glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

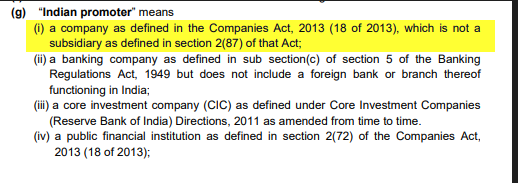

IRDAI has proposed new 2022 regulations (13/10) https://www.irdai.gov.in/admincms/cms/whatsNew_Layout.aspx?page=PageNo4834&flag=1 & they include changing the 'Indian Promoter' definition removing this requirement that a Company cannot be a subsidiary. If these are implemented as proposed, then I think it would allow Fairfax to get over this issue described above & be able to convert its convertible preferred shares to take control of Digit & recognise any MTM gain where applicable. 2022 exposure draft original 2000 regs

-

I found this https://greekvalueinvestingcentre.com/wp-content/uploads/2022/10/1.George-Chryssikos-The_Grivalia_Story-1.pdf

-

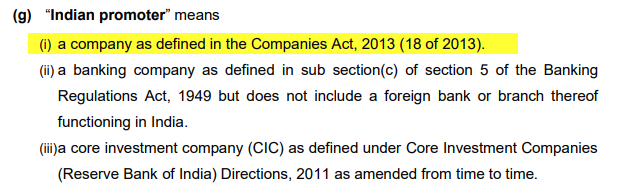

Would be good to get some more info on Grivalia Hospitality On July 5, 2022 the company increased its interest in Grivalia Hospitality S.A. ("Grivalia Hospitality") to 78.4% from 33.5% by acquiring additional shares for cash consideration of $194.6 million (€190.0 million). The company will commence consolidating Grivalia Hospitality in the third quarter of 2022. Grivalia Hospitality acquires, develops and manages hospitality real estate in Greece, Cyprus and Panama. Fairfax picked up an additional 45% stake that would value the equity at USD 430 mil approx I saw this article below that suggests a valuation for the portfolio when these luxury hotels are completed - could there be NAV upside? It is unclear what the cost to complete & capital position will be - we just don't have enough data here. 'Today the company's portfolio (Amanzoe, One&Only Aesthesis in Asteria Glyfadas, ON Residence, Avantmar in Paros, etc.) includes ultra-luxury tourism projects with a value exceeding 510 million euros and when those under development are completed, this value will exceeds 1.1 billion euros.' https://www.moneyreview.gr/business-and-finance/business/91384/oloklirothike-i-metafora-edras-tis-grivalia-hospitality-stin-ellada/

-

is this an opinion or are you referencing data/stats?

-

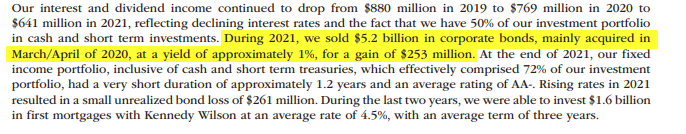

And then you have IG corporates at 6.4%, Mortgages over 7% and High yield debt 9.5% https://www.marketwatch.com/story/you-can-be-invested-in-fixed-income-again-bond-investors-say-even-before-the-fed-stops-hiking-rates-11666219818 Lets assume that rates are starting to peak & Fairfax wants to capture this higher rate upside but doesn't want to wait until all of its portfolio matures - do you think that Fairfax could use derivative strategy to capture these higher rates before they potentially start to roll the portfolio over into these higher yielding bonds - to effectively lock in some of these higher yields - can it be done - any thoughts?

-

IDBI reported in news that prem & fairfax potentially interested - i am not sure if Fairfax india are in bidding process but that might impact buyback

-

Buffett/Berkshire - general news

glider3834 replied to fareastwarriors's topic in Berkshire Hathaway

also from the same article 'Nevertheless, analysts concluded that losses will almost certainly sustain “very significant” property-catastrophe reinsurance rate increases in 2023, despite being subject to change.' https://www.reinsurancene.ws/hurricane-ian-a-very-expensive-earnings-event-says-kbw/ -

I thought this article was interesting “Credit spreads are too tight, they are not adequately reflecting the risk of recession. Other models that we use, whether it’s the yield curve or the macro-economic hard data are more bearish,” said Matthew Mish, head of credit strategy at UBS, adding that at some point “these need to converge.” https://www.reuters.com/markets/us/credit-markets-see-less-risk-recession-earnings-may-challenge-that-2022-09-23/

-

this could be another reason too - Fairfax has sold most of its IIFL Wealth stake to comply with SEBI rules https://economictimes.indiatimes.com/markets/stocks/news/sebi-lens-on-fairfax-for-alleged-breach-of-crossholding-norms/articleshow/93866786.cms?from=mdr

-

cheers nwoodman, looks like a similar issue to RBL - they settled with SEBI - had to pay a fine - then were able to IPO https://www.business-standard.com/article/markets/sebi-settles-rbl-bank-s-case-through-consent-mechanism-116060101708_1.html

-

unconfirmed at this stage but there are press reports suggesting Fairchem stake is being shopped https://www.livemint.com/companies/news/fairfax-india-to-exit-fairchem-organics-11663267206298.html

-

-

as well as treasuries, US corporate bond market is starting to look more interesting - effective yield at 5% (was around 2.5% at start of 2022) 'The Bloomberg US Corporate Bond Index of investment-grade securities now has a yield of around 4.95%, close to the highest since 2009.' https://www.washingtonpost.com/business/hot-corporate-bond-market-puts-buyers-strike-on-ice/2022/09/13/0737bc34-3354-11ed-a0d6-415299bfebd5_story.html

-

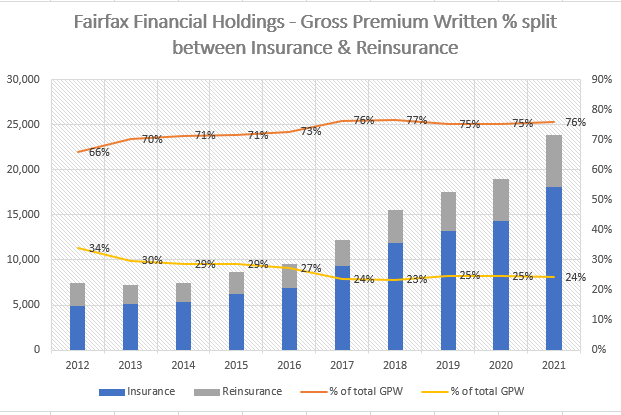

'Climate, conflict and capital are coalescing to create a “tipping point” for the reinsurance market, with 2022 mid-year renewals seeing rate increases hit their highest levels since 2006, according to a new report by international insurance broker Howden.' https://www.insurancebusinessmag.com/au/news/breaking-news/reinsurance-market-coming-close-to-a-tipping-point--report-419762.aspx I did this chart below - for the last 10 years, Fairfax has tripled gross premiums written (GPW) but at same time prioritised insurance over reinsurance with reinsurance share of total gross premium falling from 34% to 24% (& if you include non-consolidated insurers like GIG or Digit that write principally insurance, this gross premium split would skew further toward insurance) Peter Clarke on Q2'22 call - comment suggesting more rate pressure in reinsurance Peter Clarke I think the only thing I'd add is we're still getting rate and we're still getting fairly good rates, like 7.5%. So that's going to drive growth alone. And then different lines of business are increasing still DNO, VNO for example, in the US has stabilized. But property CAT, a lot of raise, a lot of capacity there. And a lot of opportunity. So we're seeing a little bit more on the reinsurance side, less on the insurance side, but I think we'll see -- we'll still see strong growth in the next six months.

-

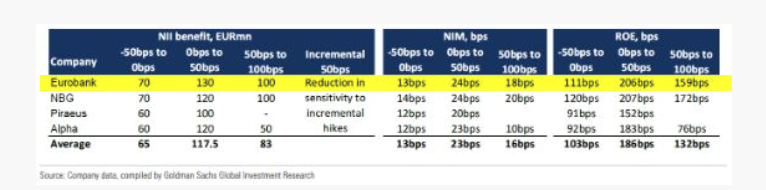

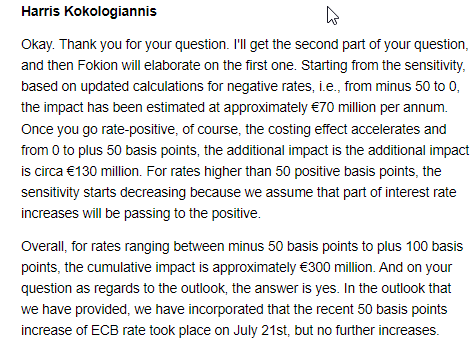

Based on GS research, impact of ECB rate increases on Eurobank (below) - the recent 0.75% increase by ECB is not in the raised guidance for 2022 provided by Eurobank after 1H results. So should have positive impact.

-

agreed - I think we are looking for an answer that can only be known over time but I would look at Andy Barnard's track record at Odyssey & Fairfax's track record on reserving over the last 10 years as well under Andy's watch. Also inflation continues to surprise to the upside you would expect interest rates to respond & Fairfax's short duration positioning means they can reinvest at higher yields. Whether we get to ROE target via underwriting or investment 'engine' doesn't really matter - @Cigarbutt if you are subtracting your projected ROE due to lower underwriting result due to higher inflation, then I think we should also add to projected ROE via higher interest/investment income. Fairfax has for last number of years been concerned about higher inflation, is it a reasonable expectation that they would also be building that into their reserving? Bearing in mind inflation is just one variable in the reserving process. Just a final one, paid losses ratio (actual payments on on claims/net earned premium) - this is a stat that WR Berkley has raised on their last two conference calls. This is worth monitoring. It has been trending down for last 5 years (ie higher percentage of their loss expenses are provisions versus actual payouts) as WRB & FFH both cautious on impact on their loss picks from economic/social inflation& due back log in court system due to covid. So we know they are sandbagging their loss reserves, whether these prove redundant or not will only be known over time.

-

Cheers! @petec

-

@petec I was curious to know your thoughts given your experiences - do you think that technology will be able meaningfully reduce labour cost in restaurants over next 3-5 yrs? And will larger restaurant chains have a scale advantage in implementing tech solutions? I am thinking about a bit about the Recipe transaction but also about the industry generally. From my own customer experience at a restaurant recently (not at a Recipe restaurant) - I used a barcode to scan the menu, ordered my food & paid for order on a mobile phone. Then the waitress brought my food when it was ready (but I guess a phone notification to pick up my food could have also worked). So I can see where staffing can be reduced and its come about partly due to contactless solutions developed during covid. I also read Recipe are looking at tech solutions including developing food automation solutions https://www.prnewswire.com/news-releases/gastronomous-technologies-awarded-1-9m-in-partnership-with-canadian-food-innovation-network-recipe-unlimited-and-sodexo-canada-limited-301563794.html implemented a customer data platform for marketing https://www.prnewswire.com/news-releases/recipe-unlimited-implements-mparticle-as-customer-data-infrastructure-for-restaurant-portfolio-301612364.html

-

I would frame that Holdco cash position in context of the dividend paying capacity of subs, the transactions announced in '22 and the operating performance of insurance business. Also check out S&P Upgrades Fairfax Operating Subsidiaries to ‘A’; Outlook Stable https://www.insurancejournal.com/news/international/2022/06/01/669854.htm

-

-

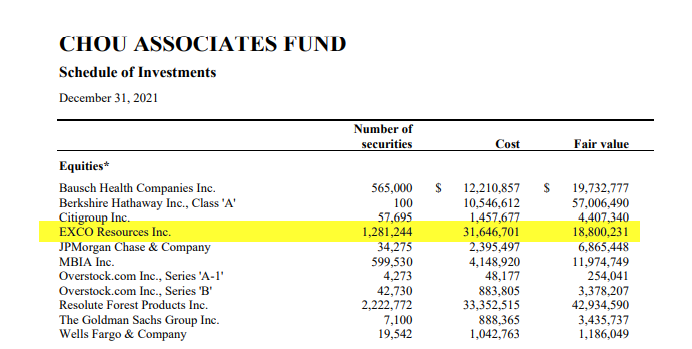

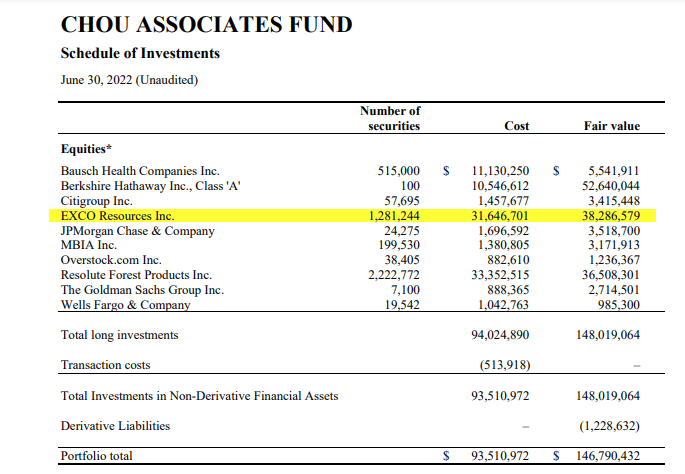

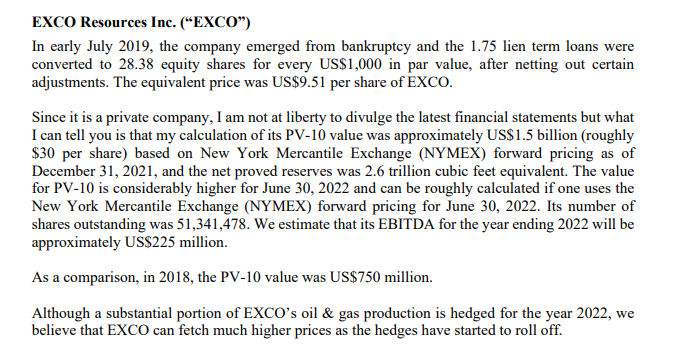

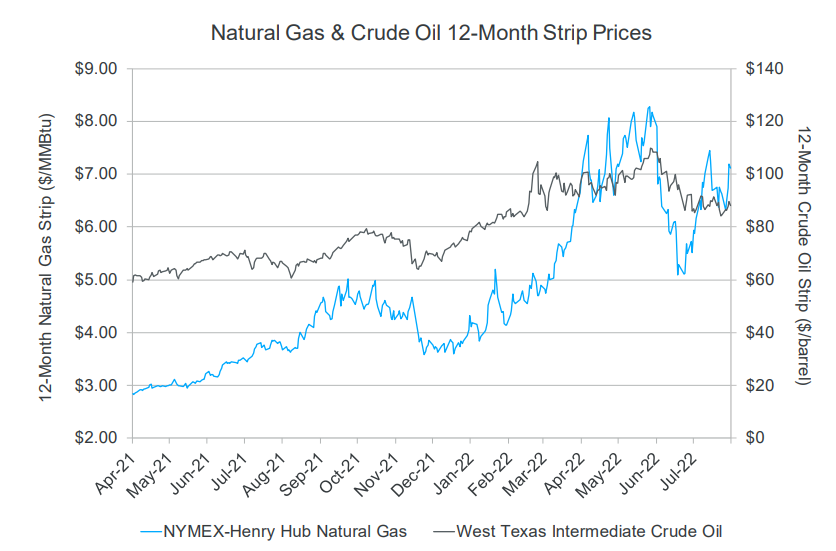

Chou Associates Fund have increased the valuation of their Exco shares by 100% over 6mths to 30 Jun-22 Using their 30 Jun-22 valuation of approx USD 23.16 per share (note CAD figures below) x 51.34 mil shares outstanding for Exco gets you to USD$1.19B valuation - implies Fairfax 43.3% stake worth approx USD 515 mil

-

https://www.reuters.com/business/finance/indias-axis-bank-eyes-10-stake-go-digit-life-insurance-business-sources-2022-08-30/

-

yes - from prospectus looks like Fairfax are continuing to engage with IRDAI on this issue - so we will see what happens. I think IRDAI concern is if there is conversion, Go Digit Infoworks becomes a subsidiary of Fairfax Asia (FAL). Go Digit Infoworks is a promoter of Digit Insurance, and an 'Indian promoter' under IRDAI regs can be a company but not a subsidiary. Having said that, it appears an 'Indian promoter' can be an LLP. This 'subsidiary' issue came up with Poonwalla controlled PFL, the promoter of Magma HDI General Insurance. The controlling shareholder of PFL got around this IRDAI reg by selling shares in the underlying insurer, Magma, to an LLP controlled by Poonwallas. https://www.business-standard.com/content/press-releases-ani/proposed-divestment-of-stake-in-magma-hdi-general-insurance-121110300487_1.html I am not sure if Fairfax could use this or another corp reorg strategy? By my estimates, these convertible preferreds could be converted to a 37% equity interest in Go Digit Infoworks or an indirect 32% economic interest in Digit - so if Fairfax doesn't convert them, this is an asset that can be sold to a third party who could & possibly this could be another option. Also I was thinking whether it would be possible for Go Digit Infoworks to use the listed price (fair value) of Digit to sell its Digit shares to FAL. FAL could in turn sell its convertible preferred shares back to Go Digit - so FAL would then have its Go Digit Infoworks Stake plus direct ownership in Digit Insurance. So maybe this could be a way for Fairfax to become controlling shareholder of Digit Insurance?? Go Digit Infoworks are selling up to 109 mil shares in this IPO , it will be interesting to see how these proceeds are used.