glider3834

Member-

Posts

960 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

@SafetyinNumbers I am just looking at this Allied World acquisition of 0.5% in Jun-23 Looks like Fairfax paid $30.6M It appears (see below) the Non-controlling interests carrying value was $27.6M - so the difference was $3M - so my take is that is P/BV of ~ 1.1x (is that right or am I missing something?)

-

For Grivalia there are clearly tailwinds in this luxury hotel traveller space in Greece so its a question of whether they can execute that to the bottom line https://news.gtp.gr/2024/03/29/luxury-hotels-in-greece-see-revenues-rise-in-h2-2023/- their One & Only hotel I believe is the most expensive hotel on Athens riviera so they are catering to a very specific traveller niche https://greekcitytimes.com/2024/03/27/grivalia-hospitality-athens-riviera/

-

https://www.reinsurancene.ws/lloyds-syndicate-ki-expands-digital-follow-capacity-with-beazley-partnership/ 'Ki’s partnership with Beazley, alongside the existing multi-year partnerships with Travelers and Aspen, and growth plans for Ki Syndicate 1618, will see Ki materially increase the follow capacity it is able to offer in 2024, the firm claimed.'

-

https://www.canadianunderwriter.ca/announcements/onlia-acquired-by-pe-firm-focused-on-canadian-pc-distribution-1004244415/

-

looks like they put most of their position on Q3'22 , Q1'23 https://www.dataroma.com/m/m_activity.php?m=FFH&typ=b not sure their avg cost but Micron was trading in a band from low 50s to low 60s - so if we assume high 50s cost & their position in MU unchanged since Q4'23, would be 2x based on AH pricing

-

Good question for AGM

-

https://www.bnnbloomberg.ca/investment-banker-turned-oil-tycoon-takes-canada-energy-patch-by-storm-1.2022426?taid=65a67416a212d8000144012c&utm_campaign=trueAnthem+Manual&utm_medium=trueAnthem&utm_source=twitter

-

interesting

-

will check this out thanks

-

I was hoping for a bit more guidance on how they are carrying BIAL & we got that from Prem in the annual letter so my understanding from this is that implied normalized free cash flow (ex Airport City) for the whole of BIAL is ~US$263M ie Equity value US$2.5B divided by 9.5x (assuming here that Prem is talking about Free Cash Flow to Equity Holders (FCFE) ie after interest payments) I am guessing by normalised they are assuming the airport is operating at 100% of capacity? Would that assumption be reasonable? I believe T2 is expected to hit that level ~ 2026 based on AERA consultation paper forecast.

-

thanks viking smaller private holding but Sporting Life/Golf town might be close to a top 30 - carrying value of US$61M (C$82M) or 4xFCF - potential market valuation?? revenues up ~50% since 2019 curious if anyone has checked out any of their team town sports stores - thoughts/feedback? https://retail-insider.com/retail-insider/2024/03/sporting-life-groups-team-town-sports-chain-expanding-national-footprint/

-

worth noting too they have assumed their Hellenic stake stays at 55.3% thru 2024-26 as part of their 2024-2026 guidance so there is potential upside if full takeover gets approved

-

https://www.livemint.com/companies/news/fairfax-india-to-invest-up-to-200-million-liquidity-support-to-iifl-finance-11709705405055.html

-

Last year agm was 20 Apr - this year 11 Apr - i wonder if that affects timing of release?

-

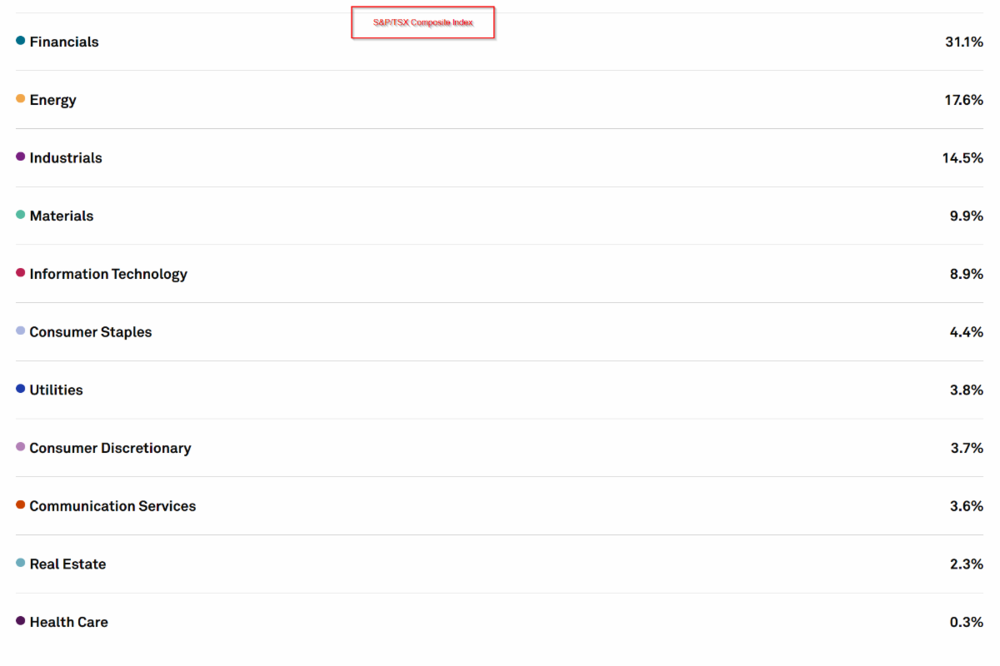

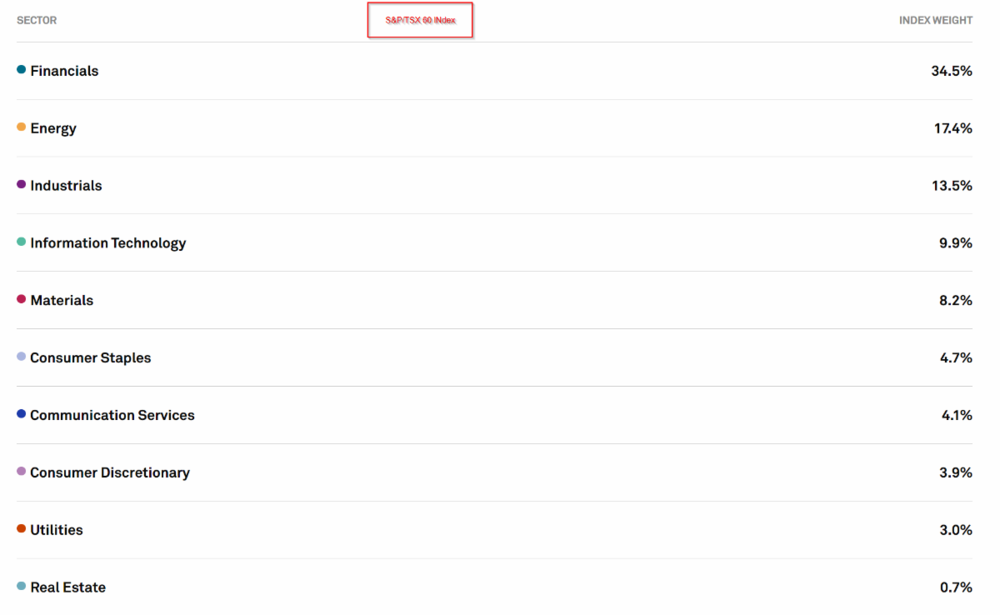

the most underweight areas in TSX60 (vs TSX composite) appear to be in real estate or materials from what I can see https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/#data https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-60-index/#data

-

-

good pick up cigarbutt cheers!

-

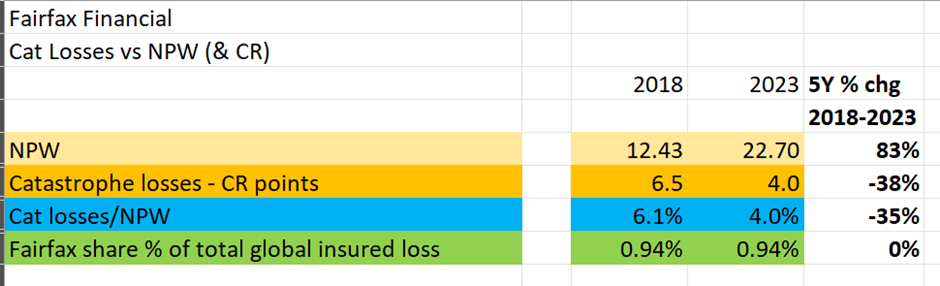

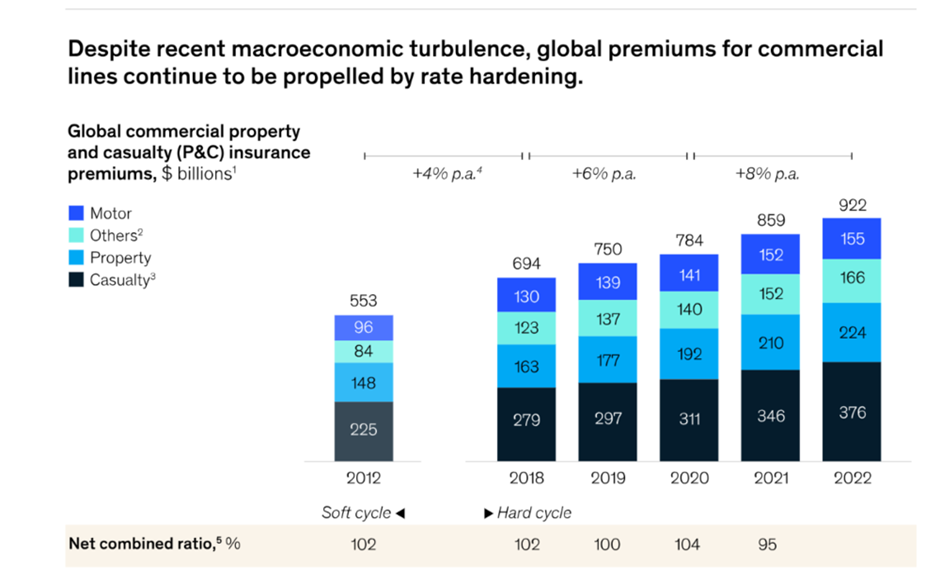

Peter Clarke did make point on a CC they are looking to grow premium while keeping their cat exposure about the same, so over time their cat loss should effectively be falling as percentage of overall net written premium and their combined ratio. And I think that is starting to show up in the numbers too, I did this table below which illustrates. Some comments on this table above. 1. Over the 2018-2023 period, Fairfax's share of global insured cat losses looks to have varied between 0.8% in 2020 to 1.0% in 2022. However, in the table above based on Munich re's estimates for global insured cat losses for 2018 & 2023, Fairfax's share of total global insured cat losses was almost the same in each year. Munich re has global insured natural cat losses at US$80B in 2018 (Fairfax share US$752M or 0.940%) https://www.reinsurancene.ws/munich-re-pegs-2018-insured-cat-losses-at-80bn-double-the-30-year-average/and US$95B in 2023 (Fairfax share US$897M or 0.944%) https://www.reuters.com/business/environment/quakes-storms-cause-95-billion-insurance-losses-2023-munich-re-2024-01-09/ 2. Fairfax's growth in net written premium over the 2018 to 2022 period was 76%. Over same period, appears that Global commercial P&C premiums grew 33%. So Fairfax appears to have more than 2x the industry growth rate, yet appears based on numbers above to have not done so by increasing cat loss exposure at same rate. https://www.mckinsey.com/industries/financial-services/our-insights/global-insurance-report-2023-expanding-commercial-p-and-cs-market-relevance 3. Just bear in mind with all above numbers & comments , these are based on Fairfax's results in last 5 years and Munich re estimates of industry cat losses. This information is useful, but of course, future loss or cat loss experience for Fairfax or Industry or both cannot be guaranteed. 4. Key point with above, we are looking at Fairfax's cat loss experience where global industry cat losses in 2 periods are not too dis-similar in size - in 2023 they were around US$95B or 19% higher than 2018 at US$80B . If global cat losses were say 50% higher in 2023 vs 2018, then cat loss impact for Fairfax in CR points is going to be much greater and cat loss/NPW ratio higher. Of course, the flipside is that with every terrible cat year comes pressure for harder insurance pricing, which if it transpires would then be likely to show up in future combined ratios. Also just a reminder -please don't rely on my numbers or comments in this post or any of my posts - always check them & do your own due diligence - my comments here are opinion and for entertainment, and this is not financial advice.

-

+1 - hopefully Eurobank can get remaining approvals to be able to offer for 100% - also Hellenic's capital ratios look decent in the 20s & NPEs have been de-risked into the low single digits - also regulators have put on hold any dividends by Hellenic pending acquisition by Eurobank ' Furthermore, despite high earning, the bank said it cannot proceed with the declaration of dividend for full year 2023 “due to regulatory restriction.” “At this moment the restriction is in place due to a series of reasons. We at this transitional phase amid a takeover which the regulators have deemed that capital should remain with the organization instead of being distributed as a dividend,” Rouvas said.' https://www.stockwatch.com.cy/en/article/trapezes/hellenic-bank-posts-highest-ever-profit-dividend-distribution-hold-due-takeover

-

https://cyprus-mail.com/2024/02/23/hellenic-bank-posts-e365-4-million-profit-for-2023-new-lending-climbs-to-e1-2-billion/

-

reported last year, but Air India are ramping up their fleet too https://www.reuters.com/business/aerospace-defense/air-india-firms-up-order-with-airbus-boeing-470-planes-2023-06-20/

-

cheers - you might want to also update with 2023 below what does the Fairfax India CR relate - I assume thats not FIH? Just with Allied, Fairfax recorded only half a year's premium in 2017 so that throws the combined ratio for 2017 and also warps the avg CR number as seasonally the cat losses are usually concentrated in 2H. In terms of CR I would look at averages in 5 year increments as well as trend in underlying CR along with qualitative info eg over last 12 mths Brit has been significantly reducing its property cat exposure

-

https://www.theinsurer.com/viewpoint/embracing-2024-allied-worlds-european-platform/ “Our growth is not just about expansion, but about strategic adaptation. I joined Allied World in 2008 and have witnessed an amazing transformation from a small team to a global force, with $6.5bn in gross written premiums, over 1,600 employees and 26 global offices.” For the European operations, the focus has been growing the teams and the business in a measured, profitable way.

-

Looking at GIG transaction again, I believe based on fair value of acquisition consideration, Fairfax is effectively paying ~ P/B 2.2x for Kipco's stake. 100% implied equity value for GIG based on below is ~US$1.63B & GIG's shareholder equity at 30 Sep-23 was ~US$742.5M, which works out to implied P/B multiple of 2.2x US$756M fair value of acquisition consideration is lower than US$860M headline number for two reasons 1. Initial US$200M upfront, cash payment is to be reduced by dividends Kipco received after 1 Jan'23. 2. Fairfax also has a payment deed for four annual instalments of US$165M (or US$660M) in aggregate which Fairfax records at its fair value ie discounted present value. At 30 Sep-23, Fairfax measured the fair value of acquisition price at US$740M - this has now increase slightly to US$756M at the time of closing. But the workings for how this US$740M is calculated is shown below & helpful.