Fairfax's associates (insurance & non-insurance) at 30 Sep-21. Broken down below (excluding Riverstone because any gains there will be MTM & come through as derivative gains on their repurchase option, if I understand it correctly) Atlas Corp 170 mil (use Atlas mgmt 2022 estimate 535mil less preferred dividends estimate 70mil) x 36.6% ownership (excl riverstone stake) Eurobank 167 mil (Eurobank mgmt. expect 10% ROE in 2022 – estimate 520 mil net income on 5.2 bil NTA) x 32.2% ownership Resolute Forest 80 mil (FFH 31% ownership (excl Riverstone) - 2022 Est net profit 260 mil or $3.25 per share - at lower end of analyst expectations ) Quess 10 mil (my estimate 10% ROE for 2022 (note mgmt. aim 20% ROE in 2023) - (10% x 2325 crore equity Sep-21 = USD 31 mil) x 31% ownership) BIAL 30 mil (use FFH share of BIAL profit in 2019 assuming international flights resuming by 1 Jan-22 - Omicron could be an issue??) Non-Insurance companies (pre-tax income)- this is a really interesting one - if you look at the Q3'21 report, the restaurants & retail segment had a pre-tax income of $56.8 mil but the overall result was only $35 mil pre-tax due to losses in Thomas Cook India & Other segment. The Q4 result for non-insurance segment will be a key one to see how restaurant & retail segment performs. Hopefully this Omicron variant won't throw a spanner in the works, but assuming most travel resumes in 2022 I think we can expect at least a breakeven result from Thomas Cook. Like Viking I don't think 100mil in 2022 looks unreasonable for this segment, but I think it could even be higher. Run-off & Life Insurance - run-off loss tends to be higher in Q4 & I believe this might be due to 4Q auditing of loss reserves. Would like to see how life insurance business performs in Q4. Will wait for Q4 result before forming estimate for 2022. Putting above together, I am estimating between $2 bil to $ 2.3 bil in operating revenues (excluding net investment gains) in 2022. Please note - with my estimates I am just looking at operating revenues & 1. ignoring run-off & life insurance for now which will be a sub $100 loss IMO 2. minority interests (eg Fairfax India) will claim a % of the above operating revenue number, but their net earnings share gets deducted at the bottom of the earnings statement.

-

all good klipbaai

-

thanks @Mick92 ok well if they can't fully complete the SIB, they will waste no time restarting the NCIB at these price levels at lower end of tender pricing IMO

-

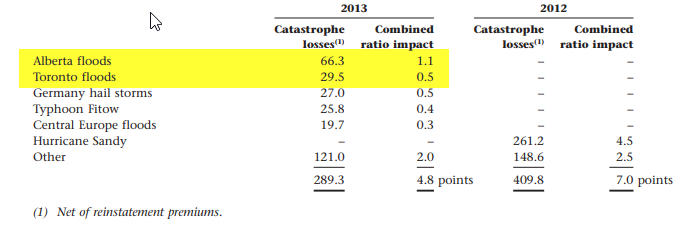

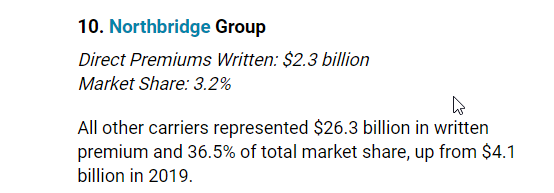

good insights SJ - expect the insured losses to be less than the actual losses - in Calgary 2013 insured losses appear to be around about 33% of the actual losses/damages https://www.theglobeandmail.com/business/article-bc-floods-will-be-canadas-most-expensive-natural-disaster-this-year/ I am going back to 2013, floods in Alberta & Toronto. https://www.reuters.com/world/americas/canadas-10-costliest-natural-disasters-by-insurance-claims-2021-11-17/ In 2013, Northbridge Insurance had 2.52% market share & looks like Fairfax incurred around 3.6% of the insured losses. Alberta C$1.7 bil (Fairfax loss 66.3 mil or 4%) Toronto C$0.94 bil (Fairfax loss 29.56 mil or 3%) In 2020, Northbridge had approx 3.2% market share so maybe we could expect 4-5% of the insured loss based on their market share? Of course just purely an estimate & their underwriting exposures would have likely changed, but I think their market share in terms of premium does provide some help in terms of measuring potential exposure. I haven't been able to find an insured losses estimate yet but anyone feel free to post if you have. Cheers

-

Can't Fairfax execute its normal course issuer bid at the same time as its substantial issuer bid? With their shares trading in the mid US$400s, why would they bother waiting for the auction tender which we know could be a challenge to fill anyway? Looking at the TSX today the volume today is over 140,000 shares when its avg volume is normally around 50,000 shares.

-

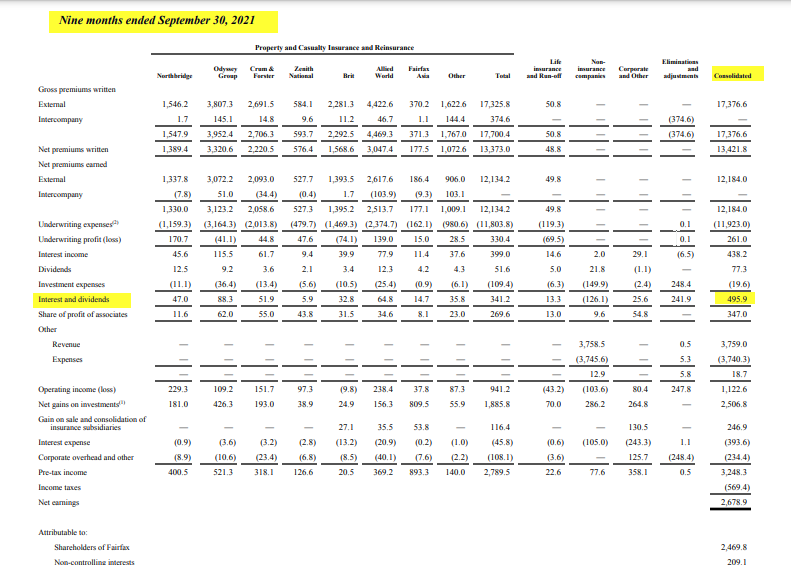

thanks viking - just on interest & dividend income - I think you might be looking at the interest & dividends for insurance business but not the consolidated number (ie including non-insurance subs, corporate etc) this number is higher Here is screenshot of 3Q Interim report which shows the breakdown of interest & dividends per operating segment - the total is $495 mil in interest & dividends for 9mths s to Sep-21.

-

https://nymag.com/intelligencer/2021/10/why-the-big-short-guys-think-bitcoin-is-a-bubble.html

-

well the lower Fairfax's share price (relative to pricing under this tender), the more attractive this buyback might look to tax advantaged funds/individuals to participate IMO Also volatility in the market would encourage funds to prioritise liquidity - another reason why funds might sell into this SIB. Finally, timing - we are coming to end of the calendar year - funds are mindful of their annual performance (particularly if markets are weak) & may have incentive to lock in gains at a fixed price under this tender. So a temporary period of volatility could work for Fairfax at least while this SIB is open - as long as we don't see the the economic recovery completely derailed (which I see as a low probability at this stage).

-

i meant to say asset side - higher loan quality

-

3Q results out from Eurobank - I haven't been able to find the 3Q call transcript but what has been reported in media https://www.kathimerini.gr/economy/561603262/eurobank-kategrapse-kerdi-298-ekat-eyro-sto-enneamino/ is - management expect double digit ROTE in 2022 - based on tangible book of 5.2 bil at 3Q - I believe that would be a NPAT in the area of 520 mil euro at 10% ROE (if mgmt can deliver then Fairfax's share or profit from this associate at 32.2% ownership would be in $167 mil area) - discussions with supervisory bodies starting in early 2022 to discuss the dividend - obviously this would be significant for Fairfax - other metrics look good - non-performing exposures down to 7.3%, deposits up 8% YTD (over 9mths) I noticed Eurobank's share price down 5% or so today which looks to be in line with many other European financials- I think people are more concerned about this new SA covid strain today anyway cheers

-

I posted under Eurobank thread - also posting here https://greekcitytimes.com/2021/11/25/surprisingly-growth-athens-property-prices/ Property prices in Athens soared by nearly ten per cent in the third quarter of the year, according to the latest batch of data, as Greece’s real estate sector proves to be one of the strongest in Europe. this bodes well for Eurobank's banking ops - on revenue side (more potential lending growth) on liability side (ie increases collateral values on their lending book) It is also a tailwind for Eurobank's 1.36 billion euro property investment portfolio https://www.ekathimerini.com/economy/1171079/athens-the-2022-commercial-property-capital-of-europe/ Athens looks forward next year to being the commercial property capital of Europe, based on the projected course of prices and rental rates for 2022. The latest annual survey by PwC and the Urban Land Institute on the European property market shows that the Greek capital will lead the ranks in future capital gains and rental hikes among 31 cities. Notably, the Athens market gained the highest marks regarding the future course of both rental rates and sale prices.

-

@SafetyinNumbers from SEC filing On November 16, 2021, the Company executed a binding agreement to sell a 9.99% minority stake in Odyssey to the Odyssey Investors for consideration of US$900,000,000. https://www.sec.gov/Archives/edgar/data/915191/000110465921140897/tm2132409d1_sc13e4f.htm I read that as an equity sale (via new issue) for a 9.99% stake(rather than a bond issuance) If it was a mandatory convertible - it must be converted by some future date into an equity interest - but in this case the 9.99% minority stake appears to vest immediately with the purchasers (and then Fairfax has option to repurchase at some future date) I would never say never but thats just my reading based on the wording

-

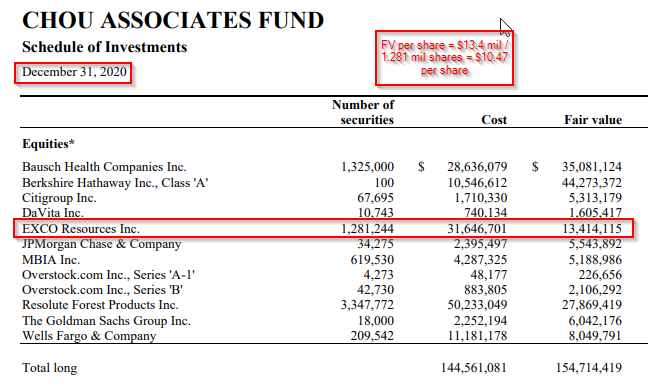

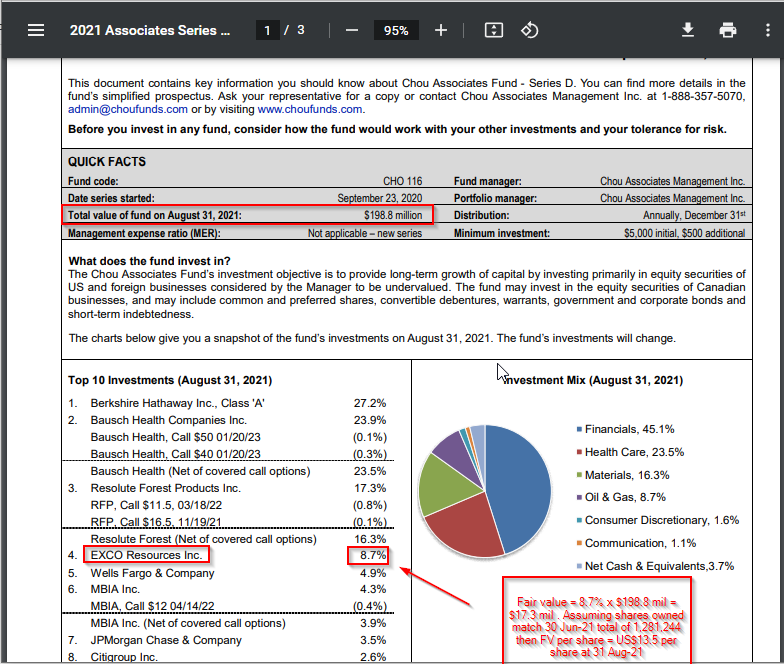

@Maxwave28Exco Resources Chou Associates Fund are also shareholders in Exco & it appears they have increased the fair value of their Exco investment by 29% YTD to 31 Aug-21. All of this fair value increase has happened since 30 June. This fair value increase in Exco is probably what might be expected given the big jump in natural gas prices in 2021. Fair value = US$10.47 per share at 31 Dec-20 Fair value per share = $13.51 at 31 Aug-21 (assuming they held same number of shares as at 30 Jun-21) Assuming Fairfax are using similar valuation approach to Chou Funds, then we could expect approx 29% increase YTD in fair (market) value of Fairfax's stake in Exco. At 31 Dec-20, Fairfax had a fair vale of $238 mil on their Exco holding(same as carrying value). A 29% increase would be $69 mil increase in fair value on this position over carrying value. Looking at the Q3 Interim report from Fairfax, it looks like they have increased the fair value of of All other - non-insurance associates (which would include Exco) between Q2 & Q3 by $67 mil - so its possible that this Exco fair value increase has already been taken up by Fairfax - we will have to wait for the 2021 Annual report to know for sure!

-

Digit wins Digital Insurer of the Year award at 25th Asia Insurance Industry Awards 2021 https://www.apnnews.com/digit-wins-digital-insurer-of-the-year-award-at-25th-asia-insurance-industry-awards-2021/

-

@Viking we can change 4. to 'Life insurance and Run-off' - see below The assets, liabilities and results of operations of Eurolife's life insurance business were consolidated in the Life insurance and Run-off reporting segment and those of Eurolife's property and casualty insurance business were consolidated in the Insurance and Reinsurance - Other reporting segment

-

100% agree

-

remember this interview with Prem in Globe & Mail in December 2020 https://www.theglobeandmail.com/business/article-fairfax-ceo-prem-watsa-touts-traditional-value-investing-amid-frenzy/ these were some of the tech stocks that Prem had concerns about (notice how he says 'wonderful companies' - his comments are strictly around valuation!)- avg YTD return of this group (PTON,SHOP,ZM,PINS) is -31% “These are all wonderful companies, but their valuations are insane,” added Mr. Watsa in an interview last week, as he described his speech to staff earlier in the month. “As in the past, this will end – and it will not be pretty.” Here are some of the value stocks that Prem was keen on - avg YTD return of this group (STLC.TO,ATCO,XOM) is +48% the contrarian investor is bullish on the prospects for Fairfax investments tied to an economic recovery, such as steel maker Stelco Holdings Inc., container shipping company Atlas Corp. and unloved energy play Exxon Mobil Corp.

-

The award for "Best Consumer Digital Bank in Western Europe for 2021" (The Best Digital Consumer Bank in Western Europe for 2021) was won by Eurobank https://www.cretapost.gr/665795/eurobank-anadichthike-kalyteri-psifiaki-trapeza-gia-katanalotes-sti-dytiki-evropi/

-

Ok so this is what I think could happen (& a lot of assumptions below so bear with me - I am simply trying to understand how these transaction could potentially impact shareholder's equity - we need to wait for final numbers in Fairfax's Q4 report !) Pre-transaction - Fairfax owns 100% of Odyssey (lets estimate carrying value at $5.6 bil at 30 Sep-21) Post transaction & post dividend (to Fairfax holdco) - Fairfax owns 90% of Odyssey ( lets call them 'B shares') - estimate $5.04 bil OMERS/CPPIB (Non-controlling interests) own 10% of Odyssey (lets call them 'A shares') - estimate $560 mil So Odyssey total equity (after dividend paid to holdco) = $5.6 bil (ie so underwriting capital strength/shareholder surplus unaffected by this transaction) So in terms of estimated impact for Fairfax's shareholder equity -common (again using assumptions above) Fairfax new carrying value (Odyssey) 90% interest ('B shares') = $5.04 bil (decrease of $560 mil on pre-transaction value) Fairfax Holdco cash = $900 mil increase (from Odyssey dividend) Estimate Net increase Fairfax shareholder equity = $340 mil So in this above scenario based on above assumptions, I am guessing there would be an increase (ignoring tax impacts if applicable) in shareholder equity for Fairfax (bottom line I would guess this Odyssey transaction is accretive to book value per common share - the actual $ amount still to be confirmed in Q4 report) And this would be before taking into account the substantial issuer bid & normal course issuer bids that if successful, should also be accretive to book value per share. Any comments/thoughts on the above guys?

-

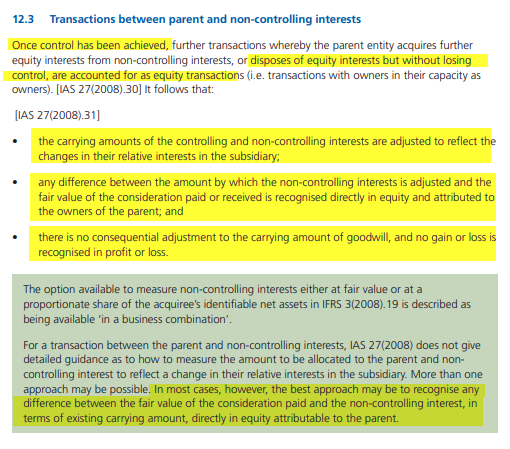

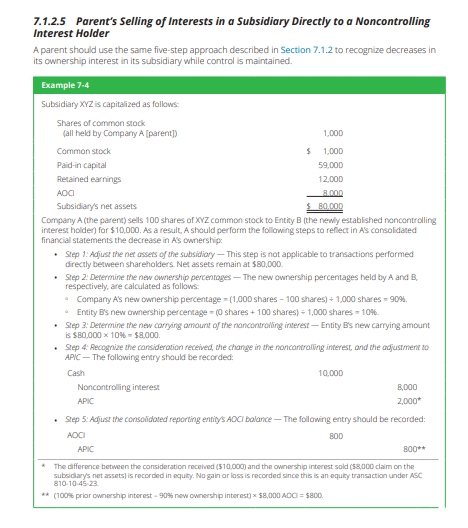

@ParsadI will have a go at this It looks like IFRS 3 gives the choice to recognise non controlling interest (NCI) at fair value or as a proportionate share (%) of net assets of the sub (Odyssey) . It looks like the more common approach is to choose the latter in this type of business combination- in that case then I suspect Fairfax's carrying value in Odyssey Group initially would increase by the difference between the $900 mil sale proceeds less proportionate share (approx 10%) of net assets of Odyssey acquired by NCI https://www.iasplus.com/de/binary/dttpubs/0807ifrs3guide.pdf Here is how the accounting could look https://www2.deloitte.com/content/dam/Deloitte/us/Documents/audit/ASC/Roadmaps/us-audit-a-roadmap-to-accounting-for-noncontrolling-interests-2020.pdf I need to look further into the impact of the subsequent dividend that is paid to holdco by Odyssey to fund the share buyback. Just my initial thoughts, we need to wait for Fairfax's reporting on these transactions to understand more about the new series of shares & impact on the financials, book value etc

-

+1 agree - Atlas's share price would be a lot higher IMO if they chartered at daily rates - but thats not the long-term sustainable model they want (short-term pain for long-term gain - as their net eps continues to tick higher the share price should respond. I think these one-off non-cash charges of around $130 mil over Q2 & Q3, related to debt extinguishment, may also be obscuring their underlying operating earnings for those investors who are just working off the headline numbers. Agree just give it time ...

-

I wanted to respond to the Fairfax owns 'cyclical crap' discussion points raised - thought better to do it in this thread & not the SIB thread. If we just take a step back for a moment & think about the whole investment portfolio positioning - because I believe the strategy is really the critical piece. 1. Fairfax has 44% of their investments in cash & investments - higher interest rates will allow them to raise their fixed income allocation & increase interest income ( if you believe interest rates are headed higher then you would give this part of their strategy a tick & this is 44% of their total portfolio!). 2. Fairfax is long India - this could be the most important & smartest strategic call by Prem over the years - India is now the number 1 emerging market economy in the world (sorry China!) & while their sharemarket looks decidedly frothy , India's economic prospects in terms of GDP growth etc look strong. Fairfax's Indian investments over the last few years have done exceptionally well. Lets take Digit in this context - India has GDP growth rate of 7% & has been growing premiums at high double digits (sounds a bit like US GDP growth rate in the 1960s & Geico when it started off when it had a similar growth rate - like Digit , Geico was challenging the status quo). Just on Digit because I am being cheeky here - media reports I have read suggest that Berkshire said no to Kamesh Goyal when he asked Berkshire to invest in Digit & Ajit Jain actually introduced Kamesh to Prem & rest is history as they say. 3. Fairfax is long Greece (& Europe) - to be fair this has been a terrible call by Fairfax for many years - but it would be a mistake now for Fairfax to throw in the towel with Greece with this economy firmly set to rebound - the real estate market & property prices are on the rise, GDP in 7% area . Fairfax's strategic decision to maintain its exposure to Greece now IMO is the right one. Eurobanks results this week will be worth checking out - I am quietly optimistic - Eurobank has now become the opportunistic, value investor picking up stakes in banks in SE Europe where it sees opportunities, so its not just recovering, its now also in growth mode (a potential dividend on the way in 2022 ?? 4. Fairfax is long resource plays - this is a bet on inflation IMO as well as the individual management teams & company prospects - insurers need to hedge their inflation risks in managing their liabilities 5. Fairfax is long real estate (eg Kennedy Wilson, Toys r us portfolio) - ditto on 4. 6. Fairfax is long covid recovery plays in travel, hospitality, dining & retail. Many of their investees that were hammered by covid, have used covid to digitise & streamline their cost bases. So coming out of covid have opportunity to deliver better earnings(eg Thomas Cook India, Recipe) - keep your eye on the profit from associates & non-insurance segment contribution to the Earnings statement over the next few quarters. 5. Fairfax is long Fairfax - their TRS position is effectively their 4th largest equity holding with around US$900 mil or so exposure ! They are also raising spare cash not to 'empire build' but to buyback their own stock - which company does Fairfax understand better than any other company as an investment - itself! This is a no brainer & good strategic call IMO. 6. Fairfax is an international insurer - owning equities in many different countries is also part of their strategy to match insurance liabilities in those different countries. 7. Fairfax is an investor that likes to own concentrated positions & have a seat at the table - thats why you will see them holding big stakes & yes liquidity is a potential issue, however, in many cases these are also publicly listed companies (also Fairfax's cash & short-term investments effectively hedge their equity positions & provide liquidity during market downturns like 2020). Often the companies Fairfax has big stakes in are in that US$1-5 bil size area & perhaps that is just a function of Fairfax's market cap & investment universe, they can't afford a BNSF like Berkshire but what about Atlas with an ex-Berkshire manager at the helm?? There are other aspects to Fairfax's strategy including their preference for management teams who are strong capital allocators with good track records , but I wanted to highlight the above. I think we would all like them to dump BB at some point but is now the best point? The challenge here is that BB operating performance actually looks to be improving, Ivy looks very interesting - are they being stubborn here - maybe - does BB need to be a great investment for Fairfax investment thesis to play out - not really IMO. I have seen a few posts suggesting Fairfax should maybe have jumped into the MSFT,APPL type investments - I agree but its too late to now jump on that bandwagen - we are talking about stocks that have gone from multiples in the teens to the 30s, 40s (that continued multiple expansion with interest rates now starting to increase looks to be challenging from here) - Fairfax do have GOOG which is a smaller $50 mil or so position -I believe they won't shy away from a big tech company investment like GOOG at the right price (personally I wish they had taken a bigger slice of GOOG when they had the chance but anyway) Worth noting two amongst Fairfax's top 10 investments that are non-cyclical- BDT partners largest investment is a beverage manufacturing business (I suspect this is Keurig Dr Pepper), Fairfax India's largest investment is in infrastructure - Bangalore Airport. Anyway there is my Sunday afternoon ramble