nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

Recipe’s Q3 is out https://www.newswire.ca/news-releases/recipe-unlimited-reports-q3-2021-results-881668597.html Looks like sales are indeed bouncing back nicely. A marginal improvement in EBITDA over pre-Covid 2019 figures too. I liked the news that they are selling positions that aren’t meeting expectations. Far from my favourite FFH position but seems to be moving in the right direction

-

The more I see everyone else not taking significant hits from Ida and Europe, the more worried I get about Fairfax. Really hope I am looking at it the wrong way.

-

I Need a Laugh. Tell me a Joke. Keep em PC.

nwoodman replied to doughishere's topic in General Discussion

-

Excellent, thanks Glider. A useful data point and with Amazon behind them may ultimately prove some stiff competition. Both companies should be able to grow nicely for the foreseeable future though.

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Two episodes in on ATV+ Invasion. Definitely worth a watch, some intriguing characters and a good tempo. Production values are up there. Was pleasantly surprised to see the Fairfax link: “Invasion is a Boat Rocker Studios production that was written and executive produced by Simon Kinberg and David Weil. Jakob Verbruggen, an Emmy Award nominee, directs and acts as executive producer. Executive producers include Audrey Chon, Amy Kaufman, and Elisa Ellis, in addition to Andrew Baldwin, who also writes. Boat Rocker Studios’ executive producer is Katie O’Connell Marsh.” Edit: Kocked over episode 3, not in any great hurry to see episode 4. -

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Yep, unfortunately Foundation not really working for us either. Will persevere for a few more episodes, they have renewed it for a second season so I remain hopeful. -

I am not enamoured with either situation.

-

A recent bullish piece on India by MS. They are arguing for corporate earnings to compound 20-25% p.a. over the next 4 years. Their reasoning: 1. The policy intent has clearly shifted from boosting consumption via transfers to boosting growth via investments. Policymakers have been initiating reforms for a while now and we believe that the economy is now in a good position to reap the cumulative benefits from past reforms 2. Macro stability indicators – which are symptoms of a weak productivity dynamic – are in good shape. 3. With deleveraging headwinds now behind, the global demand environment will turn much more supportive. “The India story stands out now, not only from an absolute perspective but also from a relative perspective, because of this rise in the ratio of corporate profit to GDP. Our strategist for India, Ridham Desai, has been pointing out the fundamentals that will drive rising corporate profits. He notes that “with nascent signs of capex, supportive government policy for higher corporate profit share in GDP and a robust global growth outlook, India seems well placed to enter a new profit cycle. For an economy that is likely to grow at a nominal rate of 10-12% per annum, if the profit share in GDP hits 3.5% over the next five years, it gives us an annual compounded growth in earnings of ~25% for the broad market. Indeed, higher profits feed into real GDP growth and back into profits so a virtuous cycle unfolds with concomitant positive impact on share prices." They explore some of the issues over the last 10 years, sound familiar? Worth a read over the weekend, enjoy. india - on the cusp of a virtuous cycle.pdf

-

Agree, a good time to be taking assets public. . I haven’t come across any news on the Anchorage float perhaps they are waiting for air travel to tick up some more.

-

MS is out with an update on the Indian Economy. A couple of graphs that may be of interest. Chart pack attached. “We expect cyclical recovery in subsequent quarters: While near-term risks have emerged due to supply-side shortages, at the margin the situation has been stable, and we expect the impact to be transitory. We expect vaccination rates to reach a critical mass by early next year, which will help in broadening the recovery, and external demand conditions remain supportive. As such we maintain our growth forecast at 10.5% for F2022e. Risks to growth outlook are balanced and stem from Covid-19 management / pace of reaching full vaccination, continued supply side disruptions which weigh on both growth and inflation negatively.” india oct 21.pdf

-

Given the large exposure Fairfax has to India, a separate thread for macro related info

-

Good stuff Glider. A couple of attachments 1. Eurobank Research MS Eurobank - Focus Shifts to Loan Growth.pdfMS Eurobank.pdf 2. MS Model 3. A link to a recent MS Podcast featuring Nida Iqbal the MS analyst on Eastern Europe, Middle East, and Africa (EEMEA) https://www.dropbox.com/s/quhxgbbck3oaj2w/MS Greek Bank Podcast.mp3?dl=0 Eurobank remains MS only overweight rec for Greece. Main reason is balance sheet clean up. 2022 is shaping up to be an absolute ripper for Fairfax. Between Atlas and Eurobank alone there could be >$100m of annual dividends heading Fairfax's way. Eurobank Model 10-21.xlsm

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

A big shoutout for the current spate of music doco's on Apple TV+. The Velvet Underground (Movie)- really enjoyed it. 2 hours was over in the blink of an eye. Todd Haynes directing style might not be for everyone but it worked for me...a masterpiece 1971: The year music changed everything (Series) - this filled in a lot of musical blanks for me. My Dad's record collection wasn't as diverse as it needed to be! Watch The Sound with Mark Ronson (Series) - Steps through the major advances in electronic music - Auto-tune, Sampling, Drum Machines etc. I didn't realise it but Mark's step father was Foreigner's guitarist Mick Jones. So he was living and breathing music from a young age. No muso, but this has inspired me to play around with Garage Band on the iPad for the first time in years. Who knows maybe one of those new Mac's with Logic Pro might be in my future -

Another article, they must be doing the rounds Digit Insurance to use funds to grow market share - Times of India (indiatimes.com) Key points: "According to Goyal, the ability to raise capital puts Digit in an advantageous position. “Last year, many non-life insurers grew aggressively. This year, the first quarter has been tough and some insurers had to release their claims reserves. We have been a bit cautious and had a good combined ratio in Q1 this year,” he said. The non-life industry is capital-constrained with three state-owned companies in loss and several Indian promoters not in a position to infuse capital. According to Goyal, Digit will use its capital to provide capacity to Indian industry including thermal power where there are capacity constraints with reinsurers backing out due to green reasons. "Digit Insurance has also reduced dependency on its call centre by enabling service requests on WhatsApp using artificial intelligence. “Earlier, for one lakh policies, we were handling 1,800 calls a day. Now, with 10x the number of policies, the call volume is around 2,300. We have, however, received 72,000 service requests on WhatsApp,” said Goyal."

-

Based on the pickup in insurance after the second wave of COVID-19/Delta, that doesn't sound like a stretch at all. An update of the monthly IRDAI figures below, the different scales masks Digit's impressive growth. The overall insurance market is off to the races and Digit has hit the "nitro button". Oh and btw Thomas Cook just hit a 52W high

-

Never Been A More Exciting Time To Be In General Insurance, Says Digit Insurance’s Goyal (moneycontrol.com) - OCTOBER 15, 2021 A few key quotes: Q. From Digit’s perspective, how has the journey been so far? "Our customer ratings substantially improved on the back of digital and self-service processes and subsequent investments have gone here. Last year, we saw growth of 44 percent. In the current year, as the second wave hit, many players had stopped underwriting Covid-19 health insurance but we continued to do that and other business lines also saw a good amount of growth. So far, the first half has been good and growth has been almost 67 percent." Q. How is your solvency ratio looking like? "It was 180 as of June 30. After the approval of the recent capital raise I would expect it to be more than 300 by December 31. It will be one of the highest in the industry. Hoping the approval should come sometime this month and we will close the transaction within thirty days." Q. Any plans on listing? "Do we want to list? Yes. When? We don’t know at this stage. This is something we always thought that we wanted to be a listed company and have completed four years, we have raised a recent capital round. We will see where we are in 6-12 months’ time."

-

+1 @Viking Great write up, looking forward to your forthcoming book

-

Three stock picks from Matco Financial’s Anil Tahiliani "The markets have been extra volatile in recent weeks, but Matco Financial portfolio manager Anil Tahiliani isn’t shoring up extra cash for his clients, waiting for the skies to clear. Instead, his firm continues to invest in what it views as “solid, good companies” poised to grow over the long term. “Typically, we do well for clients at the early part of the economic cycle,” says Mr. Tahiliani, which he believes is where we’re at today, after the COVID-19 pandemic ravaged the global economy for most of 2020. While earnings growth won’t be as impressive in the coming quarters as it has been so far in 2021, when compared with a year earlier, Mr. Tahiliani expects it to remain strong as the global economy continues to recover. It’s why he’s sticking to his portfolio mix of about 95 per cent equities and 5 per cent cash. “To us, you should still be invested in equities,” he says. “You’re getting high dividend yields and stronger economic growth in Canada, the U.S. and globally.” Many investors also have little choice. “Equities are still the only game in town in order to meet inflation-adjusted returns and compared to bonds and other fixed-income products,” says Mr. Tahiliani, who oversees the Matco Canadian Equity Income Fund. Some of the fund’s top holdings today include Constellation Software Inc., National Bank of Canada, Bank of Montreal, Canadian National Railway Co. and Dollarama Inc. The fund’s one-year return, after fees of 1 per cent, is 23.8 per cent as of Sept. 30." His three picks were: 1. TFII-T 2. MG-T 3. FFH-T FFT-T: "Mr. Tahiliani describes Fairfax as “a unique play” – the company is a property and casualty insurer and a value investor. “What you’re getting with Fairfax is an insurance company, plus a diversified investment portfolio that consists of public and private investments,” he says. His firm purchased Fairfax shares in September, in part because of the company’s attractive valuation compared with its peers. Fairfax is “capital disciplined,” Mr. Tahiliani says. “It doesn’t pay up for assets, whether it’s buying other insurance companies or making public or private investments. [The company] is more looking for either distressed assets or turnaround assets that are selling at a discount, and that they can come in and buy below intrinsic value.” Fairfax is currently trading around $515 a share on the TSX, which is up about 25 per cent over the past year. It reached a 52-week high of $581 in May."

-

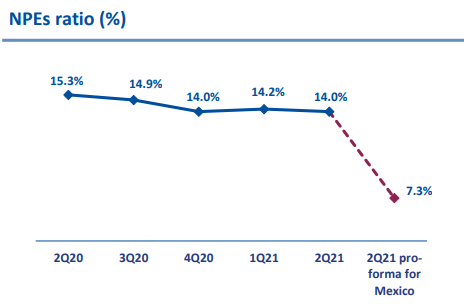

Thanks for the link. Another investment that has been 10 years in the making. “Via the great, ten-year ordeal, Greek companies endured, adapted and several (this is often overlooked) expanded and developed, having formed characteristics that allow them today, in the development phase, to look very high. And turn they have. FFH may have been too early/wrong with their investment in 2014. It doesn't matter now, the future of Eurobank is looking mighty bright. At Eurobank, we are happy that we were the first to open the way and everyone followed. And we are the first to have reached the 3rd quarter of 2021 with a single-digit NPL index of 7.5%," he noted. Graph below is from the 1H21 presentation, looks like they are still on track Update on Project Mexico UPDATE 1-Eurobank signs deal with doValue to sell bad loan portfolio notes (yahoo.com)

-

TSLA

-

NTDOY

-

+1 totally agree. A couple of quick points building on @Viking's and @glider3834comments above 1. While ATCO appears to be fully converted, the way it was structured made it much lower risk by moving up the capital structure eg warrants, senior note, prefs etc. Paid to wait - more Buffett. 2. They are going to have winners and losers. Currently the market is awarding them the title of "biggest loser" that's fine as it presents quite an opportunity. As their primary business is insurance I would be far more worried if the insurance companies were still writing at 100+ CRs. 3. As a basket their investments offer more winners than losers. At these prices they don't need to earn the title of the "biggest winner" to make an investor decent money. 4. Going one step further perhaps their investment framework is more suited to countries like India and its point in the economic cycle rather than overpriced DMs. So for me, FFH serves a dual purpose, deep discount on an OK insurance company and EM exposure. Deal flow counts for a lot when you are trying to allocate decent amounts of capital.

-

S&P Global Ratings - “Cyber Risks In a New Era: Reinsurers Could Unlock the Cyber Insurance Market” Greatly obliged

-

Well done again SJ. I had forgotten that provision, it was forced through as an amendment. I can read it and arrive at a slightly different interpretation but it is not completely at odds with your recollection. 1. Original Letter https://www.fairfax.ca/news/press-releases/press-release-details/2015/Fairfax-Calls-Special-Shareholders-Meeting-to-Consider-Amendment-to-Terms-of-Multiple-Voting-Shares/default.aspx 2. Amendments https://s1.q4cdn.com/579586326/files/doc_financials/2015/Chairman-Letter-(August).pdf

-

There has been a bit of chatter around insurance industry rags about cyber re/insurance after an S&P Global Ratings report was released a little while back. The tie in between BBY and Fairfax insurance businesses is likely not a new or unique thought. Does anyone know if a cybersecurity insurance tie-in has been discussed at any of the AGMs or anywhere else? Probably remiss of me but I don't think that much about Blackberry even though it is a fair chunk of FFH equity holdings, as a % it continues to decline. It is now in the mildly annoying but no longer a serious source of irritation, more like an option. Some snippets on the opportunity "Prices in the cyber re/insurance market could rise sharply between 2021 and 2023, in some cases doubling from current levels, according to a report from S&P Global Ratings. “Depending on the region and [terms and conditions], policyholders could expect rate adjustments of up to 100% because the risk level has fundamentally changed,” S&P Global Ratings said last week in its report, Cyber Risks In a New Era: Reinsurers Could Unlock the Cyber Insurance Market. https://www.canadianunderwriter.ca/insurance/will-cyber-insurance-rates-double-in-the-next-couple-years-1004213158/ Increasing Reinsurance Demand The report said the pandemic exacerbated the huge cyber reinsurance protection gap by causing existing and new clients to increase demand for the protect, requesting larger limits and more inclusions in their policies’ terms and conditions (T&C). “Primary insurers rely relatively heavily on the reinsurance market for cyber insurance because it has a relatively short track record compared with more traditional and mature property/casualty lines of business,” said S&P, estimating that they pass 35%-45% of global cyber premium to reinsurers, with some regional variation. Cyber Market Development S&P expects this business line to be one of the fastest growing insurance markets over the next decade. “The dynamic change in claims pattern, rise of cyber threats, and huge accumulation risk creates an opportunity for larger reinsurance capacity.” As a result of these trends, the number of reinsurers and insurers offering cyber coverage is rising, along with demand, but capacity is still limited, the report said S&P noted that the market would benefit from the development of a comprehensive retrocession market, as well as the use of insurance linked securities (ILS) or alternative capital to improve capacity. “The market faces increasing demand, but limited supply. In our opinion, lack of capacity could be holding back the development of a sustainable cyber re/insurance market,” the report affirmed. https://www.insurancejournal.com/news/international/2021/09/30/634535.htm cyber risks in a new era- reinsurers could unlock the cyber insurance market s.pdf