nwoodman

Member-

Posts

1,071 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

Nice . I wonder if ultimately this gets spun out to Eurolife.

-

Agree and prompted me to throw a few more shares on the pile. It was good to hear Sokol reiterate that contracts are ex fuel. Any further spike in fuel costs, rendering the older vessels uneconomic, should accelerate scrapping rates which will help their cause no end towards the back end of the decade. The table in the following link, I believe, is the number vessels scrapped. https://www.go-shipping.net/demolition-market “The units typically used on the demolition market page are USD per Light Displacement Tonnage (LDT). Light Displacement Tonnage represents the weight of the ship's hull and all permanently attached fixtures and fittings. This unit is used to determine the scrap value of a ship, with prices quoted per ton based on this measurement.” There was a lot of articles indicating scrapping Rates were on the rise but the table indicates otherwise…so far. Not really an issue for the next few years.

-

Sure does. Many thanks @MMM20

-

Early this month Jefferies upgraded Eurobank with a PT of €2.60 on the basis that the Hellenic “synergies” are being lowballed. Eurobank management have rightly been downplaying the opportunity. Does anyone have the Jefferies note? Please post or PM. I have asked around but no joy. The note is referred to here: https://m.au.investing.com/news/stock-market-news/jefferies-upbeat-on-eurobank-shares-cites-growth-and-diversification-93CH-3188588?ampMode=1

-

FRFHF

-

https://irdai.gov.in/life Digit Life 426 Crore => $US51m in premiums. License granted June 2023 31.03.2024 को जीवन बीमाकर्ताओं का प्रथम वर्ष का प्रीमियम _ First year premium of Life Insurers as at 31.03.2024.xlsx

-

I'm playing catch-up on some reading and came across this piece by Nida Iqbal at MS. Given last night's action in Eurobank, it looks like it might have caught up—some. Still, it makes for an interesting comparison of the Greek banks to their peers. EEMEA_20240408_2301.PDF

-

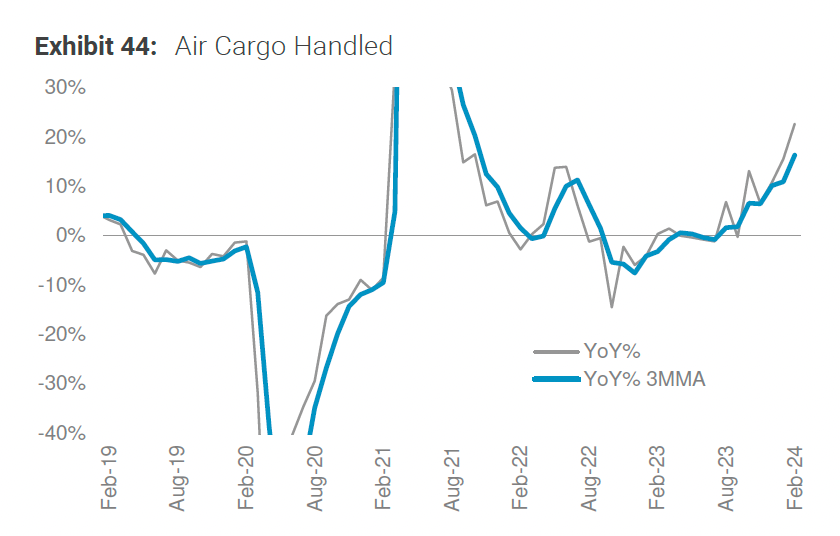

MS just released their India Macro chart pack. Always interesting, but one chart in particular caught my eye. I wonder if this is a partial "Apple/Foxcon Effect" Apple Reportedly Doubles iPhone Production in India, while Foxconn Holds 67% Share MS remain optimistic about future growth prospects as follows: Outlook: On growth, we remain constructive on the growth outlook, given support from domestic demand, as reflected in the robust trend in high-frequency growth data. As such, we expect GDP growth at 6.8% in F2025 and 6.5% in F2026. With regard to macro-stability, we anticipate headline inflation to remain supported by favourable base effects and thus remain in a range around 5% YoY in 2Q24, while it softens to 4.1% YoY in 2H24. We expect CPI to average at 4.5% YoY in F2025-26. Similarly, current account deficit is likely to remain benign, supported by strength in services exports, and remain within the policymakers comfort zone at ~1-1.5% of GDP in F2025-26. On monetary policy, we expect policy rates to remain steady at 6.5% in our forecast horizon. This is on the back of a shallower and deferred rate cut cycle for Fed on the global front and improving productivity growth, rising investment rate and inflation tracking above the target of 4% on the domestic front. Chart pack attached INDIA_20240422_2300.PDF

-

Try this FIHU - Transcripts.pdf

-

I thought it would be worthwhile running the transcript through Claude to collate the various risks identified at the AGM. Nothing that hasn’t already been discussed but may be of interest. The political risk in India post Modi is something that crosses my mind from time to time but is more than offset by the opportunity Several potential risks and challenges for Fairfax were discussed during the AGM: 1. Catastrophe losses: While Fairfax is better positioned than ever to absorb large catastrophe losses, a major event like a Category 5 hurricane hitting Miami or a powerful storm devastating the Northeast could still cause significant losses and volatility in results. Climate change is making catastrophe losses more difficult to model and predict. 2. Inflation: Rising inflation could impact both the underwriting and investment sides of the business. On underwriting, Fairfax needs to ensure premiums are keeping up with rising claims costs. On investments, higher inflation could lead to further interest rate increases which would negatively impact bond prices. 3. Recession: While a recession would provide opportunities to deploy capital at attractive returns, it could also lead to higher underwriting losses from economically sensitive lines like workers compensation and trade credit. A severe recession could also cause mark-to-market losses on Fairfax's equity and credit investments. 4. Softening insurance market: After several years of hard market conditions, the property & casualty insurance market is starting to soften. This could make it harder for Fairfax to continue growing profitably, although management believes its positioning and discipline will allow it to outperform. 5. Execution risk on investments: While Fairfax has an excellent long-term investment track record, there is always a risk of individual investments not working out as expected. The company has a large amount of capital deployed in concentrated positions like Eurobank, Resolute, BlackBerry and Poseidon. 6. Key person risk: Prem Watsa has been the key driving force behind Fairfax's success over the past 35 years. While he shows no signs of slowing down and has a strong team around him, his eventual retirement could create uncertainty around strategic direction. 7. Regulatory and political risk: As a global insurer, Fairfax is exposed to regulatory changes and political instability in the many jurisdictions where it operates. Geopolitical tensions, trade disputes, and regime changes could disrupt operations and impact investments in specific countries. 8. Foreign exchange risk: Operating in many currencies around the world creates the risk of foreign exchange losses, although Fairfax actively manages this exposure. While these risks bear watching, Fairfax's management expressed confidence in the company's ability to navigate challenges and capitalize on opportunities thanks to its strong culture, disciplined underwriting and investing approach, and decentralized structure. The company is seen as being in its strongest position ever to weather volatility.

-

Nicely put and was just writing exactly this to a family member. It might sound like hyperbole but this is the best setup for FFH I have seen in 20 years. They make out very well in a higher for longer environment but their opportunity to really make money is/when the SHTF. My only concern is they get hamstrung by an IDBI deal, due to its size, just before truly great companies go on sale. We shall see, the macro tailwind in India would suggest that even if forced to overpay it won’t end up as a BBY. They also don’t strike me as being in trophy hunting mode. The range of outcomes seems to be somewhere between good and great. The other thing that struck me from this AGM, in particular, is their emphasis on size and diversity of the insurance ops to absorb significant cats. They will hurt but size and rational U/W counts. Along these lines, I have been contemplating whether the path from $25bn to $100bn, is easier than the path from $2.5bn to $10bn.

-

Worthwhile posting two extra excerpts from the AGM that I found somewhat reassuring in terms of future capital allocation. I also can’t wait to hear Peter Clark on the CCs moving forwards, seems a very coherent and rational thinker. Peter Clarke Sure. Just on the underwriting side, though, over time, sort of when we acquired companies, our focus changed somewhat. In the late 1990s, early 2000s, we bought turnaround companies, but if you look at -- and most recent, starting with Zenith and Brit and Allied, we bought companies with strong track records, strong management teams. So it's really what we started with has been hugely successful for us, and then just having and keeping people for the long term. Like Prem has said, Brian Young has been with us 28 years. He knows the culture. He knows the company. He knows Fairfax as well as any of us. So the management teams we have in place right now have been with us so long that the culture is just ingrained within the company. Gulf, for example, we've been invested in Gulf for about 12 years, and an outstanding track record. They're 94% combined ratio for the better part of that whole time period, with very strong reserving, so it's -- I would say it's really the companies, when we're acquiring them now, are much higher quality than they might have been in the past. Are there any principles you learned from Charlie that's been applied to Fairfax' success over the years? V. Watsa The big one was just -- Charlie made this point years ago, 2 points. One was that, earlier on, like us, they depended on stock gains, bond gains. In fact, it's like when they began years ago. And then they got the ability to be a railroad company, Burlington Northern, to get operating income, but one of the biggest [ pluses ], biggest questions that -- answers that you suggested was that you have to have patience. And when you see an opportunity, you're going big when you understand it. And when you don't understand it, just stay away. So all insurance people, of course, when they saw that opportunity, we double our premium, right? Interest rates, when we saw the opportunity, [ we went 4 years ], but going forward -- it's a very good question. We're big now. And the idea of buying good businesses at fair prices, big positions, compounding for a long period of time, we're focused on that, looking at that. We've got good investments like we've had with Kennedy Wilson and with Seaspan Poseidon, but we'd be looking at -- and this is not an environment right now that you can find them because the prices are high, but we're looking at getting positions in companies where we can compound for a lot of -- without any tax, as they say. But we learned a lot from Berkshire and Charlie. I mean we followed them for a long, long time. When I first went to the Berkshire meeting, there was like less than 200 people, at the annual meeting. And we used to have a dinner on Sunday night. Mike Goldberg used to be there those days, with Ajit Jain. A dinner on Sunday night and the annual meeting on a Monday morning, before it shifted to the weekend. And so it's a long history. We learned a ton from them, yes. So thank you for your question. Maybe a follow-up there...

-

I found it via transcripts in Koyfin. I only seem to be able to copy a paragraph at a time in the app. Will try via the website later today for you

-

Just working my way thru the AGM transcript I found it interesting that Sokol introduced Will Kostlivy as the CFO. I wonder if that was news to Will. Probably reading too much into it as I guess a lack of an acting CFO means automatically the gig is his until told otherwise https://www.linkedin.com/in/william-kostlivy?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=ios_app A good summary by Sokol, that has been well summarised by others David Sokol Thank you, Prem. It's a pleasure to be here. And as the other folks have commented, Fairfax is a phenomenal partner, and our whole team appreciates the relationship. Even when you have to work through difficult issues, they work through them professionally and you move on. Seaspan, essentially a shipping company, in '20 and '21, our management team, led by Bing Chen -- by the way, our CFO, Will Kostlivy, is here with me here today. We recognized and particularly led by Bing and his development team that our customers needed refreshing of their vessels. And it was an interesting time because the market wasn't in great shape in '18 and '19, but with the new requirements for reduction of CO2, the age of the fleet that was out there, it became apparent that there was real opportunity, so working with the customers, we're building 70 new ships today. We've delivered 42. What I think is impressive about that for our team is that we designed these ships in cooperation with our customers, $8 billion construction program that we initiated in '20 and '21; simultaneously financed all the vessels to be coterminous with the long-term charters averaging 12 to 18 years. So we've delivered 42 of those ships. Every one of them has been delivered early or on time, under budget. The management of the shipyards has been really something fun to watch. We'll deliver another 26 yet this year. And then 2 of that, the final 70, will be delivered in January of 2025, so the team has done a remarkable job. One of the really remarkable things that we didn't see coming is that those same ships today, because we locked in fixed pricing in 2020 and 2021, will be 30% more expensive. So the ships we're delivering this year, if you wanted to duplicate them, a, it would take you 2 years, but also you'd pay a 30% premium. So we have a build-in margin that is purely good fortune from our perspective, but nonetheless, you take it when it comes along. So that's where we are. Now that's going to show some pretty dramatic improvement in economics this year. We'll probably see revenues up around 25%, EBITDA north of 35% and net income above 20% growth from '23 through '24, but that's just a function of these ships coming on. They go on to charter immediately when they're delivered. We operate the ships. We do not take any fuel risk in the vessels. We just manage and operate the ships. And then we'll have another significant growth step in 2026 because the rest of those ships will be on for the full year entirely. So we'll be at 196 ships operating for that we have in a partnership. And then we have 6 extremely large car-carrying vessels that we're under contract to build. They'll go into construction later this year, delivered in '26 and '27. And each of those will carry about 10,000 vehicles, so they're actually the largest car carriers ever constructed. So that's the business. It will be a step function type of business. It's not one that our revenues -- we don't take short-term risk. Or we don't get the reward in the short-term markets. We do everything on a long-term basis, tie our financings to those charters, but it's a great business. And Prem, I'm pleased to say you're -- on the same basis that we went private, your investment should go up about 50% this year just based on the increased cash flow of the business, so it's been a pleasure. And we -- hopefully, the market will keep providing us opportunity in the future. I would suggest that, the next 2 or 3 years, we're going to see fewer opportunities because the amount of newbuilding, including our own, of the last 2 years is adding 30% to the existing market. The market only grows about 2% a year in the container shipping business. And so there's going to be a huge amount of scrapping of older vessels, predominantly driven by fuel choice, but it's going to -- there's going to be a couple of years of digestion of that much; unfortunately, all of our contracts. And I should mention one of our things we focus on is contracted backlog. And we have -- last year, we used up about $1.5 billion of our contracted backlog. We've already replaced it, so far, this year, so we have about $18 billion, a little over $18 billion of contracted backlog of operational revenue. So basically trying to keep 5 or 7 years constantly ahead of ourselves before we need to recontract anything. Prem Watsa David, thank you very much. $18 billion of contracted revenue, David said, and fixed-price financing. They make the spread. Ships have gone up by 30% from when they bought it. This is the type and very, very risk conscious, unbelievably risk conscious.

-

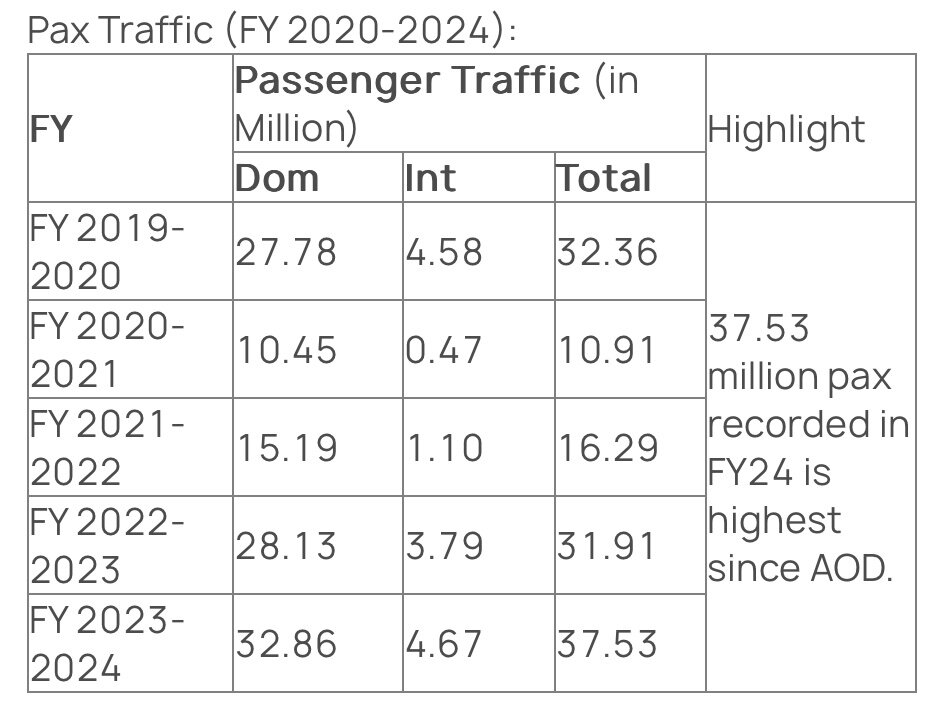

Bengaluru, April 16, 2024: During FY 2023-2024, Kempegowda International Airport Bengaluru (KIAB / BLR Airport) witnessed the highest-ever annual passenger traffic and cargo numbers, with a total of 37.53 million passengers traversing through its terminals and 439,524 metric tonnes (MT) of cargo passing through the BLR Airport. BLR Airport catered to 32.86 million domestic passengers and 4.67 million international passengers during this period. "As we reflect on the past financial year, it's been a landmark period with the highest passenger and cargo figures ever recorded in our airport's history. We've also seen an increase in the number of airlines as well as destinations we connect to. Our position as the No.1 Airport for processing perishable cargo for the third consecutive year highlights our steadfast commitment to advancing cargo development facilities. With the successful launch of Terminal 2 (T2) and partnerships with leading airlines and cargo operators, we are poised to solidify our position as the premier gateway to South and Central India." said Satyaki Raghunath, Chief Operating Officer at Bangalore International Airport Limited. https://www.bengaluruairport.com/corporate/media/news-press-releases/blr-airport-records-the-highest-ever-passenger-traffic-with------million-travellers-in-fy----

-

7974 Nintendo Co

-

Interesting Article in Mint on the future plans for Airport Privitisation in india. Apologies for the lack of a link but the app is a bit of a pain Airport privatization 3.0: Here are the 13 candidates An increasing number of airports in India will sport private-sector owners, as the country's state-owned airport operator prepares a plan to privatize 13 more airports in the coming months, and also sell its residual stake in the bigger airports of Bengaluru and Hyderabad, according to two senior officials aware of the matter. Airports Authority of India (AAI) plans to kick off the third phase of airport privatization after the general elections, beginning with offloading its remaining 13% stake in Bangalore International Airport Ltd (BIAL) this year, the officials said on condition of anonymity. A track record cannot be understated

-

What did you learn this week at Fairfax Week?

nwoodman replied to SafetyinNumbers's topic in Fairfax Financial

@dr.malone great notes and thanks to everyone else that has posted. Was there mention of IDBI? No great surprise if it was off limits but you never know -

I still think Eurobank is a good deal today. You will need to remind me why they can't buy more? FWIW, MS downgraded them a smidge, but it is more of a rounding error. If their forward estimates are correct, then you pretty much get a P/E 6 machine, which gets Fairfax their 15%. It's very boring, but there's nothing wrong with that.

-

@This2ShallPass I am hoping there a few questions asked about Atlas at the AGM. As referred to in an earlier post Graham Talbot the CFO departed after the last Fairfax AGM. It would be great to get some color around his leaving along with an overall update on their thinking in regard to this very large position. https://www.linkedin.com/in/grahamstuarttalbot?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=ios_app

-

I think the only thing that matters to Prem is control not outright ownership. I have thought for a long time that the minority stakes are there purely to provide something to do for the next generation or if they run out of ideas. I think he sees a nominal carry cost of 10% for the minority stakes as a no brainer 10% return idea if there aren’t better opportunities i.e. pay it down and your return is 10%. Goes without saying that it only works for non-wasting assets. Edit: The tantalising question is what does he see? I think you have to frame any answer through a lens of BoI, Eurobank, CSB and Indian Macro. Unfortunately as it is play, I think it will be off limits at the AGM but please give it a crack

-

"Fair" point. Just a no-go for me, but never say never. One of the things that has been bouncing around in my addled brain was Prem's comments regarding the 100-year company. He mentioned this in the 2020 letter. "As you know, we are building Fairfax for the next 100 years (long after I am gone, I think!!). Recently, I came across two books on long lived companies: ''The Living Company, Habits for Survival in a Turbulent Business Environment'' by Arie de Geus, and ''Lessons from Century Club Companies, Managing for Long Term Success'' by Vicki Tenhaken. They both make the point that companies that have survived for over 100 years have four characteristics: 1. They are sensitive to the business environment, so that they always provide outstanding customer service. 2. They have a strong culture - a strong sense of identity that encompasses not only the employees but also the community and everyone they deal with. Managers are chosen from the inside and considered stewards of the enterprise. 3. They are decentralized, refraining from centralized control. 4. They are conservatively financed, recognizing the advantage of having spare cash in the kitty. Fairfax has many of these characteristics and we continue to build our company for the future" The characteristics themselves aren't necessarily an epiphany, but I do think they may have solidified something in Prem's thinking. Perhaps this even extends to the treatment of stakeholders such as passive minority shareholders of public subs. Time will tell.

-

Cross post to a summary etc of Micron's CC. MS upgrade to $98/share. Est EPS $6.84 '25, $8.33 '26.

-

If history is any guide, that would be at the bottom of my thesis list. Not saying they have acted with impropriety but your interests rank much lower than you think.

-

Thanks @glider3834. Nice to see a bit of instant gratification come their way. MU’s forward guidance was strong too. This may be another $500+m position in the making.