glider3834

Member-

Posts

980 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

-

yes viking i would agree

-

re new Canadian tax rules - looks like they have scaled back the original plans & limited to banks & life insurers - so I would guess that would exclude P&C insurers like Fairfax, but has anyone had a closer look in terms of potential impact for Fairfax? 'Within the insurance sector, there was some relief Thursday because the government clarified that only life insurers would be affected – which means property and casualty insurers won’t be hit. https://www.theglobeandmail.com/business/article-federal-budget-2022-bank-life-insurer-tax/

-

When asked if Fairfax would bid for the public sector banks that are coming up for sale, Watsa said his company was "looking at all of those opportunities". Read more at: https://economictimes.indiatimes.com/industry/banking/finance/banking/govt-should-sell-all-its-stake-in-psu-banks-insurers-says-prem-watsa/articleshow/90695797.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

-

interesting new small position circa $42 mil position in copper miner - Atalaya Mining https://www.accesswire.com/696120/Atalaya-Mining-PLC-Announces-Holdings-in-Company I haven't looked into this but there might be a bit of a theme here with Fairfax's investment in Altius as well. Interesting article on copper market https://www.kitco.com/commentaries/2022-01-17/Copper-boom-likely-to-last-for-decades-prompting-a-global-hunt-for-new-supply.html 'In fact, analysts at Goldman Sachs are calling copper "the new oil", as the metal is a key part of sustainable technologies, including electric vehicle batteries and deriving clean energy. "Copper will be crucial in achieving decarbonization and replacing oil with renewable energy sources, and right now, the market is facing a supply crunch that could boost the price by more than 60% in four years," Goldman Sachs wrote in a report May 2021.'

-

I would try & work out what % rate can they compound book value at & then decide what P/BV you think its worth. I would check out their annual reports, Fairfax derives income from 1. underwriting income (ie (1- combined ratio estimate ) x forecast net earned premium) plus 2. investment returns ( interest & dividends, profit from associates, realised & unrealised gains) ie estimate return % x total portfolio investments Then you can subtract estimates for expenses, taxes etc to get net income (common shareholders) & then forecast ROE (ie estimate growth % rate in BVPS) Over 2017-2021 Fairfax CAGR in BVPS I believe was around 13% If Fairfax can maintain over time a CAGR % growth rate for BVPS in 12-13% area , then I would think it should trade at a premium to BVPS, if my required return rate is around 10% p.a.

-

Question - Will Fairfax will release preliminary Q1 numbers on 14 April like previous years ?

-

Yeh we don't have all the data points with Exco but Francis's forecast for EBITDA in 2022 is $225 mil (my EBITDA estimate $153 mil in 2021 based on Prem's letter). Debt is 115 mil at 31 Dec-21 (paid down $30 mil in debt in 2021 . Debt was $145 mil at 31 Dec-20) Enterprise value (EV) using Fairfax carrying value for equity is (CV 450 + debt 115) = 565 mil EV/forecast EBITDA 2022 = 2.5x EV using Fairfax market value for equity is (MV 616 + debt 115) = 731 mil EV/forecast EBITDA 2022 = 3.2x So those multiples look low but then going forward you factor in potential for further additional debt reduction in 2022 plus hedges coming off, allowing Exco to receive higher pricing - so seems reasonable to expect higher revenues & higher EBITDA in 2023. And then looking from a NAV angle, Francis's PV-10 value estimate for Exco was $1.2bil in Sep-21 or $1.085 bil after net debt and Exco appear to be aggressively expanding their proved reserves in 2021 The value of Exco’s total proved reserves increased 85%. Its reserves replacement ratio for 2021, not related to commodity price improvements, was 434% Fairfax did report a share of loss of $41 mil for Exco in 2021 (compared to $4.6 mil loss in 2020). So again we don't have data on what is driving that - D&A or one-off items?? But we do know from Prem that FCF improved in 2021 over 2020 plus they paid down $30 mil in debt.

-

no worries - I think NCIs are a smaller percentage of equity at Alleghany & Berkshire compared to Fairfax

-

Newtovalue you have to factor 1. If Fairfax controls sub it consolidates goodwill eg Recipe - if Fairfax only owned a non-controlling stake eg 5% - it would record as equity security at market value ie a tangible asset with no goodwill. 2. You have to separate goodwill belonging to common shareholders from goodwill belonging to non-controlling interests - see annual report. 3. Fairfax in last qtr reported excess of market (fair value) of non-insurance subs over their carrying value(include goodwill) - I think this one useful measure in testing whether goodwill is appropriate. Although doing discounted cash flow analysis would be key way to check.

-

Francis Chou's comment on Exco Resources from his 2021 Shareholder letter Fairfax owns 43% of Exco - based on Francis comments below, Fairfax carrying and market values look conservative IMHO 'Since it is a private company, I am not at liberty to divulge all the financial statements but what I can tell you is that my calculation of its PV-10 value was approximately US$1.2 billion based on New York Mercantile Exchange (NYMEX) forward pricing as of September 30, 2021. Its number of shares outstanding was 51,341,478. We estimate that its EBITDA for the year ending 2022 will be approximately US$225 million. Although a substantial portion of EXCO’s oil & gas production is hedged for the year 2022, we believe that EXCO can fetch much higher prices as the hedges roll off.' So my takeaway - Fairfax look to have Exco on books at forward EBITDA of 2x - and that EBITDA is substantially hedged and should increase further as those hedges come off.

-

just on this recent M&A with Y another article from Barrons on this suggesting the door could be open for a competing bid https://www.barrons.com/articles/why-the-insurer-alleghany-could-be-worth-1-000-a-share-51648754456 probably helps explain why Y shares are trading just above the bid price there are synergies with Berkshire's insurance business that probably appealed to WB https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/familiarity-similarity-driving-berkshire-s-alleghany-deal-69456428 but if you MTM Y's losses on their longer duration bond portfolio since 1 Jan, Berkshire looks to be paying more than the P/BV of 1.26x for Y although i am not certain, as I haven't sat down & pieced together rest of Y's portfolio performance since 1 Jan

-

I wonder if this to fund another substantial issuer bid/share buyback?? I guess we will have to wait & see.

-

My guess - I would say yes on both

-

-

Agreed this has been one of the most disappointing investments - mgmt execution terrible - they said in Q3 they had enough cash to get to break even, but this Fairfax loan suggests otherwise that they need more cash. I would be worried if loan was unsecured or substantially more - but at $US60 mil I can digest that - yes I don't like it but reasons below why I think they made it. 1. capital raise would be very dilutive 2. a bank/alternative lender loan would put the bank/lender in charge of FDGE as main creditor - this way it puts Fairfax at front of the line as sole secured creditor if Farmers Edge needs to go into into any business restructuring in the future then they are in a better position to dictate terms. 3. based on their cash burn, provides FDGE with around 2 yrs of cash which hopefully gets them to breakeven, however, I haven't listened to the conference call so want to wait for that in terms of their projections on future revenues and cost structure to see what they are expecting. Also I noticed Wade Barnes was left off Prem's CEO list in the Annual report - so I was not surprised with CEO resignation.

-

I did this Chart (for convenience using only the Avg US 10 yr treasury yield not considering yield curve) - shows relationship between interest rates and Fairfax's pre-tax yield - interest & dividends. One thing that struck me was that interest income appears primary driver not dividend income sources https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart https://www.fairfax.ca/financials/annual-reports

-

just thinking about impact on Fairfax bvps growth - if you take out the period 2011-2016 when they had their equity hedges on and work out compounded book value growth over 30 years (1986-2010 & then 2017-2021) you get around 22.2% CAGR excluding dividends, compared to actual 18.2% CAGR over the 36 years. And I think over 2017 to 2020 they still had some individual shorts running off.

-

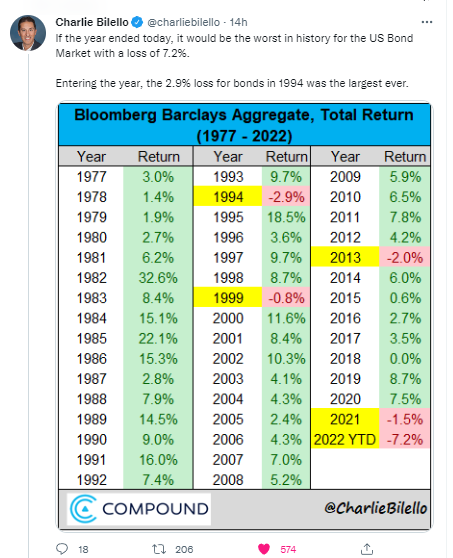

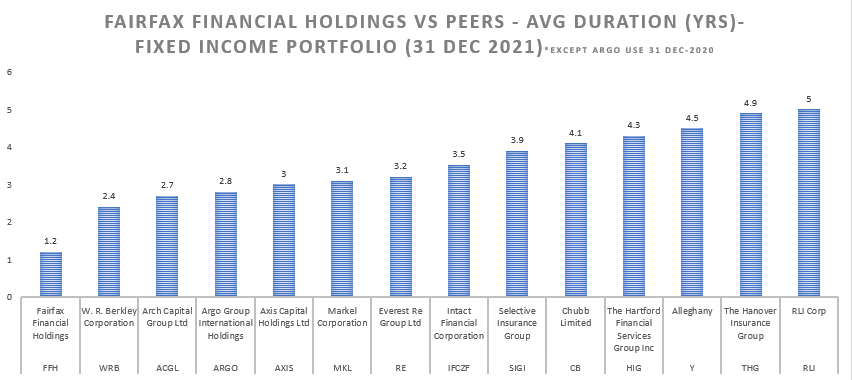

I think Markel, Berkshire, Fairfax have all said in different words over last few years that they think interest rates were too low given risks of inflation, credit risk etc. Berkshire & Fairfax are both shorter on duration in their fixed income portfolio than Markel (I couldn't find Berkshire's duration number but just looking at their balance sheet), although Markel still looks to be below the median duration level amongst peers. Markel did reduce duration from 3.3 to 3.1 yrs in 2021. Whether they are setting premium pricing, reserves or investing their portfolios, insurers have to form some type of judgement on expected levels of inflation, interest rates.

-

Berkshire acquired Alleghany at 1.26x BV https://www.cnbc.com/2022/03/21/warren-buffetts-berkshire-hathaway-agrees-to-buy-insurance-company-alleghany-for-11point6-billion.html I haven't looked into the details but my initial thoughts were WB is bullish on insurance & reinsurance space & he is prepared to pay a reasonable premium to book value

-

I was just thinking about the max dividend capacity of the insurance subs - its currently sitting at $2 bil. In 2021, they paid a dividend equal to around 27% of their 2020 dividend capacity. I just wonder given their approx 20% net premium growth rate , if that 25-30% area is what we should expect in 2022 or whether they could go for a higher dividend payment because this looks to be the primary avenue (short of FFH selling whole or part of a sub) that FFH will use to fund their share buybacks. If the hard market slows down & net premium growth rate turns into single digits, they could potentially get more aggressive on share buybacks.

-

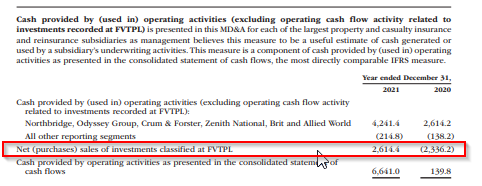

I would probably describe them as active portfolio managers - they have a mix of long-term strategic holdings & other non-strategic investments. They will be opportunistic - for example last year they were net sellers of equities & bonds & built up their cash & ST investments to 50% of their portfolio as at 31 Dec-21. I think that is just a function of them being unable to find enough value in both equity or bond markets & concern around inflation driving interest rates higher. After the stock market crash in March/April 2020, we added approximately $1.1 billion in common stocks. We have sold these positions for a gain of $620 million or 56%. During 2021, we sold $5.2 billion in corporate bonds, mainly acquired in March/April of 2020, at a yield of approximately 1%, for a gain of $253 million.

-

twocities I think the answer to your question is around how they manage liabilities/loss reserves. This is an extreme scenario but just to illustrate - in 2018, Argentina had mid 40s inflation rate, Fairfax's sub there had a CR in 120s as a result. But Fairfax I believe was able to still make a profit as it was able to invest in short-term rates at 40%. So having that flexibility by being short duration, if you believe inflation could go a lot higher can be important. I don't disagree that they should have invested more in intermediate bonds in 2018, so yes that was a missed opportunity - but at the same time we are looking in hindsight too. Fairfax have to brainstorming these 'what if' scenarios all the time & I think they will also make bets on different scenarios. Here is a good article on this subject The Inflation Specter Looms for Property/Casualty Insurers https://www.insurancejournal.com/news/national/2021/03/23/606467.htm

-

In 2018 they more than doubled their bond portfolio allocation & increased interest income 'Our interest and dividend income of $784 million was up from $559 million in 2017 as we moved from cash to 2 – 3 year treasuries and high quality corporate bonds – but we did not reach for yield!' (AR 2018) We do know that 1-3 year treasuries are yielding 100 bp more than they were at start of year. So straight away they have the play it safe, high quality, short term debt option on the table that will boost their interest income. Also we know the duration on their fixed income portfolio is 1.2 yrs at 31 Dec, so they have flexibility to redeploy their portfolio at higher rates within a short timeframe so we should see impact on interest income sooner. Plus we now have a lot more volatility in equity & credit markets, that is opening up opportunities in corporates. So I think key points here are their positioning & the fact we now have a higher rate environment that is more conducive to them increasing their interest income. There is generally a correlation between interest rates & P&C insurer P/B multiples, because lower interest rates lower interest income & contribute to lower returns on equity.

-