Spooky

Member-

Posts

677 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by Spooky

-

Now this is the news I want to hear haha. Love Krispy Kreme. When the first one opened in Mississauga with a drive through there were lineups for days.

-

Any new content in this book since the last version?

-

Bring it on I say. They have had so much time and thought so hard about putting the right pieces into place for this moment.

-

We will miss you Charlie. One of the wisest and most generous people on the planet, I learned so much from him. It's like losing a grandpa.

-

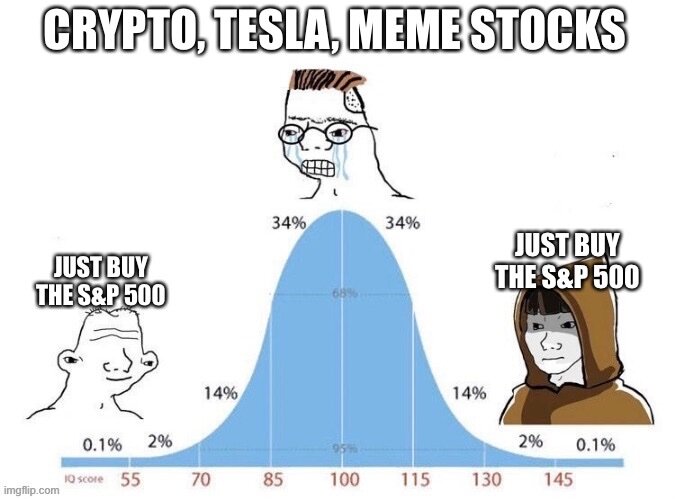

S&P 500

-

Buffett & Munger Special Letters Regarding Berkshire

Spooky replied to Parsad's topic in Berkshire Hathaway

The comments section on the Barron's article are interesting, lots of folks seem like they will sell once Buffett is gone. -

Interestingly enough, if the US were to sharply decrease government spending that could be a big deflationary force.

-

Just saw these two articles in the WSJ this morning: https://www.wsj.com/economy/consumers/black-friday-shopping-charts-3ce30588?st=vndv16w58mez10t&reflink=desktopwebshare_permalink https://www.wsj.com/economy/central-banking/the-hidden-hero-fueling-soft-landing-hopes-a-boost-in-supply-3a32bf3e?st=uis3nczau9fk4mr&reflink=desktopwebshare_permalink Looks like the supply side of the economy is less constrained - easing bottlenecks, more people available to work and possibly increases in productivity. For Black Friday many popular gifts are cheaper than last year at this time. It will be interesting to see where things go from here - in the long run, AI and automation could potentially allow us to create goods at significantly cheaper prices.

-

Is the US economy set for another Roaring ‘20s?

Spooky replied to james22's topic in General Discussion

One of the problems with the prior near zero interest rate regime is that it prevented creative destruction. Hopefully we keep a more normalized interest rate regime that wipes out some of the zombie companies. -

I've never been wealthier, and I just sat on my ass most of this year, adding to some names here and there but letting my 97% long stock portfolio do its thing.

-

Excellent movie. Jeremy Irons was also great, as usual.

-

I like it

-

Is the US economy set for another Roaring ‘20s?

Spooky replied to james22's topic in General Discussion

What we really need is a step change in productivity to improve people's quality of living. Maybe a combination of AI and automation could get us there. -

I wish this were the case but it seems to me like they have been moving in the opposite direction. We might need to wait until new leadership emerges.

-

Mark's letter from March 25, 2010. I haven't looked at that company in much depth, I'm not very familiar with the Polish exchanges / governance.

-

-

Channelling Phil Fisher, my view on a wonderful company like Apple is that the right time to sell is never.

-

Awesome. Feels to me like this environment will be pretty good for CSU in general going forward. So I also have a number of TOI and LMN shares that I received in both spin-offs. My plan is to just keep these as well as the shares of any other possible spin-offs and not sell them for a really long time, maybe I'll get lucky and one of them will generate returns similar to the early days of CSU (Mark L mentioned he hopes his kids are still holding LMN shares in 50 years). Personally, since I am holding such a large position in CSU, I like the mothership - you get an extremely well diversified stream of cash flows across many many software verticals / industries as well as geographies with minimal debt. Also, CSU still maintains a pretty hefty economic interest in both of the spin-offs, so if they do well CSU also does well. My goal with this position is to achieve above average results with a high probability of success / minimal risk of being wiped out. Also, I'm hoping / expecting more spin-offs in the future which could unlock more economic value. That being said, I could see the two smaller entities generate higher returns than CSU going forward just given their smaller size. One, Topicus, is more of a regional / European focused CSU and the other, LMN, is focused on a specific vertical. It's funny I was actually re-reading Mark L's letters again this weekend and one of the early letters talks about two potential strategies a) the "many verticals" strategy and b) concentrating on a fewer number of verticals - with b) Mark hypothesized this would likely lead to paying higher multiples for larger acquisitions and paying strategic premiums to accelerate the number of tuck-in acquisitions. I'm not sure I really answered your question but hope this is helpful.

-

Seems like a short transcript with not too much new in there. Hopefully they release the full thing.

-

Praise Wabuffo . I've been considering getting back on Twitter just for him. Seems like a pretty good time to keep your head down and keep buying.

-

Why is everyone so pessimistic. The US prints an impressive GDP figure and it's all doom and gloom.

-

Sure, you can afford to take more risks when you are younger since you have time to recover. However, the biggest advantage you have right now is a long runway to compound returns. If you stay invested / in the game, don't make any big mistakes and let your investments compound, even small amounts can turn into significant sums of money over time.

-

This chart has me wondering what is going on in Brazil...

-

Start small, experiment and lean more heavily on ETFs at the start. Try and minimize transaction fees and taxes. Be careful about investing into individual companies until you have more experience and a grounding in fundamental analysis. Invert and think about not losing money rather than hitting home runs. Read and think as much as possible rather than act. Buffet and Co are trying to make one or two good decisions a year. I like two of Buffet's analogies: 1) imagine you have a punch card with 20 spaces available in your lifetime - each time you invest in a company you punch the card - makes you need to think very carefully about committing to an investment; 2) in investing you can sit at the plate and watch pitches go by forever waiting for a fat pitch - wait for a fat pitch and then swing heavily. Some good books that really helped me: 1) Lawrence Cunningham's collection of Buffett essays; 2) Phil Fisher's Common Stocks And Uncommon Profits; 3) Howard Marks The Most Important Thing; and 4) Poor Charlie's Almanac; In terms of online resources there are a lot of great lectures from Warren Buffett and Charlie Munger on YouTube (Warren's talk to the Florida University is a great one. So is Munger lecture on elementary worldly wisdom). There is also a whole series of Google talks from famous investors.

-

Agree, it looks like he is mainly talking to pension plans that have certain required actuarial returns and have more favorable tax treatment for interest income. In his memo, he also had a strange comment about nominal vs real returns - seeming to suggest that some investors are seeking to hit nominal return targets not necessarily real returns.