glider3834

Member-

Posts

1,017 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

https://www.reuters.com/markets/europe/greeces-eurobank-posts-big-jump-2022-profit-2023-03-09/

-

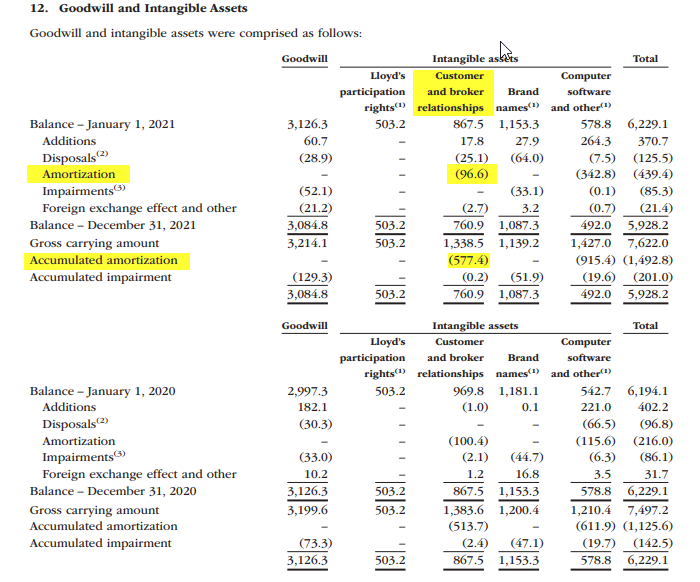

Something I just picked up from Markel's Q4 results 'While these measures, considered independently of other factors, fall below our internal targets, we remain confident in the strong operating performance of our businesses. In addition, we give consideration to the following information in assessing our compound annual growth in book value per common share: Amortization expense - As we grow through acquisitions, our intangible assets grow. GAAP requires that we amortize a portion of these acquired intangible assets, which is a non-cash charge to net income. Amortization of acquired intangible assets for the five-year period ended December 31, 2022 totaled $763.2 million.' In 2021, Fairfax recorded an approx $97M non-cash amortization expense for customer & broker relationships. It has averaged around $100M for FFH over the last 4 years. This expense is largely included in corporate overhead & other and related to acquisitions of Allied World & Crum & Forster 'Conversely, the concept of recording charges against other intangibles, such as customer relationships, arises from purchase-accounting rules and clearly does not reflect economic reality.' ( Buffett) Given the significant growth in their insurance/reinsurance subs since acquisition, I think there is a strong case to argue this expense doesn't reflect economic reality or true 'owner earnings'. If we add back this expense for last 6 years (2016-21) , FFH's book value would increase by around US$500M and pre-tax earnings by around US$100M per year. Since 2009 to 2021, the total accumulated non-cash amortization expense for customer & broker relationships is US$577M. Cheers

-

Eurobank have agreed to sell their Serbian banking business Eurobank Direktna - I think boils down to they didn't have enough scale in Serbia - they own 70% should receive b/w 195-200M euro - ‘The sale was made at a premium , if it is calculated that it values the Serbian bank almost at its book value with a P/V of 0.98, i.e. higher than not only Greek, but even European banks trading at an average P/V of around 0.90.’ https://seenews.com/news/serbias-aik-banka-to-acquire-eurobank-direktna-for-280-mln-euro-816461 - 'The sale came as the Serbian bank had a small share of around 5.5%-6% in the local market and thus its size was a hindrance in an attempt to make Eurobank a strategic player in the market.' https://www.pagenews.gr/2023/03/04/nea-agoras/eurobank-giati-poulise-ti-thygatriki-sti-serbia-ta-epomena-bimata/ - according to Eurobank - this bank was not meeting their RoTBV target threshold 'is in line with Eurobank's strategy to direct capital to investments with higher return prospects (RoTBV) and further strengthen its presence in the main markets in which it operates, specifically in Greece, Bulgaria and Cyprus.' https://www.insider.gr/epiheiriseis/265761/eurobank-desmeytiki-symfonia-me-aik-banka-beograd-gia-tin-polisi-tis - will add 0.5 % point to Eurobank's CET1 capital ratio so on paper based on media reports above, looks like another decent capital allocation move

-

RFP transaction has closed https://resolutefp.mediaroom.com/2023-03-01-Paper-Excellence-Welcomes-Resolute-Into-Its-Family-of-Companies

-

not me lol but looks like now Mr Market is in weighing mode - also they have mooted a potential dividend in 2023 - lets see what happens

-

from an investment return perspective it will be better than a double - with total return they collect share price appreciation plus the dividend - I am not sure what their interest cost is(LIBOR/reference rate + spread) but lets say around 7% p.a to keep it the TRS open - the return could be 5-6x bagger over that 2 plus year time frame - again just speculating hopefully Prem will provide their all in cost

-

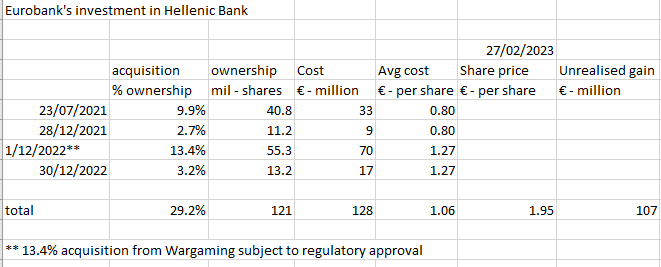

yes definitely - Hellenic Bank's mkt cap is around €800M & Hellenic expect pre-tax profit to exceed €200M in 2023 - so its trading at say 4x pre-tax profit but Eurobank look to have paid around 2.2x 2023 pre-tax profit

-

EUROB.AT - Eurobank look to have picked up around €107M or 83% return on their Hellenic Bank investment in just over 18 mths , assuming 13.4% acquisition approved

-

thanks for your work viking non-insurance ops - I think the AR should provide some detail hopefully we can dig into the numbers a bit more - I wonder how the investment team think about correlated risk in their investment portfolio - for example low natural gas 12mth strip prices are a headwind for Exco but for Stelco they are a tailwind as natural gas is key input cost for steel, similarly higher interest rates are a headwind for Atlas (although Atlas has fixed 70% or so of its borrowings) but work as a tailwind for FFH's insurance ops. interest & dividends - based on my calcs they are currently earning around 3.9% on their $38B fixed income portfolio - given US1,2,3y are all in mid to high 4s and mortgage bonds, corp bonds etc will be higher - I can see potential opportunity for them to raise bit more both yield & duration - so you have estimated 1.6B & I agree think thats possible they can push yield beyond 1.5B - each 0.5% of additional yield would be equal to an extra $190M

-

I was surprised viking when prem w on Q4 call said share profit from associates & non-insurance would conservatively be around $500M in 2023 - can we say he is possibly setting the bar low? In 2022, just Atlas & Eurobank provided $520M

-

I forgot to add for context that global insured losses from natural catastrophe in 2017 were around $130B & Aon has recently estimated a similar figure for 2022 https://www.reinsurancene.ws/natural-disasters-caused-over-130bn-global-insured-losses-in-2022-aon/ so Fairfax exposure looks to have remained around the same level - around 1% of global insured loss in both years

-

ATCO merger approved by shareholders https://ir.atlascorporation.com/2023-02-24-Atlas-Shareholders-Approve-Merger-with-Poseidon-Acquisition-Corp

-

just on cat risk exposure - yes higher than Markel but I think Fairfax have been taking pro-active steps here worth talking about Cat losses were $1.3B In 2017 & that was 12.3% of net premium (adjusted to include a full year of premium from AWH) whereas in 2022, we had $1.3B in cat losses & it was 6.2% of net premium & they generated a $1.1B underwriting profit. To me that suggests while they have more than doubled their net premium earned, they are not growing their cat exposure. They also said they are keeping their cat exposure constant on a conference call, but its also good to see it reflected in the reported figures. Also Brit recently reported they are reducing their cat risk exposure & Brit was responsible for 50% of the Ian loss that drove 50% of cat loss in 2022. This hopefully will have a flow on impact for 2023 & going forward so maybe potentially cat loss to net premium earned could fall further. Also I wouldn't want FFH to completely do a u-turn on reinsurance business given the very hard market in 2023 & much more attractive reward on risk economics there now than in last 5 yrs. MKL looks like they have scaled back their property reinsurance business appetite too.

-

Good point luca investment income only includes dividends received - i havent looked at look through earnings for MKL or FFH but would be an interesting exercise for both

-

Just reviewing some of the earnings power components of Markel & Fairfax for 2022. MKL NPW $8.2B Underwriting Profit $626M Investment income $446M Markel Ventures Operating income $325M Fairfax NPW $22.2B Underwriting profit $1.1B (mgmt conservative projection $1B in 2023) Investment income $961M (mgmt expect $1.5B in 2023) Share of Profit of Associates $1B (mgmt conservative projection $0.5B in 2023) FFH has more non-controlling interests than Markel, just under 6% of net earnings in Q4 & so the above pre-tax figures need to be adjusted down for this. FFH's interest repayments are around 452M vs 196M for MKL It looks like FFH's income pre-tax (adjusting for interest exp & non-controlling interests) is approximately 84% higher than MKL . MKL mkt cap is $17.9B and FFH mkt cap is $16B With all my posts, I try to get the numbers right but please always double check my math (ie do your own due diligence) Cheers! (note also that FFH has more RSUs than MKL - I have ignored here as they are long-term & FFH is buying back in - but there is still a buyback cost here for FFH you might want to factor in)

-

I agree Viking - put another way FFH is on a forward 15% after tax yield - see Prem's comment Q4 call - name one other insurer globally thats trading that cheaply? I agree with @Parsad that all of us want FFH to continue to improve the quality of its equity investments/operating businesses & raise credit rating & cash at holdco. I think with holdco they are in full growth mode with the insurance ops while we are in a hard market & the insurance subs as hard market starts to ease, will be receiving this 1.5B in interest/div income etc - they will be in a stronger position with excess capital & they can dividend back to the holdco - holdco's cash will increase & holdco will be in position to buyback shares or add to equity/bond holdings or buy operating businesses. So its coming, we have to be patient but as a shareholder you want them to be expanding, taking advantage of this hard market while pricing is good. On quality of the underlying operating businesses - I don't mind if they own fractional shareholdings or wholly own subs - but agree we don;t want to see them allocating money to speculative start ups (like Farmers Edge) we want them to be investing in mature, cash generative operating businesses. Now I would argue the last 3 years supports the idea that they recognise this - if you look at their larger equity purchases they are well established, cash generative businesses and examples of recent additions Mytilineos, Kennedy Wilson, Atlas, Bank of America, Micron Technology, Grivalia Hospitality, Recipe - none of these are speculative, start ups. Also I think there has been organic improvement with quality of underlying operations eg two examples Eurobank & Stelco - if you go back 3-5 years & compare to now - quality of underlying business has been raised a lot due to management.

-

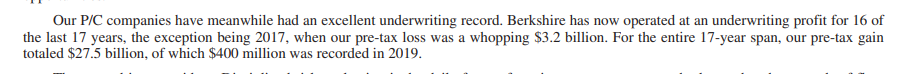

I would be curious if anyone has crunched the numbers on Berkshire's actual underwriting record since inception? I found this in 2021 annual report

-

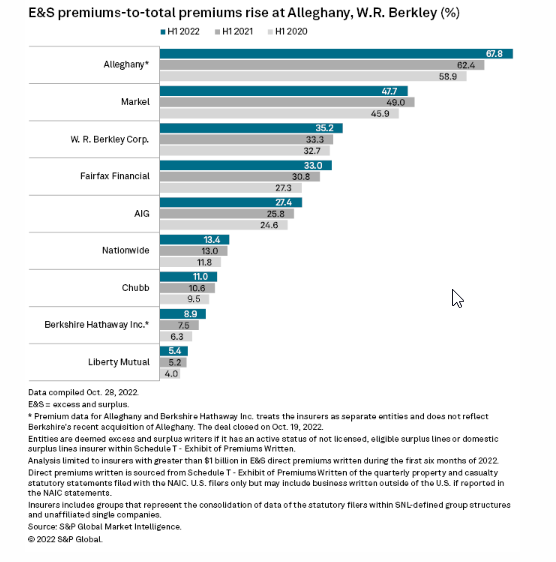

If you look at Berkshire's insurance business versus Fairfax I think there are some big differences - by product line & by growth profile- with geography (this is a little harder to determine so feel free to chime in)- but overall not a straight apples/apples comparison. Looking at Berkshire 2021 premium written Reinsurance - global - 29% Insurance - private passenger auto (US)/Geico - primary- 54% & - Commercial (primary & specialty) - 17% So I would say the rate/growth dynamics in the US private passenger auto insurance markets in US and the reinsurance markets globally are significant drivers for Berkshire's underwriting results. For Fairfax, the GPW split is around 76% insurance and 24% reinsurance. So Fairfax's reinsurance business appears smaller as a percentage of Fairfax's total written premium versus Berkshires. Also Fairfax has grown significantly in E&S/specialty - according to S&P, around 31-33% of Fairfax's total direct premiums written is E&S versus 7.5% to 9% for Berkshire before taking into account Alleghany acquisition which will lift this percentage. Then you have the premium growth profile - Berkshire is a lot larger, more mature - its growing GPW at a slower rate than Fairfax - the underwriting profit growth is a function of both combined ratio & the rate of net earned premium growth.

-

Brit are reducing their exposure to cat intensive areas of US property - around 50% of Fairfax's cat losses from hurricanes Ian (2022) and Ida (2021) were at Brit - so I view this as a positive move.

-

Just on this fixed income debate regarding whether Fairfax should push out duration to lock in extra yield. My view is they are focused on total return which includes capital gains plus yield. If economy deteriorates or for some other reason, and Fed forced to cut rates - rates (US1y,2y etc)would drop and treasury prices would increase -depending on size of these rate cuts, potentially Fairfax could go from an unrealised loss to unrealised capital gain position? Also I am not a bond expert so please someone correct me if I am wrong! But wouldn't the shorter end treasuries see the larger price (& capital gain) increases over longer end treasuries? So they could potentially sell their treasuries & realise capital gains, like they did in 2008 From 2008 AR Also, as the yield on long (30-year) U.S. Treasuries began to drop below 3%, we sold almost all our U.S. Treasuries (at year-end we had only $985 million left, compared to $6.4 billion on December 31, 2007), having realized net gains of $583 million in 2008 on sales of U.S. Treasuries....Our U.S. Treasury bond position was to a large extent replaced by $4.1 billion in U.S. state, municipal and other tax-exempt bonds (of which $3.6 billion carry a Berkshire Hathaway guarantee) with an average yield (at purchase) of approximately 5.79% per annum. The interest income may not necessarily then be lost if they re-deploy those treasury proceeds into higher yielding parts of the credit market plus they realise capital gains - again like they did in 2008. So I am just speculating here, no-one knows for sure what will transpire. Prem indicated on Q4 call they are currently pushing duration now closer to 2 years. My view is they are looking to capture some extra duration, but they want to stay nimble - corporate bonds are a big question mark for me at the moment - credit spreads look low yet a lot of refinancing still to come, already signs of problems in commercial real estate bonds https://finance.yahoo.com/news/commercial-property-market-freezes-bond-180729652.html https://www.afr.com/property/commercial/investors-seek-to-pull-20b-from-core-real-estate-funds-20230201-p5ch5f One other important point is IFRS 17, this impacts how they manage the fixed income side - I am hoping in the AR they will lay out some more details of the impact - but I also need to re-listen to Q4 call where they went into some details.

-

I just wanted to post an update on the contingent value rights (CVR) that Fairfax potentially will have(subject to Ambridge/Resolute deals closing) - these may be worth something or nothing, but they are not potentially inconsequential either. I am not sure what the state of the CVR is for the Riverstone Barbados transaction, because I can't see any update on that. Here is my list Fairfax - Contingent value rights Riverstone – up to $235.7 mil (Riverstone Barbados sale - based on performance targets) ‘On closing the company expects to receive proceeds of approximately $730 for its 60.0% joint venture interest in RiverStone Barbados and a contingent value instrument for potential future proceeds of up to $235.7’ (AR 2020) Davos Brands - up to $36 mil (based on brand performance of Aviation Gin over next 10 yrs) In 2016 we invested $50 million into Davos Brands (a spirit company) for a 36% interest alongside David Sokol. In September 2020 the company was sold to Diageo: our cash proceeds were $59 million and we are eligible to receive additional consideration of up to $36 million, contingent on the brand performance over the next ten years. (AR 2020) Ambridge - up to $100 mil (Ambridge Group sale - based on performance targets) On January 7, 2023 Brit entered into an agreement to sell Ambridge Group, its Managing General Underwriter operations, to Amynta Group. The company will receive approximately $400 million on closing, comprised principally of cash of $275 million and a promissory note of approximately $125 million. An additional $100 million may be receivable based on 2023 performance targets of Ambridge. Resolute Forest Products – up to $200M (potential refund of total lumber duty deposits – calc US$500M x 40% Fairfax stake = $200M The transaction will be carried out by way of a merger between Resolute and a newly created subsidiary of Domtar, providing for conversion of each share of Resolute common stock into the right to receive US$20.50 per share, together with one CVR, entitling the holder to a share of future softwood lumber duty deposit refunds. Under the CVR, stockholders will receive any refunds on approximately US$500 million of deposits on estimated softwood lumber duties paid by Resolute through June 30, 2022, including any interest thereon, net of certain expenses and of applicable tax and withholding.

-

article on the Keg https://www.richmond-news.com/hospitality-marketing-tourism/dine-out-vancouvers-business-bump-helps-wary-restaurant-owners-6500823 'Fairfax Financial fully owns the Keg restaurant chain thanks to it buying Recipe Unlimited Corp. in a deal that closed in October. "These days you're inundated with cautious news," Aisenstat said. "There's inflation, interest rates – all that stuff. If you're looking for something to be nervous about, in the restaurant business it's pretty easy to find it, but so far nothing [bad] has materialized, really. Fall was great. January is better than we would have expected." Aisenstat said things are also going very well at other restaurants, where he has ownership stakes.'

-

So if Q4 report shows more of the same - basically continuing a high quality bond/credit allocation but still pushing duration out more - US & CAN treasuries at 2 yrs etc - that won't surprise me. They have been doing some high yield deals too https://www.lse.co.uk/news/duke-royalty-upgrades-credit-facility-to-gbp100-million-until-2028-qdy9ut7qebkhk5b.html