nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

I thought this was an intriguing prospect to. I remember reading a lot about the potential for debt deflation given leverage in the system. Totally agree with SJ that this was a bet, not a hedge. They were looking for another MBS homerun. I ended up buying FFH as a hedge against their low ball offer on ORH in 2009. The deflation bets, hedges and even the shorts didn't worry me so much as Prem's rhetoric in 2017-2019 which I found quite remarkable, it just seemed plain confused and full of hubris. Citing individuals for massive changes in positioning eg Trump in my mind didn't warrant a multiple of book. The whole situation seemed, to quote my grandma, "discombobulated". The irony is that the index shorts may have actually helped repair his reputation in the market declines last year. Taking them off when he did, only inflicted double damage points. I sold out completely in 2019 and reinvested the funds (and got lucky). During the low's of 2020 ended up buying ATCO and later bought some FFH as a hedge, just in case of Fairfax played cute. The FFH position as subsequently grown somewhat using rather inflated currency (TSLA). A lot of what we are seeing now are seeds that were actually planted in 2017 and 2018 starting to take form. This is the best visibility/discount I can recall in the time I have been following the company. If you believe book value, then the only other low similar to this was the 9/11 sell off in 2001. It was pleasing last night to see the spike in Chemplast. While he may have lost the title of the Oracle of the North, perhaps the Oracle of India will suffice. I don't say that flippantly, foisting dogs like Farmer's Edge onto the market to have them crater only makes investors more gun shy. Chemplast is shaping up to be a win/win.

-

Excellent comments, especially the criticisms. My simple take is that this is an opportunity that is 10 years in the making. I am sure it wouldn't be lost on Prem that the opportunity that he got on Seaspan/Atlas was 10 years in the making too. Fixing the the insurance subs has probably taken just as long. I went back and grabbed the Y/E book values and overlaid them against daily prices. They don't capture the peaks or troughs but the average is around 1.1x's including today's massive discount and excluding my estimate of Q3 BV. The graph says to me that the market was more optimistic than the business warranted during the teens but is way too pessimistic now. The joys of a market. Given the share issuance during the period of optimism, I think Prem knew it too. If the thesis is correct then shares should be bought back in spades over the next few years. I would say in Baseball terms Prem and Team have a batting average that is not great but OK. Despite this they deserve a place in the big league and are finding some form again. There just may be a few home runs left in them yet and after a couple of good seasons the fans will be back.

-

This article, 22nd September, implies that the issues around Covid BI reinsurance recoverables persists. While Hiscox was highlighted as having the greatest leverage, Brit is up there. Does anyone know how much of Brit’s book was/is BI? An extract from the CC below also reinforces the view that it is still a work in progress. The table below shows Brit’s recoverables to TE dropped quite significantly from H1/20 to H1/21 is a positive. https://www.theinsurer.com/analysis/hiscox-most-exposed-to-covid-bi-reinsurance-failure-as-impasse-continues/18350.article “As the industry-wide impasse between reinsurers and their cedants over certain Covid-19 claims continues, research by The Insurer shows Hiscox is leveraged at 2x tangible equity to reinsurance collectibles. The higher the number the greater an insurer’s sensitivity to reinsurance recoveries which have been booked as an asset on its balance sheet but are yet to be collected. Last month, Hiscox revealed its reinsurance recoveries had ballooned to a new record high of $4.4bn at H1 2021, a further leap on what was a new high of $3.6bn at year-end 2020.” “In contrast, a 10 percent adverse movement in reinsurance collectibles for Hiscox peers, such as Beazley and Lancashire or even Fairfax Financial-owned Brit Insurance, would have significantly lesser impact because they have substantially lower leverage.” From the recent CC Jaeme Gloyn Good. First question is on the on the reserve developments in the quarter and I guess for the first half of the year, kind of coming in the 1%-ish range. I'm seeing a little bit more favorable reserve development from other insurance companies. I'm just wondering if you can give us a little bit more detail as to what you're seeing on that front? If you can have any comments and maybe around Odyssey where we saw some unfavorable reserve development. Prem Watsa Jaeme, we've got Peter here who's our Chief Operating Officer, and he used to be the Chief Actuary. So, Peter, your comment. Peter Clarke Sure. I guess, Jaeme, I think what's distorting the numbers a little bit is we had approximately $60 million in development on COVID losses. So, that's sort of a one-off thing in our minds. And excluding the COVID losses, I think we had favorable development of around $90 million, which isn't that far off from the previous year. But generally speaking, it's the second half of the year where we do more thorough reserve reviews, specifically off the third quarter reserves and that's when we'll make more significant adjustments. Our reserves continue to be extremely strong and I think our companies are very conservative on the lost picks they're making on the current years. So, we would expect that we'll be building up some redundancy as we go through this strong pricing environment. Prem Watsa A basic view, Jaeme, that we've said for many, many years now is that the past reserves can develop favorably or unfavorably and we just want it to be developing favorably. And so it's a risk in the property casualty business and we've had favorable development, I think for more than a decade now and perhaps even longer than that. But that's a very important requisite in the property casualty business. Jaeme Gloyn Okay, understood. On those COVID loss development, can you describe what it was that was driving that? Is that anything related to BI [ph]? A little bit more color on those COVID reserve developments at all? Prem Watsa Sure thing. Peter? Peter Clarke Yes. Really, it relates on our reinsurance business primarily at Allied and Odyssey. And it's a non-U.S., so it's in Europe where there are still uncertainty around what's covered, what's not covered. Is it one event, many events? So it's really just IBNR that's still being put up on the reinsurance books, mostly in Europe. Jaeme Gloyn Okay. And related to BI, I guess? Peter Clarke Related to BI and some of the BI issues, you might remember the UK ruling came out late last year. That's still filtering through the system.

-

Indeed, and India has suffered. Programs like the proposed NMP Seem well considered and a sign that things are changing. There will be bumps in the road, but iit is a massive opportunity for India to advance and meet it's full potential.

-

Thanks Glider, whichever way you look at it the rubber band is stretched. Not sure what the thesis would be to sell at these prices. Can only figure it is end of quarter dressing or algos. What is going on under the hood at FFH all seems to be moving in the right direction.

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

At this price, I tend to agree. Also, saw your note on the Foundation Trilogy, thanks. That is what I have started with. I was hoping to get thru them prior to the Apple release but alas not. Still reading and watching the side by side is accretive. Also appreciate the observation that some of the characters from the later books have been meshed into the first two episodes, that makes more sense now -

That's a shame, there goes our hard market without a CAT or two to act as a wake up call. On a brighter note, I was recently thinking about what US5-10bn or so in float in the Indian market might be worth with CRs of 100 in the not too distant future. Assuming the capital allocation machine is working. Anyway the observation was more born out of what I have seen as a lumpy but long run average returns out of the likes of MKL, BRK and FFH. They seem to be 10-12% CAGR machines. My take is don't get starry eyed about the potential for significant returns buy with a healthy discount, nothing new in that. I think it applies particularly to FFH at the moment that is trading at a considerable discount. It goes without saying that as long as they don't blow up, a 10% return in a 2% borrowing world is more than acceptable....in fact that is an asset that is positively geared.

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Watched the first episode of Foundation on Apple TV+. Very impressive production values. Never read Asimov’s books, so that is a work in progress which certainly helps. However, the kids were enthralled even without the background -

Totally agree, who the hell other than Fairfax fan boys know about Digit in the wider market, a couple of select PE players. In this small circle, the marks are not all that convincing but I am not saying they are way off. I would hazard a guess that they may even be conservative if let loose on an IPO mad Indian market at the moment. Digit will likely prove to be around 25% of “the Prem is a genius” or “Prem turns around Fairfax “ narrative at some point in the future but only after a few years and some other more mainstream investments that prove winners Eurobank (for the newcomers) and Atlas, and then the TRS. Even if the TRS takes a few years, the carrying cost is likely no more than OMERS, who knows maybe it is OMERS (9% funding guaranteed ) We are all here because we are value investors, and while we are here to make money I for one am also intrigued to see just how long regression to the mean actually occurs. I am betting no longer than 2024 and that the sum of the parts is growing at least 11% over the longer term. Not a high bar by any means. While we are all delighted that things are working out with a few of the investments and that there are green shoots all over the place, these seeds were sown at least 3 years ago. Many of these looked like they had withered on the vine even before Covid, so you can’t blame the market for being fascinated by shinier things. 11% CAGR kind of sucks if you bought and held but the long term opportunity cost after accounting for tax is likely acceptable. ie not completely wrong. The more I look at this Insurance/Float model you realise it is just not that exciting any more. Having said that your return is based on the price you pay and your returns suck if you drink the “Berkshire model” Kool Aid and over pay, you will not be bailed out by superior economics. You will do OK if you buy at a discount or better yet a deep discount which is where we are at with FFH I think everyone that has been in and out of FFH over the last 10-15 years knows that they are far from a 15% long term compounder. However from this point in time to get back to FV I think it will likely give you 20% CAGR for a few years. Nuts in this environment, but that’s the market for you. This will be extrapolated just as this period of “under performance” seems exaggerated. Agree with all though, that there are possibly structural and even mild cultural changes that may improve the odds of them not trading at such a large discount for long. Kkeep up the great work in terms of turning over the value rocks. It makes for interesting reading. However I must admit I am more interested In signs of misallocation at this stage that might halt or give pause to regression to the mean.

-

Very sad news. Not my area of expertise, but seems strange to have detailed on a straight section of track. Perhaps a mechanical fault rather than a structural issues with the rail itself? At Least 3 Killed In Amtrak Derailment https://www.npr.org/2021/09/25/1040734747/amtrak-train-derails-montana-injured Five Amtrak cars derailed around 3:55 p.m. Mountain Daylight Time and no other trains or equipment were involved, Weiss said. The train was traveling on a BNSF Railroad main track at the time, he said. Photos posted to social media showed several cars on their sides. Passengers were standing alongside the tracks, some carrying luggage. The images showed sunny skies, and it appeared the accident occurred along a straight section of tracks.

-

There has to be some rotation out of China as part of this. Go you good thing World-Beating Rally Pushes India’s Sensex to Record 60,000-Mark - Bloomberg The blistering rally has brought valuations back at the center of the debate over how far Indian stocks can go from here. The Nifty is trading at close to 23 times its estimated 12-month earnings, well above its five-year average of about 18 times, and much higher than the MSCI Emerging Market Index’s multiple of 13. Risks are also rising for the economy; a retreat for the Nifty 50 Index would reduce gross domestic product by 1.4% in the same quarter of the shock and by 3.8% over the following year, Ankur Shukla, an economist with Bloomberg Economics, wrote in a recent note.

-

SJ, you keep us all grounded. Empire expansion was an error of omission from the list Do you believe that their allocation ability is getting better? The warrant plays and picking up some Berkshire cast offs like Digit, Bank of Ireland, and Sokol (Atlas) does it make them seem better allocators? BoI they managed to in and out without feeling any obligation to Ritchie Boucher, unlike John Chen at Blackberry. Obviously Eurobank was a function of the BoI endorphin rush, it will work out OK but it has been some years in the making and it had the real potential to be a clusterfuck. Hopefully will turn out OK Digit, great work so far. Especially to snare it after Kamesh pitched it hard to Ajit/Berkshire and they declined. Atlas, I think this is their most astute investment to date, but by no means a tribute to Prem’s acumen. Sokol is the real deal, and deserves to end up a Billionaire hopefully he adds 5-10 Bn or more to Fairfax on the way thru. Who could have guessed that shipping would have had the pricing power it does now? Ok, Sokel who bagged the priorb senior management for not going hard some years ago and made the necessary changes I am betting whatever torturous/fortuitous route they got to the present situation, it will stand them in good stead going forwards. Prem”s seat at the table for deals, his drive to get the best of breed managers, and his dedication to his company are real.

-

As a follow up to the discussion on relative undervaluation I am interested in everyone’s expectations on: 1. Prem weighs into another pricing anomaly and buys in his personal account given this is the best value since the lows in 2020 2. Fairfax increases their TRS position 3. Buys back shares in the open market 4. Simply has used funds raised to deleverage/de-risks and sighs relief, no criticism intended 5. All is good and is share price agnostic +/-20% and playing the long game, wake them when cash is truly rolling in from investees

-

Edit approved

-

Viking, great post as always. As doodling is so much more fun than reviewing reports, I added in the regression to the mean curves for four years out on my 10,000ft view of Fairfax. Four years is quite arbitrary, but I agree that Fairfax over the last couple of years have made more good decisions than bad. This will be appreciated sooner or later. While the weighing machine is a bit broken at the moment, the current prices offers an opportunity for returns that will vary somewhere between acceptable and stellar. One thing that does standout out is how inconsequential some of those earlier dips look in retrospect, yet many thousands of words were written.

-

MS are out with a chart pack for the Indian Economy. A few caught my eye, Chart pack attached. We expect cyclical recovery in subsequent quarters: We expect economic activity to start to pick up from QE Sep, supported by pent-up demand, ramping up of the vaccination drive (daily vaccination tracking at 9mn on a 7 day avg basis), a favourable policy mix, and robust global growth. Indeed, we expect GDP to move into positive territory on a 2Y CAGR basis from QE Sept. The key risks to watch will be the pace of vaccination (any slowdown could increase risks) and trend in Covid-19 cases - potential re-acceleration, threat from new variants and restrictions on activity. INDIA_20210922_0000.pdf

-

Short article on the use of AI by Brit https://www.insurancejournal.com/news/international/2021/09/21/633025.htm Brit Ltd., the London-based specialty insurer and reinsurer, announced the creation and successful proof-of-concept launch of a proprietary machine-learning algorithm, designed to accelerate the identification of post-catastrophe property damage, based on the use of ultra-high-resolution imagery. This proof of concept is being used by the Brit claims team and its delegated claims adjusters in the wake of Hurricane Ida, to further improve claims service and expedite payments for customers. In this innovation, Brit’s Data Science team developed and overlaid a machine learning algorithm to access the ultra-high-resolution ariel images and data such that it pinpoints, color-codes, and displays properties by damage classification within days after a catastrophe event. This enables the Brit claims team to proactively identify, triage and assign response activity even before claims are reported. Since April 2019, Brit has worked with the Geospatial Insurance Consortium (GIC), a non-profit organization that captures best in class post-event ariel imagery for first responders and insurance companies. With the GIC images and the machine learning algorithm, the Brit claims team has a virtual claims adjusting platform that can expedite claims payments in locations that cannot be immediately serviced by local field adjusters in the initial days following catastrophe events. “A claim is the single most important interaction that an end client will have with their insurer and this will often be at a time of significant difficultly. We are therefore continually focused on improving the service we offer and how quickly we can provide resolution for our customers. Innovation and technology are critical to the equation,” commented Sheel Sawhney, group head of Claims and Operations. “This use of machine learning techniques and the best available imagery is further evidence of how our award-winning claims team is finding new ways to increase the speed and accuracy of claims payments,” added Sawhney. A subsidiary of Fairfax Financial Holdings, Brit underwrites a broad class of commercial specialty insurance with a strong focus on property, casualty and energy business. It has a major presence in Lloyd’s of London, the world’s specialist insurance market provider.

-

Given Trudeau’s win could we argue that the 3% tax surcharge doesn’t apply to Fairfax due to underperformance . Happy to pay it once the share price is back to BV

-

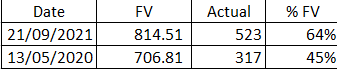

Good question. I agree that the visibility is better now than in March. In terms of the "mirage", personally I think that FFH, at times, guilds the lily a little with book value, but only time will tell. Visibility gets easier as they take their positions public. I think the bigger question is whether the compounding/capital allocation machine is broken? To this I answer a definitive no. Take the graph below with a pinch of salt, but if you think long run they can achieve low double digit CAGR then they look cheap today. Based on the 11% CAGR curve, the Fair Value (FV) today would be of order $CAD800 or ($USD650). P/B=650/540=1.2. This is my estimate of FV using a number of different measures, so quite unremarkable. We can then use this curve to back calculate the FV at the low in March. FWIW we get the following: So it was a 45c dollar at the bottom in May 2020 and is a 65c dollar now. Still cheap but not as cheap IMHO.

-

Thanks for this. The comparison between China and India is quite stark. Demography isn’t everything but it’s certainly not nothing.

-

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

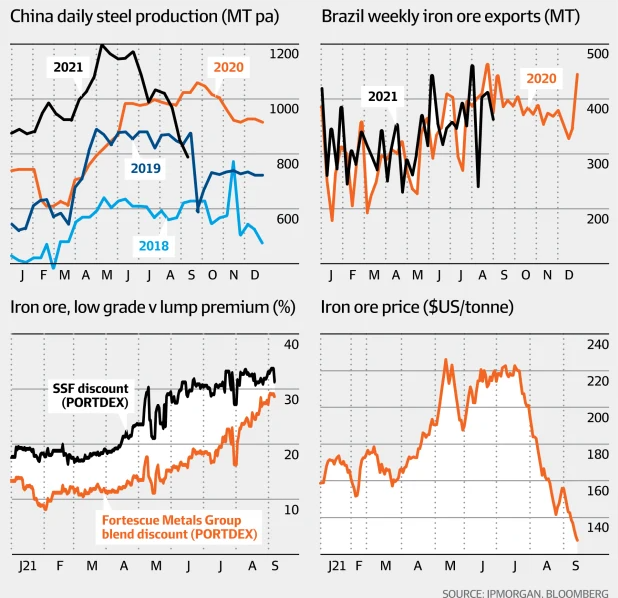

Greatly appreciated. The breakdown in Iron Ore prices is nothing short of spectacular. Under $100/tonne last night. The South Pacific Peso has held up quite well considering -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

I found this short talk by former Australian Prime Minister, Kevin Rudd quite illuminating. He frames the current changes going on in China under three driving forces: 1. Ideology 2. Demographics 3. Decoupling from the US https://youtu.be/cpLECUjTZwQ His feeling is that post Xi's election next year there might be some policy reappraisal but between now and then "fasten your seatbelts" -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

Yep it is a head scratcher. As Spek alluded to, many were bought as “investments’ where the prevailing sentiment was you don’t put tenants in them as they will depreciate. Kind of like collectibles are worth more if they are still in their original packaging. -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

They have been for years. If the credit spigot is open, then speculation takes hold and you end up in the bizarre situation of the last decade or so. The apartment is to build wealth not for living in. Ghost cities! This works wonders for GDP, jobs, wealth effect etc as long as you can keep credit growing then all good. I know, I know, the whole debt deflation thing is so 2010…. -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

I heard an interesting theory on a podcast that the fallout from the Evergrande debacle was already manifesting itself in the various crackdowns on other sectors. eg tech, education etc. There is an inevitability that the CCP will need to bail this dog out. The crackdowns in other sectors are to mask the associated moral hazard. I am also somewhat surprised that commodity currencies are holding up as well as they are between developers going bust and crackdowns on steel production, it is looking like a perfect storm. I guess the market is implying that they have a public hanging or two and then its back to business as usual Iron ore price hits 10-month low as China accelerates steel cuts (afr.com) The broker subsequently cut its 2021 steel production growth forecast from 6.5 per cent to 4 per cent and lowered its demand growth estimate from 2.8 per cent to 0.8 per cent. “Current negative sentiment towards Chinese steel production and iron ore prices is likely to continue short-term given weakness in economic data,” Mr Fagan said. JPMorgan lowered its 2021 iron ore price forecast from $US181 a tonne to $US165 a tonne and its 2022 projection from $US150 a tonne to $US125 a tonne. “A fourth-quarter 2021 pick up in infrastructure activity should help arrest the decline in prices, particularly if tight steel conditions improve,” Mr Fagan said.