glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

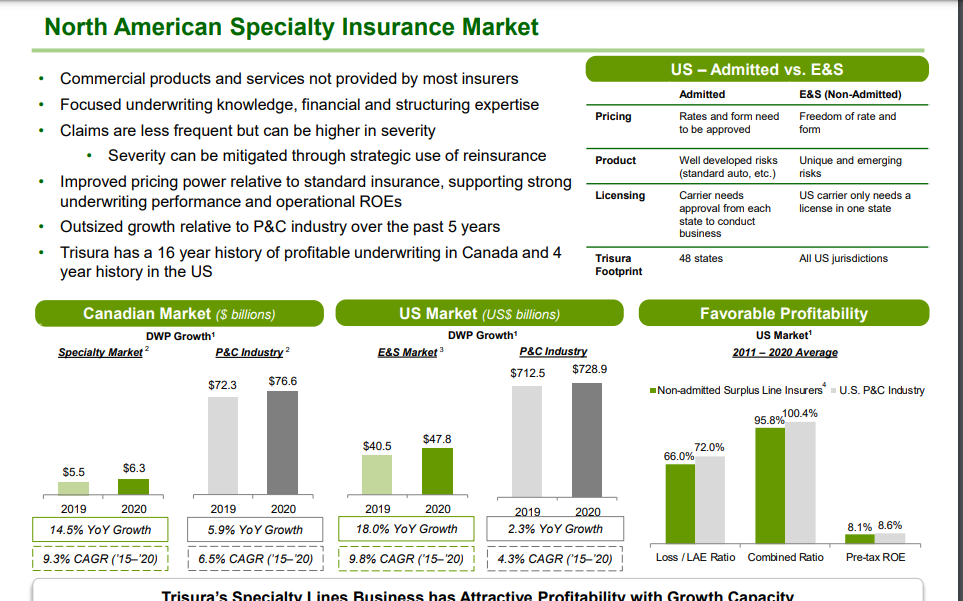

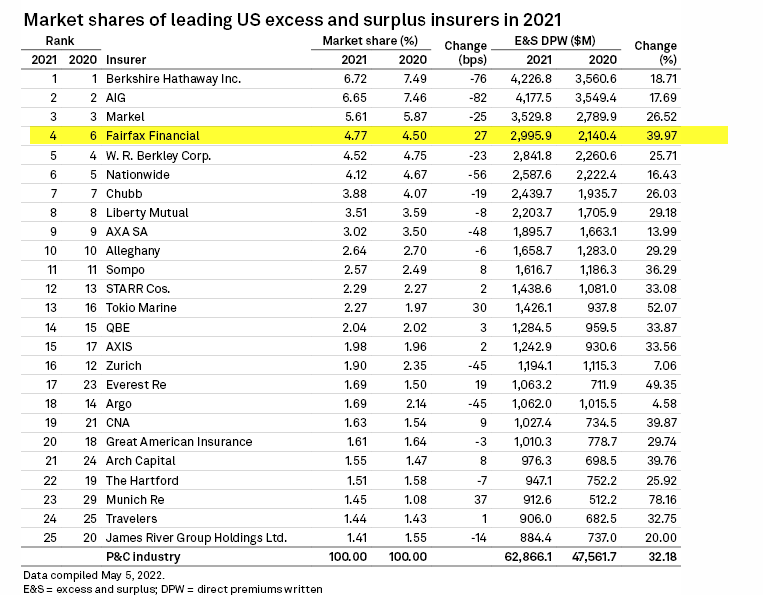

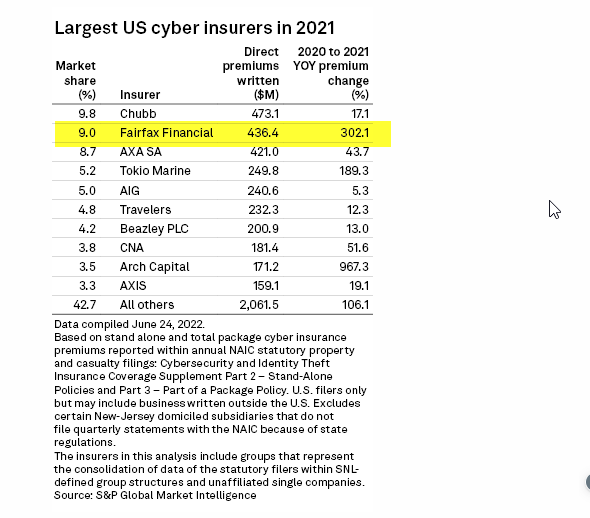

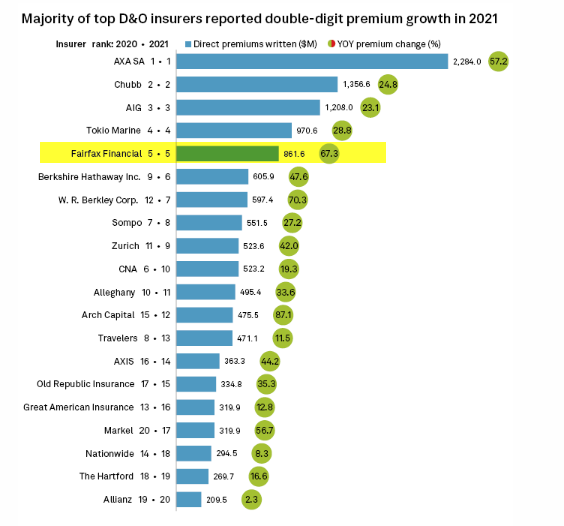

thanks viking - great summary - its interesting also where they are growing - one key area is specialty/E&S. E&S is harder to do so more specialised, less competitive & more profitable (lower CR) than standard lines. Trisura actually put up a nice summary comparing E&S(specialty market) to standard marketplace & why they are attracted to this space Fairfax has grown to be the #4 E&S (Specialty marketplace) writer in US One of the fastest sub-sector areas in insurance is cyber insurance & with rates hardening here a lot in high double digits, Fairfax has been putting emphasis on growth here - #2 US writer behind Chubb https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/insurers-revisit-cyber-coverage-as-demand-premiums-spike-70880071 #5 US writer in Directors & Officers Liability - again this market was supported by significant rate growth https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/d-o-premiums-grow-38-5-in-2021-loss-ratio-falls-to-multiyear-low-70106981

-

The investment environment & insurance cycle are inter-related because regulatory capital ultimately affect what business an insurer is permitted to write. I think hard market has also been affected by - low interest rates (were too low, depressed fixed income returns forced insurers to raise premiums) - higher inflation - social inflation (court judgement award amounts - trending up over time) & economic/financial inflation (impacts reserving/claim costs) - large natural catastrophe losses (elevated in last few years - climate change etc increasing in terms of size and severity - also factor in covid)

-

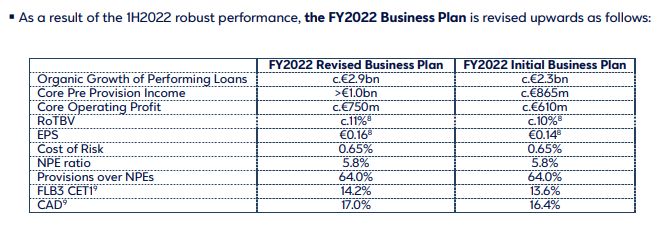

Just had a quick look at Eurobank results also released today - they are executing well - 2022 forecasts for loan growth, operating profit & EPS have been revised up - despite the challenging environment in Europe, Greece looks to be doing better with 4% GDP growth - tourism breaking records this year https://www.eurobankholdings.gr/-/media/holding/omilos/grafeio-tupou/etairikes-anakoinoseis/2022/2q-2022/2q2022-results-pr-en.pdf

-

still looking at Q2 result - heaps of moving parts but just tallying transactions coming up & MTM bonds (& not factoring in Stelco) after -tax impact estimate Pet insur/JAB 975 Bonds MTM reversal 805 estimate (965 pre-tax) (assuming bonds held to maturity) Digit gain 400 Resolute gain 150 (180 pre-tax) total $ 2.33 bil (just under $100 per share)

-

I was listening to WRB earnings call for Q2 - highly worth a listen - Rob Berkley highlighted how WRB's paid loss ratio (this is a hard number as its what an insurer has actually paid on claims) is in a falling trend - WRB are being cautious as there are still delays due to covid in court system, inflation trends etc, but it also is one data point that could suggest WRB is potentially giving themselves extra cushion on loss reserves that could potentially lead to redundancies later on if those loss picks prove too conservative - but again only time will tell! 'Loss ratio is the losses an insurer incurs due to paid claims as a percentage of premiums earned.' Investopedia One other piece on the loss ratio, and I think I shared this with all last quarter. And for us, it's just one of many data points that we pay attention to, and perhaps, it's of interest to you all and that's the paid loss ratio. From our perspective, it is an important data point. It's not the whole story, but an important data point. So here's a little bit of historical perspective for you again on Q2. And I'm going to give you what the paid loss ratio was going back to 2017 for Q2, that creates as much of an apples-to-apples basis as we can, at least using shorthand. So the paid loss ratio Q2 in '17 was a 55.9. In '18, it was a 58.3. In '19, it was a 53.8. In 2020, it was 52.9. In '21, it was a 44.3. And in '22, it was 41.9. So obviously, an attractive trend. Doesn't necessarily tell the whole story. But again, from our perspective, a meaningful data point and an encouraging indicator. I looked at the paid loss ratio for Fairfax looking at 1Q results over 2017 to 2022 and this is also in a falling trend (again try to avoid mistakes but please do your dd) - worth continuing to track this data point

-

this is interesting - it sounds like Fairfax are looking to create two new insurance company start ups in India raising their own capital. You have applied to the IRDAI for life insurance and reinsurance licences. What is the plan for those verticals? Right now the focus is to get through the licensing process. Life insurance and reinsurance will function as separate companies. Once we are successful in securing the licences, we will have talks on further plans. Both the new companies will have to raise funds separately, they will have their own management teams.

-

https://www.moneycontrol.com/news/business/startup/will-assess-timing-of-ipo-based-on-market-conditions-digit-insurance-chairman-kamesh-goyal-8881791.html

-

you can track here https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_List.aspx?DF=MBFN&mid=3.2.8 but it looks like data not loading - they might be having issues

-

good points Twocities I would just add point that was made at Fairfax's AGM that a lot of these infrastructure assets have been developed by govt over decades but are not well managed (my take - that would be reflected in the sale price).

-

Fairfax Financial Holdings Limited, a significant stockholder of Resolute, has entered into a voting and support agreement to vote its shares in favor of the transaction. As of July 5, 2022, Fairfax Financial Holdings held approximately 30,548,190 shares, or 40% of the outstanding shares as of that date.

-

Around 40%

-

Resolute Forest takeover https://www.bloomberg.com/news/articles/2022-07-06/paper-excellence-to-buy-resolute-forest-for-1-6-billion#xj4y7vzkg

-

Article on Kyle Shaw at ShawKwei https://theceomagazine.com/executive-interviews/finance-banking/kyle-shaw

-

viking I think they will separate out the pet insurance business as asset held for sale at its carrying amount in Q2 results. And the gain on sale would be reported when transaction is closed. Once we have the carrying amount, we can work out what the gain should look like. Cheers

-

Bangalore International Airport - May-22 passenger traffic now at 85% of May-19 levels https://www.aai.aero/en/business-opportunities/aai-traffic-news

-

Odyssey paid $900 mil div to Holdco in 2021 after the 10% sale transaction, but only had a $362 mil div capacity at end of 2020 - so I think that div capacity number potentially can change

-

no worries SJ these business units sit inside C&F's Accident & Health (A&H) division. FFH owns 100% of C&F. The full details of transaction are not available yet but assuming proceeds went to C&F then I guess subject to meeting regs around divs & capital requirements, potentially they could dividend to holdco.

-

this is interesting - looks like Fairfax is selling its pet insurance business for $1.4 bil WASHINGTON and TORONTO, June 20, 2022 (GLOBE NEWSWIRE) -- JAB Holding Company (“JAB”) and Fairfax Financial Holdings Limited (“Fairfax”) (TSX: FFH and FFH.U) today announced a transformational strategic partnership, in which JAB’s pet insurance business has agreed to acquire all of Fairfax’s interests in the Crum & Forster Pet Insurance Group™ (“C&F Pet”) and Pethealth Inc., including all of their worldwide operations. As part of the transaction, Fairfax will also make a $200 million1 investment in JCP V, JAB’s latest consumer fund. As a result of the transaction, in which Fairfax will receive $1.4 billion in the form of $1.15 billion cash and $250 million in seller notes, JAB’s combined global pet insurance and ecosystem platform will be estimated to have gross written premiums and pet health services revenues of well over $1.2 billion by 2023, insuring more than 2.1 million pets. https://www.kulr8.com/news/money/jab-s-pet-insurance-business-to-acquire-global-pet-insurance-operations-of-fairfax-financial/article_1a5ce79b-9f63-598e-bc0a-16401efb451c.html I can't get behind the Bloomberg paywall but here is another article https://www.bloomberg.com/news/articles/2022-06-20/jab-is-said-to-buy-fairfax-stakes-in-pethealth-crum-forster

-

https://www.hindustantimes.com/cities/bengaluru-news/bengaluru-airport-recognised-as-best-in-india-south-asia-101655461485551.html

-

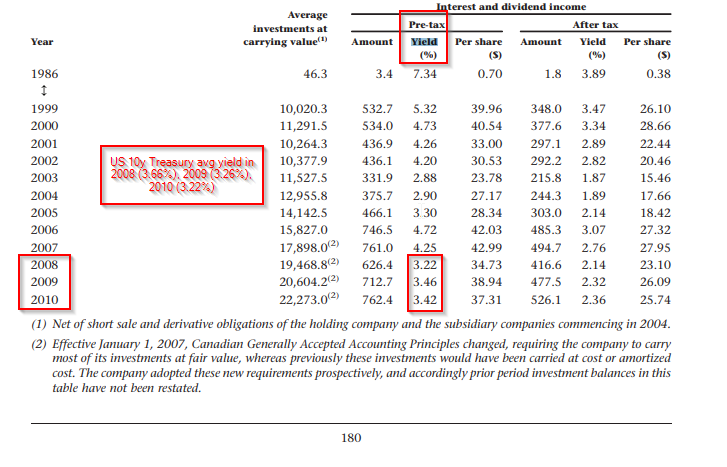

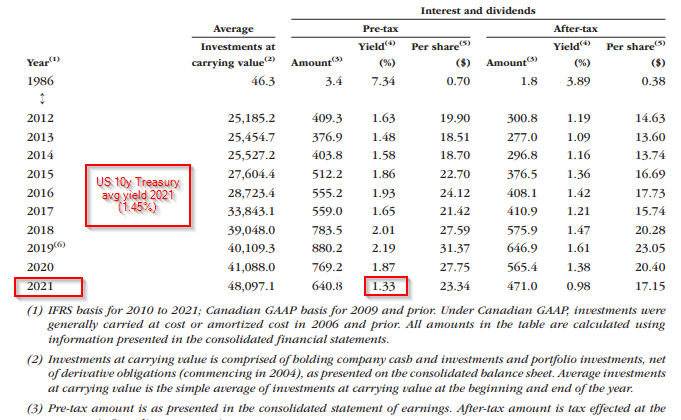

guys I decided to delete my post re interest & dividend income (pre-tax yield) forecast to wait for more clarity on how Fairfax develop their fixed income portfolio positioning. From a pre-tax yield perspective - twin drivers of higher treasury rates and higher credit spreads are both positive drivers going forward. But to model what the new pre-tax yield will look like, we need to see in particular how their fixed income positioning develops - in particular end of 2021 they had roughly 50% cash & ST maturities and 20% bonds mix. So if we assume corp bonds, mortgages etc become more attractive & they move to a 25% cash & ST maturities & 45% bond mix for example, that could have a big positive impact on pre-tax yield.

-

https://www.newindianexpress.com/cities/bengaluru/2022/jun/16/wait-is-over-modi-to-inauguratekempegowda-international-airport-terminal-2-in-october-2466118.html date to be confirmed but looks like October opening for T2 aka the 'garden terminal'

-

Yes really good point - US BBB Corporate effective yields have increased around 300bp from low 2% area in 2021 to low 5% area today- Fairfax in 2008 & 2009 had a 40-50% ish allocation to bonds & currently they are sitting around half of that level. QT has just started & there is potential for this to pressure credit spreads further.

-

Twocities yes agree they have been investing at shorter end of the curve - i just picked the US10y to show how it has tended to sit close to ffh pre-tax yield over time

-

Yes how high will interest rates go is the big question - at what point do rates start to cause problems in economy the big assumption with the above we have treasury rates (10y) sitting in 3% area - but is that sustainable, will the Fed be forced to reverse course at some point & could it come back down in a recession ???