glider3834

Member-

Posts

980 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

-

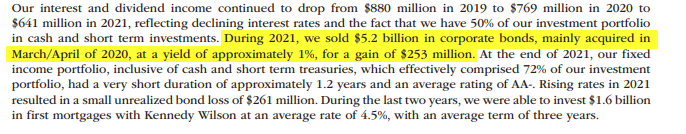

as well as treasuries, US corporate bond market is starting to look more interesting - effective yield at 5% (was around 2.5% at start of 2022) 'The Bloomberg US Corporate Bond Index of investment-grade securities now has a yield of around 4.95%, close to the highest since 2009.' https://www.washingtonpost.com/business/hot-corporate-bond-market-puts-buyers-strike-on-ice/2022/09/13/0737bc34-3354-11ed-a0d6-415299bfebd5_story.html

-

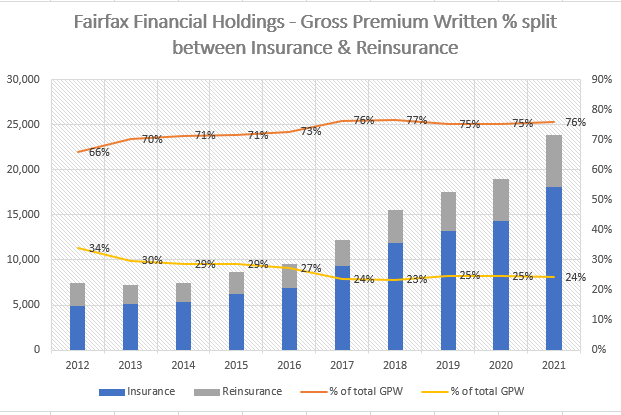

'Climate, conflict and capital are coalescing to create a “tipping point” for the reinsurance market, with 2022 mid-year renewals seeing rate increases hit their highest levels since 2006, according to a new report by international insurance broker Howden.' https://www.insurancebusinessmag.com/au/news/breaking-news/reinsurance-market-coming-close-to-a-tipping-point--report-419762.aspx I did this chart below - for the last 10 years, Fairfax has tripled gross premiums written (GPW) but at same time prioritised insurance over reinsurance with reinsurance share of total gross premium falling from 34% to 24% (& if you include non-consolidated insurers like GIG or Digit that write principally insurance, this gross premium split would skew further toward insurance) Peter Clarke on Q2'22 call - comment suggesting more rate pressure in reinsurance Peter Clarke I think the only thing I'd add is we're still getting rate and we're still getting fairly good rates, like 7.5%. So that's going to drive growth alone. And then different lines of business are increasing still DNO, VNO for example, in the US has stabilized. But property CAT, a lot of raise, a lot of capacity there. And a lot of opportunity. So we're seeing a little bit more on the reinsurance side, less on the insurance side, but I think we'll see -- we'll still see strong growth in the next six months.

-

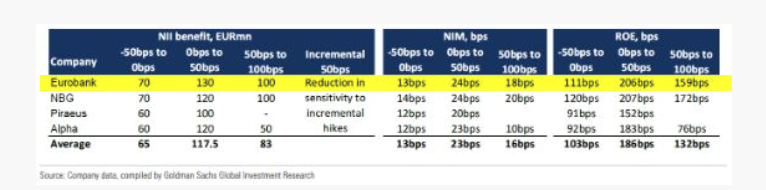

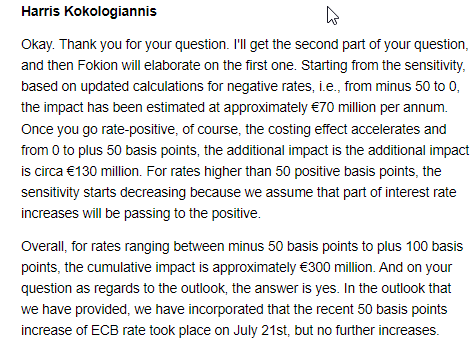

Based on GS research, impact of ECB rate increases on Eurobank (below) - the recent 0.75% increase by ECB is not in the raised guidance for 2022 provided by Eurobank after 1H results. So should have positive impact.

-

agreed - I think we are looking for an answer that can only be known over time but I would look at Andy Barnard's track record at Odyssey & Fairfax's track record on reserving over the last 10 years as well under Andy's watch. Also inflation continues to surprise to the upside you would expect interest rates to respond & Fairfax's short duration positioning means they can reinvest at higher yields. Whether we get to ROE target via underwriting or investment 'engine' doesn't really matter - @Cigarbutt if you are subtracting your projected ROE due to lower underwriting result due to higher inflation, then I think we should also add to projected ROE via higher interest/investment income. Fairfax has for last number of years been concerned about higher inflation, is it a reasonable expectation that they would also be building that into their reserving? Bearing in mind inflation is just one variable in the reserving process. Just a final one, paid losses ratio (actual payments on on claims/net earned premium) - this is a stat that WR Berkley has raised on their last two conference calls. This is worth monitoring. It has been trending down for last 5 years (ie higher percentage of their loss expenses are provisions versus actual payouts) as WRB & FFH both cautious on impact on their loss picks from economic/social inflation& due back log in court system due to covid. So we know they are sandbagging their loss reserves, whether these prove redundant or not will only be known over time.

-

Cheers! @petec

-

@petec I was curious to know your thoughts given your experiences - do you think that technology will be able meaningfully reduce labour cost in restaurants over next 3-5 yrs? And will larger restaurant chains have a scale advantage in implementing tech solutions? I am thinking about a bit about the Recipe transaction but also about the industry generally. From my own customer experience at a restaurant recently (not at a Recipe restaurant) - I used a barcode to scan the menu, ordered my food & paid for order on a mobile phone. Then the waitress brought my food when it was ready (but I guess a phone notification to pick up my food could have also worked). So I can see where staffing can be reduced and its come about partly due to contactless solutions developed during covid. I also read Recipe are looking at tech solutions including developing food automation solutions https://www.prnewswire.com/news-releases/gastronomous-technologies-awarded-1-9m-in-partnership-with-canadian-food-innovation-network-recipe-unlimited-and-sodexo-canada-limited-301563794.html implemented a customer data platform for marketing https://www.prnewswire.com/news-releases/recipe-unlimited-implements-mparticle-as-customer-data-infrastructure-for-restaurant-portfolio-301612364.html

-

I would frame that Holdco cash position in context of the dividend paying capacity of subs, the transactions announced in '22 and the operating performance of insurance business. Also check out S&P Upgrades Fairfax Operating Subsidiaries to ‘A’; Outlook Stable https://www.insurancejournal.com/news/international/2022/06/01/669854.htm

-

-

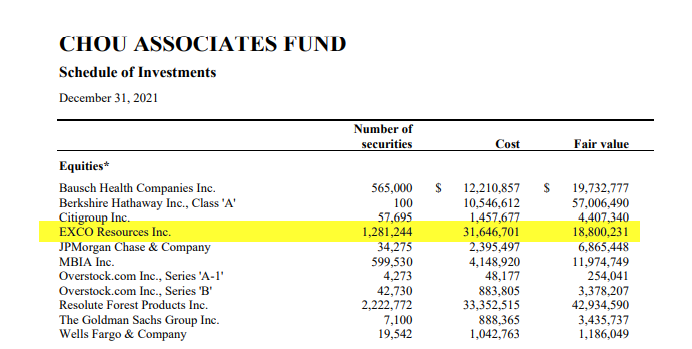

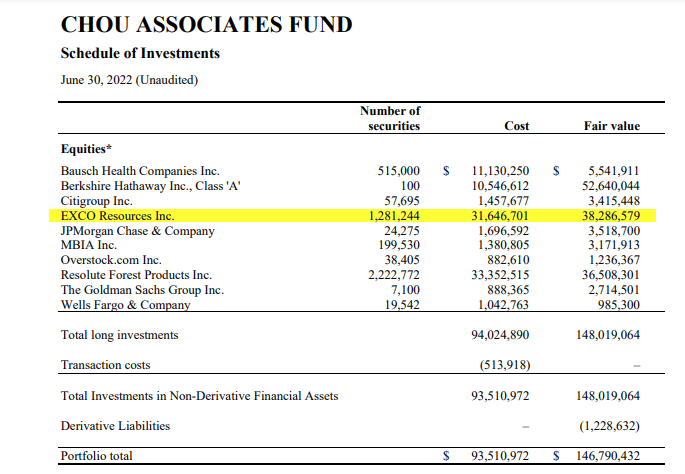

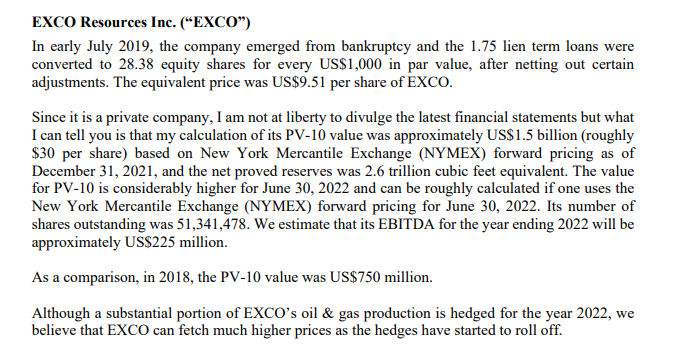

Chou Associates Fund have increased the valuation of their Exco shares by 100% over 6mths to 30 Jun-22 Using their 30 Jun-22 valuation of approx USD 23.16 per share (note CAD figures below) x 51.34 mil shares outstanding for Exco gets you to USD$1.19B valuation - implies Fairfax 43.3% stake worth approx USD 515 mil

-

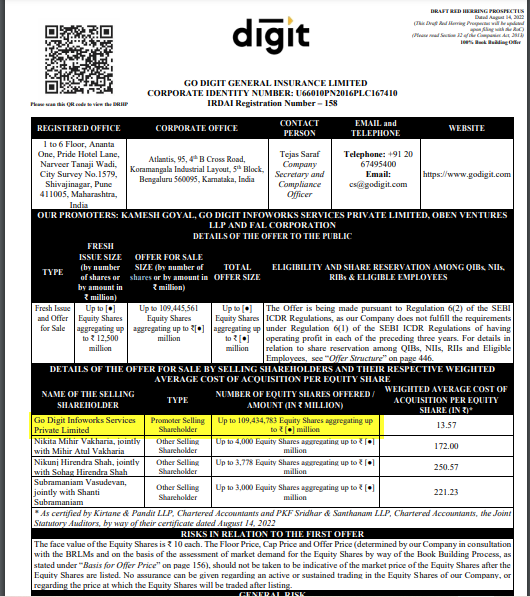

https://www.reuters.com/business/finance/indias-axis-bank-eyes-10-stake-go-digit-life-insurance-business-sources-2022-08-30/

-

yes - from prospectus looks like Fairfax are continuing to engage with IRDAI on this issue - so we will see what happens. I think IRDAI concern is if there is conversion, Go Digit Infoworks becomes a subsidiary of Fairfax Asia (FAL). Go Digit Infoworks is a promoter of Digit Insurance, and an 'Indian promoter' under IRDAI regs can be a company but not a subsidiary. Having said that, it appears an 'Indian promoter' can be an LLP. This 'subsidiary' issue came up with Poonwalla controlled PFL, the promoter of Magma HDI General Insurance. The controlling shareholder of PFL got around this IRDAI reg by selling shares in the underlying insurer, Magma, to an LLP controlled by Poonwallas. https://www.business-standard.com/content/press-releases-ani/proposed-divestment-of-stake-in-magma-hdi-general-insurance-121110300487_1.html I am not sure if Fairfax could use this or another corp reorg strategy? By my estimates, these convertible preferreds could be converted to a 37% equity interest in Go Digit Infoworks or an indirect 32% economic interest in Digit - so if Fairfax doesn't convert them, this is an asset that can be sold to a third party who could & possibly this could be another option. Also I was thinking whether it would be possible for Go Digit Infoworks to use the listed price (fair value) of Digit to sell its Digit shares to FAL. FAL could in turn sell its convertible preferred shares back to Go Digit - so FAL would then have its Go Digit Infoworks Stake plus direct ownership in Digit Insurance. So maybe this could be a way for Fairfax to become controlling shareholder of Digit Insurance?? Go Digit Infoworks are selling up to 109 mil shares in this IPO , it will be interesting to see how these proceeds are used.

-

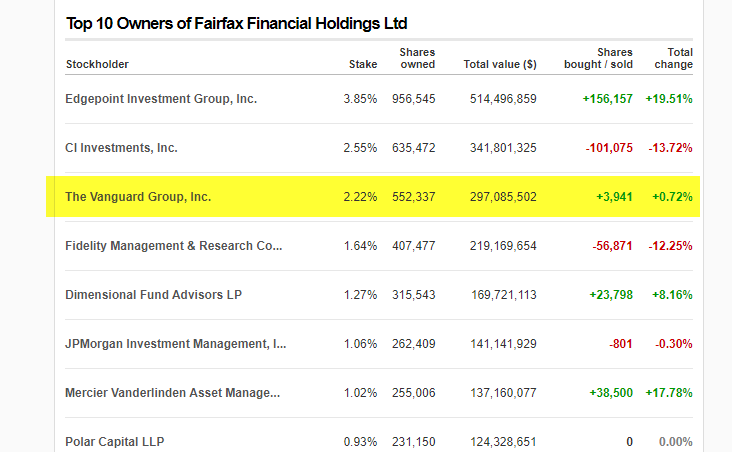

ok - not sure about Vanguard but IB does

-

ok - are you talking about the FRFHF - OTC US listed shares? I would assume a US investor with a Vanguard personal account could still buy Canadian stocks including TSX listed ie FFH.TO , or am I wrong?

-

-

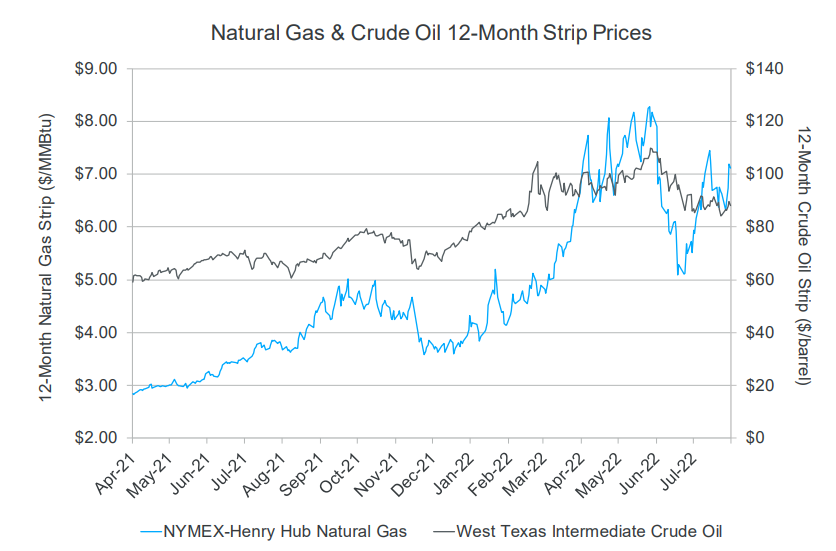

nwoodman I don't have current financials but we expect most of their hedges roll off in 2022 & they can lock in future production at higher price levels based on 12-month avg strip prices (futures) for crude oil & natural gas which have had a decent move up (see below). So pricing is looking constructive for 2023 revenues, if they can get their production volume up as well that could give them more revenue upside. https://assets.engieimpact.com/ENGIE-Impact-Market-Watch-8-16-2022.pdf?mtime=20220816144946&focal=none&utm_source=Programs+Marketing+1&utm_medium=email&utm_campaign=7013c000001ofvDAAQ

-

M&A in Oil & Gas space (might be useful to compare to Exco resources) https://worldoil.com/news/2022/8/10/devon-energy-to-spend-1-8-billion-to-buy-validus-energy-expand-in-eagle-ford/

-

viking I think they increased the CV when they exercised the warrants, so at Jun-22 the CV (excl Riverstone) is $1336 If deal goes ahead, Fairfax exchanges their Atlas shares at the merger price for BidCo shares.

-

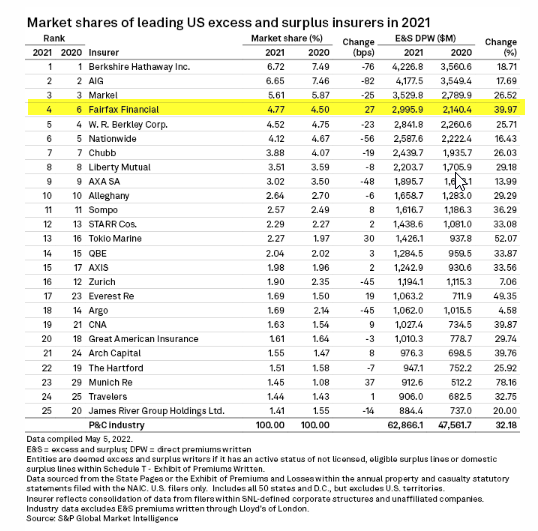

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/most-top-e-s-insurers-see-market-shares-decline-in-2021-premiums-rise-yoy-70287307

-

My view earnings are tied to ROE, so tied to rate of BV growth & what BV multiple you would apply. I think if you look at insurers that have higher P/B values, generally speaking they are focused in specialty insurance/E&S & as a result they tend to have lower combined ratios (than their peers). Higher underwriting profit combined with decent investment returns has allowed these insurers to generate decent operating earnings along with higher ROE/growth in BV. Two examples of specialty focused insurers I can think of would be RLI P/B 3.7x approx (adjusting for Maui Jim sale) & WR Berkley P/B 2.8x. During this hard market, Fairfax has been growing out its US E&S business - in fact it has close to doubled its market share in the last 5 years - from #11 in 2016 with 2.4% market share Up to #4 in 2021 with 4.7% market share - its E&S DPW has quadrupled over that time. If you look at how Fairfax's underlying combined ratio has trended in recent years, it has been trending down & Fairfax's insurance operating earnings trending up. Both favourable trends IMHO when we think about what BV multiple to use.

-

Here is the Digit IPO Draft Prospectus lodged today https://www.axiscapital.co.in/uploads/equity_documents/dhrp/go-digit-general-insurance-limited.pdf In Apr-22, Go Digit Infoworks (through which Fairfax owns its stake) had approx 729 mil shares out of total of 838 mil shares in Digit. The draft prospectus has Go Digit Infoworks proposing to sell up 109 mil shares. (These amounts could change - its just a draft!) https://www.reuters.com/markets/deals/fairfax-backed-digit-insurance-files-draft-papers-india-ipo- 2022-08-16/

-

13F new additions BAC 80mil OXY 52 mil https://www.sec.gov/edgar/browse/?CIK=915191&owner=exclude

-

https://www.albawaba.com/business/pr/gulf-insurance-group-announces-net-profit-kd-15-million-us-489-million-27-growth-first

-

https://www.cnbctv18.com/business/companies/fairfax-backed-go-digit-insurance-to-file-ipo-drhp-this-week-say-sources-14470762.htm No prospectus filed yet - but its worth keeping an eye on

-

Fairfax are paying around 126 mil priority dividend on co-investors investment of 1584 mil = 8% dividend (vs interest on notes of 5.63% - so saving here) But then the question is what will the buyout price be?