glider3834

Member-

Posts

1,017 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

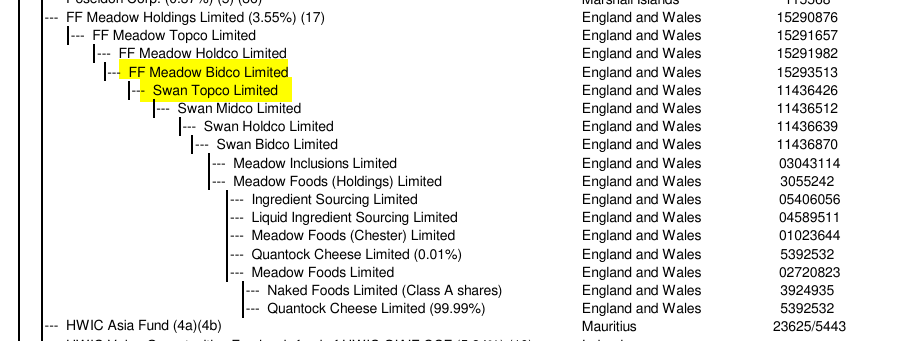

as I understand Meadow is a consolidated sub - Fairfax (via FF Meadow Bidco) bought controlling interest in Swan Topco from Exponent and Swan Topco is the controlling shareholder of underlying Meadow Foods business

-

viking assuming no changes since Dec-23, I suspect Fairfax may be carrying their AGT equity interest at nil - see Odyssey AR 2023 below

-

-

I believe Preferred divs are not deductible while interest on notes should be, so after tax cost likely cheaper with notes.

-

I think this is Seaspan ULC rather than Seaspan Corp

-

https://www.artemis.bm/news/hurricane-milton-losses-likely-below-a-5-cat-bond-market-impact-icosa-investments/ https://www.artemis.bm/news/hurricane-milton-cat-3-landfall-in-sarasota-worst-case-tampa-loss-scenarios-avoided/

-

viking yes I would expect so - a gain on consolidation - similar to Gulf Insurance transaction in the sense we are moving from equity associate to controlled sub, but we will need to wait for official confirmation from Fairfax to determine the amount of any potential consolidation gain here with Peak deal.

-

looks like Moodys insured loss estimate still to come 'In terms of insured losses, Moody’s says it remains too early to put a precise cost on the storm, but the Moody’s RMS Event Response team will be releasing an estimate in the coming weeks.' It looks like Gallagher re have upped their estimate for insured loss range to mid to high single digit billions https://www.artemis.bm/news/hurricane-helene-private-insurance-loss-seen-mid-to-high-single-digit-billions-bowen-gallagher-re/ & made these comments 'The overall economic loss is going to be well beyond $10 billion. Very limited flood insurance take-up in far inland areas is going to mean a large portion of damage will be uninsured. NFIP coverage limits (Residential: $250k structure / $100k contents + Commercial: $500k structure / $500k contents) will in many cases mean properties will not be fully insured against incurred damage. The gap between the overall direct economic cost and the portion covered by private / public insurance for Helene will be sizeable; similar to other historical flood-driven hurricane events.'

-

not sure if any salient commentary in here on Seaspan - it has a paywall https://www.tradewindsnews.com/containers/inside-seaspan-understanding-major-newbuilding-investments-and-what-comes-next/2-1-1708114

-

Hellenic share price now up to 3.84 euros which is closer to TBV - not sure what Eurobank is going to do from here with remaining minority shareholders - Eurobank stake in Hellenic has more than doubled from their cost base - mkt value ~0.89B euro (~US$1B)

-

TS Francine - new one to watch https://www.statesman.com/story/weather/hurricane/2024/09/08/nhc-hurricane-tracker-path-texas-spaghetti-models-hurricane-season-2024-tropical-storm-francine/75132485007/

-

just on reserving topic - I thought what Brit have said below from 1H24 report was interesting - they build in a net risk adjustment amount that sits above their best estimate. Ultimately they have to decide what percentile they want to set their reserves at ie what margin of safety they want to build in to their reserving.

-

-

future results may deviate the past but Northbridge had lower cat losses in combined ratio (CR) % points than Intact & Definity in 2022 & 2023. Having said that, we will have to wait for Fairfax's Q3 results to know how Northbridge has been impacted. Intact Canada P&C C$ 14.9 (cat loss 2023 7.5 CR pts; 2022 4.1 CR pts) Definity C $ 4.0 (cat loss 2023 6.2 CR pts; 2022 3.7 CR pts) Northbridge C$ 3.2 (cat loss 2023 1 CR pts; 2022 2 CR pts) * Fairfax rounded out the CR pts in the ARs

-

thanks petec

-

I don't know much about this one but I think @petec mentioned this one previously - it looks like it has come to life a bit this year but a small holding

-

-

looks like FFH's own of Eurobank has crept up to 34.5% due to share cancellation - that matches their % share of dividend below https://www.eurobankholdings.gr/en/grafeio-tupou/etairiki-anakoinosi-06-08-24 On July 31, 2024 Eurobank paid a dividend of approximately $370 million (€342 million). The company’s share of that dividend was approximately $128 million (€118 million), which will be recorded in the company’s consolidated financial reporting in the third quarter of 2024 as a reduction of Eurobank’s carrying value under the equity method of accounting.

-

https://www.business-standard.com/companies/news/no-investments-in-adani-firms-sebi-chair-not-involved-in-fund-s-ops-iifl-124081100293_1.html

-

looks like largely due to these new builds gross contracted cash flows are up to $23.4B at Q2 from $18.8B at Q1

-

https://www.sec.gov/Archives/edgar/data/1794846/000162828024036286/atlascorpq220246-k.htm 'In June 2024, the Company entered into shipbuilding contracts for the construction of 27 newbuild containership vessels, ranging between 9,000 and 17,000 TEU. Four of these contracts were immediately novated to a customer. 13 of these contracts were thereafter novated to certain nominees and upon delivery, these 13 newbuilds will be chartered by the Company from such nominees under bareboat charters. The vessels will be delivered between 2027 through 2028 and each vessel will commence a long term charter upon delivery.'

-

- unfortunately there is a paywall https://www.tradewindsnews.com/containers/seaspan-orders-27-container-ships-in-major-multi-billion-return-to-newbuilding-arena/2-1-1690516

-

historically Sleep Country's business is seasonal with higher % of revenues/earnings typically earned in Q3 & Q4 - PE 16.9x based on TTM EPS & see below https://www.bnnbloomberg.ca/business/2024/07/29/sleep-country-holders-mull-fairfaxs-offer-as-stock-rises-above-it/ 'Analysts are forecasting the company to earn $2.09 per share on an adjusted basis this year, which would be about 26% lower than two years ago, according to data compiled by Bloomberg. Profitability is expected to recover to $2.90 per share by 2026 as the economy and housing gain momentum.'

-

https://www.thestar.com/business/sleep-country-earnings-rise-as-direct-to-consumer-brands-help-buffer-softer-spending/article_6c9e8dbc-f16d-587a-b4b0-99dc40230440.html

-

they have indirect own ~ $7M of BRK via via Chou Associates Fund but yep its not material