glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

article on the Keg https://www.richmond-news.com/hospitality-marketing-tourism/dine-out-vancouvers-business-bump-helps-wary-restaurant-owners-6500823 'Fairfax Financial fully owns the Keg restaurant chain thanks to it buying Recipe Unlimited Corp. in a deal that closed in October. "These days you're inundated with cautious news," Aisenstat said. "There's inflation, interest rates – all that stuff. If you're looking for something to be nervous about, in the restaurant business it's pretty easy to find it, but so far nothing [bad] has materialized, really. Fall was great. January is better than we would have expected." Aisenstat said things are also going very well at other restaurants, where he has ownership stakes.'

-

So if Q4 report shows more of the same - basically continuing a high quality bond/credit allocation but still pushing duration out more - US & CAN treasuries at 2 yrs etc - that won't surprise me. They have been doing some high yield deals too https://www.lse.co.uk/news/duke-royalty-upgrades-credit-facility-to-gbp100-million-until-2028-qdy9ut7qebkhk5b.html

-

SJ good points. My thought in 2023 was with a recession, they could start to transition from a short duration Treasury position to investing more in corporates at higher spreads, but its interesting corp spread over treasuries has been tightening over last 4 mths https://www.barrons.com/articles/high-quality-bonds-defaults-junk-51674769295

-

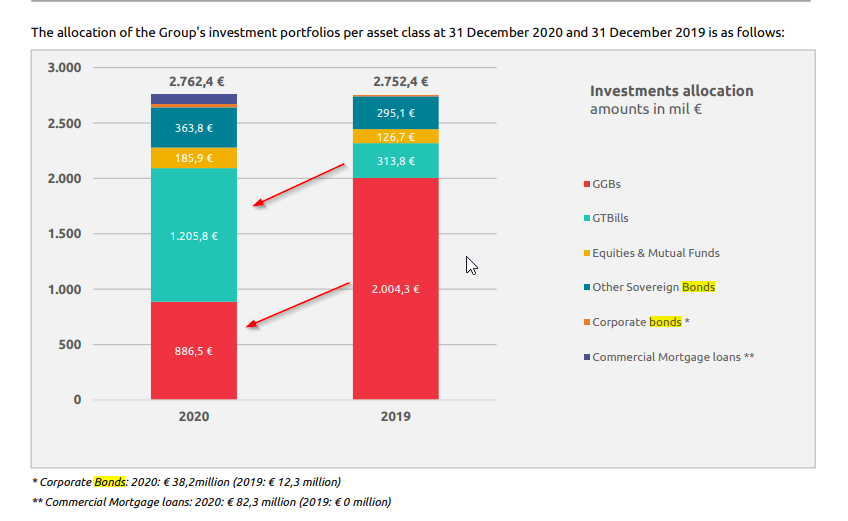

SJ I would agree in terms of being conservative as an investor & thinking about BV impact, assume they hold to maturity & those unrealised losses will reverse. At same time, we know HWIC are very active, value, bond managers who focus on total return ie investment gains not just yield eg When Greek bond yields went from 8% to 1%, they realised gains over 300mil euro over 2019-2021 - selling Greek Govt bonds & re-distributing into Greek T Bills etc. That one investment move has probably driven a big chunk their return on Eurolife FFH investment. IMHO I think there is 'alpha' in Fairfax's fixed income investment team that should be factored into their P/B multiple. Hamblin Watsa's 5,10 & 15 years record versus benchmark was last published in 2017 (see below) , so I am hoping there might be an update in the 2022 annual return.

-

Fairfax recently raised its position in Mytilineos - MYTIL.AT - on fully converted basis they will have around 9.2M shares = approx $230M position https://www.mytilineos.gr/news/company-news/fairfax-becomes-the-2nd-largest-shareholder-in-mytilineos/ And their reported results look decent https://www.ekathimerini.com/economy/1190127/mytilineos-sees-net-profit-turnover-more-than-double/

-

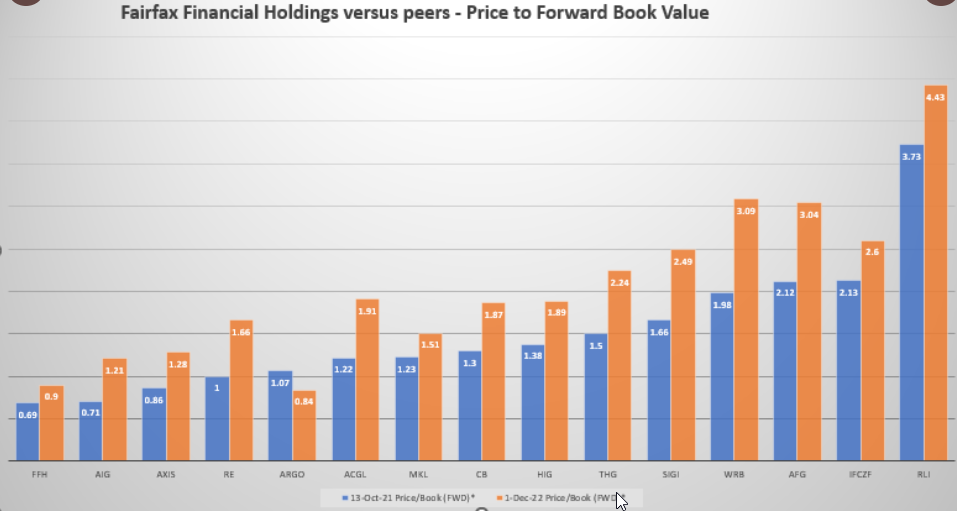

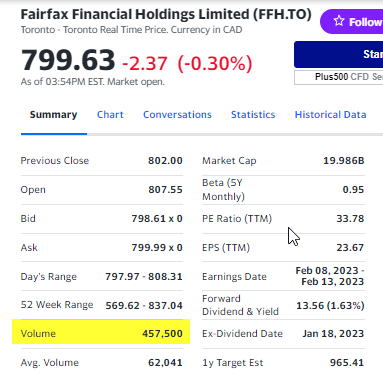

I did this chart benchmarking FFH against peers using seekingalpha data but please do your own due diligence - it was done 1 Dec-22 so bit outdated but it shows how P/B multiples have expanded likely due to interest rates - FFH's peer group median P/B was 1.8x. FFH's P/B was 0.9x at the time but probably closer to 1.0x now. BRK's p/b looks to be around 1.5x. I think the challenge for BRK in terms of forward ROE is just BRK's sheer size. A 1% increase in BVPS for Fairfax is 155M & for Berkshire its around 4.6B. Berkshire size means fewer investment options to pick from that can move the needle which impacts ROE potential.

-

that makes sense cheers!

-

thanks @SafetyinNumbers thats interesting - so potentially there is a broker &/or counterparties out there with 1.96M shares of FFH. I looked at substantial shareholder filings - I couldn't see any disclosure for this quantity of shares - I wonder if they need to disclose if the beneficial interest in the TRS effectively lies with FFH not with the broker. Another thought, a risk with a TRS would be that if there is an increase in interest rates, the receiver (Fairfax) of the swap has to pay much higher interest payments to the total return payer. But when you think about it, higher interest rates benefit insurers through higher interest income & even more so insurers (like Fairfax) that are short duration on their fixed income portfolio. And higher interest income also increases probability of higher share price so TRS appreciates. So Fairfax's strategy of short duration fixed income portfolio to benefit from higher rates plus the TRS swap are actually working hand in hand - Fairfax essentially was minimising interest rate risk on this TRS & in fact seeking to capitalise on higher rates. And if interest rates had stayed really low, Fairfax would have had to pay little to hold the TRS.

-

yes @SafetyinNumbers if you could layout how these things are usually structured that would be great because details from Fairfax are limited - Peter Clarke said they have renewed for a few years, it sounds like there are renewal clauses built in - but what if the counterparty effectively short wants to exit - would the IB then just look for other investors who are interested in replacing them? Another related question is if there are 1.96M shares sitting somewhere as part of this swap, can Fairfax in closing swap make some sort of repurchase agreement with counterparty perhaps for a partial buyback equal to their gains on the swap? or is the whole thing synthetic with no shares involved? Apologies if my questions sound stupid.

-

Yes agree I think the role has shifted from Investment focus to Insurance business focus & I would say the optimisation of Fairfax's insurance businesses has been a focus over the last 12 mths given Ambridge & C&F pet sales as examples - I think Peter Clarke has actuarial background & is go to person on conference calls on any questions relating to insurance business. So I think the role has a central focus being Strategy for Insurance business but also with a 'seat' at the Investment Committee as every decision in Fairfax needs to be considered first & foremost looking at its impact on the insurance business. Peter Clarke looks to be bridging both the investment team & the insurance operations. These profit centres also facilitate transparency when Andy Barnard and Peter Clarke monitor the insurance operations. We now have a small investment committee consisting of Roger Lace, Brian Bradstreet, Wade Burton, Lawrence Chin, Chandran Ratnaswami, Quinn McLean, Peter Clarke and me that reviews large investments, asset mix, regulatory requirements and performance

-

https://www.reinsurancene.ws/storm-elliott-to-have-limited-impact-on-lloyds-syndicates-argenta/

-

cheers good pick up Ambridge Partners LLC, our New York based MGA, generated $420.8m of premium for Brit (2020: Ambridge and BGSU combined: $317.5m). This reflects the increase in corporate transactional activity which was impacted in 2020 COVID-19 and other factors such as Brexit uncertainty. The remodelled BGSU portfolio, now rebranded Ambridge Specialty Casualty and Ambridge Re

-

Looks like they bought original 50% stake for $28.6M - so $75.2M original cost On December 9, 2015 Brit completed the acquisition of a 50% ownership interest in Ambridge Partners for $28.6.

-

Fairfax Top 10 Events of the Year - Driving Shareholder Value

glider3834 replied to Viking's topic in Fairfax Financial

Cheers viking - you too! Yes i was surprised it was $2B as well - i think that strategic shift to protect their Bal Sheet by adopting a high cash/ST invest weighting strategy ala Berkshire really set them up in 2022 and hopefully in 2023 to play offense. -

https://cyprus-mail.com/2022/12/30/greek-eurobank-further-increases-its-stake-in-hellenic-bank/ Assuming regulatory approvals given, Eurobank stake will be 29.2%, if it decides to move to 30% or above it could launch a takeover of Hellenic.

-

Fairfax Top 10 Events of the Year - Driving Shareholder Value

glider3834 replied to Viking's topic in Fairfax Financial

thanks viking - you have done an awesome job putting this together! Happy New Years! -

+1 Blackberry i think we can pop in the bottom drawer - i do think Ivy is very interesting and worth following developments there - check out this Moodys podcast from 14min mark which explains how OEMs could threaten incumbent auto insurers or end up as distribution partners with their access to vehicle data and customers https://www.moodys.com/web/en/us/about/insights/podcasts/moodys-talks-focus-on-finance.html Another related article https://www.carriermanagement.com/news/2022/03/10/233728.htm

-

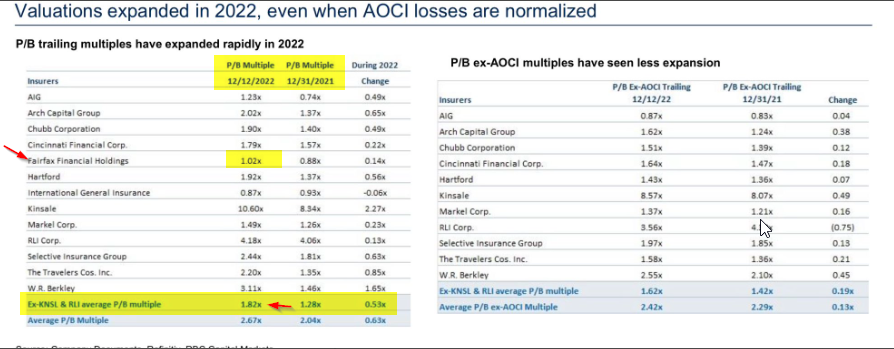

thanks viking you have made this point but it is something I wanted to just comment on I think that analysts place more emphasis on Operating income (underwriting profit & interest/dividend income & non-insurance income) than they do on Investment gains (realised or unrealised) because operating income is seen as a more predictable. So to the extent Operating income becomes a bigger component of Fairfax's earnings - we could say the earnings become more predictable/consistent or higher quality & so based on this factor (all else being equal) it would make sense to put higher P/B multiple or P/E multiple on those earnings (compared to earnings are coming principally from investment gains) IMHO earnings power of the business has transitioned meaningfully - we have gone from a business that I thought could do 12% ROE (that gets me to P/B of 1.1 to 1.2) 12 mths ago, to a business that could do ROE for 2023 closer to 15% with a significant Operating Income component in that Net income number , which IMHO takes the target P/B higher. (Aside: I am curious if we view Fairfax's fixed income management as significantly better than their peers who have lost 20-30% or more of their BV this year, should we ascribe some further premium to the P/B multiple - I believe we should) For 2023, I see the most significant opportunity in 2023 is reinsurance which could see record UWP assuming normalised cat activity & the biggest risk in 2023 I see is inflation impacting reserving - Fairfax's commercial, non-admitted business gives it flexibility to price ahead of inflation/cost trends but nevertheless remains a risk Again above comments just my opinion, please always do your own due diligence ...

-

Have a great Christmas and New Years

-

fun fact - the new 'Glass Onion' release in Netflix was filmed at Amanzoe resort owned by Grivalia https://www.housebeautiful.com/lifestyle/entertainment/a42268845/glass-onion-knives-out-2-filming-locations/ https://www.aman.com/resorts/amanzoe/accommodation/villas/villa-20

-

But can we make the argument that the baseline has moved up over the last 12 mths peer group avg P/B multiple has expanded from 1.2 to 1.8x (adj to remove RLI & KNSL) (however, less expansion with ex AOCI multiple to 1.6x)

-

S+B: How does the future look? MYTILINEOS: We completed 2021 with record-high profitability and used it to prepare for the transition to higher levels of financial performance and value creation for our shareholders in the following years. In a year full of significant challenges, we demonstrated our capability to adapt in difficult conditions, with good planning and hard work, and will continue to do so in the years to come. I think 2022 and 2023 are going to be record years for us. Our Renewables and Storage business unit is doing well, and prevailing trends are in its favor. In the metallurgy sector, we have enjoyed bumper years, and that’s part of a ten-year cycle. And in power and gas, we are establishing ourselves as the number one private utility in Greece, as our major investments in power and renewables are now maturing and starting to pay back. Considering all of this makes me very hopeful for the next two years. https://www.strategy-business.com/article/Powering-the-net-zero-transition-at-Greeces-Mytilineos

-

https://www.mytilineos.gr/news/company-news/fairfax-becomes-the-2nd-largest-shareholder-in-mytilineos/ MYTILINEOS: MYTILINEOS S.A. is a leading Greek industry active in Metallurgy, Power & Gas, Renewables & Storage and Sustainable Engineering Solutions. Established in Greece in 1990, the company is listed on the Athens Exchange, has a consolidated turnover of €4.5 billion (9M 2022) and employs directly or indirectly more than 4,820 people in Greece and abroad.

-

I think this section from AR 2021 report is relevant to this discussion - Fairfax have limits on amount of cat exposure risk by entity & for the group with the aim of limiting company wide cat loss exposure to not exceed one-year's pre tax normalised earnings One risk management tool Fairfax use to limit exposure is retrocessional cover - after Ida in 2021, Brit was very close to triggering group protection under its multi-year retrocessional cover ( reinsurance for reinsurers). Despite the significant impacts of catastrophes, Clarke said that, “At Brit, they didn’t get any benefit from their cat reinsurance program,” during the third-quarter. But Brit’s aggregate reinsurance protection is now close to coming into play, after impacts from events throughout 2021. Clarke explained, “Basically, as of now, their aggregate cat losses for the year are just coming up to the retention of their cover. “So the good news is any further, any further development or losses in the fourth quarter will be minimal for Brit.” https://www.artemis.bm/news/no-reinsurance-recoveries-for-brit-but-aggregate-deductible-almost-eroded/ Another point, with Fairfax's underlying CR around 89, assuming no favourable development, they could sustain around $2.2B In cat losses in one year & still break even on underwriting. Just a final thought, as we move into 2023 reinsurance and retro markets https://www.artemis.bm/news/retrocession-quoting-scarce-with-60-100-rate-increases-demanded/ are already undergoing a significant spiking in rates & tightening in terms, all bets could be off if we got some sort of Ian size cat event or larger!