nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

I personally think it is bad tax policy, if the article is correct. If you took it to the extreme you would need an annual appraisal on all assets, just in case they varied in price. We will see how it plays out. Definitely not the cheapest Berkshire has been recently but I will happily swap out a more fairly priced OXY for a slightly undervalued BRK for the long term.

-

BRk.B, KMX

-

50% of my OXY position. Would consider repurchasing if we get a 5 in front again

-

Cheers, there was a thread on fintwit regarding Exco, that was mildly intriguing Does anyone here have a copy of their results,? I think I know the answer if @glider3834hasn’t been able to track them down

-

If they eat their own cooking, it’s hardly a ringing endorsement of Blackberry (Cylance)

-

Many thanks, quite spectacular. “Fairfax Financial Holdings Limited, the fourth-largest insurer in the rankings, was the only company among top 10 players to log a year-over-year increase in market share. The insurer's share of the E&S market rose to 4.77% from 4.50%. Fairfax Financial jumped two spots in the rankings, thanks to a 40% increase in premiums to $3.0 billion from $2.14 billion a year ago.” Attached are a couple of MS notes on on the Industry. I noted that Morgan Stanley India are one of the parties named as book managers for the IPO so hopefully we might be able to get some further info in due course INSURANCE_20220819_0000.pdf INDIA_20220818_0000.pdf

-

Sold out a few minor positions UBER, KMX, META, TSLA & NFLX. Bought some more FFH and raised some cash

-

@glider3834 thanks for posting those tables. Great to see Berkshire and Markel jump up the list. 3 out of 4 ain’t bad. Any chance you could post the source link?

-

@Viking agree mostly. I would also add that the market may be also trying to figure out who the patsy is. Certainly minority shareholders at the sub level can lay claim to that fate from time to time. I think, given the discount, this feeling extends to FFH share holders as well. I have a decent chunk of capital betting against patsification and for regression to the mean based on their longer term results. Time will tell

-

In terms of hurricanes the season is still forecast to be above average, just off to a slow start. The next 2-3 weeks may be key https://www.insurancejournal.com/news/national/2022/08/17/680843.htm

-

....just not this decade.

-

Picked up some more FFH, price is OK I still think there is a good chance that the ATCO bid will be raised. Reading Frischer’s letter reminded me that a lot of ATCO’s remaining minority shareholders would likely rotate into FFH. So the plans for my residual ATCO stake was far from unique.

-

I quite enjoyed this article by Dr Tim Morgan "what we are witnessing now is absolute proof that the economy is an energy system, not a financial one" "It would be a good idea if, whenever anyone suggests a financial ‘fix’ – rate rises, rate cuts, QT, QE, debt-funded tax cuts, more debt – we were to ask them to explain how these measures are going to deliver cheaper energy." #237. Asking for the moon | Surplus Energy Economics (wordpress.com) Ties into the idea that the price of oil (energy) is the true discount rate or at the very least a leading indicator. The ultimate "means of production".

-

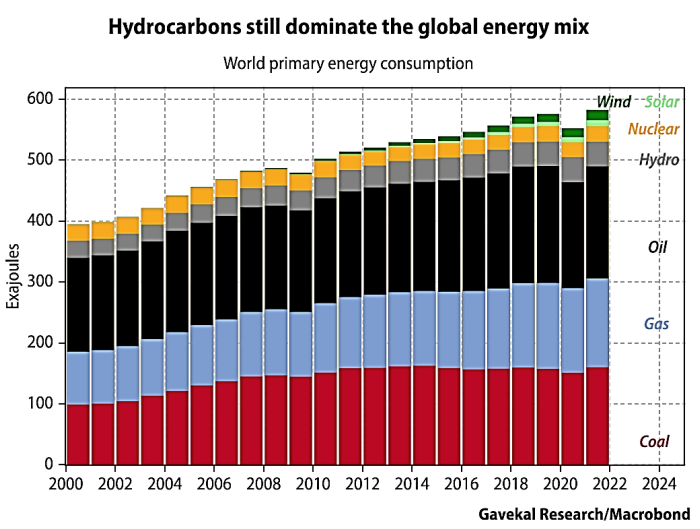

If you haven't listened to it already you might find a recent podcast with David Hay insightful MacroVoices #335 David Hay: Why US Energy Prices Can Rise Even In Recession He argues that even with a recession the price of oil isn't likely to fall much because of fuel switching (substitution) in Europe. The energy density of oil makes it a lot easier to transport too. He suggests that switching from gas to oil will equate to around 1 MMB/D of demand. Chart pack attached, this one caught my eye in terms of where we are up to with the transition. MacroVoices Chart.pdf

-

1. if that is all this company is going to be then OK. However there was some embedded optionality (speculation) that it could be a lot more. IIRC Prem muttered something about $20/share in a CC a while back. We will know in a few years time 2. Probably, but Fairfax definitely has a history of doing this. That reputation is only being reinforced here. While many others don’t agree, these episodes further tarnish their brand and make it difficult to achieve a full valuation or even a sensible valuation in the markets for their subs. I think general wariness of their way of doing business is what leads to the current discount in their own share price. Hopefully strong earnings going forwards outweighs all other concerns.

-

Nope. It is a very obliging market that is serving it up to them. Considering OXY is in the market for their own shares in the high 50’s too it is quite extraordinary.

-

I think they will eventually but will keep chipping away for a while. If I was to put a time frame on it, proof that DAC works at scale then bingo. I have thought for a while that his comments that what Hollub was doing “makes sense” is 60% capital allocation and 40% DAC. High probability I have it wrong but BHE owning the rights to a functional and scaleable DAC technology for North America would be quite the competitive advantage. This interview always brings a smile

-

I 'll play PERSONAL ACCOUNT BRK/B 34% FRFHF 25% AAPL 12% OXY 6% MKL 6% 669 4% ATCO 4% MU 3% TSLA 2% RTX 2% KMX 2% RETIREMENT ACCOUNT BRK/B 40% FFH 19% AAPL 12% MKL 7% OXY 6% UBER 2% GOOGL 2% DIS 2% MU 2% AMZN 2% TSLA 2% KMX 1% MSGE 1% NFLX 1% META 1%

-

Sold another 25% of original ATCO position and rolled it into MKL

-

Increasing signs a true hard market may be near, say analysts “While pricing had improved, the frequency and severity of events has kept accelerating as well, leaving significant questions around the adequacy of pricing,” they continued. “Time will tell and January 1 renewals will be a key test, but we believe there are increasing signs a true hard market may be near, and at the very least there is little sign that pricing increases will abate anytime soon.” Analysts at Morgan Stanley recently concurred with the comments made by JMP Securities, reporting that that widespread plans to pull back from the property catastrophe market should “bode well” for reinsurance pricing into 2023. https://www.reinsurancene.ws/increasing-signs-a-true-hard-market-may-be-near-say-analysts/ I will try and dig out the MS report from June Edit: Attached. MKL gets a mention insurance_20220614_0000.pdf

-

Do you think that Fairfax operates in a vacuum? The market watches this stuff and this is just another one in a long list of bad Fairfax experiments. Every time they do this craziness it only reinforces the perpetual discount. I am not grumpy about ATCO as it it is a fraction of my Fairfax stake. I am grumpy that this only reinforces the view that this is more Canadian $^it&uckery. Weren't we all salivating about the Digit IPO, ah that's right who needs the markets....until you do. I will get over it, so please don't anyone take it personally, nothing against anyone on this board. Perhaps we will hear something in the conference call that makes us all warm and fuzzy

-

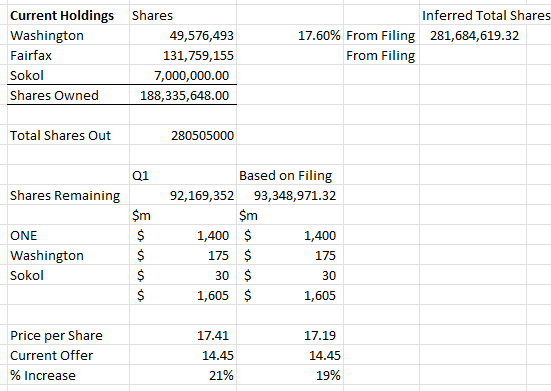

It will certainly improve certain player's prospects, I have no doubt about that. Anyway based on those numbers there certainly is capacity to improve the offer

-

Morgan Stanley just released their summary of Q2 "Early 2023 messaging suggests largely maintenance programs next year, although inflation will still drive higher capex. Across our coverage, most companies reiterated plans for low to no production growth next year and expectations for inflation to persist with constraints on the supply chain and labor. While COP, PXD & EOG did message some shale growth, this was largely consistent with prior messaging and longer-term investment frameworks. Beyond these companies, most US shale E&Ps continue to plan for maintenance investment in 2023. On inflation, we continue to model +10-15% higher costs y/y in 2023 (ex growth) – management commentary generally aligned with this view." Note attached for those interested OILAMP_20220808_0000.pdf

-

Crap, this wouldn't have legs without Fairfax's explicit approval. If they play the "who couldanode" card it only makes it look worse.